Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Investar Holding Corp | a8-kinvestorpresentationas.htm |

Exhibit 99.1 NASDAQ: ISTR 1

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the Company’s current views with respect to, among other www.investarbank.com things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” NASDAQ: ISTR “anticipates,” or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the We encourage everyone to visit future plans, estimates or expectations by the Company will be achieved. Such forward-looking the Investors Section of our statements are subject to various risks and uncertainties and assumptions relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity. If website at www.investarbank.com, one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those where we have posted additional indicated in these statements. The Company does not undertake any obligation to publicly update or important information such as review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those press releases and SEC filings. indicated by the forward-looking statements. These factors include, but are not limited to, the following, any one or more of which could materially affect the outcome of future events: • business and economic conditions generally and in the financial services industry in particular, We intend to use our website to whether nationally, regionally or in the markets in which we operate; expedite public access to time- • our ability to achieve organic loan and deposit growth, and the composition of that growth; • our ability to integrate and achieve anticipated cost savings from our acquisitions; critical information regarding the • changes (or the lack of changes) in interest rates, yield curves and interest rate spread relationships that affect our loan and deposit pricing; Company in advance of or in lieu • the extent of continuing client demand for the high level of personalized service that is a key of distributing a press release or a element of our banking approach as well as our ability to execute our strategy generally; • our dependence on our management team, and our ability to attract and retain qualified personnel; filing with the SEC disclosing the • changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers; same information. • inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; • the concentration of our business within our geographic areas of operation in Louisiana; and • concentration of credit exposure. These factors should not be construed as exhaustive. Additional information on these and other risk factors can be found in Item 1A. “Risk Factors” and Item 7. “Special Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission. 2

ADDITIONAL INFORMATION FOR INVESTORS AND SHAREHOLDERS The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed acquisition of Mainland Bank, the Company has filed a registration statement on Form S-4 with the SEC. The registration statement includes a proxy statement of Mainland Bank, and constitutes a prospectus of the Company, which Mainland Bank has provided to its shareholders. INVESTORS AND SHAREHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE COMPANY, THE BANK, MAINLAND BANK AND THE PROPOSED TRANSACTIONS. These and other documents relating to the merger filed by the Company can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing the “Investor Relations” section of the Company’s website at www.investarbank.com. Alternatively, these documents, when available, can be obtained free of charge from the Company upon written request to: Attn: Investor Relations, Investar Holding Corporation, P.O. Box 84207, Baton Rouge, Louisiana 70884-4207, or by calling (225) 227-2222. This presentation does not constitute an offer to sell, a solicitation of an offer to sell, or the solicitation or an offer to buy any securities. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirement of Section 10 of the Securities Act of 1933, as amended. 3

COMPANY PROFILE AS OF DECEMBER 31, 2018 Market Data Financial Highlights Shares Outstanding 9,484,219 Assets $1.8 billion Market Cap $235.2 million Net Loans $1.4 billion Price per Share $24.80 Deposits $1.4 billion Dividend Yield (YTD) 0.69% Tangible Equity(1) $162.5 million Price/ Tangible Book Value 144.8% TE/TA(1) 9.20% Price/LTM EPS $17.59 Net Income $13.6 million ROAA 0.81% Core ROAA(1) 0.95% ROAE 7.68% NPAs/Assets 0.54% Net Interest Margin 3.61% Cost of Funds 1.29% (1) Non-GAAP financial measure. See non-GAAP financial measures slides. 4

SENIOR MANAGEMENT John J. D’Angelo, • Founding President and Chief Executive Officer President & CEO • New Orleans native; graduate of Louisiana State University • Prior to founding Investar, Mr. D’Angelo was president and director of Aegis Lending Corporation, a mortgage lending company with operations in 46 states and the District of Columbia • Previously, Mr. D’Angelo held various senior positions at Hibernia National Bank (the predecessor to Capital One Bank, N.A.), focusing on the East Baton Rouge Parish, Louisiana, market • Current ownership of 1.9% Christopher L. Hufft, • Joined the Bank in February 2014 as Chief Accounting Officer, and assumed the Chief Financial Officer role of Chief Financial Officer in October of 2015. • Prior to joining the Bank, Mr. Hufft served for 9 years as the Vice President of Accounting at Amedisys, Inc., a publicly-traded home health and hospice company • Mr. Hufft, a licensed certified public accountant, also spent seven years in public accounting, serving both public and privately-held clients in the banking, healthcare and manufacturing sectors • B.S. Accounting – Louisiana State University Travis M. Lavergne, • Served as Executive Vice President and Chief Credit Officer since March, 2013 Chief Credit Officer and Chief Risk Management Officer since joining in July 2012 • Prior to joining the Bank, Mr. Lavergne was a Senior Examiner at the Louisiana Office of Financial Institutions from September 2005 to July 2012 • B.S. Finance – Louisiana State University • M.B.A. Southeastern Louisiana University 5

ACCOMPLISHMENTS SINCE IPO Since IPO in June 2014, Investar has experienced significant progress: Further Established in Four Key Louisiana Markets Shifted from Consumer Loans to C&I and CRE Focus Maintained High Quality Organic Loan Growth Transitioned from Transactional Banking to Relationship Banking Continued to Add Experienced Bankers in Key Areas Completed Acquisitions on July 1, 2017 and December 1, 2017 6

INVESTAR TIMELINE 2018 Opened additional branch in our Baton Rouge market 2014 Completed initial public offering 2012 Entered the New Orleans market 2006 Chartered with an initial capitalization of $10.1 million 2011 2013 2017 Acquired South Entered the Acquired Louisiana Lafayette market Citizens Business Bank Bancshares Acquired First Community Bank Acquired BOJ Bancshares, Inc. Note: Bank level data shown for 2006 through 2012 (holding company incorporated in 2013) 7

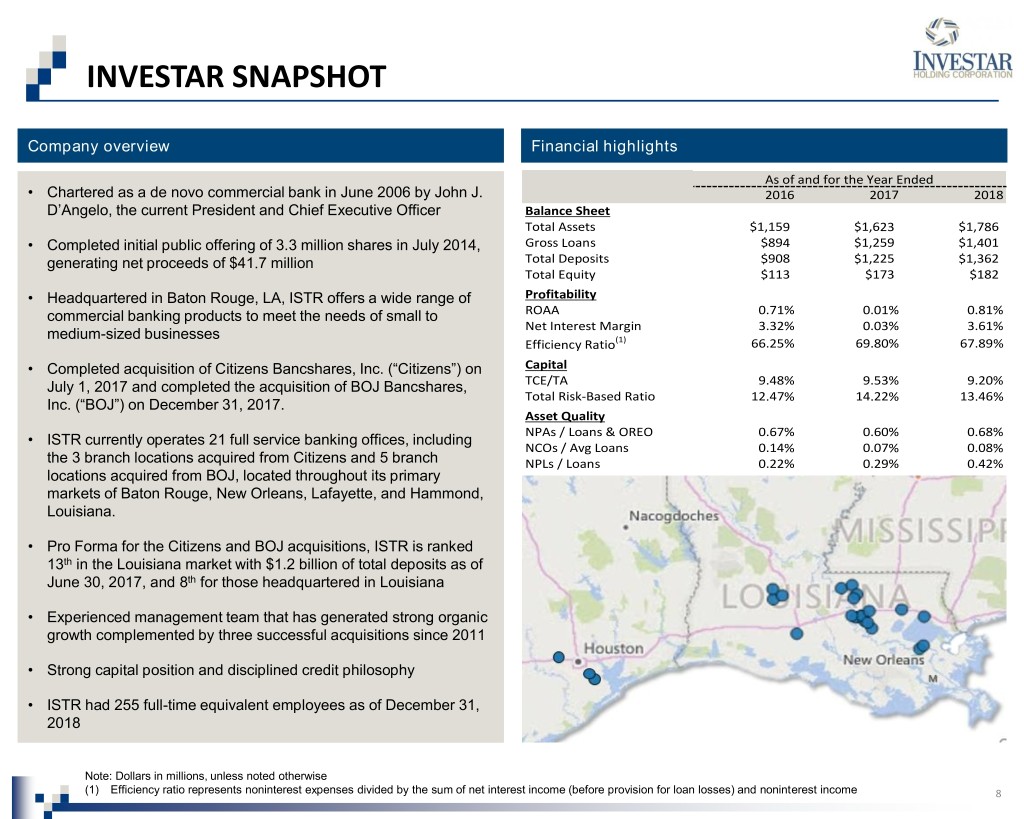

INVESTAR SNAPSHOT Company overview Financial highlights As of and for the Year Ended • Chartered as a de novo commercial bank in June 2006 by John J. 2016 2017 2018 D’Angelo, the current President and Chief Executive Officer Balance Sheet Total Assets $1,159 $1,623 $1,786 • Completed initial public offering of 3.3 million shares in July 2014, Gross Loans $894 $1,259 $1,401 generating net proceeds of $41.7 million Total Deposits $908 $1,225 $1,362 Total Equity $113 $173 $182 • Headquartered in Baton Rouge, LA, ISTR offers a wide range of Profitability commercial banking products to meet the needs of small to ROAA 0.71% 0.01% 0.81% Net Interest Margin 3.32% 0.03% 3.61% medium-sized businesses Efficiency Ratio(1) 66.25% 69.80% 67.89% • Completed acquisition of Citizens Bancshares, Inc. (“Citizens”) on Capital July 1, 2017 and completed the acquisition of BOJ Bancshares, TCE/TA 9.48% 9.53% 9.20% Total Risk-Based Ratio 12.47% 14.22% 13.46% Inc. (“BOJ”) on December 31, 2017. Asset Quality • ISTR currently operates 21 full service banking offices, including NPAs / Loans & OREO 0.67% 0.60% 0.68% NCOs / Avg Loans 0.14% 0.07% 0.08% the 3 branch locations acquired from Citizens and 5 branch NPLs / Loans 0.22% 0.29% 0.42% locations acquired from BOJ, located throughout its primary markets of Baton Rouge, New Orleans, Lafayette, and Hammond, Louisiana. • Pro Forma for the Citizens and BOJ acquisitions, ISTR is ranked 13th in the Louisiana market with $1.2 billion of total deposits as of June 30, 2017, and 8th for those headquartered in Louisiana • Experienced management team that has generated strong organic growth complemented by three successful acquisitions since 2011 • Strong capital position and disciplined credit philosophy • ISTR had 255 full-time equivalent employees as of December 31, 2018 Note: Dollars in millions, unless noted otherwise (1) Efficiency ratio represents noninterest expenses divided by the sum of net interest income (before provision for loan losses) and noninterest income 8

ATTRACTIVE MARKETS • Baton Rouge MSA • Louisiana’s second largest market by deposits and the state capital, which includes major industrial, medical, research, motion picture, and growing technology centers • Hammond MSA • Commercial hub of a large agricultural segment of Louisiana, bedroom community of New Orleans, and home to Southeastern Louisiana University with 8.24% household income growth projected from 2019 to 2024 • Lafayette MSA • Louisiana’s third largest city by population and deposits with 2.79% population growth projected from 2019 to 2024 • New Orleans MSA • Louisiana’s largest city by population and deposits and a hub of hospitality, healthcare, universities, and energy Louisiana Deposit Market Share Market Share Opportunity ISTR Deposits Market ISTR 3.5% in Market Share 2.7% Rank Institution (ST) Branches ($000) (%) 1 Capital One Financial Corp. 121 17,319,189 16.98 2 JPMorgan Chase & Co. 128 17,047,173 16.71 Small & Large Banks Mid-size 20.5% 3 Hancock Whitney Corp. 111 12,903,568 12.65 Banks 4 IBERIABANK Corp. 63 7,841,287 7.69 37.1% Large Banks 59.4% Small & Mid- 5 Regions Financial Corp. 99 7,285,163 7.14 size Banks 6 Origin Bancorp Inc. 21 1,840,250 1.80 76.8% 7 Home Bancorp Inc. 35 1,642,421 1.61 8 Business First Bancshares Inc. 24 1,593,684 1.56 Baton Rouge: Hammond: 9 Red River Bancshares Inc. 23 1,576,929 1.55 Total Deposits: $20.5 Billion Total Deposits: $1.9 Billion 10 BancorpSouth Bank 29 1,490,853 1.46 ISTR ISTR 11 Gulf Coast Bank and Trust Co. 20 1,465,117 1.44 1.2% 0.3% 12 First Guaranty Bancshares Inc. 22 1,418,590 1.39 13 MidSouth Bancorp Inc. 32 1,330,361 1.30 14 Investar Holding Corp. 22 1,231,743 1.21 Large Banks 15 Pedestal Bancshares Inc. 24 1,010,447 0.99 22.0% Small & Mid- 16 CB&T Holding Corp. 3 865,175 0.85 Small & Mid- size Banks Large Banks 17 First Trust Corp. 12 801,265 0.79 size Banks 48.4% 51.2% 18 Citizens National Bancshares Bossier Inc. 12 792,334 0.78 76.8% 19 One American Corp. 25 765,099 0.75 20 Sabine Bancshares Inc. 47 737,071 0.72 Lafayette: New Orleans: Total For Institutions In Market 1,451 102,022,809 Total Deposits: $11.4 Billion Total Deposits: $34.1 Billion Notes: Large banks defined as having over $50 billion in assets Sources: S&P Global Market Intelligence; FDIC; Deposit data as of June 30, 2018 9

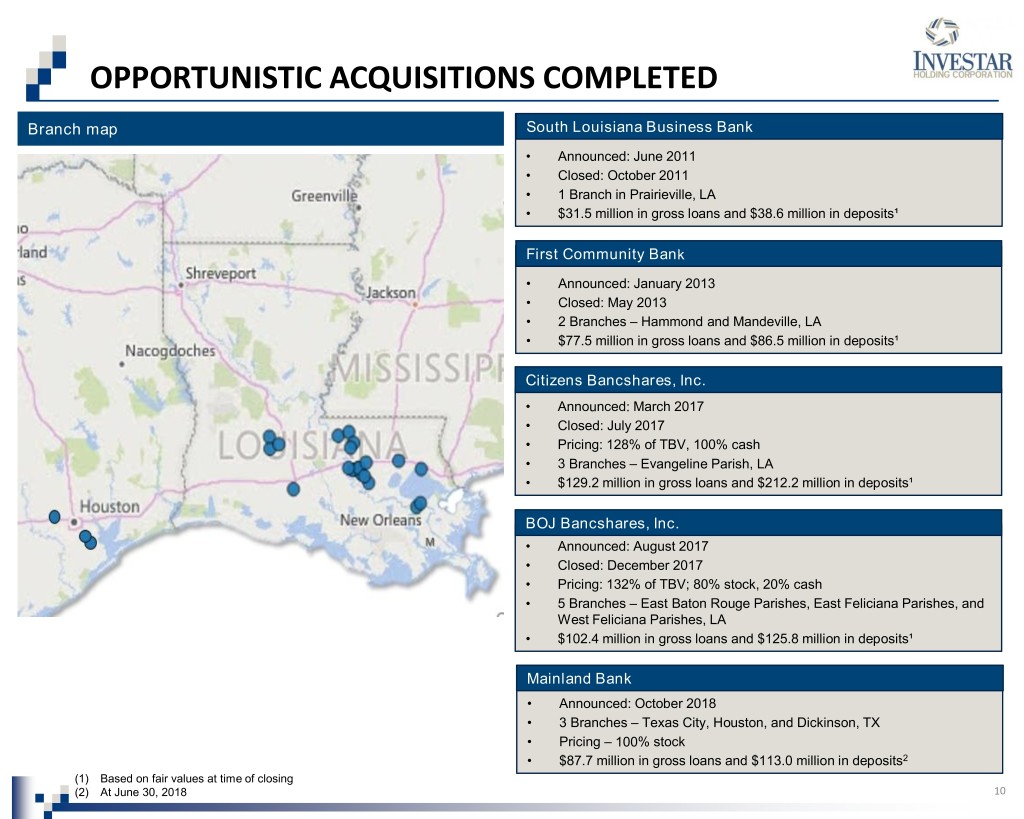

OPPORTUNISTIC ACQUISITIONS COMPLETED Branch map South Louisiana Business Bank • Announced: June 2011 • Closed: October 2011 • 1 Branch in Prairieville, LA • $31.5 million in gross loans and $38.6 million in deposits¹ First Community Bank • Announced: January 2013 • Closed: May 2013 • 2 Branches – Hammond and Mandeville, LA • $77.5 million in gross loans and $86.5 million in deposits¹ Citizens Bancshares, Inc. • Announced: March 2017 • Closed: July 2017 • Pricing: 128% of TBV, 100% cash • 3 Branches – Evangeline Parish, LA • $129.2 million in gross loans and $212.2 million in deposits¹ BOJ Bancshares, Inc. • Announced: August 2017 • Closed: December 2017 • Pricing: 132% of TBV; 80% stock, 20% cash • 5 Branches – East Baton Rouge Parishes, East Feliciana Parishes, and West Feliciana Parishes, LA • $102.4 million in gross loans and $125.8 million in deposits¹ Mainland Bank • Announced: October 2018 • 3 Branches – Texas City, Houston, and Dickinson, TX • Pricing – 100% stock • $87.7 million in gross loans and $113.0 million in deposits2 (1) Based on fair values at time of closing (2) At June 30, 2018 10

Total Assets (in millions) *Represents the compounded annual growth rate for the five years ended December 31, 2018 11

TotalTotal LoansLoans (in millions) 11.3% 40.9% 19.9%* 19.7%* * Growth % excludes Loans HFS 12

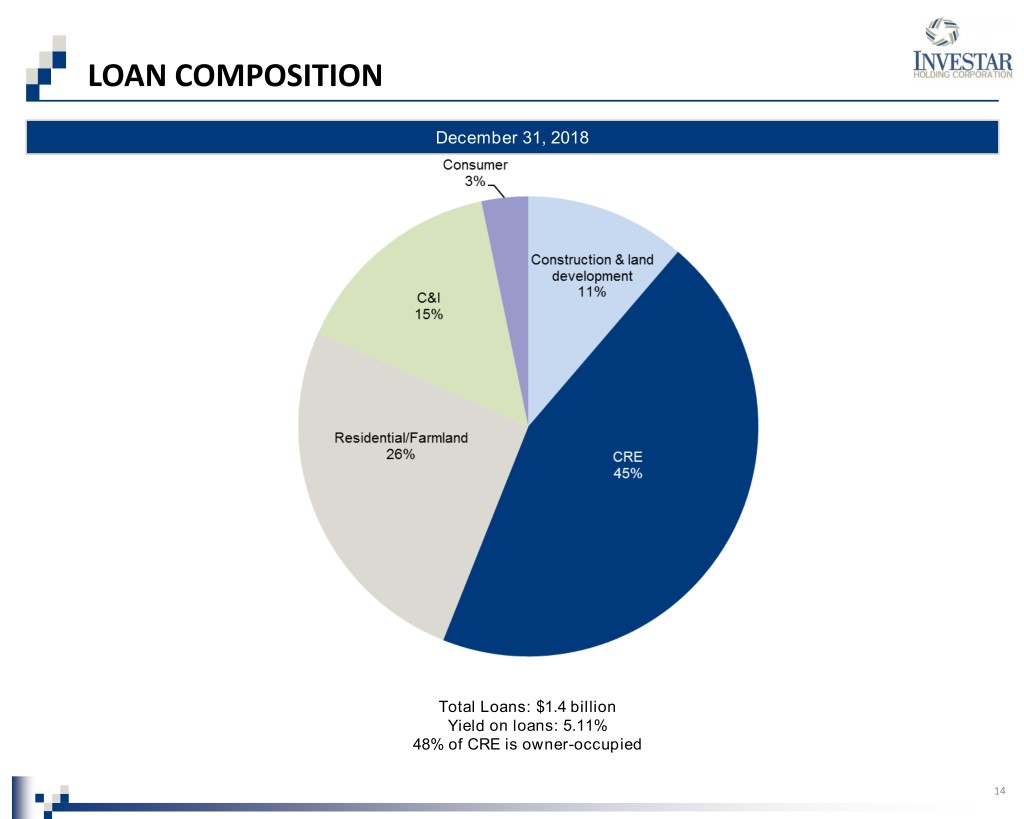

LOAN COMPOSITION 2016 2017 2018 Increase/(Decrease) (dollars in thousands) Amount % Amount % Amount % Amount % Mortgage loans on real estate Construction and land development $ 90,737 10.2% $ 157,667 12.5% $ 157,946 11.3% $ 279 0.2% 1-4 Family 177,205 19.8 276,922 22.0 287,137 20.5 10,215 3.7 Multifamily 42,759 4.8 51,283 4.1 50,501 3.6 (782) (1.5) Farmland 8,207 0.9 23,838 1.9 21,356 1.5 (2,482) (10.4) Commercial real estate Owner-occupied 180,458 20.2 272,433 21.6 298,222 21.3 25,789 9.5 Nonowner-occupied 200,258 22.4 264,931 21.0 328,782 23.5 63,851 24.1 Commercial and industrial 85,377 9.6 135,392 10.8 210,924 15.1 75,532 55.8 Consumer 108,425 12.1 76,313 6.1 45,957 3.3 (30,356) (39.8) Total loans $ 893,426 100.0% $ 1,258,779 100.0% $ 1,400,825 100.0% $ 142,046 11.3% 13

LOAN COMPOSITION December 31, 2018 Total Loans: $1.4 billion Yield on loans: 5.11% 48% of CRE is owner-occupied 14

LOAN COMPOSITION Business Lending Portfolio1 Total Business Lending Portfolio1: $509.1 million (1) Business lending portfolio includes owner-occupied CRE and C&I loans as of December 31, 2018 15

CREDIT METRICS NPAs / Total Loans + OREO Investar Peers¹ NCOs / Average Loans Investar Peers¹ (1) Peer group consists of UBPR peers produced by the FFIEC and defined by a combination of asset size, number of branches and location in a Metropolitan Statistical Area. 16

DISCIPLINED LENDING Reserves / Total Loans At December 31, 2018: • Reserves / Total Loans¹: 0.67% Reserves / NPLs Provision Expense / NCOs 17

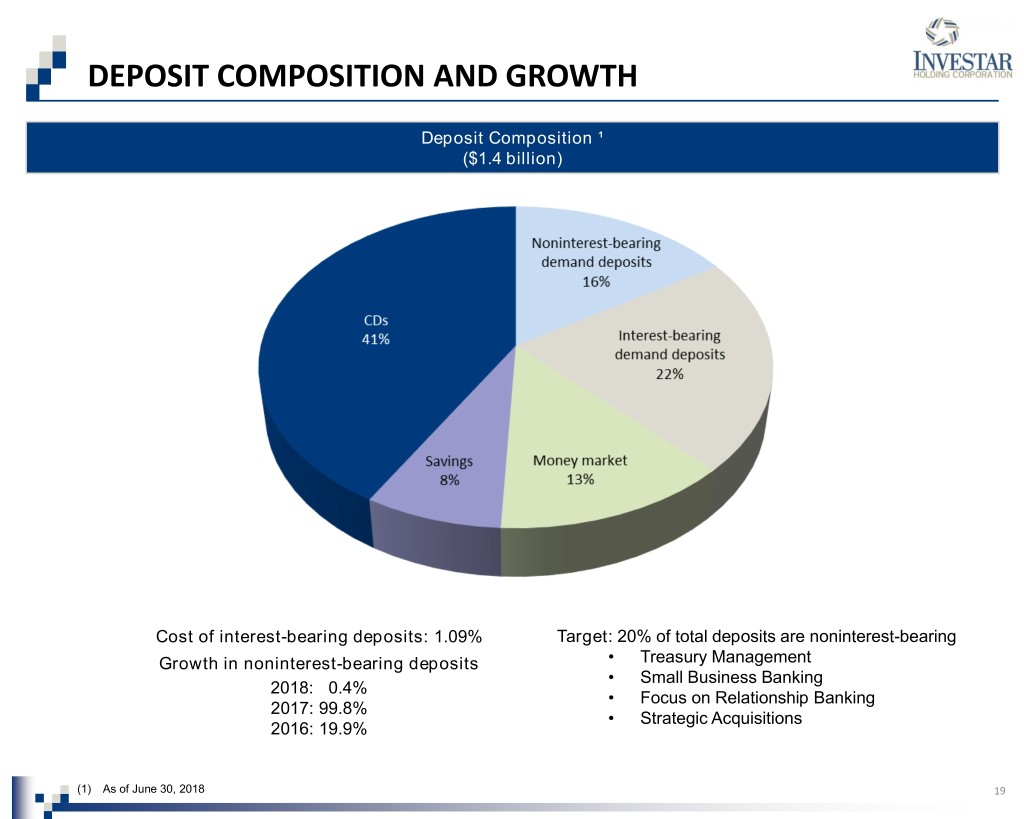

DEPOSIT COMPOSITION AND GROWTH Deposit Composition ¹ ($1.4 billion) Cost of interest-bearing deposits: 1.09% Target: 20% of total deposits are noninterest-bearing Growth in noninterest-bearing deposits • Treasury Management • Small Business Banking 2018: 0.4% • Focus on Relationship Banking 2017: 99.8% • Strategic Acquisitions 2016: 19.9% (1) As of June 30, 2018 19

DEPOSIT COMPOSITION AND GROWTH Total Deposits *Represents the compounded annual growth rate for the five years ended December 31, 2018 20

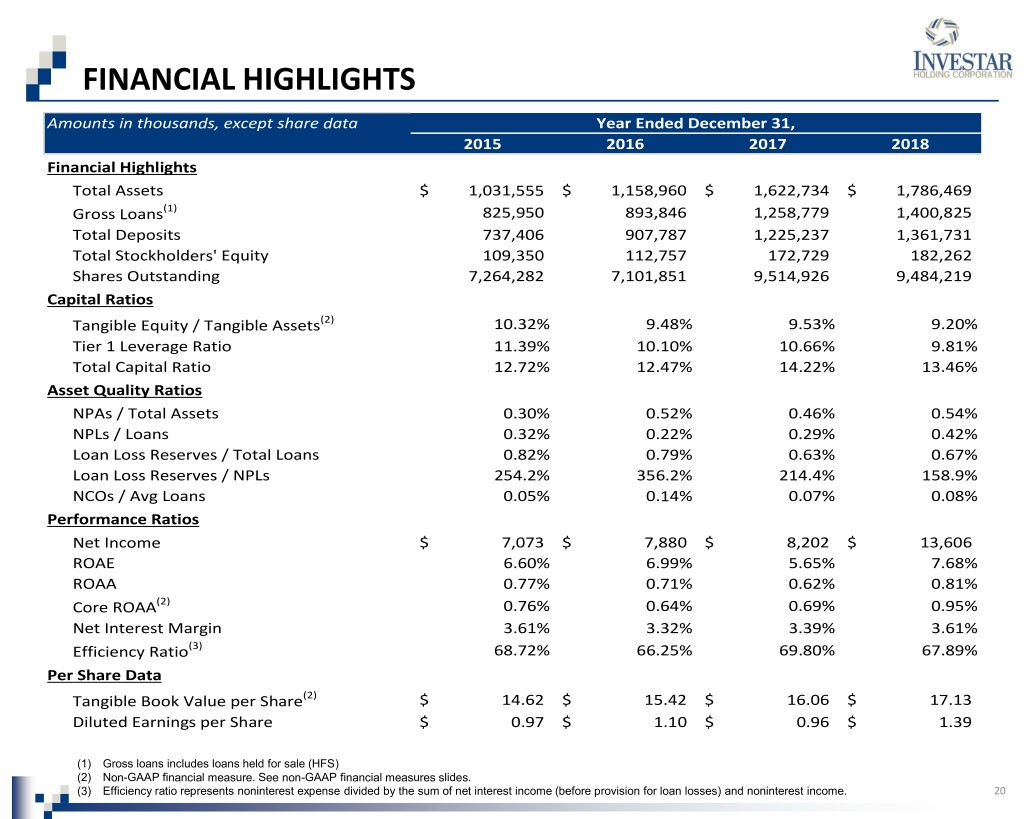

FINANCIAL HIGHLIGHTS Amounts in thousands, except share data Year Ended December 31, 2015 2016 2017 2018 Financial Highlights Total Assets $ 1,031,555 $ 1,158,960 $ 1,622,734 $ 1,786,469 Gross Loans(1) 825,950 893,846 1,258,779 1,400,825 Total Deposits 737,406 907,787 1,225,237 1,361,731 Total Stockholders' Equity 109,350 112,757 172,729 182,262 Shares Outstanding 7,264,282 7,101,851 9,514,926 9,484,219 Capital Ratios Tangible Equity / Tangible Assets(2) 10.32% 9.48% 9.53% 9.20% Tier 1 Leverage Ratio 11.39% 10.10% 10.66% 9.81% Total Capital Ratio 12.72% 12.47% 14.22% 13.46% Asset Quality Ratios NPAs / Total Assets 0.30% 0.52% 0.46% 0.54% NPLs / Loans 0.32% 0.22% 0.29% 0.42% Loan Loss Reserves / Total Loans 0.82% 0.79% 0.63% 0.67% Loan Loss Reserves / NPLs 254.2% 356.2% 214.4% 158.9% NCOs / Avg Loans 0.05% 0.14% 0.07% 0.08% Performance Ratios Net Income $ 7,073 $ 7,880 $ 8,202 $ 13,606 ROAE 6.60% 6.99% 5.65% 7.68% ROAA 0.77% 0.71% 0.62% 0.81% Core ROAA(2) 0.76% 0.64% 0.69% 0.95% Net Interest Margin 3.61% 3.32% 3.39% 3.61% Efficiency Ratio(3) 68.72% 66.25% 69.80% 67.89% Per Share Data Tangible Book Value per Share(2) $ 14.62 $ 15.42 $ 16.06 $ 17.13 Diluted Earnings per Share $ 0.97 $ 1.10 $ 0.96 $ 1.39 (1) Gross loans includes loans held for sale (HFS) (2) Non-GAAP financial measure. See non-GAAP financial measures slides. (3) Efficiency ratio represents noninterest expense divided by the sum of net interest income (before provision for loan losses) and noninterest income. 20

PERFORMANCE METRICS Net Interest Margin Margin(%) Interest Net Core Return on Average Assets 1 Core ROAA (%) ROAA Core (1) Non-GAAP financial measure. See non-GAAP financial measures slides. 21

PERFORMANCE METRICS Expense Ratios 1 Avg. (%) Assets Avg. Core Efficiency (%) Ratio Core Efficiency Noninterest Expense / Noninterest December 31, 2014 2015 2016 2017 2018 Employees 179 165 152 258 255 Locations 11 11 10 20 21 (1) Non-GAAP financial measure. See non-GAAP financial measures slides. 22

PROFITABILITY Net Income and Diluted Earnings Per Share perShare (Thousands) Income Net Net DilutedEarnings Core Diluted Earnings Per Share1 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 $0.34 $0.40 $0.40 $0.41 $0.45 (1) Non-GAAP financial measure. See non-GAAP financial measures slides. 23

INVESTMENT OPPORTUNITY 1 Management • Legacy team with proven industry expertise tied to the Southern Louisiana region • Continue to add experienced bankers in new and existing markets 2 Market • Southern Louisiana focus with complementary new market expansion 3 Growth • Leverage existing infrastructure in core markets • Limited de novo branching • Opportunistic, disciplined acquisition strategy • Focus on relationship banking 4 Asset Quality • Loan portfolio diversity • Disciplined credit philosophy – legacy delinquencies less than 1% 5 Profitability • Expected to increase as investment in infrastructure has already been made 24

APPENDIX 25

NON-GAAP FINANCIAL MEASURES Tangible equity, tangible book value per share, and the ratio of tangible equity to tangible assets are not financial measures recognized under GAAP and, therefore, are considered non-GAAP financial measures. Our management, banking regulators, many financial analysts and other investors use these non-GAAP financial measures to compare the capital adequacy of banking organizations with significant amounts of preferred equity and/or goodwill or other intangible assets, which typically stem from the use of the purchase accounting method of accounting for mergers and acquisitions. Tangible equity, tangible assets, tangible book value per share or related measures should not be considered in isolation or as a substitute for total stockholders’ equity, total assets, book value per share or any other measure calculated in accordance with GAAP. Moreover, the manner in which we calculate tangible equity, tangible assets, tangible book value per share and any other related measures may differ from that of other companies reporting measures with similar names. The following table reconciles, as of the dates set forth below, stockholders’ equity (on a GAAP basis) to tangible equity and total assets (on a GAAP basis) to tangible assets and calculates our tangible book value per share. December 31, Dollar values in thousands except per share amounts 2014 2015 2016 2017 2018 Total Stockholders' Equity - GAAP $ 103,384 $ 109,350 $ 112,757 $ 172,729 $ 182,262 Adjustments Goodwill 2,684 2,684 2,684 17,086 17,424 Other Intangibles 532 491 550 2,840 2,363 Tangible Equity $ 100,168 $ 106,175 $ 109,523 $ 152,803 $ 162,475 Total Assets - GAAP $ 879,354 $ 1,031,555 $ 1,158,960 $ 1,622,734 $ 1,786,469 Adjustments Goodwill 2,684 2,684 2,684 17,086 17,424 Other Intangibles 532 491 550 2,840 2,363 Tangible Assets $ 876,138 $ 1,028,380 $ 1,155,726 $ 1,602,808 $ 1,766,682 Total Shares Outstanding Book Value Per Share $ 14.24 $ 15.05 $ 15.88 $ 18.15 $ 19.22 Effect of Adjustment (0.45) (0.43) (0.46) (2.09) (2.09) Tangible Book Value Per Share $ 13.79 $ 14.62 $ 15.42 $ 16.06 $ 17.13 Total Equity to Total Assets 11.76% 10.60% 9.73% 10.64% 10.20% Effect of Adjustment (0.33) (0.28) (0.25) (1.11) (1.00) Tangible Equity to Tangible Assets 11.43% 10.32% 9.48% 9.53% 9.20% 26

NON-GAAP FINANCIAL MEASURES December 31, Dollar values in thousands except per share amounts 2014 2015 2016 2017 2018 Net interest income (x) $ 26,694 $ 31,458 $ 34,739 $ 42,517 $ 57,370 Provision for loan losses 1,628 1,865 2,079 1,540 2,570 Adjusted net interest income after provision for loan losses 25,066 29,593 32,660 40,977 54,800 Noninterest income (v) 5,860 8,344 5,468 3,815 4,318 Gain (loss) on sale of investment securities, net (340) (489) (443) (292) (14) Loss on sale of other real estate owned, net (230) 105 (13) (27) 24 (Loss) gain on sale of fixed assets, net (3) (15) (1,266) (127) (98) Change in the fair value of equity securities - - - - 267 Core noninterest income (y) 5,287 7,945 3,746 3,369 4,497 Noninterest expense (w) 24,384 27,353 26,639 32,342 41,882 Severance - (226) (26) (82) (293) Acquisition expense - - - (1,868) (1,445) Non-routine legal expense - - - - (89) Impairment on investment in tax credit entity (690) (54) - - - Customer reimbursements - - (584) - - Write down of other real estate owned - - - - (567) Core noninterest expense (z) 23,694 27,073 26,029 30,392 39,488 Core earnings before income tax expense 6,659 10,465 10,377 13,954 19,809 Core income tax expense 2,184 3,456 3,258 4,758 3,809 Core earnings $ 4,475 $ 7,009 $ 7,119 $ 9,196 $ 16,000 Efficiency ratio (w)/(x+v) 74.90% 68.72% 66.25% 69.80% 67.89% Core Efficiency ratio (z)/(x+y) 74.09% 68.85% 67.63% 66.23% 63.83% Core ROAA 0.61% 0.76% 0.64% 0.69% 0.95% Average Assets 734,977 920,267 1,103,712 1,333,667 1,689,623 27

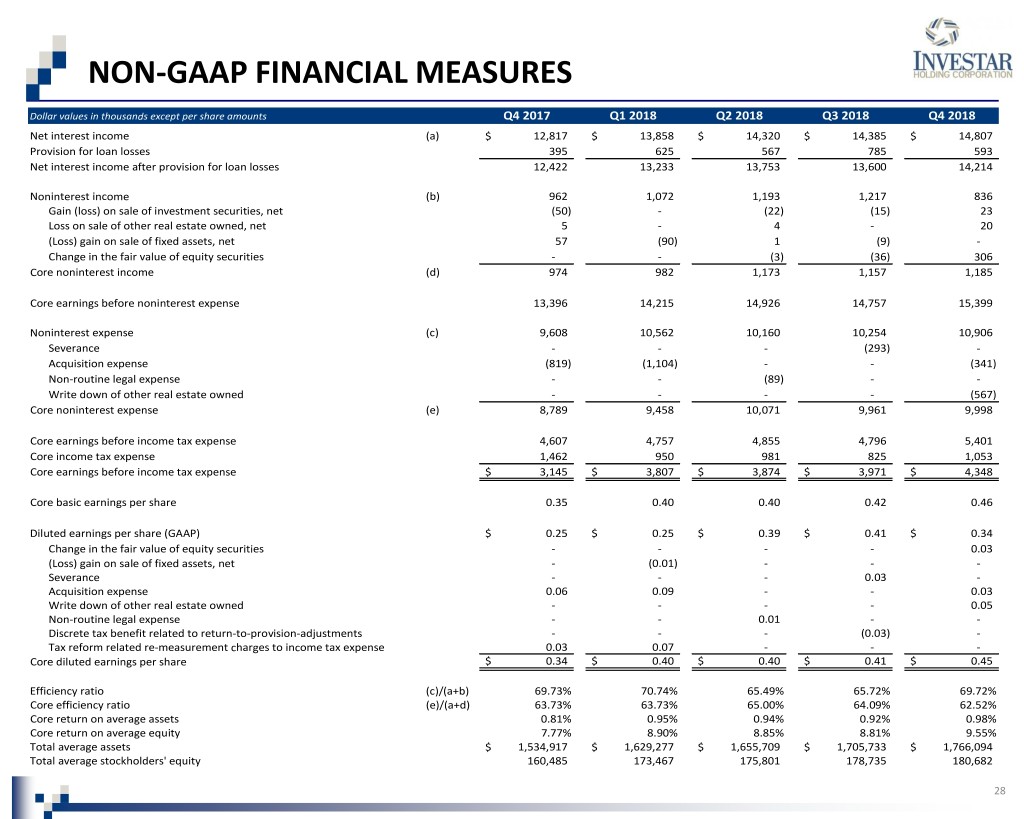

NON-GAAP FINANCIAL MEASURES Dollar values in thousands except per share amounts Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Net interest income (a) $ 12,817 $ 13,858 $ 14,320 $ 14,385 $ 14,807 Provision for loan losses 395 625 567 785 593 Net interest income after provision for loan losses 12,422 13,233 13,753 13,600 14,214 Noninterest income (b) 962 1,072 1,193 1,217 836 Gain (loss) on sale of investment securities, net (50) - (22) (15) 23 Loss on sale of other real estate owned, net 5 - 4 - 20 (Loss) gain on sale of fixed assets, net 57 (90) 1 (9) - Change in the fair value of equity securities - - (3) (36) 306 Core noninterest income (d) 974 982 1,173 1,157 1,185 Core earnings before noninterest expense 13,396 14,215 14,926 14,757 15,399 Noninterest expense (c) 9,608 10,562 10,160 10,254 10,906 Severance - - - (293) - Acquisition expense (819) (1,104) - - (341) Non-routine legal expense - - (89) - - Write down of other real estate owned - - - - (567) Core noninterest expense (e) 8,789 9,458 10,071 9,961 9,998 Core earnings before income tax expense 4,607 4,757 4,855 4,796 5,401 Core income tax expense 1,462 950 981 825 1,053 Core earnings before income tax expense $ 3,145 $ 3,807 $ 3,874 $ 3,971 $ 4,348 Core basic earnings per share 0.35 0.40 0.40 0.42 0.46 Diluted earnings per share (GAAP) $ 0.25 $ 0.25 $ 0.39 $ 0.41 $ 0.34 Change in the fair value of equity securities - - - - 0.03 (Loss) gain on sale of fixed assets, net - (0.01) - - - Severance - - - 0.03 - Acquisition expense 0.06 0.09 - - 0.03 Write down of other real estate owned - - - - 0.05 Non-routine legal expense - - 0.01 - - Discrete tax benefit related to return-to-provision-adjustments - - - (0.03) - Tax reform related re-measurement charges to income tax expense 0.03 0.07 - - - Core diluted earnings per share $ 0.34 $ 0.40 $ 0.40 $ 0.41 $ 0.45 Efficiency ratio (c)/(a+b) 69.73% 70.74% 65.49% 65.72% 69.72% Core efficiency ratio (e)/(a+d) 63.73% 63.73% 65.00% 64.09% 62.52% Core return on average assets 0.81% 0.95% 0.94% 0.92% 0.98% Core return on average equity 7.77% 8.90% 8.85% 8.81% 9.55% Total average assets $ 1,534,917 $ 1,629,277 $ 1,655,709 $ 1,705,733 $ 1,766,094 Total average stockholders' equity 160,485 173,467 175,801 178,735 180,682 28

INCOME STATEMENT December 31, (dollars in thousands, except share data) 2014 2015 2016 2017 2018 INTEREST INCOME Interest and fees on loans $ 29,979 $ 35,076 $ 39,380 $ 47,863 $ 66,750 Interest on investment securities 1,339 2,189 3,565 5,055 6,608 Other interest income 50 75 207 428 533 TOTAL INTEREST INCOME 31,368 37,340 43,152 53,346 73,891 INTEREST EXPENSE Interest on deposits 4,273 5,250 7,182 8,050 11,394 Interest on borrowings 402 632 1,231 2,779 5,127 TOTAL INTEREST EXPENSE 4,675 5,882 8,413 10,829 16,521 NET INTEREST INCOME 26,694 31,458 34,739 42,517 57,370 PROVISION FOR LOAN LOSSES 1,628 1,865 2,079 1,540 2,570 NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 25,066 29,593 32,660 40,977 54,800 NON-INTEREST INCOME Service charges on deposit accounts 305 380 343 767 1,453 Gain on sale of investment securities, net 340 489 443 292 14 Gain on sale of assets, net 3,682 4,278 1,684 154 74 Servicing fees and fee income on serviced loans 885 2,543 2,087 1,482 963 Other operating income 648 654 911 1,120 1,814 TOTAL NON-INTEREST INCOME 5,860 8,344 5,468 3,815 4,318 INCOME BEFORE NON-INTEREST EXPENSE 30,926 37,937 38,128 44,792 59,118 NON-INTEREST EXPENSE Salaries and employee benefits 14,565 16,398 15,609 18,681 25,469 Impairment on investment in tax credit entity 690 54 11 - - Operating expenses 9,129 10,901 11,019 13,661 16,413 TOTAL NON-INTEREST EXPENSE 24,384 27,353 26,639 32,342 41,882 INCOME BEFORE INCOME TAX EXPENSE 6,542 10,584 11,489 12,450 17,236 INCOME TAX EXPENSE 1,145 3,511 3,609 4,248 3,630 NET INCOME $ 5,397 $ 7,073 $ 7,880 $ 8,202 $ 13,606 Basic earnings per share $ 0.98 $ 0.98 $ 1.11 $ 0.96 $ 1.41 Diluted earnings per share $ 0.93 $ 0.97 $ 1.10 $ 0.96 $ 1.39 29