Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - MYOMO, INC. | d850023dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 14, 2020.

Registration No.333-235538

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MYOMO, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 3842 | 47-0944526 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

One Broadway, 14th Floor

Cambridge, Massachusetts 02142 (617) 996-9058

(Address, including zip code and telephone number, including area code, of Registrant’s principal executive offices)

Paul R. Gudonis

President and Chief Executive Officer Myomo, Inc.

One Broadway, 14th Floor Cambridge, Massachusetts 02142

(617) 996-9058

(Name, address, including zip code and telephone number, including area code of agent for service)

Copies to:

| Mitchell S. Bloom, Esq. James Xu, Esq. Goodwin Procter LLP 100 Northern Avenue Boston, Massachusetts 02210 (617) 570-1000 |

Paul R. Gudonis President and Chief Executive Officer Myomo, Inc. One Broadway, 14th Floor Cambridge, Massachusetts 02142 (617) 996-9058 |

Steven M. Skolnick, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, or Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, or the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Stock, $0.0001 par value per share(2) |

||||

| Investor warrants to purchase common stock(2) |

(4) | |||

| Common stock, $0.0001 par value per share, underlying the investor warrants to purchase common stock(5) |

||||

| Pre-funded warrants to purchase common stock(2) |

(4) | |||

| Common stock, $0.0001 par value per share, underlying the pre-funded warrants to purchase common stock(5) |

||||

| Underwriter warrant(3) |

(4) | |||

| Common stock, $0.0001 par value per share, underlying the underwriter warrant(5) |

||||

| Total |

$13,500,000 | $1,752.30(6) | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of any additional shares of common stock and warrants that the underwriter has an option to purchase to cover over-allotments, if any. |

| (3) | Represents an underwriter warrant to purchase up to an aggregate of 5% of the shares of common stock and the shares of common stock underlying the warrants sold in this offering, at an exercise price equal to the combined public offering price per share of common stock and related warrant paid by investors in the offering. The underwriter warrant is exercisable six months from the date of issuance and will expire five years from the date of issuance. Resales of the shares issuable upon exercise of the underwriter warrant on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, are registered hereby. See “Underwriting.” |

| (4) | No fee required pursuant to Rule 457(g). |

| (5) | Pursuant to Rule 416 under the Securities Act, there are also being registered such additional securities as may be issued to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (6) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated January 14, 2020

PROSPECTUS

Shares of Common Stock

Warrants to Purchase up to Shares of Common Stock

Pre-Funded Warrants to Purchase up to Shares of Common Stock

We are offering shares of common stock and warrants to purchase up to shares of common stock, which we refer to as “investor warrants.” Each share of our common stock is being sold with investor warrants to purchase one share of our common stock, at an assumed combined offering price of $ per share of common stock and accompanying investor warrant (the last reported sale price of our common stock on the NYSE American on January , 2020), representing an offering price of $ per share of common stock and $0.01 per accompanying investor warrant. The investor warrants are exercisable from and after the date of their issuance and expire on the fifth anniversary of such date, at an exercise price per whole share of common stock equal to % of the combined public offering price per share of common stock and related investor warrant in this offering. The shares of common stock and investor warrants will be issued separately.

We are also offering to those investors whose purchase of the common stock and investor warrants described above in this offering would result in such investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock following the consummation of this offering, the opportunity to purchase, in lieu of the common stock and investor warrants that would otherwise result in their ownership exceeding their threshold, pre-funded warrants to purchase one share of our common stock, which we refer to as pre-funded warrants. Each full pre-funded warrant is being sold with investor warrants to purchase one share of our common stock, at an assumed combined offering price of $ per pre-funded warrant and accompanying investor warrant (the last reported sale price of our common stock on the NYSE American on January , 2020), representing an offering price of $ per pre-funded warrant and $0.01 per accompanying investor warrant. The pre-funded warrants and investor warrants will be issued separately.

Each pre-funded warrant to purchase shares of common stock will be immediately exercisable and will be exercisable until the pre-funded warrant is exercised in full. The exercise price of each pre-funded warrant will be pre-paid, except for a nominal exercise price of $0.0001 per share of common stock, upon issuance of the pre-funded warrants and, consequently, no additional payment or other consideration (other than the nominal exercise price of $0.0001 per share) will be required to be delivered to us by the holder upon exercise.

Our common stock is listed on the NYSE American under the symbol “MYO.” The last reported sale price of our common stock on January , 2020 was $ per share. There is no established trading market for any of the investor warrants or the pre-funded warrants and we do not expect a market to develop. We do not intend to apply for a listing for any of the investor warrants or the pre-funded warrants on any national securities exchange.

We are an “emerging growth company” federal securities laws and, as such, are subject to reduced public company disclosure standards for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus to read about the factors you should consider before buying our securities.

| Per Share | Per Pre-Funded Warrant |

Per Investor Warrant |

Total | |||||||||||||

| Public offering price |

$ | $ | $ | $ | ||||||||||||

| Underwriting discounts and commissions(1) |

$ | $ | $ | $ | ||||||||||||

| Proceeds, before expenses, to us |

$ | $ | $ | $ | ||||||||||||

| (1) | We have agreed to reimburse certain expenses of the underwriter. We have also agreed to issue to Roth Capital Partners, LLC., the underwriter in this offering, a warrant, which we refer to as the underwriter warrant, to purchase up to that number of shares of our common stock that equates to 5.0% of the number of shares of our common stock to be issued and sold in this offering, including the shares of common stock issuable upon the exercise of investor warrants and pre-funded warrants issued to investors in this offering (including shares issuable upon exercise of the over-allotment option described below). See “Underwriting” for a description of the compensation to be received by the underwriter. |

We have granted the underwriter an option to purchase up to an additional shares of common stock, pre-funded warrants and/or investor warrants to purchase up to shares of common stock, in any combinations thereof, from us at the public offering price per security less the underwriting discounts and commissions, to cover over-allotments, if any. The underwriter may exercise this option at any time during the 45-day period from the date of this prospectus. See “Underwriting” on page of this prospectus for a description of the over-allotment option.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares, pre-funded and investor warrants to investors against payment on or about , 2020.

Roth Capital Partners

The date of this prospectus is , 2020.

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

42 | |||

| 58 | ||||

| 72 | ||||

| 79 | ||||

| 87 | ||||

| 88 | ||||

| 90 | ||||

| 98 | ||||

| 105 | ||||

| 110 | ||||

| 110 | ||||

| 110 | ||||

| F-1 | ||||

We and the underwriter are offering to sell, and seeking offers to buy, the securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this prospectus or in any free writing prospectus that we file with the Securities and Exchange Commission. Neither we nor the underwriter has authorized anyone to provide you with any information other than the information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information contained in this prospectus is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities.

Unless otherwise indicated, data contained in this prospectus concerning the orthotics and prosthetics market and the other markets relevant to our operations are based on information from various public sources. Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this prospectus, unless the context indicates otherwise, references to “Myomo,” “we,” the “Company,” “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of Myomo, Inc.

i

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire prospectus, including the risks associated with an investment in our Company discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Overview

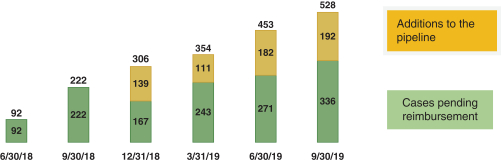

We are a commercial stage medical device company in the medical robotics industry, specializing in myoelectric braces, or orthotics, for people with neuromuscular disorders. We develop and market the MyoPro product line. MyoPro is a powered upper limb orthosis designed to help restore function to the weakened or paralyzed arms of adult or adolescent patients, which can include those impacted by cardiovascular accident, or CVA stroke, brachial plexus injury, traumatic brain injury, spinal cord injury, amyotrophic lateral sclerosis, or ALS or other neuromuscular disease or injury. It is currently the only marketed device that, sensing a patient’s own electromyography, or EMG, signals through non-invasive sensors on the arm, can help improve an individual’s ability to perform activities of daily living, including feeding themselves, carrying objects and doing household tasks. Many are potentially able to return to work, live independently and reduce their cost of care. It is custom constructed by a qualified professional during a custom fabrication process for each individual user to meet their specific needs. To date, we have been reimbursed by many of the largest commercial health insurers, as well as several state Medicaid plans and more than 40 Veterans Administration, or VA hospitals. As of September 30, 2019, more than 950 units have been delivered to patients or clinical facilities. Recently, we shifted the focus of our marketing efforts toward direct-to-patient marketing and direct billing of the MyoPro to insurers, in addition to our O&P provider channel, which has increased our mix of direct billing patients in our backlog. We believe that this shift, while causing a short-term lag in revenue recognition in the quarter ended September 30, 2019, will lead to higher revenue growth and gross margins in the long-term. During the quarter ended September 30, 2019, our reimbursement pipeline grew by a record 192 MyoPro units as we expanded our direct-to-patient marketing efforts. Our total reimbursement pipeline as of September 30, 2019 stands at 528 MyoPro units, of which direct billing units account for 43%.

Our solution is the MyoPro custom fabricated limb orthosis pictured above. It was originally pioneered in the 1960s, later refined in the labs of the Massachusetts Institute of Technology, or MIT, and made commercially feasible through our efforts. Partial paralysis is severe muscle weakness or loss of voluntary movement in one or

1

Table of Contents

more parts of the body. The MyoPro is listed with the Food and Drug Administration, or FDA as a Class II device (powered limb orthosis with biofeedback). We believe it is the only current device able to help neuromuscular-impaired adults and adolescents restore function in weak arms and hands using their own muscle signals. The device consists of a portable arm brace made of a lightweight aerospace metal, and includes advanced signal processing software, non-invasive sensors, and a lightweight battery unit. The product is worn to support the dysfunctional joint and as a functional aid for reaching and grasping, but has also been shown to have therapeutic benefits for some users to increase motor control.

The MyoPro’s control technology utilizes an advanced non-invasive human-machine interface based on non-invasive, patented, EMG control technology that continuously monitors and senses, but does not stimulate, the affected muscles. The patient self-initiates movement through their weakened muscle signals that indicate the intention to move. In addition to supporting the weakened limb, the MyoPro functions as a neuro-muscular prosthetic by helping restore function to the impaired limb similar to a myoelectric prosthetic for an amputee. It is prescribed by physicians and provided by clinical professionals trained to fit these custom fabricated myoelectric elbow-wrist-hand orthoses.

In addition to stroke patients, we believe our technology may be used to help improve upper extremity movement in patients affected by diagnoses such as peripheral nerve injury, spinal cord injury, other neurological disorders, cerebral palsy, muscular dystrophy and traumatic brain injury.

Our strategy is to establish ourselves as the market leader in myoelectric limb orthotics, and to build a set of products, software applications, and value-added services based upon our patented technology platform. We believe the market opportunity for our products is approximately $10 billion in the United States alone and $30 billion worldwide. While we currently focus on upper extremity orthotics, we anticipate that our future products may include devices for the shoulder, leg, knee, and ankle, sized for both adults and children, along with non-medical applications for industrial and military markets.

We are the exclusive licensee of two U.S. patents for the myoelectric limb orthosis device based on technology originally developed at MIT in collaboration with medical experts affiliated with Harvard Medical School. We hold a total of 11 issued patents in the U.S. and various countries and have 8 pending patent applications. Our devices are currently referred for patients at leading rehabilitation facilities, including, among others, the Mayo Clinic, Cleveland Clinic, Walter Reed National Military Medical Center, and VA hospitals across the country.

We believe that we are the only upper extremity product available in the market today that can help people afflicted with stroke or other traumatic arm injury to regain use of their arms, so that they may resume many activities of daily living. We have grown our pipeline of potential patients by nearly six times since June 30, 2018, through our direct-to-patient advertising on platforms such as Google and Facebook.

2

Table of Contents

We expect to continue to grow our pipeline of potential candidates for the MyoPro, which could lead to potential revenue growth in 2020 and beyond. Additional growth catalysts include (i) obtaining coverage and allowable fee from the Centers for Medicare and Medicaid Services, or CMS, which would expand our available market opportunity; (ii) introducing of a pediatric version of the MyoPro, which we refer to as the MyoPal, during the first half of 2020, and (iii) continuing international expansion.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include the following:

| • | We have a history of operating losses and our financial statements for the nine months ended September 30, 2019 and the fiscal year ended December 31, 2018 include disclosures regarding there being substantial doubt about our ability to continue as a going concern. |

| • | We may not have sufficient funds to meet our future capital requirements. |

| • | We depend on certain patents that are licensed to us. We do not control these patents and any loss of our rights to them could prevent us from manufacturing our products. |

| • | We currently rely, and in the future will rely, on sales of our MyoPro products for our revenue, and we may not be able to achieve or maintain market acceptance. |

| • | We depend on a single third party to manufacture the MyoPro and a limited number of third-party suppliers for certain components of the MyoPro. |

| • | We depend on a related third-party to provide the custom fabrication of the MyoPro. |

| • | The market for myoelectric braces is new and the rate of adoption is uncertain, and important assumptions about the potential market for our products may be inaccurate. |

| • | Defects in our products or the software that drives them could adversely affect the results of our operations. |

| • | We are subject to extensive governmental regulations relating to the design, development, manufacturing, labeling and marketing of our products, and a failure to comply with such regulations could lead to withdrawal or recall of our products from the market. |

Implications of Being an “Emerging Growth Company”

As a public reporting company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or JOBS Act. We have elected to avail ourselves of this provision of the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| • | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| • | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); |

| • | are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

3

Table of Contents

| • | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure; |

| • | may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations, or MD&A; and |

| • | are eligible to claim longer phase-in periods for the adoption of certain new or revised financial accounting standards under §107 of the JOBS Act. |

For so long as we continue to be an emerging growth company, we intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of certain new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under the Securities and Exchange Commission’s, or Commission’s, rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or chief executive officer pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, or the Securities Act, which includes the registration statement of which this prospectus forms a part, or such earlier time that we no longer meet the definition of an emerging growth company. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period. Furthermore, under current Commission rules, we will continue to qualify as a “smaller reporting company” for so long as we have (i) a public float (i.e., the market value of common equity held by non-affiliates) of less than $250 million as of the last business day of our most recently completed second fiscal quarter or (ii) (A) if we have no public float or a public float of less than $700 million and (B) annual revenues of less than $100 million during our most recently completed fiscal year.

Company and Other Information

We were formed in the State of Delaware on September 1, 2004. Our principal executive office is One Broadway, 14th Floor, Cambridge, Massachusetts 02142. Our telephone number is (877) 736-9666. Our Internet address is www.myomo.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website a part of this prospectus.

We own various U.S. federal trademark registrations, certain foreign trademark registrations and applications, and unregistered trademarks, including the following registered marks referred to in this prospectus: “MyoPro®”, “MYOMO”®. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the symbols ® and ™, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent possible under applicable law, their rights thereto.

4

Table of Contents

THE OFFERING

| Common stock offered: |

shares |

| Common stock to be outstanding after this offering: |

shares (or shares if the underwriter’s option to purchase additional securities is exercised in full, but assuming no exercise of pre-funded warrants or investor warrants to purchase shares of common stock) |

| Investor warrants offered: |

Warrants to purchase up to shares of common stock, which will be exercisable during the period commencing on the date of their issuance and ending five years from such date at an exercise price per whole share of common stock equal to % of the combined public offering price per share of common stock and related warrant in this offering. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. There is no established public trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the warrants on any national securities exchange or other nationally recognized trading system. |

| Pre-funded warrants offered: |

We are also offering to those investors whose purchase of shares of common stock in this offering would result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock following the consummation of this offering the opportunity to purchase, in lieu of shares of our common stock, pre-funded warrants to purchase up shares of our common stock. Each full pre-funded warrant will entitle the holder to purchase one share of common stock. Each pre-funded warrant will have an exercise price of $ per share will be immediately exercisable and will be exercisable until the pre-funded warrant is exercised in full. The exercise price of the pre-funded warrant will be pre-paid, except for a nominal exercise price of $0.0001 per share of common stock, upon issuance of the pre-funded warrants and, consequently, no additional payment or other consideration (other than the nominal exercise price of $0.0001 per share) will be required to be delivered to us by the holder upon exercise. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants. There is currently no market for the pre-funded warrants and none is expected to develop after this offering. We do not intend to list the pre-funded warrants on any national securities exchange or other trading market. See “Description of Securities” for additional information. |

| Underwriter’s option to purchase additional securities: |

We have granted the underwriter a 45-day option to purchase up to an additional shares of common stock, pre-funded warrants to purchase up to shares of common stock, and/or investor warrants to purchase up to shares of common stock, at an exercise price per whole share equal to % of the combined public offering price per share of common stock and related warrant in this |

5

Table of Contents

| offering, in any combinations thereof, from us at the public offering price per security less the underwriting discounts and commissions, to cover over-allotments, if any, on the same terms as set forth in this prospectus. |

| Use of proceeds: |

We estimate that the net proceeds from the offering will be approximately $ million, based on an assumed offering price of $ per share of common stock and accompanying investor warrant (the last reported sale price of our common stock on the NYSE American on January , 2020), after deducting underwriting discount and commissions and offering expenses payable by us. If the underwriter exercises its over-allotment option in full to purchase additional securities, we estimate that the net proceeds from this offering will be approximately $ million, based on an assumed offering price of $ per share of common stock and accompanying investor warrant (the last reported sale price of our common stock on The NYSE American on January , 2020), after deducting underwriting discounts and commissions and offering expenses payable by us. We intend to use these net proceeds, together with our cash and cash equivalents to repay all or a portion of our indebtedness to Chicago Venture Partners, or CVP as required under our term loan with them, or the Term Loan, and for working capital and other general corporate purposes. See “Use of Proceeds” in this prospectus. |

| NYSE American symbol for common stock: |

“MYO” |

| Risk Factors: |

You should carefully read “Risk Factors” beginning on page and other information included in this prospectus for a discussion of factors that you should consider before deciding to invest in our securities. |

The number of shares of common stock to be outstanding after the offering is based on 17,188,929 shares of common stock outstanding as of September 30, 2019, and excludes:

| • | 5,435,287 shares issuable upon the exercise of warrants, with a weighted-average exercise price of $2.88 per share; |

| • | shares issuable upon the exercise of investor warrants in this offering accompanying the shares of common stock and pre-funded warrants sold in this offering, with an exercise price per whole share of common stock equal to % of the combined public offering price per share of common stock and related investor warrant in this offering; |

| • | shares issuable upon the exercise of pre-funded warrants in this offering, with a nominal exercise price per whole share of common stock equal to $0.0001; |

| • | shares issuable upon exercise of the underwriter warrant, with an exercise price equal to the combined public offering price per share of common stock and related investor warrant in this offering; |

| • | 668,785 shares issuable upon exercise of stock options outstanding under our 2018 Stock Option and Incentive Plan, or the 2018 Plan; |

6

Table of Contents

| • | 385,337 shares issuable upon vesting of restricted stock units, or RSU’s, outstanding under our 2018 Plan; |

| • | 10,266 shares of unvested restricted stock issued in August 2017 under our 2016 Equity Incentive Plan, with an average per share fair value of $6.75 on the date of grant, which shares were issued with lapsing forfeiture rights extending up to 48 months; |

| • | 502,010 shares reserved for future issuance under our 2018 Plan; and |

| • | shares of common stock to be issued to MIT under our license with MIT, or the MIT License. Under the MIT License, if the combined public offering price per share of common stock and related investor warrant in this offering is less than $ , MIT is entitled to additional shares of common stock. A $0.50 decrease in the combined public offering price per share of common stock and related investor warrant in this offering, if below $ , will entitle MIT to an additional shares of common stock. |

Unless expressly indicated or the context requires otherwise, all information in this prospectus is as of September 30, 2019, assumes no exercise of outstanding options to purchase common stock, or vesting of RSU’s after September 30, 2019 and gives no effect to the exercise of the underwriter’s option to purchase additional securities.

7

Table of Contents

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this prospectus, before purchasing our securities. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment.

Risks Associated with Our Business

We may experience significant fluctuations in our quarterly and annual results.

Fluctuations in our quarterly and annual financial results have resulted and will continue to result from numerous factors, including:

| • | timing, number and dollar value of reimbursements of our products by insurance payors; |

| • | changes in the mix of products we sell; |

| • | strategic actions by us, such as acquisitions of businesses, products, or technologies; |

| • | effects of domestic and foreign economic conditions and exchange rates on our industry and/or customers; |

| • | the divestiture or discontinuation of a product line or other revenue generating activity; |

| • | the relocation and integration of manufacturing operations and other strategic restructuring; |

| • | regulatory actions which may necessitate recalls of our products or warning letters that negatively affect the markets for our products; |

| • | costs incurred by us in connection with the termination of contractual and other relationships, including distributorships; |

| • | our ability to collect outstanding accounts receivable in selected countries outside of the United States; |

| • | the expiration or exhaustion of deferred tax assets such as net operating loss carry-forwards; |

| • | increased product and price competition, due to the regulatory landscape, market conditions or other factors; |

| • | market reception of our new or improved product offerings; and |

| • | the loss of any significant customer. |

These factors, some of which are not within our control, may cause the price of our common stock to fluctuate substantially. If our quarterly operating results fail to meet or exceed the expectations of securities analysts or investors, our stock price could drop suddenly and significantly. We believe quarterly comparisons of our financial results are not always meaningful and should not be relied upon as an indication of our future performance.

We currently rely, and in the future will rely, on sales of our MyoPro products for our revenue, and we may not be able to achieve or maintain market acceptance.

We currently rely, and in the future will rely, on sales of our MyoPro products for our revenue. MyoPro products are relatively new products, and market acceptance and adoption depend on educating people with limited upper extremity mobility and healthcare providers as to the distinct features, ease-of-use, improved quality of life and other benefits of MyoPro systems compared to alternative technologies and treatments. MyoPro products may not be perceived to have sufficient potential benefits compared with these alternatives, which include rehabilitation therapy or amputation with a prosthetic replacement. Also, we believe that healthcare providers

8

Table of Contents

tend to be slow to change their medical treatment practices because of perceived liability risks arising from the use of new products and the uncertainty of third-party reimbursement. Accordingly, healthcare providers may not recommend the MyoPro until there is sufficient evidence to convince them to alter the treatment methods they typically recommend. This evidence may include prominent healthcare providers or other key opinion leaders in the upper extremity paralysis community recommending the MyoPro as effective in providing identifiable immediate and long-term health benefits, and the publication of additional peer-reviewed clinical studies demonstrating its value. Additionally, because the MyoPro is a prescription device, patients require the prescription of a healthcare provider to access our products and to have the device reimbursed by insurance.

Achieving and maintaining market acceptance of MyoPro products could be negatively impacted by many other factors, including, but not limited to:

| • | lack of sufficient evidence supporting the benefits of MyoPro over competitive products or other available treatment, or lifestyle management to accommodate the disability; |

| • | patient resistance to wearing an external device or making required insurance co-payments; |

| • | results of clinical studies relating to MyoPro or similar products; |

| • | claims that MyoPro, or any component thereof, infringes on patent or other intellectual property rights of third parties; |

| • | perceived risks associated with the use of MyoPro or similar products or technologies; |

| • | the introduction of new competitive products or greater acceptance of competitive products; |

| • | adverse regulatory or legal actions relating to MyoPro or similar products or technologies; and |

| • | problems arising from the outsourcing of our manufacturing capabilities, or our existing manufacturing and supply relationships. |

Any factors that negatively impact sales of MyoPro would adversely affect our business, financial condition and operating results.

We may not be able to obtain third-party payor reimbursement, including reimbursement by Medicare, for our products.

Currently, we are almost entirely dependent on third parties to cover the cost of our products to patients and heavily rely on our distributors’ ability to obtain reimbursement for the cost of our products. If the U.S. Department of Veterans Affairs, or the VA, health insurance companies and other third-party payors do not provide adequate coverage or reimbursement for our products, then our sales will be limited to clinical facilities and individuals who can pay for our devices without reimbursement. To our knowledge, in the year ended December 31, 2019, fewer than 15 units have been self-paid or funded by non-profit foundations. Some commercial health insurance plans have published statements that they will not cover the cost of the MyoPro for their members, so we have conducted and will continue to conduct appeals for patients covered by such policies to obtain payment authorizations on a case-by-case basis. In the event we are unsuccessful in obtaining coverage and adequate reimbursement for our products from third-party payors, our sales will be significantly constrained. Currently, reimbursement for the cost of our products is obtained primarily on a case-by-case basis until such time, if any, we obtain broad coverage policies with Medicare and third-party payors. There can be no assurance that we will be able to obtain these broad coverage policies.

In connection with Medicare reimbursement, we have filed the application for a unique Healthcare Common Procedure Coding System, or HCPCS, code applicable to our product line. We received a preliminary decision on our application in May 2018 and in November 2018 we announced that the Centers for Medicare and Medicaid Services, or CMS, had published two new codes pursuant to our application for HCPCS codes, which became effective in January 1, 2019. However, at this time, CMS has not released coverage criteria or the

9

Table of Contents

allowed charge amount for the two new codes. We cannot make any assurance that the amount of reimbursement, if any, to be approved will be sufficient to provide a reasonable profit to us or to our distributors, that the receipt of these codes would result in appropriate coverage and payment terms or otherwise lead to any greater access to our products or reimbursement for such products. We are currently awaiting a decision by CMS on coverage policy and allowable fee for the MyoPro; however, there is no specific timetable or guarantee that CMS will in fact issue such coverage and payment guidelines. In addition, decisions by CMS or other governmental payors on whether and to what extent they would cover our products, as well as decisions on what basis they would cover our products, whether as outright purchases by patients or on a rental basis, may impact similar coverage decisions by private payors that may follow the decisions by governmental payors.

Reimbursement amounts, whether on a case-by-case basis or pursuant to broader coverage policies, which may be established in the future, may be insufficient to permit us to generate sufficient gross margins to allow us to operate on a profitable basis. Third-party payors also may deny coverage, limit reimbursement or reduce their levels of payment, or our costs of production may increase faster than increases in reimbursement levels. In addition, we may not obtain coverage and reimbursement approvals in a timely manner. Our failure to receive such approvals would negatively impact market acceptance of MyoPro.

We depend on a single third party to manufacture the MyoPro and a limited number of third-party suppliers for certain components of the MyoPro.

While we are the manufacturer of record with the U.S. Food and Drug Administration, or the FDA, for the MyoPro device we sell, we have contracted with Cogmedix, Inc., or Cogmedix, a contract manufacturer with expertise in the medical device industry, for the contract manufacture of all of our products and the sourcing of all of our components and raw materials. Pursuant to this contract, Cogmedix manufactures the MyoPro pursuant to our specifications at its facility in West Boylston, Massachusetts. As the manufacturer of the MyoPro, we ultimately remain responsible to the FDA for overseeing Cogmedix’s manufacturing activities to ensure that they conform with product specifications and applicable laws and regulations, including FDA’s good manufacturing practice requirements for medical devices. Any failure to effectively oversee the regulatory compliance of the product and contract manufacturing activities by Cogmedix can lead to potential enforcement actions, including civil or criminal liabilities, as well as recalls with the FDA. We may terminate our relationship with Cogmedix at any time upon sixty (60) days’ written notice. For our business strategy to be successful, Cogmedix must be able to manufacture our products in sufficient quantities, and to source raw materials and components, in compliance with regulatory requirements and quality control standards, in accordance with agreed upon specifications, at acceptable costs and on a timely basis. Increases in our product sales, whether forecasted or unanticipated, could strain the ability of Cogmedix to manufacture an increasingly large supply of our current or future products in a manner that meets these various requirements. In addition, although we are not restricted from engaging an alternative manufacturer, the process of moving our manufacturing activities would be time consuming and costly, and may limit our ability to meet our sales commitments, which could harm our reputation and could have a material adverse effect on our business. Further, any new contract manufacturer would need to be compliant with FDA regulations and International Organization for Standardization, or ISO, standard 13485.

We also rely on third-party suppliers, some of which contract directly with Cogmedix, to supply certain components of the MyoPro products. Cogmedix does not have long-term supply agreements with most of their suppliers and, in many cases, makes purchases on a purchase order basis. We do not have any long-term supply agreement directly with Cogmedix’s suppliers. Our ability and Cogmedix’s ability to secure adequate quantities of such products may be limited. Suppliers may encounter problems that limit their ability to manufacture components for our products, including financial difficulties or damage to their manufacturing equipment or facilities. If we, or Cogmedix, fail to obtain sufficient quantities of high-quality components to meet demand on a timely basis, or fail to effectively oversee the regulatory compliance of the supply chain, we could face regulatory enforcement, have to conduct recalls, lose customer orders, our reputation may be harmed, and our business could suffer.

10

Table of Contents

Cogmedix generally uses a small number of suppliers for the MyoPro products. Depending on a limited number of suppliers exposes us to risks, including limited control over pricing, availability, quality and delivery schedules. If any one or more of our suppliers ceases to provide sufficient quantities of components in a timely manner or on acceptable terms, Cogmedix would have to seek alternative sources of supply. It may be difficult to engage additional or replacement suppliers in a timely manner. Failure of these suppliers to deliver products at the level our business requires would limit our ability to meet our sales commitments, which could harm our reputation and could have a material adverse effect on our business. Cogmedix also may have difficulty obtaining similar components from other suppliers that are acceptable to the FDA or other regulatory agencies, and the failure of Cogmedix’s suppliers to comply with strictly enforced regulatory requirements could expose us to regulatory action including warning letters, product recalls, termination of distribution, product seizures or civil penalties. It could also require Cogmedix to cease using the components, seek alternative components or technologies and we could be forced to modify our products to incorporate alternative components or technologies, which could result in a requirement to seek additional regulatory approvals. Any disruption of this nature or increased expenses could harm our commercialization efforts and adversely affect our operating results.

We also rely on a limited number of suppliers for the batteries used by the MyoPro and do not maintain any long-term supply agreement with respect to batteries. If we fail to obtain sufficient quantities of batteries in a timely manner, our reputation may be harmed and our business could suffer.

We depend on a related third-party to provide the custom fabrication of the MyoPro.

Currently, we rely on Geauga Rehabilitation Engineering, Inc., or GRE, a small, privately held firm in Chardon, Ohio, to provide custom fabrication services for all MyoPro orders. GRE also provides product development support for the development and prototyping of new MyoPro product designs. GRE is owned by Jonathan Naft, a Myomo executive. However, another member of the GRE management team oversees the fabrication contract that we have entered into for these services which is at arm’s-length. While we are seeking other fabrication partners for the MyoPro, GRE is currently the only provider of MyoPro fabrication services, and our business may be negatively impacted by any difficulties GRE has with its suppliers, operating facilities, trained personnel, and any financial issues. In the event GRE fails to fulfill our orders in a timely manner, then we may terminate our contract. In addition, Mr. Naft’s employment with us is at-will and there can be no assurance that we can retain his services to us. If our relationship with GRE or with Mr. Naft were terminated, we might have difficulty finding a replacement for GRE’s services, in particular, with respect to GRE’s prototyping services. This could result in an adverse impact on our business and financial condition.

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

Since inception through December 31, 2019, we have shipped approximately 1,000 units for use by patients at home and at clinical facilities. Our latest product line, the MyoPro, was introduced to the market in fiscal year 2012 and we have shipped more than 600 units since such time. As a result, we have a limited operating history. It is difficult to forecast our future results based upon our historical data. Because of the uncertainties related to our limited historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses.

We have a history of operating losses and our financial statements for September 30, 2019 and December 31, 2018 include disclosures regarding there being substantial doubt about our ability to continue as a going concern.

We have a history of losses since inception. For the nine months ended September 30, 2019, we incurred a net loss of approximately $8.0 million, and for the year ended December 31, 2018, we incurred a net loss of approximately $10.3 million. At September 30, 2019, we had an accumulated deficit of approximately $53.4 million. We expect to continue to incur operating and net losses for the foreseeable future as we expand

11

Table of Contents

our sales and marketing efforts, invest in product development and establish the necessary administrative functions to support our growing operations and being a public company. Our losses in future periods may be greater than the losses we would incur if we developed our business more slowly. In addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in increases in our revenues, which would further increase our losses. Our cash and cash equivalents balance at September 30, 2019 was approximately $4.3 million, which includes net proceeds from a public offering of our common stock completed in February 2019 of approximately $5.6 million, but excludes the net proceeds from the Term Loan. Despite the successful public offering and the Term Loan closing, we do not expect that existing cash and net proceeds from the offering and Term Loan will be sufficient to fund our operations for the twelve months from the filing date of this prospectus. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern, as disclosed in the notes to the financial statements for the nine months ended September 30, 2019 and the year ended December 31, 2018. Although our financial statements raise substantial doubt about our ability to continue as a going concern, they do not reflect any adjustments that might result if we are unable to continue our business. If we cannot continue as a viable entity, our stockholders may lose some or all of their investment in our company

We may not have sufficient funds to meet our future capital requirements.

We have cash and cash equivalents of approximately $4.3 million at September 30, 2019. We will need additional capital and we may be unable to obtain additional funds on reasonable terms, or at all. Our ability to secure financing and the cost of raising such capital are dependent on numerous factors, including general economic and capital markets conditions, credit availability from lenders, investor confidence and the existence of regulatory and tax incentives that are conducive to raising capital. Uncertainty in the financial markets has caused banks and financial institutions to decrease the amount of capital available for lending and has significantly increased the risk premium of such borrowings. In addition, such turmoil and uncertainty has significantly limited the ability of companies to raise funds through the sale of equity or debt securities. If we are unable to raise additional funds, we may need to delay, modify or abandon some or all of our business plans or cease operations. If we raise funds through the issuance of debt, the amount of any indebtedness that we may raise in the future may be substantial, and we may be required to secure such indebtedness with our assets and may have substantial interest expenses. If we default on any future indebtedness, our lenders could declare all outstanding principal and interest to be due and payable and our secured lenders may foreclose on the facilities securing such indebtedness. The incurrence of indebtedness could require us to meet financial and operating covenants, which could place limits on our operations and ability to raise additional capital, decrease our liquidity and increase the amount of cash flow required to service our debt. If we raise funds through the issuance of equity securities, such issuance could result in dilution to our stockholders and the newly issued securities may have rights senior to those of the holders of our common stock.

Our continuation as a going concern is dependent on our ability to generate sufficient cash flows from operations and to raise additional capital to meet our obligations. Based on our current operating plan, we anticipate that our existing cash and cash equivalents may not be sufficient to enable us to maintain our currently planned operations beyond the next twelve months from the filing date of these financial statements.

Our operating activities may be restricted as a result of covenants related to the outstanding indebtedness under our Term Loan and we may be required to repay the outstanding indebtedness in an event of default, which could have a materially adverse effect on our business.

In October 2019, we entered into a Note Purchase Agreement, Senior Note and Security Agreement, or collectively, the Term Loan with CVP. Under the Term Loan, we received gross proceeds of $3.0 million, excluding fees and expenses. Including an original issue discount, we will repay CVP $3.3 million. The Term Loan bears interest at a rate of 10% and matures 18 months from the closing date. Monthly redemptions of up to $300,000 begin six months from the closing date, with the actual amount to be determined by CVP. CVP has granted us an option to defer up to three redemption payments. If we elect to defer any payments, we will pay

12

Table of Contents

CVP a fee that is the greater of (i) $35,000, or (ii) 1%, 1.25% and 1.5% of the outstanding balance for each deferral, respectively, which shall be added to the outstanding balance. The Term Loan is secured all of our assets, excluding intellectual property.

The Term Loan subjects us to various customary covenants, including requirements relating to our ability to incur certain types of liens on our property, including our intellectual property, restrictions on future financing transactions without CVP’s prior written consent, and restrictions on our ability to pay dividends. Our ability to operate our business may be adversely affected by these restrictions.

Additionally, we are required to repay 50% of the outstanding balance with any proceeds from an equity offering, including this offering and may be required to repay the outstanding indebtedness under the Term Loan if an event of default occurs. Events of default include (i) the failure to repay the Term Loan at maturity; (ii) the failure to make monthly redemption payments; (iii) the failure to make timely filings to the SEC; (iv) the failure to obtain CVP’s prior consent to enter into a fundamental transaction, and (v) conditions of insolvency, receivership and bankruptcy filings. Upon the occurrence of an event of default, the outstanding balance shall immediately increase to up to 125% of the outstanding balance. As described in the Term Loan, upon the occurrence of certain events of default, the outstanding balance will become automatically due and payable, and upon the occurrence of other events of default, CVP may declare the outstanding balance immediately due and payable at such time or at any time thereafter. After the occurrence of an event of default, interest on the Term Loan will accrue at a rate per annum of 18%, or such lesser rate as permitted under applicable law. We may not have enough available cash or be able to raise additional funds through equity or debt financings to repay such indebtedness at the time such payments are due, including an event of default. If our available cash and capital resources are insufficient to allow us to make required payments on our debt, we may have to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our debt.

The industries in which we operate are highly competitive and subject to rapid technological change. If our competitors are better able to develop and market products that are safer, more effective, less costly, easier to use, or are otherwise more attractive, we may be unable to compete effectively with other companies.

Industrial and medical robotics is characterized by intense competition and rapid technological change, and we will face competition on the basis of product features, clinical outcomes, price, services and other factors. Competitors may include large medical device and other companies, some of which have significantly greater financial and marketing resources than we do, and firms that are more specialized than we are with respect to particular markets. Our competition may respond more quickly to new or emerging technologies, undertake more extensive marketing campaigns, and have greater financial, marketing and other resources than we do or may be more successful in attracting potential customers, employees and strategic partners.

Our competitive position will depend on multiple complex factors, including our ability to achieve market acceptance for our products, develop new products, implement production and marketing plans, secure regulatory clearances or approvals, if necessary, for products under development and protect our intellectual property. In some instances, competitors may also offer, or may attempt to develop, alternative therapies for disease states that may be delivered without a medical device. The development of new or improved products, processes or technologies by other companies may render our products or proposed products obsolete or less competitive. The entry into the market of manufacturers located in low-cost manufacturing locations may also create pricing pressure, particularly in developing markets. Our future success depends, among other things, upon our ability to compete effectively against current technology, as well as to respond effectively to technological advances, and upon our ability to successfully implement our marketing strategies and execute our research and development plans.

13

Table of Contents

We utilize distributors who are free to market products that compete with the MyoPro, and we rely on these distributors to market and promote our products in accordance with their FDA listings, select appropriate patients and provide adequate follow-on care.

We rely on our relationships with qualified orthotics and prosthetics, or O&P providers, the VA and our distribution arrangements to market and sell our products. We believe that a meaningful percentage of our sales will continue to be generated through these channels in the future. However, none of these partners are required to sell or provide our products exclusively. If a key independent O&P provider were to cease to distribute our products, our sales could be adversely affected. In such a situation, we may need to seek alternative independent providers or increase our reliance on our other independent providers or our direct field representatives, which may not prevent our sales from being adversely affected. Additionally, to the extent that we enter into additional arrangements with independent distributors to perform sales, marketing, or distribution services, the terms of the arrangements could cause our profit margins to be lower than if we directly marketed and sold our products.

If these independent O&P providers or distributors do not follow our inclusion/exclusion criteria for patient selection or do not provide adequate follow-on care, then our reputation may be harmed by patient dissatisfaction. This could also lead to product returns and adversely affect our financial condition. When issues with distributors have arisen in the past, we have supplied additional training and documentation and/or ended the distributor relationship.

The sales and marketing of medical devices is under increased scrutiny by the FDA and other enforcement bodies. If our sales and marketing activities fail to comply with FDA regulations, such as regulations for the labeling and advertising of our products, or other applicable laws, we may be subject to warnings or enforcement actions from the FDA or other enforcement bodies. For example, we are restricted from promoting our products for any use that is beyond the scope of their applicable FDA classification regulation. Such promotion could result in enforcement action by the FDA, which may include, but is not limited to untitled letters or warning letters, injunctions, recall or seizure of our products, and imposition of FDA’s premarket clearance or approval requirements.

The market for myoelectric braces is new and the rate of adoption is uncertain, and important assumptions about the potential market for our products may be inaccurate.

The market for myoelectric braces, or orthotics, is new and the rate of adoption is uncertain. Our estimates of market size are derived from statistics regarding the number of individuals with paralysis, but not necessarily limited to their upper extremities. Accordingly, it is difficult to predict the future size and rate of growth of the market. We cannot be certain whether the market will continue to develop or if orthotics will achieve and sustain a level of market acceptance and demand sufficient for us to continue to generate revenue and achieve profitability.

Limited sources exist to obtain reliable market data with respect to the number of mobility-impaired individuals and the occurrence of upper extremity paralysis in our target markets. In addition, there are no third-party reports or studies regarding what percentage of those with upper extremity paralysis would be able to use orthotics in general, or our current or planned future products in particular. In order to use our current products marketed to those with upper extremity paralysis, users must meet a set of inclusion criteria and not have a medical condition which disqualifies them from being an appropriate candidate. Future products for those with upper extremity paralysis may have the same or other restrictions. Our business strategy is based, in part, on our estimates of the number of upper extremity impaired individuals and the incidence of upper extremity injuries in our target markets and the percentage of those groups that would be able to use our current and future products. Our assumptions and estimates may be inaccurate and may change.

If the upper extremity orthotics market fails to develop or develops more slowly than we expect, or if we have relied on sources or made assumptions or estimates that are not accurate, our business could be adversely affected.

14

Table of Contents

In addition, because we operate in a new market, the actions of our competitors could adversely affect our business. Adverse events such as product defects or legal claims with respect to competing or similar products could cause reputational harm to the market on the whole. Further, adverse regulatory findings or reimbursement-related decisions with respect to other products could negatively impact the entire market and, accordingly, our business.

We may receive a significant number of warranty claims or our MyoPro may require significant amounts of service after sale.

Sales of MyoPro products generally include a three-year warranty for parts and labor, other than for normal wear and tear. As the number and complexity of the features and functionalities of our products increase, we may experience a higher level of warranty claims. If product returns or warranty claims are significant or exceed our expectations, we could incur unanticipated expenditures for parts and services, which could have a material adverse effect on our operating results.

Defects in our products or the software that drives them could adversely affect the results of our operations.

The design, manufacture and marketing of the MyoPro products involve certain inherent risks. Manufacturing or design defects, unanticipated use of the MyoPro, or inadequate disclosure of risks relating to the use of MyoPro products can lead to injury or other adverse events. In addition, because the manufacturing of our products is outsourced to Cogmedix, we may not always be aware of manufacturing defects that could occur and corrective or preventive actions implemented by Cogmedix may not be effective at resolving such defects. Such adverse events could lead to recalls or safety alerts relating to MyoPro products (either voluntary or required by the FDA or similar governmental authorities in other countries), and could result, in certain cases, in the removal of MyoPro products from the market. A recall could result in significant costs. To the extent any manufacturing defect occurs, our agreement with Cogmedix contains a limitation on Cogmedix’s liability, and therefore we could be required to incur the majority of related costs. Our agreement with GRE does not contain a similar limitation of liability; however, a defect in connection with the fabrication of our products may result in significant costs in connection with lawsuits or refunds. Product defects or recalls could also result in negative publicity, damage to our reputation or, in some circumstances, delays in new product approvals.

MyoPro users may not use MyoPro products in accordance with safety protocols and training, which could enhance the risk of injury. Any such occurrence could cause delay in market acceptance of MyoPro products, damage to our reputation, additional regulatory filings, product recalls, increased service and warranty costs, product liability claims and loss of revenue relating to such hardware or software defects.

The medical device industry has historically been subject to extensive litigation over product liability claims. We have not been subject to such claims to date, but we may become subject to product liability claims alleging defects in the design, manufacture or labeling of our products in the future. A product liability claim, regardless of its merit or eventual outcome, could result in significant legal defense costs and high punitive damage payments. Although we maintain product liability insurance, the coverage is subject to deductibles and limitations, and may not be adequate to cover future claims. Additionally, we may be unable to maintain our existing product liability insurance in the future at satisfactory rates or in adequate amounts.

While there is long-term clinical data supporting the safety of our existing MyoPro products, updates to our products inherently have uncertain safety risks as they enter the market.

While clinical data have established the safety of MyoPro products, our products undergo periodic updates for various reasons, including performance and reliability improvements and cost reductions. Because MyoPro users generally do not have feeling in their upper extremities, they may not immediately notice adverse effects from updates to the MyoPro, which could exacerbate their impact. If MyoPro products are shown to present new risks or to be unsafe or cause such unforeseen effects in the future, our business and reputation could be harmed,

15

Table of Contents

including through field corrections, withdrawals, removals, mandatory product recalls, suspension or withdrawal of FDA registration, significant legal liability or harm to our business reputation.

We may enter into collaborations, licensing arrangements, joint ventures, strategic alliances or partnerships with third parties that may not result in the development of commercially viable products or the generation of significant future revenues.

In the ordinary course of our business, in the future we may enter into collaborations, in-licensing arrangements, joint ventures, strategic alliances or partnerships to develop the MyoPro and to pursue new markets. We are selling the MyoPro in several European countries, as well as countries such as Australia and Chile. In 2019, we announced our intention to enter to technology licenses for the manufacturing and distribution of the MyoPro in international markets, including the Asia Pacific market, and we are continuing to pursue a potential license. Any of these relationships may require us to incur non-recurring and other charges, increase our near and long-term expenditures, issue securities that dilute our existing stockholders or disrupt our management and business. In addition, proposing, negotiating and implementing collaborations, licensing arrangements, joint ventures, strategic alliances or partnerships may be a competitive lengthy and complex process. We may not identify, secure, or complete any such transactions or arrangements in a timely manner, on a cost-effective basis, on acceptable terms or at all. We have limited institutional knowledge and experience with respect to these business development activities, and we may also not realize the anticipated benefits of any such transaction or arrangement. In particular, these collaborations may not result in the development of products that achieve commercial success or result in significant revenues and could be terminated prior to developing any products. Any delays in entering into new strategic partnership agreements related to our products could delay the development and commercialization of our products in certain geographies, which would harm our business prospects, financial condition and results of operations.

If we pursue collaborations, licensing arrangements, joint ventures, strategic alliances or partnerships, we may not be able to consummate them, or we may not be in a position to exercise sole decision decision-making authority regarding the transaction or arrangement, which could create the potential risk of creating impasses on decisions, and our collaborators may have economic or business interests or goals that are, or that may become, inconsistent with our business interests or goals. It is possible that conflicts may arise with our collaborators. Our collaborators may act in their self-interest, which may be adverse to our best interest, and they may breach their obligations to us. Any such disputes could result in litigation or arbitration which would increase our expenses and divert the attention of our management. Further, these transactions and arrangements are contractual in nature and may be terminated or dissolved under the terms of the applicable agreements.

If we fail to properly manage our anticipated growth, our business could suffer.

As we expand the number of locations which provide the MyoPro products, including future planned international distribution, we expect that it will place significant strain on our management team and on our financial resources. Failure to manage our growth effectively could cause us to misallocate management or financial resources and result in losses or weaknesses in our infrastructure, systems, processes and controls, which could materially adversely affect our business. Additionally, our anticipated growth will increase the demands placed on our suppliers, resulting in an increased need for us to manage our suppliers and monitor for quality assurance.

Moreover, there are significant costs and risks inherent in selling our products in international markets, including: (a) time and difficulty in building a widespread network of distribution partners; (b) increased shipping and distribution costs, which could increase our expenses and reduce our margins; (c) potentially lower margins in some regions; (d) longer collection cycles in some regions; (e) compliance with foreign laws and regulations; (f) compliance with anti-bribery, anti-corruption, and anti-money laundering laws, such as the Foreign Corrupt Practices Act and the Office of Foreign Assets Control regulations, by us, our employees, and our business partners; (g) currency exchange rate fluctuations and related effects on our results of operations; (h) economic weakness, including inflation, or political instability in foreign economies and markets; (i) compliance with tax, employment,

16

Table of Contents

immigration, and labor laws for employees living or traveling abroad; (j) workforce uncertainty in countries where labor unrest is more common than in the United States; (k) business interruptions resulting from geopolitical actions, including war and terrorism, or natural disasters, including earthquakes, typhoons, floods and fires; and (l) other costs and risks of doing business internationally, such as new tariffs which may be imposed.

These and other factors could harm our ability to implement planned international operations and, consequently, harm our business, results of operations, and financial condition. Further, we may incur significant operating expenses as a result of our planned international expansion, and it may not be successful. We have limited experience with regulatory environments and market practices internationally, and we may not be able to penetrate or successfully operate in new markets. We may also encounter difficulty expanding into international markets because of limited brand recognition, leading to delayed or limited acceptance of our products by patients in these markets. Accordingly, if we are unable to expand internationally or manage our international operations successfully, we may not achieve the expected benefits of this expansion and our financial condition and results of operations could be harmed.

We depend on the knowledge and skills of our senior management.

We have benefited substantially from the leadership and performance of our senior management and other key employees. We do not carry key person insurance. Our success will depend on our ability to retain our current management and key employees. Competition for these key persons in our industry is intense and we cannot guarantee that we will be able to retain our personnel. The loss of the services of certain members of our senior management or key employees could prevent or delay the implementation and completion of our strategic objectives or divert management’s attention to seeking qualified replacements.