Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Alpha Metallurgical Resources, Inc. | contura8-k012919.htm |

Exhibit 99.1 Contura Energy: Non-Deal Roadshow January 2019 1

Forward Looking Statements This document includes forward-looking statements. These forward-looking statements are based on Contura's expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Contura’s control. Examples of forward-looking statements include, but are not limited to: • the financial performance of the company following the mergers with Alpha Natural Resources Holdings, Inc. and ANR, Inc.; • our liquidity, results of operations and financial condition; • depressed levels or declines in coal prices; • worldwide market demand for coal, steel, and electricity, including demand for U.S. coal exports, and competition in coal markets; • utilities switching to alternative energy sources such as natural gas, renewables and coal from basins where we do not operate; • reductions or increases in customer coal inventories and the timing of those changes; • our production capabilities and costs; • inherent risks of coal mining beyond our control; • changes in, interpretations of, or implementations of domestic or international tax or other laws and regulations, including the Tax Cuts and Jobs Act and its related regulations. • changes in domestic or international environmental laws and regulations, and court decisions, including those directly affecting our coal mining and production, and those affecting our customers’ coal usage, including potential climate change initiatives; • our relationships with, and other conditions affecting, our customers, including the inability to collect payments from our customers if their creditworthiness declines; • changes in, renewal or acquisition of, terms of and performance of customers under coal supply arrangements and the refusal by our customers to receive coal under agreed contract terms; • our ability to obtain, maintain or renew any necessary permits or rights, and our ability to mine properties due to defects in title on leasehold interests; • attracting and retaining key personnel and other employee workforce factors, such as labor relations; • funding for and changes in employee benefit obligations; • cybersecurity attacks or failures, threats to physical security, extreme weather conditions or other natural disasters; • reclamation and mine closure obligations; • our assumptions concerning economically recoverable coal reserve estimates; • our ability to negotiate new United Mine Workers of America wage agreements on terms acceptable to us, increased unionization of our workforce in the future, and any strikes by our workforce; • disruptions in delivery or changes in pricing from third party vendors of key equipment and materials that are necessary for our operations, such as diesel fuel, steel products, explosives and tires; • inflationary pressures on supplies and labor and significant or rapid increases in commodity prices; • railroad, barge, truck and other transportation availability, performance and costs; • disruption in third party coal supplies; • the consummation of financing or refinancing transactions, acquisitions or dispositions and the related effects on our business and financial position; • our indebtedness and potential future indebtedness; • our ability to generate sufficient cash or obtain financing to fund our business operations; and • our ability to obtain or renew surety bonds on acceptable terms or maintain our current bonding status. Forward-looking statements in this document or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Contura to predict these events or how they may affect Contura. Except as required by law, Contura has no duty to, and does not intend to, update or revise the forward-looking statements in this document or elsewhere. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this document may not occur. Third Party Information This presentation, including certain forward-looking statements herein, includes information obtained from third party sources that we believe to be reliable. However, we have not independently verified this third party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any third party data contained in this presentation, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed in detail in our filings with the U.S. Securities and Exchange Commission. We assume no obligation to revise or update this third party information to reflect future events or circumstances. 2

Contura Snapshot Prep Plants ▪ Largest met coal producer in the United States with a Pennsylvania premier, low-cost NAPP steam coal operation and a high Export Terminal quality CAPP steam business ▪ Operating footprint of 12 preparation plants with 23 Maryland underground mines and 9 surface mines ▪ Strong logistics platform backed by its 65% stake in the DTA West Virginia coal export terminal (14.3 million tons of attributable capacity) ▪ Operations in close proximity to CSX and Norfolk Southern rail lines as well as various river ports Virginia ▪ Sizeable reserve base with access to 1,354 million tons, DTA including 669 million tons of metallurgical coal, as of 12/31/17 Significant Growth in Met Coal Platform (million tons sold) 13.0 13.2 - 14.3 1.4 1.0 - 1.5 8.9 5.7 7.4 4.9 12.2 - 12.8 1.7 4.0 4.0 4.2 2016 (2) 2017 Preliminary 2018 Results 2019 Guidance (3) Contura Alpha Trading & Logistics (1) Based on midpoint of 2019E guidance. (2) Inclusive of Predecessor and Successor Contura periods during 2016. 3 (3) 2019 guidance excludes NAPP crossover met volumes.

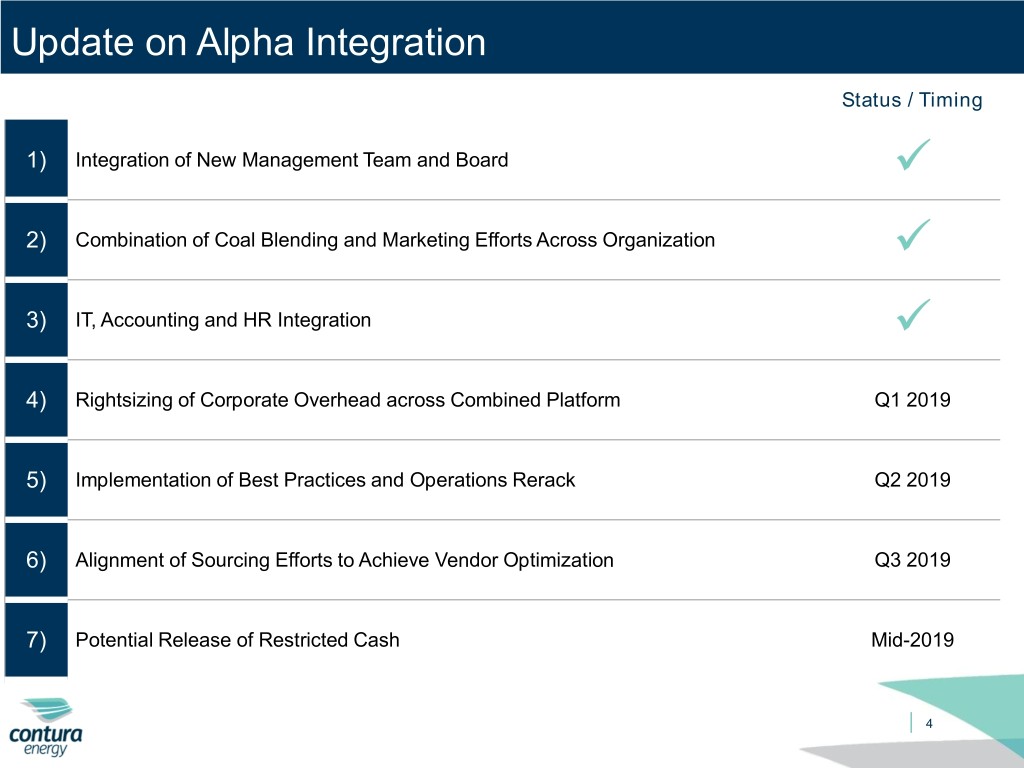

Update on Alpha Integration Status / Timing 1) Integration of New Management Team and Board ✓ 2) Combination of Coal Blending and Marketing Efforts Across Organization ✓ 3) IT, Accounting and HR Integration ✓ 4) Rightsizing of Corporate Overhead across Combined Platform Q1 2019 5) Implementation of Best Practices and Operations Rerack Q2 2019 6) Alignment of Sourcing Efforts to Achieve Vendor Optimization Q3 2019 7) Potential Release of Restricted Cash Mid-2019 4

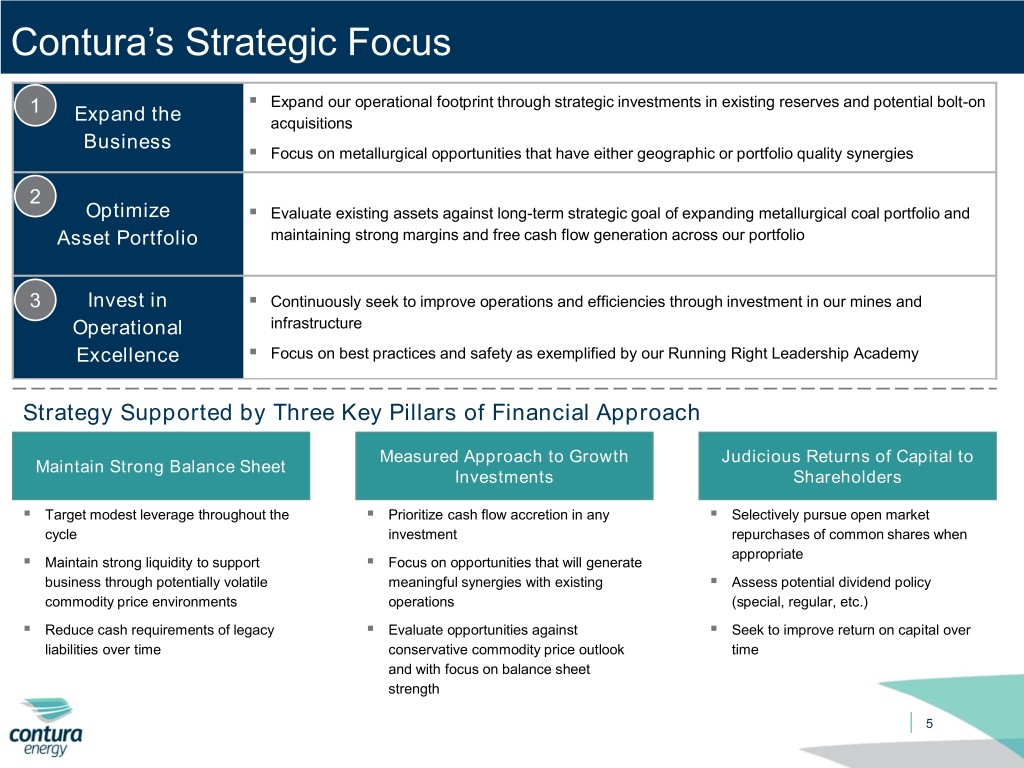

Contura’s Strategic Focus ▪ 1 Expand our operational footprint through strategic investments in existing reserves and potential bolt-on Expand the acquisitions Business ▪ Focus on metallurgical opportunities that have either geographic or portfolio quality synergies 2 Optimize ▪ Evaluate existing assets against long-term strategic goal of expanding metallurgical coal portfolio and Asset Portfolio maintaining strong margins and free cash flow generation across our portfolio ▪ 3 Invest in Continuously seek to improve operations and efficiencies through investment in our mines and Operational infrastructure ▪ Excellence Focus on best practices and safety as exemplified by our Running Right Leadership Academy Strategy Supported by Three Key Pillars of Financial Approach Measured Approach to Growth Judicious Returns of Capital to Maintain Strong Balance Sheet Investments Shareholders ▪ Target modest leverage throughout the ▪ Prioritize cash flow accretion in any ▪ Selectively pursue open market cycle investment repurchases of common shares when appropriate ▪ Maintain strong liquidity to support ▪ Focus on opportunities that will generate business through potentially volatile meaningful synergies with existing ▪ Assess potential dividend policy commodity price environments operations (special, regular, etc.) ▪ Reduce cash requirements of legacy ▪ Evaluate opportunities against ▪ Seek to improve return on capital over liabilities over time conservative commodity price outlook time and with focus on balance sheet strength 5

Investment Highlights 1) Largest and Most Diverse U.S. Metallurgical Coal Producer 2) Portfolio of Long-Lived Mines and Substantial Organic Growth Opportunities 3) Advantaged Sales & Logistics Platform Serving Both Domestic and International Markets 4) Well Positioned to Grow Through Accretive Acquisitions 5) Proven Track Record of Returning Capital to Shareholders 6) Favorable Market Dynamics Support Long-Term Pricing 7) Well Capitalized Balance Sheet With Manageable Legacy Liabilities 8) Highly Attractive and Opportunistic Timing to Invest in Contura 6

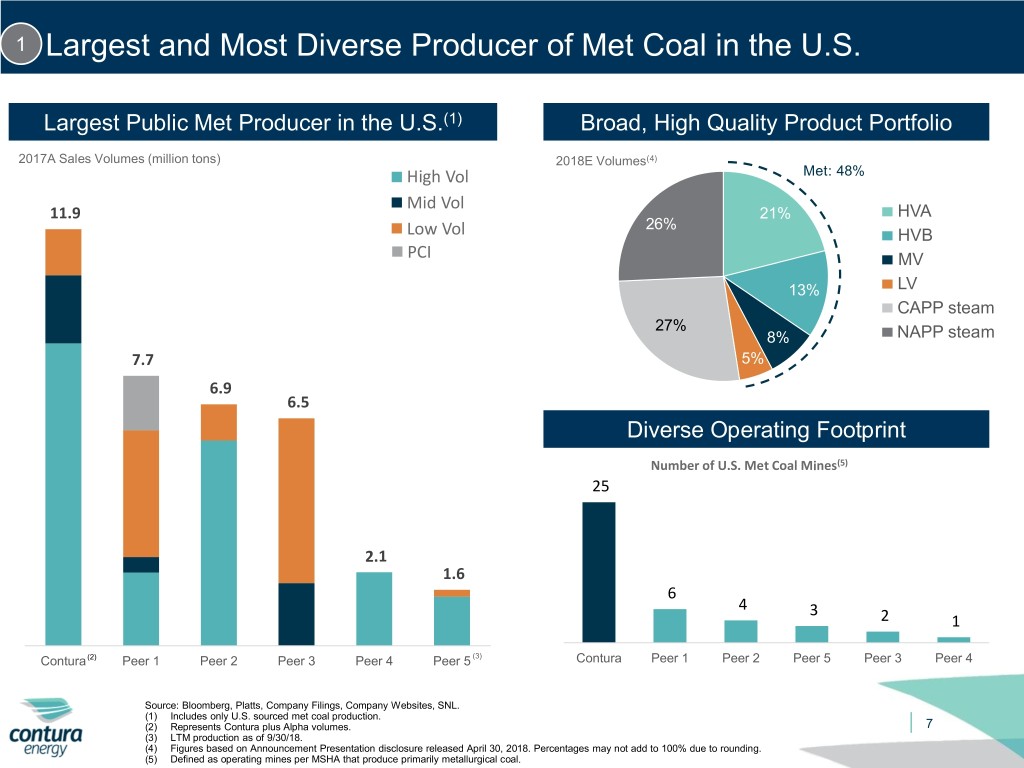

1 Largest and Most Diverse Producer of Met Coal in the U.S. Largest Public Met Producer in the U.S.(1) Broad, High Quality Product Portfolio 2017A Sales Volumes (million tons) 2018E Volumes(4) High Vol Met: 48% Mid Vol 11.9 21% HVA 26% Low Vol HVB PCI MV 13% LV CAPP steam 27% 8% NAPP steam 7.7 5% 6.9 6.5 Diverse Operating Footprint Number of U.S. Met Coal Mines(5) 25 2.1 1.6 6 4 3 2 1 Contura (2) Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 (3) Contura Peer 1 Peer 2 Peer 5 Peer 3 Peer 4 Source: Bloomberg, Platts, Company Filings, Company Websites, SNL. (1) Includes only U.S. sourced met coal production. (2) Represents Contura plus Alpha volumes. 7 (3) LTM production as of 9/30/18. (4) Figures based on Announcement Presentation disclosure released April 30, 2018. Percentages may not add to 100% due to rounding. (5) Defined as operating mines per MSHA that produce primarily metallurgical coal.

2 Long Mine Lives and Substantial Organic Growth Opportunities Met Reserve Life of Public U.S. Met Coal Producers Implied Reserve Life (Years)(1) 60+ 56 31 28 18 12 Peer 5 Contura Peer 1 Peer 4 Peer 3 Peer 2 Overview of Metallurgical Growth Projects Est. Production Development Project (2) Timing Quality (mm tons / year) Pennsylvania Freeport Panther Eagle 0.3 – 0.5 Q1 2019 HVA Black Eagle 0.3 – 0.5 Q2 2019 HVA West Virginia Road Fork 52 0.6 – 0.8 Q4 2019 LV Black Eagle / Panther Eagle Virginia Deep Mine #42 1.0 – 1.5 TBD MV Road Fork 52 Freeport 2.5 – 3.5 TBD HVB Deep Mine #42 Source: Bloomberg, Platts, Company Filings, Company Websites, SNL. 8 (1) Calculated as metallurgical reserves divided by 2017A production. Excludes idled and development projects. Data is based on U.S. based mines only. (2) Some production from organic projects will be used to replace existing depleting mines.

3 Advantaged Sales & Logistics Platform ▪ Contura’s Sales & Logistics platform is anchored by its stake in the world-class Dominion Terminal Associates, which facilitates access to international coal markets, reaching South American, European, Middle Eastern, Asian and Indian customers (60%-75% of met shipments are exported, primarily through DTA) ▪ Contura also serves a broad range of domestic steel and coke producers selling ~4 million tons of met coal to the domestic steel industry annually (25%-40% of met coal is sold domestically) Capabilities of DTA and Trading and Logistics Access to Extensive Logistics Network Port (Location) ▪ Hampton Roads (Newport News, Virginia) Pennsylvania DTA Ownership ▪ 65% (35% owned by ARCH) Maryland DTA Shipping Capacity ▪ 22 million tons (14.3 million attributable) West Virginia DTA Ground Storage ▪ 1.7 million tons (1.1 million attributable) Capacity ▪ Purchase met coal from CAPP producers (~1 Virginia million tons annually) for sale to international Trading and Logistic markets Revenue Model ▪ Blend captive and 3rd party coal at DTA to achieve broad portfolio of coal qualities required by international markets CSX Rail NS Rail Prep Plants DTA Terminal Coal River CSX NS Logistics Access Type Barge Cumberland S ✓ ✓ ✓ McClure/Toms Creek M ✓ ✓ Bandmill M ✓ Delbarton S ✓ Inman Admiral S ✓ ✓ Kepler M ✓ Kingston M ✓ ✓ ✓ Litwar M ✓ Mammoth S ✓ ✓ Marfork M ✓ ✓ Power Mountain M ✓ M = Metallurgical S = Steam 9

4 Well Positioned to Grow Through Accretive Acquisitions ▪ Contura is well positioned to Contura Met Prep Plants Regional Met Competitor Complexes expand its metallurgical operating position in the Appalachia region due to its geographic footprint, financial flexibility and market knowledge gained from the T&L Pennsylvania business ▬ The acquisition of Alpha was a key step in growing these Maryland capabilities ▪ Other US competitors are primarily focused on different basins or preoccupied with managing West Virginia balance sheets ▪ Synergies and cash flow accretion Kentucky Virginia will be a focus of any potential investment 10

5 Proven Track Record of Returning Capital to Shareholders ▪ On July 7, 2017, Contura announced that it would pay a special dividend of $8.997 per share, Dividend equal to $100.7 million(1) ▪ On September 26, 2017, Contura announced that it commenced a modified dutch auction tender offer in a price range between $58.00 - $64.00 per share for an aggregate value of $31.8 million Tender Offer tender ▪ On December 21, 2017, the results of the tender offer were finalized resulting in the repurchase of 530,000 shares at $60.00 per share ▪ In December 2018, Contura announced and completed a share repurchase plan for $15 million of the Company’s shares Share Repurchase ▪ Plan represents all available capacity currently allowed under the company’s credit agreement ▪ Beginning with the first quarter of 2019, Contura expects to begin to build additional restricted payment capacity based upon excess cash flows generated during the quarter 11 (1) Includes both the Dividend and the Dividend Equivalent.

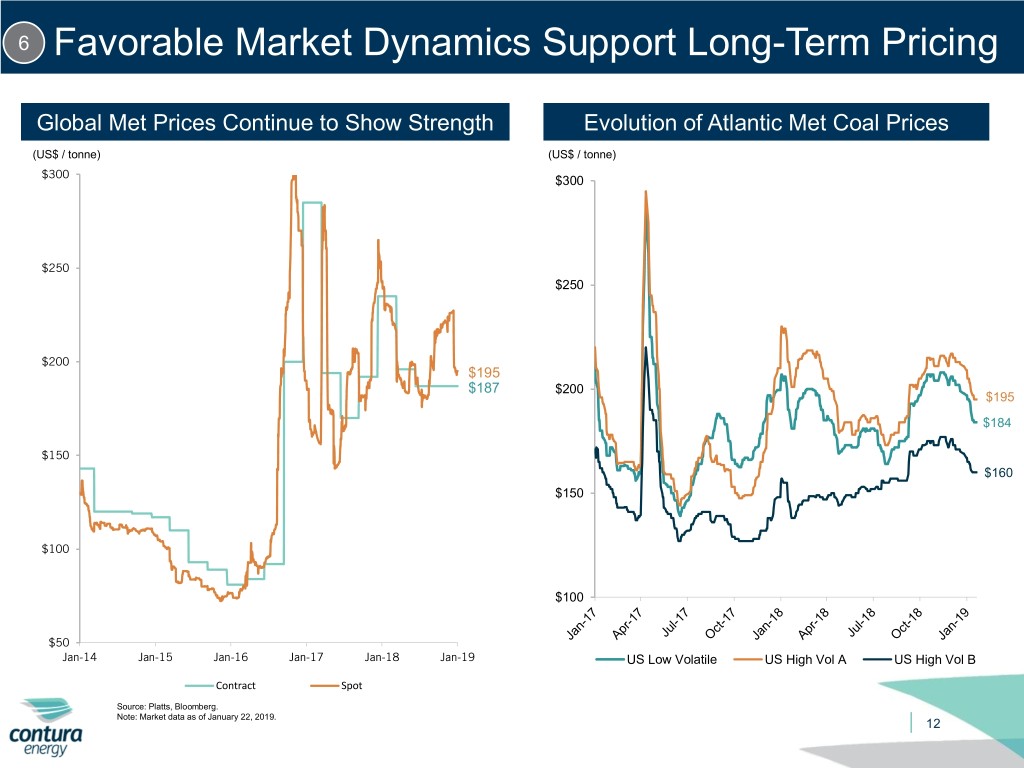

6 Favorable Market Dynamics Support Long-Term Pricing Global Met Prices Continue to Show Strength Evolution of Atlantic Met Coal Prices (US$ / tonne) (US$ / tonne) $300 $300 $250 $250 $200 $195 $187 $200 $195 $184 $150 $160 $150 $100 $100 $50 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 US Low Volatile US High Vol A US High Vol B Contract Spot Source: Platts, Bloomberg. Note: Market data as of January 22, 2019. 12

7 Well Capitalized Balance Sheet with Manageable Legacy Liabilities ▪ Strong Capitalization(1) Run rate cash flow obligations of legacy liabilities ~$60 million ▪ Contura’s Acquisition Related Liabilities and Alpha’s Contingent US$ Millions June 30, 2018 Revenue Obligation expire in 2021 and 2023, respectively Unrestricted Cash $190 ▪ ~$380 million(1) of restricted cash and deposits supporting the Term Loan $550 liabilities LCC Notes $93 ▬ Meaningful restricted cash releases expected over the next several months as part of the integration of Alpha Other $5 ▬ Tax refund of ~$50 million expected in Q4 2019 – Q1 2020 Total Debt $648 Net Debt $458 Net Debt + Legacy Liabilities in Line with Peers (Net Debt + Legacy Liabilities / 2019E EBITDA(3)) Restricted Cash and Deposits $379 1.8x Workers’ Comp, Black Lung & Insurance $295 1.4x 1.3x Pension & Post-Retirements Benefits 212 1.0x Asset Retirement Obligation 273 Other Legacy Liabilities(2) 95 Total Legacy Liabilities $875 Net Legacy Liabilities $496 Net Liabilities Contura Peer 3 Peer 2 Peer 4 (4) $954 $461 $424 $1,073 Net Debt + Legacy Liabilities $954 ($ million) Source: Company Filings and Capital IQ. Note: Market data as of January 22, 2019. (1) Pro Forma amounts as of June 30, 2018. These amounts will be adjusted once the Company finalizes acquisition accounting procedures. LCC notes and Term Loan stated at principal amount without unamortized discount. 13 (2) Includes Contura’s Acquisition-Related Liabilities and Alpha’s Contingent Revenue Obligations. (3) 2019E EBITDA as per broker average estimates. (4) Net Liabilities defined as Net Debt + Legacy Liabilities which included Worker’s Compensation, Black Lung, Pension, AROs and Acquisition Related Liabilities.

8 Highly Attractive and Opportunistic Time to Invest in Contura Trading Multiples Relative Discount Peers(1) S&P 500 MSCI Metals & Mining Index 2019E 28% 61% 36% 9.7x 2020E 35% 40% 1% 9.0x 5.4x 5.9x 5.5x 4.6x 4.6x 4.2x 3.8x 3.8x 3.1x 3.5x Contura Peabody Arch Warrior S&P 500 MSCI Metals & Mining Index 2019E 2020E 2019E Free Cash Flow Yield(2) Relative Yield Spread Peers(1) S&P 500 MSCI Metals & Mining Index 2019E 19% 10% 18% 22% 20% 19% 18% 18% 10% Contura Peabody Warrior Arch S&P 500 MSCI Metals & Mining Index Source: Company filings and Capital IQ. Market data as of January 22, 2019. (1) Peers defined as the average multiples of Warrior, Peabody and Arch (2) Free Cash Flow Yield defined as unlevered free cash flow divided by market cap. Contura cash flow net of payments for acquisition 14 related obligations, contingent revenue obligations and LCC obligations.

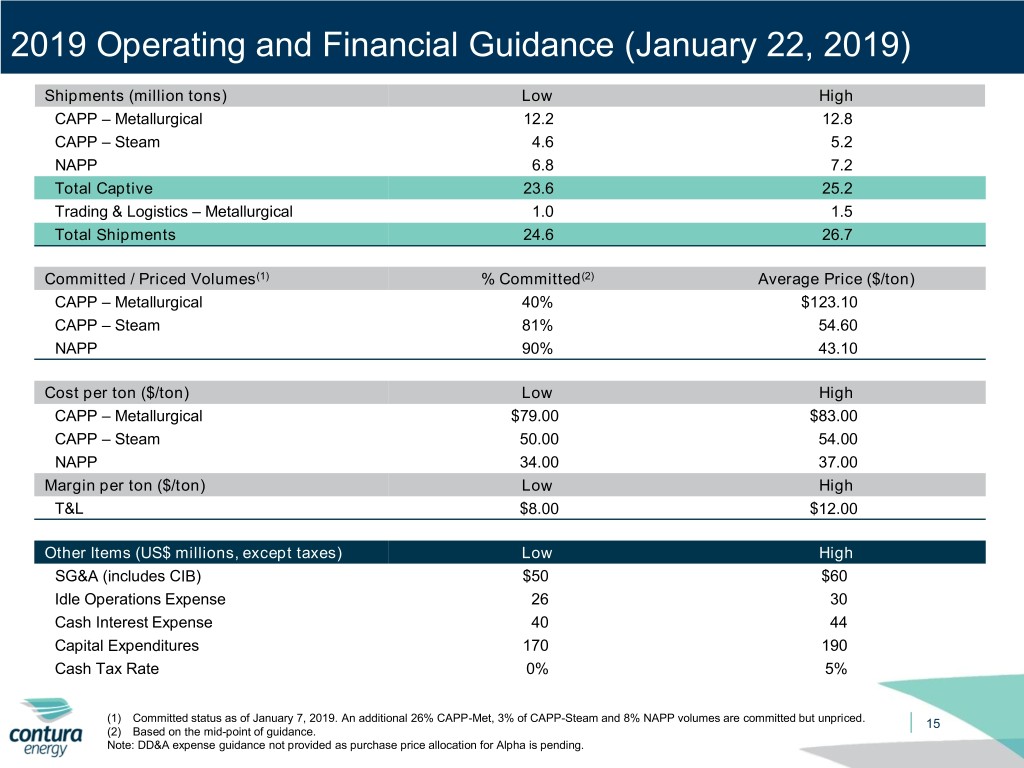

2019 Operating and Financial Guidance (January 22, 2019) Shipments (million tons) Low High CAPP – Metallurgical 12.2 12.8 CAPP – Steam 4.6 5.2 NAPP 6.8 7.2 Total Captive 23.6 25.2 Trading & Logistics – Metallurgical 1.0 1.5 Total Shipments 24.6 26.7 Committed / Priced Volumes(1) % Committed(2) Average Price ($/ton) CAPP – Metallurgical 40% $123.10 CAPP – Steam 81% 54.60 NAPP 90% 43.10 Cost per ton ($/ton) Low High CAPP – Metallurgical $79.00 $83.00 CAPP – Steam 50.00 54.00 NAPP 34.00 37.00 Margin per ton ($/ton) Low High T&L $8.00 $12.00 Other Items (US$ millions, except taxes) Low High SG&A (includes CIB) $50 $60 Idle Operations Expense 26 30 Cash Interest Expense 40 44 Capital Expenditures 170 190 Cash Tax Rate 0% 5% (1) Committed status as of January 7, 2019. An additional 26% CAPP-Met, 3% of CAPP-Steam and 8% NAPP volumes are committed but unpriced. 15 (2) Based on the mid-point of guidance. Note: DD&A expense guidance not provided as purchase price allocation for Alpha is pending.

Appendix January 2019 16

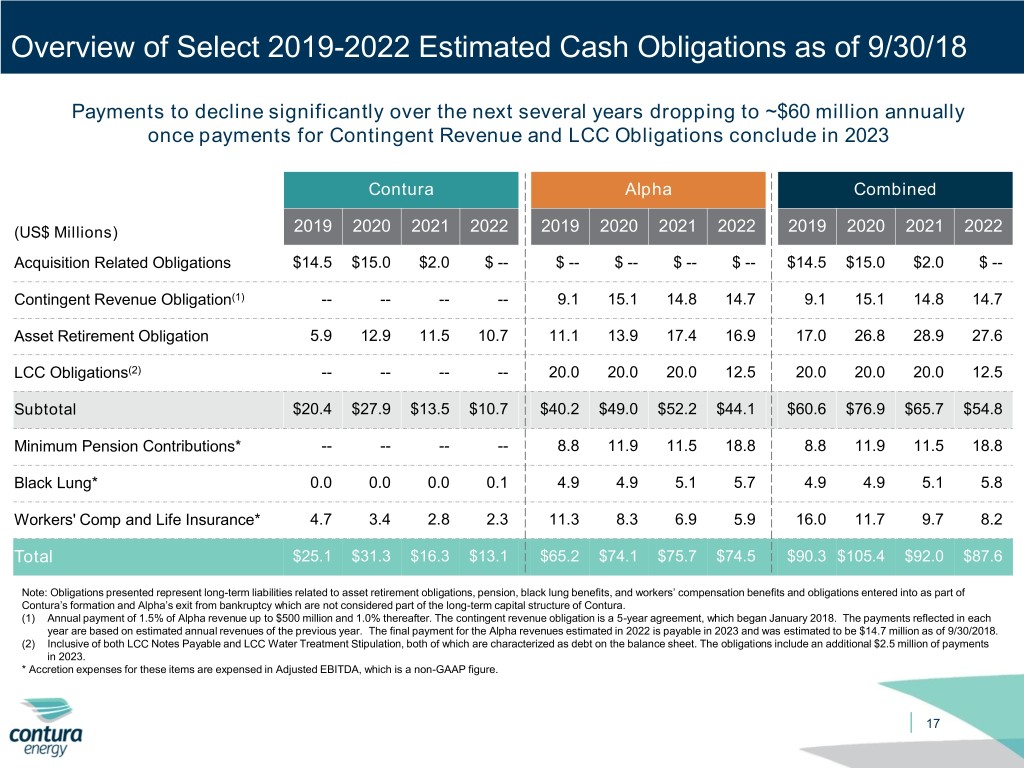

Overview of Select 2019-2022 Estimated Cash Obligations as of 9/30/18 Payments to decline significantly over the next several years dropping to ~$60 million annually once payments for Contingent Revenue and LCC Obligations conclude in 2023 Contura Alpha Combined (US$ Millions) 2019 2020 2021 2022 2019 2020 2021 2022 2019 2020 2021 2022 Acquisition Related Obligations $14.5 $15.0 $2.0 $ -- $ -- $ -- $ -- $ -- $14.5 $15.0 $2.0 $ -- Contingent Revenue Obligation(1) -- -- -- -- 9.1 15.1 14.8 14.7 9.1 15.1 14.8 14.7 Asset Retirement Obligation 5.9 12.9 11.5 10.7 11.1 13.9 17.4 16.9 17.0 26.8 28.9 27.6 LCC Obligations(2) -- -- -- -- 20.0 20.0 20.0 12.5 20.0 20.0 20.0 12.5 Subtotal $20.4 $27.9 $13.5 $10.7 $40.2 $49.0 $52.2 $44.1 $60.6 $76.9 $65.7 $54.8 Minimum Pension Contributions* -- -- -- -- 8.8 11.9 11.5 18.8 8.8 11.9 11.5 18.8 Black Lung* 0.0 0.0 0.0 0.1 4.9 4.9 5.1 5.7 4.9 4.9 5.1 5.8 Workers' Comp and Life Insurance* 4.7 3.4 2.8 2.3 11.3 8.3 6.9 5.9 16.0 11.7 9.7 8.2 Total $25.1 $31.3 $16.3 $13.1 $65.2 $74.1 $75.7 $74.5 $90.3 $105.4 $92.0 $87.6 Note: Obligations presented represent long-term liabilities related to asset retirement obligations, pension, black lung benefits, and workers’ compensation benefits and obligations entered into as part of Contura’s formation and Alpha’s exit from bankruptcy which are not considered part of the long-term capital structure of Contura. (1) Annual payment of 1.5% of Alpha revenue up to $500 million and 1.0% thereafter. The contingent revenue obligation is a 5-year agreement, which began January 2018. The payments reflected in each year are based on estimated annual revenues of the previous year. The final payment for the Alpha revenues estimated in 2022 is payable in 2023 and was estimated to be $14.7 million as of 9/30/2018. (2) Inclusive of both LCC Notes Payable and LCC Water Treatment Stipulation, both of which are characterized as debt on the balance sheet. The obligations include an additional $2.5 million of payments in 2023. * Accretion expenses for these items are expensed in Adjusted EBITDA, which is a non-GAAP figure. 17

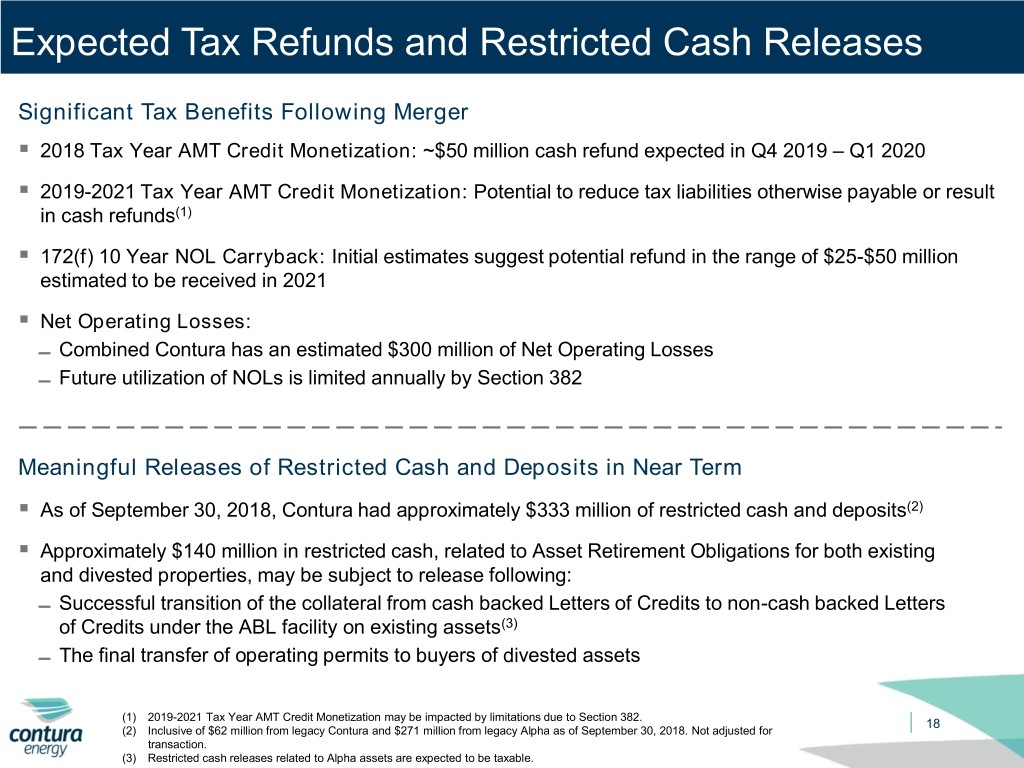

Expected Tax Refunds and Restricted Cash Releases Significant Tax Benefits Following Merger ▪ 2018 Tax Year AMT Credit Monetization: ~$50 million cash refund expected in Q4 2019 – Q1 2020 ▪ 2019-2021 Tax Year AMT Credit Monetization: Potential to reduce tax liabilities otherwise payable or result in cash refunds(1) ▪ 172(f) 10 Year NOL Carryback: Initial estimates suggest potential refund in the range of $25-$50 million estimated to be received in 2021 ▪ Net Operating Losses: ▬ Combined Contura has an estimated $300 million of Net Operating Losses ▬ Future utilization of NOLs is limited annually by Section 382 Meaningful Releases of Restricted Cash and Deposits in Near Term ▪ As of September 30, 2018, Contura had approximately $333 million of restricted cash and deposits(2) ▪ Approximately $140 million in restricted cash, related to Asset Retirement Obligations for both existing and divested properties, may be subject to release following: ▬ Successful transition of the collateral from cash backed Letters of Credits to non-cash backed Letters of Credits under the ABL facility on existing assets(3) ▬ The final transfer of operating permits to buyers of divested assets (1) 2019-2021 Tax Year AMT Credit Monetization may be impacted by limitations due to Section 382. 18 (2) Inclusive of $62 million from legacy Contura and $271 million from legacy Alpha as of September 30, 2018. Not adjusted for transaction. (3) Restricted cash releases related to Alpha assets are expected to be taxable.

Reconciliation of Combined Net Income to Adjusted EBITDA The following table represents the combination of Contura and Alpha’s reconciliations of Net Income to Adjusted EBITDA which has been calculated without making transaction and other adjustments. Therefore it is not in accordance with the requirements of Article 11 of Regulation S-X and is not presented in accordance with GAAP. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. Combined Contura + Alpha Adjusted EBITDA Reconciliation Nine Months Ended Twelve Months Ended (US$ Thousands) September 30, 2017 September 30, 2018 December 31, 2017 September 30, 2018 Net income from continuing operations $128,334 $216,658 $290,925 $379,249 Interest expense 36,713 46,965 50,481 60,733 Interest (income) (2,242) (4,255) (2,998) (5,011) Income Tax Expense / (Benefit) 36,138 133 (50,395) (86,400) Depreciation, Depletion and Amortization 59,964 61,114 49,620 50,770 Mark-to-Market Adjustment - Acquisition-Related Obligations 7,857 14,934 18,333 25,410 Merger Related Costs - 5,064 - 5,064 Management Restructuring Costs - 2,659 - 2,659 Non-cash Stock Compensation Expense 11,912 8,240 20,209 16,537 Gain on Settlement of Acquisition Related Obligations (9,200) (410) (38,886) (30,096) Secondary Offering Costs 4,499 - 4,491 (8) Loss on Early Extinguishment of Debt 55,049 - 55,049 - Bargain Purchase Gain (1,011) - (1,011) - Gain on Sale of Disposal Group - (16,386) - (16,386) Accretion Expense - Asset Retirement Obligations 24,477 17,765 32,667 25,955 Merger Related and share reclassification expenses - 14,313 - 14,313 Amortization of Acquired Intangibles, net 49,111 12,468 59,007 22,364 Amortization of Acquired Coal Supply Agreements, net 6,358 216 7,684 1,542 Expenses Related to Special Dividend 9,536 - 6,367 (3,169) Adjusted EBITDA $417,495 $379,478 $501,543 $463,526 Note: Adjusted EBITDA is a non-GAAP figure, which has been calculated based on the combined operations of Alpha and Contura and does not include adjustments in accordance with the requirements of Article 11 of Regulation S-X. 19

Reconciliation of Contura Net Income to Adjusted EBITDA In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of non-GAAP measures to GAAP measures for Contura on a standalone basis is provided below. Contura Adjusted EBITDA Reconciliation Nine Months Ended Twelve Months Ended (US$ Thousands) September 30, 2017 September 30, 2018 December 31, 2017 September 30, 2018 Net income from continuing operations $59,086 $146,953 $173,735 $261,602 Interest expense 28,080 26,538 35,977 34,435 Interest (income) (116) (829) (210) (923) Income Tax Expense / (Benefit) 7,440 133 (67,979) (75,286) Depreciation, Depletion and Amortization 25,292 33,951 34,910 43,569 Mark-to-Market Adjustment - Acquisition-Related Obligations 3,221 - 3,221 - Merger Related Costs - 5,064 - 5,064 Management Restructuring Costs 2,659 - 2,659 Non-cash Stock Compensation Expense 11,912 8,240 20,209 16,537 Gain on Settlement of Acquisition Related Obligations (9,200) (410) (38,886) (30,096) Secondary Offering Costs 4,499 - 4,491 (8) Loss on Early Extinguishment of Debt 38,701 - 38,701 - Bargain Purchase Gain (1,011) - (1,011) - Gain on Sale of Disposal Group (16,386) - (16,386) Accretion expense - Asset Retirement Obligations 7,507 5,545 9,934 7,972 Amortization of Acquired Intangibles, net 49,111 12,468 59,007 22,364 Expenses Related to Special Dividend 9,536 - 6,367 (3,169) Adjusted EBITDA $234,058 $223,926 $278,466 $268,334 Note: Adjusted EBITDA is a non-GAAP figure. Contura’s Adjusted EBITDA has been calculated on a standalone basis without transaction adjustments. 20

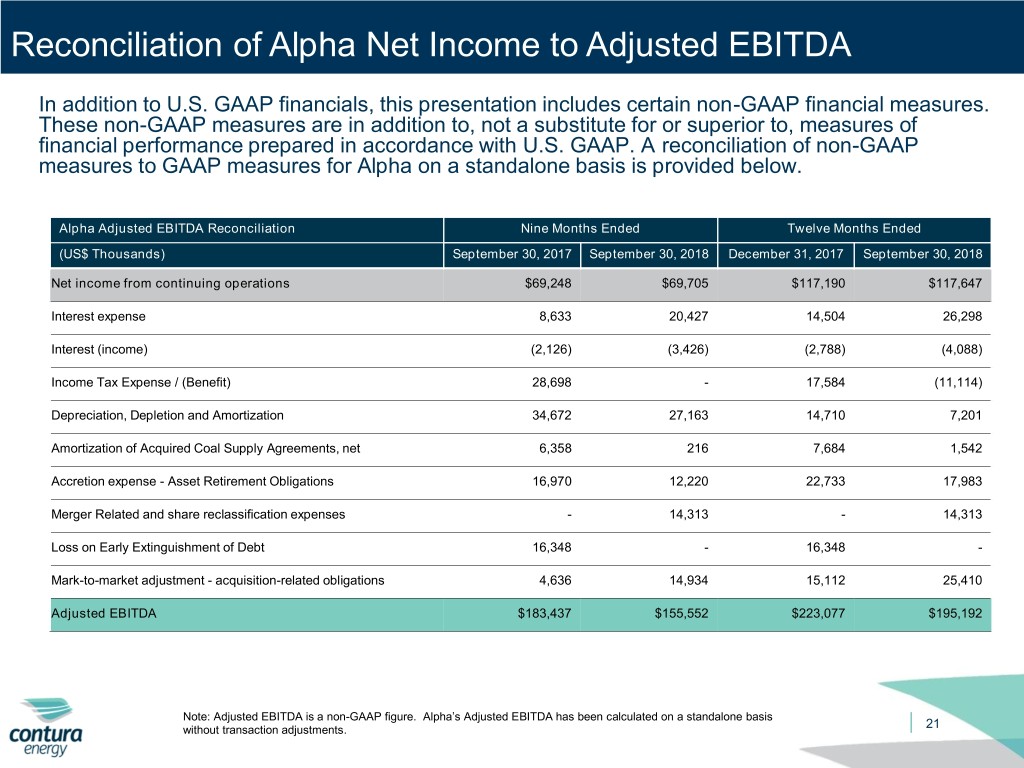

Reconciliation of Alpha Net Income to Adjusted EBITDA In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of non-GAAP measures to GAAP measures for Alpha on a standalone basis is provided below. Alpha Adjusted EBITDA Reconciliation Nine Months Ended Twelve Months Ended (US$ Thousands) September 30, 2017 September 30, 2018 December 31, 2017 September 30, 2018 Net income from continuing operations $69,248 $69,705 $117,190 $117,647 Interest expense 8,633 20,427 14,504 26,298 Interest (income) (2,126) (3,426) (2,788) (4,088) Income Tax Expense / (Benefit) 28,698 - 17,584 (11,114) Depreciation, Depletion and Amortization 34,672 27,163 14,710 7,201 Amortization of Acquired Coal Supply Agreements, net 6,358 216 7,684 1,542 Accretion expense - Asset Retirement Obligations 16,970 12,220 22,733 17,983 Merger Related and share reclassification expenses - 14,313 - 14,313 Loss on Early Extinguishment of Debt 16,348 - 16,348 - Mark-to-market adjustment - acquisition-related obligations 4,636 14,934 15,112 25,410 Adjusted EBITDA $183,437 $155,552 $223,077 $195,192 Note: Adjusted EBITDA is a non-GAAP figure. Alpha’s Adjusted EBITDA has been calculated on a standalone basis without transaction adjustments. 21