Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ENTEGRIS INC | d667754dex991.htm |

| 8-K - 8-K - ENTEGRIS INC | d667754d8k.htm |

Exhibit 99.2

Entegris and Versum Materials Merger of Equals Creation of a Premier Specialty Materials Company

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1993, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. The words “believe” “continue,” “could,” “expect,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Entegris’ and Versum Materials’ control. Statements in this communication regarding Entegris, Versum Materials and the combined company that are forward-looking, including projections as to the anticipated benefits of the proposed transaction, the impact of the proposed transaction on Entegris’ and Versum Materials’ business and future financial and operating results, the amount and timing of synergies from the proposed transaction, and the closing date for the proposed transaction, are based on management’s estimates, assumptions and projections, and are subject to significant uncertainties and other factors, many of which are beyond Entegris’ and Versum Materials’ control. These factors and risks include, but are not limited to, (i) weakening of global and/or regional economic conditions, generally or specifically in the semiconductor industry, which could decrease the demand for Entegris’ and Versum Materials’ products and solutions; (ii) the ability to meet rapid demand shifts; (iii) the ability to continue technological innovation and introduce new products to meet customers’ rapidly changing requirements; (iv) the concentrated customer base; (v) the ability to identify, effect and integrate acquisitions, joint ventures or other transactions; (vi) the ability to protect and enforce intellectual property rights; (vii) operational, political and legal risks of Entegris’ and Versum Materials’ international operations; (viii) Entegris’ dependence on sole source and limited source suppliers; (ix) the increasing complexity of certain manufacturing processes; (x) raw material shortages and price increases; (xi) changes in government regulations of the countries in which Entegris and Versum Materials operate; (xii) the fluctuation of currency exchange rates; (xiii) fluctuations in the market price of Entegris’ stock; (xiv) the level of, and obligations associated with, Entegris’ and Versum Materials’ indebtedness; and (xv) other risk factors and additional information. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the prompt and effective integration of Entegris’ businesses and the ability to achieve the anticipated synergies and value-creation contemplated by the proposed transaction; the risk associated with Entegris’ and Versum Materials’ ability to obtain the approval of the proposed transaction by their shareholders required to consummate the proposed transaction and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied on a timely basis or at all and the failure of the transaction to close for any other reason; the risk that a consent or authorization that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; unanticipated difficulties or expenditures relating to the transaction, the response of business partners and retention as a result of the announcement and pendency of the transaction; and the diversion of management time on transaction-related issues. For a more detailed discussion of such risks and other factors, see Entegris’ and Versum Materials’ filings with the Securities and Exchange Commission, including under the heading “Risks Factors” in Item 1A of Entegris’ Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed on February 15, 2018, and Versum Materials’ Annual Report on Form 10-K for the fiscal year ended September 30, 2018, filed on November 21, 2018 and in other periodic filings, available on the SEC website or www.entegris.com or www.versummaterials.com. Entegris and Versum Materials’ assume no obligation to update any forward-looking statements or information, which speak as of their respective dates, to reflect events or circumstances after the date of this communication, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

Legal Disclosures Additional Information about the Merger and Where to Find It This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between Entegris and Versum Materials. In connection with the proposed transaction, Entegris intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of Entegris and Versum Materials that also constitutes a prospectus of Entegris. Each of Entegris and Versum Materials also plan to file other relevant documents with the SEC regarding the proposed transaction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Any definitive joint proxy statement/prospectus (if and when available) will be mailed to stockholders of Entegris and Versum Materials. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about Entegris and Versum Materials, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Entegris will be available free of charge on Entegris’ website at http://www.entegris.com or by contacting Entegris’ Investor Relations Department by email at irelations@entegris.com or by phone at 978-436-6500. Copies of the documents filed with the SEC by Versum Materials will be available free of charge on Versum Materials’ website at investors.versummaterials.com or by phone at 484-275-5907. Participants in the Solicitation Entegris, Versum Materials and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Entegris is set forth in Entegris’ proxy statement for its 2018 annual meeting of shareholders, which was filed with the SEC on March 28, 2018, and Entegris’ Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on February 15, 2018. Information about the directors and executive officers of Versum Materials is set forth in its proxy statement for its 2019 annual meeting of shareholders, which was filed with the SEC on December 20, 2018, and Versum Materials’ Annual Report on Form 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 21, 2018. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Entegris or Versum Materials using the sources indicated above.

Today’s Speakers Seifi Ghasemi Bertrand Loy Guillermo Novo Chairman of the Board of Directors President & Chief Executive Officer President & Chief Executive Officer Versum Materials Entegris Versum Materials

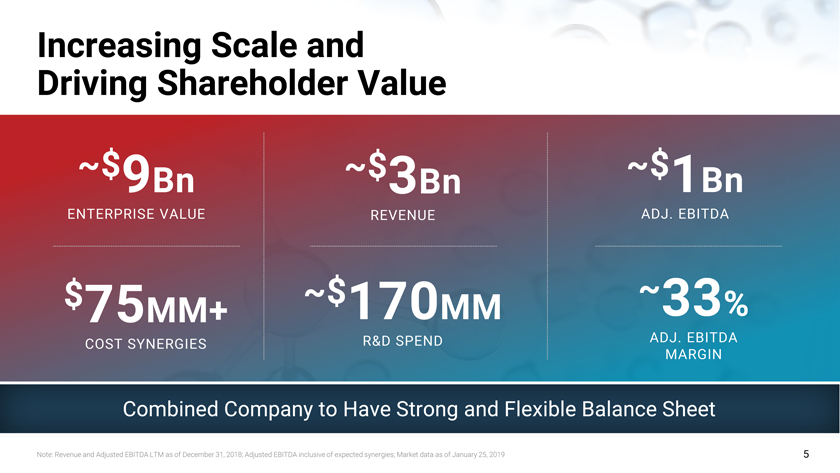

Increasing Scale and Driving Shareholder Value ~$9Bn ~$ ~$1Bn 3Bn ENTERPRISE VALUE REVENUE ADJ. EBITDA $ ~$170 ~33% 75MM+ MM COST SYNERGIES R&D SPEND ADJ. EBITDA MARGIN Combined Company to Have Strong and Flexible Balance Sheet

Compelling Strategic and Financial Rationale Yielding Significant Value to Shareholders and Customers Financial Enhanced Global World class scale, product scale and technology strength, portfolio operational capabilities stability, and diversity excellence flexibility

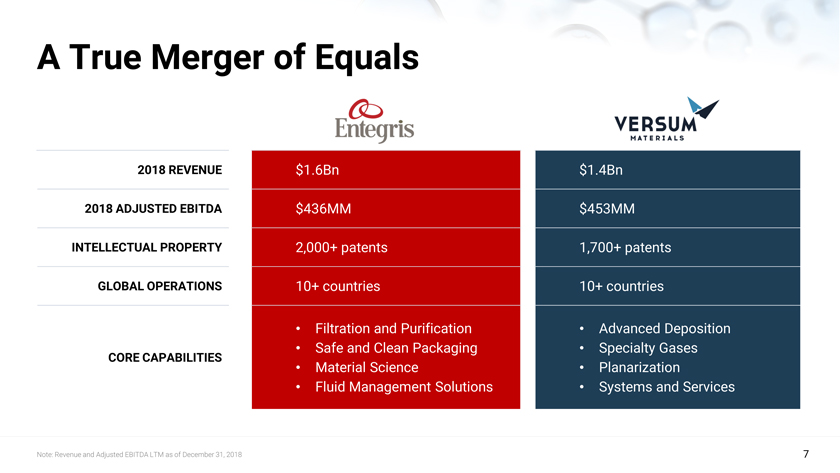

A True Merger of Equals 2018 REVENUE $1.6Bn $1.4Bn 2018 ADJUSTED EBITDA $436MM $453MM INTELLECTUAL PROPERTY 2,000+ patents 1,700+ patents GLOBAL OPERATIONS 10+ countries 10+ countries • Filtration and Purification • Advanced Deposition • Safe and Clean Packaging • Specialty Gases CORE CAPABILITIES • Material Science • Planarization • Fluid Management Solutions • Systems and Services

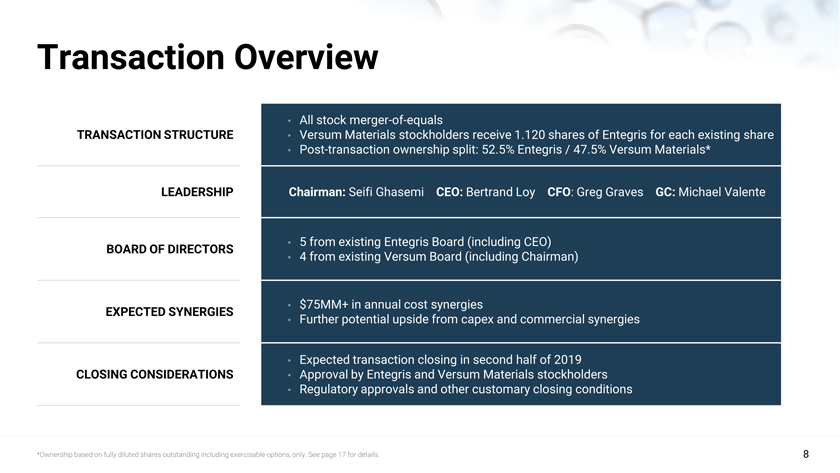

Transaction Overview • All stock merger-of-equals TRANSACTION STRUCTURE • Versum Materials stockholders receive 1.120 shares of Entegris for each existing share • Post-transaction ownership split: 52.5% Entegris / 47.5% Versum Materials* LEADERSHIP Chairman: Seifi Ghasemi CEO: Bertrand Loy CFO: Greg Graves GC: Michael Valente • 5 from existing Entegris Board (including CEO) BOARD OF DIRECTORS • 4 from existing Versum Board (including Chairman) • $75MM+ in annual cost synergies EXPECTED SYNERGIES • Further potential upside from capex and commercial synergies • Expected transaction closing in second half of 2019 CLOSING CONSIDERATIONS • Approval by Entegris and Versum Materials stockholders • Regulatory approvals and other customary closing conditions

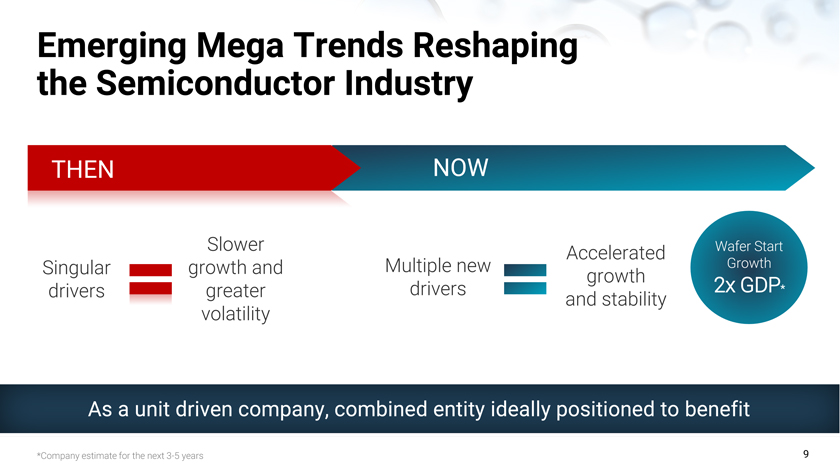

Emerging Mega Trends Reshaping the Semiconductor Industry THEN NOW Slower Accelerated Wafer Start Singular growth and Multiple new Growth growth 2x GDP* drivers greater drivers and stability volatility As a unit driven company, combined entity ideally positioned to benefit

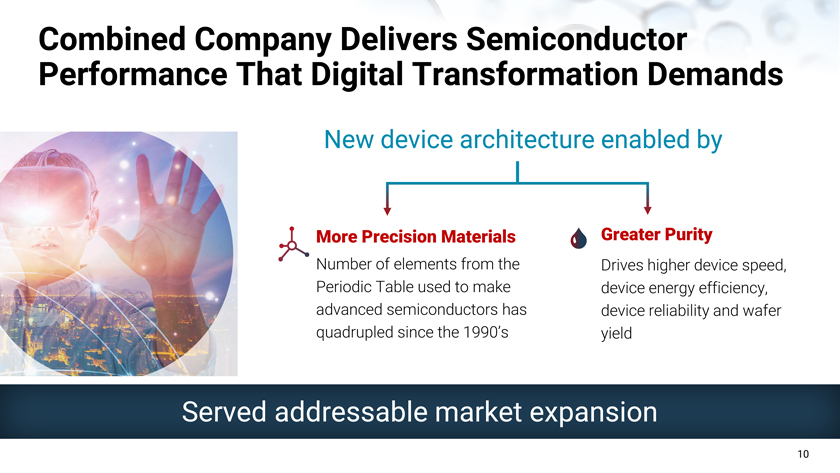

Combined Company Delivers Semiconductor Performance That Digital Transformation Demands New device architecture enabled by More Precision Materials Greater Purity Number of elements from the Drives higher device speed, Periodic Table used to make device energy efficiency, advanced semiconductors has device reliability and wafer quadrupled since the 1990’s yield Served addressable market expansion

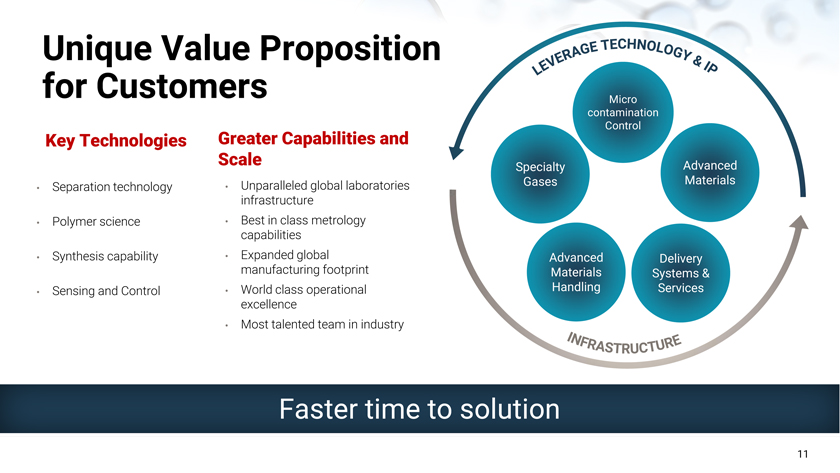

Unique Value Proposition for Customers Micro contamination Control Key Technologies Greater Capabilities and Scale Specialty Advanced Unparalleled global Gases Materials • Separation technology • laboratories infrastructure • Polymer science • Best in class metrology capabilities • Synthesis capability • Expanded global Advanced Delivery manufacturing footprint Materials Systems & Sensing and Control • World class operational Handling Services excellence • Most talented team in industry Faster time to solution

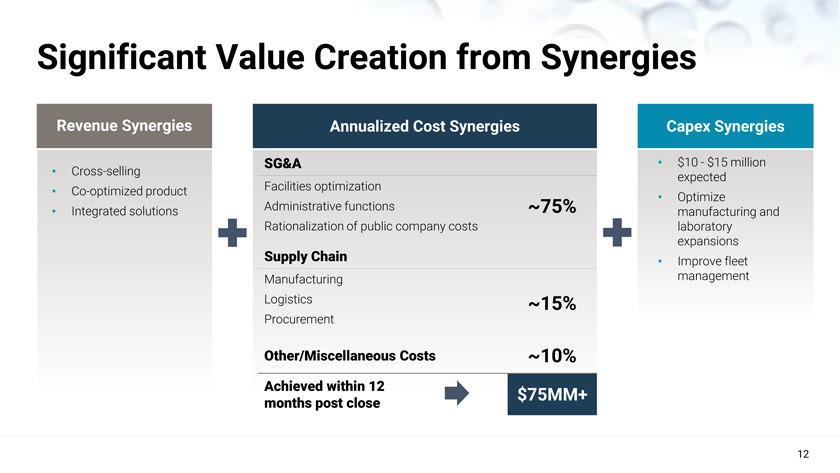

Significant Value Creation from Synergies Revenue Synergies Annualized Cost Synergies Capex Synergies SG&A • $10—$15 million • Cross-selling expected • Co-optimized product Facilities optimization • Optimize • Integrated solutions Administrative functions ~75% manufacturing and Rationalization of public company costs laboratory expansions Supply Chain • Improve fleet Manufacturing management Logistics ~15% Procurement Other/Miscellaneous Costs ~10% Achieved within 12 $75MM+ months post close

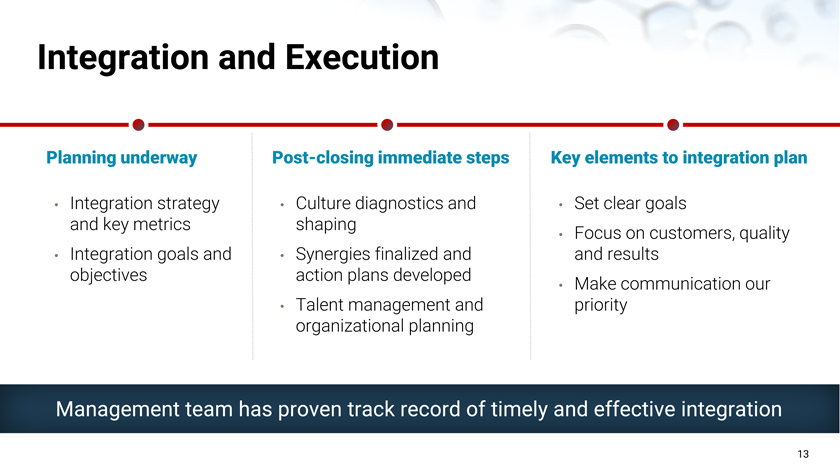

Integration and Execution Planning underway Post-closing immediate steps Key elements to integration plan • Integration strategy • Culture diagnostics and • Set clear goals and key metrics shaping • Focus on customers, quality • Integration goals and • Synergies finalized and and results objectives action plans developed • Make communication our • Talent management and priority organizational planning Management team has proven track record of timely and effective integration

A Compelling Global Specialty Materials Company Delivering Significant Value for Shareholders and Customers Shareholders Customers ✓ Attractive Growth Profile ✓ Global Manufacturing and Laboratory Infrastructure ✓ Diversified Portfolio ✓ Unique Product Breadth and ✓ Attractive and Stable Margins Depth ✓ Strong Cash Flow and Balance Commitment to R&D ✓ Unwavering Sheet ✓ Enhanced Technical Capabilities ✓ Enhanced Scale ✓ Faster Time to Solutions

Appendix

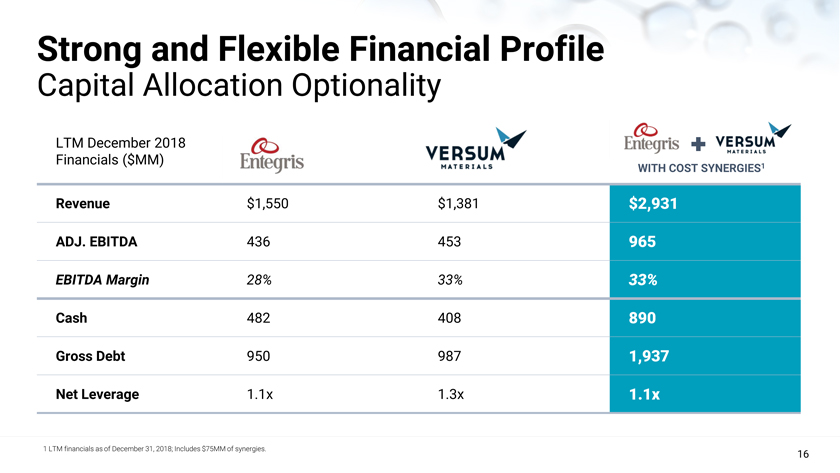

Strong and Flexible Financial Profile Capital Allocation Optionality LTM December 2018 Financials ($MM) WITH

COST SYNERGIES1 Revenue $1,550 $1,381 $2,931 ADJ. EBITDA 436 453 965 EBITDA Margin 28% 33% 33% Cash 482 408 890 Gross

Debt 950 987 1,937 Net Leverage 1.1x 1.3x

1.1x

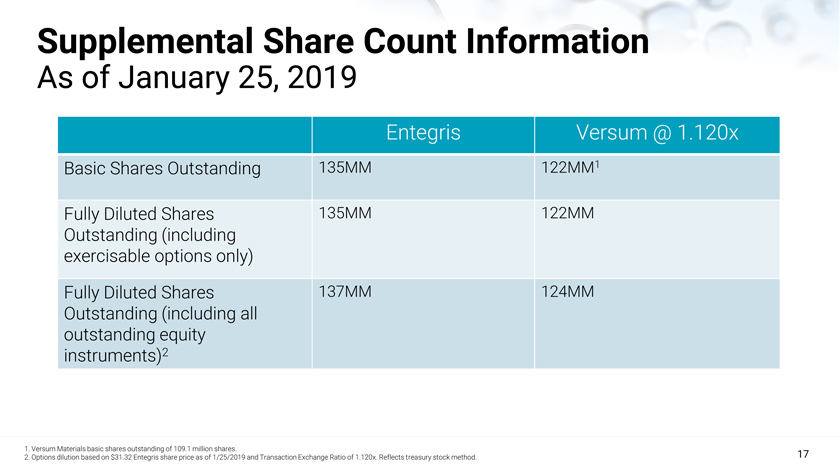

Supplemental Share Count Information As of January 25, 2019 Entegris Versum @ 1.120x Basic Shares Outstanding 135MM 122MM1 Fully Diluted Shares 135MM 122MM Outstanding (including exercisable options only) Fully Diluted Shares 137MM 124MM Outstanding (including all outstanding equity instruments)2