Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HEXCEL CORP /DE/ | d869670dex991.htm |

| EX-2.1 - EX-2.1 - HEXCEL CORP /DE/ | d869670dex21.htm |

| 8-K - 8-K - HEXCEL CORP /DE/ | d869670d8k.htm |

January 12, 2020 Merger of Equals to Create Premier Integrated Systems Provider Propelling the Future of Flight and Energy Efficiency Exhibit 99.2

Forward-Looking Statements Certain of the matters discussed in this communication which are not statements of historical fact constitute forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements. Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation, the occurrence of any event, change or other circumstances that could give rise to the right of one or both of Hexcel or Woodward to terminate the merger agreement; the outcome of any legal proceedings that may be instituted against Hexcel, Woodward or their respective directors; the ability to obtain regulatory approvals and meet other closing conditions to the merger on a timely basis or at all, including the risk that regulatory approvals required for the merger are not obtained on a timely basis or at all, or are obtained subject to conditions that are not anticipated or that could adversely affect the combined company or the expected benefits of the transaction; the ability to obtain approval by Hexcel stockholders and Woodward stockholders on the expected schedule; difficulties and delays in integrating Hexcel’s and Woodward’s businesses; prevailing economic, market, regulatory or business conditions, or changes in such conditions, negatively affecting the parties; risks that the transaction disrupts Hexcel’s or Woodward’s current plans and operations; failing to fully realize anticipated cost savings and other anticipated benefits of the merger when expected or at all; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger; the ability of Hexcel or Woodward to retain and hire key personnel; the diversion of management’s attention from ongoing business operations; uncertainty as to the long-term value of the common stock of the combined company following the merger; the continued availability of capital and financing following the merger; the business, economic and political conditions in the markets in which Hexcel and Woodward operate; and the fact that Hexcel’s and Woodward’s reported earnings and financial position may be adversely affected by tax and other factors. Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in Hexcel’s and Woodward’s publicly filed reports, including Hexcel’s Annual Report on Form 10-K for the year ended December 31, 2018 and Woodward’s Annual Report on Form 10-K for the year ended September 30, 2019. Hexcel and Woodward caution that the foregoing list of important factors is not complete and do not undertake to update any forward-looking statements that either party may make except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Hexcel, Woodward or any person acting on behalf of either party are expressly qualified in their entirety by the cautionary statements referenced above. Additional Information and Where to Find It In connection with the proposed merger, Woodward will file with the SEC a registration statement on Form S-4 to register the shares of Woodward’s common stock to be issued in connection with the merger. The registration statement will include a preliminary joint proxy statement/prospectus which, when finalized, will be sent to the respective stockholders of Hexcel and Woodward seeking their approval of their respective transaction-related proposals. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HEXCEL, WOODWARD AND THE PROPOSED MERGER. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from Hexcel at its website, www.hexcel.com, or from Woodward at its website, www.woodward.com. Documents filed with the SEC by Hexcel will be available free of charge by accessing Hexcel’s website at www.hexcel.com under the heading Investor Relations, or, alternatively, by directing a request by telephone or mail to Hexcel Corporation at 281 Tresser Boulevard Stamford, Connecticut 06901, (203) 352-6826, and documents filed with the SEC by Woodward will be available free of charge by accessing Woodward’s website at www.woodward.com under the heading Investors, or, alternatively, by directing a request by telephone or mail to Woodward, Inc. at PO Box 1519, Fort Collins, Colorado 80522, (970) 498-3580. Participants In The Solicitation Hexcel, Woodward and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the respective stockholders of Hexcel and Woodward in respect of the proposed merger under the rules of the SEC. Information about Hexcel’s directors and executive officers is available in Hexcel’s proxy statement dated March 22, 2019 for its 2019 Annual Meeting of Stockholders. Information about Woodward’s directors and executive officers is available in Woodward’s proxy statement dated December 13, 2019 for its 2019 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Hexcel or Woodward using the sources indicated above. No Offer Or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Forward-Looking Statements

Today’s Presenters Nick Stanage Hexcel Corporation Chairman, CEO and President Tom Gendron Woodward, Inc. Chairman, CEO and President

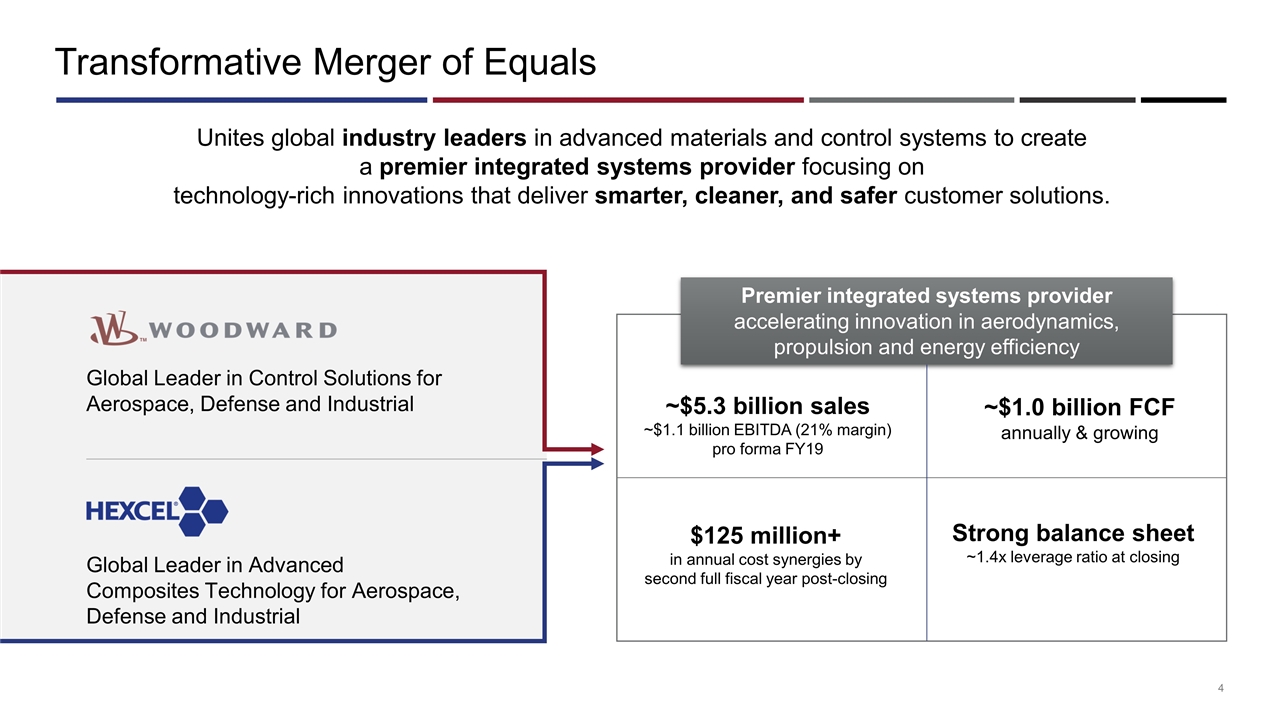

Transformative Merger of Equals Global Leader in Control Solutions for Aerospace, Defense and Industrial Unites global industry leaders in advanced materials and control systems to create a premier integrated systems provider focusing on technology-rich innovations that deliver smarter, cleaner, and safer customer solutions. Global Leader in Control Solutions for Aerospace, Defense and Industrial Global Leader in Advanced Composites Technology for Aerospace, Defense and Industrial $125 million+ in annual cost synergies by second full fiscal year post-closing Premier integrated systems provider accelerating innovation in aerodynamics, propulsion and energy efficiency ~$5.3 billion sales ~$1.1 billion EBITDA (21% margin) pro forma FY19 ~$1.0 billion FCF annually & growing Strong balance sheet ~1.4x leverage ratio at closing

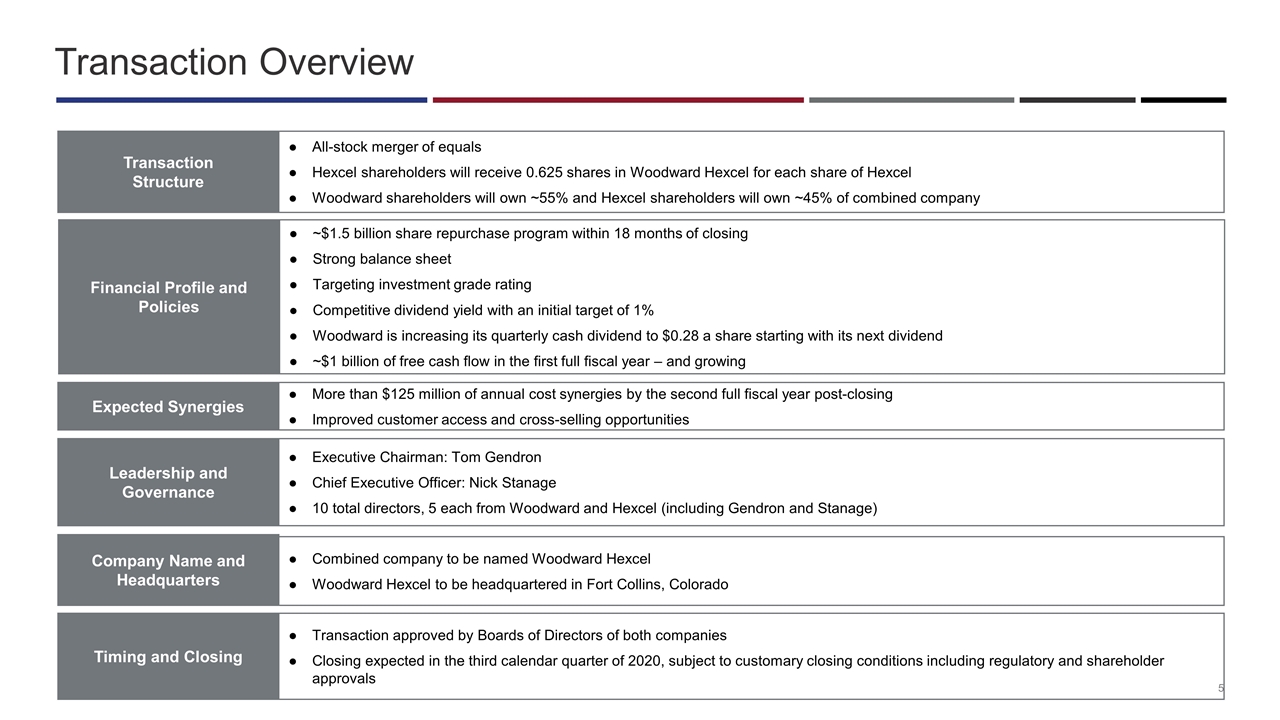

Transaction Structure All-stock merger of equals Hexcel shareholders will receive 0.625 shares in Woodward Hexcel for each share of Hexcel Woodward shareholders will own ~55% and Hexcel shareholders will own ~45% of combined company Leadership and Governance Executive Chairman: Tom Gendron Chief Executive Officer: Nick Stanage 10 total directors, 5 each from Woodward and Hexcel (including Gendron and Stanage) Expected Synergies More than $125 million of annual cost synergies by the second full fiscal year post-closing Improved customer access and cross-selling opportunities Financial Profile and Policies ~$1.5 billion share repurchase program within 18 months of closing Strong balance sheet Targeting investment grade rating Competitive dividend yield with an initial target of 1% Woodward is increasing its quarterly cash dividend to $0.28 a share starting with its next dividend ~$1 billion of free cash flow in the first full fiscal year – and growing Timing and Closing Transaction approved by Boards of Directors of both companies Closing expected in the third calendar quarter of 2020, subject to customary closing conditions including regulatory and shareholder approvals Transaction Overview Company Name and Headquarters Combined company to be named Woodward Hexcel Woodward Hexcel to be headquartered in Fort Collins, Colorado

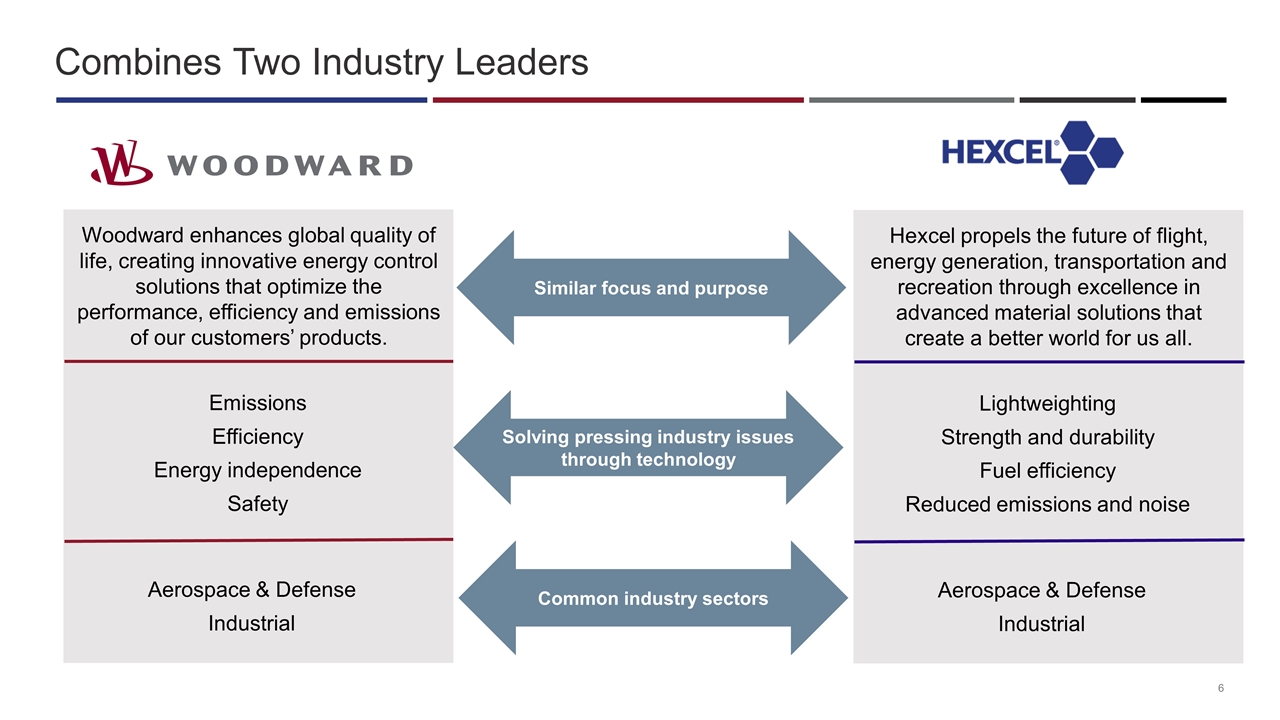

Combines Two Industry Leaders Solving pressing industry issues through technology Similar focus and purpose Common industry sectors Woodward enhances global quality of life, creating innovative energy control solutions that optimize the performance, efficiency and emissions of our customers’ products. Emissions Efficiency Energy independence Safety Aerospace & Defense Industrial Hexcel propels the future of flight, energy generation, transportation and recreation through excellence in advanced material solutions that create a better world for us all. Lightweighting Strength and durability Fuel efficiency Reduced emissions and noise Aerospace & Defense Industrial

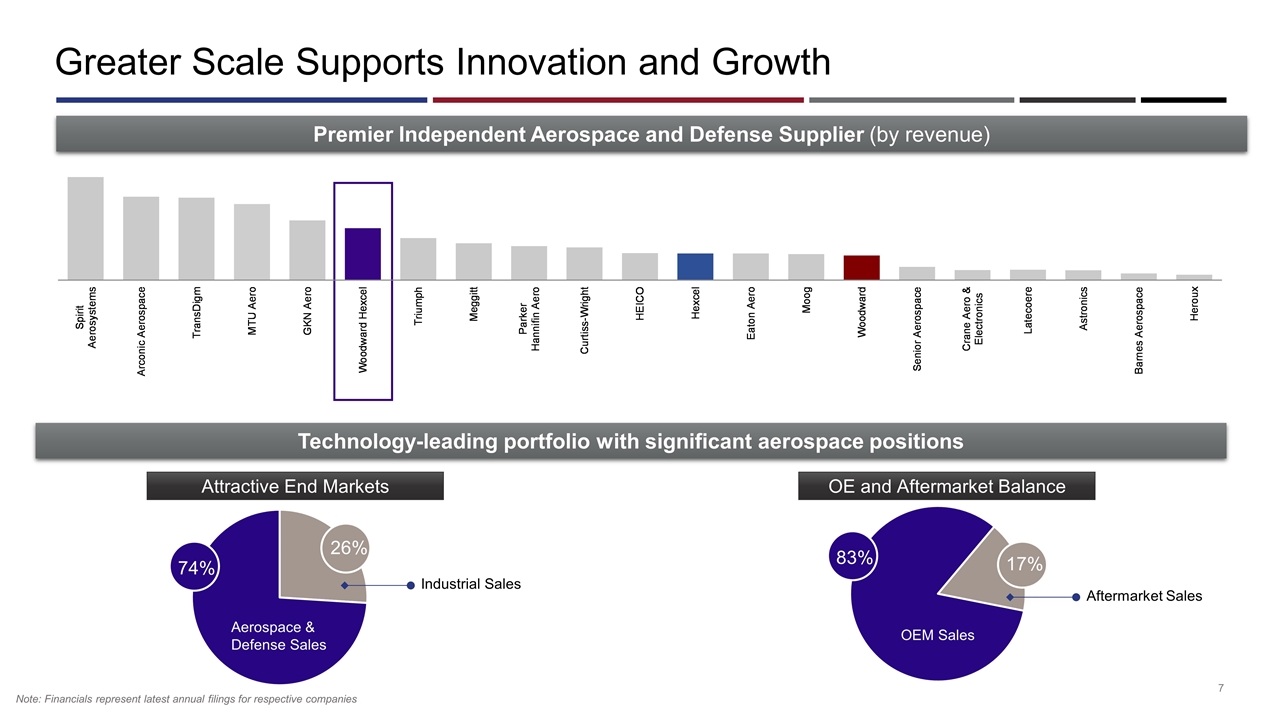

Greater Scale Supports Innovation and Growth Note: Financials represent latest annual filings for respective companies Technology-leading portfolio with significant aerospace positions Premier Independent Aerospace and Defense Supplier (by revenue) OE and Aftermarket Balance Attractive End Markets 26% 74% 83% 17% Industrial Sales Aerospace & Defense Sales Aftermarket Sales OEM Sales +++

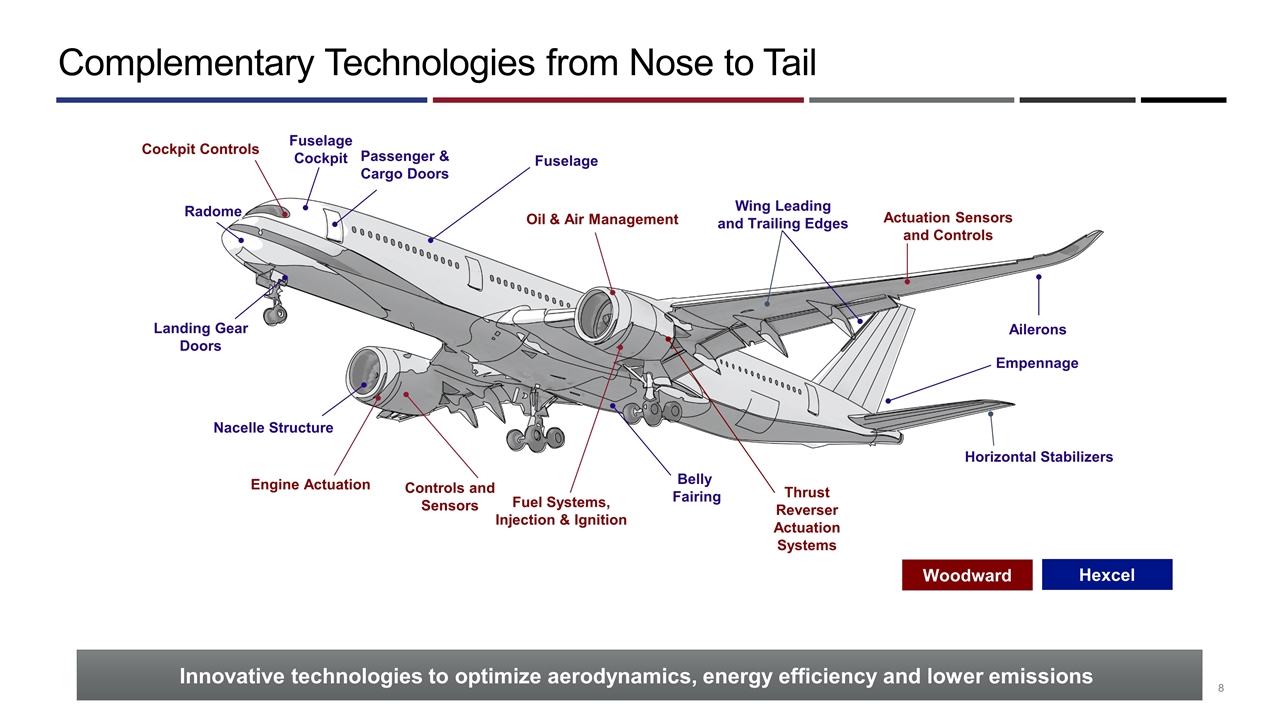

Complementary Technologies from Nose to Tail Nacelle Structure Fuel Systems, Injection & Ignition Landing Gear Doors Radome Fuselage Cockpit Passenger & Cargo Doors Cockpit Controls Wing Leading and Trailing Edges Fuselage Controls and Sensors Belly Fairing Actuation Sensors and Controls Ailerons Horizontal Stabilizers Thrust Reverser Actuation Systems Oil & Air Management Engine Actuation Empennage Woodward Innovative technologies to optimize aerodynamics, energy efficiency and lower emissions Hexcel

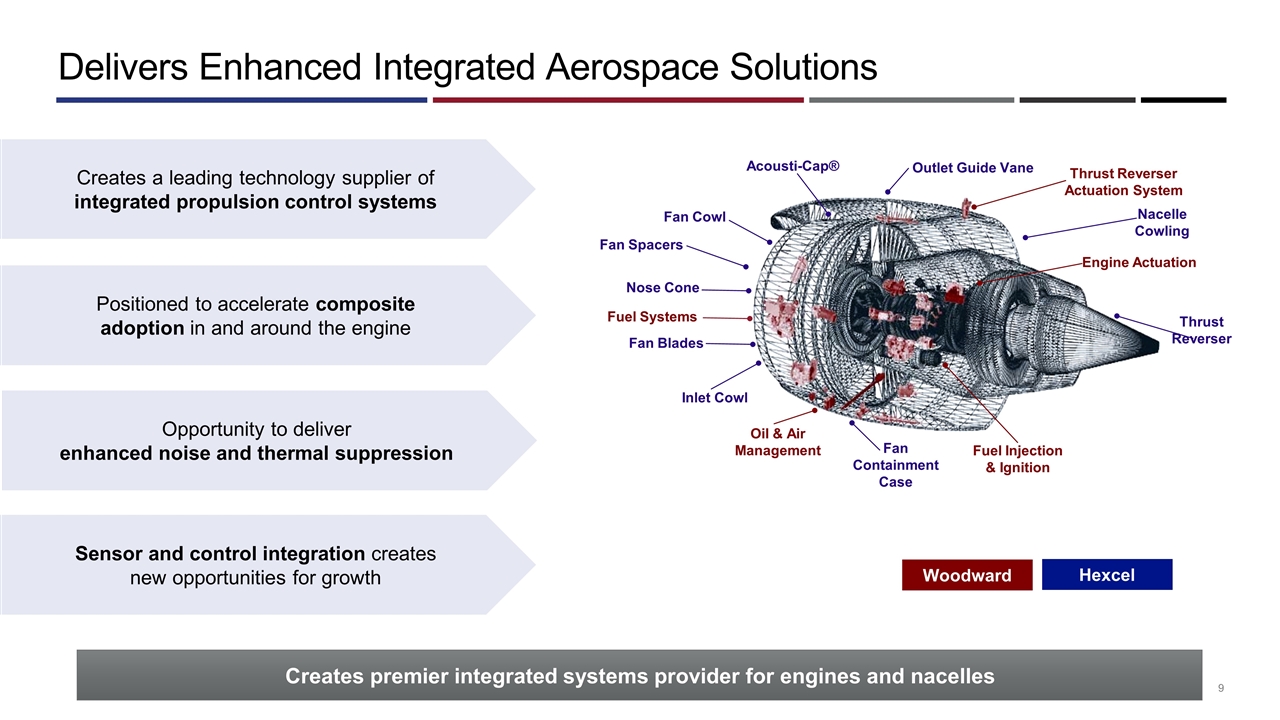

Creates a leading technology supplier of integrated propulsion control systems Positioned to accelerate composite adoption in and around the engine Sensor and control integration creates new opportunities for growth Delivers Enhanced Integrated Aerospace Solutions Fan Spacers Fan Blades Nose Cone Inlet Cowl Engine Actuation Thrust Reverser Actuation System Oil & Air Management Fuel Systems Fuel Injection & Ignition Thrust Reverser Fan Containment Case Nacelle Cowling Outlet Guide Vane Acousti-Cap® Fan Cowl Creates premier integrated systems provider for engines and nacelles Woodward Hexcel Opportunity to deliver enhanced noise and thermal suppression

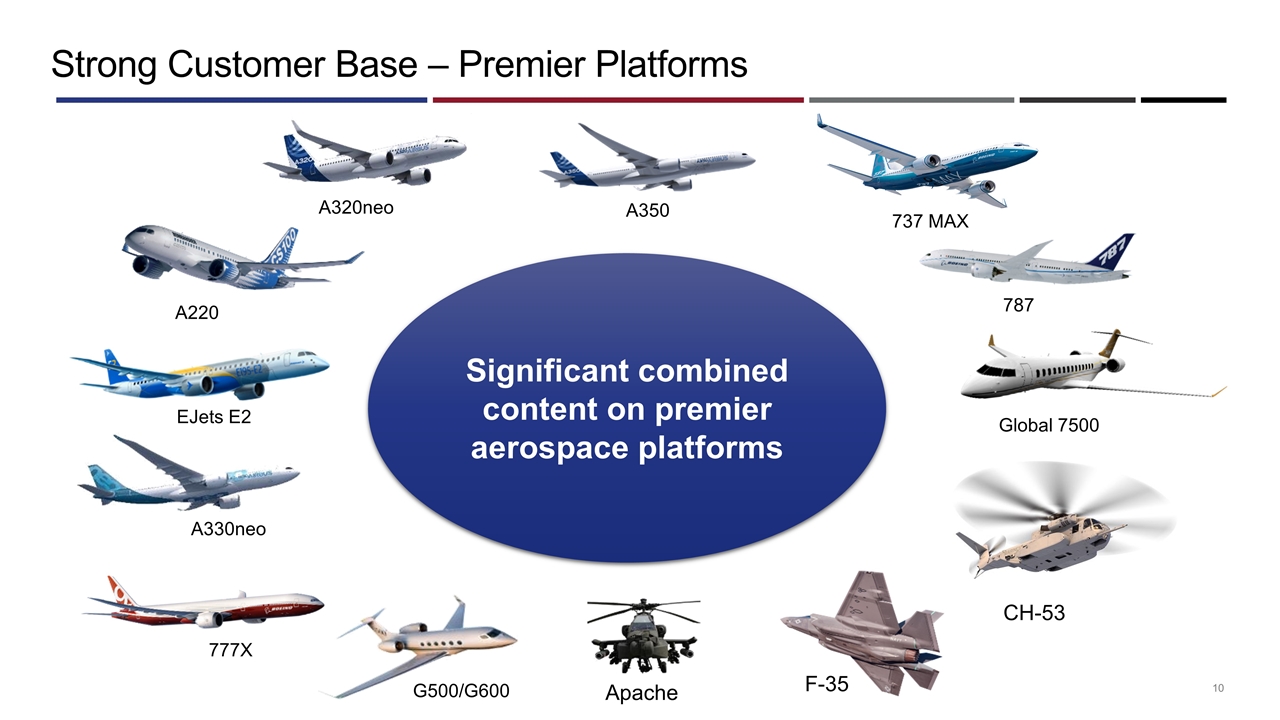

Strong Customer Base – Premier Platforms 737 MAX EJets E2 A320neo A220 787 A350 777X A330neo F-35 Apache Global 7500 G500/G600 Significant combined content on premier aerospace platforms CH-53

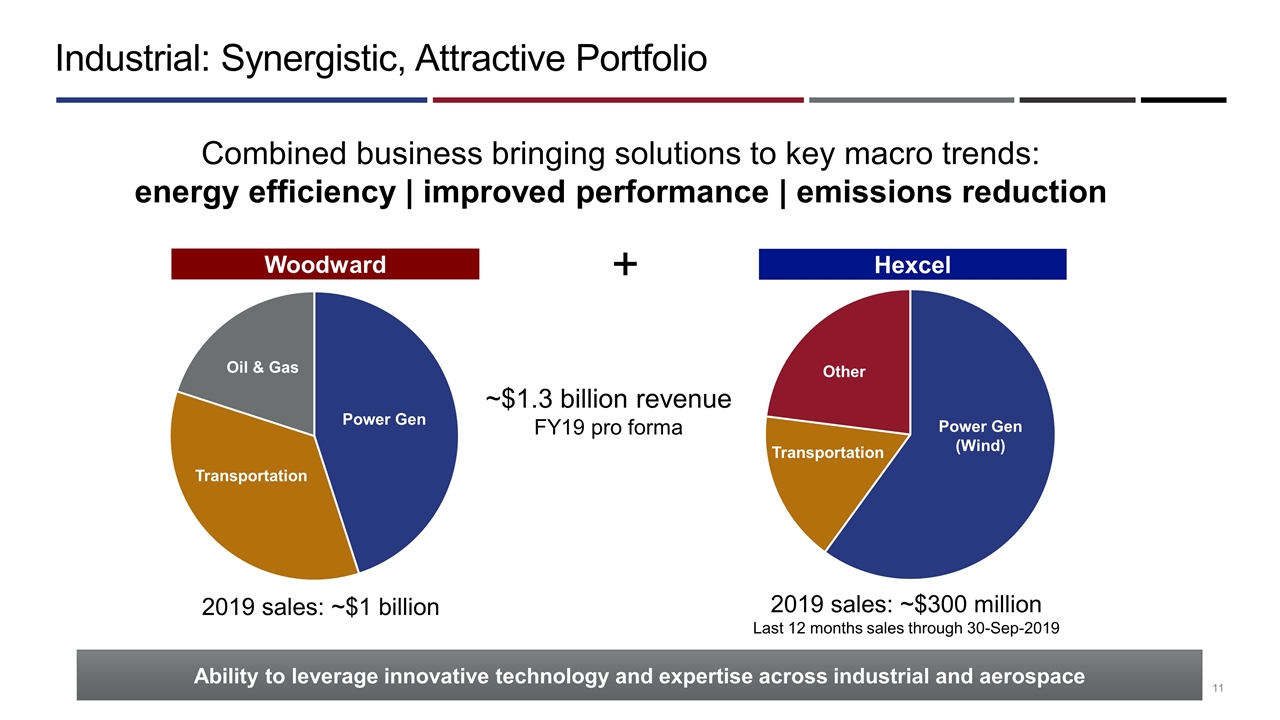

Industrial: Synergistic, Attractive Portfolio Leveraging innovative technology, processes and expertise across industrial and aerospace Ability to leverage innovative technology and expertise across industrial and aerospace Power Gen Transportation Oil & Gas Combined business bringing solutions to key macro trends: energy efficiency | improved performance | emissions reduction ~$1.3 billion revenue FY19 pro forma Woodward Hexcel Power Gen (Wind) Other 2019 sales: ~$300 million Last 12 months sales through 30-Sep-2019 2019 sales: ~$1 billion + Transportation

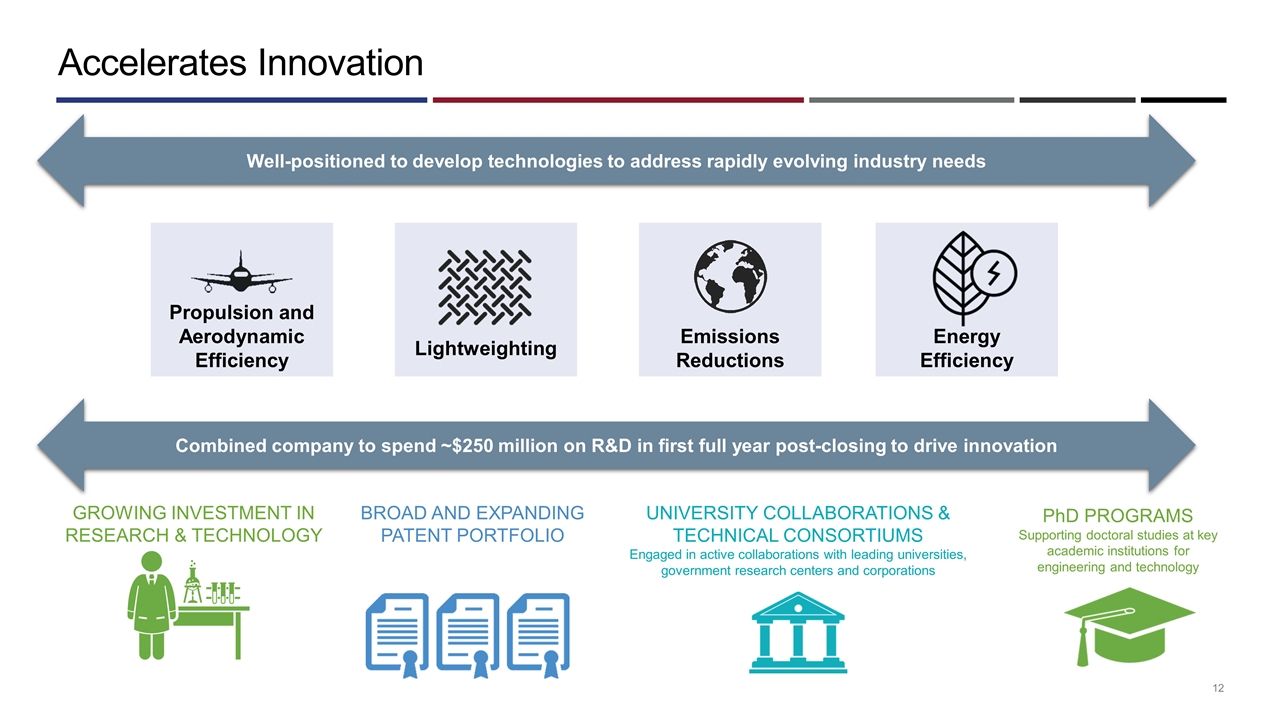

Accelerates Innovation Well-positioned to develop technologies to address rapidly evolving industry needs Propulsion and Aerodynamic Efficiency Emissions Reductions Lightweighting Energy Efficiency Combined company to spend ~$250 million on R&D in first full year post-closing to drive innovation GROWING INVESTMENT IN RESEARCH & TECHNOLOGY BROAD AND EXPANDING PATENT PORTFOLIO UNIVERSITY COLLABORATIONS & TECHNICAL CONSORTIUMS Engaged in active collaborations with leading universities, government research centers and corporations PhD PROGRAMS Supporting doctoral studies at key academic institutions for engineering and technology

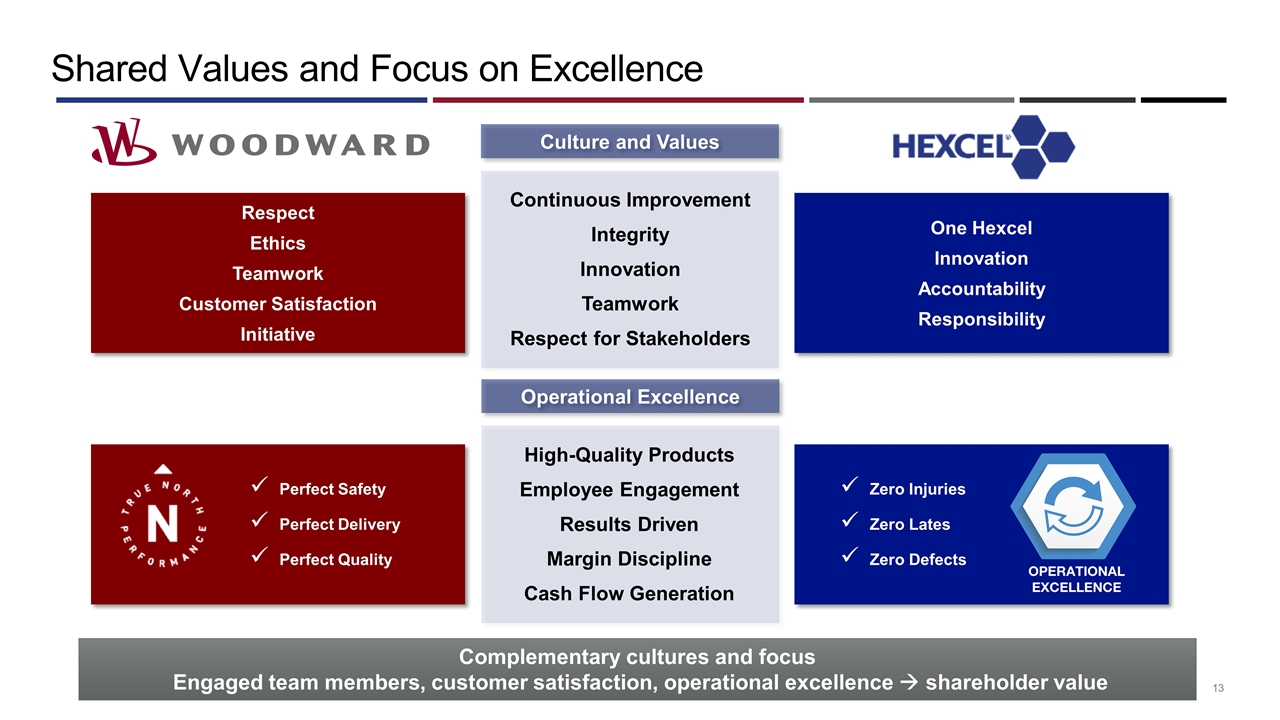

One Hexcel Innovation Accountability Responsibility Operational Excellence Culture and Values Respect Ethics Teamwork Customer Satisfaction Initiative Perfect Safety Perfect Delivery Perfect Quality Zero Injuries Zero Lates Zero Defects Continuous Improvement Integrity Innovation Teamwork Respect for Stakeholders High-Quality Products Employee Engagement Results Driven Margin Discipline Cash Flow Generation Shared Values and Focus on Excellence Complementary cultures and focus Engaged team members, customer satisfaction, operational excellence à shareholder value

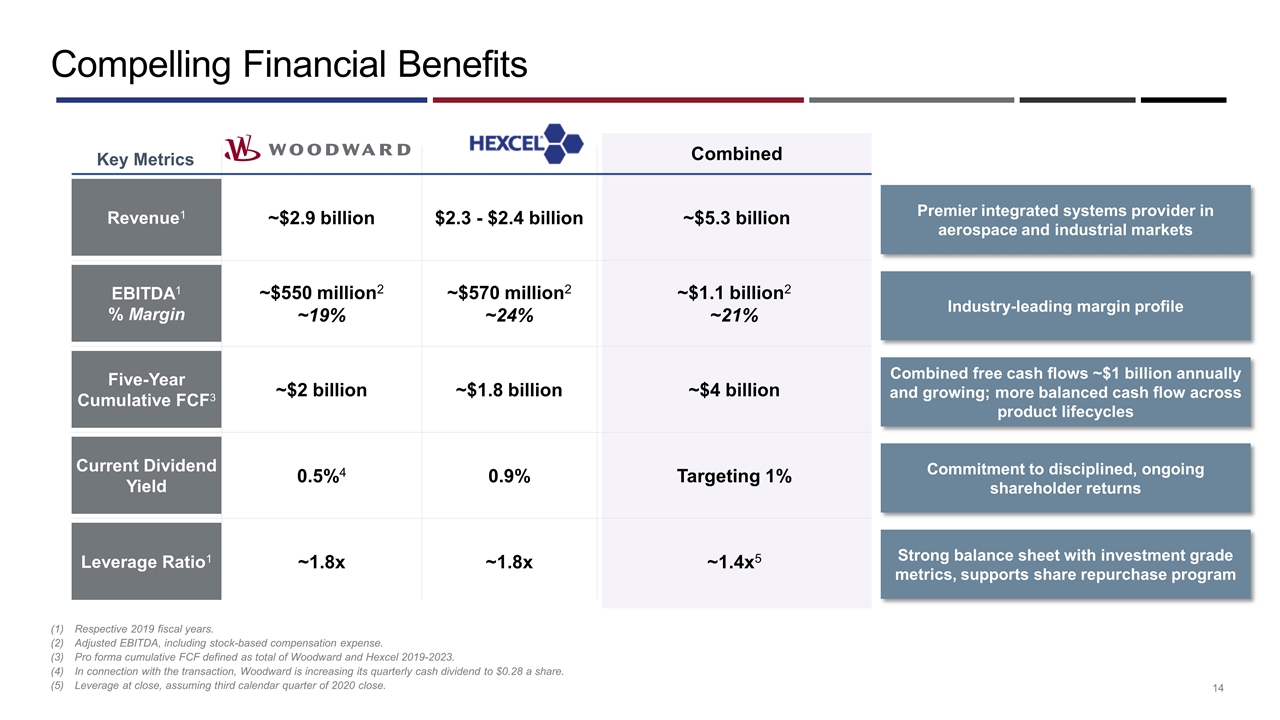

Respective 2019 fiscal years. Adjusted EBITDA, including stock-based compensation expense. Pro forma cumulative FCF defined as total of Woodward and Hexcel 2019-2023. In connection with the transaction, Woodward is increasing its quarterly cash dividend to $0.28 a share. Leverage at close, assuming third calendar quarter of 2020 close. Compelling Financial Benefits Key Metrics Revenue1 ~$2.9 billion $2.3 - $2.4 billion ~$5.3 billion EBITDA1 % Margin ~$550 million2 ~19% ~$570 million2 ~24% ~$1.1 billion2 ~21% Five-Year Cumulative FCF3 ~$2 billion ~$1.8 billion ~$4 billion Current Dividend Yield 0.5%4 0.9% Targeting 1% Leverage Ratio1 ~1.8x ~1.8x ~1.4x5 Combined Premier integrated systems provider in aerospace and industrial markets Combined free cash flows ~$1 billion annually and growing; more balanced cash flow across product lifecycles Industry-leading margin profile Commitment to disciplined, ongoing shareholder returns Strong balance sheet with investment grade metrics, supports share repurchase program

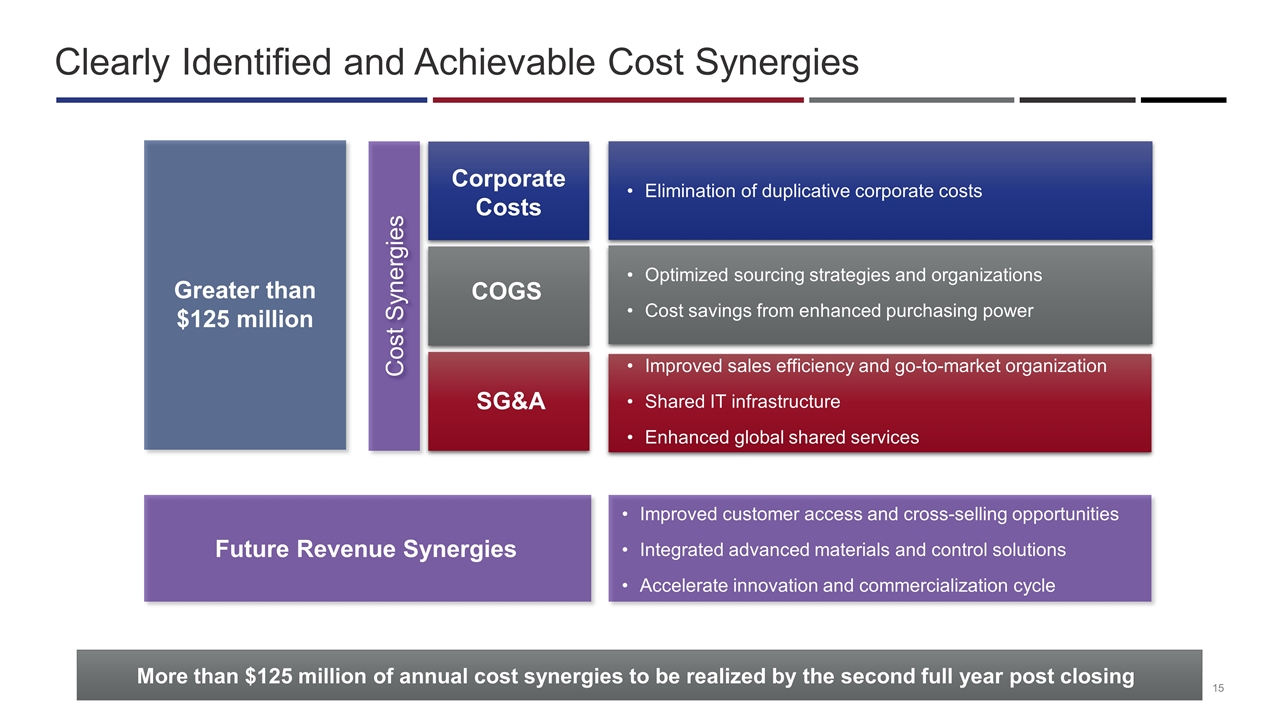

Clearly Identified and Achievable Cost Synergies Cost Synergies More than $125 million of annual cost synergies to be realized by the second full year post closing Elimination of duplicative corporate costs Optimized sourcing strategies and organizations Cost savings from enhanced purchasing power Improved sales efficiency and go-to-market organization Shared IT infrastructure Enhanced global shared services Corporate Costs COGS SG&A Future Revenue Synergies Improved customer access and cross-selling opportunities Integrated advanced materials and control solutions Accelerate innovation and commercialization cycle Greater than $125 million

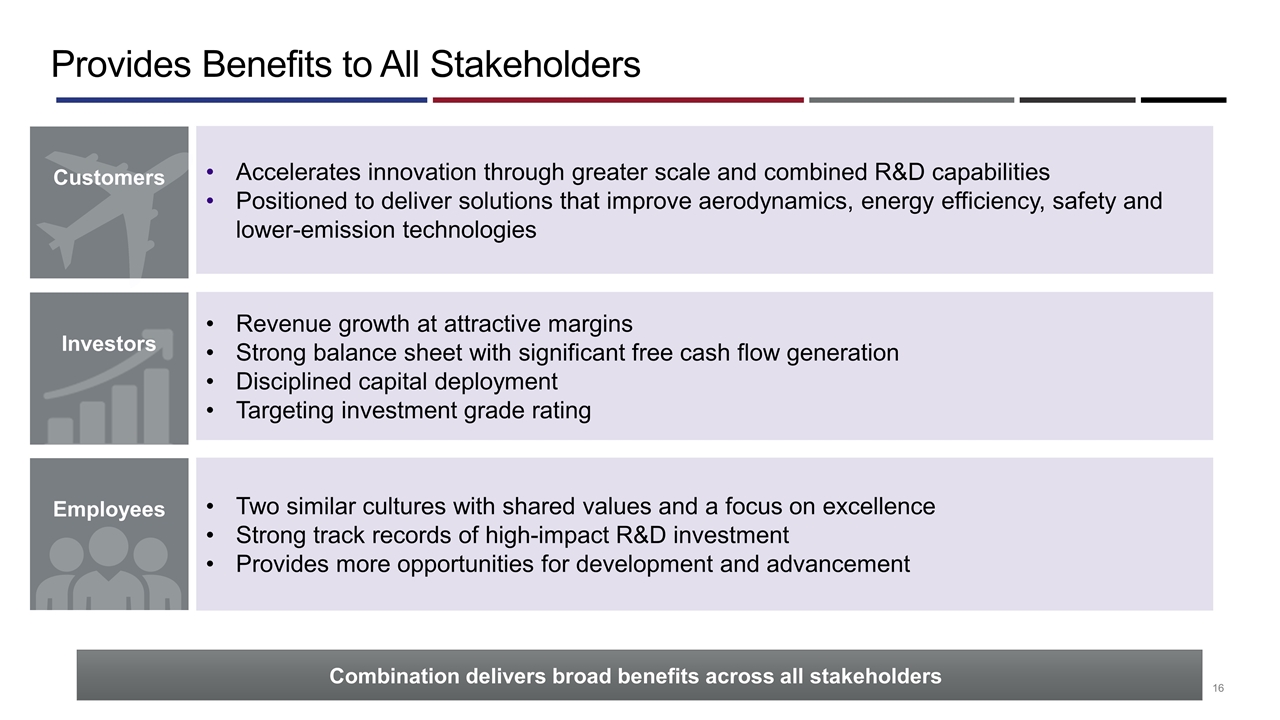

Provides Benefits to All Stakeholders Accelerates innovation through greater scale and combined R&D capabilities Positioned to deliver solutions that improve aerodynamics, energy efficiency, safety and lower-emission technologies Revenue growth at attractive margins Strong balance sheet with significant free cash flow generation Disciplined capital deployment Targeting investment grade rating Customers Investors Employees Two similar cultures with shared values and a focus on excellence Strong track records of high-impact R&D investment Provides more opportunities for development and advancement Combination delivers broad benefits across all stakeholders

Highly Strategic Combination Well positioned to deliver advanced technologies to address critical customer challenges Well-balanced portfolio across customers, end markets, and investment cycles Strong balance sheet, significant free cash flow, disciplined capital allocation strategy Accelerates innovation and growth through greater scale and combined R&D capabilities Complementary cultures and operating philosophies Significant shareholder value creation opportunities

Integrating today to solve the challenges of tomorrow