Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KURA SUSHI USA, INC. | krus-8k_20200113.htm |

Kura Sushi USA, inc. ICR Conference January 13th – 15th, 2020 Exhibit 99.1 Logo(KURA)

Disclaimer This presentation has been prepared for informational purposes only. No money or other consideration is being solicited, and if sent in response, will not be accepted. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The Company is not under any obligation to make an offering. It may choose to make an offering to some, but not all, of the people who indicate an interest in investing. Any such offering of securities will only be made by means of a registration statement (including a prospectus) filed with the SEC, after such registration statement becomes effective. No such registration statement has been filed as of the date of this presentation. The information included in any registration statement will be more complete than the information the Company is providing now, and could differ in important ways. This presentation, related video and oral communications made during the course of this presentation may contain forward-looking statements that involve risks and uncertainties. In some cases, you can identify forward-looking statements by terms such as “target,” “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “continue,” “predict,” “potential,” “plan,” “anticipate” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these assumptions, risks and uncertainties, you should not place undue reliance on these forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Unless required by United States federal securities laws, we do not intend to update any of these forward-looking statements to reflect circumstances or events that occur after the statement is made. Our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. The market data and certain other statistical information used throughout this presentation are based on independent industry publications, governmental publications, reports by market research firms or other independent sources. Some data are also based on our good faith estimates. Although we believe these third-party sources are reliable, we have not independently verified the information attributed to these third-party sources and cannot guarantee its accuracy and completeness. Similarly, our estimates have not been verified by any independent source. Certain financial measures presented in this presentation, such as Adjusted EBITDA, Adjusted EBITDA margin and Restaurant-level Contribution margin, are not recognized under generally accepted accounting principles in the United States (“GAAP”) and are defined in the accompanying Appendix. Such non-GAAP measures are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. We believe that the use of such non-GAAP measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that such non-GAAP financial measures are not indicative of overall results for the Company, and Restaurant-level Contribution margin does not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measure. Because of these limitations, non-GAAP financial measures should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. See the accompanying Appendix for a reconciliation of non-GAAP measures used in this presentation. Additional financial data and other measures for the company, including Average Unit Volume (AUVs), Comparable restaurant sales growth, Number of restaurant openings and Average check, are defined in the Appendix. By attending or receiving this presentation and viewing the related video, you acknowledge that you will be solely responsible for your own assessment of the market and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of our business. Section Title Sub-title and Scenarios

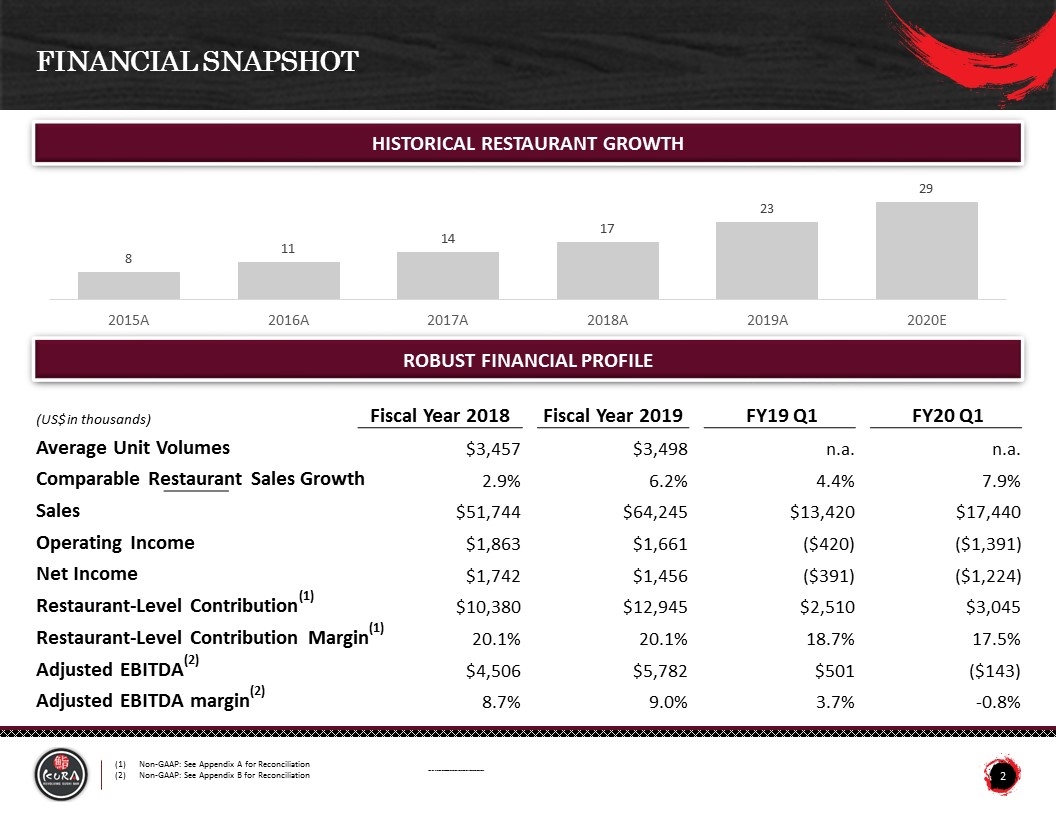

Financial Snapshot Robust Financial Profile Historical Restaurant Growth (US$ in thousands) Fiscal Year 2018 Fiscal Year 2019 FY19 Q1 FY20 Q1 Average Unit Volumes $3,457 $3,498 n.a. n.a. Comparable Restaurant Sales Growth 2.9% 6.2% 4.4% 7.9% Sales $51,744 $64,245 $13,420 $17,440 Operating Income $1,863 $1,661 ($420) ($1,391) Net Income $1,742 $1,456 ($391) ($1,224) Restaurant-Level Contribution(1) $10,380 $12,945 $2,510 $3,045 Restaurant-Level Contribution Margin(1) 20.1% 20.1% 18.7% 17.5% Adjusted EBITDA(2) $4,506 $5,782 $501 ($143) Adjusted EBITDA margin(2) 8.7% 9.0% 3.7% -0.8% Non-GAAP: See Appendix A for Reconciliation Non-GAAP: See Appendix B for Reconciliation Section Title Sub-title and Scenarios 8 2015A 11 2016A 14 2017A 17 2018A 23 2019A 29 2020E

Section 1: Growth Strategy Section 1 Growth Strategy Section 2 Financial Overview & Model Discussion Appendix Subsection Title Section Title

We have a multi-faceted and disciplined growth strategy Our growth strategy 1 Pursue New Restaurant Development 2 Deliver Consistent Comparable-Restaurant Sales Growth 3 Increase Profitability 4 Heighten Brand Awareness Section Title

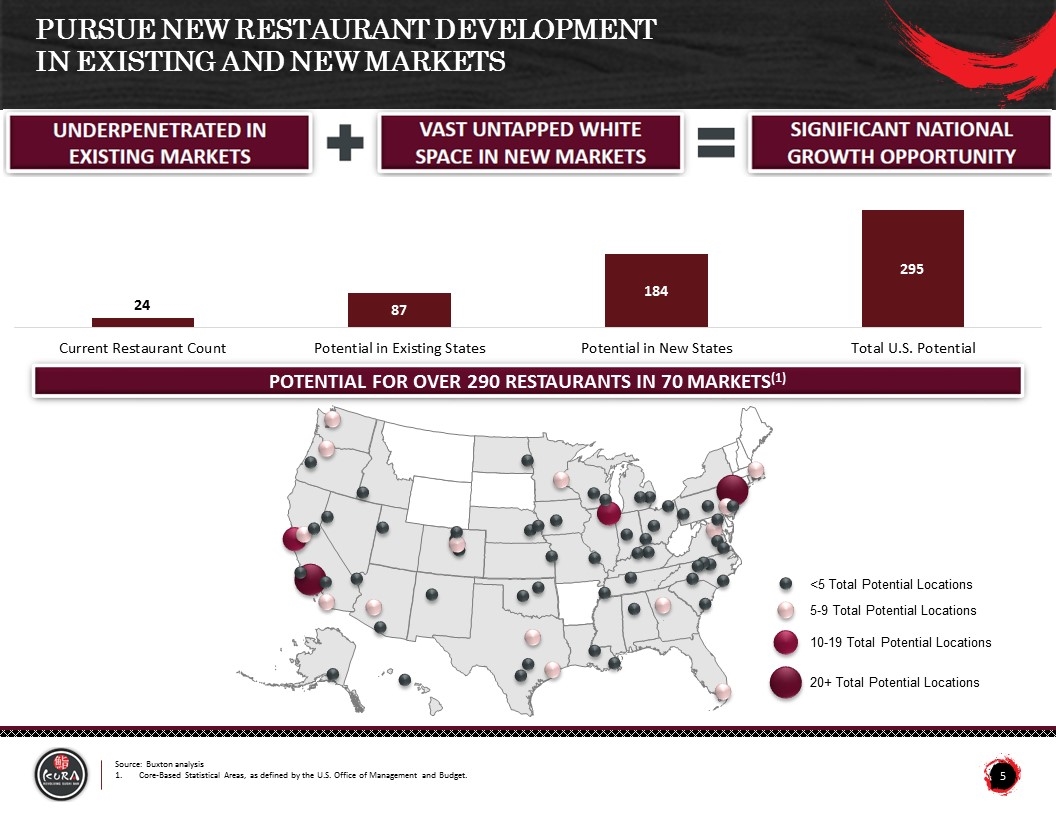

Source: Buxton analysis Core-Based Statistical Areas, as defined by the U.S. Office of Management and Budget. Pursue New Restaurant Development in Existing and New Markets 228-228-228 225-190-190 128-14-54 97-11-41 <5 Total Potential Locations 5-9 Total Potential Locations 10-19 Total Potential Locations 20+ Total Potential Locations Potential for Over 290 Restaurants in 70 Markets(1) 24 Current Restaurant Count 87 Potential Existing States 184 Potential New States 295 Total U.S. States Underpenetrated In Existing Markets Vast Untapped White Space In New Markets Significant National Growth Opportunity

Current restaurants range from 1,600 to 6,800 square feet In-line and end-cap formats Strip malls and shopping centers Suburban and urban areas Pursue New Restaurant Development in Existing and New Markets (Cont’d) Disciplined Site Selection Process Diverse population and above-average household income Proximity to highways, universities, shopping areas, and office parks Degree of competition within the market area Availability of suitable parking General availability of restaurant-level employees Residential and commercial population density Restaurant visibility & accessibility and traffic patterns Sacramento location, opened March 2019 Key Site Selection Criteria Flexible Physical Footprint Image(Map) Logo(Key Site Selection)

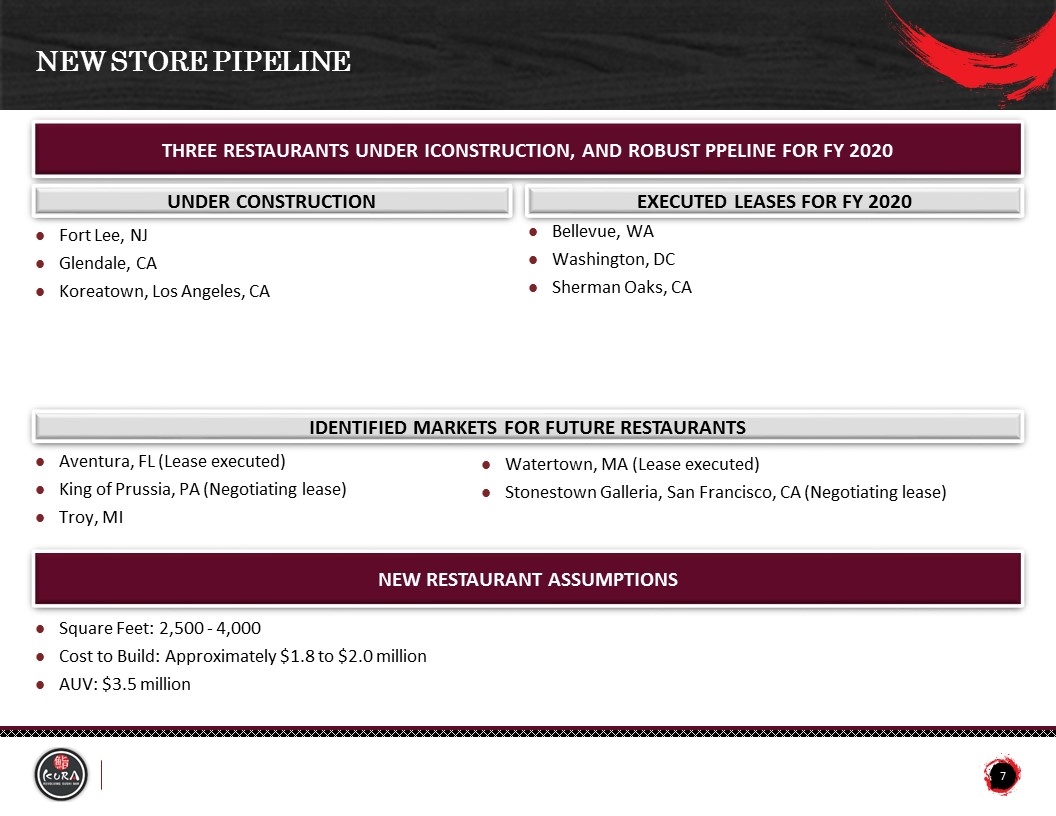

New Store Pipeline Three Restaurants Under iConstruction, and Robust Ppeline for FY 2020 Fort Lee, NJ Glendale, CA Koreatown, Los Angeles, CA Under Construction Executed Leases for FY 2020 Bellevue, WA Washington, DC Sherman Oaks, CA New Restaurant Assumptions Square Feet: 2,500 - 4,000 Cost to Build: Approximately $1.8 to $2.0 million AUV: $3.5 million Identified Markets for Future Restaurants Aventura, FL (Lease executed) King of Prussia, PA (Negotiating lease) Troy, MI Watertown, MA (Lease executed) Stonestown Galleria, San Francisco, CA (Negotiating lease)

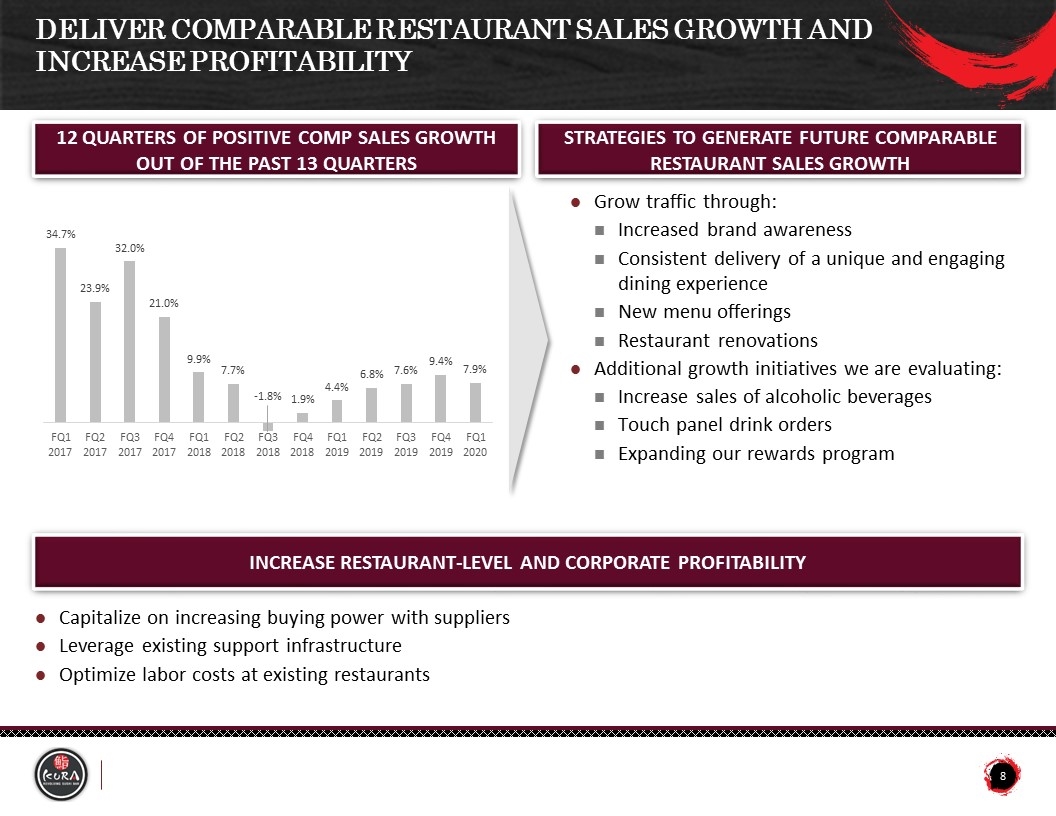

Deliver Comparable Restaurant Sales Growth and Increase Profitability 12 Quarters of Positive Comp Sales Growth Out Of The Past 13 Quarters Increase Restaurant-Level and Corporate Profitability Strategies to Generate Future Comparable Restaurant Sales Growth Grow traffic through: Increased brand awareness Consistent delivery of a unique and engaging dining experience New menu offerings Restaurant renovations Additional growth initiatives we are evaluating: Increase sales of alcoholic beverages Touch panel drink orders Expanding our rewards program Capitalize on increasing buying power with suppliers Leverage existing support infrastructure Optimize labor costs at existing restaurants Bar chart(Comp Sales Growth)

Heighten Brand Awareness Build Brand Awareness Through a Comprehensive Marketing Strategy Digital Channels Monthly DISCOVERIES Bikkura-Pon Rewards Graphics (Instagram) Graphics (Facebook) Graphics (KURA’S MONTHLY DISCOVERIES) Graphics (BIKKURA-PON)

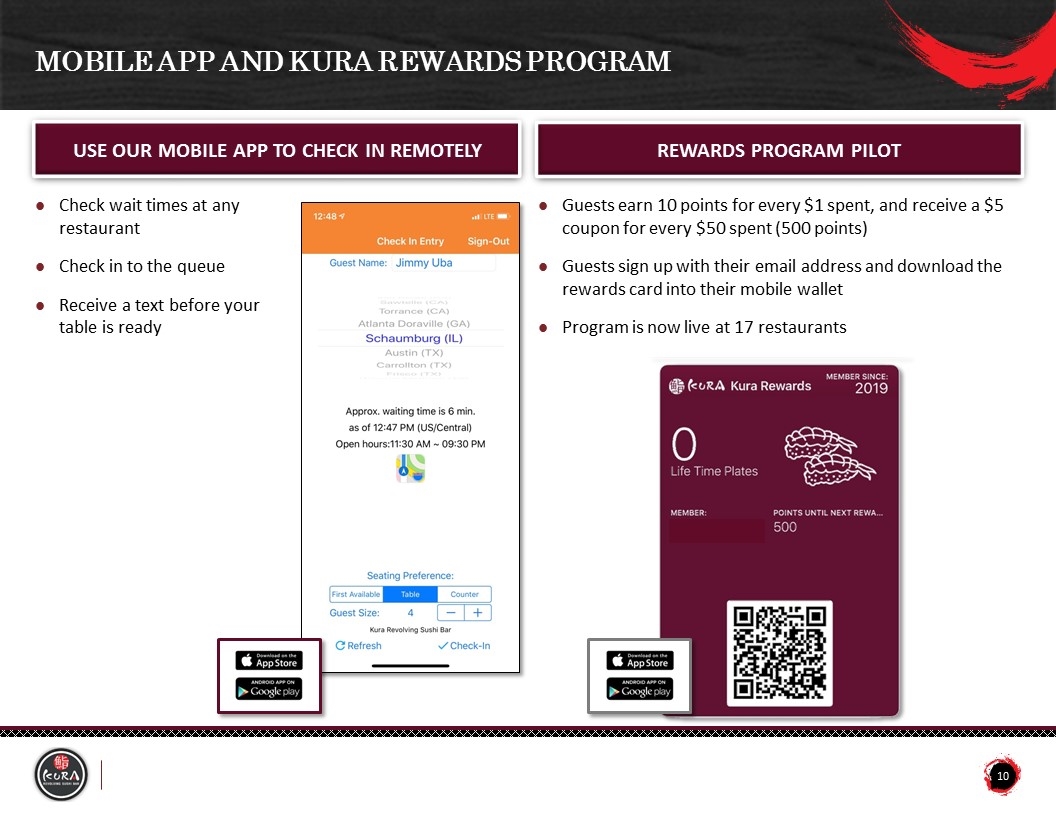

Mobile App and Kura Rewards Program Rewards Program PILOT Guests earn 10 points for every $1 spent, and receive a $5 coupon for every $50 spent (500 points) Guests sign up with their email address and download the rewards card into their mobile wallet Program is now live at 17 restaurants Use our Mobile App to Check In Remotely Check wait times at any restaurant Check in to the queue Receive a text before your table is ready Logo (App store) Logo(Google play) Graphics(kura Rewards) Graphics(Seating Preference)

Section 2: Financial Overview & Model Discussion Section 1 Growth Strategy Section 2 Financial Overview & Model Discussion Appendix Subsection Title

Midterm Model Drivers & Assumptions New Restaurants Existing Restaurants Consistent track record of comparable restaurant sales growth 2% - 3% annual comparable restaurant sales growth in the projected period Significant whitespace opportunity – potential for 290 restaurants nationwide Average restaurant size of 3,200 square feet Six restaurants opened in FY 2019 Plan to open six new restaurants in FY 2020 Approximately 20% unit growth annually in subsequent years First full fiscal year AUV of $3.5 million

Thank You Logo(Kura)

Appendix Logo(Kura)

EBITDA, a non-GAAP measure, is defined as net income before interest, income taxes and depreciation and amortization. Adjusted EBITDA, a non-GAAP measure, is defined as EBITDA plus stock-based compensation expense, pre-opening lease expense, pre-opening costs, non-cash lease expense, impairment of long-lived assets, as well as certain items that the Company believes are not indicative of its core operating results. Adjusted EBITDA margin is defined as adjusted EBITDA divided by sales. Restaurant-level Contribution, a non-GAAP measure, is defined as operating income plus depreciation and amortization, stock-based compensation expense, pre-opening lease expense, pre-opening costs, non-cash lease expense and asset disposals, impairment of long-lived assets, general and administrative expenses, less corporate-level stock-based compensation expense and corporate-level pre-opening costs. Restaurant-level contribution margin is defined as restaurant-level contribution divided by sales. Average Unit Volumes (“AUVs”) consist of the average annual sales of all restaurants that have been open for 18 months or longer at the end of the fiscal year presented. AUVs are calculated by dividing (x) annual sales for the fiscal year presented for all such restaurants by (y) the total number of restaurants in that base. The Company makes fractional adjustments to sales for restaurants that were not open for the entire fiscal year presented (e.g., a restaurant is closed for renovation) to annualize sales for such period of time. Comparable Restaurant Sales Growth refers to the change in year-over-year sales for the comparable restaurant base. The Company include restaurants in the comparable restaurant base that have been in operation for at least 18 months prior to the start of the accounting period presented, including those temporarily closed for renovations during the year. For restaurants that were temporarily closed for renovations during the year, the Company makes fractional adjustments to sales such that sales are annualized in the associated period. Growth in comparable restaurant sales represents the percent change in sales from the same period in the prior year for the comparable restaurant base. KEY FINANCIAL DEFINITIONS

Certain financial measures, such as EBITDA, adjusted EBITDA, adjusted EBITDA margin, restaurant-level contribution and restaurant-level contribution margin (“Non-GAAP measures”) are not recognized under GAAP. These Non-GAAP measures are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. The Company is presenting these Non-GAAP measures because the Company believes that they provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. Additionally, the Company presents restaurant-level contribution because it excludes the impact of general and administrative expenses which are not incurred at the restaurant-level. The Company also uses restaurant-level contribution to measure operating performance and returns from opening new restaurants. The Company believes that the use of these Non-GAAP measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that restaurant-level contribution and restaurant-level contribution margin are financial measures which are not indicative of overall results for the Company, and restaurant-level contribution and restaurant-level contribution margin do not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measures. In addition, you should be aware when evaluating these Non-GAAP measures that in the future the Company may incur expenses similar to those excluded when calculating these measures. The Company’s presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of these Non-GAAP measures may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate these Non-GAAP measures in the same fashion. Because of these limitations, these Non-GAAP measures should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company compensates for these limitations by relying primarily on our GAAP results and using these Non-GAAP measures on a supplemental basis. NON-GAAP FINANCIAL MEASURES

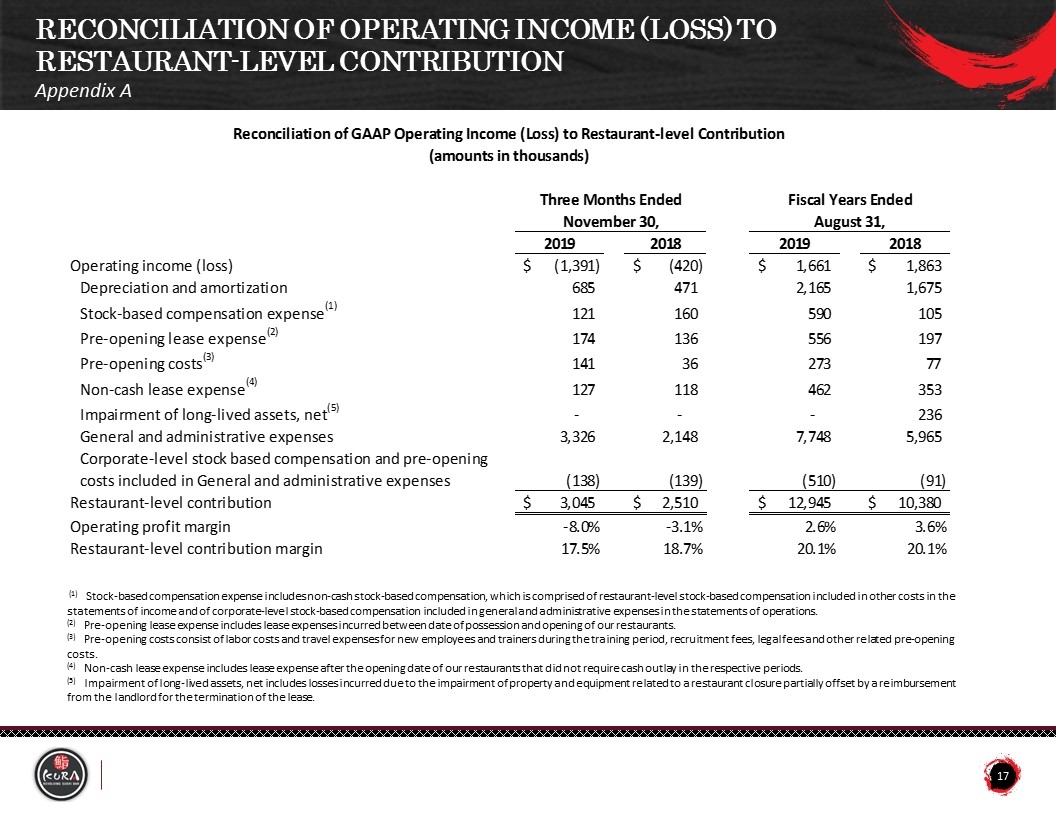

Appendix A Reconciliation of Operating Income (LOSS) to Restaurant-Level Contribution (1) Stock-based compensation expense includes non-cash stock-based compensation, which is comprised of restaurant-level stock-based compensation included in other costs in the statements of income and of corporate-level stock-based compensation included in general and administrative expenses in the statements of operations. (2) Pre-opening lease expense includes lease expenses incurred between date of possession and opening of our restaurants. (3) Pre-opening costs consist of labor costs and travel expenses for new employees and trainers during the training period, recruitment fees, legal fees and other related pre-opening costs. (4) Non-cash lease expense includes lease expense after the opening date of our restaurants that did not require cash outlay in the respective periods. (5) Impairment of long-lived assets, net includes losses incurred due to the impairment of property and equipment related to a restaurant closure partially offset by a reimbursement from the landlord for the termination of the lease. 2019 2018 2019 2018 Operating income (loss) (1,391) $ (420) $ 1,661$ 1,863 $ Depreciation and amortization 685 471 2,165 1,675 Stock-based compensation expense(1) 121 160 590 105 Pre-opening lease expense(2) 174 136 556 197 Pre-opening costs(3) 141 36 273 77 Non-cash lease expense(4) 127 118 462 353 Impairment of long-lived assets, net(5)- - - 236 General and administrative expenses3,326 2,148 7,748 5,965 Corporate-level stock based compensation and pre-opening costs included in General and administrative expenses(138) (139) (510) (91) Restaurant-level contribution 3,045$ 2,510$ 12,945$ 10,380$ Operating profit margin-8.0%-3.1%2.6%3.6% Restaurant-level contribution margin17.5%18.7%20.1%20.1% Three Months Ended Fiscal Years Ended November 30,August 31, Reconciliation of GAAP Operating Income (Loss) to Restaurant-level Contribution(amounts in thousands)

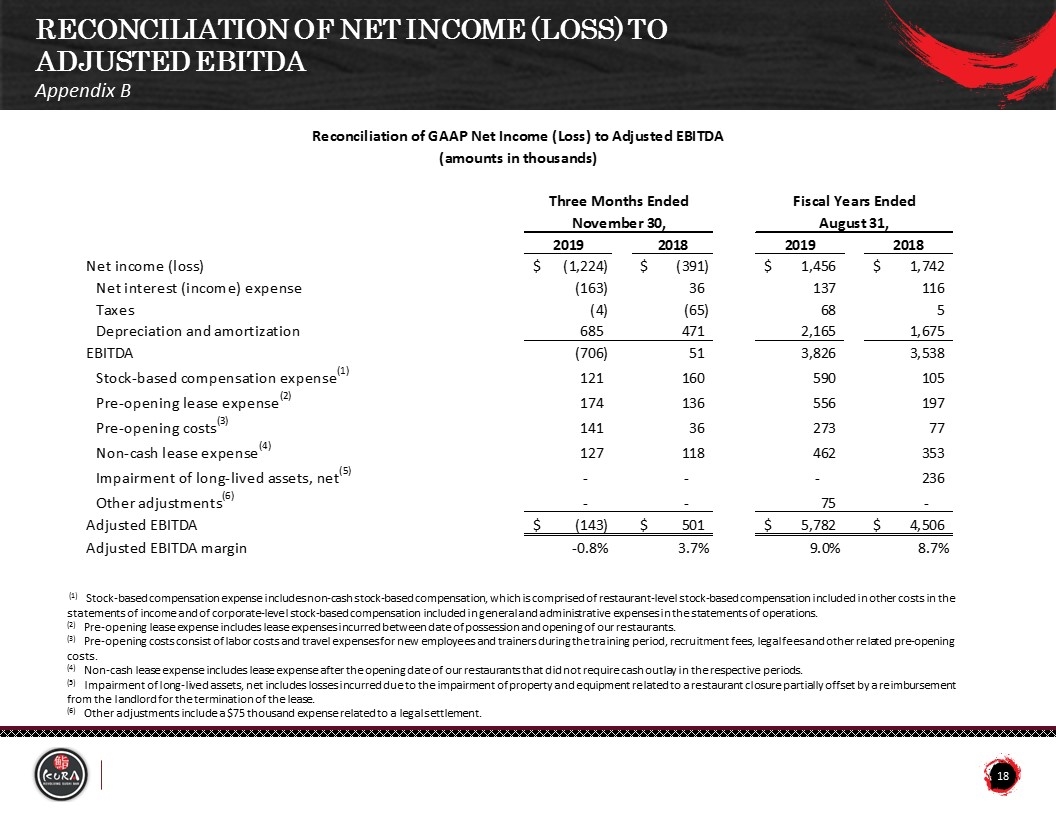

Appendix B Reconciliation of Net Income (LOSS) to Adjusted EBITDA (1) Stock-based compensation expense includes non-cash stock-based compensation, which is comprised of restaurant-level stock-based compensation included in other costs in the statements of income and of corporate-level stock-based compensation included in general and administrative expenses in the statements of operations. (2) Pre-opening lease expense includes lease expenses incurred between date of possession and opening of our restaurants. (3) Pre-opening costs consist of labor costs and travel expenses for new employees and trainers during the training period, recruitment fees, legal fees and other related pre-opening costs. (4) Non-cash lease expense includes lease expense after the opening date of our restaurants that did not require cash outlay in the respective periods. (5) Impairment of long-lived assets, net includes losses incurred due to the impairment of property and equipment related to a restaurant closure partially offset by a reimbursement from the landlord for the termination of the lease. (6) Other adjustments include a $75 thousand expense related to a legal settlement. Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (amounts in thousands) Three Months Ended Fiscal Years Ended November 30, August 31, 2019 2018 2019 2018 Net income (loss) $-1,224 $-,391 $1,456 $1,742 Net interest (income) expense -,163 36 137 116 Taxes -4 -65 68 5 Depreciation and amortization 685 471 2,165 1,675 EBITDA -,706 51 3,826 3,538 Stock-based compensation expense(1) 121 160 590 105 Pre-opening lease expense(2) 174 136 556 197 Pre-opening costs(3) 141 36 273 77 Non-cash lease expense(4) 127 118 462 353 Impairment of long-lived assets, net(5) 0 0 0 236 Other adjustments(6) 0 0 75 0 Adjusted EBITDA $-,143 $501 $5,782 $4,506 Adjusted EBITDA margin -0.8% 3.7% 8.9999221729317458 8.7% Reconciliation of GAAP Operating Income (Loss) to Restaurant-level Contribution (amounts in thousands) Three Months Ended Fiscal Years Ended November 30, August 31, 2019 2018 2019 2018 Operating income (loss) $-1,391 $-,420 $1,661 $1,863 Depreciation and amortization 685 471 2,165 1,675 Stock-based compensation expense(1) 121 160 590 105 Pre-opening lease expense(2) 174 136 556 197 Pre-opening costs(3) 141 36 273 77 Non-cash lease expense(4) 127 118 462 353 Impairment of long-lived assets, net(5) 0 0 0 236 General and administrative expenses 3,326 2,148 7,748 5,965 Corporate-level stock based compensation and pre-opening costs included in General and administrative expenses -,138 -,139 -,510 -91 Restaurant-level contribution $3,045 $2,510 $12,945 $10,380 Operating profit margin -7.9759174311926612 -3.1% 2.6% 3.6% Restaurant-level contribution margin 0.17459862385321101 0.18703427719821161 0.20149427971048331 0.20060296846011133