Attached files

| file | filename |

|---|---|

| 8-K - 12/13/19 8-K - PHX MINERALS INC. | phx-8k_20191212.htm |

| EX-99.1 - EX-99.1 - PHX MINERALS INC. | phx-ex991_6.htm |

PHX LISTED NYSE® EXHIBIT 99.2

Cautionary Statement Regarding Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this presentation that address activities, events or developments that Panhandle Oil and Gas Inc. (“Panhandle” or the “Company”) expects, believes or anticipates will or may occur in the future are forward looking statements. The words “anticipates”, “plans”, “estimates”, “believes”, “expects”, “intends”, “will”, “should”, “may” and similar expressions may be used to identify forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to: our future financial and operating results; our ability to execute our business strategies; estimations and the respective values of oil, NGL and natural gas reserves; the level of production on our properties and the future expenses associated therewith; projections and volatility of future realized oil and natural gas prices; planned capital expenditures associated with our mineral, leasehold and non-operated working interests; statements concerning anticipated cash flow and liquidity; and our strategy and other plans and objectives for future operations. Although the Company believes the expectations reflected in these and other forward-looking statements are reasonable, the Company can give no assurance such statements will prove to be correct. Such forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. These forward-looking statements involve certain risks and uncertainties that could cause the results to differ materially from those expected by the Company’s management. Information concerning these risks and other factors can be found in the Company’s filings with the Securities and Exchange Commission, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, available on the Company's website or the SEC’s website at www.sec.gov. Readers are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. The forward-looking statements in this presentation are made as of the date hereof, and the Company does not undertake any obligation to update the forward-looking statements as a result of new information, future events or otherwise. Use of Non-GAAP Financial Information This presentation includes certain non-GAAP financial measures. Adjusted EBITDA is a supplemental non-GAAP measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Panhandle defines “Adjusted EBITDA” as net income (loss) plus interest expense, provision for impairment, depreciation, depletion and amortization of properties and equipment, including amortization of other assets, provision (benefit) for income taxes and unrealized (gains) losses on derivative contracts. Panhandle references Adjusted EBITDA in this presentation because it recognizes that certain investors consider Adjusted EBITDA a useful means of measuring our ability to meet our debt service obligations and evaluating our financial performance. Adjusted EBITDA has limitations and should not be considered in isolation or as a substitute for net income, operating income, cash flow from operations or other consolidated income or cash flow data prepared in accordance with GAAP. Because not all companies use identical calculations, the Company’s calculation of adjusted EBITDA may not be comparable to a similarly titled measure of other companies. Oil and Gas Reserves The SEC generally permits oil and gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. The Company discloses only estimated proved reserves in its filings with the SEC. The Company’s estimated proved reserves as of September 30, 2019, referenced in this presentation were prepared by DeGolyer and MacNaughton, an independent engineering firm, and comply with definitions promulgated by the SEC. Additional information on the Company’s estimated proved reserves is contained in the Company’s filings with the SEC. Cautionary Statement Regarding Forward-Looking Statements

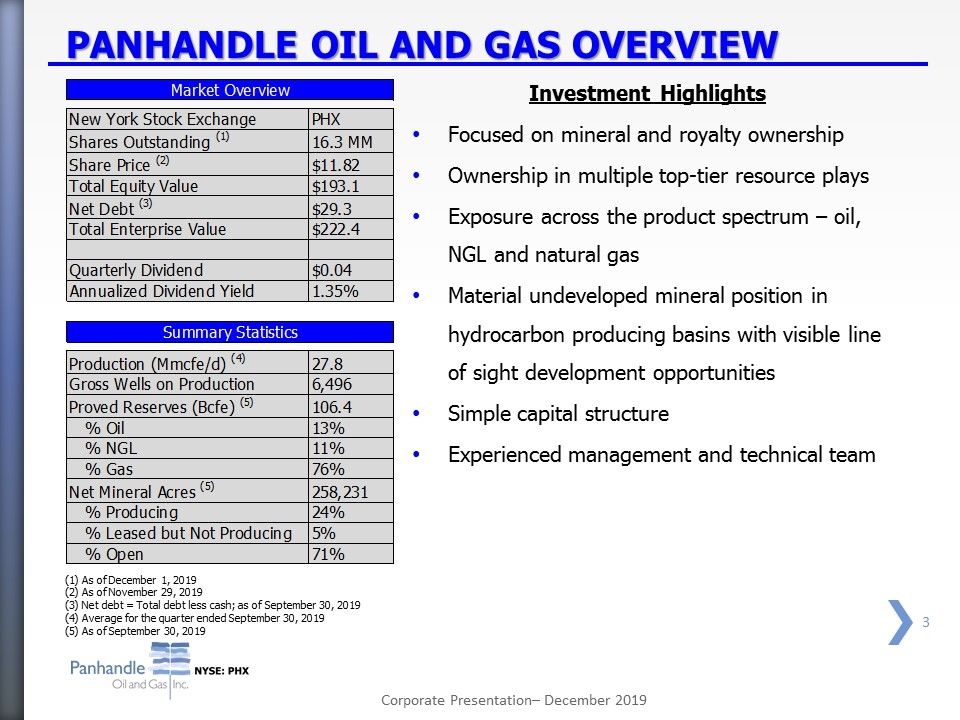

PANHANDLE OIL AND GAS OVERVIEW Investment Highlights Focused on mineral and royalty ownership Ownership in multiple top-tier resource plays Exposure across the product spectrum – oil, NGL and natural gas Material undeveloped mineral position in hydrocarbon producing basins with visible line of sight development opportunities Simple capital structure Experienced management and technical team (1) As of December 1, 2019 (2) As of November 29, 2019 (3) Net debt = Total debt less cash; as of September 30, 2019 (4) Average for the quarter ended September 30, 2019 (5) As of September 30, 2019

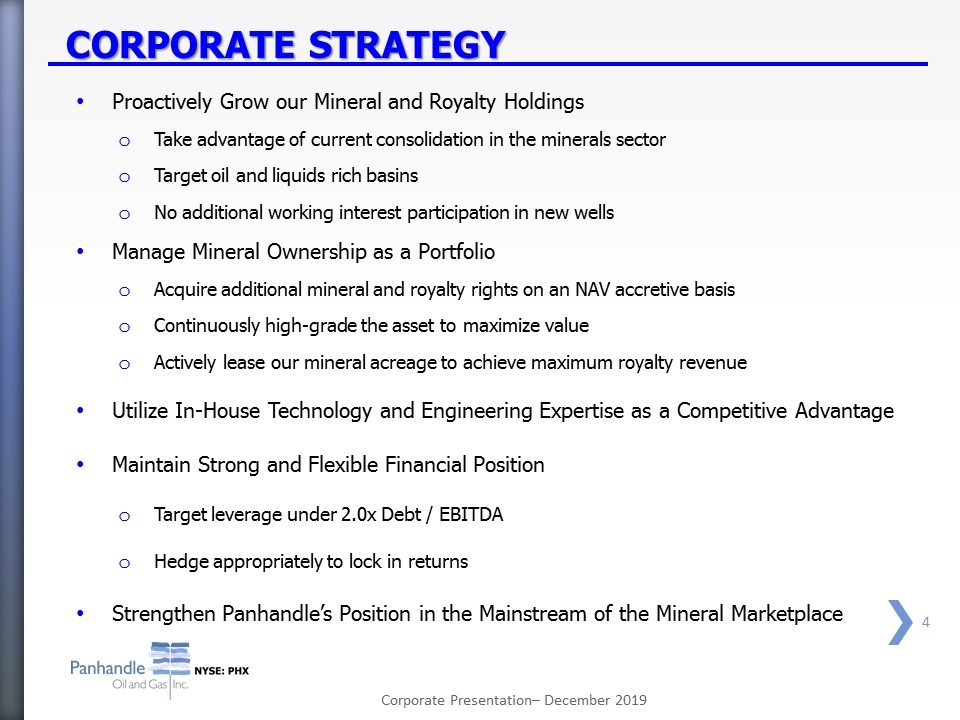

Proactively Grow our Mineral and Royalty Holdings Take advantage of current consolidation in the minerals sector Target oil and liquids rich basins No additional working interest participation in new wells Manage Mineral Ownership as a Portfolio Acquire additional mineral and royalty rights on an NAV accretive basis Continuously high-grade the asset to maximize value Actively lease our mineral acreage to achieve maximum royalty revenue Utilize In-House Technology and Engineering Expertise as a Competitive Advantage Maintain Strong and Flexible Financial Position Target leverage under 2.0x Debt / EBITDA Hedge appropriately to lock in returns Strengthen Panhandle’s Position in the Mainstream of the Mineral Marketplace CORPORATE STRATEGY

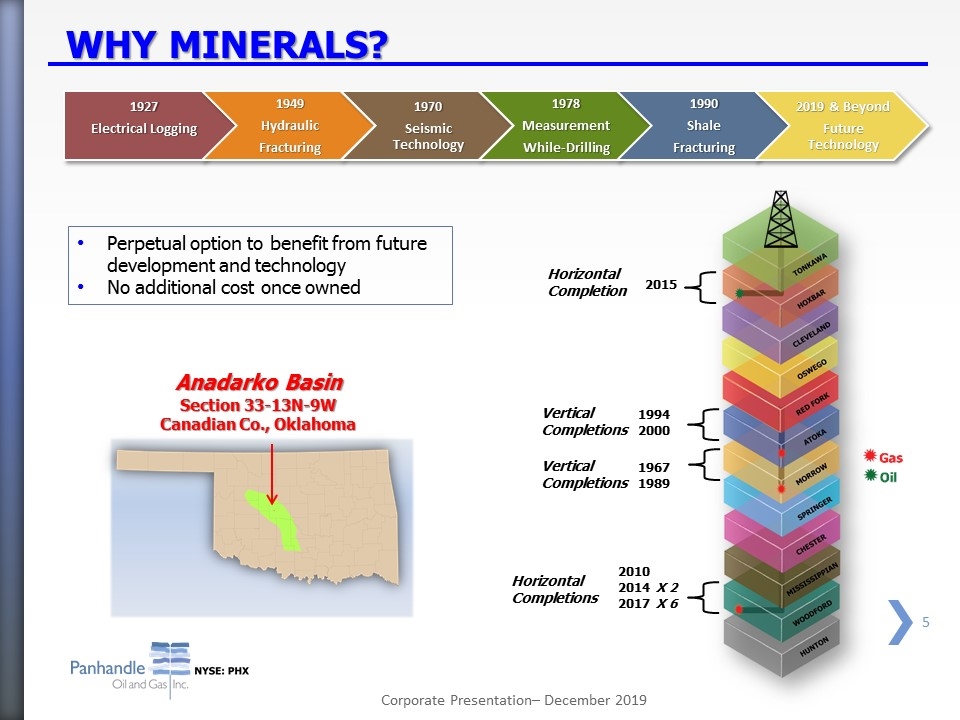

2015 1994 2000 1967 1989 2010 2014 X 2 2017 X 6 Horizontal Completions Horizontal Completion Vertical Completions Anadarko Basin Section 33-13N-9W Canadian Co., Oklahoma Vertical Completions Perpetual option to benefit from future development and technology No additional cost once owned 1927 Electrical Logging 1949 Hydraulic Fracturing 1970 Seismic Technology 1978 Measurement While-Drilling 1990 Shale Fracturing 2019 & Beyond Future Technology WHY MINERALS?

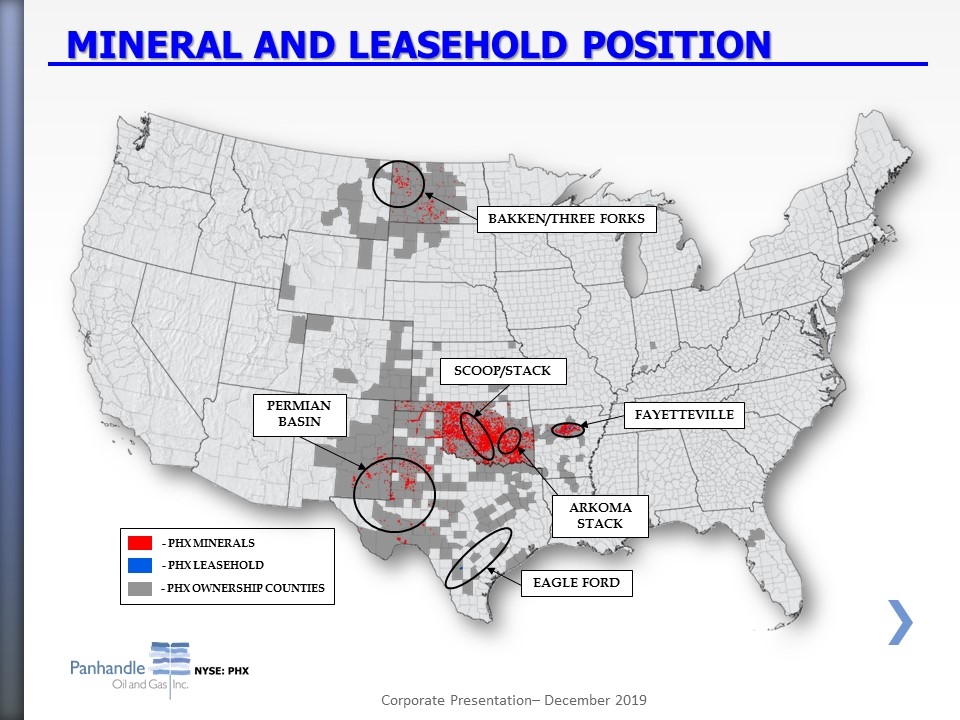

- PHX OWNERSHIP COUNTIES - PHX MINERALS - PHX LEASEHOLD BAKKEN/THREE FORKS SCOOP/STACK FAYETTEVILLE ARKOMA STACK PERMIAN BASIN EAGLE FORD MINERAL AND LEASEHOLD POSITION

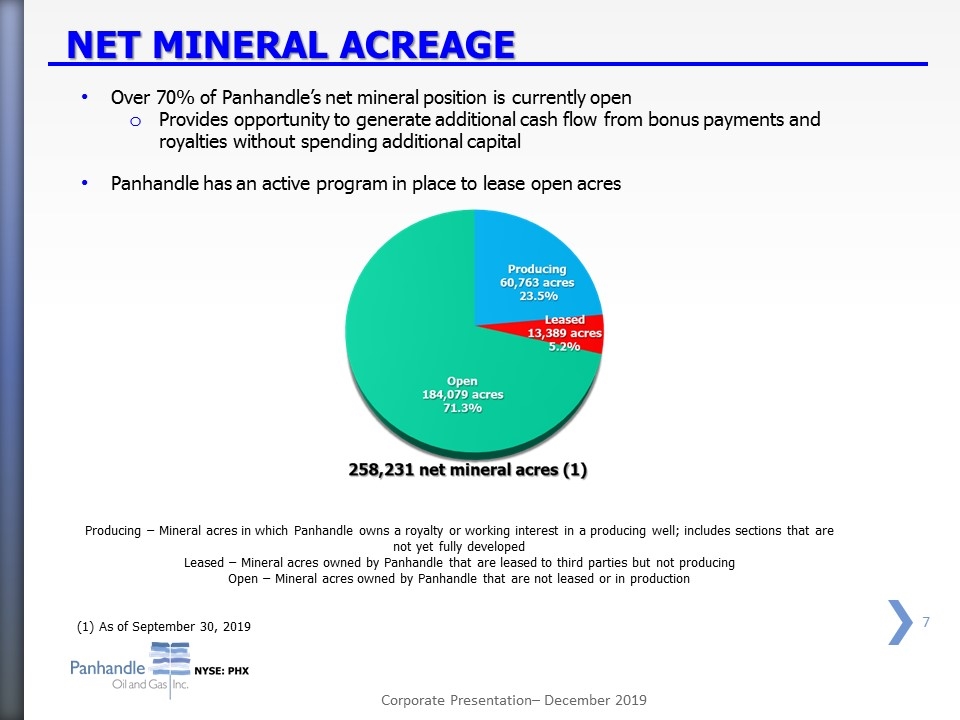

Producing – Mineral acres in which Panhandle owns a royalty or working interest in a producing well; includes sections that are not yet fully developed Leased – Mineral acres owned by Panhandle that are leased to third parties but not producing Open – Mineral acres owned by Panhandle that are not leased or in production NET MINERAL ACREAGE Over 70% of Panhandle’s net mineral position is currently open Provides opportunity to generate additional cash flow from bonus payments and royalties without spending additional capital Panhandle has an active program in place to lease open acres (1) As of September 30, 2019

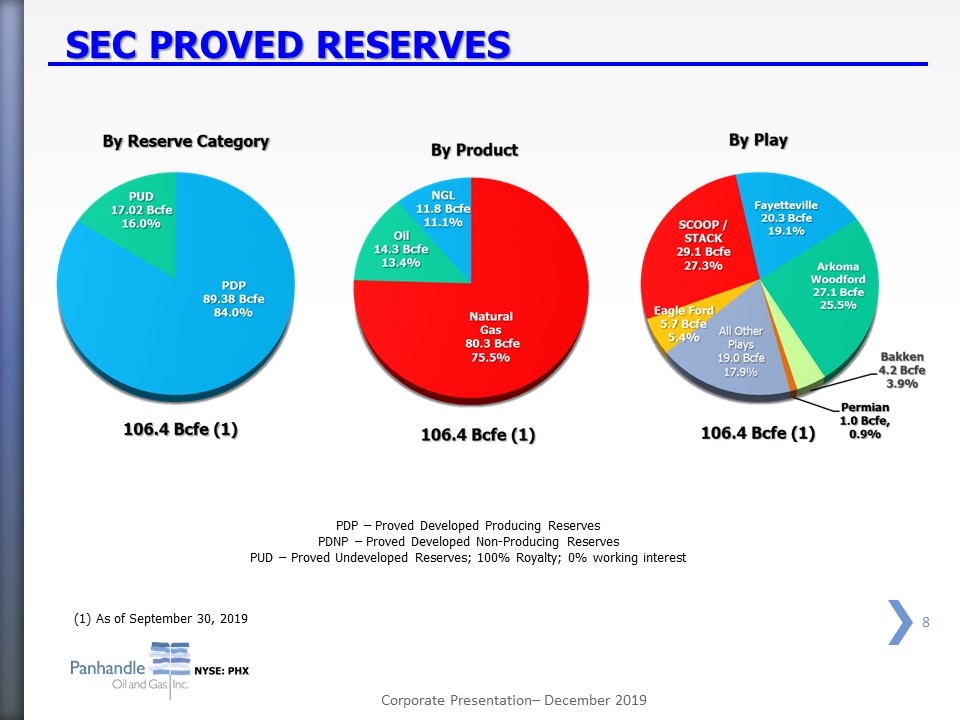

PDP – Proved Developed Producing Reserves PDNP – Proved Developed Non-Producing Reserves PUD – Proved Undeveloped Reserves; 100% Royalty; 0% working interest SEC PROVED RESERVES (1) As of September 30, 2019

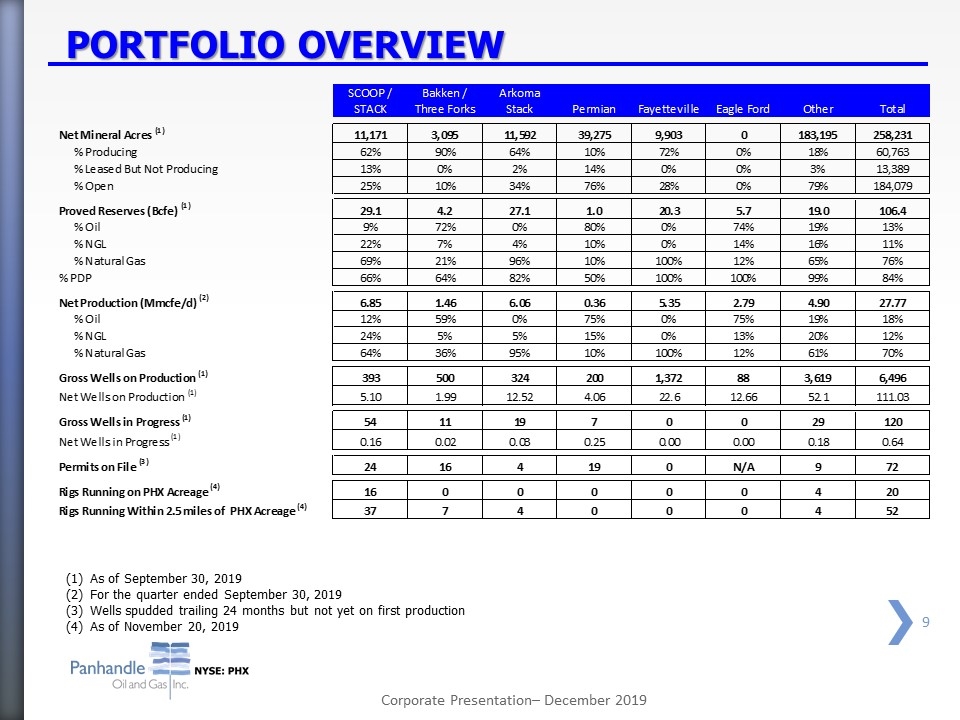

PORTFOLIO OVERVIEW As of September 30, 2019 For the quarter ended September 30, 2019 Wells spudded trailing 24 months but not yet on first production As of November 20, 2019

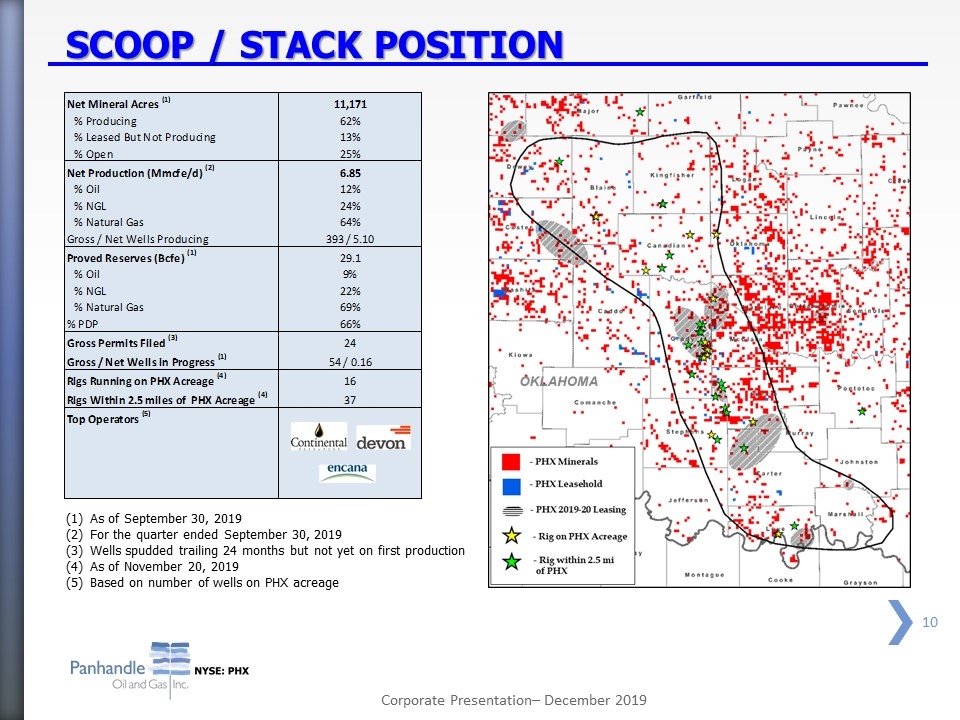

SCOOP / STACK POSITION As of September 30, 2019 For the quarter ended September 30, 2019 Wells spudded trailing 24 months but not yet on first production As of November 20, 2019 Based on number of wells on PHX acreage

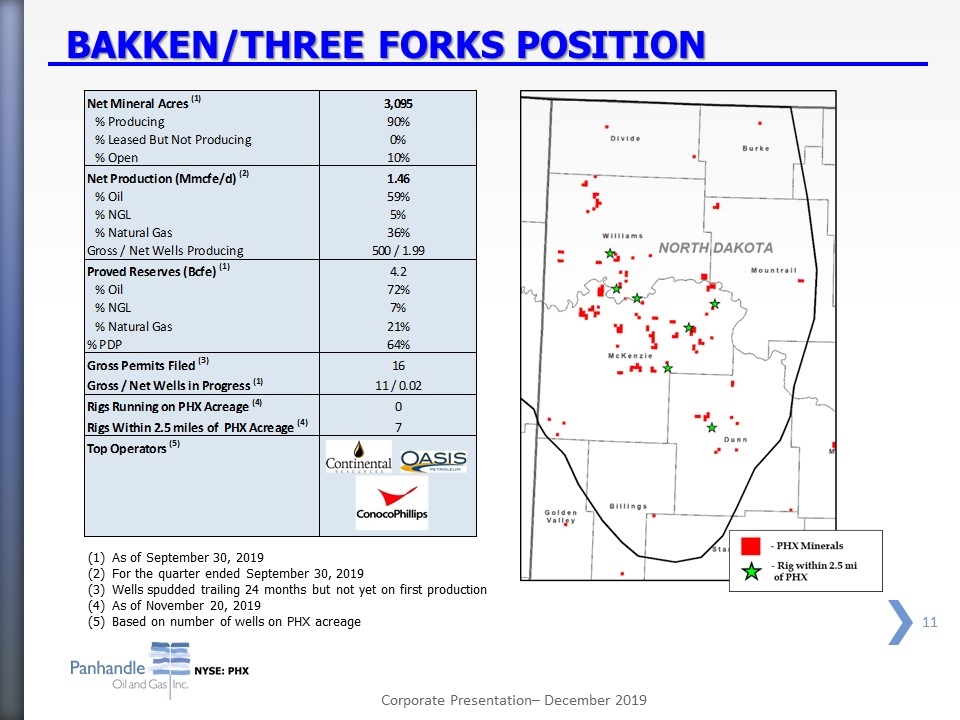

BAKKEN/THREE FORKS POSITION As of September 30, 2019 For the quarter ended September 30, 2019 Wells spudded trailing 24 months but not yet on first production As of November 20, 2019 Based on number of wells on PHX acreage

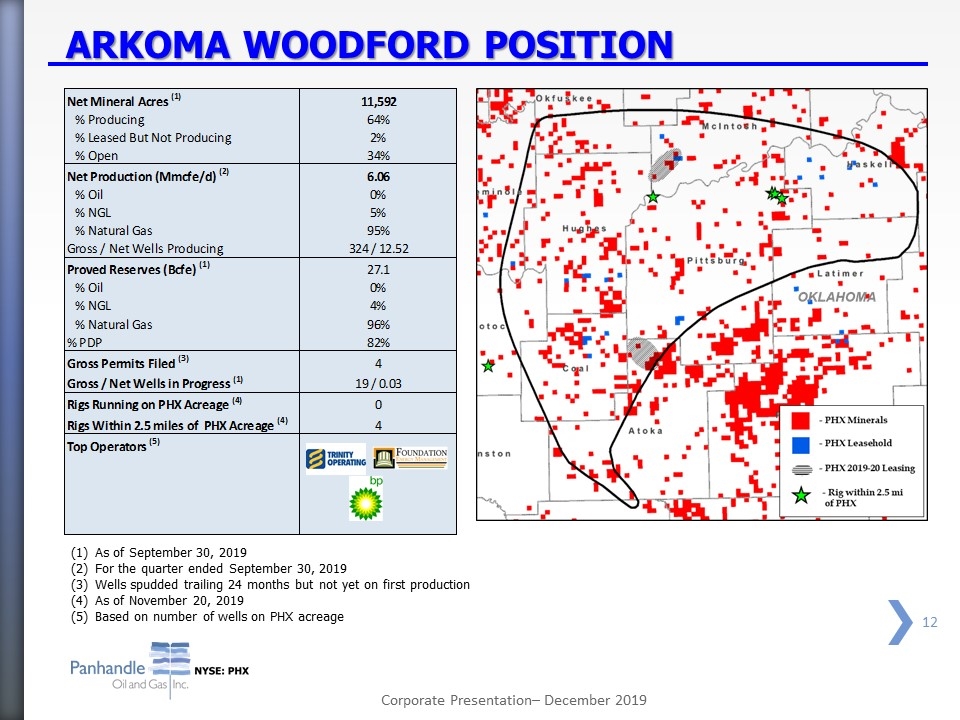

ARKOMA WOODFORD POSITION As of September 30, 2019 For the quarter ended September 30, 2019 Wells spudded trailing 24 months but not yet on first production As of November 20, 2019 Based on number of wells on PHX acreage

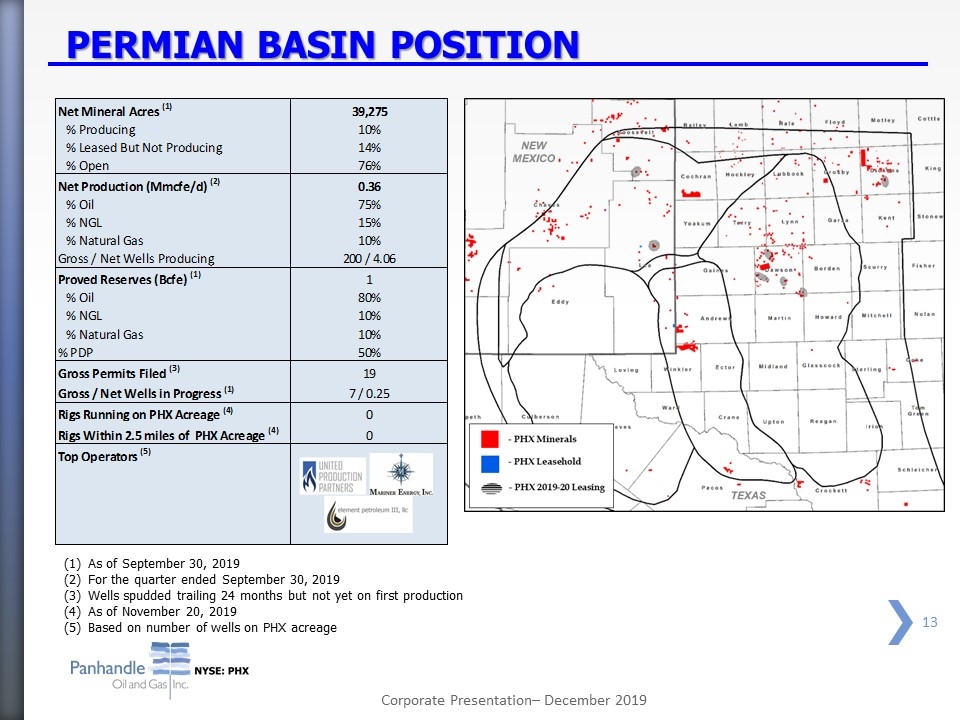

PERMIAN BASIN POSITION As of September 30, 2019 For the quarter ended September 30, 2019 Wells spudded trailing 24 months but not yet on first production As of November 20, 2019 Based on number of wells on PHX acreage

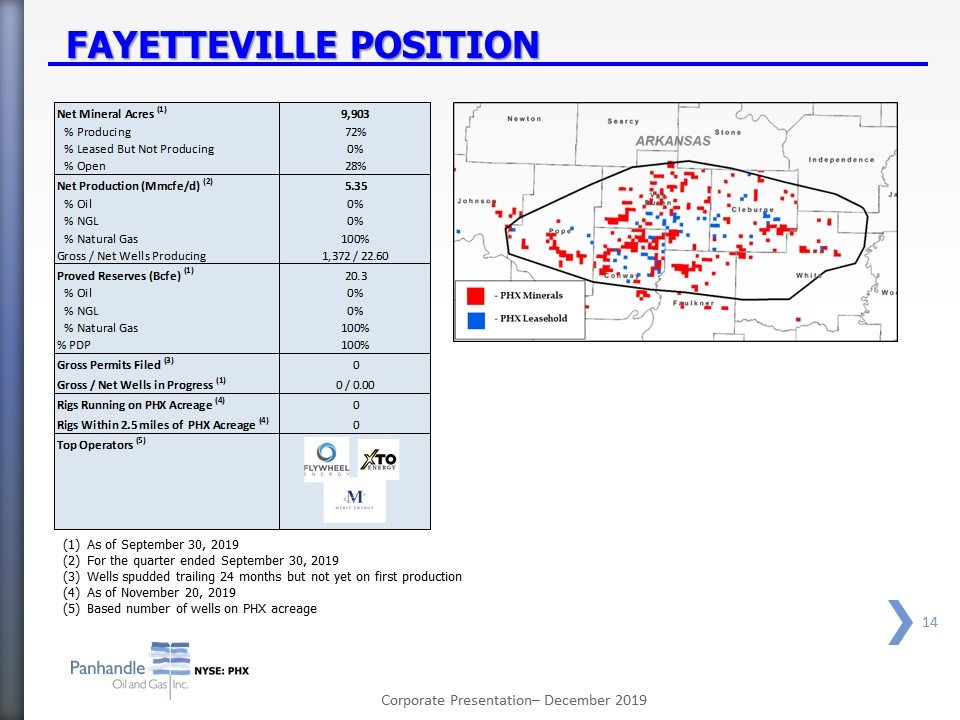

FAYETTEVILLE POSITION As of September 30, 2019 For the quarter ended September 30, 2019 Wells spudded trailing 24 months but not yet on first production As of November 20, 2019 Based number of wells on PHX acreage

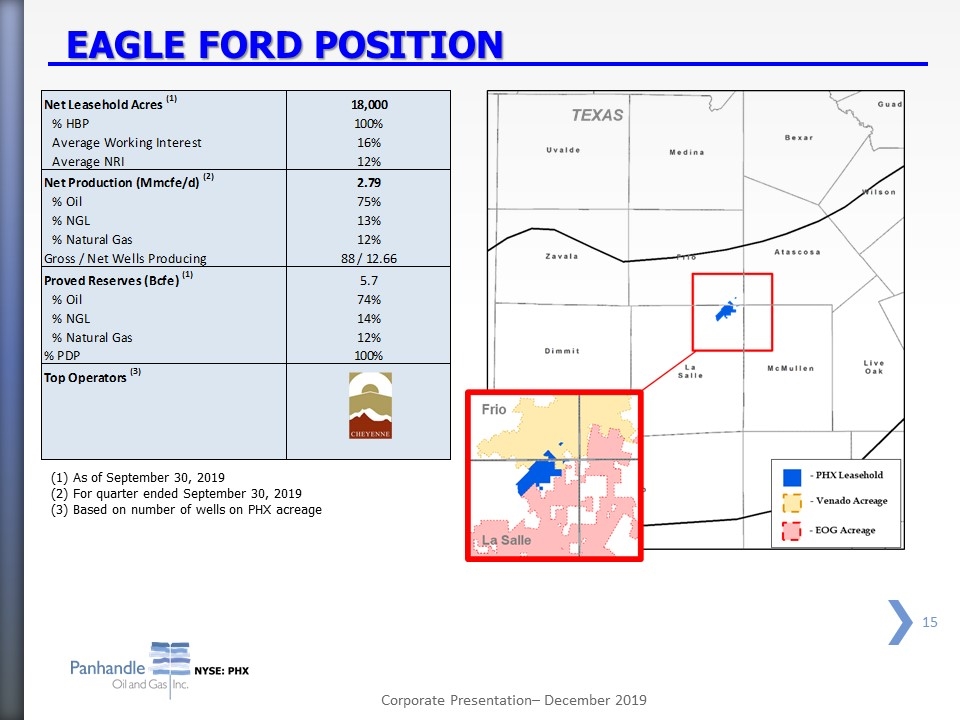

EAGLE FORD POSITION (1) As of September 30, 2019 (2) For quarter ended September 30, 2019 (3) Based on number of wells on PHX acreage

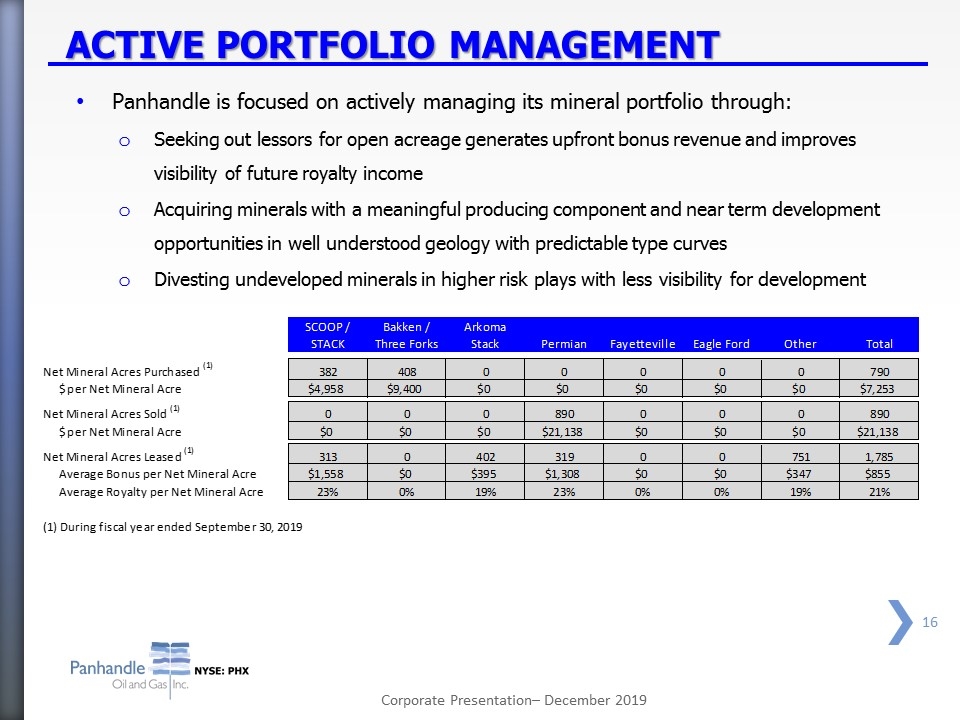

ACTIVE PORTFOLIO MANAGEMENT Panhandle is focused on actively managing its mineral portfolio through: Seeking out lessors for open acreage generates upfront bonus revenue and improves visibility of future royalty income Acquiring minerals with a meaningful producing component and near term development opportunities in well understood geology with predictable type curves Divesting undeveloped minerals in higher risk plays with less visibility for development

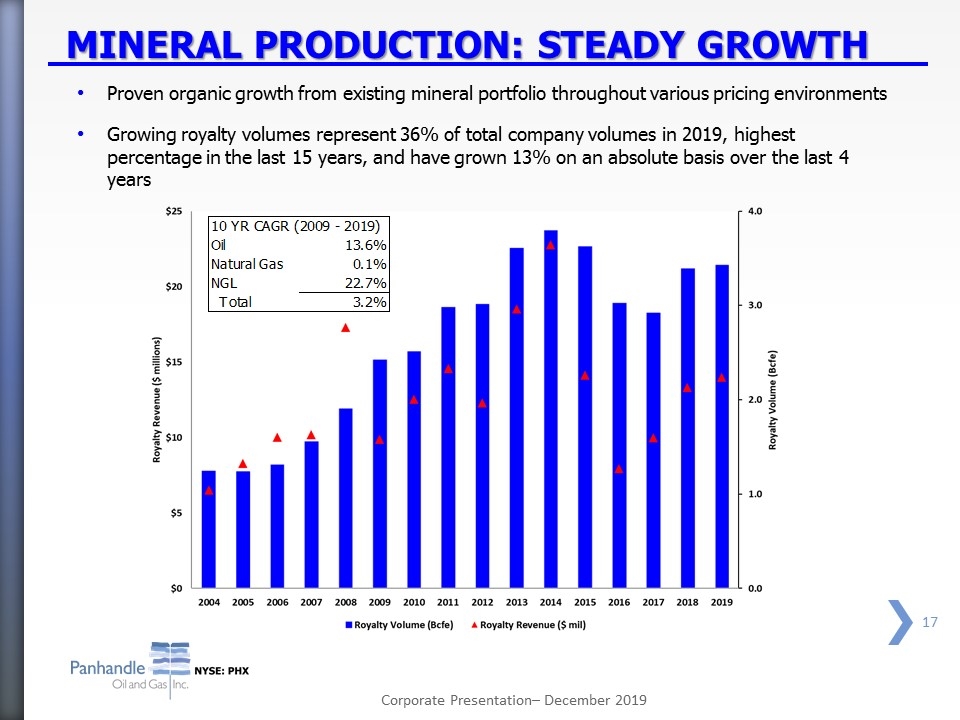

MINERAL PRODUCTION: STEADY GROWTH Proven organic growth from existing mineral portfolio throughout various pricing environments Growing royalty volumes represent 36% of total company volumes in 2019, highest percentage in the last 15 years, and have grown 13% on an absolute basis over the last 4 years

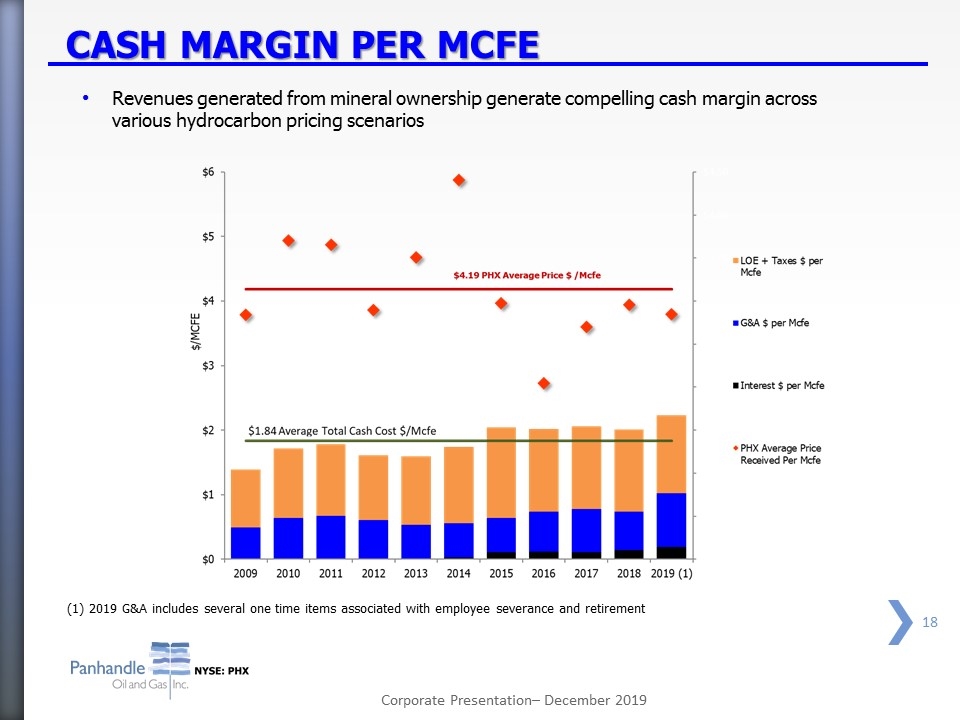

CASH MARGIN PER MCFE Revenues generated from mineral ownership generate compelling cash margin across various hydrocarbon pricing scenarios (1) 2019 G&A includes several one time items associated with employee severance and retirement

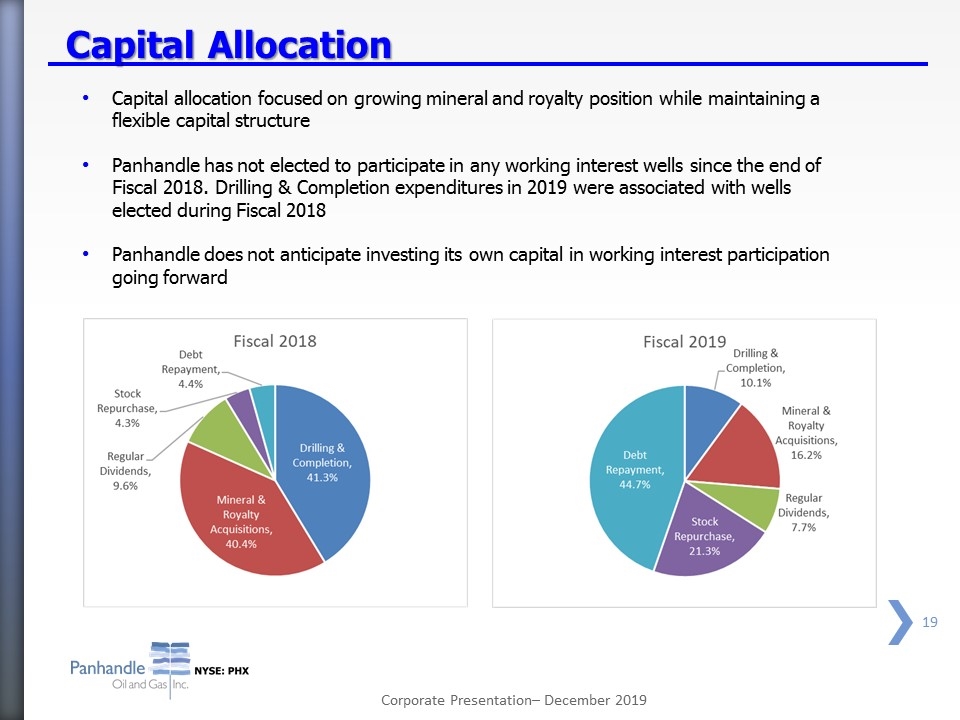

Capital Allocation Capital allocation focused on growing mineral and royalty position while maintaining a flexible capital structure Panhandle has not elected to participate in any working interest wells since the end of Fiscal 2018. Drilling & Completion expenditures in 2019 were associated with wells elected during Fiscal 2018 Panhandle does not anticipate investing its own capital in working interest participation going forward

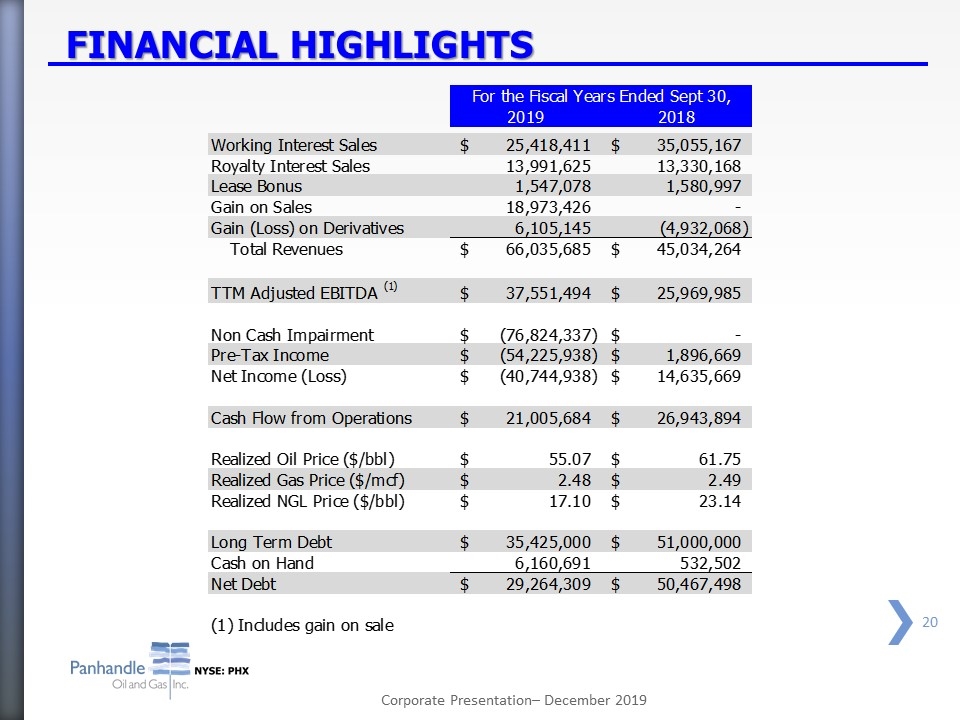

FINANCIAL HIGHLIGHTS

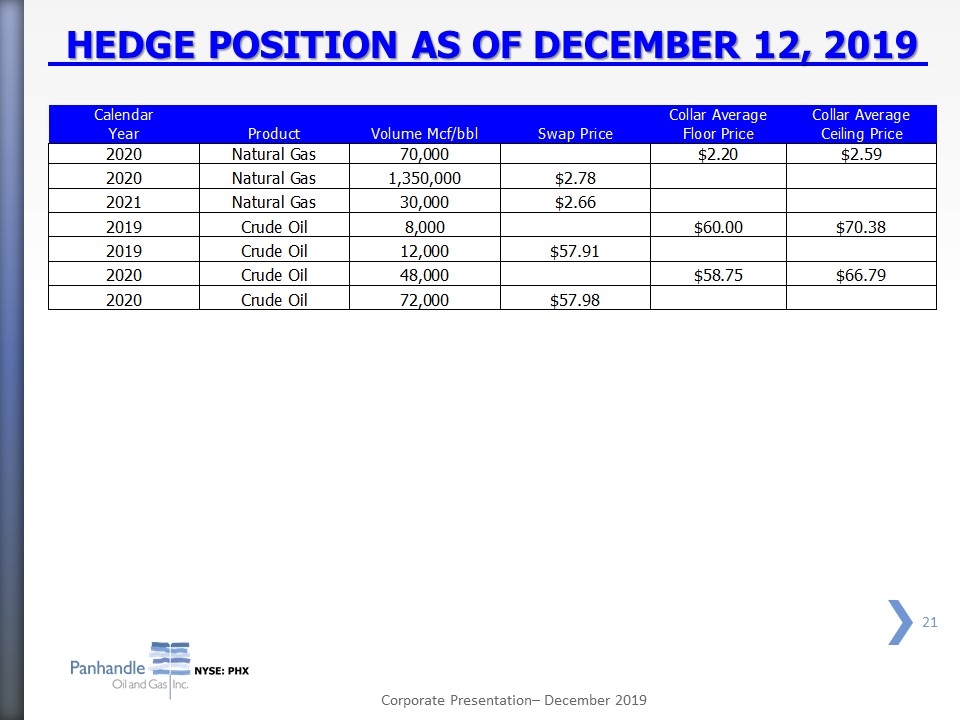

HEDGE POSITION AS OF DECEMBER 12, 2019

Focused on mineral and royalty ownership Ownership in multiple top-tier resource plays Exposure across the product spectrum – oil, NGL and natural gas Material undeveloped mineral position in hydrocarbon producing basins with visible line of sight development opportunities Simple capital structure Experienced management and technical team INVESTMENTS HIGHLIGHTS