Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - electroCore, Inc. | d869749dex991.htm |

| 8-K - 8-K - electroCore, Inc. | d869749d8k.htm |

Exhibit 99.2 A Commercial-Stage Bioelectronic Medicine Company Nasdaq: ECOR Corporate Presentation January 2020Exhibit 99.2 A Commercial-Stage Bioelectronic Medicine Company Nasdaq: ECOR Corporate Presentation January 2020

Forward Looking Statement In addition to historical information, this presentation may contain forward-looking statements with respect to our business, capital resources, strategy and growth reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All forward-looking statements are subject to a number of risks, uncertainties and assumptions, and you should not rely upon forward-looking statements as predictions of future events. All forward-looking statements will be based upon current estimates and expectations about future events and financial and other trends. There is no guarantee that future results, performance or events reflected in the forward-looking statements will be achieved or occur. No person assumes responsibility for the accuracy and completeness of the forward-looking statements, and, except as required by law, no person undertakes any obligation to update any forward-looking statements for any reason after the date of this presentation. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by terms such as anticipates, believes, could,” seeks, estimates, intends, may, plans, potential, predicts, projects, should, will, would or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management's beliefs and assumptions only as of the date they are made and are only predictions that may be inaccurate. You should read the Risk Factors set forth in our reports filed from time to time with the Securities and Exchange Commission, which factors may cause our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those or our situation may change in the future. Additionally, in an effort to provide additional information management believes is a useful indicator of operating performance for the fiscal quarter ended September 30, 2019, this presentation contains a financial measure not determined by generally accepted accounting principles (GAAP): Adjusted EBITDA net loss from operations. A reconciliation to the most directly comparable GAAP financial measure of Net Loss from Operations is available on the presentation slide entitled “Adjusted EBITDA Reconciliation.” The rationale for management’s use of non-GAAP information is included in Exhibit 99.1 to the Company’s Form 8-K furnished with the SEC on November 13, 2019. Nasdaq: ECOR 2 2 © 2019 electroCore. All rightsreserved.Forward Looking Statement In addition to historical information, this presentation may contain forward-looking statements with respect to our business, capital resources, strategy and growth reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All forward-looking statements are subject to a number of risks, uncertainties and assumptions, and you should not rely upon forward-looking statements as predictions of future events. All forward-looking statements will be based upon current estimates and expectations about future events and financial and other trends. There is no guarantee that future results, performance or events reflected in the forward-looking statements will be achieved or occur. No person assumes responsibility for the accuracy and completeness of the forward-looking statements, and, except as required by law, no person undertakes any obligation to update any forward-looking statements for any reason after the date of this presentation. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by terms such as anticipates, believes, could,” seeks, estimates, intends, may, plans, potential, predicts, projects, should, will, would or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management's beliefs and assumptions only as of the date they are made and are only predictions that may be inaccurate. You should read the Risk Factors set forth in our reports filed from time to time with the Securities and Exchange Commission, which factors may cause our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those or our situation may change in the future. Additionally, in an effort to provide additional information management believes is a useful indicator of operating performance for the fiscal quarter ended September 30, 2019, this presentation contains a financial measure not determined by generally accepted accounting principles (GAAP): Adjusted EBITDA net loss from operations. A reconciliation to the most directly comparable GAAP financial measure of Net Loss from Operations is available on the presentation slide entitled “Adjusted EBITDA Reconciliation.” The rationale for management’s use of non-GAAP information is included in Exhibit 99.1 to the Company’s Form 8-K furnished with the SEC on November 13, 2019. Nasdaq: ECOR 2 2 © 2019 electroCore. All rightsreserved.

electroCore At-a-Glance NASDAQx ECOR Headquarters: Basking Ridge, NJ Market cap: ~$46M (12/31/19) Recent close: $1.59 (12/31/19) Cash & marketable securities (12/31/19): $24.1M gammaCore ™ Sapphire 3electroCore At-a-Glance NASDAQx ECOR Headquarters: Basking Ridge, NJ Market cap: ~$46M (12/31/19) Recent close: $1.59 (12/31/19) Cash & marketable securities (12/31/19): $24.1M gammaCore ™ Sapphire 3

Experienced Management Team Daniel Goldberger Tony Fiorino, MD Chief Executive Officer Chief Medical Officer 35 years 20 years Brian Posner Eric Liebler Chief Financial Officer SVP of Neurology 35 years 30 years Ardelle Ferris Michael Ruberio VP of Market Access National Sales Director 30 years 30 years Mike Romaniw Iain Strickland VP of Operations Vice President, European 30 years Operations (UK) 15 years Nasdaq: ECOR 4 4 © 2019 electroCore. All rightsreserved.Experienced Management Team Daniel Goldberger Tony Fiorino, MD Chief Executive Officer Chief Medical Officer 35 years 20 years Brian Posner Eric Liebler Chief Financial Officer SVP of Neurology 35 years 30 years Ardelle Ferris Michael Ruberio VP of Market Access National Sales Director 30 years 30 years Mike Romaniw Iain Strickland VP of Operations Vice President, European 30 years Operations (UK) 15 years Nasdaq: ECOR 4 4 © 2019 electroCore. All rightsreserved.

Investment Summary FDA cleared, proprietary, non-invasive vagus nerve stimulator positioned to Platform Therapy unlock the broad potential of bioelectronic medicine 1 Cluster headache and migraine estimated to affect more than 36 million Large Initial Market people in the U.S. Attractive Revenue Model Recurring revenue business model Key patent coverage extends through 2033 Strong IP Portfolio 1 American Migraine Foundation Nasdaq: ECOR 5 5 © 2019 electroCore. All rightsreserved.Investment Summary FDA cleared, proprietary, non-invasive vagus nerve stimulator positioned to Platform Therapy unlock the broad potential of bioelectronic medicine 1 Cluster headache and migraine estimated to affect more than 36 million Large Initial Market people in the U.S. Attractive Revenue Model Recurring revenue business model Key patent coverage extends through 2033 Strong IP Portfolio 1 American Migraine Foundation Nasdaq: ECOR 5 5 © 2019 electroCore. All rightsreserved.

gammaCore ™ Sapphire st 1 FDA-cleared non-invasive vagus nerve stimulator Fast acting, highly targeted, comfortable, easy to use hand-held option Cleared for the prevention and treatment of cluster headache Also cleared for the treatment of acute migraine Recurring revenue modelgammaCore ™ Sapphire st 1 FDA-cleared non-invasive vagus nerve stimulator Fast acting, highly targeted, comfortable, easy to use hand-held option Cleared for the prevention and treatment of cluster headache Also cleared for the treatment of acute migraine Recurring revenue model

nVNS and the Benefits of gammaCore gammaCore for Headache Benefits of nVNS FDA cleared for prevention and treatment The vagus nerve affects multiple organs of cluster headache and systems FDA cleared for treatment of acute migraine Activates multiple mechanisms of action Use alongside existing treatments Evidence supports possible future treatment for many indications No drug-drug interactions or drug-like side effects Self-treating and no off-target effects Can decrease the use of medications, Complementary to existing care resulting in lower cost to treat cluster headache (UK’s NICE) May use multiple times per day or month Nasdaq: ECOR 7 7 © 2019 electroCore. All rightsreserved.nVNS and the Benefits of gammaCore gammaCore for Headache Benefits of nVNS FDA cleared for prevention and treatment The vagus nerve affects multiple organs of cluster headache and systems FDA cleared for treatment of acute migraine Activates multiple mechanisms of action Use alongside existing treatments Evidence supports possible future treatment for many indications No drug-drug interactions or drug-like side effects Self-treating and no off-target effects Can decrease the use of medications, Complementary to existing care resulting in lower cost to treat cluster headache (UK’s NICE) May use multiple times per day or month Nasdaq: ECOR 7 7 © 2019 electroCore. All rightsreserved.

Unmet Need in Migraine & Cluster Headache 20X MIGRAINE CLUSTER HEADACHE 1 3 36 million U.S. patients 400,000 U.S. patients Up to eight 15-180 min attacks per day Triptans represent 80% of prescribed acute therapies 3 400,000 U.S. patients Considered one of the most painful conditions known; a 40% of patients are dissatisfied or unresponsive “suicide headache” Up to eight 15-180 min attacks per day 2 to triptans gammaCore is FDA-cleared for the prevention and treatment Typically occur 4-24 weeks per year More than half of insured migraineurs receive no Rx of all types of cluster headache (acute and episodic) 2 treatment gammaCore is FDA-cleared therapy for acute and preventive treatment of Cluster Headache gammaCore is FDA-cleared for acute migraine 1. American Migraine Foundation 2. IMS Pharmetrics Plus. 3. Cephalalgia. 2008 Jun;28(6):614-8. doi: 10.1111/j.1468-2982.2008.01592.x. Epub 2008 Apr 16. Nasdaq: ECOR 8 8 © 2019 electroCore. All rightsreserved.Unmet Need in Migraine & Cluster Headache 20X MIGRAINE CLUSTER HEADACHE 1 3 36 million U.S. patients 400,000 U.S. patients Up to eight 15-180 min attacks per day Triptans represent 80% of prescribed acute therapies 3 400,000 U.S. patients Considered one of the most painful conditions known; a 40% of patients are dissatisfied or unresponsive “suicide headache” Up to eight 15-180 min attacks per day 2 to triptans gammaCore is FDA-cleared for the prevention and treatment Typically occur 4-24 weeks per year More than half of insured migraineurs receive no Rx of all types of cluster headache (acute and episodic) 2 treatment gammaCore is FDA-cleared therapy for acute and preventive treatment of Cluster Headache gammaCore is FDA-cleared for acute migraine 1. American Migraine Foundation 2. IMS Pharmetrics Plus. 3. Cephalalgia. 2008 Jun;28(6):614-8. doi: 10.1111/j.1468-2982.2008.01592.x. Epub 2008 Apr 16. Nasdaq: ECOR 8 8 © 2019 electroCore. All rightsreserved.

Reimbursement Pathway Aligned to stakeholder experience Commercial Payer Response PHYSICIANS Write a prescription for use at home CURRENT PAYER COVERAGE CVS Caremark, Highmark Blue Cross Blue Shield, North Dakota Blue Cross Blue Shield, Federal Supply Schedule (VA, DoD, Indian Health Service), cash pay PATIENTS PAYER ENGAGEMENT Acquire gammaCore from a specialty pharmacy with simple refill process Active discussions and negotiations with multiple national plans REIMBURSEMENT PATH PAYERS Prescription model with periodic refill; can be reimbursed as pharmacy or Manage utilization through pharmacy or medical benefit $ medical benefit reimbursement Nasdaq: ECOR 9 9 © 2019 electroCore. All rightsreserved.Reimbursement Pathway Aligned to stakeholder experience Commercial Payer Response PHYSICIANS Write a prescription for use at home CURRENT PAYER COVERAGE CVS Caremark, Highmark Blue Cross Blue Shield, North Dakota Blue Cross Blue Shield, Federal Supply Schedule (VA, DoD, Indian Health Service), cash pay PATIENTS PAYER ENGAGEMENT Acquire gammaCore from a specialty pharmacy with simple refill process Active discussions and negotiations with multiple national plans REIMBURSEMENT PATH PAYERS Prescription model with periodic refill; can be reimbursed as pharmacy or Manage utilization through pharmacy or medical benefit $ medical benefit reimbursement Nasdaq: ECOR 9 9 © 2019 electroCore. All rightsreserved.

Commercial Progress through PBMs CVS/Caremark gammaCore is reimbursed by CVS/Caremark at a non-exclusionary co-pay of roughly $50 - $75/month for those beneficiaries who have a benefit design that does not differentiate between drugs and devices Approximately five million CVS/Caremark members currently have a benefit design of this type Express Scripts (ESI) gammaCore is reimbursed by ESI at a non-preferred copay of roughly $50 - $75/month for those beneficiaries who have a benefit design that does not differentiate between drugs and devices Nasdaq: ECOR 10 1 © 2019 electroCore. All rightsreserved. 0Commercial Progress through PBMs CVS/Caremark gammaCore is reimbursed by CVS/Caremark at a non-exclusionary co-pay of roughly $50 - $75/month for those beneficiaries who have a benefit design that does not differentiate between drugs and devices Approximately five million CVS/Caremark members currently have a benefit design of this type Express Scripts (ESI) gammaCore is reimbursed by ESI at a non-preferred copay of roughly $50 - $75/month for those beneficiaries who have a benefit design that does not differentiate between drugs and devices Nasdaq: ECOR 10 1 © 2019 electroCore. All rightsreserved. 0

1 Growth in gammaCore Prescribers All Prescribers 3,000 2,600 2,451 2,500 2,170 2,000 1,827 1,480 1,500 997 1,000 563 500 0 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 1 Represents prescribers who have written at least one prescription Nasdaq: ECOR 11 1 © 2019 electroCore. All rightsreserved. 11 Growth in gammaCore Prescribers All Prescribers 3,000 2,600 2,451 2,500 2,170 2,000 1,827 1,480 1,500 997 1,000 563 500 0 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 1 Represents prescribers who have written at least one prescription Nasdaq: ECOR 11 1 © 2019 electroCore. All rightsreserved. 1

Active Channels With Revenue Growth Opportunities Driving Department of Defense sales through the Veterans Administration and Military Treatment Facilities Growth in the UK by leveraging: 1) Innovation Technology Program Award for cluster headache and 2) support from the National Institute for Health and Care Excellence (NICE) for the treatment of cluster headache Workers Comp and Personal Injury through a relationship with Doctor’s Medical, LLC Nasdaq: ECOR 12 1 © 2019 electroCore. All rightsreserved. 2Active Channels With Revenue Growth Opportunities Driving Department of Defense sales through the Veterans Administration and Military Treatment Facilities Growth in the UK by leveraging: 1) Innovation Technology Program Award for cluster headache and 2) support from the National Institute for Health and Care Excellence (NICE) for the treatment of cluster headache Workers Comp and Personal Injury through a relationship with Doctor’s Medical, LLC Nasdaq: ECOR 12 1 © 2019 electroCore. All rightsreserved. 2

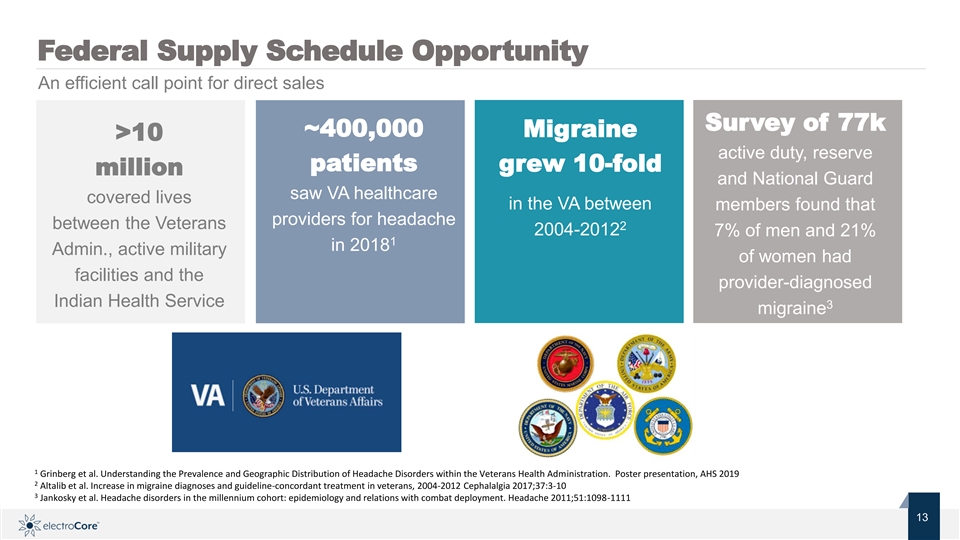

Federal Supply Schedule Opportunity An efficient call point for direct sales Survey of 77k ~400,000 Migraine >10 active duty, reserve patients grew 10-fold million and National Guard saw VA healthcare covered lives in the VA between members found that providers for headache between the Veterans 2 2004-2012 7% of men and 21% 1 in 2018 Admin., active military of women had facilities and the provider-diagnosed Indian Health Service 3 migraine 1 Grinberg et al. Understanding the Prevalence and Geographic Distribution of Headache Disorders within the Veterans Health Administration. Poster presentation, AHS 2019 2 Altalib et al. Increase in migraine diagnoses and guideline-concordant treatment in veterans, 2004-2012 Cephalalgia 2017;37:3-10 3 Jankosky et al. Headache disorders in the millennium cohort: epidemiology and relations with combat deployment. Headache 2011;51:1098-1111 Nasdaq: ECOR 13 1 © 2019 electroCore. All rightsreserved. 3Federal Supply Schedule Opportunity An efficient call point for direct sales Survey of 77k ~400,000 Migraine >10 active duty, reserve patients grew 10-fold million and National Guard saw VA healthcare covered lives in the VA between members found that providers for headache between the Veterans 2 2004-2012 7% of men and 21% 1 in 2018 Admin., active military of women had facilities and the provider-diagnosed Indian Health Service 3 migraine 1 Grinberg et al. Understanding the Prevalence and Geographic Distribution of Headache Disorders within the Veterans Health Administration. Poster presentation, AHS 2019 2 Altalib et al. Increase in migraine diagnoses and guideline-concordant treatment in veterans, 2004-2012 Cephalalgia 2017;37:3-10 3 Jankosky et al. Headache disorders in the millennium cohort: epidemiology and relations with combat deployment. Headache 2011;51:1098-1111 Nasdaq: ECOR 13 1 © 2019 electroCore. All rightsreserved. 3

gammaCore– Platform Technology with Vast Potential INFLAMMATION NEUROLOGY / PAIN Migraine 2 1 Rheumatoid Arthritis Cluster Headache 2 1 Sjogren’s Syndrome Depression Migraine 2 Post-traumatic Epilepsy headache Traumatic Brain Injury Subarachnoid hemorrhage Stroke gammaCore is the only FDA cleared non-invasive VNS GASTROENTEROLOGY 1 Approved indications therapy Gastroparesis Ulcerative colitis Post-operative Ileus 2 Corporate funded studies Nasdaq: ECOR 14 1 © 2019 electroCore. All rightsreserved. 4gammaCore– Platform Technology with Vast Potential INFLAMMATION NEUROLOGY / PAIN Migraine 2 1 Rheumatoid Arthritis Cluster Headache 2 1 Sjogren’s Syndrome Depression Migraine 2 Post-traumatic Epilepsy headache Traumatic Brain Injury Subarachnoid hemorrhage Stroke gammaCore is the only FDA cleared non-invasive VNS GASTROENTEROLOGY 1 Approved indications therapy Gastroparesis Ulcerative colitis Post-operative Ileus 2 Corporate funded studies Nasdaq: ECOR 14 1 © 2019 electroCore. All rightsreserved. 4

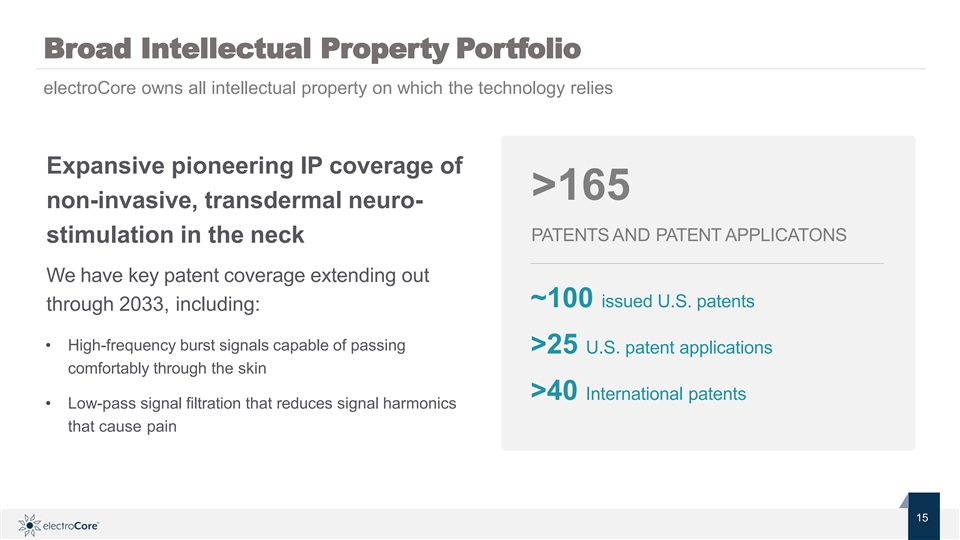

Broad Intellectual Property Portfolio electroCore owns all intellectual property on which the technology relies Expansive pioneering IP coverage of >165 non-invasive, transdermal neuro- PATENTS AND PATENT APPLICATONS stimulation in the neck We have key patent coverage extending out ~100 issued U.S. patents through 2033, including: • High-frequency burst signals capable of passing >25 U.S. patent applications comfortably through the skin >40 International patents • Low-pass signal filtration that reduces signal harmonics that cause pain Nasdaq: ECOR 15 1 © 2019 electroCore. All rightsreserved. 5Broad Intellectual Property Portfolio electroCore owns all intellectual property on which the technology relies Expansive pioneering IP coverage of >165 non-invasive, transdermal neuro- PATENTS AND PATENT APPLICATONS stimulation in the neck We have key patent coverage extending out ~100 issued U.S. patents through 2033, including: • High-frequency burst signals capable of passing >25 U.S. patent applications comfortably through the skin >40 International patents • Low-pass signal filtration that reduces signal harmonics that cause pain Nasdaq: ECOR 15 1 © 2019 electroCore. All rightsreserved. 5

Summary Financials $ In thousands 4Q 2018 1Q 2019 2Q 2019 3Q 2019 GAAP revenue 368 410 623 683 Research and Development 3,460 3,460 2,510 2,275 SG&A 12,397 11,000 9,388 8,143 Operating loss (15,681) (14,211) (12,380) (10,894) GAAP net loss from operations (15,335) (13,862) (12,101) (10,688) Adjusted EBITDA net loss from operations (14,514) (13,441) (10,775) (8,448) Shares outstanding 29,450 29,633 29,582 29,469 Cash burn $11,900 $16,200 $11,200 $7,600 Significant opportunities remain to further reduce cash burn Cash and equivalents $33,500 Debt $461 Shareholders’ Equity $32,295 Please see reconciliation of GAAP net loss from operations to adjusted EBITDA net loss from operations on slide 17. Nasdaq: ECOR 16 1 © 2019 electroCore. All rightsreserved. 6Summary Financials $ In thousands 4Q 2018 1Q 2019 2Q 2019 3Q 2019 GAAP revenue 368 410 623 683 Research and Development 3,460 3,460 2,510 2,275 SG&A 12,397 11,000 9,388 8,143 Operating loss (15,681) (14,211) (12,380) (10,894) GAAP net loss from operations (15,335) (13,862) (12,101) (10,688) Adjusted EBITDA net loss from operations (14,514) (13,441) (10,775) (8,448) Shares outstanding 29,450 29,633 29,582 29,469 Cash burn $11,900 $16,200 $11,200 $7,600 Significant opportunities remain to further reduce cash burn Cash and equivalents $33,500 Debt $461 Shareholders’ Equity $32,295 Please see reconciliation of GAAP net loss from operations to adjusted EBITDA net loss from operations on slide 17. Nasdaq: ECOR 16 1 © 2019 electroCore. All rightsreserved. 6

Adjusted EBITDA Reconciliation 4Q 2018 1Q 2019 2Q 2019 3Q 2019 (in thousands) GAAP net loss from operations $ (15,335) $ (13,862) $ (12,101) $ (10,688) Provision for income taxes $ - $ - $ - $ - Depreciation and amortization $ 25 $ 26 $ 28 $ 99 Stock-based compensation $ 1,141 $ 744 $ 727 $ 1,220 Restructuring and other severance related charges $ - $ - $ 850 $ 805 Legal fees associated with stockholders’ litigation $ - $ - $ - $ 322 Total other (income)/expense $ (346) $ (349) $ (279) $ (206) Adjusted EBIDTA net loss from operations $ (14,514) $ (13,441) $ (10,775) $ (8,448) Nasdaq: ECOR 17 1 © 2019 electroCore. All rightsreserved. 7Adjusted EBITDA Reconciliation 4Q 2018 1Q 2019 2Q 2019 3Q 2019 (in thousands) GAAP net loss from operations $ (15,335) $ (13,862) $ (12,101) $ (10,688) Provision for income taxes $ - $ - $ - $ - Depreciation and amortization $ 25 $ 26 $ 28 $ 99 Stock-based compensation $ 1,141 $ 744 $ 727 $ 1,220 Restructuring and other severance related charges $ - $ - $ 850 $ 805 Legal fees associated with stockholders’ litigation $ - $ - $ - $ 322 Total other (income)/expense $ (346) $ (349) $ (279) $ (206) Adjusted EBIDTA net loss from operations $ (14,514) $ (13,441) $ (10,775) $ (8,448) Nasdaq: ECOR 17 1 © 2019 electroCore. All rightsreserved. 7

Capitalization Table Fully diluted as of September 30, 2019 Common stock shares 29,450,034 Exercise prices ranging from $5.68 to $12.60; expirations from Warrants 756,933 April 1, 2021 through August 31, 2022 Weighted average exercise price=$10.36, options generally Options 2,355,366 vest over 4-year period (first options granted June 21, 2018) Primarily retention RSUs which will vest over two-year period Restricted Stock Units 1,246,315 starting June 2020. Total 33,808,648 Nasdaq: ECOR 18 1 © 2019 electroCore. All rightsreserved. 8Capitalization Table Fully diluted as of September 30, 2019 Common stock shares 29,450,034 Exercise prices ranging from $5.68 to $12.60; expirations from Warrants 756,933 April 1, 2021 through August 31, 2022 Weighted average exercise price=$10.36, options generally Options 2,355,366 vest over 4-year period (first options granted June 21, 2018) Primarily retention RSUs which will vest over two-year period Restricted Stock Units 1,246,315 starting June 2020. Total 33,808,648 Nasdaq: ECOR 18 1 © 2019 electroCore. All rightsreserved. 8

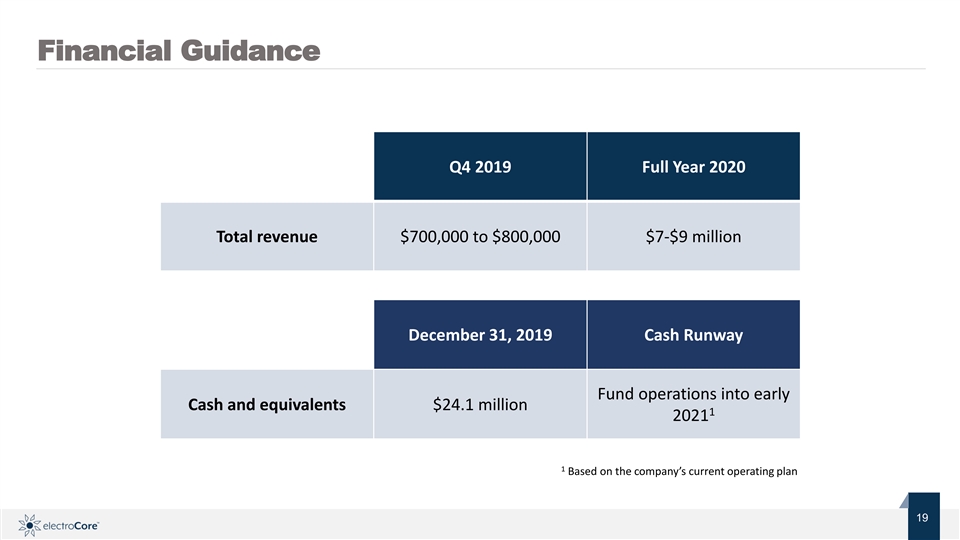

Financial Guidance Q4 2019 Full Year 2020 Total revenue $700,000 to $800,000 $7-$9 million December 31, 2019 Cash Runway Fund operations into early Cash and equivalents $24.1 million 1 2021 1 Based on the company’s current operating plan Nasdaq: ECOR 19 1 © 2019 electroCore. All rightsreserved. 9Financial Guidance Q4 2019 Full Year 2020 Total revenue $700,000 to $800,000 $7-$9 million December 31, 2019 Cash Runway Fund operations into early Cash and equivalents $24.1 million 1 2021 1 Based on the company’s current operating plan Nasdaq: ECOR 19 1 © 2019 electroCore. All rightsreserved. 9

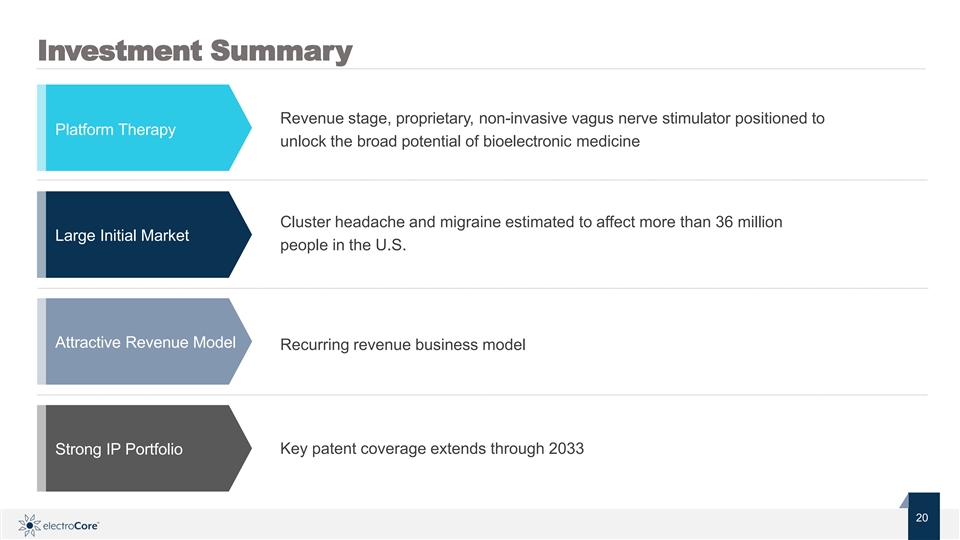

Investment Summary Revenue stage, proprietary, non-invasive vagus nerve stimulator positioned to Platform Therapy unlock the broad potential of bioelectronic medicine Cluster headache and migraine estimated to affect more than 36 million Large Initial Market people in the U.S. Attractive Revenue Model Recurring revenue business model Key patent coverage extends through 2033 Strong IP Portfolio Nasdaq: ECOR 20 2 © 2019 electroCore. All rightsreserved. 0Investment Summary Revenue stage, proprietary, non-invasive vagus nerve stimulator positioned to Platform Therapy unlock the broad potential of bioelectronic medicine Cluster headache and migraine estimated to affect more than 36 million Large Initial Market people in the U.S. Attractive Revenue Model Recurring revenue business model Key patent coverage extends through 2033 Strong IP Portfolio Nasdaq: ECOR 20 2 © 2019 electroCore. All rightsreserved. 0

APPENDIXAPPENDIX

Acute Cluster Headache: ACT 1 & ACT 2 Pooled analysis of Episodic Cluster Headache from ACT 1 & ACT 2 Trials ACT 1 PRIMARY ENDPOINT ACT 2 PRIMARY ENDPOINT RESPONDER ANALYSIS % Responders with Pain Relief at % All Treated Attacks Pain-Free % Responders at 15 Minutes in ≥ 15 Minutes for 1st Attack at 15 Minutes 50% of Attacks n = 60 n = 60 n = 52 n = 259 n = 287 n = 52 50% 40% p < 0.01 p < 0.01 30% p < 0.01 42.3% 20% 38.5% 24.1% 10% 15.0% 11.7% 7.3% 0% gammaCore Control Nasdaq: ECOR 22 2 © 2019 electroCore. All rightsreserved. 2 Response Rate (%)Acute Cluster Headache: ACT 1 & ACT 2 Pooled analysis of Episodic Cluster Headache from ACT 1 & ACT 2 Trials ACT 1 PRIMARY ENDPOINT ACT 2 PRIMARY ENDPOINT RESPONDER ANALYSIS % Responders with Pain Relief at % All Treated Attacks Pain-Free % Responders at 15 Minutes in ≥ 15 Minutes for 1st Attack at 15 Minutes 50% of Attacks n = 60 n = 60 n = 52 n = 259 n = 287 n = 52 50% 40% p < 0.01 p < 0.01 30% p < 0.01 42.3% 20% 38.5% 24.1% 10% 15.0% 11.7% 7.3% 0% gammaCore Control Nasdaq: ECOR 22 2 © 2019 electroCore. All rightsreserved. 2 Response Rate (%)

Acute Migraine: PRESTO Trial Pain Freedom Percent Pain Relief 40% Repeated Measures Analysis p = 0.01 34.8% 30% 30.4% p = 0.07 p < 0.01 25.4% 20% 21.0% p = 0.02 19.7% p = 0.03 18.1% p = 0.06 p = 0.01 12.7% 10% 10.0% 7.7% 5.4% 5.2% 4.2% 0% 30 Min 60 Min 120 Min 30 Min 60 Min 120 Min gammaCore (n = 120) Control (n = 123) Nasdaq: ECOR 23 2 © 2019 electroCore. All rightsreserved. 3 Response Rate (%)Acute Migraine: PRESTO Trial Pain Freedom Percent Pain Relief 40% Repeated Measures Analysis p = 0.01 34.8% 30% 30.4% p = 0.07 p < 0.01 25.4% 20% 21.0% p = 0.02 19.7% p = 0.03 18.1% p = 0.06 p = 0.01 12.7% 10% 10.0% 7.7% 5.4% 5.2% 4.2% 0% 30 Min 60 Min 120 Min 30 Min 60 Min 120 Min gammaCore (n = 120) Control (n = 123) Nasdaq: ECOR 23 2 © 2019 electroCore. All rightsreserved. 3 Response Rate (%)

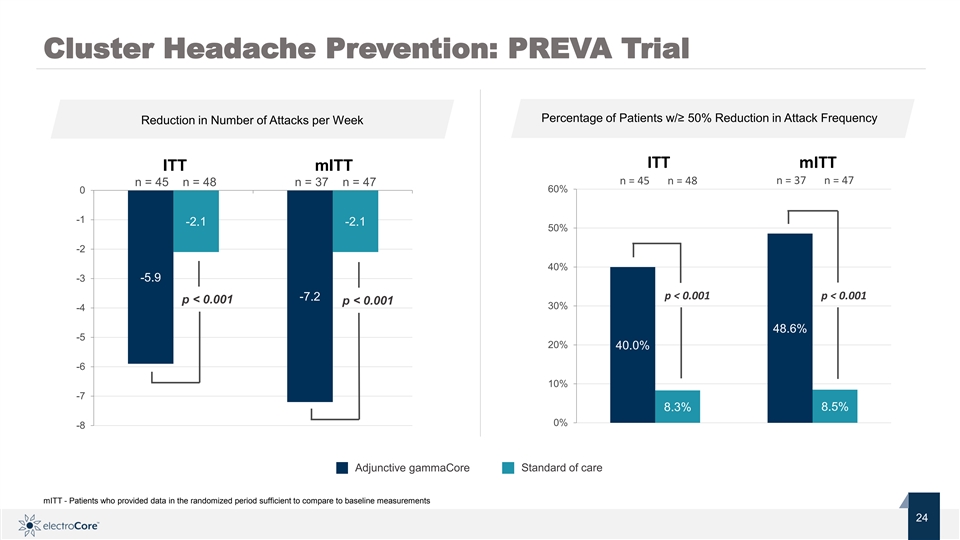

Cluster Headache Prevention: PREVA Trial Percentage of Patients w/≥ 50% Reduction in Attack Frequency Reduction in Number of Attacks per Week ITT mITT ITT mITT n = 45 n = 48 n = 37 n = 47 n = 45 n = 48 n = 37 n = 47 60% 0 -1 -2.1 -2.1 50% -2 40% -3 -5.9 p < 0.001 p < 0.001 -7.2 p < 0.001 p < 0.001 30% -4 48.6% -5 20% 40.0% -6 10% -7 8.3% 8.5% 0% -8 Standard of care Adjunctive gammaCore mITT - Patients who provided data in the randomized period sufficient to compare to baseline measurements Nasdaq: ECOR 24 2 © 2019 electroCore. All rightsreserved. 4Cluster Headache Prevention: PREVA Trial Percentage of Patients w/≥ 50% Reduction in Attack Frequency Reduction in Number of Attacks per Week ITT mITT ITT mITT n = 45 n = 48 n = 37 n = 47 n = 45 n = 48 n = 37 n = 47 60% 0 -1 -2.1 -2.1 50% -2 40% -3 -5.9 p < 0.001 p < 0.001 -7.2 p < 0.001 p < 0.001 30% -4 48.6% -5 20% 40.0% -6 10% -7 8.3% 8.5% 0% -8 Standard of care Adjunctive gammaCore mITT - Patients who provided data in the randomized period sufficient to compare to baseline measurements Nasdaq: ECOR 24 2 © 2019 electroCore. All rightsreserved. 4