Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AERIE PHARMACEUTICALS INC | d861090d8k.htm |

Company Overview Investor Presentation January 2020 Exhibit 99.1

For Investor Use Important Information The information in this presentation does not contain all of the information that a potential investor should review before investing in Aerie shares. The descriptions of Aerie Pharmaceuticals, Inc. (the “Company” or “Aerie”) in this presentation are qualified in their entirety by reference to reports filed with the SEC. Certain information in this presentation has been obtained from outside sources or is anecdotal in nature. While such information is believed to be reliable for the purposes used herein, no representations are made as to the accuracy or completeness thereof and we take no responsibility for such information. Any discussion of the potential use or expected success of Rhopressa® (netarsudil ophthalmic solution) 0.02% or Rocklatan® (netarsudil and latanoprost ophthalmic solution) 0.02%/0.005%, with respect to foreign approval or additional indications, and our current or any future product candidates, including AR-1105, AR-13503 and AVX-012, is subject to regulatory approval. In addition, any discussion of U.S. Food and Drug Administration (“FDA”) approval of Rhopressa® or Rocklatan® does not guarantee successful commercialization of Rhopressa® or Rocklatan®. For more information on Rhopressa®, including prescribing information, refer to the full Rhopressa® product label at www.rhopressa.com. For more information on Rocklatan®, including prescribing information, refer to the full Rocklatan® product label at www.rocklatan.com. The information in this presentation is current only as of its date and may have changed or may change in the future. We undertake no obligation to update this information in light of new information, future events or otherwise. We are not making any representation or warranty that the information in this presentation is accurate or complete. This presentation shall not constitute an offer to sell, nor a solicitation of an offer to buy, any of Aerie’s securities. Certain statements in this presentation, including any guidance or timelines presented herein, are “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “will,” “should,” “would,” “could,” “believe,” “expects,” “anticipates,” “plans,” “intends,” “estimates,” “targets,” “projects,” “potential” or similar expressions are intended to identify these forward-looking statements. These statements are based on the Company’s current plans and expectations. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements. In evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially from any forward-looking statements. In particular, these statements include any discussion of potential commercial sales, placement or utilization of Rocklatan® or Rhopressa® in the United States or any other market. Likewise, FDA approval of Rhopressa® and Rocklatan® does not constitute approval of any future product candidates. Any top line data presented herein is preliminary and based solely on information available to us as of the date of this presentation and additional information about the results may be disclosed at any time. FDA approval of Rhopressa® and Rocklatan® also does not constitute regulatory approval of Rhopressa® or Rocklatan® in jurisdictions outside the United States and there can be no assurance that we will receive regulatory approval for Rhopressa® or Rocklatan® in jurisdictions outside the United States. In addition, any discussion in this presentation about preclinical activities or opportunities associated with our products or discussions involving the potential for our dry eye product candidate are preliminary and the outcome of any studies may not be predictive of the outcome of later trials and ultimate regulatory approval. Any future clinical trial results may not demonstrate safety and efficacy sufficient to obtain regulatory approval related to the preclinical research findings discussed in this presentation. Any statements regarding Aerie’s future liquidity, cash balances or financing transactions also constitute forward-looking statements. These risks and uncertainties are described more fully in the quarterly and annual reports that we file with the SEC, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Such forward-looking statements only speak as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as otherwise required by law.

Aerie Overview Rhopressa® and Rocklatan® have not been approved by any regulatory authority other than the FDA. Additional potential Rhopressa® indications are being considered for further study and are not labeled indications. AR-13503 and AR-1105 are development stage product candidates and are not approved by any regulatory agency. Aerie IOP–Reducing Products (IP 2030+) Key Pipeline Activities Avizorex TRPM8 agonist for Dry Eye (Phase 2/3 clinical study H2 2020) Sustained-Release Implant Platform: - Retina AR-13503 (First-in-human clinical study commenced Q3 2019) AR-1105 (Phase 2 clinical study commenced Q1 2019) - Glaucoma Neuro-enhancement Rhopressa® and Rocklatan® commercialized Aerie Ireland plant expected to be online H1 2020 Globalization Plan Under Way – Europe and Japan For Investor Use

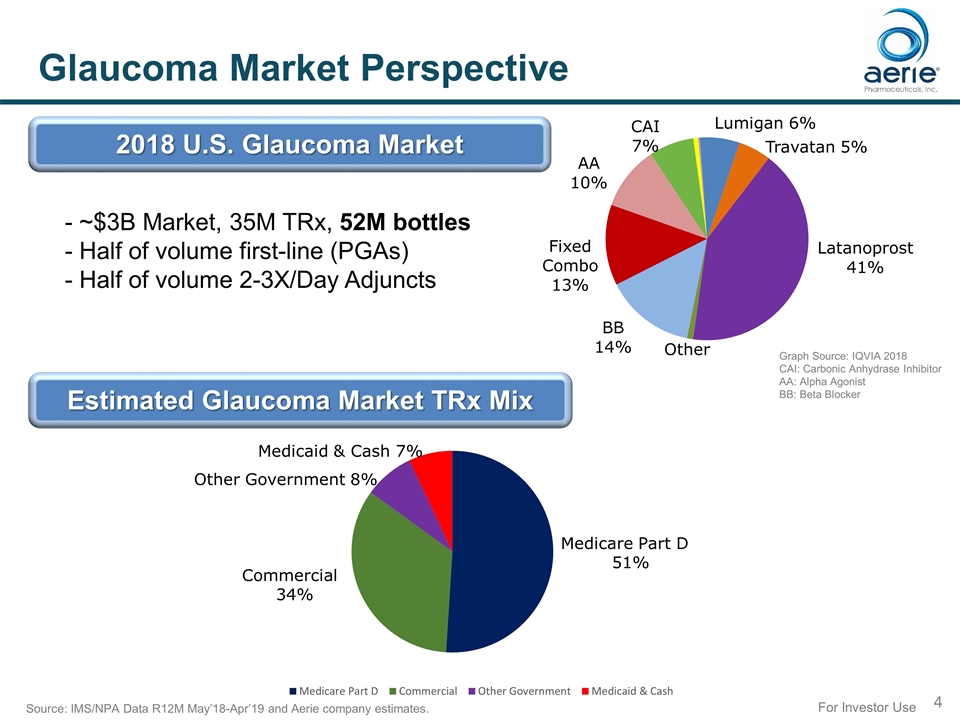

For Investor Use Glaucoma Market Perspective - ~$3B Market, 35M TRx, 52M bottles - Half of volume first-line (PGAs) - Half of volume 2-3X/Day Adjuncts 2018 U.S. Glaucoma Market Graph Source: IQVIA 2018 CAI: Carbonic Anhydrase Inhibitor AA: Alpha Agonist BB: Beta Blocker Source: IMS/NPA Data R12M May’18-Apr’19 and Aerie company estimates. Estimated Glaucoma Market TRx Mix

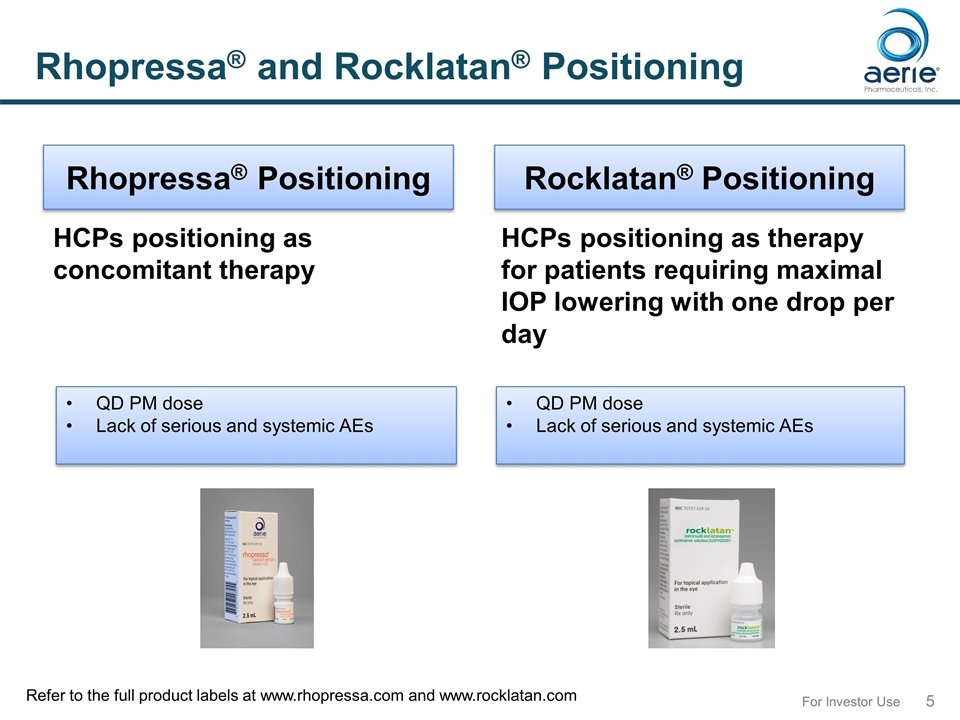

For Investor Use Rhopressa® and Rocklatan® Positioning HCPs positioning as concomitant therapy HCPs positioning as therapy for patients requiring maximal IOP lowering with one drop per day Rhopressa® Positioning Rocklatan® Positioning QD PM dose Lack of serious and systemic AEs QD PM dose Lack of serious and systemic AEs Refer to the full product labels at www.rhopressa.com and www.rocklatan.com

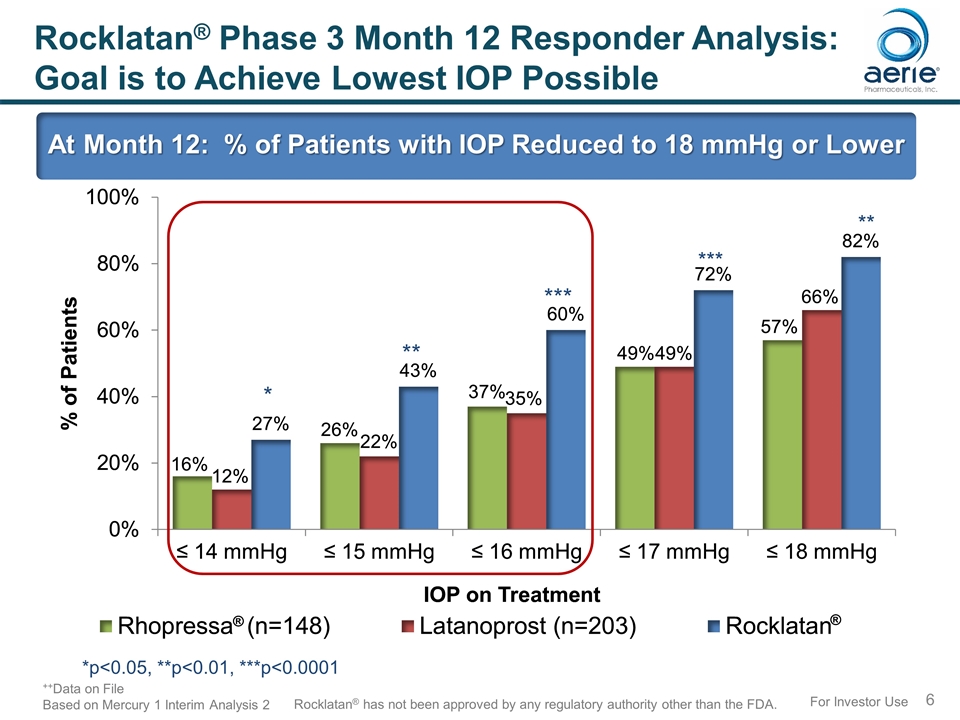

For Investor Use Rocklatan® Phase 3 Month 12 Responder Analysis: Goal is to Achieve Lowest IOP Possible At Month 12: % of Patients with IOP Reduced to 18 mmHg or Lower *p<0.05, **p<0.01, ***p<0.0001 ++Data on File Based on Mercury 1 Interim Analysis 2 Rocklatan® has not been approved by any regulatory authority other than the FDA. * ** ***

Topline Results from Rhopressa® Phase 4 Multi-center Open-label Study (MOST) 12-week MOST study evaluated efficacy, tolerability and safety of Rhopressa® use in 260 patients in a real-world clinical setting Use of Rhopressa® as monotherapy or adjunct was at discretion of the physician Used adjunctively (n=151, mITT): Rhopressa® was similarly effective when added to prior PGA monotherapy or when added to prior multi-drug therapy Additional IOP reductions of 4.3 mmHg and 4.5 mmHg, respectively (12 weeks) Used as monotherapy (n=91, mITT): Rhopressa® maintained IOP levels comparable to prior PGA following switch (n=57) Rhopressa® was well tolerated as monotherapy and adjunctive therapy No treatment-related serious adverse events (AEs) Most common AEs were Conjunctival Hyperemia (20.8%) and Vision Blurred (7.3%) 89% of patients reported Rhopressa® was tolerated “well” or better in survey (mITT) For Investor Use ++Data on File

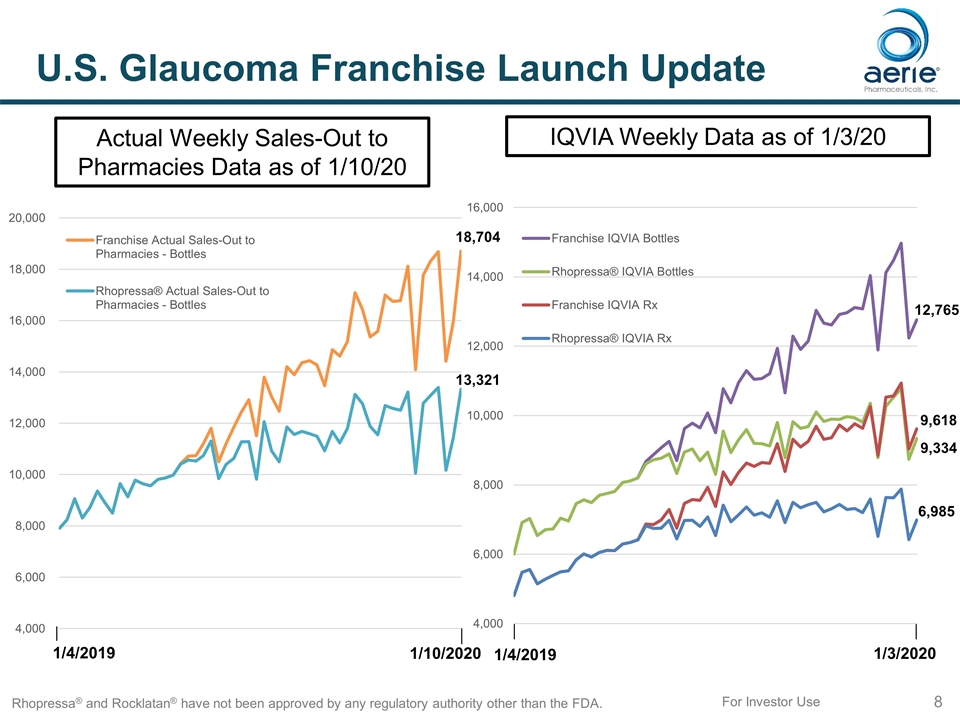

8 For Investor Use U.S. Glaucoma Franchise Launch Update Rhopressa® and Rocklatan® have not been approved by any regulatory authority other than the FDA. Actual Weekly Sales-Out to Pharmacies Data as of 1/10/20 IQVIA Weekly Data as of 1/3/20 1/4/2019 1/10/2020 1/4/2019 1/3/2020 13,321 18,704 6,985 9,618 9,334 12,765

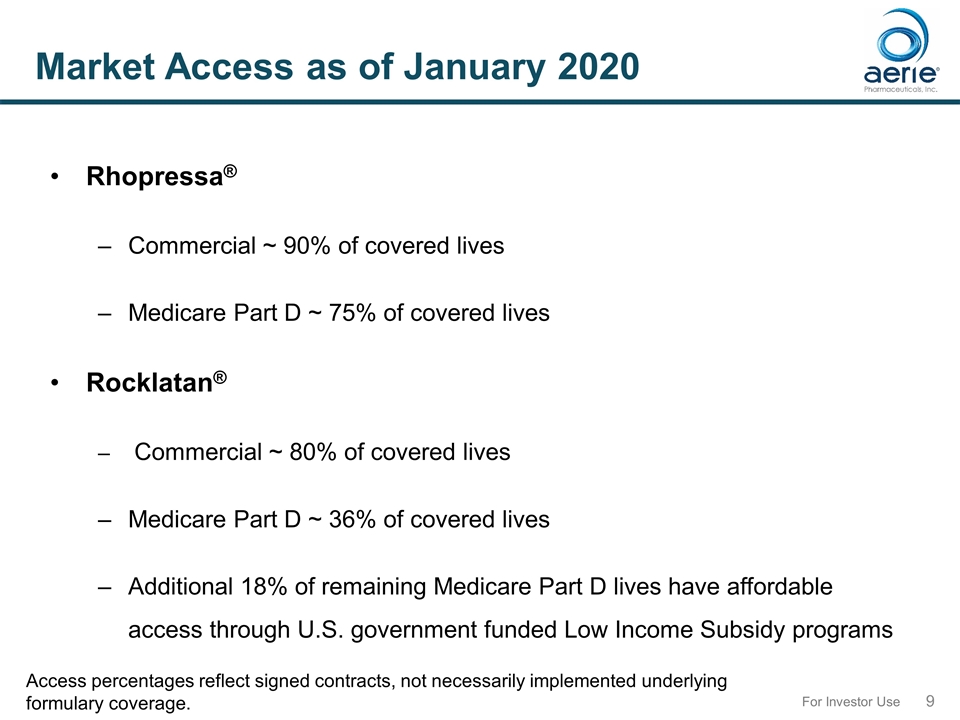

For Investor Use Market Access as of January 2020 Access percentages reflect signed contracts, not necessarily implemented underlying formulary coverage. Rhopressa® Commercial ~ 90% of covered lives Medicare Part D ~ 75% of covered lives Rocklatan® Commercial ~ 80% of covered lives Medicare Part D ~ 36% of covered lives Additional 18% of remaining Medicare Part D lives have affordable access through U.S. government funded Low Income Subsidy programs

For Investor Use Active Engagement at Key Conferences March 2019: American Glaucoma Society (AGS) April/May 2019: Association of Research in Vision and Ophthalmology (ARVO) May 2019: American Society of Cataract and Refractive Surgeons (ASCRS) July 2019: American Society for Retina Specialists (ASRS) September 2019: European Society of Cataract and Refractive Surgeons (ESCRS) September 2019: Japan Glaucoma Society (JGS) October 2019: American Academy of Ophthalmology (AAO)

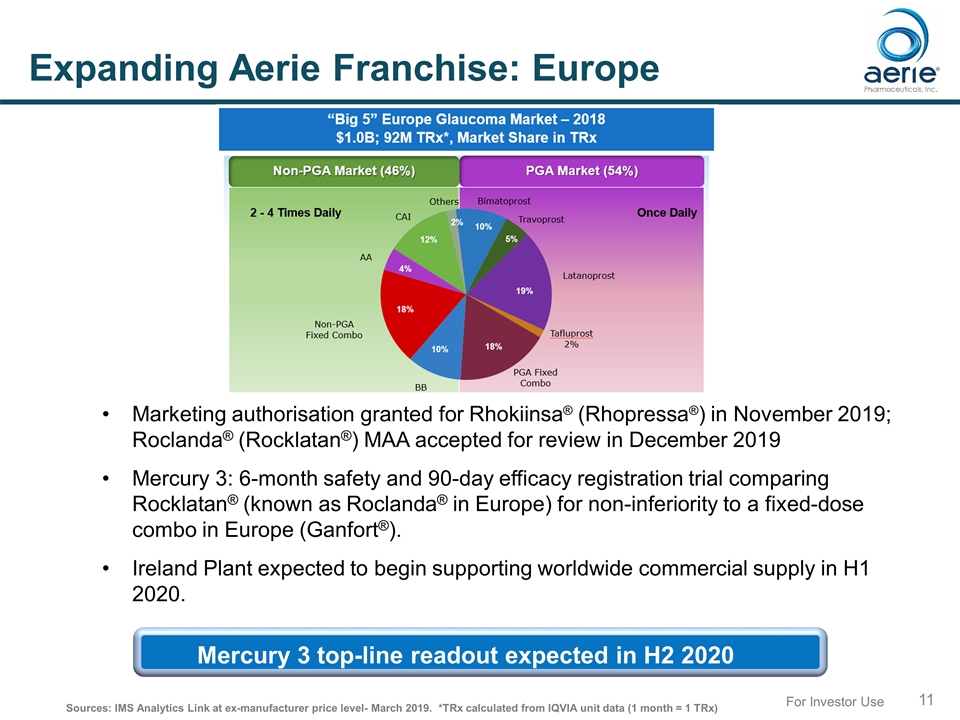

For Investor Use Expanding Aerie Franchise: Europe Marketing authorisation granted for Rhokiinsa® (Rhopressa®) in November 2019; Roclanda® (Rocklatan®) MAA accepted for review in December 2019 Mercury 3: 6-month safety and 90-day efficacy registration trial comparing Rocklatan® (known as Roclanda® in Europe) for non-inferiority to a fixed-dose combo in Europe (Ganfort®). Ireland Plant expected to begin supporting worldwide commercial supply in H1 2020. Sources: IMS Analytics Link at ex-manufacturer price level- March 2019. *TRx calculated from IQVIA unit data (1 month = 1 TRx) Mercury 3 top-line readout expected in H2 2020

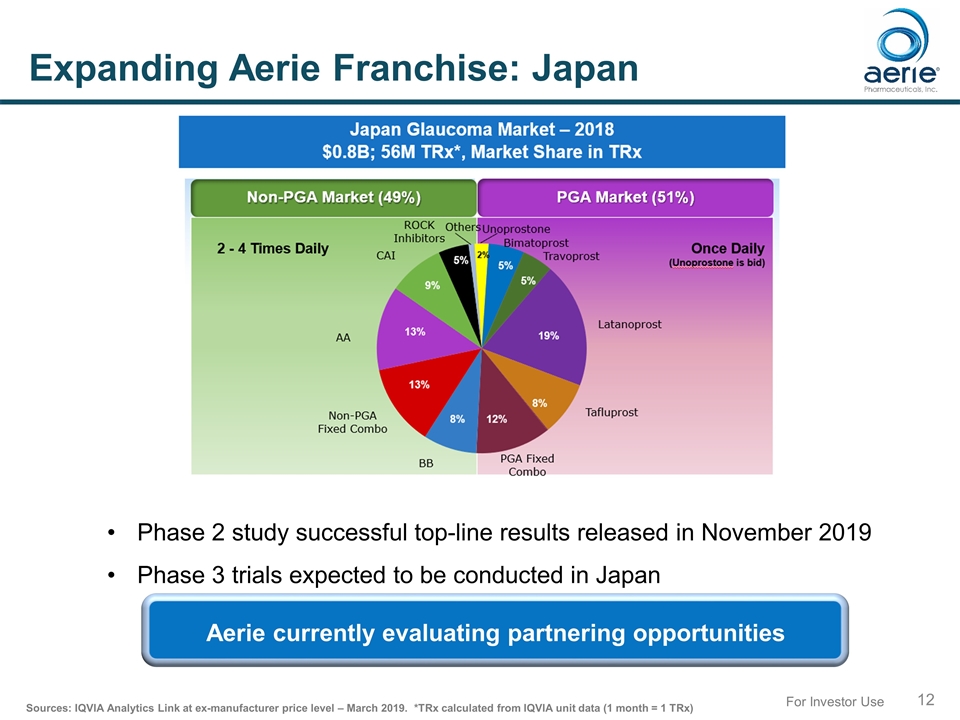

For Investor Use Expanding Aerie Franchise: Japan Phase 2 study successful top-line results released in November 2019 Phase 3 trials expected to be conducted in Japan Sources: IQVIA Analytics Link at ex-manufacturer price level – March 2019. *TRx calculated from IQVIA unit data (1 month = 1 TRx) Aerie currently evaluating partnering opportunities Aerie currently evaluating partnering opportunities

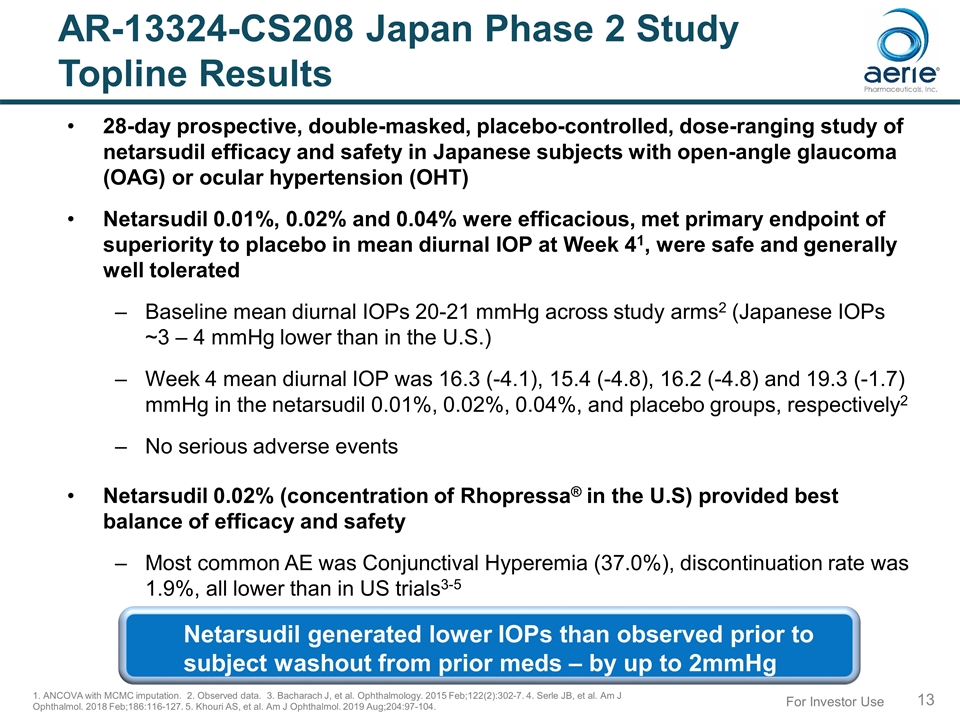

AR-13324-CS208 Japan Phase 2 Study Topline Results 28-day prospective, double-masked, placebo-controlled, dose-ranging study of netarsudil efficacy and safety in Japanese subjects with open-angle glaucoma (OAG) or ocular hypertension (OHT) Netarsudil 0.01%, 0.02% and 0.04% were efficacious, met primary endpoint of superiority to placebo in mean diurnal IOP at Week 41, were safe and generally well tolerated Baseline mean diurnal IOPs 20-21 mmHg across study arms2 (Japanese IOPs ~3 – 4 mmHg lower than in the U.S.) Week 4 mean diurnal IOP was 16.3 (-4.1), 15.4 (-4.8), 16.2 (-4.8) and 19.3 (-1.7) mmHg in the netarsudil 0.01%, 0.02%, 0.04%, and placebo groups, respectively2 No serious adverse events Netarsudil 0.02% (concentration of Rhopressa® in the U.S) provided best balance of efficacy and safety Most common AE was Conjunctival Hyperemia (37.0%), discontinuation rate was 1.9%, all lower than in US trials3-5 1. ANCOVA with MCMC imputation. 2. Observed data. 3. Bacharach J, et al. Ophthalmology. 2015 Feb;122(2):302-7. 4. Serle JB, et al. Am J Ophthalmol. 2018 Feb;186:116-127. 5. Khouri AS, et al. Am J Ophthalmol. 2019 Aug;204:97-104. For Investor Use Netarsudil generated lower IOPs than observed prior to subject washout from prior meds – by up to 2mmHg

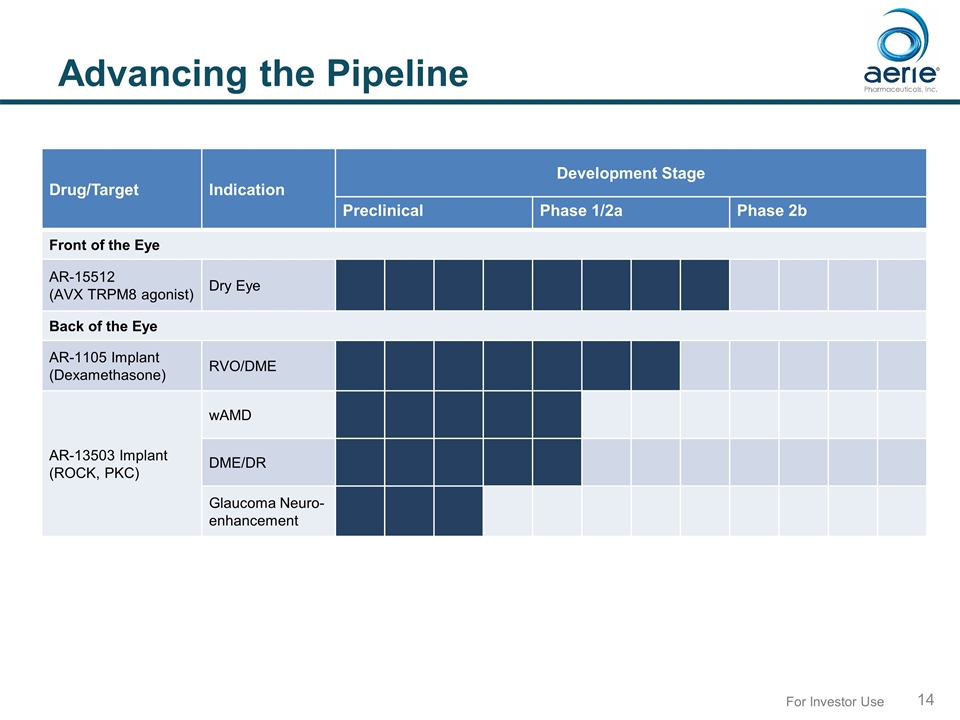

For Investor Use Advancing the Pipeline Drug/Target Indication Development Stage Preclinical Phase 1/2a Phase 2b Front of the Eye AR-15512 (AVX TRPM8 agonist) Dry Eye Back of the Eye AR-1105 Implant (Dexamethasone) RVO/DME AR-13503 Implant (ROCK, PKC) wAMD DME/DR Glaucoma Neuro- enhancement

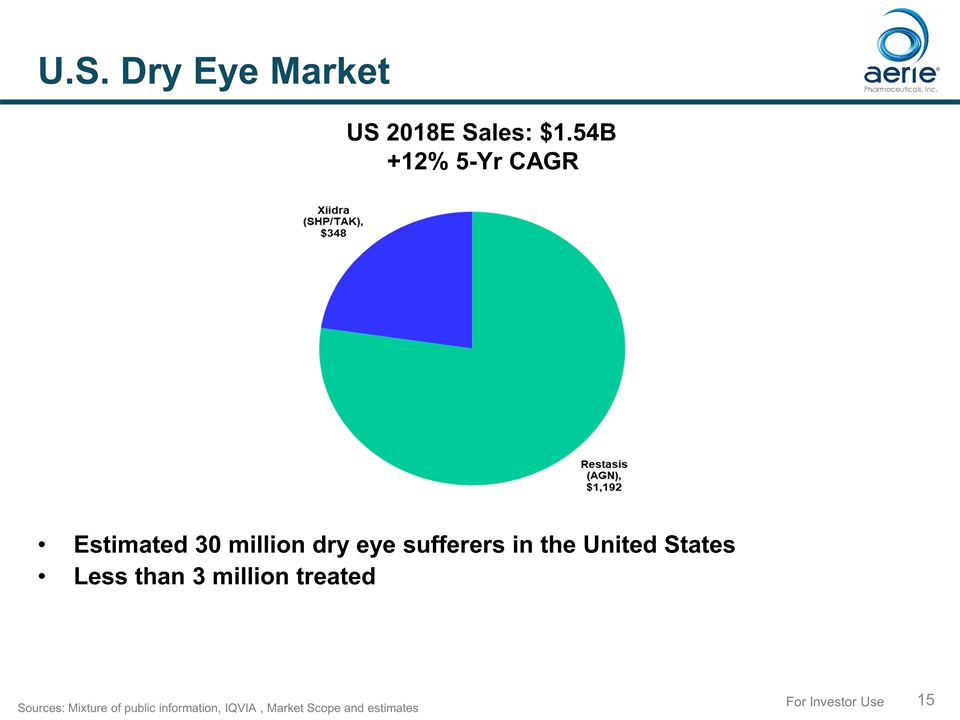

For Investor Use U.S. Dry Eye Market Estimated 30 million dry eye sufferers in the United States Less than 3 million treated Sources: Mixture of public information, IQVIA , Market Scope and estimates US 2018E Sales: $1.54B +12% 5-Yr CAGR

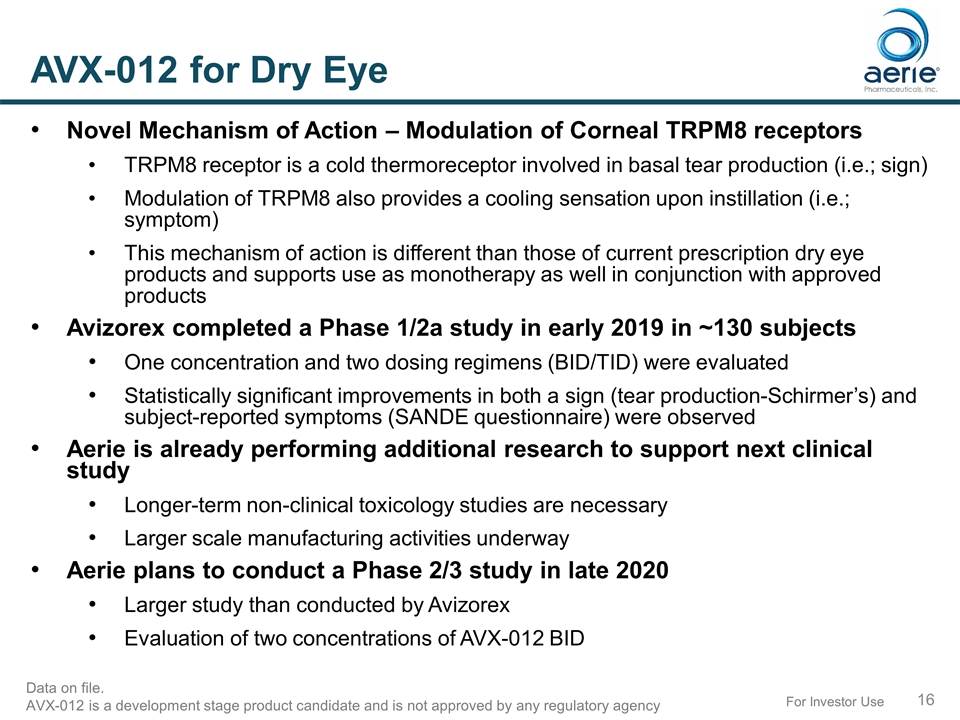

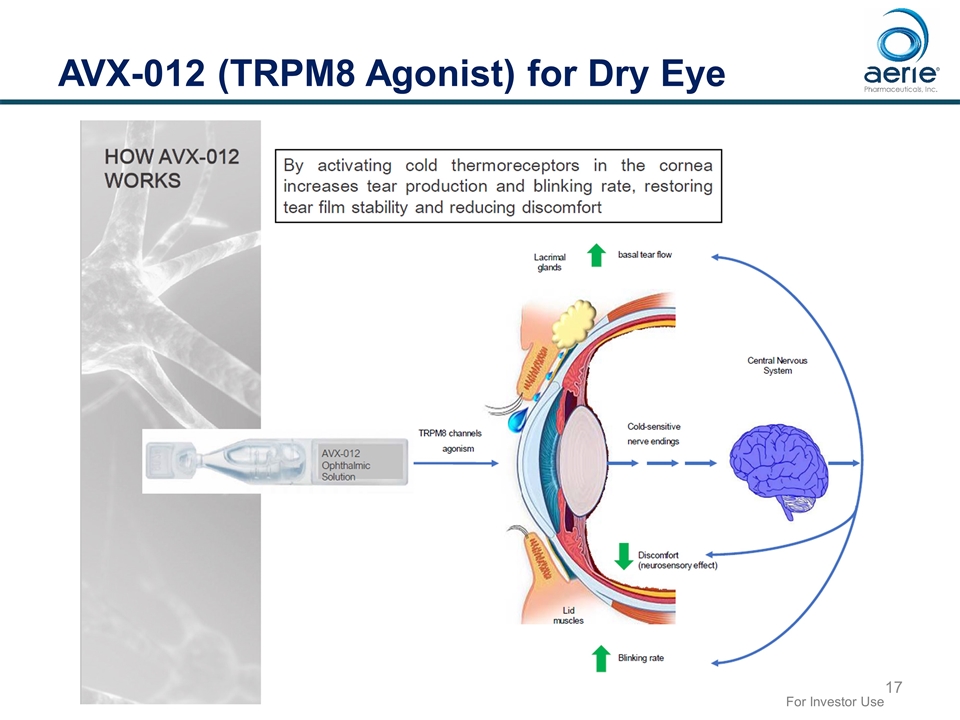

For Investor Use AVX-012 for Dry Eye Novel Mechanism of Action – Modulation of Corneal TRPM8 receptors TRPM8 receptor is a cold thermoreceptor involved in basal tear production (i.e.; sign) Modulation of TRPM8 also provides a cooling sensation upon instillation (i.e.; symptom) This mechanism of action is different than those of current prescription dry eye products and supports use as monotherapy as well in conjunction with approved products Avizorex completed a Phase 1/2a study in early 2019 in ~130 subjects One concentration and two dosing regimens (BID/TID) were evaluated Statistically significant improvements in both a sign (tear production-Schirmer’s) and subject-reported symptoms (SANDE questionnaire) were observed Aerie is already performing additional research to support next clinical study Longer-term non-clinical toxicology studies are necessary Larger scale manufacturing activities underway Aerie plans to conduct a Phase 2/3 study in late 2020 Larger study than conducted by Avizorex Evaluation of two concentrations of AVX-012 BID Data on file. AVX-012 is a development stage product candidate and is not approved by any regulatory agency

AVX-012 (TRPM8 Agonist) for Dry Eye For Investor Use

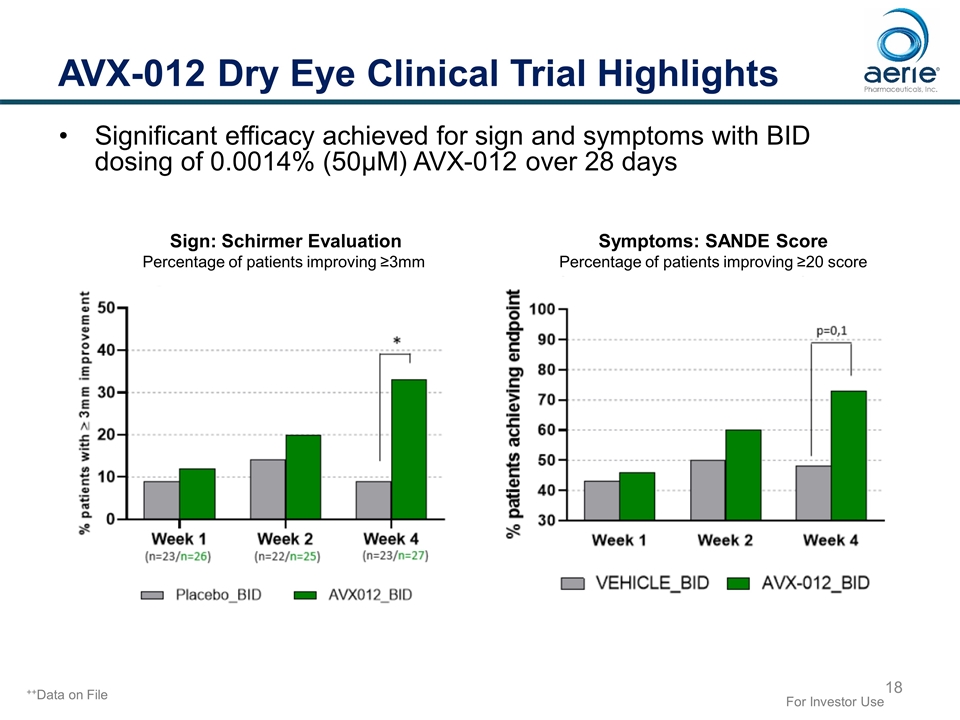

AVX-012 Dry Eye Clinical Trial Highlights Significant efficacy achieved for sign and symptoms with BID dosing of 0.0014% (50µM) AVX-012 over 28 days Sign: Schirmer Evaluation Percentage of patients improving ≥3mm Symptoms: SANDE Score Percentage of patients improving ≥20 score For Investor Use ++Data on File

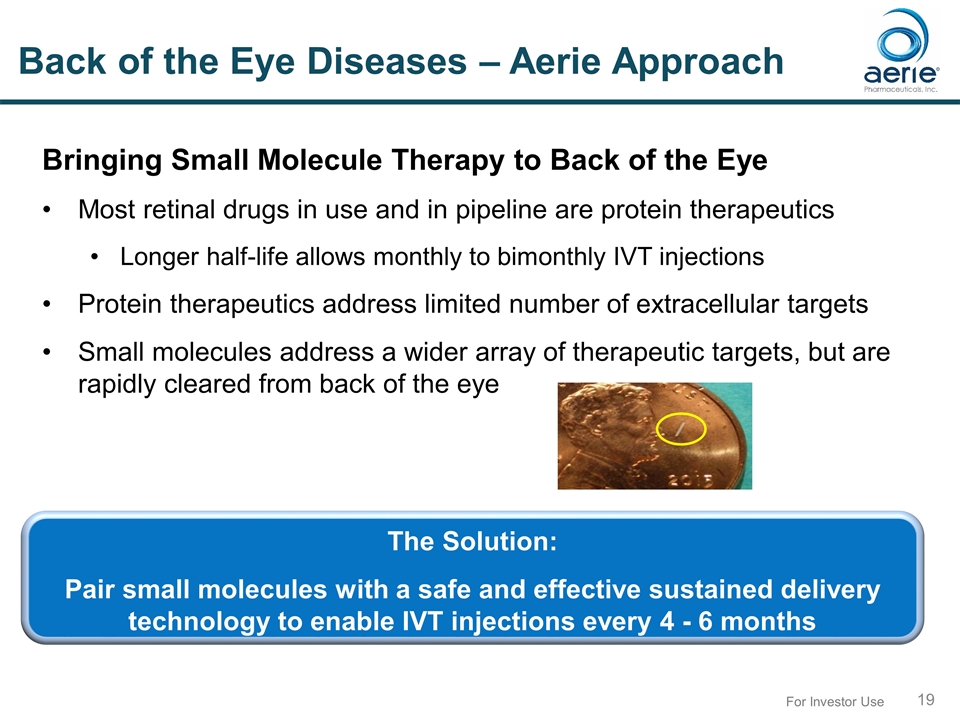

Bringing Small Molecule Therapy to Back of the Eye Most retinal drugs in use and in pipeline are protein therapeutics Longer half-life allows monthly to bimonthly IVT injections Protein therapeutics address limited number of extracellular targets Small molecules address a wider array of therapeutic targets, but are rapidly cleared from back of the eye For Investor Use Back of the Eye Diseases – Aerie Approach The Solution: Pair small molecules with a safe and effective sustained delivery technology to enable IVT injections every 4 - 6 months

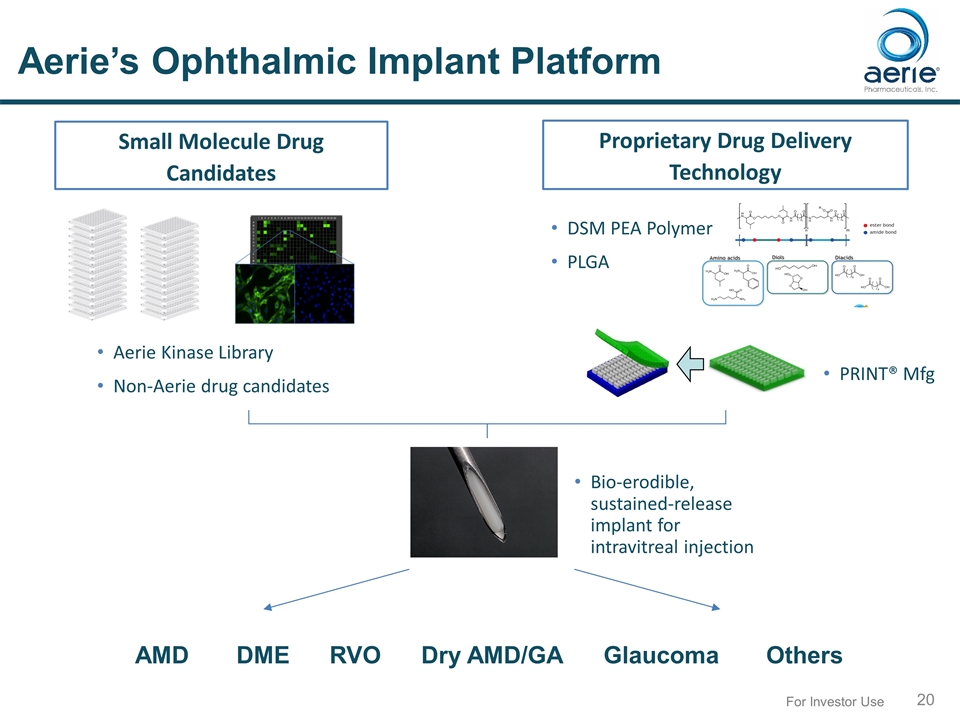

For Investor Use Aerie’s Ophthalmic Implant Platform Small Molecule Drug Candidates Proprietary Drug Delivery Technology Bio-erodible, sustained-release implant for intravitreal injection DSM PEA Polymer PLGA PRINT® Mfg AMD DME RVO Dry AMD/GA Glaucoma Others Aerie Kinase Library Non-Aerie drug candidates

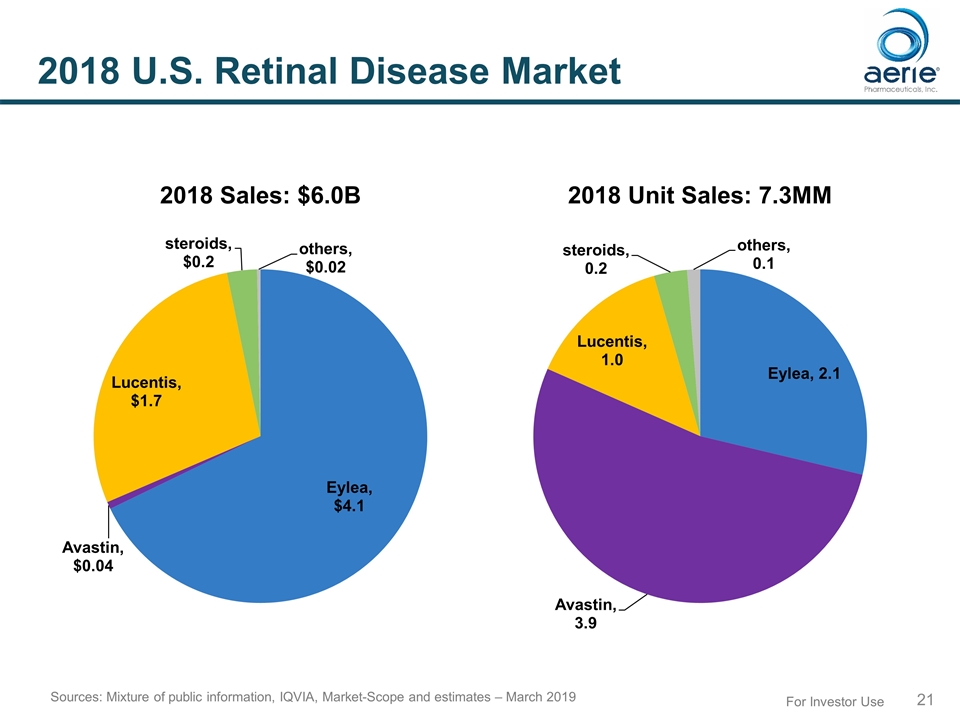

For Investor Use 2018 U.S. Retinal Disease Market 2018 Sales: $6.0B 2018 Unit Sales: 7.3MM Sources: Mixture of public information, IQVIA, Market-Scope and estimates – March 2019

For Investor Use Aerie’s Sustained Implant Opportunities Markets in Need of Further Innovation: Retinal Vein Occlusion (RVO) Wet Age Related Macular Edema (wAMD) Diabetic Macular Edema (DME) Broadly Underserved Market Opportunities: Glaucoma Neuro-enhancement Dry AMD/Geographic Atrophy (GA)

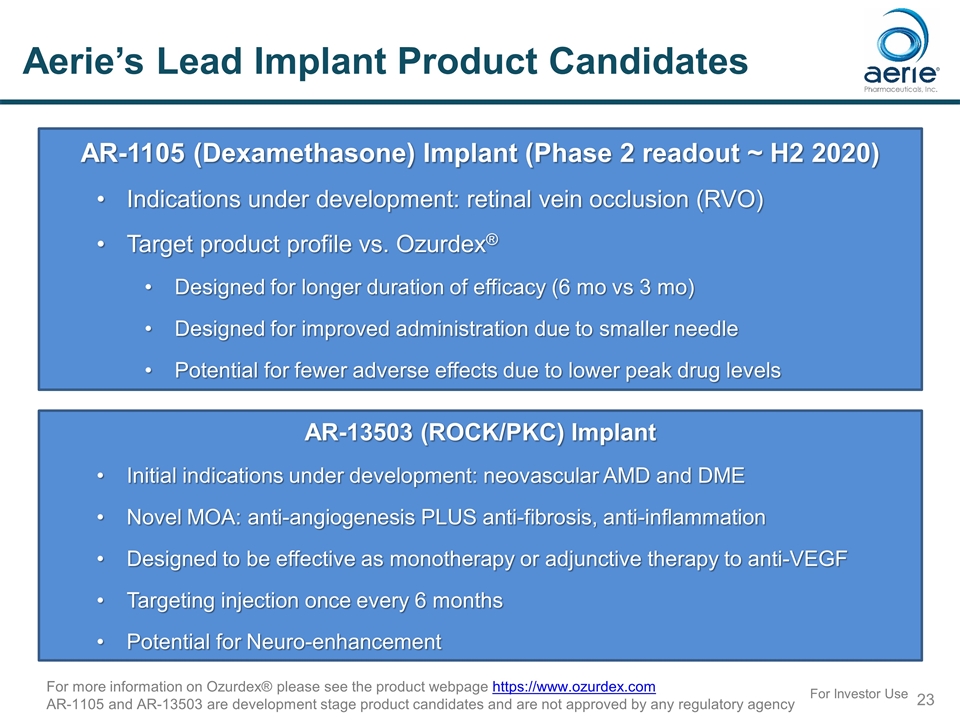

For Investor Use Aerie’s Lead Implant Product Candidates AR-1105 (Dexamethasone) Implant (Phase 2 readout ~ H2 2020) Indications under development: retinal vein occlusion (RVO) Target product profile vs. Ozurdex® Designed for longer duration of efficacy (6 mo vs 3 mo) Designed for improved administration due to smaller needle Potential for fewer adverse effects due to lower peak drug levels AR-13503 (ROCK/PKC) Implant Initial indications under development: neovascular AMD and DME Novel MOA: anti-angiogenesis PLUS anti-fibrosis, anti-inflammation Designed to be effective as monotherapy or adjunctive therapy to anti-VEGF Targeting injection once every 6 months Potential for Neuro-enhancement For more information on Ozurdex® please see the product webpage https://www.ozurdex.com AR-1105 and AR-13503 are development stage product candidates and are not approved by any regulatory agency

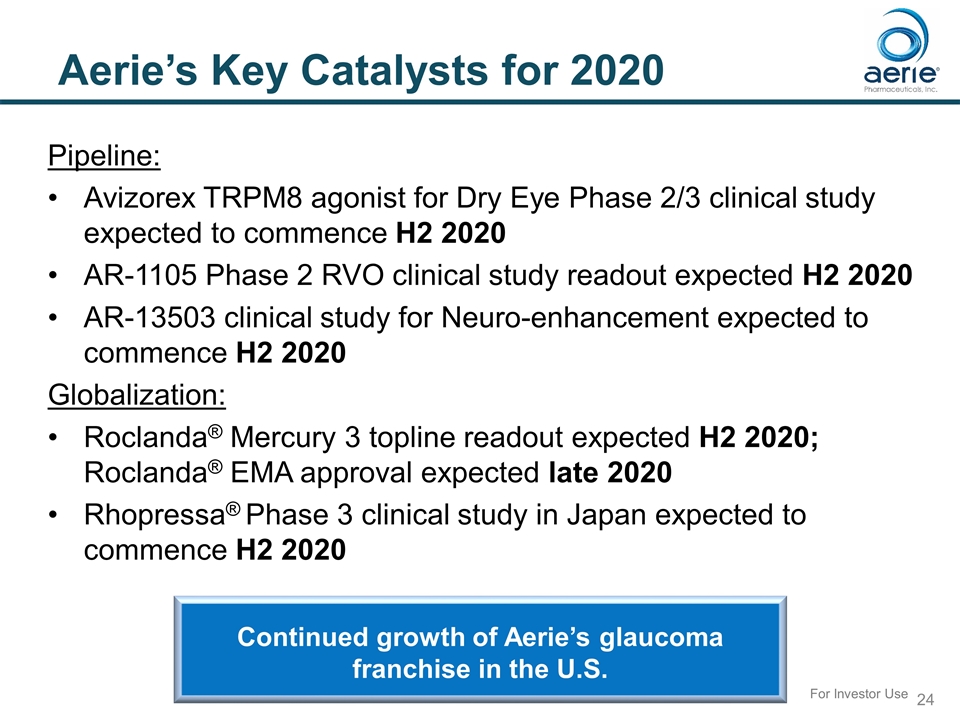

Aerie’s Key Catalysts for 2020 Pipeline: Avizorex TRPM8 agonist for Dry Eye Phase 2/3 clinical study expected to commence H2 2020 AR-1105 Phase 2 RVO clinical study readout expected H2 2020 AR-13503 clinical study for Neuro-enhancement expected to commence H2 2020 Globalization: Roclanda® Mercury 3 topline readout expected H2 2020; Roclanda® EMA approval expected late 2020 Rhopressa® Phase 3 clinical study in Japan expected to commence H2 2020 Continued growth of Aerie’s glaucoma franchise in the U.S. For Investor Use

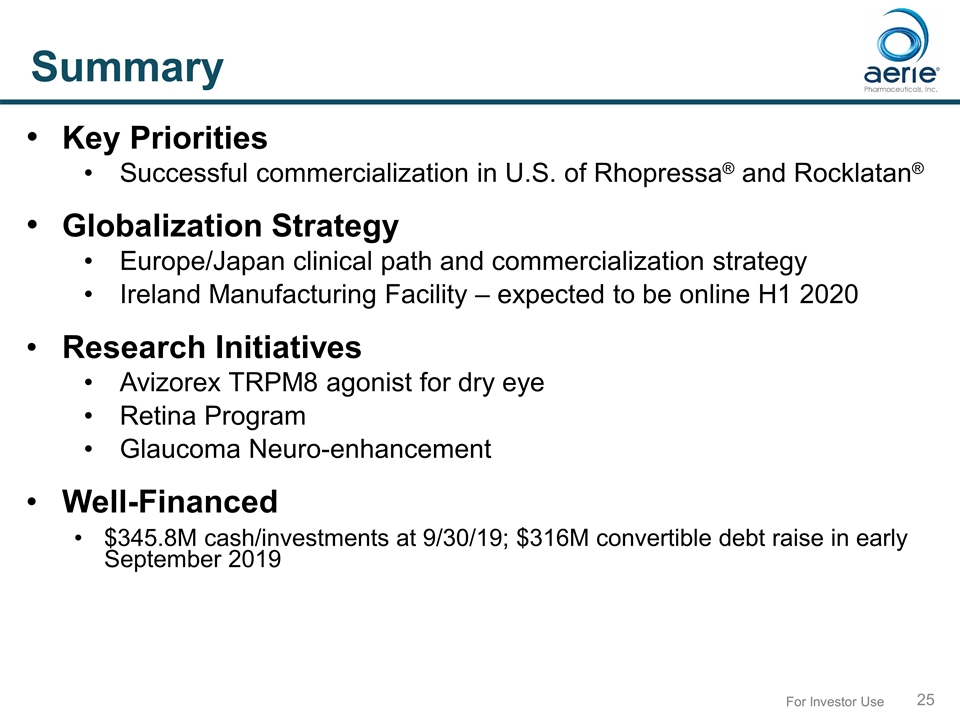

For Investor Use Summary Key Priorities Successful commercialization in U.S. of Rhopressa® and Rocklatan® Globalization Strategy Europe/Japan clinical path and commercialization strategy Ireland Manufacturing Facility – expected to be online H1 2020 Research Initiatives Avizorex TRPM8 agonist for dry eye Retina Program Glaucoma Neuro-enhancement Well-Financed $345.8M cash/investments at 9/30/19; $316M convertible debt raise in early September 2019