Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kindred Biosciences, Inc. | a8-kjanuary132020investorp.htm |

We are a Leader in Pet Therapeutics

Forward Looking Statements 2 This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to, statements regarding our expectations about the trials, regulatory approval, manufacturing, distribution and commercialization of our current and future product candidates, and statements regarding our anticipated revenues, expenses, margins, profits and use of cash. These forward-looking statements are based on our current expectations. These statements are not promises or guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results to be materially different from any future results expressed or implied by the forward-looking statements. These risks include, but are not limited to, the following: our limited operating history and expectations of losses for the foreseeable future; the absence of significant revenue from our products and our product candidates for the foreseeable future; the likelihood that our revenue will vary from quarter to quarter; our potential inability to obtain any necessary additional financing; our substantial dependence on the success of our products and our lead product candidates which may not be successfully commercialized even if they are approved for marketing; the effect of competition; our potential inability to obtain regulatory approval for our existing or future product candidates; our dependence on third parties to conduct some of our development activities; our dependence upon third-party manufacturers for supplies of our products and our product candidates; uncertainties regarding the outcomes of trials regarding our product candidates; our potential failure to attract and retain senior management and key scientific personnel; uncertainty about our ability to develop a satisfactory sales organization; our significant costs of operating as a public company; our potential inability to obtain and maintain patent protection and other intellectual property protection for our products and our product candidates; potential claims by third parties alleging our infringement of their patents and other intellectual property rights; our potential failure to comply with regulatory requirements, which are subject to change on an ongoing basis; the potential volatility of our stock price; and the significant control over our business by our principal stockholders and management. For a further description of these risks and other risks that we face, please see the risk factors described in our filings with the U.S. Securities and Exchange Commission (the SEC), including the risk factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K and any subsequent updates that may be contained in our Quarterly Reports on Form 10-Q filed with the SEC. As a result of the risks described above and in our filings with the SEC, actual results may differ materially from those indicated by the forward-looking statements made in this press release. Forward-looking statements contained in this press release speak only as of the date of this press release and we undertake no obligation to update or revise these statements, except as may be required by law. January 13, 2020

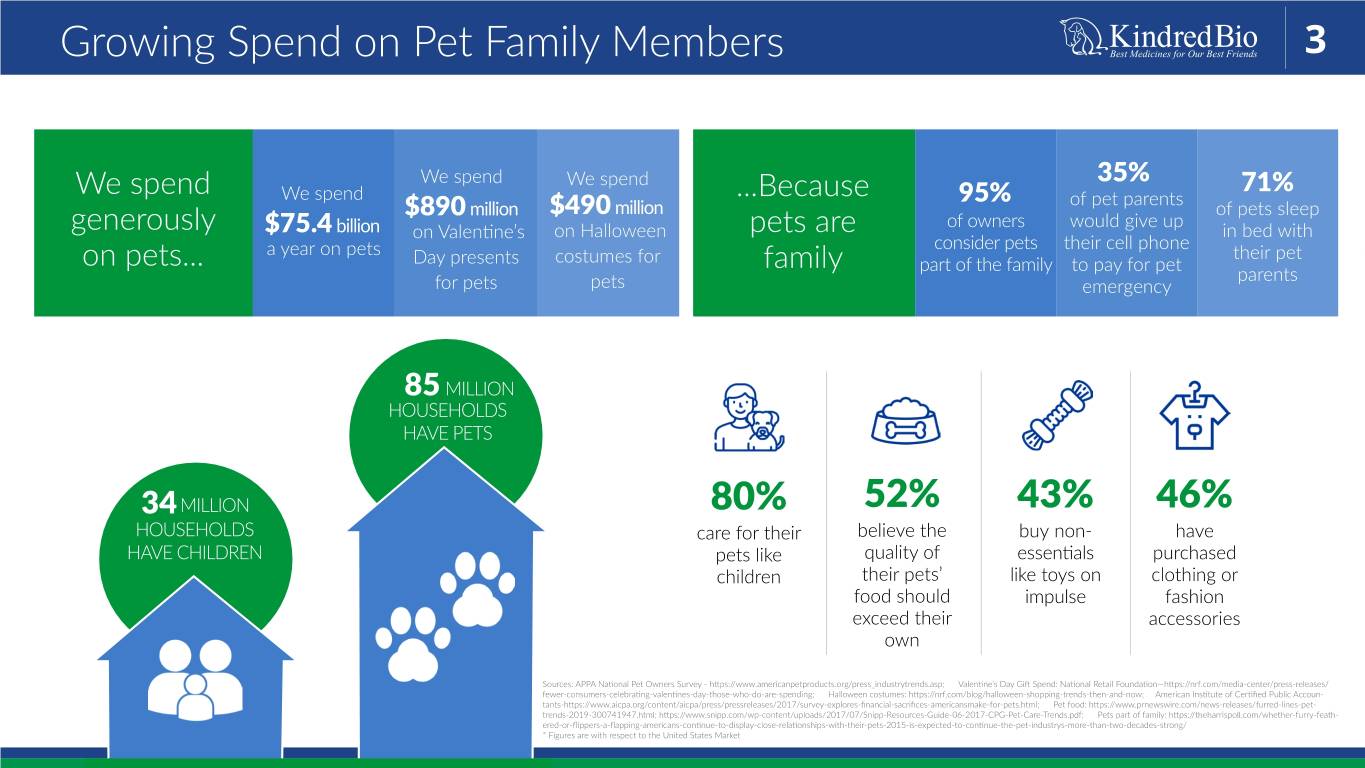

Growing Spend on Pet Family Members 3 We spend We spend 35% 71% We spend We spend ...Because 95% of pet parents million $490 million of pets sleep $890 of owners would give up generously $75.4 billion on Valentine’s on Halloween pets are in bed with consider pets their cell phone a year on pets their pet on pets... Day presents costumes for family part of the family to pay for pet parents for pets pets emergency 85 MILLION HOUSEHOLDS HAVE PETS 34 MILLION 80% 52% 43% 46% HOUSEHOLDS care for their believe the buy non- have HAVE CHILDREN pets like quality of essentials purchased children their pets’ like toys on clothing or food should impulse fashion exceed their accessories own Sources: APPA National Pet Owners Survey - https://www.americanpetproducts.org/press_industrytrends.asp; Valentine’s Day Gift Spend: National Retail Foundation—https://nrf.com/media-center/press-releases/ fewer-consumers-celebrating-valentines-day-those-who-do-are-spending; Halloween costumes: https://nrf.com/blog/halloween-shopping-trends-then-and-now; American Institute of Certified Public Accoun- tants-https://www.aicpa.org/content/aicpa/press/pressreleases/2017/survey-explores-financial-sacrifices-americansmake-for-pets.html; Pet food: https://www.prnewswire.com/news-releases/furred-lines-pet- trends-2019-300741947.html; https://www.snipp.com/wp-content/uploads/2017/07/Snipp-Resources-Guide-06-2017-CPG-Pet-Care-Trends.pdf; Pets part of family: https://theharrispoll.com/whether-furry-feath- ered-or-flippers-a-flapping-americans-continue-to-display-close-relationships-with-their-pets-2015-is-expected-to-continue-the-pet-industrys-more-than-two-decades-strong/ * Figures are with respect to the United States Market

KindredBio Highlights 4 Leveraging Attractive ROI One of the validated potential, only pet human drugs with cost of biopharmaceutical to maximize development companies probability of 100 times lower in the world success than human 1 2 3 markets First commercial Leading products for the Deep pipeline biologics management of with over 20 capabilities weight loss in cats drugs in – the future and control of development of veterinary 4 fever in horses 5 6 medicine

Unique Development Strategy 5 Reduce technical risk Pursue Shorten molecules timelines known to work in humans KindredBio Repurposes Human Drugs Average of for Pets Reduce $5-8M to financial risk develop a drug in 3-6 years Portfolio approach

High Willingness to Pay 6 Average spend to save life of pet1 Generic Dispensing Rates2 Few generic companies & low penetration 100% $10,000 $10,200 $10,330 81% No automatic 80% $8,000 substitution at pharmacy $6,000 60% Peak sales often reached post patent $4,000 40% expiration $2,000 20% 7% No biosimilar $0 0% pathway Cat owners Dog owners Companion animal Human Recession-resistant spend3 Pet industry sales: Government Personal Consumption Expenditures (“PCE”) and industry estimates $120 ($ in Billions) $100 Pet industry CONTINUED GROWTH Estimates $80 DURING RECESSIONS PCE, Pets, Pet $60 Related Services $40 $20 $0 1994 1996 1998 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1. www.lendedu.com/blog/how-much-are-dog-and-cat-owners-willing-to-spend 2. IMS Health, Putney, BofA Merill Lynch Global Research; Note: Companion Animal dispensing rate within the veterinary clinic 3. U.S Bureau of Economic Analysis (2018); American Pet Products Association (2018)

Advantages Over Human Health 7 ATTRACTIVE Market sizes are 10 times smaller than human markets, but the cost of ROI development is 100 times lower POTENTIAL Faster, less expensive development pathway Strong brand loyalty post patent expiration Portfolio approach minimizes volatility Therapeutics paid for out-of-pocket Long-term customer relationships

Industry Leading Product Pipeline 8 MAJORITY OF DEEP PIPELINE MIX OF PIPELINE IS WITH > 20 PROGRAMS NEW MODALITIES AND INNOVATIVE BIOLOGICS IN DEVELOPMENT GREENFIELD MARKETS Laboratory Field MOLECULE Proposed Indication Preclinical Pilot Studies Pilot Studies Pivotal Study IL31 antibody Atopic dermatitis IL4/13 SINK Atopic dermatitis IL17 antibody Atopic dermatitis IL4R antibody Atopic dermatitis KIND-030 Parvovirus Anti-TNF antibody Inflammatory bowel disease Control of non- KIND-510a regenerative anemia KIND-012 Control of fever (dipyrone oral gel) KIND-014 Equine gastric ulcers KIND-015 Metabolic syndrome Anti-TNF antibody Sick newborn foals (sick newborn foals) Other products in development (partial list) include KIND-bodies, VEGF antibody, and Checkpoint Inhibitors. Pipeline disclaimer: This material is intended to provide investors with information about KindredBio’s clinical development pipeline and is not intended for promotional purposes.

Recent and Expected Milestones 9 Molecule Proposed Indication 2019 2020 KIND-012 (dipyrone injection) Control of fever in horses Approval Commercial launch Mirataz® (mirtazapine Control of weight loss Approval Commercial launch transdermal ointment) EU in cats KIND-012 (dipyrone oral gel) Control of fever in horses Conduct bridging studies IL31 antibody Atopic dermatitis in dogs Positive pilot study results Commence pivotal study IL4/13 SINK Atopic dermatitis in dogs Pilot study commenced Pilot study results in 1Q 2020 IL4R antibody Atopic dermatitis in dogs Positive pilot study results Second pilot study to further assess efficacy and dosing Control of non-regenerative Positive pilot study results & KIND-510a (feline recombinant epo) Pivotal study underway anemia in cats commencement of pivotal study in 4Q Conduct pivotal study Positive pilot study results KIND-030 Parvovirus in dogs Approval late 2020, early 2021 Pivotal study commenced. KIND-014 Equine gastric ulcers Results expected 2020. Inflammatory bowel Anti-TNF antibody Pilot study commenced Pilot study complete in 1H disease in dogs Anti-TNF antibody Sick newborn foals Commence field study

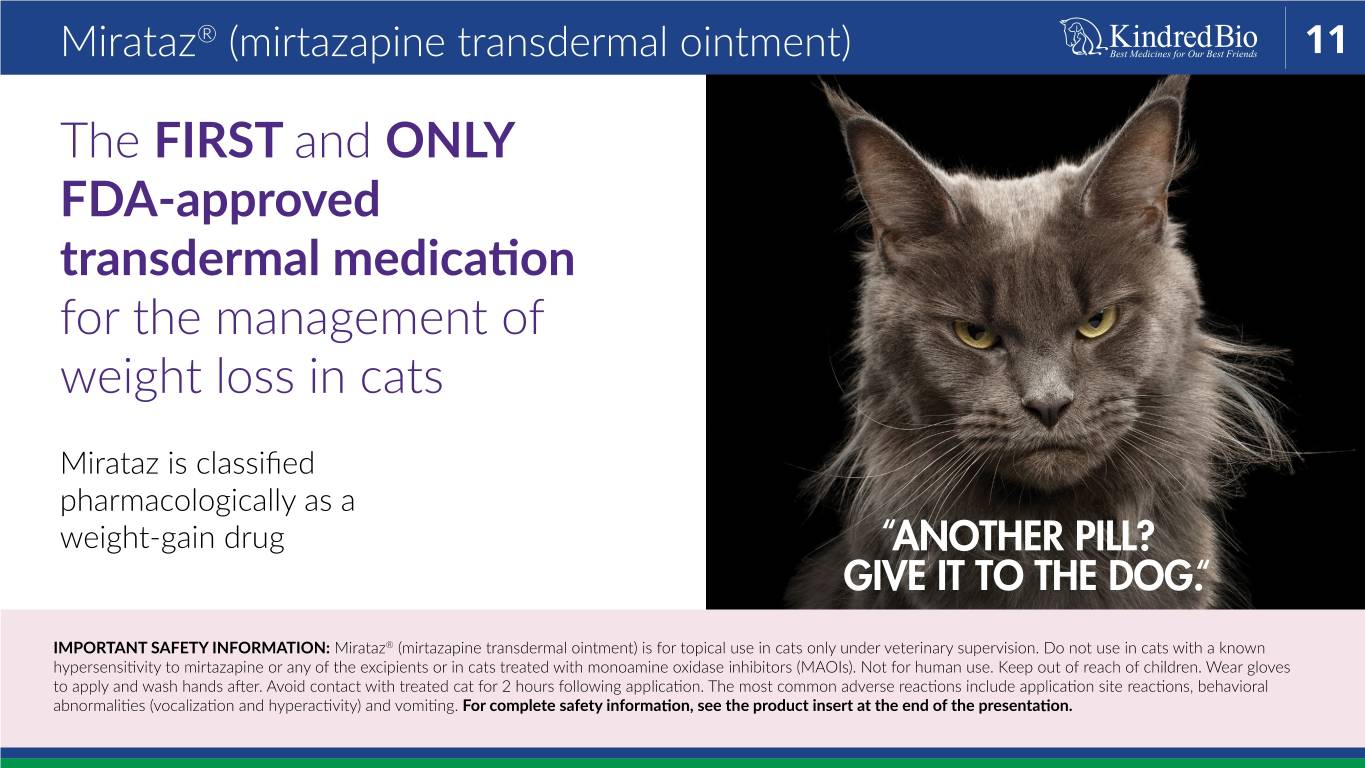

First Products & Commercialization

Mirataz® (mirtazapine transdermal ointment) 11 The FIRST and ONLY FDA-approved transdermal medication for the management of weight loss in cats Mirataz is classified pharmacologically as a weight-gain drug “ANOTHER PILL? GIVE IT TO THE DOG.“ IMPORTANT SAFETY INFORMATION: Mirataz® (mirtazapine transdermal ointment) is for topical use in cats only under veterinary supervision. Do not use in cats with a known hypersensitivity to mirtazapine or any of the excipients or in cats treated with monoamine oxidase inhibitors (MAOIs). Not for human use. Keep out of reach of children. Wear gloves to apply and wash hands after. Avoid contact with treated cat for 2 hours following application. The most common adverse reactions include application site reactions, behavioral abnormalities (vocalization and hyperactivity) and vomiting. For complete safety information, see the product insert at the end of the presentation.

Feline Weight Loss can be Fatal 12 Million cats are Million cats* diagnosed with are treated for unintended unintended weight loss weight loss 9each year 3each year Topical application to the cat’s inner ear Unintended weight loss is a leading cause of feline veterinary visits is more appealing than oral dosing Caused by underlying conditions, such as chronic kidney disease, 75% of veterinarians say that ease of cancer, and diabetes administration is important Sources: * Prior to the launch of Mirataz. 2012 U.S. Pet Ownership & Demographics Sourcebook American Veterinary Medical Association (n=50,000 U.S. Households) 2016 U.S. Veterinarian Mirtazapine Research, Wise Insights May 2016 (n=89 U.S. small animal Veterinarians). Data on file at Kindred Biosciences. 2017 Mirataz Pricing Research, Kynetec, September 2017 (n=204 U.S. small animal veterinarians). Data on file at Kindred Biosciences. 2016 U.S. Veterinarian Mirtazapine Phase 3 Research, Ipsos, September 2016 (n=201 U.S. small animal Veterinarians). Data on file at Kindred Biosciences.

Mirataz® (mirtazapine transdermal ointment) clinical results 13 MIRTAZAPINE CONCENTRATIONS IN CATS AT STEADY STATE FOLLOWING DAILY DOSING (DAY 13; 0.5 MG/KG)1 Efficacy In clinical studies, Mirataz® achieved measurable and steady plasma levels of mirtazapine and effectively resulted in weight gain Mirataz demonstrated a 3.9% increase in body weight in cats with unintended weight loss in as little as 14 days2 WEIGHT GAIN IN CATS WITH MIRATAZ VS PLACEBO (EFFECTIVENESS POPULATION) Mirataz was effective in the management of weight loss in cats associated with a wide variety of conditions2 References: 1. Buhles W, Quimby JM, Labelle D, et al. Single and multiple dose pharmacokinetics of a novel transdermal ointment in cats. J Vet Pharmacol Therap. 2018;41(5):644-651. 2. Poole M, Quimby JM, Hu T, et al. A double-blind, placebo-controlled, randomized study to evaluate the weight gain drug, mirtazapine transdermal ointment, in cats with unintended weight loss. J Vet Pharmacol Ther. 2019;42(2):179-188.

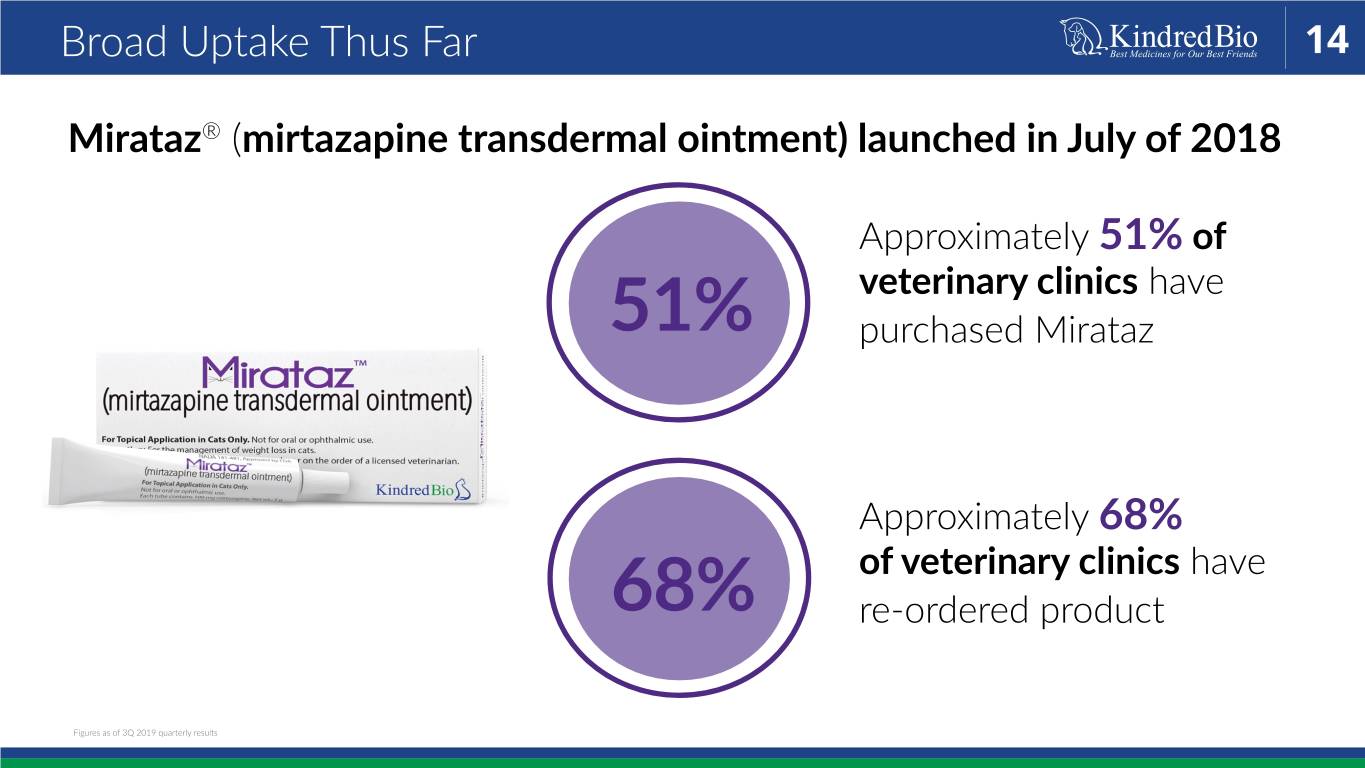

Broad Uptake Thus Far 14 Mirataz® (mirtazapine transdermal ointment) launched in July of 2018 Approximately 51% of veterinary clinics have 51% purchased Mirataz Approximately 68% of veterinary clinics have 68% re-ordered product Figures as of 3Q 2019 quarterly results

Mirataz EU Market Opportunity & Next Steps 15 NOW APPROVED! Veterinary Therapeutics Market Broad label: Mirataz is the first veterinary therapeutic for poor appetite and weight loss resulting from chronic medical conditions in the EU United States EU Other European sales may exceed the US and uptake could be swifter due to EU regulations that restrict use of human medicine once an approved veterinary therapeutic is available Partner discussions are ongoing

Zimeta™ (dipyrone injection) 16 NOW APPROVED! Zimeta™ (dipyrone injection) is the FIRST and ONLY drug FDA approved for the control of pyrexia (fever) in horses Dipyrone, the active ingredient inZimeta , is a member of the pyrazolone class of non-steroidal anti-inflammatory drugs (NSAIDs) and has a centrally acting mechanism of action on the hypothalamus where fever originates and is regulated.** **Equine clinical relevance has not been determined Zimeta is indicated for the control of pyrexia in horses Important Safety Information: ZimetaTM (dipyrone injection) should not be used more frequently than every 12 hours. For use in horses only. Do not use in horses with a hypersensitivity to dipyrone, horses intended for human consumption or any food producing animals, including lactating dairy animals. Not for use in humans, avoid contact with skin and keep out of reach of children. Take care to avoid accidental self-injection and use routine precautions when handling and using loaded syringes. Prior to use, horses should undergo a thorough history and physical examination. Monitor for clinical signs of coagulopathy and use caution in horses at risk for hemorrhage. Concomitant use with other NSAIDs, corticosteroids and nephrotoxic drugs, should be avoided. As a class, NSAIDs may be associated with gastrointestinal, renal, and hepatic toxicity. The most common adverse reactions observed during clinical trials were Elevated Serum Sorbitol Dehydrogenase (SDH), Hypoalbuminemia and Gastric Ulcers. For complete safety information, see the product insert at the end of the presentation.

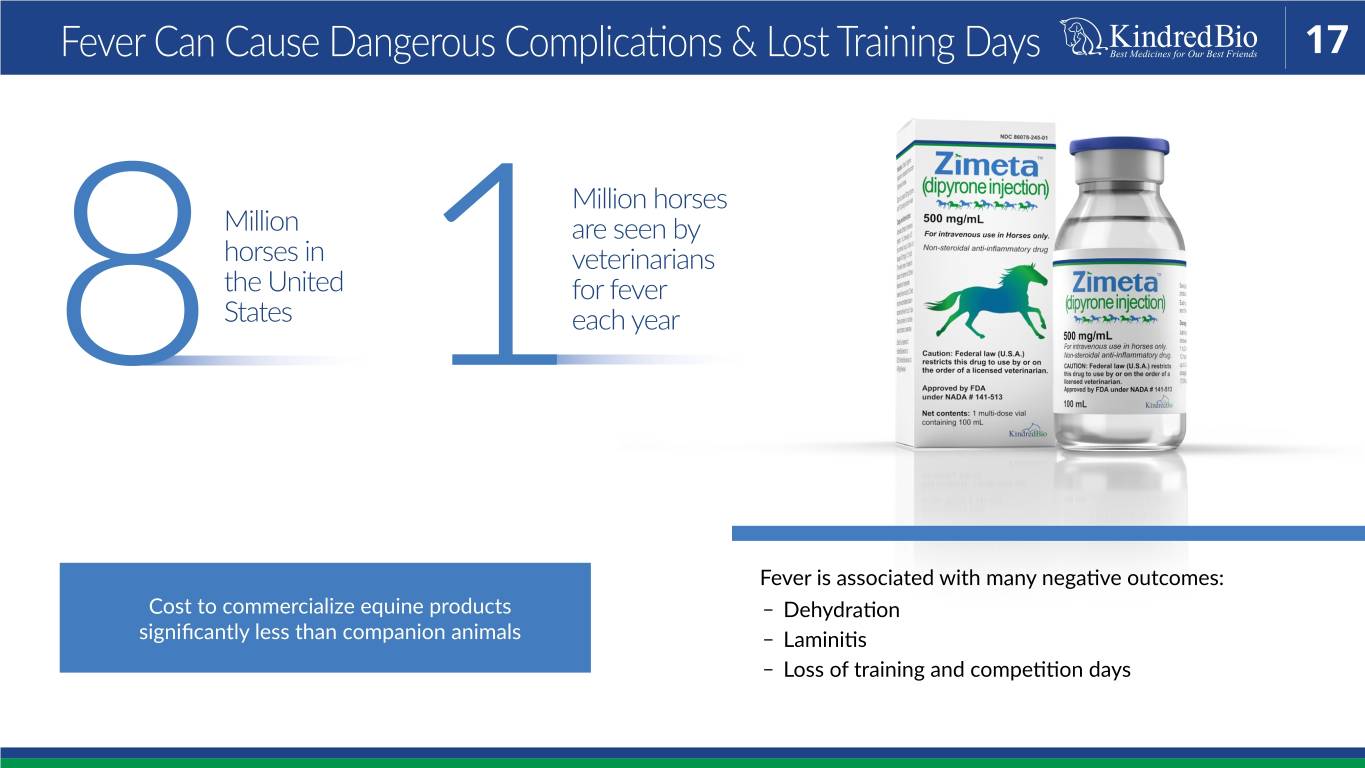

Fever Can Cause Dangerous Complications & Lost Training Days 17 Million horses Million are seen by horses in veterinarians the United for fever 8 States 1each year Fever is associated with many negative outcomes: Cost to commercialize equine products ૡ Dehydration significantly less than companion animals ૡ Laminitis ૡ Loss of training and competition days

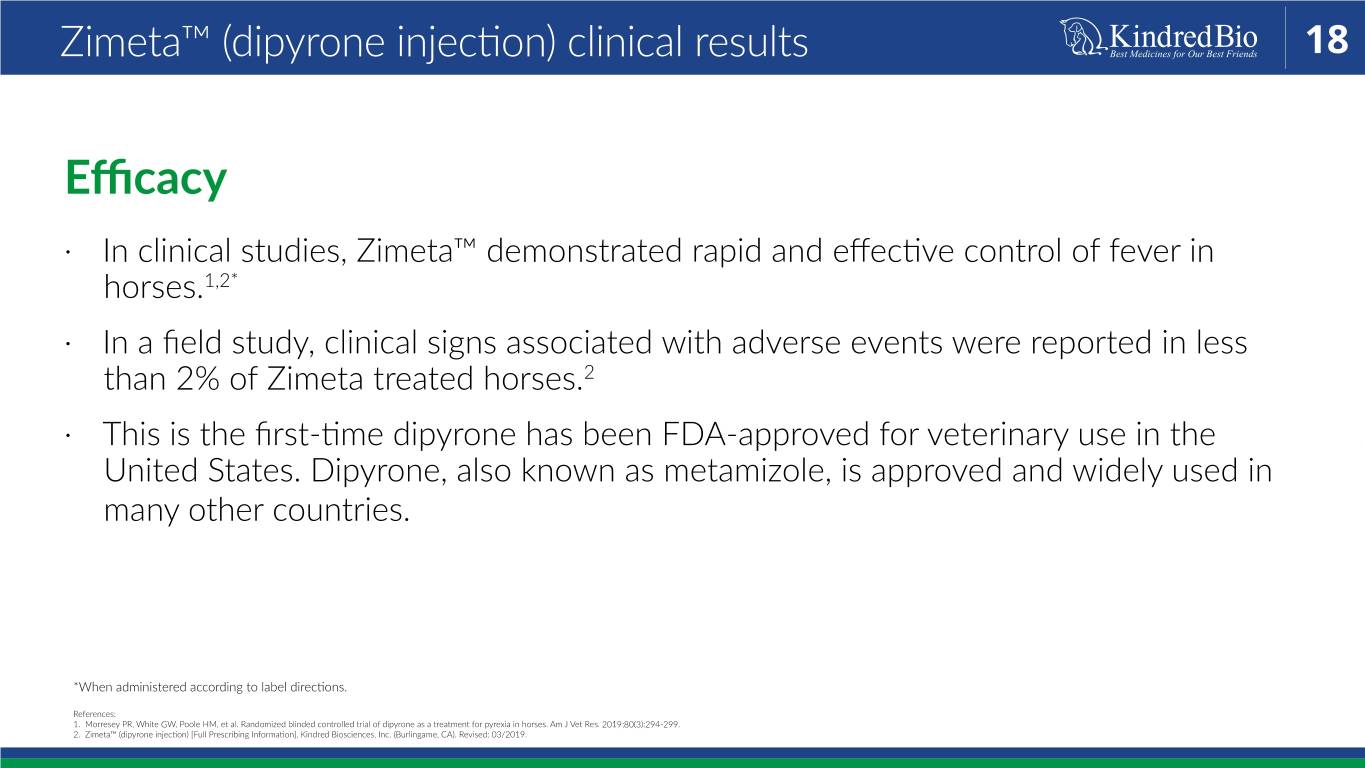

Zimeta™ (dipyrone injection) clinical results 18 Efficacy · In clinical studies, Zimeta™ demonstrated rapid and effective control of fever in horses.1,2* · In a field study, clinical signs associated with adverse events were reported in less than 2% of Zimeta treated horses.2 · This is the first-time dipyrone has been FDA-approved for veterinary use in the United States. Dipyrone, also known as metamizole, is approved and widely used in many other countries. *When administered according to label directions. References: 1. Morresey PR, White GW, Poole HM, et al. Randomized blinded controlled trial of dipyrone as a treatment for pyrexia in horses. Am J Vet Res. 2019;80(3):294-299. 2. Zimeta™ (dipyrone injection) [Full Prescribing Information], Kindred Biosciences, Inc. (Burlingame, CA). Revised: 03/2019.

Commercialization Strategy & Team 19 World-class Commercial Team Commercialization Strategy Sales force has Companion animal - average experience 25 person direct field of 15+ years sales force Over 10 launches Sales forces work per team member in conjunction with on average distributors Team comes from Equine to commercialize top veterinary with 3-5 person direct companies sales force Source: Data on file at Kindred Biosciences.

Focus on Biologics

Biologics: The Future of Veterinary Medicine 21 VETERINARY MEDICINE TO FOLLOW HUMAN MARKET, IN WHICH TOP DRUGS ARE BIOLOGICS Industry leading biologics programs Declining manufacturing costs make biologics competitive in animal health Administered in office, so veterinarian maintains revenue stream Highly experienced KindredBio team responsible for developing top human drugs End-to-end capabilities and new technologies (KIND-bodies)

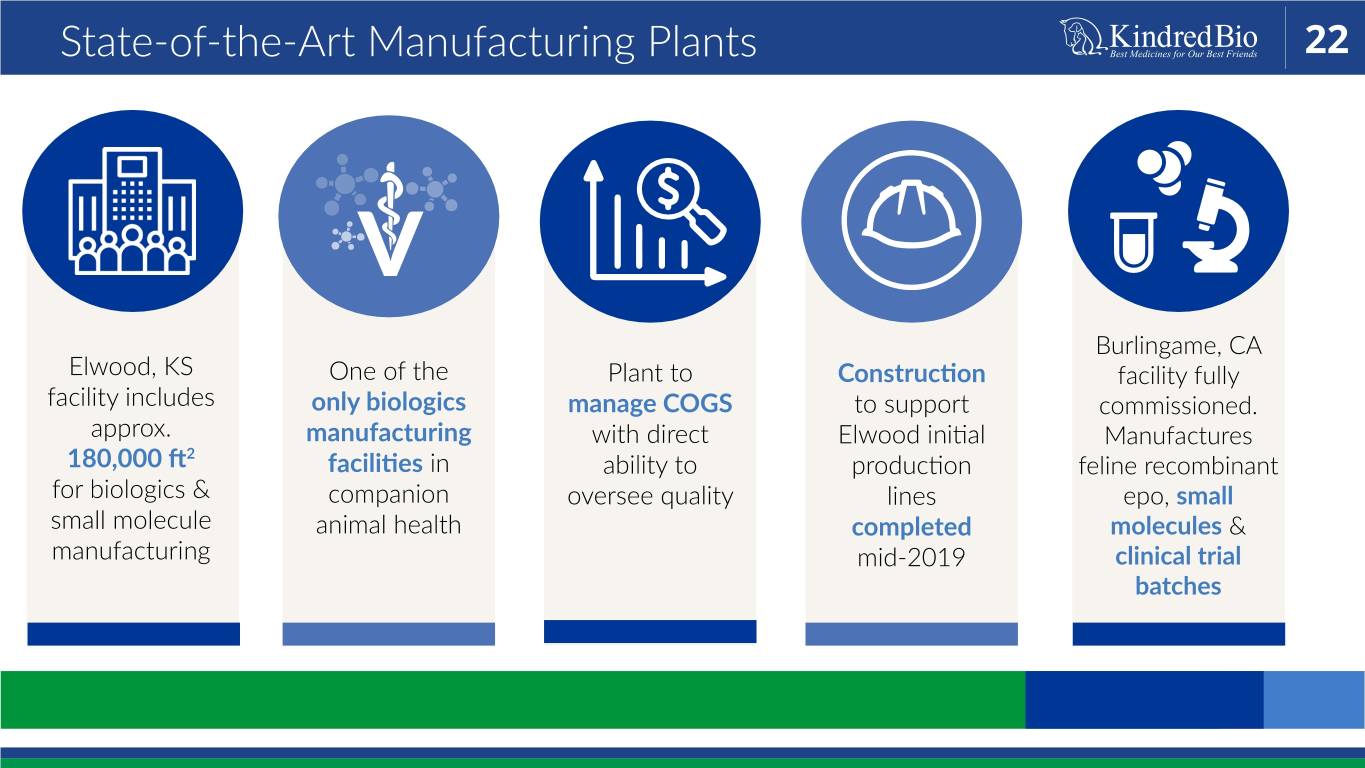

State-of-the-Art Manufacturing Plants 22 Burlingame, CA Elwood, KS One of the Plant to Construction facility fully facility includes only biologics manage COGS to support commissioned. approx. manufacturing with direct Elwood initial Manufactures 2 180,000 ft facilities in ability to production feline recombinant for biologics & companion oversee quality lines epo, small small molecule animal health completed molecules & manufacturing mid-2019 clinical trial batches

Half-Life Extension 23 ●● Normal canine antibodies have half-life of 9-12 days ●● KindredBio has developed technology to modify the Fc tail of antibodies to increase half-life to 3X normal ●● This means KindredBio antibodies could be administered every 3 months and/or could lower cost of goods by 3X ●● The technology may work for other species

Deep Pipeline

Canine Dermatitis - Large and Growing Market 25 Prevalence Diagnosis #1 10-15% Itch is #1 have atopic reason for canine dermatitis, veterinarian an allergic visits skin disease Two recent drugs Growing Market Key Profit Center are selling over 47% 83% increase in of dogs seen by $700M itchy dog dermatologists a year (combined) veterinarian suffer from visits since pruritis (itch) and are growing 2014 Sources: Hillier, A. and C.E. Griffin, The ACVD task force on canine atopic dermatitis (I): incidence and prevalence. Vet Immunol Immunopathol, 2001. 81(3-4): p. 147-51. Website, N.P.I. Top 10 Medical Conditions of 2016. Available from: https://press8.petinsurance.com/articles/2017/march/nationwide%C2%AE-data-reveals-mostcommon-medical-conditions-for-dogs-and-cats March 2018 Vetstreet Pruritus Projection Trend Report 2019 Canine Atopic Dermatitis Veterinarian Research, February, 2019 (n=173 U.S. small animal veterinarians and dermatology specialists). Data on file at Kindred Biosciences

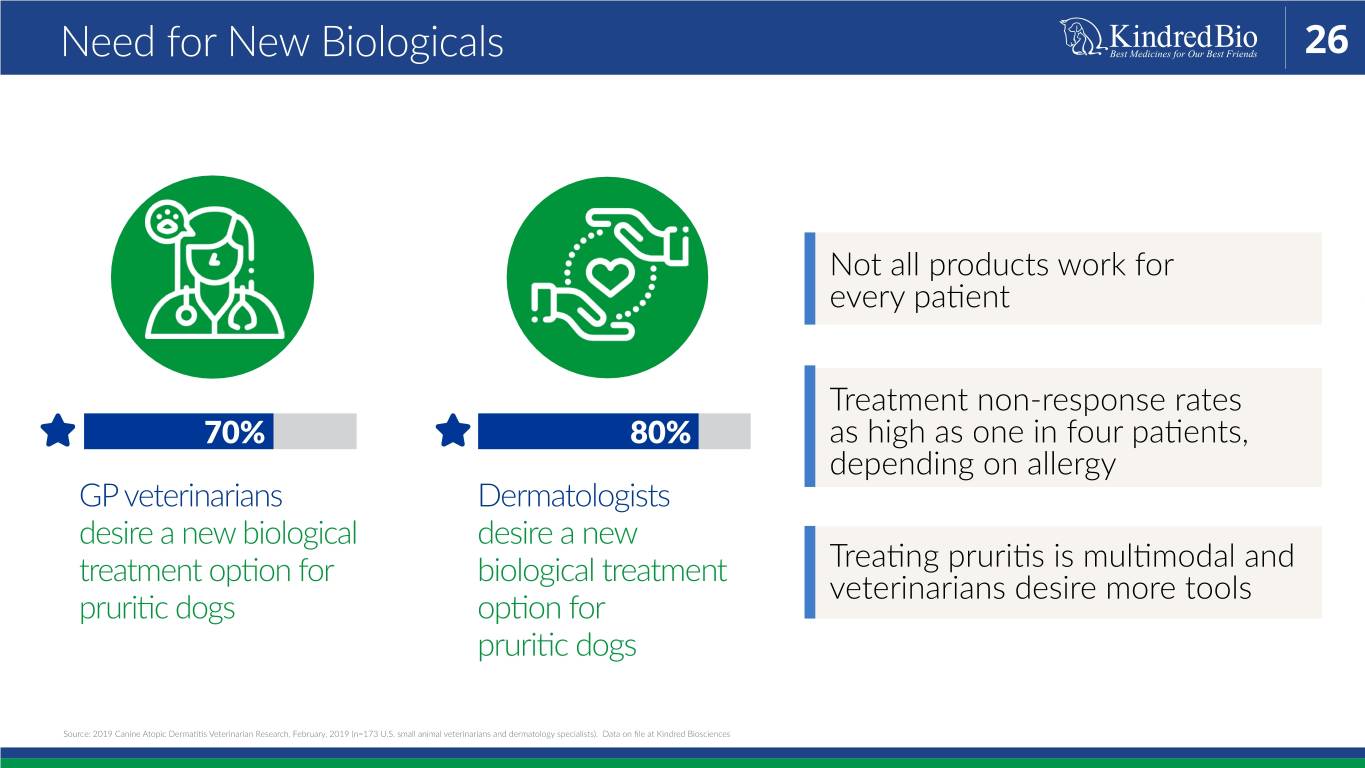

Need for New Biologicals 26 Not all products work for every patient Treatment non-response rates 70% 80% as high as one in four patients, depending on allergy GP veterinarians Dermatologists desire a new biological desire a new treatment option for biological treatment Treating pruritis is multimodal and veterinarians desire more tools pruritic dogs option for pruritic dogs Source: 2019 Canine Atopic Dermatitis Veterinarian Research, February, 2019 (n=173 U.S. small animal veterinarians and dermatology specialists). Data on file at Kindred Biosciences

Canine Dermatitis Pipeline 27 IL4R and Other IL4/IL31 SINK Candidates IL4/IL13 SINK blocks inflammation Positive results from pilot study of IL4R. Evidence of positive efficacy and dose Analogus to dupilumab - which was respose recently approved in human atopic dermatitis Inital pilot study of IL17 antibody has also been completed and the molecule Pilot safety study has been completed and was well-tolerated the molecule was well tolerated KindredBio has other preclinical candidates for atopic dermatitis Sources: Hillier, A. and C.E. Griffin, The ACVD task force on canine atopic dermatitis (I): incidence and prevalence. Vet Immunol Immunopathol, 2001. 81(3-4): p. 147-51. Website, N.P.I. Top 10 Medical Conditions of 2016. https://press8.petinsurance.com/articles/2017/march/nationwide%C2%AE-data-reveals-most-common-medical-conditions-for-dogs-and-cats. Note: The results stated in this slide have not been reviewed by the United States Department of Agriculture Center for Veterinary Biologics.

Canine Parvovirus 28 Highly Contagious Disease Affects mostly puppies, with no approved therapies Disease Burden Mortality rate as high as 91% Cost Burden Supportive care can cost thousands General practitioners, emergency hospitals, and shelters Market Opportunity More than 60% of shelter dogs lack adequate titers to protect against parvo Mortality benefit seen in both prophylaxis and treatment of Positive Pilot Efficacy Results parvovirus infection Approval Timeline Approval expected by late 2020, or early 2021

Canine Inflammatory Bowel Disease 29 Majority of cases involve chronic states of diarrhea, vomiting, gastroenteritis, and other symptoms Prevalence Diarrhea prevalence >5% Chronic condition, with diagnosis common in middle age Disease Burden Existing treatments can have significant drawbacks, leading to treatment lapses or poor quality of life Cost Burden High willingness to pay given impact on owner Near-term Catalyst Completion of pilot field effectiveness study expected in the first half of 2020

Non-regenerative Anemia in Cats 30 POSITIVE RESULTS FROM Chronic condition est. to afflict millions of PILOT EFFECTIVENESS STUDY older cats, with no approved treatments OF FELINE RECOMBINANT ERYTHROPOIETIN About 50% of older cats develop chronic Statistically significant improvement in kidney disease (CKD), which can lead to anemia hematocrit & quality of life CKD is a leading cause of feline mortality and veterinary visits Human erythropoietins are multi-billion dollar products in human market, but immunogenic in many cats Pivotal study commenced in late 2019. First cat enrolled.

Non-regenerative Anemia in Cats 31 Pilot Results* Treatment success was defined as: HCT returning to the laboratory normal Least Squares (LS) Means of Hematocrit over Time reference range by Week 6 35 P < 0.0001 P < 0.0001 ) n=19 P < 0.0001 E n=20 n=19 OR 95.5% S 100 ( 30 P < 0.0001 Success ) n=22 P < 0.0001 % ( n=19 Failure t i r c o Relative HCT t a P < 0.0001 50 m 25 n=22 e improvement of H 30% compared to n=22 4.5% baseline by Week 6 0 20 Success Failure Baseline Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Number of n=22 n=18 n=8 n=6 n=3 n=4 n=0 Cats Dosed *Data has not been evaluated by the FDA

Equine Gastric Ulcer Syndrome 32 90% Affects all types of horses 74% of racing horses develop ulcers Clinical symptoms: poor appetite, loose stools, poor >60% condition, low performance and behavioral issues of sport horses develop ulcers Pivotal study 50% commenced of recreational horses develop ulcers Source: kindredbioequine.com/3623-2/

Sepsis in Foals 33 Pilot Results* TNF Antibody in Equine Sepsis Statistically significant mortality benefit. Combined analysis of 19 foals enrolled in two studies. *Data has not been evaluated by the FDA

Corporate Information

Levers Driving Growth 35 Biologics facilities provide potential for contract Multiple potential Deep pipeline manufacturing blockbuster launches by 2022 beginning to Assessing partnership launch opportunities for pipeline candidates Targeting Focus on highest non-dilutive value capital investments sources Prioritizing R&D projects with highest ROI Business model 2019 expenditures reflect initiation of Balancing commercial provides financial multiple pivotal studies infrastructure with flexibility advancement of Goal to reduce 2020 attractive pipeline expenditures Runway through 2021

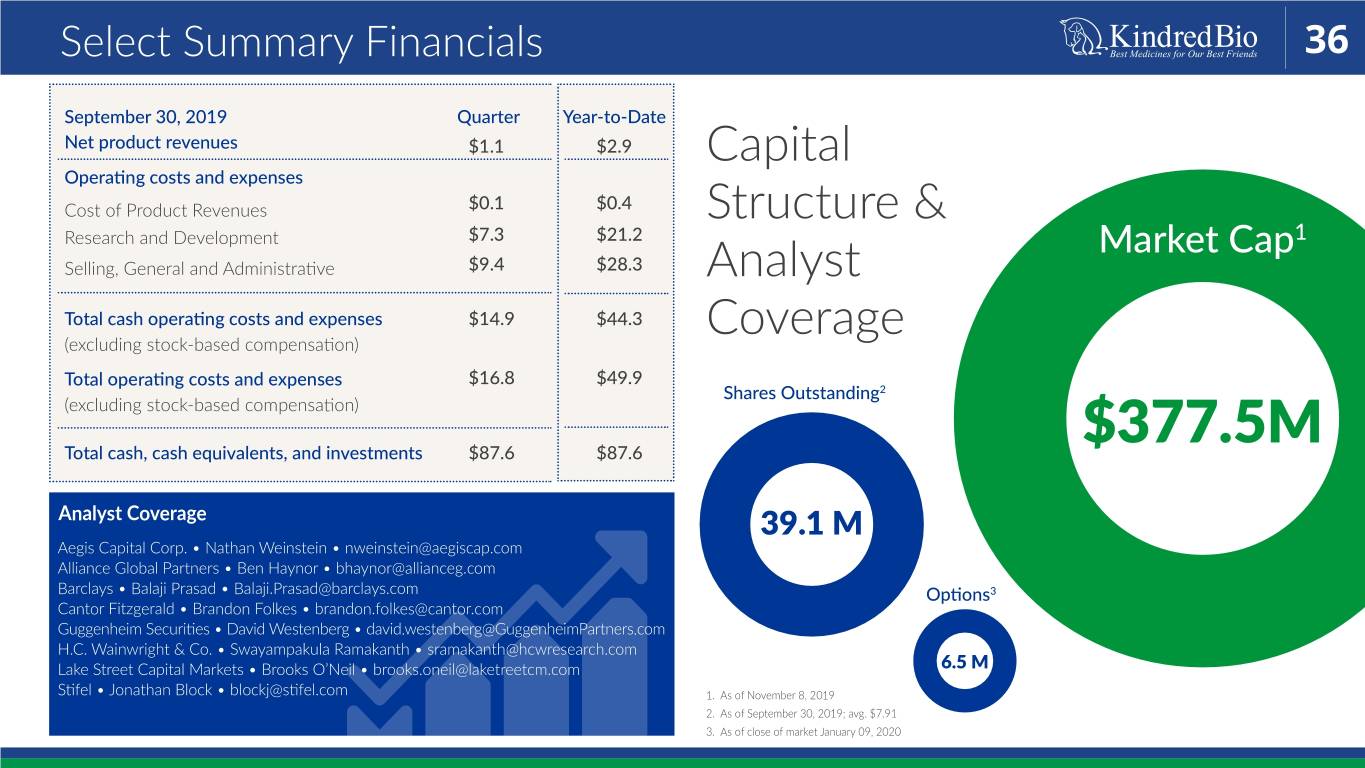

Select Summary Financials 36 September 30, 2019 Quarter Year-to-Date Net product revenues $1.1 $2.9 Capital Operating costs and expenses Cost of Product Revenues $0.1 $0.4 Structure & Research and Development $7.3 $21.2 Market Cap1 Selling, General and Administrative $9.4 $28.3 Analyst Total cash operating costs and expenses $14.9 $44.3 (excluding stock-based compensation) Coverage Total operating costs and expenses $16.8 $49.9 Shares Outstanding2 (excluding stock-based compensation) Total cash, cash equivalents, and investments $87.6 $87.6 $377.5M Analyst Coverage 39.1 M Aegis Capital Corp. • Nathan Weinstein • nweinstein@aegiscap.com Alliance Global Partners • Ben Haynor • bhaynor@allianceg.com Barclays • Balaji Prasad • Balaji.Prasad@barclays.com Options3 Cantor Fitzgerald • Brandon Folkes • brandon.folkes@cantor.com Guggenheim Securities • David Westenberg • david.westenberg@GuggenheimPartners.com H.C. Wainwright & Co. • Swayampakula Ramakanth • sramakanth@hcwresearch.com Lake Street Capital Markets • Brooks O’Neil • brooks.oneil@laketreetcm.com 6.5 M Stifel • Jonathan Block • blockj@stifel.com 1. As of November 8, 2019 2. As of September 30, 2019; avg. $7.91 3. As of close of market January 09, 2020

Compelling Value Proposition 37 Significant Progress to Date Valuable Pipeline in Place Outlook is Bright Reduce Reduce Reduce • First threetechnical approvals risk • Deep pipelinetechnical of risk>20 • Growing technicalrevenues risk validate business model product candidates - from three commercial • Two state-of-the-art substantial commercial products biologics facilities provide opportunity • Multiple pivotal studies competitive advantage • Potential blockbuster to begin in 2020 • World-class R&D team launches • Next approval expected responsible for leading • Partnership late 2020/early 2021 human drugs opportunities & • Transition to cash flow • Intellectual property contract manufacturing positive portfolio to prolong runway

Contact Investor Relations 38 For investor inquiries: Katja Buhrer katja.buhrer@kindredbio.com (917) 969-3438 Corporate Office: San Diego Office: 1555 Bayshore Hwy, Suite 200 591 Camino De La Reina, Ste 407 Burlingame, CA 94010 San Diego, CA 92108 Tel (650) 701-7901 © 2020 Kindred Biosciences, Inc, Burlingame, CA 94010. All rights reserved.

Mirataz - Prescribing Information 39

Mirataz - Prescribing Information 40

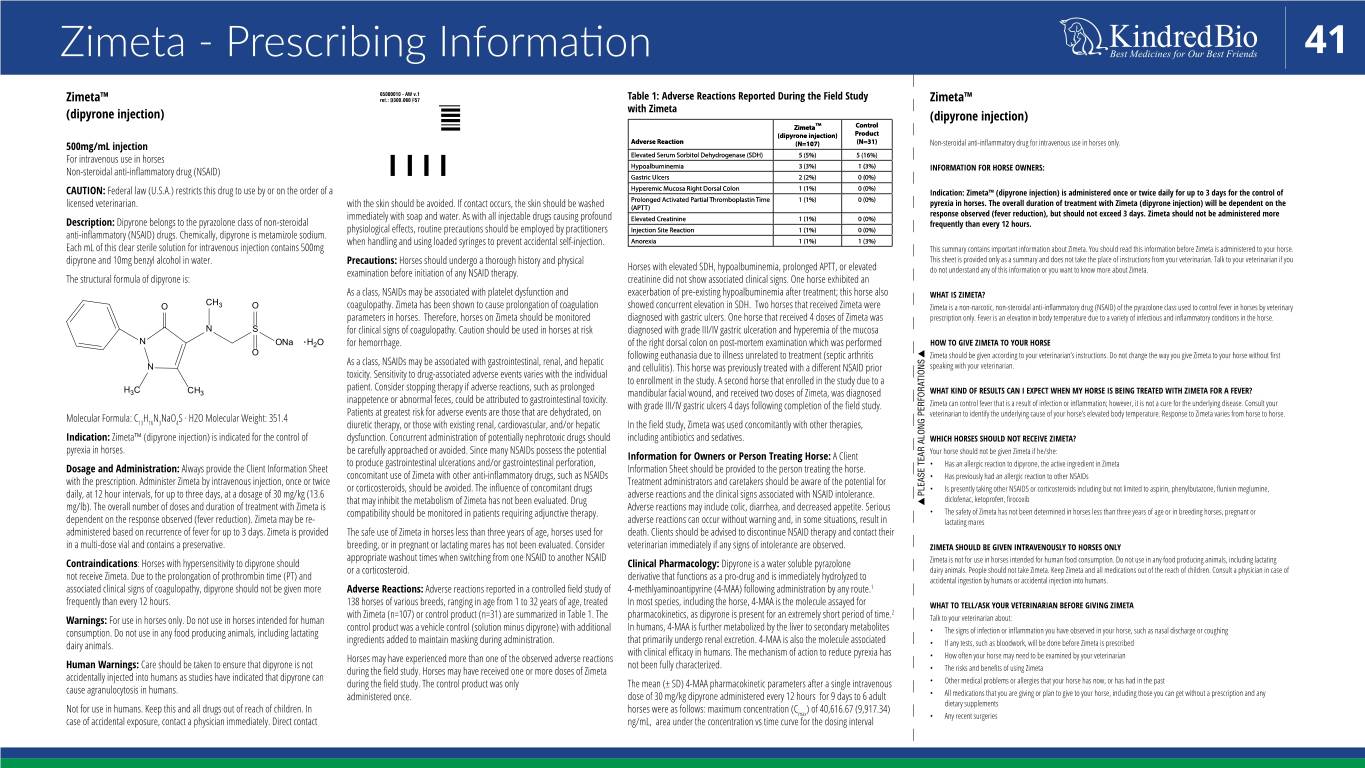

Zimeta - Prescribing Information 41 65000010 - AW v.1 ref.: D300.060 F57 Zimeta™ Control (dipyrone injection) Product Adverse Reaction (N=107) (N=31) Elevated Serum Sorbitol Dehydrogenase (SDH) 5 (5%) 5 (16%) Hypoalbuminemia 3 (3%) 1 (3%) Gastric Ulcers 2 (2%) 0 (0%) Hyperemic Mucosa Right Dorsal Colon 1 (1%) 0 (0%) Prolonged Activated Partial Thromboplastin Time 1 (1%) 0 (0%) (APTT) Elevated Creatinine 1 (1%) 0 (0%) Injection Site Reaction 1 (1%) 0 (0%) Anorexia 1 (1%) 1 (3%) O CH3 O N S N ONa H2O O N H3C CH3

Zimeta - Prescribing Information 42 65000010 - AW v1 ref.: D300.060 F57 PLEASE TEAR ALONG PERFORATIONS