Attached files

| file | filename |

|---|---|

| EX-2.1 - CHOICEONE EXHIBIT 2.1 TO FORM 8-K - CHOICEONE FINANCIAL SERVICES INC | choiceex21_010620.htm |

| EX-99.2 - CHOICEONE EXHIBIT 99.2 TO FORM 8-K - CHOICEONE FINANCIAL SERVICES INC | choiceex992_010620.htm |

| EX-99.1 - CHOICEONE EXHIBIT 99.1 TO FORM 8-K - CHOICEONE FINANCIAL SERVICES INC | choiceex991_010620.htm |

| 8-K - CHOICEONE FORM 8-K - CHOICEONE FINANCIAL SERVICES INC | choice8k_010620.htm |

EXHIBIT 99.3

ChoiceOne Financial Services, Inc. 1

Sparta, Michigan 2 Muskegon, Michigan has agreed to acquire Strategic Acquisition Pending ChoiceOne Financial Services, Inc. Community Shores Bank Corporation

3 This presentation contains forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,” “may,” “could,” “look forward,” “continue”, “future” and variations of such words and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of ChoiceOne Financial Services, Inc. (“ ChoiceOne ” or “COFS”) and Community Shores Bank Corporation (“Community Shores” or “CSHB”) with respect to their planned merger, the strategic benefits and financial benefits of the merger, including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share, cost savings, the tangible book value earn-back period and other operating and return metrics), and the timing of the closing of the transaction. These statements reflect current beliefs as to the expected outcomes of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed, implied or forecasted in such forward-looking statements. Furthermore, neither ChoiceOne nor Community Shores undertake any obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Such risks, uncertainties and assumptions, include, among others, the following: • the failure to obtain necessary regulatory approvals when expected or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); • the failure of Community Shores to obtain shareholder approval, or for ChoiceOne or Community Shores to satisfy any of the other closing conditions to the transaction on a timely basis or at all; • the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; • the possibility that the anticipated benefits of the transaction, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where ChoiceOne and Community Shores do business, or as a result of other unexpected factors or events; • the impact of purchase accounting with respect to the transaction, or any change in the assumptions used regarding the assets purchased and liabilities assumed to determine their fair value; • diversion of management’s attention from ongoing business operations and opportunities; • potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; and • the outcome of any legal proceedings that may be instituted against ChoiceOne or Community Shores. Additional risk factors include, but are not limited to, the risk factors described in Item 1A in ChoiceOne Financial Services, Inc. ’s Annual Report on Form 10-K for the year ended December 31, 2018. Forward-Looking Statements

4 This communication is being made in respect of the proposed merger transaction between ChoiceOne and Community Shores. In connection with the proposed merger, ChoiceOne will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include the Proxy Statement of Community Shores and a Prospectus of ChoiceOne, as well as other relevant documents regarding the proposed transaction. A definitive Proxy Statement/Prospectus will also be sent to Community Shores shareholders. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. A free copy of the Proxy Statement/Prospectus, once available, as well as other filings containing information about ChoiceOne and Community Shores, may be obtained at the SEC’s Internet site http://www.sec.gov. You will also be able to obtain these documents, free of charge, from ChoiceOne by accessing ChoiceOne’s website at http://www.choiceone.com (which website is not incorporated herein by reference) or from Community Shores by accessing Community Shores’ website at http://www.communityshores.com (which website is not incorporated herein by reference). Copies of the Proxy Statement/Prospectus once available can also be obtained, free of charge, by directing a request to ChoiceOne, 109 East Division Street, Post Office Box 186, Sparta, MI, 49345, Attention: Thomas L. Lampen, or by calling 616-887-7366 or to Community Shores, 1030 West Norton Avenue, Muskegon, MI, 49441, Attention: Heather Brolick, or by calling 231-780-1845. Additional Information

5 Community Shores and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from Community Shores shareholders in respect of the transaction described in the Proxy Statement/Prospectus. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding slide. Contacts: ChoiceOne Financial Services, Inc. Kelly Potes CEO ChoiceOne Bank 616-887-7366 kpotes@choiceone.com Community Shores Bank Corporation Heather Brolick President & CEO Community Shores Bank 231-780-1845 hbrolick@communityshores.com Participants In Solicitation

6 • ChoiceOne Financial Services (“ChoiceOne”) and County Bank Corp. (“County”) completed a merger of equals on 10/1/2019 • ChoiceOne is the parent company of ChoiceOne Bank headquartered in Sparta, Michigan and Lakestone Bank & Trust headquartered in Lapeer, Michigan • ChoiceOne to acquire Community Shores Bank Corp. (“Community Shores”) adding an additional ~$200 million in assets in West Michigan • Community Shores is the parent company of Community Shores Bank headquartered in Muskegon, Michigan • ChoiceOne Bank and Lakestone Bank & Trust are expected to consolidate in the second quarter of 2020 • ChoiceOne Bank and Community Shores Bank are expected to consolidate in the second half of 2020 • Community Shores acquisition allows for market expansion in Muskegon and Ottawa counties, Michigan • Under the terms of the merger agreement, each share of Community Shores common stock outstanding immediately prior to the merger will be converted into the right to receive, at the election of each Community Shores shareholder, an amount of cash equal to $5.00 or 0.17162 shares of ChoiceOne common stock, in each case subject to proration to ensure that, in the aggregate, a minimum of 50% and maximum of 75% of Community Shores’ shares of common stock are converted into ChoiceOne’s common stock • The share exchange proration range represents Community Shores pro forma ownership of 6.8% of ChoiceOne assuming 75% stock is elected; 4.7% if 50% stock is elected • Based on ChoiceOne’s closing stock price of $31.54 on January 3, 2020, and the exchange ratio of 0.17162x, the implied per share value to Community Shores shareholders equals $5.31 per share if 75% stock is elected (an aggregate value of $21.9 million) and $5.21 per share if 50% stock is elected (an aggregate value of $21.5 million) • Implied combined market capitalization equals $245.1 million based on 7.77 million pro forma shares (75% stock election by Community Shores) or $239.5 million based on 7.59 million pro forma shares (50% stock election by Community Shores) and ChoiceOne’s closing stock price of $31.54 as of January 3, 2020 Pending Strategic Acquisition Overview ChoiceOne & Community Shores

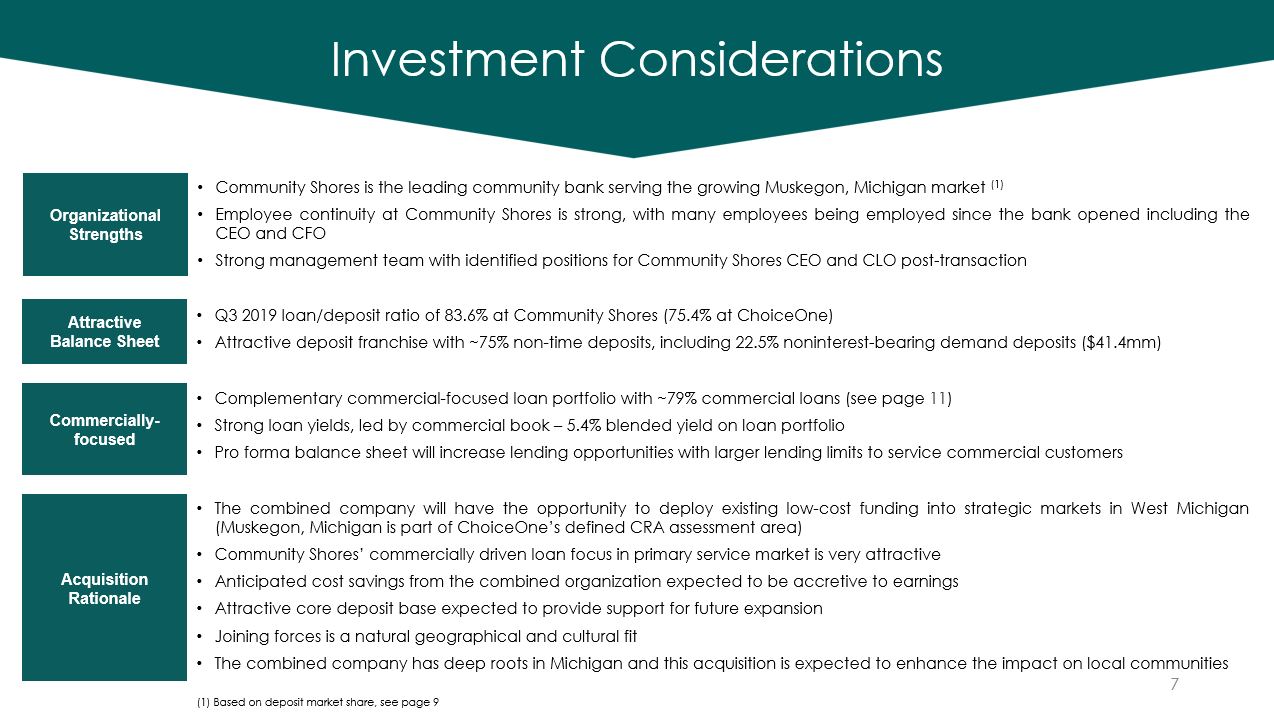

7 • Q3 2019 loan/deposit ratio of 83.6% at Community Shores (75.4% at ChoiceOne) • Attractive deposit franchise with ~75% non-time deposits, including 22.5% noninterest-bearing demand deposits ($41.4mm) Attractive Balance Sheet Commercially-focused Acquisition Rationale • Complementary commercial-focused loan portfolio with ~79% commercial loans (see page 11) • Strong loan yields, led by commercial book – 5.4% blended yield on loan portfolio • Pro forma balance sheet will increase lending opportunities with larger lending limits to service commercial customers • The combined company will have the opportunity to deploy existing low-cost funding into strategic markets in West Michigan (Muskegon, Michigan is part of ChoiceOne’s defined CRA assessment area) • Community Shores’ commercially driven loan focus in primary service market is very attractive • Anticipated cost savings from the combined organization expected to be accretive to earnings • Attractive core deposit base expected to provide support for future expansion • Joining forces is a natural geographical and cultural fit • The combined company has deep roots in Michigan and this acquisition is expected to enhance the impact on local communities • Community Shores is the leading community bank serving the growing Muskegon, Michigan market (1) • Employee continuity at Community Shores is strong, with many employees being employed since the bank opened including the CEO and CFO • Strong management team with identified positions for Community Shores CEO and CLO post-transaction Organizational Strengths Investment Considerations (1) Based on deposit market share, see page 9

8 Ownership/Share Count Consideration Mix Accounting Assumptions Transaction Costs Estimated Cost Savings / Revenue Enhancements • ChoiceOne outstanding common shares 7,238,559 • Shares Issued to Community Shores (assumes 75% election) 531,807 (1) • Pro forma shares 7,770,366 (2) • Fully phased-in cost savings estimated at $2.75 million, or 35% of Community Shores non-interest expense, with 100% expected to be realized in 2021 • No revenue enhancements modeled • Cash or stock at the election of each Community Shores shareholder subject to proration of a minimum of 50% stock and a maximum of 75% stock • Community Shores shareholders electing stock will receive 0.17162 ChoiceOne shares for each share of Community Shores stock, subject to the proration • Community Shores balance sheet will be subject to fair value accounting • Loan credit mark of 1.45% of Community Shores’ loan portfolio as of September 30, 2019 • Core deposit intangible of 1.5% on Community Shores’ non-time deposits amortized 10 years using sum-of-years digits • Community Shores deferred tax asset (3) written down (~$315k) and FHLB Lender Risk Account (“LRA”) asset written up (~$400k) • Combined one-time transaction costs estimated at $4.0 million pre-tax 93.2% 6.8% 100.0% Modeling Results • Immediately accretive to EPS; 7-10% fully phased in (depending on stock election, excluding acquisition expenses) • TBV payback of approximately 2.5 to 3 years using the crossover method • IRR of nearly 20% assuming 12x P/E multiple in terminal year Key Modeling Assumptions (3) DTA adjustment may move up or down per IRC 382 calculation at closing (1) Assumes 75% stock elected; 4,131,664 fully diluted shares x 0.17162 x 0.75 (2) Not including any outstanding ChoiceOne stock options and restricted stock units

9 Pro Forma Branch Map Lakestone Bank & Trust ChoiceOne Bank Community Shores Bank Source: S&P Global Market Intelligence; Deposit data as of June 30, 2019 Institution 2019 Rank Branches Deposits Market Share (%) Muskegon, MI Fifth Third Bancorp 1 6 434,382 27.05 PNC Financial Services Group 2 7 384,575 23.94 ChoiceOne Financial Services Pro Forma 3 5 212,500 13.23 Huntington Bancshares Inc. 3 5 206,766 12.87 Comerica Inc. 4 4 189,631 11.81 Community Shores Bank Corp. 5 3 161,800 10.07 Shelby Financial Corp. 6 4 79,080 4.92 ChoiceOne Financial Services 7 2 50,700 3.16 JPMorgan Chase & Co. 8 1 41,336 2.57 TCF Financial Corp. 9 1 35,302 2.20 Independent Bank Corp. 10 1 22,560 1.40 Total Muskegon, MI 34 1,606,132 100.00 Ottawa, MI Fifth Third Bancorp 1 13 934,132 20.71 Macatawa Bank Corp. 2 16 842,538 18.68 Huntington Bancshares Inc. 3 14 743,292 16.48 TCF Financial Corp. 4 9 602,154 13.35 West Michigan Community Bank 5 8 418,442 9.28 JPMorgan Chase & Co. 6 5 361,657 8.02 Flagstar Bancorp Inc. 7 4 171,120 3.79 PNC Financial Services Group 8 4 168,671 3.74 Comerica Inc. 9 4 100,960 2.24 Mercantile Bank Corp. 10 1 64,518 1.43 ChoiceOne Financial Services Pro Forma 11 2 61,684 1.37 ChoiceOne Financial Services 11 1 44,478 0.99 Community Shores Bank Corp. 12 1 17,206 0.38 Horizon Bancorp Inc. 13 1 14,381 0.32 First National Bancorp Inc. 14 1 13,053 0.29 United Bank Financial Corp. 15 1 9,697 0.21 Old National Bancorp 16 1 4,956 0.11 Total Ottawa, MI 85 4,511,255 100.00

10 Market Comparison ChoiceOne Financial Services Community Shores Bank Corp. Market Area Market Area State of POPULATION DATA Total (1) Total (2) Michigan 2020 Estimated 2,307,519 469,339 10,020,118 2025 Projected 2,343,516 482,533 10,106,291 % Change 2020 - 2025 1.6% 2.8% 0.9% MARKET DEPOSITS ($mm) June 2014 Deposits 35,082 5,270 June 2019 Deposits 43,440 6,117 5-Year Growth 8,358 847 5-Year Deposit CAGR 4.4% 3.0% COMPANY DEPOSITS ($mm) June 2019 Company Market Share 2.6% 2.9% June 2014 Deposits 429 177 June 2019 Deposits 1,126 179 5-Year Growth 697 2 5-Year Deposit CAGR 21.3% 0.2% (1) Market Area Total includes Kent, Newaygo, Muskegon, Ottawa, Lapeer, Saint Clair, and Macomb counties. (2) Market Area Total includes Muskegon and Ottawa counties. Note: Deposit balances sourced from FDIC

ChoiceOne Bank Lakestone Bank & Trust Community Shores Bank Pro Forma Combined Balance % of Lakestone Bank & Balance % of Community Shores Balance % of Balance % of ChoiceOne Bank ($000) Total Trust ($000) Total Bank ($000) Total Pro Forma Combined ($000) Total Construction $21,861 5.0% Construction $28,778 6.7% Construction $6,532 4.2% Construction $57,171 5.6% Farm Loans 29,450 6.7% Farm Loans 8,989 2.1% Farm Loans 210 0.1% Farm Loans 38,649 3.8% 1-4 Family 101,003 23.1% 1-4 Family 132,296 30.9% 1-4 Family 23,120 14.9% 1-4 Family 256,419 25.1% Owner-Occupied CRE 70,840 16.2% Owner-Occupied CRE 74,107 17.3% Owner-Occupied CRE 48,083 30.9% Owner-Occupied CRE 193,030 18.9% Other CRE Loans 41,230 9.4% Other CRE Loans 64,788 15.1% Other CRE Loans 22,226 14.3% Other CRE Loans 128,244 12.6% Multi-Family 21,222 4.8% Multi-Family 7,586 1.8% Multi-Family 862 0.6% Multi-Family 29,670 2.9% C&I 80,688 18.4% C&I 62,923 14.7% C&I 52,790 33.9% C&I 196,401 19.2% Consumer 24,111 5.5% Consumer 11,734 2.7% Consumer 974 0.6% Consumer 36,819 3.6% Agricultural 16,403 3.7% Agricultural 1,070 0.3% Agricultural 0 0.0% Agricultural 17,473 1.7% Other Loans 31,193 7.1% Other Loans 35,505 8.3% Other Loans 792 0.5% Other Loans 67,490 6.6% Total Loans $438,001 100.0% Total Loans $427,776 100.0% Total Loans $155,589 100.0% Total Loans $1,021,366 100.0% Pro Forma Combined 2019Q3 Loan Yield 5.06% 2019Q3 Loan Yield 5.50% 2019Q3 Loan Yield 5.41% 2019Q3 Loan Yield 5.30% Constr. 5.0% Farm 6.7% 1 - 4 Fam. 23.1% OO CRE 16.2% Other CRE 9.4% Multi-Fam. 4.8% C&I 18.4% Consumer 5.5% Agric. 3.7% Other 7.1% Constr. 6.7% Farm 2.1% 1 - 4 Fam. 30.9% OO CRE 17.3% Other CRE 15.1% Multi-Fam. 1.8% C&I 14.7% Consumer 2.7% Agric. 0.3% Other 8.3% Constr. 5.6% Farm 3.8% 1 - 4 Fam. 25.1% OO CRE 18.9% Other CRE 12.6% Multi-Fam. 2.9% C&I 19.2% Consumer 3.6% Agric. 1.7% Other 6.6% Constr. 4.2% Farm 0.1% 1 - 4 Fam. 14.9% OO CRE 30.9% Other CRE 14.3% Multi-Fam. 0.6% C&I 33.9% Consumer 0.6% Other 0.5% 11 Diversified Loan Portfolio Source: S&P Global Market Intelligence Note: Values are bank level as of 9/30/2019 and do not include purchase accounting adjustments

ChoiceOne Bank Lakestone Bank & Trust Community Shores Bank Pro Forma Combined Balance % of Lakestone Bank & Balance % of Community Shores Balance % of Balance % of ChoiceOne Bank ($000) Total Trust ($000) Total Bank ($000) Total Pro Forma Combined ($000) Total Demand $37,055 6.4% Demand $125,152 21.8% Demand $41,382 22.5% Demand $203,589 15.3% NOW & Other Trans 327 0.1% NOW & Other Trans 94,860 16.5% NOW & Other Trans 36,223 19.7% NOW & Other Trans 131,410 9.9% Savings 301,579 52.5% Savings 134,376 23.4% Savings 46,077 25.0% Savings 482,032 36.1% MMDA 90,144 15.7% MMDA 168,491 29.3% MMDA 14,554 7.9% MMDA 273,189 20.5% Retail Time 74,428 12.9% Retail Time 43,216 7.5% Retail Time 39,207 21.3% Retail Time 156,851 11.8% Jumbo Time 51,107 8.9% Jumbo Time 8,537 1.5% Jumbo Time 1,975 1.1% Jumbo Time 61,619 4.6% Brokered Deposits 20,287 3.5% Brokered Deposits 0 0.0% Brokered Deposits 4,542 2.5% Brokered Deposits 24,829 1.9% Total Deposits $574,927 100.0% Total Deposits $574,632 100.0% Total Deposits $183,960 100.0% Total Deposits $1,333,519 100.0% Pro Forma Combined 2019Q3 Cost of Funds 0.56% 2019Q3 Cost of Funds 0.62% 2019Q3 Cost of Funds 1.08% 2019Q3 Cost of Funds 0.66% Demand 22.5% NOW & Other Trans 19.7% Savings 25.0% MMDA 7.9% Retail Time 21.3% Jumbo Time 1.1% Brokered Deposits 2.5% Demand 6.4% NOW & Other Trans 0.1% Savings 52.5% MMDA 15.7% Retail Time 12.9% Jumbo Time 8.9% Brokered Deposits 3.5% Demand 21.8% NOW & Other Trans 16.5% Savings 23.4% MMDA 29.3% Retail Time 7.5% Jumbo Time 1.5% Demand 15.3% NOW & Other Trans 9.9% Savings 36.1% MMDA 20.5% Retail Time 11.8% Jumbo Time 4.6% Brokered Deposits 1.9% 12 Source: S&P Global Market Intelligence Note: Values are bank level as of 9/30/2019 and do not include purchase accounting adjustments Strong Deposit Bases

13 Financial Highlights Source: S&P Global Market Intelligence Note: Financial data shown is at bank level; TCE/TA and per share data is consolidated at holding company $ in 000s 2015 2016 2017 2018 2019 Q3 LTM 2015 2016 2017 2018 2019 Q3 LTM 2015 2016 2017 2018 2019 Q3 LTM Balance Sheet: Assets $565,408 $603,892 $642,816 $666,767 $661,031 $323,946 $583,529 $602,429 $616,168 $672,174 $180,055 $190,690 $184,074 $184,473 $203,769 Loans 354,261 370,973 407,307 430,548 438,001 171,688 315,318 344,539 363,861 427,776 122,742 140,953 148,499 147,309 155,589 Deposits 475,841 512,903 541,102 578,415 574,927 285,172 520,351 539,573 542,493 574,632 161,235 168,380 165,536 165,874 183,960 Shareholders’ Equity 66,539 67,698 71,570 75,314 81,168 36,660 54,591 58,947 59,939 67,725 13,504 17,297 17,014 18,092 19,218 Financial Performance: NIM 3.72% 3.65% 3.60% 3.81% 3.70% 3.53% 3.77% 3.65% 3.66% 3.70% 3.66% 3.64% 3.74% 4.06% 3.98% Noninterest Income / Total Revenue 29.80% 28.18% 28.29% 23.64% 24.96% 24.11% 24.80% 22.69% 21.13% 20.49% 16.86% 16.17% 15.31% 12.37% 13.02% Efficiency Ratio 67.19% 66.92% 65.55% 69.57% 72.21% 67.23% 83.23% 66.97% 66.41% 63.66% 98.88% 93.55% 83.95% 84.46% 82.49% ROAA 1.06% 1.05% 0.98% 1.14% 1.07% 1.11% 0.52% 0.93% 1.13% 1.20% 0.02% 0.17% -0.31% 0.61% 0.58% ROAE 8.80% 8.96% 8.77% 10.09% 9.18% 10.08% 5.13% 9.49% 12.00% 12.15% 0.32% 1.86% -3.37% 6.43% 6.08% Credit Quality: NPAs / Assets 0.95% 0.83% 0.57% 0.54% 0.90% 1.51% 0.45% 0.33% 0.34% 0.34% 5.62% 5.26% 5.32% 4.16% 3.27% NPAs excl. TDRs / Assets 0.40% 0.42% 0.19% 0.25% 0.58% 0.59% 0.36% 0.21% 0.33% 0.32% 1.89% 0.83% 1.85% 1.54% 1.03% ALLL / Gross Loans 1.18% 1.15% 1.12% 1.09% 0.94% 1.25% 0.53% 0.48% 0.47% 0.43% 1.36% 1.14% 1.29% 1.19% 1.03% ALLL / NPAs 77.94% 85.61% 124.61% 130.24% 69.20% 43.90% 64.20% 83.72% 80.54% 80.16% 16.52% 16.06% 19.54% 22.87% 23.95% Bank Capitalization: Leverage Ratio 9.47% 9.31% 9.19% 9.77% 9.81% 11.68% 9.84% 10.19% 10.29% 9.75% 6.12% 8.30% 8.50% 9.48% 9.01% Total Risk-based Capital Ratio 13.32% 13.43% 12.95% 12.88% 13.04% 20.92% 17.07% 16.58% 16.11% 14.62% 9.46% 11.12% 11.82% 12.44% 12.07% Consolidated Capitalization: TCE / TA 10.07% 9.77% 9.93% 10.16% 10.91% 11.44% 9.12% 9.61% 9.61% 10.11% 4.18% 7.35% 7.05% 7.50% 7.26% Per Share Data: Shares Outstanding 3,632,988 3,613,933 3,620,997 3,616,483 3,634,388 1,080,946 1,748,592 1,746,884 1,746,884 1,746,884 1,468,800 4,101,664 4,106,664 4,111,664 4,111,664 BV per Share $19.22 $19.73 $21.14 $22.25 $23.28 $34.31 $31.45 $33.92 $34.55 $39.41 $5.15 $3.43 $3.17 $3.38 $3.59 TBV per Share $15.34 $16.04 $17.35 $18.46 $19.51 $34.31 $30.35 $32.53 $33.36 $38.85 $5.15 $3.43 $3.17 $3.38 $3.59 EPS $1.58 $1.68 $1.70 $2.02 $1.64 $3.25 $2.28 $3.06 $3.96 $3.23 ($0.30) $0.05 ($0.24) $0.22 $0.22 Dividends per Share $0.60 $0.62 $0.64 $0.71 $1.38 $1.38 $1.40 $1.22 $2.00 $2.12 $0.00 $0.00 $0.00 $0.00 $0.00 ChoiceOne Bank Lakestone Bank & Trust Community Shores Bank ChoiceOne Financial Services, Inc. County Bank Corp. Community Shores Bank Corp.

14 Contribution Analysis As of September 30, 2019 Source: S&P Global Market Intelligence Pro Forma SELECT BALANCE SHEET CONTRIBUTIONS COFS Contribution CSHB Contribution Combined (1) Total Assets $1,376,506 87.1% $204,422 12.9% $1,580,928 Total Loans $865,937 84.9% $153,749 15.1% $1,019,686 Total Deposits $1,147,744 86.2% $183,827 13.8% $1,331,571 Tangible Common Equity $137,753 90.3% $14,844 9.7% $152,597 PROFITABILITY CONTRIBUTIONS LTM Pre-Tax Pre-Provision Net Income (2) $13,134 92.0% $1,138 8.0% $14,272 LTM Net Income (2) $10,878 92.4% $891 7.6% $11,769 MARKET CAPITALIZATION Current Shares Outstanding 7,238,559 4,131,664 7,770,366 Stock Price (1/3/2020) $31.54 $3.01 Current Market Cap (3) $228,304 $12,436 $245,077 (2) ChoiceOne's LTM net income and pre-tax, pre-provision net income is adjusted for County Bank Corp. merger on 10/1/2019 (1) Pro Forma Combined represents the sum of COFS (pro forma with Lakestone Bank & Trust) and CSHB and is not reflective of any purchase accounting marks or merger adjustments (3) CSHB fully diluted shares multiplied by exchange ratio of 0.17162x (75% election assumed) to arrive at pro forma shares outstanding multiplied by current COFS stock price

Thank You!