Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - ANTARES PHARMA, INC. | atrs-8k_20200113.htm |

Antares Pharma Investor’s Update January 2020 EX 99.1

This presentation contains forward-looking statements within the meaning of the safe harbour provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: achievement of the Company’s 2019 revenue guidance; future successful corporate development transactions, market acceptance, adequate reimbursement coverage and commercial success of XYOSTED® and future revenue from the same; successful development including the timing and results of the clinical bridging and Phase 3 clinical trial of the drug device combination product for Selatogrel with Idorsia Pharmaceuticals and FDA and global regulatory approvals and future revenue from the same; market acceptance of Teva’s generic epinephrine auto-injector product and future revenue from the same; our expectations regarding whether the FDA will pursue withdrawal of approval for AMAG Pharmaceuticals Inc.’s Makena® subcutaneous auto injector following the recent FDA advisory committee meeting and future prescriptions, market acceptance and revenue from Makena® subcutaneous auto injector; Teva’s ability to successfully commercialize VIBEX® Sumatriptan Injection USP and the amount of revenue from the same; continued growth of prescriptions and sales of OTREXUP®; the timing and results of the Company’s or its partners’ research projects or clinical trials of product candidates in development; actions by the FDA or other regulatory agencies with respect to the Company’s products or product candidates of its partners; continued growth in product, development, licensing and royalty revenue; the Company’s ability to meet loan extension and interest only payment milestones and the ability to repay the debt obligation to Hercules Capital; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's most recently filed Annual Report on Form 10-K, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this press release. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2020 Copyright Antares Pharma, Inc. All Rights Reserved. Safe Harbor Statement

At Antares Pharma, we leverage pharmaceutical and medical device expertise to develop innovative products that address needs in underserved therapeutic areas. Who We Are Our novel drug delivery technology can provide multiple product opportunities and life-cycle management solutions Revenue streams from our portfolio of proprietary and partnered products provide robust opportunities for continued growth

Antares Pharma is an innovative leader in self-administered injection technology We are a commercial, revenue-generating Company which develops combination products focused on rescue therapies Five products utilizing Antares devices were commercialized in the past six years. The three most recent: XYOSTED® (testosterone enanthate) Generic EpiPen® (epinephrine) Makena® (hydroxyprogesterone) Record 9 Month 2019 revenue of $86.0 M (+92% vs. 9 Mo YTD ‘18) 2019 revenue guidance - $115-$120 million Antares Pharma Overview

Dramatic growth in revenue vs. prior years $63.6 M million in product revenue Nine Month YTD 2019 – an 89% increase compared to the same period one year ago Nine Month YTD 2019 Proprietary Products Revenue: XYOSTED® and OTREXUP®: $25.2 M Nine Month YTD 2019 Partnered Products Revenue: Teva EpiPen Teva Sumatriptan AMAG Makena® Needle Free Antares Pharma Snapshot $38.4 M

Antares Pharma Proprietary Commercial Products January 2020

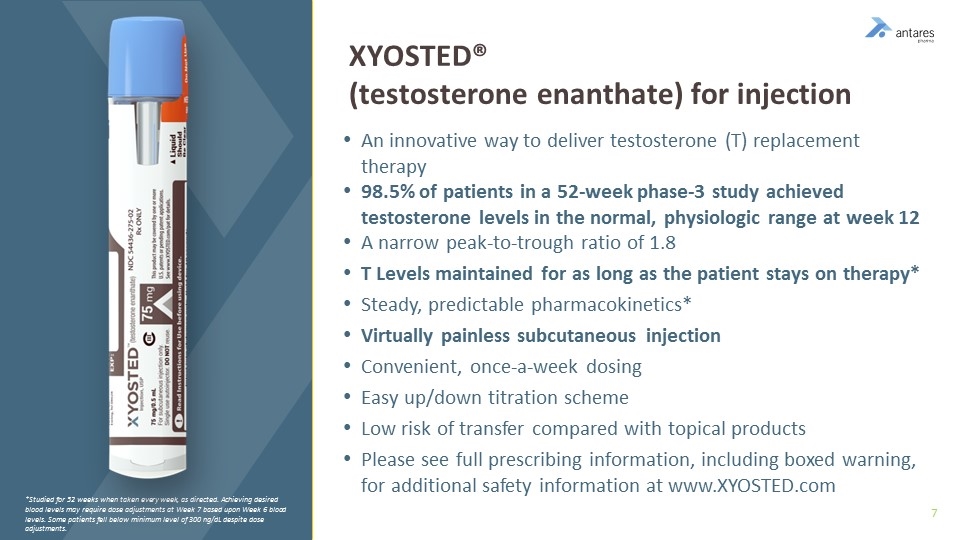

An innovative way to deliver testosterone (T) replacement therapy 98.5% of patients in a 52-week phase-3 study achieved testosterone levels in the normal, physiologic range at week 12 A narrow peak-to-trough ratio of 1.8 T Levels maintained for as long as the patient stays on therapy* Steady, predictable pharmacokinetics* Virtually painless subcutaneous injection Convenient, once-a-week dosing Easy up/down titration scheme Low risk of transfer compared with topical products Please see full prescribing information, including boxed warning, for additional safety information at www.XYOSTED.com XYOSTED® (testosterone enanthate) for injection *Studied for 52 weeks when taken every week, as directed. Achieving desired blood levels may require dose adjustments at Week 7 based upon Week 6 blood levels. Some patients fell below minimum level of 300 ng/dL despite dose adjustments.

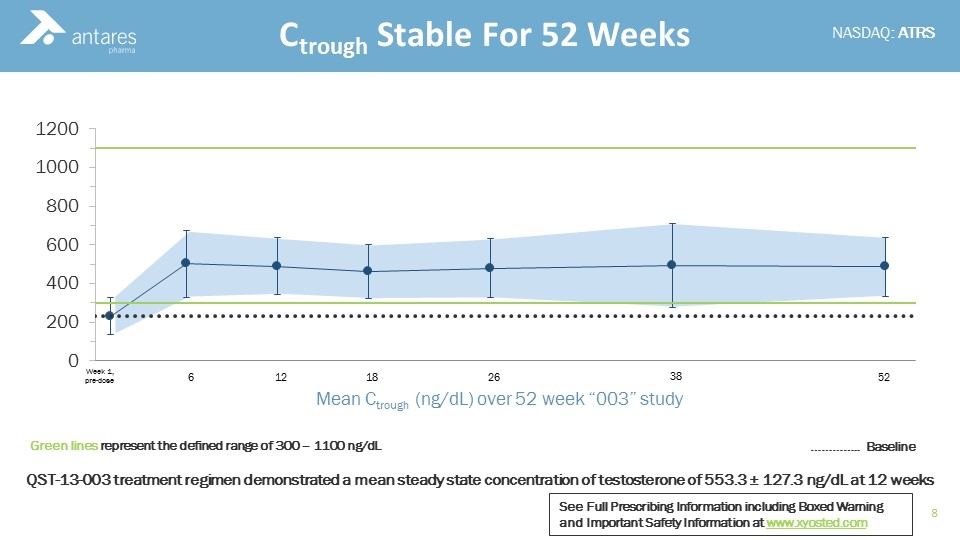

Ctrough Stable For 52 Weeks 6 12 18 26 38 52 Week 1, pre-dose Mean Ctrough (ng/dL) over 52 week “003” study Green lines represent the defined range of 300 – 1100 ng/dL ………….. Baseline QST-13-003 treatment regimen demonstrated a mean steady state concentration of testosterone of 553.3 ± 127.3 ng/dL at 12 weeks See Full Prescribing Information including Boxed Warning and Important Safety Information at www.xyosted.com

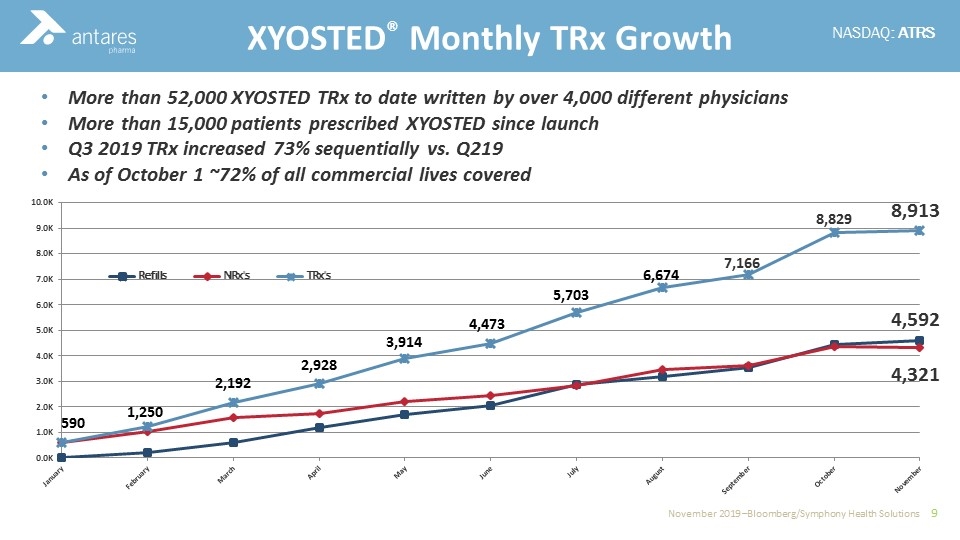

More than 52,000 XYOSTED TRx to date written by over 4,000 different physicians More than 15,000 patients prescribed XYOSTED since launch Q3 2019 TRx increased 73% sequentially vs. Q219 As of October 1 ~72% of all commercial lives covered XYOSTED® Monthly TRx Growth 7,166 4,592 4,321 8,829 8,913

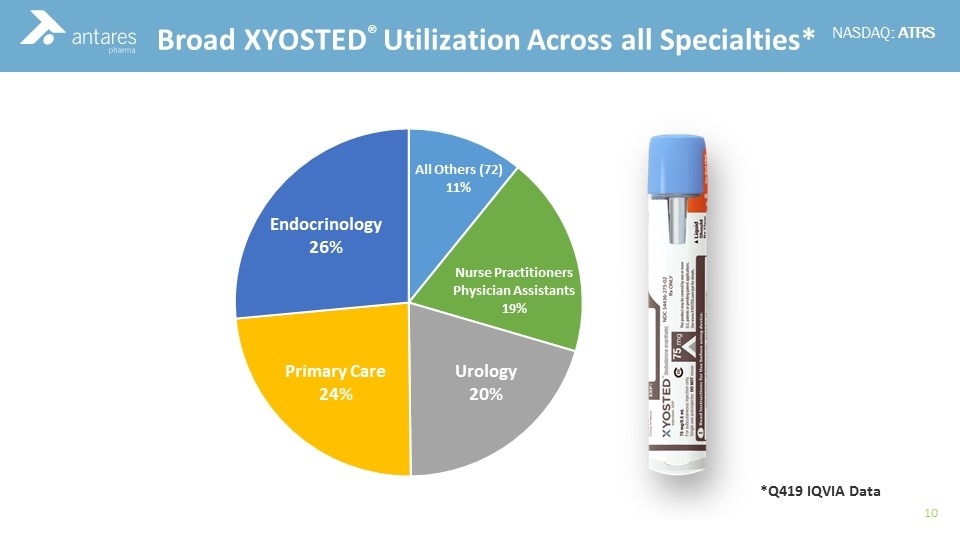

Commercial Experience Broad XYOSTED® Utilization Across all Specialties* *Q419 IQVIA Data

Trial Experience Multiple Channels Directed at Key XYOSTED® Targets Multi-channeling campaign targets physicians and patients through digital, social, enduring, and live platforms that drive awareness, prescription generation, and prescription fulfillment STEADYCare: Co-pay assistance for patients and Hub Service for both patients and HCPs to support insurance claims makes it easy to get XYOSTED Social Media and Digital Engagement Enduring Materials and Sales Assets Congresses and Exhibit Presence Prescribers and Patients Live Promotional Events

Antares Pharma Partnered Products January 2020

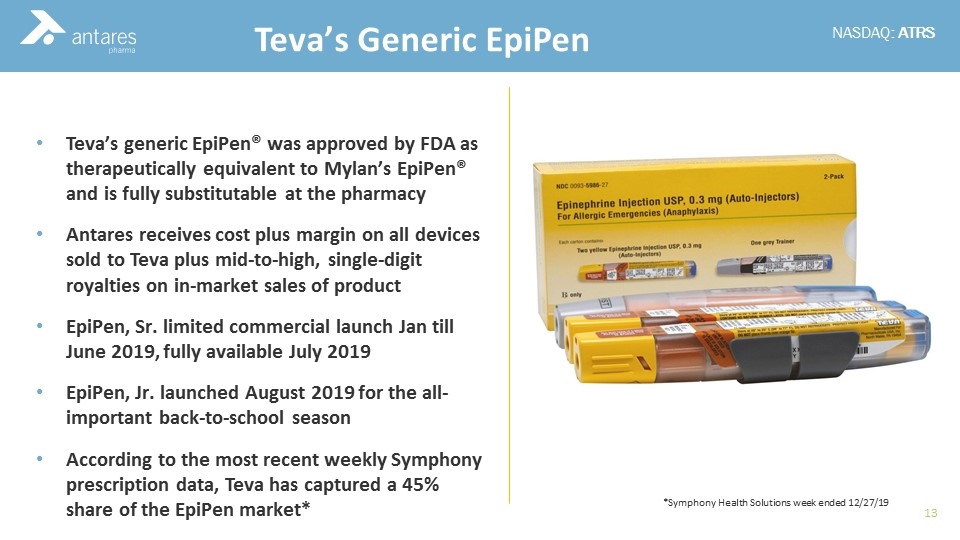

Commercial Experience Teva’s Generic EpiPen Teva’s generic EpiPen® was approved by FDA as therapeutically equivalent to Mylan’s EpiPen® and is fully substitutable at the pharmacy Antares receives cost plus margin on all devices sold to Teva plus mid-to-high, single-digit royalties on in-market sales of product EpiPen, Sr. limited commercial launch Jan till June 2019, fully available July 2019 EpiPen, Jr. launched August 2019 for the all-important back-to-school season According to the most recent weekly Symphony prescription data, Teva has captured a 45% share of the EpiPen market* *Symphony Health Solutions week ended 12/27/19

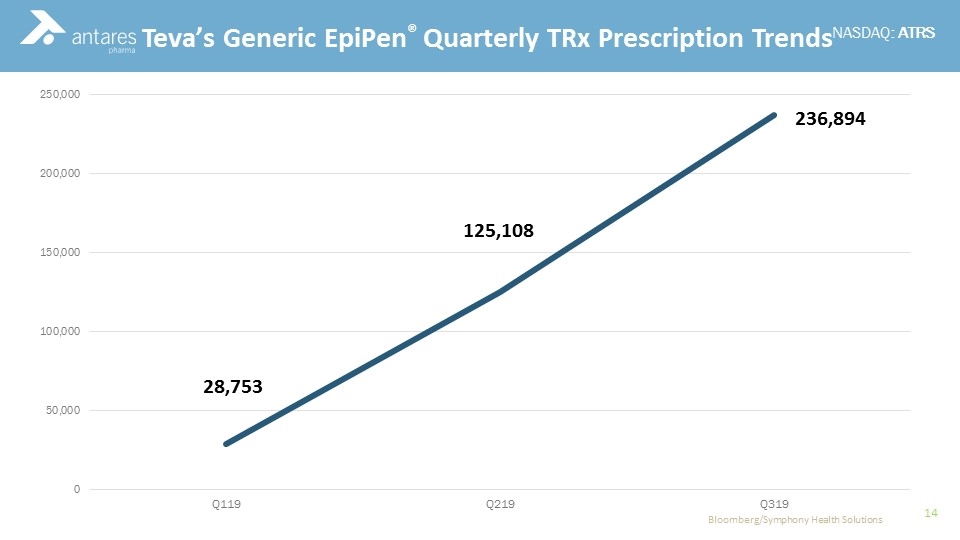

Commercial Experience Teva’s Generic EpiPen® Quarterly TRx Prescription Trends Bloomberg/Symphony Health Solutions

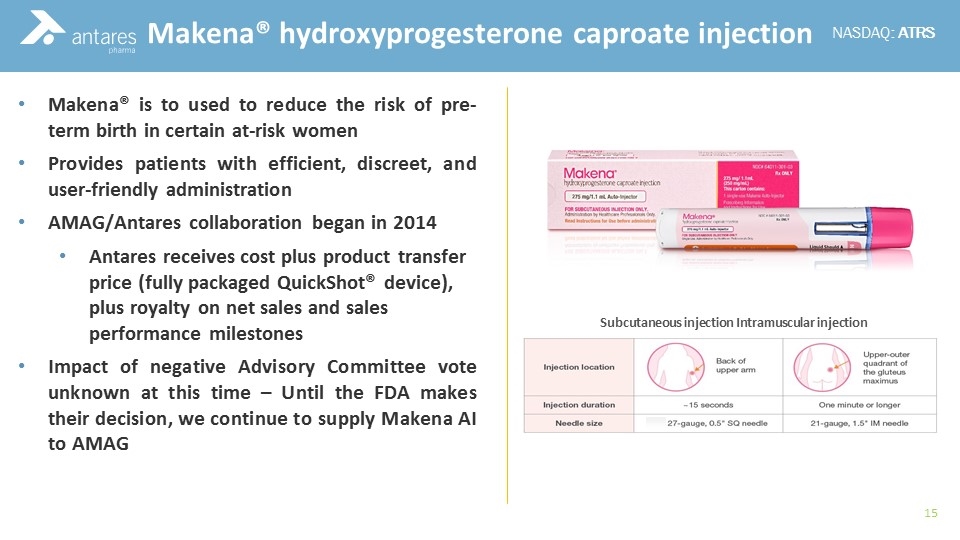

Commercial Experience Makena® hydroxyprogesterone caproate injection Makena® is to used to reduce the risk of pre-term birth in certain at-risk women Provides patients with efficient, discreet, and user-friendly administration AMAG/Antares collaboration began in 2014 Antares receives cost plus product transfer price (fully packaged QuickShot® device), plus royalty on net sales and sales performance milestones Impact of negative Advisory Committee vote unknown at this time – Until the FDA makes their decision, we continue to supply Makena AI to AMAG Subcutaneous injection Intramuscular injection

Antares Pharma Development Pipeline January 2020

Global Development Agreement with Idorsia for Selatogrel Antares entered into a global agreement with Idorsia Pharmaceuticals to develop a drug device product combining selatogrel, a New Chemical Entity - with the QuickShot Auto Injector Selatogrel is a fast acting and highly selective P2Y12 receptor antagonist for the treatment of suspected Acute Myocardial Infarction (AMI) – US IP granted until 2034 Phase 2 data demonstrated that subcutaneous administration of selatogrel resulted in a potent and rapid platelet inhibition effect Idorsia is preparing for a clinical bridging study followed by a global Phase 3 study for the pre-hospital treatment of a suspected AMI – P3 study could potentially commence mid 2021

Around 7.6 million Americans have survived an MI (Myocardial Infarction) Each year, around 750,000 have a new or recurrent MI1 550,000 have a first MI - 200,000 have a recurrent MI Product justification Onset of action of all oral P2Y12 inhibitors may be delayed by up to 6 hours or more in the setting of acute myocardial infarction (AMI) Currently, the only non-oral P2Y12 inhibitor available is Cangrelor, which is administered IV in patients undergoing PCI Need for a P2Y12 inhibitor that achieves consistently fast and effective platelet inhibition in AMI Selatogrel data – Phase II Single-dose administration of SQ selatogrel (8 mg and 16 mg) induced a rapid IPA response in patients with AMI at 30 min (as early as 15 min and maintained at 60 min post-dose) and was well-tolerated with no major bleeding events (N=47) Selatogrel has a rapid effect following SQ injection in patients with stable CAD, within 15 min in most patients and sustained for over 4 hours and was well tolerated. (N=345) Millions of Americans Have a History of MI 1. Mozaffarian D et al. Circulation 2016

Global Development Agreement with Idorsia for Selatogrel Idorsia will pay for the development of the combination product and take responsibility for obtaining global regulatory approvals Antares and Idorsia intend to enter into a separate license and commercial supply agreement under which Antares will supply fully assembled and labeled product to Idorsia at cost plus margin Idorsia will be responsible for global commercialization of the product pending FDA or foreign approval Antares will receive royalties on net sales of the commercial product

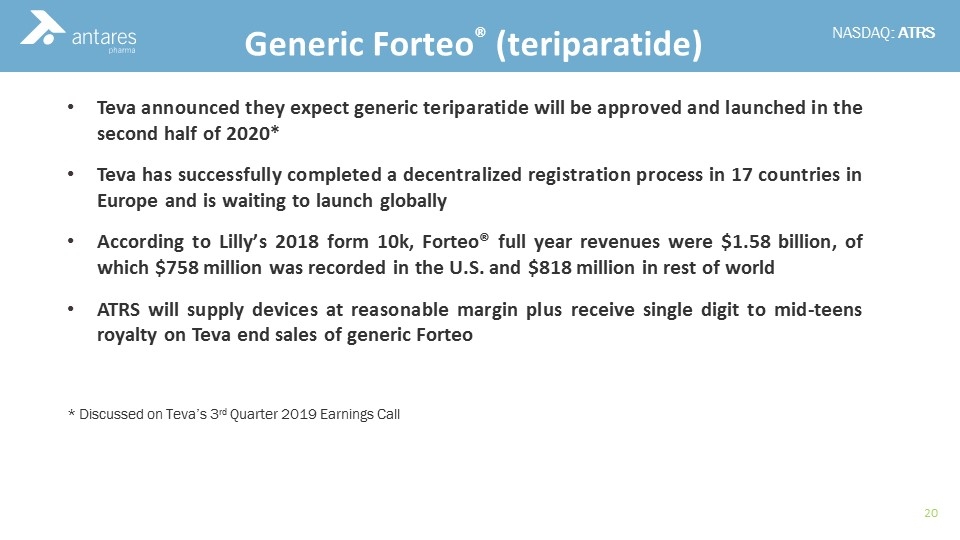

Teva announced they expect generic teriparatide will be approved and launched in the second half of 2020* Teva has successfully completed a decentralized registration process in 17 countries in Europe and is waiting to launch globally According to Lilly’s 2018 form 10k, Forteo® full year revenues were $1.58 billion, of which $758 million was recorded in the U.S. and $818 million in rest of world ATRS will supply devices at reasonable margin plus receive single digit to mid-teens royalty on Teva end sales of generic Forteo * Discussed on Teva’s 3rd Quarter 2019 Earnings Call Generic Forteo® (teriparatide)

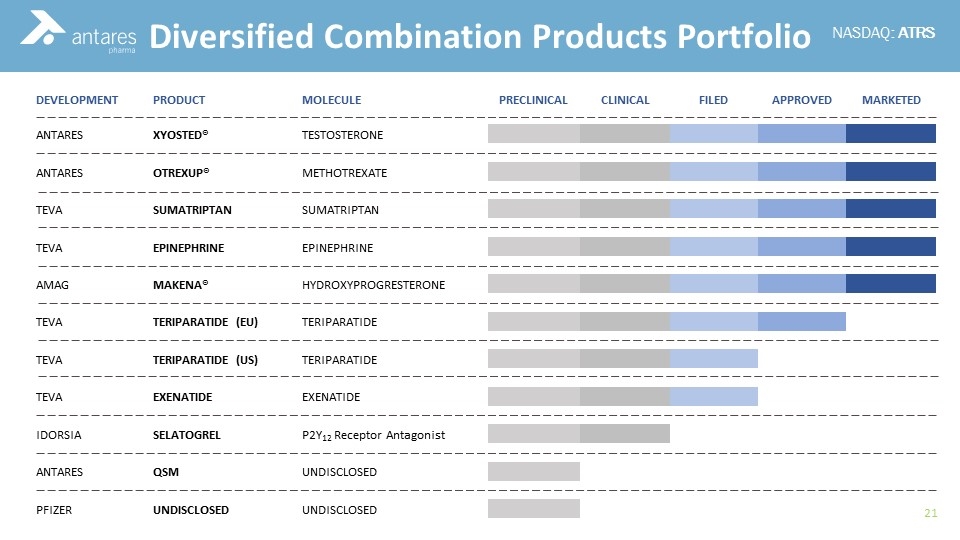

Diversified Combination Products Portfolio DEVELOPMENT PRODUCT MOLECULE PRECLINICAL CLINICAL FILED APPROVED MARKETED ANTARES XYOSTED® TESTOSTERONE ANTARES OTREXUP® METHOTREXATE TEVA SUMATRIPTAN SUMATRIPTAN TEVA EPINEPHRINE EPINEPHRINE AMAG MAKENA® HYDROXYPROGRESTERONE TEVA TERIPARATIDE (EU) TERIPARATIDE TEVA TERIPARATIDE (US) TERIPARATIDE TEVA EXENATIDE EXENATIDE IDORSIA SELATOGREL P2Y12 Receptor Antagonist ANTARES QSM UNDISCLOSED PFIZER UNDISCLOSED UNDISCLOSED

Antares Pharma Q3 2019 Financial Results January 2020

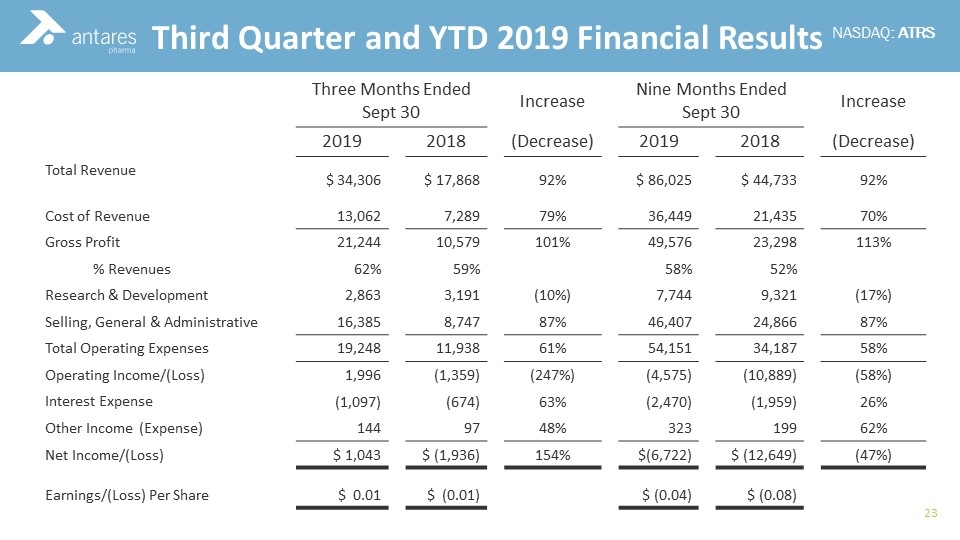

Commercial Experience Third Quarter and YTD 2019 Financial Results Three Months Ended Sept 30 Increase Nine Months Ended Sept 30 Increase 2019 2018 (Decrease) 2019 2018 (Decrease) Total Revenue $ 34,306 $ 17,868 92% $ 86,025 $ 44,733 92% Cost of Revenue 13,062 7,289 79% 36,449 21,435 70% Gross Profit 21,244 10,579 101% 49,576 23,298 113% % Revenues 62% 59% 58% 52% Research & Development 2,863 3,191 (10%) 7,744 9,321 (17%) Selling, General & Administrative 16,385 8,747 87% 46,407 24,866 87% Total Operating Expenses 19,248 11,938 61% 54,151 34,187 58% Operating Income/(Loss) 1,996 (1,359) (247%) (4,575) (10,889) (58%) Interest Expense (1,097) (674) 63% (2,470) (1,959) 26% Other Income (Expense) 144 97 48% 323 199 62% Net Income/(Loss) $ 1,043 $ (1,936) 154% $(6,722) $ (12,649) (47%) Earnings/(Loss) Per Share $ 0.01 $ (0.01) $ (0.04) $ (0.08)

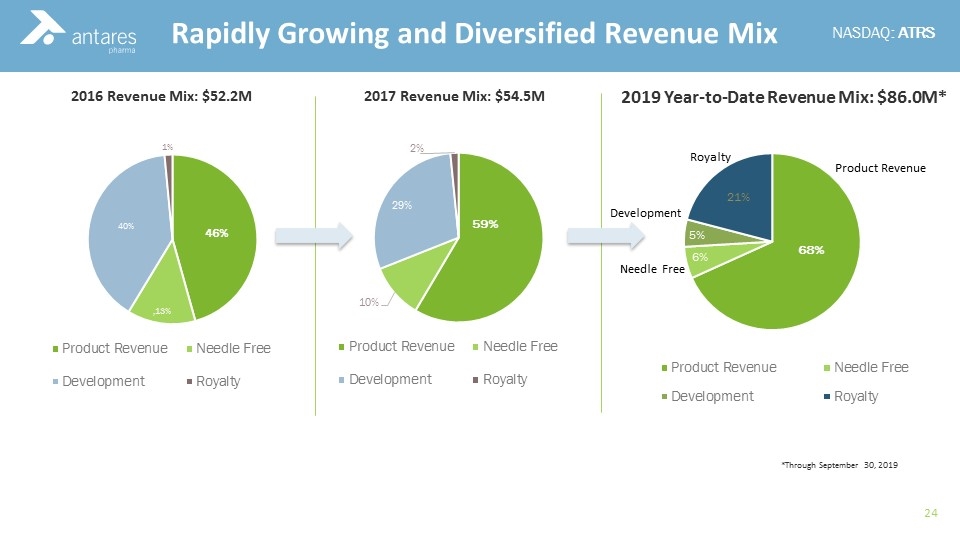

2016 Revenue Mix: $52.2M 2019 Year-to-Date Revenue Mix: $86.0M* Rapidly Growing and Diversified Revenue Mix 2017 Revenue Mix: $54.5M *Through September 30, 2019

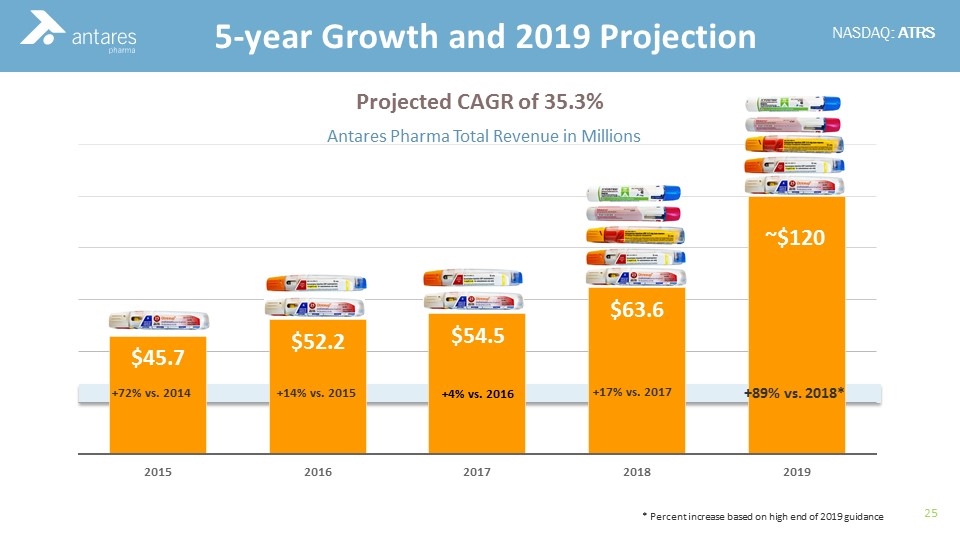

+17% vs. 2017 +89% vs. 2018* 5-year Growth and 2019 Projection Projected CAGR of 35.3% * Percent increase based on high end of 2019 guidance +72% vs. 2014 +14% vs. 2015

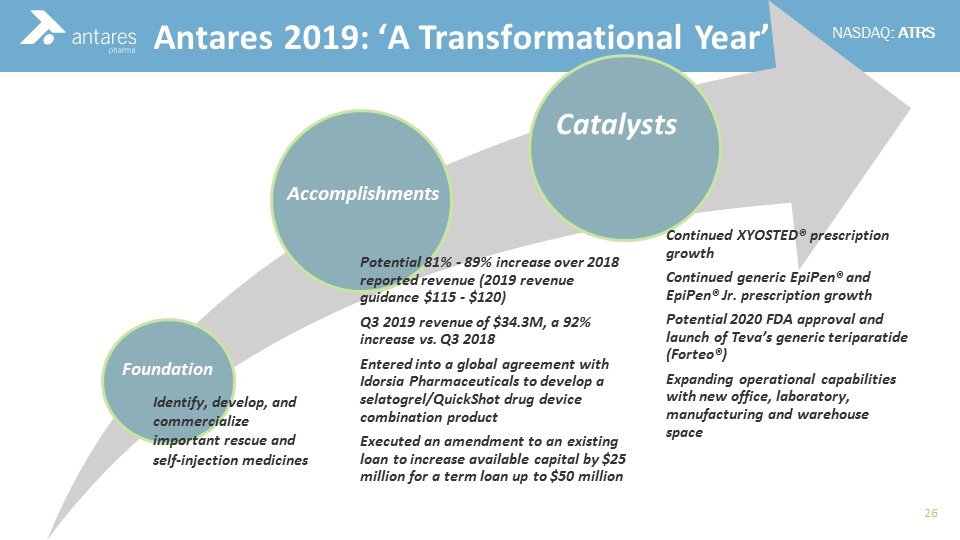

Catalysts Accomplishments Foundation Identify, develop, and commercialize important rescue and self-injection medicines Antares 2019: ‘A Transformational Year’ Potential 81% - 89% increase over 2018 reported revenue (2019 revenue guidance $115 - $120) Q3 2019 revenue of $34.3M, a 92% increase vs. Q3 2018 Entered into a global agreement with Idorsia Pharmaceuticals to develop a selatogrel / QuickShot drug device combination product Executed an amendment to an existing loan to increase available capital by $25 million for a term loan up to $50 million Continued XYOSTED® prescription growth Continued generic EpiPen® and EpiPen® Jr. prescription growth Potential 2020 FDA approval and launch of Teva’s generic teriparatide ( Forteo ®) Expanding operational capabilities with new office, laboratory, manufacturing and warehouse space

Thank you Questions