Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CalAmp Corp. | camp-8k_20200109.htm |

Investor Presentation January 2020

This presentation may contain forward-looking statements and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. These forward-looking statements include, but are not limited to, future strategic plans and other statements that describe our business strategy, outlook, objectives, plans, intentions or goals, and any discussion of future operating or financial performance, including, without limitation, the long-term growth of our revenue and gross margin. The words “may,” “will,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “estimate,” believe,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could affect the outcome of forward-looking statements are uncertain and to some extent unpredictable, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in such forward-looking statements. Any forward-looking statement is based on current plans and expectations of our management, expressed in good faith and believed to have a reasonable basis. However, there can be no assurance that anticipated results will be achieved. More information on factors that could cause actual results to differ materially from those anticipated is included in the Risk Factors section in our most recent Annual Report on Form 10-K, and other documents filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this presentation speak only as of the date hereof, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statements

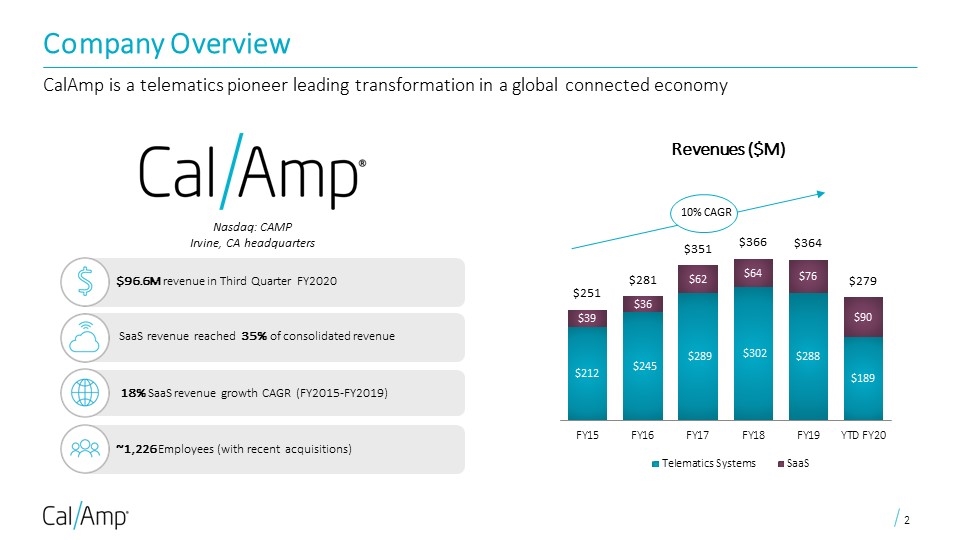

Company Overview CalAmp is a telematics pioneer leading transformation in a global connected economy Nasdaq: CAMP Irvine, CA headquarters 18% SaaS revenue growth CAGR (FY2015-FY2019) ~1,226 Employees (with recent acquisitions) $96.6M revenue in Third Quarter FY2020 SaaS revenue reached 35% of consolidated revenue Revenues ($M) 10% CAGR

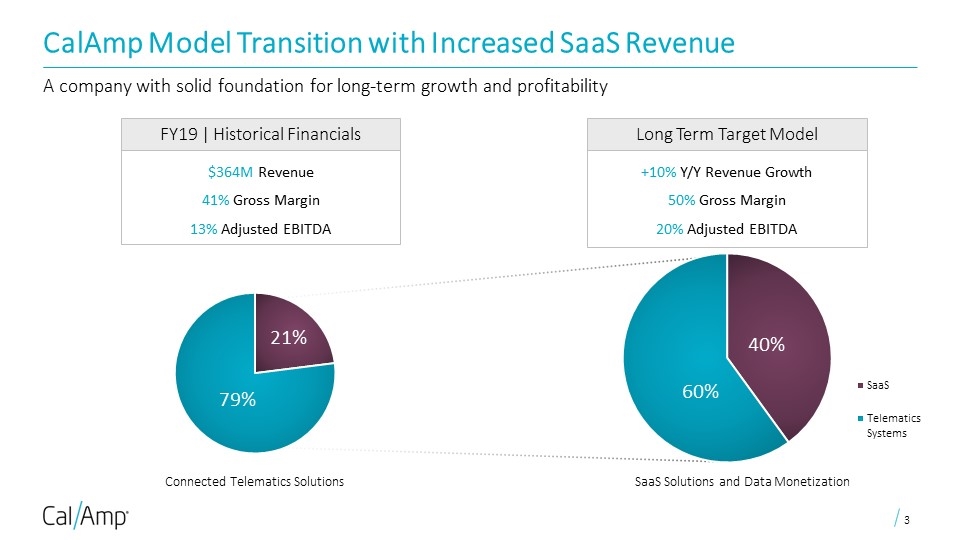

CalAmp Model Transition with Increased SaaS Revenue A company with solid foundation for long-term growth and profitability $364M Revenue 41% Gross Margin 13% Adjusted EBITDA Connected Telematics Solutions Long Term Target Model +10% Y/Y Revenue Growth 50% Gross Margin 20% Adjusted EBITDA SaaS Solutions and Data Monetization FY19 | Historical Financials

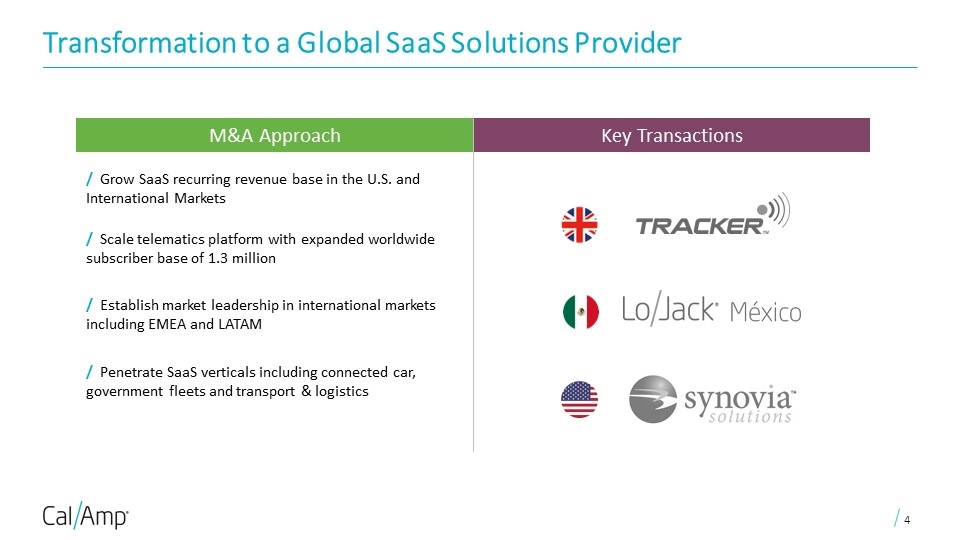

Transformation to a Global SaaS Solutions Provider M&A Approach Key Transactions / Grow SaaS recurring revenue base in the U.S. and International Markets / Penetrate SaaS verticals including connected car, government fleets and transport & logistics / Establish market leadership in international markets including EMEA and LATAM / Scale telematics platform with expanded worldwide subscriber base of 1.3 million

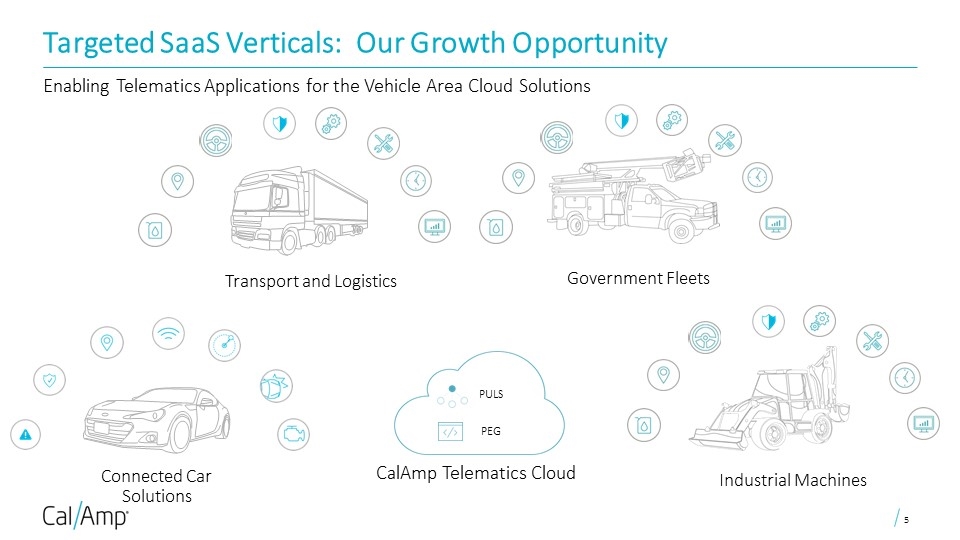

Targeted SaaS Verticals: Our Growth Opportunity Enabling Telematics Applications for the Vehicle Area Cloud Solutions PULS PEG CalAmp Telematics Cloud Connected Car Solutions Transport and Logistics Industrial Machines Government Fleets

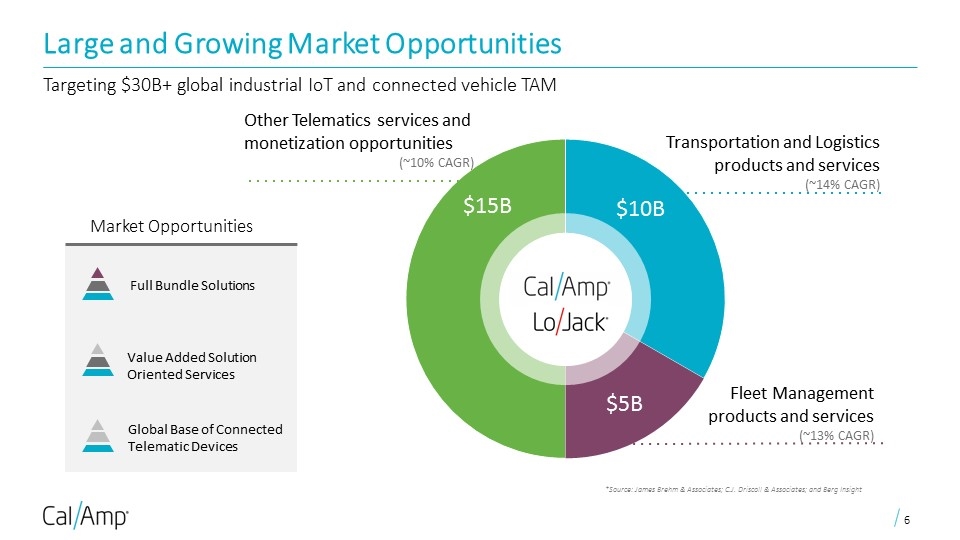

Large and Growing Market Opportunities Fleet Management products and services (~13% CAGR) Transportation and Logistics products and services (~14% CAGR) Other Telematics services and monetization opportunities (~10% CAGR) Targeting $30B+ global industrial IoT and connected vehicle TAM *Source: James Brehm & Associates; C.J. Driscoll & Associates; and Berg Insight Value Added Solution Oriented Services Full Bundle Solutions Global Base of Connected Telematic Devices Market Opportunities

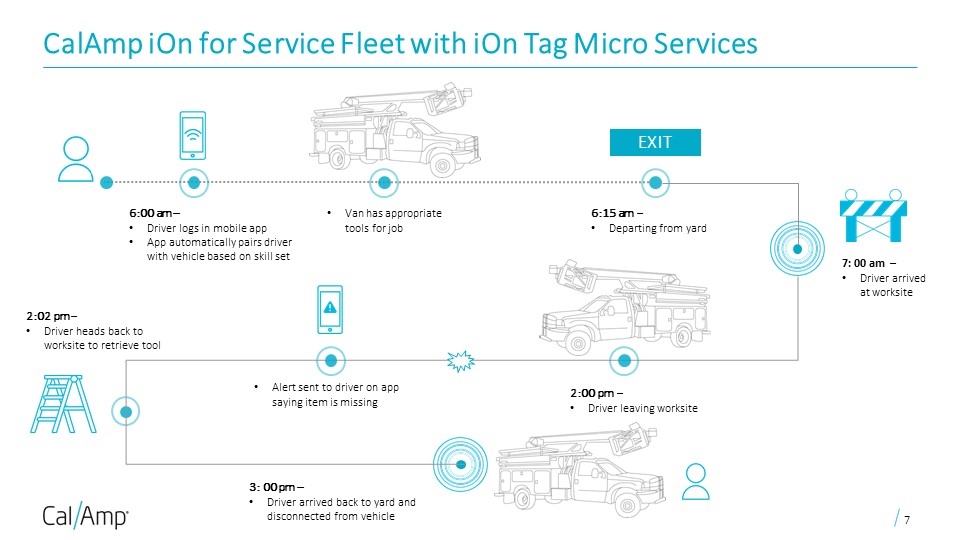

CalAmp iOn for Service Fleet with iOn Tag Micro Services 6:00 am – Driver logs in mobile app App automatically pairs driver with vehicle based on skill set Van has appropriate tools for job 6:15 am – Departing from yard 7: 00 am – Driver arrived at worksite EXIT 2:00 pm – Driver leaving worksite Alert sent to driver on app saying item is missing 3: 00 pm – Driver arrived back to yard and disconnected from vehicle 2:02 pm – Driver heads back to worksite to retrieve tool

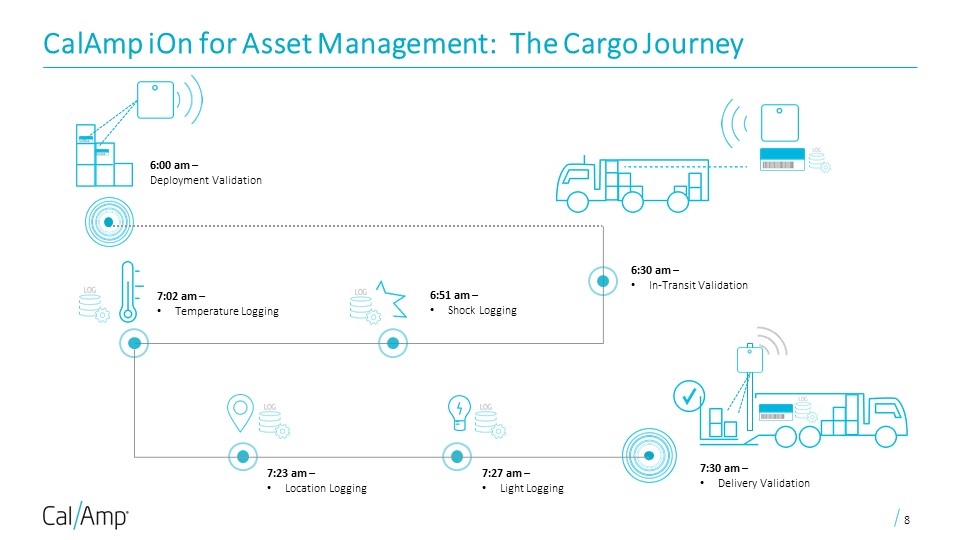

CalAmp iOn for Asset Management: The Cargo Journey 6:30 am – In-Transit Validation 6:00 am – Deployment Validation 6:51 am – Shock Logging 7:02 am – Temperature Logging 7:23 am – Location Logging 7:27 am – Light Logging 7:30 am – Delivery Validation

Telematics Systems Software & Subscription Services Representative Customer Base CalAmp technology – a hub for business critical data and decisions *CalAmp supplies its products, services, and solutions to these representative customers. The trademarks and trade names mentioned are the property of their respective owners.

Strong International Expansion CalAmp presence and International growth opportunities in key markets Revenue U.S. & Canada EMEA Latin America APAC Company HQ Investments for Growth Salesforce Realignment Geo-specific Investment 5-year CAGR 16% FY2019 revenue $95M Driving Strong Results

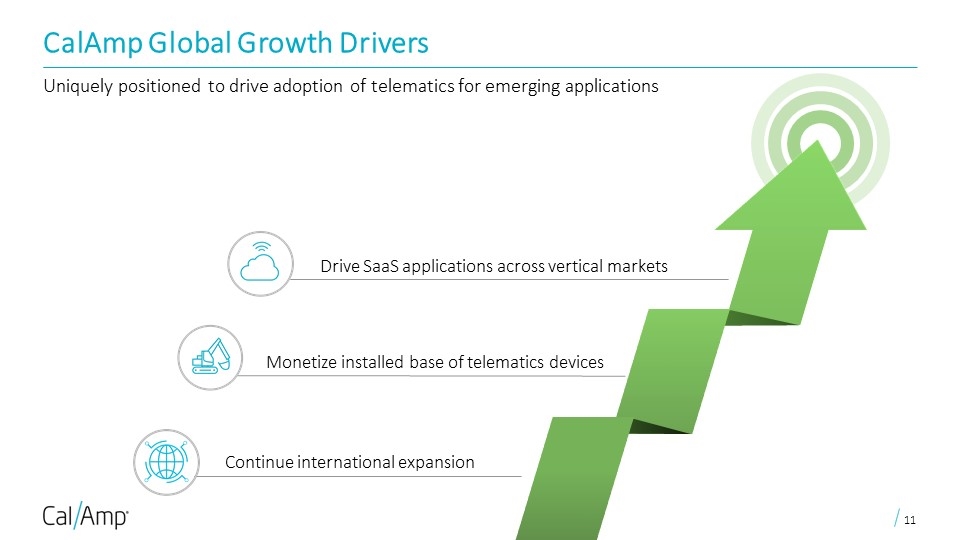

CalAmp Global Growth Drivers Uniquely positioned to drive adoption of telematics for emerging applications Drive SaaS applications across vertical markets Monetize installed base of telematics devices Continue international expansion

Financial Slides

Accelerated SaaS Revenue Growth Growth in Worldwide Subscriber Base Strong Free Cash Flow Generation Path to Margin Expansion Well-Capitalized Balance Sheet 1 2 3 4 5 Financial Highlights

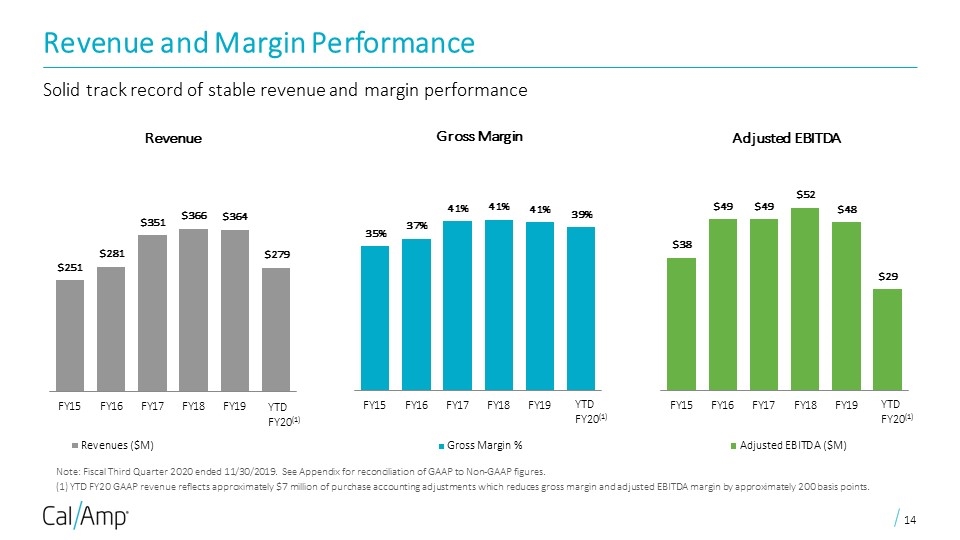

Revenue and Margin Performance Solid track record of stable revenue and margin performance Note: Fiscal Third Quarter 2020 ended 11/30/2019. See Appendix for reconciliation of GAAP to Non-GAAP figures. (1) YTD FY20 GAAP revenue reflects approximately $7 million of purchase accounting adjustments which reduces gross margin and adjusted EBITDA margin by approximately 200 basis points. Revenue Gross Margin Adjusted EBITDA

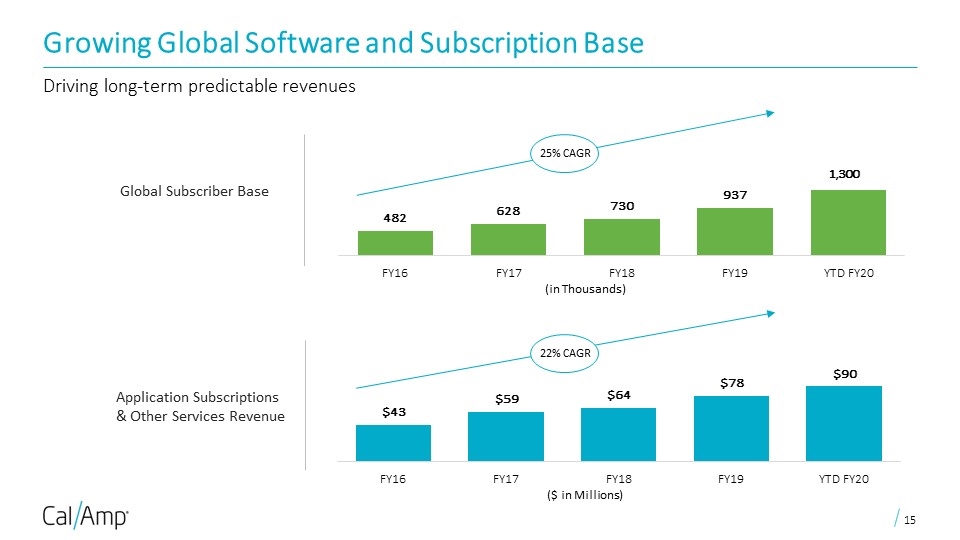

Growing Global Software and Subscription Base Driving long-term predictable revenues Application Subscriptions & Other Services Revenue Global Subscriber Base ($ in Millions) (in Thousands) 25% CAGR 22% CAGR

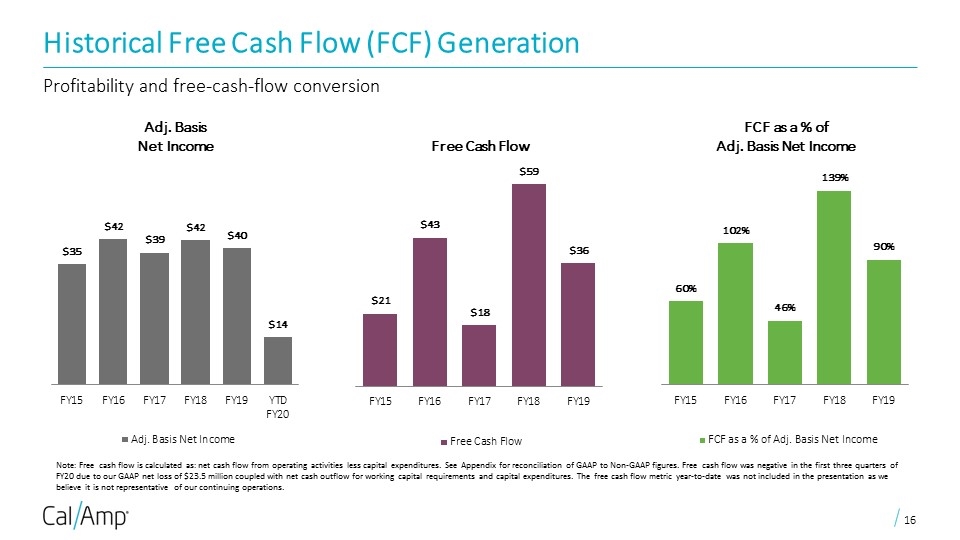

Historical Free Cash Flow (FCF) Generation Profitability and free-cash-flow conversion Note: Free cash flow is calculated as: net cash flow from operating activities less capital expenditures. See Appendix for reconciliation of GAAP to Non-GAAP figures. Free cash flow was negative in the first three quarters of FY20 due to our GAAP net loss of $23.5 million coupled with net cash outflow for working capital requirements and capital expenditures. The free cash flow metric year-to-date was not included in the presentation as we believe it is not representative of our continuing operations. Adj. Basis Net Income Free Cash Flow FCF as a % of Adj. Basis Net Income

Appendix

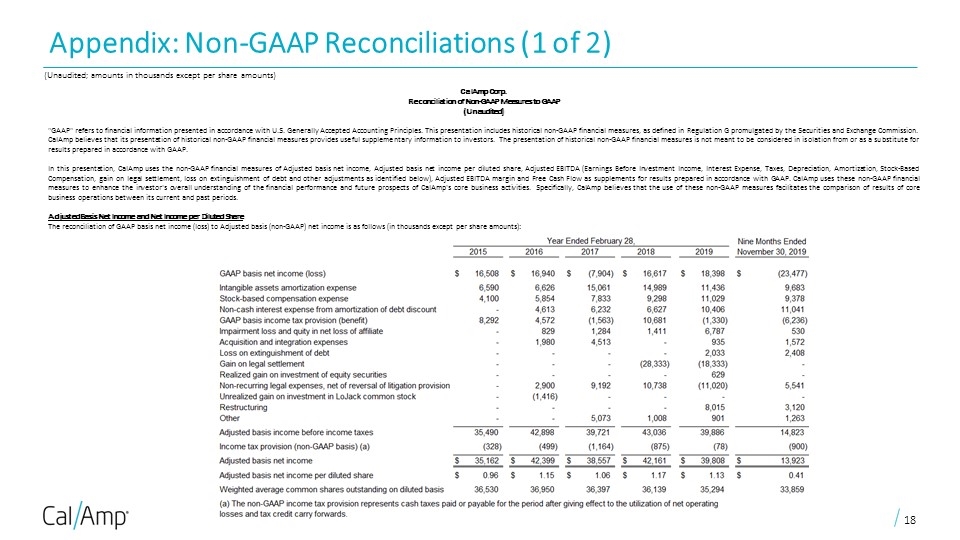

Appendix: Non-GAAP Reconciliations (1 of 2) (Unaudited; amounts in thousands except per share amounts) CalAmp Corp. Reconciliation of Non-GAAP Measures to GAAP (Unaudited) "GAAP" refers to financial information presented in accordance with U.S. Generally Accepted Accounting Principles. This presentation includes historical non-GAAP financial measures, as defined in Regulation G promulgated by the Securities and Exchange Commission. CalAmp believes that its presentation of historical non-GAAP financial measures provides useful supplementary information to investors. The presentation of historical non-GAAP financial measures is not meant to be considered in isolation from or as a substitute for results prepared in accordance with GAAP. In this presentation, CalAmp uses the non-GAAP financial measures of Adjusted basis net income, Adjusted basis net income per diluted share, Adjusted EBITDA (Earnings Before Investment Income, Interest Expense, Taxes, Depreciation, Amortization, Stock-Based Compensation, gain on legal settlement, loss on extinguishment of debt and other adjustments as identified below), Adjusted EBITDA margin and Free Cash Flow as supplements for results prepared in accordance with GAAP. CalAmp uses these non-GAAP financial measures to enhance the investor's overall understanding of the financial performance and future prospects of CalAmp's core business activities. Specifically, CalAmp believes that the use of these non-GAAP measures facilitates the comparison of results of core business operations between its current and past periods. Adjusted Basis Net Income and Net Income per Diluted Share The reconciliation of GAAP basis net income (loss) to Adjusted basis (non-GAAP) net income is as follows (in thousands except per share amounts):

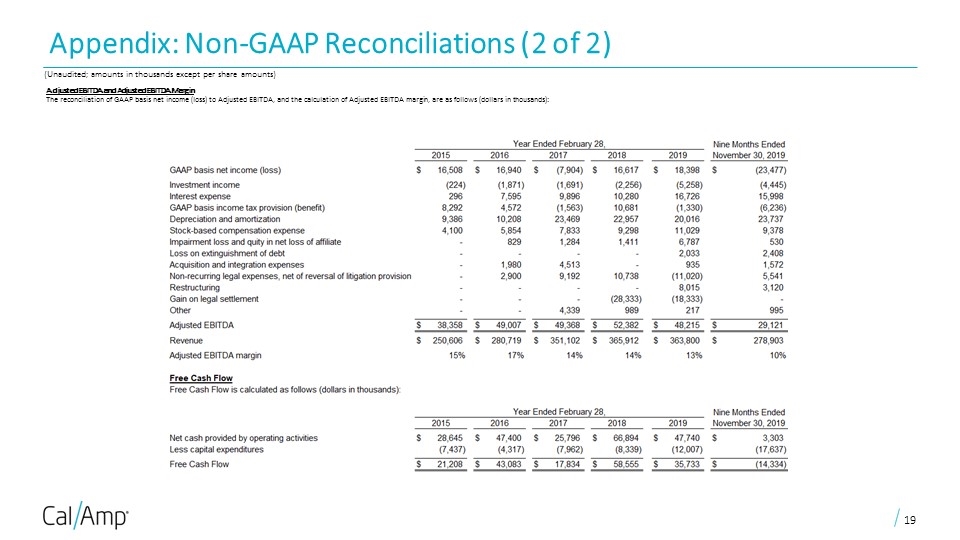

(Unaudited; amounts in thousands except per share amounts) Appendix: Non-GAAP Reconciliations (2 of 2) Adjusted EBITDA and Adjusted EBITDA Margin The reconciliation of GAAP basis net income (loss) to Adjusted EBITDA, and the calculation of Adjusted EBITDA margin, are as follows (dollars in thousands):

Business Cases

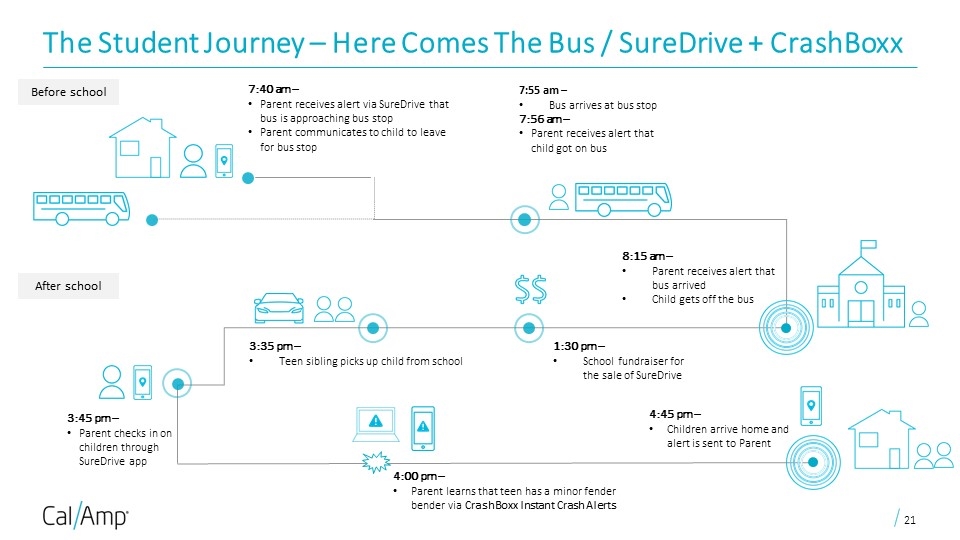

The Student Journey – Here Comes The Bus / SureDrive + CrashBoxx 7:40 am – Parent receives alert via SureDrive that bus is approaching bus stop Parent communicates to child to leave for bus stop 7:55 am – Bus arrives at bus stop 7:56 am – Parent receives alert that child got on bus 8:15 am – Parent receives alert that bus arrived Child gets off the bus After school Before school 3:45 pm – Parent checks in on children through SureDrive app 3:35 pm – Teen sibling picks up child from school 4:00 pm – Parent learns that teen has a minor fender bender via CrashBoxx Instant Crash Alerts 4:45 pm – Children arrive home and alert is sent to Parent 1:30 pm – School fundraiser for the sale of SureDrive

Case Study Challenge A major logistics company was struggling to find and provide status updates for each one of their trailers to optimize integration for their delivery service. It required significant amounts of staff to scour depots nationwide to continuously capture utilization data Solution CalAmp’s asset telematics solution was selected to help streamline the management of thousands of trailers, providing location and other data to the CalAmp Telematics Cloud for reporting and notification alerts. CalAmp’s TTU devices were installed on the trailers in a weekly rotation Results The company has benefited from real-time information, while reducing manual labor. They are now better able to schedule the trailers based on location and reduce idle time. The data helps them right-size their fleet and optimize utilization

Case Study Challenge A major insurance company was seeking to improve the manual processes of managing accident reporting by drivers and vehicle damage for almost 1,000 company taxis. Since drivers are liable for damages, the incidence rate of false reports filed was very high Solution LMU-3050 telematics devices were installed on the taxis for a controlled pilot. The accident data was transmitted to two accident management systems, CalAmp’s CrashBoxx™ and an alternate solution Results 1,000 connected taxis CrashBoxx detected all crash incidents within 90 seconds of impact. In comparison, the alternate system registered less than half of the crashes CrashBoxx identified 6 accidents that were not called in to dispatch Our solution provided more location aware data than the driver could iterate

Thank You