Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Citizens Community Bancorp Inc. | d679643dex993.htm |

| EX-99.1 - EX-99.1 - Citizens Community Bancorp Inc. | d679643dex991.htm |

| EX-2.1 - EX-2.1 - Citizens Community Bancorp Inc. | d679643dex21.htm |

| 8-K - 8-K - Citizens Community Bancorp Inc. | d679643d8k.htm |

Exhibit 99.2

Filed by Citizens Community Bancorp, Inc. Commission File No. 001-33003 Filed Pursuantto Rule 425 under the Securities Act of 1933 Subject Company: F. & M. Bancorp. of Tomah, Inc. The following presentation materials will be used by Citizens Community Bancorp, Inc. at one or more investor relations conferences, or meetings with analysts or potential investors.

ACQUISITION OF F. & M. Bancorp. of Tomah, Inc. parent company of

Forward-Looking Statements This presentation contains certain forward-looking information about Citizens Community Bancorp, Inc. and subsidiaries (collectively, “CZWI”) that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about CZWI. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of CZWI. Forward-looking statements speak only as of the date they are made and CZWI assumes no duty to update such statements. In addition to factors previously disclosed in reports filed by CZWI with the Securities and Exchange Commission (“SEC”), additional risks and uncertainties may include, but are not limited to: the satisfaction of the conditions to closing the proposed merger in the anticipated timeframe or at all; the failure to obtain necessary regulatory and shareholder approvals; the occurrence of any event, change or other circumstances that could give riseto the termination of the definitive merger agreement; the ability to realize the anticipated benefits of the proposed merger; the ability to successfully integrate the businesses; disruption from the proposed merger making it more difficult to maintain business and operational relationships; the negative effects of this announcement or the consummation of the proposed merger on the market price of CZWI’s common stock; significant transaction costs and unknown liabilities; and litigation or regulatory actions related to the proposed transaction. Additional factors affecting CZWI are discussed in CZWI’s Annual Report onForm10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K, filed with the SEC. Please refer to the SEC’s website at www.sec.gov where you can review those documents. Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is being made in respect of the proposed merger transaction between CZWI and F. & M. Bancorp. of Tomah, Inc. (“F&M”). In connection with the proposed merger, CZWI will file with the SEC a registration statement on Form S-4 that will include the proxy statement of F&M and a prospectus of CZWI, as well as other relevant documents regarding the proposed merger. A definitive proxy statement/prospectus will also be sent to F&M shareholders. INVESTORS AND SHAREHOLDERS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED MERGER THAT CZWI WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement, including the proxy statement/prospectus, and other relevant documents (when they become available), and any other documents filed by CZWI with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CZWI’s website at www.ccf.us, or by directing a request to CZWI’s CEO, Stephen Bianchi at Citizens Community Bancorp, Inc., 2174 EastRidge Center, EauClaire, Wisconsin 54701, Attention: Stephen M. Bianchi or by e-mail at sbianchi@ccf.us. F&M and its directors, executive officers and certain other members of its management and employees may be deemed to be participants in the solicitation of proxies from F&M’s shareholders in connection with the proposed merger. Information about such participants may be obtained by reading the proxy statement/prospectus and the other relevant documents regarding the proposed merger when it becomes available. Free copies of these documents may be obtained as described in the preceding paragraph.

Table of Contents SECTION DESCRIPTION I. Transaction Summary II. Overview of F. & M. Bancorp of Tomah III. Pro Forma Summary

I. Transaction Summary

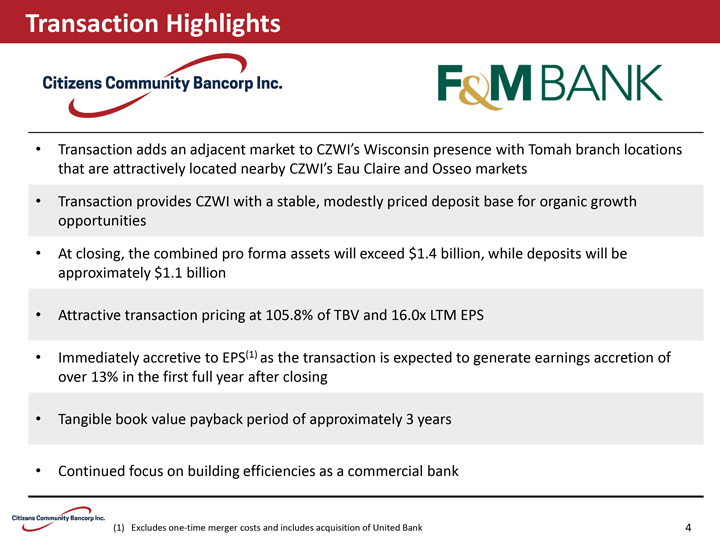

Transaction Highlights • Transaction adds an adjacent market to CZWI’s Wisconsin presence with Tomah branch locations that are attractively located nearby CZWI’s Eau Claire and Osseo markets • Transaction provides CZWI with a stable, modestly priced deposit base for organic growth opportunities • At closing, the combined pro forma assets will exceed $1.4 billion, while deposits will be approximately $1.1 billion • Attractive transaction pricing at 105.8% of TBV and 16.0x LTM EPS • Immediately accretive to EPS(1) as the transaction is expected to generate earnings accretion of over 13% in the first full year after closing • Tangible book value payback period of approximately 3 years • Continued focus on building efficiencies as a commercial bank (1) Excludes one-time merger costs and includes acquisition of United Bank 4

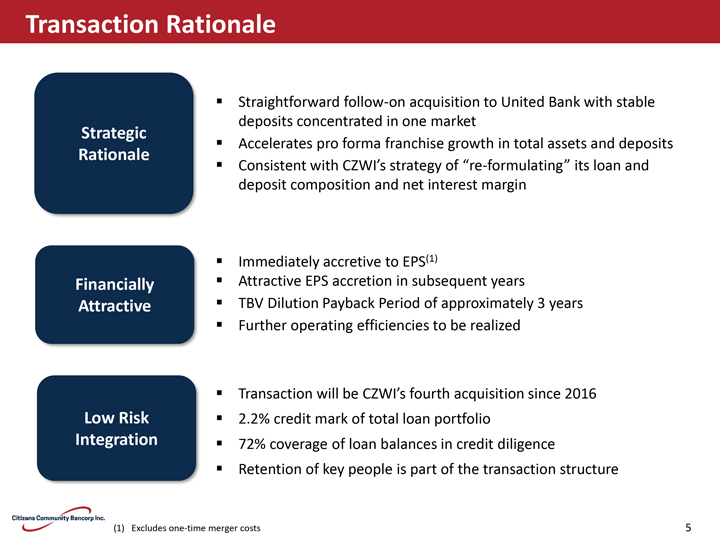

Transaction Rationale â–ª Straightforward follow-on acquisition to United Bank with stable deposits concentrated in one market Strategic â–ª Accelerates pro forma franchise growth in total assets and deposits Rationale â–ª Consistent with CZWI’s strategy of “re-formulating” its loan and deposit composition and net interest margin â–ª Immediately accretive to EPS(1) Financially â–ª Attractive EPS accretion in subsequent years Attractive â–ª TBV Dilution Payback Period of approximately 3 years â–ª Further operating efficiencies to be realized â–ª Transaction will be CZWI’s fourth acquisition since 2016 Low Risk â–ª 2.2% credit mark of total loan portfolio Integration â–ª 72% coverage of loan balances in credit diligence â–ª Retention of key people is part of the transaction structure (1) Excludes one-time merger costs 5

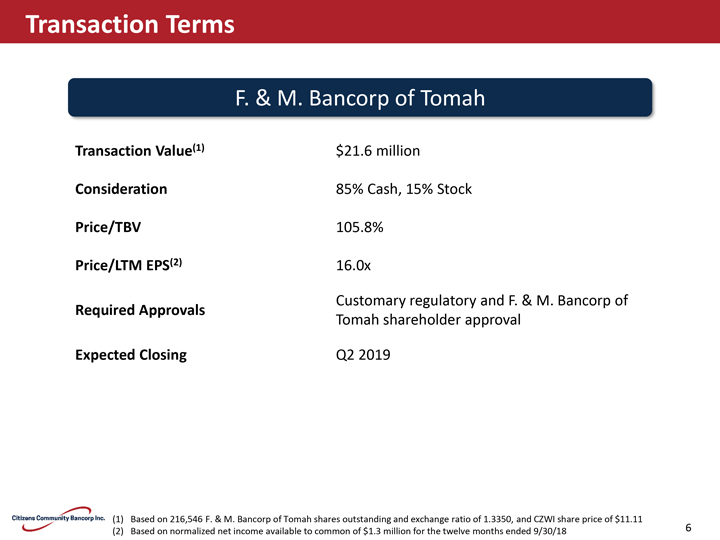

Transaction Terms F. & M. Bancorp of Tomah Transaction Value(1) $21.6 million Consideration 85% Cash, 15% Stock Price/TBV 105.8% Price/LTM EPS(2) 16.0x Customary regulatory and F. & M. Bancorp of Required Approvals Tomah shareholder approval Expected Closing Q2 2019 (1) Based on 216,546 F. & M. Bancorp of Tomah shares outstanding and exchange ratio of 1.3350, and CZWI share price of $11.11 6 (2) Based on normalized net income available to common of $1.3 million for the twelve months ended 9/30/18

II. F. & M. Bancorp of Tomah Overview

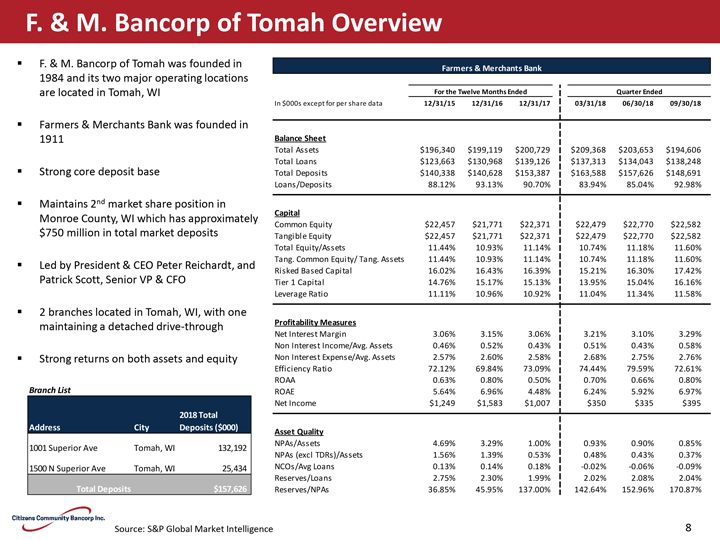

F. & M. Bancorp of Tomah Overview â–ª F. & M. Bancorp of Tomah was founded in Farmers & Merchants Bank 1984 and its two major operating locations are located in Tomah, WI For the Twelve Months Ended Quarter Ended In $000s except for per share data 12/31/15 12/31/16 12/31/17 03/31/18 06/30/18 09/30/18 â–ª Farmers & Merchants Bank was founded in 1911 Balance Sheet Total Assets $196,340 $199,119 $200,729 $209,368 $203,653 $194,606 Total Loans $123,663 $130,968 $139,126 $137,313 $134,043 $138,248 â–ª Strong core deposit base Total Deposits $140,338 $140,628 $153,387 $163,588 $157,626 $148,691 Loans/Deposits 88.12% 93.13% 90.70% 83.94% 85.04% 92.98% â–ª Maintains 2nd market share position in Capital Monroe County, WI which has approximately $750 million in total market deposits Common Equity $22,457 $21,771 $22,371 $22,479 $22,770 $22,582 Tangible Equity $22,457 $21,771 $22,371 $22,479 $22,770 $22,582 Total Equity/Assets 11.44% 10.93% 11.14% 10.74% 11.18% 11.60% â–ª Tang. Common Equity/ Tang. Assets 11.44% 10.93% 11.14% 10.74% 11.18% 11.60% Led by President & CEO Peter Reichardt, and Risked Based Capital 16.02% 16.43% 16.39% 15.21% 16.30% 17.42% Patrick Scott, Senior VP & CFO Tier 1 Capital 14.76% 15.17% 15.13% 13.95% 15.04% 16.16% Leverage Ratio 11.11% 10.96% 10.92% 11.04% 11.34% 11.58% â–ª 2 branches located in Tomah, WI, with one maintaining a detached drive-through Profitability Measures Net Interest Margin 3.06% 3.15% 3.06% 3.21% 3.10% 3.29% Non Interest Income/Avg. Assets 0.46% 0.52% 0.43% 0.51% 0.43% 0.58% â–ª Strong returns on both assets and equity Non Interest Expense/Avg. Assets 2.57% 2.60% 2.58% 2.68% 2.75% 2.76% Efficiency Ratio 72.12% 69.84% 73.09% 74.44% 79.59% 72.61% ROAA 0.63% 0.80% 0.50% 0.70% 0.66% 0.80% Branch List ROAE 5.64% 6.96% 4.48% 6.24% 5.92% 6.97% Net Income $1,249 $1,583 $1,007 $350 $335 $395 2018 Total Address City Deposits ($000) Asset Quality NPAs/Assets 4.69% 3.29% 1.00% 0.93% 0.90% 0.85% 1001 Superior Ave Tomah, WI 132,192 NPAs (excl TDRs)/Assets 1.56% 1.39% 0.53% 0.48% 0.43% 0.37% 1500 N Superior Ave Tomah, WI 25,434 NCOs/Avg Loans 0.13% 0.14% 0.18% -0.02% -0.06% -0.09% Reserves/Loans 2.75% 2.30% 1.99% 2.02% 2.08% 2.04% Total Deposits $157,626 Reserves/NPAs 36.85% 45.95% 137.00% 142.64% 152.96% 170.87% Source: S&P Global Market Intelligence 8

III. Pro Forma Summary

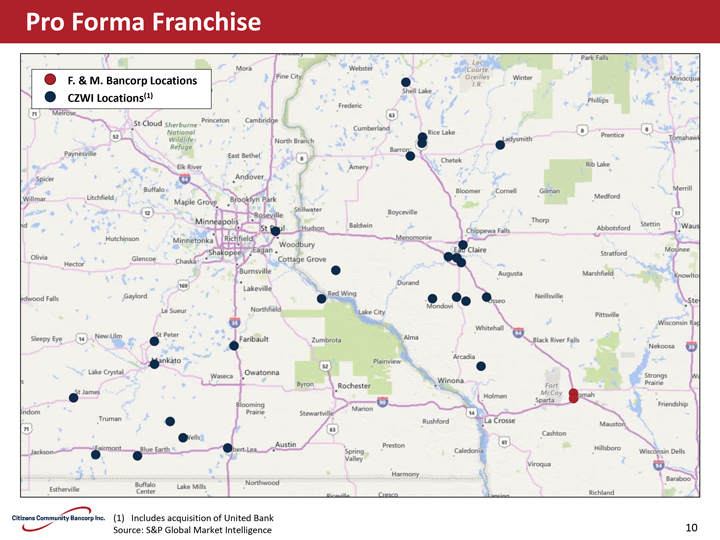

Pro Forma Franchise F. & M. Bancorp Locations CZWI Locations(1) (1) Includes acquisition of United Bank Source: S&P Global Market Intelligence 10

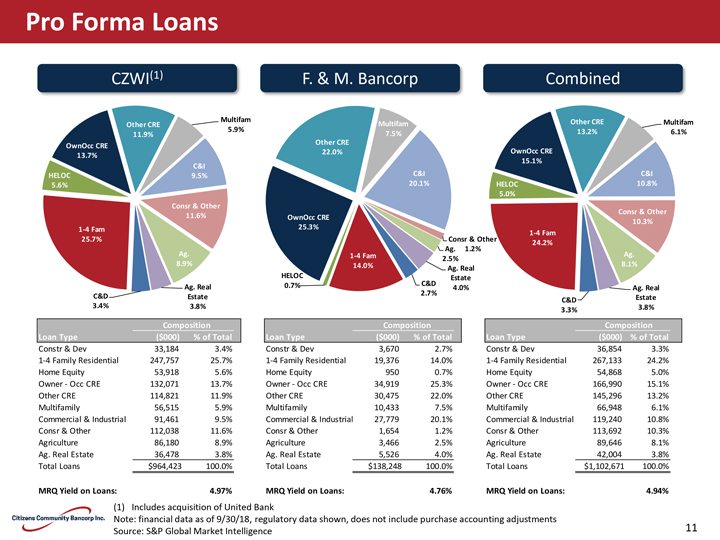

Pro Forma Loans CZWI(1) F. & M. Bancorp Combined Multifam Other CRE Multifam Other CRE 5.9% Multifam 11.9% 7.5% 13.2% 6.1% Other CRE OwnOcc CRE 22.0% OwnOcc CRE 13.7% 15.1% C&I HELOC 9.5% C&I C&I 5.6% 20.1% HELOC 10.8% 5.0% Consr & Other Consr & Other 11.6% OwnOcc CRE 10.3% 1-4 Fam 25.3% 1-4 Fam 25.7% Consr & Other Ag. 1.2% 24.2% Ag. 1-4 Fam Ag. 2.5% 8.9% 14.0% 8.1% Ag. Real HELOC Estate 0.7% C&D Ag. Real 2.7% 4.0% Ag. Real C&D Estate Estate 3.4% 3.8% C&D 3.3% 3.8% Composition Composition Composition Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total Constr & Dev 33,184 3.4% Constr & Dev 3,670 2.7% Constr & Dev 36,854 3.3% 1-4 Family Residential 247,757 25.7% 1-4 Family Residential 19,376 14.0% 1-4 Family Residential 267,133 24.2% Home Equity 53,918 5.6% Home Equity 950 0.7% Home Equity 54,868 5.0% Owner—Occ CRE 132,071 13.7% Owner—Occ CRE 34,919 25.3% Owner—Occ CRE 166,990 15.1% Other CRE 114,821 11.9% Other CRE 30,475 22.0% Other CRE 145,296 13.2% Multifamily 56,515 5.9% Multifamily 10,433 7.5% Multifamily 66,948 6.1% Commercial & Industrial 91,461 9.5% Commercial & Industrial 27,779 20.1% Commercial & Industrial 119,240 10.8% Consr & Other 112,038 11.6% Consr & Other 1,654 1.2% Consr & Other 113,692 10.3% Agriculture 86,180 8.9% Agriculture 3,466 2.5% Agriculture 89,646 8.1% Ag. Real Estate 36,478 3.8% Ag. Real Estate 5,526 4.0% Ag. Real Estate 42,004 3.8% Total Loans $964,423 100.0% Total Loans $138,248 100.0% Total Loans $1,102,671 100.0% MRQ Yield on Loans: 4.97% MRQ Yield on Loans: 4.76% MRQ Yield on Loans: 4.94% (1) Includes acquisition of United Bank Note: financial data as of 9/30/18, regulatory data shown, does not include purchase accounting adjustments 11 Source: S&P Global Market Intelligence

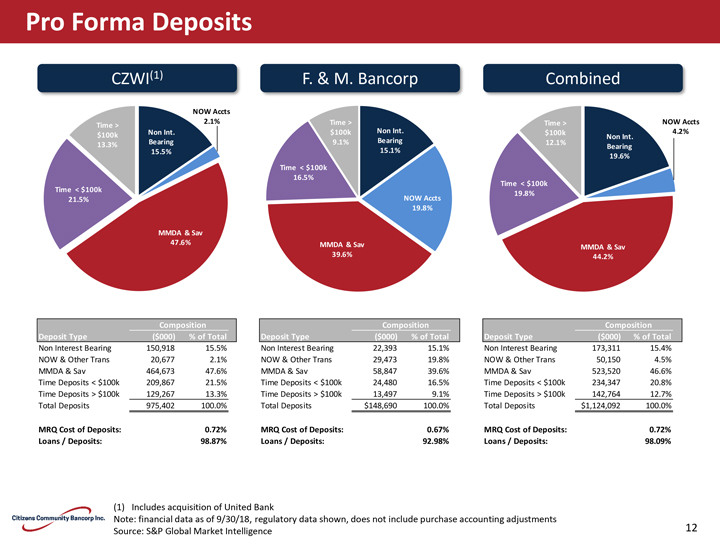

Pro Forma Deposits CZWI(1) F. & M. Bancorp Combined NOW Accts 2.1% Time > Time > NOW Accts Time > Non Int. 4.2% $100k Non Int. $100k $100k Non Int. Bearing 9.1% Bearing 12.1% 13.3% 15.1% Bearing 15.5% 19.6% Time < $100k 16.5% Time < $100k Time < $100k 19.8% 21.5% NOW Accts 19.8% MMDA & Sav 47.6% MMDA & Sav MMDA & Sav 39.6% 44.2% Composition Composition Composition Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total Non Interest Bearing 150,918 15.5% Non Interest Bearing 22,393 15.1% Non Interest Bearing 173,311 15.4% NOW & Other Trans 20,677 2.1% NOW & Other Trans 29,473 19.8% NOW & Other Trans 50,150 4.5% MMDA & Sav 464,673 47.6% MMDA & Sav 58,847 39.6% MMDA & Sav 523,520 46.6% Time Deposits < $100k 209,867 21.5% Time Deposits < $100k 24,480 16.5% Time Deposits < $100k 234,347 20.8% Time Deposits > $100k 129,267 13.3% Time Deposits > $100k 13,497 9.1% Time Deposits > $100k 142,764 12.7% Total Deposits 975,402 100.0% Total Deposits $148,690 100.0% Total Deposits $1,124,092 100.0% MRQ Cost of Deposits: 0.72% MRQ Cost of Deposits: 0.67% MRQ Cost of Deposits: 0.72% Loans / Deposits: 98.87% Loans / Deposits: 92.98% Loans / Deposits: 98.09% (1) Includes acquisition of United Bank Note: financial data as of 9/30/18, regulatory data shown, does not include purchase accounting adjustments 12 Source: S&P Global Market Intelligence

Transaction Summary â–ª Transaction drives earnings growth and overall shareholder value for both CZWI and F. & M. Bancorp of Tomah shareholders â–ª Straightforward follow on acquisition to United Bank further improves CZWI’s balance sheet composition, operating efficiencies and earnings power â–ª Increases CZWI’s ability to serve larger commercial accounts and absorb technology costs to better serve all customers

Investor Contacts Stephen M. Bianchi President & Chief Executive Officer James S. Broucek Executive VP & Chief Financial Officer Citizens Community Bancorp, Inc. 2174 EastRidge Center Eau Claire, WI 54701 (715) 836-9994 www.ccf.us