Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Apawthecary Pets USA | apaw_ex321.htm |

| EX-31.1 - CERTIFICATION - Apawthecary Pets USA | apaw_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2019

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

333-176705

Commission file number

APAWTHECARY PETS USA. |

(Exact name of registrant as specified in its charter) |

Nevada | 26-1679929 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

c/o Brad Kersch 619 S. Ridgeley Drive, Los Angeles, CA | 90036 | |

(Address of principal executive offices) | (Zip Code) |

(323) 345-4587

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ¨ Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Non-accelerated filer | ¨ |

Accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) | Emerging Growth | x | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of December 13, 2019 24,827,264 common shares are Issued and Outstanding.

PART I

Item 1. Business.

Apawthecary Pets USA was formerly known as Bookedbyus Inc., a development stage company, which was formed on December 27, 2007. Bookedbyus Inc. had commenced limited operations, primarily focused on organizational matters. The Company had not yet implemented its business model and has generated $31,502 in revenue since inception from consulting projects unrelated to our planned business model and has incurred losses of $436,946 through August 31, 2019.

On July 20, 2017 the Company changed its name to Apawthecary Pets USA

On August 24, 2017 Apawthecary Pets USA entered into a license agreement with Solace Management Group Inc. a British Columbia corporation. The material terms of such license agreement are:

| 1. | Upon execution of the Agreement, Apawthecary Pets USA shall provide a non-refundable license fee in the amount of $100,000 (the “License Fee”) to be held in an escrow account pursuant and subject to the terms of an escrow agreement whereby the License Fee will remain in the escrow account until the earlier of a $3,000,000 raise by the Licensee or after the Set-up Period. |

|

|

|

| 2. | Term of the Licence Agreement is 10 years with a 5 year renewal term. |

|

|

|

| 3. | The license is an exclusive, non-transferable, non-sub licensable license to manufacture, sell, represent, market, distribute and advertise the Licensed Products within the Territory on the terms and conditions set forth in the License Agreement and shall include access to, and use of, the Solace Management Group Inc.’s Licensed Products and Services, Marks, Manuals, brands, and the business format, formulations, methods, specifications, standards, and operating procedures. |

|

|

|

| 4. | Apawthecary Pets USA shall pay the Solace Management Group Inc. for all packaging and shipment expenses to the Licensee at the then current market rate plus 20%. |

|

|

|

| 5. | Royalties will commence to accrue when the Licensed Products are accepted by the Apawthecary Pets USA. Apawthecary Pets USA shall pay quarterly royalties in addition to the yearly royalty fee, 10% of sales based on the wholesale price of each item. |

Apawthecary Pets Inc., a Canadian corporation, licensed the brand and distribution rights for Apawthecary Pets for use in Canada from Solace Management Group Inc. Apawthecary Pets Inc. licensed the same brand and products that were licensed by Apawthecary Pets USA however Apawthecary Pets Inc.’s distribution rights are restricted to Canada. Apawthecary Pets Inc. is not affiliated with Apawthecary Pets USA. Apawthecary Pets Inc.’s sole shareholder and sole officer Tami Kersch has a 13% ownership in Apawthecary Pets USA and is married to Bradley Kersch the Company’s President, Director and significant shareholder.

Solace Management Group Inc. and Apawthecary Pets USA have an officer and director in common, Bradley Kersch. Apawthecary Pets USA has negotiated a licensing and distribution agreement with Solace Management Group Inc.

The Company has raised $102,500 through recent sales of its common stock. In the event we do not raise any proceeds from this offering, the Company’s existing cash will not be sufficient to maintaining a reporting status and to implement its planned business. The Company will continue to raise money through private placements of its common stock.

The Company’s auditors have issued an opinion that the ability of the Company to continue as a going concern is dependent on raising capital to fund its business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern.

Our business office is located at 297 Kingsbury Grade Suite 100, Lake Tahoe NV 89449-4470, our telephone number is (323) 345-4587 and our fax number is (323) 634-1001. Our United States and registered statutory office is located at 297 Kingsbury Grade, Lake Tahoe NV 89449-4470, telephone number (800) 553-0615.

Product Overview

Apawthecary Treats are wellness treats infused with our proprietary blend of plant-based ingredients. AMERICAN made with non-GMO human grade food ingredients. Our products are created to help maintain health and alleviate aches and pains from injury or old age.

Apawthecary is committed to researching and developing pet treat products using all natural ingredients. We source organic wherever we can. Our treats are for overall health benefits, from pain to calming. 200g bags, |

| |

| ||

Apawthecary Tinctures - Apawthecary Pet Tinctures higher concentrate of hemp terpenes per 30ml bottles. The concentrates come in Bacon flavour and Seafood flavouring Ingredients: Hemp Terpenes, MCT Oil, Natural flavourings. (no animal by products) For pain and anxiety. |

| |

|

| 2 |

Apawthecary’s - Wild Tails- Meal replacement bars: COMPLETE K9 MEAL BARS ON THE GO! Made with 100% grain-free, all natural, human grade ingredients. Convenient, healthy, premium products interchangeable with regular dog food. Four Flavours – Pumpkin, Peanut Butter, Bacon, Beef |

| |

| ||

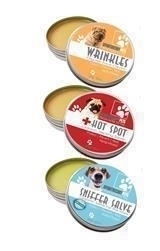

Wrinkles by APAWTHECARY PETS All-natural organic face cream specially formulated to treat & prevent skin fold disease, infection & discomfort. For treating & preventing: Skin fold dermatitis, Yeast & bacterial infections, Redness, chaffing, inflammation, Crusty buildup, Sores, pimples, scabbing, Interdigital cysts, Itchy, flaky skin, hair loss, baldness, Unpleasant odor.

Hot Spot by APAWTHECARY PETS 100% all-natural organic salve specially formulated to treat “hot spots” Hotspots are essentially an immune-mediated response of the skin. They appear as red, moist, irritated, sometimes oozy skin lesions.

Nose Soother by APAWTHECARY PETS 100% all-natural organic salve specially formulated to treat Crusty and damaged noses. May heal crusty, dry, cracked, chapped, even bleeding dog noses. Our cream for dog’s noses is a synergistic, perfect blend of organic, vegan, nourishing, healing and moisturizing ingredients. Snout Soother can be applied to a dog’s nose to treat painful cracking and dryness as well as a preventative with its natural sunscreen elements. |

|

Pet Paw Protection: 100% All Natural Organic Pet Paw Protection Wax. Prevent damage and paw conditions with Apawthecary’s Paw Protection. The paw protection comes in wax form and provides protection even in the most extreme conditions. Recommended for dogs who don’t like boots on their feet! |

| |

| ||

Horse Tincture: 100% All Natural Organic tincture for horses. Specifically formulated and flavored for horses. Apple cinnamon flavour in a 50ml bottle contains 250mg of hemp terpenes / medicine |

| |

| ||

Vet-Line: Our Vet-Line of tinctures have been specially formulated for use by and recommended by Veterinarians. This line of tinctures are higher in Hemp medicine than our regular tinctures and are only sold through Veterinarians. From 120mg to 2000mg dosages. |

|

| 3 |

According to the American Pet Products Association, The USA pet industry has tripled in size since 1994 from annual revenues of $17 billion to over $60 billion today. (American Pet Products Association’s U.S. Pet Industry Spending Figures & Outlook) This dramatic rise can be linked to three significant paradigm shifts:

1. | The awareness and acceptance of pets being a member of our family |

| |

2. | The increasing focus on product ‘premium’, wellness and quality of life in our society |

| |

3. | Rising awareness of food safety and security concerns related to continuing pet food recalls |

Apawthecary Pet’s initial hemp-based treats and tinctures will compete in the ‘wellness pet treat or functional chew’ category. This market segment continues to grow as sophisticated ‘treat’ formulas provide functional health benefits and attract supplement consumers.

Apawthecary Pet’s products will be sold online, in pet stores and will be offered as an anti-inflammatory and anti-anxiety supplement, from the supplement and pet medication market who are seeking more natural - yet effective alternatives to pharmaceutical medicines.

Competition

Several companies have similar offerings to Apawthecary. To managements best of knowledge, none have combined the benefits of hemp into an all-in-one product offering to the dog, cat and equestrian markets to date. With Apawthecary’s proprietary process we can infuse any product from jerky to bones with our enriched formulas.

Popular competitive products include: Zuke’s® ‘Hip-Action’ Hip and Joint Chews, Pet Naturals® ‘Calming’ Soft Moist Chews, Cloud Star® ‘Dynamo Dog’ Hip and Joint Treats, Blue Buffalo® ‘Jolly Joints’ Jerky Treats.

Hemp supplement products: There are four companies that we know of who are currently operating in this category. They are offering products in capsule and baked biscuit formats; Canna-PetTM ’Canna-Biscuits’ and capsules, Canna-CompanionTM Hemp capsules, TreatiblesTM baked CBD dog biscuits and TruLeaf dog chews.

Market Opportunity

Apawthecary Pets USA is an American hemp company positioning a niche in the fast growing and dynamic $60 billion American pet industry (http://www.americanpetproducts.org/press_industrytrends.asp ) with its line of Pet products branded under “Apawthecary Pets”. Apawthecary has entered the natural pet product sector with a product line consisting of innovative hemp-based wellness pet products pet treats, pet tinctures, creams and slaves followed by hemp based supplements for pets in the USA market. This will lay a profitable foundation for the company’s long-term strategy to secure a new animal drug application for a Hemp-based pet medication sold via veterinary prescription in the $13.8 billion pet medication market.

Statistics show that consumers are looking for higher quality products that address health needs common to their pets, without having to worry about food safety or harmful side effects. Products containing hemp, including hemp seed oil, hemp protein and hemp terpenes, are gaining significant acceptance as evidence of their nutritional and medicinal effectiveness becomes recognized. (http://www.forbes.com/sites/nancygagliardi/2015/02/18/consumers-want-healthy-foods-and-will-pay-more-for-them/#236d595875c5)

| 4 |

Apawthecary is well-positioned to meet the consumer demand for innovative pet health by marketing hemp-focused natural products that are professionally designed and, scalable for sale in the USA market. The Apawthecary product line-up provides hemp-based antioxidant, joint and calming support in biscuit format and a liquid tincture that are currently sold successfully across Canada. Apawthecary Pets USA has acquired the worldwide rights, with an option to purchase the Canadian rights for the Apawthecary Pet brand and its proprietary formulations. The company will be introducing this line to the American market and will utilize all natural ingredients including but not limited hemp as the active ingredient for anti-inflammatory and anti-anxiety supplements in the USA and worldwide. Apawthecary Pets has tremendous benefits by having continued R&D done by Apawthecary Pets Canada. This would include and not limited to new formulations and on-going updates in product development, expanding development into cat treats, horse treats and a full meal replacement bar for dogs. Apawthecary will utilize its proprietary procedures to infuse its products, this process allows pets to absorb the medicine and nutrients more effectively.

The USA pet industry has tripled in size since 1994 from annual revenues of $17 billion to over $60 billion today. – (http://www.americanpetproducts.org/press_industrytrends.asp) This dramatic rise can be linked to three significant paradigm shifts:

| · | The awareness and acceptance of pets being a member of our family |

| · | The increasing focus on product ‘premium’, wellness and quality of life in our society |

| · | Rising awareness of food safety and security concerns related to continuing pet food recalls |

Apawthecary Pet’s initial hemp-based treats and tinctures will enter the $3.2 billion natural pet product market and compete in the ‘wellness pet treat or functional chew’ category. This market segment continues to grow as sophisticated ‘treat’ formulas provide functional health benefits and attract supplement consumers. (http://www.packagedfacts.com/Pet-Supplements-Nutraceutical-7259313/)

Apawthecary Pet’s products will be sold online, in pet stores and will be offered as an anti-inflammatory and anti-anxiety supplement, capturing consumers from the supplement and pet medication market who are seeking more natural - yet effective alternatives to pharmaceutical medicines.

Item 1A. Risk Factors.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

Item 1B. Unresolved Staff Comments.

None

Item 2. Properties.

We do not own any real estate or other properties and have not entered into any long-term lease or rental agreements for property.

Item 3. Legal Proceedings.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or stockholder is a party adverse to the Company or has a material interest adverse to the Company.

Item 4. (Removed and Reserved)

| 5 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Although our common stock is not listed on a public exchange, we intend to apply for quotation on the Over-the-Counter Bulletin Board (OTCBB). In order to be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, who, generally speaking, must approve the first quotation of a security by a market maker on the OTCBB, nor can there be any assurance that such an application for quotation will be approved.

Item 6. Selected Financial Data

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Management’s Discussion and Analysis

This section of the Registration Statement includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Capital Resources and Liquidity

Our auditors have issued a “going concern” opinion, meaning that there is substantial doubt if we can continue as an on-going business unless we obtain additional capital. No substantial revenues from our planned business model are anticipated until we have completed financing the Company.

We need to seek capital from resources such as the sale of private placements in the Company’s common stock or debt financing, which may not even be available to the Company. However, if such financing were available, because we are a, early stage company with no or limited operations to date, it would likely have to pay additional costs associated with such financing and in the case of high risk loans be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such financing. If the company cannot raise additional proceeds via such financing, it may be required to cease business operations.

As of August 31, 2019, we had $20,256 in cash as compared to $42,594 as of August 31, 2018 As of the date of this Form 10-K, the current funds available to the Company will not be sufficient to fund the expenses related to maintaining a reporting status. We are in the process of seeking additional equity financing in the form of private placements to fund our intended business operations.

Management believes that if subsequent private placements are successful or we are successful in raising funds from registered securities, we will generate sales revenue within twelve months thereof. However, additional equity financing may not be available to us on acceptable terms or at all, and thus we could fail to satisfy our future cash requirements.

We do not anticipate researching any further products nor the purchase or sale of any significant equipment. We also do not expect any significant additions to the number of employees.

Results of Operations

At August 31, 2019, the Company was not engaged in continued business and has been primarily involved in early stage activities to date. Due to a lack of funding, we have not implemented our Plan of Operations.

The Company has not yet implemented its business model. We must raise cash to implement our strategy and stay in business. In the event we do not raise any proceeds, the Company’s existing cash will not be sufficient to fund the expenses related to maintaining a reporting status and to implement its planned business. Accordingly, the Company intends to implement a different business plan, a business that will sell 100% all natural hemp infused wellness treats for dogs, cats and horses.

We had $Nil in revenue for the fiscal year ended August 31, 2019 as compared to revenue for the fiscal year ended August 31, 2018 of $Nil.

| 6 |

Total expenses in the fiscal year ended August 31, 2019 were $36,397 as compared to total expenses for the fiscal year ended August 31, 2018 of $48,274 resulting in a net loss for the fiscal year ended August 31, 2019 of $36,397 as compared to a net loss of $48,274 for the fiscal year ended August 31, 2018. The net loss for the fiscal year ended August 31, 2019 is a result of Professional fees of $26,572, comprised primarily of legal and accounting expense, General and administrative expense of $2,625 and impairment loss of $7,200 as compared to the net loss for the fiscal year ended August 31, 2018 of $48,274 which was a result of Professional fees of $35,677, comprised primarily of legal and accounting expense and General and administrative expense of $12,597.

Off-balance sheet arrangements

The Company has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect or change on the company’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. The term “off-balance sheet arrangement” generally means any transaction, agreement or other contractual arrangement to which an entity unconsolidated with the company is a party, under which the company has (i) any obligation arising under a guarantee contract, derivative instrument or variable interest; or (ii) a retained or contingent interest in assets transferred to such entity or similar arrangement that serves as credit, liquidity or market risk support for such assets.

Plan of Operations

Over the 12 month period our company must raise capital to introduce its planned products and start its sales. The amount of the offering will likely allow us to operate for at least one year however, due to the fact that there is no minimum on sold shares, you may be investing in a company that will not have the funds necessary to fully develop its Plan of Operations.

We are highly dependent upon the success of the offering described herein. Therefore, the failure thereof would result in need to seek capital from other resources such as private placements in the Company’s common stock or debt financing, which may not even be available to the Company. However, if such financing were available, because we are a development stage company with no or limited operations to date, it would likely have to pay additional costs associated with such financing and in the case of high risk loans be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such financing. If the company cannot raise additional proceeds via such financing, it would be required to cease business operations.

Over the next twelve months, we intend to l (i) open our office in Washington (ii) introduce all of our products described in the Product Overview section on page 33; (iii) launch our website as licensed from Solace Management Group Inc.

The first phase of our planned operations over this period would be to lease office space in Washington and build out the office to meets the Company needs. Immediately thereafter, the Company will launch its website and secure initial inventory.

The Company has budgeted: $11,450 for legal and accounting; $988,550 for general business development, build out of USA sales office lease of equipment for production travel expenses, wages; $300,000 sales commissions as necessary; $100,000 Legal fees; $1,600,000 additional product research and development, working capital, inventory & raw materials.

Apawthecary Pet’s products will be sold online, in pet stores, veterinary clinics, distributers and will be offered as an anti-inflammatory and anti-anxiety supplement, capturing consumers from the supplement and pet medication market who are seeking more natural - yet effective alternatives to pharmaceutical medicines.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

| 7 |

Item 8. Financial Statements and Supplementary Data.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

Apawthecary Pets USA

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Apawthecary Pets USA (the “Company”) as of August 31, 2019 and 2018, and the related statements of operations, changes in stockholders’ deficit and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of August 31, 2019 and 2018, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Going Concern Matter

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations and has a net capital deficiency that raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

| /s/ MaloneBailey, LLP | ||

| www.malonebailey.com | ||

| We have served as the Company’s auditor since 2015. | ||

Houston, Texas |

|

|

December xx, 2019 |

|

|

| F-1 |

Apawthecary Pets USA |

Balance Sheets |

(Expressed in U.S. Dollars) |

|

| August 31, |

|

| August 31, |

| ||

|

| 2019 |

|

| 2018 |

| ||

Assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

Current assets |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 20,256 |

|

| $ | 42,594 |

|

Inventory (Note 4) |

|

| - |

|

|

| 7,200 |

|

Total current assets |

|

| 20,256 |

|

|

| 49,794 |

|

|

|

|

|

|

|

|

|

|

Total Assets |

| $ | 20,256 |

|

| $ | 49,794 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Deficit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

| $ | 9,957 |

|

| $ | 5,069 |

|

Accounts payable due to related parties (Note 3) |

|

| 2,522 |

|

|

| 551 |

|

Due to related parties (Note 3) |

|

| 70,673 |

|

|

| 70,673 |

|

Total current liabilities |

|

| 83,152 |

|

|

| 76,293 |

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

| 83,152 |

|

|

| 76,293 |

|

|

|

|

|

|

|

|

|

|

Stockholders' deficit |

|

|

|

|

|

|

|

|

Capital stock (Note 5) |

|

|

|

|

|

|

|

|

Authorized 75,000,000 of common shares, par value $0.001 |

|

|

|

|

|

|

|

|

Issued and outstanding 24,827,264 common shares issued and outstanding (2018 - 24,827,264), par value $0.001 |

|

| 24,827 |

|

|

| 24,827 |

|

Additional paid in capital |

|

| 349,223 |

|

|

| 349,223 |

|

Accumulated deficit |

|

| (436,946 | ) |

|

| (400,549 | ) |

|

|

|

|

|

|

|

|

|

Total stockholders' deficit |

|

| (62,896 | ) |

|

| (26,499 | ) |

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Deficit |

| $ | 20,256 |

|

| $ | 49,794 |

|

| F-2 |

Apawthecary Pets USA | ||

Statements of Operations | ||

(Expressed in U.S. Dollars) |

|

| For the |

|

| For the |

| ||

|

| year ended |

|

| year ended |

| ||

|

| August 31, |

|

| August 31, |

| ||

|

| 2019 |

|

| 2018 |

| ||

|

|

|

|

|

|

| ||

Operating Expenses |

|

|

|

|

|

| ||

Professional fees |

| $ | 26,572 |

|

| $ | 35,677 |

|

General and administrative |

|

| 2,625 |

|

|

| 12,597 |

|

Impairment Loss (Note 4) |

|

| 7,200 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

| 36,397 |

|

|

| 48,274 |

|

|

|

|

|

|

|

|

|

|

Net loss |

| $ | (36,397 | ) |

| $ | (48,274 | ) |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share - basic and diluted |

|

| (0.00 | ) |

|

| (0.00 | ) |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares - basic and diluted |

|

| 24,827,264 |

|

|

| 24,799,935 |

|

| F-3 |

Apawthecary Pets USA |

Statements of Changes in Stockholders' Deficit |

(Expressed in U.S. Dollars) |

For the years ended August 31, 2019 and August 31, 2018 |

|

| Number of |

|

|

|

|

| Additional |

|

| Accumulated |

|

| Stockholders' |

| |||||

|

| shares issued |

|

| Capital stock |

|

| paid in capital |

|

| deficit |

|

| deficit |

| |||||

|

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ |

| |||||

Balance at August 31, 2017 |

|

| 23,977,264 |

|

|

| 23,977 |

|

|

| 265,073 |

|

|

| (352,275 | ) |

|

| (63,225 | ) |

Common shares sold for cash |

|

| 850,000 |

|

|

| 850 |

|

|

| 84,150 |

|

|

| - |

|

|

| 85,000 |

|

Net loss for the year |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (48,274 | ) |

|

| (48,274 | ) |

Balance at August 31, 2018 |

|

| 24,827,264 |

|

|

| 24,827 |

|

|

| 349,223 |

|

|

| (400,549 | ) |

|

| (26,499 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at August 31, 2018 |

|

| 24,827,264 |

|

|

| 24,827 |

|

|

| 349,223 |

|

|

| (400,549 | ) |

|

| (26,499 | ) |

Net loss for the year |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (36,397 | ) |

|

| (36,397 | ) |

Balance at August 31, 2019 |

|

| 24,827,264 |

|

|

| 24,827 |

|

|

| 349,223 |

|

|

| (436,946 | ) |

|

| (62,896 | ) |

| F-4 |

Apawthecary Pets USA | ||

Statements of Cash Flows | ||

(Expressed in U.S. Dollars) |

|

| For the |

|

| For the |

| ||

|

| year ended |

|

| year ended |

| ||

|

| August 31, |

|

| August 31, |

| ||

|

| 2019 |

|

| 2018 |

| ||

|

|

|

|

|

|

| ||

Cash flows from operating activities |

|

|

|

|

|

| ||

Net loss |

| $ | (36,397 | ) |

| $ | (48,274 | ) |

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

|

|

Inventory Impairment |

|

| 7,200 |

|

|

| - |

|

Changes in operating asssets and liabilities: |

|

|

|

|

|

|

|

|

Decrease (increase) in inventory |

|

| - |

|

|

| (7,200 | ) |

Increase (decrease) in accounts payable and accrued liabilities |

|

| 4,888 |

|

|

| (264 | ) |

Increase (decrease) in accounts payable due to related parties |

|

| 1,971 |

|

|

| (48 | ) |

|

|

|

|

|

|

|

|

|

Cash flows used in operating activities |

|

| (22,338 | ) |

|

| (55,786 | ) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Proceeds from common shares sold for cash |

|

| - |

|

|

| 85,000 |

|

|

|

|

|

|

|

|

|

|

Cash provided by financing activities |

|

| - |

|

|

| 85,000 |

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash |

|

| (22,338 | ) |

|

| 29,214 |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of year |

|

| 42,594 |

|

|

| 13,380 |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of year |

| $ | 20,256 |

|

| $ | 42,594 |

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information |

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

Interest |

| $ | - |

|

| $ | - |

|

Income taxes |

| $ | - |

|

| $ | - |

|

| F-5 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 1. | Nature and Continuance of Operations |

|

|

| Apawthecary Pets USA (the ”Company”) was incorporated under the laws of the States of Nevada on December 27, 2007. The Company intends to operate in the pet industry.

On July 20, 2017, the Company changed its name from Bookedbyus Inc. to Apawthecary Pets USA.

The Company’s financial statements as at August 31, 2019 and for the year then ended have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. The Company has a loss of $36,397 for the year ended August 31, 2019 and $48,274 for the year ended August 31, 2018 and has a working capital deficit at August 31, 2019. These factors raise substantial doubt about the ability of the Company to continue as a going concern.

Management cannot provide assurance that the Company will ultimately achieve profitable operations or become cash flow positive, or raise additional debt and/or equity capital. Management believes that the Company’s capital resources should be adequate to continue operating and maintaining its business strategy during the fiscal year ended August 31, 2020. However, if the Company is unable to raise additional capital in the near future, due to the Company’s liquidity problems, management expects that the Company will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures. These financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

As of August 31, 2019, the Company was not engaged in continued business, and had significant expenses from early stage activities. Although management is currently attempting to implement its business plan and is seeking additional sources of financing, there is no assurance the activity will be successful. Accordingly, the Company must rely on its president to perform essential functions without compensation until a business operation can be commenced. The financial statements do not include any adjustments that may result from the outcome of this uncertainty. |

| F-6 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 2. | Significant Account Policies |

|

|

| The following is a summary of significant accounting policies used in the preparation of these financial statements.

Definition of fiscal year

The Company’s fiscal year end is August 31st.

Basis of presentation

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.GAAP”).

Cash and cash equivalents

Cash and cash equivalents include highly liquid investments with original maturities of three months or less.

Inventory Write-downs

Inventory will be written down if the cost exceeds its net realizable value, and the amount will be realized as impairment loss.

Financial instruments

Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements and Disclosures”, requires disclosing fair value to the extent practicable for financial instruments that are recognized or unrecognized in the balance sheet. Fair value of financial instruments is the amount at which the instruments could be exchanged in a current transaction between willing parties. The Company considers the carrying amounts of cash, restricted cash, accounts receivable, related party and other receivables, accounts payable, notes payable, related party and other payables, customer deposits, and short-term loans approximate their fair values because of the short period of time between the origination of such instruments and their expected realization. The Company considers the carrying amount of long term bank loans to approximate their fair values based on the interest rates of the instruments and the current market rate of interest.

Level 1 The preferred inputs to valuation efforts are “quoted prices in active markets for identical assets or liabilities,” with the caveat that the reporting entity must have access to that market. Information at this level is based on direct observations of transactions involving the same assets and liabilities, not assumptions, and thus offers superior reliability. However, relatively few items, especially physical assets, actually trade in active markets. |

| F-7 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 2. | Significant Account Policies (Continued) |

|

|

| Financial instruments (Continued)

Level 2 FASB acknowledged that active markets for identical assets and liabilities are relatively uncommon and, even when they do exist, they may be too thin to provide reliable information. To deal with this shortage of direct data, the board provided a second level of inputs that can be applied in three situations.

Level 3 If inputs from levels 1 and 2 are not available, FASB acknowledges that fair value measures of many assets and liabilities are less precise. The board describes Level 3 inputs as “unobservable,” and limits their use by saying they “shall be used to measure fair value to the extent that observable inputs are not available.” This category allows “for situations in which there is little, if any, market activity for the asset or liability at the measurement date”. Earlier in the standard, FASB explains that “observable inputs” are gathered from sources other than the reporting company and that they are expected to reflect assumptions made by market participants.

As at August 31, 2019, the fair value of cash and cash equivalents, accounts payable and due to related party approximates their carrying value because of their short term maturities.

Credit Risk

Financial instruments that potentially subject the Company to credit risk consist of cash and cash equivalents. The Company deposits cash and cash equivalents with high credit quality financial institutions as determined by rating agencies.

Currency Risk

The Company’s assets and liabilities are in U.S. dollars, which is the Company’s functional and presentation currency. The Company has no transactions in currencies other than U.S. dollar. As a result, foreign currency risk is insignificant.

Interest Rate Risk

The Company has cash balances and no interest-bearing debt. It is management’s opinion that the Company is not exposed to significant interest risk arising from these financial instruments.

Liquidity Risk

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with its financial liabilities. The Company is reliant upon equity issuances and advances from related parties as its sole source of cash. The Company has been successful in raising equity financing in the past; however, there is no assurance that it will be able to do so in the future. |

| F-8 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 2. | Significant Account Policies (Continued) |

|

|

| Financial instruments (Continued)

Income taxes

Deferred income taxes are reported for timing differences between items of income or expense reported in the financial statements and those reported for income tax purposes in accordance with ASC 740, “Income Taxes”, which requires the use of the asset/liability method of accounting for income taxes. Deferred income taxes and tax benefits are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and for tax loss and credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company provides for deferred taxes for the estimated future tax effects attributable to temporary differences and carry-forwards when realization is more likely than not.

Basic and diluted net loss per share

The Company computes net loss per share in accordance with ASC 260 “Earnings per Share”. ASC 260 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net loss available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all potentially dilutive common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all potentially dilutive shares if their effect is anti-dilutive.

Related parties

Accounts payable due to related party represents an obligation to pay for services that were used in the ordinary course of business. The amount is classified as a current liability as payment is due on demand.

Comprehensive loss

ASC 220, “Comprehensive Income”, establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As at August 31, 2019, the Company has no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the financial statements. |

| F-9 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 2. | Significant Account Policies (Continued) |

|

|

| Financial instruments (Continued)

Foreign currency translation

The Company’s functional and reporting currency is in U.S. dollars. The financial statements of the Company are translated to U.S. dollars in accordance with ASC 830, “Foreign Currency Matters”. Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. The Company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

Use of estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenditures during the reporting period. Actual results could differ from these estimates.

Recent accounting pronouncements

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606)”, which supersedes nearly all existing revenue recognition guidance under accounting principles generally accepted in the United States of America. The core principle of this ASU is that revenue should be recognized for the amount of consideration expected to be received for promised goods or services transferred to customers. This ASU also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments, and assets recognized for costs incurred to obtain or fulfill a contract. ASU 2014-09 was scheduled to be effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. In August 2015, the FASB issued ASU 2015-14, “Revenue from Contracts with Customers (Topic 606): Deferral of Effective Date,” which deferred the effective date of ASU 2014-09 by one year and allowed entities to early adopt, but no earlier than the original effective date. ASU 2014-09 is now effective for public business entities for the annual reporting period beginning December 15, 2017. |

| F-10 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 2. | Significant Account Policies (Continued) |

|

|

| Financial instruments (Continued)

Recent Accounting Pronouncements (Continued)

This update allows for either full retrospective or modified retrospective adoption. In April 2016, the FASB issued ASU 2016-10, “Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing,” which amends guidance previously issued on these matters in ASU 2014-09. The effective date and transition requirements of ASU 2016-10 are the same as those for ASU 2014-09. In May 2016, the FASB issued ASU 2016-12, “Revenue from Contracts with Customers (Topic 606): Narrow Scope Improvements and Practical Expedients,” which clarifies certain aspects of the guidance, including assessment of collectability, treatment of sales taxes and contract modifications, and providing certain technical corrections. The effective date and transition requirements of ASU 2016-12 are the same as those forASU 2014-09. The Company adopted the new guidance, Accounting Standards Codification ASC - 606, Revenue from Contracts with Customers as of August 31, 2019. This adoption created no impact to the company’s financial statements since the Company has not generated any revenues.

The Company has considered all recent accounting pronouncements issued and determined that the adoption of these pronouncements would not have a material effect on the financial position, results of operations or cash flows of the Company.

3. Due to Related Parties and Related Party Transactions

During the year ended August 31, 2019, the Company accrued management fee to Brad Kersch in the amount of $Nil (2018 - $Nil). The outstanding balance of management fees payable is $551 as of August 31, 2019 and 2018.

During the year ended August 31, 2019, Aerock Fox, an Officer and Director of the Company, paid bills from Discount Edgar and Vstock Transfer for the Company’s general expenses for the total of $1,971. The amount remains outstanding as of August 31, 2019.

As of August 31, 2019, related parties of the Company have provided a series of loans, totaling $70,673 (2018 - $70,673) in prior years for working capital purposes. No additional loans were issued in the current year. These amounts are unsecured, interest-free and are due on demand.

On August 24, 2017 Apawthecary Pets USA entered into a license agreement with Solace Management Group Inc. a British Columbia corporation. The material terms of such license agreement are: |

| F-11 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 3. | Due to Related Parties and Related Party Transactions (Continued) |

|

| 1. | Upon execution of the Agreement, the Apawthecary Pets USA shall provide a non-refundable license fee in the amount of $100,000 (the “License Fee”) to be held in an escrow account pursuant and subject to the terms of an escrow agreement whereby the License Fee will remain in the escrow account until the earlier of a $3,000,000 raise by the Licensee or after the Set-up Period. |

|

|

|

|

|

| 2. | Term of the License Agreement is 10 years with a 5 year renewal term. |

|

|

|

|

|

| 3. | The license is an exclusive, non-transferable, non-sub licensable license to manufacture, sell, represent, market, distribute and advertise the Licensed Products within the Territory on the terms and conditions set forth in the License Agreement and shall include access to, and use of, the Solace Products within the Territory on the terms and conditions set forth in the License Agreement and shall include access to, and use of, the Solace Management Group Inc.’s Licensed Products and Services, Marks, Manuals, brands, and the business format, formulations, methods, specifications, standards, and operating procedures. |

|

|

|

|

|

| 4. | Apawthecary Pets USA shall pay the Solace Management Group Inc. for all packaging and shipment expenses to the Licensee at the then current market rate plus 20%. |

|

|

|

|

|

| 5. | Royalties will commence to accrue when the Licensed Products are accepted by the Apawthecary Pets USA. Apawthecary Pets USA shall pay quarterly royalties in addition to the yearly royalty fee, 10% of sales based on the wholesale price of each item. |

|

|

|

|

| Solace Management Group Inc. owns the brand and intellectual property rights to Apawthecary Pets.

Apawthecary Pets Inc., a Canadian corporation licensed the brand and distribution rights for Apawthecary Pets for use in Canada from Solace Management Group Inc.

Solace Management Group Inc. and Apawthecary Pets USA have an officer and director in common, Bradley Kersch. Apawthecary Pets USA has negotiated a licensing and distribution agreement with Solace Management Group Inc. The $100,000 License fee has not been paid as of August 31, 2019. | ||

| 4. | Inventory |

|

|

| As of August 31, 2019, the Company did not sell its inventory purchased in 2017. Due to the nature of the inventory items, it is written off to impairment loss. |

| F-12 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 5. | Capital Stock |

|

|

| The total authorized capital is 75,000,000 common shares with a par value of $0.001 per common share.

Issued and outstanding

The Company had 24,827,264 common shares issued and outstanding as at August 31, 2019 and August 31, 2018.

During the year ended August 31, 2018, the Company issued 850,000 common shares at a price of $0.10 per common share to raise total cash proceeds of $85,000.

During the year ended August 31, 2019, the Company did not issue any common shares. |

| 6. | Income Taxes |

|

|

| The Company accounts for income taxes under FASB Accounting Standard Codification ASC 740 “Income Taxes”. ASC 740 requires use of the liability method. ASC 740 provides that deferred tax assets and liabilities are recorded based on the differences between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes, referred to as temporary differences. Deferred tax assets and liabilities at the end of each period are determined using the currently enacted tax rates applied to taxable income in the periods in which the deferred tax assets and liabilities are expected to be settled or realized. There was a change in control in the current year and as such the total amount should be limited to section 382 of the Internal Revenue Code such a change in control negates much of the tax loss carry forward and deferred income tax.

As of August 31, 2019, and 2018, the Company had net operating loss carry forwards of $436,946 and $400,549, respectively, that may be available to reduce future years’ taxable income. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization is determined not likely to occur and accordingly, the Company has recorded a valuation allowance for the deferred tax asset relating to these tax loss carryforwards. Net operation losses will begin to expire in 2030. The Company has not filed any tax returns and as such all tax years are open for inspection. |

| F-13 |

Apawthecary Pets USA |

Notes to Financial Statements |

(Expressed in U.S. Dollars) |

| 6. | Income Taxes (Continued) |

|

|

| Components of net deferred tax assets, including a valuation allowance, are as follows at August 31, 2019 and 2018: |

|

| 2019 |

|

| 2018 |

| ||

Deferred tax assets: |

|

|

|

|

|

| ||

Net operating loss carry forward |

|

| 91,759 |

|

|

| 102,855 |

|

Less: valuation allowance |

|

| (91,759 | ) |

|

| (102,855 | ) |

Net deferred tax assets |

|

| - |

|

|

| - |

|

| On December 22, 2017, the Tax Cuts and Jobs Act (the “Tax Act”), was signed into law. The Tax Act includes numerous changes to tax laws impacting business, the most significant being a permanent reduction in the federal corporate income tax rate from 35% to 21%. The rate reduction took effect on January 1, 2018. As the Company’s 2018 fiscal year ended on August 31, 2018, the Company’s federal blended corporate tax rate for fiscal year 2018 is 25.7%, based on the applicable tax rates before and after the Tax Act and the number of days in the fiscal year to which the two different rates applied. For fiscal year ended August 31, 2019, the federal corporate income tax rate is 21%.

The valuation allowance for deferred tax assets as of August 31, 2019 was $91,759, as compared to $102,855 as of August 31, 2018. In assessing the recovery of the deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income in the periods in which those temporary differences become deductible.

Management considers the scheduled reversals of future deferred tax assets, projected future taxable income, and tax planning strategies in making this assessment. As a result, management determined it was more likely than not the deferred tax assets would not be realized as of August 31, 2019.

The provision for income taxes differs from the amount computed by applying the statutory federal income tax rate to income before provision for income taxes.

The sources and tax effects of the differences are as follows: |

U.S. federal statutory rate |

|

| 21 | % |

Valuation reserve |

| (21 | %) | |

Total |

|

| 0 | % |

| At August 31, 2019, the Company had unused net operating loss carryover approximating $436,946 with a full valuation allowance of $91,759 that is available to offset future taxable income which expires beginning 2030. |

| F-14 |

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

None

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time period specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is accumulated and communicated to management including our principal executive officer and principal financial officer as appropriate, to allow timely decisions regarding required disclosure.

In connection with this annual report, as required by Rule 13a -15d and 15d-15e under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of the design and operation of our company’s disclosure controls and procedures. This evaluation was carried out under the supervision and with the participation of our company’s management, including our company’s principal executive officer and principal financial officer. Based upon that evaluation, our company’s principal executive officer and principal financial officer concluded that as of August 31, 2019 our disclosure controls and procedures were not effective due to the existence of material weaknesses in our internal controls over financial reporting.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934 as a process designed by, or under the supervision of, the Company’s Principal Executive and Principal Financial officer and effected by the Company’s board of directors, management and other personnel to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

| 1. | Pertains to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and disposition of assets; |

|

|

|

| 2. | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of our financial statements in accordance with accounting principles generally accepted in the United States of America and receipts and expenditures are being made in accordance with authorizations of management and directors; and |

|

|

|

| 3. | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements. |

Management assessed the effectiveness of the Company’s internal control over financial reporting based on the criteria for effective internal control over financial reporting established in SEC guidance on conducting such assessments as of the end of the period covered by this report. Management conducted the assessment based on certain criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission in 2013. As of August 31, 2019, management determined material weaknesses occurred over our internal control over financial reporting as discussed below.

The matters involving internal controls and procedures that the Company’s management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee and lack of a majority of outside directors on the Company’s board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes. Due to these material weaknesses management concluded that our internal control over financial reporting was not effective as of August 31, 2019.

Material Weakness Discussion and Remediation

Management believes that the material weaknesses set forth in items (2), (3) and (4) above did not have an affect on the Company’s previous reported financial results. However, management believes that the lack of a functioning audit committee and lack of a majority of outside directors on the Company’s board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures can result in the Company’s determination to its financial statements for the future periods.

| 8 |

We are committed to improving our financial organization. As part of this commitment, we will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to the Company: i) Appointing one or more outside directors to our board of directors who shall be appointed to the audit committee of the Company resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures; and ii) Preparing and implementing sufficient written policies and checklists which will set forth procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on the Company’s Board. In addition, management believes that preparing and implementing sufficient written policies and checklists will remedy the following material weaknesses (i) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (ii) ineffective controls over period end financial close and reporting processes. Further, management believes that the hiring of additional personnel who have the technical expertise and knowledge will result proper segregation of duties and provide more checks and balances within the department. Additional personnel will also provide the cross training needed to support the Company if personnel turn over issues within the department occur. This coupled with the appointment of additional outside directors will greatly decrease any control and procedure issues the company may encounter in the future.

We will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

This annual report does not include an attestation report of the company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

Changes in Internal Control Over Financial Reporting

There have been no changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rules 13a-15 or 15d-15 under the Exchange Act that occurred during the small business issuer’s last fiscal year that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

None

| 9 |

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Identification of directors and executive officers

Our directors serve until their successor are elected and qualified. Our officers are elected by the Board of Directors to a term of one (1) year and serve until their successor(s) is duly elected and qualified, or until they are removed from office. The Board of Directors has no nominating or compensation committees. The company’s current Audit Committee consists of our officers and directors.

Our directors serve until a successor is elected and qualified. Our officers are elected by the Board of Directors to a term of one (1) year and serves until their successor(s) is duly elected and qualified, or until they are removed from office. The Board of Directors has no nominating or compensation committees. The company’s current Audit Committee consists of our officers and directors.

The name, address, age and position of our present officers and directors is set forth below:

Name |

| Age |

| Position(s) |

Bradley Kersch1 |

| 53 |

| President, Director |

Aerock Fox2 |

| 73 |

| Secretary, Director |

_________

1 The person named above held this office from February 24, 2017 and is expected to hold his offices/positions at least until the next annual meeting of our stockholders.

2 The person named above held this office from February 24, 2017 and is expected to hold his offices/positions at least until the next annual meeting of our stockholders.

Bradley Kersch

Since June 2014 Bradley is the President and CEO of Solace Management Group Inc. From January 2010 until May 2014, he was the CEO of Blackrock Films and the Executive Producer of Blackrock Media. From May 1995 until January 2010 Bradley was the CEO and Executive Producer at Shoreline Studios Inc. He holds a Bachelor of Commerce degree from the University of British Columbia

Aerock Fox

Since 1981 Aerock has been the President of Fox Productions Inc. He graduated from Bishop’s University with a Bachelor of Arts Degree in 1971 and graduated from University of British Columbia with a Masters of Counselling Psychology in 1979.

Our directors and officers do not hold positions on the board of directors of any other U.S. reporting companies and have no affiliation with any company that has filed for bankruptcy within the last five years. The Company is not aware of any proceedings to which any of the Company’s officers or directors, or any associate of any such officer or director, is a party adverse to the Company or any of the Company’s subsidiaries or has a material interest adverse to it or any of its subsidiaries.

The Company believes that Mr. Kersch’s and Mr. Fox’s business experience and their entrepreneurial success make them well suited to serve as our officers and directors.

Our directors and officers do not hold positions on the board of directors of any other U.S. reporting companies and has no affiliation with any company that has filed for bankruptcy within the last five years. The Company is not aware of any proceedings to which any of the Company’s officers or directors, or any associate of any such officer or director, is a party adverse to the Company.

Significant Employees

The Company does not, at present, have any employees other than the current officer and director. We have not entered into any employment agreements, as we currently do not have any employees other than the current officer and director.

Family Relations

There are no family relationships among the Directors and Officers of Apawthecary Pets USA.

Involvement in Legal Proceedings

No executive Officer or Director of the Company has been convicted in any criminal proceeding or is the subject of a criminal proceeding that is currently pending.

No Executive Officer or Director of the Company is involved in any bankruptcy petition by or against any business in which they are a general partner or executive officer at this time or within two years of any involvement as a general partner, executive officer, or Director of any business.

| 10 |

Item 11. Executive Compensation.

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officers and director for all services rendered in all capacities to us for the period from inception through August 31, 2019.

SUMMARY COMPENSATION TABLE | ||||||||||||||||||||||||||||||||||

Name and principal position |

| Year |

| Salary ($) |

|

| Bonus ($) |

|

| Stock Awards ($) |

|

| Option Awards ($) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Nonqualified Deferred Compensation Earnings ($) |

|

| All Other Compensation ($) |

|

| Total ($) |

| ||||||||

Bradley D Kersch |

| 2018 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

President/Treasurer |

| 2019 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aerock Fox |

| 2018 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Secretary |

| 2019 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of August 31, 2019.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | ||||||||||||||||||||||||||||||||||||

OPTION AWARDS |

|

| STOCK AWARDS |

| ||||||||||||||||||||||||||||||||

Name |

|

Number of Securities Underlying Unexercised Options (#) Exercisable |

|

|

Number of Securities Underlying Unexercised Options (#) Unexercisable |

|

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

|

|

Option Exercise Price ($) |

|

|

Option Expiration Date |

|

|

Number of Shares or Units of Stock That Have Not Vested (#) |

|

|

Market Value of Shares or Units of Stock That Have Not Vested ($) |

|

| Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

|

| Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

| |||||||||

Bradley |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|