Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MOMENTA PHARMACEUTICALS INC | tm201894d1_ex99-1.htm |

| 8-K - FORM 8-K - MOMENTA PHARMACEUTICALS INC | tm201894-1_8k.htm |

Exhibit 99.2

38th Annual J.P. Morgan Healthcare Conference January 14, 2020 Exhibit 99.2

This presentation contains forward - looking statements about our financial outlook, business plans and objectives and other futur e events and developments. These forward - looking statements include, but are not limited to, statements about our pipeline of novel drug candidates for immune - mediated disorders , which include M281, M254 and M230, the advancement of our late stage biosimilar candidate, M710, and our plans regarding our M923 program; the use, efficacy, safety , p otency, tolerability, dosing, convenience, differentiation and commercial potential of our products and product candidates, including their potential as best or first i n c lass; the design, timing and goals of clinical trials and the availability, timing and announcement of data and results; estimates of incidence of disease and patient populations; mar ket potential and acceptance of our products and product candidates; the timing of regulatory submissions, potential regulatory approvals, market formation and launches of ou r p roduct candidates and products; market potential and product revenues of our products and product candidates; our priorities, goals and strategy; our development timelines; p ote ntial future out - licensing/collaborations/partnerships; our non - GAAP operating expense, restructuring expense and collaborative revenue reimburse ment projections; Glatopa revenue from 2019 and our future financial expectations. Such forward - looking statements involve known and unknown risks, uncertainties, and other important factors, which could cause actual results, performance or achievements to differ materially from those expressed or implied in such statements. These risks and un certainties include, but are not limited to, the unpredictable nature of our early stage development efforts for our novel product candidates; failure to raise additional cap ita l as required; unexpected regulatory decisions regarding any of these activities, unexpected expenses or inaccurate financial assumptions or forecasts; additional or increa sed litigation efforts by our competitors; insufficient resources or failure to prioritize competing projects and efforts; disputes with our collaboration partners; inability to suc ces sfully partner the development and commercialization of our product candidates; delays or unfavorable decisions of regulatory agencies; unfavorable regulatory guidance pronouncement s; safety, efficacy or tolerability problems with our product candidates; and competition for targeted indications or within targeted markets. Risks and uncertainties also includ e t hose referred to under “Risk Factors” in our Quarterly Report on Form 10 - Q for the quarter ended September 30, 2019 filed with the Securities and Exchange Commission (SEC), as well as other documents that we may file from time to time with the SEC. Information provided in this presentation speaks only as of the date of this presentation, and we assume n o o bligation to update forward - looking statements to reflect events or circumstances occurring after this presentation. Forward - Looking Statements Non - GAAP Operating Expense Guidance 2 Forward Looking Statements Non - GAAP Operating Expense Guidance Momenta provides non - GAAP operating expense guidance, which it believes can enhance an overall understanding of its financial pe rformance when considered together with GAAP financial measures. Non - GAAP operating expense is total operating, less stock - based compensation expense, restructuring expense and collaborative reimbursement revenue. While Momenta believes this non - GAAP financial measure is useful to investors because it provides greater transparency regarding Momen ta’s operating performance, it should not be considered a substitute or an alternative to GAAP total operating expense. The Company has not provided a GAAP reconciliation fo r its forward - looking non - GAAP annual operating expense because Momenta cannot reliably predict without unreasonable efforts the timing or amount of the factors that substan tia lly contribute to the projection of stock compensation expense, which is excluded from the forward - looking non - GAAP financial measure. The Company does not expect restruc turing expense and collaborative reimbursement revenue to be material.

Developing Therapies to Treat Patients with Rare Immune - Mediated Disorders 4 Multiple data readouts and key value inflection points anticipated in 2020 SIFbody platform and other platforms offer multiple new product and partnering opportunities $545.1M in cash, cash equivalents, and marketable securities at December 31, 2019* 3 Novel drug candidates currently in clinical development Hematology Neurology Maternal/Fetal *Unaudited

Legacy Business Continues to Support Development Pipeline 5 *Unaudited estimate Glatopa ® (glatiramer acetate injection) • A generic version of COPAXONE ® 20 mg and 40 mg developed and commercialized in collaboration with Sandoz • 2019 Revenue: $20M* • 2020 Trends: Continued competition M710 (b - EYLEA® candidate) • Partner Mylan advancing Phase 3 towards completion • BLA submission expected in 2021 • Market formation expected in 2023 • Deal terms: 50% global cost/profit share

Phase 1 Phase 2 Phase 3 M230 (CSL730) (Recombinant Fc multimer ) Novel Drug Candidates CD38 SIFbody Preclinical Nipocalimab (M281) (Anti - FcRn antibody) Product Candidate Indication Myasthenia Gravis (MG) Hemolytic Disease of Fetus and Newborn (HDFN) Immune Thrombocytopenic Purpura (ITP) Warm Autoimmune Hemolytic Anemia (wAIHA) M254 (Hypersialylated IgG) Next Anticipated Milestone Pipeline of Novel Drug Candidates 6 Ph. 2 Data Q3 2020 Ph. 2 Data 2021 Ph. 2/3 Data by YE 2021 Additional data in Q2 2020 Initiate Ph. 1 SubQ formulation 2020 Chronic Inflammatory De - myelinating Polyneuropathy (CIDP) Initiate Ph. 2 in Q4 2020 IND in 2021

7 Nipocalimab (M281): Attributes of a Best - in - Class FcRn Antagonist Dosing Dose - dependent IgG reduction Rapidly infused IV Weekly SC option Highest IgG reduction observed, >80% Ability to maintain 100% receptor occupancy drives IgG lowering and ability to maintain low IgG levels Efficacy Effectorless antibody design minimizes effector function related AEs Strong safety profile Safety

Nipocalimab (M281): Generalized Myasthenia Gravis Phase 2 Study 8 Placebo Q2W 5 mg/kg/Q4W 30 mg/kg/Q4W 60 mg/kg/Q2W 60 mg/kg single dose Open Label Extension Trial R a n d o m i z a t I o n Screening up to 4 weeks Weeks Treatment Follow - Up 0 4 2 6 1 8 8 8 Primary Endpoint Assessment n= 60 (approximately 12 per group) Dosing (M281 or placebo) given Q2W Key Objective : Define the relationship between IgG reduction and response Data could support claim of Best in Class FcRn agent Current Status : 80% enrolled Targeting study completion and top - line results in Q3 2020

9 Nipocalimab (M281): Warm Hemolytic Anemia Phase 2/3 Study Key Objective : Aiming to be First in Class in wAIHA Regulatory Milestones : Fast Track (US) Orphan Designation (EU) Current Status : Active enrollment (n=105 patients) Targeting readout by end of 2021 Randomization Placebo Q2W Nipocalimab 30 mg/kg Q2W Nipocalimab 30 mg/kg Q4W alternating with Placebo Q4W 24 - Week Double - blind Period Complete Week 24 assessment Screening (up to 6 weeks)

• Rare fetal - maternal disorder, affecting 4,000 – 8,000 pregnancies in US annually • Causes fetal anemia, with 20% fetal mortality in high - risk population • Standard - of - care: Intrauterine transfusions, which can lead to increased morbidity (bleeding, infection risk) • Full FcRn receptor occupancy critical in this patient population The Prevention of Early - Onset Hemolytic Disease of the Fetus and Newborn (HDFN) 10 15 patient safety and efficacy study 4 patients enrolled Fast Track Designation (US) Orphan Drug Designation (EU) Targeting full enrollment in 2020; 2021 for study readout Potential for accelerated approval

Building a Winning FcRn Franchise Based on Efficacy, Safety and Dosing 11 Dermatology E.g., Pemphigus Rheumatology E.g., SLE*, myositis Nephrology E.g., Lupus nephritis Autoimmune Disorders Fetal / Maternal Antibody Transfer Disorders Fetal / Maternal HDFN Other Potential Applications Fetal Neonatal Alloimmune Thrombocytopenia (FNAIT) Congenital heart block Neonatal hemochromatosis Others Neurology MG NMOSD*, GBS*, CIDP* *Neuromyelitis optica spectrum disorder (NMOSD), Guillain - Barré syndrome (GBS), chronic inflammatory demyelinating polyneuropathy (CIDP), immune thr ombocytopenic purpura (ITP), systemic lupus erythematosus (SLE). Efficacy Safety Dose Hematology wAIHA ITP*, Autoimmune Neutropenia

2023 2022 2023 Nipocalimab (M281): Planning for Commercialization HDFN wAIHA MG Exploring Additional Applications: Immunogenic biologic therapies, gene therapy, transplantation

13 • Multifocal Motor Neuropathy • Myasthenia Gravis • Guillain - Barre syndrome • Inflammatory Myopathies • Other CIDP 37% Other Neurology 25% ITP 10% Other 28% M254 Target Attributes Source: Health Advances Immune Globulin G is a $6B Product in Neurological and Other Autoimmune Disorders Dosing <2 hrs vs 2+ days administration SC potential Safety Decreased dose may reduce AEs Potential steroid - sparing Efficacy Greater immune modulation Potentially increased efficacy

• Patients responded at all M254 dose levels tested to date (N=6; 43 - 250 mg/Kg) - Defined as having >=50 x 10 9 /L platelet count for >=3 days and >=20 x 10 9 /L increase from baseline - One non - responder to M254 and IVIg • Equivalent response between M254 and IVIg seen in one patient in each dose cohort • Variability observed in maximum platelet counts achieved and compared to IVIg dose in other patients • Safety profile similar to Part A • Lowering and expanding dose cohorts in Part B M254 Phase 1/2 ITP Study: Platelet Response at All Doses Tested to Date 14 * M254 IVIG(1000mg/kg) (43 mg/kg)* * One patient under - dosed

Patient Response to IVIg is Variable - Typical Response Rate of 70 - 80% 15 Limited published data available related to individual patient response to IVIg Data obtained from three registrational ITP studies reflects variable patient response to IVIg 83.3% 16.7% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% Response Insufficient Response N=6 ITP patients GAM10 - 02: Octagam 2gr/Kg pivotal study; IG0601 and IG202: Flebogamma 10% 2gr/Kg studies pivotal studies M254 Responses Patient Response to IVIg from 3 ITP Studies 50 x 10 9 /L

• Adding at least one additional lower dose cohort to Part B M254 Phase 1/2 ITP Study Update 16 • Enrolling additional ITP patients in Part B • Plan to submit data at medical meeting in Q2 • Update M254 clinical strategy on Q2 2020 earnings call • Intend to initiate Phase 2 CIDP study in 2H 2020 Goal: POC and Identify Doses to Advance into ITP and CIDP Studies

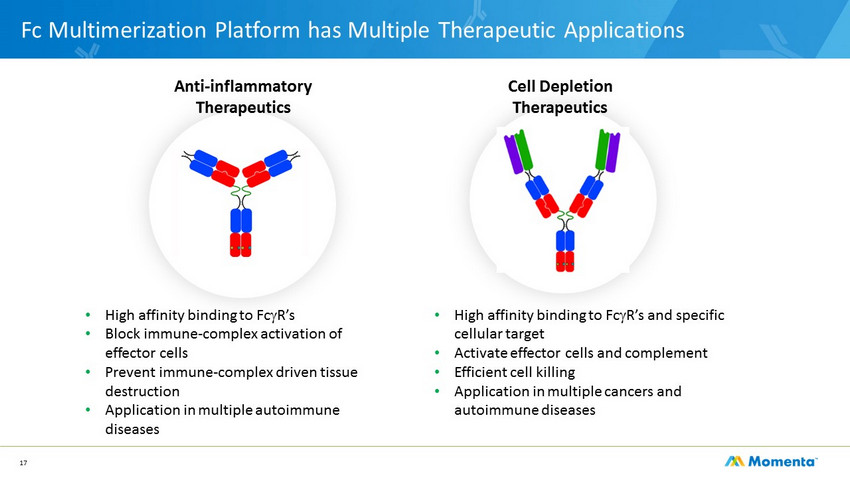

17 Fc Multimerization Platform has Multiple Therapeutic Applications Anti - inflammatory Therapeutics Cell Depletion Therapeutics • High affinity binding to Fc g R’s • Block immune - complex activation of effector cells • Prevent immune - complex driven tissue destruction • Application in multiple autoimmune diseases • High affinity binding to Fc g R’s and specific cellular target • Activate effector cells and complement • Efficient cell killing • Application in multiple cancers and autoimmune diseases

M230 (CSL730) – Potential First - in - Class Fc Multimer Designed with Enhanced Avidity for Fc Receptors 18 • Phase 1 study ongoing • Up to $300M in contingent milestones • 50% cost/profit share US • Right to co - commercialize in US • Royalties on EU and rest of world sales M230 License Agreement with CSL M230 Demonstrated Up to 50 Times Higher Potency than IVIg in Multiple Preclinical Models

Fc #1 Fc #2 Fc #3 Fab’s Data from Subject MM536 CD38 SIFbody Candidate In Preclinical Development; IND Enabling Studies Underway 19 Anti - CD38 SIFbody Improved Plasma Cell Depletion in Multiple Myeloma Patient’s Cells Anti - CD38 SIFbody Improved B Cell Depletion in Cynomolgus Monkeys % Change in B cell Counts (normalized to pre - dose baseline) Time post dose (hours) Drug Concentration ( nM ) 0 48 96 144 192 240 288 336 0 20 40 60 80 100 Anti - CD38 mAb (1 mpk ) Anti - CD38 SIFbody (1.7 mpk ) Anti - CD38 SIFbody (5.1 mpk )

2020 Anticipated Milestones Nipocalimab (M281) • MG top - line data readout in 3Q • HDFN trial full enrollment M254 • ITP top - line data readout 1H • CIDP Phase 2 trial initiation M230 • SC Phase 1 trial initiation M710 • Complete Phase 3 trial enrollment CD38 SIFbody • Initiate IND enabling studies 20 2019 YE Cash, Cash Equivalents and Marketable Securities: $545.1M 1 2020 Estimated Annual Non - GAAP Operating Expenses: $220M - $240M 2 1) Unaudited 2) See “ Non - GAAP Operating Expense Guidance” for our disclosures on non - GAAP operating expense

38th Annual J.P. Morgan Healthcare Conference January 14, 2020