Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TCF FINANCIAL CORP | exhibit991jointpressrelease.htm |

| 8-K - 8-K - TCF FINANCIAL CORP | chfc8kmergerpressrelease20.htm |

TRANSFORMATIONAL PARTNERSHIP E n h a n c i n g Va l u e f o r O u r S h a r e h o l d e r s , C u s t o m e r s a n d C o m m u n i t i e s J A N U A R Y 2 8 , 2 0 1 9

Cautionary Note Regarding Forward-Looking Statements Statements included in this communication which are not historical in nature are intended to be, and hereby are identified as, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of Chemical and TCF with respect to their planned merger, the strategic benefits and financial benefits of the merger, including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share, the tangible book value earn-back period and other operating and return metrics), and the timing of the closing of the transaction. Words such as “may,” “anticipate,” “plan,” “estimate,” “expect,” “project,” “assume,” “approximately,” “continue,” “should,” “could,” “will,” “poised,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include, among others, the following: • the failure to obtain necessary regulatory approvals when expected or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); • the failure of either Chemical or TCF to obtain shareholder approval, or to satisfy any of the other closing conditions to the transaction on a timely basis or at all; • the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; • the possibility that the anticipated benefits of the transaction, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where Chemical and TCF do business, or as a result of other unexpected factors or events; • the impact of purchase accounting with respect to the transaction, or any change in the assumptions used regarding the assets purchased and liabilities assumed to determine their fair value; • diversion of management’s attention from ongoing business operations and opportunities; • potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; • the ability of either company to effectuate share repurchases and the prices at which such repurchases may be effectuated; • the outcome of any legal proceedings that may be instituted against Chemical or TCF; • the integration of the businesses and operations of Chemical and TCF, which may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to Chemical’s or TCF’s existing businesses; • business disruptions following the merger; and • other factors that may affect future results of Chemical and TCF including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause results to differ materially from those described above can be found in the risk factors described in Item 1A of each of Chemical’s and TCF’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2017. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Chemical and TCF disclaim any obligation to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by law. 2

Additional Information Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction between Chemical and TCF. In connection with the proposed merger, Chemical will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of Chemical and TCF and a Prospectus of Chemical, as well as other relevant documents regarding the proposed transaction. A definitive Joint Proxy Statement/Prospectus will also be sent to Chemical and TCF shareholders. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. A free copy of the Joint Proxy Statement/Prospectus, once available, as well as other filings containing information about Chemical and TCF, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Chemical by accessing Chemical’s website at http://www.chemicalbank.com (which website is not incorporated herein by reference) or from TCF by accessing TCF’s website at http://www.tcfbank.com (which website is not incorporated herein by reference). Copies of the Joint Proxy Statement/Prospectus once available can also be obtained, free of charge, by directing a request to Chemical Investor Relations at Investor Relations, Chemical Financial Corporation, 333 W. Fort Street, Suite 1800, Detroit, MI 48226, by calling (800) 867-9757 or by sending an e-mail to investorinformation@chemicalbank.com, or to TCF Investor Relations at Investor Relations, TCF Financial Corporation, 200 Lake Street East, EXO-02C, Wayzata, MN 55391 by calling (952) 745-2760 or by sending an e-mail to investor@tcfbank.com. Participants in Solicitation Chemical and TCF and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Chemical and TCF shareholders in respect of the transaction described in the Joint Proxy Statement/Prospectus. Information regarding Chemical’s directors and executive officers is contained in Chemical’s Annual Report on Form 10-K for the year ended December 31, 2017, its Proxy Statement on Schedule 14A, dated March 16, 2018, and certain of its Current Reports on Form 8-K, which are filed with the SEC. Information regarding TCF’s directors and executive officers is contained in TCF’s Annual Report on Form 10-K for the year ended December 31, 2017, its Proxy Statement on Schedule 14A, dated March 14, 2018, and certain of its Current Reports on Form 8-K, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures that are not in accordance with U.S. generally accepted accounting principles (GAAP). Chemical and TCF use certain non-GAAP financial measures to provide meaningful, supplemental information regarding their operational results and to enhance investors’ overall understanding of Chemical’s and TCF’s financial performance. The limitations associated with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s and TCF’s GAAP results. 3

Presenters David T. Provost Craig R. Dahl President & CEO | Chemical Chairman, President & CEO | TCF Dennis Klaeser Brian W. Maass CFO | Chemical CFO | TCF 4

Partnering to Create Significant Strategic and Financial Value Enhanced . Creates a premier bank in the Midwest¹ Competitive − Top 10 regional player with $45 billion of assets² Position − Scale, profitability and consistent performance required to compete and win in an evolving market . Strengthens each company’s standalone growth profile Complementary − Lower risk—limited overlap minimizes disruption of go-to-market strategies and customer relationships Partners − Significant upside—more diversified balance sheet, broader product set, exportable expertise Exceptional . Accelerates shareholder value creation Financial − Material GAAP EPS accretion – 17% to Chemical 3, 31% to TCF 3 – with just 2.7-year TBVPS earnback 4 Benefits − Approximately 19% pro forma ROATCE 5 drives significant capital generation and compounds TBVPS . Retains deep community ties, customer-centric focus and commitment to performance Shared Values − Common legacy of providing philanthropic, civic and economic development support − Strong pro forma governance, clear leadership and status as a best-in-class employer (1) Midwest defined as IL, IN, OH, MI, MN and WI (2) Pro forma balance sheet metrics as of the period ended December 31, 2018; excludes purchase accounting adjustments (3) See page 31 for detail regarding calculation of run-rate GAAP EPS accretion (4) See page 32 for detail regarding calculation of tangible book value per share dilution and earnback (5) Pro forma metric based on 2020E consensus estimates, assuming $180mm pre-tax cost savings are fully phased in 5

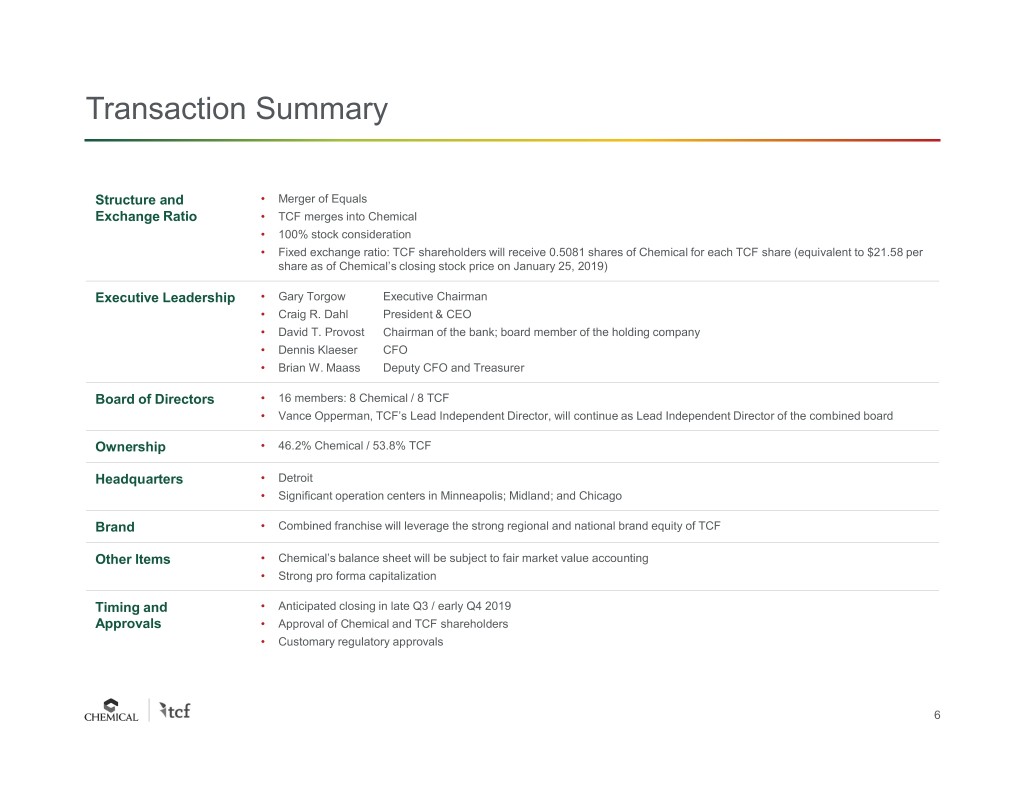

Transaction Summary Structure and • Merger of Equals Exchange Ratio • TCF merges into Chemical • 100% stock consideration • Fixed exchange ratio: TCF shareholders will receive 0.5081 shares of Chemical for each TCF share (equivalent to $21.58 per share as of Chemical’s closing stock price on January 25, 2019) Executive Leadership • Gary Torgow Executive Chairman • Craig R. Dahl President & CEO • David T. Provost Chairman of the bank; board member of the holding company • Dennis Klaeser CFO • Brian W. Maass Deputy CFO and Treasurer Board of Directors • 16 members: 8 Chemical / 8 TCF • Vance Opperman, TCF’s Lead Independent Director, will continue as Lead Independent Director of the combined board Ownership • 46.2% Chemical / 53.8% TCF Headquarters • Detroit • Significant operation centers in Minneapolis; Midland; and Chicago Brand • Combined franchise will leverage the strong regional and national brand equity of TCF Other Items • Chemical’s balance sheet will be subject to fair market value accounting • Strong pro forma capitalization Timing and • Anticipated closing in late Q3 / early Q4 2019 Approvals • Approval of Chemical and TCF shareholders • Customary regulatory approvals 6

Stronger Combined Franchise Significant Upside Two Growth Franchises, Together Scaled for Success 3 EPS accretion to Chemical: $45B $34B $34B Combined assets Gross loans & leases Total deposits 17% 13% GAAP¹ Cash¹ +13% +11% +12% 2013–2018 combined CAGR 2013–2018 combined CAGR 2013–2018 combined CAGR EPS accretion to TCF: Strong Profitability 4 Balanced Loan & Lease Portfolio 3 31% 27% GAAP¹ Cash¹ Commercial & ~1.6% ROAA 39% Business Banking Residential & ~19% ROATCE 38% Consumer Banking Capitalized value of net cost savings 2: Leasing, Equipment $1.3B ~53% Efficiency ratio 23% & Inventory Finance (1) See page 31 for detail regarding calculation of run-rate GAAP and Cash EPS accretion; Cash EPS accretion excludes all purchase accounting amortization (2) Capitalized value of cost synergies is calculated as $180 million pre-tax / $142 million after-tax cost synergies, multiplied by market cap weighted NTM P/E multiple of 10.8x, net of $325 million pre-tax / $270 million after-tax one-time restructuring charges; Capitalized value is not discounted to present value (3) Pro forma balance sheet metrics as of the periods ended December 31, 2018 (for combined balances) and periods ended December 31, 2018 (for 2013–2018 CAGR calculations); CAGR calculations exclude both companies’ auto finance portfolios (4) Pro forma profitability metrics are based on 2020E consensus estimates and assume $180mm pre-tax cost savings are fully phased in 7

Accelerating the Achievement of Chemical and TCF’s Standalone Strategic Priorities Together Build core business banking: Significantly enhance our Increase return on capital − Treasury management operating performance, Leverage existing infrastructure, − Hiring best-in-market talent profitability, and returns deliver operating leverage, lower efficiency ratio Grow specialty commercial lines: Expand geographically, and − ABL deploy our respective Re-mix balance sheet to increase capital efficiency and reduce risk − Leasing strengths into each other’s − Commercial finance markets Grow C&I and CRE lending and deposits Enhance digital platform Enable faster growth without building concentrations Invest in technology to provide a Double southeast Michigan presence differentiated customer experience Achieve greater scale on our Expand in adjacent markets technology and marketing Continue expanding national lending investments Expand mortgage product offering Attract and retain top talent 8

Together, We Are Best in Class Pro Forma Financial Performance Relative to $20–100B Asset Banks 1 Merger Benefits Accrue to All Shareholders Top Quartile 5.0% Revenue Consistently higher returns Generation (Operating revenue / total assets) 2 Double-digit EPS growth Pro forma 53% Strong capital, liquidity and credit quality Solid Efficiency Ratio 3 Increased growth and revenue diversification Pro forma 19% Significant upside and Top Quartile value creation Return on Average Tangible Common Expanded strategic 3 Equity flexibility Pro forma Source: S&P Global Market Intelligence (1) Includes publicly traded U.S. banks with $20–100 billion in assets as of most recent available financial data (2) Annualized performance from Q1 2018 to Q3 2018 is shown for peers; Q4 2018 data is shown for the pro forma company (3) Annualized performance from Q1 2018 to Q3 2018 is shown for peers; 2020 pro forma is shown for the pro forma company, based on standalone consensus EPS estimates plus $180 million of pre-tax cost savings (fully phased in) 9

Strategic Rationale

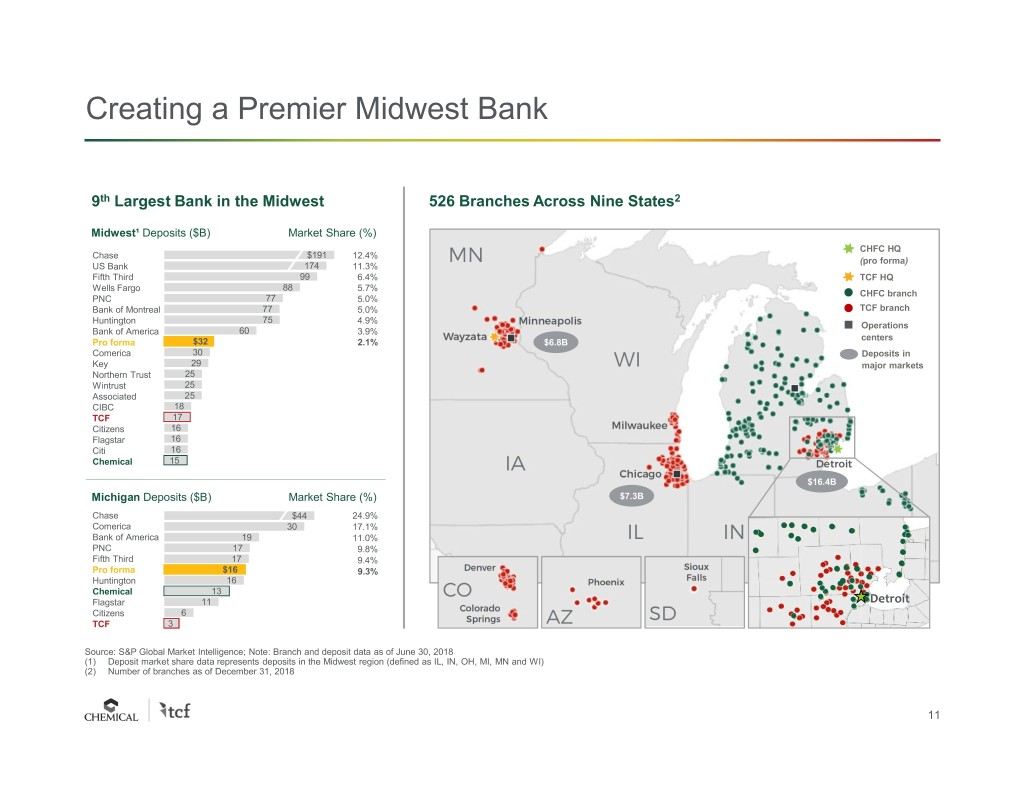

Creating a Premier Midwest Bank 9th Largest Bank in the Midwest 526 Branches Across Nine States 2 Midwest¹ Deposits ($B) Market Share (%) CHFC HQ Chase $191 12.4% (pro forma ) US Bank 174 11.3% Fifth Third 99 6.4% TCF HQ Wells Fargo 88 5.7% CHFC branch PNC 77 5.0% Bank of Montreal 77 5.0% TCF branch Huntington 75 4.9% Operations Bank of America 60 3.9% centers Pro forma $32 2.1% $6.8B Comerica 30 Deposits in Key 29 major markets Northern Trust 25 Wintrust 25 Associated 25 CIBC 18 TCF 17 Citizens 16 Flagstar 16 Citi 16 Chemical 15 $16.4B Michigan Deposits ($B) Market Share (%) $7.3B Chase $44 24.9% Comerica 30 17.1% Bank of America 19 11.0% PNC 17 9.8% Fifth Third 17 9.4% Pro forma $16 9.3% Huntington 16 Chemical 13 Detroit Flagstar 11 Citizens 6 TCF 3 Source: S&P Global Market Intelligence; Note: Branch and deposit data as of June 30, 2018 (1) Deposit market share data represents deposits in the Midwest region (defined as IL, IN, OH, MI, MN and WI) (2) Number of branches as of December 31, 2018 11

Better Positioned to Compete, Invest and Win—Today and in the Future External landscape is rapidly changing across many industry sectors Banking industry is faced with these same trends Together, Chemical and TCF are well positioned to leverage joint resources and serve evolving customer needs Environmental Trends Our Partnership Provides Chemical and TCF Together Customer needs and expectations Scale Invest and innovate more efficiently • Better leverages enterprise-wide services Digitization and overhead to drive near-term value creation Sustain our competitive advantages and • Supports more efficient infrastructure ability to compete as experts in our Mobile capabilities • Provides greater profit pool to support chosen segments future growth initiatives Data analytics Enhance customer-facing digital service offerings and streamline internal Scope Non-bank and fin-tech competitors systems and processes • More customers • Wider geographic reach AI / robotics / automation • More complete product set Momentum from adding and expanding customer relationships 12

Balanced Go-to-Market Business Model The New TCF: Strong Regional and National Brand Equity Local Business Banking Retail & Community Banking National Lending $13B / 39% of total loans and leases $13B / 38% of total loans and leases $8B / 23% of total loans and leases $12B / 36% of deposits $22B / 64% of deposits • In-Market, Relationship Commercial • Full suite of deposit products and services, • Leasing and Equipment Finance Banking including wealth management and trust • Inventory Finance • Deposit expertise in Treasury Management • Strong digital experience • Diversified portfolio by asset class, and local government • 526 branches in nine states geography, industry, loan size and collateral • Focused in densely populated metros • Branch-based mortgage originations type • Expanded small business mobile platform • Both companies have been running off / de- • Granular client base: 77,000 lending • Strong talent acquisition program emphasizing auto lending portfolio relationships • Short duration and highly asset sensitive • Capacity for growth 71% Chemical¹ 29% TCF¹ 44% Chemical¹ 56% TCF¹ ~100% TCF¹ Note: Pro forma financial metrics as of the period ended December 31, 2018; excludes purchase accounting adjustments (1) Represents approximate contribution of total loans and leases 13

Highly Diversified Loan and Lease Portfolio • Upside growth potential from multiple loan origination engines–without building concentrations − TCF’s Leasing & Equipment Finance and Inventory Finance exposures are reduced from 41% of standalone total loans and leases to 23% of pro forma − Chemical’s Commercial Real Estate and Construction exposures are reduced from 297% of standalone risk based capital to 193% of pro forma • High asset quality; lower-risk loans and leases − Both companies have less than 60 bps of NPAs / total assets¹ − Consistent vision to deemphasize the consumer auto business $34B in Pro Forma Total Loans & Leases² Composition by product type Composition by geography Leasing & Equipment Finance C&I 14% 14% All other CRE Inventory Finance 33% Michigan 9% 38% 193% of Risk- 22% Other consumer 4% Based Capital 4 3% 8% 28% 5% 6% California 4% Consumer Construction 6% 6% Real Estate Auto Other Midwest 3 Minnesota Ohio Illinois Note: Chemical and TCF financial data as of the period ended December 31, 2018 (1) NPAs exclude performing troubled debt restructurings (TDRs) (2) Excludes the impact of purchase accounting adjustments (3) Other Midwest includes WI and IN (4) Estimated pro forma risk-based capital at transaction closing incorporating purchase accounting adjustments 14

Strong Combined Deposit Base • Core deposits are well balanced across both retail and commercial franchises • Limited reliance on wholesale funding • Access to diverse markets and funding sources enables low beta: Chemical and TCF’s combined cumulative deposit beta has been just 23% cycle-to-date¹ • 77% of all deposits are FDIC insured 2 versus 60% median of $20–100B asset banks $34B in Pro Forma Deposits 3 Composition by type Composition by geography Other 4 Non-interest Greater bearing transaction Michigan 5 Time 11% 23% 18% 27% Minneapolis 20% 15% Detroit 17% 73% non-time 3% 20% 7% Ann Arbor 34% Interest-bearing 6% Savings and transaction MMDA Chicago Midland Grand Rapids Note: Chemical and TCF composition data by type of deposit as of the period ended December 31, 2018; Geography composition data as of June 30, 2018 (1) Calculated as change in combined cost of deposits (combined interest expense on deposits divided by average combined total deposits), relative to the change in the Fed Funds Target Rate, between Q3 2015 and Q4 2018 (2) FDIC insurance data as of September 30, 2018 (3) Does not include the impact of purchase accounting adjustments (4) Includes all other markets, including Denver, Youngstown and Cleveland (5) Greater Michigan excludes Detroit, Midland, Grand Rapids and Ann Arbor 15

Robust and Complementary Fee Income Streams ~$600mm of Pro Forma Fee Income¹ Composition by type • Combined fee income represents approximately 61% from Overlapping Sources 39% from Unique Sources 28% of total revenue—relative to 23% median of $20–100B asset banks¹ Trust and Wealth Management Card, Electronic and ATM • Complementary mix of non-overlapping revenue 4% − TCF brings Leasing & Equipment Finance and 16% Inventory Finance Service Charges Leasing & Equipment − Chemical brings trust and wealth management and Fees Finance 30% • Overlapping fee income sources are primarily recurring service charges and deposit-based fees 28% • Combined company is well positioned to leverage each partner’s unique businesses across its 4% broader pro forma footprint 11% 7% Mortgage Servicing Mortgage Other² Banking (1) Full year 2018 data shown for combined company metric; excludes the impact of identified revenue enhancements; Performance from Q1 2018 to Q3 2018 is shown for peers (2) Includes bank-owned life insurance 16

Strong Governance and Proven Leadership Pro Forma Board of Directors Chemical’s eight directors will include: TCF’s eight directors will include: Gary Torgow David Provost Craig Dahl Vance Opperman Executive Chairman Director, Chairman of Bank 8 8 President & CEO Lead Independent Director • Chairman of Chemical • President & CEO of • Chairman of TCF since • Serves as lead since 2016 Chemical since mid-2017 April 2017; CEO since independent director of • Previously served as • Previously served as January 2016 TCF and Thomson Reuters Chairman of Talmer President & CEO of • Joined TCF in 1999 to • Owner and CEO of MSP Bancorp Talmer Bancorp establish its equipment Communications • 42-year career in banking finance division • 41-year career in banking TCF’s Performance With Craig Dahl as CEO TCF KRX S&P 500 Proven track record of organically building and growing businesses 52% 20.9% 2015–2018 EPS CAGR 1 28% Top quartile total shareholder return since January 2016 2 21% Reduced risk profile Jan-16 Jan-17 Jan-18 Jan-19 Improved balance sheet positioning and liquidity Source: S&P Global Market Intelligence; Market data as of January 25, 2019 (1) Based on adjusted diluted earnings per common share (2) Top quartile return relative to publicly traded U.S. banks with $20–100 billion in assets 17

Combination Benefits Key Stakeholders Customers Communities Employees & Culture • Broader product suite • Combined company will • Shared values and have several major • Improved speed to market principles with a strong centers of influence community orientation • Lower credit - Detroit concentrations enabled - Twin Cities • Highly complementary increased lending - Chicago business models capabilities - Midland • Strengthened ability to • Further investments in • Longstanding commitment recruit and retain top-tier technology and digital to meeting needs of our talent banking supported by communities • Ability to invest in talent, strong profitability and • Continued focus on programs and infrastructure ability to leverage supporting community driven by strength of investments across development combined balance sheet broader customer base • Commitment to continue to • Increased professional • Maintain strong provide meaningful development and career compliance culture contributions to various opportunities within larger charitable and community banking platform organizations 18

Merger Structure

Key Merger Assumptions Standalone • Chemical: 2020 consensus estimate of $4.38 per share Earnings Per Share • TCF: 2020 consensus estimate of $2.00 per share Estimated Cost • $180 million pre-tax (represents approximately 13% of combined 2019 expense base) Savings • Assumed phase-in schedule: $75 million in first 12 months after closing, full $180 million run-rate thereafter Revenue • Identified but not modeled Enhancements Estimated Marks on • Gross credit mark: $189 million (equivalent to 1.18% of gross loans and 1.6x ALLL); approximately $25 million of Chemical Chemical’s Balance non-accretable credit discount will be reversed at closing and netted against the gross credit mark Sheet • Rate, spread and other fair market value marks: $200 million discount, accreted based on estimated remaining lives of individual assets and liabilities • Core deposit intangible: $168 million (equivalent to 1.50% of non-time deposits), amortized over 10 years utilizing sum-of-the- years-digits methodology Estimated Merger & • $325 million pre-tax Integration Costs • 80% tax deductible • Fully reflected in computation of pro forma tangible book value per share at closing Other • TCF repurchases $78 million of its stock prior to closing, representing the completion of its existing authorized share repurchase plan 20

Exceptional Financial Returns Relative to Recent Bank Mergers and Acquisitions / Recent $1B+ bank M&A¹ Premium At-market merger of equals 15% 17% to Chemical Run-rate GAAP EPS accretion 2 8% 31% to TCF ROAA improvement 3 +30 bps +16 bps ROATCE improvement 3 ~300bps +200bps TBVPS dilution 4 7.9% 5.5% TBVPS crossover earnback 4 2.7 years 3.7 years Source: S&P Global Market Intelligence (1) Median of $1 billion+ bank mergers and acquisitions since January 1, 2014; Transactions include WSFS-Beneficial, Synovus-FCB, Veritex-Green, Independent-Guaranty, Fifth Third-MB Financial, Cadence-State Bank, First Financial-MainSource, First Horizon-Capital Bank, Sterling-Astoria, IBERIABANK-Sabadell, Pinnacle-BNC, F.N.B.-Yadkin, Chemical-Talmer, Huntington-FirstMerit, BBCN-Wilshire, KeyCorp-First Niagara, BB&T-National Penn, BB&T-Susquehanna and CIT-OneWest (2) Relative to 2020 IBES consensus estimates; see page 31 for additional detail; assumes fully phased in cost savings (3) Relative to Chemical’s standalone 2020 ROAA and ROATCE implied by IBES consensus estimates (4) See TVBPS dilution and earnback details on page 32 21

Achievable Cost Synergies Drive Material Value Creation $180 million pre-tax cost savings (13% of combined) Composition by type Illustrative market value creation $7.8B Other Chemical $1.3B $6.5B $3.6B Retail banking, Centralized overhead +19% 5% Chemical +20% including branches and shared services $3.0B 15% 35% Facilities, contracts and 10% TCF procurement TCF $4.2B $3.5B +19% 35% IT efficiencies Standalone market Capitalized value of Illustrative capitalizations¹ net cost savings² combined value By reducing duplication, we gain material leverage on $1.3 billion capitalized value of net cost savings categories of costs (e.g. overhead, IT) that have represents 19% value creation relative to each been accelerating for the past decade company’s standalone market capitalization (1) Standalone market capitalizations as of January 25, 2019 (2) Capitalized value of cost synergies reflects $180 million pre-tax / $142 million after-tax cost synergies, multiplied by market-cap weighted NTM P/E multiple of 10.8x, as of closing share prices and consensus estimates on January 25, 2019, net of $325 million pre-tax / $270 million after-tax one-time restructuring charges; Capitalized value is not discounted to present value 22

Positioned for Significant Upside $20–100B asset banks² / Median Top Quartile Profitability¹ ROATCE ~19% 14.7% 17.3% ROAA ~1.6% 1.23% 1.49% Efficiency Ratio ~53% 56.0% 47.7% Fee Income / Revenue ~28% 22.7% 26.5% NIM ~4.0% 3.54% 3.71% Balance Sheet and Capital Loans / Deposits ~94% 93% 86% CET1 ~10.0% 11.2% 13.0% Market Information Stock Price 3 $42.47 – – Pro forma core / run-rate 2020E EPS $4.73 4 / $5.13 5 – – Price to core / run-rate 2020E EPS 9.0x / 8.3x 10.1x 11.4x Source: S&P Global Market Intelligence (1) Pro forma profitability figures for combined company estimated for 2020 assuming fully phased in cost savings; balance sheet estimated for September 30, 2019 transaction close; Balance sheet data includes purchase accounting adjustments (2) Peers include publicly traded U.S. banks with $20–100 billion in assets; Profitability data based on annualized performance from Q1 2018 to Q3 2018; Balance sheet information as of September 30, 2018 (3) Chemical’s closing share price on January 25, 2019 (4) Based on consensus 2020 estimates for Chemical and TCF, plus approximately $101 million of cost savings phased in during calendar year 2020 (assuming the transaction closes in Q3 2019, and cost savings are phased in on a schedule of $75 million annualized during the first four calendar quarters and $180 million annualized thereafter) (5) Represents run rate EPS with fully phased in cost savings. See page 31 for detail regarding calculation of run-rate EPS accretion 23

Partnering to Create Significant Strategic and Financial Value Premier bank in the Midwest —scaled to compete and win Complementary partners together positioned for superior growth, profitability and consistency Exceptional financial benefits and value creation for shareholders of both companies Shared values—strong community ties, customer-centric focus and commitment to performance 24

Appendix

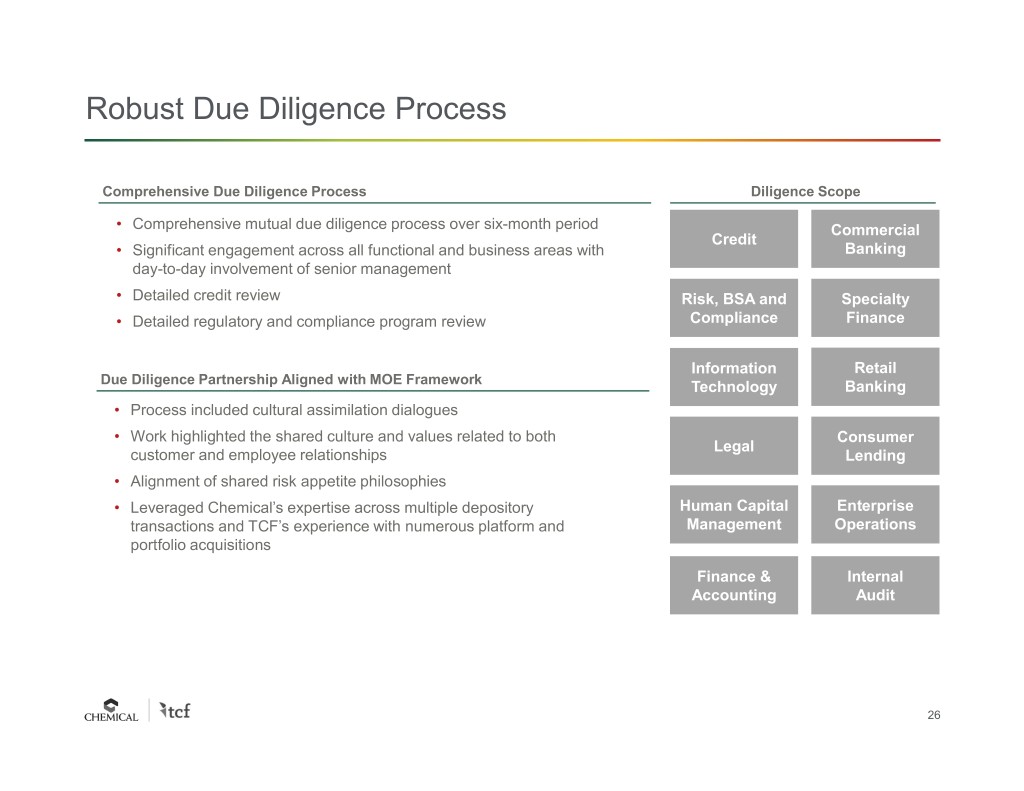

Robust Due Diligence Process Comprehensive Due Diligence Process Diligence Scope • Comprehensive mutual due diligence process over six-month period Commercial Credit • Significant engagement across all functional and business areas with Banking day-to-day involvement of senior management • Detailed credit review Risk, BSA and Specialty • Detailed regulatory and compliance program review Compliance Finance Information Retail Due Diligence Partnership Aligned with MOE Framework Technology Banking • Process included cultural assimilation dialogues • Work highlighted the shared culture and values related to both Consumer Legal customer and employee relationships Lending • Alignment of shared risk appetite philosophies • Leveraged Chemical’s expertise across multiple depository Human Capital Enterprise transactions and TCF’s experience with numerous platform and Management Operations portfolio acquisitions Finance & Internal Accounting Audit 26

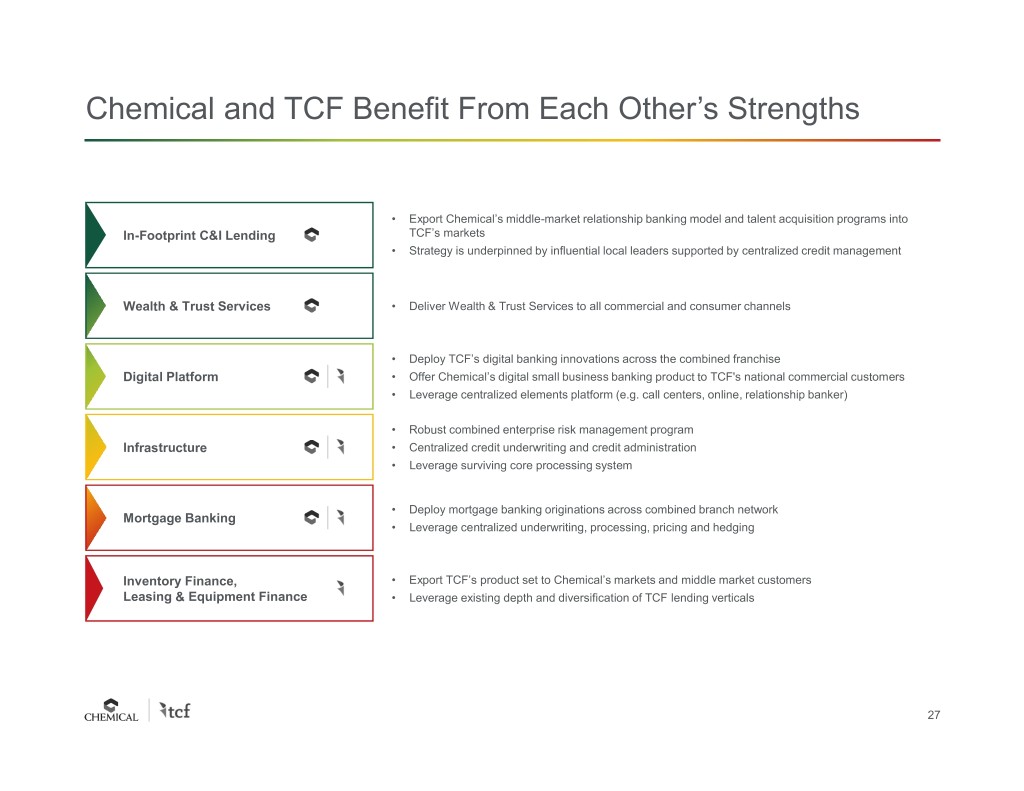

Chemical and TCF Benefit From Each Other’s Strengths • Export Chemical’s middle-market relationship banking model and talent acquisition programs into In-Footprint C&I Lending TCF’s markets • Strategy is underpinned by influential local leaders supported by centralized credit management Wealth & Trust Services • Deliver Wealth & Trust Services to all commercial and consumer channels • Deploy TCF’s digital banking innovations across the combined franchise Digital Platform • Offer Chemical’s digital small business banking product to TCF's national commercial customers • Leverage centralized elements platform (e.g. call centers, online, relationship banker) • Robust combined enterprise risk management program Infrastructure • Centralized credit underwriting and credit administration • Leverage surviving core processing system • Deploy mortgage banking originations across combined branch network Mortgage Banking • Leverage centralized underwriting, processing, pricing and hedging Inventory Finance, • Export TCF’s product set to Chemical’s markets and middle market customers Leasing & Equipment Finance • Leverage existing depth and diversification of TCF lending verticals 27

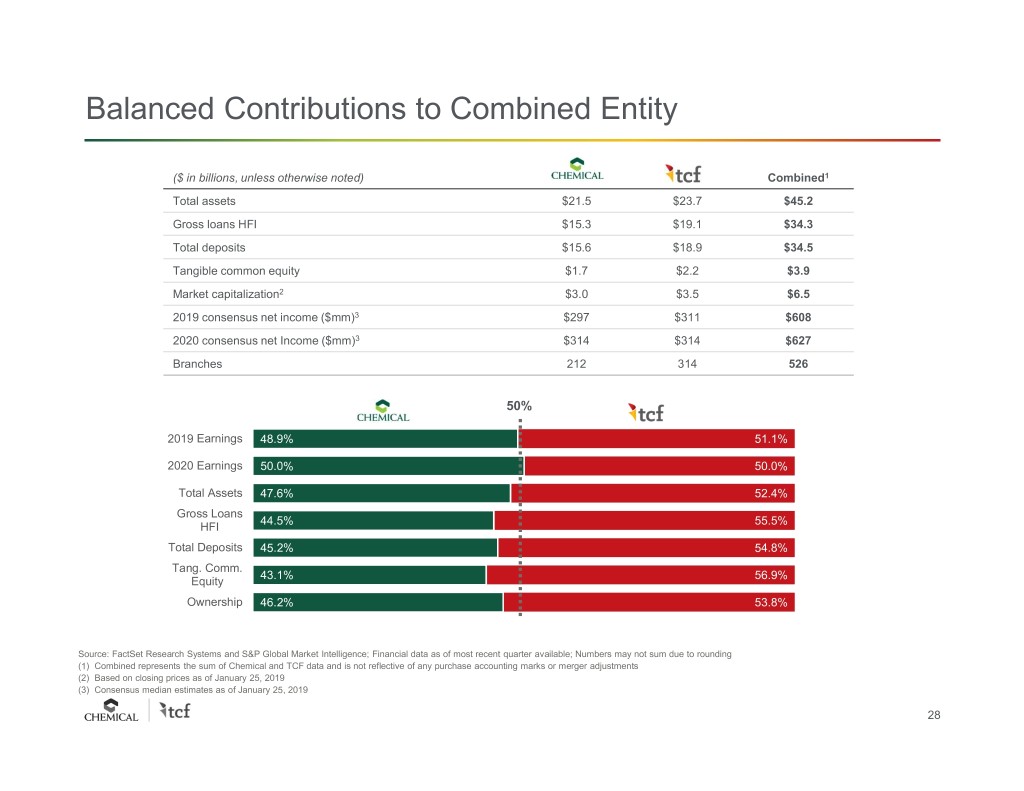

Balanced Contributions to Combined Entity ($ in billions, unless otherwise noted) Combined 1 Total assets $21.5 $23.7 $45.2 Gross loans HFI $15.3 $19.1 $34.3 Total deposits $15.6 $18.9 $34.5 Tangible common equity $1.7 $2.2 $3.9 Market capitalization 2 $3.0 $3.5 $6.5 2019 consensus net income ($mm) 3 $297 $311 $608 2020 consensus net Income ($mm) 3 $314 $314 $627 Branches 212 314 526 50% 2019 Earnings 48.9% 51.1% 2020 Earnings 50.0% 50.0% Total Assets 47.6% 52.4% Gross Loans 44.5% 55.5% HFI Total Deposits 45.2% 54.8% Tang. Comm. 43.1% 56.9% Equity Ownership 46.2% 53.8% Source: FactSet Research Systems and S&P Global Market Intelligence; Financial data as of most recent quarter available; Numbers may not sum due to rounding (1) Combined represents the sum of Chemical and TCF data and is not reflective of any purchase accounting marks or merger adjustments (2) Based on closing prices as of January 25, 2019 (3) Consensus median estimates as of January 25, 2019 28

Pro Forma Loan and Deposit Composition / Other Leasing & consumer Leasing & C&I Equipment Finance Equipment Finance C&I Consumer C&I 5% CRE Real Estate 10% 14% 14% 26% 25% 13% Inventory Construction Finance 2% 9% 28% CRE 10% 4% 22% $15B $19B Other $34B Auto consumer 16% 3% 4% Inventory Loans and leases 28% 32% 28% 6% CRE Finance Construction Construction Consumer Consumer Real Estate Real Estate Auto Non-interest Non-interest Non-interest bearing transaction bearing transaction bearing transaction Time Time Time 21% 23% 28% 25% 25% 27% $16B Interest- $19B 13% $34B bearing 17% Deposits transaction 21% Interest- Interest- 26% bearing 34% bearing Savings Savings 41% transaction Savings transaction and MMDA and MMDA and MMDA Note: Chemical and TCF financial data as of the period ended December 31, 2018, numbers may not add due to rounding 29

Combined Company Has a Strong Presence in the Most Attractive Midwest Markets Total Population (mm) 9.5 Nearly 60% of 4.3 the pro forma 3.7 franchise 2.8 2.2 2.2 2.1 2.1 2.1 located in 5 of 1.6 the top 10 1 Midwest MSAs Chicago Detroit MSP St. Cincinatti Kansas Columbus Indianapolis Cleveland Milwaukee Louis City % of Pro forma 19.9% 15.1% 20.0% 1.7% 1.9% franchise 2 Pro forma market share #2 #1 #4 #1 rank 82.3% Solid deposit market share in desirable mid- Pro forma 11.8% 12.0% size urban deposit 9.0% markets 3 market share 4 Ann Arbor Midland Grand Rapids Greater MI Deposits in $1.0 $2.2 $1.9 $6.0 market ($B) Source: S&P Global Market Intelligence (1) Ranked in terms of total MSA population (2) Percent of pro forma total deposits; does not include the impact of purchase accounting (3) Deposit data as of 6/30/2018; shown pro forma for pending and recently completed acquisitions (4) Defined as the state of MI excluding the Detroit, Ann Arbor, Midland, and Grand Rapids MSAs 30

Earnings Per Share Accretion GAAP “Cash” Millions of $mm $mm diluted shares Chemical 2020 EPS consensus median estimate $314 $314 72 TCF 2020 consensus median estimate 314 314 157 After-tax “cash” adjustments Fully phased-in cost savings 1 $142 $142 Cost of financing (7) (7) Reversal of Chemical standalone intangible amortization expense 4 4 Add-back of TCF standalone intangible amortization expense – 2 After-tax GAAP adjustments Loan interest rate mark accretion 2 40 – Core deposit intangible amortization 3 (24) – Other purchase accounting adjustments 3 – Pro forma 2020 Chemical net income $786 $769 153 4 Chemical 2020 standalone EPS $4.38 $4.43 TCF 2020 standalone EPS 2.00 2.01 Pro forma 2020 EPS $5.13 $5.02 $ EPS accretion to Chemical $0.75 $0.59 % EPS accretion to Chemical 17.1% 13.2% Pro forma 2020 EPS $5.13 $5.02 (x) Fixed exchange ratio 0.5081x 0.5081x Pro forma 2020 EPS attributable to TCF $2.61 $2.55 153 4 $ EPS accretion to TCF $0.61 $0.54 % EPS accretion to TCF 30.6% 27.0% Note: Pro forma adjustments assume 21% marginal tax rate; Assumes TCF repurchases ~$78 million (~3.5 million shares) of its stock between announcement and closing which represents the remaining authorization of its current repurchase plan (1) $180 million pre-tax fully phased-in reduction in combined company’s total noninterest expense base (2) Estimated loan interest rate mark of $201 million accreted back through earnings over 7 years; accelerated method (3) Core deposit intangible estimate of 1.5% ($168 million) on non-time deposits, amortized 10 years; accelerated method (4) The pro forma diluted shares outstanding include Chemical shares and shares issued to TCF based on 0.5081 exchange ratio 31

Purchase Accounting Summary Tangible book value per share dilution and earnback Forma Calculation of intangibles created Millions $ millions of basic shares $ per share $ millions Chemical standalone Merger consideration for accounting purposes 2 $3,044 Chemical tangible book value as of December 31, 2018 1 $1,673 71 Standalone Chemical tangible book value at close 6 $1,824 Three quarters of consensus earnings prior to close 221 (+) Net after-tax credit mark 7 (39) Three quarters of consensus per share common dividends 74 (+) After-tax other fair value adjustments (158) Amortization of existing core deposit intangibles 4 Adjusted tangible book value $1,627 Standalone Chemical tangible book value at close $1,824 71 $25.52 Excess over adjusted tangible book value $1,416 Pro forma (+) Core deposit intangible created (168) Standalone Chemical tangible book value at close $1,824 71 $25.52 (+) DTL on CDI 35 Standalone TCF tangible book value at close 2,275 Goodwill created $1,283 Reversal of Chemical equity capital and intangibles (1,824) Goodwill and other intangibles created $1,451 Merger consideration for accounting purposes 2 3,044 82 3 Goodwill and other intangibles created 4 (1,451) After-tax restructuring expenses (270) TBVPS earnback illustration Pro forma Chemical tangible book value at close $3,596 153 $23.51 $50.00 $ dilution to Chemical ($2.01) Static % dilution to Chemical (7.9%) Tangible book value per share earnback 5 2.7 years $40.00 Crossover Crossover (dynamic) earnback The point at which the company’s pro forma tangible book 2.7 years Tangible value per share crosses where it would have been based $30.00 upon standalone estimates ($) Share TBV per book value per share Static earnback $20.00 earnback Per share level of tangible book value per share dilution Pre- Pro Forma 0.25 1.25 2.25 3.25 4.25 5.25 6.25 divided by the per share level of fully phased-in 2.7 years Merger At Close TBV Earnback (Years) annual EPS accretion Pro Forma TBV per Share ($) CHFC TBV per Share ($) CHFC Est. TBV per Share ($) at Close Note: Pro forma adjustments assume 21% marginal tax rate; Assumes TCF repurchases ~$78 million (~3.5 million shares) of its stock between announcement and closing which represents the remaining authorization of its current repurchase plan (1) Chemical tangible book value equal to common shareholders equity less goodwill and other intangible assets (2) Reflects hypothetical transaction value based on 1.9681 shares of TCF stock for each Chemical common share outstanding, based on the reciprocal of the actual consideration being offered (3) Based on 0.5081 shares of Chemical stock for each TCF common share outstanding (4) Based on expectations and assumptions as of announcement date; subject to change at transaction closing 9/30/2019 (5) Based on when pro forma tangible book value per share crosses over and begins to exceed projected stand alone Chemical tangible book value per share (6) Estimated TCF tangible common equity at close based on 1Q – 3Q ’19 consensus earnings and dividend estimates (7) Gross pre-tax credit mark of $189mm, net of projected ALLL at closing and certain existing credit marks on Chemical’s loans, tax-effected at a 21% tax rate 32