Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ADT Inc. | d858837dex991.htm |

| 8-K - 8-K - ADT Inc. | d858837d8k.htm |

Exhibit 99.2 ADT’s Acquisition of Defenders January 6, 2020 Confidential, not for distribution or publication without express consent of ADTExhibit 99.2 ADT’s Acquisition of Defenders January 6, 2020 Confidential, not for distribution or publication without express consent of ADT

Forward Looking Statements and Non-GAAP Measures ADT has made statements in this presentation and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. ADT is continuing to review the potential impacts of the acquisition on the Company’s financial statements including, for example, the impact of Defenders’ historic business model of customer-owned equipment which differs from ADT’s historic model of Company-owned equipment, possible modifications to such business models, and conforming Defender’s existing accounting policies to ADT’s policies. Ongoing decisions made by the Company may materially impact the amount and timing of the financial impact of the acquisition on the combined entity. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions and other matters. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this document, including among others, risk factors that are described in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Non-GAAP Measures To provide investors with additional information in connection with our results as determined by generally accepted accounting principles in the United States (“GAAP”), we refer to Adjusted EBITDA, Free Cash Flow, and Free Cash Flow before special items as non-GAAP measures. The definition of each such non-GAAP financial measure can be found in the appendix. 2 Confidential, not for distribution or publication without express consent of ADTForward Looking Statements and Non-GAAP Measures ADT has made statements in this presentation and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. ADT is continuing to review the potential impacts of the acquisition on the Company’s financial statements including, for example, the impact of Defenders’ historic business model of customer-owned equipment which differs from ADT’s historic model of Company-owned equipment, possible modifications to such business models, and conforming Defender’s existing accounting policies to ADT’s policies. Ongoing decisions made by the Company may materially impact the amount and timing of the financial impact of the acquisition on the combined entity. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions and other matters. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this document, including among others, risk factors that are described in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Non-GAAP Measures To provide investors with additional information in connection with our results as determined by generally accepted accounting principles in the United States (“GAAP”), we refer to Adjusted EBITDA, Free Cash Flow, and Free Cash Flow before special items as non-GAAP measures. The definition of each such non-GAAP financial measure can be found in the appendix. 2 Confidential, not for distribution or publication without express consent of ADT

Acquisition Overview 1 ▪ ADT acquired Defenders, its largest dealer, for approximately $381 million from the Lindsey family − The Lindsey family is taking nearly the entirety of their transaction consideration in the form of ADT stock (~16.3 million shares), demonstrating their conviction in the strength of ADT’s business ▪ Represents an exciting next step on ADT’s journey to drive capital efficient growth − By eliminating the dealer “margin,” the acquisition is expected to drive improvement in unit economics and return on capital going forward 2 ▪ Opportunistic transaction at accretive FCF multiple − Transaction expected to be modestly beneficial to 2020 FCF and expected to accelerate growth in subsequent years ▪ Enhances the customer experience and simplifies the sales process by controlling a greater portion of ADT’s go-to-market operations Exciting transaction allows ADT to continue to drive capital efficient growth and enhance customer experience and sales process Notes: 3 1. Based on ADT’s closing stock price of $7.45 on January 3, 2020. 2. FCF refers to Free Cash Flow before special items throughout presentation. Confidential, not for distribution or publication without express consent of ADTAcquisition Overview 1 ▪ ADT acquired Defenders, its largest dealer, for approximately $381 million from the Lindsey family − The Lindsey family is taking nearly the entirety of their transaction consideration in the form of ADT stock (~16.3 million shares), demonstrating their conviction in the strength of ADT’s business ▪ Represents an exciting next step on ADT’s journey to drive capital efficient growth − By eliminating the dealer “margin,” the acquisition is expected to drive improvement in unit economics and return on capital going forward 2 ▪ Opportunistic transaction at accretive FCF multiple − Transaction expected to be modestly beneficial to 2020 FCF and expected to accelerate growth in subsequent years ▪ Enhances the customer experience and simplifies the sales process by controlling a greater portion of ADT’s go-to-market operations Exciting transaction allows ADT to continue to drive capital efficient growth and enhance customer experience and sales process Notes: 3 1. Based on ADT’s closing stock price of $7.45 on January 3, 2020. 2. FCF refers to Free Cash Flow before special items throughout presentation. Confidential, not for distribution or publication without express consent of ADT

Defenders Acquisition Enables Capital Efficient Growth 1 2 3 4 5 DRIVE DIY AND PURSUE INDUSTRY GROW COMMERCIAL MAXIMIZE LIFETIME FOCUS ON FCF OTHER INNOVATIVE, PARTNERSHIPS AND BUSINESS VALUE OF CUSTOMER LOW-COST GROWTH NEW OPPORTUNITIES Improve Attrition ▪ Improve Customer Experience ▪ Exit of Canada Payback Reduction ▪ Defenders Integration ▪ Consumer Financing Solution Drives significant capital Attractive revenue payback In-demand products for Broader consumer base to Access to a lower customer efficiency and growth over characteristics more diverse customer deliver partner offerings acquisition cost channel time; modestly beneficial to base near-term FCF We continue to focus on reducing the cost to acquire new customers as we grow our business 4 Confidential, not for distribution or publication without express consent of ADTDefenders Acquisition Enables Capital Efficient Growth 1 2 3 4 5 DRIVE DIY AND PURSUE INDUSTRY GROW COMMERCIAL MAXIMIZE LIFETIME FOCUS ON FCF OTHER INNOVATIVE, PARTNERSHIPS AND BUSINESS VALUE OF CUSTOMER LOW-COST GROWTH NEW OPPORTUNITIES Improve Attrition ▪ Improve Customer Experience ▪ Exit of Canada Payback Reduction ▪ Defenders Integration ▪ Consumer Financing Solution Drives significant capital Attractive revenue payback In-demand products for Broader consumer base to Access to a lower customer efficiency and growth over characteristics more diverse customer deliver partner offerings acquisition cost channel time; modestly beneficial to base near-term FCF We continue to focus on reducing the cost to acquire new customers as we grow our business 4 Confidential, not for distribution or publication without express consent of ADT

Strategic Advantages of Defenders Acquisition Unique opportunity to acquire ADT’s largest dealer to enhance customer experience, simplify the sales ecosystem, unify marketing, reduce customer acquisition costs, and generate FCF Enhances ▪ Provides ability to drive a unified brand message and premium customer Customer Experience experience to the majority of ADT’s residential customers. Simplifies ▪ Establishes a single party focused on the customer experience and lifetime Operating Ecosystem value, and reduces channel conflict and potential for customer confusion. ▪ Leverages Defenders’ strengths in customer acquisition to drive optimized Improves spend across channels and enable more effective marketing messaging Marketing Prowess and customer segmentation. ▪ Significantly enhances ability to bring new initiatives to a broader customer Increases base more quickly, including consumer financing, DIY, and innovative Go to Market Efficiency equipment and service offerings. ▪ Results in a more capital efficient ADT through the elimination of dealer “margin.” Expected to be modestly beneficial to 2020 net cash Drives provided by operating activities and FCF and to create synergies to Capital Efficiency further drive net cash provided by operating activities and FCF in 5 5 subsequent years. Confidential, not for distribution or publication without express consent of ADTStrategic Advantages of Defenders Acquisition Unique opportunity to acquire ADT’s largest dealer to enhance customer experience, simplify the sales ecosystem, unify marketing, reduce customer acquisition costs, and generate FCF Enhances ▪ Provides ability to drive a unified brand message and premium customer Customer Experience experience to the majority of ADT’s residential customers. Simplifies ▪ Establishes a single party focused on the customer experience and lifetime Operating Ecosystem value, and reduces channel conflict and potential for customer confusion. ▪ Leverages Defenders’ strengths in customer acquisition to drive optimized Improves spend across channels and enable more effective marketing messaging Marketing Prowess and customer segmentation. ▪ Significantly enhances ability to bring new initiatives to a broader customer Increases base more quickly, including consumer financing, DIY, and innovative Go to Market Efficiency equipment and service offerings. ▪ Results in a more capital efficient ADT through the elimination of dealer “margin.” Expected to be modestly beneficial to 2020 net cash Drives provided by operating activities and FCF and to create synergies to Capital Efficiency further drive net cash provided by operating activities and FCF in 5 5 subsequent years. Confidential, not for distribution or publication without express consent of ADT

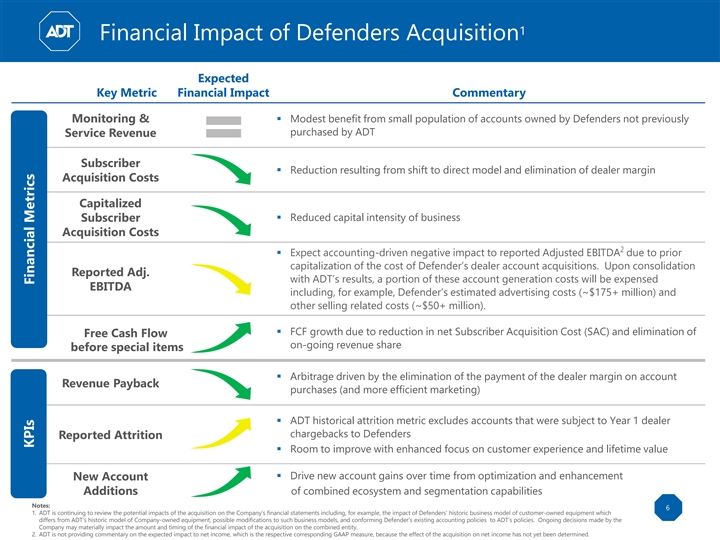

1 Financial Impact of Defenders Acquisition Expected Key Metric Financial Impact Commentary ▪ Modest benefit from small population of accounts owned by Defenders not previously Monitoring & purchased by ADT Service Revenue Subscriber ▪ Reduction resulting from shift to direct model and elimination of dealer margin Acquisition Costs Capitalized ▪ Reduced capital intensity of business Subscriber Acquisition Costs 2 ▪ Expect accounting-driven negative impact to reported Adjusted EBITDA due to prior capitalization of the cost of Defender’s dealer account acquisitions. Upon consolidation Reported Adj. with ADT’s results, a portion of these account generation costs will be expensed EBITDA including, for example, Defender’s estimated advertising costs (~$175+ million) and other selling related costs (~$50+ million). ▪ FCF growth due to reduction in net Subscriber Acquisition Cost (SAC) and elimination of Free Cash Flow on-going revenue share before special items ▪ Arbitrage driven by the elimination of the payment of the dealer margin on account Revenue Payback purchases (and more efficient marketing) ▪ ADT historical attrition metric excludes accounts that were subject to Year 1 dealer chargebacks to Defenders Reported Attrition ▪ Room to improve with enhanced focus on customer experience and lifetime value ▪ Drive new account gains over time from optimization and enhancement New Account Additions of combined ecosystem and segmentation capabilities Notes: 6 1. ADT is continuing to review the potential impacts of the acquisition on the Company’s financial statements including, for example, the impact of Defenders’ historic business model of customer-owned equipment which differs from ADT’s historic model of Company-owned equipment, possible modifications to such business models, and conforming Defender’s existing accounting policies to ADT’s policies. Ongoing decisions made by the Company may materially impact the amount and timing of the financial impact of the acquisition on the combined entity. Confidential, not for distribution or publication without express consent of ADT 2. ADT is not providing commentary on the expected impact to net income, which is the respective corresponding GAAP measure, because the effect of the acquisition on net income has not yet been determined. KPIs Financial Metrics1 Financial Impact of Defenders Acquisition Expected Key Metric Financial Impact Commentary ▪ Modest benefit from small population of accounts owned by Defenders not previously Monitoring & purchased by ADT Service Revenue Subscriber ▪ Reduction resulting from shift to direct model and elimination of dealer margin Acquisition Costs Capitalized ▪ Reduced capital intensity of business Subscriber Acquisition Costs 2 ▪ Expect accounting-driven negative impact to reported Adjusted EBITDA due to prior capitalization of the cost of Defender’s dealer account acquisitions. Upon consolidation Reported Adj. with ADT’s results, a portion of these account generation costs will be expensed EBITDA including, for example, Defender’s estimated advertising costs (~$175+ million) and other selling related costs (~$50+ million). ▪ FCF growth due to reduction in net Subscriber Acquisition Cost (SAC) and elimination of Free Cash Flow on-going revenue share before special items ▪ Arbitrage driven by the elimination of the payment of the dealer margin on account Revenue Payback purchases (and more efficient marketing) ▪ ADT historical attrition metric excludes accounts that were subject to Year 1 dealer chargebacks to Defenders Reported Attrition ▪ Room to improve with enhanced focus on customer experience and lifetime value ▪ Drive new account gains over time from optimization and enhancement New Account Additions of combined ecosystem and segmentation capabilities Notes: 6 1. ADT is continuing to review the potential impacts of the acquisition on the Company’s financial statements including, for example, the impact of Defenders’ historic business model of customer-owned equipment which differs from ADT’s historic model of Company-owned equipment, possible modifications to such business models, and conforming Defender’s existing accounting policies to ADT’s policies. Ongoing decisions made by the Company may materially impact the amount and timing of the financial impact of the acquisition on the combined entity. Confidential, not for distribution or publication without express consent of ADT 2. ADT is not providing commentary on the expected impact to net income, which is the respective corresponding GAAP measure, because the effect of the acquisition on net income has not yet been determined. KPIs Financial Metrics

Overview of Defenders 1 Business Overview Combined Geographic Coverage Defenders adds more than 3,000 incremental zip codes with approximately 70% overlap for total combined zip code Largest ADT dealer and the only dealer to coverage of ~21.1K be designated as an Authorized Premier Provider ADT Direct marketing engine – over 1.5 million customer inquiries per year Headquartered in Indianapolis, Indiana with 130+ field branch locations ~2.9K+ team members Defenders Represents more than 50% of ADT’s indirect channel ~85% interactive take rate Note: 7 1. Represents full year 2018 coverage areas. Confidential, not for distribution or publication without express consent of ADTOverview of Defenders 1 Business Overview Combined Geographic Coverage Defenders adds more than 3,000 incremental zip codes with approximately 70% overlap for total combined zip code Largest ADT dealer and the only dealer to coverage of ~21.1K be designated as an Authorized Premier Provider ADT Direct marketing engine – over 1.5 million customer inquiries per year Headquartered in Indianapolis, Indiana with 130+ field branch locations ~2.9K+ team members Defenders Represents more than 50% of ADT’s indirect channel ~85% interactive take rate Note: 7 1. Represents full year 2018 coverage areas. Confidential, not for distribution or publication without express consent of ADT

Summary Transaction Terms 1 Transaction Value ▪ ~$381 million purchase price ▪ Modestly beneficial to FCF and expected to accelerate growth in subsequent years Key Financial ▪ Elimination of dealer margin that currently goes to largest dealer partner Benefits ▪ Marketing efficiency expected to enable more effective customer messaging and enhance unit growth over time 1 ▪ ~$121 million of transaction consideration to be funded with ADT shares ▪ The remaining $260 million of the purchase price was paid in cash to retire Financing existing Defenders debt, fund other liabilities and pay transaction expenses ▪ The cash consideration was partially funded from existing revolving credit facilities Significant equity consideration demonstrates seller’s confidence in upside potential of ADT shares Note: 8 1. Based on ADT’s closing stock price of $7.45 on January 3, 2020. Confidential, not for distribution or publication without express consent of ADTSummary Transaction Terms 1 Transaction Value ▪ ~$381 million purchase price ▪ Modestly beneficial to FCF and expected to accelerate growth in subsequent years Key Financial ▪ Elimination of dealer margin that currently goes to largest dealer partner Benefits ▪ Marketing efficiency expected to enable more effective customer messaging and enhance unit growth over time 1 ▪ ~$121 million of transaction consideration to be funded with ADT shares ▪ The remaining $260 million of the purchase price was paid in cash to retire Financing existing Defenders debt, fund other liabilities and pay transaction expenses ▪ The cash consideration was partially funded from existing revolving credit facilities Significant equity consideration demonstrates seller’s confidence in upside potential of ADT shares Note: 8 1. Based on ADT’s closing stock price of $7.45 on January 3, 2020. Confidential, not for distribution or publication without express consent of ADT

AppendixAppendix

Non-GAAP Measures To provide investors with additional information in connection with our results as determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we disclose Adjusted EBITDA, Free Cash Flow, and Free Cash Flow before special items as non-GAAP measures. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income, operating income, cash flows, or any other measure calculated in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about our operating profitability adjusted for certain non-cash items, non-routine items that we do not expect to continue at the same level in the future, as well as other items that are not core to our operations. Further, we believe Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance, making budgeting decisions, and comparing our performance against that of other peer companies using similar measures. We define Adjusted EBITDA as net income or loss adjusted for (i) interest, (ii) taxes, (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets, (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions, (v) share-based compensation expense, (vi) merger, restructuring, integration, and other, (vii) losses on extinguishment of debt, (viii) radio conversion costs, (ix) financing and consent fees, (x) foreign currency gains/losses, (xi) acquisition related adjustments, and (xii) other charges and non-cash items. There are material limitations to using Adjusted EBITDA. Adjusted EBITDA does not take into account certain significant items, including depreciation and amortization, interest, taxes, and other adjustments which directly affect our net income or loss. These limitations are best addressed by considering the economic effects of the excluded items independently, and by considering Adjusted EBITDA in conjunction with net income or loss as calculated in accordance with GAAP. Free Cash Flow We believe that the presentation of Free Cash Flow is appropriate to provide additional information to investors about our ability to repay debt, make other investments, and pay dividends. We define Free Cash Flow as cash flows from operating activities less cash outlays related to capital expenditures. We define capital expenditures to include purchases of property, plant, and equipment; subscriber system asset additions; and accounts purchased through our network of authorized dealers or third parties outside of our authorized dealer network. These items are subtracted from cash flows from operating activities because they represent long-term investments that are required for normal business activities. Free Cash Flow adjusts for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP measure. Free Cash Flow is not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non- discretionary expenditures are not deducted. These limitations are best addressed by using Free Cash Flow in combination with the cash flows as calculated in accordance with GAAP. Free Cash Flow before special items We define Free Cash Flow before special items as Free Cash Flow adjusted for payments related to (i) financing and consent fees, (ii) restructuring and integration, (iii) integration related capital expenditures, (iv) radio conversion costs, and (v) other payments or receipts that may mask the operating results or business trends of the Company. As a result, subject to the limitations described below, Free Cash Flow before special items is a useful measure of our cash available to repay debt, make other investments, and pay dividends. Free Cash Flow before special items adjusts for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP measure. Free Cash Flow before special items is not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures are not deducted. These limitations are best addressed by using Free Cash Flow before special items in combination with the GAAP cash flow numbers. 10 Confidential, not for distribution or publication without express consent of ADTNon-GAAP Measures To provide investors with additional information in connection with our results as determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we disclose Adjusted EBITDA, Free Cash Flow, and Free Cash Flow before special items as non-GAAP measures. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income, operating income, cash flows, or any other measure calculated in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about our operating profitability adjusted for certain non-cash items, non-routine items that we do not expect to continue at the same level in the future, as well as other items that are not core to our operations. Further, we believe Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance, making budgeting decisions, and comparing our performance against that of other peer companies using similar measures. We define Adjusted EBITDA as net income or loss adjusted for (i) interest, (ii) taxes, (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets, (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions, (v) share-based compensation expense, (vi) merger, restructuring, integration, and other, (vii) losses on extinguishment of debt, (viii) radio conversion costs, (ix) financing and consent fees, (x) foreign currency gains/losses, (xi) acquisition related adjustments, and (xii) other charges and non-cash items. There are material limitations to using Adjusted EBITDA. Adjusted EBITDA does not take into account certain significant items, including depreciation and amortization, interest, taxes, and other adjustments which directly affect our net income or loss. These limitations are best addressed by considering the economic effects of the excluded items independently, and by considering Adjusted EBITDA in conjunction with net income or loss as calculated in accordance with GAAP. Free Cash Flow We believe that the presentation of Free Cash Flow is appropriate to provide additional information to investors about our ability to repay debt, make other investments, and pay dividends. We define Free Cash Flow as cash flows from operating activities less cash outlays related to capital expenditures. We define capital expenditures to include purchases of property, plant, and equipment; subscriber system asset additions; and accounts purchased through our network of authorized dealers or third parties outside of our authorized dealer network. These items are subtracted from cash flows from operating activities because they represent long-term investments that are required for normal business activities. Free Cash Flow adjusts for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP measure. Free Cash Flow is not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non- discretionary expenditures are not deducted. These limitations are best addressed by using Free Cash Flow in combination with the cash flows as calculated in accordance with GAAP. Free Cash Flow before special items We define Free Cash Flow before special items as Free Cash Flow adjusted for payments related to (i) financing and consent fees, (ii) restructuring and integration, (iii) integration related capital expenditures, (iv) radio conversion costs, and (v) other payments or receipts that may mask the operating results or business trends of the Company. As a result, subject to the limitations described below, Free Cash Flow before special items is a useful measure of our cash available to repay debt, make other investments, and pay dividends. Free Cash Flow before special items adjusts for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP measure. Free Cash Flow before special items is not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures are not deducted. These limitations are best addressed by using Free Cash Flow before special items in combination with the GAAP cash flow numbers. 10 Confidential, not for distribution or publication without express consent of ADT