Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ASSOCIATED BANC-CORP | asb12312018ex991.htm |

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | asb12312018form8-kpressrel.htm |

Exhibit 99.2 FOURTH QUARTER 2018 EARNINGS PRESENTATION January 24, 2019

DISCLAIMER Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target," “outlook” or similar expressions. Forward- looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference. Non-GAAP Measures This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation. 2

2018: MOMENTUM CONTINUES ($ in millions) $356 Total $353 $333 noninterest Positive revenue growth trends... Accelerating $296 ▪ income $261 $269 ▪ Net interest income up 19% year over year Revenue Fee-based 1 1 ▪ Fee-based revenue up 10% year over year Growth $707 $741 $880 ▪ revenue Net interest 2016 2017 2018 ▪ income ($ in millions) ...coupled with improving credit quality metrics... Improving $70 ▪ Allowance for loan losses to nonaccrual loans Credit Provision for was 186% ▪ credit losses Dynamics $26 ▪ 2018 net charge-offs to average loans of 13 bps $0 ▪ Maintaining disciplined underwriting standards 2016 2017 2018 9.5% 10.1% 10.3% ...and disciplined capital deployment while maintaining a strong capital position... Capital CET1 Ratio ▪ ▪ 2018 dividend payout ratio of 32% Discipline 6.9% 7.1% 7.0% ▪ Repurchased $240M of shares in 2018 ▪ TCE Ratio2 2016 2017 2018 $1.89 ...are driving earnings per share growth $1.42 ▪ EPS up 33% year over year Earnings $1.26 EPS ▪ Return on common equity Tier 1 up ~270 bps Momentum ▪ year over year 2016 2017 2018 1Fee-based revenue, a non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees, insurance commissions, and brokerage and advisory fees. Please refer to the appendix for a reconciliation of fee-based revenue to total noninterest income. 2Tangible common equity / tangible assets. This is a non-GAAP financial measure. See Appendix for a reconciliation of non-GAAP financial measures to GAAP 3 financial measures.

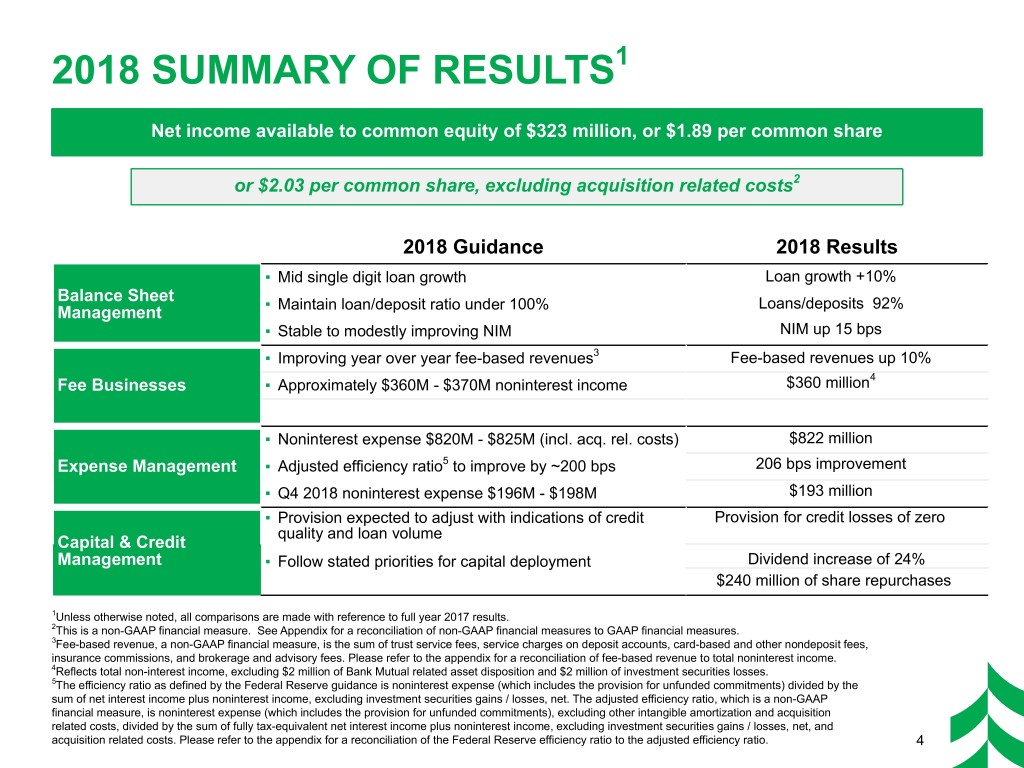

2018 SUMMARY OF RESULTS1 Net income available to common equity of $323 million, or $1.89 per common share or $2.03 per common share, excluding acquisition related costs2 2018 Guidance 2018 Results ▪ Mid single digit loan growth Loan growth +10% Balance Sheet Loans/deposits 92% Management ▪ Maintain loan/deposit ratio under 100% ▪ Stable to modestly improving NIM NIM up 15 bps ▪ Improving year over year fee-based revenues3 Fee-based revenues up 10% 4 Fee Businesses ▪ Approximately $360M - $370M noninterest income $360 million ▪ Noninterest expense $820M - $825M (incl. acq. rel. costs) $822 million Expense Management ▪ Adjusted efficiency ratio5 to improve by ~200 bps 206 bps improvement ▪ Q4 2018 noninterest expense $196M - $198M $193 million ▪ Provision expected to adjust with indications of credit Provision for credit losses of zero quality and loan volume Capital & Credit Management ▪ Follow stated priorities for capital deployment Dividend increase of 24% $240 million of share repurchases 1Unless otherwise noted, all comparisons are made with reference to full year 2017 results. 2This is a non-GAAP financial measure. See Appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 3Fee-based revenue, a non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees, insurance commissions, and brokerage and advisory fees. Please refer to the appendix for a reconciliation of fee-based revenue to total noninterest income. 4Reflects total non-interest income, excluding $2 million of Bank Mutual related asset disposition and $2 million of investment securities losses. 5The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio, which is a non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net, and acquisition related costs. Please refer to the appendix for a reconciliation of the Federal Reserve efficiency ratio to the adjusted efficiency ratio. 4

LOAN PORTFOLIO - ANNUAL TRENDS Average Annual Loans Average Net Loan Change (from 2017) ($ in billions) ($ in millions) Residential mortgage $1,184 $22.7 Commercial real estate $481 $20.6 General commercial $191 $19.7 Oil and gas $145 $18.3 $7.7 REIT $107 $16.8 $7.3 Power & utilities $75 $7.4 $(29) Mortgage warehouse $7.0 $6.5 $(29) Home equity & other consumer Loan Mix – 2018 Year End $8.3 $7.1 $6.2 Commercial: 58% Consumer: 42% $5.5 $4.9 $1.3 $1.3 $1.5 $1.4 Commercial & Residential $1.5 business mortgage 36% 36% $5.0 $5.4 $4.0 $4.2 $4.7 CRE 2014 2015 2016 2017 2018 investor Home equity & other consumer Residential mortgage Construction 16% Home equity & Commercial real estate Commercial & business 6% other consumer 5% 5

LOAN PORTFOLIO - QUARTERLY TRENDS1 Average Quarterly Loans Average Net Loan Change (from 3Q 2018) ($ in billions) ($ in millions) YoY Oil &Gas $47 Growth $23.0 $23.0 $22.8 Total $22.1 Commercial & REIT $43 $20.9 business loans: + $81 million $7.7 12% Power & utilities $23 $7.3 $7.9 $8.0 $7.2 General commercial $6 $(19) Residential mortgage $8.1 $8.3 $8.3 $8.3 10% $7.5 $(20) Home equity & other consumer $(39) Mortgage warehouse $1.3 $1.3 $1.3 $1.3 $1.3 $(50) Real estate construction $4.9 $5.4 $5.7 $5.4 $5.2 7% $(161) CRE - investor 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Home equity & other consumer Residential mortgage Commercial real estate Commercial & business 1 First quarter 2018 includes Bank Mutual loans for two months, from 2/1/2018 through 3/31/2018. 6

DEPOSIT PORTFOLIO - ANNUAL TRENDS Average Annual Deposits Period End Low-cost Deposit Mix (%) ($ in billions) 49% 50% 51% 47% 46% $24.1 24% 23% 24% 25% $21.9 26% $21.0 $5.2 $19.9 19% 20% 16% 14% 17% $5.0 $17.6 $5.1 7% 6% 7% 7% 8% $4.5 $4.8 2014 2015 2016 2017 2018 $4.2 $4.0 Savings Interest-bearing demand $3.4 $3.0 Noninterest-bearing demand $1.9 $1.5 $2.9 $1.3 $1.4 Period End Network Transaction Deposit Mix (%) $1.2 18% $7.3 $6.4 $6.0 $6.3 15% 15% $5.4 11% 9% $1.6 $1.6 $2.0 $1.6 $2.8 $3.5 $2.3 $3.0 $3.1 $2.1 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Network transaction deposits Time deposits Network transaction deposits Money market Savings Interest-bearing demand Noninterest-bearing demand 7

DEPOSIT PORTFOLIO - QUARTERLY TRENDS1 Average Quarterly Deposits Quarter-end Loan to Deposit Ratio ($ in billions) YoY 98% $24.7 $24.2 Growth $23.7 $23.7 96% $22.2 94% 94% 95% $5.3 $5.4 5% $5.1 $5.1 92% $5.1 91% 90% 89% $5.0 $4.5 $4.7 $4.8 16% 1Q 2Q 3Q 4Q $4.2 $1.9 Historical Quarter-end Range 2014 - 2018 2018 $1.7 $1.9 $2.0 $1.6 Avg. Quarterly Network Transaction Dep. Mix (%) $7.2 $7.5 $6.5 $7.2 $7.1 25% YoY reduction 11% $2.4 $2.7 $2.6 $3.0 $3.1 10% 9% $2.5 $2.4 $2.1 $2.0 $1.9 8% 8% 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Network transaction deposits Time deposits Money market Savings 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Interest-bearing demand Noninterest-bearing demand 1First quarter 2018 includes Bank Mutual deposits for two months, from 2/1/2018 through 3/31/2018. 8

NET INTEREST INCOME AND MARGIN - ANNUAL TRENDS Average Yields Net Interest Income & Net Interest Margin ($ in millions) 5.04% 3.08% 2.97% 3.89% 4.51% 3.68% $880 3.47% 3.46% 2.84% $14 2.80% 2.82% $15 3.66% $8 3.38% 3.40% 3.18% 3.23% 3.23% $741 2.59% 2.58% 2.45% 2.34% 2.42% $707 $681 $677 1.16% $844 0.69% $737 0.40% 0.42% $702 0.31% 0.94% $674 $670 0.56% 0.20% 0.22% 0.32% 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Net interest margin Commercial real estate Investments and other loans Bank Mutual prepayments and other adjustments Commercial and business Total interest-bearing liabilities Bank Mutual acquisition related purchase loan accretion, net lending loans Other prepayments and interest recoveries1 Net interest income net of purchased loan Total residential Total interest-bearing deposits mortgage loans accretion, prepayments and interest recoveries 9 1Includes recognition of fees and costs upon repayment or refinancing other than Bank Mutual related.

NET INTEREST INCOME AND MARGIN - QUARTERLY TRENDS Average Yields Net Interest Income & Net Interest Margin ($ in millions) 5.51% 2.92% 3.02% 2.92% 3.02% 2.79% 5.06% 4.98% 4.62% $227 $224 4.78% $5 4.05% 4.56% 4.52% $5 $219 $5 $1 $2 4.14% $2 $4 $3 3.79% $210 $1 3.52% $2 3.32% 3.36% 3.45% $4 3.18% $1 2.61% 2.70% 2.47% 2.44% 2.56% $187 $215 $212 $213 1.26% 1.39% $1 1.08% $203 0.81% 0.90% 1.03% 1.14% $186 0.83% 0.65% 0.73% 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Commercial real estate Investments and other Net interest margin loans Bank Mutual prepayments and other adjustments Commercial and business Total interest-bearing liabilities lending loans Bank Mutual acquisition related purchase loan accretion, net Other prepayments and interest recoveries1 Total residential Total interest-bearing deposits mortgage loans Net interest income net of purchased loan accretion, prepayments and interest recoveries 10 1Includes recognition of fees and costs upon repayment or refinancing other than Bank Mutual related.

NONINTEREST INCOME - ANNUAL TRENDS ($ IN MILLIONS) Banking Fees $353 $356 $329 $333 $66 $69 $65 $67 $64 $291 $20 $38 $20 $32 $47 $48 $50 $53 $57 $21 2014 2015 2016 2017 2018 Card-based fees Service charges Trust & Asset Management, Insurance, $296 and Brokerage & Advisory Income $269 $253 $261 $172 $225 $151 $139 $144 $28 $16 $20 $108 $15 $16 $90 $75 $81 $81 $44 $48 $49 $47 $50 $54 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Fee-based revenue1 Mortgage banking, net Brokerage & advisory Insurance Other Trust & asset management 1Fee-based revenue, a non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees, 11 insurance commissions, and brokerage and advisory fees. Please refer to the appendix for a reconciliation of fee-based revenue to total noninterest income.

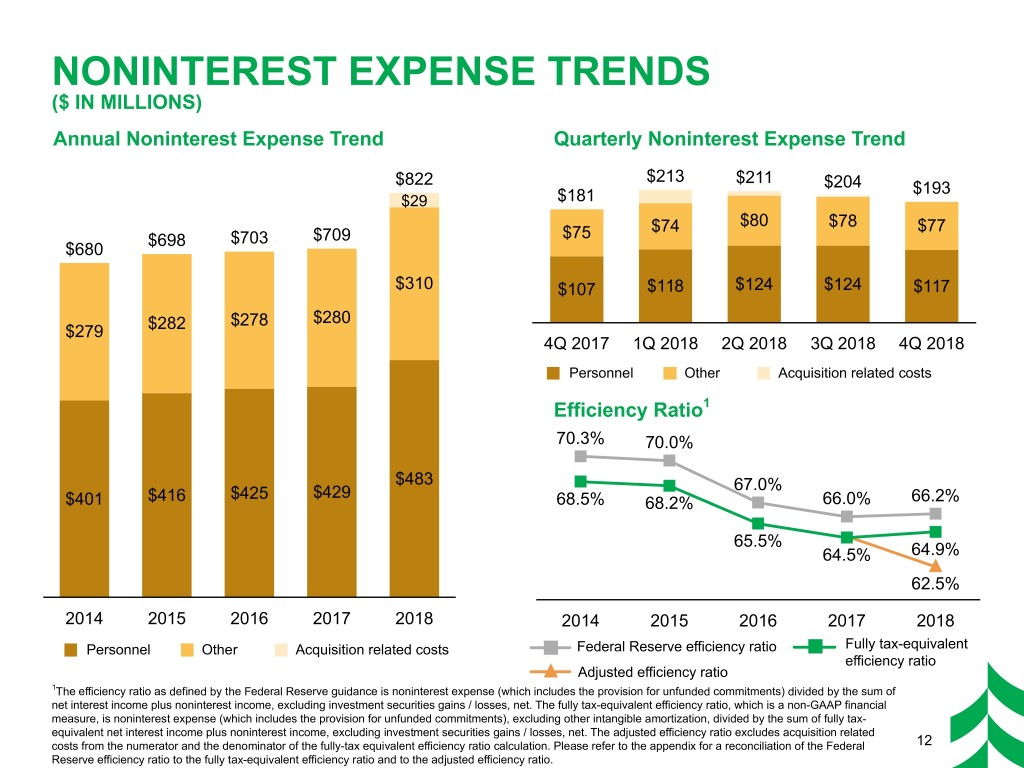

NONINTEREST EXPENSE TRENDS ($ IN MILLIONS) Annual Noninterest Expense Trend Quarterly Noninterest Expense Trend $822 $213 $211 $204 $193 $29 $181 $74 $80 $78 $77 $698 $703 $709 $75 $680 $310 $107 $118 $124 $124 $117 $278 $280 $279 $282 4Q 2017 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Personnel Other Acquisition related costs Efficiency Ratio1 70.3% 70.0% $483 67.0% $425 $429 $401 $416 68.5% 68.2% 66.0% 66.2% 65.5% 64.5% 64.9% 62.5% 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Personnel Other Acquisition related costs Federal Reserve efficiency ratio Fully tax-equivalent efficiency ratio Adjusted efficiency ratio 1The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax- equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio excludes acquisition related costs from the numerator and the denominator of the fully-tax equivalent efficiency ratio calculation. Please refer to the appendix for a reconciliation of the Federal 12 Reserve efficiency ratio to the fully tax-equivalent efficiency ratio and to the adjusted efficiency ratio.

CREDIT QUALITY - ANNUAL TRENDS ($ IN MILLIONS; AT OR FOR THE YEAR ENDED) Nonperforming Assets Nonaccrual Loans $293 $275 $229 $209 $194 $193 $177 $178 $140 $128 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Net Charge Offs Allowance for Loan Losses to Loans $65 1.5% 1.5% 1.4% 1.3% 1.0% $39 $30 $30 $15 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 13

STRONG CAPITAL POSITION Highlights CET1 and TCE Ratios ▪ Disciplined management of both regulatory and economic capital 10.3% 9.7% 9.5% 9.5% 10.1% ▪ Maintained TCE ratio1 ~7% while improving common equity Tier 1 ratio by reducing risk in the loan and investment books ▪ Increased common dividend 24% to $0.62 in 2018; 7.0% 6.9% 6.9% 7.1% 7.0% increased 68% in the last five years ▪ Repurchased $240 million of common shares in 2018 2014 2015 2016 2017 2018 and ~$650 million in the last five years TCE ratio1 CET1 ratio Dividends to Common Shareholders Share Repurchases $0.62 $259 $240 $0.50 $0.45 $0.41 $0.37 $93 $37 $20 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 1Tangible common equity / tangible assets. This is a non-GAAP financial measure. See Appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 14

HUNTINGTON BRANCH TRANSACTION SUMMARY Seller: The Huntington National Bank Existing ASB Branches Acquired Branches Assets Purchased: ▪ 32 Branches and ~$134M of WI related loans Deposits Assumed: ~$850M Consideration: 100% cash Transaction Value: ▪ ~4% net blended premium on deposits acquired1 Required Approvals: ▪ Application submitted January 8 ▪ Approval anticipated Q1 2019 Closing and Conversion: ▪ Simultaneous closing and conversion anticipated in Q2 2019 ▪ Expanding into 13 new communities ▪ 14 net branches retained 1Estimated net premium, based on an estimated deposit mix and ~$850M of deposits to be assumed at close. 15

ACQUISITIONS Bank Mutual completed... ...and Huntington up next Was an in-market, cost takeout Is an in-market, cost takeout driven acquisition depository acquisition Delivering on Filled in network gaps and boosts our Fills in network gaps and boosts our our Strategy network in key locations network in key locations Further improved branch density and Further improves branch density and scale across the state scale across the state Expanded into 11 new communities Expanding into 13 new communities Enhancing ASB Added over 89,000 deposit accounts Expected to add over 60,000 deposit Franchise Value and ~49,000 households accounts and 33,000 households Acquired $1.9B in granular branch ~$850M in granular branch deposits deposits with <1% cost of funds with <1% cost of funds Adjusted efficiency ratio1 improved by Accretive to efficiency metrics and over 200 bps year over year EPS outlook Financially Delivered on 45% cost savings Approximately 45% cost savings Attractive expected on conversion Minimal TBV dilution and earnback on Minimal expected TBV dilution track for less than 3 years (~1.5%); $34M net premium 1The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio, which is a non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net, and acquisition related 16 costs. Please refer to the appendix for a reconciliation of the Federal Reserve efficiency ratio to the adjusted efficiency ratio.

2019 OUTLOOK This outlook reflects a stable to improving economy and includes our expectation of two rate increases in 2019. We may adjust our outlook if, and when, we have more clarity on any one, or more, of these factors. ▪ 3% - 6% annual average loan ▪ Approximately $800M noninterest growth for 2019 expense ▪ Maintain loan to deposit ratio ▪ Adjusted efficiency ratio1 Balance Sheet under 100% Expense expected to improve by ~100 bps Management Management ▪ Stable to improving full-year 2019 ▪ Effective tax rate: 21% - 23% for NIM, based on continued upward full year 2019 Fed rate action ▪ Approximately $360M - $375M ▪ Provision expected to adjust with full-year noninterest income changes to risk grade, other indications of credit quality, and ▪ Improving year over year fee- Capital & loan volume Fee based revenues Credit Businesses ▪ Continue to follow stated Management corporate priorities for capital deployment 1The 2019 Outlook includes the adjusted efficiency ratio which is a non-GAAP financial measure. This non-GAAP measure excludes acquisition related costs which by their nature are unpredictable and have low visibility. Estimates of these unpredictable and low visibility costs for 2019 which would be included in the GAAP efficiency measurement of the Federal Reserve Board are, therefore, unavailable. 17

APPENDIX

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS Efficiency Ratio 2014 2015 2016 2017 2018 Federal Reserve efficiency ratio 70.28 % 69.96 % 66.95 % 65.97 % 66.23 % Fully tax-equivalent adjustment (1.36)% (1.41)% (1.29)% (1.28)% (0.71)% Other intangible amortization (0.39)% (0.31)% (0.20)% (0.18)% (0.66)% Fully tax-equivalent efficiency ratio1 68.53 % 68.24 % 65.46 % 64.51 % 64.87 % Acquisition related costs adjustment — % — % — % — % (2.42)% Fully tax-equivalent efficiency ratio, excluding acquisition related costs (adjusted efficiency ratio)1 68.53 % 68.24 % 65.46 % 64.51 % 62.45 % The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio excludes acquisition related costs from the fully tax-equivalent efficiency ratio. Fee-based Revenue ($ millions)1 2014 2015 2016 2017 2018 Insurance commissions and fees 44 75 81 81 90 Service charges and deposit account fees 69 65 67 64 66 Card-based and loan fees 47 48 50 53 57 Trust and asset management fees 48 49 47 50 54 Brokerage and advisory fees 16 15 16 20 28 Fee-based revenue $ 225 $ 253 $ 261 $ 269 $ 296 Other 66 76 92 64 60 Total noninterest income $ 291 $ 329 $ 353 $ 333 $ 356 YTD 2018 4Q 2018 3Q 2018 2Q 2018 1Q 2018 Acquisition Related Costs YTD 2018 per share 4Q 2018 per share 3Q 2018 per share 2Q 2018 per share 1Q 2018 per share ($ in millions, except per share data) data2 data2 data2 data2 data2 GAAP earnings $ 323 $ 1.89 $ 85 $ 0.51 $ 84 $ 0.48 $ 87 $ 0.50 $ 67 $ 0.40 Change of control and severance 7 — 1 (1) 7 Merger advisors and consultants 5 — 1 — 4 Facilities and other 8 — 1 2 5 Contract terminations and conversion costs 10 (1) — 6 5 Asset losses (gains), net $ 2 $ — $ 1 $ 1 $ — Total acquisition related costs $ 31 $ (1) $ 3 $ 8 $ 21 Less additional tax expense $ 8 $ — $ 1 $ 2 $ 5 Earnings, excluding acquisition related costs1 $ 346 $ 2.03 $ 84 $ 0.50 $ 87 $ 0.49 $ 93 $ 0.53 $ 83 $ 0.50 1This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. 19 2Earnings and per share data presented after tax.

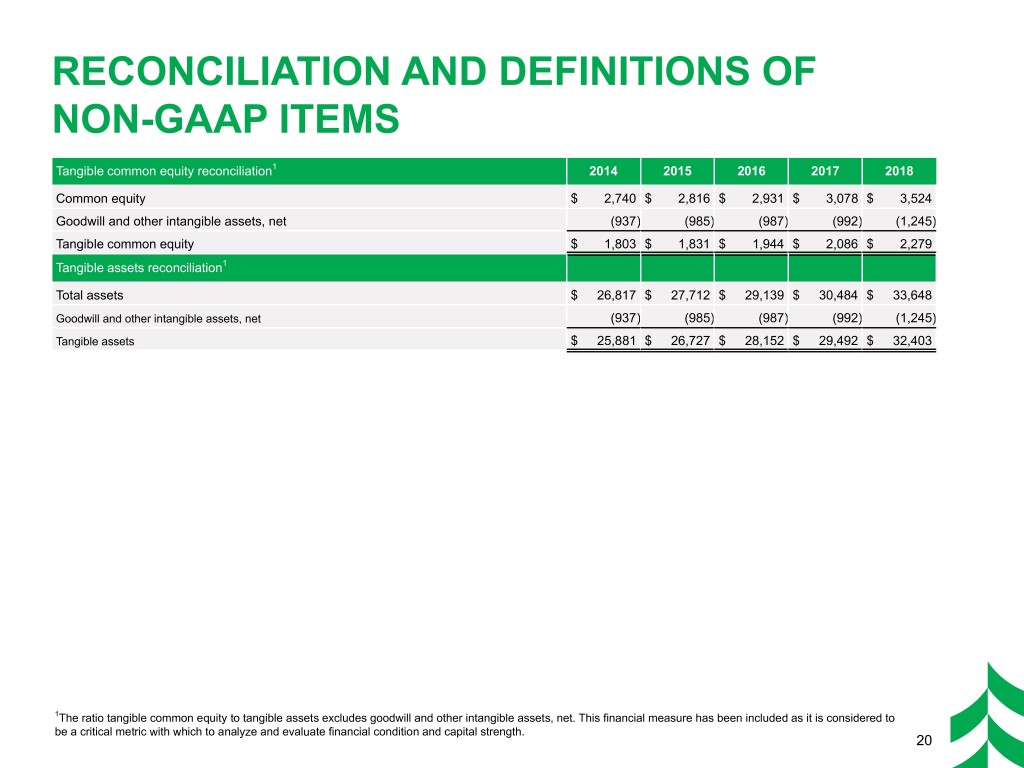

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS Tangible common equity reconciliation1 2014 2015 2016 2017 2018 Common equity $ 2,740 $ 2,816 $ 2,931 $ 3,078 $ 3,524 Goodwill and other intangible assets, net (937) (985) (987) (992) (1,245) Tangible common equity $ 1,803 $ 1,831 $ 1,944 $ 2,086 $ 2,279 Tangible assets reconciliation1 Total assets $ 26,817 $ 27,712 $ 29,139 $ 30,484 $ 33,648 Goodwill and other intangible assets, net (937) (985) (987) (992) (1,245) Tangible assets $ 25,881 $ 26,727 $ 28,152 $ 29,492 $ 32,403 1The ratio tangible common equity to tangible assets excludes goodwill and other intangible assets, net. This financial measure has been included as it is considered to be a critical metric with which to analyze and evaluate financial condition and capital strength. 20