Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE ACCOUNCING FOURTH QUARTER AND FULL YEAR 2018 FINANCIAL RESULTS - UMPQUA HOLDINGS CORP | umpq-20181231ex991earnings.htm |

| 8-K - 8-K - UMPQUA HOLDINGS CORP | umpqq420188-k.htm |

UMPQUA HOLDINGS CORPORATION 4th Quarter 2018 Earnings Conference Call Presentation January 24, 2019

Forward-looking Statements This presentation includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward-looking statements and we undertake no obligation to update any such statements. In this presentation we make forward-looking statements about corporate initiatives and the related savings and restructuring charges and financial goals, store consolidations and facilities optimization and related costs and savings. Risks that could cause results to differ from forward-looking statements we make are set forth in our filings with the SEC and include, without limitation, prolonged low interest rate environment; the effect of interest rate increases on the cost of deposits; unanticipated weakness in loan demand or loan pricing; deterioration in the economy; lack of strategic growth opportunities or our failure to execute on those opportunities; our inability to effectively manage problem credits; our inability to successfully implement efficiency and operational excellence initiatives on time and in amounts projected; our ability to successfully develop and market new products and technology; and changes in laws or regulations. 2

Umpqua Next Gen: Good Progress Toward Financial Goals Return on Average Tangible Common Equity Rate scenario (1) 18.00% 17.5% “Moderately Increasing” 16.00% 14.45% 15.0% “Flat Rate” 14.00% 11.49% 12.00% 11.34% 10.00% 8.00% FY 2016 FY 2017 FY 2018 2020 Goal Net impact of fair value losses and exit or disposal costs (2) (0.86)% (0.87)% (0.73)% Efficiency Ratio 70.00% 64.41% 65.11% 65.00% 60.61% 60.00% Mid 50s “Flat Rate” 55.00% 50.00% Low 50s “Moderately Increasing” 45.00% 40.00% 35.00% FY 2016 FY 2017 FY 2018 2020 Goal Net impact of fair value losses and exit or disposal costs (2) 1.75% 1.89% 1.28% > (1) Financial goals as presented under two different rate scenarios laid out in the 2Q 2018 earnings call slide presentation on July 19, 2018. 3 > (2) Impact from fair value gains or losses and exit or disposal goals were excluded from the calculation of financial goals presented in mid-2017, and subsequently updated in April 2018. See appendix of this presentation for further information.

Full Year 2018 Highlights (compared to 2017) Net earnings available to common shareholders of $316.2 million, or $1.43 per diluted common share, up 30% from prior year Gross loan and lease growth of $1.4 billion, or 7% Deposit growth of $1.2 billion, or 6% Net interest income increased by $73.0 million, driven primarily by higher average balances of loans and leases, along with a 10 basis point increase in net interest margin Provision for loan and lease losses increased by $8.7 million primarily due to loan and lease growth and higher net charge-offs Non-interest income increased by $0.9 million, reflecting higher levels of other fee income, the gain related to Pivotus, Inc. and the net loss on junior subordinated debentures carried at fair value no longer being recognized in earnings, partially offset by lower net mortgage banking revenue and lower portfolio loan sale gains Non-interest expense decreased by $8.4 million, driven primarily by lower salaries and benefits expense and lower merger-related expense, partially offset by higher services expense Paid dividends of $0.82 per common share (versus $0.68 per share in the prior year) and repurchased 327,000 shares of stock Book value increased by 2%, or $0.39 per common share, and tangible book value(1) increased by 4%, or $0.42 per common share > (1) "Non-GAAP" financial measure. More information regarding this measurement and a reconciliation to the comparable GAAP measurement is provided in 4 the appendix to this presentation.

Q4 2018 Highlights (compared to Q3 2018) Net earnings available to common shareholders of $80.3 million, or $0.36 per diluted common share Gross loan and lease growth of $568.6 million, or 11% annualized Deposit growth of $244.7 million, or 5% annualized Net interest income increased by $6.0 million, attributable to higher average balances of loans and leases, along with an increase in average yields on loans and leases and a lower level of premium amortization on the investment securities portfolio, partially offset by higher funding costs Provision for loan and lease losses increased by $5.5 million, driven primarily by the strong loan and lease growth during the quarter and a seven basis point increase in net charge-offs to 0.32% of average loans and leases (annualized) Non-interest income decreased by $15.6 million, reflecting the linked quarter declines in the fair value of the MSR asset and debt capital market swap derivatives, partially offset by the gain related to Pivotus, Inc. Non-interest expense decreased by $0.8 million, driven primarily by lower salaries and benefits and FDIC assessments, partially offset by higher other expense and loss on other real estate owned Non-performing assets to total assets decreased by one basis point to 0.36% Estimated total risk-based capital ratio of 13.4% and estimated Tier 1 common to risk weighted assets ratio of 10.7% Declared quarterly cash dividend of $0.21 per common share 5

Selected Ratios For the year ended For the quarter ended FY 2018 FY 2017 Q4 2018 Q3 2018 Q2 2018 Q1 2018 Q4 2017 Return on average assets 1.21% 0.97% 1.19% 1.36% 1.02% 1.25% 1.17% Return on average tangible assets 1.30% 1.04% 1.28% 1.46% 1.09% 1.35% 1.26% Return on average common equity 7.90% 6.17% 7.90% 9.00% 6.64% 8.06% 7.54% Performance Return on average tangible common equity 14.45% 11.49% 14.34% 16.42% 12.18% 14.84% 13.93% Efficiency ratio - consolidated 60.61% 65.11% 58.58% 57.06% 65.84% 61.21% 65.46% Net interest margin - consolidated 4.04% 3.94% 4.15% 4.09% 3.89% 4.00% 3.93% Non-performing loans and leases to loans and leases 0.43% 0.43% 0.43% 0.44% 0.40% 0.37% 0.43% Credit Quality Non-performing assets to total assets 0.36% 0.37% 0.36% 0.37% 0.34% 0.33% 0.37% Net charge-offs to average loans and leases (annualized) 0.26% 0.22% 0.32% 0.25% 0.22% 0.26% 0.25% Tangible common equity to tangible assets (1) 8.93% 9.02% 8.93% 8.83% 8.78% 8.97% 9.02% Capital Tier 1 common to risk-weighted asset ratio (2) 10.7% 11.1% 10.7% 10.8% 10.7% 11.0% 11.1% Total risk-based capital ratio (2) 13.4% 14.1% 13.4% 13.7% 13.5% 13.9% 14.1% > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. 6 > (2) Capital ratio estimated for current quarter, pending completion and filing of regulatory reports.

Summary Income Statement Year Ended Quarter ended ($ in millions except per share data) FY 2018 FY 2017 Q4 2018 Q3 2018 Q4 2017 Net interest income before provision $ 938.6 $ 865.7 $ 247.4 $ 241.4 $ 223.0 Provision for loan and lease losses 55.9 47.3 17.2 11.7 12.9 Net interest income after provision 882.7 818.4 230.2 229.7 210.0 Non-interest income 279.4 278.5 56.8 72.4 70.5 Non-interest expense 739.5 747.9 178.5 179.3 192.8 Income before provision for income taxes 422.7 349.0 108.5 122.8 87.7 Provision for income taxes 106.4 106.7 28.2 31.8 12.4 Net income 316.3 242.3 80.3 91.0 75.3 Dividends and undistributed earnings allocated to participating securities 0.0 0.1 0.0 0.0 0.0 Net earnings available to common shareholders $ 316.2 $ 242.3 $ 80.3 $ 91.0 $ 75.2 Earnings per share - diluted $1.43 $1.10 $0.36 $0.41 $0.34 > Note: tables may not foot due to rounding. 7

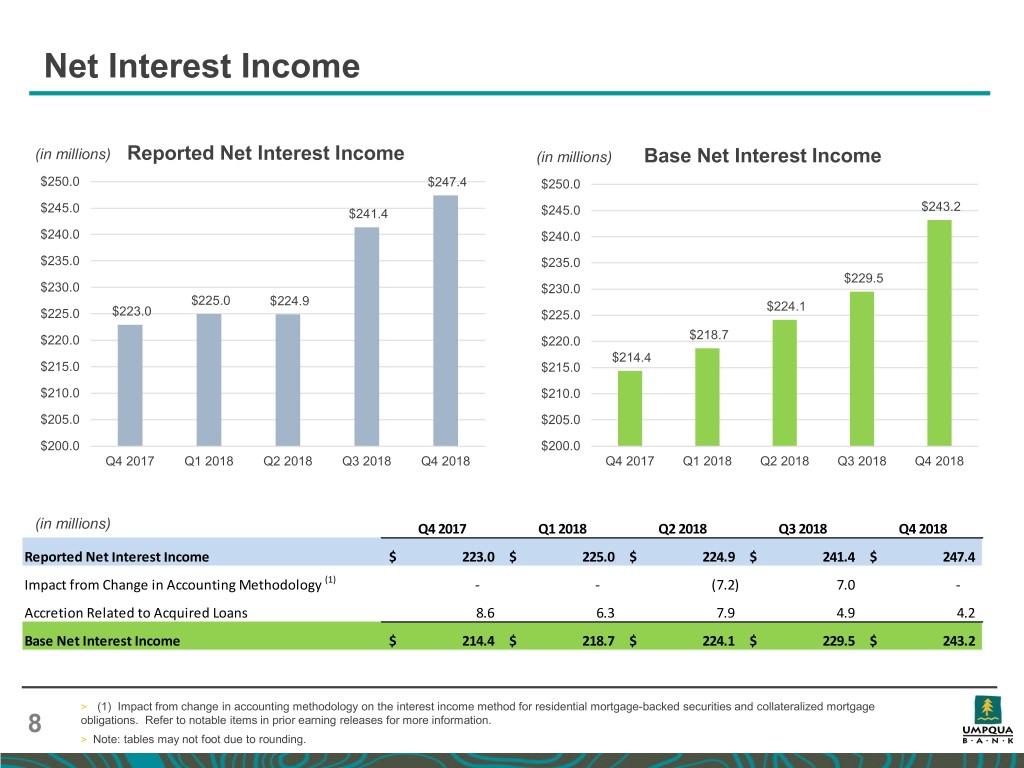

Net Interest Income (in millions) Reported Net Interest Income (in millions) Base Net Interest Income $250.0 $247.4 $250.0 $243.2 $245.0 $241.4 $245.0 $240.0 $240.0 $235.0 $235.0 $229.5 $230.0 $230.0 $225.0 $224.9 $224.1 $225.0 $223.0 $225.0 $220.0 $220.0 $218.7 $214.4 $215.0 $215.0 $210.0 $210.0 $205.0 $205.0 $200.0 $200.0 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 (in millions) Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Reported Net Interest Income $ 223.0 $ 225.0 $ 224.9 $ 241.4 $ 247.4 Impact from Change in Accounting Methodology (1) - - (7.2) 7.0 - Accretion Related to Acquired Loans 8.6 6.3 7.9 4.9 4.2 Base Net Interest Income $ 214.4 $ 218.7 $ 224.1 $ 229.5 $ 243.2 > (1) Impact from change in accounting methodology on the interest income method for residential mortgage-backed securities and collateralized mortgage obligations. Refer to notable items in prior earning releases for more information. 8 > Note: tables may not foot due to rounding.

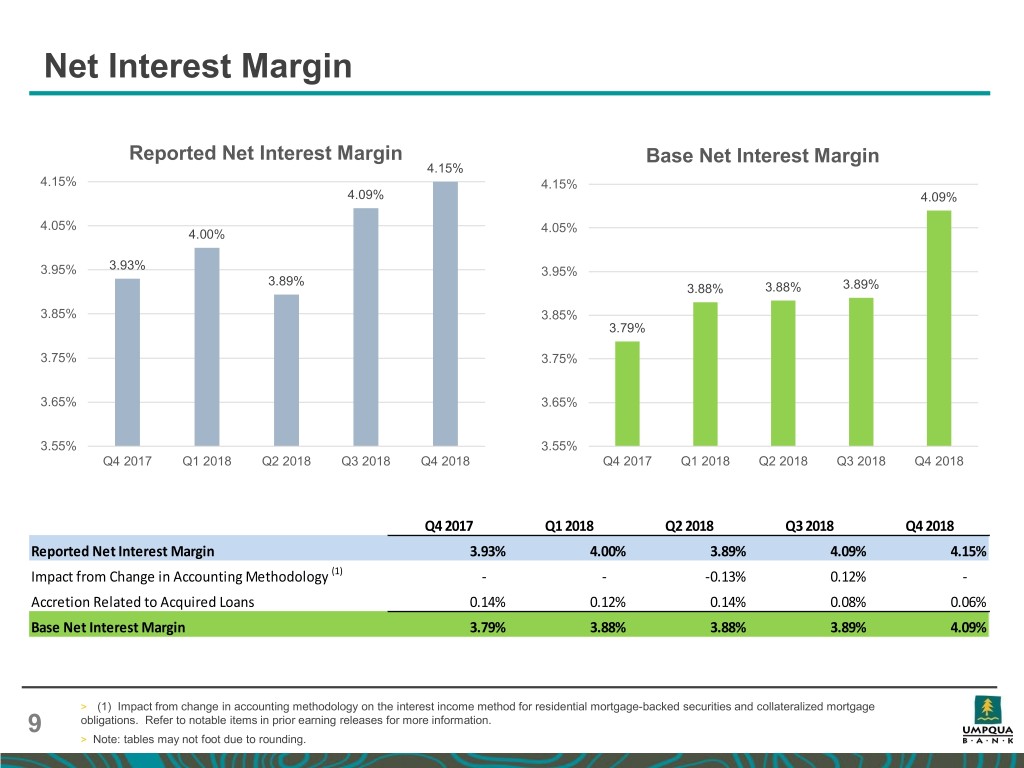

Net Interest Margin Reported Net Interest Margin Base Net Interest Margin 4.15% 4.15% 4.15% 4.09% 4.09% 4.05% 4.05% 4.00% 3.95% 3.93% 3.95% 3.89% 3.88% 3.88% 3.89% 3.85% 3.85% 3.79% 3.75% 3.75% 3.65% 3.65% 3.55% 3.55% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Reported Net Interest Margin 3.93% 4.00% 3.89% 4.09% 4.15% Impact from Change in Accounting Methodology (1) - - -0.13% 0.12% - Accretion Related to Acquired Loans 0.14% 0.12% 0.14% 0.08% 0.06% Base Net Interest Margin 3.79% 3.88% 3.88% 3.89% 4.09% > (1) Impact from change in accounting methodology on the interest income method for residential mortgage-backed securities and collateralized mortgage obligations. Refer to notable items in prior earning releases for more information. 9 > Note: tables may not foot due to rounding.

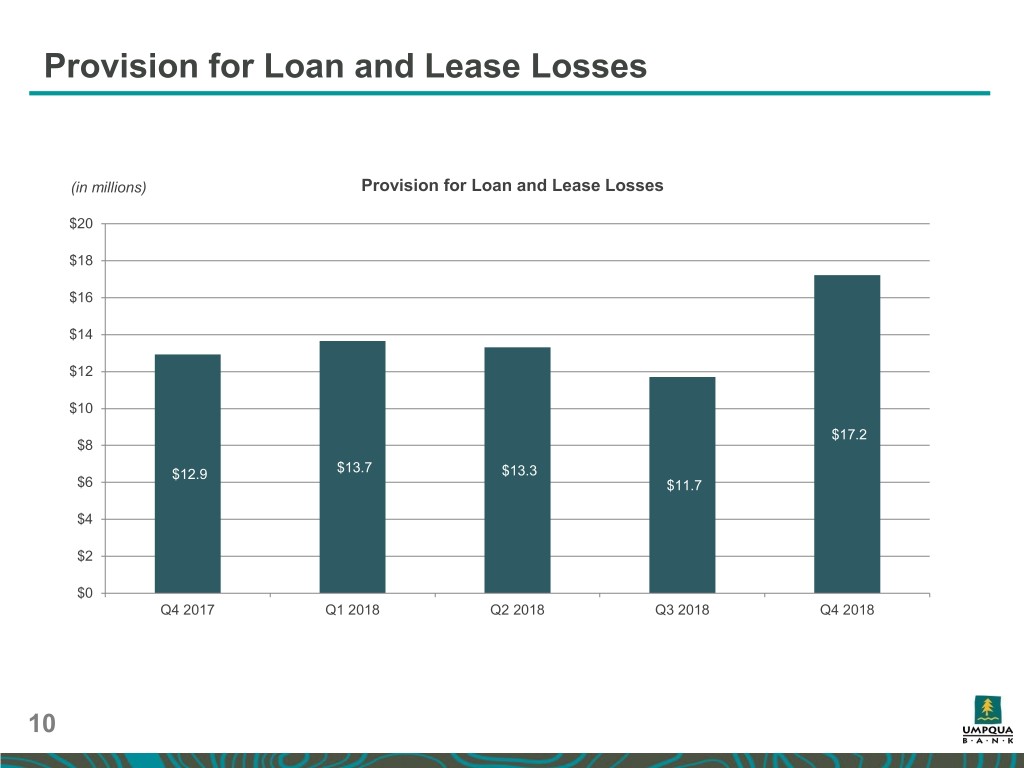

Provision for Loan and Lease Losses (in millions) Provision for Loan and Lease Losses $20 $18 $16 $14 $12 $10 $17.2 $8 $12.9 $13.7 $13.3 $6 $11.7 $4 $2 $0 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 10

Non-interest Income (in millions) $90 $80 $78.6 $70.5 $71.7 $72.4 $70 $15.0 $15.6 $15.4 $15.5 $60 $4.2 $56.8 $3.9 $4.2 $4.2 $50 $16.0 $40 $38.4 $4.2 $33.2 $31.5 $42.1 $30 $15.2 $2.1 $2.1 $20 $2.1 $2.1 $1.2 $2.5 $1.3 $2.8 $10 $2.0 $17.6 $15.4 $16.6 $16.8 $3.7 $0 $3.0 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Other (1) Gain on loan sales BOLI income Residential mortgage banking revenue, net Brokerage revenue Service charges > (1) Includes other income, gains or losses on investment securities, unrealized holding losses on equity securities not held for trading, and losses on junior subordinated debentures carried at fair value. 11 > Note: tables may not foot due to rounding.

Mortgage Banking (in millions) Closed mortgage volume $1,200 $1,116 $1,134 $1,081 $1,000 $925 $902 $800 $850 $839 $757 $600 $687 $589 $400 $200 $266 $238 $295 $324 $313 $0 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Portfolio For Sale Gain on sale margin 4.50% 4.00% 3.51% 3.35% 3.50% 3.32% 3.00% 2.77% 2.83% 2.50% 2.00% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 > Note: tables may not foot due to rounding. 12

Non-Mortgage Fee Growth (in millions) Non-mortgage Fee Revenue (1) $150 $146.3 $145 Annual Growth: $140 $15.1 million, or 12% $135 Annual Growth: $131.2 $4.8 million, or $130 4% $126.4 $125 $120 $115 FY 2016 FY 2017 FY 2018 > (1) Non-mortgage fee revenue includes non-interest income generated from the Wholesale, Retail Bank, and Wealth Management divisions, excluding fair 13 value gains or losses and gains from portfolio loan sales.

Non-interest Expense Non-interest Expense and Efficiency Ratio Non-interest Expense Bridge (in millions) (in millions) $205.0 110.0% $195.6 $179.3 $2.8 $195.0 $192.8 $186.1 100.0% $1.7 $185.0 $179.3 $178.5 $1.5 $(1.2) $178.5 90.0% $(1.5) $175.0 $1.0 $0.8 $(4.3) $165.0 80.0% $0.6 $155.0 65.5% 65.8% 70.0% 61.2% $145.0 57.1% 58.6% 60.0% $135.0 50.0% $125.0 $115.0 40.0% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Non-interest expense Efficiency ratio 14

Umpqua Next Gen: Operational Excellence Key Initiative Progress Achieved Continue to rationalize store network 36 stores consolidated and 1 sold since Q3 Store 2017 $0.4 million in annual savings per store, Consolidations with 35% of savings re-invested in human 15 stores to be consolidated and 4 to be sold digital initiatives during Q1 2019 ~$18 - $24 million in annual savings by ~$16 million (annualized) in expense mid-2019 savings embedded in Q4 2018 run-rate Phase I – Back Office (1) $4 million in professional fees for Q4 2018, ~$6 - $8 million (annualized) in incremental with $1 million of that relating to commercial expense savings phased in over first half of end-to-end journey re-design (Phase II) 2019 ~$6 - $12 million in net annual run-rate Commercial loan end-to-end journey re- savings by end of 2019 design started Q3 2018, to be completed Q1 2019 Phase II – ~$2 - $3 million in professional fees for Q1 (2) 2019 Consumer deposit origination end-to-end Back Office journey re-design started January 2019 Additional costs to achieve net savings to be determined > (1) Phase I includes organizational simplification & design and procurement. 15 > (2) Phase II includes commercial end-to-end journey redesign, real-estate optimization, technology simplification and other end-to-end journey redesign.

Selected Balance Sheet ($ in millions) Q4 2018 Q3 2018 Q4 2017 Total assets $ 26,939.8 $ 26,615.1 $ 25,680.4 Interest bearing cash and temporary investments 287.2 570.3 303.4 Investment securities available for sale, fair value 2,977.1 2,864.4 3,065.8 Loans and leases, gross 20,422.7 19,854.0 19,019.2 Allowance for loan and lease losses (144.9) (144.0) (140.6) Goodwill and other intangibles, net 1,811.6 1,813.2 1,817.8 Deposits 21,137.5 20,892.8 19,948.3 Securities sold under agreements to repurchase 297.2 287.0 294.3 Term debt 751.8 751.8 802.4 Total shareholders' equity 4,056.4 4,003.9 3,969.4 Ratios: Loan to deposit ratio 96.6% 95.0% 95.3% Book value per common share $18.42 $18.18 $18.03 Tangible book value per common share (1) $10.19 $9.95 $9.77 Tangible common equity to tangible assets (1) 8.93% 8.83% 9.02% > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation. 16

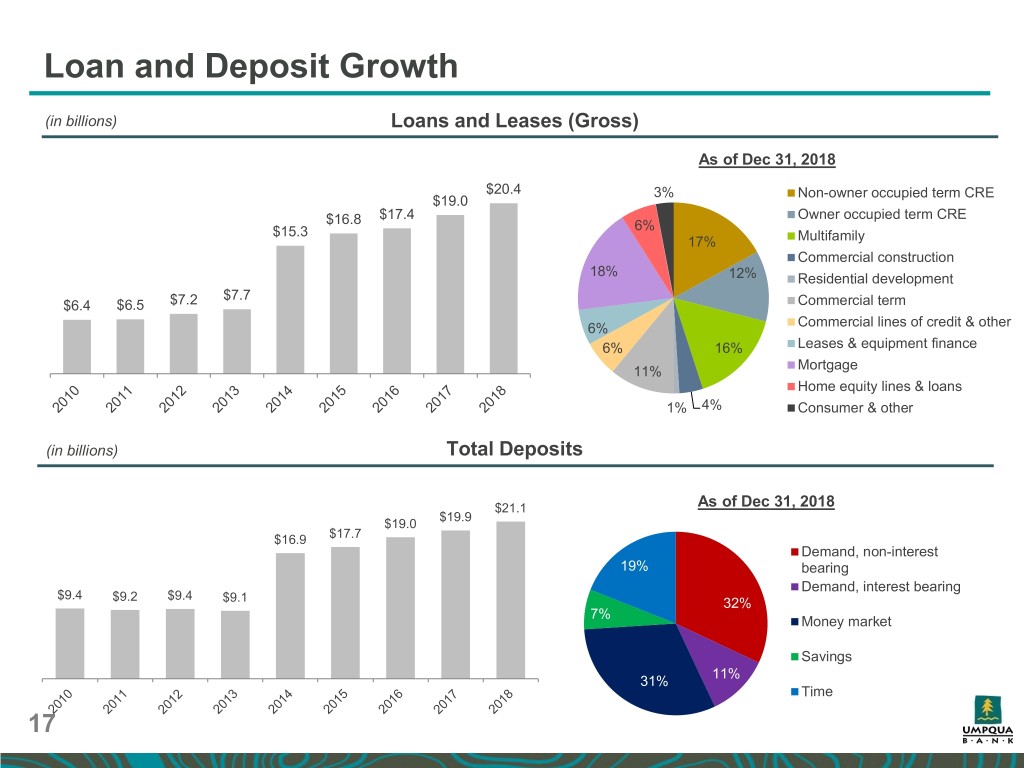

Loan and Deposit Growth (in billions) Loans and Leases (Gross) As of Dec 31, 2018 $20.4 3% Non-owner occupied term CRE $19.0 $16.8 $17.4 Owner occupied term CRE $15.3 6% 17% Multifamily Commercial construction 18% 12% Residential development $7.7 $6.4 $6.5 $7.2 Commercial term 6% Commercial lines of credit & other 6% 16% Leases & equipment finance 11% Mortgage Home equity lines & loans 1% 4% Consumer & other (in billions) Total Deposits $21.1 As of Dec 31, 2018 $19.9 $19.0 $16.9 $17.7 Demand, non-interest 19% bearing Demand, interest bearing $9.4 $9.4 $9.2 $9.1 32% 7% Money market Savings 11% 31% Time 17

Loan and Lease Portfolio Repricing Schedule Adjustable Rate Breakout – Q4 2018 (1) Loan and Lease Portfolio (1) 100% 17.8% 31.1% 90% 20.9% 80% 42.4% 42.1% 42.3% 42.2% 70% 27.5% 60% 2.7% 50% Libor 6 Month Libor 12 Month 3 Year 5 Year Other 25.6% 25.9% 26.5% 27.4% 40% 30% Floating Rate Breakout – Q4 2018 (1) 20% 0.3% 32.1% 32.0% 31.2% 30.4% 10% 0% Q1 2018 Q2 2018 Q3 2018 Q3 2018 36.5% 63.2% Fixed Rate Floating Rate (monthly repricing) Adjustable (> 1 month repricing) Prime Libor 1 Month Other > (1) Includes loans available for sale. 18 > Note: totals may not foot due to rounding.

Loan and Lease Portfolio Characteristics Mortgage Owner Occupied CRE . Represents 18% of overall portfolio . Represents 12% of overall portfolio . Total delinquencies of 0.97% . Total delinquencies of 0.56% . De minimis annualized net charge-off . Annualized net charge-off rate of 1 bp rate . Average loan size of $765,000 . Average loan size of $431,000 Geographic Diversification . Average LTV of 63% . Average FICO of 761 and LTV of 65% Other Portland / 11% Vancouver Multifamily Non-owner Occupied CRE WA, Other 12% 6% . . Represents 17% of overall portfolio Represents 16% of overall portfolio Southern CA . Total delinquencies of 0.13% . Total delinquencies of 0.34% OR, Other 17% 13% . . Annualized net charge-off rate of 0.04% Annualized net charge-off rate of 1 bp . . Average loan size of $1.4 million Average loan size of $1.6 million Northern CA . . Average LTV of 60% and DSC of 1.8 Puget Sound Average LTV of 59% and DSC of 1.6 15% 13% Bay Area Commercial & Industrial 13% Lease & Equipment Finance . Represents 6% of overall portfolio . Represents 17% of overall portfolio . Total delinquencies of 2.57% . Total delinquencies of 0.49% . Annualized net charge-off rate of 3.02% . Annualized net charge-off rate of 0.16% . ~10.5% average yield . Average loan size of $345,000 . Average loan size of $35,000 > Note: Balances and delinquencies as of December 31, 2018. Annualized net charge-off rate for Q4 2018. LTV, FICO and Debt Service Coverage (DSC) are based on weighted average for portfolio. LTV for the Mortgage portfolio represents average LTV based on most recent appraisal against updated loan 19 balance.

Credit Quality Non-performing assets to total assets Classified Assets 1.60% 1.00% 1.40% 14.00% 1.20% 1.07% 0.80% 0.90% 12.00% 1.00% 0.86% 0.83% 0.75% 0.80% 0.60% 11.10% 10.00% 0.37% 0.37% 0.60% 0.33% 0.34% 0.36% 9.80% 9.70% 0.40% 0.40% 9.10% 8.00% 0.20% 8.40% Classified Assets / RBC 0.20% 0.00% 6.00% Classified/ Loans Total Loans Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 0.00% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Classified Loans to Total Loans Classified Assets to Risk-Based Capital Allowance for loan and lease losses to loans Net charge-offs to average loans and leases and leases (annualized) 1.00% 1.00% 0.80% 0.80% 0.60% 0.74% 0.74% 0.74% 0.73% 0.71% 0.60% 0.40% 0.40% 0.32% 0.26% 0.25% 0.22% 0.25% 0.20% 0.20% 0.00% 0.00% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 20

Capital Management > All regulatory capital ratios remained in excess of well-capitalized and internal policy limits > Focused on prudently managing capital • Declared quarterly dividend of $0.21 per share, ~4.6% current dividend yield • Q4 total payout ratio of 58% Q4 2018 Capital Ratios (1) 13.4% 10.7% 10.7% 8.9% 9.3% Tangible Common Tier 1 Leverage Tier 1 Common Risk Based Tier 1 Risk Based Total Risk Based Equity/Tangible Assets > (1) Regulatory capital ratios are estimates pending completion and filing of the Company’s regulatory reports. 21

Appendix – Non-GAAP Reconciliation

Non-GAAP Reconciliation – Tangible Book Value 23

Impacts on ROATCE ($ in millions) FY 2016 FY 2017 FY 2018 Net Income (a) $ 230.1 $ 242.3 $ 316.2 Average Tangible Common Equity (b) 2,028.3 2,108.3 2,187.9 ROATCE (a/b) 11.34% 11.49% 14.45% $ impact (1) from: Exit or disposal costs $ 2.8 $ 3.6 $ 5.1 Loss (gain) on fair value of MSR asset $ (15.6) $ (14.0) $ (9.9) Loss (gain) on fair value of debt capital market swap derivatives $ 0.9 $ (0.9) $ (1.0) bps impact (1) from: Exit or disposal costs -0.14% -0.17% -0.23% Loss (gain) on fair value of MSR asset -0.77% -0.66% -0.45% Loss (gain) on fair value of debt capital market swap derivatives 0.04% -0.04% -0.05% Total -0.86% -0.87% -0.73% > (1) Income tax effect at 25% for 2018, and 40% for 2017 and 2016. 24 > Note: tables may not foot due to rounding.

Impacts on Efficiency Ratio ($ in millions) FY 2016 FY 2017 FY 2018 Net interest income $ 838.1 $ 865.7 $ 938.6 Non interest income $ 301.7 $ 278.5 $ 279.4 Tax Equiv Adjustment $ 4.6 $ 4.5 $ 1.9 Total (a) $ 1,144.4 $ 1,148.7 $ 1,220.0 Non interest expense (b) $ 737.2 $ 747.9 $ 739.5 Efficiency ratio (b/a) 64.41% 65.11% 60.61% $ impact from: Exit or disposal costs $ 4.7 $ 6.0 $ 6.8 Loss (gain) on fair value of MSR asset $ (25.9) $ (23.3) $ (13.2) Loss (gain) on fair value of debt capital market swap derivatives $ 1.5 $ (1.5) $ (1.4) bps impact from: Exit or disposal costs 0.41% 0.52% 0.56% Loss (gain) on fair value of MSR asset 1.43% 1.29% 0.65% Loss (gain) on fair value of debt capital market swap derivatives -0.08% 0.08% 0.07% Total 1.75% 1.89% 1.28% > Note: tables may not foot due to rounding. 25

Thank you