Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - FB Financial Corp | a51928738_ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - FB Financial Corp | a51928738_ex991.htm |

| 8-K - FB FINANCIAL CORPORATION 8-K - FB Financial Corp | a51928738.htm |

2018 Fourth Quarter and Annual Earnings Presentation January 23, 2019

This presentation contains “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that have been made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements in some cases through the Company’s use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,”

“potential” and other similar words and expressions of the future or otherwise regarding the proposed acquisition, including the timing, anticipated benefits and financial impact thereof, and the outlook for the Company’s future business and

financial performance.These forward-looking statements include, without limitation, statements relating to the Company’s assets, business, cash flows, condition (financial or otherwise), credit quality, financial performance, liquidity, short

and long-term performance goals, prospects, results of operations, strategic initiatives and the timing, benefits, as well as statements relating to the anticipated benefits, financial impact and closing of the proposed acquisition by the Bank

of the Atlantic Capital branches, including: the anticipated timing of the closing of the proposed acquisition, acceptance by the customers of the acquired Atlantic Capital branches of the Company’s products and services, the opportunities to

enhance market share in certain markets, market acceptance of the Company generally in new markets, expectations regarding future investment in the acquired Atlantic Capital branches’ markets and the integration of the acquired Atlantic Capital

branches’ operations, disposition and other growth opportunities. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and

uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of important factors could cause actual results to differ materially from those contemplated by the forward-looking

statements in this presentation including, without limitation, the parties’ ability to consummate the Atlantic Capital acquisition or satisfy the conditions to the completion of the Atlantic Capital acquisition; the receipt of regulatory

approvals required for the Atlantic Capital acquisition on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing and completion and accounting and tax treatment of the Atlantic Capital

acquisition; the possibility that any of the anticipated benefits of the Atlantic Capital acquisition will not be fully realized or will not be realized within the expected time period; the risk that integration of the acquired Atlantic Capital

branches’ operations with those of the Company will be materially delayed or will be more costly or difficult than expected; the failure of the Atlantic Capital acquisition to close for any other reason; the effect of the announcement of the

Atlantic Capital acquisition on employee and customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees and customers); the possibility that the Atlantic Capital

acquisition may be more expensive to complete than anticipated, including as a result of unexpected factors or events; general competitive, economic, political and market conditions and fluctuations; and the other risk factors set forth in the

Company’s December 31, 2017 Form 10-K, filed with the Securities and Exchange Commission on March 16, 2018, under the captions “Cautionary note regarding forward-looking statements” and “Risk factors”. Many of these factors are difficult to

foresee and are beyond the Company’s ability to control or predict. The Company believes the forward-looking statements contained herein are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are

based on current expectations and speak only as of the date that they are made. The Company does not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as

otherwise may be required by law. Forward looking statements

Use of non-GAAP financial measures This presentation contains certain financial measures that are not

measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non‐GAAP financial measures include, without limitation, adjusted net income, adjusted diluted

earnings per share, adjusted pro forma net income, adjusted pro forma diluted earnings per share, core noninterest expense, core noninterest income, core efficiency ratio (tax-equivalent basis), banking segment core efficiency ratio

(tax-equivalent basis), mortgage segment core efficiency ratio (tax-efficiency basis), adjusted mortgage contribution, adjusted return on average assets and equity. Each of these non-GAAP metrics excludes certain income and expense items that

the Company’s management considers to be non‐core/adjusted in nature. The Company refers to these non‐GAAP measures as adjusted or core measures. The corresponding Earnings Release also presents tangible assets, tangible common equity, tangible

book value per common share, tangible common equity to tangible assets, return on tangible common equity, return on average tangible common equity, adjusted return on average assets, adjusted return on average equity, adjusted return on average

tangible common equity, pro forma return on average assets and equity, pro forma adjusted return on average assets and equity. Each of these non-GAAP metrics excludes the impact of goodwill and other intangibles.The Company’s management uses

these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful

indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non-GAAP financial measures provide a greater

understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrating the effects of significant non-core gains and charges in the current and prior periods. The Company’s management also believes

that investors find these non-GAAP financial measures useful as they assist investors in understanding the Company’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such

as goodwill and other intangibles, and the other items excluded each vary extensively from company to company, the Company believes that the presentation of this information allows investors to more easily compare the Company’s results to the

results of other companies. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP.

Moreover, the manner in which the Company calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations

calculate their financial measures similar or with names similar to the non-GAAP financial measures the Company has discussed herein when comparing such non-GAAP financial measures. The following tables provide a reconciliation of these

measures to the most directly comparable GAAP financial measures.

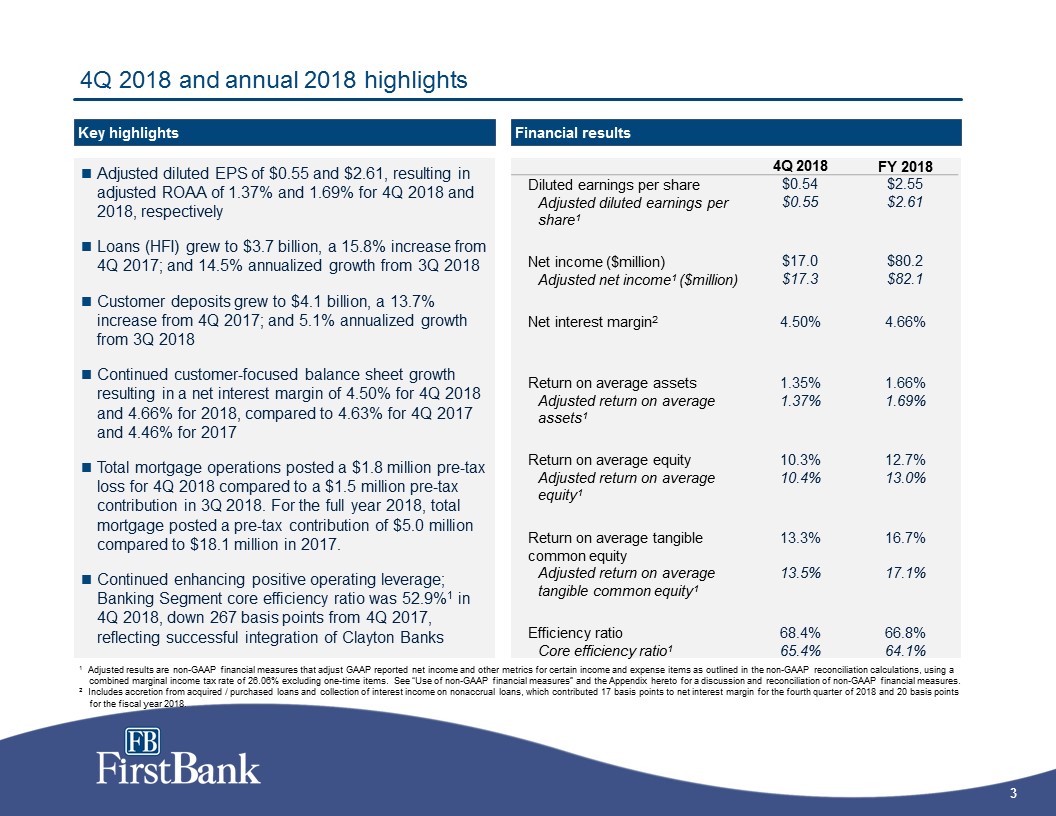

4Q 2018 FY 2018 Diluted earnings per shareAdjusted diluted earnings per

share1 $0.54$0.55 $2.55$2.61 Net income ($million)Adjusted net income1 ($million) $17.0$17.3 $80.2$82.1 Net interest margin2 4.50% 4.66% Return on average assets Adjusted return on average

assets1 1.35%1.37% 1.66%1.69% Return on average equityAdjusted return on average equity1 10.3%10.4% 12.7%13.0% Return on average tangible common equityAdjusted return on average tangible common

equity1 13.3%13.5% 16.7%17.1% Efficiency ratioCore efficiency ratio1 68.4%65.4% 66.8%64.1% 4Q 2018 and annual 2018 highlights Key highlights Financial results 1 Adjusted results are non-GAAP financial measures that adjust GAAP

reported net income and other metrics for certain income and expense items as outlined in the non-GAAP reconciliation calculations, using a combined marginal income tax rate of 26.06% excluding one-time items. See “Use of non-GAAP financial

measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures.2 Includes accretion from acquired / purchased loans and collection of interest income on nonaccrual loans, which contributed 17 basis points

to net interest margin for the fourth quarter of 2018 and 20 basis points for the fiscal year 2018. Adjusted diluted EPS of $0.55 and $2.61, resulting in adjusted ROAA of 1.37% and 1.69% for 4Q 2018 and 2018, respectivelyLoans (HFI) grew to

$3.7 billion, a 15.8% increase from 4Q 2017; and 14.5% annualized growth from 3Q 2018Customer deposits grew to $4.1 billion, a 13.7% increase from 4Q 2017; and 5.1% annualized growth from 3Q 2018Continued customer-focused balance sheet growth

resulting in a net interest margin of 4.50% for 4Q 2018 and 4.66% for 2018, compared to 4.63% for 4Q 2017 and 4.46% for 2017Total mortgage operations posted a $1.8 million pre-tax loss for 4Q 2018 compared to a $1.5 million pre-tax contribution

in 3Q 2018. For the full year 2018, total mortgage posted a pre-tax contribution of $5.0 million compared to $18.1 million in 2017.Continued enhancing positive operating leverage; Banking Segment core efficiency ratio was 52.9%1 in 4Q 2018,

down 267 basis points from 4Q 2017, reflecting successful integration of Clayton Banks

Delivering balanced profitability and growth Drivers of profitability Pro forma return on average

assets, adjusted1 Net interest margin Noninterest income ($mn) Loans / deposits 1 Our pro forma net income includes a pro forma provision for federal income taxes using a combined effective income tax rate of 35.63%, 35.08% and 36.75%

for the years ended December 31, 2014, 2015 and 2016, respectively, and also includes the exclusion of a one-time tax charge from C Corp conversion in 3Q 2016 and the 4Q 2017 benefit from the 2017 Tax Cuts and Jobs Act. The years ended December

31 2014, 2015, 2016, 2017 and 2018 are annual percentages. See "Use of non-GAAP financial measures" and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. +73 bps NPLs (HFI) / loans (HFI) (%)

Net interest margin remains strong Historical yield and costs 1 Includes tax-equivalent

adjustment Loan (HFI) yield 4Q17 3Q18 4Q18 Contractual interest rate on loans HFI1 5.20% 5.47% 5.56% Origination and other loan fee income 0.26% 0.40% 0.33% 5.46% 5.87% 5.89% Nonaccrual interest

collections 0.15% 0.07% 0.01% Accretion on purchased loans 0.24% 0.25% 0.21% Syndication fee income 0.03% 0.00% 0.00% Total loan yield (HFI) 5.88% 6.19% 6.11% NIM (%) 4.63% 4.64% 4.81% 4.71% 4.50% Impact of

accretion and nonaccrual interest collections (bps) 29 20 20 25 17 Deposit cost (%) 0.50% 0.55% 0.62% 0.80% 1.03%

Consistent loan growth and balanced portfolio Total loan growth1 ($million) and commercial real

estate concentration Loan portfolio breakdown1 4Q12 4Q18 Total HFI loans: $3,668 million 1 Exclude HFS loans, C&I includes owner-occupied CRE.2 Risk-based capital at FirstBank as defined in Call Report. 4Q 2018 calculation is

preliminary and subject to change.3 Excludes owner-occupied CRE. Commercial real estate (CRE) concentrations2 % of Risk-Based Capital 3Q18 4Q18(preliminary) C&D loans subject to 100% risk-based capital threshold3 91% 94% Total

CRE loans subject to 300% risk-based capital threshold3 222% 232%

Stable core deposit franchise Total deposits ($million) 1 Includes mortgage servicing-related escrow

deposits of $53.7 million, $74.1 million, $88.4 million, $78.0 million and $53.5 million for the quarters ended December 31, 2017, March 31, 2018, June 30, 2018 September 30, 2018 and December 31, 2018, respectively. Noninterest bearing

deposits ($million)1 Growth: 6.9% y/y Deposit composition Cost of deposits Customer growth: 13.7% y/y

$29.6 $26.0 $21.5 ($3.3) ($2.3) ($4.6) $4.2 $5.6 $4.6 ($0.2) ($2.7) ($2.5) $30.3 $26.6 $19.0 Mortgage

operations overview Total mortgage pre-tax loss (including retail footprint) of $1.8 million for 4Q18, in-line with prior guidance, and contribution of $5.0 million 2018 YTDMortgage banking income $19.0 million, down 37.3% from 4Q 2017 and

28.7% from 3Q 2018Actively reducing operational expenses and repositioning origination channels for projected future lower volumesVolumes and profitability will adjust similarly to industry volumes2 Highlights Gain on Sale Annual

mortgage production Quarterly mortgage production Consumer Direct Correspondent Third party originated Retail Retail footprint 4Q17 3Q18 4Q18 Fair value changes Fair value MSR change Mortgage banking income

($mm) Servicing Revenue Total Income $1,814mm $1,705mm IRLC volume: $1,311mm IRLC pipeline1: $504mm $453mm $319mm Refinance %: 50% 31% 34% Purchase %: 50% 69% 66% 1 As of the respective period end.2 See Forward Looking

Statements on Slide 1. Consumer Direct Correspondent Third party originated Retail Retail footprint $7,570mm IRLC volume: $7,121mm IRLC pipeline1: $504mm $319mm Refinance %: 42% 34% Purchase %: 58% 66%

Improving operating leverage Consolidated 4Q 2018 core efficiency ratio of 65.4% driven by Banking

Segment core efficiency ratio of 52.9%, which has decreased by 250 basis points since 4Q 2017 2018 illustrates solidified operating leverage achieved through organic growth, merger and ongoing cost efficienciesContinued investment in revenue

producers, technology and operational capabilities to improve on scalable platformExpect structural and operational changes in Mortgage Segment to improve efficiency ratio in the intermediate term Core efficiency ratio (tax-equivalent

basis)1 Improving operating efficiency 1 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures.

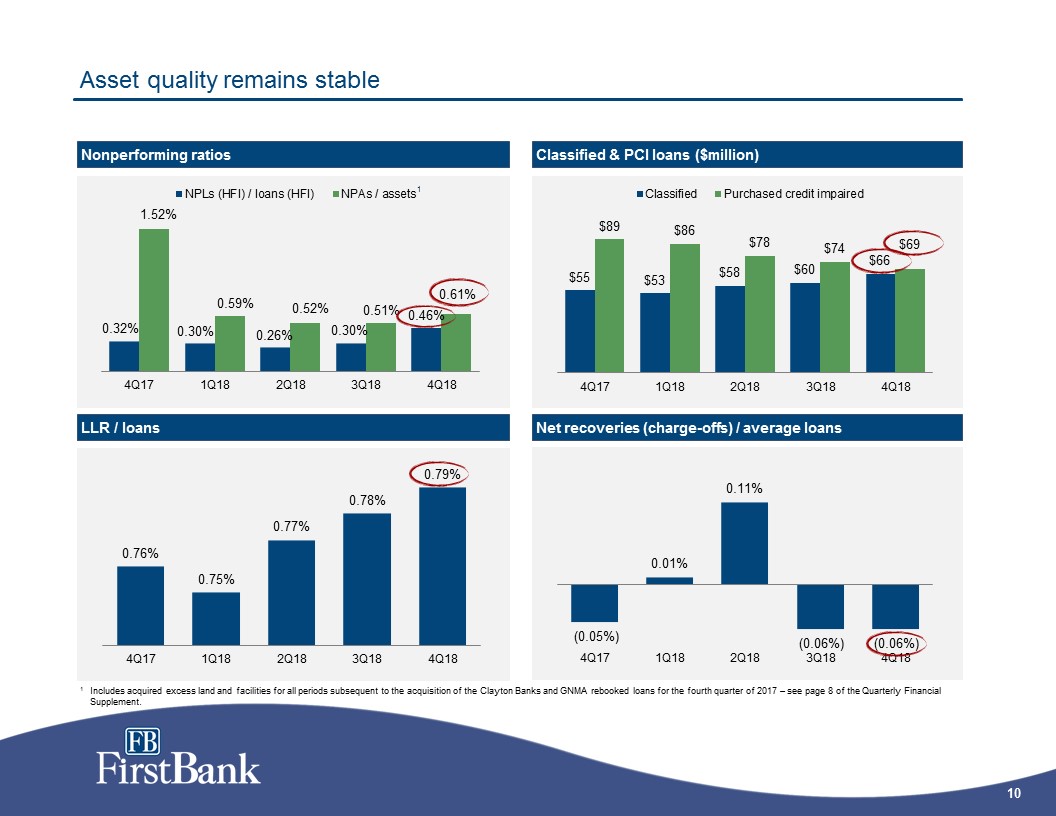

Asset quality remains stable Classified & PCI loans ($million) Net recoveries (charge-offs) /

average loans Nonperforming ratios LLR / loans 1 Includes acquired excess land and facilities for all periods subsequent to the acquisition of the Clayton Banks and GNMA rebooked loans for the fourth quarter of 2017 – see page 8

of the Quarterly Financial Supplement. 1

Strong capital position for future growth 1 Total regulatory capital, FB Financial Corporation. 4Q

2018 calculation is preliminary and subject to change.2 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. Capital position Simple capital

structure 4Q17 3Q18 4Q181 Shareholder’s equity / Assets 12.6% 12.8% 13.1% TCE / TA2 9.7% 10.2% 10.5% Common equity tier 1 / Risk-weighted assets 10.7% 11.5% 11.7% Tier 1 capital / Risk-weighted

assets 11.4% 12.2% 12.4% Total capital / Risk-weighted assets 12.0% 12.8% 13.0% Tier 1 capital / Average assets 10.5% 11.3% 11.5% Tangible book value per share Growth: 47.2% since IPO (September 2016)

Appendix

GAAP reconciliation and use of non-GAAP financial measures Net income, adjusted

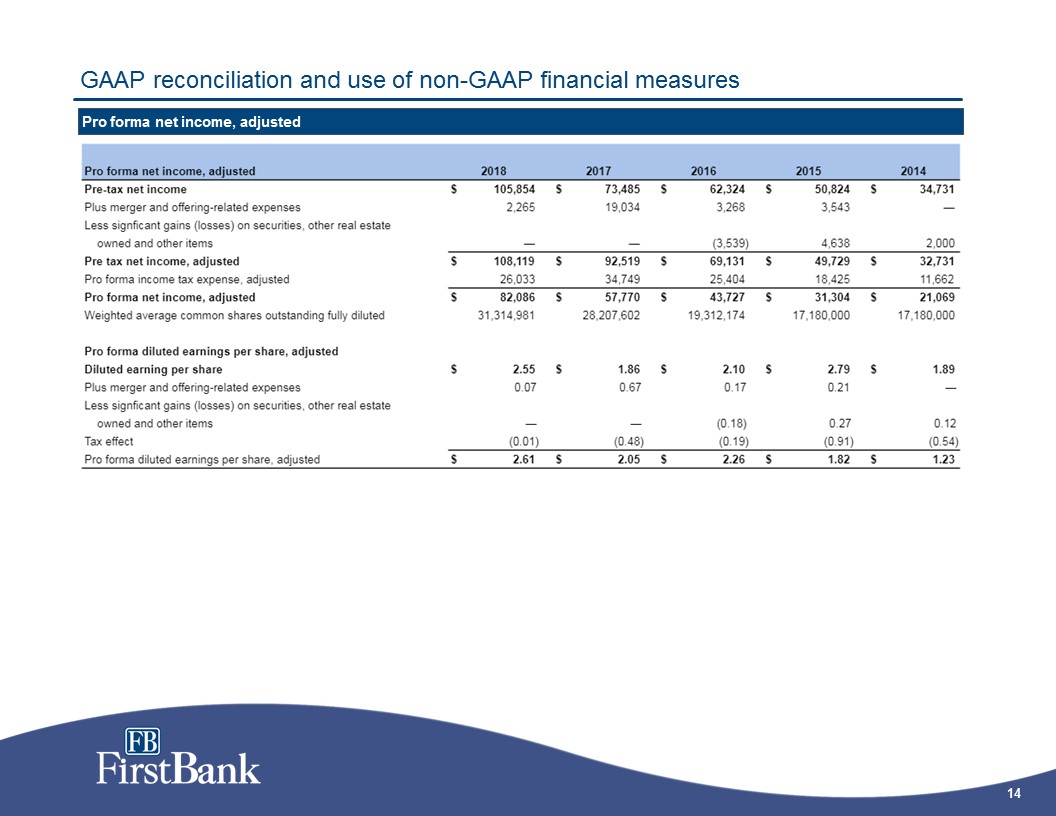

GAAP reconciliation and use of non-GAAP financial measures Pro forma net income, adjusted

GAAP reconciliation and use of non-GAAP financial measures Tax-equivalent efficiency ratio

GAAP reconciliation and use of non-GAAP financial measures Tax-equivalent efficiency ratio

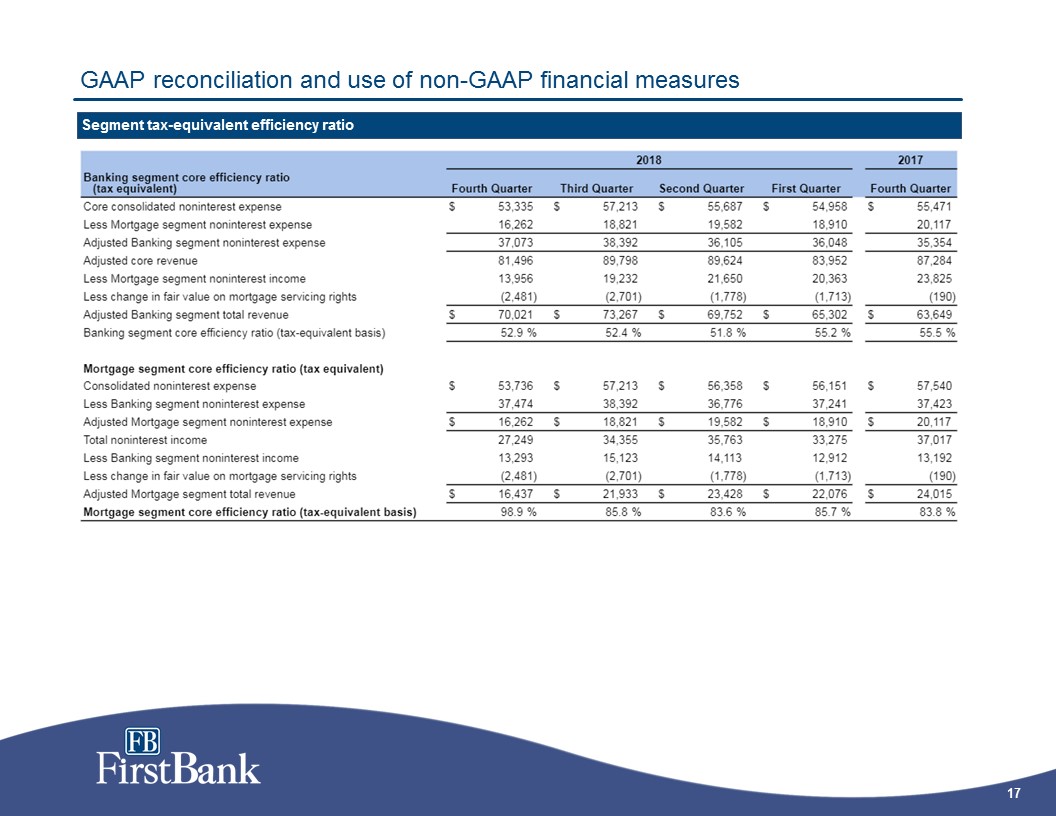

GAAP reconciliation and use of non-GAAP financial measures Segment tax-equivalent efficiency ratio

GAAP reconciliation and use of non-GAAP financial measures Mortgage contribution, adjusted

GAAP reconciliation and use of non-GAAP financial measures Tangible assets and equity Return on average

tangible equity

GAAP reconciliation and use of non-GAAP financial measures Return on average tangible equity,

adjusted

GAAP reconciliation and use of non-GAAP financial measures Return on average assets and equity,

adjusted

GAAP reconciliation and use of non-GAAP financial measures Return on average tangible common

equity Return on average tangible common equity, adjusted