Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - TEXAS CAPITAL BANCSHARES INC/TX | a01232019exhibit991.htm |

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | a01232019-8k.htm |

TCBI Q4 2018 Earnings January 23, 2019

Certain matters discussed within or in connection with these materials may contain “forward-looking statements” as defined in federal securities laws, which are subject to risks and uncertainties and are based on Texas Capital’s current estimates or expectations of future events or future results. These statements are not historical in nature and can generally be identified by such words as “believe,” “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “intend” and similar expressions. A number of factors, many of which are beyond our control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the credit quality of our loan portfolio, general economic conditions in the United States and in our markets, including the continued impact on our customers from declines and volatility in oil and gas prices, the financial impact of the Tax Cuts and Jobs Act on our results of operations, rates of default or loan losses, volatility in the mortgage industry, the success or failure of our business strategies, future financial performance, future growth and earnings, the appropriateness of our allowance for loan losses and provision for credit losses, the impact of increased regulatory requirements and legislative changes on our business, increased competition, interest rate risk, the success or failure of new lines of business and new product or service offerings and the impact of new technologies. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect our business, can be found in our Annual Report on Form 10-K and in other filings we make with the Securities and Exchange Commission. Forward-looking statements speak only as of the date of this presentation. Texas Capital is under no obligation, and expressly disclaims any obligation, to update, alter or revise its forward-looking statements, whether as a result of new information, future events or otherwise. 2

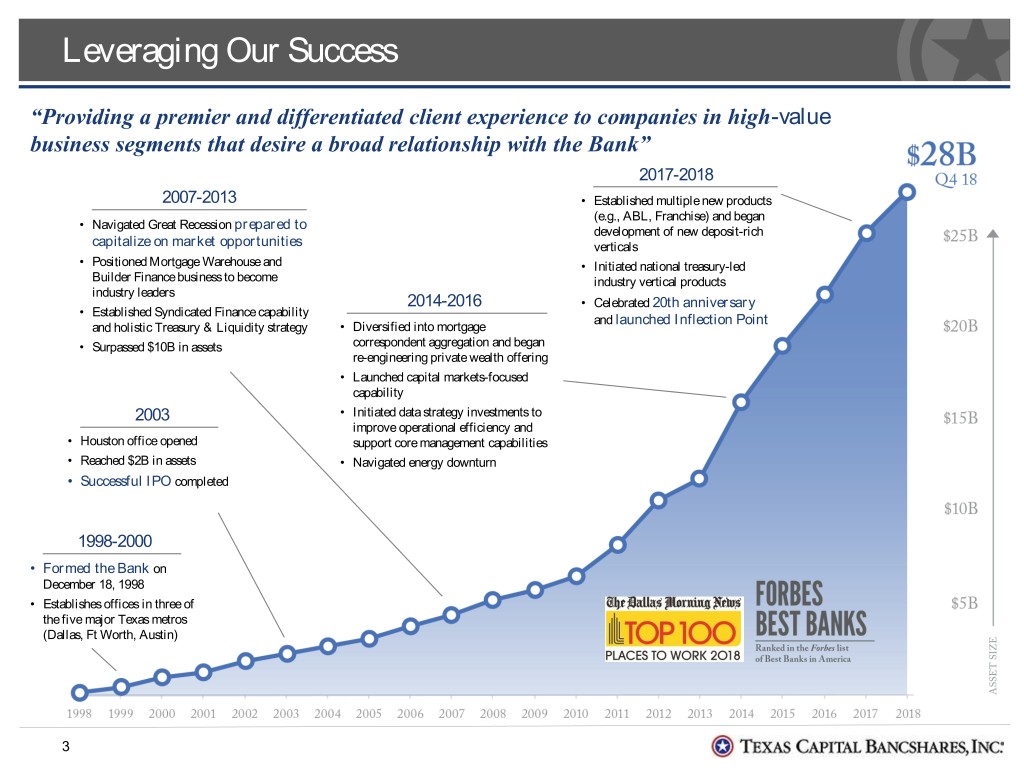

Leveraging Our Success “Providing a premier and differentiated client experience to companies in high-value business segments that desire a broad relationship with the Bank” 2017-2018 2007-2013 • Established multiple new products (e.g., ABL, Franchise) and began • Navigated Great Recession prepared to development of new deposit-rich capitalize on market opportunities verticals • Positioned Mortgage Warehouse and • Initiated national treasury-led Builder Finance business to become industry vertical products industry leaders 2014-2016 • Celebrated 20th anniversary • Established Syndicated Finance capability and launched Inflection Point and holistic Treasury & Liquidity strategy • Diversified into mortgage • Surpassed $10B in assets correspondent aggregation and began re-engineering private wealth offering • Launched capital markets-focused capability 2003 • Initiated data strategy investments to improve operational efficiency and • Houston office opened support core management capabilities • Reached $2B in assets • Navigated energy downturn • Successful IPO completed 1998-2000 • Formed the Bank on December 18, 1998 • Establishes offices in three of the five major Texas metros (Dallas, Ft Worth, Austin) 3

Opening Remarks & Financial Highlights Total Loans Total Deposits Net Income EPS ROE ROA Operating HFI Results $22.6 billion $20.6 billion $71.9 million $1.38 11.82% 1.09% • Net interest income grew 4% from Q3-2018 and 14% from Q4-2017 Net Interest Income • Net interest margin increased 8 bps from 3.70% at Q3-2018 to 3.78% due to increase in yield on earning assets and Margin • LIBOR movement reflected in core LHI yields; stabilized mortgage finance yields • Average LHI, excluding MFLs, growth of 2% from Q3-2018 ($311.9 million); 11% from Q4-2017 ($1.6 billion) Balance Sheet • Average MFLs increased 2% from Q3-2018 ($167.6 million); 14% from Q4-2017 ($849.7 million) Growth • Average total deposits increased 1% from Q3-2018 ($143.3 million); 2% from Q4-2017 ($444.1 million) M • Net revenue decreased 1% from Q3-2018 and increased 11% from Q4-2017 Operating • Non-interest expense decreased 5% from Q3-2018 and decreased 2% from Q4-2017 Leverage • Improvement in full year operating leverage as compared to 2017; net revenue up 19% and non-interest expense up 13% • NCOs / average total LHI of .37% for full year 2018 compared to .16% for full year 2017 Credit • Small number of deals that were previously identified, primarily leveraged Quality • Non-accrual loans / total LHI of .36%, compared to .49% in both Q3-2018 and Q4-2017 4

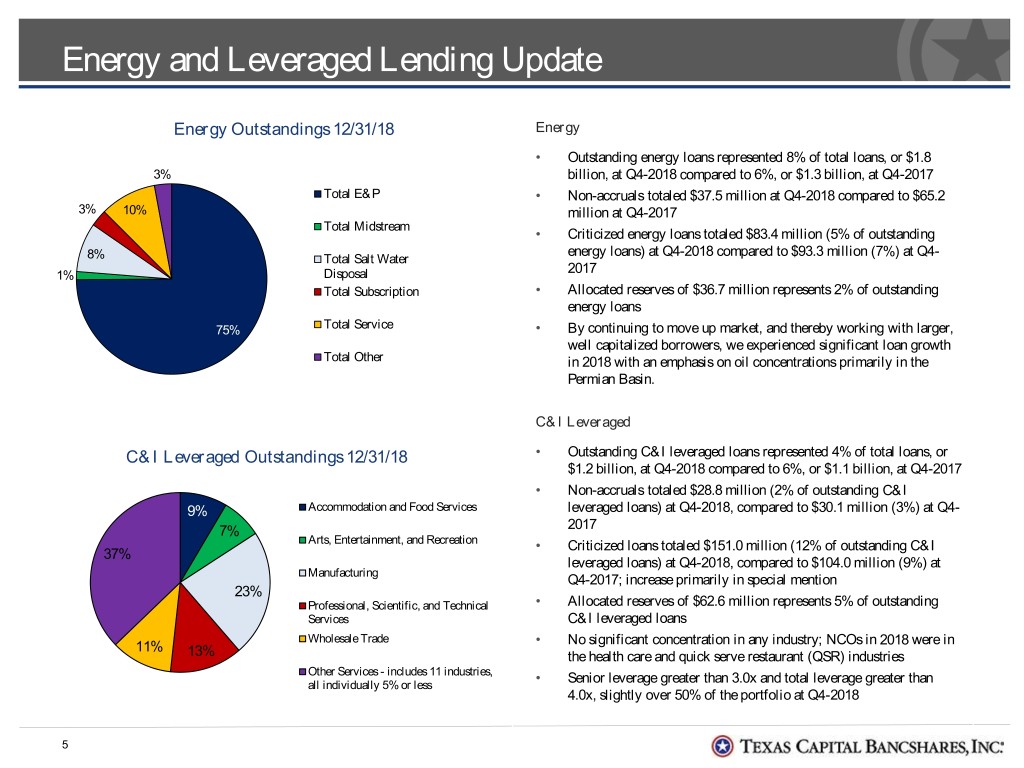

Energy and Leveraged Lending Update Energy Outstandings 12/31/18 Energy • Outstanding energy loans represented 8% of total loans, or $1.8 3% billion, at Q4-2018 compared to 6%, or $1.3 billion, at Q4-2017 Total E&P • Non-accruals totaled $37.5 million at Q4-2018 compared to $65.2 3% 10% million at Q4-2017 Total Midstream • Criticized energy loans totaled $83.4 million (5% of outstanding energy loans) at Q4-2018 compared to $93.3 million (7%) at Q4- 8% Total Salt Water 1% Disposal 2017 Total Subscription • Allocated reserves of $36.7 million represents 2% of outstanding energy loans 75% Total Service • By continuing to move up market, and thereby working with larger, well capitalized borrowers, we experienced significant loan growth Total Other in 2018 with an emphasis on oil concentrations primarily in the Permian Basin. C&I Leveraged C&I Leveraged Outstandings 12/31/18 • Outstanding C&I leveraged loans represented 4% of total loans, or $1.2 billion, at Q4-2018 compared to 6%, or $1.1 billion, at Q4-2017 • Non-accruals totaled $28.8 million (2% of outstanding C&I 9% Accommodation and Food Services leveraged loans) at Q4-2018, compared to $30.1 million (3%) at Q4- 7% 2017 Arts, Entertainment, and Recreation • Criticized loans totaled $151.0 million (12% of outstanding C&I 37% leveraged loans) at Q4-2018, compared to $104.0 million (9%) at Manufacturing Q4-2017; increase primarily in special mention 23% Professional, Scientific, and Technical • Allocated reserves of $62.6 million represents 5% of outstanding Services C&I leveraged loans Wholesale Trade 11% • No significant concentration in any industry; NCOs in 2018 were in 13% the health care and quick serve restaurant (QSR) industries Other Services - includes 11 industries, • all individually 5% or less Senior leverage greater than 3.0x and total leverage greater than 4.0x, slightly over 50% of the portfolio at Q4-2018 5

Mortgage Finance Core Strengths • Technology investments have allowed for scalability • Historically low credit risk • Strong funding opportunities • Other product offerings developed to serve the industry • Commitment to clients in the industry allow for increased market share Efficiency Earnings & Combined Yield 6.0 50.0% 60 45.0% 13.50% 5.0 5.4 50 4.0 40.0% 3.8 3.5 5.1 5.0 4.0 4.9 49.7 11.50% 35.0% 47.1 47.3 4.0 40 44.5 3.4 30.0% 4.1 9.50% 37.4 3.0 25.0% 30 7.50% 15.0% 20.0% 2.0 12.1% 12.2% 20 12.1% 15.0% 5.50% 9.2% 3.77% 4.04% 4.16% 3.91% 3.99% 10.0% Income ($M) 1.0 10 3.50% 5.0% AvgBalance ($B) 0.0% 0.0 0 1.50% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 1M LIBOR* 1.34% 1.66% 1.97% 2.11% 2.35% MFLs Efficiency Ratio Interest Income Fees (NIR) Combined Yield *Average of quarter’s daily 1M LIBOR rates 6

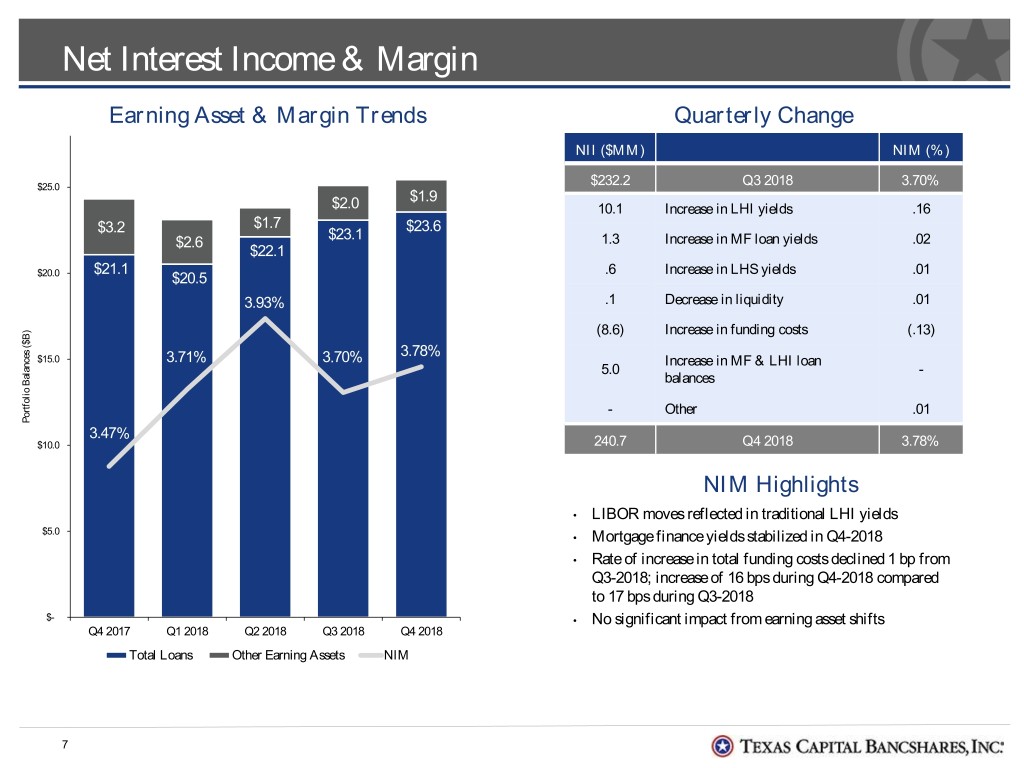

Net Interest Income & Margin Earning Asset & Margin Trends Quarterly Change NII ($MM) NIM (%) 4.40% $25.0 $232.2 Q3 2018 3.70% $1.9 $2.0 10.1 Increase in LHI yields .16 $1.7 $23.6 $3.2 $23.1 4.20% $2.6 1.3 Increase in MF loan yields .02 $22.1 $21.1 .6 Increase in LHS yields .01 $20.0 $20.5 3.93% 4.00% .1 Decrease in liquidity .01 (8.6) Increase in funding costs (.13) 3.78% $15.0 3.71% 3.70% 3.80% Increase in MF & LHI loan 5.0 - balances - Other .01 Portfolio Balances Balances ($B) Portfolio 3.60% 3.47% $10.0 240.7 Q4 2018 3.78% 3.40% NIM Highlights • LIBOR moves reflected in traditional LHI yields $5.0 • Mortgage finance yields stabilized in Q4-2018 3.20% • Rate of increase in total funding costs declined 1 bp from Q3-2018; increase of 16 bps during Q4-2018 compared to 17 bps during Q3-2018 $- 3.00% • No significant impact from earning asset shifts Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Total Loans Other Earning Assets NIM 7

Loan Growth Average Balance Trends ($B) Total Loan Composition ($24.5Billion at 12/31/18) $24.0 8.00% 7.80% Business Assets $22.0 $6.9 7.60% 29% $6.4 $7.1 7.40% $20.0 $6.2 $5.3 7.20% Energy $18.0 7.00% 6.80% 5% $16.0 $16.6 6.60% $15.9 $16.3 6.40% Highly Liquid $14.0 $15.4 Unsecured $15.0 6.20% 4% Assets 6.00% 1% $12.0 5.72% 5.80% Owner Occupied 5.47% 5.48% 5.60% R/E $10.0 5% 5.14% 5.40% PortfolioBalances ($B) $8.0 4.89% 5.20% Residential R/E 5.00% Mkt. Risk $6.0 4.80% 5% 4.60% $4.0 4.40% 4.20% $2.0 Total Mortgage 4.00% Comml R/E Mkt. Finance $- 3.80% Risk 32% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 15% Other Assets LHI (excl. MFLs) Total MFLs LHI (excl. MFL) Yield 4% Growth Highlights • Growth in average traditional LHI; up $311.9 million (2%) from Q3-2018 and $1.6 billion (11%) from Q4-2017 • Modest growth in traditional LHI at end of the quarter; period-end balance $47.0 million higher than Q4-2018 average balance • Increase in average total MFL balances of $167.6 million (2%) from Q3-2018 and $849.7 million (14%) from Q4-2017 • Average total MFLs represent 30% of average total loans at Q4-2018 compared to 30% in Q3-2018 and 32% at period end 8

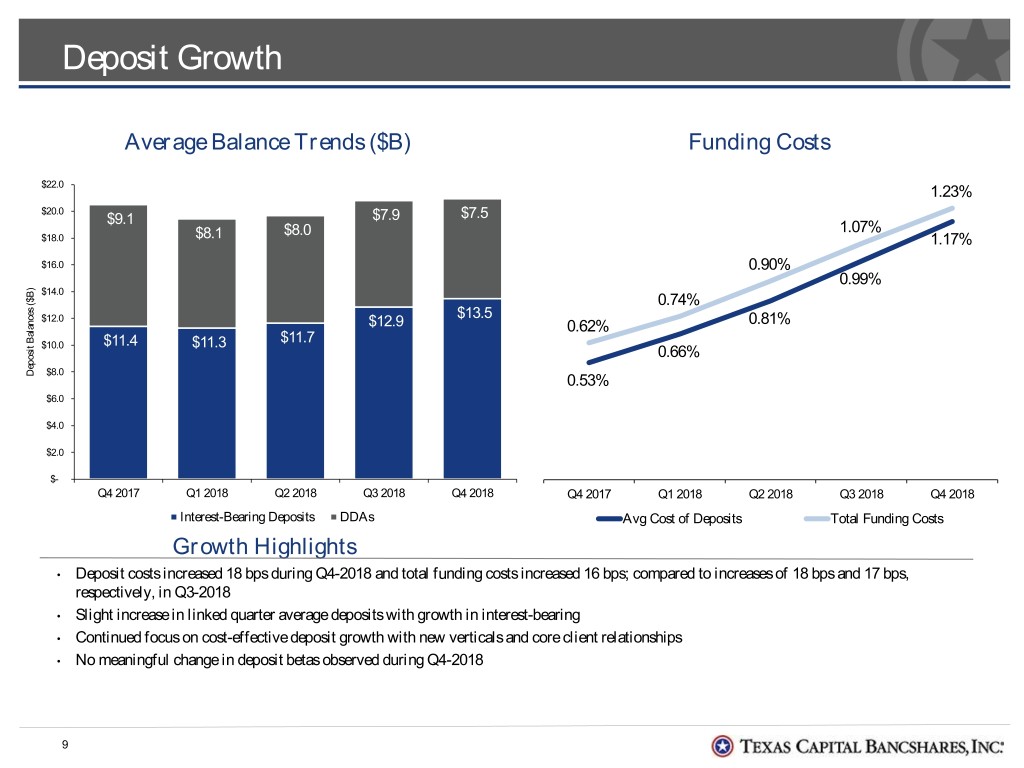

Deposit Growth Average Balance Trends ($B) Funding Costs 1.40% $22.0 1.23% $20.0 $9.1 $7.9 $7.5 1.20% $8.0 1.07% $18.0 $8.1 1.17% 1.00% $16.0 0.90% 0.99% $14.0 0.80% 0.74% $12.0 $13.5 $12.9 0.62% 0.81% $11.7 $10.0 $11.4 $11.3 0.60% 0.66% Deposit Balances ($B) Balances Deposit $8.0 0.53% 0.40% $6.0 $4.0 0.20% $2.0 $- 0.00% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Interest-Bearing Deposits DDAs Avg Cost of Deposits Total Funding Costs Growth Highlights • Deposit costs increased 18 bps during Q4-2018 and total funding costs increased 16 bps; compared to increases of 18 bps and 17 bps, respectively, in Q3-2018 • Slight increase in linked quarter average deposits with growth in interest-bearing • Continued focus on cost-effective deposit growth with new verticals and core client relationships • No meaningful change in deposit betas observed during Q4-2018 9

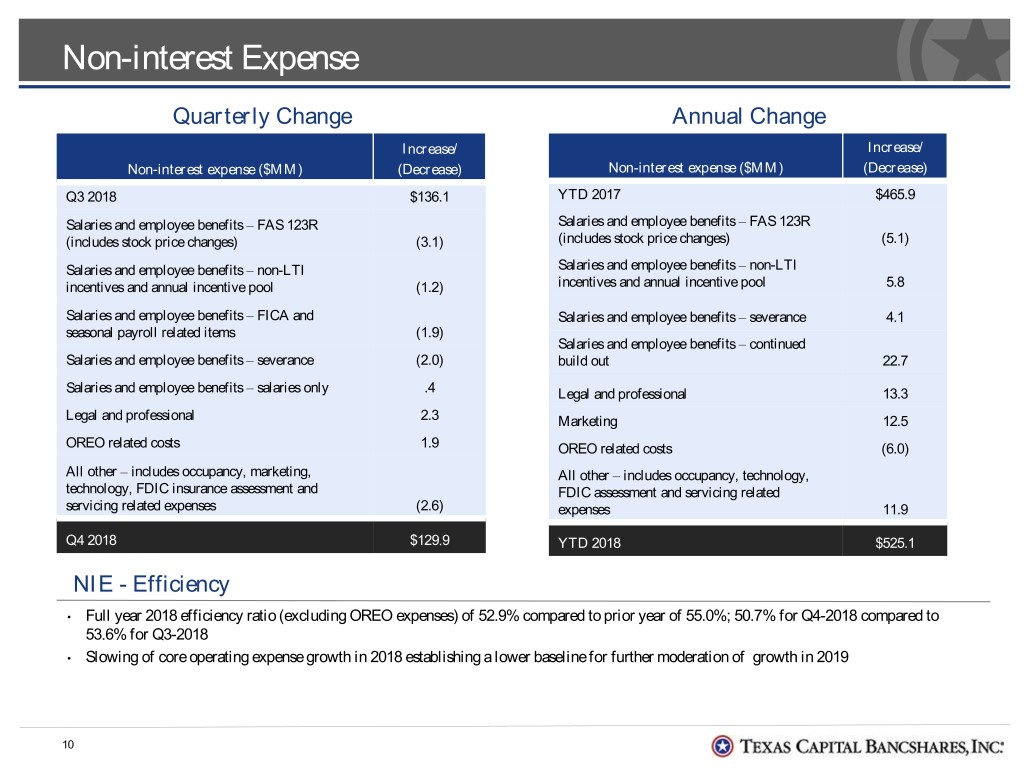

Non-interest Expense Quarterly Change Annual Change Increase/ Increase/ Non-interest expense ($MM) (Decrease) Non-interest expense ($MM) (Decrease) Q3 2018 $136.1 YTD 2017 $465.9 Salaries and employee benefits – FAS 123R Salaries and employee benefits – FAS 123R (includes stock price changes) (3.1) (includes stock price changes) (5.1) Salaries and employee benefits – non-LTI Salaries and employee benefits – non-LTI incentives and annual incentive pool (1.2) incentives and annual incentive pool 5.8 Salaries and employee benefits – FICA and Salaries and employee benefits – severance 4.1 seasonal payroll related items (1.9) Salaries and employee benefits – continued Salaries and employee benefits – severance (2.0) build out 22.7 Salaries and employee benefits – salaries only .4 Legal and professional 13.3 Legal and professional 2.3 Marketing 12.5 OREO related costs 1.9 OREO related costs (6.0) All other – includes occupancy, marketing, All other – includes occupancy, technology, technology, FDIC insurance assessment and FDIC assessment and servicing related servicing related expenses (2.6) expenses 11.9 Q4 2018 $129.9 YTD 2018 $525.1 NIE - Efficiency • Full year 2018 efficiency ratio (excluding OREO expenses) of 52.9% compared to prior year of 55.0%; 50.7% for Q4-2018 compared to 53.6% for Q3-2018 • Slowing of core operating expense growth in 2018 establishing a lower baseline for further moderation of growth in 2019 10

Asset Quality Allowance for Credit Losses NCO/Average Total LHI $220.0 3.5x 3.4x3.5x 3.4x3.3x 1.40% $200.0 3.3x 3.2x $200.5 $200.6 $203.0 3.2x 3.1x $180.0 $193.7 $189.6 3.x 1.20% 2.9x3.x 2.8x2.9x $160.0 2.8x 2.7x 2.6x2.7x 1.00% 2.6x $140.0 2.4x 2.5x 2.4x2.5x 2.2x 2.3x2.4x $120.0 2.3x 0.80% 2.2x 1.8x 2.1x $100.0 2.x 0.60% ALLL ALLL ($M) 1.8x 1.9x 1.8x1.9x $80.0 1.5x 1.8x 1.7x 0.37% 1.6x 0.40% $60.0 1.5x 0.29% 1.5x1.4x 1.3x1.4x 0.16% $40.0 1.2x1.3x 0.20% 1.2x 0.05% 0.07% 1.1x $20.0 1.x 1.x .9x 0.00% .8x $- .8x 2014 2015 2016 2017 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 ALLL ALLL to Non-accrual Loans Combined Criticized Loans as % of Total LHI Reserves/ .76% .90% 1.03% .94% .90% $500.0 5.00% Total LHI $442.1 $400.0 4.00% Asset Quality Highlights $369.6 $364.0 $359.6 • Credit cost of $35.0 million for Q4-2018, compared to $11.0 million ($13.0 $339.1 $300.0 3.00% million provision, net $2.0 million reversal of OREO valuation allowance) in Q3-2018 and $8.1 million ($2.0 million provision, $6.1 million OREO 1.96% write-down) in Q4-2017 1.81% 1.62% $200.0 1.64% 1.63% 2.00% • NCOs $32.6 million, or 60 bps of average total LHI, in Q4-2018 compared Criticized Loans Criticized Loans ($M) to $2.0 million, or 4 bps, in Q3-2018 and 2 bps in Q4-2017 $100.0 1.00% • Q4-2018 NCOs related to small number of deals; previously identified • NPL ratio decreased to .36% of total LHI compared to Q3-2018 • Criticized levels remain low and favorable to industry levels $- 0.00% Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Criticized Loans Criticized Loans as a % of Total LHI 11

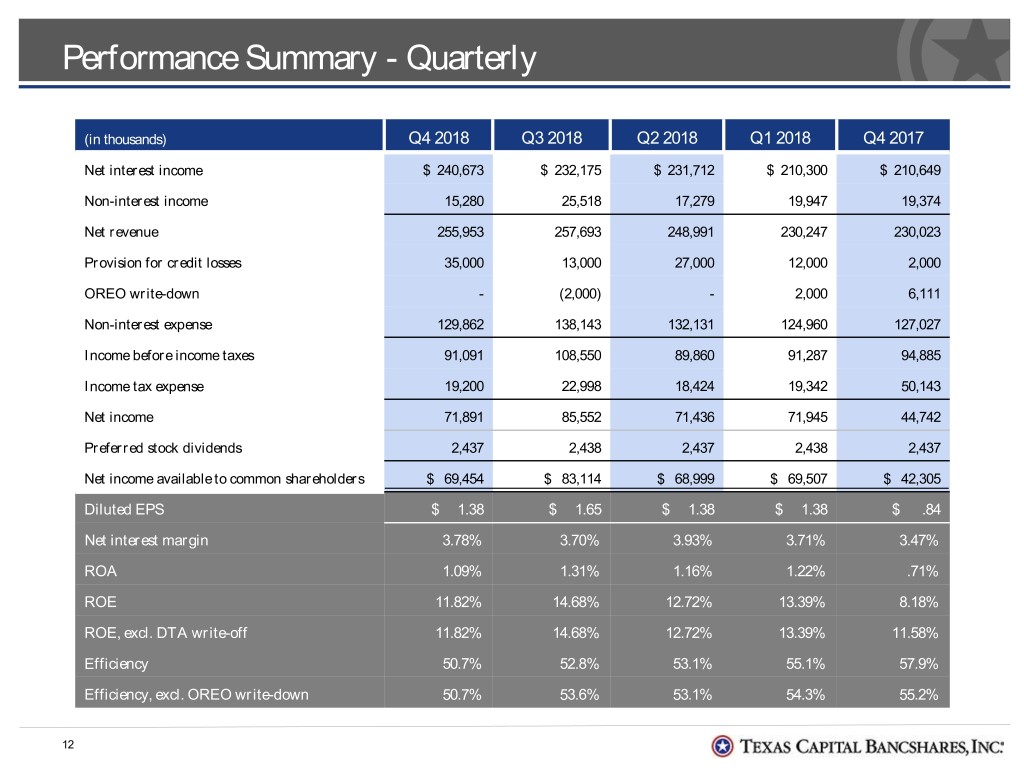

Performance Summary - Quarterly (in thousands) Q4 2018 Q3 2018 Q2 2018 Q1 2018 Q4 2017 Net interest income $ 240,673 $ 232,175 $ 231,712 $ 210,300 $ 210,649 Non-interest income 15,280 25,518 17,279 19,947 19,374 Net revenue 255,953 257,693 248,991 230,247 230,023 Provision for credit losses 35,000 13,000 27,000 12,000 2,000 OREO write-down - (2,000) - 2,000 6,111 Non-interest expense 129,862 138,143 132,131 124,960 127,027 Income before income taxes 91,091 108,550 89,860 91,287 94,885 Income tax expense 19,200 22,998 18,424 19,342 50,143 Net income 71,891 85,552 71,436 71,945 44,742 Preferred stock dividends 2,437 2,438 2,437 2,438 2,437 Net income available to common shareholders $ 69,454 $ 83,114 $ 68,999 $ 69,507 $ 42,305 Diluted EPS $ 1.38 $ 1.65 $ 1.38 $ 1.38 $ .84 Net interest margin 3.78% 3.70% 3.93% 3.71% 3.47% ROA 1.09% 1.31% 1.16% 1.22% .71% ROE 11.82% 14.68% 12.72% 13.39% 8.18% ROE, excl. DTA write-off 11.82% 14.68% 12.72% 13.39% 11.58% Efficiency 50.7% 52.8% 53.1% 55.1% 57.9% Efficiency, excl. OREO write-down 50.7% 53.6% 53.1% 54.3% 55.2% 12

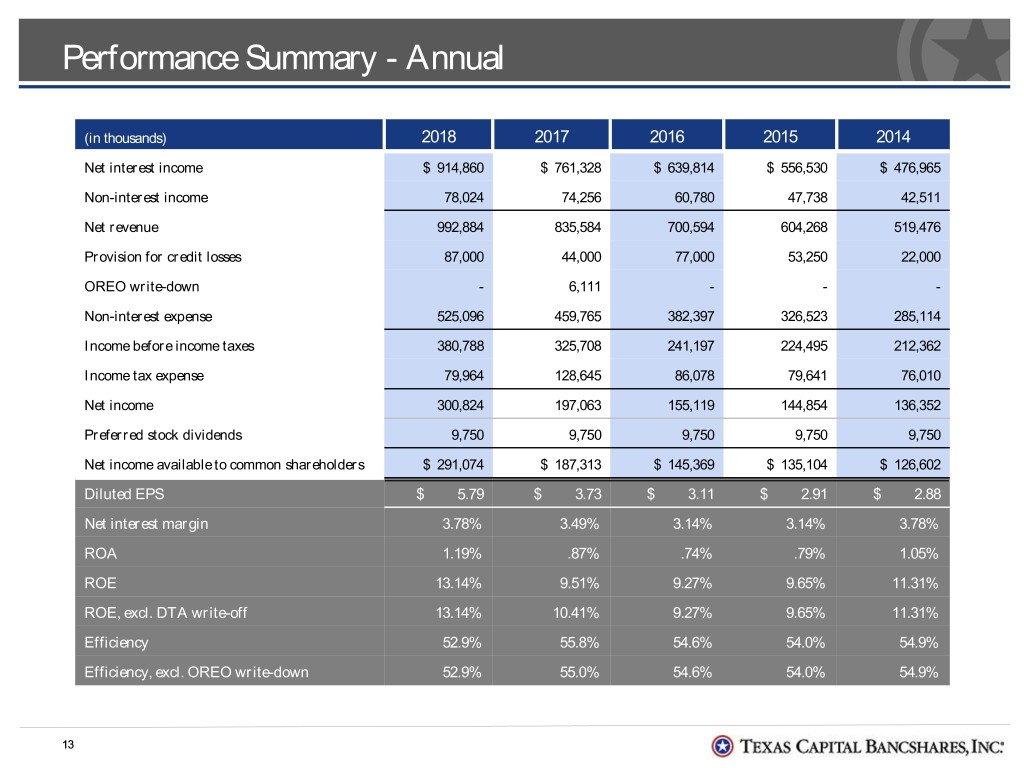

Performance Summary - Annual (in thousands) 2018 2017 2016 2015 2014 Net interest income $ 914,860 $ 761,328 $ 639,814 $ 556,530 $ 476,965 Non-interest income 78,024 74,256 60,780 47,738 42,511 Net revenue 992,884 835,584 700,594 604,268 519,476 Provision for credit losses 87,000 44,000 77,000 53,250 22,000 OREO write-down - 6,111 - - - Non-interest expense 525,096 459,765 382,397 326,523 285,114 Income before income taxes 380,788 325,708 241,197 224,495 212,362 Income tax expense 79,964 128,645 86,078 79,641 76,010 Net income 300,824 197,063 155,119 144,854 136,352 Preferred stock dividends 9,750 9,750 9,750 9,750 9,750 Net income available to common shareholders $ 291,074 $ 187,313 $ 145,369 $ 135,104 $ 126,602 Diluted EPS $ 5.79 $ 3.73 $ 3.11 $ 2.91 $ 2.88 Net interest margin 3.78% 3.49% 3.14% 3.14% 3.78% ROA 1.19% .87% .74% .79% 1.05% ROE 13.14% 9.51% 9.27% 9.65% 11.31% ROE, excl. DTA write-off 13.14% 10.41% 9.27% 9.65% 11.31% Efficiency 52.9% 55.8% 54.6% 54.0% 54.9% Efficiency, excl. OREO write-down 52.9% 55.0% 54.6% 54.0% 54.9% 13

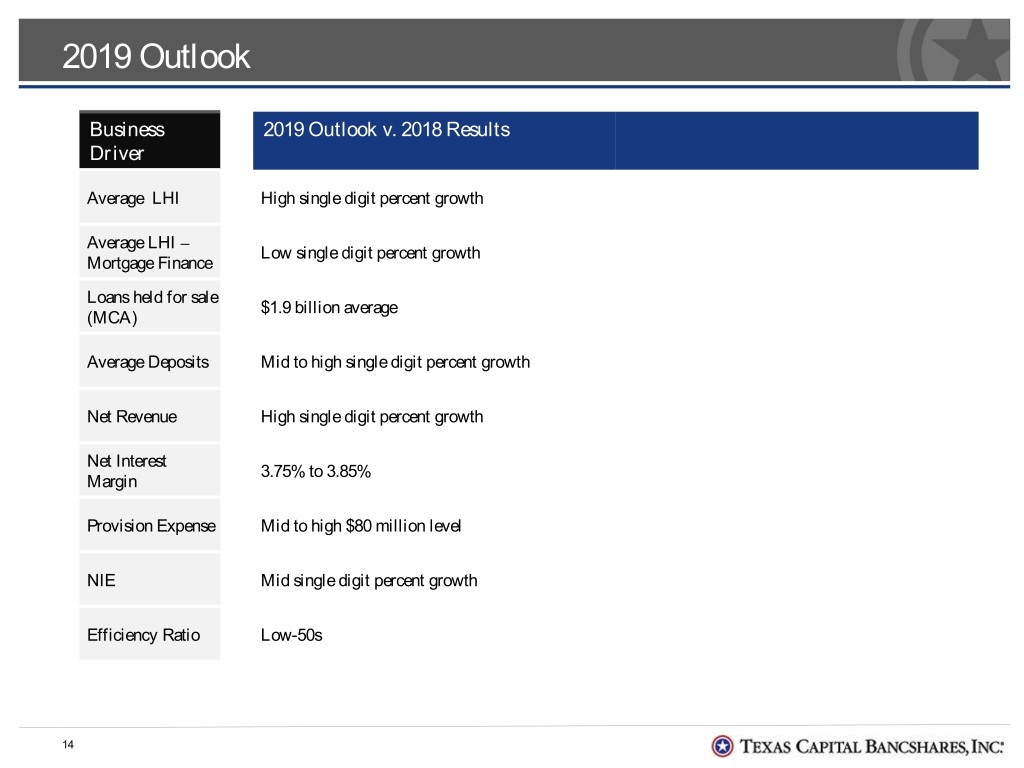

2019 Outlook Business 2019 Outlook v. 2018 Results Driver Average LHI High single digit percent growth Average LHI – Low single digit percent growth Mortgage Finance Loans held for sale $1.9 billion average (MCA) Average Deposits Mid to high single digit percent growth Net Revenue High single digit percent growth Net Interest 3.75% to 3.85% Margin Provision Expense Mid to high $80 million level NIE Mid single digit percent growth Efficiency Ratio Low-50s 14

Long-term Outlook Rising-Rate Financial Goals Benefit ~ 10 bps ROA > 1.3% ~1.5% ROCE > 15% (~1.5%) Efficiency Ratio < 50% Fed Fund Target Max Reaches 3.50% Key Assumptions • Continuation of current economic conditions, allowing the Bank to capitalize on Inflection Point initiatives of growing higher return businesses and limiting investments in lower return or non-strategic portfolios • Despite more potential volatility in provision, NCOs remain 20-25 bps of average total LHI • Mortgage Finance brand strengthens and relationships expand, despite additional growth headwinds generated by point in rate cycle • Lower-cost, lower-beta deposit verticals achieve growth and ROI targets • Product enhancements and expanded offerings maintain non-interest income contribution to total revenue, even amidst ex-liquidity NIM expansion • Internal investments yield efficiency benefits and allow Bank to maintain moderate overhead growth over the horizon • Bank remains committed to efficient use of shareholder capital and maintaining liquidity at appropriate levels 15

Closing Comments • Inflection Point focuses on further differentiating our reputation for premium client service in the market • Solid traditional LHI growth in 2018, with further risk appropriate growth levels in 2019 • Deposit initiatives launched in 2018 and continued roll-out in 2019 to improve funding mix and cost of funding • Level of loan loss provisioning provided in guidance to ensure we’re strengthening our balance sheet late cycle • Targeted approach in slowing pace of NIE growth, as we continue improving efficiencies through technology and better processes • Record earnings in 2018 with fundamentals in place for continued earnings growth in 2019 16

Q&A 17

Appendix 18

Average Balances, Yields & Rates - Quarterly (in thousands) Q4 2018 Q3 2018 Q4 2017 Avg. Bal. Yield Rate Avg. Bal. Yield Rate Avg. Bal. Yield Rate Assets Securities $ 117,371 5.22% $ 115,519 4.87% $ 23,678 3.57% Liquidity assets 1,759,417 2.25% 1,901,759 1.96% 3,217,486 1.28% Loans held for sale 2,049,395 4.72% 1,484,459 4.62% 1,144,124 3.99% LHI, mortgage finance 5,046,540 3.72% 5,443,829 3.62% 5,102,107 3.46% LHI 16,643,559 5.72% 16,331,622 5.48% 15,010,041 4.89% Total LHI, net of reserve 21,507,285 5.30% 21,596,224 5.06% 19,928,915 4.57% Total earning assets 25,433,468 5.04% 25,097,961 4.80% 24,314,203 4.11% Total assets $26,261,624 $25,975,915 $25,080,825 Liabilities and Stockholders’ Equity Total interest bearing deposits $13,474,308 1.82% $12,852,883 1.61% $11,406,769 .96% Other borrowings 2,290,520 2.39% 2,275,640 2.11% 1,852,750 1.31% Total long-term debt 395,114 5.47% 395,025 5.45% 394,754 5.17% Total interest bearing liabilities 16,159,942 1.99% 15,523,548 1.78% 13,654,273 1.13% Demand deposits 7,462,392 7,940,503 9,085,819 Total deposits 20,936,700 1.17% 20,793,386 .99% 20,492,588 .53% Stockholders’ equity 2,482,012 2,395,562 2,202,683 Total liabilities and stockholders’ equity $26,261,624 1.23% $25,975,915 1.07% $25,080,825 .62% Net interest margin 3.78% 3.70% 3.47% Total deposits and borrowed funds $23,227,220 1.29% $23,069,026 1.10% $22,345,338 .60% 19

Average Balances, Yields & Rates - Annual (in thousands) 2018 2017 Avg. Bal. Yield Rate Avg. Bal. Yield Rate Assets Securities $ 70,695 4.75% $ 51,806 2.06% Liquidity assets 1,970,310 1.85% 2,953,040 1.08% Loans held for sale 1,561,530 4.56% 1,016,144 3.85% LHI, mortgage finance 4,875,860 3.72% 4,136,653 3.46% LHI 16,705,007 5.46% 14,040,965 4.77% Total LHI, net of reserve 20,767,004 5.10% 18,003,513 4.52% Total earning assets 24,369,539 4.80% 22,024,503 4.02% Total assets $25,197,689 $22,704,848 Liabilities and Stockholders’ Equity Total interest bearing deposits $12,323,299 1.50% $10,133,206 .79% Other borrowings 2,102,404 2.03% 1,618,238 1.10% Total long-term debt 394,980 5.44% 394,619 5.16% Total interest bearing liabilities 14,820,683 1.68% 12,146,063 .97% Demand deposits 7,890,304 8,320,650 Total deposits 20,213,603 18,453,856 Stockholders’ equity 2,365,449 2,119,191 Total liabilities and stockholders’ equity $25,197,689 .99% $22,704,848 .52% Net interest margin 3.78% 3.49% Total deposits and borrowed funds $22,316,007 1.02% $20,072,094 .49% 20

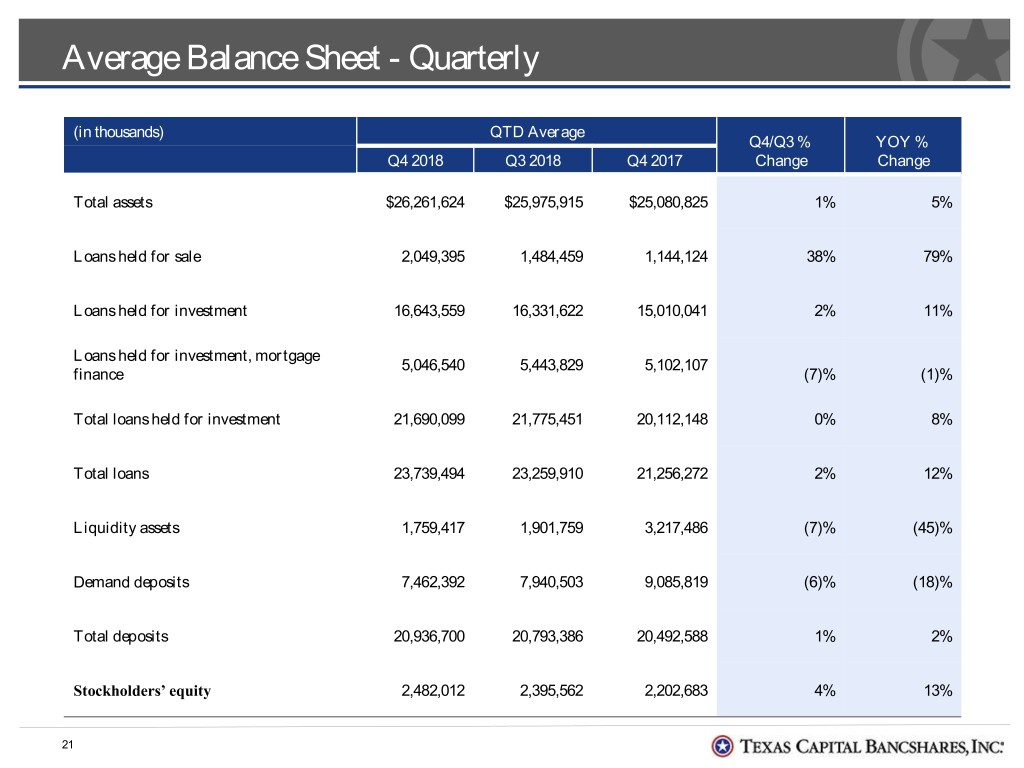

Average Balance Sheet - Quarterly (in thousands) QTD Average Q4/Q3 % YOY % Q4 2018 Q3 2018 Q4 2017 Change Change Total assets $26,261,624 $25,975,915 $25,080,825 1% 5% Loans held for sale 2,049,395 1,484,459 1,144,124 38% 79% Loans held for investment 16,643,559 16,331,622 15,010,041 2% 11% Loans held for investment, mortgage 5,046,540 5,443,829 5,102,107 finance (7)% (1)% Total loans held for investment 21,690,099 21,775,451 20,112,148 0% 8% Total loans 23,739,494 23,259,910 21,256,272 2% 12% Liquidity assets 1,759,417 1,901,759 3,217,486 (7)% (45)% Demand deposits 7,462,392 7,940,503 9,085,819 (6)% (18)% Total deposits 20,936,700 20,793,386 20,492,588 1% 2% Stockholders’ equity 2,482,012 2,395,562 2,202,683 4% 13% 21

Period End Balance Sheet (in thousands) Period End Q4/Q3 % YOY % Q4 2018 Q3 2018 Q4 2017 Change Change Total assets $28,257,767 $27,127,107 $25,075,645 4% 13% Loans held for sale 1,969,474 1,651,930 1,011,004 19% 95% Loans held for investment 16,690,550 16,569,538 15,366,252 1% 9% Loans held for investment, mortgage 5,877,524 5,477,787 5,308,160 7% 11% finance Total loans held for investment 22,568,074 22,047,325 20,674,412 2% 9% Total loans 24,537,548 23,699,255 21,685,416 4% 13% Liquidity assets 2,865,874 2,615,570 2,727,581 10% 5% Demand deposits 7,317,161 7,031,460 7,812,660 4% (6)% Total deposits 20,606,113 20,385,637 19,123,180 1% 8% Stockholders’ equity 2,500,394 2,426,442 2,202,721 3% 14% 22