Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE - ENTERPRISE FINANCIAL SERVICES CORP | ex991financialstatementsan.htm |

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a8kearningsrelease123118.htm |

EXHIBIT 99.2 Filed by Enterprise Financial Services Corp Pursuant to Rule 425 of the Securities Act of 1933 and deemed filed pursuant to Rule 14a-6(b) of the Securities Exchange Act of 1934 Subject Company: Trinity Capital Corporation Commission File No.: 001-15373 Enterprise Financial Services Corp 2018 Fourth Quarter Earnings Webcast

Forward-Looking Statements Some of the information in this report contains “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified with use of terms such as “may,” “might,” “will, “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “could,” “continue” and the negative of these terms and similar words, although some forward-looking statements may be expressed differently. Forward-looking statements also include, but are not limited to, statements regarding plans, objectives, expectations or consequences of announced transactions and statements about the future performance, operations, products and services of the Company and its subsidiaries. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. You should be aware that our actual results could differ materially from those anticipated by the forward-looking statements or historical performance due to a number of factors, including, but not limited to: our ability to efficiently integrate acquisitions into our operations, retain the customers of these businesses and grow the acquired operations; reputational risks; credit risk; changes in the appraised valuation of real estate securing impaired loans; outcomes of litigation and other contingencies; exposure to general and local economic conditions; risks associated with rapid increases or decreases in prevailing interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in regulatory requirements; changes in accounting regulation or standards applicable to banks; and other risks discussed under the caption “Risk Factors” of our most recently filed Form 10-K and in Part II, 1A of our most recently filed Form 10-Q, all of which could cause the Company’s actual results to differ from those set forth in the forward-looking statements. Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis and expectations only as of the date of such statements. Forward-looking statements speak only as of the date they are made, and the Company does not intend, and undertakes no obligation, to publicly revise or update forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise, except as required by federal securities law. You should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file from time to time with the Securities and Exchange Commission (the “SEC”) which are available on our website at www.enterprisebank.com under "Investor Relations." 2

Financial Scorecard Q4 2018 Compared to Q4 2017 Continued Growth in EPS 219%2 • Drive Net Interest Income Growth in 7% Dollars with Favorable Loan Growth Trends • Defend Core Net Interest Margin1 4 bps • Maintain High Quality Credit Profile Consistent NPLs/Loans • Achieve Further Improvement in Consistent efficiency 1 Core Operating Leverage ratio Enhance Deposit Levels to Support 10% Growth 1A Non GAAP Measure, Refer to Appendix for Reconciliation 2Q4 2017 included the impact of deferred tax asset charges due to tax reform 3

2018 Focus • Achieved Organic Loan and Deposit Growth • Maintained Focus on Long-Term Strategic Development • Improved Overall Sales Culture Through a Refreshed Sales Process and External Message 4

2019 Focus • Closing and Integration of the TCC Acquisition • Achieve Organic Loan and Deposit Goals • Continued Incremental Improvement of Our Sales and Operational Processes 5

Portfolio Loan Trends 7% Portfolio Loan Growth In Millions $4,333 $4,252 $4,250 $4,162 $4,067 Q4' 17 Q1' 18 Q2' 18 Q3' 18 Q4' 18 6

Commercial & Industrial Loan Trends 11% C&I Growth In Millions $2,121 $2,038 $2,033 $1,982 $1,919 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 7

Loan Details QTR LTM Q4 ’18 Q3 ’18 Change Q4 ’17 Change In Millions C&I - General $ 994 $ 968 $ 26 $ 937 $ 57 CRE, Investor Owned - General 857 841 16 801 56 CRE, Owner Occupied - General 495 480 15 468 27 Enterprise Value Lending1 466 442 24 408 58 Life Insurance Premium Financing1 418 379 39 365 53 Residential Real Estate - General 299 309 (10) 342 (43) Construction and Land Development ) - General 308 310 (2 294 14 Tax Credits1 263 257 6 235 28 Agriculture1 136 138 (2) 91 45 Consumer & Other - General 97 126 (29) 126 (29) Portfolio Loans 4,333 4,250 83 4,067 266 Non-core Acquired 17 17 — 30 (13) Total Loans $ 4,350 $ 4,267 $ 83 $ 4,097 $ 253 1Specialized categories may include a mix of C&I, CRE, Construction and land development, or Consumer and other loans. 8

Portfolio Loans By Business Unit In Millions Specialized Lending St. Louis $965 $2,300 $2,312 $856 $901 $2,233 Q4 '17 Q3 '18 Q4 '18 Q4 '17 Q3 '18 Q4 '18 Kansas City Arizona $331 $337 $687 $718 $719 $291 Q4 '17 Q3 '18 Q4 '18 Q4 '17 Q3 '18 Q4 '18 9

Deposit Trend 27.0% In Millions 25.7% 24.7% 25.2% 24.0% $4,588 $4,281 $4,248 $4,210 $4,156 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Deposits DDA % u Last Twelve Months Growth Rate = 10% 10

Earnings Per Share Trend - 2018 Year to Date Changes in EPS $0.19 $1.11 $0.14 $0.13 $(0.33) $0.52 $3.83 $2.07 2017 Net Interest Loan Loss Noninterest Merger Related Noninterest Income Tax 2018 Income Provision Income Expense Expense Expense 11

Earnings Per Share Trend - Q4 2018 Changes in EPS $0.09 $0.01 $0.09 $(0.04) $(0.10) $1.02 $0.97 Q3 '18 Net Interest Noninterest Noninterest Merger Related Income Tax Q4 '18 Income Income Expense Expense Expense 12

Net Interest Income Trend In Millions 3.73% 3.74% 3.75% 3.74% 3.77% $50.6 $48.1 $47.4 $46.2 $47.0 $48.5 $46.8 $47.6 $44.9 $45.4 8% Core NII Growth Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Core Net Interest Income* Incremental Accretion On Non Core Acquired Assets FTE Core Net Interest Margin* Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation 13

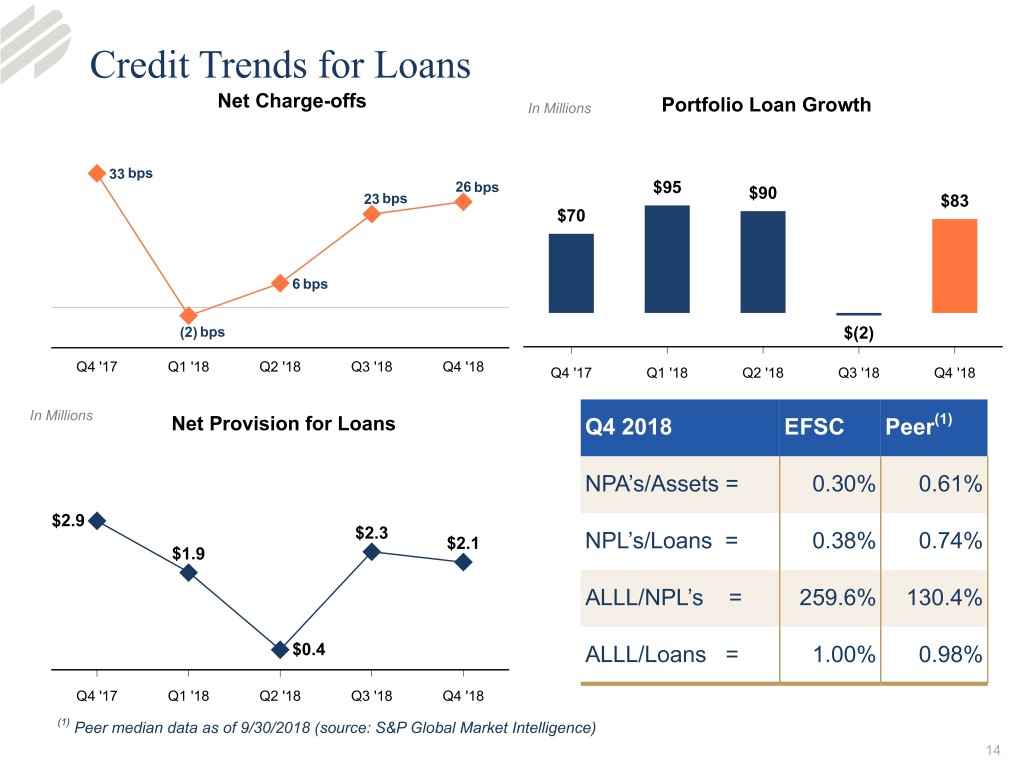

Credit Trends for Loans Net Charge-offs In Millions Portfolio Loan Growth 33 bps 26 bps $95 23 bps $90 $83 $70 6 bps (2) bps $(2) Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 In Millions Net Provision for Loans Q4 2018 EFSC Peer(1) NPA’s/Assets = 0.30% 0.61% $2.9 $2.3 $2.1 NPL’s/Loans = 0.38% 0.74% $1.9 ALLL/NPL’s = 259.6% 130.4% $0.4 ALLL/Loans = 1.00% 0.98% Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 (1) Peer median data as of 9/30/2018 (source: S&P Global Market Intelligence) 14

Noninterest Income In Millions Fee Income Other Fee Income Detail $11.1 $10.7 $2.8 $2.8 $0.1 $0.1 $2.2 $9.7 $9.5 $0.1 $0.2 $0.3 $2.3 $2.3 $1.0 $8.4 $0.2 $0.3 $2.8 $0.2 $2.8 $0.2 $2.3 $1.4 $1.7 $0.1 $1.7 $1.5 $1.7 $1.8 $1.8 $0.6 $0.2 $0.3 $1.5 $0.1 $1.4 $0.2 $0.4 $2.1 $0.2 $2.9 $2.8 $3.0 $3.0 $2.9 $1.3 $1.4 $1.0 $1.0 $2.2 $2.1 $2.1 $2.0 $2.0 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Wealth Management Deposit Services Charge Miscellaneous Swap Fees Card Services Other CDE Mortgage State Tax Credits Noncore Acquired 15

Operating Expenses Trend 54.0% In Millions 52.4% 52.2% 50.2% 49.8% $30.7 $29.9 $29.1 $29.2 $1.3 $28.3 $0.7 $0.1 $15.3 $16.5 $16.6 $16.3 $16.6 $2.4 $2.4 $2.3 $2.4 $2.4 $10.5 $10.2 $10.3 $10.5 $10.4 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Other Occupancy Employee compensation and benefits Merger related expenses/other noncore expenses Core Efficiency Ratio* Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation 16

Positive Momentum in Earnings Per Share $1.02 $0.97 $0.95 $0.90 Five-Year CAGR 42% $0.69 $0.67 $0.61 $0.59 $0.56 $0.54 $0.52 $0.50 $0.48 $0.46 $0.43 $0.41 $0.36 $0.32 $0.30 $0.30 $0.18 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4 '18 467% EPS Growth from Q4 2013 to Q4 2018 Note: Q1 and Q2 2017 included merger related charges. Q4 2017 included the impact of deferred tax asset charges due to tax reform 17

Fourth Quarter 2018 Earnings Webcast Appendix

Effective Tax Rate Reconciliation 2018 2017 Q4 2017 Federal Tax Rate 21.00% 35.00% 35.00% State Tax, Net of Federal Benefit 2.32% 1.94% 1.94% Excess Tax Benefits (1.56)% (2.47)% (1.25)% Tax Credit Investments (4.66)% (1.89)% (3.62)% Other Tax Adjustments 0.23% (2.28)% (3.90)% Pre-DTA Effective Tax Rate 17.33% 30.30% 28.17% Impact of Tax Law Changes (2.64)% 14.00% 44.30% Ending Effective Tax Rate 14.69% 44.30% 72.47% 19

Use of Non-GAAP Financial Measures The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as net interest margin, efficiency ratios, regulatory capital ratios, and the tangible common equity ratio, in this presentation that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Commencing in the fourth quarter of 2018, due to declining balances in the non-core acquired loan portfolio, the Company determined to no longer report core earnings, which is a non-GAAP measure, on a full income statement presentation basis as the variance to the most directly comparable GAAP measure is now insignificant and to avoid any suggestion that such non-GAAP presentation exhibits prominence over the most directly comparable GAAP measure. The Company considers its core performance measures presented in this presentation as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of non-core acquired loans and related income and expenses, the impact of non-comparable items, and the Company's operating performance on an ongoing basis. Core performance measures include contractual interest on non-core acquired loans but exclude incremental accretion on these loans. Core performance measures also exclude the gain or loss on sale of other real estate from non-core acquired loans, and expenses directly related to the non-core acquired loans and other assets formerly covered under FDIC loss share agreements. Core performance measures also exclude certain other income and expense items, such as executive separation costs, merger related expenses, facilities charges, deferred tax asset revaluation due to U.S. corporate income tax reform, and the gain or loss on sale of investment securities, the Company believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company's capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the tables below, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measure for the periods indicated. Peer group data consists of median of publicly traded banks with total assets from $2-$10 billion with commercial loans greater than 20% and consumer loans less than 10%. 20

Reconciliation of Non-GAAP Financial Measures For the Quarter ended For the Year ended Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Dec 31, Dec 31, ($ in thousands, except per share data) 2018 2018 2018 2018 2017 2018 2017 CORE PERFORMANCE MEASURES Net interest income $ 50,593 $ 48,093 $ 47,048 $ 46,171 $ 47,404 $ 191,905 $ 177,304 Less: Incremental accretion income 2,109 535 291 766 2,503 3,701 7,718 Core net interest income 48,484 47,558 46,757 45,405 44,901 188,204 169,586 Total noninterest income 10,702 8,410 9,693 9,542 11,112 38,347 34,394 Less: Other income from non-core acquired assets 10 7 18 1,013 (6) 1,048 (6) Less: Gain on sale of investment securities — — — 9 — 9 22 Less: Other non-core income 26 — 649 — — 675 — Core noninterest income 10,666 8,403 9,026 8,520 11,118 36,615 34,378 Total core revenue 59,150 55,961 55,783 53,925 56,019 224,819 203,964 Total noninterest expense 30,747 29,922 29,219 29,143 28,260 119,031 115,051 Less: Other expenses related to non-core acquired loans 40 12 (229) 14 114 (163) 240 Less: Facilities disposal — — 239 — — 239 389 Less: Merger related expenses 1,271 — — — — 1,271 6,462 Less: Non-recurring excise tax — 682 — — — 682 — Core noninterest expense 29,436 29,228 29,209 29,129 28,146 117,002 107,960 Core efficiency ratio 49.77% 52.23% 52.36% 54.02% 50.24% 52.04% 52.93% 21

Fourth Quarter 2018 Earnings Webcast Q & A