Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PG&E Corp | d661551d8k.htm |

Exhibit 99.1 PUBLIC-SIDE LENDER PRESENTATION January 23, 2019Exhibit 99.1 PUBLIC-SIDE LENDER PRESENTATION January 23, 2019

Forward Looking Statements This presentation contains statements regarding management’s expectations and objectives for future periods as well as forecasts and estimates regarding potential liability in connection with the 2017 and 2018 Northern California wildfires, the proposed Community Wildfire Safety Program, Adjusted EBITDA and ratebase, 2018-2023 capital expenditures, 2018-2023 weighted average ratebase and the potential DIP Financing. It also includes assumptions regarding capital expenditures, authorized rate base, authorized cost of capital, and certain other factors. These statements and other statements that are not purely historical constitute forward-looking statements that are necessarily subject to various risks and uncertainties. Actual results may differ materially from those described in forward-looking statements. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are not limited to: · the impact of the 2017 and 2018 Northern California wildfires, including whether the Utility will be able to timely recover costs incurred in connection therewith in excess of the Utility's currently authorized revenue requirements; the timing and outcome of the remaining wildfire investigations and the extent to which the Utility will have liabilities associated with these fires; the timing and amount of insurance recoveries; and potential liabilities in connection with fines or penalties that could be imposed on the Utility if the CPUC or any other law enforcement agency were to bring an enforcement action and determined that the Utility failed to comply with applicable laws and regulations; · the timing and outcome of the Butte fire litigation and of any proceeding to recover costs in excess of insurance through regulatory mechanisms and the timing of such recovery; and whether additional investigations and proceedings in connection with the Butte fire will be opened and any additional fines or penalties imposed on the Utility; · the timing and outcome of issuance of recovery bonds (securitization) of 2017 Northern California wildfires costs that the CPUC finds just and reasonable; · whether PG&E Corporation and the Utility are able to successfully challenge the application of the doctrine of inverse condemnation to investor-owned utilities; · whether the Utility will be able to obtain full recovery of its significantly increased insurance premiums, and the timing of any such recovery; · whether the Utility can obtain wildfire insurance at a reasonable cost in the future, or at all, and whether insurance coverage is adequate for future losses or claims; · the timing and outcome of any CPUC decision related to the Utility’s March 30, 2018 submissions in connection with the impact of the Tax Cuts and Jobs Act of 2017 on the Utility’s rate cases, and its implementation plan; · the timing and outcomes of the 2019 GT&S rate case, 2020 GRC, FERC TO18, TO19, and TO20 rate cases, 2018 CEMA, WEMA, FHPMA, future cost of capital proceeding, and other ratemaking and regulatory proceedings; · the timing and outcome of future regulatory and legislative developments in connection with SB 901, including the customer harm threshold in connection with the 2017 Northern California wildfires, and future wildfire reforms; · the ability of PG&E Corporation and the Utility to access capital markets and other sources of financing in a timely manner and on acceptable terms; · PG&E Corporation's and the Utility's recent credit ratings downgrades to below investment grade and any further credit ratings downgrades that could, among other things, result in higher borrowing costs, fewer financing options, and additional collateral postings; · the cost of the Utility’s Community Wildfire Safety Program, and the timing and outcome of any proceeding to recover such cost through rates; · the timing and outcomes of phase two of the ex parte order instituting investigation (OII), of the safety culture OII, and the locate and mark OII; · the Utility’s ability to efficiently manage capital expenditures and its operating and maintenance expenses within the authorized levels of spending and timely recover its costs through rates, and the extent to which the Utility incurs unrecoverable costs that are higher than the forecasts of such costs; · the outcome of the probation and the monitorship, the timing and outcomes of the debarment proceeding, and investigations that have been or may be commenced in the future, and the ultimate amount of fines, penalties, and remedial and other costs that the Utility may incur as a result; and · the other factors disclosed in PG&E Corporation and the Utility’s joint annual report on Form 10-K for the year ended December 31, 2017, their joint quarterly reports on Form 10-Q for the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018, respectively, and other reports filed with the SEC, which are available on PG&E Corporation’s website at www.pgecorp.com and on the SEC website at www.sec.gov. This presentation does not purport to be all-inclusive or to contain all of the information that a person considering the credit facilities may require to make a full analysis of the matters referred to herein. Each recipient of this presentation must make its own independent investigation and analysis. Unless otherwise indicated, the statements in this presentation are made as of January 23, 2019. PG&E Corporation and the Utility undertake no obligation to update information contained herein. Portions of this presentation have been furnished by PG&E Corporation and the Current Report on Form 8-K that was filed with the SEC on January 23, 2019, and is also available on PG&E Corporation's website at www.pgecorp.com. PG&E's financial statements as of and for the year ended December 31, 2018 have not been completed. Accordingly, any 2018 financial and operating information in this presentation is based on management estimates, which are subject to change. References herein to“LTM’18” are to the twelve months ended September 30, 2018. 2Forward Looking Statements This presentation contains statements regarding management’s expectations and objectives for future periods as well as forecasts and estimates regarding potential liability in connection with the 2017 and 2018 Northern California wildfires, the proposed Community Wildfire Safety Program, Adjusted EBITDA and ratebase, 2018-2023 capital expenditures, 2018-2023 weighted average ratebase and the potential DIP Financing. It also includes assumptions regarding capital expenditures, authorized rate base, authorized cost of capital, and certain other factors. These statements and other statements that are not purely historical constitute forward-looking statements that are necessarily subject to various risks and uncertainties. Actual results may differ materially from those described in forward-looking statements. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are not limited to: · the impact of the 2017 and 2018 Northern California wildfires, including whether the Utility will be able to timely recover costs incurred in connection therewith in excess of the Utility's currently authorized revenue requirements; the timing and outcome of the remaining wildfire investigations and the extent to which the Utility will have liabilities associated with these fires; the timing and amount of insurance recoveries; and potential liabilities in connection with fines or penalties that could be imposed on the Utility if the CPUC or any other law enforcement agency were to bring an enforcement action and determined that the Utility failed to comply with applicable laws and regulations; · the timing and outcome of the Butte fire litigation and of any proceeding to recover costs in excess of insurance through regulatory mechanisms and the timing of such recovery; and whether additional investigations and proceedings in connection with the Butte fire will be opened and any additional fines or penalties imposed on the Utility; · the timing and outcome of issuance of recovery bonds (securitization) of 2017 Northern California wildfires costs that the CPUC finds just and reasonable; · whether PG&E Corporation and the Utility are able to successfully challenge the application of the doctrine of inverse condemnation to investor-owned utilities; · whether the Utility will be able to obtain full recovery of its significantly increased insurance premiums, and the timing of any such recovery; · whether the Utility can obtain wildfire insurance at a reasonable cost in the future, or at all, and whether insurance coverage is adequate for future losses or claims; · the timing and outcome of any CPUC decision related to the Utility’s March 30, 2018 submissions in connection with the impact of the Tax Cuts and Jobs Act of 2017 on the Utility’s rate cases, and its implementation plan; · the timing and outcomes of the 2019 GT&S rate case, 2020 GRC, FERC TO18, TO19, and TO20 rate cases, 2018 CEMA, WEMA, FHPMA, future cost of capital proceeding, and other ratemaking and regulatory proceedings; · the timing and outcome of future regulatory and legislative developments in connection with SB 901, including the customer harm threshold in connection with the 2017 Northern California wildfires, and future wildfire reforms; · the ability of PG&E Corporation and the Utility to access capital markets and other sources of financing in a timely manner and on acceptable terms; · PG&E Corporation's and the Utility's recent credit ratings downgrades to below investment grade and any further credit ratings downgrades that could, among other things, result in higher borrowing costs, fewer financing options, and additional collateral postings; · the cost of the Utility’s Community Wildfire Safety Program, and the timing and outcome of any proceeding to recover such cost through rates; · the timing and outcomes of phase two of the ex parte order instituting investigation (OII), of the safety culture OII, and the locate and mark OII; · the Utility’s ability to efficiently manage capital expenditures and its operating and maintenance expenses within the authorized levels of spending and timely recover its costs through rates, and the extent to which the Utility incurs unrecoverable costs that are higher than the forecasts of such costs; · the outcome of the probation and the monitorship, the timing and outcomes of the debarment proceeding, and investigations that have been or may be commenced in the future, and the ultimate amount of fines, penalties, and remedial and other costs that the Utility may incur as a result; and · the other factors disclosed in PG&E Corporation and the Utility’s joint annual report on Form 10-K for the year ended December 31, 2017, their joint quarterly reports on Form 10-Q for the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018, respectively, and other reports filed with the SEC, which are available on PG&E Corporation’s website at www.pgecorp.com and on the SEC website at www.sec.gov. This presentation does not purport to be all-inclusive or to contain all of the information that a person considering the credit facilities may require to make a full analysis of the matters referred to herein. Each recipient of this presentation must make its own independent investigation and analysis. Unless otherwise indicated, the statements in this presentation are made as of January 23, 2019. PG&E Corporation and the Utility undertake no obligation to update information contained herein. Portions of this presentation have been furnished by PG&E Corporation and the Current Report on Form 8-K that was filed with the SEC on January 23, 2019, and is also available on PG&E Corporation's website at www.pgecorp.com. PG&E's financial statements as of and for the year ended December 31, 2018 have not been completed. Accordingly, any 2018 financial and operating information in this presentation is based on management estimates, which are subject to change. References herein to“LTM’18” are to the twelve months ended September 30, 2018. 2

Non-GAAP Information PG&E refers to the term “Adjusted EBITDA” in various places in this presentation. Adjusted EBITDA is a supplemental financial measure that is not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA is provided herein in order to provide a measure that may allow investors to compare the underlying financial performance of the business from one period to another, exclusive of certain items impacting comparability listed below. Adjusted EBITDA is calculated as PG&E Corporation’s net income plus income tax provision (or less income tax benefit); less other income, net; plus interest expense; less interest income; plus depreciation, amortization and decommissioning; plus 2017 Northern California wildfire- and Butte fire-related costs; less insurance recoveries, and plus a penalty decision in connection with the San Bruno incident. Adjusted EBITDA is not a substitute or alternative for GAAP measures such as net income and may not be comparable to similarly titled measures used by other companies. See the Appendix for a reconciliation of GAAP net income to non-GAAP Adjusted EBITDA. From time to time PG&E Corporation discloses “earnings from operations”. “Earnings from operations” is a supplemental financial measure that is not presented in accordance with GAAP and is calculated as PG&E Corporation's income available for common shareholders less items impacting comparability. “Items impacting comparability” represent items that management does not consider part of the normal course of operations and that affect comparability of financial results between periods. Such items are described in more detail, along with a reconciliation from earnings from operations to the most directly comparable GAAP measure, in PG&E Corporation materials that present such measure. 3 Non-GAAP Information PG&E refers to the term “Adjusted EBITDA” in various places in this presentation. Adjusted EBITDA is a supplemental financial measure that is not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA is provided herein in order to provide a measure that may allow investors to compare the underlying financial performance of the business from one period to another, exclusive of certain items impacting comparability listed below. Adjusted EBITDA is calculated as PG&E Corporation’s net income plus income tax provision (or less income tax benefit); less other income, net; plus interest expense; less interest income; plus depreciation, amortization and decommissioning; plus 2017 Northern California wildfire- and Butte fire-related costs; less insurance recoveries, and plus a penalty decision in connection with the San Bruno incident. Adjusted EBITDA is not a substitute or alternative for GAAP measures such as net income and may not be comparable to similarly titled measures used by other companies. See the Appendix for a reconciliation of GAAP net income to non-GAAP Adjusted EBITDA. From time to time PG&E Corporation discloses “earnings from operations”. “Earnings from operations” is a supplemental financial measure that is not presented in accordance with GAAP and is calculated as PG&E Corporation's income available for common shareholders less items impacting comparability. “Items impacting comparability” represent items that management does not consider part of the normal course of operations and that affect comparability of financial results between periods. Such items are described in more detail, along with a reconciliation from earnings from operations to the most directly comparable GAAP measure, in PG&E Corporation materials that present such measure. 3

Executive summary Ÿ PG&E Corporation (NYSE: PCG) (the “Corporation”) is an energy-based holding company, headquartered in San Francisco − It is the parent company of Pacific Gas and Electric Company (the “Utility” and, together with the Company, “PG&E”), an energy company that serves 16 million Californians across a 70,000-square-mile service area in Northern and Central California Ÿ PG&E faces extraordinary challenges relating to the 2017 and 2018 Northern California wildfires − While investigations remain ongoing, if PG&E were to be found liable, the liability could be significant − Following a comprehensive review with the assistance of outside advisors, the boards of directors of the Corporation and the Utility have determined that commencing reorganization cases under Chapter 11 of the U.S. Bankruptcy Code (“Chapter 11”) is appropriate, necessary and in the best interests of all stakeholders, including wildfire claimants, PG&E's other creditors and shareholders, and is ultimately the only viable option to restore PG&E's financial stability to fund ongoing operations and provide safe service to customers − PG&E expects that the Chapter 11 process will, among other things: • enable continued safe delivery of natural gas and electric service to PG&E's millions of customers, • support the orderly, fair and expeditious resolution of PG&E's potential liabilities resulting from the 2017 and 2018 Northern California wildfires, • enable PG&E to continue its extensive restoration and rebuilding efforts to assist communities affected by the 2017 and 2018 Northern California wildfires, • allow PG&E to work with regulators and policymakers to determine the most effective way for customers to receive safe natural gas and electric service for the long term in an environment that continues to be challenged by climate change, and • assure PG&E has access to the financial resources necessary to support ongoing operations and enable PG&E to continue investing in its systems, infrastructure and critical safety efforts Ÿ PG&E is seeking $5.5 billion of DIP financing to fund operations, required investments and safety initiatives, as well as the Chapter 11 proceeding − Sized to fund a ~2 year Chapter 11 proceeding, with 12-month extension option − DIP financing provided in the form of a $3.5 billion secured revolver and $2.0 billion secured term loan, of which $0.5 billion will be a delayed-draw term loan − The DIP loans will benefit from superpriority administrative claim status and be secured by first priority liens on substantially all of the Utility’s assets subject to A/R liens, to the extent outstanding − The Utility's obligations under the DIP financing will be guaranteed by the Corporation, and such guarantee will be a senior secured obligation of the Corporation, with superpriority administrative claim status and first priority liens on substantially all of the Corporation's assets th Ÿ PG&E is seeking to enter into financing agreements on or about January 29 , 2019 5 Executive summary Ÿ PG&E Corporation (NYSE: PCG) (the “Corporation”) is an energy-based holding company, headquartered in San Francisco − It is the parent company of Pacific Gas and Electric Company (the “Utility” and, together with the Company, “PG&E”), an energy company that serves 16 million Californians across a 70,000-square-mile service area in Northern and Central California Ÿ PG&E faces extraordinary challenges relating to the 2017 and 2018 Northern California wildfires − While investigations remain ongoing, if PG&E were to be found liable, the liability could be significant − Following a comprehensive review with the assistance of outside advisors, the boards of directors of the Corporation and the Utility have determined that commencing reorganization cases under Chapter 11 of the U.S. Bankruptcy Code (“Chapter 11”) is appropriate, necessary and in the best interests of all stakeholders, including wildfire claimants, PG&E's other creditors and shareholders, and is ultimately the only viable option to restore PG&E's financial stability to fund ongoing operations and provide safe service to customers − PG&E expects that the Chapter 11 process will, among other things: • enable continued safe delivery of natural gas and electric service to PG&E's millions of customers, • support the orderly, fair and expeditious resolution of PG&E's potential liabilities resulting from the 2017 and 2018 Northern California wildfires, • enable PG&E to continue its extensive restoration and rebuilding efforts to assist communities affected by the 2017 and 2018 Northern California wildfires, • allow PG&E to work with regulators and policymakers to determine the most effective way for customers to receive safe natural gas and electric service for the long term in an environment that continues to be challenged by climate change, and • assure PG&E has access to the financial resources necessary to support ongoing operations and enable PG&E to continue investing in its systems, infrastructure and critical safety efforts Ÿ PG&E is seeking $5.5 billion of DIP financing to fund operations, required investments and safety initiatives, as well as the Chapter 11 proceeding − Sized to fund a ~2 year Chapter 11 proceeding, with 12-month extension option − DIP financing provided in the form of a $3.5 billion secured revolver and $2.0 billion secured term loan, of which $0.5 billion will be a delayed-draw term loan − The DIP loans will benefit from superpriority administrative claim status and be secured by first priority liens on substantially all of the Utility’s assets subject to A/R liens, to the extent outstanding − The Utility's obligations under the DIP financing will be guaranteed by the Corporation, and such guarantee will be a senior secured obligation of the Corporation, with superpriority administrative claim status and first priority liens on substantially all of the Corporation's assets th Ÿ PG&E is seeking to enter into financing agreements on or about January 29 , 2019 5

PG&E System At a Glance Service Territory 2017 Revenue Sources Key Highlights (2018) Employees ~23,000 Gas General Transmission Rate Case & Storage Californians served ~16M ~7% ~43% Net income (2017) ~$1.7B Electric Pass- Transmission Ratebase (2017) ~$34.4B through ~9% ~41% Miles of electric lines ~130,000 California Public Utilities Commission Federal Energy Regulatory Commission Miles of natural gas pipelines ~50,000 MW utility-owned generation ~7,700 GWh electricity generated ~61,400 and procured (2017) Carbon-free and renewable ~80% energy delivered 7 PG&E System At a Glance Service Territory 2017 Revenue Sources Key Highlights (2018) Employees ~23,000 Gas General Transmission Rate Case & Storage Californians served ~16M ~7% ~43% Net income (2017) ~$1.7B Electric Pass- Transmission Ratebase (2017) ~$34.4B through ~9% ~41% Miles of electric lines ~130,000 California Public Utilities Commission Federal Energy Regulatory Commission Miles of natural gas pipelines ~50,000 MW utility-owned generation ~7,700 GWh electricity generated ~61,400 and procured (2017) Carbon-free and renewable ~80% energy delivered 7

2017 and 2018 Northern California Wildfires Recent Wildfires Overview 2017 Northern California Wildfires • According to the California Department of Forestry and Fire Protection’s (“Cal Fire”) California Statewide Fire Summary dated October 30, 2017, at the peak of the 2017 Northern California wildfires, there were 21 major fires that, in total, resulted in 44 fatalities, burned over 245,000 acres and destroyed an estimated 8,900 structures • Cal Fire issued its determination on the causes of 18 of the 2017 Northern California wildfires, and alleged that each of these fires involved the Utility's equipment. The remaining wildfires remain under Cal Fire’s investigation, including the possible role of the Utility’s power lines and other facilities 2017 fires 2018 Camp Wildfire (“Camp Fire”) • Cal Fire’s Camp Fire Incident Information Website as of January 4, 2019 (the “Cal Fire website”), indicated that the Camp Fire consumed 153,336 acres. On the Cal Fire website, Cal Fire reported 86 fatalities and the destruction of 13,972 residences, 528 commercial structures and 4,293 other buildings resulting from the Camp Fire • The cause of the Camp Fire remains under investigation, and PG&E is cooperating with those investigations. The Utility has submitted two Electric Incident Reports (the “EIRs”) to the CPUC, one on November 8, 2018 and one on November 16, 2018. On December 11, 2018, the Utility publicly released a letter to the CPUC supplementing the EIRs Inverse Condemnation Overview 2018 fires • If the Utility's facilities, such as its electric distribution and transmission lines, are determined to be the substantial cause of one or more fires, and the doctrine of inverse condemnation applies, the Utility could be liable for property damage, business interruption, interest and attorneys' fees without having been found negligent – Courts have imposed liability under the doctrine of inverse condemnation in legal actions brought by property holders against utilities on the grounds that losses borne by the person whose property was damaged through a public use undertaking should be spread across the community that benefitted from such undertaking, and based on the assumption that utilities have the ability to recover these costs from their customers IC – California courts have determined that the doctrine of inverse condemnation is applicable regardless of whether the CPUC ultimately allows recovery by the Utility for any such costs Third Party Claims & Potential Losses in Connection with 2017 and 2018 Northern California Wildfires • The dollar amounts announced by the California Department of Insurance represent an aggregate amount of approximately $17 billion of insurance claims made as of December 12, 2018 for the Camp Fire and as of September 6, 2018 for the 2017 Northern California wildfires Losses – PG&E expects that additional claims have been submitted and will continue to be submitted to insurers, particularly with respect to the Camp Fire. These claims reflect insured property losses only – The scope of all claims related to the 2017 and 2018 Northern California wildfires is not known at this time because of the applicable statutes of limitations under California law • PG&E has approximately $840 million of insurance coverage for liabilities, including wildfire events, for the period from August 1, 2017 through July 31, 2018. During the third quarter of 2018, PG&E renewed its liability insurance coverage for wildfire events in an aggregate amount of approximately $1.4 billion for the period from August 1, Insurance 2018 through July 31, 2019 • If PG&E were to be found liable for certain or all of the costs, expenses and other losses described herein with respect to the 2017 and 2018 Northern California wildfires, the amount of such liability could exceed $30 billion, which amount does not include potential punitive damages, fines and penalties or damages related to future claims. 8 2017 and 2018 Northern California Wildfires Recent Wildfires Overview 2017 Northern California Wildfires • According to the California Department of Forestry and Fire Protection’s (“Cal Fire”) California Statewide Fire Summary dated October 30, 2017, at the peak of the 2017 Northern California wildfires, there were 21 major fires that, in total, resulted in 44 fatalities, burned over 245,000 acres and destroyed an estimated 8,900 structures • Cal Fire issued its determination on the causes of 18 of the 2017 Northern California wildfires, and alleged that each of these fires involved the Utility's equipment. The remaining wildfires remain under Cal Fire’s investigation, including the possible role of the Utility’s power lines and other facilities 2017 fires 2018 Camp Wildfire (“Camp Fire”) • Cal Fire’s Camp Fire Incident Information Website as of January 4, 2019 (the “Cal Fire website”), indicated that the Camp Fire consumed 153,336 acres. On the Cal Fire website, Cal Fire reported 86 fatalities and the destruction of 13,972 residences, 528 commercial structures and 4,293 other buildings resulting from the Camp Fire • The cause of the Camp Fire remains under investigation, and PG&E is cooperating with those investigations. The Utility has submitted two Electric Incident Reports (the “EIRs”) to the CPUC, one on November 8, 2018 and one on November 16, 2018. On December 11, 2018, the Utility publicly released a letter to the CPUC supplementing the EIRs Inverse Condemnation Overview 2018 fires • If the Utility's facilities, such as its electric distribution and transmission lines, are determined to be the substantial cause of one or more fires, and the doctrine of inverse condemnation applies, the Utility could be liable for property damage, business interruption, interest and attorneys' fees without having been found negligent – Courts have imposed liability under the doctrine of inverse condemnation in legal actions brought by property holders against utilities on the grounds that losses borne by the person whose property was damaged through a public use undertaking should be spread across the community that benefitted from such undertaking, and based on the assumption that utilities have the ability to recover these costs from their customers IC – California courts have determined that the doctrine of inverse condemnation is applicable regardless of whether the CPUC ultimately allows recovery by the Utility for any such costs Third Party Claims & Potential Losses in Connection with 2017 and 2018 Northern California Wildfires • The dollar amounts announced by the California Department of Insurance represent an aggregate amount of approximately $17 billion of insurance claims made as of December 12, 2018 for the Camp Fire and as of September 6, 2018 for the 2017 Northern California wildfires Losses – PG&E expects that additional claims have been submitted and will continue to be submitted to insurers, particularly with respect to the Camp Fire. These claims reflect insured property losses only – The scope of all claims related to the 2017 and 2018 Northern California wildfires is not known at this time because of the applicable statutes of limitations under California law • PG&E has approximately $840 million of insurance coverage for liabilities, including wildfire events, for the period from August 1, 2017 through July 31, 2018. During the third quarter of 2018, PG&E renewed its liability insurance coverage for wildfire events in an aggregate amount of approximately $1.4 billion for the period from August 1, Insurance 2018 through July 31, 2019 • If PG&E were to be found liable for certain or all of the costs, expenses and other losses described herein with respect to the 2017 and 2018 Northern California wildfires, the amount of such liability could exceed $30 billion, which amount does not include potential punitive damages, fines and penalties or damages related to future claims. 8

Comprehensive Program to Address Wildfire Risk (1) (1) (3) Proposed Community Wildfire Safety Program ~$6B Program Spend through 2023 ($B) Increase Enhanced Infrastructure 1.5 Operational Situational Hardening Awareness Practices ~600 ~2,800 12’ 1.0 HD Cameras miles of tree wire in radial vegetation providing coverage HFTD clearance (2) for >90% of HFTD ~1,300 ~80K 4’ 0.5 weather stations strengthened poles conductor to sky vegetation overhang clearing 24/7 ~25K ~7K - Wildfire Safety line miles enhanced 2018 2019 2020 2021 2022 2023 miles of system Operations Center vegetation management hardening in 10 years during peak season in 8 years CapEx Opex (2) Multi-faceted program to systematically mitigate risk in targeted HFTD Note: The Community Wildfire Safety Program was established after the 2017 wildfires to implement additional precautionary measures intended to further reduce wildfire risks. Information is as of November 2018 and is subject to change, including in connection with PG&E’s February 2019 Wildfire Mitigation Plan filing. (1) Program spend pending CPUC approval. Reflects plan from 2018 through 2023, except as otherwise specified. HD cameras and weather stations to be deployed by 2022. (2) Defined as Tier 2 and 3 high-fire threat districts. (3) Excludes forecasted base vegetation management and drought-related expense spend of ~$300 to $400 million annually. 9 Comprehensive Program to Address Wildfire Risk (1) (1) (3) Proposed Community Wildfire Safety Program ~$6B Program Spend through 2023 ($B) Increase Enhanced Infrastructure 1.5 Operational Situational Hardening Awareness Practices ~600 ~2,800 12’ 1.0 HD Cameras miles of tree wire in radial vegetation providing coverage HFTD clearance (2) for >90% of HFTD ~1,300 ~80K 4’ 0.5 weather stations strengthened poles conductor to sky vegetation overhang clearing 24/7 ~25K ~7K - Wildfire Safety line miles enhanced 2018 2019 2020 2021 2022 2023 miles of system Operations Center vegetation management hardening in 10 years during peak season in 8 years CapEx Opex (2) Multi-faceted program to systematically mitigate risk in targeted HFTD Note: The Community Wildfire Safety Program was established after the 2017 wildfires to implement additional precautionary measures intended to further reduce wildfire risks. Information is as of November 2018 and is subject to change, including in connection with PG&E’s February 2019 Wildfire Mitigation Plan filing. (1) Program spend pending CPUC approval. Reflects plan from 2018 through 2023, except as otherwise specified. HD cameras and weather stations to be deployed by 2022. (2) Defined as Tier 2 and 3 high-fire threat districts. (3) Excludes forecasted base vegetation management and drought-related expense spend of ~$300 to $400 million annually. 9

Highlights of Senate Bill 901 On September 21, 2018, California's governor signed legislation to strengthen California's ability to prevent and recover from catastrophic wildfires, including SB 901. Highlights below: • Imposing more restrictive forest management practices and providing support and incentives to facilitate forest management • Providing factors that the CPUC should consider when it conducts a review of the reasonableness of costs and expenses arising from a catastrophic SB 901: wildfire occurring on or after January 1, 2019 • In applications for cost recovery in connection with the 2017 wildfires, directing the CPUC to consider the electric corporation's financial status and https://www.bamsec.c determine the maximum amount a utility can pay without harming customers or materially impacting its ability to provide adequate and safe service, and ensuring that the costs or expenses that are disallowed for recovery in rates assessed for the wildfires, in the aggregate, do not exceed that om/filing/1004980180 amount • Authorizing the CPUC to issue a financing order that permits recovery, through issuance of recovery bonds (securitization), of wildfire-related costs 00015/1?cik=100498 found to be just and reasonable by the CPUC and, only for the 2017 wildfires, any amounts in excess of the maximum disallowance (see above). Securitization is available, for prudently incurred costs, for the 2017 wildfires and catastrophic wildfires occurring on or after January 1, 2019, not for fires 0&hl=231116:231132 that occurred in 2018, including the Camp Fire &hl_id=4kce0o_f8 • Based on the CPUC's interpretation of Section 451.2 as outlined in the OIR, PG&E believes that any securitization of costs relating to the 2017 Northern California wildfires would not occur, if at all, until: – PG&E has paid claims relating to the 2017 Northern California wildfires, – PG&E has filed application for recovery of such costs and – the CPUC makes a determination that such costs are just and reasonable or in excess of the maximum disallowance • PG&E therefore does not expect the CPUC to permit PG&E to securitize costs relating to the 2017 Northern California wildfires on an expedited or emergency basis • Based on the OIR, as well as prior experience and precedent, and unless the CPUC alters the position expressed in the OIR, PG&E believes it likely would take years to obtain authorization to securitize any amounts relating to the 2017 Northern California wildfires • Requiring electric corporations to prepare and submit to the CPUC a wildfire mitigation plan. Among other things, the plan will include a description of the preventive strategies and programs of electric corporations that are designed to minimize the risk of their electrical lines and equipment causing catastrophic wildfires and protocols related to plan activities. Failure to substantially comply with such plan will result in penalties. The CPUC will consider whether the cost of implementing the plan is just and reasonable in each electric corporation's GRC • Establishing a Commission on Catastrophic Wildfire Cost and Recovery to evaluate wildfire reforms, including inverse condemnation reform, a potential state wildfire insurance fund, and other wildfire mitigation measures 10 Highlights of Senate Bill 901 On September 21, 2018, California's governor signed legislation to strengthen California's ability to prevent and recover from catastrophic wildfires, including SB 901. Highlights below: • Imposing more restrictive forest management practices and providing support and incentives to facilitate forest management • Providing factors that the CPUC should consider when it conducts a review of the reasonableness of costs and expenses arising from a catastrophic SB 901: wildfire occurring on or after January 1, 2019 • In applications for cost recovery in connection with the 2017 wildfires, directing the CPUC to consider the electric corporation's financial status and https://www.bamsec.c determine the maximum amount a utility can pay without harming customers or materially impacting its ability to provide adequate and safe service, and ensuring that the costs or expenses that are disallowed for recovery in rates assessed for the wildfires, in the aggregate, do not exceed that om/filing/1004980180 amount • Authorizing the CPUC to issue a financing order that permits recovery, through issuance of recovery bonds (securitization), of wildfire-related costs 00015/1?cik=100498 found to be just and reasonable by the CPUC and, only for the 2017 wildfires, any amounts in excess of the maximum disallowance (see above). Securitization is available, for prudently incurred costs, for the 2017 wildfires and catastrophic wildfires occurring on or after January 1, 2019, not for fires 0&hl=231116:231132 that occurred in 2018, including the Camp Fire &hl_id=4kce0o_f8 • Based on the CPUC's interpretation of Section 451.2 as outlined in the OIR, PG&E believes that any securitization of costs relating to the 2017 Northern California wildfires would not occur, if at all, until: – PG&E has paid claims relating to the 2017 Northern California wildfires, – PG&E has filed application for recovery of such costs and – the CPUC makes a determination that such costs are just and reasonable or in excess of the maximum disallowance • PG&E therefore does not expect the CPUC to permit PG&E to securitize costs relating to the 2017 Northern California wildfires on an expedited or emergency basis • Based on the OIR, as well as prior experience and precedent, and unless the CPUC alters the position expressed in the OIR, PG&E believes it likely would take years to obtain authorization to securitize any amounts relating to the 2017 Northern California wildfires • Requiring electric corporations to prepare and submit to the CPUC a wildfire mitigation plan. Among other things, the plan will include a description of the preventive strategies and programs of electric corporations that are designed to minimize the risk of their electrical lines and equipment causing catastrophic wildfires and protocols related to plan activities. Failure to substantially comply with such plan will result in penalties. The CPUC will consider whether the cost of implementing the plan is just and reasonable in each electric corporation's GRC • Establishing a Commission on Catastrophic Wildfire Cost and Recovery to evaluate wildfire reforms, including inverse condemnation reform, a potential state wildfire insurance fund, and other wildfire mitigation measures 10

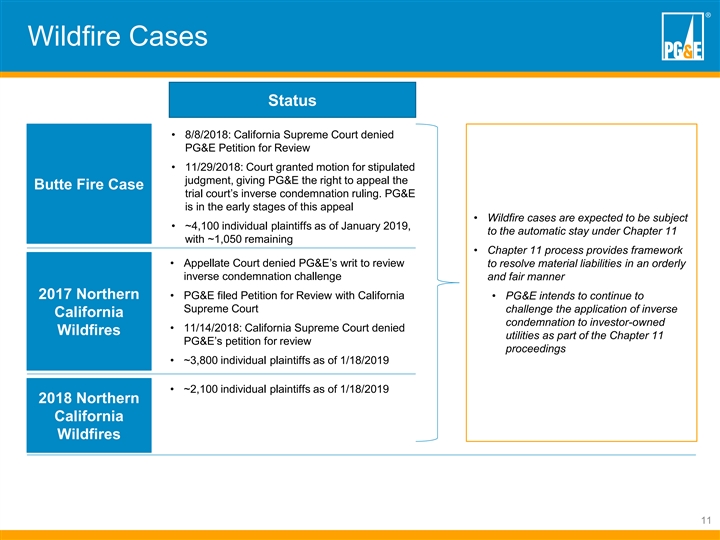

Wildfire Cases Status • 8/8/2018: California Supreme Court denied PG&E Petition for Review • 11/29/2018: Court granted motion for stipulated judgment, giving PG&E the right to appeal the Butte Fire Case trial court’s inverse condemnation ruling. PG&E is in the early stages of this appeal • Wildfire cases are expected to be subject • ~4,100 individual plaintiffs as of January 2019, to the automatic stay under Chapter 11 with ~1,050 remaining • Chapter 11 process provides framework • Appellate Court denied PG&E’s writ to review to resolve material liabilities in an orderly inverse condemnation challenge and fair manner 2017 Northern • PG&E filed Petition for Review with California • PG&E intends to continue to Supreme Court challenge the application of inverse California condemnation to investor-owned • 11/14/2018: California Supreme Court denied Wildfires utilities as part of the Chapter 11 PG&E’s petition for review proceedings • ~3,800 individual plaintiffs as of 1/18/2019 • ~2,100 individual plaintiffs as of 1/18/2019 2018 Northern California Wildfires 11Wildfire Cases Status • 8/8/2018: California Supreme Court denied PG&E Petition for Review • 11/29/2018: Court granted motion for stipulated judgment, giving PG&E the right to appeal the Butte Fire Case trial court’s inverse condemnation ruling. PG&E is in the early stages of this appeal • Wildfire cases are expected to be subject • ~4,100 individual plaintiffs as of January 2019, to the automatic stay under Chapter 11 with ~1,050 remaining • Chapter 11 process provides framework • Appellate Court denied PG&E’s writ to review to resolve material liabilities in an orderly inverse condemnation challenge and fair manner 2017 Northern • PG&E filed Petition for Review with California • PG&E intends to continue to Supreme Court challenge the application of inverse California condemnation to investor-owned • 11/14/2018: California Supreme Court denied Wildfires utilities as part of the Chapter 11 PG&E’s petition for review proceedings • ~3,800 individual plaintiffs as of 1/18/2019 • ~2,100 individual plaintiffs as of 1/18/2019 2018 Northern California Wildfires 11

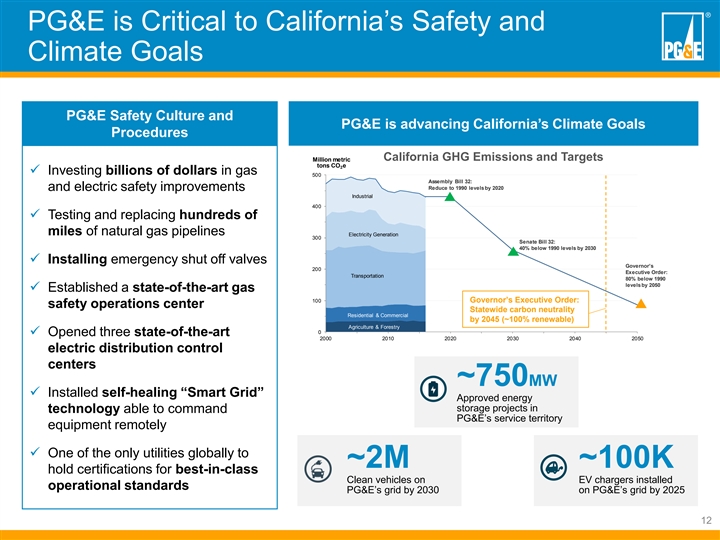

PG&E is Critical to California’s Safety and Climate Goals PG&E Safety Culture and PG&E is advancing California’s Climate Goals Procedures California GHG Emissions and Targets Million metric tons CO e 2 ü Investing billions of dollars in gas 500 Assembly Bill 32: Reduce to 1990 levels by 2020 and electric safety improvements Industrial 400 ü Testing and replacing hundreds of miles of natural gas pipelines Electricity Generation 300 Senate Bill 32: 40% below 1990 levels by 2030 ü Installing emergency shut off valves Governor’s 200 Executive Order: Transportation 80% below 1990 levels by 2050 ü Established a state-of-the-art gas 100 Governor’s Executive Order: safety operations center Statewide Goc va erno rbon r’s Exneut ecutivra e Olrde ity r: Residential & Commercial Statewide carbon neutrality by 2045 (~100% renewable) by 2045 Agriculture & Forestry 0 ü Opened three state-of-the-art 2000 2010 2020 2030 2040 2050 electric distribution control centers ~750MW ü Installed self-healing “Smart Grid” Approved energy storage projects in technology able to command PG&E’s service territory equipment remotely ü One of the only utilities globally to ~2M ~100K hold certifications for best-in-class Clean vehicles on EV chargers installed operational standards PG&E’s grid by 2030 on PG&E’s grid by 2025 12 PG&E is Critical to California’s Safety and Climate Goals PG&E Safety Culture and PG&E is advancing California’s Climate Goals Procedures California GHG Emissions and Targets Million metric tons CO e 2 ü Investing billions of dollars in gas 500 Assembly Bill 32: Reduce to 1990 levels by 2020 and electric safety improvements Industrial 400 ü Testing and replacing hundreds of miles of natural gas pipelines Electricity Generation 300 Senate Bill 32: 40% below 1990 levels by 2030 ü Installing emergency shut off valves Governor’s 200 Executive Order: Transportation 80% below 1990 levels by 2050 ü Established a state-of-the-art gas 100 Governor’s Executive Order: safety operations center Statewide Goc va erno rbon r’s Exneut ecutivra e Olrde ity r: Residential & Commercial Statewide carbon neutrality by 2045 (~100% renewable) by 2045 Agriculture & Forestry 0 ü Opened three state-of-the-art 2000 2010 2020 2030 2040 2050 electric distribution control centers ~750MW ü Installed self-healing “Smart Grid” Approved energy storage projects in technology able to command PG&E’s service territory equipment remotely ü One of the only utilities globally to ~2M ~100K hold certifications for best-in-class Clean vehicles on EV chargers installed operational standards PG&E’s grid by 2030 on PG&E’s grid by 2025 12

(1) Adjusted EBITDA and Ratebase (1) Adjusted EBITDA ($B) 2014-LTM 2018 Ratebase ($B) 2014-2018 $7.0 $40.0 (2) (2) $36.8 7% CAGR 7% CAGR $34.4 $5.9 $35.0 $6.0 $32.4 $5.6 $5.6 $29.5 $5.0 $30.0 $28.2 $4.9 $5.0 $25.0 $4.0 $20.0 $3.0 $15.0 $2.0 $10.0 $1.0 $5.0 $0.0 $0.0 (3) 2014 2015 2016 2017 LTM '18 2014 2015 2016 2017 2018 (1) Adjusted EBITDA is a non-GAAP measure. See “Non-GAAP Information” on Slide 3 and “GAAP net income to non-GAAP Adjusted EBITDA reconciliation” in Appendix. (2) 2014-2017 CAGR. 14 (3) LTM Adjusted EBITDA for twelve months ended 09/30/2018; LTM Adjusted EBITDA lower due to impact of Tax Cuts and Jobs Act of 2017.(1) Adjusted EBITDA and Ratebase (1) Adjusted EBITDA ($B) 2014-LTM 2018 Ratebase ($B) 2014-2018 $7.0 $40.0 (2) (2) $36.8 7% CAGR 7% CAGR $34.4 $5.9 $35.0 $6.0 $32.4 $5.6 $5.6 $29.5 $5.0 $30.0 $28.2 $4.9 $5.0 $25.0 $4.0 $20.0 $3.0 $15.0 $2.0 $10.0 $1.0 $5.0 $0.0 $0.0 (3) 2014 2015 2016 2017 LTM '18 2014 2015 2016 2017 2018 (1) Adjusted EBITDA is a non-GAAP measure. See “Non-GAAP Information” on Slide 3 and “GAAP net income to non-GAAP Adjusted EBITDA reconciliation” in Appendix. (2) 2014-2017 CAGR. 14 (3) LTM Adjusted EBITDA for twelve months ended 09/30/2018; LTM Adjusted EBITDA lower due to impact of Tax Cuts and Jobs Act of 2017.

2018 Financial and Regulatory Snapshot / Assumptions Capital Expenditures Authorized Ratebase (weighted average) ($ billions) ($ billions) 2018E 2018 General Rate Case $4.2 General Rate Case $25.9 Gas Transmission and Storage 1.0 Gas Transmission and Storage 3.8 Transmission Owner 19 1.3 Transmission Owner 7.1 Total Cap Ex $6.5 billion Total Ratebase $36.8 billion Other Factors Affecting Authorized Cost of Capital* (1) Non-GAAP Earnings from Operations + Incentive revenues, efficiencies and other benefits Return on Equity: 10.25% - GT&S amounts not requested - Ex parte settlement GT&S revenue adjustment Equity Ratio: 52% - Insurance premiums, net of regulatory cost recovery *CPUC authorized - Incremental wildfire risk mitigation costs CWIP earnings: offset by below-the-line costs (1) Earnings from operations is a non-GAAP measure. See “Non-GAAP Information” on Slide 3. 152018 Financial and Regulatory Snapshot / Assumptions Capital Expenditures Authorized Ratebase (weighted average) ($ billions) ($ billions) 2018E 2018 General Rate Case $4.2 General Rate Case $25.9 Gas Transmission and Storage 1.0 Gas Transmission and Storage 3.8 Transmission Owner 19 1.3 Transmission Owner 7.1 Total Cap Ex $6.5 billion Total Ratebase $36.8 billion Other Factors Affecting Authorized Cost of Capital* (1) Non-GAAP Earnings from Operations + Incentive revenues, efficiencies and other benefits Return on Equity: 10.25% - GT&S amounts not requested - Ex parte settlement GT&S revenue adjustment Equity Ratio: 52% - Insurance premiums, net of regulatory cost recovery *CPUC authorized - Incremental wildfire risk mitigation costs CWIP earnings: offset by below-the-line costs (1) Earnings from operations is a non-GAAP measure. See “Non-GAAP Information” on Slide 3. 15

Robust Cap Ex Bolsters Safety Initiatives Capital Expenditures 2018-2023 ~$7B ~$0.2B ~$0.1B ~$1.0B $6.5B $6.6B ~$5.7B (2) CWSP $~700M Other GRC $~300M 2018E 2018 2019 Currently Incremental Incremental Incremental Authorized Authorized GRC Request GT&S Request TO Request Plus Requested CapEx CapEx Range of ~$5.7B to ~$7B (3) annually from 2020-2023 (1) General Rate Case Gas Transmission & Storage Electric Transmission Owner Range (1) General Rate Case spend includes transportation electrification. The General Rate Case forecast was prepared before the 2018 wildfires and is subject to updates. (2) Community Wildfire Safety Program (CWSP) proposed spend. (3) Includes estimated capital expenditures for 2020 of approximately $6.9 billion. 16 Robust Cap Ex Bolsters Safety Initiatives Capital Expenditures 2018-2023 ~$7B ~$0.2B ~$0.1B ~$1.0B $6.5B $6.6B ~$5.7B (2) CWSP $~700M Other GRC $~300M 2018E 2018 2019 Currently Incremental Incremental Incremental Authorized Authorized GRC Request GT&S Request TO Request Plus Requested CapEx CapEx Range of ~$5.7B to ~$7B (3) annually from 2020-2023 (1) General Rate Case Gas Transmission & Storage Electric Transmission Owner Range (1) General Rate Case spend includes transportation electrification. The General Rate Case forecast was prepared before the 2018 wildfires and is subject to updates. (2) Community Wildfire Safety Program (CWSP) proposed spend. (3) Includes estimated capital expenditures for 2020 of approximately $6.9 billion. 16

Ratebase Supports Stable Revenues & Cash Flows (1) 2018-2023 Estimated Weighted Average Ratebase ~7 – 8.5% CAGR ~$52.0-56.0B ~$49.5-52.5B ~$47.0-49.0B ~$44.5-45.5B ~$40.5B $36.8B (3) 2018 2019 2020 2021 2022 2023 (2) General Rate Case Gas Transmission & Storage Electric Transmission Owner Range (1) Estimated weighted average ratebase reflects the estimated impacts from the Tax Cuts and Jobs Act. (2) General Rate Case spend includes transportation electrification. (3) Includes $400M for 2011-2014 spend subject to audit added in 2019. 17 Ratebase Supports Stable Revenues & Cash Flows (1) 2018-2023 Estimated Weighted Average Ratebase ~7 – 8.5% CAGR ~$52.0-56.0B ~$49.5-52.5B ~$47.0-49.0B ~$44.5-45.5B ~$40.5B $36.8B (3) 2018 2019 2020 2021 2022 2023 (2) General Rate Case Gas Transmission & Storage Electric Transmission Owner Range (1) Estimated weighted average ratebase reflects the estimated impacts from the Tax Cuts and Jobs Act. (2) General Rate Case spend includes transportation electrification. (3) Includes $400M for 2011-2014 spend subject to audit added in 2019. 17

Strong collateral coverage with first priority lien Note: No valuation work has been performed Illustrative Collateral Coverage ($mm) Substantial Enterprise Value (3) Firm Value / LTM Adjusted EBITDA (1) $61,200 Book Value Median: 11.3x 14.0x $500 Inventory 12.4x 11.9x 11.7x $4,500 11.5x 11.3x 11.0x 10.4x 10.4x A/R 9.3x 7.8x WEC DUK ES AEP CMS XEL ED AEE SO PNW EIX Implied Illustrative Enterprise Value Range ($mm) Adjusted Enterprise Enterprise Enterprise (4) (5) (6) EBITDA Mult. Value Range Value Coverage Value Coverage Net PP&E $56,200 1.0x $5,600 1.0x 0.5x 2.0x $11,200 2.0x 1.0x 3.0x $16,800 3.0x 2.0x 4.0x $22,400 4.0x 2.5x 5.0x $28,050 5.0x 3.0x 6.0x $33,650 6.0x 3.5x 7.0x $39,250 7.0x 4.0x Incremental 8.0x $44,850 8.0x 4.5x $4,000 Facility 9.0x $50,450 9.0x 5.5x (2) 10.0x $56,050 10.0x 6.0x $5,500 DIP Facility 11.0x $61,650 11.0x 6.5x 12.0x $67,250 12.0x 7.0x Book Value of Assets DIP Facilities 13.0x $72,900 13.5x 7.5x (1) Book Value of Inventory, A/R, and Net PP&E (net of depreciation) as of 09/30/18; Values rounded to nearest $100mm. (2) DIP Facility consists of $3,500mm Revolver, $1,500mm Term Loan, and $500mm Delayed Draw Term Loan. (3) Source: FactSet as of 01/17/2019. (4) Based on LTM Adjusted EBITDA of $5,606mm, values rounded to nearest $50mm; LTM as of 09/30/18. (5) Based on $5,500mm DIP Facility only, values rounded to nearest 0.5x. 20 (6) Based on $5,500mm DIP Facility and $4,000mm Incremental Facility; Values rounded to nearest 0.5x. Strong collateral coverage with first priority lien Note: No valuation work has been performed Illustrative Collateral Coverage ($mm) Substantial Enterprise Value (3) Firm Value / LTM Adjusted EBITDA (1) $61,200 Book Value Median: 11.3x 14.0x $500 Inventory 12.4x 11.9x 11.7x $4,500 11.5x 11.3x 11.0x 10.4x 10.4x A/R 9.3x 7.8x WEC DUK ES AEP CMS XEL ED AEE SO PNW EIX Implied Illustrative Enterprise Value Range ($mm) Adjusted Enterprise Enterprise Enterprise (4) (5) (6) EBITDA Mult. Value Range Value Coverage Value Coverage Net PP&E $56,200 1.0x $5,600 1.0x 0.5x 2.0x $11,200 2.0x 1.0x 3.0x $16,800 3.0x 2.0x 4.0x $22,400 4.0x 2.5x 5.0x $28,050 5.0x 3.0x 6.0x $33,650 6.0x 3.5x 7.0x $39,250 7.0x 4.0x Incremental 8.0x $44,850 8.0x 4.5x $4,000 Facility 9.0x $50,450 9.0x 5.5x (2) 10.0x $56,050 10.0x 6.0x $5,500 DIP Facility 11.0x $61,650 11.0x 6.5x 12.0x $67,250 12.0x 7.0x Book Value of Assets DIP Facilities 13.0x $72,900 13.5x 7.5x (1) Book Value of Inventory, A/R, and Net PP&E (net of depreciation) as of 09/30/18; Values rounded to nearest $100mm. (2) DIP Facility consists of $3,500mm Revolver, $1,500mm Term Loan, and $500mm Delayed Draw Term Loan. (3) Source: FactSet as of 01/17/2019. (4) Based on LTM Adjusted EBITDA of $5,606mm, values rounded to nearest $50mm; LTM as of 09/30/18. (5) Based on $5,500mm DIP Facility only, values rounded to nearest 0.5x. 20 (6) Based on $5,500mm DIP Facility and $4,000mm Incremental Facility; Values rounded to nearest 0.5x.

GAAP Net Income to Non-GAAP Adjusted EBITDA reconciliation ($MM) 2014 2015 2016 2017 9 mo. ended 09/30/17 9 mo. ended 09/30/18 LTM ended 09/30/18 PG&E Corporation’s Net Income on a GAAP Basis $ 1,450 $ 888 $ 1,407 $ 1,660 $ 1,542 $ 32 $ 150 Income tax provision (benefit) 345 (27) 55 511 403 (527) (419) Other income, net (70) (117) (91) (72) (98) (318) (292) Interest expense 734 773 829 888 663 678 903 Interest income (9) (9) (23) (31) (22) (35) (44) Operating income $ 2,450 $ 1,508 $ 2,177 $ 2,956 $ 2,488 $ ( 170) $ 298 Depreciation, amortization, & decommissioning 2,433 2,612 2,755 2,854 2,134 2,257 2,977 2017 Northern California wildfire-related costs – – – 18 – 2,660 2,678 Butte fire-related costs – – 857 410 396 31 45 Insurance Recoveries – – (625) (350) (350) (392) (392) San Bruno Penalty Decision – 907 412 32 32 – – Adjusted EBITDA $ 4,883 $ 5,027 $ 5,576 $ 5,920 $ 4,700 $ 4,386 $ 5,606 Adjusted EBITDA is a non-GAAP financial measure. See Non-GAAP Information on slide 3. 26GAAP Net Income to Non-GAAP Adjusted EBITDA reconciliation ($MM) 2014 2015 2016 2017 9 mo. ended 09/30/17 9 mo. ended 09/30/18 LTM ended 09/30/18 PG&E Corporation’s Net Income on a GAAP Basis $ 1,450 $ 888 $ 1,407 $ 1,660 $ 1,542 $ 32 $ 150 Income tax provision (benefit) 345 (27) 55 511 403 (527) (419) Other income, net (70) (117) (91) (72) (98) (318) (292) Interest expense 734 773 829 888 663 678 903 Interest income (9) (9) (23) (31) (22) (35) (44) Operating income $ 2,450 $ 1,508 $ 2,177 $ 2,956 $ 2,488 $ ( 170) $ 298 Depreciation, amortization, & decommissioning 2,433 2,612 2,755 2,854 2,134 2,257 2,977 2017 Northern California wildfire-related costs – – – 18 – 2,660 2,678 Butte fire-related costs – – 857 410 396 31 45 Insurance Recoveries – – (625) (350) (350) (392) (392) San Bruno Penalty Decision – 907 412 32 32 – – Adjusted EBITDA $ 4,883 $ 5,027 $ 5,576 $ 5,920 $ 4,700 $ 4,386 $ 5,606 Adjusted EBITDA is a non-GAAP financial measure. See Non-GAAP Information on slide 3. 26

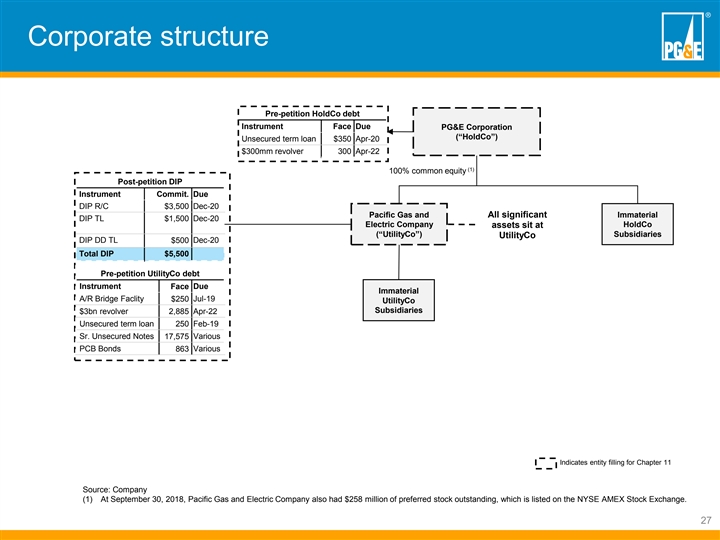

Corporate structure Pre-petition HoldCo debt Instrument Face Due PG&E Corporation (“HoldCo”) Unsecured term loan $350 Apr-20 $300mm revolver 300 Apr-22 (1) 100% common equity Post-petition DIP Instrument Commit. Due DIP R/C $3,500 Dec-20 Pacific Gas and All significant Immaterial DIP TL $1,500 Dec-20 Electric Company HoldCo assets sit at (“UtilityCo”) Subsidiaries UtilityCo DIP DD TL $500 Dec-20 Total DIP $5,500 Pre-petition UtilityCo debt Instrument Face Due Immaterial A/R Bridge Faclity $250 Jul-19 UtilityCo Subsidiaries $3bn revolver 2,885 Apr-22 Unsecured term loan 250 Feb-19 Sr. Unsecured Notes 17,575 Various PCB Bonds 863 Various Indicates entity filling for Chapter 11 Source: Company (1) At September 30, 2018, Pacific Gas and Electric Company also had $258 million of preferred stock outstanding, which is listed on the NYSE AMEX Stock Exchange. 27 Corporate structure Pre-petition HoldCo debt Instrument Face Due PG&E Corporation (“HoldCo”) Unsecured term loan $350 Apr-20 $300mm revolver 300 Apr-22 (1) 100% common equity Post-petition DIP Instrument Commit. Due DIP R/C $3,500 Dec-20 Pacific Gas and All significant Immaterial DIP TL $1,500 Dec-20 Electric Company HoldCo assets sit at (“UtilityCo”) Subsidiaries UtilityCo DIP DD TL $500 Dec-20 Total DIP $5,500 Pre-petition UtilityCo debt Instrument Face Due Immaterial A/R Bridge Faclity $250 Jul-19 UtilityCo Subsidiaries $3bn revolver 2,885 Apr-22 Unsecured term loan 250 Feb-19 Sr. Unsecured Notes 17,575 Various PCB Bonds 863 Various Indicates entity filling for Chapter 11 Source: Company (1) At September 30, 2018, Pacific Gas and Electric Company also had $258 million of preferred stock outstanding, which is listed on the NYSE AMEX Stock Exchange. 27