Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GOLDMAN SACHS GROUP INC | d826637d8k.htm |

| EX-99.1 - EX-99.1 - GOLDMAN SACHS GROUP INC | d826637dex991.htm |

Exhibit 99.2 Full Year and Fourth Quarter 2019 Earnings Results Presentation January 15, 2020Exhibit 99.2 Full Year and Fourth Quarter 2019 Earnings Results Presentation January 15, 2020

Results Snapshot EPS Net Revenues Net Earnings 2019 $36.55 billion $21.03 2019 $8.47 billion 2019 4Q $9.96 billion 4Q $1.92 billion 4Q $4.69 1 1 ROTE ROE Impact of Litigation 2019 10.0% 2019 10.6% -$3.16 2019 EPS 8.7% 4Q 4Q 9.2% 2019 ROE / ROTE -1.5pp / -1.6pp Annual Highlights 2 Record FICC financing net revenues #1 in Announced and Completed M&A 2 3,4 Record AUS #1 in Equity and equity-related offerings nd 2 highest Investment Banking net revenues Record Consumer & Wealth Management net revenues 1Results Snapshot EPS Net Revenues Net Earnings 2019 $36.55 billion $21.03 2019 $8.47 billion 2019 4Q $9.96 billion 4Q $1.92 billion 4Q $4.69 1 1 ROTE ROE Impact of Litigation 2019 10.0% 2019 10.6% -$3.16 2019 EPS 8.7% 4Q 4Q 9.2% 2019 ROE / ROTE -1.5pp / -1.6pp Annual Highlights 2 Record FICC financing net revenues #1 in Announced and Completed M&A 2 3,4 Record AUS #1 in Equity and equity-related offerings nd 2 highest Investment Banking net revenues Record Consumer & Wealth Management net revenues 1

Macro Perspectives Constructive Fundamentals Macro Factors Accelerating global growth U.S. – China Trade GDP Growth: U.S. Global 2020 │ 2021 +2.2% │ +2.4% +3.4% │ +3.6% Brexit Supportive sentiment and fundamentals Strong Consumer Low Global Low U.S. Low Global Rates Sentiment Inflation Unemployment Operating Backdrop in 4Q19 Steeper Accommodative Higher Muted Corporate Yield Curve Central Banks Equity Markets Sentiment U.S. 2-10 Year Spread 25bps Fed rate cut in S&P 500: +9% CEO Economic ~30bps wider October Stoxx Europe 600: +6% Outlook Index: -3% QoQ 2020 and 2021 estimated real gross domestic product (GDP) growth per Goldman Sachs Research 2Macro Perspectives Constructive Fundamentals Macro Factors Accelerating global growth U.S. – China Trade GDP Growth: U.S. Global 2020 │ 2021 +2.2% │ +2.4% +3.4% │ +3.6% Brexit Supportive sentiment and fundamentals Strong Consumer Low Global Low U.S. Low Global Rates Sentiment Inflation Unemployment Operating Backdrop in 4Q19 Steeper Accommodative Higher Muted Corporate Yield Curve Central Banks Equity Markets Sentiment U.S. 2-10 Year Spread 25bps Fed rate cut in S&P 500: +9% CEO Economic ~30bps wider October Stoxx Europe 600: +6% Outlook Index: -3% QoQ 2020 and 2021 estimated real gross domestic product (GDP) growth per Goldman Sachs Research 2

Financial Overview Full Year Net Revenue Mix by Segment Financial Results $ in millions, vs. vs. vs. except per share amounts 4Q19 3Q19 4Q18 2019 2018 Investment Banking $ 2,064 12% -6% $ 7,599 -7% Consumer & Wealth Management Investment 14% Global Markets 3,480 -2% 33% 14,779 2% Banking 21% Asset Management 3,003 85% 52% 8,965 1% Consumer & Wealth Management 1,408 7% 8% 5,203 1% Net revenues $ 9,955 20% 23% $ 36,546 -% Asset Management Provision for credit losses 336 15% 51% 1,065 58% 25% (FICC 20%) Operating expenses 7,298 30% 42% 24,898 6% Pre-tax earnings 2,321 -4% -14% 10,583 -15% (Equities 20%) Net earnings 1,917 2% -24% 8,466 -19% Global Net earnings to common $ 1,724 -4% -26% $ 7,897 -20% Markets FY19 Litigation Impact 40% Diluted EPS $ 4.69 -2% -22% $ 21.03 -17% Diluted EPS $ -3.16 1 ROE 8.7% -0.3pp -3.4pp 10.0% -3.3pp ROE -1.5pp 1 ROTE -1.6pp ROTE 9.2% -0.3pp -3.6pp 10.6% -3.5pp 3Financial Overview Full Year Net Revenue Mix by Segment Financial Results $ in millions, vs. vs. vs. except per share amounts 4Q19 3Q19 4Q18 2019 2018 Investment Banking $ 2,064 12% -6% $ 7,599 -7% Consumer & Wealth Management Investment 14% Global Markets 3,480 -2% 33% 14,779 2% Banking 21% Asset Management 3,003 85% 52% 8,965 1% Consumer & Wealth Management 1,408 7% 8% 5,203 1% Net revenues $ 9,955 20% 23% $ 36,546 -% Asset Management Provision for credit losses 336 15% 51% 1,065 58% 25% (FICC 20%) Operating expenses 7,298 30% 42% 24,898 6% Pre-tax earnings 2,321 -4% -14% 10,583 -15% (Equities 20%) Net earnings 1,917 2% -24% 8,466 -19% Global Net earnings to common $ 1,724 -4% -26% $ 7,897 -20% Markets FY19 Litigation Impact 40% Diluted EPS $ 4.69 -2% -22% $ 21.03 -17% Diluted EPS $ -3.16 1 ROE 8.7% -0.3pp -3.4pp 10.0% -3.3pp ROE -1.5pp 1 ROTE -1.6pp ROTE 9.2% -0.3pp -3.6pp 10.6% -3.5pp 3

Investment Banking Investment Banking Highlights Financial Results vs. vs. vs. n 4Q19 net revenues lower YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Financial advisory 4Q19 net revenues significantly lower YoY, compared with a strong prior $ 855 23% -29% $ 3,197 -7% Financial advisory year period, reflecting a significant decrease in industry-wide completed M&A volumes — Underwriting 4Q19 net revenues significantly higher YoY, driven by asset-backed activity Equity underwriting 378 3% 23% 1,482 -9% and an increase in industry-wide equity underwriting transactions n 2019 net revenues lower YoY compared with a strong 2018, reflecting lower net revenues in 599 14% 37% 2,119 -10% Debt underwriting Underwriting and Financial advisory 3 n Overall backlog increased QoQ, reflecting increases in advisory and equity underwriting Underwriting 977 10% 31% 3,601 -10% backlog, and essentially unchanged YoY Corporate lending 232 -9% -8% 801 7% Investment Banking Net Revenues ($ in millions) Net revenues 2,064 12% -6% 7,599 -7% $2,193 $2,064 Provision for credit losses 75 -18% 108% 333 169% $1,948 $251 $1,841 $232 $1,746 $187 $437 $254 $128 2 $599 $514 Full Year Worldwide League Table Rankings $482 $307 $524 $378 $262 $476 $366 #1 #1 Equity & equity-related Announced M&A $1,198 $874 $855 $771 $697 #1 #1 Completed M&A Common stock offerings 4Q18 1Q19 2Q19 3Q19 4Q19 #2 Financial advisory Equity underwriting Debt underwriting Corporate lending High-yield debt 4Investment Banking Investment Banking Highlights Financial Results vs. vs. vs. n 4Q19 net revenues lower YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Financial advisory 4Q19 net revenues significantly lower YoY, compared with a strong prior $ 855 23% -29% $ 3,197 -7% Financial advisory year period, reflecting a significant decrease in industry-wide completed M&A volumes — Underwriting 4Q19 net revenues significantly higher YoY, driven by asset-backed activity Equity underwriting 378 3% 23% 1,482 -9% and an increase in industry-wide equity underwriting transactions n 2019 net revenues lower YoY compared with a strong 2018, reflecting lower net revenues in 599 14% 37% 2,119 -10% Debt underwriting Underwriting and Financial advisory 3 n Overall backlog increased QoQ, reflecting increases in advisory and equity underwriting Underwriting 977 10% 31% 3,601 -10% backlog, and essentially unchanged YoY Corporate lending 232 -9% -8% 801 7% Investment Banking Net Revenues ($ in millions) Net revenues 2,064 12% -6% 7,599 -7% $2,193 $2,064 Provision for credit losses 75 -18% 108% 333 169% $1,948 $251 $1,841 $232 $1,746 $187 $437 $254 $128 2 $599 $514 Full Year Worldwide League Table Rankings $482 $307 $524 $378 $262 $476 $366 #1 #1 Equity & equity-related Announced M&A $1,198 $874 $855 $771 $697 #1 #1 Completed M&A Common stock offerings 4Q18 1Q19 2Q19 3Q19 4Q19 #2 Financial advisory Equity underwriting Debt underwriting Corporate lending High-yield debt 4

Global Markets - FICC Financial Results FICC Highlights vs. vs. vs. $ in millionsn 4Q19 net revenues significantly higher YoY compared with a weak 4Q18 4Q19 3Q19 4Q18 2019 2018 — FICC intermediation net revenues were significantly higher, reflecting higher net revenues $ 1,382 5% 83% $ 6,009 5% FICC intermediation across most major businesses n 2019 net revenues higher YoY, due to higher net revenues in FICC intermediation and FICC FICC financing 387 6% 17% 1,379 10% financing n 4Q19 operating environment generally characterized by improved market conditions compared with 1,769 5% 63% 7,388 6% FICC 3Q19, while client activity levels were lower Equities intermediation 979 -9% 9% 4,374 -7% Equities financing 732 -7% 17% 3,017 9% FICC Net Revenues ($ in millions) Equities 1,711 -8% 12% 7,391 -1% $2,238 $366 Net revenues 3,480 -2% 33% 14,779 2% $1,769 $1,702 $1,679 Provision for credit losses 20 25% 186% 35 -33% $262 $387 $364 $1,087 $1,872 $330 $1,440 $1,382 $1,315 $757 4Q18 1Q19 2Q19 3Q19 4Q19 Intermediation Financing 5Global Markets - FICC Financial Results FICC Highlights vs. vs. vs. $ in millionsn 4Q19 net revenues significantly higher YoY compared with a weak 4Q18 4Q19 3Q19 4Q18 2019 2018 — FICC intermediation net revenues were significantly higher, reflecting higher net revenues $ 1,382 5% 83% $ 6,009 5% FICC intermediation across most major businesses n 2019 net revenues higher YoY, due to higher net revenues in FICC intermediation and FICC FICC financing 387 6% 17% 1,379 10% financing n 4Q19 operating environment generally characterized by improved market conditions compared with 1,769 5% 63% 7,388 6% FICC 3Q19, while client activity levels were lower Equities intermediation 979 -9% 9% 4,374 -7% Equities financing 732 -7% 17% 3,017 9% FICC Net Revenues ($ in millions) Equities 1,711 -8% 12% 7,391 -1% $2,238 $366 Net revenues 3,480 -2% 33% 14,779 2% $1,769 $1,702 $1,679 Provision for credit losses 20 25% 186% 35 -33% $262 $387 $364 $1,087 $1,872 $330 $1,440 $1,382 $1,315 $757 4Q18 1Q19 2Q19 3Q19 4Q19 Intermediation Financing 5

Global Markets - Equities Financial Results Equities Highlights vs. vs. vs. n 4Q19 net revenues higher YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Equities financing net revenues were higher, reflecting improved spreads and higher average FICC intermediation $ 1,382 5% 83% $ 6,009 5% customer balances — Equities intermediation net revenues were higher, driven by cash products FICC financing 387 6% 17% 1,379 10% n 2019 net revenues essentially unchanged YoY, as lower net revenues in Equities intermediation were offset by higher net revenues in Equities financing FICC 1,769 5% 63% 7,388 6% n 4Q19 operating environment was characterized by generally higher global equity prices and lower levels of volatility compared with 3Q19 Equities intermediation 979 -9% 9% 4,374 -7% 732 -7% 17% 3,017 9% Equities financing Equities Net Revenues ($ in millions) Equities 1,711 -8% 12% 7,391 -1% $2,014 $1,864 $1,802 Net revenues 3,480 -2% 33% 14,779 2% $1,711 $1,522 $860 $641 $784 Provision for credit losses 20 25% 186% 35 -33% $732 $625 $1,161 $1,154 $1,080 $979 $897 4Q18 1Q19 2Q19 3Q19 4Q19 Intermediation Financing 6Global Markets - Equities Financial Results Equities Highlights vs. vs. vs. n 4Q19 net revenues higher YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Equities financing net revenues were higher, reflecting improved spreads and higher average FICC intermediation $ 1,382 5% 83% $ 6,009 5% customer balances — Equities intermediation net revenues were higher, driven by cash products FICC financing 387 6% 17% 1,379 10% n 2019 net revenues essentially unchanged YoY, as lower net revenues in Equities intermediation were offset by higher net revenues in Equities financing FICC 1,769 5% 63% 7,388 6% n 4Q19 operating environment was characterized by generally higher global equity prices and lower levels of volatility compared with 3Q19 Equities intermediation 979 -9% 9% 4,374 -7% 732 -7% 17% 3,017 9% Equities financing Equities Net Revenues ($ in millions) Equities 1,711 -8% 12% 7,391 -1% $2,014 $1,864 $1,802 Net revenues 3,480 -2% 33% 14,779 2% $1,711 $1,522 $860 $641 $784 Provision for credit losses 20 25% 186% 35 -33% $732 $625 $1,161 $1,154 $1,080 $979 $897 4Q18 1Q19 2Q19 3Q19 4Q19 Intermediation Financing 6

Asset Management Financial Results Asset Management Highlights vs. vs. vs. n 4Q19 net revenues significantly higher YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Equity investments net revenues were significantly higher, reflecting net gains in public and Management and other fees $ 666 1% 6% $ 2,600 -% private equities — Lending net revenues were significantly higher, primarily reflecting higher net gains from Incentive fees 45 88% -33% 130 -66% investments in debt instruments — Management and other fees were higher, reflecting higher average AUS Equity investments 1,865 N.M. 96% 4,765 13% n 2019 net revenues essentially unchanged YoY, reflecting higher net revenues in Equity investments, offset by significantly lower Incentive fees and lower net revenues in Lending Lending 427 25% 31% 1,470 -10% Net revenues 3,003 85% 52% 8,965 1% Asset Management Net Revenues ($ in millions) $3,003 Provision for credit losses 120 48% 155% 274 71% $427 $2,548 $351 4 $1,974 Equity Investments Asset Mix $1,793 $327 $1,621 $ in billions $ in billions 4Q19 4Q19 $1,865 $351 $1,499 $341 Corporate $ 17 Public equity $ 2 $951 5 20 Real estate Private equity $805 $596 Total $ 22 Total $ 22 $45 $31 $67 $24 $30 $667 $660 $666 $629 $607 5 n In addition, the firm’s consolidated investment entities have a carrying value of $17 billion, funded with liabilities of approximately $9 billion, substantially all of which were nonrecourse 4Q18 1Q19 2Q19 3Q19 4Q19 Management and other fees Incentive fees Equity investments Lending 7Asset Management Financial Results Asset Management Highlights vs. vs. vs. n 4Q19 net revenues significantly higher YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Equity investments net revenues were significantly higher, reflecting net gains in public and Management and other fees $ 666 1% 6% $ 2,600 -% private equities — Lending net revenues were significantly higher, primarily reflecting higher net gains from Incentive fees 45 88% -33% 130 -66% investments in debt instruments — Management and other fees were higher, reflecting higher average AUS Equity investments 1,865 N.M. 96% 4,765 13% n 2019 net revenues essentially unchanged YoY, reflecting higher net revenues in Equity investments, offset by significantly lower Incentive fees and lower net revenues in Lending Lending 427 25% 31% 1,470 -10% Net revenues 3,003 85% 52% 8,965 1% Asset Management Net Revenues ($ in millions) $3,003 Provision for credit losses 120 48% 155% 274 71% $427 $2,548 $351 4 $1,974 Equity Investments Asset Mix $1,793 $327 $1,621 $ in billions $ in billions 4Q19 4Q19 $1,865 $351 $1,499 $341 Corporate $ 17 Public equity $ 2 $951 5 20 Real estate Private equity $805 $596 Total $ 22 Total $ 22 $45 $31 $67 $24 $30 $667 $660 $666 $629 $607 5 n In addition, the firm’s consolidated investment entities have a carrying value of $17 billion, funded with liabilities of approximately $9 billion, substantially all of which were nonrecourse 4Q18 1Q19 2Q19 3Q19 4Q19 Management and other fees Incentive fees Equity investments Lending 7

Consumer & Wealth Management Financial Results Consumer & Wealth Management Highlights vs. vs. vs. n 4Q19 net revenues higher YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Wealth management net revenues higher YoY, due to higher Management and other fees, Management and other fees $ 967 10% 17% $ 3,475 6% reflecting higher average AUS, partially offset by lower Incentive fees — Consumer banking net revenues higher YoY, driven by higher net interest income, primarily Incentive fees 19 -10% -78% 81 -82% reflecting an increase in deposit balances n 2019 net revenues essentially unchanged YoY, as significantly higher net revenues in Consumer Private banking and lending 194 -3% -4% 783 -5% banking and record Management and other fees were offset by significantly lower Incentive fees n Continued to scale our online deposit platform, as consumer deposits increased $24 billion in 2019 4 1,180 7% 6% 4,339 -5% Wealth management to $60 billion Consumer banking 228 5% 23% 864 41% Consumer & Wealth Management Net Revenues ($ in millions) $1,408 Net revenues 1,408 7% 8% 5,203 1% $1,318 $1,304 $1,249 $1,228 $228 $186 $217 Provision for credit losses 121 17% -8% 423 25% $216 $203 $194 $202 $199 $187 $19 $203 $21 $86 $13 $28 $967 $881 $833 $830 $794 4Q18 1Q19 2Q19 3Q19 4Q19 Management and other fees Incentive fees Private banking and lending Consumer banking 8Consumer & Wealth Management Financial Results Consumer & Wealth Management Highlights vs. vs. vs. n 4Q19 net revenues higher YoY $ in millions 4Q19 3Q19 4Q18 2019 2018 — Wealth management net revenues higher YoY, due to higher Management and other fees, Management and other fees $ 967 10% 17% $ 3,475 6% reflecting higher average AUS, partially offset by lower Incentive fees — Consumer banking net revenues higher YoY, driven by higher net interest income, primarily Incentive fees 19 -10% -78% 81 -82% reflecting an increase in deposit balances n 2019 net revenues essentially unchanged YoY, as significantly higher net revenues in Consumer Private banking and lending 194 -3% -4% 783 -5% banking and record Management and other fees were offset by significantly lower Incentive fees n Continued to scale our online deposit platform, as consumer deposits increased $24 billion in 2019 4 1,180 7% 6% 4,339 -5% Wealth management to $60 billion Consumer banking 228 5% 23% 864 41% Consumer & Wealth Management Net Revenues ($ in millions) $1,408 Net revenues 1,408 7% 8% 5,203 1% $1,318 $1,304 $1,249 $1,228 $228 $186 $217 Provision for credit losses 121 17% -8% 423 25% $216 $203 $194 $202 $199 $187 $19 $203 $21 $86 $13 $28 $967 $881 $833 $830 $794 4Q18 1Q19 2Q19 3Q19 4Q19 Management and other fees Incentive fees Private banking and lending Consumer banking 8

Firmwide Assets Under Supervision 3,4 3,4 Firmwide Assets Under Supervision Assets Under Supervision Highlights By Segment vs. vs. 6 n Firmwide AUS increased $317 billion in 2019 to a record $1.86 trillion, including Asset Management $ in billions 4Q19 3Q19 4Q18 3Q19 4Q18 6 6 AUS increasing $211 billion and Consumer & Wealth Management increasing $106 billion $ 1,298 $ 1,232 $ 1,087 5% 19% Asset Management — Long-term net inflows of $108 billion, primarily in fixed income and equity assets Consumer & Wealth Management 561 530 455 6% 23% — Liquidity products net inflows of $65 billion Firmwide AUS $ 1,859 $ 1,762 $ 1,542 6% 21% — Net market appreciation of $144 billion, primarily in equity and fixed income assets n Over past five years, total cumulative organic long-term AUS net inflows of ~$195 billion By Asset Class vs. vs. $ in billions 4Q19 3Q19 4Q18 3Q19 4Q18 $ 185 $ 182 $ 167 2% 11% Alternative investments 3,4 4Q19 AUS Mix 423 392 301 8% 41% Equity Asset Distribution Fixed income 789 784 677 1% 17% Region Vehicle Class Channel Long-term AUS 1,397 1,358 1,145 3% 22% Private Alternative 9% 10% 10% Asia Liquidity products 462 404 397 14% 16% investments funds and other Wealth 30% 15% management $ 1,859 $ 1,762 $ 1,542 6% 21% Firmwide AUS EMEA Equity 23% 32% Public funds 3,4,6 Liquidity Long-Term AUS Net Flows ($ in billions) Third-party 25% products 33% distributed $69 Americas 76% Separate 58% Fixed accounts income 42% Institutional 37% $20 $17 $3 $2 9 4Q18 1Q19 2Q19 3Q19 4Q19Firmwide Assets Under Supervision 3,4 3,4 Firmwide Assets Under Supervision Assets Under Supervision Highlights By Segment vs. vs. 6 n Firmwide AUS increased $317 billion in 2019 to a record $1.86 trillion, including Asset Management $ in billions 4Q19 3Q19 4Q18 3Q19 4Q18 6 6 AUS increasing $211 billion and Consumer & Wealth Management increasing $106 billion $ 1,298 $ 1,232 $ 1,087 5% 19% Asset Management — Long-term net inflows of $108 billion, primarily in fixed income and equity assets Consumer & Wealth Management 561 530 455 6% 23% — Liquidity products net inflows of $65 billion Firmwide AUS $ 1,859 $ 1,762 $ 1,542 6% 21% — Net market appreciation of $144 billion, primarily in equity and fixed income assets n Over past five years, total cumulative organic long-term AUS net inflows of ~$195 billion By Asset Class vs. vs. $ in billions 4Q19 3Q19 4Q18 3Q19 4Q18 $ 185 $ 182 $ 167 2% 11% Alternative investments 3,4 4Q19 AUS Mix 423 392 301 8% 41% Equity Asset Distribution Fixed income 789 784 677 1% 17% Region Vehicle Class Channel Long-term AUS 1,397 1,358 1,145 3% 22% Private Alternative 9% 10% 10% Asia Liquidity products 462 404 397 14% 16% investments funds and other Wealth 30% 15% management $ 1,859 $ 1,762 $ 1,542 6% 21% Firmwide AUS EMEA Equity 23% 32% Public funds 3,4,6 Liquidity Long-Term AUS Net Flows ($ in billions) Third-party 25% products 33% distributed $69 Americas 76% Separate 58% Fixed accounts income 42% Institutional 37% $20 $17 $3 $2 9 4Q18 1Q19 2Q19 3Q19 4Q19

Net Interest Income and Loans 4 Net Interest Income by Segment ($ in millions) Loans $ in billions 4Q19 3Q19 4Q18 $4,362 Corporate $ 46 $ 46 $ 42 $3,767 Commercial real estate 17 16 14 $1,661 7 7 8 Residential real estate $1,356 $1,065 $1,008 $991 Real estate 24 23 22 $511 $482 $444 28 26 25 Wealth management $375 $425 Consumer 5 5 5 $136 $1,670 $165 $124 $1,607 Credit cards 2 1 - $316 $314 $388 Other 5 5 5 $520 $143 $142 $322 $92 Allowance for loan and lease losses (1) (1) (1) 2018 2019 4Q18 3Q19 4Q19 $ 109 $ 105 $ 98 Total Loans Consumer & Wealth Management Asset Management Global Markets Investment Banking Net Interest Income Highlights Loan Highlights n Total loans increased $11 billion, up 11%, during 2019 n 2019 net interest income increased $595 million YoY, reflecting growth in loans n Provision for credit losses was $1.07 billion for 2019, 58% higher YoY, primarily reflecting higher n 4Q19 net interest income increased $74 million YoY, reflecting growth in loans impairments (primarily related to corporate loans) and higher provisions related to consumer loans (reflecting growth in credit card loans). The 2019 firmwide net charge-off rate was 0.6% n Provision for credit losses was $336 million for 4Q19, 51% higher YoY, primarily reflecting higher impairments (primarily related to corporate loans). The 4Q19 annualized firmwide net charge-off rate was 0.7% 10Net Interest Income and Loans 4 Net Interest Income by Segment ($ in millions) Loans $ in billions 4Q19 3Q19 4Q18 $4,362 Corporate $ 46 $ 46 $ 42 $3,767 Commercial real estate 17 16 14 $1,661 7 7 8 Residential real estate $1,356 $1,065 $1,008 $991 Real estate 24 23 22 $511 $482 $444 28 26 25 Wealth management $375 $425 Consumer 5 5 5 $136 $1,670 $165 $124 $1,607 Credit cards 2 1 - $316 $314 $388 Other 5 5 5 $520 $143 $142 $322 $92 Allowance for loan and lease losses (1) (1) (1) 2018 2019 4Q18 3Q19 4Q19 $ 109 $ 105 $ 98 Total Loans Consumer & Wealth Management Asset Management Global Markets Investment Banking Net Interest Income Highlights Loan Highlights n Total loans increased $11 billion, up 11%, during 2019 n 2019 net interest income increased $595 million YoY, reflecting growth in loans n Provision for credit losses was $1.07 billion for 2019, 58% higher YoY, primarily reflecting higher n 4Q19 net interest income increased $74 million YoY, reflecting growth in loans impairments (primarily related to corporate loans) and higher provisions related to consumer loans (reflecting growth in credit card loans). The 2019 firmwide net charge-off rate was 0.6% n Provision for credit losses was $336 million for 4Q19, 51% higher YoY, primarily reflecting higher impairments (primarily related to corporate loans). The 4Q19 annualized firmwide net charge-off rate was 0.7% 10

Expenses Expense Highlights Financial Results n 2019 total operating expenses increased YoY, reflecting: vs. vs. vs. 4Q19 3Q19 4Q18 2019 2018 $ in millions — Higher non-compensation expenses, which included: Compensation and benefits $ 3,046 12% 64% $ 12,353 -% o Significantly higher net provisions for litigation and regulatory proceedings ($1.24 billion in 2019 vs. $844 million in 2018) Brokerage, clearing, exchange and o Higher expenses for consolidated investments and technology (primarily reflected in 814 -5% -2% 3,252 2% distribution fees depreciation and amortization, communications and technology, occupancy, and other expenses) Market development 200 18% -4% 739 -% o Higher expenses related to the firm’s credit card and transaction banking activities (primarily reflected in professional fees and other expenses) and expenses related to United Capital Communications and technology 308 9% 18% 1,167 14% — Compensation and benefits expenses were essentially unchanged n 2019 effective income tax rate of 20.0%, up from 16.2% for 2018, as 2018 included a $487 million Depreciation and amortization 464 -2% 23% 1,704 28% income tax benefit related to the finalization of the enactment impact of the Tax Cuts and Jobs Act — 2020 effective tax rate expected to be ~21% Occupancy 318 26% 48% 1,029 27% 3 366 5% 15% 1,316 8% Efficiency Ratio Professional fees 68% 64% Other expenses 1,782 N.M. 64% 3,338 18% Total operating expenses $ 7,298 30% 42% $ 24,898 6% Provision for taxes $ 404 -25% 138% $ 2,117 5% Effective Tax Rate 20.0% 3.8pp 2018 2019 Impact of Litigation: +2.3pp +3.4pp 11Expenses Expense Highlights Financial Results n 2019 total operating expenses increased YoY, reflecting: vs. vs. vs. 4Q19 3Q19 4Q18 2019 2018 $ in millions — Higher non-compensation expenses, which included: Compensation and benefits $ 3,046 12% 64% $ 12,353 -% o Significantly higher net provisions for litigation and regulatory proceedings ($1.24 billion in 2019 vs. $844 million in 2018) Brokerage, clearing, exchange and o Higher expenses for consolidated investments and technology (primarily reflected in 814 -5% -2% 3,252 2% distribution fees depreciation and amortization, communications and technology, occupancy, and other expenses) Market development 200 18% -4% 739 -% o Higher expenses related to the firm’s credit card and transaction banking activities (primarily reflected in professional fees and other expenses) and expenses related to United Capital Communications and technology 308 9% 18% 1,167 14% — Compensation and benefits expenses were essentially unchanged n 2019 effective income tax rate of 20.0%, up from 16.2% for 2018, as 2018 included a $487 million Depreciation and amortization 464 -2% 23% 1,704 28% income tax benefit related to the finalization of the enactment impact of the Tax Cuts and Jobs Act — 2020 effective tax rate expected to be ~21% Occupancy 318 26% 48% 1,029 27% 3 366 5% 15% 1,316 8% Efficiency Ratio Professional fees 68% 64% Other expenses 1,782 N.M. 64% 3,338 18% Total operating expenses $ 7,298 30% 42% $ 24,898 6% Provision for taxes $ 404 -25% 138% $ 2,117 5% Effective Tax Rate 20.0% 3.8pp 2018 2019 Impact of Litigation: +2.3pp +3.4pp 11

Capital and Balance Sheet 3,4 Capital Capital and Balance Sheet Highlights 4Q19 3Q19 4Q18n Advanced CET1 ratio increased YoY, while Standardized CET1 ratio was unchanged $ in billions Common equity tier 1 (CET1) capital $ 74.9 $ 75.7 $ 73.1 — Decrease in Advanced RWAs reflected lower credit RWAs driven by updates to the firm’s 7 calculation of loss given default Standardized RWAs $ 564 $ 557 $ 548 — Increase in Standardized RWAs reflected higher credit RWAs n Returned $6.88 billion of capital to common shareholders during the year Standardized CET1 capital ratio 13.3% 13.6% 13.3% — Paid $1.54 billion in common stock dividends Advanced RWAs $ 545 $ 566 $ 558 3 — Repurchased 25.8 million shares of common stock, for a total cost of $5.34 billion 7 Advanced CET1 capital ratio 13.7% 13.4% 13.1% n Maintained highly liquid balance sheet and robust liquidity metrics Supplementary leverage ratio 6.2% 6.2% 6.2% — Deposits increased $32 billion, reflecting strong growth in Consumer deposits — Continue to expect vanilla debt maturities to outpace issuance in 2020 although to a lesser extent than in 2019 4 Selected Balance Sheet Data $ in billions 4Q19 3Q19 4Q18 Book Value Total assets $ 993 $ 1,007 $ 932 In millions, except per share amounts 4Q19 3Q19 4Q18 Deposits 190 183 158 3 Basic shares 361.8 369.3 380.9 Unsecured long-term borrowings 207 217 224 Book value per common share $ 218.52 $ 218.82 $ 207.36 Shareholders’ equity 90 92 90 1 Tangible book value per common share $ 205.15 $ 205.59 $ 196.64 Average GCLA 237 238 229 12Capital and Balance Sheet 3,4 Capital Capital and Balance Sheet Highlights 4Q19 3Q19 4Q18n Advanced CET1 ratio increased YoY, while Standardized CET1 ratio was unchanged $ in billions Common equity tier 1 (CET1) capital $ 74.9 $ 75.7 $ 73.1 — Decrease in Advanced RWAs reflected lower credit RWAs driven by updates to the firm’s 7 calculation of loss given default Standardized RWAs $ 564 $ 557 $ 548 — Increase in Standardized RWAs reflected higher credit RWAs n Returned $6.88 billion of capital to common shareholders during the year Standardized CET1 capital ratio 13.3% 13.6% 13.3% — Paid $1.54 billion in common stock dividends Advanced RWAs $ 545 $ 566 $ 558 3 — Repurchased 25.8 million shares of common stock, for a total cost of $5.34 billion 7 Advanced CET1 capital ratio 13.7% 13.4% 13.1% n Maintained highly liquid balance sheet and robust liquidity metrics Supplementary leverage ratio 6.2% 6.2% 6.2% — Deposits increased $32 billion, reflecting strong growth in Consumer deposits — Continue to expect vanilla debt maturities to outpace issuance in 2020 although to a lesser extent than in 2019 4 Selected Balance Sheet Data $ in billions 4Q19 3Q19 4Q18 Book Value Total assets $ 993 $ 1,007 $ 932 In millions, except per share amounts 4Q19 3Q19 4Q18 Deposits 190 183 158 3 Basic shares 361.8 369.3 380.9 Unsecured long-term borrowings 207 217 224 Book value per common share $ 218.52 $ 218.82 $ 207.36 Shareholders’ equity 90 92 90 1 Tangible book value per common share $ 205.15 $ 205.59 $ 196.64 Average GCLA 237 238 229 12

Cautionary Note on Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these statements. For information about some of the risks and important factors that could affect the firm’s future results and financial condition and the forward-looking statements below, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10- K for the year ended December 31, 2018. Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets (GCLA) and the impact of adopting ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326) – Measurement of Credit Losses on Financial Instruments” consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements. Statements regarding (i) the firm’s planned 2020 vanilla debt issuance, (ii) the firm’s 2020 effective income tax rate, (iii) estimated GDP growth, (iv) the timing and profitability of business initiatives, (v) the level of future compensation expense as a percentage of operating expenses, (vi) the firm’s investment banking transaction backlog, and (vii) the projected growth of the firm’s deposits and associated interest expense savings are forward-looking statements. Statements regarding the firm’s planned 2020 vanilla debt issuance are subject to the risk that actual issuances may differ, possibly materially, due to changes in market conditions, business opportunities or the firm’s funding needs. Statements about the firm's expected 2020 effective income tax rate are subject to the risk that the firm's 2020 effective income tax rate may differ from the anticipated rate indicated, possibly materially, due to, among other things, changes in the firm's earnings mix or profitability, the entities in which the firm generates profits and the assumptions made in forecasting the firm’s expected tax rate and potential future guidance from the U.S. IRS. Statements regarding estimated GDP growth are subject to the risk that actual GDP growth may differ, possibly materially, due to, among other things, changes in general economic conditions. Statements about the timing and benefits of business initiatives are based on the firm’s current expectations regarding our ability to implement these initiatives and may change, possibly materially, from what is currently expected. Statements about the level of compensation expense, including as a percentage of operating expenses, as the firm's platform business initiatives reach scale are subject to the risks that the compensation costs to operate the firm's businesses, including platform initiatives, may be greater than currently expected. Statements about the firm’s investment banking transaction backlog are subject to the risk that transactions may be modified or not completed at all and associated net revenues may not be realized or may be materially less than those currently expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, an outbreak of hostilities, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. Statements regarding the projected growth of the firm’s deposits and associated interest expense savings are subject to the risk that the actual growth and savings may differ, possibly materially, due to, among other things, market conditions and competition from other similar products. 13Cautionary Note on Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these statements. For information about some of the risks and important factors that could affect the firm’s future results and financial condition and the forward-looking statements below, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10- K for the year ended December 31, 2018. Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets (GCLA) and the impact of adopting ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326) – Measurement of Credit Losses on Financial Instruments” consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements. Statements regarding (i) the firm’s planned 2020 vanilla debt issuance, (ii) the firm’s 2020 effective income tax rate, (iii) estimated GDP growth, (iv) the timing and profitability of business initiatives, (v) the level of future compensation expense as a percentage of operating expenses, (vi) the firm’s investment banking transaction backlog, and (vii) the projected growth of the firm’s deposits and associated interest expense savings are forward-looking statements. Statements regarding the firm’s planned 2020 vanilla debt issuance are subject to the risk that actual issuances may differ, possibly materially, due to changes in market conditions, business opportunities or the firm’s funding needs. Statements about the firm's expected 2020 effective income tax rate are subject to the risk that the firm's 2020 effective income tax rate may differ from the anticipated rate indicated, possibly materially, due to, among other things, changes in the firm's earnings mix or profitability, the entities in which the firm generates profits and the assumptions made in forecasting the firm’s expected tax rate and potential future guidance from the U.S. IRS. Statements regarding estimated GDP growth are subject to the risk that actual GDP growth may differ, possibly materially, due to, among other things, changes in general economic conditions. Statements about the timing and benefits of business initiatives are based on the firm’s current expectations regarding our ability to implement these initiatives and may change, possibly materially, from what is currently expected. Statements about the level of compensation expense, including as a percentage of operating expenses, as the firm's platform business initiatives reach scale are subject to the risks that the compensation costs to operate the firm's businesses, including platform initiatives, may be greater than currently expected. Statements about the firm’s investment banking transaction backlog are subject to the risk that transactions may be modified or not completed at all and associated net revenues may not be realized or may be materially less than those currently expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, an outbreak of hostilities, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. Statements regarding the projected growth of the firm’s deposits and associated interest expense savings are subject to the risk that the actual growth and savings may differ, possibly materially, due to, among other things, market conditions and competition from other similar products. 13

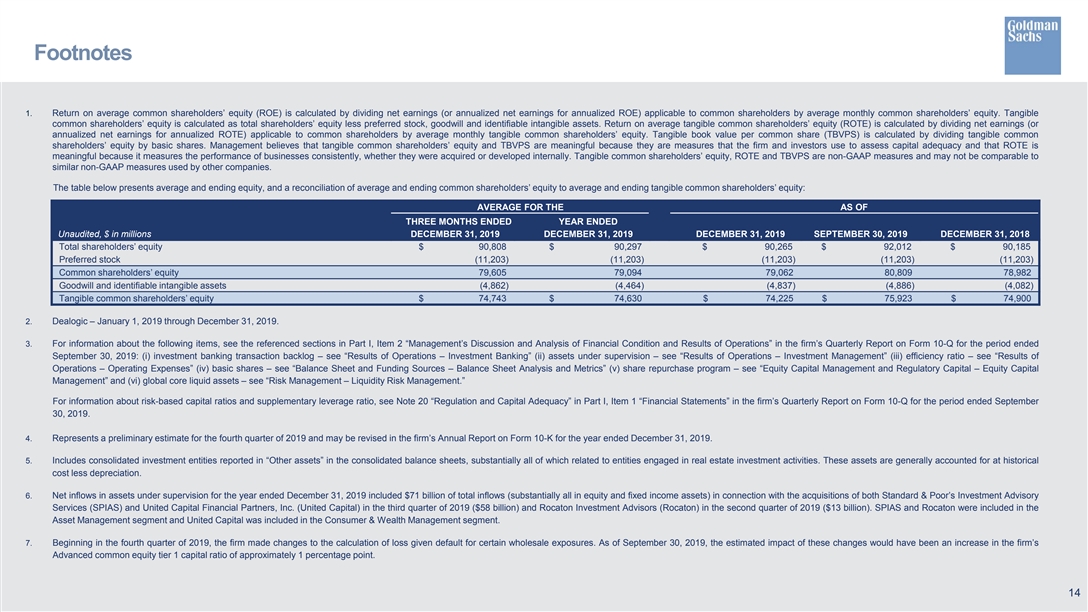

Footnotes 1. Return on average common shareholders’ equity (ROE) is calculated by dividing net earnings (or annualized net earnings for annualized ROE) applicable to common shareholders by average monthly common shareholders’ equity. Tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets. Return on average tangible common shareholders’ equity (ROTE) is calculated by dividing net earnings (or annualized net earnings for annualized ROTE) applicable to common shareholders by average monthly tangible common shareholders’ equity. Tangible book value per common share (TBVPS) is calculated by dividing tangible common shareholders’ equity by basic shares. Management believes that tangible common shareholders’ equity and TBVPS are meaningful because they are measures that the firm and investors use to assess capital adequacy and that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally. Tangible common shareholders’ equity, ROTE and TBVPS are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. The table below presents average and ending equity, and a reconciliation of average and ending common shareholders’ equity to average and ending tangible common shareholders’ equity: AVERAGE FOR THE AS OF THREE MONTHS ENDED YEAR ENDED Unaudited, $ in millions DECEMBER 31, 2019 DECEMBER 31, 2019 DECEMBER 31, 2019 SEPTEMBER 30, 2019 DECEMBER 31, 2018 Total shareholders’ equity $ 90,808 $ 90,297 $ 90,265 $ 92,012 $ 90,185 Preferred stock (11,203) (11,203) (11,203) (11,203) (11,203) Common shareholders’ equity 79,605 79,094 79,062 80,809 78,982 Goodwill and identifiable intangible assets (4,862) (4,464) (4,837) (4,886) (4,082) Tangible common shareholders’ equity $ 74,743 $ 74,630 $ 74,225 $ 75,923 $ 74,900 2. Dealogic – January 1, 2019 through December 31, 2019. 3. For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2019: (i) investment banking transaction backlog – see “Results of Operations – Investment Banking” (ii) assets under supervision – see “Results of Operations – Investment Management” (iii) efficiency ratio – see “Results of Operations – Operating Expenses” (iv) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” (v) share repurchase program – see “Equity Capital Management and Regulatory Capital – Equity Capital Management” and (vi) global core liquid assets – see “Risk Management – Liquidity Risk Management.” For information about risk-based capital ratios and supplementary leverage ratio, see Note 20 “Regulation and Capital Adequacy” in Part I, Item 1 “Financial Statements” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2019. 4. Represents a preliminary estimate for the fourth quarter of 2019 and may be revised in the firm’s Annual Report on Form 10-K for the year ended December 31, 2019. 5. Includes consolidated investment entities reported in “Other assets” in the consolidated balance sheets, substantially all of which related to entities engaged in real estate investment activities. These assets are generally accounted for at historical cost less depreciation. 6. Net inflows in assets under supervision for the year ended December 31, 2019 included $71 billion of total inflows (substantially all in equity and fixed income assets) in connection with the acquisitions of both Standard & Poor’s Investment Advisory Services (SPIAS) and United Capital Financial Partners, Inc. (United Capital) in the third quarter of 2019 ($58 billion) and Rocaton Investment Advisors (Rocaton) in the second quarter of 2019 ($13 billion). SPIAS and Rocaton were included in the Asset Management segment and United Capital was included in the Consumer & Wealth Management segment. 7. Beginning in the fourth quarter of 2019, the firm made changes to the calculation of loss given default for certain wholesale exposures. As of September 30, 2019, the estimated impact of these changes would have been an increase in the firm’s Advanced common equity tier 1 capital ratio of approximately 1 percentage point. 14Footnotes 1. Return on average common shareholders’ equity (ROE) is calculated by dividing net earnings (or annualized net earnings for annualized ROE) applicable to common shareholders by average monthly common shareholders’ equity. Tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets. Return on average tangible common shareholders’ equity (ROTE) is calculated by dividing net earnings (or annualized net earnings for annualized ROTE) applicable to common shareholders by average monthly tangible common shareholders’ equity. Tangible book value per common share (TBVPS) is calculated by dividing tangible common shareholders’ equity by basic shares. Management believes that tangible common shareholders’ equity and TBVPS are meaningful because they are measures that the firm and investors use to assess capital adequacy and that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally. Tangible common shareholders’ equity, ROTE and TBVPS are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. The table below presents average and ending equity, and a reconciliation of average and ending common shareholders’ equity to average and ending tangible common shareholders’ equity: AVERAGE FOR THE AS OF THREE MONTHS ENDED YEAR ENDED Unaudited, $ in millions DECEMBER 31, 2019 DECEMBER 31, 2019 DECEMBER 31, 2019 SEPTEMBER 30, 2019 DECEMBER 31, 2018 Total shareholders’ equity $ 90,808 $ 90,297 $ 90,265 $ 92,012 $ 90,185 Preferred stock (11,203) (11,203) (11,203) (11,203) (11,203) Common shareholders’ equity 79,605 79,094 79,062 80,809 78,982 Goodwill and identifiable intangible assets (4,862) (4,464) (4,837) (4,886) (4,082) Tangible common shareholders’ equity $ 74,743 $ 74,630 $ 74,225 $ 75,923 $ 74,900 2. Dealogic – January 1, 2019 through December 31, 2019. 3. For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2019: (i) investment banking transaction backlog – see “Results of Operations – Investment Banking” (ii) assets under supervision – see “Results of Operations – Investment Management” (iii) efficiency ratio – see “Results of Operations – Operating Expenses” (iv) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” (v) share repurchase program – see “Equity Capital Management and Regulatory Capital – Equity Capital Management” and (vi) global core liquid assets – see “Risk Management – Liquidity Risk Management.” For information about risk-based capital ratios and supplementary leverage ratio, see Note 20 “Regulation and Capital Adequacy” in Part I, Item 1 “Financial Statements” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2019. 4. Represents a preliminary estimate for the fourth quarter of 2019 and may be revised in the firm’s Annual Report on Form 10-K for the year ended December 31, 2019. 5. Includes consolidated investment entities reported in “Other assets” in the consolidated balance sheets, substantially all of which related to entities engaged in real estate investment activities. These assets are generally accounted for at historical cost less depreciation. 6. Net inflows in assets under supervision for the year ended December 31, 2019 included $71 billion of total inflows (substantially all in equity and fixed income assets) in connection with the acquisitions of both Standard & Poor’s Investment Advisory Services (SPIAS) and United Capital Financial Partners, Inc. (United Capital) in the third quarter of 2019 ($58 billion) and Rocaton Investment Advisors (Rocaton) in the second quarter of 2019 ($13 billion). SPIAS and Rocaton were included in the Asset Management segment and United Capital was included in the Consumer & Wealth Management segment. 7. Beginning in the fourth quarter of 2019, the firm made changes to the calculation of loss given default for certain wholesale exposures. As of September 30, 2019, the estimated impact of these changes would have been an increase in the firm’s Advanced common equity tier 1 capital ratio of approximately 1 percentage point. 14