Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kfiginvconfpresentation2.htm |

Exhibit 99.1 Filed by Citizens Community Bancorp, Inc. Commission No. 001-33003 Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: F. & M. Bancorp. of Tomah, Inc. The following presentation materials will be used by Citizens Community Bancorp, Inc. at one or more investor relations conferences, or meetings with analysts or potential investors.

Filed Pursuant to Rule 433 Registration Statement No. __________ Issuer Free Writing Prospectus Dated October __, 2015 Relating to Preliminary Prospectus Supplement Dated October __, 2015 FIG CEO Forum January 30-31, 2019 1

Cautionary Notes and Additional Disclosures CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCF Bank”) . The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “seek,” “target,” “potential,” “focus,” “may,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include the satisfaction of the conditions to closing the proposed merger in the anticipated timeframe or at all; the failure to obtain necessary regulatory and shareholder approvals; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger agreement; the ability to realize the anticipated benefits of the proposed merger; the ability to successfully integrate the businesses; disruption from the proposed merger making it more difficult to maintain business and operational relationships; the negative effects of the announcement or the consummation of the proposed merger on the market price of CZWI common stock; significant transaction costs and unknown liabilities; litigation or regulatory actions related to the proposed transaction; conditions in the financial markets and economic conditions generally; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; our ability to realize the benefits of net deferred tax assets; our ability to maintain or increase our market share; acts of terrorism and political or military actions by the United States or other governments; legislative or regulatory changes or actions, or significant litigation, adversely affecting CZWI or CCF Bank; increases in FDIC insurance premiums or special assessments by the FDIC; disintermediation risk; our inability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; the possibility that our internal controls and procedures could fail or be circumvented; our ability to attract and retain key personnel; our ability to keep pace with technological change; cybersecurity risks; risks posed by acquisitions and other expansion opportunities; difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; changes in federal or state tax laws; changes in accounting principles, policies or guidelines and their impact on financial performance; restrictions on our ability to pay dividends; and the potential volatility of our stock price. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, "Risk Factors," in the Company's Form 10-K, for the year ended September 30, 2018 filed with the Securities and Exchange Commission ("SEC") on December 10, 2018 and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward-looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. UNAUDITED PRO FORMA FINANCIAL INFORMATION This presentation contains certain unaudited pro forma information regarding the financial condition and results of operations of the company after giving effect to the acquisition of F. & M. Bancorp. of Tomah, Inc. (“F&M”) and other pro forma adjustments. The unaudited pro forma information assumes that the acquisition is accounted for under the acquisition method of accounting, and that the assets and liabilities of United Bank will be recorded by CZWI at their respective fair values as of the date the acquisition is completed. The unaudited pro forma balance sheet gives effect to the transaction as if the acquisition had occurred on September 30, 2018. The unaudited pro forma information has been derived from and should be read in conjunction with the consolidated financial statements and related notes of CZWI, which are included in its Annual Report on Form 10-K for the year ended September 30, 2018 and subsequent Quarterly Reports on Form 10-Q. The unaudited pro forma information is presented for illustrative purposes only and does not indicate the financial results of the combined company had the companies actually been combined at the beginning of each period presented, nor the impact of possible business model changes. This unaudited pro forma information reflects adjustments to illustrate the effect of the acquisition had it been completed on the date indicated, which are based upon preliminary estimates, to record United Bank’s identifiable assets acquired and liabilities assumed at fair value and the resulting goodwill recognized. The unaudited pro forma information also does not consider any potential effects of changes in market conditions on revenues, potential revenue enhancements, or asset dispositions, among other factors. The purchase price allocation reflected in this information is preliminary, and the final allocation of the purchase price will be based upon the actual purchase price and the fair value of United Bank’s assets and liabilities as of the date of the completion of the acquisition. In addition, following the completion of the acquisition, there may be further refinements of the purchase price allocation as additional information becomes available. Accordingly, the final purchase accounting adjustments may differ materially from the pro forma adjustments reflected in this presentation. 2

Cautionary Notes and Additional Disclosures (Cont’d) NON-GAAP FINANCIAL MEASURES These slides may contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non·GAAP financial measures referred to herein include net income as adjusted, EPS as adjusted, ROATCE, tangible book value per share and tangible common equity / tangible assets. Reconciliations of all Non·GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is being made in respect of the proposed merger transaction between CZWI and F. & M. Bancorp. of Tomah, Inc. (“F&M”). In connection with the proposed merger, CZWI will file with the SEC a registration statement on Form S-4 that will include the proxy statement of F&M and a prospectus of CZWI, as well as other relevant documents regarding the proposed merger. A definitive proxy statement/prospectus will also be sent to F&M shareholders. INVESTORS AND SHAREHOLDERS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED MERGER THAT CZWI WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement, including the proxy statement/prospectus, and other relevant documents (when they become available), and any other documents filed by CZWI with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CZWI's website at www.ccf.us, or by directing a request to CZWI's CEO, Stephen Bianchi at Citizens Community Bancorp, Inc., 2174 EastRidge Center, Eau Claire, Wisconsin 54701, Attention: Stephen M. Bianchi or by e-mail at sbianchi@ccf.us. F&M and its directors, executive officers and certain other members of its management and employees may be deemed to be participants in the solicitation of proxies from F&M’s shareholders in connection with the proposed merger. Information about such participants may be obtained by reading the proxy statement/prospectus and the other relevant documents regarding the proposed merger when it becomes available. Free copies of these documents may be obtained as described in the preceding paragraph. 3

CZWI Focus Items ENHANCING THE QUANTITY AND QUALITY OF EARNINGS We are enhancing shareholder value by improving the loan and deposit mix, deepening customer relationships and strengthening other sources of revenue. EXPERTISE IN COMMERCIAL & AG BANKING We take pride in serving small and mid-sized business and Ag operators in our communities with the best professionals, products and process. EXPERIENCED & PROVEN STRATEGIC LEADERSHIP TEAM Our team has over 206 years of banking experience to draw upon with national, regional and community banks. ENTERPRISE PRODUCTIVITY & RISK MANAGEMENT We are leveraging technology to improve productivity and support future growth, while proactively managing operating and credit risk. Source: Company documents 4

Key Market Differentiators • Serving small to mid-sized • Experienced, energetic entrepreneurs leadership team • Responsive professionals • Accountability for doing the • Products to compete vs. big right thing and getting results banks, superior to smaller • Entrepreneurial spirit, winning community banks attitude BUSINESS CULTURE MODEL STRATEGIC GROWTH CREDIT • Loan and deposit growth • Prudent risk taking through prudent M&A • Process driven, transparent • Robust commercial loan and • Nimble, centralized approval deposit growth process • Quality and quantity of • Proactive risk management earnings improving Source: Company documents 5

Execution of Current Business Strategy Total Loans Loans / Deposits $993 $1,000 120% $800 $733 $759 110% 103% 102% 99% 99% 99% $574 100% $600 $451 90% $400 80% $200 70% $0 60% 2015 2016 2017 2018 Dec-18 2015 2016 2017 2018 Dec-18 NPAs / Assets(1) Diluted Earnings Per Share 3.0% $1.00 2.5% $0.80 2.0% $0.58 $0.54 1.49% $0.60 $0.49 1.5% $0.46 1.14% $0.40 1.0% 0.83% 0.62% 0.5% 0.37% $0.20 $0.12 0.0% $0.00 2015 2016 2017 2018 Dec-18 2015 2016 2017 2018 Dec-18 (1) Nonperforming assets include nonaccrual loans, accruing loans past due 90 days or more, other real estate owned and other collateral owned Note: Dec-18 refers to the 3 – Month period ended December 31, 2018 Source: SEC filings; Company documents 6

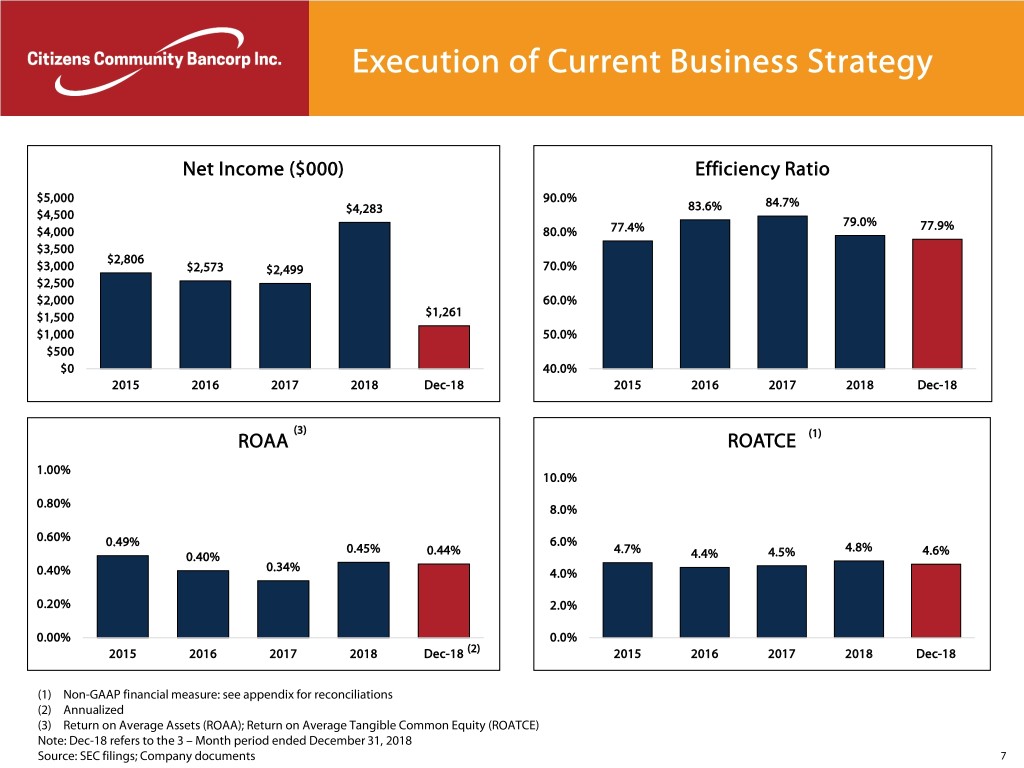

Execution of Current Business Strategy Net Income ($000) Efficiency Ratio $5,000 90.0% 83.6% 84.7% $4,500 $4,283 79.0% $4,000 80.0% 77.4% 77.9% $3,500 $2,806 $3,000 $2,573 $2,499 70.0% $2,500 $2,000 60.0% $1,500 $1,261 $1,000 50.0% $500 $0 40.0% 2015 2016 2017 2018 Dec-18 2015 2016 2017 2018 Dec-18 (3) ROAA ROATCE (1) 1.00% 10.0% 0.80% 8.0% 0.60% 0.49% 6.0% 0.45% 0.44% 4.7% 4.8% 4.6% 0.40% 4.4% 4.5% 0.34% 0.40% 4.0% 0.20% 2.0% 0.00% 0.0% 2015 2016 2017 2018 Dec-18 (2) 2015 2016 2017 2018 Dec-18 (1) Non-GAAP financial measure: see appendix for reconciliations (2) Annualized (3) Return on Average Assets (ROAA); Return on Average Tangible Common Equity (ROATCE) Note: Dec-18 refers to the 3 – Month period ended December 31, 2018 Source: SEC filings; Company documents 7

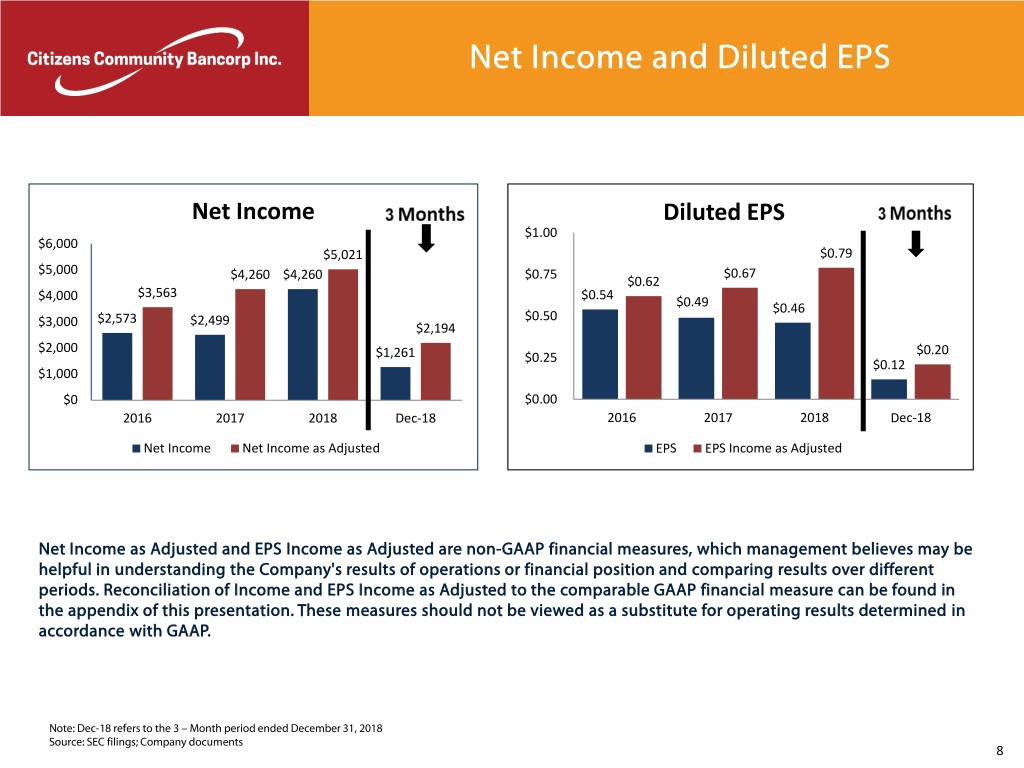

Net Income and Diluted EPS Net Income Diluted EPS $1.00 $6,000 $5,021 $0.79 $5,000 $0.75 $0.67 $4,260 $4,260 $0.62 $4,000 $3,563 $0.54 $0.49 $0.46 $2,573 $2,499 $0.50 $3,000 $2,194 $2,000 $0.20 $1,261 $0.25 $0.12 $1,000 $0 $0.00 2016 2017 2018 Dec-18 2016 2017 2018 Dec-18 Net Income Net Income as Adjusted EPS EPS Income as Adjusted Net Income as Adjusted and EPS Income as Adjusted are non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations or financial position and comparing results over different periods. Reconciliation of Income and EPS Income as Adjusted to the comparable GAAP financial measure can be found in the appendix of this presentation. These measures should not be viewed as a substitute for operating results determined in accordance with GAAP. Note: Dec-18 refers to the 3 – Month period ended December 31, 2018 Source: SEC filings; Company documents 8

Loan Portfolio . CZWI has transformed its loan 100% portfolio through organic growth and 1-4 Family Cons & Other acquisitions 80% C&D - 1-4 Family C&D - Commercial . Change has occurred from a primarily 60% consumer focused portfolio to a Ag. Real Estate diversified mix consisting of 40% Ag. Non-RE commercial real estate, agricultural HELOC and commercial business loans 20% Owner-Occ. CRE Investor 1-4 . Credit quality remains a focus in 0% Non-Owner Occ. CRE conjunction with loan growth 2015 FY 2016 FY 2017 FY 2018 FQ3 2018 FQ4 Dec-18 ($000s) 2015 FY 2016 FY 2017 FY 2018 FQ3 2018 FQ4 Dec-18 1-4 Family 178,830 176,362 193,535 166,660 156,182 185,433 Cons & Other 193,600 195,424 141,596 111,774 104,486 105,229 C&D - 1-4 Family $0 $3,924 $6,265 $4,454 $5,871 $14,845 C&D - Commercial $6,099 $14,809 $17,196 $14,952 $16,422 $20,273 Ag. Real Estate 2,073 27,997 68,003 70,881 70,517 86,015 Ag. Non-RE 3,718 14,466 23,874 26,367 26,549 36,327 HELOC 2,433 9,775 52,901 48,642 46,784 44,954 MRQ Owner-Occ. CRE 7,176 23,311 56,122 69,723 77,657 142,107 Yield Investor 1-4 CRE 18,149 32,170 48,351 56,466 57,366 62,806 5.09% Non-Owner Occ. CRE 10,158 30,813 52,902 79,712 83,699 133,229 C&I 10,975 26,062 49,640 69,411 69,975 100,271 Multifamily 14,869 19,135 26,228 45,707 48,062 69,399 Total Gross Loans $448,080 $574,248 $736,613 $764,749 $763,570 $1,000,888 9

Commercial Loan Detail C&D . Commercial loan portfolio well diversified 3.1% C&I . Total portfolio of $665.3 million at 12/31/2018 15.4% Non-Owner Occ. CRE 20.5% . Strong growth in all commercial loan categories Owner-Occ. CRE Investor 1-4 . Average note size is under $235 thousand 21.8% CRE 9.7% Multifamily $300 Ag. Real 10.7% Estate AG. Non-RE Ag. Non-RE 13.2% 5.6% $250 C&I & Owner. Occ. CRE $242.4 $222.9 CRE ($M) Dec-18 $200 Investor 1-4 CRE C&D $20.2 Non-Owner Occ. CRE 133.3 $148.7 $149.5 $150 Investor 1-4 CRE 62.8 $122.3 Multifamily 69.4 $105.7 $97.0 $100 $91.9 $96.3 Ag. Real Estate 86.0 Ag. Non-RE 36.3 $64.8 $60.6 $62.8 $49.4 $48.4 Owner-Occ. CRE 142.1 $50 $42.5 $31.1 $32.2 C&I 100.3 $18.2 $18.1 $5.8 Total Gross Commercial Loans $650.4 $0 Sep-15 Sep-16 Sep-17 Sep-18 Dec-18 Source: Company documents, S&P Global Market Intelligence, bank level regulatory data (call report) 10

Deposit Composition 100% . Since 2016 FQ2, demand Demand deposit growth has significantly 80% outpaced the growth of the rest NOW & Other Trans. of the portfolio 60% MMDA & Sav . CZWI remains focused on a 40% lower cost deposit base CDs < 100k 20% CDs > 100k 0% 2017 2017 2017 2017 2018 2018 2018 2018 Dec-18 FQ1 FQ2 FQ3 FQ4 FQ1 FQ2 FQ3 FQ4 Deposit Composition - Quarter Lookback ($000) 2017 FQ1 2017 FQ2 2017 FQ3 2017 FQ4 2018 FQ1 2018 FQ2 2018 FQ3 2018 FQ4 Dec-18 Demand $98,337 $99,355 $98,804 $221,761 $226,889 $230,559 $232,319 $225,420 $309,691 NOW & Other Trans. 112 157 721 1,457 848 1,248 931 1,311 15,017 MRQ MMDA & Sav 177,759 175,942 181,002 228,511 224,780 215,666 213,796 206,644 318,338 Cost of Deposits CDs < 100k 128,716 132,806 127,673 177,659 172,403 187,230 184,560 195,157 225,371 0.84% CDs > 100k 130,188 122,669 110,933 113,116 116,149 113,912 112,929 117,997 139,095 Total Deposits $535,112 $530,929 $519,133 $742,504 $741,069 $748,615 $744,535 $746,529 $1,007,512 Source: SEC filings 11

Market Demographics CZWI operates in diverse markets within the northwestern region of Wisconsin, metro Twin Cities and the Mankato, Minnesota MSA Eau Claire: . Features a broad-based, diverse economy, which is driven by commercial, retail and medical industries Mankato: . The Mankato market also possesses a broad-based, diverse economy Eau Claire Area Employers Mankato Area Employers Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images 12

Net Interest Margin Analysis Quarter ended December 31, 2018 Quarter ended September 30, 2018 Interest Average Interest Average Average Income/ Yield/ Average Income/ Yield/ ($ Dollars in Thousands) Balance Expense Rate Balance Expense Rate Average interest earning assets: Cash and cash equivalents $ 40,733 $ 195 1.90% $ 24,468 $ 117 1.90% Loans receivable $ 921,951 $ 11,839 5.09% 754,442 9,414 4.95% Interest-bearing deposits $ 7,268 $ 40 2.18% 7,971 42 2.09% Investment securities (1) $ 145,114 $ 861 2.47% 124,991 674 2.30% Non-marketable equity securities, at cost $ 7,974 $ 112 5.57% 7,581 115 6.02% Total interest earning assets $ 1,123,040 $ 13,047 4.62% $ 919,453 $ 10,362 4.49% Average interest-bearing liabilities: Total deposits 815,838 2,131 1.04% 666,674 1,659 0.99% FHLB Advances & Other Borrowings 99,595 876 3.49% 96,448 763 3.14% Total interest bearing liabilities $ 915,433 $ 3,007 1.30% $ 763,122 $ 2,422 1.26% Net interest income $ 10,040 $ 7,940 Interest Rate Spread 3.32% 3.23% Net interest margin 3.56% 3.45% (1) Fully taxable equivalent. The average yield on tax exempt securities is computed on a tax equivalent basis using a tax rate of 21% for the quarter ended December 31, 2018 and 24.5% for the quarter ended September 30, 2018 13

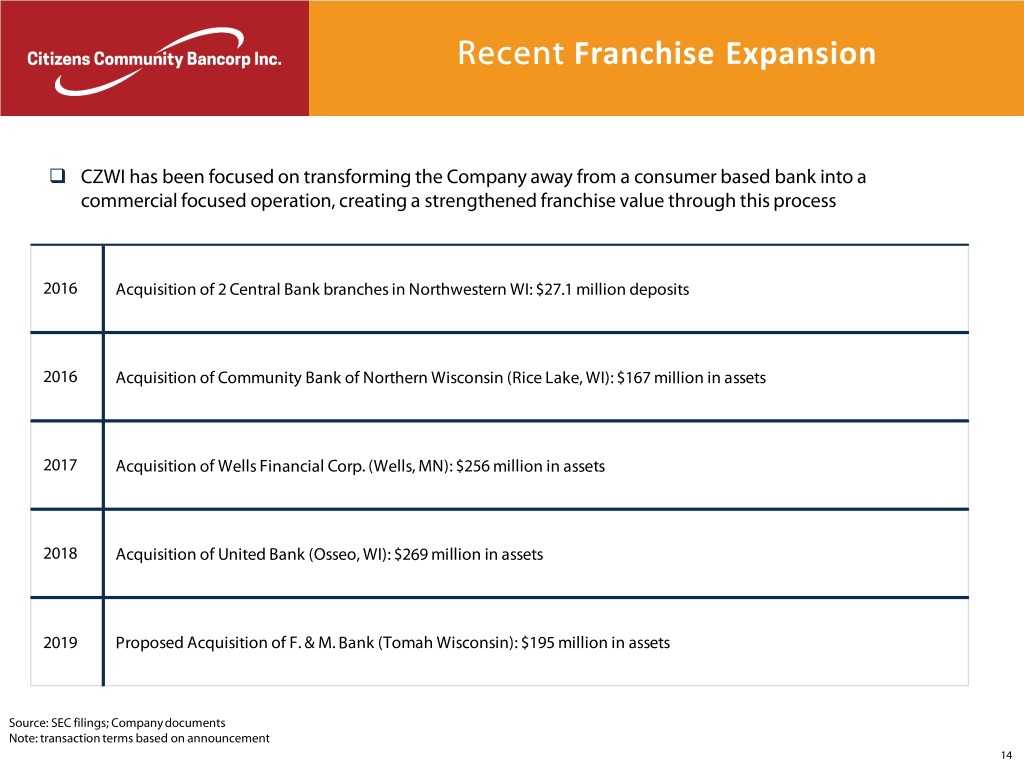

Recent Franchise Expansion CZWI has been focused on transforming the Company away from a consumer based bank into a commercial focused operation, creating a strengthened franchise value through this process 2016 Acquisition of 2 Central Bank branches in Northwestern WI: $27.1 million deposits 2016 Acquisition of Community Bank of Northern Wisconsin (Rice Lake, WI): $167 million in assets 2017 Acquisition of Wells Financial Corp. (Wells, MN): $256 million in assets 2018 Acquisition of United Bank (Osseo, WI): $269 million in assets 2019 Proposed Acquisition of F. & M. Bank (Tomah Wisconsin): $195 million in assets Source: SEC filings; Company documents Note: transaction terms based on announcement 14

Pro Forma Map CZWI Locations (1) F. & M. Bancorp Locations (1) Includes acquisition of United Bank Source: S&P Global Market Intelligence 15

Transaction Highlights • Transaction adds an adjacent market to CZWI’s Wisconsin presence with Tomah branch locations that are attractively located nearby CZWI’s Eau Claire and Osseo markets • Transaction provides CZWI with a stable, modestly priced deposit base for organic growth opportunities • At closing, the combined pro forma assets will exceed $1.4 billion, while deposits will be approximately $1.2 billion • Attractive transaction pricing at 105.8% of TBV and 16.0x LTM EPS • Immediately accretive to EPS(1) as the transaction is expected to generate earnings accretion of over 13% in the first full year after closing • Tangible book value payback period of approximately 3 years • Continued focus on building efficiencies as a commercial bank (1) Excludes one-time merger costs and includes acquisition of United Bank 16

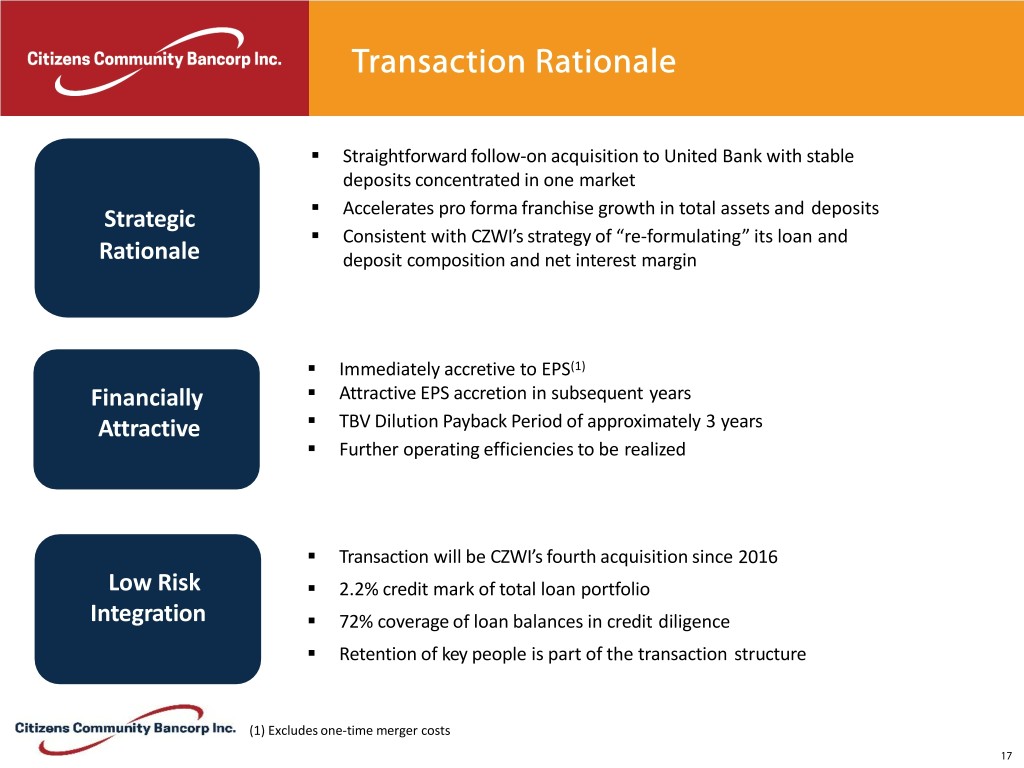

Transaction Rationale . Straightforward follow-on acquisition to United Bank with stable deposits concentrated in one market . Strategic Accelerates pro forma franchise growth in total assets and deposits . Consistent with CZWI’s strategy of “re-formulating” its loan and Rationale deposit composition and net interest margin . Immediately accretive to EPS(1) Financially . Attractive EPS accretion in subsequent years Attractive . TBV Dilution Payback Period of approximately 3 years . Further operating efficiencies to be realized . Transaction will be CZWI’s fourth acquisition since 2016 Low Risk . 2.2% credit mark of total loan portfolio Integration . 72% coverage of loan balances in credit diligence . Retention of key people is part of the transaction structure (1) Excludes one-time merger costs 17

Transaction Terms F. & M. Bancorp of Tomah Transaction Value(1) $21.6 million Consideration 85% Cash, 15% Stock Price/TBV 105.8% Price/LTM EPS(2) 16.0x Customary regulatory and F. & M. Bancorp of Required Approvals Tomah shareholder approval Expected Closing Q2 2019 (1) Based on 216,546 F. & M. Bancorp of Tomah shares outstanding and exchange ratio of 1.3350, and CZWI share price of $11.11 (2) Based on normalized net income available to common of $1.3 million for the twelve months ended 9/30/18 18

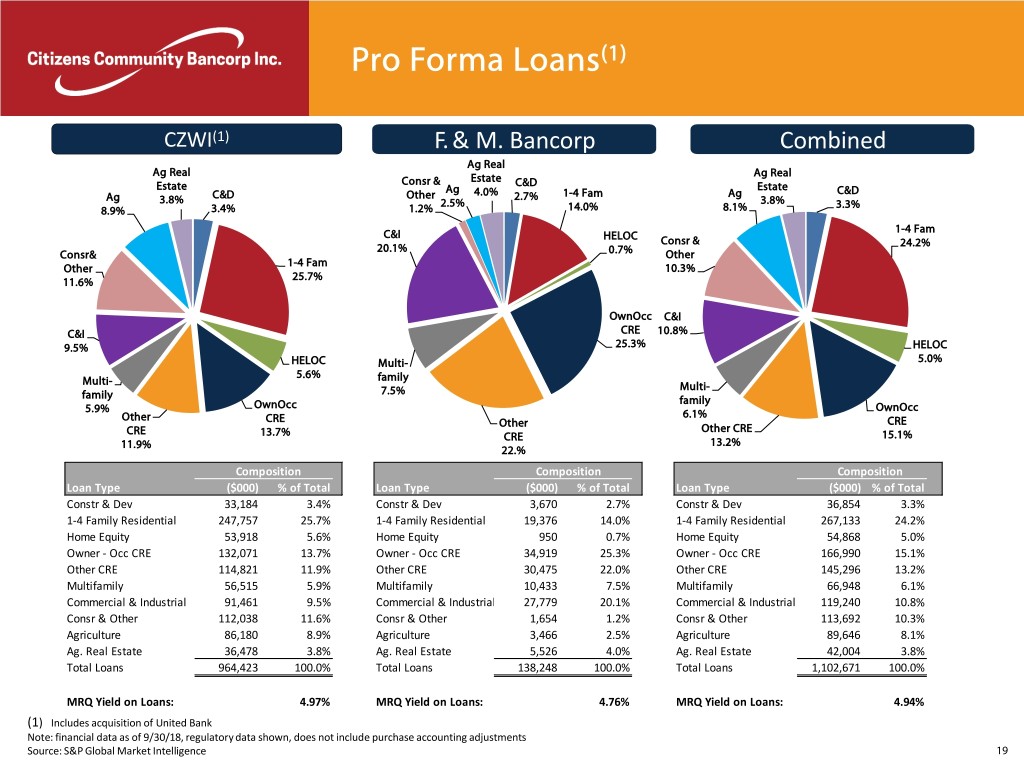

Pro Forma Loans(1) CZWI(1) F. & M. Bancorp Combined Ag Real Ag Real Ag Real Consr & Estate C&D Estate Ag Estate C&D Ag C&D Other 4.0% 2.7% 1-4 Fam Ag 3.8% 2.5% 3.8% 3.3% 8.9% 3.4% 1.2% 14.0% 8.1% C&I 1-4 Fam HELOC Consr & 20.1% 24.2% Consr& 0.7% Other 1-4 Fam Other 10.3% 25.7% 11.6% OwnOcc C&I C&I CRE 10.8% 9.5% 25.3% HELOC HELOC Multi- 5.0% 5.6% Multi- family 7.5% Multi- family family 5.9% OwnOcc OwnOcc Other 6.1% CRE Other CRE CRE Other CRE 13.7% CRE 15.1% 11.9% 13.2% 22.% Composition Composition Composition Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total Constr & Dev 33,184 3.4% Constr & Dev 3,670 2.7% Constr & Dev 36,854 3.3% 1-4 Family Residential 247,757 25.7% 1-4 Family Residential 19,376 14.0% 1-4 Family Residential 267,133 24.2% Home Equity 53,918 5.6% Home Equity 950 0.7% Home Equity 54,868 5.0% Owner - Occ CRE 132,071 13.7% Owner - Occ CRE 34,919 25.3% Owner - Occ CRE 166,990 15.1% Other CRE 114,821 11.9% Other CRE 30,475 22.0% Other CRE 145,296 13.2% Multifamily 56,515 5.9% Multifamily 10,433 7.5% Multifamily 66,948 6.1% Commercial & Industrial 91,461 9.5% Commercial & Industrial 27,779 20.1% Commercial & Industrial 119,240 10.8% Consr & Other 112,038 11.6% Consr & Other 1,654 1.2% Consr & Other 113,692 10.3% Agriculture 86,180 8.9% Agriculture 3,466 2.5% Agriculture 89,646 8.1% Ag. Real Estate 36,478 3.8% Ag. Real Estate 5,526 4.0% Ag. Real Estate 42,004 3.8% Total Loans 964,423 100.0% Total Loans 138,248 100.0% Total Loans 1,102,671 100.0% MRQ Yield on Loans: 4.97% MRQ Yield on Loans: 4.76% MRQ Yield on Loans: 4.94% (1) Includes acquisition of United Bank Note: financial data as of 9/30/18, regulatory data shown, does not include purchase accounting adjustments Source: S&P Global Market Intelligence 19

Pro Forma Deposits(1) CZWI(1) F. & M. Bancorp Combined Now & Now & other Other Time> Time > Trans Non Int. Time> Non Int. Trans $100k $100k Non Int. 2.1% Bearing $100K Bearing 4.5% 13.3% Bearing 9.1% 15.5% 12.7% 15.4% Time< 15.5% $100k 16.5% Time < Time < NOW & Other $100k $100k 20.8% 21.5% Trans 19.8% MMDA & MMDA & Sav Sav MMDA & 47.6% 39.6% Sav 46.6% Composition Composition Composition Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total Non Interest Bearing 150,918 15.5% Non Interest Bearing 22,393 15.1% Non Interest Bearing 173,311 15.4% NOW & Other Trans 20,677 2.1% NOW & Other Trans 29,473 19.8% NOW & Other Trans 50,150 4.5% MMDA & Sav 464,673 47.6% MMDA & Sav 58,847 39.6% MMDA & Sav 523,520 46.6% Time Deposits < $100k 209,867 21.5% Time Deposits < $100k 24,480 16.5% Time Deposits < $100k 234,347 20.8% Time Deposits > $100k 129,267 13.3% Time Deposits > $100k 13,497 9.1% Time Deposits > $100k 142,764 12.7% Total Deposits 975,402 100% Total Deposits 148,690 100% Total Deposits 1,124,092 100% MRQ Cost of Deposits: 0.76% MRQ Cost of Deposits: 0.67% MRQ Cost of Deposits: 0.76% Loans / Deposits 98.87% Loans / Deposits 92.98% Loans / Deposits 98.09% (1) Includes acquisition of United Bank Note: financial data as of 9/30/18, regulatory data shown, does not include purchase accounting adjustments Source: S&P Global Market Intelligence 20

Pro Forma Balance Sheet Pro Forma Balance Sheet: Fair Value M&A CZWI (1) F. & M. Bancorp Pro Forma Adjustments Adjustments 9/30/18 9/30/18 Cash and equivalents $ 96,874 $ 7,075 $ - $ (22,467) G $ 81,482 Securities 130,814 41,860 - - $ 172,674 Total loans held for investment 958,881 138,248 (7,250) A - 1,089,879 Loan loss reserve (6,748) (2,821) 2,821 B - (6,748) Loans held for sale 2,034 - - - 2,034 Goodwill 30,933 - - 2,799 H 33,732 Core deposit and other intangibles 7,904 - - 1,352 I 9,256 OREO 2,768 263 (53) C - 2,978 Other assets 43,526 9,778 919 D 839 J 55,062 Total Assets $ 1,266,986 $ 194,403 $ (3,562) $ (17,478) $ 1,440,349 Total deposits $ 974,295 $ 148,691 $ (380) E $ - $ 1,122,606 Short and long term borrowings 149,510 24,500 (425) F - 173,585 Trust preferred securities - - - - - Other liabilities 7,334 830 - - 8,164 Total Liabilities $ 1,131,139 $ 174,021 $ (805) $ - $ 1,304,355 Preferred equity - - - - - Common equity 135,847 20,382 (2,757) (17,478) 135,994 Total Equity $ 135,847 $ 20,382 $ (2,757) $ (17,478) $ 135,994 Total Liabilities and Equity $ 1,266,986 $ 194,403 $ (3,562) $ (17,478) $ 1,440,349 Shares Issued Shares Outstanding 10,914,379 216,546 289,081 11,203,460 TBVPS $8.89 $94.12 $8.30 Dilution / Accretion $ (0.06) TCE/ TA 7.90% 10.48% 6.66% Total loans / total deposits 98.4% 93.0% 97.1% LLR / total loans 0.70% 2.04% 0.62% Regulatory Capital Ratios: Top-Tier Consolidated Leverage Ratio 8.19% 10.47% 7.01% CET1 Ratio 10.57% 14.61% 9.13% Tier 1 RBC Ratio 10.57% 14.61% 9.13% Total RBC Ratio 12.88% 15.87% 11.13% Bank-Level Only Leverage Ratio 9.54% 11.58% 8.11% CET1 Ratio 12.32% 16.16% 10.56% Tier 1 RBC Ratio 12.32% 16.16% 10.56% Total RBC Ratio 13.03% 17.42% 11.18% (1) Includes acquisition of United Bank Source: S&P Global Market Intelligence, FIG Partners 21

Pro Forma Balance Sheet Footnotes A) 2.2% credit mark; 3.0% interest rate mark; 5.2% total loan mark B) Reversal of existing F. & M. reserves C) 20% mark on OREO D) DTA created from fair value adjustment E) 0.3% mark on deposits F) 1.7% mark on borrowings G) Cash consideration + options cash out + $4.1 million in estimated transaction expenses H) New goodwill created I) New CDI created (1.0% of F. & M. core deposits) J) Net DTA impact from taxable transaction expenses and DTL of new CDI created 22

Disciplined Acquisition Strategy Strategic consolidation of community banks Areas of Potential Acquisition Opportunities . Provides scale and operating efficiencies . Adds experienced and knowledgeable banking talent CZWI Locations . Opportunity to continue commercial loan growth F. & M. Locations . Opportunity to drive down cost of funds Potential Markets . Adds portfolios of seasoned loans Maintain disciplined approach . Low loan to deposit ratio Duluth Superior . Low-cost deposit funding Rice Lake . Attractive market share Eau Claire . Compelling noninterest income Minneapolis St. Paul Enhance the performance of acquired banks Mankato . Developed core competency evaluating, structuring, Wausau acquiring and integrating target banks Mason City Target markets – Select Midwest Markets . Wisconsin – Northwestern/Western/North Central . Minnesota – Areas in or in close proximity to micropolitan La Crosse or metropolitan markets Winona . Iowa – Northern Iowa only Rochester Size Criteria . Banks with assets between $100 million and $1.0 billion Total Banks Median Asset Size Banks $100M-$250M 102 $154,711 There are 167 banks within our target markets that meet our Banks $250M-$500M 50 $364,257 size criteria Banks $500M-$1.0B 15 $689,536 Source: FIG Partners, S&P Global Market Intelligence 23

Appendix 24

Reconciliation of Non-GAAP Financial Measures Reconciliation of GAAP Net Income and Net Income as Adjusted (non-GAAP): FY2016 FY2017 FY2018 Dec-18 (Dollars in Thousands, except share data) GAAP earnings before income taxes $ 3,859 $ 3,822 $ 6,609 $ 1,822 Merger related costs (1) 701 1,860 463 1,057 Branch closure costs (2) 839 951 26 12 Settlement proceeds (3) - (283) - - FHLB borrowings prepayment fee (4) - 104 - - Audit and Financial Reporting (5) - - - 135 Net Income as adjusted before income taxes (6) 5,399 6,454 7,098 3,026 Provision for income tax on net income as adjusted (7) 1,836 2,194 1,739 832 Tax Cuts and Jobs Act of 2017 - - 338 - Total Provison for income tax 1,836 2,194 2,077 832 Net Income as adjusted after income taxes (non-GAAP) (6) $ 3,563 $ 4,260 $ 5,021 $ 2,194 GAAP diluted earnings per share, net of tax $ 0.49 $ 0.46 $ 0.58 $ 0.12 Merger related costs, net of tax 0.09 0.23 0.06 0.07 Branch related costs, net of tax 0.09 0.12 - - Settlement proceeds - (0.03) - - FHLB borrowings prepayment fee - 0.01 - - Audit and Financial Reporting - - - 0.01 Tax Cuts and Jobs Act of 2017 tax provision (8) - - 0.04 - Diluted earnings per share, as adjusted, net of tax (non-GAAP) $ 0.67 $ 0.79 $ 0.68 $ 0.20 Average diluted shares outstanding 5,257,304 5,378,548 7,335,247 10,967,386 25

Reconciliation of Non-GAAP Financial Measures (1) Costs incurred are included as data processing, advertising, marketing and public relations, professional fees and other noninterest expense in the consolidated statement of operations. (2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated statement of operations. In addition, other non-interest expense includes costs related to the reduction in valuation of the Ridgeland branch office in the fourth quarter of fiscal 2017. (3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage Backed Security (RMBS) claim. This JP Morgan RMBS was previously owned by the Bank and sold in 2011. (4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in the consolidated statement of operations. (5) Audit and financial reporting costs include professional fees related to Initial SOX compliance and additional audit and professional fees related to the change in our year end from September 30 to December 31. (6) Net income as adjusted is a non-GAAP measure that management believes enhances the markets ability to assess the underlying business performance and trends related to core business activities. (7) Provisions for income tax on net income as adjusted is calculated at 21.0% for the quarter ended December 31, 2018 and at 24.5% for all quarters in fiscal 2018, which represents our federal statutory tax rate for each respective period presented. (8) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $275 and $63 in December 2017 and September 2018, respectively, totaling $338 in fiscal 2018. These tax entries are included in provision for income taxes expense in the consolidated statement of operations. 26

Reconciliation of Non-GAAP Financial Measures Return on Average Tangible Common Equity (ROATCE) (In thousands except ROATCE) 2016 2017 2018 Dec-18 Common Equity $ 64,544 $ 73,483 $ 135,847 138187 Less: Goodwill (4,663) (10,444) (10,444) (30,933) Less: Core Deposit and other intangibles (5,449) (5,449) (4,805) (7,904) Tangible Common Equity (TCE) $ 54,432 $ 57,590 $ 120,598 $ 99,350 Average Tangible Common Equity $ 57,891 $ 56,011 $ 89,094 $ 109,974 Net Income (annualized for 2018 YTD) $ 2,573 $ 2,499 $ 4,283 $ 5,044 ROATCE 4.4% 4.5% 4.8% 4.6% Proforma Tangible Book Value Per Share (TBVPS) CZWI Pro Forma Total Equity $ 134,056 $ 134,179 Less: Goodwill (29,693) (32,615) Less: Core deposit and intangibles (7,058) (8,410) Tangible Book Value (TBV) $ 97,305 $ 93,154 Shares outstanding 10,914,379 11,203,460 TBVPS $ 8.92 $ 8.31 Proforma Tangible Common Equity /Tangible Assets CZWI Pro Forma Tangible Common Equity (TCE) $ 97,305 $ 93,154 Total Assets $ 1,212,912 $ 1,386,251 Less: Goodwill (29,693) (32,615) Less: Core Deposit and other intangibles (7,058) (8,410) Tangible Assets (TA) $ 1,176,161 $ 1,345,226 TCE/TA 8.3% 6.9% 27