Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 AUDITOR'S CONSENT - Texas Mineral Resources Corp. | s1_ex23z2.htm |

| EX-5.1 - EXHIBIT 5.1 LEGAL OPINION - Texas Mineral Resources Corp. | s1_ex5z1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

TEXAS MINERAL RESOURCES CORP.

(Exact name of registrant as specified in its charter)

Delaware |

| 1090 |

| 87-0294969 |

(State or other jurisdiction of |

| (Primary Standard Industrial |

| (I. R. S. Employer |

incorporation or organization) |

| Classification Code Number) |

| Identification Number) |

539 El Paso Ave.

Sierra Blanca, TX 79851

(361) 790-5831

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel E. Gorski

Chief Executive Officer

516 South Spring Ave.

Tyler, Texas 75702

(361) 790-5831

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copy to:

Thomas C. Pritchard, Esq.

Thomas C. Pritchard, P.C.

800 Bering Dr., Suite 201

Houston, Texas 77057

Tel: (713) 209-2911

Fax: (832) 538-1265

As soon as practicable after this Registration Statement becomes effective

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filed, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filed,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934 (“Exchange Act”).

[ ] | Large accelerated filer | [ ] | Accelerated filer |

[ ] | Non-accelerated filer |

| (Do not check if a smaller reporting company) |

|

| [X] | Smaller reporting company |

|

| [ ] | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

2

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to Be Registered | Amount Being Registered (1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

Shares of Common Stock underlying the Warrants(3) | 11,032,730 | $0.64 | $7,060,947 | $916.51 |

TOTAL | 11,032,730 | $0.64 | $7,060,947 | $916.51 |

Shares to Register:

(1)Pursuant to Rule 416 under the Securities Act of 1933, the Registrant is also registering such additional indeterminate number of shares as may become necessary to adjust the number of shares as a result of a stock split, stock dividend or similar adjustment of its outstanding Common Stock.

(2)Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average high and low prices of the Common Stock as traded on the OTC QB on December 16, 2019.

(3)Represents shares of Common Stock issuable by the registrant upon the exercise of warrants comprised of the following: (i) 2,253,865 shares of Common Stock underlying class A warrants exercisable at $0.35 per share expiring in December 2020; (ii) 2,253,865 shares of Common Stock underlying class B warrants exercisable at $0.50 per share expiring in December 2020; and (iii) 6,525,000 shares of Common Stock underlying other warrants exercisable at $0.35 per share expiring in December 2020.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

3

The information in this prospectus is not complete and may be amended. The selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

Prospectus dated December 26, 2019

TEXAS MINERAL RESOURCES CORP.

11,032,730 Shares of Common Stock

This prospectus relates to the resale of up to 11,032,730 shares of common stock, par value $0.01 (“Common Stock”), by certain shareholders (the “selling security holders”). The shares of Common Stock subject to this prospectus are issuable to the selling security holders upon exercise of outstanding warrants as follows: (i) 2,253,865 shares of Common Stock underlying class A warrants exercisable at $0.35 per share expiring in December 2020; (ii) 2,253,865 shares of Common Stock underlying class B warrants exercisable at $0.50 per share expiring in December 2020; and (iii) 6,525,000 shares of Common Stock underlying other warrants exercisable at $0.35 per share expiring in December 2020 (the warrants are collectively referred to as the “Warrants”). The Warrants were issued by the Company to the selling security holders in two separate financings during 2015.

We will not receive any proceeds from the resale of any of the shares offered hereby,

Our Common Stock is listed for quotation on the OTC QB quotation systems under the symbol “TMRC.” The market for the Common Stock is limited, sporadic and volatile. The closing price of our Common Stock on December 16, 2019 was $0.64 per share.

We are not selling any of the Common Stock that we are registering. The Common Stock will be sold by the selling security holders at the market price as of the date of sale or a price negotiated in a private sale.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss of your investment. You should read this prospectus in its entirety and carefully consider the risk factors beginning on page 10 of this prospectus and the financial data and related notes incorporated by reference before deciding to invest in the shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _______, 2019

4

TABLE OF CONTENTS

PROSPECTUS SUMMARY | 6 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 10 |

GLOSSARY OF TERMS | 12 |

RISK FACTORS | 13 |

USE OF PROCEEDS | 25 |

SELLING SECURITY HOLDERS | 25 |

PLAN OF DISTRIBUTION | 29 |

DESCRIPTION OF OUR CAPITAL STOCK | 30 |

BUSINESS | 31 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 41 |

DETERMINATION OF OFFERING PRICE | 43 |

MARKET PRICE INFORMATION AND DIVIDEND POLICY | 43 |

MANAGEMENT | 44 |

PRINCIPAL STOCKHOLDERS | 50 |

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 52 |

EXPERTS | 52 |

LEGAL MATTERS | 52 |

WHERE YOU CAN FIND MORE INFORMATION | 52 |

INDEX TO FINANCIAL STATEMENTS | 53 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale of these securities is not permitted. You should assume that the information contained in this prospectus is accurate as of the date on the front of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus will be updated as required by law.

5

PROSPECTUS SUMMARY

This summary highlights selected information about the Company and this offering. This summary is not complete and does not contain all of the information that may be important to you. You should read carefully the entire prospectus, including “Risk Factors” and the other information contained or incorporated by reference in this prospectus before making an investment decision.

General

We were incorporated in the State of Nevada in 1970 as Standard Silver Corporation. In September 2008, we amended and restated our Articles of Incorporation to (i) increase of the number of shares of Common Stock from 25,000,000 to 100,000,000, and (ii) authorize an additional 10,000,000 shares of preferred stock, to be issued at management’s discretion. In August 2012, we changed our state of incorporation from the State of Nevada to the State of Delaware (the “Reincorporation”) pursuant to a plan of conversion. In March 2016, the Company amended its Certificate of Incorporation to change the name of the Company from “Texas Rare Earth Resources Corp” to “Texas Mineral Resources Corp”. Our Common Stock is traded on the OTCQB under the symbol “TMRC,” and the market for our Common Stock is extremely limited, sporadic and highly volatile.

As used in this registration statement and prospectus, “we”, “us”, “our”, “TMRC” or the “Company” refers to Texas Mineral Resources Corp, unless otherwise noted.

This prospectus contains certain “forward-looking statements” within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. In some cases, it is possible to identify forward-looking statements because they contain words such as “anticipates,” believes,” “contemplates,” “continue,” “could,” “estimates,” “expects,” “future,” “intends,” “likely,” “may,” “plans,” “potential,” “predicts,” “projects,” “seek,” “should,” “target” or “will,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Many factors could cause our actual operations or results to differ materially from the operations and results anticipated in forward-looking statements. These factors include, but are not limited to, those set forth under “Risk Factors” commencing on page 10.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements in this prospectus include, but are not limited to:

the progress, potential and uncertainties of our 2019-2020 rare-earth exploration program at our Round Top project, located near Sierra Blanca, Texas (the “Round Top Project”);

costs, timing, and actual obtainable results from and of feasibility studies, including preliminary economic assessments, for our Round Top Project;

the success of getting the necessary permits for future drill programs and future project exploration;

expectations regarding the ability to continue to obtain funding and/or ability to raise capital and to continue our exploration plans at our Round Top Project; and

plans regarding anticipated expenditures at the Round Top Project.

Business of the Company

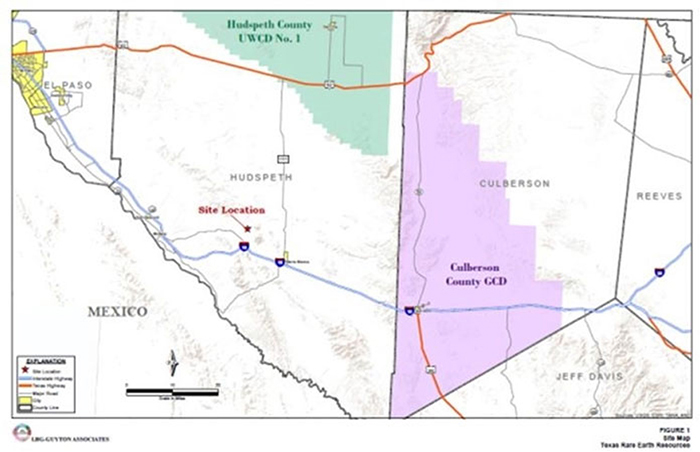

We are a mining company engaged in the business of the acquisition, exploration and development of mineral properties. We currently hold two eleven year leases with the Texas General Land Office (“GLO”), executed in September 2011 and November 2011, respectively, to explore and develop a 950 acre rare earths project located in Hudspeth County, Texas, known as the Round Top Project. We also have prospecting permits covering 9,345 acres adjacent to the Round Top Project. Our principal focus is on developing a metallurgical process to concentrate or otherwise extract the metals from the Round Top Project’s rhyolite, and to conduct additional engineering, design, geotechnical work and permitting necessary for a bankable feasibility study. We currently have limited operations and have not established that any of our projects or properties contain any Proven or Probable Reserves under Guide 7.

6

In March 2013, we purchased the 54,990 acre surface lease at the Round Top Project, known as the West Lease, from the Southwest Wildlife and Range Foundation (the “Foundation”) for $500,000 and the issuance of 1,063,830 shares of our Common Stock. We also agreed to support the Foundation through an annual payment of $45,000 for ten years to support conservation efforts within the Rio Grande Basin and in particular engaging in stewardship of Lake Amistad, a large and well-known fishing lake near Del Rio, Texas. The West Lease provides unrestricted surface access for the potential development and mining of our Round Top Project.

In October 2014, we executed agreements with the GLO securing the option to purchase the surface rights covering the potential Round Top Project mine and plant areas and, separately, a lease to develop the water necessary for the potential Round Top Project mine operations. The option to purchase the surface rights covers approximately 5,670 acres over the mining lease and the additional acreage adequate to site all potential heap leaching and processing operations as currently anticipated by the Company. We may exercise the option for all or part of the option acreage at any time during the sixteen year primary term of the mineral lease. The option can be kept current by an annual payment of $10,000. The purchase price will be the appraised value of the surface at the time of exercising the option. The ground water lease secures our right to develop the ground water within a 13,120 acre lease area located approximately 4 miles from the Round Top deposit. The lease area contains five existing water wells. It is anticipated that all potential water needs for the Round Top Project mine operations will be satisfied by the existing wells covered by this water lease. This lease has an annual minimum production payment of $5,000 prior to production of water for the operation. After initiation of production we will pay $0.95 per thousand gallons or $20,000 annually, whichever is greater. This lease remains effective as long as the mineral lease is in effect.

In March 2015, we conducted a trial mining test during which we mined 500 tonnes of rhyolite, transported and crushed the ore to 80% passing an approximate one inch screen. This rock is now stockpiled and is expected to be used in our contemplated pilot plant development.

In April 2015, we executed a uranium offtake agreement with UG USA, a subsidiary of Areva, to supply up to 300,000 pounds of natural uranium concentrates (U308) per year based upon a pricing formula indexed to U308 spot prices at the times of delivery. The agreement is for a term of five years commencing in 2018 or as soon thereafter, contingent upon development and production at its Round Top Project, and the other terms and conditions reflect industry standards.

During 2017 TMRC in association with Penn State University, REE Tech and Inventure Renewables of Tuscaloosa, Alabama, jointly applied for a Department of Energy grant to evaluate the economic potential of rare earth elements associated with Appalachian coal deposits. Our group was awarded the first phase of this grant on October 19 2017. Work in progress consists of our identification of a resource, developing the physical metallurgy to concentrate the minerals (Penn State) and developing the CIX/CIC process to separate the individual rare earth elements and to separate and refine various other elements including iron and aluminum (Inventure and K-Tech).

In August 2018, we executed a joint venture agreement with Morzev PTY LTD, doing business as USA Rare Earth (“Morzev” or “USA Rare Earth”), to develop the Round Top Project. Terms of the agreement require Morzev to expend up to $10 million to produce a bankable feasibility study. The funds will be allocated in two tranches, the first of $2.5 million to optimize and finalize the metallurgical processing, and the remaining $7.5 million to be used to fund the engineering, design, geotechnical work, and permitting necessary for a bankable feasibility study. Upon completion of these funding milestones, Morzev will earn and own 70% of the Round Top Project and will have a six-month option to purchase an additional 10% (bringing its ownership in the Round Top Project to 80%) for a purchase price of $3 million. In August 2019, Morzev assigned its ownership right to USA Rare Earth LLC. In connection with entering into this agreement, Morzev purchased 646,054 shares of Common Stock for $140,000.

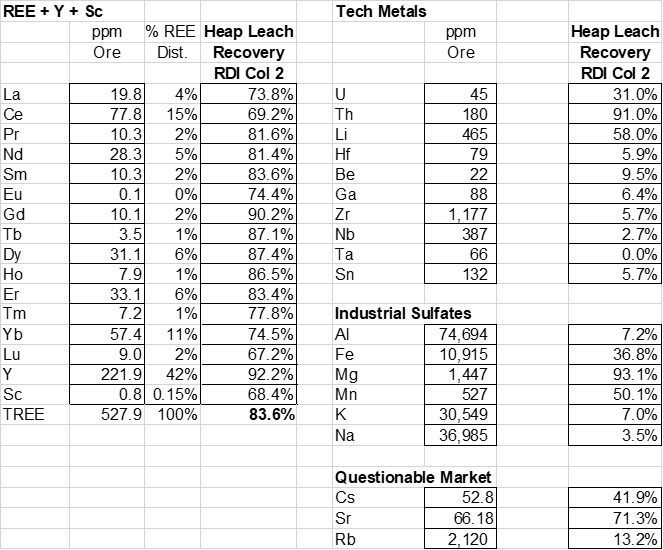

In August 2019, we published a PEA prepared in accordance with Canadian NI 43-101 specifications. The PEA calls for a 20,000 tonnes per day heap leach operation producing three basic revenue streams, one a REE stream, second a tech metal stream that includes lithium and uranium, and a third consisting of a variety of industrial and fertilizer sulfate products.

7

Cautionary Note to Investors: The PEA has been prepared in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. The Company has voluntarily had the PEA prepared in accordance with NI 43-101 but the Company is not subject to regulation by Canadian regulatory authorities and no Canadian regulatory authority has reviewed the PEA or passed upon its accuracy or compliance with NI 43-101. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures. Accordingly, information in the PEA contains descriptions of our mineral deposits that may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. Our project as described in the PEA currently does not contain any known proven or probable ore reserves under SEC Industry Guide 7 reporting standards. U.S. investors are urged to consider closely the disclosure in the Registrant’s latest reports and registration statements filed with the SEC. U.S. Investors are cautioned not to assume that any defined resources in these categories will ever be converted into SEC Guide 7 compliant reserves.

In August 2019, we issued 5,111,625 shares of our Common Stock for $1,840,185 to the Navajo Transitional Energy Company, a company formed under the laws of the Navajo Nation. Concurrently with this purchase, the Company agreed to expand its Board from five members to seven and granted this investor the right to appoint two Board members. In connection therewith, Peter Denetclaw and Clark Moseley were nominated and elected as directors in August 2019.

Executive Officers of the Company

The following table sets forth certain information regarding our executive officers as of the date of this prospectus:

Name |

| Age |

| Position |

Daniel E. Gorski |

| 82 |

| Chief Executive Officer and Director |

Wm Chris Mathers |

| 60 |

| Chief Financial Officer |

Daniel E. Gorski – Mr. Gorski has served as a director of the Company since January 2006 and as the Company’s chief operating officer since May 2011. Prior thereto, Mr. Gorski served as the Company’s president and chief executive officer from January 2007 to May 2011. From July 2004 to January 2006, Mr. Gorski was the co-founder and vice president of operations for High Plains Uranium Inc., a uranium exploration and development company that went public on the Toronto Stock Exchange in December 2005. Between June 1996 to May 2004, Mr. Gorski served as an officer and director of Metalline Mining Co., a publicly traded mining and development company with holdings in the Sierra Mojada Mining District, Coahuila, Mexico. From January 1992 to June 1996, Mr. Gorski was the exploration geologist under contract to USMX Inc. and worked exclusively in Latin America. Mr. Gorski earned a BS in 1960 from Sul Ross State College, in Alpine, Texas and an MA in 1970 from the University of Texas in Austin, Texas. Mr. Gorski has over forty-three years of experience in the mining industry.

Wm Chris Mathers – Mr. Mathers was appointed as the Company’s Chief Financial Officer from 2010 through 2012 and again from February 2016 through the present. Mr. Mathers is also involved in providing contract chief financial officer and consulting services to a wide variety of privately and publicly held companies. From 1993 through 1999, Mr. Mathers served as CFO to InterSystems, Inc. (AMEX:II). Mr. Mathers began his career in public accounting with the international accounting firm of PriceWaterhouse. Mr. Mathers holds a BBA in accounting from Southwestern University located in Georgetown, Texas, and is also a Certified Public Accountant.

Warrants

8

The shares of Common Stock underlying the Warrants are comprised of the following: (i) 2,253,865 shares of Common Stock issuable at an exercise price of $0.35 per share expiring in December 2020; (ii) 2,253,865 shares of Common Stock issuable at an exercise price of $0.50 per share expiring in December 2020; and (iii) 6,525,000 shares of Common Stock issuable at an exercise price of $0.35 per share expiring in December 2020. The Warrants were issued by the Company to the selling security holders in two separate financings during 2015 and contain customary anti-dilution provisions. The Company will not receive any proceeds from the resale of the shares underlying the Warrants.

Risk Factors

Investing in our Common Stock involves risks that include the speculative nature of the mining business, competition, need for additional capital and other material factors. You should read carefully the section of this prospectus entitled “Risk Factors” beginning on page 10 for an explanation of these risks before investing in our Common Stock. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities, which could cause a decrease in the price of our Common Stock and a loss of all or part of your investment:

our business is difficult to evaluate because of our limited operating history;

we have incurred net losses from inception and expect to continue to incur net losses;

we have no mining revenue and don’t expect mining revenue in the near future;

we need to raise capital to continue to fund working capital obligations if USA Rare Earth fails to fund its obligations to earn ownership in the Round Top Project;

we will need to raise significant additional funds to exploit the Round Top Project subsequent to the $10 million funding contemplated to be provided by USA Rare Earth;

the mining industry is intensely competitive;

regulations that govern the mining industry are significant; and

the selling security holders’ ability to sell shares of our Common Stock from time to time under this prospectus may have an adverse effect on the public market of our Common Stock.

About This Offering

Common Stock offered by the selling security holders | 11,032,730 shares beneficially held by the selling security holders that may be sold from time to time. |

Shares outstanding prior to the offering | 56,228,508 shares of Company Common Stock |

Shares to be outstanding after the offering | 67,261,238 shares of Company Common Stock(1)(2) |

Use of proceeds | The selling security holders will receive all of the proceeds from the sale of shares of our Common Stock. We will not receive any proceeds from the sale of the Common Stock. |

Risk Factors | The securities offered hereby involve a high degree of risk. See “Risk Factors.” |

Stock symbol | TMRC |

(1)Assuming the exercise and issuance by the Company of all shares underlying the Warrants as of the date of the prospectus.

(2)Excluding 12,551,010 shares of Common Stock underlying other outstanding derivative securities.

Corporate Address

Our executive offices are located at 539 El Paso Avenue, Sierra Blanco, Texas 79851, and our telephone number is (361) 790-5831.

9

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the federal securities laws. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements in this prospectus include, but are not limited to:

the progress, potential and uncertainties of our 2019-2020 rare-earth exploration program at our Round Top Project, located near Sierra Blanca, Texas;

cost, timing and actual obtainable results from and of feasibility studies, including PEAs for our Round Top Project;

the success of getting the necessary permits for future drill programs and future project exploration;

expectation that USA Rare Earth will fund its up to $10 million obligation to further develop the Round Top Project;

expectations regarding the ability to raise the significant required capital to continue our exploration plans on the Round Top Project (subsequent to completion of the assumed $10 million of USA Rare Earth funding); and

plans regarding anticipated expenditures at the Round Top Project.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

risks associated with our ability to continue as a going concern in future periods;

risks associated with our history of losses and need for additional financing (both from the contemplated USA Rare Earth funding and subsequent to such expected financing);

risks associated with our limited operating history;

risks associated with our properties all being in the exploration stage;

risks associated with our lack of history in producing metals from the Round Top Project;

risks associated with a shortage of equipment and supplies;

risks associated with our need for additional financing to develop the Round Top Project;

risks associated with our exploration activities not being commercially successful;

risks associated with ownership of surface rights and other title issues with respect to our Round Top Project;

risks associated with increased costs affecting our financial condition;

risks associated with a shortage of equipment and supplies adversely affecting our ability to operate;

risks associated with mining and mineral exploration being inherently dangerous;

risks associated with mineralization estimates;

risks associated with changes in mineralization estimates affecting the economic viability of our properties;

10

risks associated with uninsured risks;

risks associated with mineral operations being subject to market forces beyond our control;

risks associated with fluctuations in commodity prices;

risks associated with permitting, licenses and approval processes;

risks associated with the governmental and environmental regulations;

risks associated with future legislation regarding the mining industry and climate change;

risks associated with potential environmental lawsuits;

risks associated with our land reclamation requirements;

risks associated with rare earth and beryllium mining presenting potential health risks;

risks related to competition in the mining and rare earth elements industries;

risks related to economic conditions;

risks related to our ability to manage growth;

risks related to the potential difficulty of attracting and retaining qualified personnel;

risks related to our dependence on key personnel;

risks related to our United States Securities and Exchange Commission (the “SEC”) filing history; and

risks related to our securities.

This list is not exhaustive of the factors that may affect the Company’s forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this prospectus. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, the Company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this prospectus by the foregoing cautionary statements.

In light of these risks and uncertainties, many of which are described in greater detail elsewhere in this prospectus, there can be no assurance that the events predicted in forward-looking statements contained in the prospectus will in fact transpire.

Should any of these risks or uncertainties materialize (in whole or in part), or should any of assumptions prove incorrect, actual results may differ materially from those included within these forward-looking statements. Except as may be required under applicable securities laws, the Company undertakes no obligation to update or publicly release the result of any revision to these forward-looking statements to reflect events or circumstances occurring after the date they are made or to reflect the occurrence of unanticipated events.

An investment in our Common Stock involves significant risks, including the risk of a loss of your entire investment. You should carefully consider the risks and uncertainties described below before purchasing our Common Stock. The risks set forth below are not the only ones facing our Company. Additional risks and uncertainties may exist and others could arise that could also adversely affect our business, financial condition, operations and prospects. If any of the following risks actually materialize, our business, financial condition, prospects and operations would suffer. In such event, the value of our Common Stock would decline, and you could lose all or a substantial portion of your investment.

11

GLOSSARY OF TERMS

Alteration | Any physical or chemical change in a rock or mineral subsequent to its formation. |

|

|

Breccia | A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

|

|

Concession | A grant of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose. |

|

|

Core | The long cylindrical piece of a rock, about an inch in diameter, brought to the surface by diamond drilling. |

|

|

Diamond drilling | A drilling method in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock, which is recovered in long cylindrical sections. |

|

|

Drift | A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a cross-cut which crosses the rock formation. |

|

|

Exploration | Work involved in searching for ore, usually by drilling or driving a drift. |

|

|

Exploration expenditures | Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects that may contain mineral deposit reserves. |

|

|

GLO | Texas General Land Office. |

|

|

Grade | The average assay of a ton of ore, reflecting metal content. |

|

|

HREE | Heavy rare earth element(s). |

|

|

Host rock | The rock surrounding an ore deposit. |

|

|

Intrusive | A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

|

|

Lode | A mineral deposit in solid rock. |

|

|

LREE | Light rare earth element(s). |

|

|

Ore | The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives. The term is generally but not always used to refer to metalliferous material, and is often modified by the names of the valuable constituent; e.g., iron ore. |

|

|

Ore body | A continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible. |

|

|

Mine development | The work carried out for the purpose of opening up a mineral deposit and making the actual ore extraction possible. |

|

|

Mineral | A naturally occurring homogeneous substance having definite physical properties and chemical composition, and if formed under favorable conditions, a definite crystal forms. |

|

|

Mineralization | The presence of minerals in a specific area or geological formation. |

|

|

Mineral Reserve | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of “Ore” when dealing with metalliferous minerals. |

|

|

PEA | Preliminary economic assessment. |

|

|

12

Probable (Indicated) Reserves | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

|

|

Prospect | A mining property, the value of which has not been determined by exploration. |

|

|

Proven (Measured) Reserves | Reserves for which (i) (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes and (b) grade and/or quality are computed from the results of detailed sampling and (ii) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

|

|

REE | Rare earth element(s). |

|

|

REO | Rare earth oxide(s). |

|

|

Tonne | A metric ton which is equivalent to 2,200 pounds. |

|

|

Trend | A general term for the direction or bearing of the outcrop of a geological feature of any dimension, such as a layer, vein, ore body, or fold. |

|

|

Unpatented mining claim | A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim. |

|

|

Vein | A mineralized zone having a more or less regular development in length, width, and depth, which clearly separates it from neighboring rock. |

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risk Related to Our Business

We have a history of losses and will require additional financing to fund operations. Failure to obtain additional financing could have a material adverse effect on our financial condition and results of operation and could cast uncertainty on our ability to continue as a going concern in future periods.

During the fiscal year ended August 31, 2019, we had no revenues. For the fiscal year ended August 31, 2019, our net loss was approximately $1,206,000 and our accumulated deficit at August 31, 2019 was approximately $36.6 million. At August 31, 2019, our cash position was approximately $1,825,000 and our working capital surplus was approximately $448,000. We have not commenced commercial production on any of our mineral properties. We have no revenues from operations and anticipate we will have no operating revenues until we place one or more of our properties into production. All of our properties are in the exploration stage.

We will need to raise additional funding to implement our business strategy (whether from USA Rare Earth or through other best efforts), the failure of which could cause us to curtail or cease our operations. As of the date of this prospectus, we currently have nominal working capital.

13

During the next 12 months, USA Rare Earth is expected to fund the expenditure of up to $2,500,000 to optimize the leaching and developing of the CIX/CIC processing of the Round Top Project. This work will consist of mining and crushing an additional 500 tons of rhyolite and setting up and equipping a facility to conduct the column leaching. It is estimated that the project will require additional time and further expenditure of an approximate amount of up to $7,500,000 to prepare a bankable feasibility study. We anticipate (but there can be no assurance) that USA Rare Earth will fund these required expenditures, and the failure of USA Rare Earth to fund will require us to effect best efforts to raise sufficient capital to finish this work. We currently do not have any funds to complete exploration and development work on the Round Top Project, which means that we are reliant upon USA Rare Earth or best efforts financings for our immediate working capital needs. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration and development or contemplated production at the Round Top Project. This includes our leases over claims covering the principal deposits at the Round Top Project, which may expire unless we expend minimum levels of expenditures over the terms of such leases. We cannot be certain that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable or acceptable to us. Our ability to arrange additional financing in the future will depend, in part, on the prevailing capital market conditions as well as our business performance.

The most likely source of future financing presently available to us (other than through our agreement with USA Rare Earth) is through the sale of our securities. Any sale of our shares of Common Stock will result in dilution of equity ownership to existing stockholders. This means that if we sell shares of Common Stock, more shares will be outstanding and each existing stockholder will own a smaller percentage of the shares then outstanding. Alternatively, we may rely on debt financing and assume debt obligations that require us to make substantial interest and capital payments. Also, we may issue or grant warrants or options in the future pursuant to which additional shares of Common Stock may be issued. Exercise of such warrants or options will result in dilution of equity ownership to our existing stockholders.

We have a limited operating history on which to base an evaluation of our business and properties.

Any investment in the Company should be considered a high-risk investment because investors will be placing funds at risk in an early stage, under-capitalized business with unforeseen costs, expenses, competition, a history of operating losses and other problems to which start-up ventures are often subject. Investors should not invest in the Company unless they can afford to lose their entire investment. Your investment must be considered in light of the risks, expenses, and difficulties encountered in establishing a new business in a highly competitive and mature industry. Our operating history has been restricted to the acquisition and sampling of our Round Top Project and this does not provide a meaningful basis for an evaluation of our Round Top Project. Other than through conventional and typical exploration methods and procedures, we have no additional way to evaluate the likelihood of whether our Round Top Project or our other mineral properties contain commercial quantities of mineral reserves or, if they do, that they will be operated successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties.

The Round Top Project is in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve from the Round Top Project in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from the Round Top Project, and our business could fail.

We have not established that the Round Top Project contains any commercial exploitable quantities of mineral reserve, nor can there be any assurance that we will be able to do so. The probability of the Round Top Project ever having a commercial exploitable mineral reserve that meets the requirements of the SEC is extremely remote. Even if we do eventually discover commercial exploitable quantities of mineral reserve on the Round Top Project, there can be no assurance that it can be developed into a producing mine and extract those minerals. Both mineral exploration and development involve a high degree of risk and few properties, which are explored, are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the deposit to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Even if commercial viability of a mineral deposit is established, it may take several years in the initial phases of drilling until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to establish proven and probable reserves through drilling and bulk sampling, to determine the optimal metallurgical process to extract the metals from the ore and, in the case of new properties, to construct mining and processing facilities. Because of these uncertainties, no assurance can be given that our exploration programs will result in the establishment or expansion of a mineral deposit or reserves.

14

We have no history of producing metals from the Round Top Project.

We have no history of producing metals from the Round Top Project. The Round Top Project is an exploration stage property in the early stage of exploration and evaluation. Advancing properties from exploration into the development stage requires significant capital and time, and successful commercial production from the Round Top Project, if any, will be subject to completing feasibility studies, permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient REE or gold reserves to support a commercial mining operation;

the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities;

the availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required;

the availability and cost of appropriate smelting and/or refining arrangements, if required, and securing a commercially viable sales outlet for our products;

compliance with environmental and other governmental approval and permit requirements;

the availability of funds to finance exploration, development and construction activities, as warranted;

potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities;

potential increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies; and

potential shortages of mineral processing, construction and other facilities related supplies.

The costs, timing and complexities of exploration, development and construction activities may be increased by the location of the Round Top Project (or other properties that may subsequently be acquired) and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if warranted, development, construction and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties.

If we establish the existence of a mineral reserve in the Round Top Project in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve, and our business could fail.

If we do discover mineral reserves in commercially exploitable quantities in the Round Top Project (or any of our properties that may subsequently be acquired), we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. We do not have adequate capital to develop necessary facilities and infrastructure and will need to raise additional funds (the expected capital from USA Rare Earth will not address these needs). Although we may derive substantial benefits from the discovery of a major mineral deposit, there can be no assurance that such a deposit will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail and your investment in our Common Stock will be lost.

Our exploration activities may not be commercially successful.

Our long-term success depends on our ability to identify mineral deposits in the Round Top Project or other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Our belief that the Round Top Project contains commercially exploitable minerals has been based solely on preliminary tests that we have conducted and data provided by third parties, including the data published in various third party reports. There can be no assurance that the tests and data upon which we have relied is correct or accurate. Moreover, mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of exploration programs. The success of mineral exploration and development is determined in part by the following factors:

15

the identification of potential mineralization based on analysis;

the availability of exploration permits;

the quality of our management and our geological and technical expertise; and

the capital available for exploration.

Substantial expenditures and time are required to establish existing proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, allowable production, importing and exporting of minerals and environmental protection. Any one or a combination of these factors may result in us not receiving an adequate return on our investment capital. The decision to abandon a project may have an adverse effect on the market value of our securities and our ability to raise future financing.

Increased costs could affect our financial condition.

We anticipate that costs at the Round Top Project as it is developed, if warranted, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber, and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of production.

Mining and mineral exploration is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business and plans.

Mining and mineral exploration involves various types of risks and hazards, including:

environmental hazards;

power outages;

metallurgical and other processing problems;

unusual or unexpected geological formations;

personal injury, flooding, fire, explosions, cave-ins, landslides and rock-bursts;

inability to obtain suitable or adequate machinery, equipment, or labor;

metals losses;

fluctuations in exploration, development and production costs;

labor disputes;

unanticipated variations in grade;

mechanical equipment failure; and

periodic interruptions due to inclement or hazardous weather conditions.

16

These risks could result in damage to, or destruction of, the Round Top Project, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, may be prohibitively expensive. We may suffer a material adverse effect on our business if we incur losses related to any significant events that are not covered by our insurance policies.

The figures for our mineralization are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralization figures presented in this prospectus and in our filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

Estimates can be imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

these interpretations and inferences will be accurate;

mineralization estimates will be accurate; or

this mineralization can be mined or processed profitably.

Any material changes in mineralization estimates and grades of mineralization will affect the economic viability of placing the Round Top Project into production and the Round Top Project’s return on capital.

Because we have not completed feasibility studies on the Round Top Project and have not commenced actual production, mineralization estimates for the Round Top Project may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The mineralization estimates contained in this prospectus have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for rare earth minerals may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability determinations we reach. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our share price and the value of our properties.

Analytical Uncertainties

All resource and grade estimates are based of state of the art analytical methods. However, any procedure for analyzing for small amounts of metals in a chemically complex matrix may be subject to error and other uncertainties.

Our operations contain significant uninsured risks which could negatively impact future profitability as we maintain no insurance against our operations.

Our exploration of the Round Top Project contains certain risks, including unexpected or unusual operating conditions including rock bursts, cave-ins, flooding, fire and earthquakes. It is not always possible to insure against these risks. Should events such as these arise, they could reduce or eliminate our assets and shareholder equity as well as result in increased costs and a decline in the value of our securities. We expect to maintain only general liability and director and officer insurance but no insurance against our properties or operations. We may decide to take out this insurance in the future if it is available at economically viable rates.

Mineral operations are subject to market forces outside of our control which could negatively impact our operations.

The marketability of minerals is affected by numerous factors beyond our control including market fluctuations, government regulations relating to prices, taxes, royalties, allowable production, imports, exports and supply and demand. One or more of these risk elements could have an impact on the costs of our operations and if significant enough, reduce the profitability of our operations.

17

We may be adversely affected by fluctuations in demand for, and prices of, rare earth products.

We expect to derive revenues, if any, from sale of rare earth and related minerals. Changes in demand for, and the market price of, these minerals could significantly affect our profitability. The value and price of our Common Stock and our financial results may be significantly adversely affected by declines in the prices of rare earth minerals and products. Rare earth minerals and product prices may fluctuate and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the U.S. dollar against foreign currencies on the world market, global and regional supply and demand for rare earth minerals and products, and the political and economic conditions of countries that produce rare earth minerals and products.

A prolonged or significant economic contraction in the United States or worldwide could put further downward pressure on market prices of rare earth minerals and products. Protracted periods of low prices for rare earth minerals and products could significantly reduce revenues and the availability of required development funds in the future. This could cause substantial reductions to, or a suspension of, REO production operations, impair asset values and if reserves are established on our prospects, reduce our proven and probable rare earth ore reserves.

In contrast, extended periods of high commodity prices may create economic dislocations that may be destabilizing to rare earth minerals supply and demand and ultimately to the broader markets. Periods of high rare earth mineral market prices generally are beneficial to our financial performance. However, strong rare earth mineral prices also create economic pressure to identify or create alternate technologies that ultimately could depress future long-term demand for rare earth minerals and products, and at the same time may incentivize development of otherwise marginal mining properties.

Permitting, licensing and approval processes are required for our operations at the Round Top Project and obtaining and maintaining required permits and licenses is subject to conditions which we may be unable to achieve.

Both mineral exploration and extraction at the Round Top Project requires permits from various federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Permits known to be required are (i) an operating plan for the conduct of exploration and development approved by the GLO, (ii) an operating plan for production approved by the GLO, (iii) various reporting to and approval by the Texas Railroad Commission regarding drilling and plugging of drill holes, and (v) reporting to and compliance with regulations of the Texas Commission of Environmental Quality. If we recover uranium at the Round Top Project, we will be required to obtain a source material license from the United States Nuclear Regulatory Commission. We may also be subject to the reporting requirements and regulations of the Texas Department of Health. Such licenses and permits are subject to changes in regulations and changes in various operating circumstances. Companies such as ours that engage in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Issuance of permits for our activities is subject to the discretion of government authorities, and we may be unable to obtain or maintain such permits. Permits required for future exploration or development may not be obtainable on reasonable terms or on a timely basis. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration or development of the Round Top Project (or any other of our mineral properties that we may subsequently acquire) or for the construction and operation of a mine on our properties that we may subsequently acquire at economically viable costs. If we cannot accomplish these objectives, our business could face difficulty and/or fail.

We are subject to significant governmental regulations, which affect our operations and costs of conducting our business.

Our current and future operations are and will be governed by laws and regulations, including:

laws and regulations governing mineral concession acquisition, prospecting, development, mining and production;

laws and regulations related to exports, taxes and fees;

labor standards and regulations related to occupational health and mine safety;

environmental standards and regulations related to waste disposal, toxic substances, land use and environmental protection; and

other matters.

18

Companies engaged in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in enforcement actions, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. We may be required to compensate those suffering loss or damage by reason of our mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation, could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in exploration.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

Our exploration and development activities are subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations.

The exploration, possible future development and production phases of our business will be subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set out limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulations, if any, may adversely affect our operations. If we fail to comply with any of the applicable environmental laws, regulations or permit requirements, we could face regulatory or judicial sanctions. Penalties imposed by either the courts or administrative bodies could delay or stop our operations or require a considerable capital expenditure. Although we intend to comply with all environmental laws and permitting obligations in conducting our business, there is a possibility that those opposed to exploration and mining will attempt to interfere with our operations, whether by legal process, regulatory process or otherwise.

Environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the properties, may exist on the properties in which we hold an interest. It is possible that our properties could be located on or near the site of a Federal Superfund cleanup project. Although we will endeavor to avoid such sites, it is possible that environmental cleanup or other environmental restoration procedures could remain to be completed or mandated by law, causing unpredictable and unexpected liabilities to arise.

U.S. Federal Laws

The Comprehensive Environmental, Response, Compensation, and Liability Act (“CERCLA”), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government-incurred cleanup costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (“RCRA”), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

19

The Clean Air Act, as amended, restricts the emission of air pollutants from many sources, including mining and processing activities. Our mining operations may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the Clean Air Act and state air quality laws. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to incur capital costs in order to remain in compliance. In addition, permitting rules may impose limitations on our production levels or result in additional capital expenditures in order to comply with the rules.

The National Environmental Policy Act (“NEPA”) requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including issuance of permits to mining facilities, and assessing alternatives to those actions. If a proposed action could significantly affect the environment, the agency must prepare a detailed statement known as an Environmental Impact Statement (“EIS”). The U.S. Environmental Protection Agency, other federal agencies, and any interested third parties will review and comment on the scoping of the EIS and the adequacy of and findings set forth in the draft and final EIS. This process can cause delays in issuance of required permits or result in changes to a project to mitigate its potential environmental impacts, which can in turn impact the economic feasibility of a proposed project.

The Clean Water Act (“CWA”), and comparable state statutes, imposes restrictions and controls on the discharge of pollutants into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the Environmental Protection Agency (“EPA”) or an analogous state agency. The CWA regulates storm water mining facilities and requires a storm water discharge permit for certain activities. Such a permit requires the regulated facility to monitor and sample storm water run-off from its operations. The CWA and regulations implemented thereunder also prohibit discharges of dredged and fill material in wetlands and other waters of the United States unless authorized by an appropriately issued permit. The CWA and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release.

The Safe Drinking Water Act (“SDWA”) and the Underground Injection Control (“UIC”) program promulgated thereunder, regulate the drilling and operation of subsurface injection wells. EPA directly administers the UIC program in some states and in others the responsibility for the program has been delegated to the state. The program requires that a permit be obtained before drilling a disposal or injection well. Violation of these regulations and/or contamination of groundwater by mining related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under the SWDA and state laws. In addition, third party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

We could be subject to environmental lawsuits.

Neighboring landowners and other third parties could file claims based on environmental statutes and common law for personal injury and property damage allegedly caused by the release of hazardous substances or other waste material into the environment on or around our properties. There can be no assurance that our defense of such claims will be successful. A successful claim against us could have an adverse effect on our business prospects, financial condition and results of operation.

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

control dispersion of potentially deleterious effluents;

treat ground and surface water to drinking water standards; and

reasonably re-establish pre-disturbance land forms and vegetation.

In order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected. In accordance with our GLO lease/prospecting permits all the areas impacted by the surface operations shall be reclaimed upon completion of the activity such that: (a) Remove all trash, debris, plastic and contaminated soil by off-site disposal; and (b) Upon completion of surface grading, the soil surface shall be left in a roughened condition to negate wind and enhance water infiltration.

20

Rare earth and beryllium mining presents potential health risks; payment of any liabilities that arise from these health risks may adversely impact our Company.