Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | ex991192020.htm |

| EX-10.1 - EXHIBIT 10.1 - AMAG PHARMACEUTICALS, INC. | ex101.htm |

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | amag8-k1920.htm |

AMAG Pharmaceuticals JP Morgan 38th Healthcare Conference January 2020 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 1

Forward-Looking Statements This presentation contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, 2019 preliminary fourth quarter and full year financial results, including revenues, operating loss and adjusted EBITDA; expectations related to the time to complete a CEO search and that Mr. Heiden will remain in his role until a successor is found; plans to divest Vyleesi and Intrarosa and beliefs about such products; plans to reduce operating expenses; beliefs that a streamlined portfolio and infrastructure will position AMAG for near- and long-term profitability; AMAG’s expectations that Feraheme will continue to grow and provide positive cash flow to fund its development programs; expectations that Makena will be cash flow positive in 2020; 2020 financial guidance, including forecasted GAAP operating income and positive adjusted EBITDA and the related assumptions used to determine the guidance ranges, including the various potential regulatory outcomes for Makena and the treatment of Vyleesi and Intrarosa as discontinued operations; AMAG’s expectations for its product and product candidate portfolio, including beliefs about the assumptions regarding market share and commercial potential of AMAG’s key commercial products and commercial potential of its key product candidates; plans to continue to invest in late-stage development programs and the results thereof; beliefs about the behaviors of patients and prescribers of 17P and the associated risks; beliefs about the NOAC market and that ciraparantag’s characteristics may make it the ideal reversal agent; beliefs regarding WBCT and plans for the automated coagulometer; expectations that there is a strong scientific rationale for AMAG-423; beliefs that AMAG will be able to work collaboratively with the FDA on a path forward that would allow for continued patient access to Makena; the anticipated regulatory and clinical trial timelines for ciraparantag; AMAG’s expectations regarding the potential for ex-U.S. out-licensing and partnership opportunities; and AMAG’s 2020 goals and key areas of focus, including expectations and beliefs regarding (i) AMAG’s ability to successfully achieve benefits from its leadership transition plan, including managing the search for and transition to a new chief executive officer, (ii) AMAG’s ability to successfully divest Intrarosa and Vyleesi and the effect and amount of associated expense reductions; (iii) AMAG’s ability to drive continued Feraheme growth sufficient to support AMAG’s development programs, (iv) AMAG’s ability to ensure continued patient access to Makena and that Makena is cash flow positive in 2020, (v) AMAG’s pipeline, including AMAG-423 and ciraparantag, (vi) AMAG’s ability to successfully out-license its products or product candidates in ex-U.S. territories and (vii) AMAG’s ability to meet or exceed its 2020 financial guidance are forward‐looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward‐looking statements. Such risks and uncertainties include, among others: the risk that AMAG will be unable to successfully divest Intrarosa and Vyleesi or that the effect and amount of expense reductions associated with the planned divestments will be less than anticipated, or that cash expenditures will be greater than anticipated; the risk that the FDA will recommend that Makena be removed from the market, particularly in light of the recommendation of the Advisory Committee of the FDA; the risk that, even if the FDA does not recommend that Makena be removed from the market, sales of Makena will continue to be negatively impacted, including as a result of the recommendation of the Advisory Committee; the risk that AMAG will be unable to successfully achieve the anticipated benefits from its leadership transition plan; the possibility that AMAG will encounter challenges retaining or attracting talent; the risk that AMAG may be unable to gain approval of its product candidates, including AMAG-423 and ciraparantag, on a timely basis, or at all; the potential for such approvals, if obtained, to include unanticipated restrictions or warnings; the risk that the costs and time investments for AMAG’s development efforts will be higher than anticipated; the possibility that AMAG has over-estimated the market and potential revenues for its products and product candidates, if approved, including AMAG-423 and ciraparantag; the risk that Feraheme and Makena will not achieve the level of revenues needed to support AMAG’s development efforts, including because (i) such efforts require greater costs than anticipated, (ii) because approval of any such products is withdrawn, (iii) the FDA takes other adverse action with respect to any such products or (iv) Sandoz Inc. launches a generic version of Feraheme in accordance with the 2018 settlement agreement we entered into with Sandoz; the risk that AMAG will be unable to successfully identify and enter into partnerships with out-licensees for its product candidates in ex-U.S. territories, which could delay the commercialization of those product candidates in certain geographies; the risk that AMAG will not be able to continue to execute on its business plan; the speculative nature of AMAG’s estimates as to market share for its products and potential market share for its product candidates and the risk that such estimates are inaccurate and those risks identified in AMAG’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10‐K for the year ended December 31, 2018, its Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019, and subsequent filings with the SEC, which are available at the SEC’s website at www.sec.gov. Any such risks and uncertainties could materially and adversely affect AMAG’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock price. AMAG cautions you not to place undue reliance on any forward‐looking statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward‐looking statements. AMAG Pharmaceuticals®, the logo and designs, Feraheme® and Vyleesi ® are registered trademarks of AMAG Pharmaceuticals, Inc. Makena® is a registered trademark of AMAG Pharma USA, Inc. Intrarosa® is a registered trademark of Endoceutics, Inc. © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 2

2019 In Review 3

AMAG's 2019 Year In Review Option 4 Completed acquisition of Perosphere Pharmaceuticals and added ciraparantag to development portfolio Grew Feraheme to record revenue of $167M-$169M and achieved Q4 market share of 17.7%1 • IM supply disruptions resulted in removal of both brand and authorized generic Mixed year for Makena • Maintained strong Q4 market share of 63% for subcutaneous auto-injector, but experienced market contraction and price erosion post AdCom meeting 2019 • PROLONG study results and AdCom meeting challenges brand durability YEAR IN REVIEW Steadily grew Intrarosa revenue and market share Gained FDA approval of Vyleesi and commercially launched in September Advanced enrollment in Phase 2b/3a trial for orphan drug candidate AMAG-423 for severe preeclampsia 1) All data is preliminary and unaudited; Feraheme market share is based on IQVIA data and internal analytics. © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 4

2019 Financial Results Preliminary and unaudited ($M) Actual Preliminary Preliminary Guidance 9-months 2019 Q4-2019 FY 2019 FY 2019 Revenue Feraheme $126 $40 - $42 $167- 169 -- Makena 97 24 - 27 120 - 123 -- Intrarosa 15 6.5 21 -- Other product revenue -- (0.5) (1) -- Collaboration revenue1 -- 16 16 -- Total revenue $238 $86 - $91 $323 - $328 $320 - $330 Operating loss2 ($252) ($22) - ($12) ($274) - ($264) ($278) - ($268) Adjusted EBITDA3 ($59) ($10) - $0 ($70) - ($60) ($75) - ($65) 1) Includes the recognition of $16M of collaboration revenue due to the termination and settlement agreement entered into with Daiichi Sankyo, Inc. (DSI) in December 2019 related to a clinical trial collaboration agreement that AMAG acquired as part of the Perosphere acquisition. As part of the settlement, AMAG received $10M in cash from DSI in December 2019. 2) Operating loss does not include the impact of material impairment charges or the associated acceleration of amortization, which are likely to be recognized in the 2019 audited financial statements. 3) See slide 31 for a reconciliation of GAAP to non-GAAP financials. © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 5

Recently Announced News – January 9, 2020 6

Experienced Leadership Team Committed to Realize AMAG’s Potential Leadership Transition William Heiden will step down as • AMAG’s Board of Directors has initiated a search for his successor, which it expects to complete by mid-2020 President and Chief Executive Officer • Mr. Heiden will remain in his role until the appointment of his successor Ted Myles Julie Krop, MD Joseph Vittiglio Chief Financial Officer and General Counsel and Chief Medical Officer Chief Operating Officer Chief Business Officer • Nearly 20 years of executive leadership • More than 20 years experience in clinical • More than 25 years of experience at at several biopharma companies development and regulatory affairs with large law firm and as in-house counsel • Proven financial acumen; retired nearly history of multiple FDA approvals at several biopharma companies $1B in debt at AMAG • Experience across multiple therapeutic • Experience in complex biopharma • Deep operational and capital markets areas for both biologics and small licensing / collaborations and M&A expertise molecules • Deep legal, compliance and operational • Board certified internal medicine and expertise endocrinology and former Robert Wood Johnson Clinical Scholar Tony Casciano Kelly Schick Chief Commercial Officer Chief Human Resources Officer • 20 years experience in sales and marketing • More than 15 years of human resource across a range of therapeutic areas experience in pharmaceutical industry • Successful drug launches across multiple • Led large organization transformation and therapeutic areas change • Strategic planning and implementation • Expertise in talent management, building process of mature brands, line extensions strong corporate culture and driving and portfolio maximization in global organizational engagement organization © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 7

Current Portfolio Valuable but Requires Extensive Resources PHYSICIAN/CONSUMER(DTC) PHYSICIAN DRIVEN DRIVEN Hematology Maternal Health Women’s Health COMMERCIAL Divest PIPELINE Ciraparantag AMAG-423 Divest Vyleesi and Intrarosa Completed strategic review of product portfolio • Vyleesi launch is off to a strong start and strategy to unlock shareholder value and return to positive adjusted EBITDA in 2020 • Intrarosa continues to grow steadily • Received preliminary expressions of interest to acquire/sub-license the rights to these products © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 8

Streamlined Portfolio and Infrastructure Positions AMAG for Near- and Long-term Profitability PHYSICIAN DRIVEN PORTFOLIO Hematology Maternal Health SNAPSHOT 2020 COMMERCIAL PIPELINE Ciraparantag AMAG-423 Feraheme • Provides continued growth and positive cash flow ‒ Sufficient to fund pipeline assets Focus on • Exploring new opportunities for future growth Core Value Makena Drivers • Risk profile heightened with PROLONG study results and FDA AdCom meeting ‒ Soft Q4-2019 results inform view of 2020 ‒ Proactively managing product to be cash-flow positive Development Assets • Continue to invest in late-stage development programs with opportunities to address significant unmet medical needs ‒ Development assets provide opportunity for next chapter of long-term revenue growth © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 9

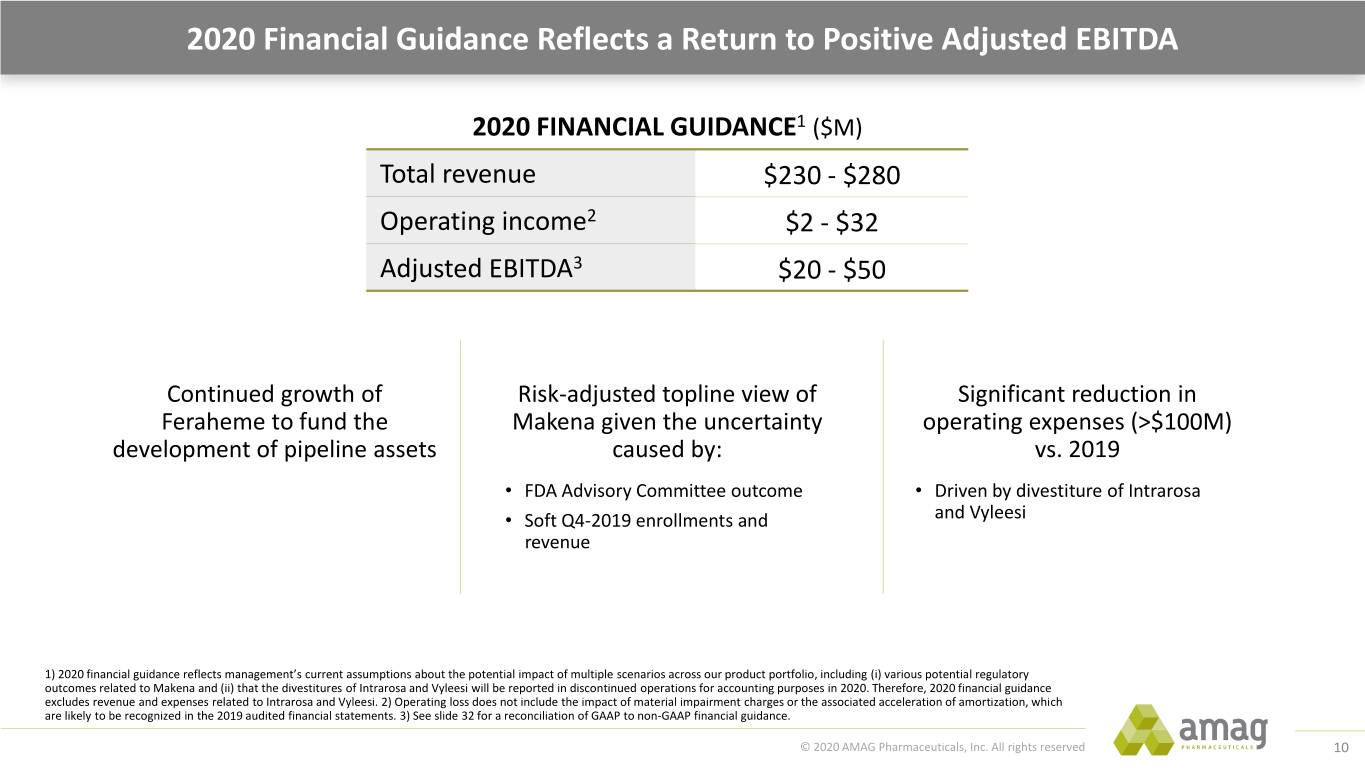

2020 Financial Guidance Reflects a Return to Positive Adjusted EBITDA 2020 FINANCIAL GUIDANCE1 ($M) Total revenue $230 - $280 Operating income2 $2 - $32 Adjusted EBITDA3 $20 - $50 Continued growth of Risk-adjusted topline view of Significant reduction in Feraheme to fund the Makena given the uncertainty operating expenses (>$100M) development of pipeline assets caused by: vs. 2019 • FDA Advisory Committee outcome • Driven by divestiture of Intrarosa • Soft Q4-2019 enrollments and and Vyleesi revenue 1) 2020 financial guidance reflects management’s current assumptions about the potential impact of multiple scenarios across our product portfolio, including (i) various potential regulatory outcomes related to Makena and (ii) that the divestitures of Intrarosa and Vyleesi will be reported in discontinued operations for accounting purposes in 2020. Therefore, 2020 financial guidance excludes revenue and expenses related to Intrarosa and Vyleesi. 2) Operating loss does not include the impact of material impairment charges or the associated acceleration of amortization, which are likely to be recognized in the 2019 audited financial statements. 3) See slide 32 for a reconciliation of GAAP to non-GAAP financial guidance. © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 10

Core Value Drivers: 2020 and Beyond 11

Feraheme® (ferumoxytol injection) 12

Continued Strong Feraheme Performance1 $200 Consistent Revenue Growth $100 Revenue ($M) $0 2017 2018 2019 • Build on strong performance of past years, including record annual 2019 revenues 300,000 − Performance-based contracting drives volume, Consistent with stable price Volume 200,000 Growth 100,000 • Strong IV iron market growth Ex-factory Grams 0 • 2017 2018 2019 Feraheme to fund development of pipeline assets • Exploring new opportunities for future growth Growing 20% Market 15% Share2 10% Avg. Market Share 5% 0% 2017 2018 2019 1) Data is preliminary. FERAHEME © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 13

Makena® (hydroxyprogesterone caproate injection) 14

Preterm Birth is a Significant Public Health Issue in the U.S. MEIS TRIAL PROLONG TRIAL Conducted in U.S. patient population Conducted primarily in non-U.S. which had a high rate of preterm birth patient population Demonstrated a Did not show a reduction in preterm birth rates 30% reduction Lower risk patient population with significantly in preterm birth rates lower preterm birth rates than Meis trial (in both the treatment and placebo arms) Confirmed strong safety profile of Makena ACOG and SMFM reiterated continued support (post-PROLONG) for the use of Makena in at-risk pregnant women Today, Makena (and generic 17P1) If Makena is no longer available, AMAG is committed to working is the only FDA-approved therapy those committed to the use of 17P collaboratively with the FDA on a to reduce the risk of preterm birth would likely seek compounded path forward that could allow at- drug, which could create a risk pregnant women to continue potential safety risk to have access to Makena 1) Hydroxyprogesterone caproate injection MAKENA © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 15

Managing Makena to Remain Cash Flow Positive in 2020 Subcutaneous Auto-injector • Well established in the marketplace ‒ Entered 2020 with a strong market share for subcutaneous auto-injector of 63% • Uncertainty surrounding Makena’s future following AdCom meeting ‒ AdCom meeting outcome negatively impacted Makena Care Connection enrollments and prescriptions in Q4 ‒ Focused on working with FDA to maintain patient access • Proactively managing Makena to be cash flow positive in 2020 MAKENA © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 16

Development Pipeline Ciraparantag 17

Novel Oral Anticoagulant (NOAC) Use Growing Improved reversal agents could lead to even broader NOAC use Anticoagulants (often referred to as blood thinners) reduce the ability of the blood to form clots • Prevention of stroke in patients with nonvalvular atrial fibrillation • Prevention and treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE) 2010 Introduction of NOACs Xarelto® (rivaroxaban) | Eliquis® (apixaban) | Savaysa® (edoxaban) | Pradaxa® (dabigatran) • October 2018 approval of expanded label for Xarelto® to reduce the risk of major cardiovascular Anticipate broader events in patients with chronic coronary artery disease or peripheral artery disease future use of NOACs • American Heart Association 2019 guidelines recommend use of NOACs over warfarin in majority of patients with atrial fibrillation1 1) January CT, et al. 2019 Focused Update on Atrial Fibrillation. 2019 AHA/ACC/HRS Focused Update of the 2014 AHA/ACC/HRS Guideline for the Management of Patients With Atrial Fibrillation. A Report of the American College of Cardiology/American Heart Association Task Force on Clinical Practice Guidelines and the Heart Rhythm Society. CIRAPARANTAG © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 18

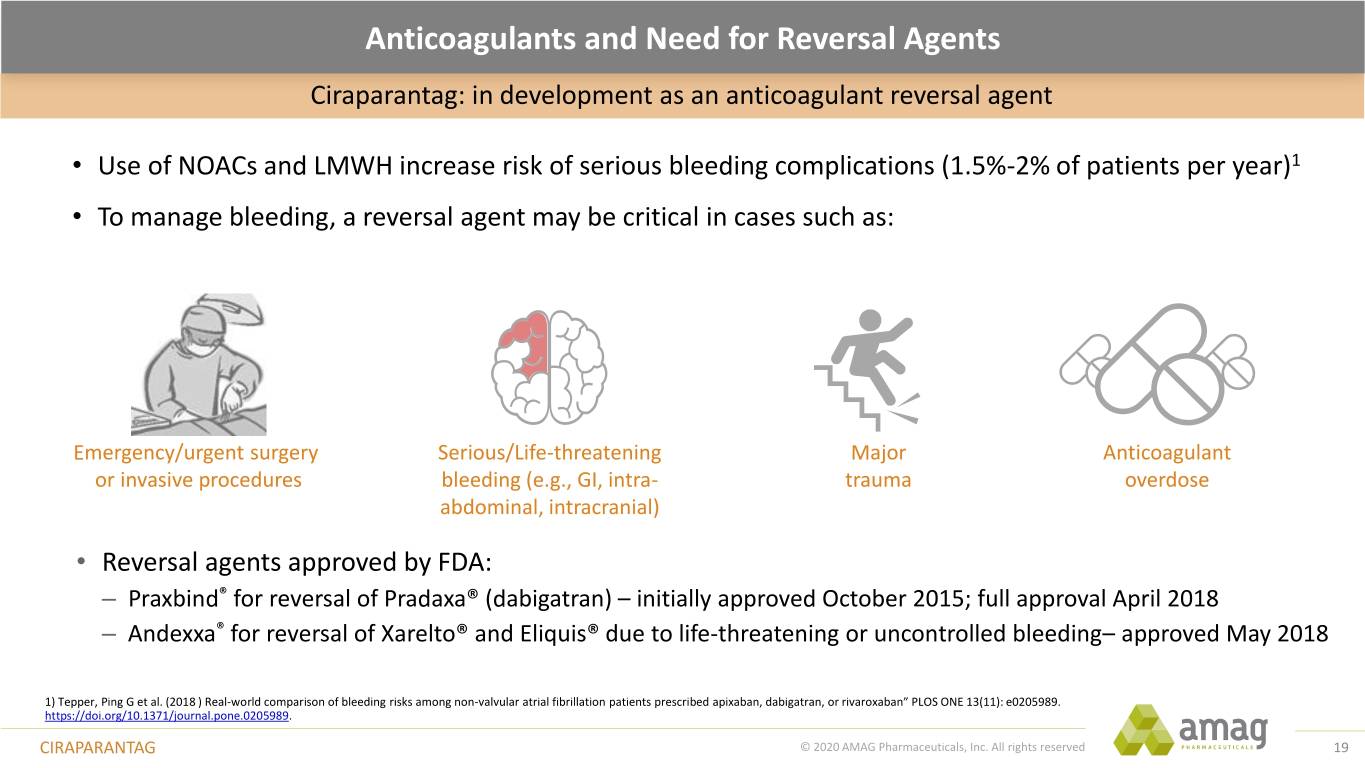

Anticoagulants and Need for Reversal Agents Ciraparantag: in development as an anticoagulant reversal agent • Use of NOACs and LMWH increase risk of serious bleeding complications (1.5%-2% of patients per year)1 • To manage bleeding, a reversal agent may be critical in cases such as: Emergency/urgent surgery Serious/Life-threatening Major Anticoagulant or invasive procedures bleeding (e.g., GI, intra- trauma overdose abdominal, intracranial) • Reversal agents approved by FDA: – Praxbind® for reversal of Pradaxa® (dabigatran) – initially approved October 2015; full approval April 2018 – Andexxa® for reversal of Xarelto® and Eliquis® due to life-threatening or uncontrolled bleeding– approved May 2018 1) Tepper, Ping G et al. (2018 ) Real-world comparison of bleeding risks among non-valvular atrial fibrillation patients prescribed apixaban, dabigatran, or rivaroxaban” PLOS ONE 13(11): e0205989. https://doi.org/10.1371/journal.pone.0205989. CIRAPARANTAG © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 19

Large Unmet Medical Need with Significant Global Commercial Potential Large unmet medical need • Opportunity to provide an improved reversal agent to NOACs Numerous characteristics suggest U.S. market opportunity ciraparantag may offer a more optimal reversal agent 2 • Ready to use ~6 Million ~150,000 • Potential for a fixed dose for all Xa inhibitors Patients on NOAC / LMWH patients • Demonstrates sustained effect over 24 hours after NOAC / LMWH therapy1 per year requiring a one IV dose reversal agent ‒ Opportunity to include patients requiring emergent surgery • No prothrombotic signal to date Potential ex-U.S. partnership opportunities Every 1% of patients requiring reversal treatment = $36M3 / Year 1) Perosphere sponsored commercial assessment report conducted by a third party in May 2016. 2) AMAG estimate based on the following: (i) Zhu J., Alexander GC, et al. Pharmacotherapy 2018 September; 38(9): 907-920. (ii) Sindet-Pedersen C, et al. European Heart Journal - Cardiovascular Pharmacotherapy (2018) 4, 220–227. (iii) Garcia D, Alexander JH, et al. Blood 2014 124: 3692-3698. (iv) www.aha-org/statistics/fast-facts-us-hospitals. (v) Balakrishna, P, et al. Blood 2017 130:5585. (vi) www.cdc.gov/dhdsp/data_statistics/fact_sheets/fs_atrial_fibrillation.hem. 3 Illustrative of commercial opportunity for overall NOAC/LMWH market. Price reference: The currently approved reversal agent (coagulation factor Xa recombinant, inactivated-zhzo) price of ~$24,000. CIRAPARANTAG © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 20

Phase 2b Study of Ciraparantag: Reversal of Xarelto® Rapid and sustained reversal of NOACs in healthy volunteer study Mean Whole Blood Clotting Time (WBCT) by Timepoint Individual Responder Analysis (n=12 per dose) Ciraparantag or placebo dose 1 100.0% 40% Placebo 100% Baseline +3 days of Ciraparantag 60 mg dosing Ciraparantag 120 mg 80% 30% with Ciraparantag 180 mg 66.7% Xarelto® 58.3% 60% 20% 40% % of % Subjects of 10% 20% WBCT % of Normal BaselineWBCT % Normalof 0.0% 0% 0% Baseline Day 3 0.25 0.5 0.75 1 2 4 6 8 24 *WBCT reversed to within 10% of Hours Post Dose -10% baseline within 30 minutes and sustained for 24 hours 1) Doses previously presented as ciraparantag acetate doses: 300 mg acetate = 180 mg; 200 mg acetate = 120 mg; 100 mg acetate = 60 mg. CIRAPARANTAG © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 21

Whole Blood Clotting Time (WBCT) is a Good Measure of Anticoagulation • WBCT is a measure of the time it takes for blood to clot – clinically relevant physiologic outcome Perosphere Technologies’ broad spectrum 1 – WBCT is currently evaluated manually Point-of-Care coagulometer – Anticoagulant activity (and reversal) is best measured by WBCT – WBCT (manually measured) was the clinical endpoint measured in the Phase 2b clinical trials • Perosphere Technologies has developed an automated coagulometer to measure WBCT at the bedside, with results within minutes1 – Progressing through validation for submission of Investigative Device Exemption (IDE) for FDA approval – AMAG plans to utilize the automated coagulometer in its clinical development program – Once IDE is approved, plan to conduct small healthy volunteer study with automated coagulometer, then schedule end-of-Phase 2 meeting with FDA to review Phase 3 study design 1) AMAG entered into an agreement with Perosphere Technologies related to the development and clinical supply of the automated coagulometer, which the company plans to utilize in the Phase 3 clinical program. CIRAPARANTAG © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 22

AMAG-423 23

Severe Preeclampsia: Significant Unmet Medical Need Globally AMAG-423 (Digoxin Immune Fab: DIF) in development for the treatment of severe preeclampsia Preeclampsia is the Maternal morbidity Adverse neonatal leading cause of: and mortality outcomes No effective treatments FDA granted AMAG-423 Significant $2.2 billion for preeclampsia orphan status annual burden to U.S. (7-years exclusivity 1 Only “treatment” is delivery of healthcare system the baby, often times very expected at approval) preterm and fast track review 1) Stevens W et al, Short-term costs of preeclampsia to the U.S. health care system. American Journal of Obstetrics & Gynecology. September 2017, Volume 217, Issue 3, pp237- 248.e16 . AMAG-423 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 24

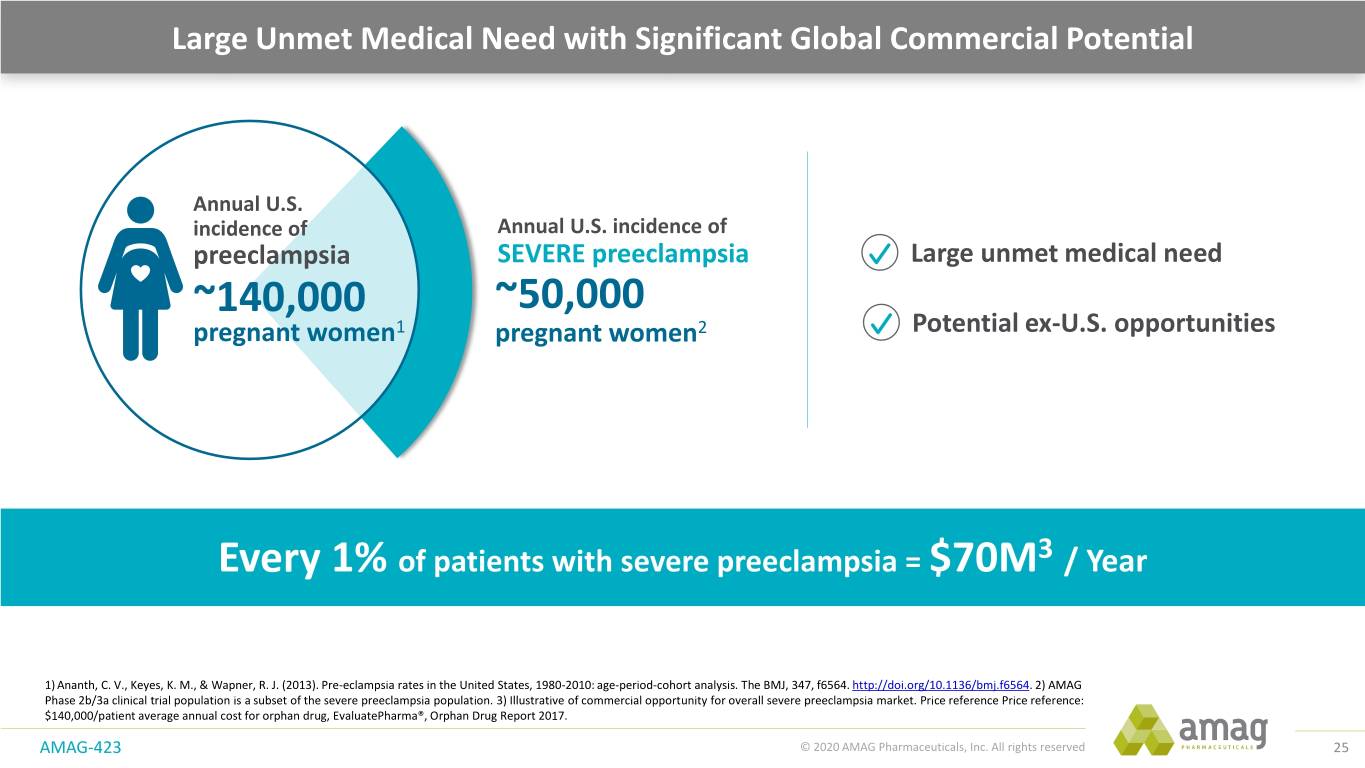

Large Unmet Medical Need with Significant Global Commercial Potential Annual U.S. incidence of Annual U.S. incidence of preeclampsia SEVERE preeclampsia Large unmet medical need ~140,000 ~50,000 pregnant women1 pregnant women2 Potential ex-U.S. opportunities Every 1% of patients with severe preeclampsia = $70M3 / Year 1) Ananth, C. V., Keyes, K. M., & Wapner, R. J. (2013). Pre-eclampsia rates in the United States, 1980-2010: age-period-cohort analysis. The BMJ, 347, f6564. http://doi.org/10.1136/bmj.f6564. 2) AMAG Phase 2b/3a clinical trial population is a subset of the severe preeclampsia population. 3) Illustrative of commercial opportunity for overall severe preeclampsia market. Price reference Price reference: $140,000/patient average annual cost for orphan drug, EvaluatePharma®, Orphan Drug Report 2017. AMAG-423 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 25

Strong Scientific Rationale for AMAG-423 Reverses effect of EDLFs on sodium pump activity MECHANISM OF ACTION • Endogenous digitalis-like factors (EDLFs) are 30 DEEP Trial4: Sodium Pump Activity circulating inhibitors of the Na+ K+ ATPase pump 25 (Surrogate for EDLF Activity) (“sodium pump”) and when elevated can lead to vasoconstriction, elevated blood pressure, and 20 1 15 decreased blood flow n=19 n=15 10 n=21 n=22 • Elevations in EDLFs have been implicated in a 5 n=20 n=12 n=21 number of diseases including hypertension and 0 1 n=19 preeclampsia -5 % Change from baseline from Change % -10 p=0.05 p=0.10 p=0.07 • DIF binds to and reverses effects of EDLFs 0-12h 12-24h 24-48h restoring sodium pump activity and has the (LOCF)* potential to improve vascular blood flow2,3 ‒ DIF ‒ Placebo * Last observation carried forward 1) Lam GK et al. Digoxin antibody fragment, antigen binding (Fab), treatment of preeclampsia in women with EDLF: a secondary analysis of the DEEP Trial. American Journal of Obstetrics & Gynecology. August 2013, pp119.e1- 119.e6. 2) DigiFab® Prescribing Information, 12.1 Mechanism of Action. 3) Wang Y et al, Digoxin Immune Fab Protects Endothelial Cells from Ouabain-Induced barrier Injury. Am J Reprod Immunol. Author manuscript; available in PMC 2016 December 07. 4 Adair CD, Buckalew VM, Graves SW, et al. Digoxin immune fab treatment for severe preeclampsia. Am J Perinatol. 2010;27:655-62. AMAG-423 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 26

DEEP Trial: Improvements in Select Neonatal Outcome Measures1 Primary composite endpoint in current Phase 2b/3a study of AMAG-423 Intraventricular Hemorrhage (IVH) Necrotizing Enterocolitis (NEC) Deaths Severe (grades 3 and 4) p=0.24 p=0.61 p=0.49 n=3 n=3 n=2 n=1 % of neonatal Deaths neonatal of % % of neonates with IVH with neonates of % % of neonates with NEC with neonates of % n=0 n=0 DIF n=24 Placebo n=27 DIF n=24 Placebo n=27 DIF n=24 Placebo n=27 1) Adair CD, Buckalew VM, Graves SW, et al. Digoxin immune fab treatment for severe preeclampsia. Am J Perinatal. 2010;27:655-62 AMAG-423 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 27

2020: Goals and Key Areas of Focus for AMAG Divest Intrarosa and Work with the FDA Complete successful Drive continued Vyleesi to align with to maintain patient CEO transition Feraheme growth new strategic direction access to Makena Advance ciraparantag Pursue ex-U.S. Meet/exceed and AMAG-423 portfolio partnering financial guidance development programs opportunities © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 28

Breakout Session: Kent Room © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 29

Appendix 30

Reconciliation of GAAP to Non-GAAP Preliminary Financial Results ($M) 9-Mos 2019 Q4-2019 FY 2019 GAAP operating loss ($251.6) ($22) - ($12) ($274) - ($264) Depreciation and intangible asset amortization 13.9 7.0 21.0 Stock-based compensation 13.7 5.0 18.5 Restructuring 7.4 -- 7.4 Transaction/acquisition-related costs 0.3 -- 0.3 Acquired IPR&D 74.9 -- 74.9 Asset impairment charges 82.2 -- 82.2 Non-GAAP adjusted EBITDA ($59.2) ($10) - $0 ($70) - ($60) APPENDIX © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 31

Reconciliation of GAAP to Non-GAAP 2020 Financial Guidance ($M) 2020 Financial Guidance GAAP operating income $2 - $32 Depreciation 2 Stock-based compensation 16 Non-GAAP adjusted EBITDA $20 - $50 APPENDIX © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 32

AMAG Pharmaceuticals JP Morgan 38th Healthcare Conference January 2020 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 33