Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LiveXLive Media, Inc. | f8k010820_livexlivemedia.htm |

Exhibit 99.1

INVESTOR PRESENTATION NASDAQ: LIV X December 2019

statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those expressed or implied by such forward - looking statements . These factors include uncertainties as to identifying, acquiring, securing and developing content, reliance on one key customer for a substantial percentage of the Company’s revenue, ability to attract, maintain and increase the number of the Company’s users and paid subscribers, successfully implementing the Company’s growth strategy, including relating to its technology platform and applications, management’s relationships with industry stakeholders, changes in economic conditions, competition and other risks including, but not limited to, those described in the Company’s Annual Report on Form 10 - K, filed with the Securities and Exchange Commission (the “SEC”) on June 24 , 2019 , Quarterly Report on Form 10 - Q, filed with the SEC on November 8 , 2019 , and other filings and submissions with the SEC . These forward - looking statements speak only as of the date set forth below and the Company disclaims any obligations to update these statements except as may be required by law . Neither the Company nor any of its affiliates, advisors, placement agents or representatives has any obligation to, nor do any of them undertake to, revise or update the forward - looking statements contained in this presentation to reflect future events or circumstances . This presentation speaks as of December 31 , 2019 . The information presented or contained in this presentation is subject to change without notice and its accuracy is not guaranteed . Neither the delivery of this presentation nor any further discussion of the Company or any of its affiliates, shareholders, officers, directors, employees, agents or advisors with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since that date . Safe Harbor The information in this presentation is provided to you by LiveXLive Media, Inc . (the “Company”) solely for informational purposes and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument of the Company, or to participate in any investment activity or trading strategy, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment in the United States or anywhere else . By viewing or participating in this presentation, you acknowledge and agree that (i) the information contained in this presentation is intended for the recipient of this information only and shall not be disclosed, reproduced or distributed in any way to anyone else, (ii) no part of this presentation or any other materials provided in connection herewith may be copied, retained, taken away, reproduced or redistributed following this presentation, and (iii) all participants must return all materials provided in connection herewith to the Company at the completion of the presentation . By viewing, accessing or participating in this presentation, you agree to be bound by the foregoing limitations . No representations, warranties or undertakings, express or implied, are made and no reliance should be placed on the accuracy, fairness or completeness of the information, sources or opinions presented or contained in this presentation, or in the case of projections contained herein, as to their attainability or the accuracy and completeness of the assumptions from which they are derived, and it is expected that each prospective investors will pursue his, her or its own independent investigation . The statistical and industry data included herein was obtained from various sources, including certain third parties, and has not been independently verified . By viewing or accessing the information contained in this presentation, the recipient hereby acknowledges and agrees that neither the Company nor any representatives of the Company accepts any responsibility for or makes any representation or warranty, express or implied, with respect to the truth, accuracy, fairness, completeness or reasonableness of the information contained in, and omissions from, these materials and that neither the Company nor any of its affiliates, employees, officers, directors, advisers, placement agents or representatives accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in these materials . This presentation contains forward - looking statements, including descriptions about the intent, belief or current expectations of the Company and its management about future performance and results. Such forward - looking 2

LIVE X LIVE The world’s leading social music platform devoted to the live music experience, internet radio, music video content and music culture We give brands, fans and bands the best seat in the house 3

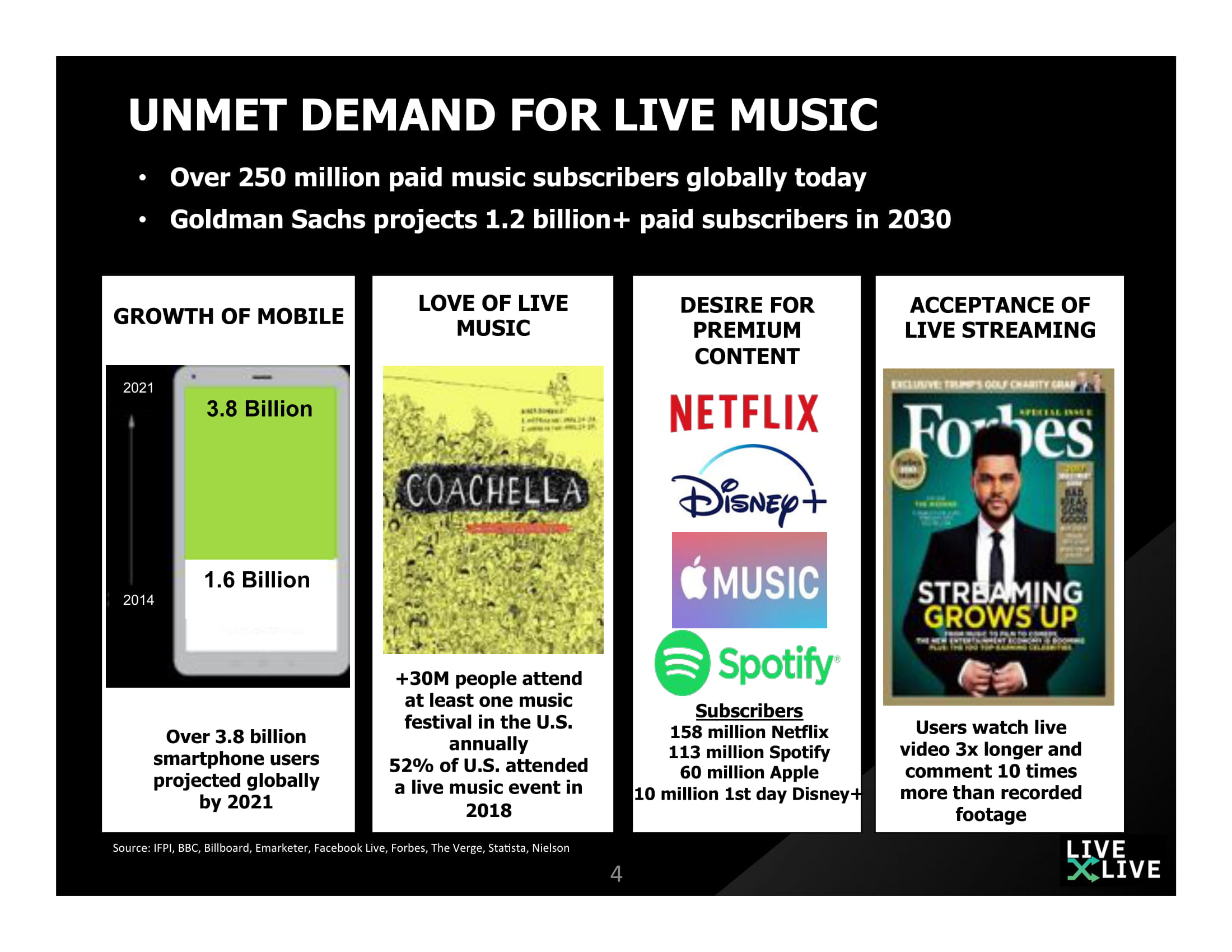

UNMET DEMAND FOR LIVE MUSIC 2014 2021 20 1 3.8 Billion GROWTH OF MOBILE 1.6 Billion Over 3.8 billion smartphone users projected globally by 2021 LOVE OF LIVE MUSIC +30M people attend at least one music festival in the U.S. annually 52% of U.S. attended a live music event in 2018 DESIRE FOR PREMIUM CONTENT Subscribers 158 million Netflix 113 million Spotify 60 million Apple 10 million 1st day Disney + ACCEPTANCE OF LIVE STREAMING Users watch live video 3x longer and comment 10 times more than recorded footage Source: IFPI, BBC, Billboard, Emarketer, Facebook Live, Forbes, The Verge, StaAsta, Nielson • Over 250 million paid music subscribers globally today • Goldman Sachs projects 1.2 billion+ paid subscribers in 2030 4

U.S. LIVE MUSIC GLOBAL OTT/STREAMING $29.5B $ 28.0B $30.3B $19.6B GLOBAL DIGITAL MUSIC STREAMING $11.1B $5.4B POSITIONED AT THE CENTER OF THREE EXPLODING SECTORS Source: IBISWorld, PWC 5

Note: LIVX's fiscal year ends March 31 st YTD progress denotes 3/31/2019 – 12/31/2019 FesAval Livestreams 63M+ • Live Streams YTD vs. +51MM in FY19 28 • Music Events (YTD) 230+ • ArAsts Streamed (YTD) Reach & PlaZorms 179+ • Countries Reached by Live Music Streaming 820K+ • Paid Subscribers (YTD) 2. M+ • Monthly AcAve Users (average YTD) Original Content 275+ • Hours of Live Music (YTD) Pla2orms • O&O • Facebook • YouTube • Twitch • Twi`er • Daily MoAon • STIRR LIVE X LIVE at a Glance • Fiscal Year 2019: 51M+ Livestreams, 24 Live Events, 360+ hours of content 6

7 Aggreg ati ng the Most Festivals in One Place 2,000+ Music Festivals Worldwide 7

FY’20 POTENTIAL STREAMING LINEUP – 2x YoY SOCIAL REACH DEMI LOVATO | BRUNO MARS | LIL WAYNE | DAVID GUETTA | KE$HA | TAYLOR SWIFT | TIËSTO | KENDRICK LAMAR | CARDI B | HARDWELL | AVENGED SEVENFOLD | MUSE | RICK ROSS | LORDE | ZEDD | J. COLE | FOO FIGHTERS | THE CHAINSMOKERS | DJ KHALED | JONAS BROS | AFROJACK | WAKA FLOCKA FLAME | A$AP ROCKY | FRENCH MONTANA | THE KILLERS | TYLER, THE CREATOR | MARTIN GARRIX | THIRTY SECONDS TO MARS | ARMIN VAN BUUREN | POST MALONE | GORILLAZ | MARSHMELLO | TRAVIS SCOTT | LIL PUMP | LIL UZI VERT | TIM MCGRAW | MIGOS | FEARNE COTTON | 21 SAVAGE | DJ SNAKE | THE SCRIPT | BULLET FOR MY VALENTINE | DIPLO | ARCTIC MONKEYS | ALESSO | MAJOR LAZER | RAE SREMMURD | BUGZY MALONE | XXXTENTACION | KODAK BLACK | W&W | ZARA LARSSON | JACK JOHNSON | MUMFORD & SONS | THE OFFSPRING | SCHOOLBOY Q | ZIGGY MARLEY | ALICE IN CHAINS | KYGO | AXWELL ^ INGROSSO | YOUNG THUG | LIONEL RICHIE | FY’19 SOCIAL FOLLOWING INCREASED TO 2.2 BILLION FROM FY’18 OF 1.1 BILLION * SAMPLE LINEUP PROVIDES AN ILLUSTRATION OF THE SIZE OF OUR OPPORTUNITY USING ONLY A HANDFUL OF TOP FESTIVALS 8

DISTRIBUTION: A GLOBAL STREAMING SERVICE LiveXLive streams in over +170 countries around the world . 9

NEW UNIFIED PRODUCT – Live + Audio TOGETHER FOR THE FIRST TIME Services combine recorded music, live music, audio and video including the U.S. music libraries of: 10

Link to Vimeo: vimeo.com/ 310841546 Original Content: LiveZone • Launched in December 2018 • Powerful platform for brands and sponsors to extend their audience reach via advertising and partnerships • In - house production • Top - tier broadcast facilities • Best - in - class crew LiveXLive can produce premium live events for $20K/hr. (compared to current industry comps at $500K/hr.) 11

DISTRIBUTION CHANNELS Des k top Mo bile O T T 12

MARKETING: ENGAGEMENT DRIVEN BY INFLUENCERS AND PERFORMING ARTISTS JOHANNES BARTL KING BACH JUSTIN ROBERTS JAKE PAUL AMANDA CERNY JUSTIN BIEBER ED SHEERAN CHARLIE PUTH POST MALONE SHAWN MENDES INFLUENCERS ARTISTS Post Malone – Sunflower at Rolling Loud +3,5000,000 FesAval liveviews POST MALONE AT ROLLING LOUD - LA, STREAMED BY LIVEXLIVE LIVEXLIVE INFLUENCER, JAKE PAUL, EARNING OVER 1M YOUTUBE VIEWS 13

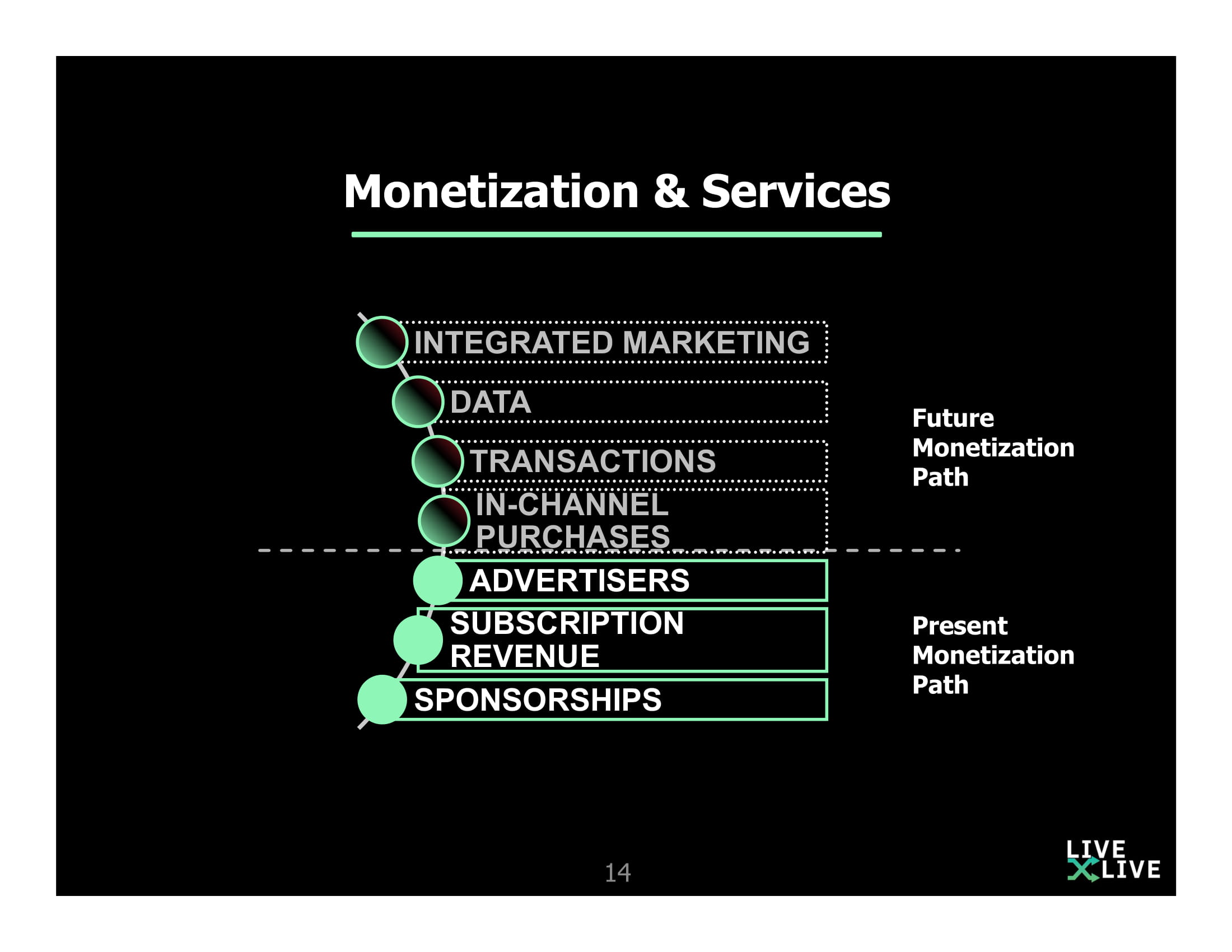

Present Mone t iz at ion Path Monetization & Services Future Mone t iz at ion Path INTEGRATED MARKETING DATA TRANSACTIONS IN - CHANNEL PURCHASES ADVERTISERS SUBSCRIPTION REVENUE SPONSORSHIPS 14

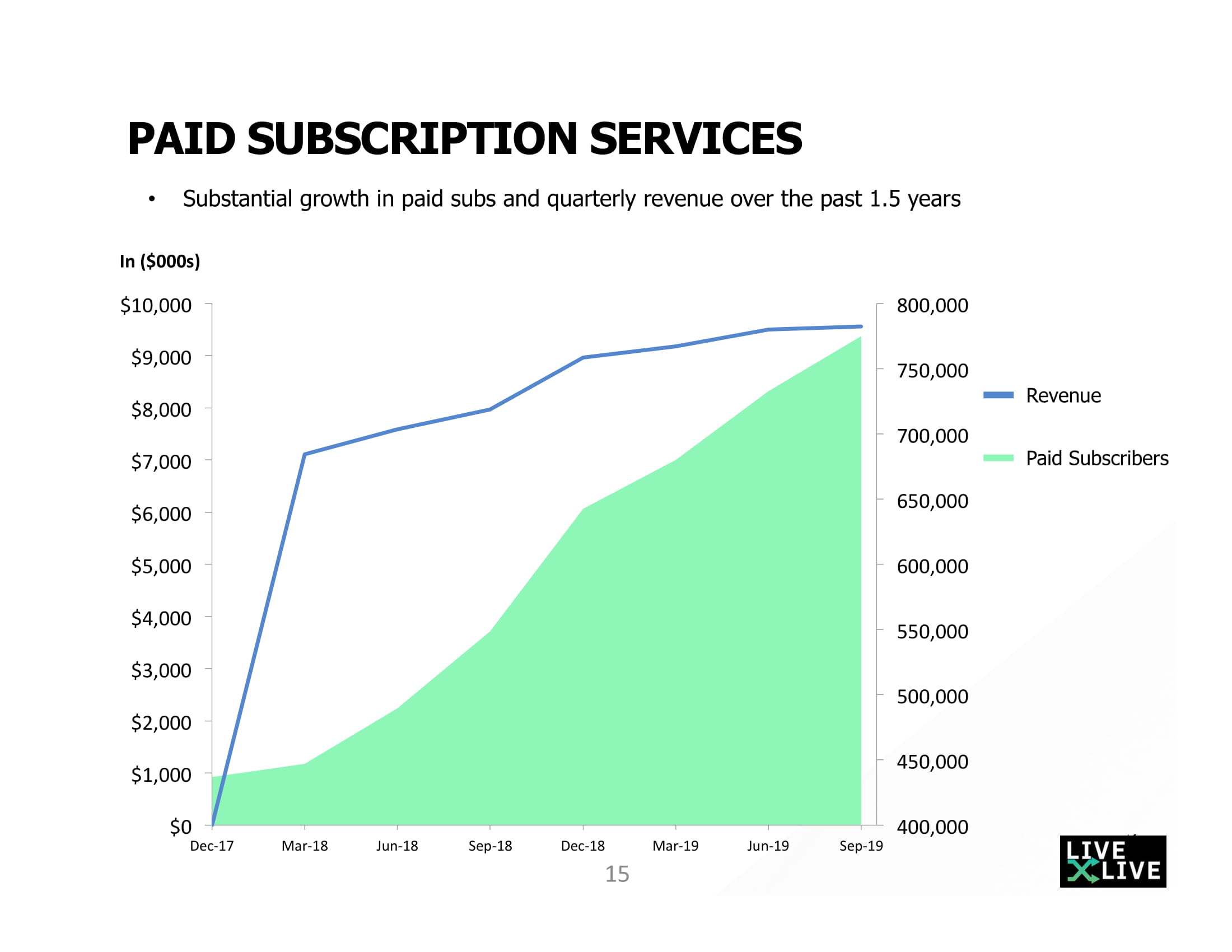

400,000 450,000 500,000 550,000 600,000 650,000 700,000 750,000 800,000 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 D e c - 17 Ma r - 18 Jun - 18 S e p - 1 8 D e c - 18 Ma r - 19 Jun - 19 S e p - 1 9 R e v e nu e Paid Subscribers • Substantial growth in paid subs and quarterly revenue over the past 1.5 years PAID SUBSCRIPTION SERVICES In ($000s) $10,000 15

► KIA ► SAMSUNG ► DOS EQUIS INITIAL S PON S O RSHIP TRACTION 16

• Full year March 31, 2020 guidance Revenue ($38M - $40M) and Adj Ops Loss* ($12M - $14M ) SELECT FINANCIALS – SUBSTANTIAL GROWTH * Adj. Operating Income (Loss) – see definition on p.18 / slide R e v e nu e Adj Ops Income (Loss)* FY 2018 FY 2019 1H ‘19 $33 . 7M $15.6M $ 7 .2M +350% YOY R e v e nu e growth 1H ‘20 $19.1M +22% YOY R e v e nu e growth ($12.6M) ($8.1M) ($6.1M) FY ‘18 vs FY ‘19 1H ‘19 vs 1H ‘20 ($8.2M) 17

(USD $ in Millions) Six Months Ended September 30, 2019 Revenue $19.1 Adjusted Operating Income (Loss) 1 ($8.2) Cash & Cash Equivalents $16.1 Total Debt 2 $15.8 Total Stockholder’s Equity $4.3 Shares Outstanding 3 57,834,822 Fully Diluted Shares Outstanding 4 68,084,209 During the the Q2 quarter ended September 30, 2019, LiveXLive raised $9.6M in net proceeds by issuing 5.0M shares of common stock. 1 Adj . Operating Income (Loss), a non - GAAP term, is defined as operating income (loss) before (a) non - cash GAAP purchase accounting adjustments for certain deferred revenue and costs, (b) legal, accounting and other professional fees directly attributable to acquisition activity, (c) employee severance payments and third party professional fees directly attributable to acquisition or corporate realignment activities, (d) certain non - recurring expenses associated with legal settlements or reserves for legal settlements in the period that pertain to historical matters that existed at acquired companies prior to their purchase date, and (e) depreciation and amortization (including goodwill impairment, if any), and certain stock - based compensation expense . 2 Composed of senior secured and unsecured convertible notes, net of discounts . 3 As of 9 / 30 / 2019 . Includes 5 , 000 , 000 shares of common stock sold in a registered direct offering effective July 30 , 2019 , raising net proceeds of approximately $ 9 . 6 million . 4 This number includes 167,363 warrants outstanding, 7,453,514 options and RSUs outstanding and 2,839,546 shares issuable underlying the Company’s convertible notes as of September 30, 2019. SELECT FINANCIALS – 1H 2020 RESULTS 18

World Class Management Team Dermot McCormack PRESIDENT Renowned music industry executive, with expertise from content development to technology, growth strategies and monetization. Michael Zemetra CFO Seasoned executive with extensive financial and operational experience in building, managing and scaling large global organizations, systems and operations Doug Schaer COO Experienced entrepreneur & business strategist who specializes in franchise asset development & foundation building in the entertainment & sports sectors Robert Ellin CHAIRMAN & CEO Over 30 years of investment and turnaround experience, deep relationships in media and entertainment, prior public company experience as Executive Chairman of Mandalay Digital Group Jerry Gold DIRECTOR & CSO Music & entertainment executive for the past 37 years, including serving as the Executive VP & CFO of Warner Music Group for nearly a decade Mike Bebel SENIOR EXECUTIVE VICE PRESIDENT Music industry veteran & digital music service entrepreneur with more than 20 years of global operating experience Jackie Stone CMO Top 50 Marketer with over 27 years of global expertise across brand building, growth, acquisition and loyalty. David Schulhof CDO Executive with more than 20 years of experience in the music, digital media & private equity sectors Rahman Dukes HEAD OF URBAN PROGRAMMING A digital pioneer of hip hop and hip hop culture and an entrepreneur who has created and produced original content across TV, radio and web Kevin Stapleford VP OF PROGRAMING Content development executive with 20+ years of success growing audiences, revenue and brand engagement Jason Miller GLOBAL HEAD OF SALES National brand advertising developer who has integrated solutions across audio, video, digital, social, mobile, & event platforms Garret English CHIEF CREATIVE OFFICER Deep experience in music content, news and live productio and programming, including producing the VMAs and launching MTV internationally in Japan, Africa and Russia 19

Distinguished & Experienced Board of Directors Craig Foster INDEPENDENT DIRECTOR Former Chief Financial Officer and Chief Accounting Officer of Amobee, Inc. Patrick Wachsberger INDEPENDENT DIRECTOR Founder and CEO of Picture Perfect Entertainment and former Chairman of Lionsgate Films Kenneth Solomon INDEPENDENT DIRECTOR Chairman and CEO of The Tennis Channel, partner at Arcadia Investment Partners and Chairman of Ovation TV Ramin Arani INDEPENDENT DIRECTOR Former lead manager of Fidelity’s Puritan Fund and current Board member of Vice Media, Ellen Digital and Opportunity Network Tim Spengler INDEPENDENT DIRECTOR Current President of Dentsu Aegis and former President of Clear Channel Media and Interpublic Group Jay Krigsman INDEPENDENT DIRECTOR Executive Vice President and Asset Manager of The Krausz Companies Strong Suite of Formal Advisors Jason Flom CEO of Lava Records Chris McGurk Former CEO of MGM and Universal Pictures Steven Bornstein Former CEO of ESPN and NFL Network Roger Werner Former CEO and President of ESPN and Speedvision Jules Haimovitz Former President of Viacom and founder of Showtime 20 Bridget Baker INDEPENDENT DIRECTOR Former President of Content and TV Network Distrubution of Comcast and NBCUniversal 20

Strong opportunity for growth Predictable revenue driven by subscription Early wins with key sponsors, advertisers & distribution partners Low content costs Multiple monetization paths LIVE X LIVE Summary Proven management team and experienced board and advisors with industry expertise 21

NASDAQ: LIV X IR@LIV E XLIV E .COM