Attached files

| file | filename |

|---|---|

| EX-32.2 - Optex Systems Holdings Inc | ex32-2.htm |

| EX-32.1 - Optex Systems Holdings Inc | ex32-1.htm |

| EX-31.2 - Optex Systems Holdings Inc | ex31-2.htm |

| EX-31.1 - Optex Systems Holdings Inc | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 29, 2019

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ until ___

Commission File Number 000-54114

OPTEX SYSTEMS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-143215 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation organization) | Identification No.) | |

| 1420 Presidential Drive | ||

| Richardson, TX | 75081-2439 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (972) 764-5700

Securities Registered under Section 12(b) of the Act

None

Securities Registered under Section 12(g) of the Act

Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| [ ] | Emerging growth company |

| [ ] | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None. |

The aggregate market value of the 4,944,573 shares of voting stock held by non-affiliates of the registrant based on the closing price on the OTCQB on March 21, 2019 was $9,889,146.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Shares Outstanding | ||

| Title of Class | December 16, 2019 | |

| Common Stock | 8,436,422 |

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| PART I | ||

| Item 1. | Description of Business | 4 |

| Item 1A. | Risk Factors | 20 |

| Item 2. | Properties | 28 |

| Item 3. | Legal Proceedings | 28 |

| Item 4. | Mine Safety Disclosures | 28 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Securities | 28 |

| Item 7. | Management’s Discussion and Analysis of Financial Conditions and Results of Operations | 30 |

| Item 8. | Financial Statements and Supplementary Data | 40 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 65 |

| Item 9A. | Controls and Procedures | 65 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 65 |

| Item 11. | Executive Compensation | 69 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 76 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 77 |

| Item 14. | Principal Accountant Fees and Services | 77 |

| PART IV | ||

| Item 15. | Exhibits | 78 |

| Item 16. | 10-K Summary | 82 |

| 2 |

Cautionary Note Regarding Forward-Looking Information

This Report on Form 10-K, in particular Part II Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the defense industry, all of which were subject to various risks and uncertainties.

When used in this Report on Form 10- K and other reports, statements, and information we have filed with the Securities and Exchange Commission (“Commission” or “SEC”), in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors.

We do not assume the obligation to update any forward-looking statement. You should carefully evaluate such statements in light of factors described in this annual report. In this Form 10-K, Optex Systems Holdings, Inc. (“Optex Systems Holdings”) has identified important factors that could cause actual results to differ from expected or historic results. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete list of all potential risks or uncertainties.

| 3 |

Item 1 Description of Business

Background

Current Line of Business

We manufacture optical sighting systems and assemblies, primarily for Department of Defense applications. Our products are installed on various types of U.S. military land vehicles, such as the Abrams and Bradley fighting vehicles, light armored and armored security vehicles and have been selected for installation on the Stryker family of vehicles. We also manufacture and deliver numerous periscope configurations, rifle and surveillance sights and night vision optical assemblies. Our products consist primarily of build-to-customer print products that are delivered both directly to the armed services and to other defense prime contractors. Less than 1% of today’s revenue is related to the resale of products substantially manufactured by others. In this case, the product would likely be a simple replacement part of a larger system previously produced by us.

We continue to field new product opportunities from both domestic and international customers. Given continuing unrest in multiple global hot spots, the need for precision optics continues to increase. Most of these requirements are for observation and situational awareness applications; however, we continue to see requests for higher magnification and custom reticles in various product modifications. The basic need to protect the soldier while providing information about the mission environment continues to be the primary driver for these requirements.

Recent Events

Board Changes

On November 4, 2019, the Board of Directors of Optex Systems Holdings, Inc. (the “Company”) appointed three new directors: Larry Hagenbuch, Dale Lehmann and Rimmy Malhotra, all of whom have been qualified as independent as defined under Nasdaq Listing Rules by the Board. All three new independent directors will be compensated in accordance with the Company’s non-employee director compensation policies. Larry Hagenbuch will serve as the Audit Committee Chair and Rimmy Malhotra will serve as the Compensation Committee Chair. Bill Bates and Karen Hawkins have resigned as directors of the Company in order to enable the Company to have this reconstituted Board comprised of a majority of independent directors. David Kittay also resigned from the Company’s Board and Audit Committee to pursue other business interests.

| 4 |

Executive and Board Compensation

On November 20, 2018 the Company’s executive compensation committee recommended and the board of directors approved executive compensation as follows:

| ● | A 30% officer bonus of base salary to Danny Schoening and Karen Hawkins for fiscal year 2018 performance to be paid during December 2018. The bonuses of $76 thousand, and $56 thousand were paid to Danny Schoening and Karen Hawkins, respectively on December 7, 2018. | |

| ● | A base salary increase of 8% for Danny Schoening and Karen Hawkins effective as of January 1, 2019. | |

| ● | The issuance of 150,000 and 50,000 restricted stock units with a January 2, 2019 grant date, to Danny Schoening and Karen Hawkins, respectively, and vesting as of January 1 each year subsequent to the grant date over a three year period at a rate of 34% in year one, and 33% each year thereafter. |

On November 14, 2019, the Board of Directors reviewed the compensation for nonemployee directors and concluded to keep the compensation at the current $5.5 thousand per quarter served. The board determined to revisit the independent board compensation during the first calendar quarter of 2020.

On November 19, 2019, the Board of Directors of Optex Systems Holdings, Inc. approved annual executive bonuses for Danny Schoening, CEO and Karen Hawkins, CFO of $75 thousand and $54 thousand, respectively, to be paid in December 2019.

Stock & Warrant Repurchases

On May 16, 2018, we announced that our Board of Directors has approved a purchase of 200,000 shares of its common stock in a private transaction. The transaction was priced at $1.00 per share for a total transaction amount of $200,000.

On July 10, 2018, we announced that our Board of Directors has approved a purchase of 500,000 shares of its common stock in a private transaction. The transaction was priced at $1.00 per share for a total transaction amount of $500,000.

Upon repurchase in the aforementioned transactions, the shares were returned to treasury and cancelled thereby reducing the total outstanding common stock.

On June 26, 2019, we repurchased 88,081 of the outstanding warrants from private investors at a warrant price of $0.85 per warrant, for a total purchase price of $75 thousand. Upon repurchase, the warrants were cancelled.

Recent Orders

| ● | On February 19, 2018, we announced we have been awarded three separate multi-year Indefinite Delivery Indefinite Quantity (IDIQ) awards through Defense Logistics Agency (DLA) for Laser Protected Periscopes for a total combined amount of up to $7.7 million over a 3-5 year period. |

| ● | On March 27, 2018, we announced we have been awarded a $1.62 million purchase order as part of a multi-year strategic supplier agreement with a domestic manufacturer of premium optical devices. |

| 5 |

| ● | On September 10, 2018, we announced we have been awarded over $7 million in new contracts to date during the fourth fiscal quarter of 2018. The majority of these contracts are for Laser Protected Periscopes but also contain Non-Laser Protected Periscopes and various Sighting Systems. |

| ● | On November 19, 2018, the Company announced a follow on $0.9 million order from an international customer for its patented Digital Day Digital Night (DDAN) Weapon System with deliveries through 2021. |

| ● | On November 26, 2018, the Company announced a $1.9 million order from Defense Logistics Agency Land and Maritime for Laser Protected Periscopes for delivery in 2019 and 2020. |

| ● | On January 29, 2019, the Company announced a $1.0 million order associated with a multi-year agreement to supply a variety of optical components in support of the M1 Abrams Tank program. The products will be manufactured at the Applied Optics Center (AOC). |

| ● | On February 12, 2019, the Company announced a $1.9 Million order from Defense Logistics Agency Troop Support, Philadelphia. The products will be manufactured at the Applied Optics Center (AOC) Division of Optex Systems, Inc. |

| ● | On March 4, 2019, the Company announced a multi-year Indefinite Delivery Indefinite Quantity (IDIQ) award from Defense Logistics Agency Land and Maritime for periscopes for up to $1.3 Million over a 3-5 year period and a Firmed Fixed Price award for $0.7 Million for 2019 and 2020 delivery. |

| ● | On June 10, 2019, the Company announced it has been awarded a $1.3 Million order as part of a multi-year strategic supplier agreement with a domestic manufacturer of premium optical devices. |

| ● | On November 12, 2019, the Company announced a multi-year Indefinite Delivery Indefinite Quantity (IDIQ) award from Defense Logistics Agency Land and Maritime for periscopes for up to $2.3 Million over a 5 year period. |

| ● | On December 3, 2019 the Company announced a shared award for a maximum of $35 Million for Improved Commander Weapon System (ICWS) periscopes under a three year Indefinite Delivery - Indefinite Quantity (IDIQ) contract with two additional optional years. Optex and another recipient have been awarded this shared award from Defense Logistics Agency, Land and Maritime. Each company’s portion of the award will depend on price and performance over the ordering periods. |

Products

Our products are installed on various types of U.S. military land vehicles, such as the Abrams and Bradley, and Stryker families of fighting vehicles, as well as light armored and armored security vehicles. We also manufacture and deliver numerous periscope configurations, rifle and surveillance sights and night vision optical assemblies. We deliver our products both directly to the federal government and to prime contractors.

We deliver high volume products, under multi-year contracts, to large defense contractors and government customers. Increased emphasis in the past two years has been on new opportunities to promote and deliver our products in foreign military sales, where U.S.-manufactured, combat and wheeled vehicles, are supplied (and upgraded) in cooperation with the U.S. Department of Defense. We have a reputation for quality and credibility with our customers as a strategic supplier. We also anticipate the opportunity to integrate some of our night vision and optical sights products into commercial applications.

Specific product categories are grouped by product line and include:

| 6 |

| Product Line | Product Category | |

| Periscopes | Laser & Non Laser Protected Plastic & Glass Periscopes, Electronic M17 Day/Thermal Periscopes, Vision Blocks | |

| Sighting Systems | Back Up Sights, Digital Day and Night Sighting Systems (DDAN), M36 Thermal Periscope, Unity Mirrors | |

| Howitzers | M137 Telescope, M187 Mount, M119 Aiming Device | |

| Other | Muzzle Reference Systems (MRS), Binoculars, Collimators, Optical Lenses & Elements, Windows | |

| Applied Optics Center | Laser Filter Interface, Optical Assemblies, ACOG Laser filter, Day Windows, Binoculars |

Location and Facility

We are headquartered in Richardson, TX and lease approximately 93,967 combined square feet of facilities between Richardson, Texas and Dallas, Texas. As of December 9, 2019, we had 112 full time equivalent employees. We operate with a single shift, and capacity could be expanded by adding a second shift. Our proprietary processes and methodologies provide barriers to entry for other competing suppliers. In many cases, we are the sole source provider or one of only two providers of a product. We have capabilities which include machining, bonding, painting, tracking, engraving and assembly and can perform both optical and environmental testing in-house.

We renewed the lease on our 49,100 square foot, Richardson, Texas facility, effective as of December 10, 2013, with a lease expiration of March 31, 2021. As of December 9, 2019, the Richardson facility operated with 77 full time equivalent employees in a single shift operation.

In November 2014, we acquired the Applied Optics Center (formerly a business unit of L-3 Communications, Inc.), which is located in Dallas, Texas with leased premises consisting of approximately 44,867 square feet of space. As of December 9, 2019, the Applied Optics Center operated with 35 full time equivalent employees in a single shift operation.

Contracts

Some of our contracts may allow for government contract financing in the form of contract progress payments pursuant to Federal Acquisition Regulation 52.232-16, “Progress Payments”. As a small business, and subject to certain limitations, this clause provides for government payment of up to 90% of incurred program costs prior to product delivery. To the extent any contracts allow for progress payments and the respective contracts would result in significant preproduction cash requirements for design, process development, tooling, material or other resources which could exceed our current working capital or line of credit availability, we intend to utilize this benefit to minimize any potential negative impact on working capital prior to receipt of payment for the associated contract deliveries.

Our contracts allow for Federal Acquisition Regulation 52.243-1 which entitles the contractor to an “equitable adjustment” for contract or statement of work changes effecting cost or time of performance. In essence, an equitable price adjustment request is a request for a contract price modification (generally an increase) that allows for the contractor to be “made whole” for additional costs incurred which were necessitated by some modification of the contract effort. This modification may come from an overt change in U.S. Government requirements or scope, or it may come from a change in the conditions surrounding the contract (e.g., differing site conditions or late delivery of U.S. Government-furnished property) which result in statement of work additions, deletions, part substitutions, schedule or other changes to the contract which impact the contractor’s overall cost to complete.

| 7 |

Each contract with our customers has specific quantities of material that need to be purchased, assembled, and then shipped. Prior to bidding a contract, we contact potential sources of material and receive qualified quotations for each material. In some cases, the entire volume is given to a single supplier and in other cases, the volume might be split between several suppliers. If a contract has a single source supplier and that supplier fails to meet their obligations (e.g., quality, delivery), then we would attempt to find an acceptable alternate supplier, and if successful, we would then renegotiate contractual deliverables (e.g., specifications, delivery or price). As of November 8, 2019, approximately 5% of our material requirements are single-sourced across 7 suppliers representing approximately 5% of our active supplier orders. Single-sourced component requirements span across all of our major product lines. Of these single sourced components, we have material contracts (purchase orders) with firm pricing and delivery schedules in place with each of the suppliers to supply the parts necessary to satisfy our current contractual needs.

We are subject to, and must comply with, various governmental regulations that impact, among other things, our revenue, operating costs, profit margins and the internal organization and operation of our business. The material regulations affecting our U.S. government business are summarized in the table below.

| Regulation | Summary | |

Federal Acquisition Regulation (FAR) |

The principal set of rules in the Federal Acquisition Regulation System. This system consists of sets of regulations issued by agencies of the federal government of the United States to govern what is called the “acquisition process,” which is the process through which the government acquires goods and services. That process consists of three phases: (1) need recognition and acquisition planning, (2) contract formation, and (3) contract administration. This system regulates the activities of government personnel in carrying out that process. It does not regulate the purchasing activities of private sector firms, except to the extent that those activities involve government solicitations and contracts by reference. | |

| International Traffic in Arms Regulations (ITAR) | United States government regulations that control the export and import of defense-related articles and services on the United States Munitions List. These regulations implement the provisions of the Arms Export Control Act. | |

| Truth in Negotiations Act (TINA) | A public law enacted for the purpose of providing for full and fair disclosure by contractors in the conduct of negotiations with the government. The most significant provision included is the requirement that contractors submit certified cost and pricing data for negotiated procurements above a defined threshold of $750,000 for contracts entered into prior to June, 30, 2018. On July 1, 2018, the threshold for obtaining certified cost and pricing data increased substantially from $750,000 to two million dollars. The change was authorized by the Department of Defense pursuant to a class deviation, pending official rulemaking and publication in the Federal Acquisition Regulation (“FAR”) Section 811 of the fiscal year 2018 NDAA. The law requires contractors to provide the government with an extremely broad range of cost or pricing information relevant to the expected costs of contract performance, and it requires contractors and subcontractors to submit cost or pricing data to the government and to certify that, to the best of their knowledge and belief, the data are current, accurate, and complete. A contracting officer may still request cost or price data, if necessary, without certification, to determine whether the proposed cost or price is fair and reasonable for contracts which are below the threshold. |

We are responsible for full compliance with the Federal Acquisition Regulation (FAR). Upon award, the contract may identify certain regulations that we need to meet. For example, a contract may allow progress billing pursuant to specific FAR clauses incorporated into the contract. Other contracts may call for specific first article acceptance and testing requirements. The FAR will identify the specific regulations that we must follow based on the type of contract awarded and contains guidelines and regulations for managing a contract after award, including conditions under which contracts may be terminated, in whole or in part, at the government’s convenience or for default. These regulations also subject us to financial audits and other reviews by the government of our costs, performance, accounting and general business practices relating to our government contracts, which may result in adjustment of our contract-related costs and fees and, among other things and impose accounting rules that define allowable and unallowable costs governing our right to reimbursement under certain contracts.

| 8 |

First Article Testing and Acceptance requirements consist of specific steps which could be comprehensive and time consuming. The dimensions and material specifications of each piece of the assembly must be verified, and some products may have in excess of 100 piece parts. Once the individual piece parts are verified to be compliant to the specification, the assembly processes are documented and verified. A sample of the production (typically three units) is verified to meet final performance specifications. Once the units meet the final performance specification, they are then subjected to accelerated life testing, a series of tests which simulate the lifetime use of the product in the field. This consists of exposing the units to thermal extremes, humidity, mechanical shock, vibration, and other physical exposure tests. Once completed, the units undergo a final verification process to ensure that no damage has occurred as a result of the testing and that they continue to meet the performance specification. All of the information and data is recorded into a final first article inspection and test report and submitted to the customer along with the test units for final approval. First Article Acceptance and Testing is generally required on new contracts/product awards but may also be required on existing products or contracts where there has been a significant gap in production, or where the product has undergone significant manufacturing process, material, tooling, equipment or product configuration changes.

We are also subject to laws, regulations and executive orders restricting the use and dissemination of information deemed classified for national security purposes and the exportation of certain products and technical data as covered by the International Traffic in Arms Regulation (ITAR). In order to import or export items listed on the U.S. Munitions List, we are required to be registered with the Directorate of Defense Trade Controls office. The registration is valid for one year, and the registration fees are established based on the number of license applications submitted the previous year. We currently have an approved and current registration on file with the Directorate of Defense Trade Controls office. Once the registration is approved, each import/export license must be filed separately. License approval requires the company to provide proof of need, such as a valid contract or purchase order requirement for the specific product or technical data requested on the license and requires a detailed listing of the items requested for export/import, the end-user, the end-user statement, the value of the items, consignees/freight forwarders and a copy of a valid contract or purchase order from the end-user. The approval process for the license can vary from several weeks to six months or more. The licenses we currently use are the Department of State licenses: DSP-5 (permanent export), DSP-6 (license revisions) and DSP-73 (temporary export) and Department of Commerce: BIS-711 (export).

The aforementioned licenses are valid for 48 months from date that each license is issued. A summary of our active ITAR licenses is presented below (updated as of December 9, 2019):

| Fiscal Year | Number of | Total Contract | ||||||||||

| Active ITAR Licenses | of Expiration | Licenses | Value of Licenses | |||||||||

| DSP-5 | ||||||||||||

| Issued in Fiscal Year 2016 | 2020 | 19 | $ | 1,789,141 | ||||||||

| Issued in Fiscal Year 2017 | 2021 | 6 | 1,686,003 | |||||||||

| Issued in Fiscal Year 2018 | 2022 | 8 | 2,742,658 | |||||||||

| Issued in Fiscal Year 2019 | 2023 | 4 | 20,934,845 | |||||||||

| Total DSP-5 Licenses | 37 | $ | 27,152,647 | |||||||||

| DSP-6 (no active licenses) | N/A | — | $ | — | ||||||||

| DSP-73 | ||||||||||||

| Issued in Fiscal Year 2019 | 2023 | 1 | $ | 4,000 | ||||||||

| Total DSP-73 Licenses | 1 | $ | 4,000 | |||||||||

| BIS-711 | ||||||||||||

| Issued in Fiscal Year 2017 | 2021 | 8 | $ | 1,708,894 | ||||||||

| Issued in Fiscal Year 2018 | 2022 | 4 | 113,907 | |||||||||

| Issued in Fiscal Year 2019 | 2023 | 4 | 3,413 | |||||||||

| Total BIS-711 Licenses | 16 | $ | 1,826,214 | |||||||||

| Total All Licenses | 54 | $ | 28,982,861 | |||||||||

| 9 |

These licenses are subject to termination if a licensee is found to be in violation of the Arms Export Control Act or the ITAR requirements. If a licensee is found to be in violation, in addition to a termination of its licenses, it can be subject to fines and penalties by the government.

Our contracts may also be governed by the Truth in Negotiation Act (TINA) requirements where certain of our contracts or proposals exceed the TINA threshold (updated from $750 thousand to $2 million for awards after June 30, 2018), and/or are deemed as sole source, or non-competitive awards, covered under this act. For these contracts, we must provide a vast array of cost and pricing data in addition to certification that our pricing data and disclosure materials are current, accurate and complete upon conclusion of the negotiation. Due to the additional disclosure and certification requirements, if a post contract award audit were to uncover that the pricing data provided was in any way not current, accurate or complete as of the certification date, we could be subjected to a defective pricing claim adjustment with accrued interest. We have no history of defective pricing claim adjustments and have no outstanding defective pricing claims pending. Additionally, as a result of this requirement, contract price negotiations may span from two to six months and can result in undefinitized or not to exceed ceiling priced contracts subject to future downward negotiations and price adjustments. Currently, we do not have any undefinitized contracts subject to further price negotiation.

Our failure to comply with applicable regulations, rules and approvals or misconduct by any of our employees could result in the imposition of fines and penalties, the loss of security clearances, the loss of our U.S. government contracts or our suspension or debarment from contracting with the U.S. government generally, any of which could have a material adverse effect our business, financial condition, results of operations and cash flows. We are currently in compliance with all applicable regulations and do not have any pending claims as a result of noncompliance.

The terms of our material contracts are as follows (updated as of September 29, 2019):

| Customer | Customer PO/Contract | Contract Type(1) | Total Award Value(2) (millions) | Remaining Value(3) (millions) | Delivery Period | |||||||||||

| GDLS - Canada(4) | Subcontract | FFPQ | $ | 1.6 | $ | 1.1 | Dec 2017- Feb 2022 | |||||||||

| Periscopes | PO 35506523 | |||||||||||||||

| DLA Land at Aberdeen(5) | Prime | IDIQ | $ | 4.4 | $ | 0.3 | Jan 2018- Dec 2019 | |||||||||

| Laser Filter Assemblies (AOC) | SPRBL117D0008 | |||||||||||||||

| GDLS – Canada(6) | Subcontract | FFPQ | $ | 2.1 | $ | 1.2 | Oct 2017- Feb 2022 | |||||||||

| Sighting Systems | PO 35515590 | |||||||||||||||

| DLA Land and Maritime(7) | Prime | IDIQ | $ | 2.2 | $ | 0.1 | Oct 2017- Dec 2019 | |||||||||

| Periscopes | SPE7LX17D0053 | |||||||||||||||

| DLA Warren(8) | Prime | FFPQ | $ | 2.6 | $ | 1.0 | Oct 2018- Oct 2019 | |||||||||

| Collimator Assembly - Other | SPRDL118C0087 | |||||||||||||||

| DLA Land and Maritime(9) | Prime | IDIQ | $ | 1.3 | $ | - | No current open task orders | |||||||||

| Periscopes | SPE7LX18D0038 | |||||||||||||||

| DLA Land and Maritime(10) | Prime | IDIQ | $ | 1.3 | $ | 0.3 | Jul 2018- Mar 2020 | |||||||||

| Periscopes | SPE7LX18D0039 | |||||||||||||||

| DLA Land and Maritime(11) | Prime | IDIQ | $ | 3.4 | $ | 1.3 | Jul 2018- Jan 2020 | |||||||||

| Periscopes | SPE7MX18D0061 | |||||||||||||||

| DLA Land and Maritime(12) | Prime | IDIQ | $ | 0.3 | $ | 0.3 | Aug 2019- Dec 2019 | |||||||||

| Periscopes | SPE7LX18D0108 | |||||||||||||||

| U.S. Army Contracting Command-Warren(13) | Prime | IDIQ | $ | 2.5 | $ | 0.3 | Apr 2017- Jun 2020 | |||||||||

| Periscopes | SPRDL116D0062/ W56HZV19F0544 | |||||||||||||||

| General Dynamics-Canada(14) | Subcontract | FFP | $ | 0.9 | $ | 0.9 | Jul 2020- Dec 2020 | |||||||||

| Sighting Systems | PO 35558221 | |||||||||||||||

| DLA Land and Maritime(15) | Prime | FFP | $ | 2.0 | $ | 2.0 | Oct 2019- Jun 2020 | |||||||||

| Glass Periscopes | SPE7M819C003 | |||||||||||||||

| General Dynamics(16) | Subcontract | IDIQ | $ | 2.0 | $ | 1.0 | Aug 2017- Oct 2021 | |||||||||

| Day Windows (AOC) | PO 40269398 | |||||||||||||||

| DLA Troop Support(17) | Prime | IDIQ | $ | 1.9 | $ | 1.6 | Mar 2019- Sep 2020 | |||||||||

| Day Windows (AOC) | SPE8E619CF009 | |||||||||||||||

| DLA Land and Maritime(18) | Prime | IDIQ | $ | - | $ | - | No task awards as of current date | |||||||||

| Periscopes | SPE7LX19D0089 | |||||||||||||||

| DLA Land and Maritime(19) | Prime | FFP | $ | 0.7 | $ | 0.6 | Aug 2019- Dec 2019 | |||||||||

| Periscopes | SPE7M819P1690 | |||||||||||||||

ADS Inc.(20) Laser Filter Unit and ARD | Subcontract | FFP | $ | 1.3 | $ | 0.9 | Nov 2019- Apr 2020 | |||||||||

| Assy, 24mm | PO 1024867 | |||||||||||||||

| 10 |

| (1) | FFPQ – Firm fixed price and quantity, IDIQ – Indefinite delivery indefinite quantity, PP – Progress Billable. Payment terms on shipments are net 30 or net-45 days. |

| (2) | “Total Award Value” as included in the table represents the total value of all delivery orders against the prime contract that have already been awarded to us. The total award value represents already awarded delivery order contracts. Based on our historical experience with these contracts and other similar contracts, the amount awarded has directly correlated to the amount received. |

| (3) | The “Remaining Value” depicts the open undelivered values remaining to be delivered against the contract awards as of October 30, 2017. Only these undelivered values of the contracts may be subject to the contract termination clause. It has been our experience that these clauses are rarely invoked. |

| (4) | Contract quantity awarded on December 14, 2016 for laser protected periscopes installed on Light Armored Vehicles in the Middle East. |

| (5) | Five year IDIQ contract for Light Interference Filter Assemblies awarded on July 3, 2017. The contract calls for five one-year ordering periods running consecutively commencing on July 5, 2017. The Company expects to generate between $8.4 and $12.4 million in revenue over the next five year period from this contract. As of September 29, 2019 three task orders against the contract have been released for a total value of $4.4 million to date. |

| (6) | Contract awarded on September 11, 2017 to provide LAV 6.0 optimized weapon system support for Optex’s Commander Sighting System. The in-service support will continue over the next three years for their existing fleet of Light Armored Vehicles. |

| (7) | Three year IDIQ contract for periscopes awarded on September 18, 2017. The contract includes three base years and two option years. The based contract expires September 11, 2020. The company expects to generate between $1.5 and $2.4 million in revenue over the next five year period from this contract. As of September 29, 2019 total task orders awarded against the contract were $1.5 million. |

| (8) | Initial contract award on December 7, 2017 for $0.8 million with subsequent modifications bringing the total contract value to $2.6 million as of September 29, 2019. |

| (9) | Contract awarded February 11, 2018. This is a long-term, Indefinite Delivery Indefinite Quantity (IDIQ) Contract with firm fixed pricing for the duration of a base period of three (3) years plus two (2) firm fixed priced option years for a potential total of (5) five years. As of September 29, there was $1.3 million in task orders released against the contract which have been delivered. |

| (10) | Contract awarded February 16, 2018. This is a long-term, Indefinite Delivery Indefinite Quantity (IDIQ) Contract with firm fixed pricing for the duration of a base period of three (3) years plus two (2) firm fixed priced option years for a potential total of (5) five years. As of September 29, there was $0.7 million in task orders released against the contract. |

| (11) | Contract awarded February 22, 2018. This is a long-term, Indefinite Delivery Indefinite Quantity (IDIQ) Contract with firm fixed pricing for the duration of a base period of three (3) years plus two (2) firm fixed priced option years for a potential total of (5) five years. As of September 29, there was $1.1 million in task orders released against the contract. |

| (12) | Contract awarded September 5, 2018. This is a long-term, Indefinite Delivery Indefinite Quantity (IDIQ) Contract with firm fixed pricing for the duration of a base period of three (3) years plus two (2) firm fixed priced option years for a potential total of (5) five years. As of September 29, 2019, there was $0.3 million task orders released against the base contract award. |

| (13) | Contract awarded July 20, 2016. This is a long-term, Indefinite Delivery Indefinite Quantity (IDIQ) Contract with firm fixed pricing for the duration of a base period of five (5) years. As of September 29, 2019, there was $2.5 million task orders released against the contract award through ordering period 4. |

| (14) | Contract awarded July 20, 2016 for delivery of DDAN sighting system spare units. |

| (15) | Contract awarded November 19, 2018. This is a Firm Fixed Price order for Laser Protected Periscopes for delivery in 2019 and 2020. |

| (16) | Contract awarded February 6, 2017 with an additional quantity executed on January 24, 2019. This is a Firm Fixed Price order for Day Windows manufactured at the Applied Optics Center for delivery through October 2021. |

| (17) | Contract awarded February 11, 2019. This is a Firm Fixed Price order for Day Windows manufactured at the Applied Optics Center for delivery through November 2019. |

| (18) | Contract awarded March 4, 2019. This is a long-term, Indefinite Delivery Indefinite Quantity (IDIQ) Contract with firm fixed pricing for the duration of a base period of three (3) years plus two (2) firm fixed priced option years for a potential total of (5) five years. As of September 29, 2019, there have been no task orders released against the base contract award. |

| (19) | Contract awarded February 27, 2019. This is a Firm Fixed Price order for Laser Protected Periscopes for delivery in August 2019 through December 2019. |

| (20) | Contract awarded May 6, 2019. This is a multi-year strategic supplier agreement for premium optical devices. Delivery for the current purchase order is November 2019 through April 2020 with early delivery accepted. |

| 11 |

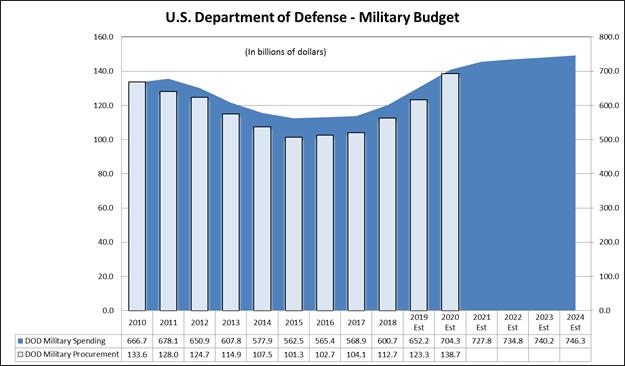

Market Opportunity — U.S. Military

During the twelve months ended September 29, 2019, approximately 87% of our business was in support of U.S. military products. The chart below was derived from public government spending sources and depicts total U.S. military spending from 2010 through 2019 and estimated spending through 2024. The purpose of including this chart is to provide the reader with historical trend data and projected U.S. military defense and procurement spending over time. Military spending peaked at $678.1 billion in 2011. As of fiscal year 2019 the total projected military spending is projected to be $652.2 billion, an overall increase of 8.6% over 2018 spending, but 3.8% below the peak spending in 2011. However, the military spending in the chart below depicts increased spending through 2024 of 14.4% from the current projected fiscal year 2019 level. The largest projected increases of 8.0% and 3.3% to occur in the 2020 and 2021 fiscal years, respectively.

Military spending was negatively impacted by the Budget Control Act of 2011 (BCA 2011), which was passed in August 2011. The BCA 2011 mandated a $917.0 billion reduction in discretionary spending over the next decade, and $1.2 trillion in automatic spending cuts over a nine-year period to be split between defense and non-defense programs beginning in January 2013. During the years 2015-2019 Congress enacted additional legislative budget measures which eased the strict spending caps set forth in sequestration of the BCA 2011 through the 2021 fiscal budget year.

On February 9, 2018, Congress enacted the Bipartisan Budget Act of 2018 (BBA 2018), a budget stop gap resolution which lifted the sequestration limits on military spending by $165 billion through fiscal year 2019. On August 2, 2019, the Bipartisan Budget Act of 2019 (BBA 2019) was signed into law. The BBA 2019 raises the budget caps for both defense and nondefense for FY 2020 and FY 2021, the final two years of the BCA 2011 discretionary cap period. The 2019 bill increases the defense base budget by $171 billion over the BCA 2011 and sets limits on the Overseas Contingency Operations (OCO) Emergency Funding of $141 billion over the two year period. Under the current law, there are no caps on defense and nondefense discretionary spending for FY 2022 and beyond.

We believe that the procurement budget increases in the federal government’s 2019 National Defense Authorization Act (2019 NDAA) combined with the lifting of the 2011 budget sequestration cap on defense spending levels are favorable to the Company for its U.S. military products during the next two years. As of the filing date, the 2020 NDAA has not been passed through Congress.

Source: Government Publishing Office, U.S. Budget Historical Tables, FY 2020, Table 3.2 Outlays by function and sub function, 1962-2024.

The table below depicts the U.S. Department of Defense budget request for fiscal year 2020 for major ground system programs. The total fiscal year 2020 budget request for major ground system programs is decreased by 4.7% from the fiscal year 2019 levels and increased by 6.1% over the fiscal year 2018 levels. Although it is difficult to directly tie the budget request to specific components provided by Optex Systems, we provide periscopes, collimator assemblies, vision blocks and laser interface filters to the U.S. armed forces on almost all of the ground system platforms categorized below.

| 12 |

| FY 2020 | ||||||||||||||||||||||

| Major Weapon System Summary | Base | OCO | Total | |||||||||||||||||||

| ($ in Millions) | FY 2018 | FY 2019 | Budget | Budget | Request | |||||||||||||||||

| Ground Systems - Joint Service | ||||||||||||||||||||||

| JLTV | Joint Light Tactical Vehicle | $ | 1,162.4 | $ | 1,928.3 | $ | 1,600.6 | $ | 41.0 | $ | 1,641.6 | |||||||||||

| Ground Systems - USA | ||||||||||||||||||||||

| M-1 | Abrams Tank Modification/Upgrades | 1,784.0 | 2,652.0 | 2,221.2 | 13.1 | 2,234.3 | ||||||||||||||||

| AMPV | Armored Multi-Purpose Vehicle | 742.6 | 784.5 | 360.7 | 221.6 | 582.3 | ||||||||||||||||

| PIM | Paladin Integrated Management | 778.0 | 525.9 | 553.4 | — | 553.4 | ||||||||||||||||

| FMTV | Family of Medium Tactical Vehicles | 278.7 | 172.8 | 108.8 | — | 108.8 | ||||||||||||||||

| FHTV | Family Of Heavy Tactical Vehicles | 120.3 | 118.0 | 265.5 | — | 265.5 | ||||||||||||||||

| GMV | Ground Mobility Vehicle | 44.6 | 44.0 | 40.0 | — | 40.0 | ||||||||||||||||

| Stryker | Stryker | 981.3 | 442.9 | 750.8 | 4.1 | 754.9 | ||||||||||||||||

| Ground Systems - USMC | ||||||||||||||||||||||

| ACV | Amphibious Combat Vehicle | 307.1 | 233.6 | 395.3 | — | 395.3 | ||||||||||||||||

| Total Ground Systems | $ | 6,199.0 | $ | 6,902.0 | $ | 6,296.3 | $ | 279.8 | $ | 6,576.1 | ||||||||||||

Source: Office of the Under Secretary of Defense (Comptroller)/Chief Financial Officer, “Program Acquisition Cost by Weapon System, United States Department of Defense, Fiscal Year 2020 Budget Request”, March 2019

Market Opportunity — Foreign Military

Apart from the significant U.S. military spending increases experienced since 2018 and projected forward, we also continue to see substantial increases in foreign military sales (FMS) in our direct government contracts as well as through our major defense contract customers. Fiscal year 2018 saw a 33% increase in US FMS contracts, with fiscal year 2019 contracts at roughly the same high levels. Thus, we have increased efforts to promote our proven military products, as well as newly improved product solutions directly to foreign military representatives and domestic defense contractors supporting the FMS initiatives. Our products directly support FMS combat vehicles globally, including Canada, the Kingdom of Saudi Arabia, Kuwait, Morocco, Egypt, South America, and Israel.

In addition, we recently partnered with G&H for the supply of acrylic-based sighting system technology to meet European Customer requirements for a total package single-technology source supply. Some foreign customers desire the reduced weight and cost savings provided by acrylic based periscopes when compared directly to glass based periscopes. Our partnership will allow us to deliver this technology through ITAR licenses directly to them or their customers. G&H designs and manufactures periscopes and sighting systems for armored fighting vehicles under the Kent Periscopes brand. With a strong footprint in Europe and Asia, G&H supplies glass based products for both periscope external viewing and system sensor based imaging by commanders, drivers, and gunners.

We are also exploring possibilities to adapt some of our products for commercial use in those markets that demonstrate potential for solid revenue growth, both domestically and internationally.

| 13 |

Market Opportunity — Commercial

Our products are currently sold to military and related government markets. We believe there may be opportunities to commercialize various products we presently manufacture to address other markets. Our initial focus will be directed in four product areas.

| ● | Big Eye Binoculars — While the military application we produce is based on mature military designs, we own all castings, tooling and glass technology. These large fixed mount binoculars could be sold to cruise ships, personal yachts and cities/municipalities. The binoculars are also applicable to fixed, land based outposts for private commercial security as well as border patrols and regional law enforcement. |

| ● | Night Vision Sight — We have manufactured the optical system for the NL-61 Night Vision Sight for the Ministry of Defense of Israel. This technology could be implemented for commercial applications. |

| ● | Thin Film Coatings — The acquisition of the Applied Optics Center (AOC) also creates a new sector of opportunity for commercial products for us. Globally, commercial optical products use thin film coatings to create product differentiation. These coatings can be used for redirecting light (mirrors), blocking light (laser protection), absorbing select light (desired wavelengths), and many other combinations. They are used in telescopes, rifle scopes, binoculars, microscopes, range finders, protective eyewear, photography, etc. Given this broad potential, the commercial applications are a key opportunity going forward. |

| ● | Optical Assemblies – Through the Applied Optics Center, we are utilizing our experience in military sighting systems to pursue commercial opportunities associated with products that incorporate multi-lens optical cell assemblies, bonded optical elements and mechanical assemblies. There are a wide variety of products in the medical, machine vision, automotive and outdoor recreation fields that can benefit from our capabilities. Support to domestic customers for these type products has driven significant increases in overall sales during the last two years. |

Customer Base

We serve customers in four primary categories: as prime defense contractor (Defense Logistics Agency (DLA) Land and Maritime, DLA Warren, DLA Aviation, U.S. Army, Navy and Marine Corps), as defense subcontractor (General Dynamics, L-3 Communications, Harris Corporations, BAE, and NorcaTec), as a military supplier to foreign governments (Israel, Australia, South America and Canada) and also as a commercial optical assembly supplier (Nightforce Optics, Cabela’s, Amazon). During the twelve months ended September 29, 2019, we derived approximately 88% of our gross business revenue from three major customers: U.S. government agencies (60%), one major defense contractor, (22%), one commercial customer (7%). We have approximately 116 discrete contracts for items that are utilized in vehicles, optical product lines and as spare parts. Due to the high percentage of prime and subcontracted U.S. defense revenues, large customer size and the fact that there are multiple contracts with each entity, which are not interdependent, we are of the opinion that this provides us with a fairly well diversified revenue pool.

Marketing Plan

We believe we are well positioned to service both U.S. and foreign military needs by our focus on delivering products that satisfy the following factors important to the U.S. military:

| ● | Product reliability — failure can cost lives |

| ● | Speed to delivery and adherence to delivery schedule |

| ● | System life cycle extension |

| ● | Low cost/best value |

| 14 |

| ● | Visual aids for successful execution of mission objectives |

| ● | Mission critical products specifically related to soldier safety. |

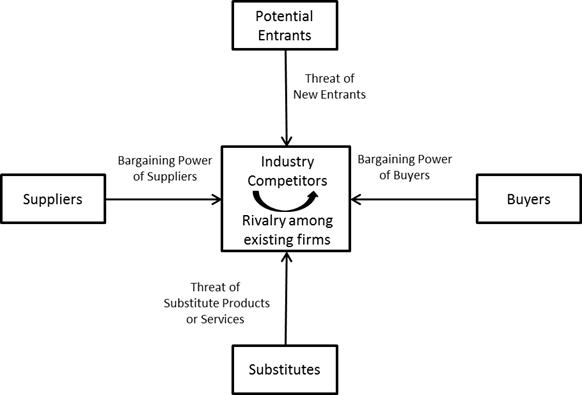

Potential Entrants — Low Risk to us. In order to enter this market, potential competitors must overcome several barriers to entry. The first hurdle is that an entrant would need to prove to the government agency in question the existence of a government approved accounting system for larger contracts. Second, the entrant would need to develop the processes required to produce the product. Third, the entrant would then need to produce the product and then submit successful test requirements (many of which require lengthy government consultation for completion). Finally, in many cases, the customer has an immediate need and therefore cannot wait for this qualification cycle and therefore must issue the contracts to existing suppliers.

Historically, we competed with two other companies in different spaces. First, we previously competed with Miller-Holzwarth in the plastic periscope business. In July 2012, Miller-Holzwarth, Inc. ceased operations apparently as a result of an inability to meet its financial obligations combined with a decline in defense market conditions. Second, we currently compete with Seiler Instruments for fire control products. These contracts are higher value products, but lower quantities. Given the expense of development and qualification testing, the barrier to entry is high for new competitors. During the last four years, overall plastic periscope demand quantities have declined, while competition on the lower level periscope products has significantly increased as new contractors aggressively compete for market share amongst the existing customer base and quantities.

Buyers — Medium Risk to us. In most cases the buyers (usually government agencies or defense contractors) have two fairly strong suppliers. It is in their best interest to keep at least two, and therefore, in some cases, the contracts are split between suppliers. In the case of larger contracts, the customer can request an open book policy on costs and expects a reasonable margin to have been applied.

| 15 |

Substitutes — Low Risk to us. We have both new vehicle contracts and replacement part contracts for the exact same product. Three combat vehicles have a long history of service in the Army. The first M-1 Abrams Tank entered service with the Army in 1980; the M-2/M-3 Bradley Fighting Vehicle in 1981; and the Stryker Combat Vehicle in 2001. Under current Army modernization plans, the Army envisions all three vehicles in service with Active and National Guard forces beyond FY2028. Optex Systems provides periscopes and optical sighting systems in support of all three vehicle platforms. Since the early 2010’s, the U.S. Army has been upgrading its outdated Bradley design with the Operation Desert Storm-Situational Awareness model and since 2012, upgrading the underbelly armor to improve mine and improvised explosive device resistance. The Army is massively revving up its fleet of M2A4 and M7A4 Bradley Fighting Vehicles through a 2018 deal to add up to 473 of the new infantry carriers. The army is currently working on an A5 Bradley variant with vastly improved targeting sights and on-board power. The redesigned vehicle will support next-generation weapons systems and resolve the Bradley’s long-standing issues with weight and mobility. Since it was first fielded in 1980, the Abrams tank has undergone near-continuous upgrades and improvements. On average, there has been a new improvement package every seven years. The Army is just beginning to receive the first of the latest Abrams upgrade, the System Enhancement Package Version 3 (SEPv3), with additional upgrades in development. Additionally, the US Army has announced contracts to produce 742 Stryker DVH vehicles, redesigned (dual v-hulled vehicles) to be more resistant to land mines, as retrofits and as new production vehicles. The Abrams, Bradley and Striker vehicles are the only production tanks currently in production by the government. This, in conjunction with the 30-year life span, supports their continued use through 2040. The Abrams is the principal battle tank of the United States Army and Marine Corps, and the armies of Egypt, Kuwait, Saudi Arabia, Iraq, and since 2007, Australia.

Suppliers — Low to Medium Risk to Optex Systems Holdings. The suppliers of standard processes (e.g., casting, machining and plating) need to be very competitive to gain and/or maintain contracts. Those suppliers of products that use top secret clearance processes are slightly better off; however, there continues to be multiple avenues of supply and therefore only moderate power.

Consistent with our marketing plan and business model, the AOC acquisition strengthened our overall position by decreasing the bargaining power of their suppliers through the backwards integration of a key supplier and created additional barriers of entry of potential competitors. Overall, the customer base and the competition have seen the acquisition as creating a stronger company.

The second model is a two by two matrix for products and customers.

| Existing Customers | New Customers | |||

| New Products | Chile M17 Day/Thermal | |||

| USACC Binoculars | Brazil M17 Day/Thermal | |||

| GDLS DDAN | Israel M17 Day/Thermal | |||

| Commercial Optical Lens | ||||

| Commercial: Optical Lens, Spotting Scopes, Monocular Lens | ||||

| Existing Products | USACC Periscopes, Back Up Sights, | Marines Sighting Systems | ||

| Binoculars, Vision Blocks, | ||||

| ACOG Filter Units | Commercial: Optical Lens, Spotting | |||

| GDLS Periscopes, Collimators | Scopes, Monocular Lens | |||

| BAE Periscopes | ||||

| L3- Laser Interface Filters | ||||

| DLAOptical Elements |

| 16 |

This product/customer matrix sets forth our four basic approaches:

| 1) | Sell existing products to existing customers. |

| 2) | Sell existing products to new customers. |

| 3) | Develop new products to meet the needs of our existing customers. |

| 4) | Develop new products to meet the needs of new customers. |

Operations Plan

Our operations plan can be broken down into three distinct areas: material management, manufacturing space planning and efficiencies associated with economies of scale.

Materials Management

The largest portion of our costs is materials. We have completed the following activities in order to demonstrate continuous improvement:

| - | Successful completion of annual surveillance audit for ISO 9001:2008 certificate, with no major nonconformance issues |

| - | Weekly cycle counts on inventory items |

| - | Weekly material review board meeting on non-moving piece parts |

| - | Kanban kitting on products with consistent ship weekly ship quantities |

| - | Daily cross functional floor meetings focused on delivery, yields and labor savings |

| - | Redesigned floor layout using tenant improvement funds |

| - | Daily review of yields and product velocity |

| - | Bill of material reviews prior to work order release |

Future continuous improvement opportunities include installation and training of shop floor control module within the ERP system and organizational efficiencies of common procurement techniques among buyers.

Manufacturing Space Planning

We currently lease 93,967 square feet of manufacturing space (see “Location and Facility”). Our current facilities are sufficient to meet our immediate production needs without excess capacity. As our processes are primarily labor driven, we are able to easily adapt to changes in customer demand by adjusting headcounts, overtime schedules and shifts in line with production needs. In the event additional floor space is required to accommodate new contracts, Optex has the option to lease adjacent floor space at the current negotiated lease cost per square foot. Consistent with the space planning, we will drive economies of scale to reduce support costs on a percentage of sales basis. These cost reductions can then be either passed through directly to the bottom line or used for business investment.

Our manufacturing process is driven by the use of six sigma techniques and process standardization. Initial activities in this area have been the successful six sigma projects in several production areas which have led to improved output and customer approval on the aesthetics of the work environment. In addition, we use many tools including 5S programs, six sigma processes, and define, measure, analyze, improve, control (DMAIC) problem solving techniques to identify bottlenecks within the process flow, reduce cost and improve product yields. Successful results can then be replicated across the production floor and drive operational improvements.

| 17 |

Economies of Scale

Plant efficiencies fluctuate as a function of program longevity, complexity and overall production volume. Our internal processes are primarily direct labor intensive and can be more easily adapted to meet fluctuations in customer demand; however, our material purchases, subcontracted operations and manufacturing support costs are extremely sensitive to changes in volume. As our volume increases, our support labor, material and scrap costs decline as a percentage of revenue as we are able to obtain better material pricing, and scrap, start up and support labor (fixed) costs and they are spread across a higher volume base. On the contrary, as production volumes decline, our labor and material costs per unit of production generally increase. Additional factors that contribute to economies of scale relate to the longevity of the program. Long running, less complex programs (e.g., periscopes) do not experience as significant of an impact on labor costs as production volumes change, as the associated workforce is generally less skilled and can be ramped quickly as headcounts shift. Our more complex thin laser filter coatings, Howitzer and thermal day/night programs are more significantly impacted by volume changes as they require a more highly-skilled workforce and ramp time is longer as the training is more complex. We continually monitor customer demand over a rolling twelve-month window and in order to anticipate any changes in necessary manpower and material which allows us to capitalize on any benefits associated with increased volume and minimize any negative impact associated with potential declines in product quantities.

Intellectual Property

We utilize several highly specialized and unique processes in the manufacture of our products. While we believe that these trade secrets have value, it is probable that our future success will depend primarily on the innovation, technical expertise, manufacturing and marketing abilities of our personnel. We cannot assure you that we will be able to maintain the confidentiality of our trade secrets or that our non-disclosure agreements will provide meaningful protection of our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or other disclosure. The confidentiality agreements that are designed to protect our trade secrets could be breached, and we might not have adequate remedies for the breach. Additionally, our trade secrets and proprietary know-how might otherwise become known or be independently discovered by others. We possess three utility patents and two design patents.

Our competitors, many of which have substantially greater resources, may have applied for or obtained, or may in the future apply for and obtain, patents that will prevent, limit or interfere with our ability to make and sell some of our products. Although we believe that our products do not infringe on the patents or other proprietary rights of third parties, we cannot assure you that third parties will not assert infringement claims against us or that such claims will not be successful.

On June 18, 2019 we were issued U.S. Patent No. 10,324,298 titled “Offset Image Wedge with Dual Capability and Alignment Technique”. The invention relates to an offset image wedge for use on a bore-sighted rifle mounted directly onto the scope via a clamp mounting device. The wedge allows for a dual image which can be aligned in the field and provides the user with a choice of either a bore-sighted image or an offset image without removing the wedge.

On July 11, 2017, we were issued U.S. Patent No. D791,852 S, for our Red Tail Digital Spotting Scope. We have a retail sales relationship with Cabela’s Inc. and Amazon, to distribute these scopes. They are currently the only digital spotting scope offered by Cabela’s. Our Red Tail Digital Spotting Scopes also received a favorable review from Trigger Magazine in 2017.

In May 2015, we announced the issuance to us of U.S. Patent No. 13,792,297 titled “ICWS Periscope”. This invention improves previously accepted levels of periscope performance that, in turn, improve soldier’s safety.

| 18 |

In December 2013, Optex Systems, Inc. was issued U.S. Patent No. 23,357,802 titled “Multiple Spectral Single Image Sighting System Using Single Objective Lens Set.” The technology platform, designed for our DDAN program, is applicable to all ground combat vehicles used by the US and foreign militaries. This invention presents a single image to both day and night sensors using precision optics, which in turn allows the user to individually observe day, night, or day and night simultaneously. In addition, it has proven to be especially useful in light transition points experienced at dusk and dawn. We are in production and currently delivering sighting systems with this advanced technology, a significant upgrade in the goal of supporting our customers as they modernize the worldwide inventory of aging armored vehicles. This technology is applicable to many sighting systems, and it has already been designed for implementation on the Light Armored Vehicles, the Armored Security Vehicle, the Amphibious Assault Vehicle, and the M60 Main Battle Tank. Digital Day and Night technology has advanced the capabilities of these installed weapon systems and is the first in a series of patents we have applied for to protect our Intellectual Property portfolio in support of the warfighters who use these systems.

In May 2012, we purchased a perpetual, non-exclusive license, with a single up front license fee of $200,000 to use Patent 7,880,792 “Optical and Infrared Periscope with Display Monitor” owned by Synergy International Optronics, LLC. We believe the purchase of the license agreement may allow us to extend and expand our market potential for the M113APC vehicle type which has the highest number of commonly used armored vehicles in the world. The current estimated active M113 APC worldwide inventory is over 80,000 units. This licensing of this patent allows us to develop additional products for this vehicle type, including the M17 Day/Thermal and M17 Day/Night periscopes. We are actively marketing the new periscopes internationally and completed our first international shipment utilizing this technology in March 2014. We continue to prototype these products and demonstrate them to potential customers.

Competition

The markets for our products are competitive. We compete primarily on the basis of our ability to design and engineer products to meet performance specifications set by our customers. Our customers include military and government end users as well as prime contractors that purchase component parts or subassemblies, which they incorporate into their end products. Product pricing, quality, customer support, experience, reputation and financial stability are also important competitive factors.

There are a limited number of competitors in each of the markets for the various types of products that we design, manufacture and sell. At this time, we consider our primary competitors for the Optex, Richardson site to be Kent Periscopes and Synergy International Optronics, LLC. The Applied Optics Center thin film and laser coatings products compete primarily with Materion-Barr, Artemis and Alluxa.

Our competitors are often well entrenched, particularly in the defense markets. Some of these competitors have substantially greater resources than we do. While we believe that the quality of our technologies and product offerings provides us with a competitive advantage over certain manufacturers, some of our competitors have significantly more financial and other resources than we do to spend on the research and development of their technologies and for funding the construction and operation of commercial scale plants.

We expect our competitors to continue to improve the design and performance of their products. We cannot assure investors that our competitors will not develop enhancements to, or future generations of, competitive products that will offer superior price or performance features, or that new technology or processes will not emerge that render our products less competitive or obsolete. Increased competitive pressure could lead to lower prices for our products, thereby adversely affecting our business, financial condition and results of operations. Also, competitive pressures may force us to implement new technologies at a substantial cost, and we may not be able to successfully develop or expend the financial resources necessary to acquire new technology. We cannot assure you that we will be able to compete successfully in the future.

Employees

We had 101 full time equivalent employees as of September 29, 2019 which include a small temporary work force to handle peak loads as needed. We are in compliance with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees, who are not currently unionized.

| 19 |

Leases

We are headquartered in Richardson, TX and lease 93,967 combined square feet of facilities between Richardson, Texas and Dallas, Texas. We operate with a single shift, and capacity could be expanded by adding a second shift. Our proprietary processes and methodologies provide barriers to entry for other competing suppliers. In many cases, we are the sole source provider or one of only two providers of a product. We have capabilities which include machining, bonding, painting, tracking, engraving and assembly and can perform both optical and environmental testing in-house.

We renewed the lease on our 49,100 square foot, Richardson, Texas facility, effective as of December 10, 2013, with a lease expiration of March 31, 2021. Our Applied Optics Center, is located in Dallas, Texas with leased premises consisting of approximately 44,867 square feet of space. The Applied Optics Center lease effective as of October 1, 2016, expires on October 31, 2021. There are two renewal options available to the tenant, and each renewal term is five years in duration.

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this annual report, before purchasing shares of our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. The risks described below are not the only risks we will face. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment. The risks and uncertainties described below are not exclusive and are intended to reflect the material risks that are specific to us, material risks related to our industry and material risks related to companies that undertake a public offering or seek to maintain a class of securities that is registered or traded on any exchange or over-the-counter market.

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this annual report, before purchasing shares of our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. The risks described below are not the only risks we will face. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment. The risks and uncertainties described below are not exclusive and are intended to reflect the material risks that are specific to us, material risks related to our industry and material risks related to companies that undertake a public offering or seek to maintain a class of securities that is registered or traded on any exchange or over-the-counter market.

Risks Related to our Business

We expect that we may need to raise additional capital in the future beyond any cash flow from our existing business; additional funds may not be available on terms that are acceptable to us, or at all.

We anticipate we may have to raise additional capital in the future to service our debt and to finance our future working capital needs. We cannot assure you that any additional capital will be available on a timely basis, on acceptable terms, or at all. Future equity or debt financings may be difficult to obtain. If we are not able to obtain additional capital as may be required, our business, financial condition and results of operations could be materially and adversely affected.

We anticipate that our capital requirements will depend on many factors, including:

| ● | our ability to fulfill backlog; |

| ● | our ability to procure additional production contracts; |

| ● | our ability to control costs; |

| ● | the timing of payments and reimbursements from government and other contracts, including but not limited to changes in federal government military spending and the federal government procurement process; |

| 20 |

| ● | increased sales and marketing expenses; |

| ● | technological advancements and competitors’ response to our products; |

| ● | capital improvements to new and existing facilities; |

| ● | our relationships with customers and suppliers; and |

| ● | general economic conditions including the effects of future economic slowdowns, acts of war or terrorism and the current international conflicts. |

Even if available, financings may involve significant costs and expenses, such as legal and accounting fees, diversion of management’s time and efforts, and substantial transaction costs. If adequate funds are not available on acceptable terms, or at all, we may be unable to finance our operations, develop or enhance our products, expand our sales and marketing programs, take advantage of future opportunities or respond to competitive pressures.

Changes in current economic conditions may adversely affect our ability to continue operations.

Changes in current economic conditions may cause a decline in business, consumer and defense spending and capital market performance, which could adversely affect our business and financial performance. Our ability to raise funds, which could be required for business continuity or expansion of our operations, may be adversely affected by current and future economic conditions, such as a reduction in the availability of credit, financial market volatility and economic recession.

Our ability to fulfill our backlog may have an effect on our long term ability to procure contracts and fulfill current contracts.

Our ability to fulfill our backlog may be limited by our ability to devote sufficient financial and human capital resources and limited by available material supplies. If we do not fulfill our backlog in a timely manner, we may experience delays in product delivery which would postpone receipt of revenue from those delayed deliveries. Additionally, if we are consistently unable to fulfill our backlog, this may be a disincentive to customers to award large contracts to us in the future until they are comfortable that we can effectively manage our backlog.

Our historical operations depend on government contracts and subcontracts. We face risks related to contracting with the federal government, including federal budget issues and fixed price contracts.

Future general political and economic conditions, which cannot be accurately predicted, may directly and indirectly affect the quantity and allocation of expenditures by federal agencies. Even the timing of incremental funding commitments to existing, but partially funded, contracts can be affected by these factors. Therefore, cutbacks or re-allocations in the federal budget could have a material adverse impact on our results of operations. Obtaining government contracts may also involve long purchase and payment cycles, competitive bidding, qualification requirements, delays or changes in funding, budgetary constraints, political agendas, extensive specification development, price negotiations and milestone requirements. In addition, our government contracts are primarily fixed price contracts, which may prevent us from recovering costs incurred in excess of budgeted costs. Fixed price contracts require us to estimate the total project cost based on preliminary projections of the project’s requirements. The financial viability of any given project depends in large part on our ability to estimate such costs accurately and complete the project on a timely basis. Some of those contracts are for products that are new to our business and are thus subject to unanticipated impacts to manufacturing costs. Given the current economic conditions, it is also possible that even if our estimates are reasonable at the time made, that prices of materials are subject to unanticipated adverse fluctuation. In the event our actual costs exceed fixed contractual costs of our product contracts, we will not be able to recover the excess costs which could have a material adverse effect on our business and results of operations. We examine these contracts on a regular basis and accrue for anticipated losses on these contracts, if necessary. As of September 29, 2019, there was zero in accrued loss provisions for loss contracts or cost overruns.

| 21 |

Approximately 85% of our contracts contain termination clauses for convenience. In the event these clauses should be invoked by our customer, future revenues against these contracts could be affected, however these clauses allow for a full recovery of any incurred contract costs plus a reasonable fee up through and as a result of the contract termination. We are currently unaware of any pending terminations on our existing contracts.

In some cases, contract awards may be issued that are subject to renegotiation at a date (up to 180 days) subsequent to the initial award date. Generally, these subsequent negotiations have had an immaterial impact (zero to 5%) on the contract price of the affected contracts. Currently, none of our awarded contracts are subject to renegotiation.