Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST HORIZON CORP | a4q18financialsupplement8-.htm |

| EX-99.1 - EXHIBIT 99.1 FINANCIAL SUPPLEMENT - FIRST HORIZON CORP | a4q18financialsupplement.htm |

First Horizon National Corporation Fourth Quarter 2018 Earnings January 18, 2019

Portions of this presentation use non-GAAP financial information. Each of those portions is so noted, and a reconciliation of that non-GAAP information to comparable GAAP information is provided in a footnote or in the appendix at the end of this presentation. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity” and certain financial measures excluding notable items, including merger-related charges. Notable items include certain revenue or expense items that may occur in a reporting period which management does not consider indicative of ongoing financial performance. Management believes it is useful for the investment community to consider financial metrics with and without notable items in order to enable a better understanding of company results, facilitate comparability of period-to-period financial results, and to evaluate and forecast those results. Although FHN has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation. This presentation contains forward-looking statements, which may include guidance, involving significant risks and uncertainties which will be identified by words such as “believe”,“expect”,“anticipate”,“intend”,“estimate”, “should”,“is likely”,“will”,“going forward” and other expressions that indicate future events and trends and may be followed by or reference cautionary statements. A number of factors could cause actual results to differ materially from those in the forward-looking statements. These factors are outlined in our recent earnings and other press releases and in more detail in the most current 10-Q and 10-K. FHN disclaims any obligation to update any such forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements to reflect future events or developments. 2

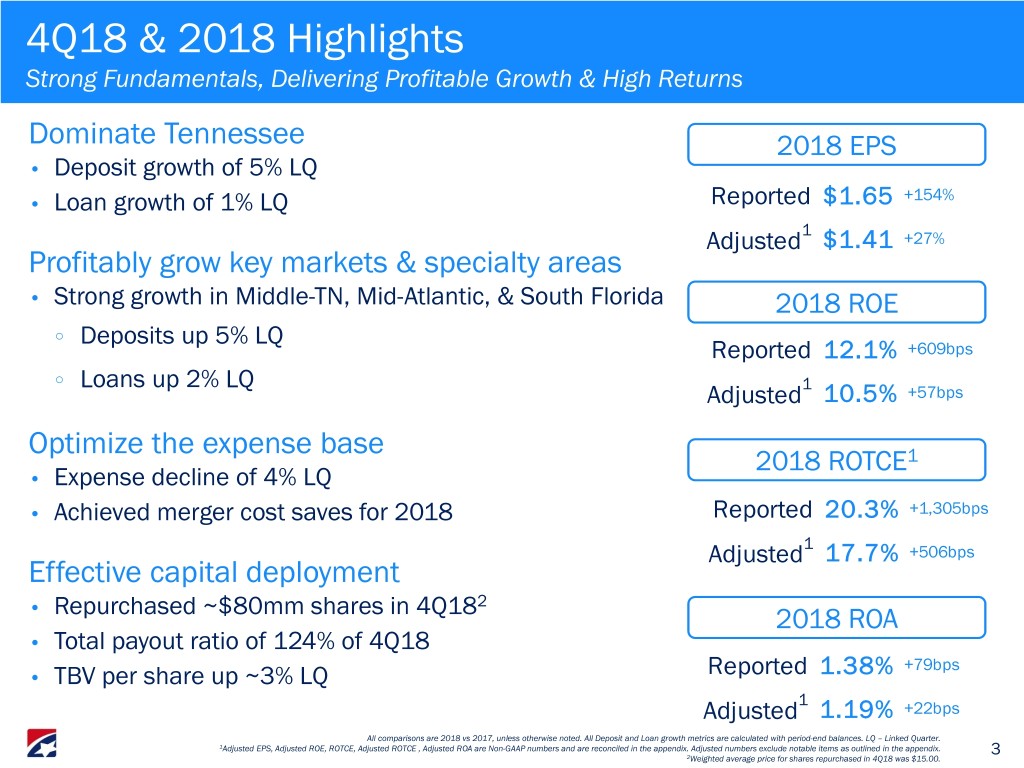

4Q18 & 2018 Highlights Strong Fundamentals, Delivering Profitable Growth & High Returns Dominate Tennessee 2018 EPS • Deposit growth of 5% LQ • Loan growth of 1% LQ Reported $1.65 +154% 1 Adjusted $1.41 +27% Profitably grow key markets & specialty areas • Strong growth in Middle-TN, Mid-Atlantic, & South Florida 2018 ROE ○ Deposits up 5% LQ Reported 12.1% +609bps ○ Loans up 2% LQ 1 Adjusted 10.5% +57bps Optimize the expense base 2018 ROTCE1 • Expense decline of 4% LQ • Achieved merger cost saves for 2018 Reported 20.3% +1,305bps 1 Adjusted 17.7% +506bps Effective capital deployment 2 • Repurchased ~$80mm shares in 4Q18 2018 ROA • Total payout ratio of 124% of 4Q18 +79bps • TBV per share up ~3% LQ Reported 1.38% 1 Adjusted 1.19% +22bps All comparisons are 2018 vs 2017, unless otherwise noted. All Deposit and Loan growth metrics are calculated with period-end balances. LQ – Linked Quarter. 1Adjusted EPS, Adjusted ROE, ROTCE, Adjusted ROTCE , Adjusted ROA are Non-GAAP numbers and are reconciled in the appendix. Adjusted numbers exclude notable items as outlined in the appendix. 3 2Weighted average price for shares repurchased in 4Q18 was $15.00.

FINANCIAL RESULTS 4

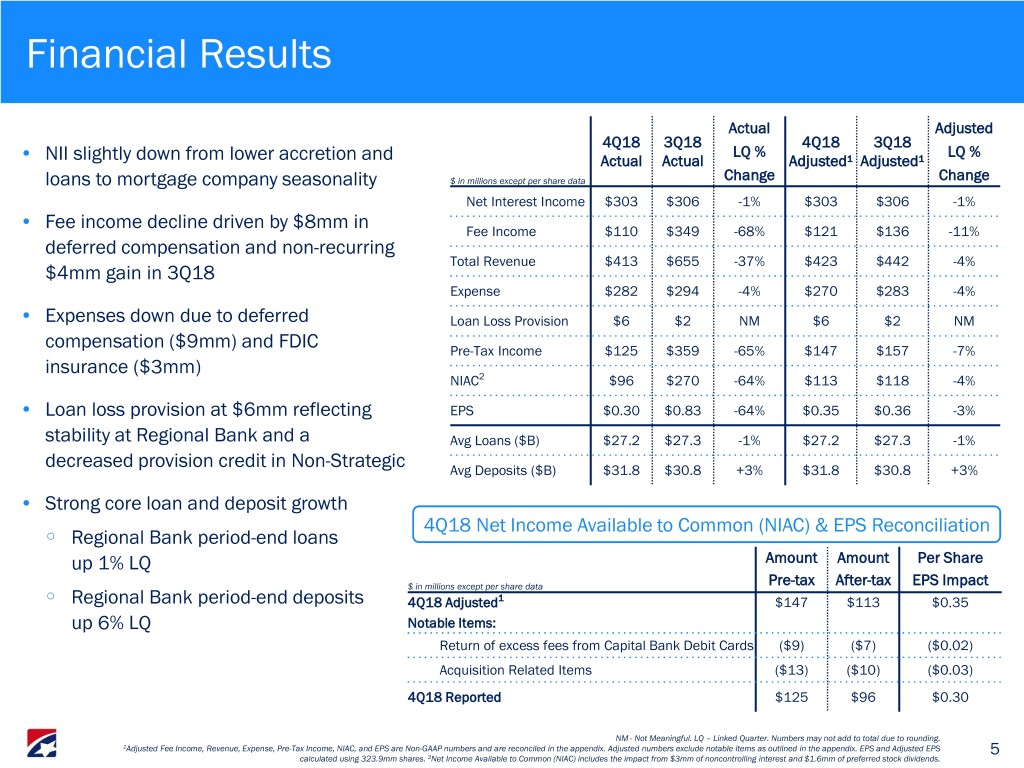

Financial Results Actual Adjusted 4Q18 3Q18 4Q18 3Q18 LQ % LQ % • NII slightly down from lower accretion and Actual Actual Adjusted¹ Adjusted¹ loans to mortgage company seasonality $ in millions except per share data Change Change Net Interest Income $303 $306 -1% $303 $306 -1% • Fee income decline driven by $8mm in Fee Income $110 $349 -68% $121 $136 -11% deferred compensation and non-recurring Total Revenue $413 $655 -37% $423 $442 -4% $4mm gain in 3Q18 Expense $282 $294 -4% $270 $283 -4% • Expenses down due to deferred Loan Loss Provision $6 $2 NM $6 $2 NM compensation ($9mm) and FDIC Pre-Tax Income $125 $359 -65% $147 $157 -7% insurance ($3mm) NIAC2 $96 $270 -64% $113 $118 -4% • Loan loss provision at $6mm reflecting EPS $0.30 $0.83 -64% $0.35 $0.36 -3% stability at Regional Bank and a Avg Loans ($B) $27.2 $27.3 -1% $27.2 $27.3 -1% decreased provision credit in Non-Strategic Avg Deposits ($B) $31.8 $30.8 +3% $31.8 $30.8 +3% • Strong core loan and deposit growth 4Q18 Net Income Available to Common (NIAC) & EPS Reconciliation ○ Regional Bank period-end loans up 1% LQ Amount Amount Per Share $ in millions except per share data Pre-tax After-tax EPS Impact ○ Regional Bank period-end deposits 4Q18 Adjusted1 $147 $113 $0.35 up 6% LQ Notable Items: Return of excess fees from Capital Bank Debit Cards ($9) ($7) ($0.02) Acquisition Related Items ($13) ($10) ($0.03) 4Q18 Reported $125 $96 $0.30 NM - Not Meaningful. LQ – Linked Quarter. Numbers may not add to total due to rounding. 1Adjusted Fee Income, Revenue, Expense, Pre-Tax Income, NIAC, and EPS are Non-GAAP numbers and are reconciled in the appendix. Adjusted numbers exclude notable items as outlined in the appendix. EPS and Adjusted EPS 5 calculated using 323.9mm shares. 2Net Income Available to Common (NIAC) includes the impact from $3mm of noncontrolling interest and $1.6mm of preferred stock dividends.

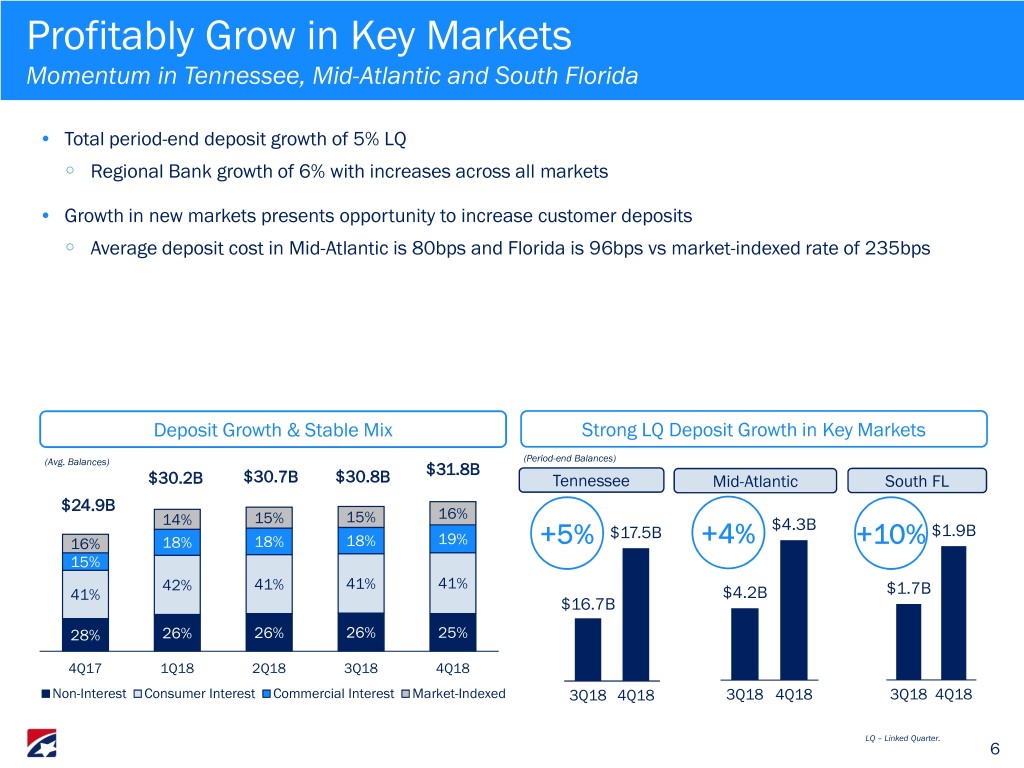

Profitably Grow in Key Markets Momentum in Tennessee, Mid-Atlantic and South Florida • Total period-end deposit growth of 5% LQ ○ Regional Bank growth of 6% with increases across all markets • Growth in new markets presents opportunity to increase customer deposits ○ Average deposit cost in Mid-Atlantic is 80bps and Florida is 96bps vs market-indexed rate of 235bps Deposit Growth & Stable Mix Strong LQ Deposit Growth in Key Markets (Period-end Balances) (Avg. Balances) $31.8B $30.2B $30.7B $30.8B Tennessee Mid-Atlantic South FL $24.9B 14% 15% 15% 16% $17.5B $4.3B $1.9B 16% 18% 18% 18% 19% +5% +4% +10% 15% 42% 41% 41% 41% 41% $4.2B $1.7B $16.7B 28% 26% 26% 26% 25% 4Q17 1Q18 2Q18 3Q18 4Q18 Non-Interest Consumer Interest Commercial Interest Market-Indexed 3Q18 4Q18 3Q18 4Q18 3Q18 4Q18 LQ – Linked Quarter. 6

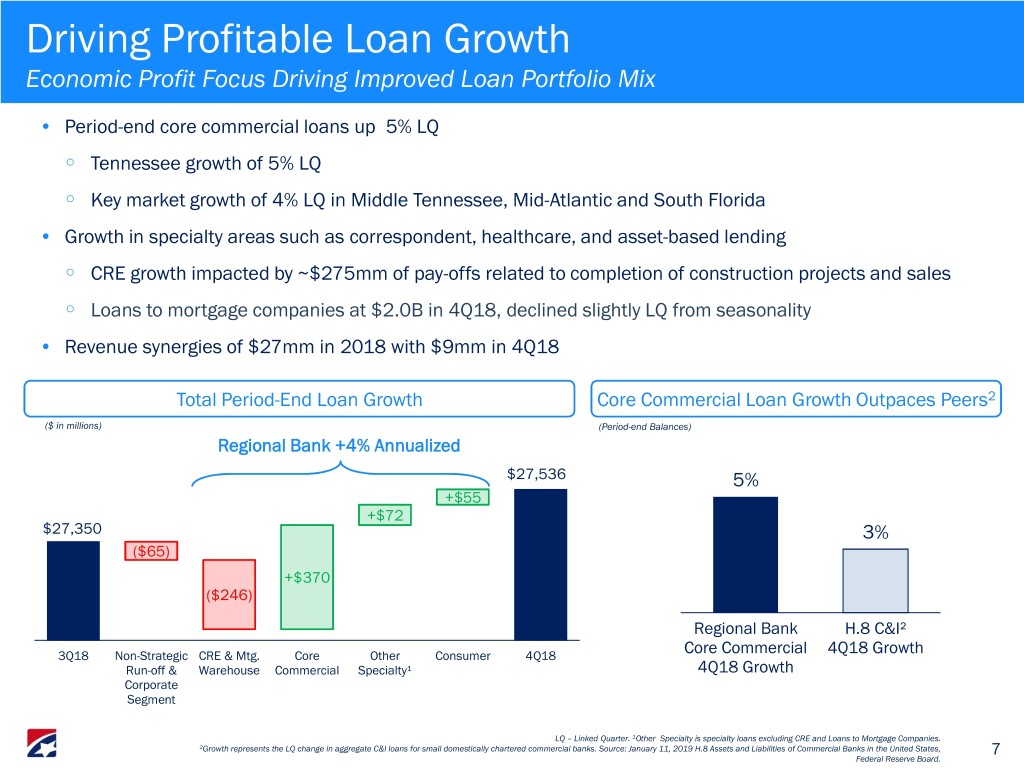

Driving Profitable Loan Growth Economic Profit Focus Driving Improved Loan Portfolio Mix • Period-end core commercial loans up 5% LQ ○ Tennessee growth of 5% LQ ○ Key market growth of 4% LQ in Middle Tennessee, Mid-Atlantic and South Florida • Growth in specialty areas such as correspondent, healthcare, and asset-based lending ○ CRE growth impacted by ~$275mm of pay-offs related to completion of construction projects and sales ○ Loans to mortgage companies at $2.0B in 4Q18, declined slightly LQ from seasonality • Revenue synergies of $27mm in 2018 with $9mm in 4Q18 Total Period-End Loan Growth Core Commercial Loan Growth Outpaces Peers2 ($ in millions) (Period-end Balances) Regional Bank +4% Annualized $27,536 5% +$55 +$72 $27,350 3% ($65) +$370 ($246) Regional Bank H.8 C&I² 3Q18 Non-Strategic CRE & Mtg. Core Other Consumer 4Q18 Core Commercial 4Q18 Growth Run-off & Warehouse Commercial Specialty¹ 4Q18 Growth Corporate Segment LQ – Linked Quarter. 1Other Specialty is specialty loans excluding CRE and Loans to Mortgage Companies. 2Growth represents the LQ change in aggregate C&I loans for small domestically chartered commercial banks. Source: January 11, 2019 H.8 Assets and Liabilities of Commercial Banks in the United States, 7 Federal Reserve Board.

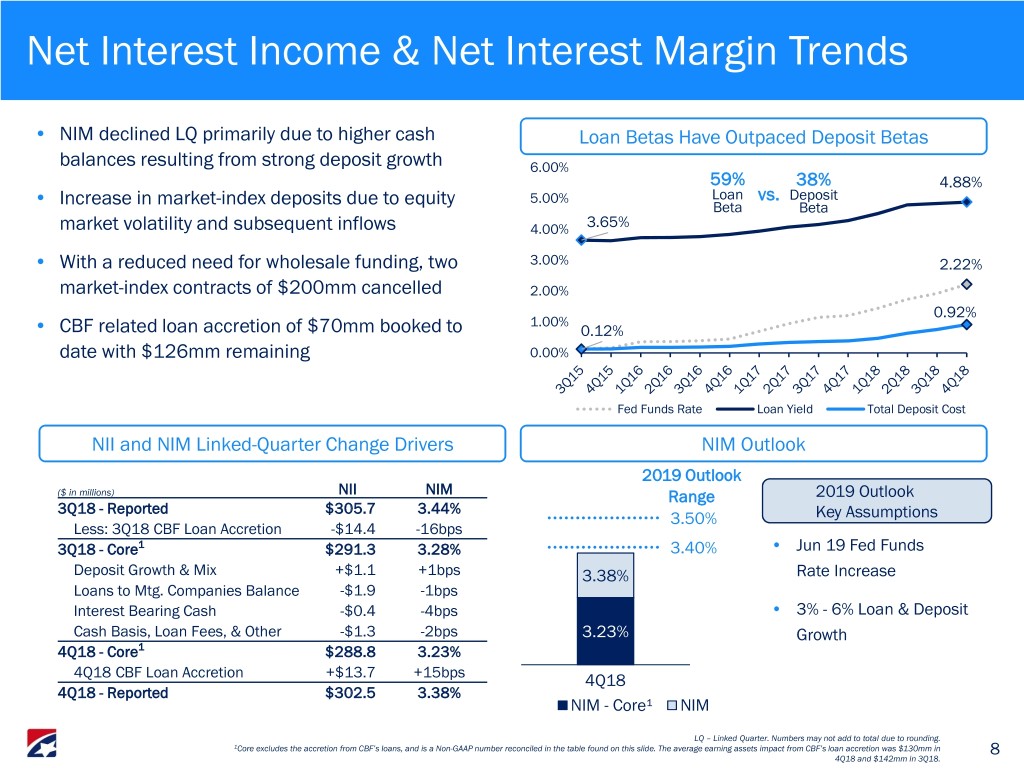

Net Interest Income & Net Interest Margin Trends • NIM declined LQ primarily due to higher cash Loan Betas Have Outpaced Deposit Betas balances resulting from strong deposit growth 6.00% 59% 38% 4.88% 5.00% Loan vs. Deposit • Increase in market-index deposits due to equity Beta Beta market volatility and subsequent inflows 4.00% 3.65% • With a reduced need for wholesale funding, two 3.00% 2.22% market-index contracts of $200mm cancelled 2.00% 0.92% 1.00% • CBF related loan accretion of $70mm booked to 0.12% date with $126mm remaining 0.00% Fed Funds Rate Loan Yield Total Deposit Cost NII and NIM Linked-Quarter Change Drivers NIM Outlook 2019 Outlook ($ in millions) NII NIM Range 2019 Outlook 3Q18 - Reported $305.7 3.44% 3.50% Key Assumptions Less: 3Q18 CBF Loan Accretion -$14.4 -16bps 3Q18 - Core1 $291.3 3.28% 3.40% • Jun 19 Fed Funds Deposit Growth & Mix +$1.1 +1bps 3.38% Rate Increase Loans to Mtg. Companies Balance -$1.9 -1bps Interest Bearing Cash -$0.4 -4bps • 3% - 6% Loan & Deposit Cash Basis, Loan Fees, & Other -$1.3 -2bps 3.23% Growth 4Q18 - Core1 $288.8 3.23% 4Q18 CBF Loan Accretion +$13.7 +15bps 4Q18 4Q18 - Reported $302.5 3.38% NIM - Core¹ NIM LQ – Linked Quarter. Numbers may not add to total due to rounding. 1Core excludes the accretion from CBF’s loans, and is a Non-GAAP number reconciled in the table found on this slide. The average earning assets impact from CBF’s loan accretion was $130mm in 8 4Q18 and $142mm in 3Q18.

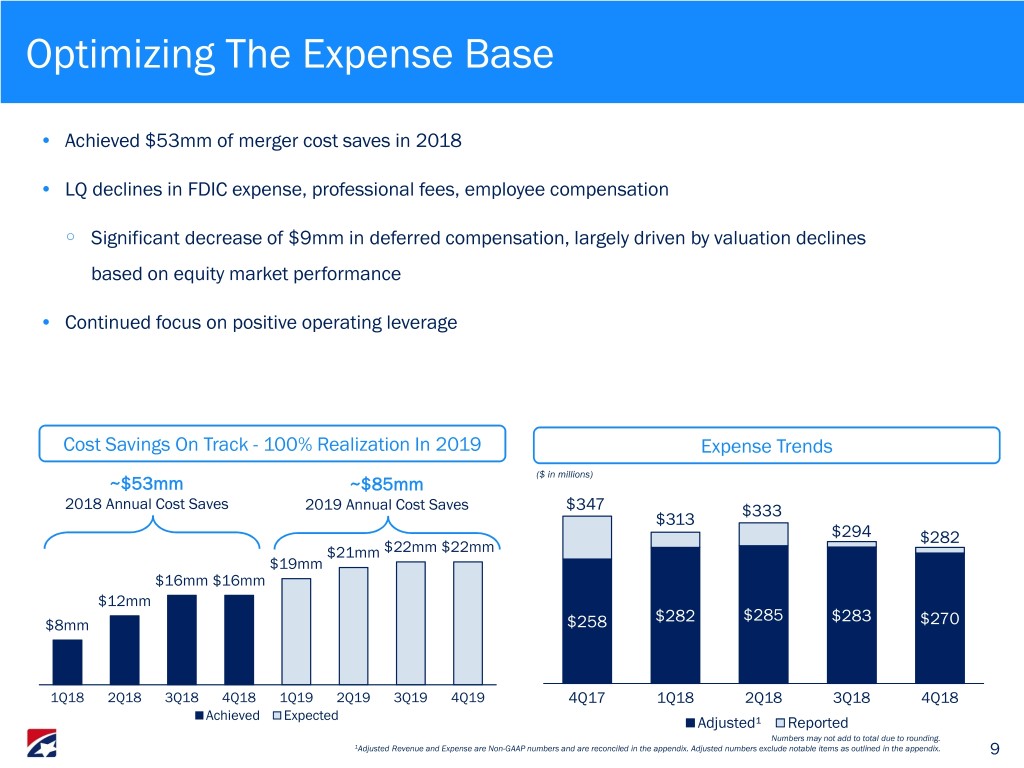

Optimizing The Expense Base • Achieved $53mm of merger cost saves in 2018 • LQ declines in FDIC expense, professional fees, employee compensation ○ Significant decrease of $9mm in deferred compensation, largely driven by valuation declines based on equity market performance • Continued focus on positive operating leverage Cost Savings On Track - 100% Realization In 2019 Expense Trends ($ in millions) ~$53mm ~$85mm 2018 Annual Cost Saves 2019 Annual Cost Saves $347 $313 $333 $294 $282 $21mm $22mm $22mm $19mm $16mm $16mm $12mm $282 $285 $283 $8mm $258 $270 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 4Q17 1Q18 2Q18 3Q18 4Q18 Achieved Expected Adjusted¹ Reported Numbers may not add to total due to rounding. 1Adjusted Revenue and Expense are Non-GAAP numbers and are reconciled in the appendix. Adjusted numbers exclude notable items as outlined in the appendix. 9

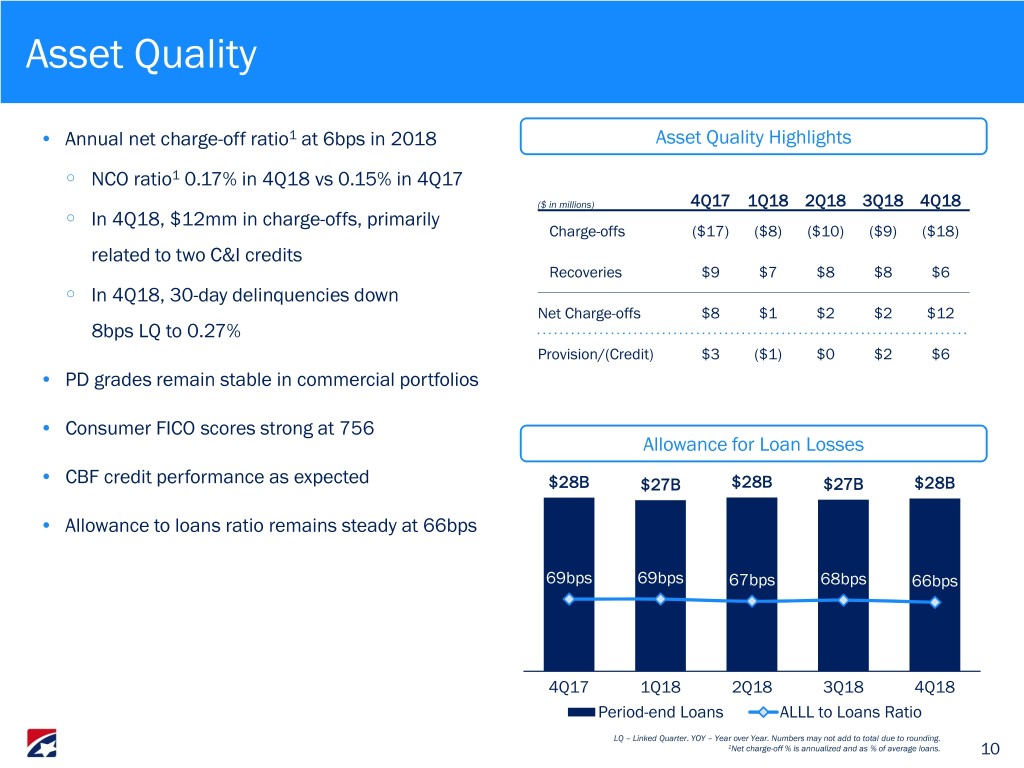

Asset Quality • Annual net charge-off ratio1 at 6bps in 2018 Asset Quality Highlights ○ NCO ratio1 0.17% in 4Q18 vs 0.15% in 4Q17 ($ in millions) 4Q17 1Q18 2Q18 3Q18 4Q18 ○ In 4Q18, $12mm in charge-offs, primarily Charge-offs ($17) ($8) ($10) ($9) ($18) related to two C&I credits Recoveries $9 $7 $8 $8 $6 ○ In 4Q18, 30-day delinquencies down Net Charge-offs $8 $1 $2 $2 $12 8bps LQ to 0.27% Provision/(Credit) $3 ($1) $0 $2 $6 • PD grades remain stable in commercial portfolios • Consumer FICO scores strong at 756 Allowance for Loan Losses • CBF credit performance as expected $28B $27B $28B $27B $28B • Allowance to loans ratio remains steady at 66bps 69bps 69bps 67bps 68bps 66bps 4Q17 1Q18 2Q18 3Q18 4Q18 Period-end Loans ALLL to Loans Ratio LQ – Linked Quarter. YOY – Year over Year. Numbers may not add to total due to rounding. 1Net charge-off % is annualized and as % of average loans. 10

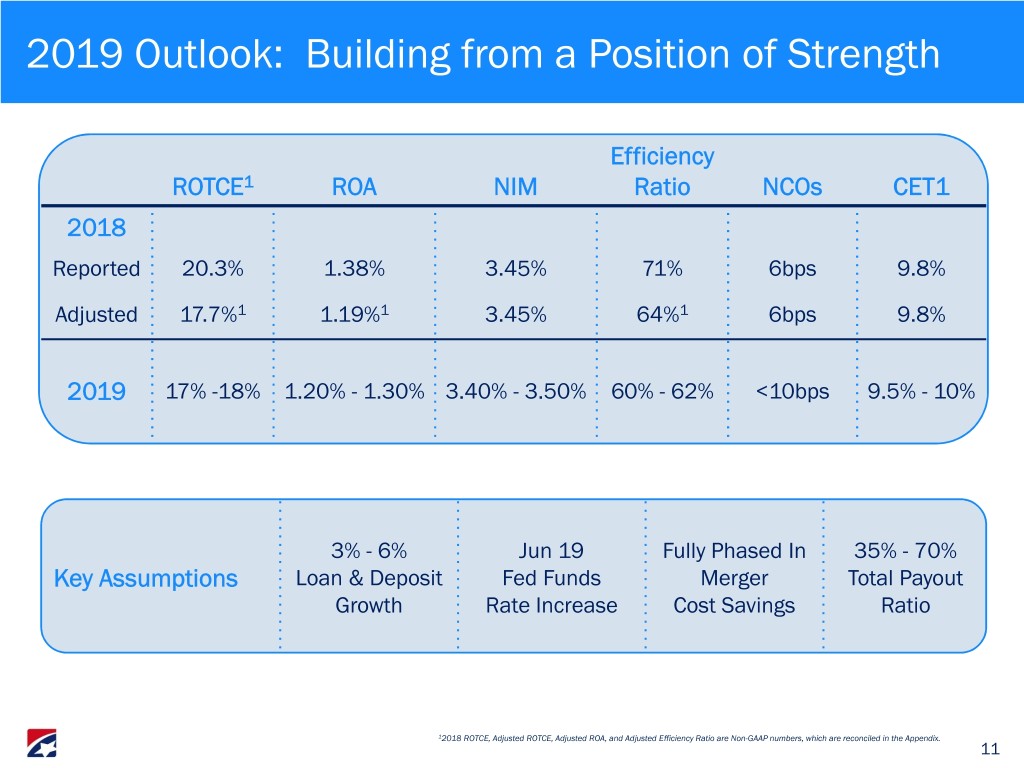

2019 Outlook: Building from a Position of Strength Efficiency ROTCE1 ROA NIM Ratio NCOs CET1 2018 Reported 20.3% 1.38% 3.45% 71% 6bps 9.8% Adjusted 17.7%1 1.19%1 3.45% 64%1 6bps 9.8% 2019 17% -18% 1.20% - 1.30% 3.40% - 3.50% 60% - 62% <10bps 9.5% - 10% 3% - 6% Jun 19 Fully Phased In 35% - 70% Key Assumptions Loan & Deposit Fed Funds Merger Total Payout Growth Rate Increase Cost Savings Ratio 12018 ROTCE, Adjusted ROTCE, Adjusted ROA, and Adjusted Efficiency Ratio are Non-GAAP numbers, which are reconciled in the Appendix. 11

Top-Quartile Returns Better Risk Profile Evolving the Bonefish: Long-term Objectives Profitable Growth Enhanced Operating Leverage 12

APPENDIX 13

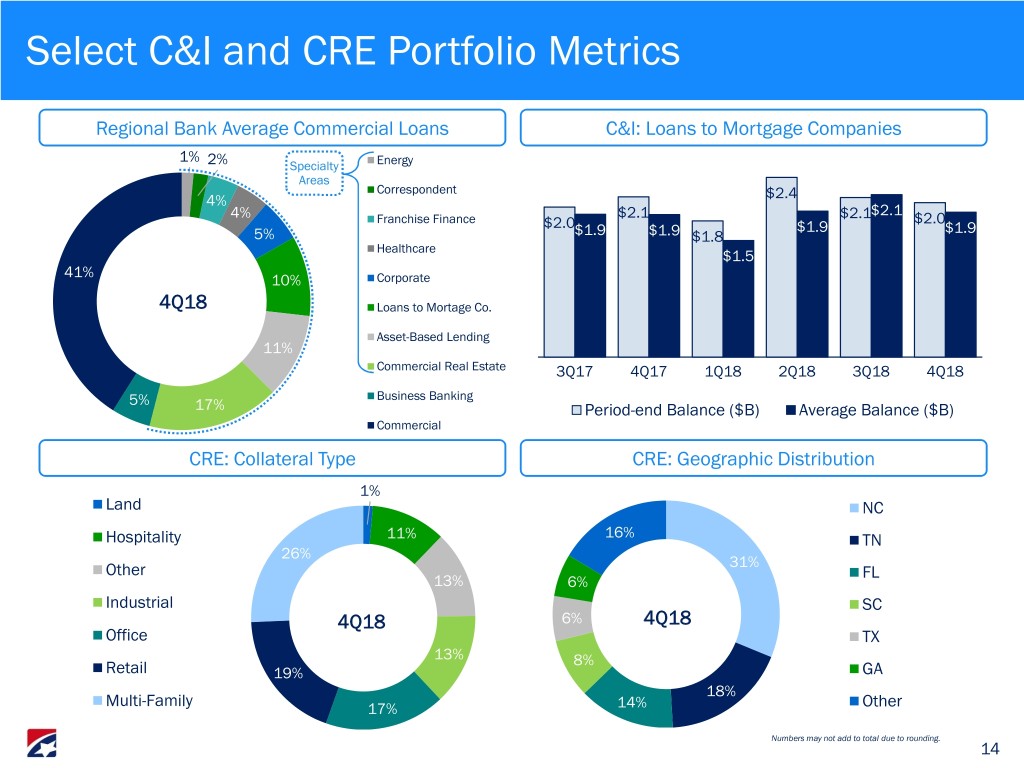

Select C&I and CRE Portfolio Metrics Regional Bank Average Commercial Loans C&I: Loans to Mortgage Companies 1% 2% Specialty Energy Areas Correspondent 4% $2.4 $2.1 4% Franchise Finance $2.1 $2.1 $2.0 $2.0 $1.9 $1.9 5% $1.9 $1.9 $1.8 Healthcare $1.5 41% 10% Corporate 4Q18 Loans to Mortage Co. Asset-Based Lending 11% Commercial Real Estate 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 5% Business Banking 17% Period-end Balance ($B) Average Balance ($B) Commercial CRE: Collateral Type CRE: Geographic Distribution 1% Land NC Hospitality 11% 16% TN 26% 31% Other FL 13% 6% Industrial SC 4Q18 6% 4Q18 Office TX 13% 8% Retail 19% GA 18% Multi-Family 17% 14% Other Numbers may not add to total due to rounding. 14

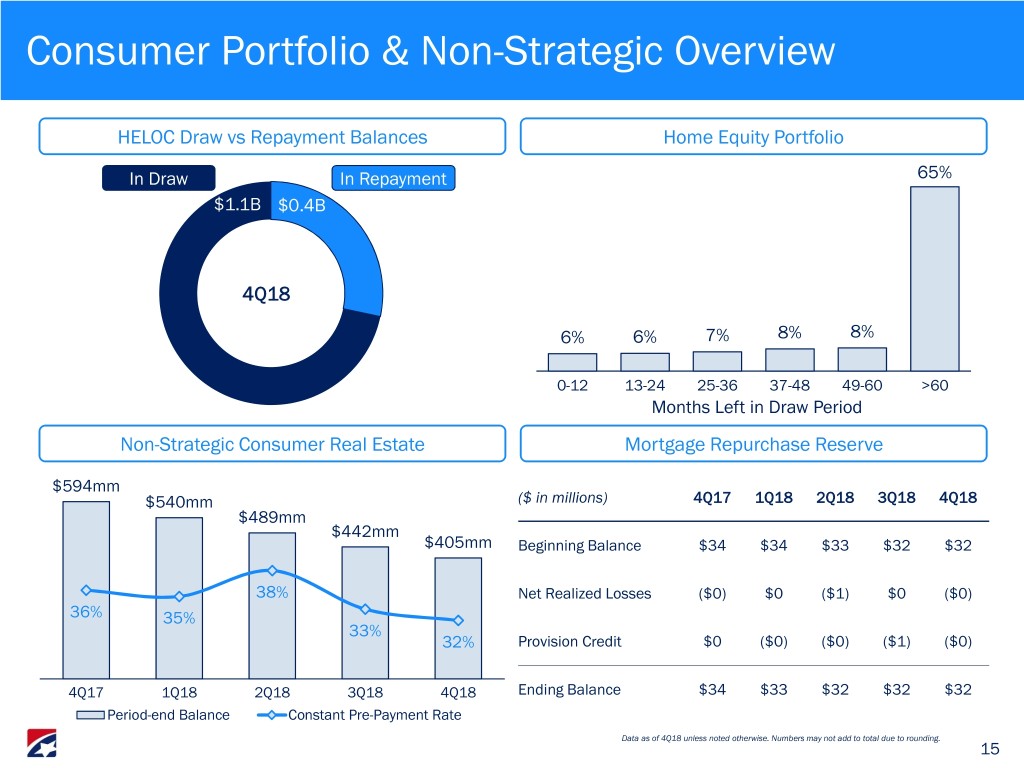

Consumer Portfolio & Non-Strategic Overview HELOC Draw vs Repayment Balances Home Equity Portfolio In Draw In Repayment 65% $1.1B $0.4B 4Q18 6% 6% 7% 8% 8% 0-12 13-24 25-36 37-48 49-60 >60 Months Left in Draw Period Non-Strategic Consumer Real Estate Mortgage Repurchase Reserve $594mm $540mm ($ in millions) 4Q17 1Q18 2Q18 3Q18 4Q18 $489mm $442mm $405mm Beginning Balance $34 $34 $33 $32 $32 38% Net Realized Losses ($0) $0 ($1) $0 ($0) 36% 35% 33% 32% Provision Credit $0 ($0) ($0) ($1) ($0) 4Q17 1Q18 2Q18 3Q18 4Q18 Ending Balance $34 $33 $32 $32 $32 Period-end Balance Constant Pre-Payment Rate Data as of 4Q18 unless noted otherwise. Numbers may not add to total due to rounding. 15

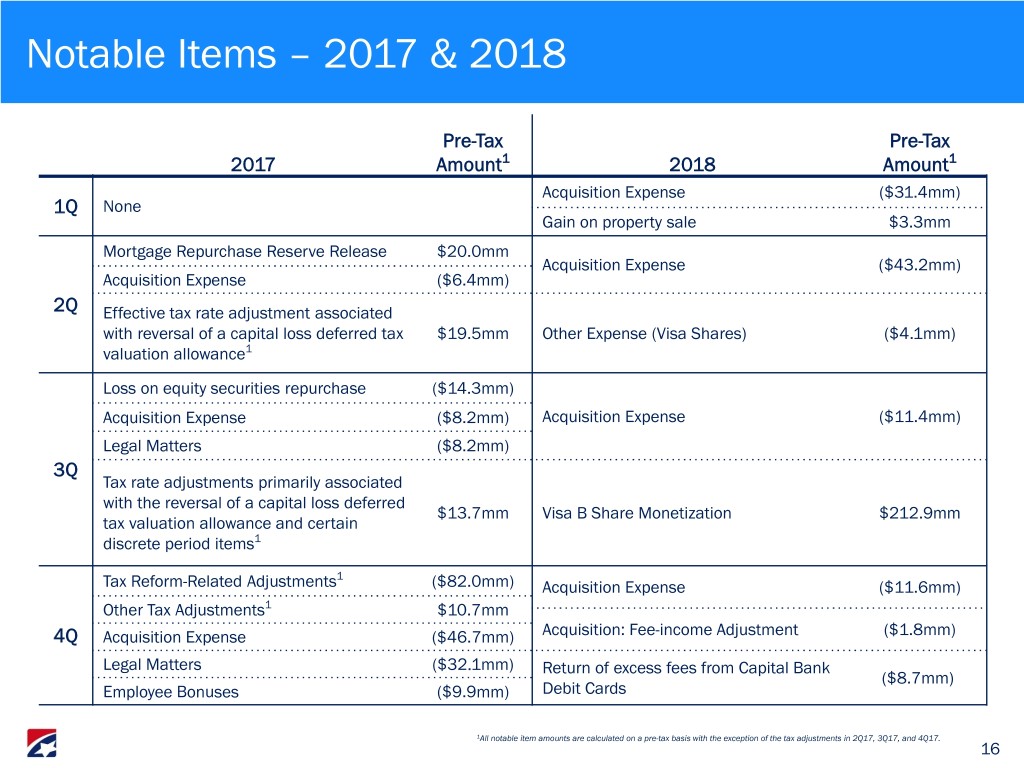

Notable Items – 2017 & 2018 Pre-Tax Pre-Tax 2017 Amount1 2018 Amount1 Acquisition Expense ($31.4mm) 1Q None Gain on property sale $3.3mm Mortgage Repurchase Reserve Release $20.0mm Acquisition Expense ($43.2mm) Acquisition Expense ($6.4mm) 2Q Effective tax rate adjustment associated with reversal of a capital loss deferred tax $19.5mm Other Expense (Visa Shares) ($4.1mm) valuation allowance1 Loss on equity securities repurchase ($14.3mm) Acquisition Expense ($8.2mm) Acquisition Expense ($11.4mm) Legal Matters ($8.2mm) 3Q Tax rate adjustments primarily associated with the reversal of a capital loss deferred $13.7mm Visa B Share Monetization $212.9mm tax valuation allowance and certain discrete period items1 1 Tax Reform-Related Adjustments ($82.0mm) Acquisition Expense ($11.6mm) Other Tax Adjustments1 $10.7mm 4Q Acquisition Expense ($46.7mm) Acquisition: Fee-income Adjustment ($1.8mm) Legal Matters ($32.1mm) Return of excess fees from Capital Bank ($8.7mm) Employee Bonuses ($9.9mm) Debit Cards 1All notable item amounts are calculated on a pre-tax basis with the exception of the tax adjustments in 2Q17, 3Q17, and 4Q17. 16

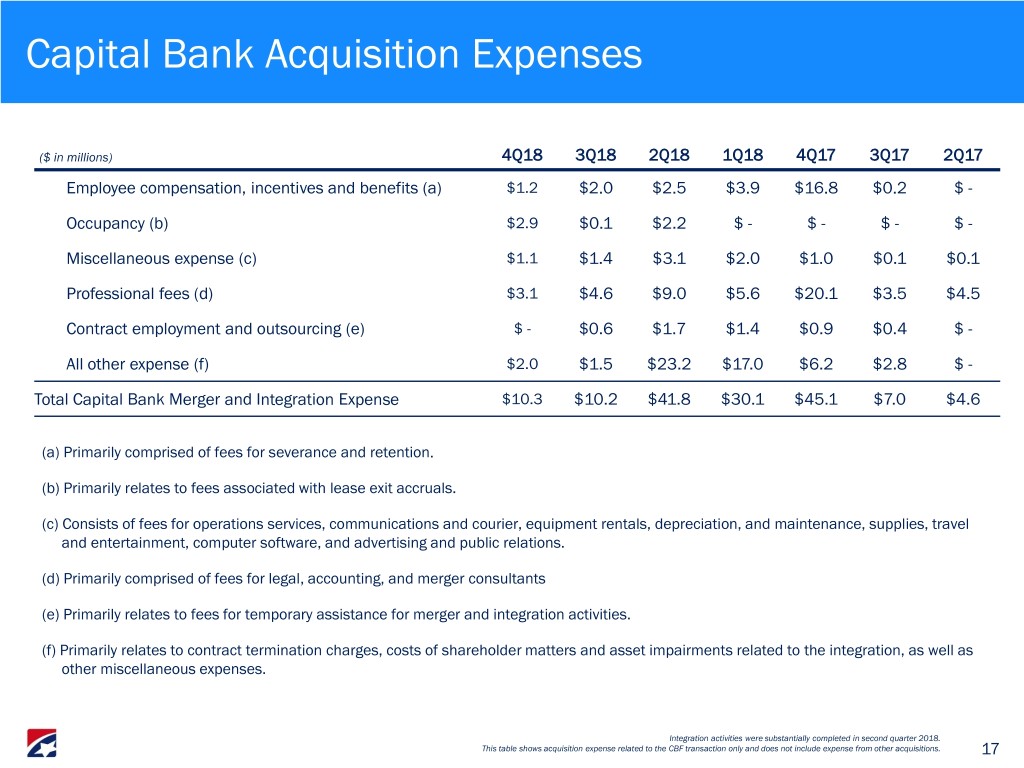

Capital Bank Acquisition Expenses ($ in millions) 4Q18 3Q18 2Q18 1Q18 4Q17 3Q17 2Q17 Employee compensation, incentives and benefits (a) $1.2 $2.0 $2.5 $3.9 $16.8 $0.2 $ - Occupancy (b) $2.9 $0.1 $2.2 $ - $ - $ - $ - Miscellaneous expense (c) $1.1 $1.4 $3.1 $2.0 $1.0 $0.1 $0.1 Professional fees (d) $3.1 $4.6 $9.0 $5.6 $20.1 $3.5 $4.5 Contract employment and outsourcing (e) $ - $0.6 $1.7 $1.4 $0.9 $0.4 $ - All other expense (f) $2.0 $1.5 $23.2 $17.0 $6.2 $2.8 $ - Total Capital Bank Merger and Integration Expense $10.3 $10.2 $41.8 $30.1 $45.1 $7.0 $4.6 (a) Primarily comprised of fees for severance and retention. (b) Primarily relates to fees associated with lease exit accruals. (c) Consists of fees for operations services, communications and courier, equipment rentals, depreciation, and maintenance, supplies, travel and entertainment, computer software, and advertising and public relations. (d) Primarily comprised of fees for legal, accounting, and merger consultants (e) Primarily relates to fees for temporary assistance for merger and integration activities. (f) Primarily relates to contract termination charges, costs of shareholder matters and asset impairments related to the integration, as well as other miscellaneous expenses. Integration activities were substantially completed in second quarter 2018. This table shows acquisition expense related to the CBF transaction only and does not include expense from other acquisitions. 17

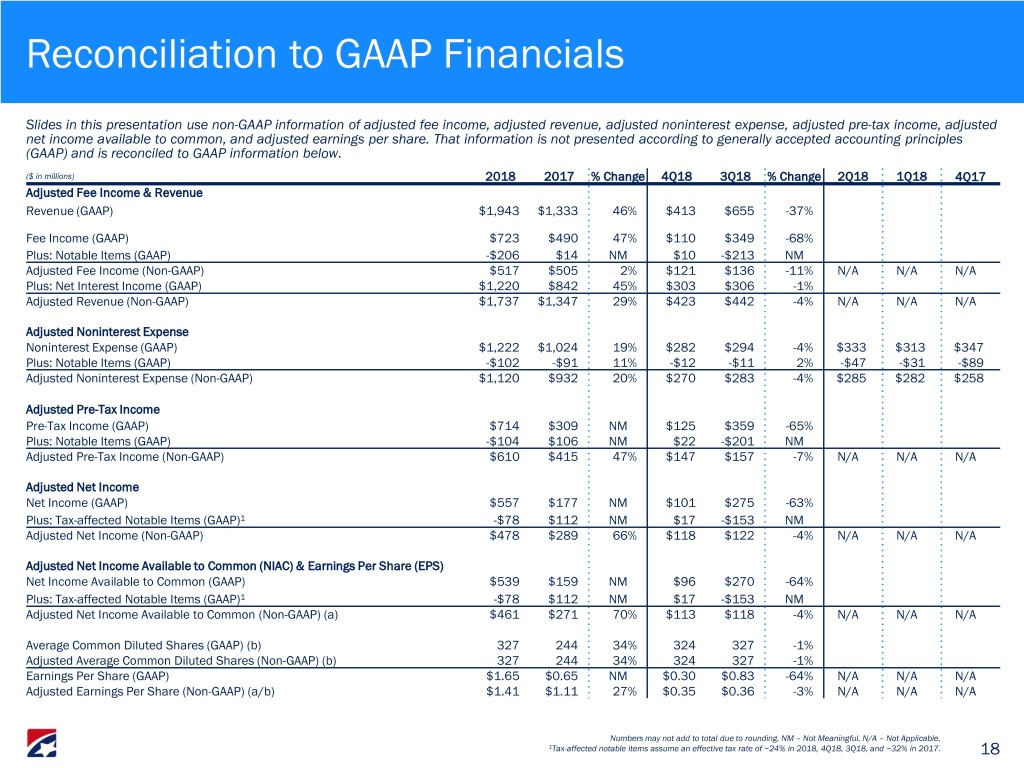

Reconciliation to GAAP Financials Slides in this presentation use non-GAAP information of adjusted fee income, adjusted revenue, adjusted noninterest expense, adjusted pre-tax income, adjusted net income available to common, and adjusted earnings per share. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. ($ in millions) 2018 2017 % Change 4Q18 3Q18 % Change 2Q18 1Q18 4Q17 Adjusted Fee Income & Revenue Revenue (GAAP) $1,943 $1,333 46% $413 $655 -37% Fee Income (GAAP) $723 $490 47% $110 $349 -68% Plus: Notable Items (GAAP) -$206 $14 NM $10 -$213 NM Adjusted Fee Income (Non-GAAP) $517 $505 2% $121 $136 -11% N/A N/A N/A Plus: Net Interest Income (GAAP) $1,220 $842 45% $303 $306 -1% Adjusted Revenue (Non-GAAP) $1,737 $1,347 29% $423 $442 -4% N/A N/A N/A Adjusted Noninterest Expense Noninterest Expense (GAAP) $1,222 $1,024 19% $282 $294 -4% $333 $313 $347 Plus: Notable Items (GAAP) -$102 -$91 11% -$12 -$11 2% -$47 -$31 -$89 Adjusted Noninterest Expense (Non-GAAP) $1,120 $932 20% $270 $283 -4% $285 $282 $258 Adjusted Pre-Tax Income Pre-Tax Income (GAAP) $714 $309 NM $125 $359 -65% Plus: Notable Items (GAAP) -$104 $106 NM $22 -$201 NM Adjusted Pre-Tax Income (Non-GAAP) $610 $415 47% $147 $157 -7% N/A N/A N/A Adjusted Net Income Net Income (GAAP) $557 $177 NM $101 $275 -63% Plus: Tax-affected Notable Items (GAAP)1 -$78 $112 NM $17 -$153 NM Adjusted Net Income (Non-GAAP) $478 $289 66% $118 $122 -4% N/A N/A N/A Adjusted Net Income Available to Common (NIAC) & Earnings Per Share (EPS) Net Income Available to Common (GAAP) $539 $159 NM $96 $270 -64% Plus: Tax-affected Notable Items (GAAP)1 -$78 $112 NM $17 -$153 NM Adjusted Net Income Available to Common (Non-GAAP) (a) $461 $271 70% $113 $118 -4% N/A N/A N/A Average Common Diluted Shares (GAAP) (b) 327 244 34% 324 327 -1% Adjusted Average Common Diluted Shares (Non-GAAP) (b) 327 244 34% 324 327 -1% Earnings Per Share (GAAP) $1.65 $0.65 NM $0.30 $0.83 -64% N/A N/A N/A Adjusted Earnings Per Share (Non-GAAP) (a/b) $1.41 $1.11 27% $0.35 $0.36 -3% N/A N/A N/A Numbers may not add to total due to rounding. NM – Not Meaningful. N/A – Not Applicable. 1Tax-affected notable items assume an effective tax rate of ~24% in 2018, 4Q18, 3Q18, and ~32% in 2017. 18

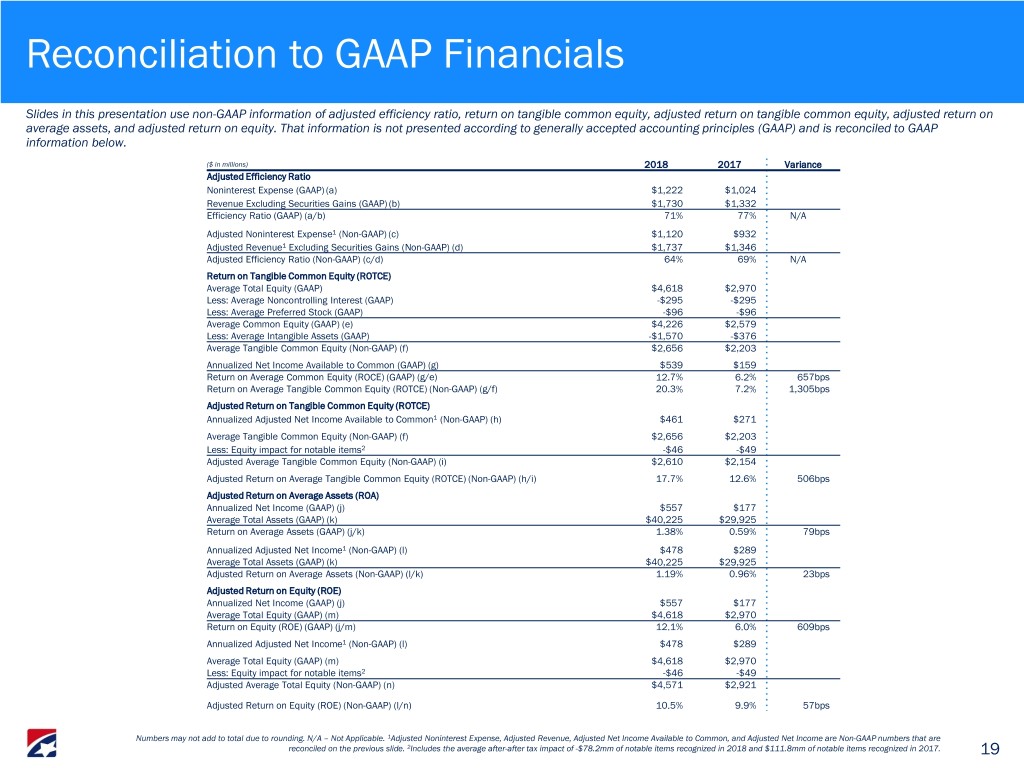

Reconciliation to GAAP Financials Slides in this presentation use non-GAAP information of adjusted efficiency ratio, return on tangible common equity, adjusted return on tangible common equity, adjusted return on average assets, and adjusted return on equity. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. ($ in millions) 2018 2017 Variance Adjusted Efficiency Ratio Noninterest Expense (GAAP) (a) $1,222 $1,024 Revenue Excluding Securities Gains (GAAP) (b) $1,730 $1,332 Efficiency Ratio (GAAP) (a/b) 71% 77% N/A Adjusted Noninterest Expense1 (Non-GAAP) (c) $1,120 $932 Adjusted Revenue1 Excluding Securities Gains (Non-GAAP) (d) $1,737 $1,346 Adjusted Efficiency Ratio (Non-GAAP) (c/d) 64% 69% N/A Return on Tangible Common Equity (ROTCE) Average Total Equity (GAAP) $4,618 $2,970 Less: Average Noncontrolling Interest (GAAP) -$295 -$295 Less: Average Preferred Stock (GAAP) -$96 -$96 Average Common Equity (GAAP) (e) $4,226 $2,579 Less: Average Intangible Assets (GAAP) -$1,570 -$376 Average Tangible Common Equity (Non-GAAP) (f) $2,656 $2,203 Annualized Net Income Available to Common (GAAP) (g) $539 $159 Return on Average Common Equity (ROCE) (GAAP) (g/e) 12.7% 6.2% 657bps Return on Average Tangible Common Equity (ROTCE) (Non-GAAP) (g/f) 20.3% 7.2% 1,305bps Adjusted Return on Tangible Common Equity (ROTCE) Annualized Adjusted Net Income Available to Common1 (Non-GAAP) (h) $461 $271 Average Tangible Common Equity (Non-GAAP) (f) $2,656 $2,203 Less: Equity impact for notable items2 -$46 -$49 Adjusted Average Tangible Common Equity (Non-GAAP) (i) $2,610 $2,154 Adjusted Return on Average Tangible Common Equity (ROTCE) (Non-GAAP) (h/i) 17.7% 12.6% 506bps Adjusted Return on Average Assets (ROA) Annualized Net Income (GAAP) (j) $557 $177 Average Total Assets (GAAP) (k) $40,225 $29,925 Return on Average Assets (GAAP) (j/k) 1.38% 0.59% 79bps Annualized Adjusted Net Income1 (Non-GAAP) (l) $478 $289 Average Total Assets (GAAP) (k) $40,225 $29,925 Adjusted Return on Average Assets (Non-GAAP) (l/k) 1.19% 0.96% 23bps Adjusted Return on Equity (ROE) Annualized Net Income (GAAP) (j) $557 $177 Average Total Equity (GAAP) (m) $4,618 $2,970 Return on Equity (ROE) (GAAP) (j/m) 12.1% 6.0% 609bps Annualized Adjusted Net Income1 (Non-GAAP) (l) $478 $289 Average Total Equity (GAAP) (m) $4,618 $2,970 Less: Equity impact for notable items2 -$46 -$49 Adjusted Average Total Equity (Non-GAAP) (n) $4,571 $2,921 Adjusted Return on Equity (ROE) (Non-GAAP) (l/n) 10.5% 9.9% 57bps Numbers may not add to total due to rounding. N/A – Not Applicable. 1Adjusted Noninterest Expense, Adjusted Revenue, Adjusted Net Income Available to Common, and Adjusted Net Income are Non-GAAP numbers that are reconciled on the previous slide. 2Includes the average after-after tax impact of -$78.2mm of notable items recognized in 2018 and $111.8mm of notable items recognized in 2017. 19