Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VINCE HOLDING CORP. | vnce-8k_20200113.htm |

| EX-99.1 - EX-99.1 - VINCE HOLDING CORP. | vnce-ex991_48.htm |

Management Presentation J A N U A R Y2 0 2 0 Exhibit 99.2

DISCLAIMER This Management Presentation (this “Presentation”) is the property of Vince Holding Corp. and its subsidiaries (collectively, “Vince” or the “Company”). By accepting this Presentation, the recipient acknowledges that it has read, understood and accepted the terms of this disclaimer. This Presentation is not a formal offer to sell or solicitation of an offer to buy the Company’s securities. Information contained in this Presentation should not be relied upon as advice to buy or sell or hold such securities or as an offer to sell such securities. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this Presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements relating thereto. By acceptance of this Presentation, each recipient agrees not to copy, reproduce or distribute to others the Presentation, in whole or in part, without the prior written consent of the Company, and will promptly return this Presentation to the Company upon request. This Presentation contains the Company’s financial results in conformity with U.S. generally accepted accounting principles (“GAAP”) as well as adjusted results which are non-GAAP financial measures, including adjusted operating income (loss), which eliminates the effect on operating results of various factors. The Company believes the presentation of these non-GAAP measures facilitates an understanding of the Company’s continuing operations without the impact of such factors. The factors excluded to arrive at non-GAAP financial measures included in this Presentation and the reconciliation of GAAP to non-GAAP results are further detailed on page 26 of this Presentation. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information of the Company prepared in accordance with GAAP. This Presentation may contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact or relating to present facts or current conditions included in this Presentation are forward-looking statements, including information provided on pages 26 and 30 of this Presentation. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “target,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. These forward- looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including those as set forth from time to time in our Securities and Exchange Commission (the “SEC”) filings, including those described in our Annual Report on Form 10-K as well as our Quarterly Reports on Form 10-Q under “Item 1A – Risk Factors” filed with the SEC. Any forward-looking statement made by the Company in this Presentation speaks only as of the date on which it is made. Except as may be required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Market data and industry information used in this presentation are based on independent industry surveys and publications and other publicly available information prepared by third party sources. Although the Company believes that these sources are reliable as of their respective dates, it has not verified the accuracy or completeness of this information from independent sources.

KEY INVESTMENT HIGHLIGHTS Strategically positioned with contemporary fashion portfolio consisting of three highly recognized and distinct brands Multiple actionable growth opportunities across brands Potential to achieve meaningfully higher operating margin expansion through gross margin expansion and synergies Experienced management team, with strong track record, to execute long term plan Financial flexibility to execute growth initiatives

COMPANY OVERVIEW

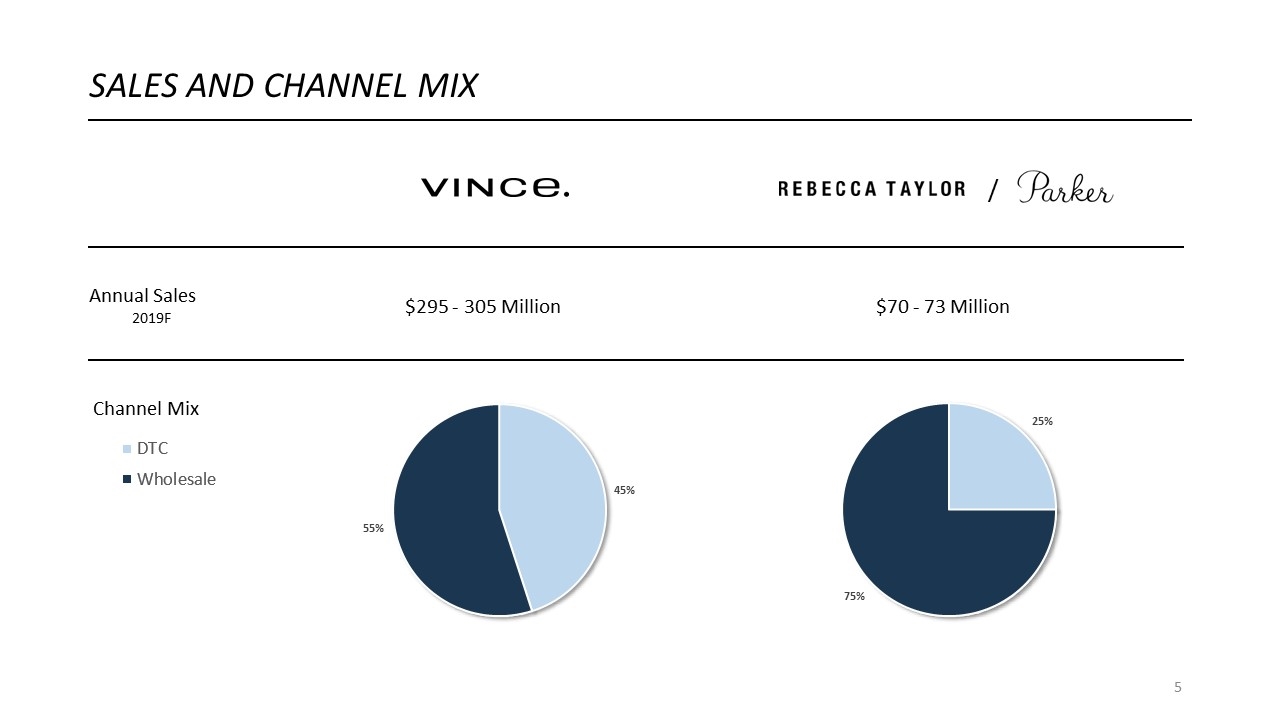

SALES AND CHANNEL MIX Annual Sales 2019F $70 - 73 Million $295 - 305 Million / Channel Mix 25% 75% 45% 55%

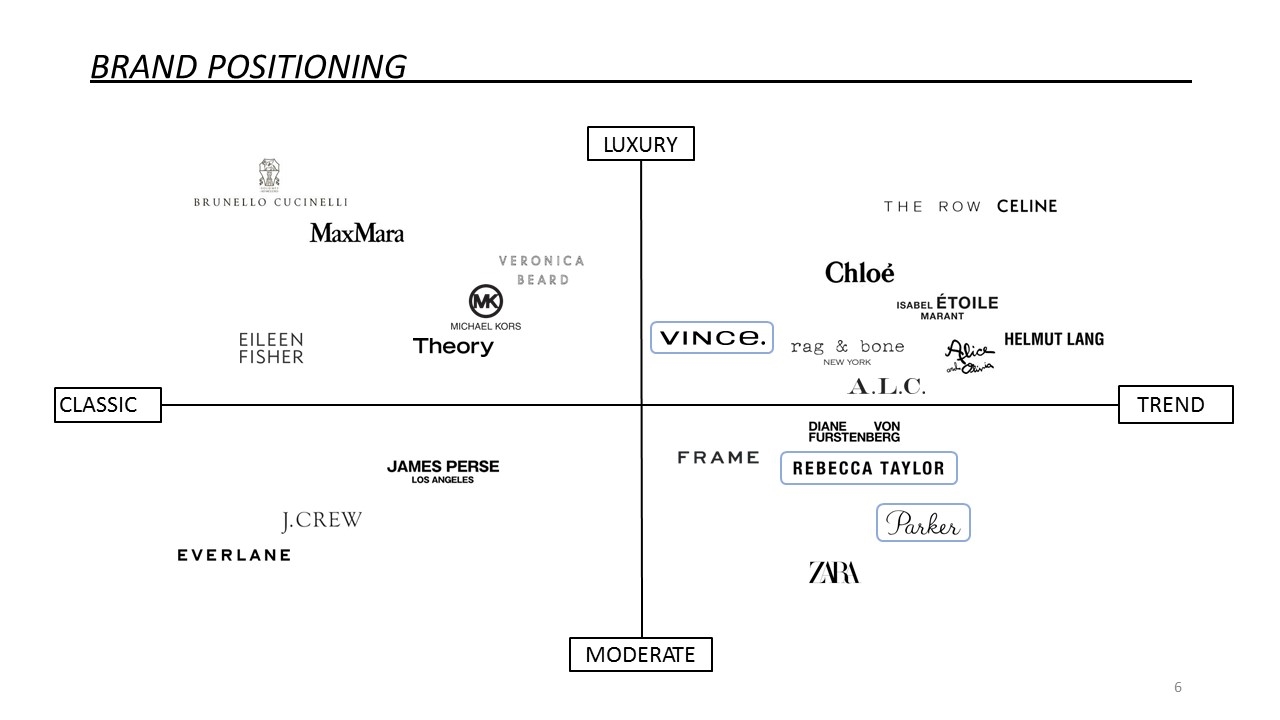

CLASSIC TREND LUXURY MODERATE BRAND POSITIONING

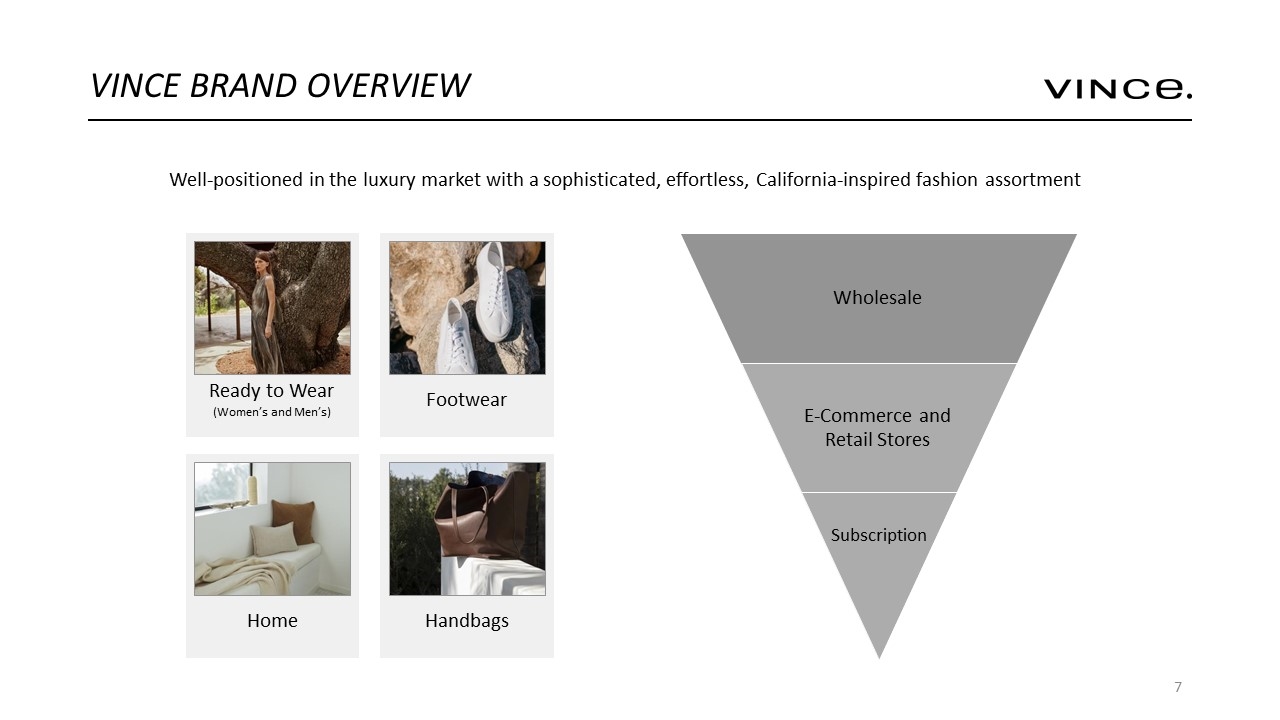

VINCE BRAND OVERVIEW Well-positioned in the luxury market with a sophisticated, effortless, California-inspired fashion assortment Ready to Wear (Women’s and Men’s) Footwear Home Handbags Wholesale E-Commerce and Retail Stores Subscription

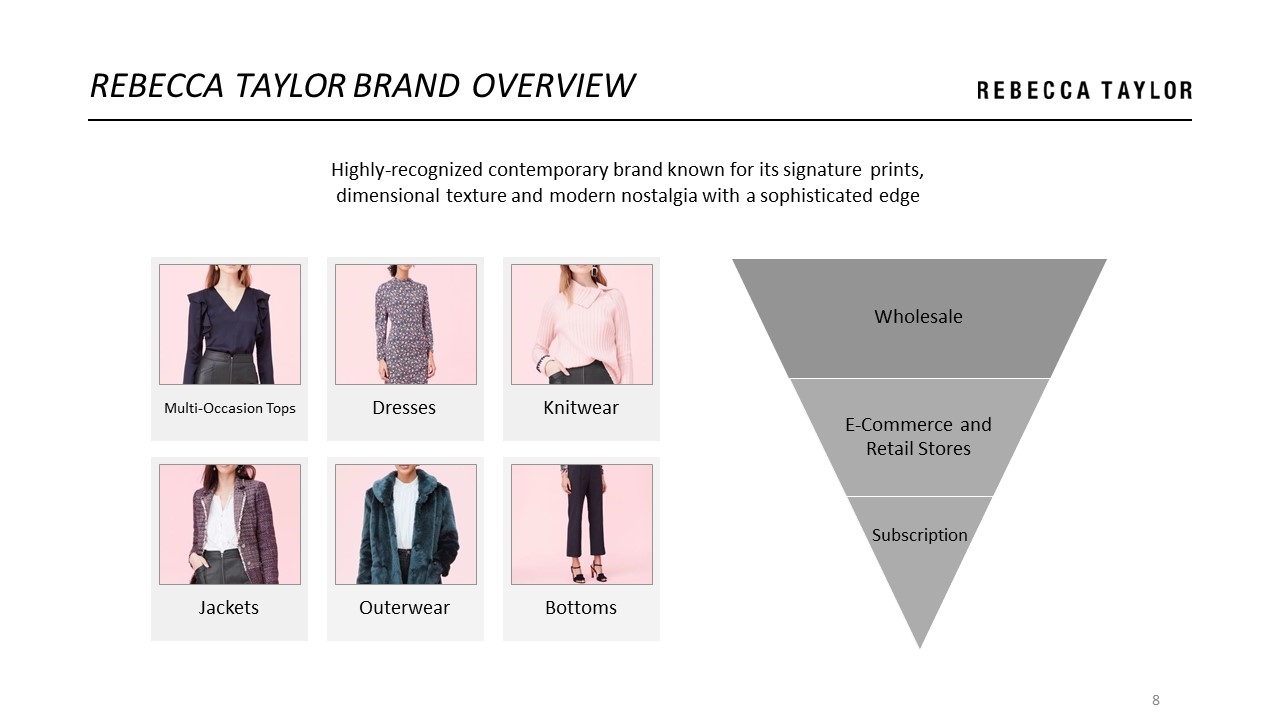

8 REBECCA TAYLOR BRAND OVERVIEW Multi-Occasion Tops Dresses Knitwear Jackets Outerwear Bottoms Wholesale E-Commerce and Retail Stores Subscription Highly-recognized contemporary brand known for its signature prints, dimensional texture and modern nostalgia with a sophisticated edge

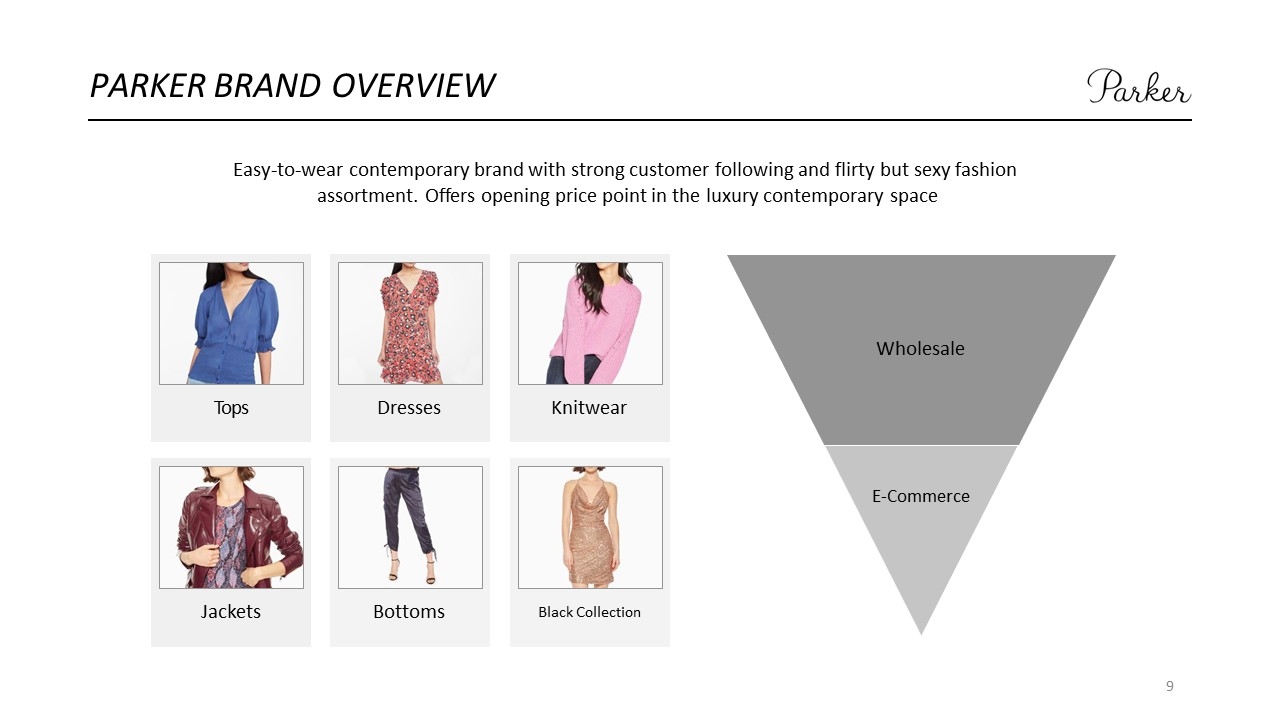

Wholesale E-Commerce PARKER BRAND OVERVIEW Tops Dresses Knitwear Jackets Bottoms Black Collection Easy-to-wear contemporary brand with strong customer following and flirty but sexy fashion assortment. Offers opening price point in the luxury contemporary space

STRATEGIC GROWTH INITIATIVES

VINCE GROWTH INITIATIVES Expand International Presence Fuel e-commerce growth Expand brand relevant product categories Open 2-3 net new stores in North America annually Drive brand engagement Explore acquisitions

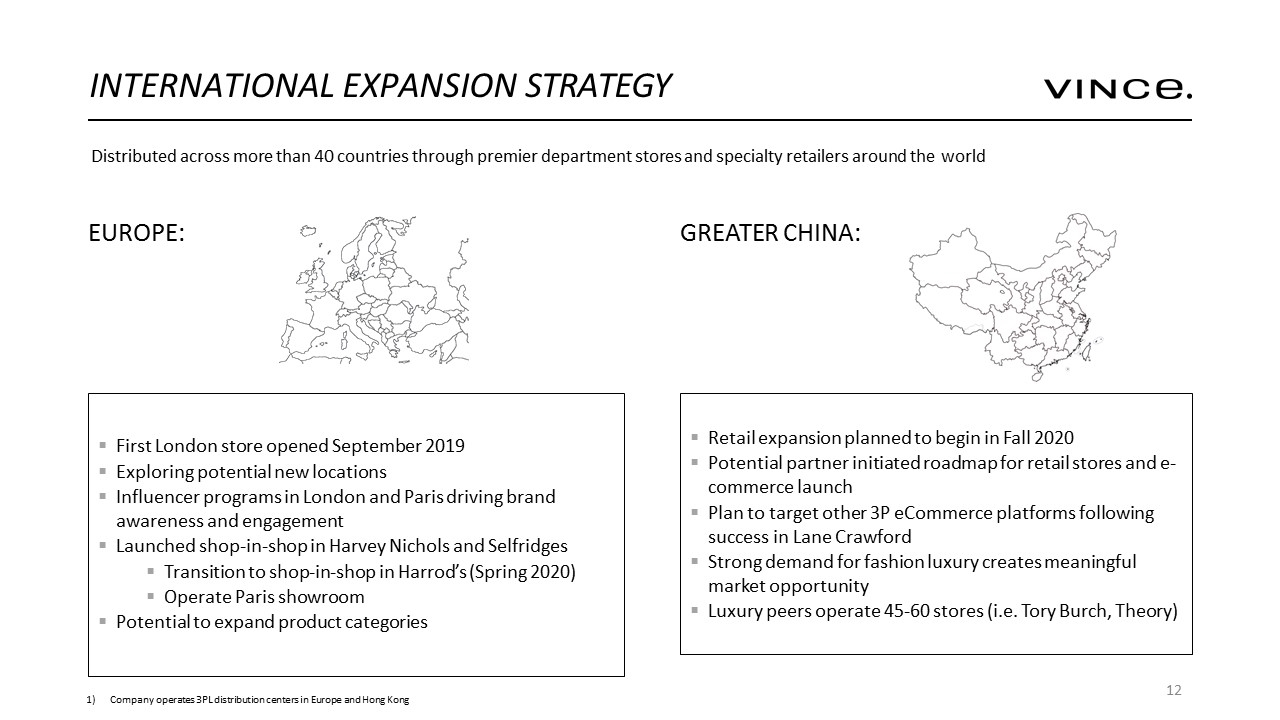

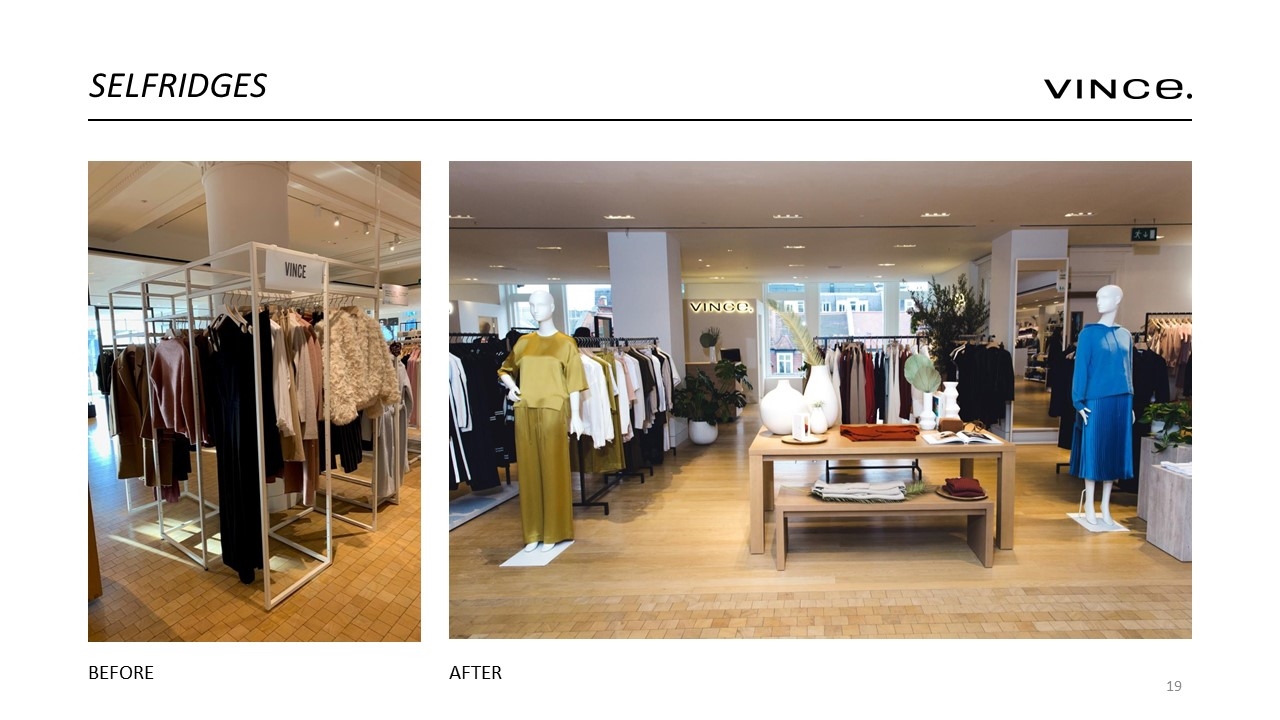

INTERNATIONAL EXPANSION STRATEGY Distributed across more than 40 countries through premier department stores and specialty retailers around the world EUROPE:GREATER CHINA: 12 First London store opened September 2019 Exploring potential new locations Influencer programs in London and Paris driving brand awareness and engagement Launched shop-in-shop in Harvey Nichols and Selfridges Transition to shop-in-shop in Harrod’s (Spring 2020) Operate Paris showroom Potential to expand product categories 1)Company operates 3PL distribution centers in Europe and Hong Kong Retail expansion planned to begin in Fall 2020 Potential partner initiated roadmap for retail stores and e- commerce launch Plan to target other 3P eCommerce platforms following success in Lane Crawford Strong demand for fashion luxury creates meaningful market opportunity Luxury peers operate 45-60 stores (i.e. Tory Burch, Theory)

E-COMMERCE CHANNEL OVERVIEW Double digit annual growth Content-rich e-commerce site creates elevated customer engagement Mobile application for iOS and Android offers elevated customer experience Launched subscription service in the fourth quarter of 2018 Plan to launch men’s in 2020

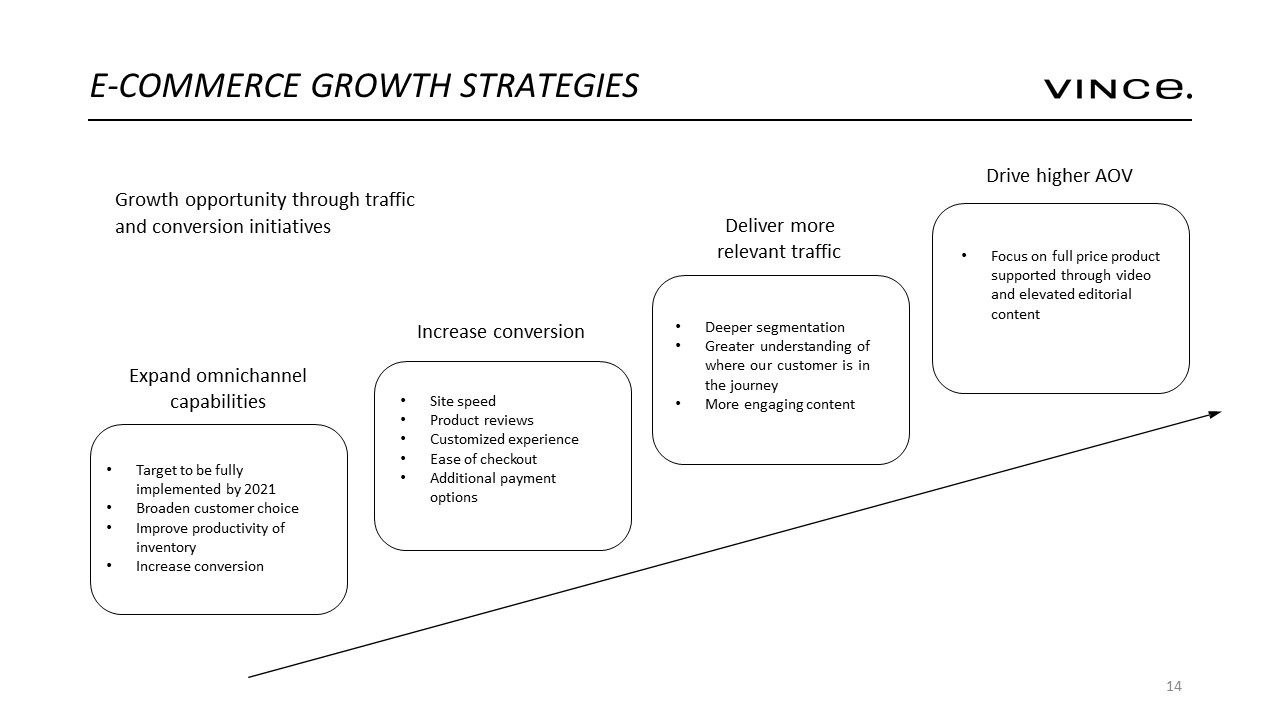

Site speed Product reviews Customized experience Ease of checkout Additional payment options E-COMMERCE GROWTH STRATEGIES Growth opportunity through traffic and conversion initiatives Target to be fully implemented by 2021 Broaden customer choice Improve productivity of inventory Increase conversion Deeper segmentation Greater understanding of where our customer is in the journey More engaging content Focus on full price product supported through video and elevated editorial content Expand omnichannel capabilities Increase conversion Deliver more relevant traffic Drive higher AOV

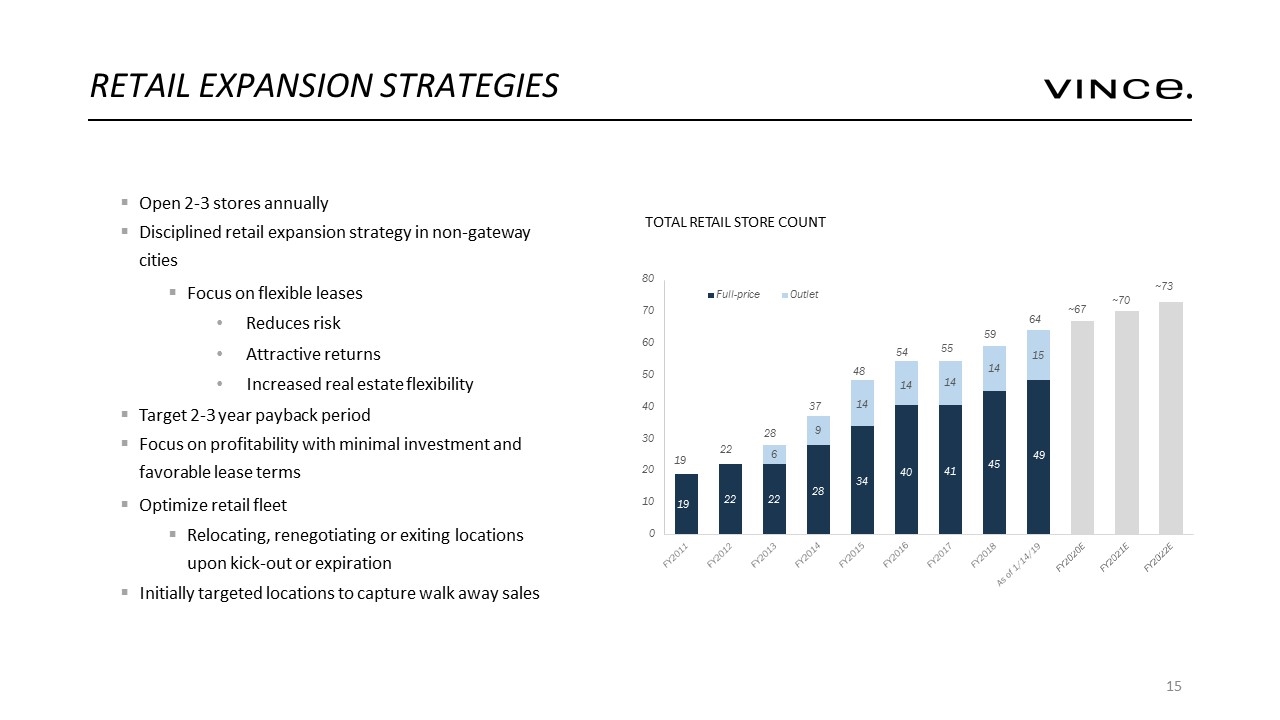

RETAIL EXPANSION STRATEGIES Open 2-3 stores annually Disciplined retail expansion strategy in non-gateway cities Focus on flexible leases Reduces risk Attractive returns Increased real estate flexibility Target 2-3 year payback period Focus on profitability with minimal investment and favorable lease terms Optimize retail fleet Relocating, renegotiating or exiting locations upon kick-out or expiration Initially targeted locations to capture walk away sales TOTAL RETAIL STORE COUNT 19 22 22 28 34 40 41 45 49 6 9 14 14 14 14 15 0 10 20 30 40 50 60 70 80 Full-price Outlet 19 22 28 37 48 54 55 59 64 ~67 ~73 ~70

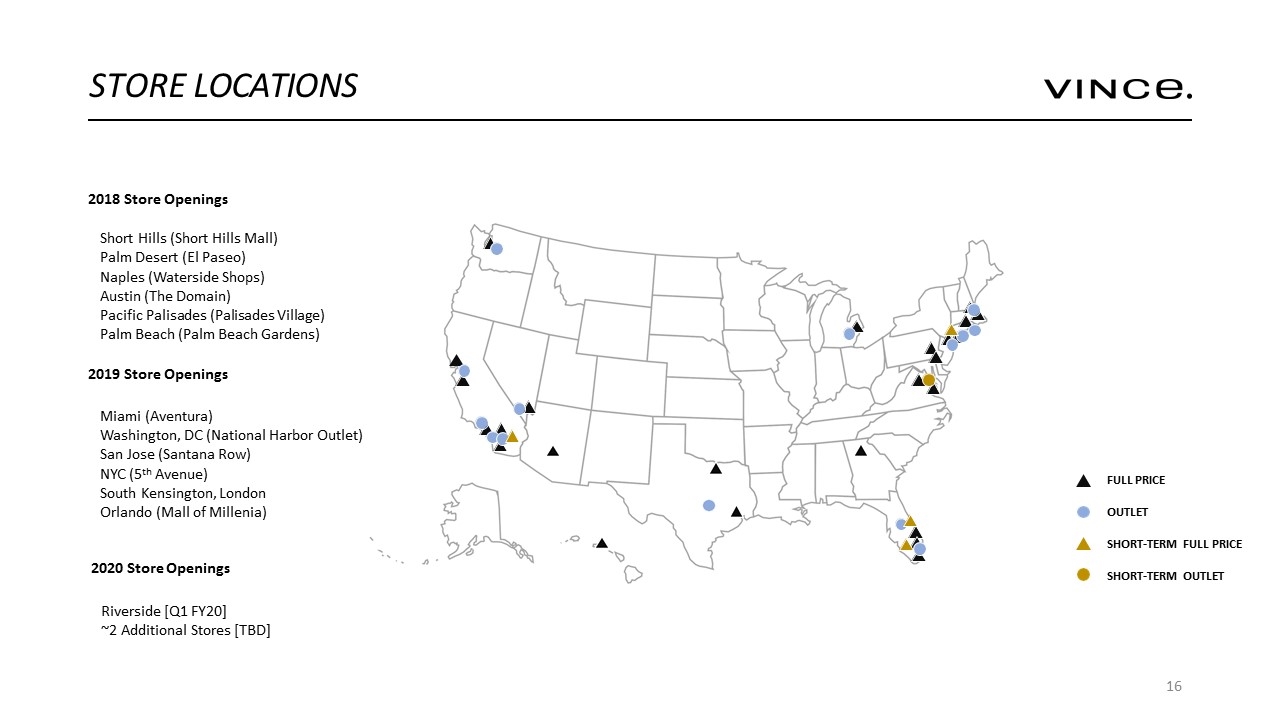

2020 Store Openings 2018 Store Openings Short Hills (Short Hills Mall) Palm Desert (El Paseo) Naples (Waterside Shops) Austin (The Domain) Pacific Palisades (Palisades Village) Palm Beach (Palm Beach Gardens) 2019 Store Openings Miami (Aventura) Washington, DC (National Harbor Outlet) San Jose (Santana Row) NYC (5th Avenue) South Kensington, London Orlando (Mall of Millenia) Riverside [Q1 FY20] ~2 Additional Stores [TBD] STORE LOCATIONS FULL PRICE OUTLET SHORT-TERM FULL PRICE SHORT-TERM OUTLET

WHOLESALE GROWTH STRATEGIES PREMIER WHOLESALE PARTNERS Refined distribution through select global department and specialty stores, drove improved performance in 2019 Expect to drive continued growth in 2020 and beyond Drive penetration through best-positioned and dramatically expanded floor space Optimize pure play e-commerce network Product expansion into new categories Continued market share gains

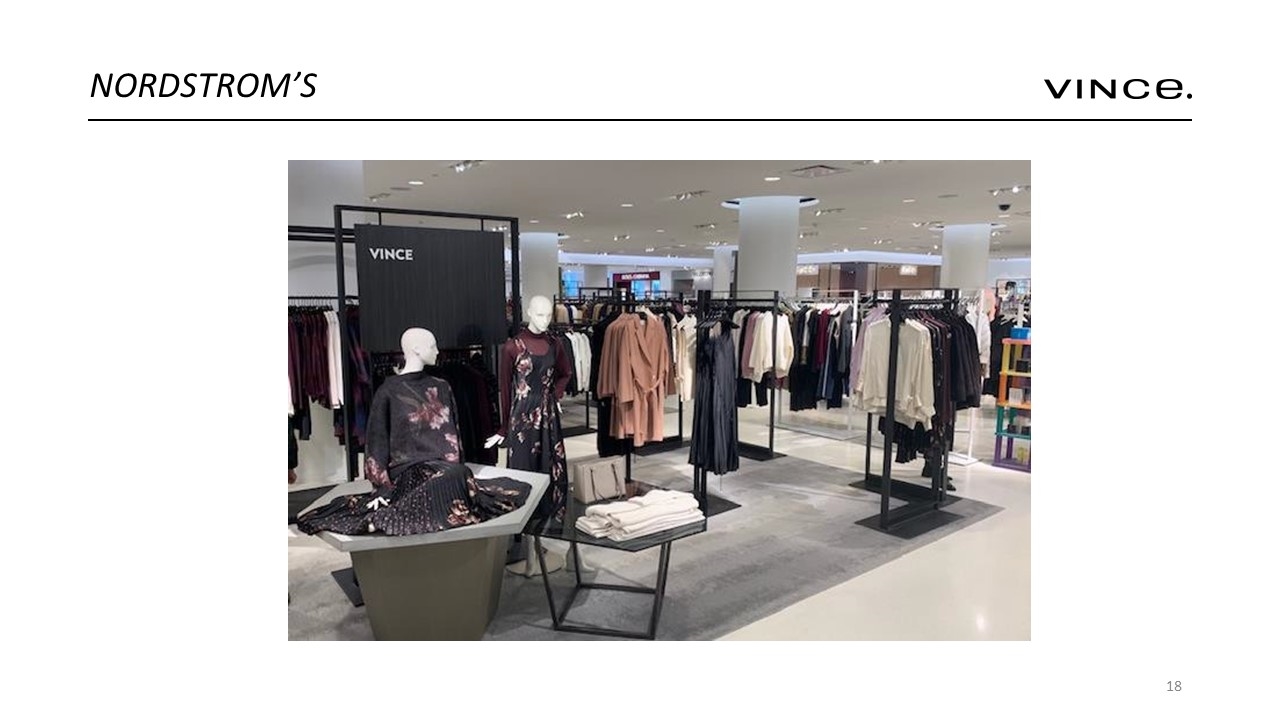

NORDSTROM’S

SELFRIDGES AFTER BEFORE

ELEVATE CUSTOMER JOURNEY Deliver a more impactful, customer-centric experience Invest in technology to elevate all touch-points of the customer journey Deliver more personalized engagement to drive higher customer retention Invest in both CRM technology and resources to improve clienteling through enhanced customer data Communicate a clear, consistent and relevant brand story across all channels and all customer interactions Create a new position of Chief Customer Officer Expected to hire in Q1

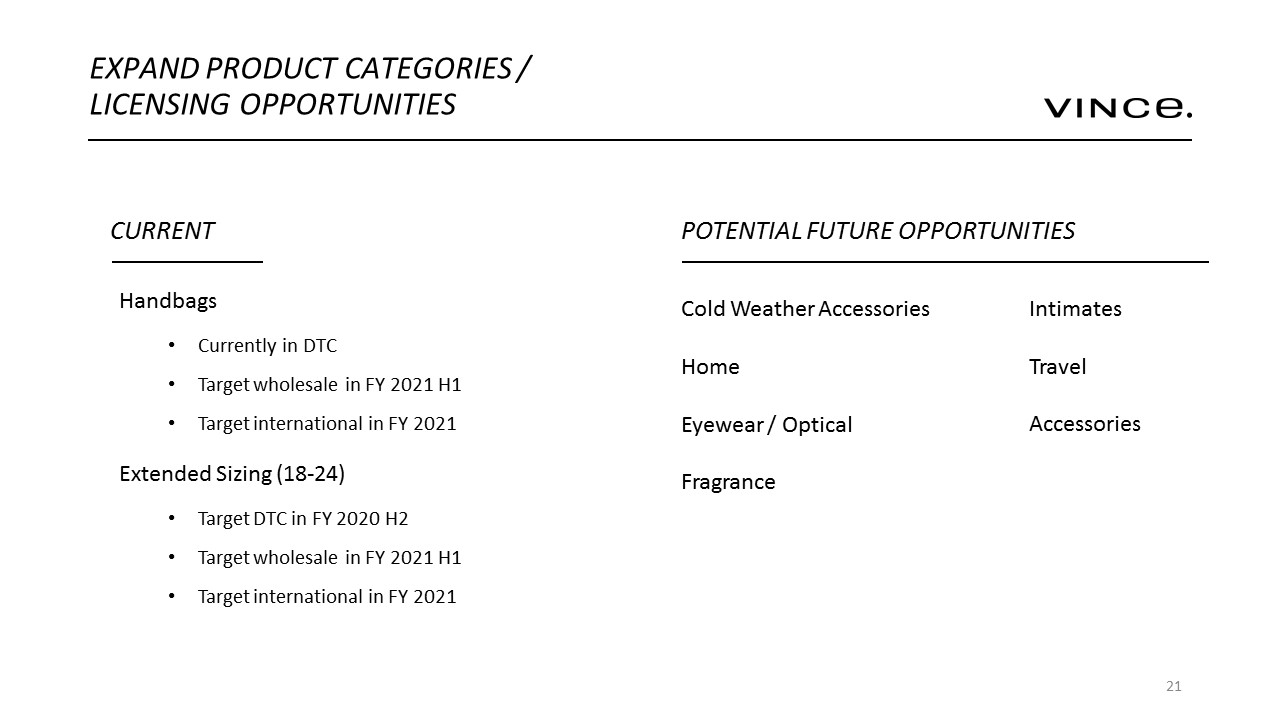

EXPAND PRODUCT CATEGORIES / LICENSING OPPORTUNITIES Cold Weather Accessories Home Eyewear / Optical Fragrance Intimates Travel Accessories CURRENT POTENTIAL FUTURE OPPORTUNITIES Handbags Currently in DTC Target wholesale in FY 2021 H1 Target international in FY 2021 Extended Sizing (18-24) Target DTC in FY 2020 H2 Target wholesale in FY 2021 H1 Target international in FY 2021

REBECCA TAYLOR GROWTH INITIATIVES Run Vince playbook across acquired brands Hired Steven Cateron as Senior Creative Director Plan to swiftly re-capture the brand aesthetic Accelerate direct-to-consumer business Open 10-20 new stores overtime using the Vince flexible leasing strategy Grow e-commerce leveraging Vince expertise Expand product classifications Grow Rebecca Taylor RNTD (Rental Business) Accelerate international distribution in Europe and Asia Achieve synergies

PARKER GROWTH INITIATIVES Well-positioned small brand with significant growth potential Leverage resources to optimize market position and drive accelerated growth New markets Grow e-commerce leveraging Vince expertise Achieve synergies Run Vince playbook across acquired brands Hired Steven Cateron as Senior Creative Director

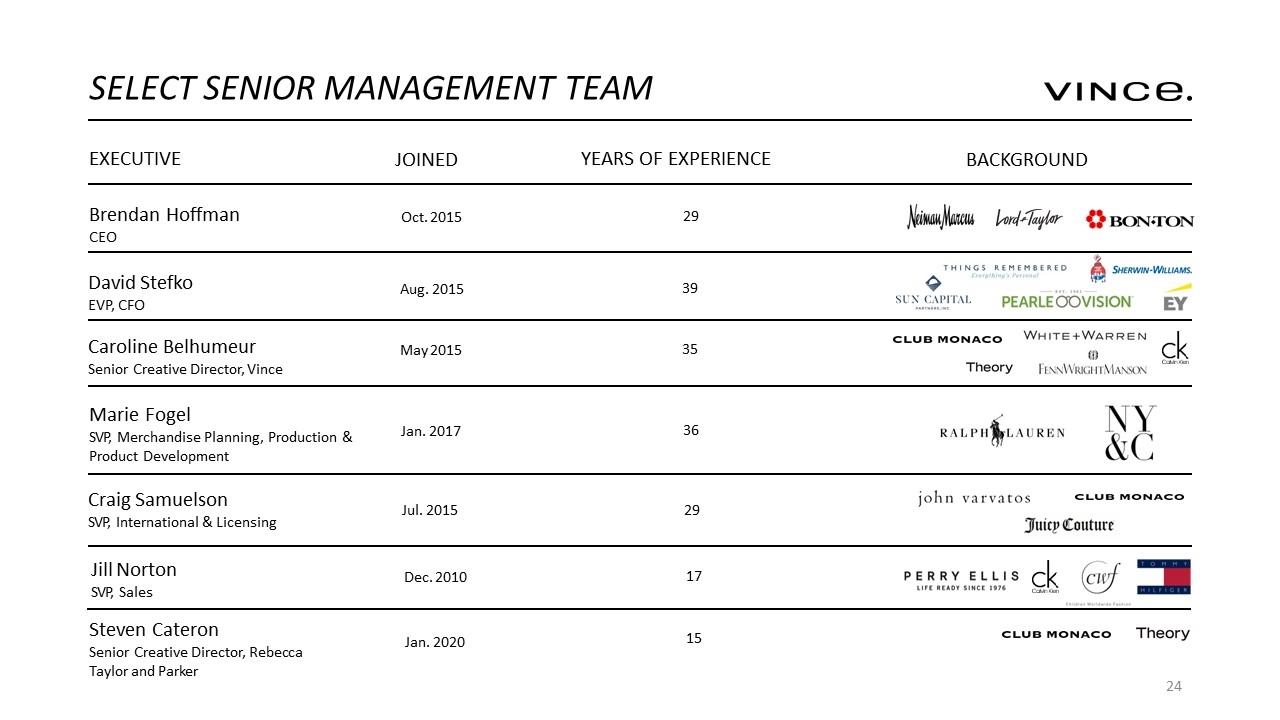

SELECT SENIOR MANAGEMENT TEAM BACKGROUND Brendan Hoffman CEO David Stefko EVP, CFO Caroline Belhumeur Senior Creative Director, Vince Marie Fogel SVP, Merchandise Planning, Production & Product Development Craig Samuelson SVP, International & Licensing Oct. 2015 Aug. 2015 May 2015 Jan. 2017 Jul. 2015 Jill Norton SVP, Sales Steven Cateron Senior Creative Director, Rebecca Taylor and Parker Dec. 2010 EXECUTIVEJOINEDYEARS OF EXPERIENCE 29 39 35 36 29 17 15 Jan. 2020

FINANCIAL OVERVIEW

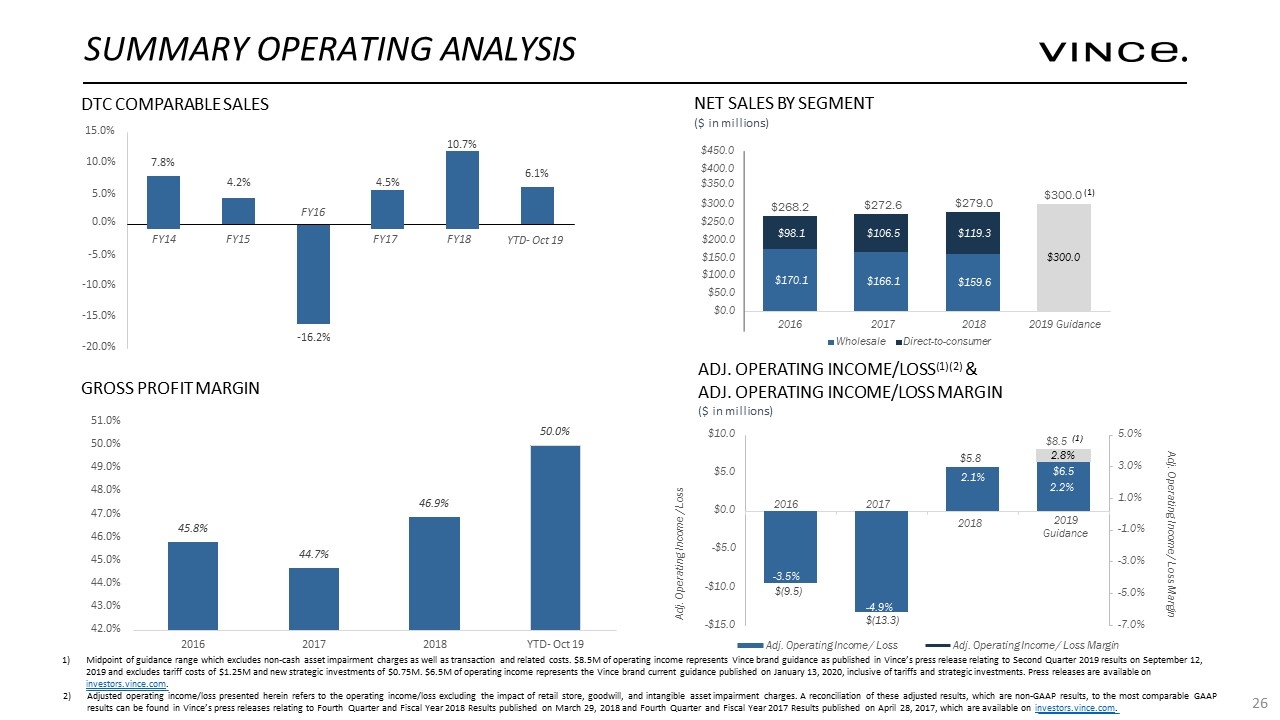

SUMMARY OPERATING ANALYSIS NET SALES BY SEGMENT ($ in millions) DTC COMPARABLE SALES 26 $450.0 GROSS PROFIT MARGIN ADJ. OPERATING INCOME/LOSS(1)(2) & ADJ. OPERATING INCOME/LOSS MARGIN ($ in millions) 2)Adjusted operating income/loss presented herein refers to the operating income/loss excluding the impact of retail store, goodwill, and intangible asset impairment charges. A reconciliation of these adjusted results, which are non-GAAP results, to the most comparable GAAP results can be found in Vince’s press releases relating to Fourth Quarter and Fiscal Year 2018 Results published on March 29, 2018 and Fourth Quarter and Fiscal Year 2017 Results published on April 28, 2017, which are available on investors.vince.com. 1)Midpoint of guidance range which excludes non-cash asset impairment charges as well as transaction and related costs. $8.5M of operating income represents Vince brand guidance as published in Vince’s press release relating to Second Quarter 2019 results on September 12, 2019 and excludes tariff costs of $1.25M and new strategic investments of $0.75M. $6.5M of operating income represents the Vince brand current guidance published on January 13, 2020, inclusive of tariffs and strategic investments. Press releases are available on investors.vince.com. $(9.5) $5.8 -7.0% -5.0% -3.0% -1.0% 1.0% 3.0% 5.0% -$15.0 -$10.0 -$5.0 $0.0 $5.0 $10.0 Adj. Operating Income / Loss Margin Adj. Operating Income / Loss $(13.3) Adj. Operating Income / LossAdj. Operating Income / Loss Margin 2.1% -3.5% -4.9% 2018 2019 Guidance 2017 2016 $6.5 2.2% $8.5 (1) 2.8% 10.0% 7.8% 4.2% 4.5% 6.1% $400.0 $350.0 5.0% 0.0% FY16 $300.0 $250.0 $268.2 $272.6 $279.0 $300.0 (1) FY14 FY15 FY17 FY18 YTD- Oct 19 $200.0 $98.1 $106.5 $119.3 -5.0% $150.0 $300.0 -10.0% $100.0 $50.0 $170.1 $166.1 $159.6 -15.0% $0.0 2016 2017 2018 2019 Guidance -20.0% -16.2% Wholesale Direct-to-consumer 10.7% 15.0% 45.8% 44.7% 46.9% 50.0% 42.0% 43.0% 44.0% 45.0% 46.0% 47.0% 48.0% 49.0% 50.0% 51.0% 201620172018YTD- Oct 19

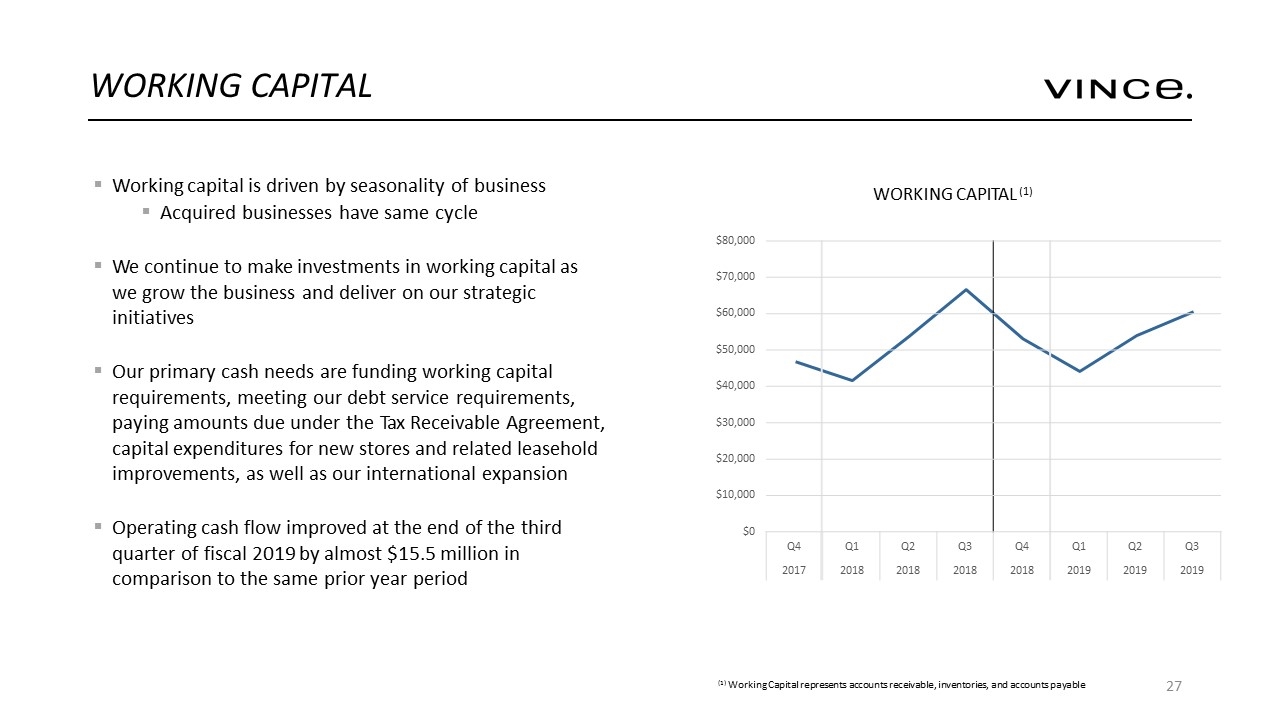

WORKING CAPITAL Working capital is driven by seasonality of business Acquired businesses have same cycle We continue to make investments in working capital as we grow the business and deliver on our strategic initiatives Our primary cash needs are funding working capital requirements, meeting our debt service requirements, paying amounts due under the Tax Receivable Agreement, capital expenditures for new stores and related leasehold improvements, as well as our international expansion Operating cash flow improved at the end of the third quarter of fiscal 2019 by almost $15.5 million in comparison to the same prior year period WORKING CAPITAL (1) 27 (1) Working Capital represents accounts receivable, inventories, and accounts payable Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000

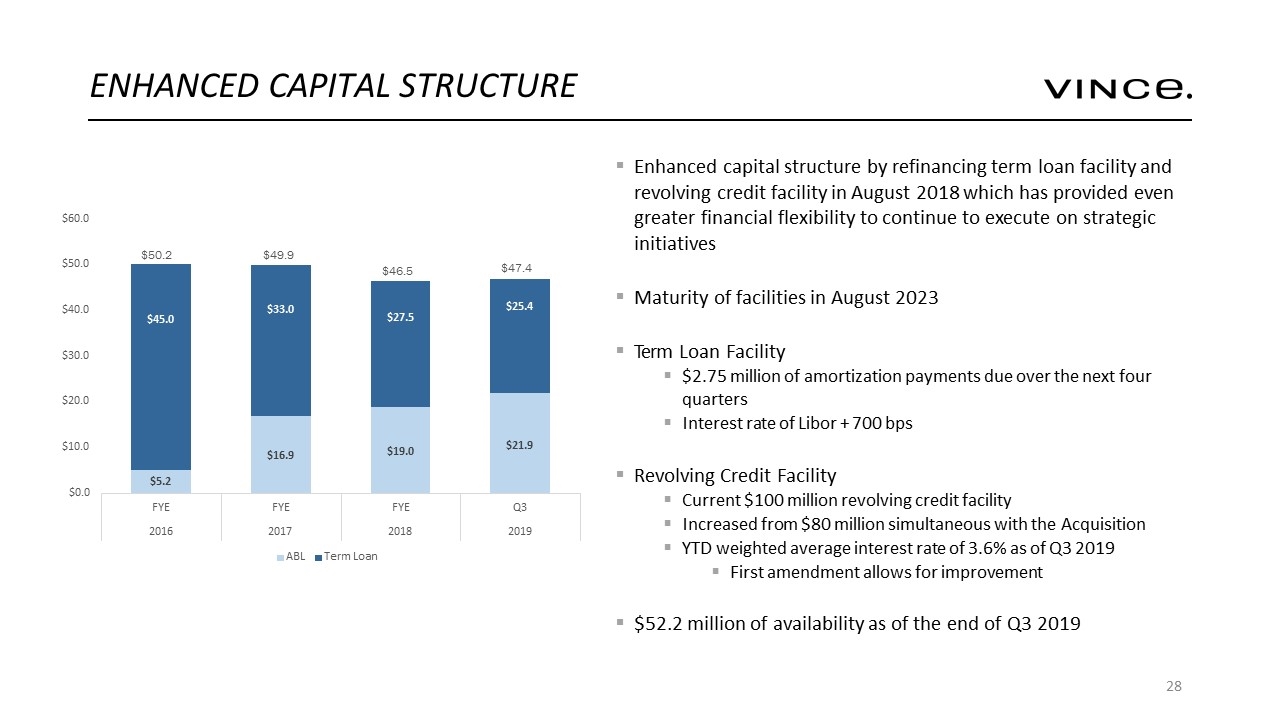

$5.2 $16.9 $19.0 $21.9 $45.0 $33.0 $27.5 $25.4 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 FYE FYE FYE Q3 2016 2017 2018 2019 ABLTerm Loan $50.2 $47.4 $46.5 $49.9 Enhanced capital structure by refinancing term loan facility and revolving credit facility in August 2018 which has provided even greater financial flexibility to continue to execute on strategic initiatives Maturity of facilities in August 2023 Term Loan Facility $2.75 million of amortization payments due over the next four quarters Interest rate of Libor + 700 bps Revolving Credit Facility Current $100 million revolving credit facility Increased from $80 million simultaneous with the Acquisition YTD weighted average interest rate of 3.6% as of Q3 2019 First amendment allows for improvement $52.2 million of availability as of the end of Q3 2019 ENHANCED CAPITAL STRUCTURE

Opportunity for cost savings: Leverage of talent Economies of scale: Fabric buys Improved factory costs Distribution centers Freight consolidation E-Commerce platform savings Third party vendors SYNERGIES

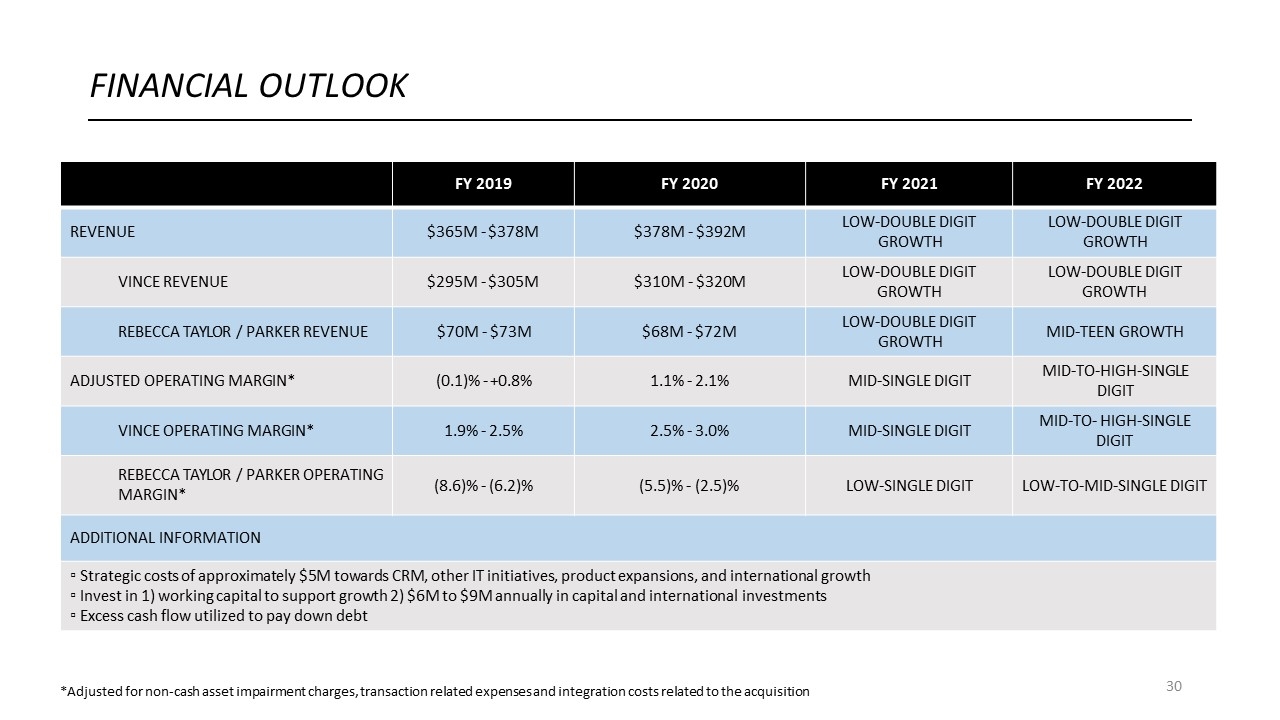

FINANCIAL OUTLOOK 30 FY 2019 FY 2020 FY 2021 FY 2022 REVENUE $365M - $378M $378M - $392M LOW-DOUBLE DIGIT GROWTH LOW-DOUBLE DIGIT GROWTH VINCE REVENUE $295M - $305M $310M - $320M LOW-DOUBLE DIGIT GROWTH LOW-DOUBLE DIGIT GROWTH REBECCA TAYLOR / PARKER REVENUE $70M - $73M $68M - $72M LOW-DOUBLE DIGIT GROWTH MID-TEEN GROWTH ADJUSTED OPERATING MARGIN* (0.1)% - +0.8% 1.1% - 2.1% MID-SINGLE DIGIT MID-TO-HIGH-SINGLE DIGIT VINCE OPERATING MARGIN* 1.9% - 2.5% 2.5% - 3.0% MID-SINGLE DIGIT MID-TO- HIGH-SINGLE DIGIT REBECCA TAYLOR / PARKER OPERATING MARGIN* (8.6)% - (6.2)% (5.5)% - (2.5)% LOW-SINGLE DIGIT LOW-TO-MID-SINGLE DIGIT ADDITIONAL INFORMATION ▫ Strategic costs of approximately $5M towards CRM, other IT initiatives, product expansions, and international growth ▫ Invest in 1) working capital to support growth 2) $6M to $9M annually in capital and international investments ▫ Excess cash flow utilized to pay down debt *Adjusted for non-cash asset impairment charges, transaction related expenses and integration costs related to the acquisition

31