Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99.3 - VIVIC CORP. | ex993.htm |

| EX-99 - EXHIBIT 99.2 - VIVIC CORP. | ex992.htm |

| EX-99 - EXHIBIT 99.1 - VIVIC CORP. | ex991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 15, 2019

Commission file # 333-219148

Vivic Corp.

(Exact name of registrant as specified in its charter)

Nevada | 7999 | 98-1353606 |

State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Number) | (IRS Employer Identification Number) |

189 E Warm Spring Rd., PMB#B450

Las Vegas, NV 89119

Tel: 702-899-0818

(Address and telephone number of registrant's executive office)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

Item 2.01 Completion of Acquisition or Disposition of Assets.

On October 15, 2019,Vivic Corp (“Company”) completed the acquisition of 100% ownership of Guangzhou Monte Fino Yacht Co., Ltd., a Chinese limited liability company (“Guangzhou Monte Fino”).

Guangzhou Monte Fino holds the exclusive license to use the brand “Monte Fino” in mainland China. Monte Fino is a famous yacht brand owned by Taiwan Kha Shing Yacht Company, one of the leading yacht manufacturers in the world. Guangzhou Monte Fino has acquired the rights to develop a yacht marina in Shanwei City, Guangdong Province, China and has also developed and operated “Surf”(享浪),an online yacht rental and leisure service platform in Guangzhou, China. Guangzhou Monte Fino engaged in business in multiple Chinese provinces including Guangdong, Fujian and Hainan, and it has received numerous awards at the famous China Boat Show.

The acquisition of Guangzhou Monte Fino is a milestone for the Company’s business in mainland China. Guangzhou Monte Fino’s operations will contribute significantly to the main business of the Company, including marine tourism, yacht rental and marina management.

Subsequent to the acquisition, Guangzhou Monte Fino will assume the continuing operations of the post-acquisition entity, and its senior management acted as the senior management of the post-acquisition entity. The acquisition is considered as a re-capitalization of the company. Therefore, the assets, liabilities and operating results of Guangzhou Monte Fino will be merged with us from the date of acquisition.

We are a corporation established under the corporation laws in the State of Nevada on February 16, 2017. Yoel Rosario Duran and Dmitriy Perfilyev were our directors and officers. We mainly engaged in the tourism business. On December 27, 2018, Honetech Inc, a Samoa company, purchased 2,499,800 shares of common stock of Company from Yoel Rosario Duran for the price of $151,984.80 and 1,999,800 shares of common stock of the Company from Dmitriy Perfilyev for the price of $151,984.80 pursuant to the share purchase agreements entered on December 21, 2018. Upon the consummation of these transactions, Hontech Inc became the controlling shareholder of the Company. In connection with this share purchase transaction, on December 21, 2018, the following new members have been appointed to the board of directors and principal offices of the Company:

Wen-Chi Huang became Chairman of the Board and a Board Director.

Huilan Chen became Secretary of the Board, a Board Director and the Controller of the Company.

Cheng-Hsing Hsu became a Board Director and the Chief Financial Officer of the Company.

Yun-Kuang Kung became the Chief Executive Office of the Company.

Kuen-Horng Tsai became the Supervisor of the Board of Directors and a Board Director.

Kun-Teng Liao became a Board Director.

Effective on December 21, 2018, Yoel Rosario Duran resigned from all positions he held in the Company, including Chief Executive Officer, Chief Financial Officer, President, Treasurer, and Board Director, and Dmitriy Perfilyev resigned as the Secretary of the Company.

Starting December 27, 2018, accompanying the change of new management, we expanded our main business operations to the research and development of yacht manufacturing, tourism, pier, real estate operations and the application of new energy saving technologies.

There are currently two main sectors in the Company's business:

1)In mainland China and Taiwan, we carried out the development, sales and operation of new energy electric yachts and traditional power yachts, covering the entire yacht industry chain. Through the Internet platform, we provided our own proprietary and third-party yacht tourism products, covering the best coastal tourism attractions in Taiwan and China including Hainan, Xiamen, and Guangzhou.

2)For the global energy market, we developed a series of oil and gas energy-saving products with new energy-saving technologies. This cross-century energy-saving solution can be applied in various scenarios with oil and natural gas as energy sources. This energy-saving innovative technology will also be applied to new energy-saving ships and traditional boat reconstruction equipment to save energy.

2

On June 25, 2019, we formed Vivic Corporation (Hong Kong) Co., Ltd (“Vivic HK”), a wholly owned subsidiary company in Hong Kong. We intended to use Vivic HK as the primary entity to carry out the new business development in Hong Kong, Macau and mainland China (“Target Areas”), coordinate the cooperation with other business entities in Target Areas, and invest in the potential mergers and acquisitions in Target Areas.

On July 6, 2019, Huilan Chen resigned and Cheng Lung Sung became the new Secretary of the Company.

On July 11, 2019, we formed a wholly owned branch company in Taiwan (“VIVC Taiwan”) at 19 Jianping Third Street, Tainan City. VIVC Taiwan will be responsible for the research, development and application of energy-saving technologies, and the research and development of the manufacturing of electric ships.

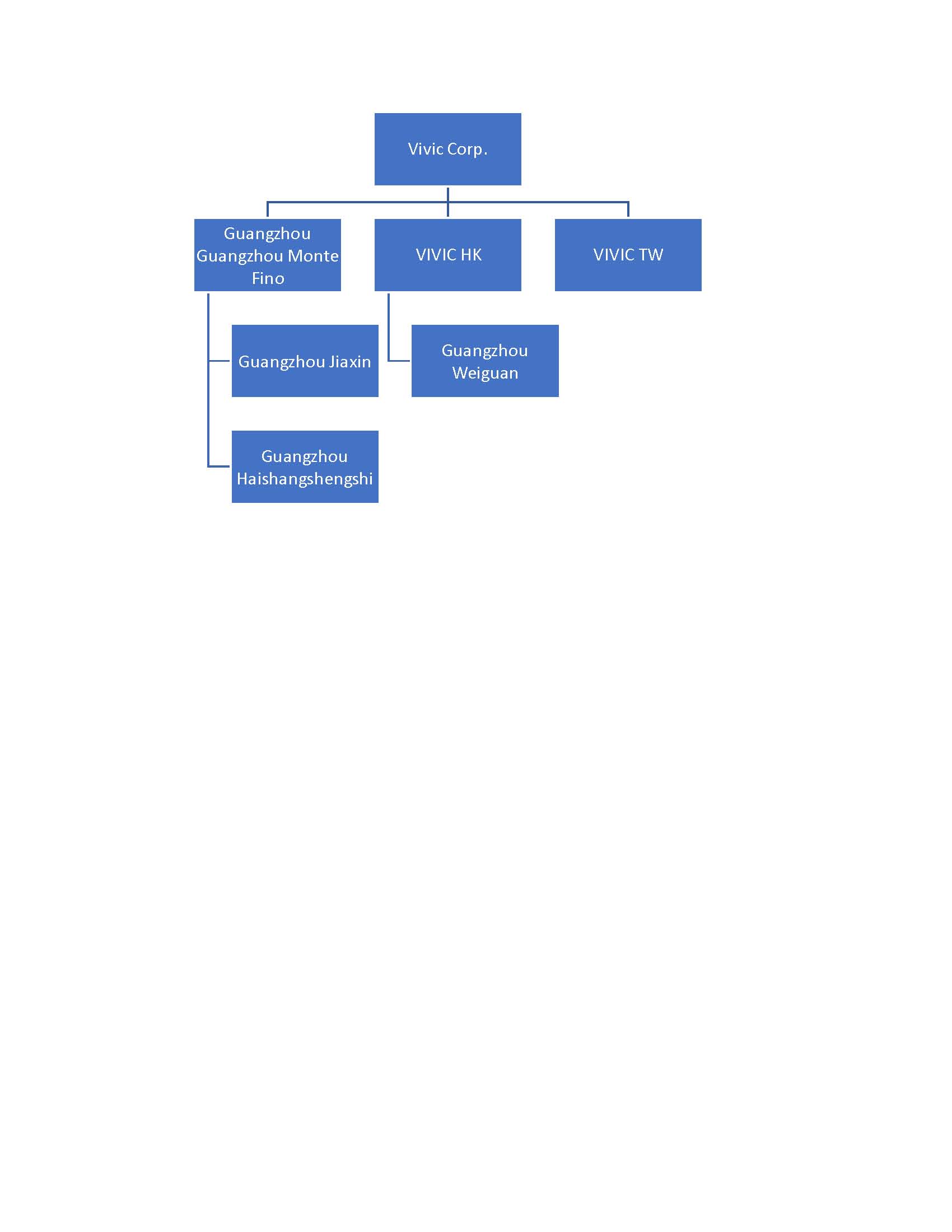

Corporate Structure:

Upon the acquisition of Guangzhou Monte Fino, our corporate structure is as follows:

Brief Description of the Business of Guangzhou Monte Fino

Guangzhou Monte Fino is committed to building a yacht wharf centered business with multiple channels of revenues. It focuses on the wharf construction operation, yacht R&D, brand promotion, marketing and resource integration. It combines the online platform with numerous third party service providers to deliver yacht based recreational and leisure packages and services. Guangzhou Monte Fino was incorporated in Guangzhou on October 11, 2016 and has two subsidiaries:

Guangzhou Haishangshengshi yacht co., LTD., focusing on yacht sales, yacht rental, Internet platform development and operation;

3

Guangzhou Jiaxin Yacht Co., Ltd. focusing on dock development, new energy yacht research and development, yacht maintenance and other industry chain undertakings.

Business and Services

Guangzhou Monte Fino’s business operations mainly consist of:

Operation of the yacht wharf:

Acquire the right to the construction land of the yacht wharf, co-develop the yacht wharf with local developers and operate the yacht wharf afterwards

Yacht sales: Guangzhou Monte Fino is the general agent of Monte Fino yacht brand in mainland China. Monte Fino is a luxury yacht brand established for 30 years with approximately 1200 luxury superyachts sold under its brand.

Yacht leasing: we operate yacht leasing business in Fujian, Guangdong and Hainan and can also reach out to customers in other regions through Internet sharing platform.

Internet platform development and operation: the company has developed an Internet yacht platform with the brand of Surf ("Xianglang"). Through the distribution mechanism, the company enrolled members and sold membership subscription to expand yacht consumption customers. It provides marine tourism products through the time share mechanism.

Yacht maintenance: provide yacht maintenance service for Chinese mainland customers.

New energy yacht research and development: research and development through full electric or hybrid electric yacht, reduce the cost of yacht tourism operation, protect the earth environment, and reduce the use of yacht pollution.

Core Strengths

Our business has the following core strengths to meet the needs of our merchants and consumers.

Industrial chain support of yacht factory. Through cooperation with various yacht companies, and with the support of Taiwan Monte Fino, the Company has supported its business development with a 40-year industry chain of yacht manufacturing, maintenance, sales, operation, tourism and wharf management and construction.

Closer to the mainland China market. As the Chinese yacht market has just started, it is difficult for European and American yacht companies to establish after-sales service network in a short period of time, and maintenance services often cannot meet the needs of customers in real time. The Company is based in Guangdong, Fujian and Hainan, which is closer to the consumer group in terms of customer response, driving experience, after-sales maintenance and so on. After perfecting the national marketing service network, we will be able to provide all-round after-sales service for domestic yacht users.

Technology. In terms of technology, the Company has a sound R&D system for yacht research and development, and at the same time, it cooperates with excellent design companies in China and abroad, so that the products can always meet the market demand. In terms of yacht manufacturing, the company has advanced 3d printing manufacturing technology in yacht manufacturing, which can greatly reduce the research and development cost and produce better results.

Outstanding cost performance. Compared with Europe and the United States and other yacht manufacturing regions, the company's yacht products are very outstanding cost-effective advantages. The quality and performance of the company's yacht products reach or exceed the European and American yacht brands, but in terms of price, it is roughly half to three-fifths of the international brands’comparable products.

Flexibility of customization. The company has a strong ability to produce products according to customers' specific requirements. According to the consumption environment of the target market, it can carry out different interior design and

4

decoration for the same type of ship, and regardless of Chinese and international customers, it can understand the production process of the yacht at any time, timely adjust the function design.

Merchant/user scale. We want to include products from mass market merchants, such as food and beverages, as part of our products and services. We believe that by adopting a blockchain driven incentive model, simple to complex transactions will be more effectively extended to the mass market.

Brand. We believe that one of the benefits of our brand is that Monte Fino, as a luxury yacht brand, has been established for many years and has good quality control and customer reviews, as well as good customer reviews on the internet platform. A good brand image will help our ecosystem gain more users, distributors and merchants.

Sales and Marketing

Brand awareness. We raise the profile of our company, products, and services directly through the following platforms: mobile applications, social media platforms, in-person promotions, events, and cross-working with business partners.

·Mobile applications: consumers access our products through our mobile platform. Businesses promote their products through the same platform.

·Social media platforms: we promote our products and ecosystem on various social media platforms, including trill, purchase, local BBS, and WeChat Moments.

·Face to face: notify potential users by word of mouth.

·Business partners: we actively seek brand partners to cross-promote our brands, products and services.

·Recommendation and distributor: we actively encourage the development of distributor and subsidiary communities, which will encourage the sale of our products and services.

Offline marketing。

·Ground promotion: use shopping malls, squares, hotels and other channels to obtain customers and traffic.

·Membership: development through member recommendation.

·Alliance: promote brands and products by cooperating with other industries without competition.

Markets and Regions-Greater China includes Taiwan and Hong Kong

The yacht industry in mainland China started in the 1950s, but before the development slowed down, really into the development is nearly a decade, especially in recent years is the most rapid development of China's yacht manufacturing industry, become the world's most attention to the yacht emerging market. In 1978, when ten of the world's major car companies visited Shanghai, few people believed that Chinese people could afford a car. Now almost every family has a car. The yacht industry will be the same as the auto industry 20 years ago. It is estimated that the next 5-10 years will be an acceleration period and a golden period for the development of China's yacht industry. The output value of China's yacht industry is expected to reach 200 billion yuan in the next few years, and 1.5 million people will be employed.

According to international practice, when GDP per capita reaches $3,000, the yacht economy starts to sprout; When reaching 5000 dollars, people begin to pay attention to the pursuit of leisure and enjoyment in life, and the consumers who can afford it begin to buy yachts. And when the per capita GDP exceeds 6000 us dollars, the yacht industry will also enter the high-speed development stage. Neither Italy, France, the United Kingdom, the United States and the Netherlands, nor "upstarts" such as Taiwan, Australia, Japan, Singapore, the Arab states, or even Thailand, have grown much beyond this trajectory. With the per capita GDP of the Yangtze river delta, the pearl river delta and the developed coastal areas around the sea now above us $8,000, the yacht industry on the Chinese mainland should have entered a stage of unstoppable rapid development. aiwan's GDP per capita exceeded us $25,000 in 2018, and the number of yachts registered in Taiwan increased by 50% in the past three years, reaching 568 in total, despite the liberalization of government policies and the increase of berths. There is still a huge market potential, and the growth of domestic demand for yachts is also expected.

On the consumption side, Hurun wealth report 2010 shows that there are 875,000 multimillionaires and 55,000 billionaires in mainland China, half of whom are willing to buy yachts. Calculate on this base, with average yacht unit price 4 million yuan estimate, the potential market size of luxury yacht in Chinese mainland alone is likely to reach 110 billion yuan. No wonder a lot of personage inside course of study sigh with regret, as long as the person that has 1000 per cent or 10, 000

5

per cent of people buys houseboat, this quantity will be very considerable, and the consumption potential to boat of middle and low end of the middle class once be dug out fully, this scale will be more astonishing.

We see rising incomes in the region's emerging economies and strong spending power. In the near future, we hope to focus our business on China.

Corporate Growth Strategy

Develop and perfect our yacht and waterfront tourism industry chain through one circle, two cores and three drives.

Through the physical carrier such as the dock, the development of the industry chain of the yacht, the current pure real estate management to develop into industrial management, the introduction of professional real estate developers in the real estate for authorized development, the company can maximize the land profits, the enterprise can concentrate resources to develop the yacht industry. Through the company's mature operation of a circle + dual core + three drive, the marina will be a good operation, economic benefits.

The yacht ecosphere mainly includes physical industry, yacht manufacturing, yacht sales, yacht trusteeship, yacht training, yacht finance, yacht leasing, membership service, yacht maintenance, yacht wharf, yacht real estate and yacht exhibition.

The front end is the yacht production and maintenance base, and the back end is the yacht commercial complex.

Sales, turn the yacht into a sustainable income - generating asset package, enhance the appeal. Operation, the use of the Internet + big data, the formation of a yacht operation platform, has been registered to own the brand "Surf" platform. Customers can use mobile phones to place orders to visit the yacht, while strengthening sales training, developed a number of excellent sales representatives. Products, actively research and development of new electric yacht, the launch of products in line with market demand.

Intellectual Property And Patents

We expect to rely on patents, trade secrets, Copyrights, proprietary technology, trademarks, license agreements and contractual terms to build our intellectual property and protect our Monte Fino and Surf brands and services. However, these legal instruments provide only limited protection and do not fully protect our rights. Litigation may be necessary in the future to protect our intellectual property, protect our trade secrets, or determine the validity and scope of ownership by others. Litigation can result in substantial costs and diversion of resources and management attention. Any unauthorized disclosure or use of our intellectual property may increase the cost of our business and impair our operating results.

We intend to seek the broadest possible protection for major products and developments in our major markets by combining trade secrets, trademarks, Copyrights and patents, if applicable. We register our trademarks in most parts of the world to protect the brand names of our companies and products.

We will require our employees to sign a non-disclosure agreement with us at the commencement of employment. We expect these agreements to provide that all confidential information developed or disclosed to individuals in the course of their employment with us shall be confidential and shall not be disclosed to third parties except in certain limited circumstances. The agreement will also provide that all inventions conceived by individuals at the time of providing services to us shall be the exclusive property of the company.

Employee

As of December 19, 2019, we have the following employees:

Customer/merchant service representative 2

Business development 2

Business information technology 2

Planning/promotion 1

Management/finance 2

Total 9

All of our employees work in mainland China. We believe we have maintained a good relationship with our employees and have not experienced any strikes or lockouts, nor have we been involved in any Labour disputes.

6

Government and Trade Regulations

We comply with the general laws governing business in China, including labor, occupational safety and health, general corporations, intellectual property and similar laws.

Insurance

We insure according to the usual practice in mainland China. Buy endowment insurance, medical insurance, unemployment insurance, work-related injury insurance and maternity insurance for employees.

Recent Capital Requirements

We believe we will need approximately $30 million over the next 18 months to implement our expansion plans in the China region. In the near future, we intend to finance our expansion through loans from existing shareholders or financial institutions.

An investment in our securities involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained in this prospectus before making an investment decision. Our business, prospects, financial condition, and results of operations may be materially and adversely affected as a result of any of the following risks. The value of our securities could decline as a result of any of these risks. You could lose all or part of your investment in our securities. Some of the statements in “Risk Factors” are forward looking statements.

Risks Relating to our Business

We are susceptible to economic conditions in Taiwan and China where our principal business, assets, suppliers, merchants and customers are located.

Our business and assets are primarily located in Taiwan and China. Our results of operations, financial state of affairs and future growth are, to a significant degree, subject to Taiwan and China’s economic, political and legal development and related uncertainties. Our operations and results could be materially affected by a number of factors, including, but not limited to:

| · | Changes in policies by the Taiwanese or Chinese government resulting in changes in laws or regulations or the interpretation of laws or regulations; changes in taxation, |

| · | Changes in employment restrictions; |

| · | Import duties, and |

| · | Currency revaluation. |

Our limited operating history may make it difficult for us to accurately forecast our operating results and control our business expense which means we face a high risk of business failure which could result in the loss of your investment.

Our planned expense levels are, and will continue to be, based in part on our expectations, which are difficult to forecast accurately based on our stage of development and factors outside of our control. We may be unable to adjust spending in a timely manner to compensate for any unexpected developments. Further, business development expenses may increase significantly as we expand operations or make acquisitions. To the extent that any unexpected expenses precede, or are not rapidly followed by, a corresponding increase in revenue, our business, operating results, and financial condition may be materially and adversely affected which could result in the loss of your investment.

Our future performance depends to a significant degree upon the continued service of key members of management as well as marketing, sales and product development personnel.

7

We believe our future success will also depend in large part upon our ability to attract, retain and further motivate highly skilled management, marketing, sales and product development personnel. We expect to establish an incentive compensation plan for our key personnel to retain their services. We have experienced intense competition for personnel, and we cannot assure you that we will be able to retain our key employees or that we will be successful in attracting, assimilating and retaining personnel in the future.

If we are unable to successfully manage growth, our business and operating results could be adversely affected.

We expect the growth of our business and operations to place significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our reputation and operating results. Our expansion and growth in international markets heighten these risks as a result of the particular challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, alternative dispute systems, regulatory systems, and commercial infrastructures. To effectively manage this growth, we will need to develop and improve our operational, financial and management controls, and our reporting systems and procedures. These systems enhancements and improvements may require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

We may need to raise additional financing to support our operations and future acquisitions, but we cannot be sure that we will be able to obtain additional financing on terms favorable to us when needed. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated.

We have limited financial resources. There can be no assurance that we will be able to obtain financing to fund our operations in light of factors beyond our control such as the market demand for our securities, the state of financial markets, generally, and other relevant factors. Any sale of our Common Stock in the future may result in dilution to existing stockholders. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any future indebtedness or that we will not default on our future debts, which would thereby jeopardize our business viability. We may not be able to borrow or raise additional capital in the future to meet our needs, which might result in the loss of some or all of your investment in our Common Stock. Even if we do raise sufficient capital and generate revenues to support our operating expenses, there can be no assurance that the revenue will be sufficient to enable us to develop our business to a level where it will generate profits and cash flows from operations or provide a return on investment. In addition, if we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted, the newly-issued securities may have rights, preferences or privileges senior to those of existing stockholders and the trading price of our Common Stock could be adversely affected. Further, if we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we are unable to continue as a going concern, you may lose your entire investment.

A significant disruption in our computer systems and our inability to adequately maintain and update those systems could adversely affect our operations and our ability to maintain user confidence.

We rely extensively on our computer systems to manage and account for inventory, process user transactions, manage and maintain the privacy of user’s data, communicate with our vendors and other third parties, service accounts, and summarize and analyze results. We also rely on continued and unimpeded access to the Internet to use our computer systems. Our systems are subject to damage or interruption from power outages, telecommunications failures, computer viruses, malicious attacks, security breaches, and catastrophic events. If our systems are damaged or fail to function properly or reliably, we may incur substantial repair or replacement costs, experience data loss or theft and impediments to our ability to manage inventories or process user transactions, engage in additional promotional activities to retain our users, and encounter lost user confidence, which could adversely affect our results of operations.

We continually invest to maintain and update our computer systems. Implementing significant system changes increases the risk of computer system disruption. The potential problems and interruptions associated with implementing technology initiatives, as well as providing training and support for those initiatives, could disrupt or reduce our operational efficiency, and could negatively impact user experience and user confidence.

8

If our efforts to protect the security of information about our Resellers, customers, and other third parties are unsuccessful, we may face additional costly government enforcement actions and private litigation, and our sales and reputation could suffer.

We regularly receive and store information about our Resellers, customers, merchants, vendors and other third parties. We have programs in place to detect, contain, and respond to data security incidents. However, because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be difficult to detect for long periods of time, we may be unable to anticipate these techniques or implement adequate preventive measures. In addition, hardware, software, or applications we develop or procure from third parties or through open source solutions may contain defects in design or manufacture or other problems that could unexpectedly compromise information security. Unauthorized parties may also attempt to gain access to our systems or facilities, or those of third parties with whom we do business, through fraud, trickery, or other forms of deceiving our team members, contractors, and vendors.

To date, we have not encountered significant incidents of data breach or breaches that were material to our consolidated financial statements. If we, our vendors, or other third parties with whom we do business experience significant data security breaches or fail to detect and appropriately respond to significant data security breaches, we could be exposed to government enforcement actions and private litigation. In addition, our users could lose confidence in our ability to protect their information, which could cause them to discontinue using our e-wallets, our digital products, or loyalty programs, or stop shopping with us altogether.

Other factors can have a material adverse effect on our future profitability and financial condition.

Many other factors can affect our profitability and financial condition, including:

| · | changes in, or interpretations of, laws and regulations including changes in accounting standards and taxation requirements; |

| · | changes in the rate of inflation, interest rates and the performance of investments held by us; |

| · | changes in the creditworthiness of counterparties that transact business with; |

| · | changes in business, economic, and political conditions, including: war, political instability, terrorist attacks, the threat of future terrorist activity and related military action; natural disasters; the cost and availability of insurance due to any of the foregoing events; labor disputes, strikes, slow-downs, or other forms of labor or union activity; and, pressure from third-party interest groups; |

| · | changes in our business and investments and changes in the relative and absolute contribution of each to earnings and cash flow resulting from evolving business strategies, changing product mix, changes in tax rates and opportunities existing now or in the future; |

| · | difficulties related to our information technology systems, any of which could adversely affect business operations, including any significant breakdown, invasion, destruction, or interruption of these systems; |

| · | changes in credit markets impacting our ability to obtain financing for our business operations; or |

| · | legal difficulties, any of which could preclude or delay commercialization of products or technology or adversely affect profitability, including claims asserting statutory or regulatory violations, adverse litigation decisions, and issues regarding compliance with any governmental consent decree. |

9

Risks Related to our International Operations

We are subject to risks associated with doing business internationally including compliance with domestic and foreign laws and regulations, economic downturns, political instability and other risks that could adversely affect our operating results.

We conduct our businesses in Asia and Southeast Asia and have assets located in Taiwan and China. We are required to comply with numerous and broad reaching laws and regulations administered by United States federal, state and local, and foreign governmental authorities. We must also comply with other general business regulations such as those directed toward accounting and income taxes, anti-corruption, anti-bribery, global trade, handling of regulated substances, and other commercial activities, conducted by our employees and third-party representatives globally. Any failure to comply with applicable laws and regulations could subject us to administrative penalties and injunctive relief, and civil remedies including fines, injunctions, and recalls of our products. In addition, changes to regulations or implementation of additional regulations may require us to modify existing processing facilities and/or processes, which could significantly increase operating costs and negatively impact operating results.

We operate in both developed and emerging markets in Southeast Asia which are subject to impacts of economic downturns, including decreased demand for our products, reduced availability of credit, or declining credit quality of our suppliers, customers, and other counterparties. We anticipate that emerging market areas could be subject to more volatile economic, political and market conditions. Economic downturns and volatile conditions may have a negative impact on our operating results and ability to execute its business strategies.

Our operating results may be affected by changes in trade, monetary, fiscal and environmental policies, laws and regulations, and other activities of governments, agencies, and similar organizations. These conditions include but are not limited to changes in a country’s or region’s economic or political conditions, trade regulations affecting production, pricing and marketing of products, local labor conditions and regulations, reduced protection of intellectual property rights, changes in the regulatory or legal environment, restrictions on currency exchange activities, currency exchange fluctuations, burdensome taxes and tariffs, enforceability of legal agreements and judgments, other trade barriers, and regulation or taxation of greenhouse gases. International risks and uncertainties, including changing social and economic conditions as well as terrorism, political hostilities, and war, may limit our ability to transact business in these markets and may adversely affect our revenues and operating results.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We will have operations, agreements with third parties and make sales in Asia, which may experience corruption. Our proposed activities in Asia create the risk of unauthorized payments or offers of payments by one of the employees, consultants, or sales agents of our Company, because these parties are not always subject to our control. It will be our policy to implement safeguards to discourage these practices by our employees. Also, our existing practices and any future improvements may prove to be less than effective, and the employees, consultants, or sales agents of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

10

We expect our revenues to be paid in non-U.S. currencies, and if currency exchange rates become unfavorable, we may lose some of the economic value of the revenues in U.S. dollar terms.

Our operations are conducted in Taiwan and China and our operating currency is the New Taiwan Dollar and RMB. Since we conduct business in currencies other than U.S. dollars but report our financial results in U.S. dollars, we face exposure to fluctuations in currency exchange rates. For instance, if currency exchange rates were to change unfavorably, the U.S. dollar equivalent of our operating income recorded in foreign currencies would be diminished.

We currently do not, but may in the future, implement hedging strategies, such as forward contracts, options, and foreign exchange swaps to mitigate this risk. There is no assurance that our efforts will successfully reduce or offset our exposure to foreign exchange fluctuations. Additionally, hedging programs expose us to risks that could adversely affect our financial results, including the following:

| · | We have limited experience in implementing or operating hedging programs. Hedging programs are inherently risky and we could lose money as a result of poor trades; |

| · | We may be unable to hedge currency risk for some transactions or match the accounting for the hedge with the exposure because of a high level of uncertainty or the inability to reasonably estimate our foreign exchange exposures; |

| · | We may be unable to acquire foreign exchange hedging instruments in some of the geographic areas where we do business, or, where these derivatives are available, we may not be able to acquire enough of them to fully offset our exposure; |

| · | We may determine that the cost of acquiring a foreign exchange hedging instrument outweighs the benefit we expect to derive from the derivative, in which case we would not purchase the derivative and would be exposed to unfavorable changes in currency exchange rates; |

| · | To the extent we recognize a gain on a hedge transaction in one of our subsidiaries that is subject to a high statutory tax rate, and a loss on the related hedged transaction that is subject to a lower rate, our effective tax rate would be higher; and |

| · | Significant fluctuations in foreign exchange rates could greatly increase our hedging costs. |

We anticipate increased exposure to exchange rate fluctuations as we expand the breadth and depth of our international sales.

In our financial statements, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period or the exchange rate at the end of that period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currency denominated transactions could result in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions could result in increased revenue, operating expenses and net income for our international operations.

Risks Related to our Common Stock

We can provide no assurances as to our future financial performance or the investment result of a purchase of our Common Stock.

Any projected results of operations involve significant risks and uncertainty and should be considered speculative, and depend on various assumptions which may not be correct. The future performance of our Company and the return on our common stock depends on a complex series of events that are beyond our control and that may or may not occur. Actual results for any period may or may not approximate any assumptions that are made and may differ significantly from such assumptions. We can provide no assurance or prediction as to our future profitability or to the ultimate success of an investment in our Common Stock.

11

The market price of our common stock may be volatile, and our stock price may fall below your purchase price at the time you desire to sell your shares of our common stock, resulting in a loss on your investment.

The market price of our common stock may fluctuate substantially due to a variety of factors, many of which are beyond our control, including, without limitation:

| · | actual or anticipated variations in our quarterly and annual operating results, financial condition or asset quality; |

| · | changes in general economic or business conditions, both domestically and internationally; |

| · | the effects of, and changes in, trade, monetary and fiscal policies, including the interest rate policies of the Federal Reserve, or in laws and regulations affecting us; |

| · | the number of securities analysts covering us; |

| · | publication of research reports about us, our competitors, or the financial services industry generally, or changes in, or failure to meet, securities analysts’ estimates of our financial and operating performance, or lack of research reports by industry analysts or ceasing of coverage; |

| · | changes in market valuations or earnings of companies that investors deemed comparable to us; |

| · | the average daily trading volume of our common stock; |

| · | future issuances of our common stock or other securities; |

| · | additions or departures of key personnel; |

| · | perceptions in the marketplace regarding our competitors and/or us; |

| · | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving our competitors or us; and |

| · | other news, announcements or disclosures (whether by us or others) related to us, our competitors, our core market or the financial services industry. |

The stock market and, in particular, the market for financial institution stocks have experienced significant fluctuations in recent years. In many cases, these changes have been unrelated to the operating performance and prospects of particular companies. In addition, significant fluctuations in the trading volume in our common stock may cause significant price variations to occur. Increased market volatility may materially and adversely affect the market price of our common stock, which may make it difficult for you to resell your shares at the volume, prices and times desired.

We will be subject to the “penny stock” rules which will adversely affect the liquidity of our common stock.

In the event that our shares are traded, and our stock trades about $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of about $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established members and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to. These rules also limit the ability of broker-dealers to solicit purchases of our Common Stock and therefore reduce the liquidity of the public market for our shares should one develop.

The market for penny stocks has experienced numerous frauds and abuses that could adversely impact investors in our stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

12

| · | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| · | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| · | "Boiler room" practices involving high pressure sales tactics and unrealistic price projections by sales persons; |

| · | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| · | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

It is not likely that we will pay dividends on the Common Stock or any other class of stock.

We intend to retain any future earnings for the operation and expansion of our business. We do not anticipate paying cash dividends on our Common Stock, or any other class of stock, in the foreseeable future. Stockholders should look solely to appreciation in the market price of our common shares to obtain a return on investment.

Investing in our Company is highly speculative and could result in the entire loss of your investment.

An investment in our shares is highly speculative and involves significant risk. Our shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

Financial Condition

During the twelve-month period following the date of this current report, we anticipate that we may not generate sufficient operating revenue to fund our business plan. Accordingly, we will be required to obtain additional financing in order to pursue our plan of operations during and beyond the next twelve months. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock or shareholder loans. However, we do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or shareholder loans to establish our new business.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

We generated net revenue of $856 and $1,117 during the fiscal years ended December 31, 2018 and 2017, respectively. Our net revenue for nine months ended September 30, 2019 was $7,389 and compared to $869 for the same period ended in 2018. The increase in the net revenue was mostly due to more yacht services rendered with focus on the Greater China region.

Our general and administrative expenses for year ended December 31, 2018 and 2017 were $195,761 and 194,842 respectively. For these year ends, they remained stable. For the nine months ended September 30, 2019, the general and administrative expenses of $232,900 were incurred, compared to $149,579 incurred for the same period ended September 30, 2018. The reason for the rise in the general and administrative expenses was that the company tried to develop new and more business opportunities. General and administrative expenses were basically the corporate overhead, such as legal, accounting and office expenses, etc.

For the year ended December 31, 2018, the net loss was $194,683, compared to the net loss $108,437 for year ended December 31, 2017. Our net loss for the nine months ended September 30, 2019 and 2018 were $225,756 and $148,495 respectively. The rise in the net loss was mainly because our general and administrative expenses increased.

LIQUIDITY AND CAPITAL RESOURCES

13

As of December 31, 2018, our total assets were $378,996, compared to $402,377 as of December 31, 2017. As of September 30, 2019, our total assets were $339,006. The decrease was mainly because of the annual depreciation on the plant and equipment.

As of December 31, 2018 and 2017, our total liabilities were $557,194 and $392,786 respectively. The increase was mostly caused by rising in the amount due to a director. As of September 30, 2019, our total liabilities were $553,248.

As of December 31, 2018 and 2017, our accumulated deficits were $332,503 and $137,820 respectively. As of September 30, 2019, our accumulated deficit was $558,259. The additional accumulated deficit was mainly due to the increase in the general and administrative expenses.

Total stockholder’s deficit was $178,198 as of December 31, 2018 and total stockholder’s equity was $9,591 as of December 31, 2017. As of September 30, 2019, total stockholder’s deficit was $214,242.

Cash Flows from Operating Activities

For the year ended December 31, 2018 and 2017, net cash flows used in operating activities were $113,291 and $364,444 respectively. For the nine months period ended September 30, 2019, the net cash flows used in operating activities was $180,686, compared to the same period in 2018 was $73,375. It was mostly caused by the increase in the account and other receivables.

Cash Flows from Investing Activities

For the year ended December 31, 2018, net cash used in investing activities was nil, compared to $2,456 for the year ended December 31, 2017. For the nine-month period ended September 30, 2019 and 2018, net cash used in investing activities were $17,734 and $0 respectively. It was mostly caused by the purchase of plant and equipment.

Cash Flows from Financing Activities

For the year ended December 31, 2018, net cash generated from financing activities was $99,772, compared to $389,405 for the year ended December 31, 2017. It was mainly due to the advance from a director. For the nine months period ended September 30, 2019, net cash generated from financing activities was $160,084, compared to $68,496 for the same period in 2018. The reason mostly was that the proceeds from capital injection was made.

Item 9.01 Financial Statements and Exhibits.

Financial statements of business acquired.

The Audited Consolidated Financial Statements and Unaudited Consolidated Financial Statements of Guangzhou Monte Fino are filed as Exhibit 99.1to this current report and are incorporated herein by reference.

Financial statements of business acquired.

The unaudited Consolidated Financial Statements and Unaudited Consolidated Financial Statements of Guangzhou Monte Fino are filed as Exhibit 99.2 to this current report and are incorporated herein by reference.

Pro forma financial information.

Unaudited Pro Forma Financial Statements are filed as Exhibit 99.2 to this current report and are incorporated herein by reference.

14

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: December 30, 2019

Vivic Corp.

/s/ Yun-Kuang Kung

___________________

By: Yun-Kuang Kung

Chief Executive Officer

/s/ Cheng-Hsing Hsu

___________________

By: Cheng-Hsing Hsu

Chief Financial Officer

|

|

|

|

|

|

15