Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT ACCOUNTING FIRM - Exceed World, Inc. | consent_231.htm |

| EX-5.1 - LEGAL OPINION LETTER - Exceed World, Inc. | legalopinion_1920.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

EXCEED WORLD, INC.

(Exact name of registrant as specified in its charter)

Date: January 14, 2020

| Delaware | 8200 | 98-1339955 |

|

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) |

(IRS Employer Identification No.) |

1-2-38-6F, Esaka-cho,

Suita-shi, Osaka 564-0063, Japan

ceo.exceed.world@gmail.com

Telephone: +81-6-6339-4177

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

NewRev General Counsel, LLC

8547 E. Arapahoe Road #J453

Greenwood Village, CO 80112

TELEPHONE: (303) 953-4245

Email: conn.flanigan@newrevgc.com

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer |_| | Accelerated filer |_| |

| Non-accelerated filer |_| |

Smaller reporting company |X| Emerging Growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share (1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee (2) |

|

Common Stock, $0.0001 par value |

3,000,000 | $0.09 | $270,000 | $35.046 |

(1) The offering price has been arbitrarily determined by the Company and affiliated parties and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price.

(2) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SECURITIES BEING REGISTERED HEREIN MAY NOT BE SOLD UNTIL THIS REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

PRELIMINARY PROSPECTUS

EXCEED WORLD, INC.

3,000,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

As of the date of this Prospectus, our shares are quoted on the OTC Pink under the stock symbol “EXDW”.

In this public offering our selling shareholders are offering 3,000,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. Rather our selling shareholders will receive any and all proceeds from this offering. There is no minimum number of shares required to be purchased by each investor. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

This primary offering will automatically terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however, at our discretion terminate the offering at any time.

In their audit report dated January 2, 2018, our auditors have expressed substantial doubt as to our ability to continue as a going concern.

| SHARES OFFERED | PRICE TO | SELLING AGENT | PROCEEDS TO THE SELLING | ||||||

| BY SELLING SHAREHOLDERS | PUBLIC | COMMISSIONS | SHAREHOLDERS | ||||||

| Per Share | $ | 0.09 | Not applicable | $ | 0.09 | ||||

| Minimum Purchase | None | Not applicable | Not applicable | ||||||

| Total (3,000,000 shares) | $ | 270,000 | Not applicable | $ | 270,000.00 | ||||

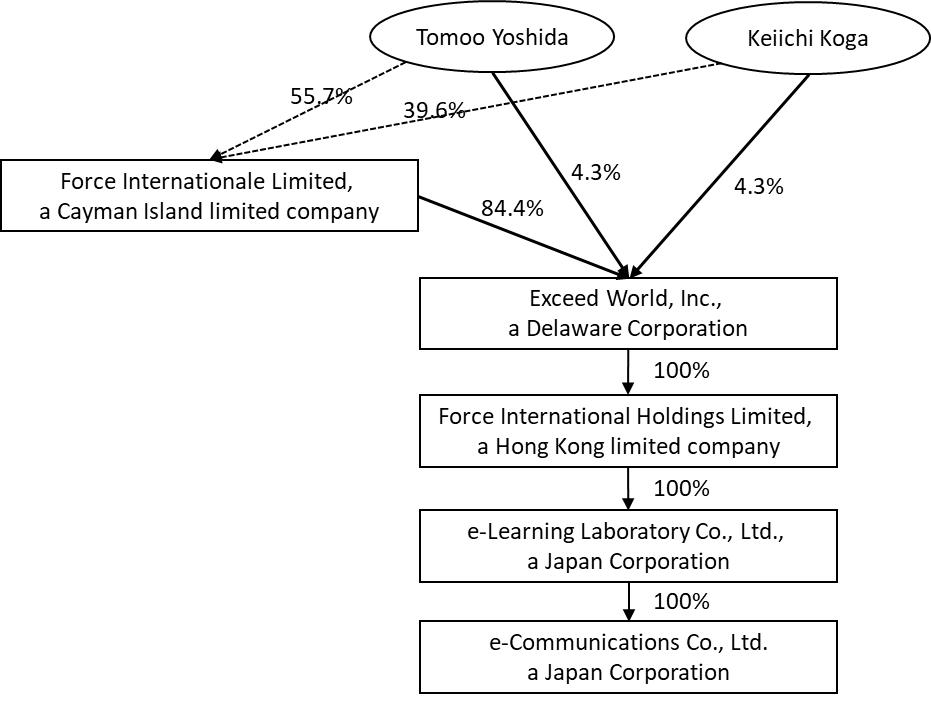

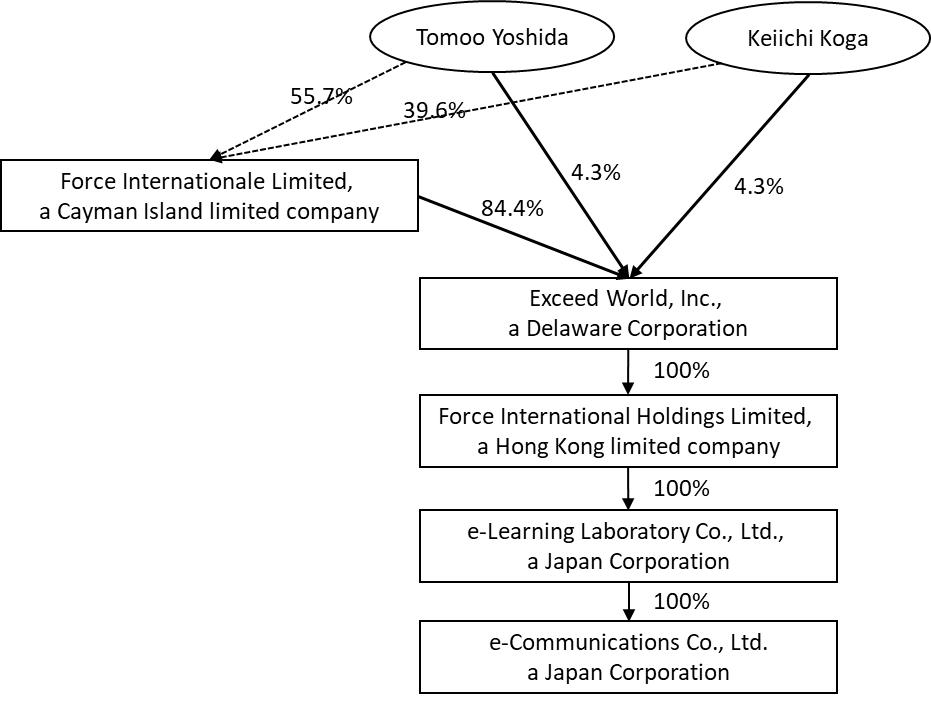

Currently, our Chief Executive Officer Tomoo Yoshida directly owns approximately 4.3% of the voting power of our outstanding capital stock, and Force Internationale Limited, a Cayman Island Company (“Force Internationale”), of which Mr. Yoshida also owns and controls, owns approximately 84.4% of the voting power of our outstanding capital stock. After the offering, assuming all of the shares that are being registered herein of Force Internationale are sold, Mr. Yoshida and Force Internationale will have the ability to collectively control approximately 75.2% of the voting power of our outstanding capital stock.

The Company estimates the costs of this offering at $60,000. All expenses incurred in this offering are being paid for by the Company. If the Company has insufficient funds to do so, it will rely upon funds provided by the Company’s Chief Executive Officer, Tomoo Yoshida. Mr. Yoshida has no legal obligation to provide the Company funds.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Our selling shareholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

The date of this prospectus is January 14, 2020.

-1-

In this Prospectus, “Exceed World, the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to Exceed World, Inc., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending September 30. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 4, and the financial statements in their entirety, before making an investment decision.

All dollar amounts refer to US dollars unless otherwise indicated.

The Company

The Company is an education service provider in Japan and it offers a range of e-learning education programs as well as supporting services to complement such education programs through an internet platform named “Force Club” (“Force Club”), which was launched in 2007. The Company has offered e-learning programs through Force Club, all of which were procured from independent third-party software developers, including pre-school learning resources, learning resources supplementing elementary school, junior high school and senior high school curriculum, preparation courses for university entrance examinations and professional qualification examinations, and English learning, appealing to a diverse customer base from pre-school children to students and adult learners. The e-learning programs of Force Club mainly serve as supplemental learning resources and self-learning tools for students and adult learners.

The Company was originally incorporated with the name Brilliant Acquisition, Inc., under the laws of the State of Delaware on November 25, 2014, with an objective to acquire, or merge with, an operating business. On January 12, 2016, Thomas DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with e-Learning Laboratory Co., Ltd. (“e-Learning”). Pursuant to the Agreement, Mr. DeNunzio transferred to e-Learning, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares. Following the closing of the share purchase transaction, e-Learning gained a 100% interest in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

On January 12, 2016, the Company changed its name to Exceed World, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment. On January 12, 2016, Mr. Thomas DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Also, on January 12, 2016, Mr. Tomoo Yoshida was appointed as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On February 29, 2016, the Company entered into a Stock Purchase Agreement with Tomoo Yoshida, our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Pursuant to this Agreement, Tomoo Yoshida transferred to Exceed World, Inc., 10 shares of the common stock of E&F Co., Ltd., a Japan corporation (“E&F”), which represents all of its issued and outstanding shares in consideration of $4,835 (JPY 500,000). Following the effective date of the share purchase transaction on February 29, 2016, Exceed World, Inc. gained a 100% interest in the issued and outstanding shares of E&F’s common stock and E&F became a wholly owned subsidiary of Exceed World. On August 4, 2016, the E&F changed its name to School TV Co., Ltd (“School TV”) and filed with the Legal Affairs Bureau in Osaka, Japan.

On August 1, 2016, the Company changed its fiscal year end from November 30 to September 30.

On October 28, 2016, the Company, with the approval of its board of directors and its majority shareholders by written consent in lieu of a meeting, authorized the cancellation of shares owned by e-Learning. e-Learning consented to the cancellation of shares. The total number of shares cancelled was 19,000,000 shares which was comprised of 16,500,000 restricted common shares and 2,500,000 free trading shares.

On October 28, 2016, every one (1) share of common stock, par value $.0001 per share, of the Company issued and outstanding was automatically reclassified and changed into twenty (20) shares fully paid and non-assessable shares of common stock of the Company, par value $.0001 per share. (“20-for-1 Forward Stock Split”) No fractional shares were issued. The authorized number of shares, and par value per share, of common stock are not affected by the 20-for-1 Forward Stock Split.

On September 26, 2018, Force Internationale Limited, a Cayman Island limited company (“Force Internationale”) entered into a Share Purchase Agreement with its wholly-owned subsidiary, e-Learning Laboratory Co., Ltd., a Japan corporation (“e-Learning”) and 74.5% owner of the Company. Under this Share Purchase Agreement, e-Learning transferred its 74.5% interest in the Company to Force Internationale. As consideration for this transfer, Force Internationale paid $26,000.00 to e-Learning. Immediately subsequent, the Company entered into a Share Purchase Agreement with Force Internationale, to acquire 100% of Force International Holdings Limited, a Hong Kong limited company (“Force Holdings”) and 100% direct owner of e-Learning. In consideration of this agreement, the Company issued 12,700,000 common shares to Force Internationale. The result of these transaction is that Force Internationale is a 84.4% owner of the Company, the Company is a 100% owner of Force Holdings, and Force Holdings is a 100% owner of e-Learning. Prior to the Share Purchase Agreements, Force Internationale was an indirect owner of 74.5% of the Company and subsequent to the Share Purchase Agreements, Force Internationale is a direct owner of 84.4% of the Company. The Share Purchase Agreements were approved by the boards of directors of each of the Company, Force Internationale, Force Holdings, and e-Learning.

On December 6, 2018, the Company entered into a share contribution agreement (the “Contribution Agreement”) with Force Internationale. Under this Agreement, the Company transferred 100% of the equity interest of School TV Co., Ltd. ("School TV"), to Force Internationale without consideration. This Contribution Agreement was approved by the board of directors of the Company, Force Internationale and School TV. Upon the completion of the disposal, School TV was deconsolidated from the Company's consolidated financial statements. Pursuant to the Contribution Agreement, the Company no longer has any interest in the previous businesses related to the sale and distribution of health related products, the promotion of third party consumer goods and services, and a RE/MAX realtor business in Kanagawa, Okinawa, and Tokyo, Japan.

Currently, we own the following affiliated entities:

| Name of Subsidiary | State or Other Jurisdiction of Incorporation or Organization |

| Force International Holdings Limited | Hong Kong |

| e-Learning Laboratory Co., Ltd. | Japan |

| e-Communications Co., Ltd. | Japan |

* The following chart illustrates the structure of our consolidated affiliated entities:

Our principal executive offices are located at 1-1-36, 1-2-38-6F, Esaka-cho, Suita-shi, Osaka 564-0063, Japan. Our phone number is +81-6-6339-4177.

The Company has elected September 30th as its fiscal year end.

The Company estimates the costs of this offering at $60,000. All expenses incurred in this offering are being paid for by the Company. If the Company has insufficient funds to do so, it will rely upon funds provided by the Company’s Chief Executive Officer, Tomoo Yoshida. Mr. Yoshida has no legal obligation to provide the Company funds.

-2-

Our Offering

We have authorized capital stock consisting of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). We have 32,700,000 shares of Common Stock and no shares of Preferred Stock issued and outstanding. Through this offering we will register a total of 3,000,000 shares. These shares represent 3,000,000 shares of common stock held by our selling stockholders. The selling stockholders will sell shares at a fixed price of $0.09 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will not receive any proceeds from the selling stockholders.

*We will notify investors of any extension to this offering by filing a supplement to our prospectus pursuant to Rule 424(b)(3).

| Securities being offered by the Selling Stockholders | 3,000,000 shares of common stock, at a fixed price of $0.09 offered by selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times for the duration of this offering. This offering will automatically terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at our discretion terminate the offering at any time. |

| Offering price per share | The selling shareholders will sell the shares at a fixed price per share of $0.09 for the duration of this Offering. |

| Number of shares outstanding before the offering of common stock | 32,700,000 common shares are currently issued and outstanding. |

| Number of shares outstanding after the offering of common shares | 32,700,000 common shares will be issued and outstanding. |

| The minimum number of shares to be sold in this offering |

None. |

|

Use of Proceeds |

We will not receive any proceeds from the sale of the shares in this offering. |

| Market for the common shares | Our common shares are quoted on the OTC Pink. |

| Termination of the Offering | This offering will automatically terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 3,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days or terminate the offering at any time. |

| Registration Costs |

We estimate our total offering registration costs to be approximately $60,000.

|

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

Currently, our Chief Executive Officer Tomoo Yoshida owns approximately 4.3% of the voting power of our outstanding capital stock and Force Internationale of which Mr. Yoshida also owns and controls, owns approximately 84.4% of the voting power of our outstanding capital stock. After the offering, assuming all of the shares that are being registered herein of Force Internationale are sold, Mr. Yoshida and Force Internationale will have the ability to collectively control approximately 75.2% of the voting power of our outstanding capital stock.

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

-3-

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

Risks Relating to Our Company

Since one of our products constitutes a significant portion of our net sales, significant decreases in consumer demand for this product or our failure to produce a suitable replacement should we cease offering it would harm our financial condition and operating results.

If consumer demand for this product decreases significantly or we cease offering this product without a suitable replacement, then our financial condition and operating results would be harmed.

If we lose the services of members of our senior management team, then our financial condition and operating results could be harmed.

We depend on the continued services of our Chief Executive Officer, Tomoo Yoshida, who also serves as our Chief Financial Officer, Director, President, Secretary, and Treasurer, and our senior management team as it works to create an environment of inspiration, motivation and entrepreneurial business success. Any significant leadership change or senior management transition involves inherent risk and any failure to ensure a smooth transition could hinder our strategic planning, execution and future performance. While we strive to mitigate the negative impact associated with changes to our senior management team, there may be uncertainty among investors, employees, Force Club and Premium Members and others concerning our future direction and performance. Any disruption in our operations or uncertainty could have a material adverse effect on our business, financial condition or results of operations.

Additionally, although we do not believe that any of our senior management team are planning to leave or retire in the near term, we cannot assure you that our senior managers will remain with us. The loss or departure of any member of our senior management team could adversely impact our Force Club and Premium Member relations and operating results. If any of these executives do not remain with us, our business could suffer. Also, our continued success will also be dependent on our ability to retain existing, and attract additional, qualified personnel to meet our needs. We currently do not maintain “key person” life insurance with respect to our senior management team.

Foreign-currency fluctuations and inflation in foreign markets could impact our financial position and results of operations.

In 2017, 100% of our sales occurred in Japan. In preparing our financial statements, we translate revenue and expenses in our markets outside the United States from their local currencies into U.S. dollars using weighted-average exchange rates. Foreign-currency fluctuations can also cause losses and gains resulting from translation of foreign-currency-denominated balances on our balance sheet. In addition, high levels of inflation and currency devaluations in any of our markets could negatively impact our balance sheet and results of operations. It is difficult to predict future fluctuations and the effect these fluctuations may have upon future reported results or our overall financial condition.

Difficult economic conditions could harm our business.

Global economic conditions continue to be challenging. Difficult economic conditions could adversely affect our business by causing a decline in demand for our products, particularly if the economic conditions are prolonged or worsen. In addition, such economic conditions may adversely impact access to capital for us and may otherwise adversely impact our operations and overall financial condition.

We may become involved in legal proceedings and other matters that, if adversely adjudicated or settled, could adversely affect our financial results.

We have been, and may again become in the future, party to litigation, investigations or other legal matters. In general, litigation claims could result in settlements or damages that could significantly affect financial results. It is not possible to predict the final resolution of any litigation to which we may become party, and the impact of these matters on our business, results of operations and financial condition could be material.

Government authorities may question our tax or customs positions or change their laws in a manner that could increase our effective tax rate or otherwise harm our business.

As a U.S. company doing business globally, we are subject to all applicable tax laws. We are subject to audit by tax authorities. If authorities challenge our tax positions, we may be subject to penalties, interest and payment of back taxes. The tax laws are continually changing and are further subject to interpretation by the local government agencies. Such situations may require that we defend our positions and/or adjust our operating procedures in response to such changes. Any or all of these potential risks may increase our effective tax rate, increase our overall tax costs or otherwise harm our business.

We may be held responsible for certain taxes or assessments relating to the activities of our Premium Members, which could harm our financial condition and operating results.

Our Premium Members are independent contractors and subject to taxation in their country of residency. In the event that our independent distributors are deemed as employees rather than independent distributors under local laws and regulations, or the interpretation of local laws and regulations, we may be held responsible for a variety of obligations that are imposed upon employers relating to their employees, including withholding and related taxes plus any related assessments and penalties, which could harm our financial condition and operating results. If our independent distributors were deemed to be employees rather than independent contractors, we would also face the risk of increased liability for their actions.

Market conditions and the strengths of competitors may harm our business.

Our results of operations may be harmed by market conditions and competition in the future. In addition, our business may be negatively impacted if we fail to adequately adapt to trends in consumer behavior and technologies.

-4-

The intellectual property we utilize may infringe on the rights of others, resulting in costly litigation.

Currently, the rights of 70% of our products are licensed from third party providers and the remaining 30% are owned by the Company. We expect that competition for developing new products will become more severe in the competitive education industry. Under such circumstances, if we depend on development of our own products, it would be time consuming and expensive. Rather, as our established sales system has proved effective, we plan to continue to use the products developed by other companies. We expect to increase the ratio of the products licensed by third parties.

In recent years, there has been significant litigation involving patents and other intellectual property rights. In particular, there has been an increase in the filing of suits alleging infringement of intellectual property rights, which pressure defendants into entering settlement arrangements quickly to dispose of such suits, regardless of their merit. Other companies or individuals may allege that we, or our members consumers, licensees or other parties indemnified by us infringe on their intellectual property rights. Even if we believe that such claims are without merit, defending such intellectual property litigation can be costly, distract management's attention and resources, and the outcome is inherently uncertain. Claims of intellectual property infringement also might require us to redesign affected products, enter into costly settlement or license agreements, pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our products. Any of these results may adversely affect our financial condition.

If we are unable to protect our intellectual property rights, our ability to compete could be negatively impacted.

Many of our products rely on technologies developed or licensed by third parties, and we may not be able to obtain or continue to obtain licenses and technologies from these third parties on reasonable terms or at all. The market for our products depends to a significant extent upon the value associated with our product innovations and our brand equity. We rely upon patent, copyright, trademark and trade secret laws in Japan and similar laws in other markets, and non-disclosure, confidentiality and other types of agreements with our employees, members, consumers, suppliers and other parties, to establish, maintain and enforce our intellectual property rights. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated, or such intellectual property rights may not be sufficient to permit us to provide competitive advantages, which could result in costly product redesign efforts, discontinuance of certain product offerings or other competitive harm. The costs required to protect our intellectual property may be substantial or even not practical.

To enforce and protect our intellectual property rights, we may initiate litigation against third parties. Any lawsuits that we initiate could be expensive, take significant time and divert management's attention from other business concerns, and we may ultimately fail to prevail or recover on any claim. Litigation also puts our intellectual property at risk of being invalidated or interpreted narrowly. Additionally, we may provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate and the damages or other remedies awarded, if any, may not be commercially valuable. The occurrence of any of these events may adversely affect our financial condition or diminish our investments in this area.

If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our products could be adversely affected.

We rely on our licenses, copyrights, trade secrets, processes and know-how. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated. We generally seek to protect this information by confidentiality, non-disclosure and assignment of invention agreements with our employees, consultants, scientific advisors and third parties. Our employees may leave to work for competitors. Our distributors or sales leaders may seek other opportunities. These agreements may be breached, and we may not have adequate remedies for any such breach. In addition, our trade secrets may be disclosed to or otherwise become known or be independently developed by competitors. To the extent that our current or former employees, distributors, sales leaders, consultants or contractors use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions. If, for any of the above reasons, our intellectual property is disclosed or misappropriated, it would harm our ability to protect our rights and adversely affect our financial condition.

A failure of our internal controls over financial reporting or our compliance efforts could harm our stock price and our financial and operating results or could result in fines or penalties.

We have implemented internal controls to help ensure the accuracy and completeness of our financial reporting and have implemented compliance policies and programs to help ensure that our employees and members comply with applicable laws and regulations. Our management regularly reviews our internal controls and various aspects of our business and compliance program, and we regularly assess the effectiveness of our internal controls. There can be no assurance, however, that our internal or external assessments and audits will identify all significant deficiencies or material weaknesses in our internal controls. If a material weakness results in a material misstatement of our financial results, we would be required to restate our financial statements.

Cyber security risks and the failure to maintain the integrity of company, employee, member data could expose us to data loss, litigation, liability and harm to our reputation.

We collect, store and transmit large volumes of company, employee and member data, including personally identifiable information, for business purposes, including for transactional and promotional purposes, and our various information technology systems enter, process, summarize and report such data. The integrity and protection of this data is critical to our business.

In addition, a penetrated or compromised data system or the intentional, inadvertent or negligent release, misuse or disclosure of data could result in theft, loss or fraudulent or unlawful use of company, employee or member data. Although we take measures to protect the security, integrity and confidentiality of our data systems, we experience cyber attacks of varying degrees and types on a regular basis, and our infrastructure may be vulnerable to these attacks. Our security measures may also be breached due to employee error or malfeasance, system errors or otherwise. Additionally, outside parties may attempt to fraudulently induce employees, users, or customers to disclose sensitive information to gain access to our data or our users' or customers' data. Any such breach or unauthorized access could result in the unauthorized disclosure, misuse or loss of sensitive information and lead to significant legal and financial exposure, regulatory inquiries or investigations, loss of confidence by our members, disruption of our operations and damage to our reputation. These risks are heightened as we work with third-party partners and as our members use social media, as the partners and social media platforms could be vulnerable to the same types of breaches.

We will need additional capital to expand our current operations or to enter into new fields of operations.

Currently, a significant portion of our revenue derives from sales of our premium package. We expect this revenue to continue to grow. While we will maintain and further increase the base for sale of this product, we also aim to expand our business by developing other services as well as entering into other promising market. We will need to seek additional financing either through borrowing, private offerings of our securities or through strategic partnerships and other arrangements with corporate partners. We cannot be assured that additional financing will be available to us, or if available, will be available to us on terms favorable to us. If adequate additional financing is not available on acceptable terms, we may not be able to implement our business development plan or expand our operations.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the expansion of our operations, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to hire additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Relationships with our majority shareholder and its parent and affiliates may be on terms which are perceived by investors as more or less favorable than those that could be obtained from third parties.

Our majority shareholder, Force Internationale, presently owns 84.4% of our issued and outstanding common stock. While we anticipate that such percentage will be diluted over time, our majority shareholder, its parent and affiliates will be perceived as having influence over our management and operations, and any loans or other agreements which we may enter into with our majority shareholder and its parents and affiliates may be perceived by investors as being on terms that are less favorable than we could otherwise receive; such perception could adversely impact the price of our common stock. Similarly, such agreements could be perceived as being on terms more favorable than those that could be obtained from third parties, and any unwillingness by our majority shareholder and its parent and affiliates to engage with our common stock could discourage investors.

-5-

If we fail to further penetrate existing markets, then the growth in sales of our products, along with our operating results, could be negatively impacted.

We plan to expand business around Asia. Recently the number of foreigners visiting Japan for sightseeing and other purposes is increasing and there has been a growing interest in Japanese culture. We plan to start providing language education services which include Japanese language education to foreigners.

Our business could be materially and adversely affected as a result of natural disasters, other catastrophic events, acts of war or terrorism, or cyber-security incidents and other acts by third parties.

We depend on the ability of our business to run smoothly, including the ability of Premium Members to engage in their business building activities and the ability of our programs and products to be available to consumers. Any material disruption caused by natural disasters, including, but not limited to, fires, floods, hurricanes, volcanoes, and earthquakes; power loss or shortages; environmental disasters; telecommunications or business information systems failures; acts of war or terrorism and other similar disruptions, including those due to cyber-security incidents, ransomware, or other actions by third parties, could adversely affect our ability to conduct business.

We depend on the integrity and reliability of our information technology infrastructure, and any related inadequacies may result in substantial interruptions to our business.

Our ability to provide products and services to our Force Club and Premium Members depends on the performance and availability of our core transactional systems. While we continue to invest in our information technology infrastructure, there can be no assurance that there will not be any significant interruptions to such systems or that the systems will be adequate to meet all of our future business needs.

The most important aspect of our information technology infrastructure is the system through which we calculate, record and store Premium Member sales and other incentives. We have encountered, and may encounter in the future, errors in our software or our enterprise network, or inadequacies in the software and services supplied by our vendors, although to date none of these errors or inadequacies has had a meaningful adverse impact on our business. Any such errors or inadequacies that we may encounter in the future may result in substantial interruptions to our services and may damage our relationships with, or cause us to lose, our Force Club and Premium Members if the errors or inadequacies impair our ability to calculate sales and pay royalty overrides, bonuses and other incentives, which would harm our financial condition and operating results. Such errors may be expensive or difficult to correct in a timely manner, and we may have little or no control over whether any inadequacies in software or services supplied to us by third parties are corrected, if at all.

Anyone who is able to circumvent our security measures could misappropriate confidential or proprietary information, including that of third parties such as our Force Club and Premium Members, cause interruption in our operations, damage our computers or otherwise damage our reputation and business. We may need to expend significant resources to protect against security breaches or to address problems caused by such breaches. Any actual security breaches could damage our reputation and result in a violation of applicable privacy and other laws, legal and financial exposure, including litigation and other potential liability, and a loss of confidence in our security measures, which could have an adverse effect on our results of operations and our reputation as a brand, business partner or employer. In addition, employee error or malfeasance or other errors in the storage, use or transmission of any such information could result in a disclosure to third parties. If this should occur, we could incur significant expenses addressing such problems. Since we collect and store Force Club and Premium Member and vendor information, these risks are heightened.

Risks Relating to the Education Industry

It is expected that if the birthrate continues to be declining in Japan, the Japanese education industry will face severe competition and face reduced revenues over the medium and long terms. Taking such risk into consideration, we are planning to develop business in the emerging countries in Asia and establish education platform adding usability to provision of content. However, if the change in the market is faster than expected or conversion into new business is not promptly made, our revenue or financial condition may be adversely affected.

Risks Associated with Multi-Level Marketing

Our failure to establish and maintain Force Club and Premium Member relationships for any reason could negatively impact sales of our products and harm our financial condition and operating results.

We distribute our products exclusively to and through Force Club and Premium Members, and we depend upon them directly for substantially all of our sales. Our Force Club and Premium Members may voluntarily terminate their agreements with us at any time subject to the termination provisions. To increase our revenue, we must increase the number of, or the productivity of, our Force Club and Premium Members. Accordingly, our success depends in significant part upon our ability to recruit, retain and motivate a large base of Premium Members. The loss of a significant number of Force Club or Premium Members for any reason could negatively impact sales of our products and could impair our ability to attract new Force Club or Premium Members. Our operating results could be harmed if our existing and new business opportunities and products do not generate sufficient interest to retain existing, and attract new, Force Club and Premium Members. Further, we may have disputes with our Force Club and Premium Members resulting in cancellation of their contracts, resulting in the loss of a sales agency relationship and potentially the return of fees to the Force Club or Premium Members. See “Force Club Membership” below under the heading “Description of Business.”

Adverse publicity associated with our products, ingredients or network marketing program, or those of similar companies, could harm our financial condition and operating results.

The size of our Force Club and Premium Members and the results of our operations may be significantly affected by the public’s perception of the Company and similar companies. This perception is dependent upon opinions concerning:

| • | the quality of our products; |

| • | the quality of similar products distributed by other companies; |

| • | our Force Club and Premium Members; |

Adverse publicity concerning any actual or purported failure of our Company or our Force Club and Premium Members to comply with applicable laws and regulations could have an adverse effect on the goodwill of our Company and could negatively affect our ability to attract, motivate and retain Force Club and Premium Members, which would negatively impact our ability to generate revenue.

In addition, our Force Club and Premium Members’ and consumers’ perception of the quality of our products and as well as similar products distributed by other companies can be significantly influenced by media attention concerning our products or similar products distributed by other companies. Adverse publicity questions the benefits of our or similar products could lead to lawsuits or other legal challenges and could negatively impact our reputation, the market demand for our products, or our general business.

Inability of products to gain or maintain Force Club or Premium Membership could harm our business.

Our operating results could be adversely affected if our products, business opportunities, and other initiatives do not generate sufficient enthusiasm and economic benefit to retain our existing Force Club and Premium Members or to attract new Force Club or Premium Members. Potential factors affecting the attractiveness of our products, business opportunities, and other initiatives include, among other items, perceived product quality and value, product exclusivity or effectiveness, economic success in our business opportunity, adverse media attention, or regulatory restrictions.

Challenges to the form of our network marketing system could harm our business.

We may be subject to challenges by government regulators regarding the form of our network marketing system. Legal and regulatory requirements concerning the multi-level marketing industry generally do not include "bright line" rules and are inherently fact-based and subject to interpretation. As a result, regulators and courts have discretion in their application of these laws and regulations, and the enforcement or interpretation of these laws and regulations by government agencies or courts can change. We could also be subject to challenges by private parties in civil actions. All of these actions and any future scrutiny of us or our industry could generate negative publicity or further regulatory actions that could result in fines, restrict our ability to conduct our business in our various markets, enter into new markets, motivate our membership, and attract consumers.

-6-

Improper actions by our Members could harm our business.

Actions by our Members, sanctioned by our Company or not, could violate applicable laws or regulations could result in government or third-party actions against us, which could harm our business.

The direct selling industry in Japan continues to experience regulatory and media scrutiny, and other direct selling companies have been suspended from sponsoring activities in the past. Japan imposes strict requirements regarding how distributors approach prospective customers. As a result, we continually evaluate and enhance our distributor compliance, education and training efforts in Japan. However, we cannot be certain that our efforts will successfully prevent regulatory actions against us, including fines, suspensions or other sanctions, or that the company and the direct selling industry will not receive further negative media attention, all of which could harm our business.

The loss of key Premium Members could negatively impact our growth and our revenue.

Currently we have 20 key Premium Members. They are responsible for sales promotion to expand their group and provide support and compliance training to the members of their group. The loss of a key Premium Member, or a sales leader or a group of leading sales leaders, whether by their own choice or through disciplinary actions by us for violations of our policies and procedures, could negatively impact our growth and our revenue.

Laws and regulations may prohibit or severely restrict direct selling and cause our revenue and profitability to decline, and regulators could adopt new regulations that harm our business.

Laws and regulations in Japan are particularly stringent and subject to broad discretion in enforcement by regulators. These laws and regulations are generally intended to prevent fraudulent or deceptive schemes, often referred to as "pyramid schemes," that compensate participants primarily for recruiting additional participants without significant emphasis on product sales to consumers.

Complying with these rules and regulations can be difficult, time-consuming and expensive, and may require significant resources. The laws and regulations governing direct selling are modified from time to time, and, like other direct selling companies, we are subject from time to time to government inquiries and investigations related to our direct selling activities. In addition, markets where we currently do business could change their laws or regulations to prohibit direct selling. If we are unable to continue business in existing markets or commence operations in new markets because of these laws, our revenue and profitability may decline.

If we change sales compensation plans, such changes could be viewed negatively by some or all of our membership and could contribute to a failure to achieve desired long-term results and have a negative impact on revenue.

Risks Relating to the Company’s Stock

The shares of our common stock are currently not being traded and there can be no assurance that there will be an active market in the future.

Our shares of common stock are traded on the OTC Pink, which does not have the liquidity or corporate standards of the NYSE or NASDAQ and as such, the price per share quoted on the OTC Pink may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock in the future. As a result, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business.

It is possible that we will not establish an active market unless our stock is listed for trading on an exchange, and we cannot assure you that we will ever satisfy exchange listing requirements.

It is possible that a significant trading market for our shares will not develop unless the shares are listed for trading on a national exchange. Exchange listing would require us to satisfy a number of tests as to corporate governance, public float, shareholders, equity, assets, market makers and other matters, some of which we do not currently meet. We cannot assure you that we will ever satisfy listing requirements for a national exchange or that there ever will be significant liquidity in our shares.

If we issue additional shares of our common stock, you will experience dilution of your ownership interest.

We may issue shares of our authorized but unissued equity securities in the future. Such shares may be issued in connection with raising capital, acquiring assets or firing or retaining employees or consultants. If we issue such shares, your ownership will be diluted.

We do not intend to pay dividends in the foreseeable future, and investors should not purchase our stock expecting to receive dividends.

We have not paid any dividends on our common stock in the past, and we do not anticipate that we will pay dividends in the foreseeable future. Accordingly, some investors may decline to invest in our common stock, and this may reduce the liquidity of our stock.

The limitations on liability for officers, directors and employees under the laws of the State of Delaware and the existence of indemnification rights for our officers, directors and employees could result in substantial expenditures by the Company and could discourage lawsuits against our officers, directors and employees.

Our Articles of Incorporation contain a specific provision that eliminates the liability of our officers and directors for monetary damages to our company and shareholders. Further, we intend to provide indemnification to our officers and directors to the fullest extent permitted by the laws of the State of Delaware. We may also enter into employment and other agreements in the future pursuant to which we will have indemnification obligations. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against officers and directors. These obligations may discourage the filing of derivative litigation by our shareholders against our officers and directors even where such litigation may be perceived as beneficial by our shareholders.

Exceed World will incur increased costs and compliance risks as a result of becoming a public company.

As a public company, Exceed World will have additional legal, accounting and other expenses that Exceed World did not have prior to acquiring Force Holdings and its subsidiaries.

-7-

SUMMARY OF OUR FINANCIAL INFORMATION

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis” section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

| EXCEED WORLD, INC. | |||||

| CONSOLIDATED BALANCE SHEETS | |||||

| As of | As of | ||||

| September 30, 2018 | September 30, 2017 | ||||

| Restated | Restated | ||||

| ASSETS | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | 22,737,755 | $ | 13,226,698 | |

| Marketable securities | 830,331 | 1,398,133 | |||

| Accounts receivable, trade, net | 1,032 | 1,011 | |||

| Short-term loan receivable | 395,848 | - | |||

| Income tax recoverable | 425,303 | - | |||

| Prepaid expenses | 295,510 | 326,612 | |||

| Inventories, net | 380,925 | 1,282,610 | |||

| Other current assets | 255,030 | 439,040 | |||

| TOTAL CURRENT ASSETS | 25,321,734 | 16,674,104 | |||

| Non-current Assets | |||||

| Long-term prepaid expenses | $ | 58,341 | $ | 343,698 | |

| Deferred tax assets | 287,157 | 195,908 | |||

| Property, plant and equipment, net | 343,991 | 457,118 | |||

| Other intangible assets, net | 3,228,655 | 3,406,262 | |||

| TOTAL NON-CURRENT ASSETS | 3,918,144 | 4,402,986 | |||

| TOTAL ASSETS | $ | 29,239,878 | $ | 21,077,090 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||

| Current Liabilities | |||||

| Accounts payable, trade | $ | 4,572,204 | $ | 1,094,635 | |

| Accrued expenses | 65,811 | 70,489 | |||

| Income tax payable | - | 350,995 | |||

| Deposit receipt | 100,657 | 47 | |||

| Deferred income | 4,460,652 | 1,845,457 | |||

| Capital lease obligations-current portion | 9,327 | 9,244 | |||

| Due to related parties | 338,725 | 368,527 | |||

| Due to director | 596,059 | 166,660 | |||

| Other accounts payable | 1,741,639 | 1,975,261 | |||

| TOTAL CURRENT LIABILITIES | 11,885,074 | 5,881,315 | |||

| Capital lease obligations-long term portion | 41,786 | 51,664 | |||

| Long-term note payable | 483,814 | 489,019 | |||

| Long-term deferred income | 2,183 | - | |||

| TOTAL LIABILITIES | 12,412,857 | 6,421,998 | |||

| Shareholders' Equity | |||||

| Preferred stock ($0.0001 par value, 20,000,000 shares authorized; | |||||

| none issued and outstanding as of September 30, 2018 and 2017) | - | - | |||

| Common stock ($0.0001 par value, 500,000,000 shares authorized, | |||||

| 32,700,000 and 20,000,000 shares issued and outstanding | |||||

| as of September 30, 2018 and 2017) | 3,270 | 2,000 | |||

| Additional paid-in capital | 99,440 | 59,679 | |||

| Accumulated earnings | 16,896,299 | 14,520,667 | |||

| Accumulated other comprehensive income (loss) | (171,988) | 72,746 | |||

| TOTAL SHAREHOLDERS' EQUITY | 16,827,021 | 14,655,092 | |||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 29,239,878 | $ | 21,077,090 | |

| EXCEED WORLD, INC. | |||||

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME | |||||

| Year Ended | Year Ended | ||||

| September 30, 2018 | September 30, 2017 | ||||

| Restated | Restated | ||||

| Revenues | $ | 34,878,988 | $ | 36,860,282 | |

| Cost of revenues | 18,654,182 | 22,219,015 | |||

| Gross profit | 16,224,806 | 14,641,267 | |||

| OPERATING EXPENSE | |||||

| Selling and distributions expenses | 1,989,146 | 1,120,970 | |||

| Administrative expenses | 11,623,028 | 9,724,573 | |||

| Total operating expenses | 13,612,174 | 10,845,543 | |||

| Income from operations | 2,612,632 | 3,795,724 | |||

| Other income | |||||

| Other income | 266,946 | 192,089 | |||

| Change in fair value of marketable securities | - | 781,681 | |||

| Total other income | 266,946 | 973,770 | |||

| Other expenses | |||||

| Change in fair value of marketable securities | 568,990 | - | |||

| Interest expenses | 6,082 | 2,801 | |||

| Other expenses | 18,171 | - | |||

| Total other expenses | 593,243 | 2,801 | |||

| Net income before tax | 2,286,335 | 4,766,693 | |||

| Income tax expense (credit) | (89,297) | 533,439 | |||

| NET INCOME | $ | 2,375,632 | $ | 4,233,254 | |

| OTHER COMPREHENSIVE INCOME | |||||

| Foreign currency translation adjustment | (244,734) | (1,210,808) | |||

| TOTAL COMPREHENSIVE INCOME | $ | 2,130,898 | $ | 3,022,446 | |

| BASIC AND DILUTED NET LOSS PER COMMON SHARE | $ | 0.12 | $ | 0.21 | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED | |||||

| 20,173,973 | 20,000,000 | ||||

-8-

|

EXCEED WORLD, INC. CONSOLIDATED BALANCE SHEETS (Unaudited) | |||||

| As of | As of | ||||

| June 30, 2019 | September 30, 2018 | ||||

| (Unaudited) | (Restated) | ||||

| ASSETS | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | 17,423,173 | $ | 22,737,755 | |

| Marketable securities | 963,685 | 830,331 | |||

| Accounts receivable | - | 1,032 | |||

| Short-term loan receivable | - | 395,848 | |||

| Income tax recoverable | - | 425,303 | |||

| Prepaid expenses | 934,647 | 295,510 | |||

| Inventories | 930,475 | 380,925 | |||

| Due from related party | 95,888 | - | |||

| Other current assets | 360,282 | 255,030 | |||

| TOTAL CURRENT ASSETS | 20,708,150 | 25,321,734 | |||

| Non-current Assets | |||||

| Property, plant and equipment, net | $ | 399,844 | $ | 343,991 | |

| Other intangible assets, net | 2,102,152 | 3,228,655 | |||

| Long-term prepaid expenses | 80,939 | 58,341 | |||

| Deferred tax assets | 302,596 | 287,157 | |||

| Long-term loan receivable from related party | 231,739 | - | |||

| TOTAL NON-CURRENT ASSETS | 3,117,270 | 3,918,144 | |||

| TOTAL ASSETS | $ | 23,825,420 | $ | 29,239,878 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||

| Current Liabilities | |||||

| Accounts payable | $ | 485,154 | $ | 4,572,204 | |

| Accrued expenses and other payables | 203,247 | 166,468 | |||

| Income tax payable | 685,356 | - | |||

| Deferred income | 225,451 | 4,460,652 | |||

| Capital lease obligations, current | 9,829 | 9,327 | |||

| Due to related parties | 1,353,565 | 934,784 | |||

| Other current liabilities | 1,338,832 | 1,741,639 | |||

| TOTAL CURRENT LIABILITIES | 4,301,434 | 11,885,074 | |||

| Non-current Liabilities | |||||

| Long-term note payable | $ | - | $ | 483,814 | |

| Long term deferred income | - | 2,183 | |||

| Capital lease obligations, long-term | 36,942 | 41,786 | |||

| TOTAL NON-CURRENT LIABILITIES | 36,942 | 527,783 | |||

| TOTAL LIABILITIES | $ | 4,338,376 | $ | 12,412,857 | |

| Shareholders' Equity | |||||

| Preferred stock ($0.0001 par value, 20,000,000 shares authorized; | |||||

| none issued and outstanding as of June 30, 2019 and September 30, 2018) | $ | - | $ | - | |

| Common stock ($0.0001 par value, 500,000,000 shares authorized, | |||||

| 32,700,000 shares issued and outstanding as of June 30, 2019 and September 30, 2018) | 3,270 | 3,270 | |||

| Additional paid-in capital | 261,516 | 99,440 | |||

| Accumulated earnings | 18,425,020 | 16,896,299 | |||

| Accumulated other comprehensive income (loss) | 797,238 | (171,988) | |||

| TOTAL SHAREHOLDERS' EQUITY | $ | 19,487,044 | $ | 16,827,021 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 23,825,420 | $ | 29,239,878 | |

EXCEED WORLD, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | ||||||

| June 30, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | ||||||

| Restated | Restated | ||||||||

| Revenues | $ | 8,101,607 | $ | 8,850,448 | $ | 21,902,288 | $ | 19,795,079 | |

| Cost of revenues | 3,836,269 | 5,238,558 | 10,906,629 | 11,459,004 | |||||

| Gross profit | 4,265,338 | 3,611,890 | 10,995,659 | 8,336,075 | |||||

| Operating expenses | |||||||||

| Selling and distribution expenses | 783,576 | 241,223 | 1,422,496 | 1,073,667 | |||||

| Administrative expenses | 2,170,782 | 2,240,801 | 8,383,166 | 8,408,361 | |||||

| Total operating expenses | 2,954,358 | 2,482,024 | 9,805,662 | 9,482,028 | |||||

| Income (loss) from operations | 1,310,980 | 1,129,866 | 1,189,997 | (1,145,953) | |||||

| Other income (expenses) | |||||||||

| Other income | 754,529 | 24,470 | 774,623 | 137,281 | |||||

| Gain on disposal of a subsidiary | - | 15,031 | - | 15,031 | |||||

| Change in fair value of marketable securities | 341,412 | 126,490 | 230,373 | (50,994) | |||||

| Total other income | 1,095,941 | 165,991 | 1,004,996 | 101,318 | |||||

| Net income (loss) before tax | 2,406,921 | 1,295,857 | 2,194,993 | (1,044,635) | |||||

| Income tax expense (benefit) | 513,190 | (155,979) | 666,272 | (68,045) | |||||

| NET INCOME (LOSS) | $ | 1,893,731 | $ | 1,451,836 | $ | 1,528,721 | $ | (976,590) | |

| OTHER COMPREHENSIVE INCOME (LOSS) | |||||||||

| Foreign currency translation adjustment | 492,360 | (488,263) | 969,226 | 233,251 | |||||

| TOTAL COMPREHENSIVE INCOME (LOSS) | $ | 2,386,091 | $ | 963,573 | $ | 2,497,947 | $ | (743,339) | |

| EARNINGS (LOSS) PER COMMON SHARE, BASIC AND DILUTED | |||||||||

| $ | 0.06 | $ | 0.07 | $ | 0.05 | $ | (0.05) | ||

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED | |||||||||

| 32,700,000 | 20,000,000 | 32,700,000 | 20,000,000 | ||||||

-9-

The Company is electing to not opt out of JOBS Act extended accounting transition period. This may make its financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

Emerging Growth Company

The recently enacted JOBS Act is intended to reduce the regulatory burden on emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

| · | be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act; |

| · | be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”, and “CEO pay ratio”; |

| · | be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; |

| · | be temporarily exempted from having to solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended; |

| · | be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and, |

| · | be permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if the standard applies to private companies). |

Our company will continue to be an emerging growth company until the earliest of:

| · | the last day of the fiscal year during which we have annual total gross revenues of $1 billion or more; |

| · | the last day of the fiscal year following the fifth anniversary of the first sale of our common equity securities in an offering registered under the Securities Act; |

| · | the date on which we issue more than $1 billion in non-convertible debt securities during a previous three-year period; or |

| · | the date on which we become a large accelerated filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2). |

-10-

MANAGEMENT’S DISCUSSION AND ANALYSIS

Liquidity and Capital Resources

As of June 30, 2019 and September 30, 2018, we had cash and cash equivalents in the amount of $17,423,173 and $22,737,755, respectively. The decrease in cash is attributed to the decrease of deferred income and accounts payable. These accounts payable were mainly unpaid commissions to Force Club premium members and these payments were completed as of the date of this report. Currently, our cash balance is sufficient to fund our operations without the need for additional funding.

As of September 30, 2018 and 2017, we had cash and cash equivalents in the amount of $22,737,755 and 13,226,698, respectively. The increase in cash is attributed to the increase of accounts payable and deferred income. These accounts payable were mainly unpaid commissions to force club premium members and these payments were completed as of the date of this report. Currently, our cash balance is sufficient to fund our operations without the need for additional funding.

Revenues

We recorded revenue of $8,101,607 and $8,850,448 for the three months ended June 30, 2019 and 2018, respectively. We recorded revenue of $21,902,288 and $19,795,079 for the nine months ended June 30, 2019 and 2018, respectively. The increase in revenue, in our opinion, is attributed to an increase in recruitment activities of Force Club premium members.

We recorded revenue of $34,878,988 for the year ended September 30, 2018 as opposed to $36,860,282 for the year ended September 30, 2017. The decrease in revenue, in our opinion, is attributed to a decrease in recruitment activities of premium force club members in the first half of the year from 2017 to 2018.

Net Income (Loss)

We recorded net income of $1,893,731 and $1,451,836 for the three months ended June 30, 2019 and 2018, respectively. We recorded net income of $1,528,721 and net loss of $976,590 for the nine months ended June 30, 2019 and June 30, 2018, respectively. The increase in net income is attributed to an increase in revenue.

We recorded net income of $2,375,632 for the year ended September 30, 2018 and net income of $4,233,254 for the year ended September 30, 2017. The decrease in net income is attributed to a decrease in revenue from 2017 to 2018.

Cash flow

For the nine months ended June 30, 2019, we recorded negative cash flows from operations in the amount of $8,050,479. For the nine months ended June 30, 2018, we recorded cash flows from operations in the amount of $504,462.

For the year ended September 30, 2018 and 2017, we generated cash flows from operations in the amount of $10,665,370 and $6,093,381, respectively.

Working capital

As of June 30, 2019 and September 30, 2018, we had working capital of $16,406,716 and $13,436,660, respectively.

As of September 30, 2018 and 2017, we had working capital of $13,436,660 and $10,792,789, respectively. The increase in working capital is attributed to an increase in cash from 2017 to 2018.

Advertising

Advertising costs are expensed as incurred and included in selling and distributions expenses. For the three months ended June 30, 2019 and 2018, advertising expenses were $783,576 and $241,223, respectively. For the nine months ended June 30, 2019 and 2018, advertising expenses were $1,422,496 and $1,073,667, respectively.

Advertising costs are expensed as incurred and included in selling and distributions expenses. Advertising expenses were $913,480 and $761,891 for the years ended September 30, 2018 and 2017, respectively.

Advertising expenses were comprised of, but not limited to, sales events hosted for sales agents, exhibitions to promote and display company product offerings, signboards, and public relations activities.

Future Plans

Over the course of the next twelve months, the Company intends to focus on expanding its sales network in order to strengthen its business activities. Currently, revenue is derived primarily from sales of the Company’s Force Club premium package. While it is the intention of the Company to maintain this revenue stream, and to further increase the number of premium users of the Force Club, the Company also intends to diversify its operations and develop additional business activities.

In order to do so, the Company intends to focus on development of an online educational platform on which additional advertising income can be generated. At present, there are no definitive plans that have been made regarding the implementation or direction of this future online educational platform. However, we intend to begin efforts to hire additional personnel with extensive experience in web marketing in order to assist in the development of our future platform.

In addition to e-learning business, the Company has also been engaged in school business such as abacus school and programming school. In July 2019, we opened “After School” which provides various after school education and activities programs to children.

-11-

This prospectus contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this prospectus.

Corporate History

The Company was originally incorporated with the name Brilliant Acquisition, Inc., under the laws of the State of Delaware on November 25, 2014, with an objective to acquire, or merge with, an operating business. On January 12, 2016, Thomas DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with e-Learning. Pursuant to the Agreement, Mr. DeNunzio transferred to e-Learning, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares. Following the closing of the share purchase transaction, e-Learning gained a 100% interest in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

On January 12, 2016, the Company changed its name to Exceed World, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment. On January 12, 2016, Mr. Thomas DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Also, on January 12, 2016, Mr. Tomoo Yoshida was appointed as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On February 29, 2016, the Company entered into a Stock Purchase Agreement with Tomoo Yoshida, our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Pursuant to this Agreement, Tomoo Yoshida transferred to Exceed World, Inc., 10 shares of the common stock of E&F Co., Ltd., a Japan corporation (“E&F”), which represents all of its issued and outstanding shares in consideration of $4,835 (JPY 500,000). Following the effective date of the share purchase transaction on February 29, 2016, Exceed World, Inc. gained a 100% interest in the issued and outstanding shares of E&F’s common stock and E&F became a wholly owned subsidiary of Exceed World. On August 4, 2016, the E&F changed its name to School TV Co., Ltd (“School TV”) and filed with the Legal Affairs Bureau in Osaka, Japan.

On April 1, 2016, e-Learning entered into stock purchase agreements with 7 Japanese individuals. Pursuant to these agreements, e-Learning sold 140,000 shares of common stock in total to these individuals and received $270 as aggregate consideration. Each paid JPY0.215 per share. At the time of purchase the price paid per share by each was the equivalent of about $0.002. This sale of shares was exempt from registration in accordance with Regulation S of the Securities Act of 1933, as amended ("Regulation S") because the above sales of the stock were made to non-U.S. persons as defined under Rule 902 section (k)(2)(i) of Regulation S, pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On August 1, 2016, the Company changed its fiscal year end from November 30 to September 30.

On August 9, 2016, e-Learning entered into stock purchase agreements with 33 Japanese individuals. Pursuant to these agreements, e-Learning sold 3,300 shares of common stock in total to these individuals and received $330 as aggregate consideration. Each paid JPY10 per share. At the time of purchase the price paid per share by each shareholder was the equivalent to about $0.1. These shares were sold pursuant to the Company’s effective S-1 Registration Statement deemed effective on July 20, 2016 at 4pm EST.

On October 28, 2016, the Company, with the approval of its board of directors and its majority shareholders by written consent in lieu of a meeting, authorized the cancellation of shares owned by e-Learning. e-Learning consented to the cancellation of shares. The total number of shares cancelled was 19,000,000 shares which was comprised of 16,500,000 restricted common shares and 2,500,000 free trading shares.

On October 28, 2016, every one (1) share of common stock, par value $.0001 per share, of the Company issued and outstanding was automatically reclassified and changed into twenty (20) shares fully paid and non-assessable shares of common stock of the Company, par value $.0001 per share. (“20-for-1 Forward Stock Split”) No fractional shares were issued. The authorized number of shares, and par value per share, of common stock are not affected by the 20-for-1 Forward Stock Split.