Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - NORWOOD FINANCIAL CORP | d763208dex992.htm |

| EX-2.1 - EX-2.1 - NORWOOD FINANCIAL CORP | d763208dex21.htm |

| 8-K - 8-K - NORWOOD FINANCIAL CORP | d763208d8k.htm |

Norwood Financial Corp. Merger With UpState New York Bancorp, Inc. January 9, 2020 Transaction Summary Exhibit 99.1

Forward Looking Statements & Disclaimers Statements contained in this presentation that are not historical facts are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, possible delays in completing the merger, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected time frame, customer and employee relationships may be disrupted by the merger, the ability to obtain regulatory and shareholder approvals, and difficulties in integrating USNY Bank into Wayne Bank, as well as factors discussed in documents filed by Norwood Financial Corp. (“Norwood”) with the Securities and Exchange Commission (SEC) from time to time. Neither Norwood Financial Corp. nor UpState New York Bancorp, Inc. (“UpState”) undertakes and both specifically disclaim any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of Norwood Financial Corp. or UpState New York Bancorp, Inc. Important Information About the Transaction Norwood Financial Corp. will file a Registration Statement on Form S-4 with the SEC, , which will contain the proxy materials of Norwood and UpState and certain other information regarding Norwood. These proxy materials will set forth complete details of the merger. Investors are urged to carefully read the proxy materials when filed with the SEC, as they will contain important information. Investors will be able to obtain a free copy of the proxy materials free of charge at the SEC's website at www.sec.gov. The materials may also be accessed for free on Norwood's website at www.waynebank.com/stockholder-services or by directing a written request to UpState New York Bancorp, Inc., 389 Hamilton Street, Geneva, New York 14456, Attention: Corporate Secretary. Investors should read the proxy materials before making a decision regarding the merger. This Presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. Investors and shareholders of Norwood and UpState are urged to read, when available, the Registration Statement on Form S-4, the joint proxy statement/prospectus to be included within the Registration Statement and any other relevant documents filed or to be filed with the SEC in connection with the proposed transaction, as well as any amendments or supplements to those documents, because they will contain important information about Norwood, UpState and the proposed transaction. Participants in the Solicitation Norwood, UpState and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Norwood’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 22, 2019, and certain of its Current Reports on Form 8-K. UpSstate’s directors and executive officers who may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction are R. Michael Briggs, Robert W. Sollenne, Scott D. White, Jeffrey E. Franklin, H. Todd Bullard, H. Taylor Fitch III, Jeffrey S. Gifford, Jeffrey K. Haggerty, Murray P. Heaton, J. Michael Moffat, Alexandra K. Nolan and Steven C. Smith. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described above.

Transaction Highlights and Rationale (*) Annual returns between year ended December 31, 2010 through December 31, 2018 and latest twelve months ended September 30, 2019 Propels Norwood to $1.7 Billion in Assets $440 million of assets, four branch partner in UpState New York Bancorp, Inc. $1.7 billion in proforma consolidated assets 31 branches Cultural Fit with a Strong Performing Partner UpState New York Bancorp, Inc. 10 year average return on average assets of 1.48%* Efficient operator that has made necessary investments to support growth Further Compliment to the Norwood New York State Franchise Material addition to the Norwood deposit and loan franchises in New York state Will further utilize Wayne Bank deposit generation from Sullivan and Delaware Counties in New York state Strong Increase in Norwood Earnings per Share Approximately 18% accretive to EPS in first full year of consolidated operations

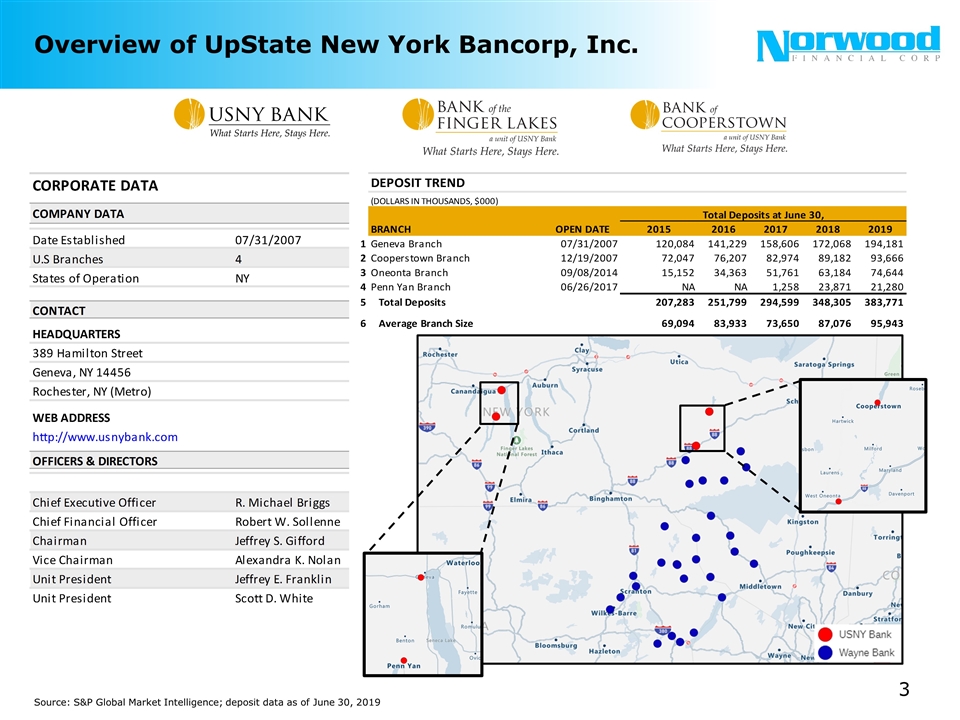

Overview of UpState New York Bancorp, Inc. Source: S&P Global Market Intelligence; deposit data as of June 30, 2019

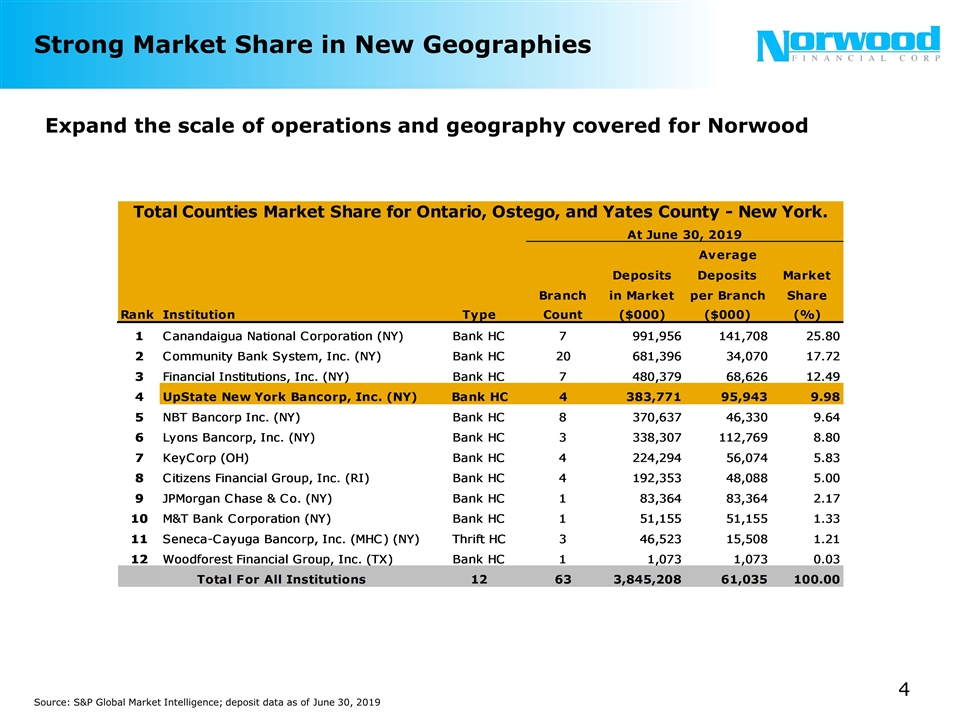

Strong Market Share in New Geographies Expand the scale of operations and geography covered for Norwood Source: S&P Global Market Intelligence; deposit data as of June 30, 2019

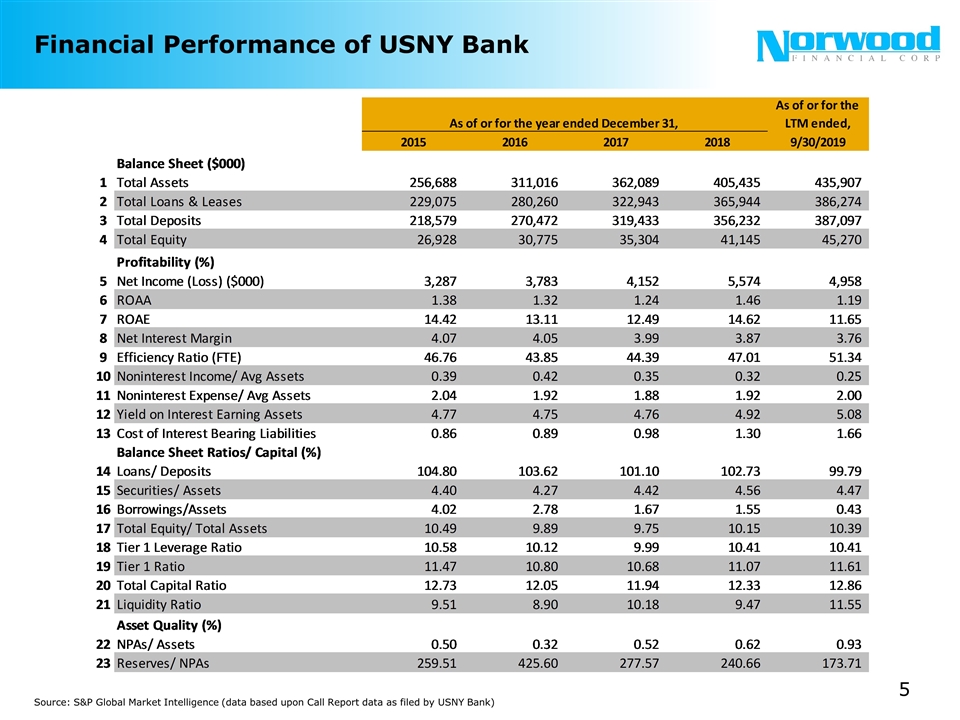

Financial Performance of USNY Bank Source: S&P Global Market Intelligence (data based upon Call Report data as filed by USNY Bank)

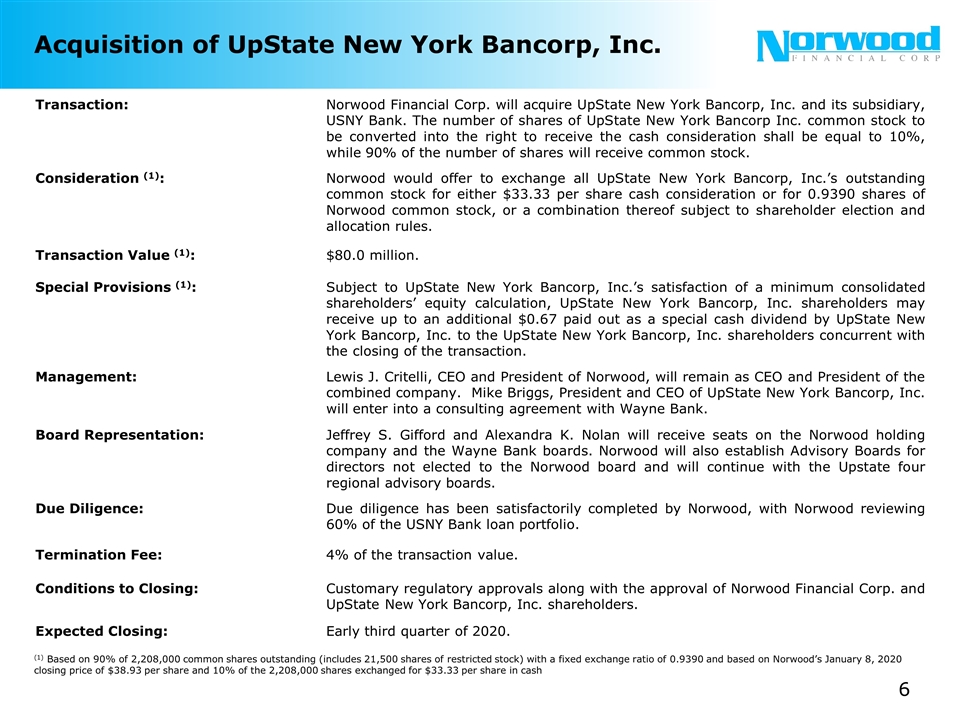

Acquisition of UpState New York Bancorp, Inc. Transaction: Norwood Financial Corp. will acquire UpState New York Bancorp, Inc. and its subsidiary, USNY Bank. The number of shares of UpState New York Bancorp Inc. common stock to be converted into the right to receive the cash consideration shall be equal to 10%, while 90% of the number of shares will receive common stock. Consideration (1): Norwood would offer to exchange all UpState New York Bancorp, Inc.’s outstanding common stock for either $33.33 per share cash consideration or for 0.9390 shares of Norwood common stock, or a combination thereof subject to shareholder election and allocation rules. Transaction Value (1): $80.0 million. Special Provisions (1): Subject to UpState New York Bancorp, Inc.’s satisfaction of a minimum consolidated shareholders’ equity calculation, UpState New York Bancorp, Inc. shareholders may receive up to an additional $0.67 paid out as a special cash dividend by UpState New York Bancorp, Inc. to the UpState New York Bancorp, Inc. shareholders concurrent with the closing of the transaction. Management: Lewis J. Critelli, CEO and President of Norwood, will remain as CEO and President of the combined company. Mike Briggs, President and CEO of UpState New York Bancorp, Inc. will enter into a consulting agreement with Wayne Bank. Board Representation: Jeffrey S. Gifford and Alexandra K. Nolan will receive seats on the Norwood holding company and the Wayne Bank boards. Norwood will also establish Advisory Boards for directors not elected to the Norwood board and will continue with the Upstate four regional advisory boards. Due Diligence: Due diligence has been satisfactorily completed by Norwood, with Norwood reviewing 60% of the USNY Bank loan portfolio. Termination Fee: 4% of the transaction value. Conditions to Closing: Customary regulatory approvals along with the approval of Norwood Financial Corp. and UpState New York Bancorp, Inc. shareholders. Expected Closing: Early third quarter of 2020. (1) Based on 90% of 2,208,000 common shares outstanding (includes 21,500 shares of restricted stock) with a fixed exchange ratio of 0.9390 and based on Norwood’s January 8, 2020 closing price of $38.93 per share and 10% of the 2,208,000 shares exchanged for $33.33 per share in cash

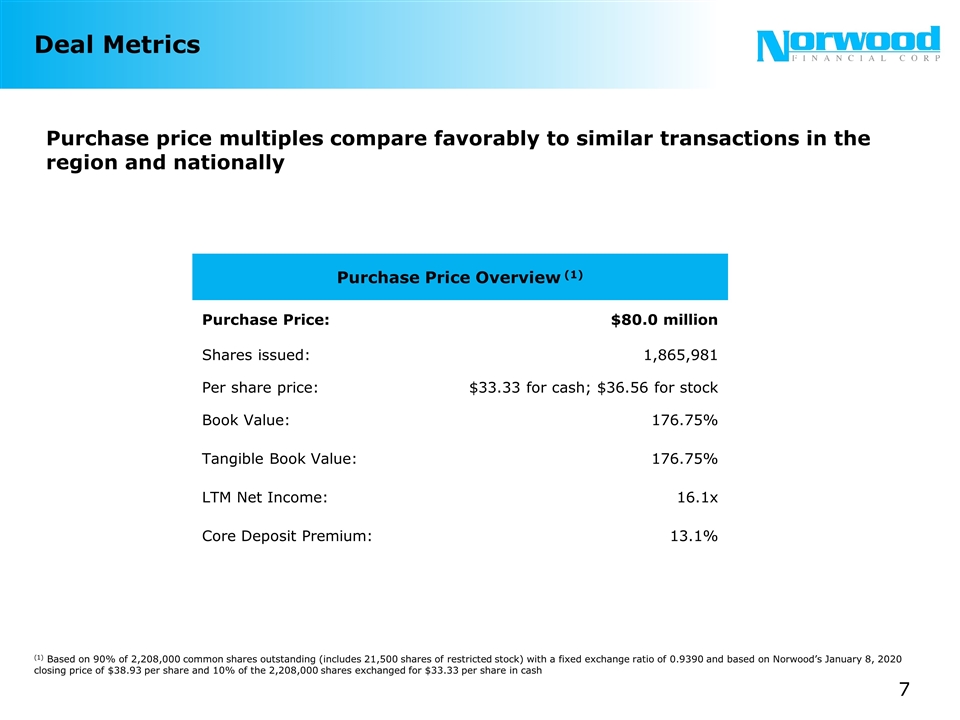

Deal Metrics (1) Based on 90% of 2,208,000 common shares outstanding (includes 21,500 shares of restricted stock) with a fixed exchange ratio of 0.9390 and based on Norwood’s January 8, 2020 closing price of $38.93 per share and 10% of the 2,208,000 shares exchanged for $33.33 per share in cash Purchase price multiples compare favorably to similar transactions in the region and nationally Purchase Price Overview (1) Purchase Price: $80.0 million Shares issued: 1,865,981 Per share price: $33.33 for cash; $36.56 for stock Book Value: 176.75% Tangible Book Value: 176.75% LTM Net Income: 16.1x Core Deposit Premium: 13.1%

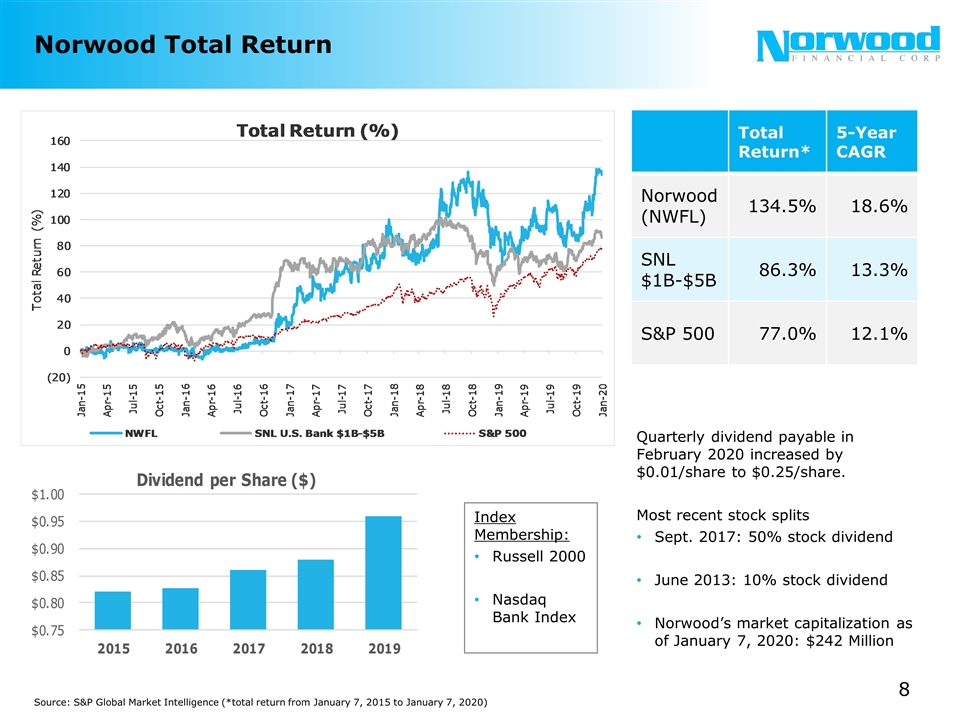

Norwood Total Return Source: S&P Global Market Intelligence (*total return from January 7, 2015 to January 7, 2020) Total Return* 5-Year CAGR Norwood (NWFL) 134.5% 18.6% SNL $1B-$5B 86.3% 13.3% S&P 500 77.0% 12.1% Quarterly dividend payable in February 2020 increased by $0.01/share to $0.25/share. Most recent stock splits Sept. 2017: 50% stock dividend June 2013: 10% stock dividend Norwood’s market capitalization as of January 7, 2020: $242 Million Index Membership: Russell 2000 Nasdaq Bank Index

Transaction Highlights and Rationale (1) Utilizing cross-over method Favorable Financial Transaction Metrics Approximately 18% accretive to Norwood earnings per share in 2021, the first full year of consolidated operations Minimally dilutive to Norwood’s pro forma tangible book value per share (“TBVPS”) with a TBVPS earnback(1) period of approximately 1.8 years Norwood remains well-capitalized post-closing of the transaction Minimal Execution Risk Expiration of core processing contract expected to minimize transitional costs Norwood merger history and integration experience suggest smooth transition Capacity For Cross Selling Ability to introduce wealth management, electronic and mobile banking, cash management and related services to the expanded customer base Further Strengthens Wayne Bank’s New York Franchise Acquires top four deposit market share in new geographies with strong market demographics Continues to leverage the brand names of Bank of Cooperstown and Bank of the Finger Lakes

Stockholders or others seeking information regarding the Company may call or write: Norwood Financial Corp. Investor Relations 717 Main Street Honesdale, Pennsylvania 18431 www.waynebank.com info@waynebank.com Lewis J. Critelli President & Chief Executive Officer (570) 253-8512 William S. Lance Executive Vice President & Chief Financial Officer (570) 253-8505 Transaction Advisors Norwood Financial Corp: The Kafafian Group, Inc. – Financial Advisor Jones Walker LLP (Washington, DC) – Legal Counsel UpState New York Bancorp, Inc: Boenning & Scattergood, Inc.– Financial Advisor Stevens & Lee, P.C. – Legal Counsel More Information