Attached files

| file | filename |

|---|---|

| 8-K - VITRO DIAGNOSTICS, INC. - VITRO DIAGNOSTICS INC | vitro_8k.htm |

Press Release | Source: Vitro Diagnostics, Inc. |

Vitro Biopharma 2018 CEO Shareholder Letter:

Record Revenues from Stem Cell Treatments Lead to 4th Quarter Breakeven Cashflow & Growth Continues in Early 2019.

Golden, Colorado—January 24, 2019—Vitro Diagnostics, Inc. (OTCQB: VODG), dba Vitro Biopharma, announced its CEO letter to its shareholders including discussion of its 2018 results of operations ended October 31st 2018 and its expansion plans for 2019.

Dear Shareholders,

In 2017-2018 we achieved:

Increased allogeneic MSC stem cell therapy sales drove revenue in our Cayman Island and New Zealand clinical trials.

Launched a stem cell based cosmetic device for topical use only through a partnership with Jack Zamora MD, a Denver-based cosmetic surgeon. We private label this product as Limitless MD Cell. We are an FDA-Registered Cosmetic manufacturer for this product and its sales contributed over $100,000 to our 2018 revenues. The company expects this new product to more than triple in its contributions to revenue in 2019.

Expanded our clinical product regulatory compliance leading to ISO 9001 certification in early 2019. This complements our clinical laboratory (CLIA) registration and cGMP/FDA compliant laboratory. Additional quality certifications are underway for 2019.

During the year we added 4 new US patent applications for our stem cell activation technology and expanded filings for our proprietary stem cell line in the UK for filings in the Cayman Islands, other Caribbean countries and Hong Kong under the umbrella of former British Protectorates.

Expanded our management team and Advisory Board with the addition of Keith Burge as our Director of Sales and Marketing. Dr. Jack Zamora was added to our advisory board to support the development of our new Stem Cell Cosmetic product.

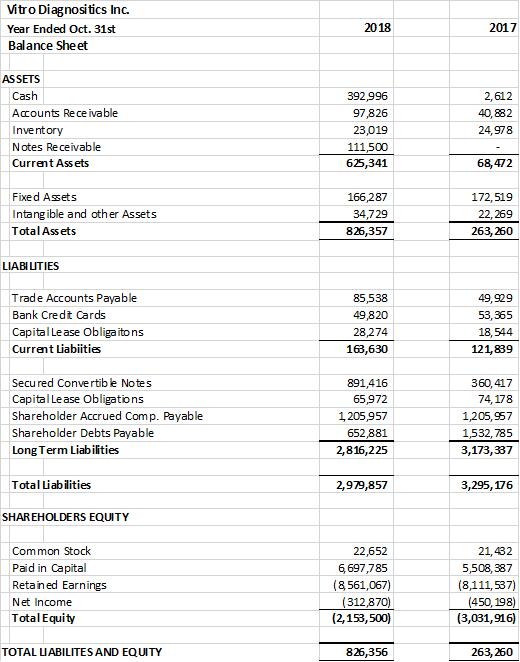

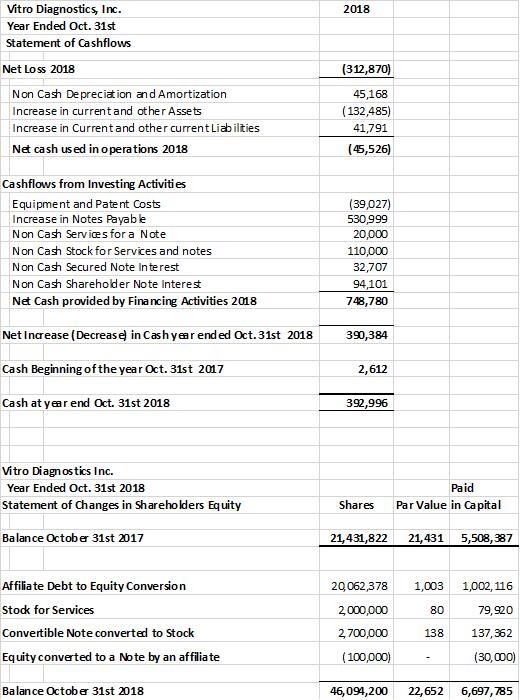

Raised over $500,000 in capital and financing to fund expansion of laboratory operations, new product development, consultants to support ISO 9001 & CLIA certification and the expanded management team. Re-capitalized the company with the financing and with the founder’s debt to equity conversion of $1,003,119 and restatement of outstanding debts as long-term debts to the company. As a result, the company had a healthy current ratio of approx. 4 to 1 at the end of the fiscal year 2018 and $392,996 of cash on hand versus $2,612 in 2017.

The company plans to double its laboratory capacity and clean room capacity in the latter half of 2019.

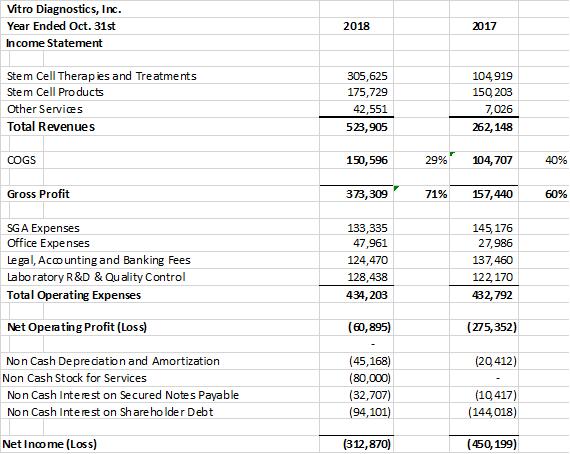

Vitro Biopharma, announced record revenues for the fiscal year ended October 31st 2018 of $523,905 vs. $262,148 in 2017 based on the expansion of stem cell therapies and treatments of $305,625 in 2018 vs. $104,919 in 2017. Total stem cell revenues were up approximately 300% from 2017. This represented 58% of total revenue derived from stem cell treatments in the fiscal year ended October 31st 2018 versus 40% in 2017. The growth in stem cell treatment revenues is expected to comprise over 70% of the company’s Revenues in 2019. The company also experienced a significant improvement in its operating loss going from an Operating loss of ($275,352) in 2017 to ($60,895) in 2018.

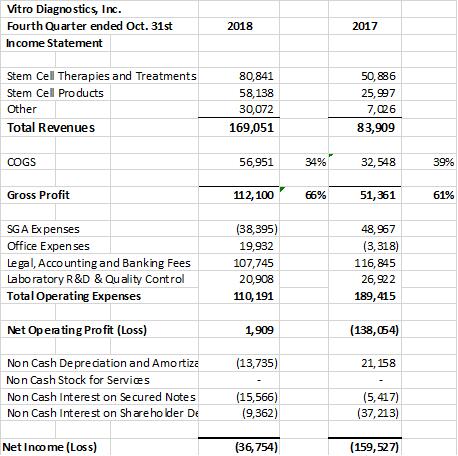

In the 4th quarter of 2018 the company had record quarterly revenues of $169,051 versus $83,909 in 2017. The company experienced a break even cashflow quarter of $1,909 in the fourth quarter ended October 31st 2018. The financial statements (unaudited) for 2018 & 2017 are summarized below. The Company converted short term debt to long term debt; raised over $500,000 during the year and reduced overall debts when offset by $392,996 of cash on hand in 2018 versus $2,612 of cash on hand in 2017. Overall the company’s profit margins were 71% for 2018 up from 60% in 2017. The stem cell revenues continue to improve overall margins that translated into an increased gross profit of $373,309 in 2018 versus $157,440 in 2017. As a result, the companies’ sales are starting to support its overall operations with only a ($60,895) Net Operating profit ($Loss) in 2018 versus ($275,352) in the prior year 2017.

The company experienced growth in its allogenic MSC product for clinical therapies being conducted in New Zealand under right to try laws (Section 25 of the Medicines Act of 1981).

The company also saw growth with its Cayman Island Partnership with DVCStem www.dvcstem.com under oversight by the Cayman Island IRB Approval #: IRCM-SI-181.

The company launched a new stem cell-based cosmetic device product in 2018 and added Dr. Jack Zamora, MD to its scientific advisory board. Our joint development arrangement contributed over $100,000 to stem cell revenue treatments in 2018 vs none in 2017. The company expects sales of this new product to increase substantially in 2019. www.jackzamoramd.com

Our Stem Cell research products continued to grow providing $179,729 of revenues in 2018 up from $150,203 a 20% year over year increase. The company is experiencing growth in its international customers from prestigious Universities and Medical Institutions. We expect these products to continue to grow as the research community continues to expand its stem cell research and clinical trials of stem cell regenerative medicine. (Our customer base includes such prestigious names as Harvard University; Cambridge University; The University of France; the Mayo Clinic, Pfizer, amongst others)

The company put out a major effort in 2018 to upgrade our quality systems to the elite status of a biologics manufacturer with ISO 9001:2015 certification. The company is pursuing new international sources of stem cell therapies and many foreign ministries require ISO9001 Certification to conduct business. We expect the cost of being ISO9001 certified to be more than offset by these new revenues in the latter half of 2019 and into 2020.

We continue to expand our intellectual property (IP) that includes a novel US stem cell line patent application for use in numerous regenerative medicine applications including auto-immune disorders such as MS, Lupus; cardiovascular disease, musculoskeletal conditions such as OA and various neurodegenerative disorders. Additional patent applications had been previously filed for treatment of neurological disorders by activation of stem cells within the brain. Our IP now allows proprietary therapies of neurological conditions including Parkinson’s disease, Alzheimer’s disease and traumatic brain injury (TBI), etc. Neurological conditions have been under-treated for many years while stem cell therapies offer potentially effective solutions. Hence, we plan commercialization of TBI therapies in 2019. There are more than 1.7 million TBI patients per year in the US while therapy consists of life-saving measures followed by rehabilitation with minimal therapeutic options. Recent advances in stroke recovery by stem cell therapy highlight the regenerative potential of stem cell therapies for neurodegenerative conditions and support the concept of brain regeneration by stem cell therapy. Our TBI initiative involves stem cell activation therapy and advanced diagnostics including biomarker profiling and brain scans. www.vitrobiopharma.com/blog/

Current management has decided to focus our operational resources to achieve rapid revenue growth & profitability in our high value-added Stem Cell therapies while seeking appropriate strategic alliances and partnerships. Our eventual goal is to be acquired by a larger firm with complimentary resources to those of the Company. The company has made a strategic decision to focus its resources on expanding its revenue base driven by internal growth and limited capital raising. This decision will minimize shareholder dilution while building the company’s market value. We intend to return to SEC reporting compliance once cashflow from operations supports the added burden of SEC legal counsel and SEC auditors. Until then the company will provide unaudited quarterly and yearly financial reports and the publication of material transactions while maintaining future options to becoming fully reporting with the SEC if required or be acquired in an acquisition transaction.

In summary, Vitro Biopharma is advancing as a key player in regenerative medicine with 10-years’ experience in the development and commercialization of stem cell products for research, recognized by a “Best in Practice Technology Innovation Leadership award for Stem Cell Tools and Technology” www.vitrobiopharma.com/frost-sullivan and a growing track record of successful translation to therapy. We plan to leverage our proprietary and patented technology platform to the establishment of international Stem Cell Centers of Excellence while operating in full compliance of FDA and other applicable regulations.

Sincerely yours,

James R. Musick, PhD.

President, CEO & Chairman of the Board

Forward-Looking Statements

Statements herein regarding financial performance have not yet been reported to the SEC nor reviewed by the Company’s auditors. Certain statements contained herein and subsequent statements made by and on behalf of the Company, whether oral or written may contain “forward-looking statements”. Such forward looking statements are identified by words such as “intends,” “anticipates,” “believes,” “expects” and “hopes” and include, without limitation, statements regarding

the Company’s plan of business operations, product research and development activities, potential contractual arrangements, receipt of working capital, anticipated revenues and related expenditures. Factors that could cause actual results to differ materially include, among others, acceptability of the Company’s products in the market place, general economic conditions, receipt of additional working capital, the overall state of the biotechnology industry and other factors set forth in the Company’s filings with the Securities and Exchange Commission. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking statements. Except as otherwise required by applicable securities statutes or regulations, the Company disclaims any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT:

Dr. James Musick

Chief Executive Officer

Vitro Biopharma

(303) 999-2130 Ext. 3

E-mail: jim@vitrobiopharma.com

Source: Vitro Diagnostics, Inc.

The company provides its financial information for investor information purposes only. The results published however are not audited or necessarily SEC and/or GAAP compliant.

The company provides its financial information for investor information purposes only. The results published however are not audited or necessarily SEC and/or GAAP compliant.

The company provides its financial information for investor information purposes only. The results published however are not audited or necessarily SEC and/or GAAP compliant.

The fourth quarter financial statement adjustments include a recategorization of accounting consulting expenses from SGA to Legal, Accounting and Banking fees of approximately $120,000 as a year end category reassignment. Depreciation in the 4th quarter was also adjusted to reflect the reconciliation to depreciation being included for 2017 in SGA but broken out on the prior quarterly disclosures as a separately reported non cash line item by quarter but not at the 2017 year end.

The company provides its financial information for investor information purposes only. The results published however are not audited or necessarily SEC and/or GAAP compliant.