Attached files

| file | filename |

|---|---|

| EX-23.3 - CONSENT OF YICHIEN YEH, CPA - XT Energy Group, Inc. | fs12019ex23-3_xtenergy.htm |

| EX-23.2 - CONSENT OF WEINBERG & COMPANY, P.A. - XT Energy Group, Inc. | fs12019ex23-2_xtenergy.htm |

| EX-23.1 - CONSENT OF FRIEDMAN LLP - XT Energy Group, Inc. | fs12019ex23-1_xtenergy.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - XT Energy Group, Inc. | fs12019ex21-1_xtenergy.htm |

| EX-3.1 - ARTICLES OF INCORPORATION, AS AMENDED - XT Energy Group, Inc. | fs12019ex3-1_xtenergy.htm |

As filed with the Securities and Exchange Commission on February 1, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

XT ENERGY GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 2860 | 98-0632932 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

No.1, Fuqiao Village, Henggouqiao Town

Xianning, Hubei, China 437012

+86 (400) 103-7733

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CT Cooperation

701 S. Carson Street Suite 200

Carson City, Nevada NV

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to

|

Richard I. Anslow, Esq. David Selengut, Esq. Ellenoff, Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 Phone: (212) 370-1300 Fax: (212) 370-7889 |

Ralph V. De Martino, Esq. F. Alec Orudjev, Esq. Cavas S. Pavri, Esq. Schiff Hardin LLP 901 K Street NW, Suite 700 Washington, D.C. 20001 Phone: (202) 778-6400 Fax: (202) 778-6460 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1) | Amount of registration fee | ||||||

| Common stock, par value $0.001 | $ | 20,000,000 | $ | 2,424 | ||||

| Placement agent’s warrant to purchase shares of common stock(2)(4) | - | - | ||||||

| Common stock underlying placement agent’s warrants(2)(3) | $ | 1,300,000 | $ | 157.56 | ||||

| Total | $ | 21,300,000 | $ | 2,581.56 | ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | We have agreed to issue to the placement agent, upon closing of this offering, warrants exercisable for a period of five years from the effective date of this registration statement representing 6.5% of the aggregate number of shares of common stock issued in this offering. Resales of shares of common stock issuable upon exercise of the placement agent’s warrants are being similarly registered on a delayed or continuous basis. See “Plan of Distribution.” |

| (3) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. We have calculated the proposed maximum aggregate offering price of the common stock underlying the placement agent’s warrants by assuming that such warrants are exercisable at a price per share equal to 100% of the price per share sold in this offering. |

| (4) | No separate registration fee required pursuant to Rule 457(g) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS (Subject to Completion) | Dated February 1, 2019 |

XT Energy Group, Inc.

Minimum Offering: shares of common stock

Maximum Offering: shares of common stock

XT Energy Group, Inc. is offering a minimum of and a maximum of shares of its common stock at a public offering price of $ per share.

Our common stock is currently quoted on the OTC QB Marketplace, operated by the OTC Markets Group, Inc. (“OTCQB”) under the symbol “XTEG.” We intend to apply to have our common stock listed on the NASDAQ Capital Market under the symbol “XTEG.” We believe that upon the completion of the offering contemplated by this prospectus, we will meet the standards for listing on the NASDAQ Capital Market. We cannot guarantee that we will be successful in listing our common stock on the NASDAQ Capital Market; however, we will not complete this offering unless we are so listed. We expect the offering price of our common stock in this offering will be between $ and $ per share. On January 30, 2019, the last reported sale price of our common stock on OTCQB was $4.60 per share.

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 8 of this prospectus.

| Per Share | Minimum Offering | Maximum Offering | |||||

| Public offering price | $ | $ | $ | ||||

| Commissions (1)(2) | |||||||

| Proceeds to us, before expenses | |||||||

| Total | $ | $ | $ |

| (1) | Represents commissions equal to 7% per share, which is the commission we have agreed to pay on all investors in this offering introduced by the placement agent. We and the placement agent have agreed to a commission of 5.75% per share on all investors in this offering introduced by us.

|

| (2) | Does not include a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering, payable the placement agent, or the reimbursement of certain expenses of the placement agent. See “Plan of Distribution” for additional information regarding the placement agent’s compensation and our arrangements with the placement agent. |

Our placement agent, Axiom Capital Management Inc. (“Axiom”), must sell the minimum number of securities offered ( shares) if any are sold. The placement agent is only required to use its best efforts to sell the maximum number of securities offered ( shares). The offering will terminate upon the earlier of: (i) a date mutually acceptable to us and our placement agent after which the minimum offering is sold or (ii) , 2019. Until we sell at least shares of our common stock, all investor funds will be held in an escrow account at , as Escrow Agent. If we do not sell at least shares of common stock by , 2019, all funds will be promptly returned to investors without interest or deduction by noon of the next business day after the termination of the offering. If we complete this offering, net proceeds will be delivered to our company on the closing date. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China.

The SEC and state regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The placement agent expects to deliver the common stock to purchasers on or about , 2019.

Axiom Capital Management Inc.

The date of this prospectus is , 2019

Neither we nor our placement agent have authorized anyone to provide you with additional information or information that is different from or to make any representations other than those contained in this prospectus or in any free-writing prospectus prepared by or on behalf of us to which we may have referred you in connection with this offering. We and the placement agent take no responsibility for, and can provide no assurances as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and future growth prospects may have changed since that date.

For investors outside the United States, neither we nor the placement agents have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free-writing prospectus outside the United States.

Industry and Market Data

We obtained the industry, market and competitive position data described or referred to in this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires.

1

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our common stock. You should carefully consider, among other things, our financial statements and related notes and the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Overview

We are a holding company incorporated in Nevada. We are engaged in a variety of renewable energy related businesses, including development of electricity generation systems powered by our proprietary air compression generation technology, installation of photovoltaic (“PV”) solar panels, production and sales of synthetic fuel and related products, hydraulic parts and electronic components through our subsidiaries and consolidated affiliated entities in China.

We operate in a number of facilities in Tianjin City, Hubei and Hebei Provinces in China. We sell our products in China mainly through distributors.

The table below illustrates the businesses we conduct through our subsidiaries and consolidated affiliated entities:

| Subsidiary | Principal Business | Location | ||

| Sanhe Xiangtian | Sales of PV panes, air compression equipment and heat pump products and sale and installation of power generation systems and PV systems | Hebei Province | ||

| Xiangtian Zhongdian | Manufacture and sales of PV panels | Hubei Province | ||

| Jingshan Sanhe | Manufacturing and sales of Synthetic fuel products | Hubei Province | ||

| Hubei Jinli | Manufacture and sales of hydraulic parts and electronic components | Hubei Province | ||

| Tianjin Jiabaili | Synthetic fuel production | Tianjin | ||

| Xianning Xiangtian | Manufacturing and sales of air compression equipment and heat pump products | Hubei Province | ||

| Xiangtian Trade | Sale of synthetic fuel products | Hubei Province | ||

| Rongentang Wine | Wine production | Hubei Province | ||

| Rongentang Herbal Wine | Herbal Wine production | Hubei Province |

During the years ended July 31, 2018, 2017 and 2016, we generated revenue of $15,269,788, $9,521,371 and $10,839,955, respectively and incurred net losses of $1,299,422, $4,564,159 and $608,184, respectively. We had accumulated deficit of $5,517,175 as of October 31, 2018. We achieved profitability in the three months ended October 31, 2018 and generated revenue of $19,988,438 and net income of $1,578,209.

Our Market Opportunity

We believe the market for renewable energy generation is expanding and rapidly evolving. Renewable energy, such as solar, wind, biomass, hydropower and geothermal, has recently been recognized as a “mainstream” energy source. Global investment in renewable energy edged up 2% in 2017 to $279.8 billion, taking cumulative investment since 2010 to $2.2 trillion, and since 2004 to $2.9 trillion. China has been the leading destination for renewable energy investment, accounting for 45% of the global investment.

Solar power rose to record prominence in 2017, as the world installed 98 gigawatts of new solar power projects, more than the net additions of coal, gas and nuclear plants put together. China accounted for just over half of that new global solar capacity in 2017, and it accounted for 45% of the $279.8 billion committed worldwide to all renewables (excluding large hydro-electric projects).

Blending methanol with gasoline allows refiners to extend China’s gasoline supply and increase the octane level of its gasoline. According to IHS Markit, a leading global information provider, global methanol demand reached 75 million metric tons in 2015 (24 billion gallons/91 billion liters), driven in large part by emerging energy applications for methanol which now account for 40% of methanol consumption.

In December 2016, the PRC National Development and Reform Commission established targets for renewable energy, including increasing the share of non-fossil fuel energy of total primary energy consumption from 12% in 2015 to 20% by 2030. In the 2018 PRC National Ecological Environmental Protection Conference, the PRC government re-emphasized its determination to adjust the national energy structure and to foster the development of environmental protection industries and clean energy industries. In 2018, the PRC Ministry of Industry and Information Technology started to promote the adoption of fuel with a higher percentage of methanol in several provinces in China and encourage the production of methanol-fueled vehicles.

2

Our Competitive Strengths

We believe the continued growth of our company will be driven by the following competitive strengths:

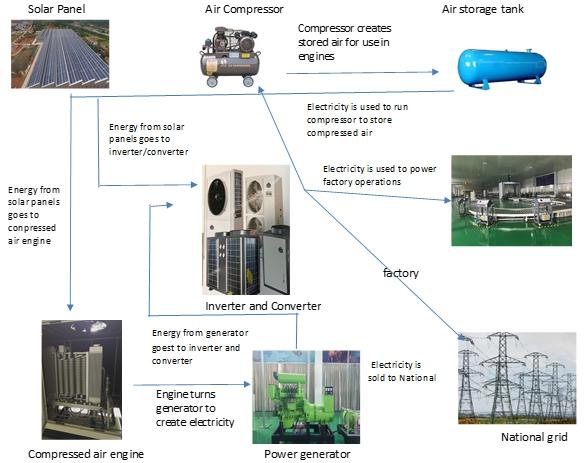

| ● | Pioneer to market with an innovative air compression generation technology solution. We believe we are a pioneer in the field of compressed air energy storage in China. The only competitor in China that we are aware of is a pilot project established in Wuhu city in November 2014 by the Chinese Academy of Science, an academic and research institute. |

| ● | Environmentally friendly solutions and products. We utilize compressed air energy storage equipment in conjunction with the power generation system of alternative energy sources to produce electricity, which is a novel approach and provides customers with an advanced power generation capability with no carbon or toxic emissions. In addition, our green energy products can be blended with gasoline or diesel to generate a fuel that is efficient and can boost the gasoline’s octane number with lower emissions compared to conventional gasoline. |

| ● | Flexible solutions and products. Our compressed air technology can be used with any other power sources, including solar energy, wind energy, geothermal energy, tidal energy, water energy and all the available natural energy as a raw power in conjunction with our compressed air energy storage technology. The collected mechanical energy from the raw power source is converted into compressed air and is then converted and released into direct current power. In addition, our high-grade synthetic fuel products can be mixed into gasoline or diesel reducing exhaust emissions of carbon monoxide—a regulated pollutant linked to smog, acid rain, global warming and other environmental problems. |

| ● | Comprehensive intellectual property portfolio. We have a comprehensive patent portfolio (including licensed patents) to protect our intellectual property and technology, with rights as of October 31, 2018 to 12 issued patents and two pending patent applications in China that cover aspects of our air compression generation technology, green energy products and future product concepts. In addition, we are collaborating with experts in the synthetic fuel industry to develop new synthetic fuel products to meet the market demand. |

Our Strategy

Our goal is to be a leader in providing renewable energy solutions in Asia. We believe the following strategies will play a critical role in achieving this goal and our future growth:

| ● | Continue to expand our diversified business units. We believe that a significant opportunity for increased high margin, recurring revenue exists in our current air compression generation systems, PV panels, synthetic fuels, hydraulic parts and electronic components products as a result of our strong relationships with existing customers and the synergy among those product offerings. Our sales and marketing team is also seeking to identify utilities, transportation companies and industrial end-users who may view synthetic fuel as a potentially compelling addition to traditional fuels and enter into long-term, take-or-pay contracts for our green energy products. Following this offering, we intend to expand our manufacturing capacity for green energy products, such as Green Energy No. 1. |

| ● | Invest in research and development to drive innovation and expand indications. We are committed to research and development to further improve our products and increase customer acceptance. For example, we are collaborating with experts in the synthetic fuel industry to develop new synthetic fuel products to meet the market demand. We plan to invest RMB1,000,000 (US$145,347) in our research and development activities in 2019. |

| ● | Further penetrate domestic markets and expand into new international markets. All of our current customers are located in China. We plan to establish our international presence in other regions of Asia, including Laos, Myanmar, Vietnam and Cambodia. We target fast-growing markets where we believe we can deliver significant value including energy generation power plants. |

| ● | Opportunistically grow through more complementary acquisitions. We plan to selectively pursue acquisitions in the future, to further enforce our competitive advantages, scale and grow our business and increase profitability. Our acquisition strategy is based on identifying and acquiring companies that complement our existing product offerings and production capacities. We plan to execute our acquisition strategy through entering into production contracts or leases of production facilities with potential targets with an option to purchase a controlling interest in such targets. We have identified several potential targets and are in various stages of discussion and diligence with such targets. |

3

Risks and Challenges

Investing in our common stock involves a high degree of risk. You should carefully consider the risks highlighted in the section titled “Risk Factors” immediately following this prospectus summary before making an investment decision. Among these important risks are the following:

| ● | We have a limited operating history in the industries we recently entered into (such as oil and gas industry and wine industry), which makes it difficult to evaluate our future prospects and makes our business subject to inherent risk. | |

| ● | Failure to produce our synthetic fuel products as scheduled and budgeted would materially and adversely affect our business and financial condition. | |

| ● | Failure to accurately forecast customer demand could lead to excess supplies or supply shortages, which could result in decreased operating margins, reduced cash flows and harm to our business. | |

| ● | Because we rely upon third party vendors to supply part of our solar panels and heat pumps, problems with these suppliers could impair our ability to meet our obligations to our customers and affect our profitability. | |

| ● | We have identified material weaknesses in our internal control over financial reporting, and our business and stock price may be adversely affected if we do not adequately address those weaknesses or if we have other material weaknesses or significant deficiencies in our internal control over financial reporting. | |

| ● | We have experienced substantial growth and expansion in recent years, and if we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of customer satisfaction or adequately address competitive challenges, and our financial performance may be adversely affected. | |

| ● | The methanol industry is an industry that is changing rapidly which can result in unexpected developments that could negatively impact our operations and the value of our units. | |

| ● | Fluctuations in crude oil and natural gas prices and refining margins may adversely affect our business, operating results, cash flows and financial condition. | |

| ● | Increased use of fuel cells, plug-in hybrids and electric cars may lessen the demand for fuels. | |

| ● | Failure to obtain regulatory approvals or permits could adversely affect our operations. | |

| ● | We may be subject to product liability claims and other claims of our customers and partners. | |

| ● | Two of our stockholders have significant voting power and may take actions that may not be in the best interests of other stockholders. | |

| ● | We rely on contractual arrangements with our consolidated affiliated entities to operate our business, which may not be as effective as direct ownership in providing operational control and otherwise have a material adverse effect on our business. |

| ● | Uncertainties with respect to the PRC legal system could adversely affect us. | |

| ● | Certain PRC regulations may make it more difficult for us to pursue growth through acquisitions. | |

| ● | The PRC government may determine that the New VIE Agreements are not in compliance with applicable PRC laws, rules and regulations. |

See “Risk Factors” for a more detailed discussion of these and other risks and uncertainties that we may face. If we are unable to adequately address these and other risks we face, our business, financial condition, operating results and prospects may be adversely affected.

4

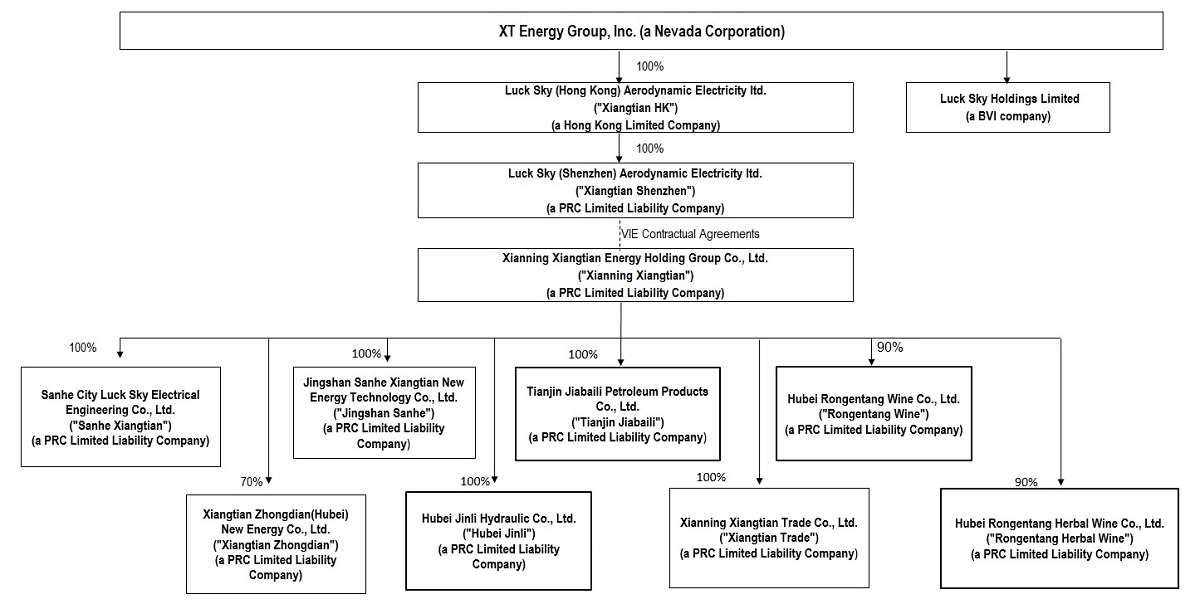

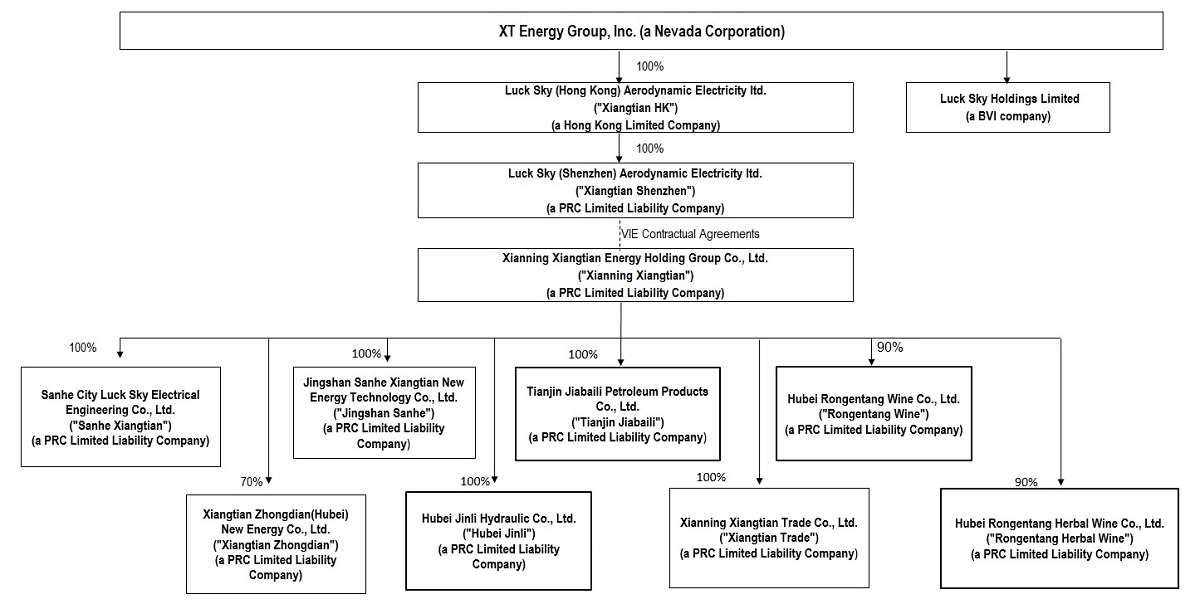

Our Corporate Structure

The following diagram illustrates our corporate structure as of the date of this prospectus. For more detail on our corporate history please refer to “Business – Corporate History and Information” appearing on page 59 of this prospectus.

Corporate Information

Our principal executive offices are located at No.1, Fuqiao Village, Henggouqiao Town, Xianning, Hubei, China 437012. Our telephone number is +86 (400) 103-7733.

Recent Developments

On October 17, 2018, Xianning Xiangtian entered into a lease agreement with Xi’An Jiadeli Fine Petrochemical Co., Ltd. (“Jiadeli”), pursuant to which, Xianning Xiangtian leases the factory including the production and office facilities and equipment located at No. 30 Jingwei Sixth Road, Jinghe Industrial Park, Gaoling, Xi’an, Shaanxi, China. The lease commenced on November 1, 2018 and expires on October 31, 2021. Pursuant to the lease, Xianning Xiangtian paid a refundable security deposit of RMB500,000 (US$72,673) and will pay an annual rent of RMB4,000,000 (US$581,387). The parties also agreed on liquidated damages of RMB1,000,000 (US$145,347) in addition to any claim and costs associated with the litigation, in the event of a breach. The lease contains customary representations and warranties of the parties and customary termination rights. We will use this facility in order produce our green energy products, commencing the first quarter of 2019.

On November 20, 2018, Xianning Xiangtian signed a letter of intent with Aksu Duolang Investment Limited Liability Company to purchase a 70% ownership of Kuche Xincheng Chemical Co., Ltd. (“Kuche Xincheng”), a chemical manufacturer located in Xijiang Province, processing all the requisite permits and approvals for the production of our green energy products. Under the letter of intent, we also have the option to lease the facilities of Kuche Xincheng if we decide not to pursue with the acquisition. The transaction is subject to satisfactory due diligence on Kuche Xincheng.

On December 14, 2018, we, through our variable interest entity, Xianning Xiangtian, entered into an equity investment agreement, pursuant to which we would acquire 90% of the equity interest in each of the two liquor producers, Hubei Rongentang Wine Co., Ltd. and Hubei Rongentang Herbal Wine Co., Ltd. (collectively, “Rongentang”). We completed the acquisition of Rongentang on December 21, 2018. We believe the acquisition of Rongentang represented a good investment in that Rongentang possesses land and buildings worth approximately $6.8 million and we believe we can recoup our investment within a short period of time by selling Rongentang’s liquor inventories through our distribution network. Upon completion of the acquisition, we are now engaged in the production and sales of compound liquor and medicinal liquor in China.

5

Conventions

Unless the context requires otherwise, references to

| ● | “China” or the “PRC” are references to the People’s Republic of China, excluding, for the purposes of this prospectus only, Macau, Taiwan and Hong Kong. |

| ● | “fiscal year” refers to our fiscal year ending July 31. |

| ● | “Hubei Jinli” refers to Hubei Jinli Hydraulic Co., Ltd., a PRC limited liability company, a wholly owned subsidiary of Xianning Xiangtian, and engaged in the manufacture and sale of hydraulic parts and electronic components. |

| ● | “Jingshan Sanhe” refers to Jingshan Sanhe Xiangtian New Energy Technology Co. Ltd., a PRC limited liability company, a wholly owned subsidiary of Xianning Xiangtian that produces and sells synthetic fuels and related products. |

| ● | “Luck Sky Holdings Limited” refers to our wholly owned subsidiary, which was incorporated under the laws of British Virgin Islands with no operations and has been struck off the register of companies. |

| ● | “PRC Entities” refer to Xiangtian Shenzhen, Xianning Xiangtian, Sanhe Xiangtian, Jingshan Sanhe, Tianjin Jiabaili, Xiangtian Trade, Hubei Jinli, Xiangtian Zhongdian, Rongentang Wine and Rongentang Herbal Wine. |

| ● | “RMB” means Renminbi, the legal currency of China. |

| ● | “Rongentang Herbal Wine” means Hubei Rongentang Herbal Wine Co., Ltd., a PRC limited liability company, 90% owned by Xianning Xiangtian, and engaged in the business of manufacture and sales of herbal wines. |

| ● | “Rongentang Wine” means Hubei Rongentang Wine Co., Ltd., a PRC limited liability company, 90% owned by Xianning Xiangtian, and engaged in the business of manufacture and sales of wines. |

| ● | “Sanhe Xiangtian” refers to Sanhe Xiangtian Electrical Engineering Limited Company, a PRC limited liability company, the wholly owned subsidiary of Xianing Xiangtian, and engaged in the business of sales of air compression equipment and heat pumps, as well as the installation of compressed air energy storage power generation systems utilizing our proprietary compressed air energy storage power generation technology. |

| ● | “Tianjin Jiabaili” refers to Tianjin Jiabaili Petroleum Products Co., Ltd., a PRC limited liability company, a wholly owned subsidiary of Xianning Xiangtian, and engaged in the business of production of synthetic fuels and related products. |

| ● | “U.S. dollar,” “US$” and “$” means the legal currency of the United States of America. |

| ● | “Xiangtian HK” refers to Luck Sky (Hong Kong) Aerodynamic Electricity Limited, our wholly owned subsidiary and a limited liability company formed in Hong Kong with no business operations. |

| ● | “Xiangtian Shenzhen” refers to Luck Sky (Shenzhen) Aerodynamic Electricity Limited, a wholly foreign owned enterprise registered under the laws of PRC, the subsidiary of Xiangtian HK, with no business operations. |

| ● | “Xiangtian Trade” refers to Xianning Xiangtian Trade Co., Ltd., a PRC limited liability company, a wholly owned subsidiary of Xianning Xiangtian, and engaged in the trade of chemical raw materials for our synthetic fuel operations. |

| ● | “Xianning Xiangtian” refers to our variable interest entity, Xianning Xiangtian Energy Holding Group Co., Ltd., formerly known as Xianning Sanhe Power Equipment Manufacturing Co., which is a PRC limited liability company engaged in the business of manufacture and sale of air compression equipment, heat pumps and related products. |

| ● | “Xiangtian Zhongdian” refers to Xiangtian Zhongdian (Hubei) New Energy Co. Ltd., a PRC limited liability company, 70% owned by Xianning Xiangtian, and engaged in the business of manufacture and sales of PV panels utilizing our proprietary technology to enhance the power production capabilities of the PV panels. |

| ● | “XT,” “Company,” “we,” “us” and “our” refer to XT Energy Group, Inc. |

This prospectus contains information and statistics relating to China’s economy and the industries in which we operate derived from various publications issued by market research companies and PRC governmental entities, which have not been independently verified by us, the placement agents or any of their affiliates or advisers. The information in such sources may not be consistent with other information compiled in or outside of China.

We use U.S. dollars as the reporting currency in our financial statements and in this prospectus. Monetary assets and liabilities denominated in Renminbi are translated into U.S. dollars at the rates of exchange as of the applicable balance sheet date. Equity accounts are translated at historical exchange rates, and revenues, expenses, gains and losses are translated using the average rates for the applicable period. In other parts of this prospectus, any Renminbi denominated amounts are accompanied by the related translations. With respect to amounts not recorded in our consolidated financial statements included elsewhere in this prospectus, all translations from Renminbi to U.S. dollars were made at RMB6.7596 to $1.00, the average rate set forth in the H.10 statistical release of the Federal Reserve Board on January 11, 2019. We make no representation that the Renminbi or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions — overseas investments in areas including real estate, hotels, cinemas, the entertainment industry, and sports clubs will be limited, while investments in some sectors such as gambling will be banned.

6

THE OFFERING

| Common stock offered by us: | A minimum of and a maximum of shares of common stock. | |

| Offering price: | $ per share. | |

| Shares of common stock outstanding before this offering |

591,042,000 shares. | |

| Shares of common stock outstanding after this offering: |

Minimum Offering: shares of our common stock assuming no exercise of the placement agent’s warrants Maximum Offering: shares of our common stock assuming no exercise of the placement agent’s warrants

The placement agent is selling the shares of our common stock offered in this prospectus on a “best efforts” basis and is not required to sell any specific number or dollar amount of the shares offered by this prospectus, but will use its best efforts to sell such shares. | |

| Use of proceeds: |

We estimate that we will receive net proceeds, after deducting estimated commissions and estimated offering expenses payable by us, of approximately $ from this offering assuming no exercise of the placement agent’s warrants and completion of the minimum offering, or $ assuming no exercise of the placement agent’s warrants and completion of the maximum offering. The net proceeds from this offering must be remitted to China before we will be able to use the funds to grow our business.

Although we will have broad discretion on the use of proceeds we receive in this offering, we plan to use the net proceeds of this offering for the lease of additional production facilities for our green energy products, the addition of a new packaging line for our green energy products in Jingshan Sanhe as well as general corporate purposes. For more information on the use of proceeds, see “Use of Proceeds” on page 35.

| |

| Placement agent’ warrants |

Upon the closing of this offering, we will issue to Axiom, as the placement agent, warrants entitling it to purchase up to 6.5% of the number of shares of common stock sold in this offering. The warrants shall be exercisable for a period of five years from the effective date of the Registration Statement on Form S-1 of which this prospectus forms a part.

| |

| Lock-up |

[ ]

| |

| Indemnification escrow |

Proceeds of this offering in the amount of $400,000 shall be used to fund an escrow account for a period of 18 months following the closing date of this offering, which account shall be used in the event we have to indemnify the placement agent pursuant to the terms of a placement agency agreement with the placement agent. See “Use of Proceeds” for more information.

| |

| The Nasdaq ticker symbol: | “XTEG” | |

| Risk factors: | See “Risk Factors” beginning on page 8 and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

7

Investing in our common stock is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our common stock. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

Risks Related to Our Business

We have a limited operating history in the industries we recently entered into, which makes it difficult to evaluate our future prospects and makes our business subject to inherent risk.

Although we have been in existence for many years, we only began the production and sales of synthetic fuel products in June 2018 and started manufacturing and sales of hydraulic parts, electronic components and liquor through companies acquired in 2018. Our lack of familiarity with these new industries and lack of relevant client data relating to these new products may make it more difficult for us to keep pace with the evolving client demands, identify and recruit new third-party merchants, manage inventory as well as acquire more customers. Our limited history in operating the new businesses may not provide a meaningful basis for investors to evaluate our overall business, financial performance and prospects. If we cannot successfully address challenges in connection with our expansion into new markets, we may not be able to continue to generate revenue in the future.

Failure to produce our synthetic fuel products as scheduled and budgeted would materially and adversely affect our business and financial condition.

We cannot be certain that we will deliver ordered products in a timely manner. We have limited production capacity for our synthetic fuel products. From June 2018 to November 2018, we received significant purchase orders for our synthetic fuel products with deposits totaling approximately $26.8 million of which approximately $9.4 million worth of orders have been fulfilled as of January 20, 2019 and the remainder is expected to be delivered by the end of June 2019. In order to meet the customer demand, we are currently expanding our own production capacity at our Jingshan Sanhe facility from 800 tons to 1,000 tons per day, as well as seeking to lease new production facilities from third parties. We have leased the production facility from Jiadeli which is capable of producing 300 tons a day and expect the production at this facility to start in the first quarter of 2019. Based on existing capacity and planned expansion, we believe we will be able to fulfill the orders for our synthetic fuel products in time. However, there is no assurance that we will be successful. Any delays in production will increase our costs, reduce future production capacity and could negatively impact our business, financial condition and operating results and diminish brand loyalty. If we could not fulfill the purchase orders, we may need to return the customer deposit and indemnify for any losses suffered by our customers.

Failure to accurately forecast customer demand could lead to excess supplies or supply shortages, which could result in decreased operating margins, reduced cash flows and harm to our business.

We may fail to correctly anticipate product supply requirements or suffer delays in production resulting from issues with our suppliers. Our suppliers may not supply us with a sufficient amount of components or components of adequate quality, or they may provide components at significantly increased prices. We have in the past and may in the future, experience delays or reductions in supply shipments, which could reduce our revenue and profitability. If key components or materials are unavailable, our costs would increase and our revenue would decline.

Some of our components are currently available only from a single source or limited sources. We may experience delays in production if we fail to identify alternative suppliers, or if any parts supply is interrupted, each of which could materially adversely affect our business and operations. We currently rely on a few key suppliers to provide a significant percentage of components to our products. For the fiscal year ended July 31, 2018, four vendors accounted for 19.0%, 18.3%, 15.4% and 10.95% of our total supply purchases, respectively. For the year ended July 31 2017, four vendors accounted for 13.6%, 11.6%, 11.2% and 10.9% of our total supply purchases, respectively.

8

If we fail to anticipate customer demand properly, an oversupply of parts could result in excess or obsolete inventories, which could adversely affect our business. Additionally, if we fail to correctly anticipate our internal supply requirements, an undersupply of parts could limit our production capacity. Our inability to meet volume commitments with suppliers could affect the availability or pricing of our parts and components. A reduction or interruption in supply, a significant increase in price of one or more components or a decrease in demand of products could materially adversely affect our business and operations and could materially damage our customer relationships. Financial problems of suppliers on whom we rely could limit our supply of components or increase our costs. Also, we cannot guarantee that any of the parts or components that we purchase will be of adequate quality or that the prices we pay for the parts or components will not increase. Inadequate quality of products from suppliers could interrupt our ability to supply quality products to our customers in a timely manner. Additionally, defects in materials or products supplied by our suppliers that are not identified before our products are placed in service by our customers could result in higher warranty costs and damage to our reputation.

The difficulty in forecasting demand also makes it difficult to estimate our future results of operations, financial condition and cash flows from period to period. A failure to accurately predict the level of demand for our products could adversely affect our net revenues and net income, and we are unlikely to forecast such effects with any certainty in advance.

Because we rely upon third party vendors to supply part of our solar panels and heat pumps, problems with these suppliers could impair our ability to meet our obligations to our customers and affect our profitability.

We have relied on third party vendors to provide us with part of our solar panels and heat pumps. In the event we have any quality, delivery or other problems with these vendors or in the event that we are not otherwise able to purchase solar panels or heat pumps from these vendors, it may be more difficult for us to find alternative suppliers. If we fail to develop or maintain our relationships with these or our other suppliers, or if the suppliers are not able to meet our quality, quantity and delivery schedules, we may not be able to meet our delivery and installation schedules and we may be unable to enter into new contracts with potential customers, thus impairing our revenue base. Any increases in price would affect our profitability. We cannot assure you that our current suppliers will be able to meet our quality, quantity and delivery requirements or that we will be able to find alternate suppliers that can meet our quality, quantity, deliver and price requirement. The failure to find alternate suppliers could materially affect our ability to conduct our business. Although there are a number of suppliers or solar panels, we cannot assure you that we will be able to negotiate reasonable terms for the purchase of solar panels if our existing suppliers are unable to meet our quality, delivery and price requirements. The failure to obtain find alternate suppliers or negotiate reasonable terms for the purchase of solar panels and heat pumps could materially impair our ability to generate revenue.

We have identified material weaknesses in our internal control over financial reporting, and our business and stock price may be adversely affected if we do not adequately address those weaknesses or if we have other material weaknesses or significant deficiencies in our internal control over financial reporting.

We have identified material weaknesses in our internal control over financial reporting. In particular, we concluded that our management, including our Chief Executive Officer and our Chief Financial Officer, has identified material weaknesses in the control environment of the Company. The material weaknesses include, but are not limited to (i) ineffective control environment, (ii) ineffective controls over our financial statement close and reporting process; (iii) inadequate controls over recording of sales and accounts receivable, inventory valuation, tax return filing, interest expense accrual, business acquisitions and investments and information technology.

Although we are undertaking steps to address these material weaknesses, the existence of a material weakness is an indication that there is more than a remote likelihood that a material misstatement of our financial statements will not be prevented or detected in the current or any future period. Management is committed to remediating the material weakness in a timely fashion. We have begun the process of executing remediation plans that address the material weakness in internal control over financial reporting. Specifically, we established an Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee in July 2017, engaged a third-party consultant to start the internal control implementation project since 2017, and appointed a suitable and qualified Chief Financial Officer in July 2018. In December 2018, we engaged Ernest & Young (China) Advisory Limited to assist us with our compliance under Section 404 of the Sarbanes-Oxley Act of 2002, as amended. We will continue to improve our internal control by establishing a desired level of corporate governance with respect to identifying and measuring the risk of material misstatement, hiring additional consultant to further assist us establish and maintain an effective control environment and address the inadequacy of our existing internal control, and holding regular US GAAP trainings for our accounting staff.

9

In addition, we may in the future identify further material weaknesses in our internal control over financial reporting that we have not discovered to date. Although we are engaged in remediation efforts with respect to the material weaknesses, the existence of one or more material weaknesses could result in errors in our financial statements, and substantial costs and resources may be required to rectify these or other internal control deficiencies. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our common stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business, and our business and financial condition could be harmed. We cannot assure you that we will be able to remediate these material weaknesses in a timely manner.

We have experienced substantial growth and expansion in recent years, particularly in 2018, and if we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of customer satisfaction or adequately address competitive challenges, and our financial performance may be adversely affected.

With our entry into the synthetic fuel industries and the acquisitions of Hubei Jinli, Tianjin Jiabaili and Rongentang, we expect significant expansion will be required to address potential growth in our customer base, the breadth of our product offerings, and other opportunities. The growth and expansion could strain our management, operations, systems and financial resources. To manage any future growth of our operations and personnel, we must improve and effectively utilize operational, management, marketing and financial systems and successfully recruit, hire, train and manage personnel and maintain close coordination among our technical, finance, marketing, sales and recruitment staffs. We also will need to manage an increasing number of complex relationships with customers, strategic partners, advertisers and other third parties. Our success will depend on our ability to plan for and manage this growth effectively. Our failure to manage growth could disrupt our operations and ultimately prevent us from generating the revenue we expect. While we intend to further expand our overall business, customer base, and number of employees, our historical growth rate is not necessarily indicative of the growth that we may achieve in the future.

We were granted licenses to intellectual property rights in our products, including patents and trademarks, from affiliated entities or third parties. If such entities do not properly maintain or enforce the intellectual property underlying such licenses, our competitive position and business prospects could be harmed. Our licensors may also seek to terminate our license.

We are granted licenses to multiple patents and trademarks that are necessary or useful to our business. Two of our trademarks are licensed from Xiangtian International Investment Group Co., Ltd, a company controlled by Zhou Deng Rong, our former Chief Executive Officer. In addition, we have licensed certain patents and trademarks from Nanjing Zhongdian Photovoltaic Co., Ltd., We believe The other shareholder of Xiangtian Zhongdian. We have also licensed one trademark for the wine and herbal wine products from Hubei Rongentang Pharmaceutical Co., Ltd. We believe these intellectual property rights possess unique characteristics and provide us with a competitive advantage. Our success will depend in part on the ability of our licensors to obtain, maintain and enforce our licensed intellectual property.

Our licensors may not successfully prosecute any applications for or maintain intellectual property to which we have licenses, may determine not to pursue litigation against other companies that are infringing such intellectual property, or may pursue such litigation less aggressively than we would.

In addition, we are required under the PRC law to register the intellectual property licenses with relevant government authorities. Lack of registration of such licenses will not affect the validity of our licenses between us and the licensors but will not provide us a valid defense to good faith third party claims. We are currently in the process of registering our licenses and expect to complete such registrations by February 2019. If we do not complete the registration timely or at all, our rights to the licensed intellectual properties may be affected.

Without protection for the intellectual property we license, other companies might be able to offer similar products for sale, which could adversely affect our competitive business position and harm our business prospects. If we lose any of our right to use these intellectual property, it could adversely affect our ability to commercialize our technologies, products or services, as well as harm our competitive business position and our business prospects.

10

We may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position.

We regard our patents, trademarks, domain names, know-how, proprietary technologies and similar intellectual property we own as critical to our success, and we rely on a combination of intellectual property laws and contractual arrangements, including confidentiality and non-compete agreements with our key employees and others to protect our proprietary rights. Thus, we cannot assure you that any of our intellectual property rights would not be challenged, invalidated, circumvented or misappropriated, or such intellectual property will be sufficient to provide us with competitive advantages. In addition, because of the rapid pace of technological change in our industry, parts of our business rely on technologies developed or licensed by others, and we may not be able to obtain or continue to obtain licenses and technologies from these parties on reasonable terms, or at all.

It is often difficult to register, maintain and enforce intellectual property rights in China. Statutory laws and regulations are subject to judicial interpretation and enforcement and may not be applied consistently due to the lack of clear guidance on statutory interpretation. Confidentiality and non-compete agreements may be breached by counterparties, and there may not be adequate remedies available to us for any such breach. Accordingly, we may not be able to effectively protect our intellectual property rights or to enforce our contractual rights in China. Preventing any unauthorized use of our intellectual property is difficult and costly and the steps we take may be inadequate to prevent the misappropriation of our intellectual property. In the event that we resort to litigation to enforce our intellectual property rights, such litigation could result in substantial costs and a diversion of our managerial and financial resources. We can provide no assurance that we will prevail in such litigation. In addition, our trade secrets may be leaked or otherwise become available to, or be independently discovered by, our competitors. To the extent that our employees or consultants use intellectual property owned by others in their work for us, disputes may arise as to the rights in related know-how and inventions. Any failure in protecting or enforcing our intellectual property rights could have a material adverse effect on our business, financial condition and results of operations.

If we do not compete effectively in our target markets, our operating results could be harmed.

The industries we are operating in are intensely competitive. Some of our competitors in China operate with different business models and have different cost structures or participate selectively in different market segments. They may ultimately prove more successful or more adaptable to new regulatory, technological and other developments. Our competitors may be better at developing new products, responding faster to new technologies and undertaking more extensive and effective marketing campaigns.

In the synthetic fuel market, we compete with independent and integrated oil refiners, large oil and gas companies and, in certain fuels markets, with other companies producing synthetic fuels. The refiners compete with us by selling conventional fuel products, and some are also pursuing hydrocarbon fuel production using non-renewable feedstocks, such as natural gas and coal, as well as production using renewable feedstocks, such as vegetable oil and biomass. We also compete with companies that are developing the capacity to produce diesel and other transportation fuels from renewable resources in other ways. These include advanced biofuels companies using specific engineered enzymes that they have developed to convert cellulosic biomass, which is non-food plant material such as wood chips, corn stalks and sugarcane bagasse, into fermentable sugars and ultimately, renewable diesel and other fuels. Biodiesel companies convert vegetable oils and animal oils into diesel fuel and some are seeking to produce diesel and other transportation fuels using thermochemical methods to convert biomass into renewable fuels.

Our competitors may also have longer operating histories, more extensive user bases, greater brand recognition and broader partner relationships than us. Some of our current and potential competitors have more significant resources than we do, such as financial, technical, and marketing resources, and may be able to devote greater energy towards the development, promotion, sale and support of their products and services. The oil companies, large chemical companies and well-established agricultural products companies with whom we expect to compete have more resources, developed distribution network, established customer relationship and more devoted marketing teams.

Additionally, a current or potential competitor may acquire one or more of our existing competitors or form a strategic alliance with one or more of our competitors. Also, when new competitors seek to enter our target markets, or when existing market participants seek to increase their market share, they sometimes undercut the pricing and/or terms common place in that market, which could adversely affect our market share or ability to exploit new market opportunities. All of the foregoing could adversely affect our business, results of operations, financial condition and future growth.

11

We may not be familiar with new markets we enter and may not be successful in offering new products and services.

We have entered into new markets in 2018 including production and sales of synthetic fuel, hydraulic parts, electronic components as well as liquors. We may expand our business and enter other markets in the future. However, we may be unable to achieve success in new markets. In expanding our business, we may enter markets in which we have limited, or no, experience. We may not be familiar with the business and regulatory environment and we may fail to attract a sufficient number of customers due to our limited experience. In addition, competitive conditions in new markets may be different from those in our existing market and may make it difficult or impossible for us to operate profitably in these new markets. If we are unable to manage these and other difficulties in our expansion into other markets, our prospects and results of operations may be adversely affected.

As we continuously adjust our business strategies in response to the changing market and evolving customer needs, our new business initiatives will likely lead us to offer new products and services. However, we may not be able to successfully introduce new products or services to address our customers’ needs because we may not have adequate capital resources or lack the relevant experience or expertise or otherwise. In addition, we may be unable to obtain regulatory approvals for our new products and services. Furthermore, our new products and services may involve increased and unperceived risks and may not be accepted by the market and they may not be as profitable as we anticipated, or at all. If we are unable to achieve the intended results for our new products and services, our business, financial condition, results of operations and prospects may be adversely affected.

Our results of operations may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our results of operations, including our operating revenue, expenses and other key metrics, may vary significantly in the future and period-to-period comparisons of our operating results may not be meaningful. Accordingly, the results for any one quarter are not necessarily an indication of future performance. Our financial results may fluctuate due to a variety of factors, some of which are outside of our control and, as a result, may not fully reflect the underlying performance of our business. Fluctuation in our operational results may adversely affect the price of our common stock. Factors that may cause fluctuations in our quarterly results include:

| ● | our ability to attract new customers, maintain relationships with existing customers, and expand into new territories in China; | |

| ● | our ability to produce products to meet customer orders; | |

| ● | the amount and timing of operating expenses related to acquiring customers and the maintenance and expansion of our business, operations and infrastructure; | |

| ● | general economic, industry and market conditions in China; | |

| ● | our emphasis on customer experience instead of near-term growth; and | |

| ● | the timing of expenses related to the development or acquisition of technologies or businesses and potential future charges for impairment of goodwill from acquired technologies or businesses. |

Fluctuations in crude oil and natural gas prices and refining margins may adversely affect our business, operating results, cash flows and financial condition.

Market prices for crude oil and natural gas fluctuate as they are subject to local and international supply and demand fundamentals and other factors over which we have no control. Worldwide supply conditions and the price levels of crude oil may be significantly influenced by general economic conditions, industry inventory levels, technology advancements, production quotas or other actions that might be imposed by international cartels that control the production of a significant proportion of the worldwide supply of crude oil, weather-related damage and disruptions, competing fuel prices and geopolitical risks, especially in the Middle East, North Africa and West Africa.

A decline in the price of crude oil may reduce demand for our products and may otherwise adversely affect our business. We believe that the increased demand for synthetic fuel products, which are either an alternative to gasoline or fuel additives to increase gasoline mileage, results from the recent increases in petroleum cost. An increase in the price of natural gas may increase the cost of our synthetic fuel products, as natural gas is the feedstock of methanol, a key component of our synthetic fuel products. As a result, substantial changes in crude oil and natural gas prices could have a substantial adverse effect on our financial condition and results of operations.

12

The methanol industry is an industry that is changing rapidly which can result in unexpected developments that could negatively impact our operations and the value of our units.

The methanol industry has grown significantly in the last decade. This rapid growth has resulted in significant shifts in supply and demand of methanol over a very short period of time. As a result, past performance by the methanol plant or the methanol industry generally might not be indicative of future performance.

Methanol is typically produced industrially from synthesis gas which is a mixture of carbon monoxide and hydrogen. Natural gas, coal and oil waste are used as the principal feedstock for methanol. Currently we purchased methanol from three suppliers. We don’t rely on any single one of these suppliers and believe they are easily replaceable on the market. However, we may experience a rapid shift in the economic conditions in the methanol industry which may make it difficult to operate the methanol plant profitably. If changes occur in the methanol industry that make it difficult for us to operate the methanol plant profitably, it could result in a reduction in the value of our units.

Changes and advances in methanol production technology could require us to incur costs to update our plant or could otherwise hinder our ability to compete in the methanol industry or operate profitably.

Advances and changes in the technology of methanol production are expected to occur. Such advances and changes may make the methanol production technology installed in our plant less desirable or obsolete. These advances could also allow our competitors to produce methanol at a lower cost than we are able. If we are unable to adopt or incorporate technological advances, our methanol production methods and processes could be less efficient than our competitors, which could cause our plant to become uncompetitive or completely obsolete. If our competitors develop, obtain or license technology that is superior to ours or that makes our technology obsolete, we may be required to incur significant costs to enhance or acquire new technology so that our methanol production remains competitive. Alternatively, we may be required to seek third-party licenses, which could also result in significant expenditures. These third-party licenses may not be available or, once obtained, they may not continue to be available on commercially reasonable terms. These costs could negatively impact our financial performance by increasing our operating costs and reducing our net income.

Increased use of fuel cells, plug-in hybrids and electric cars may lessen the demand for fuels.

A number of automotive, industrial and power generation manufacturers are developing alternative clean power systems using fuel cells, plug-in hybrids, electric cars or clean burning gaseous fuels. Electric car technology has recently grown in popularity, especially in urban areas, which has led to an increase in recharging stations which may make electric car technology more widely available in the future. This additional competition from alternate sources could reduce the demand for our fuel products, resulting in lower fuel prices which could negatively impact our results of operations and financial condition.

Changes in environmental regulations or violations of these regulations could be expensive and reduce our profitability.

We are subject to extensive air, water and other environmental laws and regulations. In addition, some of these laws require our plant to operate under a number of environmental permits. These laws, regulations and permits can often require expensive pollution control equipment or operational changes to limit actual or potential impacts to the environment. A violation of these laws and regulations or permit conditions can result in substantial fines, damages, criminal sanctions, permit revocations and/or plant shutdowns. In the future, we may be subject to legal actions brought by environmental advocacy groups and other parties for actual or alleged violations of environmental laws or our permits. Additionally, any changes in environmental laws and regulations could require us to spend considerable resources in order to comply with future environmental regulations. The expense of compliance could be significant enough to reduce our profitability and negatively affect our financial condition.

13

Failure to obtain regulatory approvals or permits could adversely affect our operations.

We will need to obtain and maintain regulatory approvals and permits in order to operate our business. Because it is in the process of expanding its production facilities, Jingshan Sanhe has not obtained the permit to manufacture hazardous chemicals, and the fire inspection approval, all of which are material to Jingshan Shahe’s operations. Jingshan Shanhe may not apply for these approvals until the completion of its expansion. Obtaining necessary approvals and permits could be a time-consuming and expensive process, and we may not be able to obtain them on a timely basis or at all. In the event that we fail to ultimately obtain all necessary permits, we may be forced to delay operations of the facility and the receipt of related revenues, or abandon the project completely and lose the benefit of any development costs already incurred, which would have an adverse effect on our results of operations. In addition, governmental regulatory requirements may substantially increase our construction costs, which could have a material adverse effect on our business, results of operations and financial condition. Any delay in obtaining any required regulatory approvals could negatively affect the progress of our manufacturing. In addition, we may be required to make capital expenditures on an ongoing basis to comply with increasingly stringent environmental, health and safety laws, regulations and permits.

We use hazardous materials in our business and any claims relating to improper handling, storage or disposal of these materials or noncompliance with applicable laws and regulations could adversely affect our business and results of operations.

We are subject to and affected by numerous environmental regulations. These regulations govern air emissions, water quality, wastewater discharge and disposal of solid and hazardous waste.

We use chemicals materials in our business and are subject to a variety of laws and regulations governing the use, generation, manufacture, storage, handling and disposal of these materials. Although we have implemented safety procedures for handling and disposing of these materials and waste products, we cannot be sure that our safety measures are compliant with legal requirements or adequate to eliminate the risk of accidental injury or contamination. In the event of contamination or injury, we could be held liable for any resulting damages, and any liability could exceed our insurance coverage. There can be no assurance that we will not violate environmental, health and safety laws as a result of human error, accident, equipment failure or other causes. Compliance with applicable environmental laws and regulations is expensive and time consuming, and the failure to comply with past, present, or future laws could result in the imposition of fines, third-party property damage, product liability and personal injury claims, investigation and remediation costs, the suspension of production, or a cessation of operations. Our liability in such an event may exceed our total assets. Liability under environmental laws can be joint and several and without regard to comparative fault. Environmental laws could become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with violations, which could impair our research, development or production efforts and harm our business. Accordingly, violations of present and future environmental laws could restrict our ability to expand facilities, or pursue certain technologies, and could require us to acquire equipment or incur potentially significant costs to comply with environmental regulations.

We may be subject to product liability claims and other claims of our customers and partners.

The design, development, production and sale of our synthetic fuel products and wine products involve an inherent risk of product liability claims and the associated adverse publicity. Because these products are directly used by customers or incorporated into other products directly used by customers, and because use of those ultimate products may cause injury to those customers and damage to property, we are subject to a risk of claims for such injuries and damages. In addition, we may be named directly in product liability suits relating to any products we develop or third-party products integrating our products, even for defects resulting from errors of our partners, contract manufacturers or other third parties working with our products. These claims could be brought by various parties, including customers who are purchasing products directly from us or other users who purchase products from our customers or partners. We could also be named as co-parties in product liability suits that are brought against manufacturing partners that produce our products.

In addition, our customers and partners may bring suits against us alleging damages for the failure of our products to meet stated claims, specifications or other requirements. Any such suits, even if not successful, could be costly, disrupt the attention of our management and damage our negotiations with other partners and/or customers. Any attempt by us to limit our product liability in our contracts may not be enforceable or may be subject to exceptions. We only maintain product liability insurance for our green energy products. However, insurance coverage may not be sufficient to cover potential claims. In addition, we cannot be sure that our contract manufacturers who produce our green energy products will have adequate insurance coverage themselves to cover against potential claims. If we experience a large insured loss, it may exceed any insurance coverage limits we have at that time, or our insurance carrier may decline to cover us or may raise our insurance rates to unacceptable levels, any of which could impair our financial position and potentially cause us to go out of business.

14

We may be adversely affected by the defects in our titles of or rights to use our properties.

Hubei Jinli has not received the property ownership certificate from the relevant authority for four of its buildings used as dormitory and plant. The land use right certificate for the buildings which are required for the application for property ownership certificates is used as collateral and held by the bank for a loan, which remains outstanding as of the date of this prospectus. Hubei Jinli does not have valid title or right to the four buildings until it obtains relevant property ownership certificates which are contingent on the payment of the outstanding bank loan. Any dispute or claim in relation to the title to these properties, including any litigation involving allegations of illegal or unauthorized use of such properties, may materially and adversely affect Hubei Jinli’s operations, financial condition, reputation and future growth. However, Hubei Jinli is in the process of applying to relevant authority to obtain the property ownership certificates for the properties.

We could be adversely affected by the complexity, uncertainties and changes in PRC regulation of Secrecy Qualification.

According to Management Measures of Secrecy Qualification Examination and Certification for Weapons and Equipment Research and Production Units (“Circular 8”) issued by the National Defense Science and Technology Bureau of PRC, entities engaged in the research and production of classified weapons and equipment are required to implement a confidentiality qualification examination and certification system and obtain the corresponding confidentiality qualifications (“Secrecy Qualification”). According to Circular 8, foreign invested entities may not obtain the Secrecy Qualification. Hubei Jinli is engaged in producing parts for the military products and has obtained the Secrecy Qualification. Notwithstanding our control over Hubei Jinli through the New VIE Agreements, Hubei Jinli is 100% held by Xianning Xiangtian, a PRC company and the shareholders of Xianning Xiangtian, Messrs. Zhou Jian and Zhou Deng Rong, are both PRC residents and therefore we believe Hubei Jinli may continue to use the Secrecy Qualification. However, there is no assurance that the relevant government authorities will hold the same position as we do, and Hubei Jinli may not renew its Secrecy Qualification upon expiration. Failure to renew its Secrecy Qualification will have a material adverse impact on Hubei Jinli’s operating results and financial condition.

If we are unable to provide high quality client experience, our business and reputation may be materially and adversely affected.

The success of our business largely depends on our ability to provide quality client experience, which in turn depends on a variety of factors. If our clients are not satisfied with our products or services, or the prices at which we offer the products or otherwise fail to meet our clients’ requests, our reputation and client loyalty could be adversely affected. If we are unable to continue to maintain our client experience and provide high quality client service, we may not be able to retain existing clients or attract new clients, which could have a material adverse effect on our business, financial condition and results of operations.

15

If we fail to promote and maintain our brands in an effective and cost-efficient way, our business and results of operations may be harmed.

We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing customers. Our efforts to build our brand have caused us to incur significant expenses, and it is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brands while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees needed to support our business.

As we continue to experience growth, we believe our success depends on the efforts and talents of our employees, including engineers, financial personnel and marketing professionals. Our future success depends on our continued ability to attract, develop, motivate and retain highly qualified and skilled employees. Competition for highly skilled engineering, sales, technical and financial personnel is extremely intense. We may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. Many of the companies with which we compete for experienced employees have greater resources than we have and may be able to offer more attractive terms of employment.