Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TILLY'S, INC. | tlys2019holidaycompsalespr.htm |

| 8-K - 8-K - TILLY'S, INC. | a8-ktlysinterimearningsrel.htm |

ICR Investor Presentation January 2020 1

Safe Harbor Statement This presentation, and responses to certain questions about this presentation, will contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, particularly with regard to future financial and operating expectations, business plans and key initiatives. All such statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those indicated by such forward-looking statements. Please see “Risk Factors” in our Annual and Quarterly Reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission for a description of such risks and uncertainties. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We do not undertake any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation should be read in conjunction with our financial statements and notes thereto contained in our most recent Form 10-K for the fiscal year ended February 2, 2019 and our Form 10-Qs for the fiscal quarters ended May 4, August 3, and November 2, 2019. 2

Tillys at a Glance • Leading specialty retailer offering apparel, footwear and accessories for young adults, teens and children • Unparalleled blend of over 400 iconic global, emerging, and proprietary brands • 240 stores in 33 states, both in-mall and off-mall, averaging ~7,500 SF • Approx. 15 new stores planned for fiscal 2020 following 14 new stores in fiscal 2019 • Profitable e-commerce business represents ~15% of YTD net sales thru Dec 2019 and is expected to continue to grow both in net sales and total sales penetration over time • HQ in Irvine, CA and founded in 1982 3

Evolution of Tillys from IPO to Entering a New Phase of Growth IPO and Expansion Stabilize, Invest for Future of Tillys (2012 – 2015) Growth (2016 – 2017) (2018 – 2020+) • Significant store expansion • Paused store growth to address • Disciplined approach to store following IPO, mostly to new under-performance and brand growth, clustering in key markets markets without clustering awareness • Build brand awareness and • Lack of brand awareness and • Invested in physical and enhance customer experience inconsistency of merchandising technological infrastructure to • Limited incremental investment in new markets led to challenges support omni-channel and future required for store productivity growth +84 -5 +36 Net Stores Net Stores Net Stores 4

Destination Retailer with a Unique Store Experience and a Broad and Differentiated Assortment • Over 400 third-party lifestyle brands in a given year with a variety of styles, colors, sizes and price points • ~25% of our net sales comes from our own brands, supplemented by exclusive offerings from third-party brands • Top 3 third-party brands represent ~20% of total net sales combined with no other third-party brand above 3%. • ~90% of our stores have been remodeled or refreshed in last 3 years, keeping them current and fresh looking 5

Flexible Real Estate Strategy Across Real Estate Venues and Geographies • Stores located in malls, power centers, neighborhood and lifestyle centers, outlet centers and street-front locations • Store locations in 86 markets in 33 states • Began as an off-mall concept in 1982 • Strategy of clustering stores in promising markets to further enhance brand awareness Irvine Spectrum, California Off-Mall Location Arrowhead, Arizona In-Mall Location 6

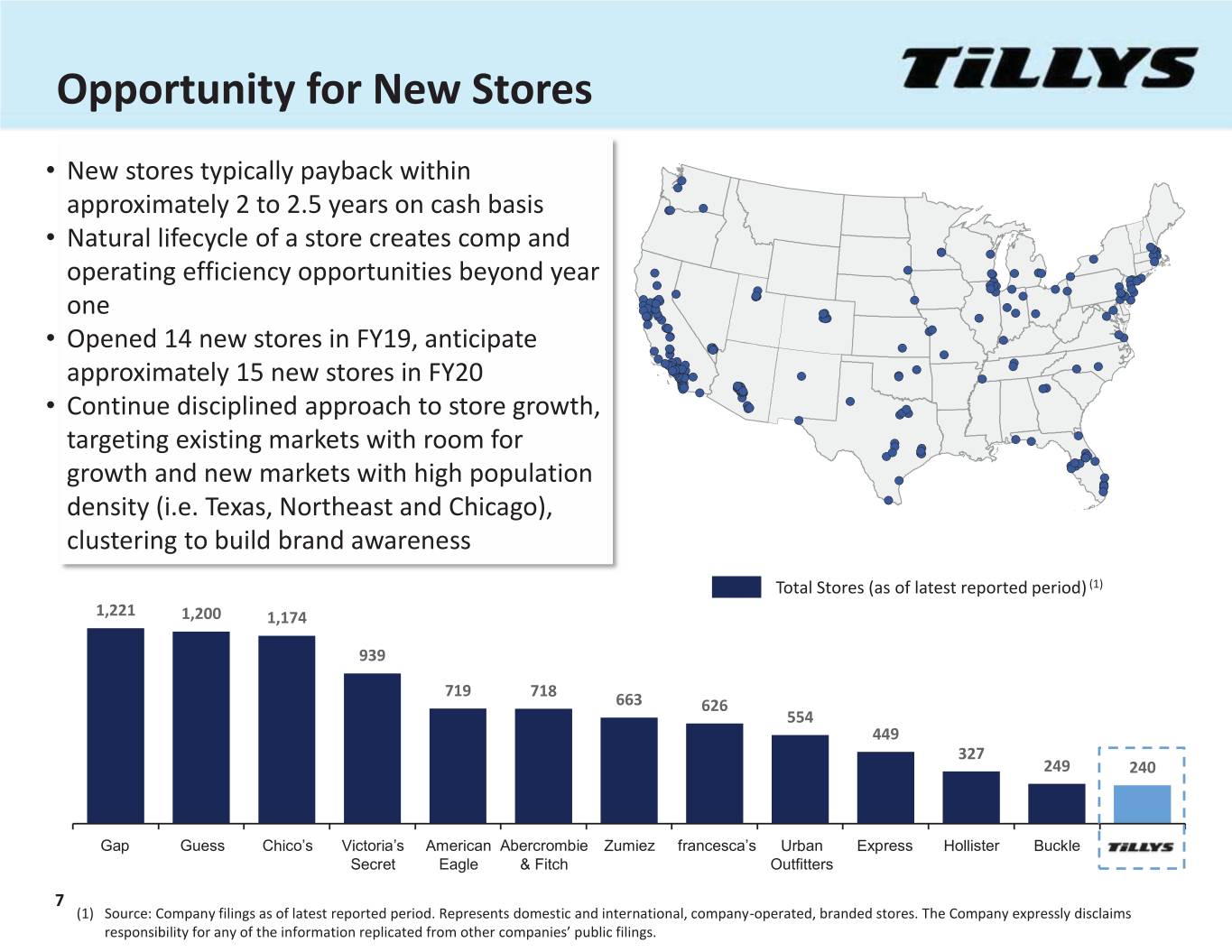

Opportunity for New Stores • New stores typically payback within approximately 2 to 2.5 years on cash basis • Natural lifecycle of a store creates comp and operating efficiency opportunities beyond year one • 1094144_1.wor (NY008SR4) Opened 14 new storesTBU in FY19, anticipate approximately 15 new stores in FY20 • Continue disciplined approach to store growth, targeting existing markets with room for growth and new markets with high population density (i.e. Texas, Northeast and Chicago), clustering to build brand awareness Total Stores (as of latest reported period) (1) 1,221 1,200 1,174 939 719 718 663 626 554 449 327 249 240 Gap GuessChico’s Victoria’s American Abercrombie Zumiez francesca’s Urban Express Hollister Buckle Secret Eagle & Fitch Outfitters 7 (1) Source: Company filings as of latest reported period. Represents domestic and international, company-operated, branded stores. The Company expressly disclaims responsibility for any of the information replicated from other companies’ public filings.

Continue to Grow E-com and Leverage Omni-Channel Capabilities • Opportunity exists to continue to grow current ~$100M E-commerce Revenue as Percentage e-com business from its current 15% of total net sales of Total Revenue (1) to beyond 20-25% of total net sales. Urban Outfitters 40% • Create seamless experience for customer to shop in- store or online, leveraging re-platformed website, Victoria’s 39% upgraded mobile app and social media presence Secret Abercrombie 31% • Enhance customer convenience: & Fitch • Pick up in-store • Ship-from-store Express 29% • Same-day delivery Chico’s 26% 15% Buckle 12% francesca’s 9% 8 (1) Source: Company filings, earnings releases and transcripts. Represents e-commerce revenue as a percentage of total revenue as of FY 2018 or the latest available company- filed information. The Company expressly disclaims responsibility for any of the information replicated from other companies’ public filings.

Our Core Customers • Pre-teens, teens and young adults, both male and female • Active, connected, creative and adventurous • Passionate about an active lifestyle, including sports, music, art and fashion • Highly engaged on social media channels 9

Constantly Evolving Merchandise Mix • Keep merchandise mix current with emerging brands and new merchandise from established brands • Exclusive styles from popular brands that are limited or not offered at other retailers • Analyze and adjust to performance trends within different markets • Ship products to stores multiple times per week 10

New Chief Merchandising Officer Drives New Merchandising Priorities for FY2020 • Tricia Smith joined Tillys at the end of September 2019 following a 25-year career at Nordstrom leading their Womens, Young Contemporary, Designer and Specialized Apparel efforts. Her early reads on some of our future opportunities include: • Increasing our inventory investment in denim, particularly by expanding the available size range • Greater emphasis of our proprietary RSQ brand, which is our 2nd largest brand in terms of net sales and our strongest denim brand, by expanding categories and introducing our first RSQ concept store in May 2020 at the Irvine Spectrum in CA. The RSQ concept store will provide an elevated assortment from a collection of brands, including RSQ. • Additional growth from our Boys/Girls business, which is a key differentiator for Tillys • Expansion of the age reach of Tillys’ Womens business, including through the recently introduced proprietary brand collection, West of Melrose, along with other new Young Contemporary brands • Improve emphasis of online assortment, including online-only styles, categories and brands to drive further growth in Tillys’ e-com business 11

Multi-pronged Marketing Approach to Drive Traffic and Customer Engagement Leverage proprietary customer database to further engage customers and drive traffic • Partner with social media stars and influencers to drive brand awareness • Promote in-store events (prior to and post-t- event) TBUT • Increase opportunities to reach our core Social Media customer • Partner and collaborate with vendors onn exclusive, compelling in-store events (e.g..g. pizza parties, bean bag toss contests, TBUTB Events augmented reality searches) • Build credibility with target customers • Distribute catalogs and postcards to new and existing customers • Distribute exclusive Kids catalog to existinggTBUTBT U Print customers with children • Promote new brands and merchandise 12

Significant Investments Across Stores, E-commerce, Systems and Distribution / Fulfillment Ability to capitalize on recent investments to drive traffic to our stores and website • Remodeled or refreshed ~90% of our 240 stores within the last 3 years Stores • Limited store capex requirements goingTBU forward, other than for new stores • Implemented new point-of-sale, order management, and website platform in late FY17 Systems • Enhanced customer relationship management, e-commerce and omni-channel capabilities TBU • Updating mobile application • Dedicated e-com fulfillment center Distribution • Online orders can also be served from and stores TBU Fulfillment • Along with broader assortment, we carry certain online-only styles 13

Driving Comparable Store Sales Growth Entering Q4 of FY2019, the Company produced 14 consecutive quarters of flat to positive comparable store sales growth. 14

Increase Operating Margins Continued opportunity to increase operating margins through scale efficiencies driven by comparable store sales growth combined with continuous process improvements 9 Largely fixed occupancy costs Leverage Fixed Costs through 9 Favorable buying costs due to scale Top-Line 9 Leverage our store management and Growth corporate overhead costs 9 Dedicated e-commerce fulfillment center Capitalize on 9 Upgraded e-commerce platform Previous 9 Upgraded point-of-sale, merchandise Investments allocation and merchandise planning systems 9 46 lease decisions to make in FY2020 Evaluate Real 9 Generally favorable leasing Estate environment Opportunities 9 Possibility of closing stores with unacceptable profitability 15 (1) Operating margin represents operating income as a percentage of net sales for the corresponding period. FY19 Estimate is subject to completion of the period.

Why Invest in TLYS? Driving Store Traffic and Comparable Store Sales Growth Growing E-com and Leveraging Omni-Channel Capabilities Opening New Stores Driving Brand Awareness Opportunity to Improve Operating Margins 16