Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IBERIABANK CORP | earningsreleaseq42018cover.htm |

| EX-99.1 - EXHIBIT 99.1 - IBERIABANK CORP | earningsreleaseq42018docum.htm |

Exhibit 99.2 4Q18 Earnings Presentation January 25, 2019

Safe Harbor And Non-GAAP Financial Measures Safe Harbor To the extent that statements in this PowerPoint presentation relate to future plans, objectives, financial results or performance of IBERIABANK Corporation, these statements are deemed to be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates and assumptions and the current economic environment, are generally identified by the use of the words “plan”, “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. The Company’s actual strategies, results and financial condition in future periods may differ materially from those currently expected due to various risks and uncertainties. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Consequently, no forward-looking statement can be guaranteed. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason. This PowerPoint presentation supplements information contained in the Company’s earnings release dated January 25, 2019, and should be read in conjunction therewith. The earnings release may be accessed on the Company’s web site, www.iberiabank.com, under “Investor Relations” and then “Financial Information” and then “Press Releases.” Non-GAAP Financial Measures This PowerPoint presentation contains financial information determined by methods other than in accordance with GAAP. The Company’s management uses core non-GAAP financial metrics (“Core”) in their analysis of the Company’s performance to identify core revenues and expenses in a period that directly drive operating net income in that period. These Core measures typically adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax benefits associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain significant activities or transactions that in management’s opinion can distort period-to-period comparisons of the Company’s performance. Reference is made to “Non-GAAP Financial Measures” and “Caution About Forward Looking Statements” in the earnings release which also apply to certain disclosures in this PowerPoint presentation. 2

Corporate Profile Driving long-term value creation for our clients, associates, communities and shareholders Our Franchise Corporate Snapshot • $4.0 billion market cap as of January 24, 2019 • $72.34 share price • 2.27% dividend yield • $30.8 billion in total assets as of December 31, 2018 • $22.5 billion in loans • $23.8 billion in deposits • Operating continuously for over 131 years • 329 offices serving 33 MSAs across 12 states • Investment grade rated – S&P Rating BBB/A-2 3

Corporate Profile Driving long-term value creation for our clients, associates, communities and shareholders Mission Statement Our Focus • Provide exceptional value-based client • Relationship-driven commercial and services private banking business • Market-centric, people-driven approach in Great place to work • attractive Southeastern markets • Growth that is consistent with high • Building long-term A-list client performance relationships through service and care • “Branch-lite” delivery model with focus on Shareholder-focused • operating efficiency • Strong sense of community • Diversification across asset classes, business lines and geographies 4

Quarterly Summary 4Q18 And Full-Year 2018 Non- Non- Non- Non- GAAP GAAP GAAP GAAP Key Metrics GAAP GAAP GAAP GAAP 3Q18 4Q18 2017 2018 Core 3Q18 Core 4Q18 Core 2017 Core 2018 Earnings Per Common Share $1.73 $2.32 $1.74 $1.86 $2.59 $6.46 $4.47 $6.69 Return On Average Assets 1.34% 1.70% 1.35% 1.37% 0.58% 1.25% 0.98% 1.30% Return on Average Common Equity 10.21% 13.38% 10.27% 10.75% 3.95% 9.63% 6.82% 9.97% Return on Tangible Common Equity (TE) -- -- 16.34% 16.98% -- -- 9.86% 16.01% Tangible Efficiency Ratio (TE) -- -- 51.9% 50.7% -- -- 57.6% 53.7% Fourth Quarter Highlights: • 4Q18 earnings improved due to higher net interest income from increasing earning assets, margin expansion, and continued efforts to reduce non-interest expense; core tangible efficiency ratio of 50.69%, a 118 basis points improvement over prior quarter • Reported net interest margin of 3.81% and cash margin of 3.52%, an increase of 7 and 5 basis points, respectively - the Company realized $2 million more in recoveries compared to 3Q18 • Revenue growth and continued expense reductions produced positive operating leverage in the quarter • Core non-interest expense declined by $2.0 million, or 5% on an annualized basis, due to lower net cost of OREO and insurance expense offset by increases in benefits and marketing expense • Asset quality metrics improved and continue to be strong and stable • Declared cash dividend of $0.41 per common share, a 5% increase compared to the third quarter of 2018 • Repurchased 1.21 million shares at a weighted average price per share of $72.61 during the quarter 5

Fourth Quarter Items • On November 5, 2018, the Company announced a new repurchase plan, its 11th, of up to 2,765,000 shares of the outstanding common stock. The authorized repurchase represented approximately 5% of common shares outstanding. There were 2,265,000 remaining common shares that may be repurchased under the current Board authorized plan at December 31, 2018. • In connection with filing its 2017 income tax returns, the Company recorded a non-core, permanent net income tax benefit of approximately $65 million in the fourth quarter of 2018. This benefit was a result of deductions claimed on the 2017 income tax returns associated with unrealized losses on securities and loans and depreciation on real property. • During the quarter, the Company restructured portions of its investment portfolio selling approximately $1 billion of securities at a pre-tax loss of approximately $50 million ($38 million after-tax) and subsequently purchased $1.0 billion in securities. The restructure resulted in a 164 basis point in yield improvement on the bonds purchased. 6

Profitability Trends GAAP EPS Core EPS Return on Average Assets Return on Common Equity 7

Profitability – Pro Forma Impact of Tax Rate Changes on 2017 EPS GAAP EPS Core EPS 2017 GAAP EPS 2017 Core EPS As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted 1Q $1.00 $0.12 $1.12 1Q $1.02 $0.12 $1.14 2Q $0.99 $0.19 $1.18 2Q $1.10 $0.21 $1.31 3Q $0.49 $0.13 $0.62 3Q $1.00 $0.24 $1.24 4Q $0.17 $0.19 $0.36 4Q $1.33 $0.23 $1.56 Pro Forma impact on 2017 EPS includes the federal statutory income tax rate change from 35% to 21% and eliminating the deduction for FDIC Insurance 8

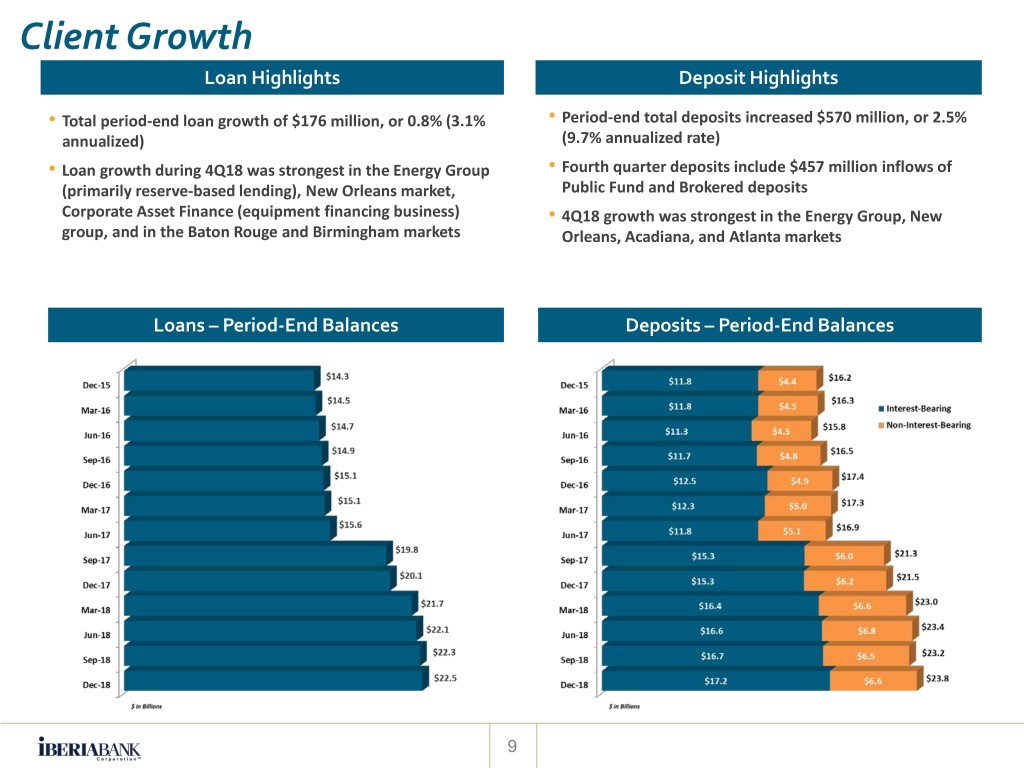

Client Growth Loan Highlights Deposit Highlights • Total period-end loan growth of $176 million, or 0.8% (3.1% • Period-end total deposits increased $570 million, or 2.5% annualized) (9.7% annualized rate) • Loan growth during 4Q18 was strongest in the Energy Group • Fourth quarter deposits include $457 million inflows of (primarily reserve-based lending), New Orleans market, Public Fund and Brokered deposits Corporate Asset Finance (equipment financing business) • 4Q18 growth was strongest in the Energy Group, New group, and in the Baton Rouge and Birmingham markets Orleans, Acadiana, and Atlanta markets Loans – Period-End Balances Deposits – Period-End Balances 9

Net Interest Margin Changes For 4Q18 Net Interest Primary Reason Net Interest Income ($MM) For Change Margin (%) $259.2 3Q18 3.74% (3.9) Changes in Acquired Loan Portfolios 0.01% Continued Upward Repricing of Variable Rate 13.3 0.10% Loans Change in Recovery/Reversal Income on 1.2 0.02% Legacy Loans 1.3 Change in Fee Income on Legacy Loans 0.02% 15.7 Changes in Legacy Loan Portfolios 0.14% 0.8 Improved Securities Portfolio Purchase Yields 0.04% Lower Borrowings Balance due to Lower 0.9 0.00% Funding Need Greater Deposit Yields From Repricing, (7.7) Promotional Activity, and Brokered CD -0.11% Issuance $265.0 4Q18 3.81% • Net interest margin was impacted by repricing of variable rate loans, security portfolio restructuring, and deposit and funding costs in 4Q18 • Variable rate loans represent 60% of total portfolio, with over 85% repricing within the next 12 months 10

Interest Rate Betas 1 YTD YTD Cycle to 4Q18 3Q18 2018 2017 Date 3Q18 2Q18 Dec-17 Dec-16 Nov-15 4Q18 3Q18 Dec-18 Dec-17 Dec-18 Total Loans 67% 43% 67% 60% 49% Earning Assets 70% 44% 70% 70% 46% Int. Bearing Deposits 66% 71% 61% 17% 38% Total Deposits2 49% 53% 45% 12% 27% • Total deposit beta fell in 4Q18 to 49% as compared to 53% in 3Q18 • Cycle to Date deposit beta equal to 27% on Total Deposits and 38% on Interest Bearing Deposits 1 Interest rate betas calculated based on the change in yield divided by the absolute change in indices between periods 2 Total deposits includes non-interest bearing deposits which represent 28% of average total deposits at December 31, 2018 11

Revenues Net Interest Income and Margins Components of Core Non-Interest Income1 • GAAP non-interest income decreased by $52.1 million as a result of a $49.8 million loss on sales of securities as the Company restructured its • Reported net interest margin increased 7 basis investment portfolio points and cash margin increased 5 basis points • Core non-interest income decreased by $2 • Margin increase resulted from higher loan and million, or 3%, mainly as a result of seasonal investment security yields offset by increases in influences short-term funding rates (1) Certain prior period amounts have been reclassified to conform to the net presentation requirements of ASU No. 2014-09, Revenue from Contracts with Customers, which was adopted effective January 1, 2018. On average, the adoption resulted in a reduction of non-interest income and non-interest expense of Dollars in millions approximately $2.3 million on a quarterly basis, and had no impact on net income. 12

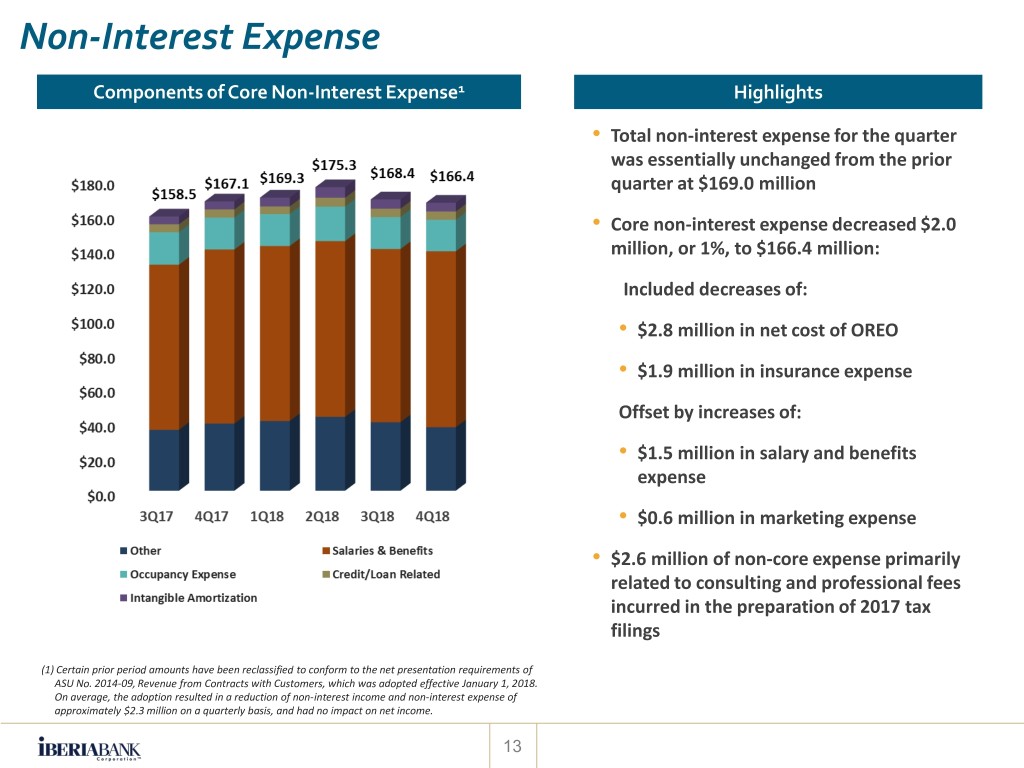

Non-Interest Expense Components of Core Non-Interest Expense1 Highlights • Total non-interest expense for the quarter was essentially unchanged from the prior quarter at $169.0 million • Core non-interest expense decreased $2.0 million, or 1%, to $166.4 million: Included decreases of: • $2.8 million in net cost of OREO • $1.9 million in insurance expense Offset by increases of: • $1.5 million in salary and benefits expense • $0.6 million in marketing expense • $2.6 million of non-core expense primarily related to consulting and professional fees incurred in the preparation of 2017 tax filings (1) Certain prior period amounts have been reclassified to conform to the net presentation requirements of ASU No. 2014-09, Revenue from Contracts with Customers, which was adopted effective January 1, 2018. On average, the adoption resulted in a reduction of non-interest income and non-interest expense of approximately $2.3 million on a quarterly basis, and had no impact on net income. 13

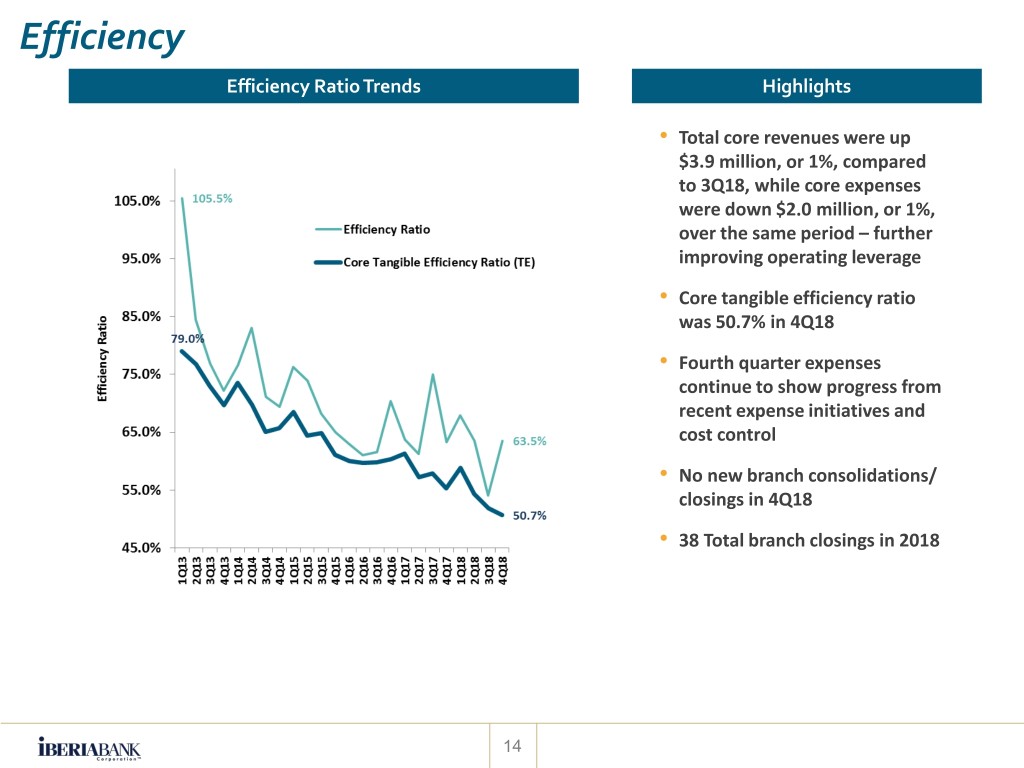

Efficiency Efficiency Ratio Trends Highlights • Total core revenues were up $3.9 million, or 1%, compared to 3Q18, while core expenses were down $2.0 million, or 1%, over the same period – further improving operating leverage • Core tangible efficiency ratio was 50.7% in 4Q18 • Fourth quarter expenses continue to show progress from recent expense initiatives and cost control • No new branch consolidations/ closings in 4Q18 • 38 Total branch closings in 2018 14

Asset Quality Highlights Diversified Loan Portfolio • The Company remains well-positioned with stable and improving asset quality metrics and diversified loan growth • Residential Mortgages are 19% of loan portfolio at 4Q18 compared to 9% at 1Q17, contributing to a more granular loan portfolio • Classified Assets decreased 16% on a linked quarter basis and 30% since prior year. Classified Assets to Total Assets of Non-Performing Assets 0.98% in 4Q18 compared to 1.20% in 3Q18 and 1.54% in 4Q17 • Non-performing assets decreased 10% from $188 million at 3Q18 to $170 million at 4Q18 15

Asset Quality Highlights Provision & Net Charge-Offs • Net charge-offs remain at historically low NCOs / Avg Loans levels 2016 0.23% 2017 0.33% 2018 0.15% • Net charge-offs decreased $1.2 million on a linked quarter basis, to $7.7 million at 4Q18 • Annualized QTD net charge-offs equate to 0.14% of average loans at 4Q18. 2018 net charge-offs equate to 0.15% of average loans, compared to 0.33% for 2017 Allowance for Loan Losses • Provision expense of $13.1 million covered net charge-offs by 170% in 4Q18 16

Capital Position Highlights Capital Ratios (Preliminary) • Capital ratios remain strong IBERIABANK Corporation 3Q18 4Q18 Change • IBKC Ratios impacted by common stock Tangible Common Equity ratio 8.69% 8.82% 13 bps share repurchases during the quarter; IBERIABANK ratios reflect upstream Common Equity Tier 1 (CET 1) ratio 10.79% 10.69% -10 bps dividend to parent during the quarter • Declared quarterly common stock Tier 1 Leverage 9.65% 9.60% -5 bps dividend of $0.41 per share, an Tier 1 Risk-Based 11.33% 11.22% -11 bps increase of $0.02 per share over the prior quarter, or 5%, payable on Total Risk-Based 12.42% 12.31% -11 bps January 25, 2019 • Repurchased 1.21 million shares IBKC common stock, 2% of shares outstanding, during the quarter at a IBERIABANK and Subsidiaries 3Q18 4Q18 Change weighted average price of $72.61 per Common Equity Tier 1 (CET 1) ratio 11.27% 10.93% -34 bps common share • Under the current Board-authorized Tier 1 Leverage 9.60% 9.35% -25 bps share repurchase plan there are approximately 2.265 million shares of Tier 1 Risk-Based 11.27% 10.93% -34 bps common stock remaining that may be Total Risk-Based 11.89% 11.55% -34 bps purchased by the Company 17

2018 Financial Guidance - Result Comparison 2018 Guidance Actual Average Earning Assets $27.2B ~ $27.4B $27.2B Consolidated Loan Growth % 12% ~ 13.5% 12% Consolidated Deposit Growth % 9% ~ 10% 11% Provision Expense $34MM ~ $37MM $40MM Non-Interest Income (Core Basis) $198MM ~ $203MM $203MM Non-Interest Expense (Core Basis) $682MM ~ $686MM $679MM Tax Rate (Core Basis) 22.0% ~ 23.0% 22.8% Net Interest Margin 3.70% ~ 3.71% 3.75% Pre–tax One time Charges $41MM ~ $42MM -$35MM Credit Quality Stable Improved • One-time charges includes income tax benefit recorded in 4Q18 18

2019 Financial Guidance 2019 Guidance Average Earning Assets $28.6B ~ $28.9B Consolidated Loan Growth % 5% ~ 7% Consolidated Deposit Growth % 5% ~ 7% Provision Expense $42MM ~ $50MM Non-Interest Income (Core Basis) $215MM ~ $225MM Non-Interest Expense (Core Basis) $685MM ~ $700MM Net Interest Margin 3.60% ~ 3.70% Tax Rate 23.0% ~ 24.0% Preferred Dividend & Unrestricted Shares $12.5MM ~ $13.5MM Share Repurchase Activity $135MM ~ $150MM Credit Quality Stable • Assumes one additional federal funds rate increase in mid-2019 • Includes impact of 4Q18 investment portfolio restructuring • Increased range of provision to $42-$50 million • Annual effective tax rate range increased to 23.0% to 24.0% • Anticipate historical seasonal softness to influence 1Q19 results • We continue to manage the business for long-term value creation for all shareholders The Company’s guidance is subject to risks, uncertainties, and assumptions which could, individually or in aggregate, cause actual results or financial condition to differ materially from those anticipated above. Reference is made to “Caution About Forward-Looking Statements” in the earnings release which also applies to this guidance. 19

APPENDIX 20

Loans and Deposits By State Total Loans Total Deposits $22.5 Billion $23.8 Billion Note:Figures at period-end December 31, 2018 21

Energy Lending Portfolio – December 31, 2018 • Total outstanding balance of energy-related loans equal to $1.0 billion at 4Q18, or 4.5% of total loans • Energy loans as a percentage of total loans peaked at 8.4% in 2Q14 with 70% in E&P and Midstream, compared to the 91% at year-end 2018 • Current price decks set at a discount to current market future strip price – since resumption of energy- lending, price deck has never exceeded $60 per barrel (even as market spot rates approached $75 per barrel). Clients have higher levels of hedging, lower leverage, longer-dated hedges, and more conforming borrowing bases than prior cycle clients. Over 65% of current commitments were originated after early 2017 • Non-performing loans were $20 million, or 2% of energy portfolio at 4Q18, a 60% decline since 4Q17 • Criticized loans were less than $35 million, or 3.5% of energy loans at 4Q18 • Portfolio is well diversified with minimal exposure to oil field service clients 22

Non-Interest Income And Expense Trend Details 4Q18 vs. 3Q18 % Non-interest Income ($ millions) 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 $ Change Change Service Charges on Deposit Accounts $ 12.5 $ 12.6 $ 12.9 $ 12.9 $ 13.5 $ 13.4 $ (0.1) -1% ATM / Debit Card Fee Income 2.5 2.6 2.6 2.9 2.5 2.3 (0.2) -8% BOLI Proceeds and CSV Income 1.3 1.3 1.3 1.3 1.7 2.0 0.3 16% Mortgage Income 16.0 13.7 9.6 13.7 12.7 10.8 (1.9) -15% Title Revenue 5.6 5.4 5.0 6.8 6.3 6.0 (0.3) -5% Broker Commissions 2.1 1.9 2.2 2.4 2.6 1.9 (0.7) -26% Other Non-interest Income 11.0 14.8 11.0 13.9 13.8 14.8 1.0 8% Non-interest income excluding non-core income $ 51.0 $ 52.3 $ 44.6 $ 53.9 $ 53.1 $ 51.2 $ (1.9) -3% Gain (Loss) on Sale of Investments, Net (0.2) 0.0 (0.1) 0.0 0.0 (49.8) (49.8) -100% Other Non-core income - - - - - (0.4) (0.4) -100% Total Non-interest Income $ 50.8 $ 52.3 $ 44.5 $ 53.9 $ 53.1 $ 1.0 $ (52.1) -98% 4Q18 vs. 3Q18 % Non-interest Expense ($ millions) 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 $ Change Change Mortgage Commissions $ 5.3 $ 5.3 $ 4.4 $ 6.6 $ 5.3 $ 3.5 $ (1.8) -33% Hospitalization Expense 5.7 6.8 6.7 6.9 5.2 8.1 2.9 56% Other Salaries and Benefits 84.4 88.5 90.0 88.0 89.6 90.0 0.4 0% Salaries and Employee Benefits $ 95.4 $ 100.6 $ 101.1 $ 101.5 $ 100.1 $ 101.6 $ 1.5 2% Credit/Loan Related 4.6 4.7 4.4 5.1 4.8 4.8 (0.0) -1% Occupancy and Equipment 18.8 18.4 18.4 19.9 18.5 18.2 (0.3) -1% Amortization of Acquisition Intangibles 4.5 4.6 5.1 6.1 5.4 5.1 (0.3) -6% All Other Non-interest Expense 35.2 38.8 40.3 42.7 39.6 36.7 (2.9) -7% Nonint. Exp. (Ex-Non-Core Exp.) $ 158.5 $ 167.1 $ 169.3 $ 175.3 $ 168.4 $ 166.4 $ (2.0) -1% Compensation-related expense $ 1.1 $ 1.5 $ 1.2 $ 1.8 $ 1.1 $ 0.2 (0.9) -83% Gain on early termination of loss share - - - - (2.7) - 2.7 -100% Storm-related expense 0.4 0.1 - 0.0 - 0.0 0.0 100% Impairment of branch properties, net of gains on sales 3.7 3.2 2.1 5.4 3.3 0.1 (3.2) -98% Consulting and Professional 5.7 - - - - 3.0 3.0 100% Other Non-interest Expense - 0.3 (0.7) (0.1) (2.0) (0.3) 1.7 -84% Merger-related expense 28.5 11.4 16.2 14.3 1.0 (0.2) (1.2) -124% Total Non-interest Expense $ 197.8 $ 183.6 $ 188.1 $ 196.8 $ 169.1 $ 169.0 $ (0.1) 0% Tangible Efficiency Ratio - excl Non-Core-Exp 56.8% 55.8% 58.8% 54.3% 51.9% 50.7% Certain prior period amounts have been reclassified to conform to the net presentation requirements of ASU No. 2014-09, Revenue from Contracts with Customers, which was adopted effective January 1, 2018. On average, the adoption resulted in a reduction of non-interest income and non-interest expense of approximately $2.3 million on a quarterly basis, and had no impact on net income. 23

GAAP And Non-GAAP Cash Margin Balances, As As Adjusted Reported Adjustments Non-GAAP 4Q17 Average Balance $ 25,686 $ 161 $ 25,847 Income $ 235.5 $ (21.4) $ 214.1 • Adjustments represent accounting Rate 3.69% -0.36% 3.33% impacts of purchase discounts on acquired loans and related 1Q18 Average Balance $ 25,814 $ 142 $ 25,956 accretion Income $ 232.9 $ (14.8) $ 218.1 Rate 3.67% -0.25% 3.42% 2Q18 Average Balance $ 27,443 $ 142 $ 27,585 Income $ 256.1 $ (16.9) $ 239.2 Rate 3.76% -0.27% 3.49% 3Q18 Average Balance $ 27,722 $ 144 $ 27,866 Income $ 259.2 $ (17.5) $ 241.7 Rate 3.74% -0.27% 3.47% 4Q18 Average Balance $ 27,792 $ 144 $ 27,936 Income $ 265.0 $ (19.4) $ 245.6 Rate 3.81% -0.29% 3.52% Dollars in millions 24

Reconciliation Of Non-GAAP Financial Measures For The Quarter Ended June 30, 2018 September 30, 2018 December 31, 2018 Dollar Amount Dollar Amount Dollar Amount Pre-tax After-tax (2) Per share Pre-tax After-tax (2) Per share Pre-tax After-tax (2) Per share Income available to common shareholders (GAAP) $ 105.6 $ 74.2 $ 1.30 $ 131.9 $ 97.9 $ 1.73 $ 83.9 $ 129.1 $ 2.32 Non-interest income adjustments Gain on sale of investments and other non-interest income (0.0) (0.0) (0.00) (0.0) (0.0) (0.00) 50.3 38.2 0.68 Non-interest expense adjustments Merger-related expense 14.3 11.0 0.20 1.0 0.7 0.01 (0.2) (0.4) - Compensation-related expense 1.8 1.4 0.02 1.1 0.8 0.01 0.2 0.1 - Impairment of long-lived assets, net of (gain) loss on sale 5.4 4.1 0.07 3.3 2.5 0.05 0.1 0.0 - (Gain) on early termination of loss share agreements - - - (2.7) (2.0) (0.04) - - - Other non-operating non-interest expense (0.1) (0.1) - (2.0) (1.5) (0.02) 2.6 2.0 0.04 Total non-interest expense adjustments 21.4 16.4 0.29 0.7 0.5 0.01 2.6 1.8 0.04 Income tax expense (benefit) - 6.6 0.12 - - - - (65.3) (1.18) Core earnings (Non-GAAP) 127.0 97.2 1.71 132.6 98.4 1.74 136.8 103.8 1.86 Provision for credit losses 7.7 5.8 11.4 8.7 13.1 9.9 Pre-provision earnings, as adjusted (Non-GAAP) $ 134.7 $ 103.0 $ 144.0 $ 107.1 149.9 113.7 (1) Per share amounts may not appear to foot due to rounding. (2) Excluding merger-related expense and litigation expense, after-tax amounts are calculated using a tax rate of 24% in 2018 and 35% in 2017, which approximates the marginal tax rate. • Non-core income equal to -$50.3 million pre-tax, or $0.68 after-tax, related to restructuring of investment securities portfolio in 4Q18 • Net non-core expenses equal to $2.6 million pre-tax, or $0.04 EPS after-tax, primarily related to the preparation of 2017 tax filings and gains on sales of former bank properties • Non-core tax benefit of $65.3 million, or $1.18 EPS after-tax, related to 2017 income tax filings • $536.8 million in pre-tax pre-provision core earnings for full-year 2018, and increase of 31% over 2017 Dollars in millions 25