Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - DIXIE GROUP INC | consentandeleventhamendmen.htm |

| 8-K - 8-K - DIXIE GROUP INC | a8kleasebackclosing.htm |

Exhibit 10.2

AGREEMENT FOR THE PURCHASE

AND SALE OF REAL PROPERTY

THIS AGREEMENT (this “Agreement”) is made and entered into by and between Saraland Industrial , LLC or assigns, a Alabama limited liability company whose address is 9325 Pflumm Road Lenexa, Kansas 66215 c/o Kevan Accord-Bridge Builder (agent for the LLC), (herein referred to as "Purchaser"), and TDG Operations LLC, a Georgia limited liability company whose address is 475 Reed Road, Dalton, GA 30720_ (herein referred to as "Seller") on this 15th day of November, 2018 (“Effective Date”).

W I T N E S S E T H :

WHEREAS, Seller owns and desires to sell to Purchaser and Purchaser desires to acquire from Seller certain real property more particularly hereinafter described upon the terms and conditions hereinafter set forth; and

WHEREAS, simultaneously with the sale of the real property, Purchaser desires to lease from the Seller the real property being conveyed herein on the terms substantially as contained in the form of lease (the “Lease”) attached hereto as Exhibit B, and to be guaranteed by The Dixie Group, Inc., the parent of Seller.

NOW, THEREFORE, for and in consideration of the premises, the mutual covenants and agreements herein set forth, and for other good and valuable consideration, the receipt, adequacy and sufficiency of which are hereby expressly acknowledged by the parties hereto, Seller and Purchaser do hereby covenant and agree as follows:

1. Agreement to Buy and Sell.

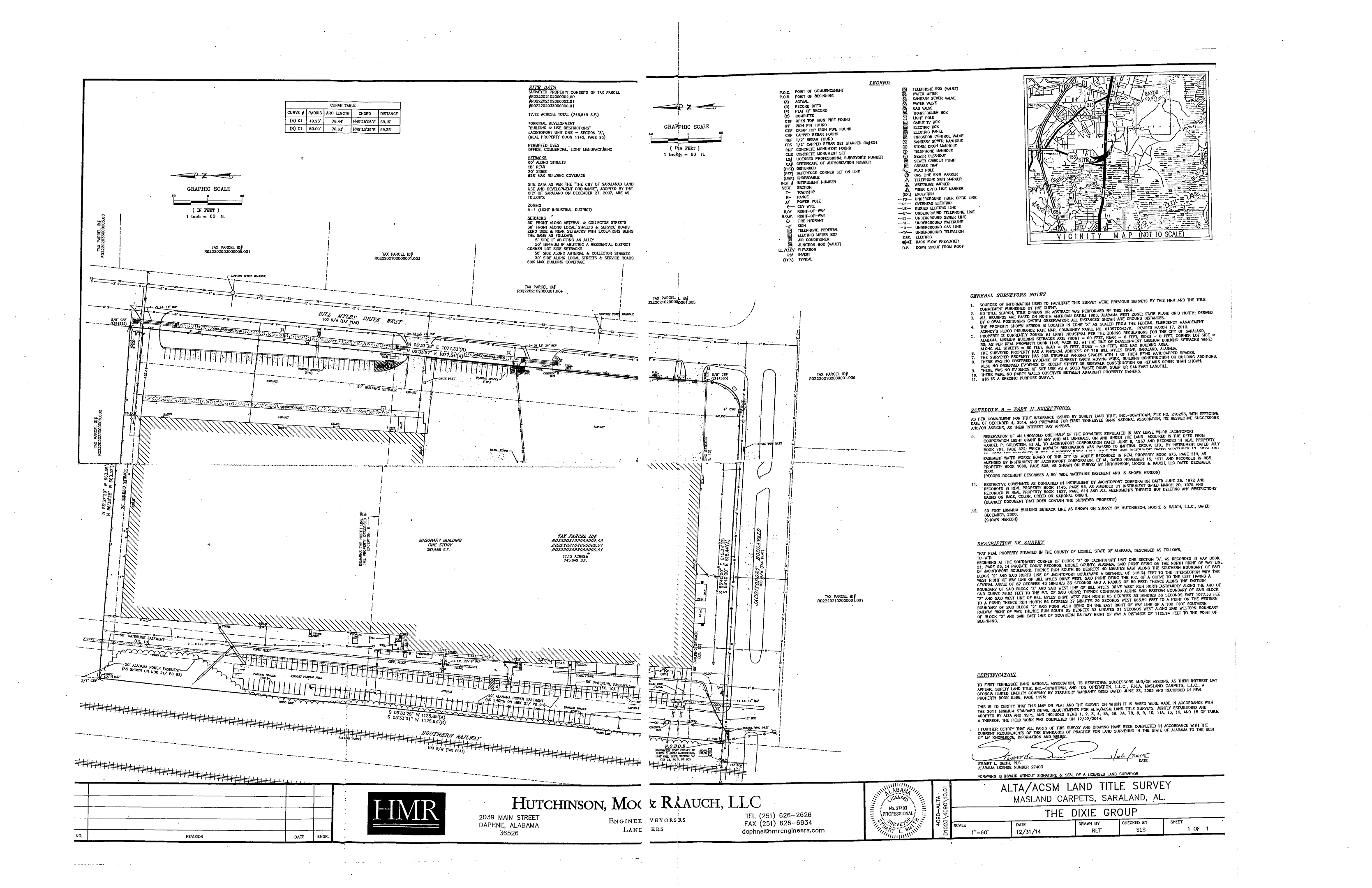

(a) Upon the terms and conditions set forth in this Agreement, Purchaser agrees to buy from Seller and Seller agrees to sell to Purchaser that certain real property located in Saraland, Alabama, containing industrial buildings on a site whose address is 716 Bill Myles Drive, Saraland, Alabama 36571, and which is legally described on Exhibit “A” attached hereto and made a part hereof, along with all easements, improvements and appurtenances thereto (“Property”).

2. Earnest Money. Purchaser will deliver, within three (3) business days of the Effective Date, the sum of One Hundred Thousand and No/100 Dollars ($100,000.00), as earnest money under the terms of this Agreement (the "Earnest Money"). The Earnest Money will be held in escrow by Surety Land Title, Inc., at 5909 Airport Blvd., Mobile, AL 36608, Attn: Charlie Gray (Phone: 251-343-4200) (“Escrow Agent”). The Earnest Money will be applied to the Purchase Price at Closing or otherwise paid to Seller or refunded to Purchaser in accordance with the terms of this Agreement.

3. Purchase Price. Purchaser shall pay to Seller, in consideration of the conveyance of the Property to Purchaser, and subject to adjustments and prorations as expressly provided herein, the purchase price of ELEVEN MILLION FIVE HUNDRED THOUSAND AND NO/100 DOLLARS ($11,500,000.00) (the "Purchase Price"), which Purchase Price shall be paid by Purchaser to Seller at the Closing (as hereinafter defined) by wire transfer of immediately available funds to an account designated by Seller. The Purchase Price shall not be subject to change due to any increase or decrease in the actual acreage of the Property revealed by the Survey, Purchaser’s inspection or otherwise.

4. Title. Within ten (10) days after the Effective Date, Seller will deliver to Purchaser electronic copies of any Property related items it may have in its files which may include environmental, reports, title insurance policy, site plans, surveys, building plans, tax bills for 2016,

2017 and 2018, utility bills-reports, zoning information, Licenses, permits, certificate of occupancy, building inspections/engineering reports, documentation of any major repairs or improvements in the last two years, roof and or other warranties. Seller shall also order from Escrow Agent a commitment (the “Title Commitment”) for an owner’s title policy (the “Title Policy”) to be issued by Chicago Title Insurance Company (the “Title Company”) in the amount of the Purchase Price. Should Purchaser elect to obtain an updated survey of the Property (“Survey”), Purchaser will obtain the Survey at its expense.

So long as Purchaser has received the Title Commitment within ten (10) days after the Effective Date hereof, Purchaser shall have until the twentieth (20th) day of the Inspection Period (which is defined in Paragraph 7), or extended for any days receipt of the Title Commitment is delayed past the 10-day period described above, to examine title and any survey of the Property. Purchaser will advise Seller, in writing, of any defects or objections affecting the title to the Property or the use thereof by Purchaser disclosed by such title and/or survey review no later than the twentieth (20th) day of the Inspection Period or as extended above. Such matters as are disclosed by Purchaser's title and/or survey review and not objected to by Purchaser in a timely manner, and all exceptions disclosed in the documents identified in the first paragraph of this Section 4, are herein referred to as the "Permitted Exceptions". In addition, if Purchaser elects not to order a new Survey, the term “Permitted Exceptions” shall include any matter that would have been revealed by an ALTA survey. If the Inspection Period terminates without Purchaser providing written notice of termination to Seller, the Earnest Money shall become non-refundable and shall be applied toward the Purchase Price at Closing, but if the Closing fails to occur in a timely fashion as required hereunder due to Purchaser’s breach of this Agreement, the Earnest Money shall be promptly paid over to Seller by the Escrow Agent after the last day for Closing has passed unless Purchaser notifies Escrow Agent

and Seller in writing of a breach by the Seller of this Agreement (such notice shall expressly state the grounds for declaring Seller in breach).

Seller shall have five (5) days after receipt of such written notice from Purchaser setting forth any defects or objections from Purchaser’s review of title or any survey of the Property (the “Title Objections”) to advise Purchaser in writing which of such Title Objections Seller does not intend to satisfy or cure; provided, however, Seller hereby agrees that Seller shall satisfy or cure any such defects or objections consisting of taxes, mortgages, mechanic's or materialmen's liens or other such monetary encumbrances (the “Monetary Encumbrances”), which Seller may elect to satisfy at Closing out of the sales proceeds of the Property. In the event Seller fails to give such written advice to Purchaser within such five (5) day period, Seller shall be deemed to have elected not to cure any Title Objections that are not Monetary Encumbrances. If Seller shall advise Purchaser in writing that Seller does not intend to satisfy or cure any Title Objections which are not Monetary Encumbrances, or if Seller is deemed to have elected not to cure such Title Objections, Purchaser may elect either (a) to terminate this Agreement by written notice to Seller, in which event the Earnest Money shall be immediately refunded to Purchaser, and this Agreement shall be of no further force or effect, and Purchaser and Seller shall have no further rights, obligations or liabilities hereunder except for the Inspection Indemnity, or (b) to accept title subject to such specific Title Objections which are not Monetary Encumbrances as though they are Permitted Exceptions. Seller shall have until Closing to satisfy or cure all such Title Objections which Seller expressly agreed to satisfy or cure as provided above. In the event Seller fails or refuses to cure any Title Objections which are required herein to be satisfied or cured by Seller prior to the Closing, then, at the option of Purchaser, (i) Purchaser may terminate this Agreement by written notice to Seller, in which event the Earnest Money shall be immediately refunded to Purchaser; Seller shall reimburse up to $25,000

of Purchaser’s actual 3rd party expenses incurred in its review of the Property; and this Agreement shall be of no further force and effect and Purchaser and Seller shall have no further rights, obligations or liabilities hereunder except for the Inspection Indemnity, or (ii) Purchaser may accept title to the Property subject to such uncured Title Objections as though they are Permitted Exceptions.

5. Closing and Closing Date. Unless extended by other provisions of this Agreement, the Closing shall be held on or before the date which is thirty (30) days after the expiration of the Inspection Period defined in Paragraph 7 below (the “Closing Date”).

At Closing, Seller shall execute and deliver to Purchaser (a) a Special Warranty Deed conveying fee simple marketable record title to the Property to Purchaser free and clear of all liens, special assessments, easements, reservations, restrictions and encumbrances whatsoever, excepting only the Permitted Exceptions (“Deed”); (b) an Affidavit of Seller which has as its subject matter averments that, with respect to the Property, there are no rights or claims of parties in possession not shown by the public records and that there are no liens, or rights to a lien, for services, labor or materials furnished and/or imposed by law and not shown by the public records; (c) an Affidavit of Seller stating that Seller is not a "foreign person", as that term is defined in Section 1445 of the Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder, and otherwise in form and content sufficient to eliminate Purchaser's withholding obligations under said Section 1445 with respect to the sale and purchase of the Property; (d) such information as is required for Purchaser to file IRS Form 1099‑S; (e) a broker’s lien affidavit signed by Seller, Purchaser and the Broker, as described herein; (f) the Lease, in substantially the form attached hereto as Exhibit B, and a Memorandum of Lease, in substantially the form attached hereto as Exhibit C; (g) any and all other documents deemed reasonably necessary by Purchaser, Seller, the Title Company, or

other governmental requirement to consummate the transaction contemplated herein in accordance with the terms of this Agreement (“Other Documents”); and (h) a signed counterpart of a closing statement.

At the Closing, the Purchaser shall deliver to Seller (a) the Purchase Price after deduction of the Earnest Money and adjustments for prorations as required herein, all in accordance with Section 3 of this Agreement; (b) a signed counterpart of a closing statement; (c) the broker’s lien affidavit; (d) the Lease and Memorandum of Lease; and (e) the Other Documents.

6. Expenses and Prorations. Since Seller will be leasing the Property under an absolute triple net lease, there is no need to prorate ad valorem real estate taxes, but Seller shall have paid the real estate taxes for 2018 and any previous year before Closing. At Closing, Seller shall pay the costs of the Title Policy and any recording fees or taxes for recording the Deed. Any closing escrow fees charged by the Title Company shall be split equally between Seller and Purchaser. Seller shall also, at Closing, pay its own attorneys’ fees and any recording fees and taxes for recording the Memorandum of Lease. Purchaser shall, at Closing, pay its own attorneys’ fees, the cost of any new Survey it obtains, the costs of any endorsements to the Title Policy required by Purchaser as well as the cost of any lender title insurance policy, the costs of any financing the Purchaser obtains to consummate the purchase hereunder including costs to record any mortgage lien against the Leased Premises, and any costs associated with any 1031 transaction which may involve the Purchaser.

7. Conditions of Purchase.

(a) Purchaser and its agents, employees and independent contractors shall have a period of thirty (30) days from the Effective Date (the “Inspection Period”) in which to conduct, at Purchaser’s sole expense, such physical, non-invasive environmental, engineering and feasibility

reports, inspections, examinations, tests and studies as Purchaser deems appropriate in an effort to determine, if Purchaser elects to purchase the Property. Any invasive testing on the Property shall be subject to prior review and approval by Seller but Seller’s consent to such testing shall not be unreasonably withheld, conditioned or delayed. If Purchaser elects not to purchase the Property, it must notify Seller on or before the expiration of the Inspection Period at which point it will be entitled to a return of the Earnest Money. Failure to notify Seller of its intent to terminate this Agreement within the Inspection Period will be deemed an election to proceed to Closing, in which event the Earnest Money will be considered non-refundable and paid to Seller if Closing fails to occur for any reason except for Seller’s default.

(b) During the Inspection Period, Purchaser, Purchaser’s agents, employees and independent contractors shall have the right to come onto the Property, after providing reasonable notice to Seller, for the purpose of conducting the foregoing reports, inspections, examinations, tests and studies as described herein, so long as their entry does not unreasonably disturb the Seller’s business operating on the Property. Copies of all such reports, inspections, examinations, tests and studies shall be provided to Seller in the event of: (1) termination of this Agreement by Purchaser, or (2) Purchaser’s default under the terms of this Agreement; provided that Seller shall be solely responsible for the reasonable costs of such copies only. Any report, inspection, examination, test or study shall not unreasonably interfere with Seller’s use of the Property and shall not violate any law or regulation of any governmental entity having jurisdiction over the Property. Upon the completion of any inspection, examination, test or study, if any, Purchaser shall restore the Property to its former condition. Purchaser hereby agrees to indemnify, defend, and hold Seller, and its affiliates, and their respective owners, managers, directors, officers, employees, and agents free and harmless from and against any and all liabilities (including attorneys’ fees and expenses) arising

out of or relating to the entry on the Property and/or the conduct of any due diligence by Purchaser or any agent or consultant of Purchaser (the “Inspection Indemnity”). The Inspection Indemnity shall survive the closing or the earlier termination of this Agreement for the applicable statute of limitations. Prior to entering the Property,

Purchaser’s third-party inspectors shall provide Seller evidence of liability insurance policy(ies) in force, of at least $1,000,000.00, covering Purchaser, its employees and agents, and naming Seller as an additional insured.

8. Defaults. In the event Seller fails to comply with or perform any of the covenants, agreements and obligations to be performed by Seller under the terms and provisions of this Agreement: (i) Purchaser shall be entitled to exercise any and all rights and remedies available to Purchaser at law or in equity including, without limitation, specific performance; or (ii) Purchaser shall be entitled, upon giving written notice to Seller as herein provided, to terminate this Agreement. Upon any such termination, all Earnest Money shall be immediately returned to Purchaser; Seller shall reimburse up to $25,000 of Purchasers actual out of pocket 3rd party cost related to inspection of the Property; and this Agreement and all rights and obligations created hereunder shall be deemed of no further force or effect except for the Inspection Indemnity which survives Closing. The Escrow Agent will release the Earnest Money to Purchaser upon receipt of written notice from Seller and Purchaser that this Agreement has been terminated, whether by reason of the default of the Seller or any other event which permits the Purchaser to request the return of the Earnest Money. In the event Purchaser fails to purchase the Property in accordance with the terms of this Agreement, Seller's sole and exclusive remedy for any such default shall be to terminate this Agreement and to receive the Earnest Money and retain the Earnest Money as full liquidated damages for such default, the parties hereto acknowledging that it is impossible to more precisely estimate the damages to be

suffered by Seller upon Purchaser's default. Upon any such termination, all rights and obligations created hereby shall terminate and be of no further force or effect whatsoever except for the Inspection Indemnity which survives Closing.

9. Condemnation and Casualty. In the event the Property or any portion or portions thereof shall be taken or condemned by any governmental authority or other entity prior to the Closing Date, or in the event Purchaser receives notice of a proposed taking prior to the Closing Date, or in the event of a casualty loss which exceeds Two Hundred Fifty Thousand Dollars ($250,000.00), Purchaser shall have the option of either (a) terminating this Agreement by giving written notice thereof to the other, whereupon all Earnest Money shall be immediately refunded to Purchaser and this Agreement and all rights and obligations created hereunder shall be of no further force or effect except for the Inspection Indemnity, or (b) if no termination is requested, requiring Seller to convey the remaining portion of the Property to Purchaser pursuant to the terms and provisions hereof (without adjustment to the Purchase Price for such taking) and to transfer and assign to Purchaser at Closing all of Seller's right, title and interest in and to any award made or to be made by reason of such condemnation or any insurance proceeds.

10. Broker. Stream Capital Partners, LLC (“Seller’s Broker”) represents the Seller. Seller shall pay Seller’s Broker a fee at Closing pursuant to separate agreement. Purchaser and Seller represent and warrant to each other that, except for the Seller’s Broker and Purchaser’s Broker listed above, there are no brokers connected with the sale of the Property. To the extent Seller or Purchaser have an obligation to pay any broker, Seller and Purchaser will hold each other harmless and indemnify the other party from any liability related to the payment of any commission or fee such party may owe to a broker or the Broker or any other party related to the sale of the Property.

11. Notices. Every notice, approval, consent, or other communication authorized or required by this Agreement shall not be effective unless the same shall be in writing and delivered (i) by courier, (ii) by reputable overnight courier guaranteeing next day delivery, (iii) sent postage prepaid by United States registered or certified mail, return receipt requested, directed to the other party at its address hereinabove first mentioned, or such other address as either party may designate by notice given from time to time in accordance with this Paragraph, or (iv) by electronic mail, so long as such electronic mail notice is also sent via one of the methods in (i)-(iii) using the following contact information:

Notices to Seller shall be sent to: TDG Operations LLC

475 Reed Road

Dalton, GA 30720

Attention: Jon Faulkner

Email: jon.faulkner@dixiegroup.com

With copy to: Miller & Martin PLLC

832 Georgia Avenue, Suite 1200

Chattanooga, TN 37402

Attention: Robert Dann

Email: bobby.dann@millermartin.com

Notices to Purchaser shall be sent to: Saraland Industrial LLC

c/o Bridge Builder 9325 Pflumm Road

Lenexa Kansas 66215

Attention: Kevan Acord

Email: KAcord@bbtaxlaw.com

Such notices or other communications shall be effective (i) in the case of courier delivery, on the date of delivery to the party to whom such notice is addressed as evidenced by a written receipt signed on behalf of such party, (ii) if by overnight courier, one (1) day after the deposit thereof with

all delivery charges prepaid, (iii) in the case of registered or certified mail, the earlier of the date receipt is acknowledged on the return receipt for such notice or five (5) business days after the date of posting by the United States Post Office, and (iv) in the case of electronic mail, upon the date of transmission provided that delivery thereof is acknowledged by the receiving party. Notices served on a party’s attorney shall be deemed effective service upon the party and notices served from a party’s attorney shall be deemed effective service by a party.

12. General Provisions. No failure of either party to exercise any power given hereunder or to insist upon strict compliance with any obligation specified herein, and no custom or practice at variance with the terms hereof, shall constitute a waiver of either party's right to demand exact compliance with the terms hereof. This Agreement contains the entire agreement of the parties hereto, and no representations, inducements, promises or agreements, oral or otherwise, between the parties not embodied herein shall be of any force or effect. Any amendment to this Agreement shall not be binding upon any of the parties hereto unless such amendment is in writing and executed by both Seller and Purchaser. The provisions of this Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, administrators, executors, personal representatives, successors and assigns. At the election of Purchaser, this transaction shall be closed in the name of and the deed delivered to its nominee or assigns. Time is of the essence of this Agreement. This Agreement and all amendments hereto shall be governed by and construed under the laws of Alabama. This Agreement may be executed in multiple counterparts, each of which shall constitute an original, but all of which taken together shall constitute one and the same agreement. All personal pronouns used in this Agreement, whether used in the masculine, feminine or neuter gender, shall include all genders, the singular shall include the plural and vice versa. The headings inserted at the beginning of each paragraph are for convenience only, and do not add to

or subtract from the meaning of the contents of each paragraph. Seller and Purchaser do hereby covenant and agree that such documents as may be legally necessary or otherwise appropriate to carry out the terms of this Agreement shall be executed and delivered by each party at the Closing.

13. Day for Performance. Wherever herein there is a day or time period established for performance and such day or the expiration of such time period is a Saturday, Sunday or holiday, then such time for performance shall be automatically extended to the next business day.

14. Survival of Provisions. All covenants, warranties and agreements set forth in this Agreement shall survive the Closing of the transaction contemplated hereby and shall survive the execution or delivery of any and all deeds and other documents at any time executed or delivered under, pursuant to or by reason of this Agreement, and shall survive the payment of all monies made under, pursuant to or by reason of this Agreement.

15. Severability. This Agreement is intended to be performed in accordance with, and only to the extent permitted by, all applicable laws, ordinances, rules, and regulations. If any provision of this Agreement, or the application thereof to any person or circumstance, shall for any reason and to any extent be invalid or unenforceable, the remainder of this Agreement and the application of such provision to other persons or circumstances shall not be affected thereby but rather shall be enforced to the greatest extent permitted by law.

16. Lease Agreement. Seller and Purchaser have entered into this Contract with the understanding and agreement that, as an integral part of the Closing, Purchaser will enter into a lease, as landlord, with Seller as tenant at Closing. The parties’ mutual agreement, execution and delivery of the Lease in substantially the form attached hereto as Exhibit B shall be an absolute prerequisite to each party’s obligation to close the purchase and sale contemplated by this Agreement.

17. Representations and Warranties. Seller hereby makes the following representations and warranties to Seller’s actual knowledge, each of which individual representations and warranties (i) is material and being relied upon by Purchaser and (ii) is true in all material respects as of the effective date hereof and (iii) and shall be true in all material respects on the Closing Date:

i) Seller has good, marketable and insurable title to the Property and, at Closing, if this Agreement is not sooner terminated, will convey the Property free and clear of all liens, covenants, conditions, restrictions, rights-of-way, easements and encumbrances, except the Lease and the Permitted Exceptions.

ii) There are no existing, pending or threatened mechanic's liens, contractor's claims, unpaid bills for material or labor pertaining to the Property, nor any other similar items of like nature which might adversely affect the Property, or Seller's title thereto. No party other than Seller is in possession of the Property and no party has been granted any lease, license or other right relating to the Property.

iii) All public utilities including, without limitation, storm sewer, gas, electricity, water, sanitary sewer and telephone service, are available on the Property.

iv) Neither this Agreement, nor anything provided to be done hereunder, including but not limited to the transfer, assignment and sale of the Property, violates or shall violate any contract, agreement or instrument to which Seller is a party, or affects the Property or any part thereof; except the consent of Seller’s current lender, Wells Fargo Capital, which consent shall be obtained within ten (10) days of the Effective Date.

v) Except as disclosed in the environmental report(s) provided to Purchaser hereunder, there are no Hazardous Materials presently located on the surface or in the subsurface of the Property or in the ground waters running on or under the Property, except as used in the ordinary and normal course of business and in material compliance with Applicable Environmental Laws (as hereinafter defined); to Seller’s actual knowledge there are no underground fuel storage tanks located on the Property; and, to Seller’s actual knowledge, the Property is not now and has never been used to store, treat, dispose or dump Hazardous Materials, except in the ordinary and normal course of business and in material compliance with Applicable Environmental Laws. “Applicable Environmental Laws” means all federal, state and local or municipal, statutory, regulatory and common law requirements relating to the protection of human health and safety or the environment

vi) There is full, free and adequate access to the Property to and from public highways and right-of-ways, and Seller has no knowledge of any fact or condition which would result in the termination of such access, or of any restriction on or participation in the use of the parking areas. To the best of Seller’s knowledge, the current uses of the Property comply with the current zoning restrictions on the Property.

vii) There is no action, suit, arbitration, unsatisfied order or judgment, governmental investigation or proceeding pending against the Property or the transaction contemplated by this Agreement, which, if adversely determined, could individually or in the aggregate have a material adverse effect on title to or the current use or occupancy of the Property or any portion thereof or which could in any material way interfere with the consummation by Seller of the transaction contemplated by this Agreement.

viii) Seller shall not sell or encumber any of the Property or execute any leases or contracts affecting the Property between the Effective Date and the Closing Date without the prior consent of Purchaser.

ix) Seller has no actual knowledge of any latent defects or structural problems effecting the property.

(x) The undersigned is authorized to sign this agreement on behalf of the Seller.

[Signatures on Following Pages]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date set forth above.

"PURCHASER"

Saraland Industrial LLC

a Alabama LLC

/s/ Gary C. Carry By: _/s/ Kevan D. Acord________________

Witness Name: Kevan D. Acord

Its: Manager

"SELLER”

TDG OPERATIONS, LLC

a Georgia limited liability company

/s/Anna Whitman By: /s/ Daniel Frierson

Witness Name: Daniel Frierson

Its: CEO__

EXHIBIT "A"

LEGAL DESCRIPTION

EXHIBIT “B”

FORM OF LEASE

LEASE AGREEMENT

THIS LEASE (“Lease”) is made and entered into this ______ day of January, 2019, by and between Saraland Industrial, LLC, an Alabama limited liability company, or Assigns (“Landlord”), and TDG Operations LLC, a Georgia limited liability company (“Tenant”), and The Dixie Group, Inc., a Tennessee corporation (“Guarantor”), upon the following terms and conditions:

ARTICLE I

GRANT AND TERM

1.01 Leased Premises. Landlord demises and leases to Tenant, and Tenant rents from Landlord, the real property described on Exhibit “A” attached hereto and incorporated herein and existing improvements thereon (said real property and the buildings and improvements located thereon from time to time herein called the “Property”), located in Saraland, Alabama; any additions to the Property, any loading docks and all other appurtenances to the Property, all parking lots, public walkways, aisles and driveways for ingress and egress to said improvements and parking areas and to and from the streets and highways, the storm water retention basin, if any, all landscaping, all utility lines and sewers to the perimeter walls of the Property or servicing such improvements, and existing signage, if any (collectively, the “Leased Premises”), IN ITS “AS IS” CONDITION, SUBJECT TO THE EXISTING STATE OF TITLE (WITHOUT EXPRESS OR IMPLIED WARRANTY OF LANDLORD WITH RESPECT TO THE CONDITION, QUALITY, REPAIR OR FITNESS OF THE LEASED PREMISES FOR A PARTICULAR USE OR TITLE THERETO, ALL SUCH WARRANTIES BEING HEREBY WAIVED AND RENOUNCED BY TENANT), AND THE MINIMUM RENT (AS HEREINAFTER DEFINED) AND ALL OTHER SUMS PAYABLE HEREUNDER BY TENANT SHALL IN NO CASE BE WITHHELD OR DIMINISHED ON ACCOUNT OF ANY DEFECT IN SUCH LEASED PREMISES, ANY CHANGE IN THE CONDITION THEREOF, ANY DAMAGE OCCURRING THERETO OR THE EXISTENCE WITH RESPECT THERETO OF ANY VIOLATION OF LAWS EXCEPT AS OTHERWISE PROVIDED HEREIN.

1.02 Commencement of Rental. Tenant’s obligation to pay rent shall commence on the date hereof.

1.03 Length of Term. Subject to Landlord’s right to terminate, the term (“Term”) of this Lease shall be for a period of twenty (20) years, commencing with the commencement date determined in accordance with Section 1.02 hereof. If said commencement date is other than the first day of the month, the first year of the Lease term shall be deemed to be extended to include such partial month and the following twelve (12) months, so as to end on the last day of the month. So long as no Defaults exist and with (12) months written notice to Landlord then Tenant shall have Two (2) Ten (10) years option periods to renew the Lease under the same annual increases as provided in section 2.01 herein.

1.04 Acceptance of Leased Premises. Tenant accepts the Leased Premises “as-is.” No rights or remedies shall accrue to Tenant arising out of the condition of the Property. Exhibit “B” sets forth the general layout of the Property but shall not be deemed as a warranty, representation or agreement on the part of Landlord that the Property layout will be exactly as depicted on said exhibit.

ARTICLE I

RENT

2.01 Minimum Rent. “Minimum Rent” shall be payable by Tenant to Landlord in advance, without setoff, on the first day of each and every month throughout the Lease Term at Landlord’s office at P. O. Box 10485, Kansas City, Missouri 64171, or at such other place designated by Landlord, in the per annum amount of Nine Hundred Seventy-Seven Thousand Five Hundred and 00/100 Dollars ($977,500.00) for the first year of the Lease Term, payable in the amount of Eighty-One Thousand Four Hundred Fifty-Eight and 33/100 ($81,458.33) per month. The annual Minimum Rent shall increase each year on February 1st by 1.25% over the prior year’s Minimum Rent. Minimum Rent for any fractional month shall be prorated and payable in advance.

2.02 Taxes. During the term of this Lease, Tenant shall pay as additional rent, the real estate taxes and special taxes and current installments of assessments (collectively, the “taxes”) attributable to the Leased Premises. Tenant shall pay said taxes and assessments directly to said taxing authority and provide evidence of said payment to Landlord prior to delinquency. However, if required by Landlord’s lender (secured by the Leased Premises) or if Landlord reasonably believes that Tenant’s financial condition warrants Landlord holding a tax escrow, Landlord, at Landlord’s option, may bill Tenant on a monthly basis, based on one‑twelfth (1/12) of the estimated annual amount for taxes and assessments, and Tenant shall pay Landlord the amount of such billings within thirty (30) days of Tenant’s receipt of each such billing. Landlord agrees to supply to Tenant an explanation for the method of computing said taxes, or a copy of the prior assessment bill or statement of any governmental agencies owed tax. In the event Tenant does not make said payment as hereinabove required, Tenant shall be in default of this Lease. Additionally, with respect to taxes:

(a) Right to Contest Taxes and Assessments. Tenant, at its expense and with prior written notice to Landlord, may contest any and all such real estate taxes.

(b) Municipal, County, State or Federal Taxes. Tenant shall pay, before delinquency, all municipal, county and state or federal taxes assessed against any leasehold interest of Tenant or any fixtures, furnishings, equipment, stock-in-trade or other personal property of any kind owned, installed or used in or on the Leased Premises.

(c) Real Estate Tax. Real estate tax means: (i) any fee, license fee, license tax, business license fee, commercial rental tax, levy, charge, assessment, penalty or tax imposed by any taxing authority against the Property or land upon which the Property is located; (ii) any sales or other tax on Landlord’s right to receive, or the receipt of, rent or income from the Property or against Landlord’s business of leasing the Property but excluding any of Landlord’s “personal” income tax; (iii) any tax or charge for fire protection, streets,

sidewalks, road maintenance, refuse or other services provided to the Property by any governmental agency; (iv) any tax imposed upon this transaction or based upon a re‑assessment of the Property due to a change in ownership or transfer of all or part of Landlord’s interest in the Property; and (v) any charge or fee replacing any tax previously included within the definition of real property tax.

ARTICLE I

CONDUCT OF BUSINESS BY TENANT

3.01 Use of Premises. Tenant shall only use the Leased Premises for the purpose of manufacturing, storage, sale and distribution of flooring materials and products that are produced and distributed by Tenant; and including products and materials which are not materially different from Tenant’s primary business but for no other business or purpose or under any name other than under the name(s) which Tenant uses to market its products in its ordinary course of its business, without the prior written consent of Landlord. Consent may be subject to such conditions as Landlord deems appropriate, but shall not be unreasonably withheld or unduly delayed.

ARTICLE I

ALTERATIONS, LIENS AND SIGNS

4.01 Alterations. Tenant shall not, without Landlord’s prior written consent, either make or cause to be made any structural or exterior alterations, including additions and improvements, to the Leased Premises or to any exterior building signs or free-standing signs. Landlord shall not unreasonably withhold or delay its consent. Any alterations, additions or improvements consented to by Landlord shall be made at Tenant’s sole expense. Tenant shall secure any and all governmental permits, approvals or authorizations required in connection with any such work and shall hold Landlord harmless from any and all liability, costs, damages, expenses (including attorneys’ fees) and liens resulting therefrom. All alterations (expressly including all light fixtures and floor coverings, except trade fixtures, appliances and equipment that do not become a part of the Leased Premises), shall immediately become the property of Landlord. Upon completion of any such work, Tenant shall provide Landlord with “as built” plans, copies of all construction contracts, and proof of payment for all labor and materials.

4.02 Tenant Shall Discharge All Liens. Tenant shall promptly pay its contractors and materialmen for all work done and performed by Tenant, so as to prevent the assertion or imposition of liens upon or against the Leased Premises, and shall, upon request provide Landlord with lien waivers, and should any such lien be asserted or filed, Tenant shall bond against or discharge the same within thirty (30) days after written request by Landlord. In the event Tenant fails to remove said lien within said thirty (30) days, Landlord may at its sole option elect to satisfy and remove the lien by paying the full amount claimed or otherwise, without investigating the validity thereof, and Tenant shall pay Landlord upon demand the amount paid out by Landlord in Tenant’s behalf, including Landlord’s costs and expenses with interest or Tenant shall be in default hereunder.

Landlord’s election to discharge liens as provided hereunder shall not be construed to be a waiver or cure of Tenant’s default hereunder.

ARTICLE I

MAINTENANCE OF LEASED PREMISES, SURRENDER AND RULES

5.01 Net Lease.

5.02 This is an absolutely net lease and the Minimum Rent and all other sums payable hereunder by Tenant shall be paid without notice (except as may be expressly provided herein), demand, set-off, counterclaim, abatement, suspension, or deduction as “Additional Rent.” It is the intention of the parties hereto that the Minimum Rent shall be an absolute net lease to Landlord throughout the Term. In order that this Lease shall be absolutely net to Landlord, Tenant shall pay when due, and indemnify and hold Landlord harmless from and against, any and all claims, damages, losses, risks, liabilities, charges and expenses (including reasonable attorneys’ fees and costs) attributable to the Leased Premises, including each fine, fee, penalty, charge (including governmental charges), assessments, sewer rent, impositions, insurance premiums, utility expenses, carrying charges, costs, expenses and obligations of every kind and nature whatsoever, general and special, ordinary and extraordinary, foreseen and unforeseen, the payment for which Landlord or Tenant is, or shall become liable by reason of any rights or interest of Landlord or Tenant in, to or under the Leased Premises or this Lease or in any manner relating to the leasing, operation, management, maintenance, repair, replacement, reconstruction, use or occupation of the Leased Premises, or of any portion thereof.

5.03 This Lease shall not terminate, nor shall Tenant have any right to terminate this Lease, nor shall Tenant be entitled to any abatement or reduction of Minimum Rent hereunder, nor shall the obligations of Tenant under this Lease be affected, solely by reason of (i) any damage to or destruction of all or any part of the Leased Premises from whatever cause; (ii) the taking of the Leased Premises or any portion thereof by condemnation, requisition, eminent domain proceedings or otherwise for any reason, except as provided herein; (iii) any default on the part of Landlord under this Lease, or under any other agreement to which Landlord and Tenant may be parties, unless such default has a material adverse effect on Tenant’s ability to use the Leased Premises; or (iv) any other cause whether similar or dissimilar to the foregoing, any present or future law to the contrary notwithstanding unless otherwise specified herein. It is the intention of the parties hereto that the obligations of Tenant hereunder shall be separate and independent covenants and agreements, that the Minimum Rent and all other sums payable by Tenant hereunder (collectively, “Additional Rent”) shall continue to be payable in all events and that the obligations of Tenant hereunder shall continue unaffected unless the requirement to pay or perform the same shall have been terminated pursuant to any express provision of this Lease.

5.04 Tenant agrees that it will remain obligated under this Lease in accordance with its terms, and that it will not take any action to terminate, rescind or void this Lease, notwithstanding (i) the bankruptcy, insolvency, reorganization, composition, readjustment, liquidation, dissolution or winding-up or other proceeding affecting Landlord or its successor in interest, or (ii) any action

with respect to this Lease which may be taken by any trustee or receiver of Landlord or its successor in interest or by any court in any such proceeding.

5.05 Except as otherwise expressly provided herein, Tenant waives all rights which may now or hereafter be conferred by law (i) to quit, terminate or surrender this Lease or the Leased Premises or any part thereof, or (ii) to any abatement, suspension, deferment or reduction of the Minimum Rent or any other sums payable under this Lease.

5.06 Landlord shall have no obligation to provide any services, perform any acts or pay any expenses, charges, obligations or costs of any kind whatsoever with respect to the Leased Premises, and Tenant hereby agrees to pay one hundred percent (100%) of any and all Operating Expenses as hereafter defined for the entire term of the Lease and any extensions thereof in accordance with specific provisions hereinafter set forth. The term “Operating Expenses” shall include, but shall not be limited to, the total costs and expenses incurred in operating, maintaining, protecting, managing, replacing and repairing the exterior and interior of the building and all building facilities on the Leased Premises, the parking and sidewalk areas on the Leased Premises, and any other improvements on the Leased Premises, including, without limitation, the cost and expense of the following: snow removal, landscaping, planting, replanting, and replacing flowers, shrubbery and other plantings; repairs and maintenance, painting and decorating of the building and other improvements; electricity, water, gas and other utilities (including, without limitation, all expenditures intended to reduce the cost of any utilities); maintenance, repair and replacement of fixtures, bulbs and any and all building systems and parts thereof and thereto; sanitary control, extermination, and sump maintenance and improvements; removal of rubbish, garbage and other refuse; security systems and policing of the building and facilities; sewer charges; structural and building repairs and replacements; heating, ventilating and air conditioning the building; cleaning and janitorial services; maintenance of decorations, and lavatories; maintenance and repair of all doors and glass in common areas and building roof and exterior walls and glass; fire sprinkler systems; cost of personnel directly involved in implementing all of the aforementioned (including wages, uniforms, fringe benefits and workers’ compensation insurance covering personnel); sale and excise taxes and the like upon any of the expenses enumerated herein any and all other expenditures with respect to the operation, repair, maintenance, protection and management of the Leased Premises. It is specifically understood and agreed that Landlord shall have no obligation to expend any monies with regard to the Leased Premises during the term of this Lease and any extensions thereof.

5.07 Tenant shall, at its sole cost and expense, keep the Leased Premises in good order and repair, including, without limitation, structural maintenance, non-structural exterior maintenance, the roof and walls, as well as the interior of the Leased Premises in good repair. Tenant shall timely and properly maintain, repair and replace all parking surfaces and stripes, driveways, all landscaping, mechanical systems, electrical and lighting systems, plumbing and sewage systems, fixtures and appurtenances, interior and exterior walls, roof, foundations, floor slabs, columns and structural elements. All such maintenance, repair or replacement shall be performed so as to to preserve the effectiveness of any warranty relating thereto and all such repairs and replacements shall be at least equal in quality and class to the original work. Tenant further agrees, at its expense, to keep the Leased Premises free of obstructions, clean, swept and in good repair, reasonable wear

and tear excepted, to remove snow and ice therefrom, and to keep the parking area properly lighted during hours of darkness. Tenant shall keep in good repair all exterior supply lines for and up to the Leased Premises for water, gas and sewers (including sanitary sewers, which shall be Tenant’s responsibility) and electrical utility lines on or relating to the Leased Premises. Tenant shall not commit waste upon the Leased Premises and at the end of the Term shall deliver same to Landlord in as good a condition as the Leased Premises were as of the Commencement Date, reasonable wear and tear and damage by insured casualty excepted. Tenant shall maintain the Leased Premises in compliance with all applicable Laws.

5.08 It is intended by Tenant and Landlord that Landlord shall have no obligation, in any manner whatsoever, to repair or maintain the Leased Premises (or any fixture or equipment therein), whether structural or nonstructural, all of which obligations are intended, as between Landlord and Tenant, to be those of Tenant. Tenant expressly waives the benefit of any Laws now or in the future in effect which would otherwise afford Tenant the right to make repairs at Landlord’s expense or to terminate this Lease because of Landlord’s failure to keep the Leased Premises in good order, condition and repair. Tenant hereby assumes the full and sole responsibility for the condition, operation, repair, replacement, maintenance and management of the Leased Premises. Notwithstanding the foregoing, on Tenant’s event of default, and following Tenant’s receipt of a written notice from Landlord which specifies the nature of such non-monetary default, and after a reasonable time to cure, Landlord may, but shall not be required to, make such repairs or replacements for Tenant’s account. On demand, Tenant shall reimburse Landlord for the costs and expenses incurred by Landlord in connection with such repairs or replacements.

5.09 Surrender of Premises. At the expiration of the tenancy hereby created, Tenant shall peaceably surrender the Leased Premises, including all alterations, additions, improvements, decorations and repairs made thereto which were approved by Landlord (but excluding all trade fixtures, equipment, signs and other personal property installed by Tenant, provided that in no event shall Tenant remove any of the following materials or equipment without Landlord’s prior written consent: any free-standing signs, any power wiring or power panels; lighting or lighting fixtures; wall coverings; drapes, blinds or other window coverings; carpets or other floor coverings; or other similar building operating equipment and decorations), in good first class condition and repair, reasonable wear and tear, subject to Landlord’s reasonable approval, and damage by casualty, if fully insured, excepted. Tenant shall remove all its property not required to be surrendered to Landlord before surrendering the Leased Premises as aforesaid, and shall repair any damage to the Leased Premises caused thereby. Any personal property remaining in the Leased Premises at the expiration of the Lease period may be deemed abandoned by Tenant and Landlord may claim the same and shall in no circumstances have any liability to Tenant therefor or, at Landlord’s election, Landlord may cause the removal of such property and Tenant shall pay to Landlord the cost of such removal and repair.

If the Leased Premises are not surrendered at the end of the term as hereinabove set out, Tenant shall indemnify Landlord against loss or liability resulting from delay by Tenant in so surrendering the Leased Premises, including without limitation claims made by the succeeding Tenant founded on such delay. Tenant’s obligation to observe or perform this covenant shall survive the expiration or other termination of the term of this Lease.

ARTICLE I

INSURANCE AND INDEMNITY

6.01 Casualty Insurance. Throughout the term of this Lease and any extensions thereof, Tenant shall obtain and pay for all casualty insurance for the building and other improvements on the Leased Premises, with such comprehensive or so-called “all risk” that includes wind and flood and such loss of rental and vandalism endorsements as Landlord may, from time to time, reasonably deem necessary, and shall show Landlord as the primary insured thereon with Landlord’s lender as an additional named insured therein. Tenant shall at all times keep such insurance in force and provide Landlord with copies of said policies or certificates evidencing said coverage. The policies shall be in form and content reasonably required by Landlord, and shall be in an insurance company rated A+ to A+++ by A.M. Best Company and approved by Landlord. Such policy(ies) shall provide for full replacement cost coverage and that such amount of coverage shall be subject to increase at least annually so as to provide full insured hazard or risk loss coverage. In no event shall such coverage be in an amount less than the replacement value of the Leased Premises as of the date of any such loss. If Tenant fails to keep said insurance in effect, then Landlord may, but shall not be required to, immediately obtain insurance coverage as provided for herein.

6.02 Liability Insurance. Tenant shall, during the entire term hereof, keep in full force and effect a policy of public liability and property damage insurance with respect to the Leased Premises and the business operated by Tenant and permitted Tenants of Tenant in the Leased Premises in which the limits of coverage shall not be less than $5,000,000 per occurrence for bodily and/or personal injuries, and in which the coverage for property damage liability shall not be less than $5,000,000 or a combined single limit of $5,000,000. The policy shall be in form approved by Landlord, shall name Landlord and Tenant as the insured, and shall contain a clause that the insurer will not cancel, materially modify or fail to renew the insurance without first giving Landlord thirty (30) days’ prior written notice. The insurance shall be in an insurance company rated A+ to A+++ by A.M. Best Company and approved by Landlord, and a copy of the policy or a certificate of insurance shall be delivered to Landlord. The policy shall insure Tenant’s performance of the indemnity provisions herein.

6.03 Business Interruption Insurance. During the Term, Tenant shall procure, maintain and pay for, rental value insurance or business interruption insurance covering risk of loss due to the occurrence of any of the hazards insured against under Tenant’s “all risk” coverage insurance and providing coverage in an amount sufficient to permit the payment of Minimum Rent payable hereunder.

6.04 Umbrella or Excess Liability Insurance. During the Term, Tenant shall procure, maintain and pay for, umbrella or excess liability insurance written on an occurrence basis and covering claims in excess of the underlying insurance described above, with a $5,000,000 limit per occurrence. Such insurance shall contain a provision that it will not be more restrictive than the primary insurance and shall drop down as primary insurance in the event that the underlying insurance policy aggregate is exhausted.

6.05 Insurance Requirements. Throughout the entire term of this Lease and any extension hereof, Tenant shall keep in force and effect such other policies of insurance in respect of the Leased Premises and the operations thereon, as reasonably required by Landlord or Landlord’s Lender (herein defined). The policies of insurance required to be obtained by Tenant hereunder shall be issued in favor of and in the name of Tenant, Landlord and Landlord’s mortgagee, as their respective interests may appear, and Tenant shall furnish to Landlord a certificate evidencing such coverage, which certificate shall be in ACORD format and provide that the insurance shall not be canceled, modified or allowed to lapse without thirty (30) days prior written notice thereof being given by the insurance carrier to Landlord. The insurance company shall be rated A+ to A+++ by A.M. Best Company and the form of insurance shall be subject to approval by Landlord, such approval not to be unreasonably withheld or delayed.

6.06 Waiver of Subrogation. Notwithstanding anything to the contrary contained in this Lease, Tenant’s insurance policies required hereunder shall contain a waiver of any rights of subrogation against Landlord and its mortgagee provided such a provision is not prohibited by applicable law. Each policy hereunder shall contain a clause or endorsement to the effect that any release shall not adversely affect or impair said policies or prejudice the right of the releasing party to recover thereunder. Tenant agrees that each of its policies shall include such a clause or endorsement if available under applicable law.

6.07 Limit to Landlord’s Liability. Landlord shall not be liable for any damage to property of Tenant or of others located on the Leased Premises, nor for the loss of or damages to any property of Tenant or of others by theft, and Landlord shall not be liable for any injury or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water, smoke, rain, or snow, bursting of or leaks from any part of the Leased Premises or from the pipes, appliances, or plumbing works, or from the roof, street or subsurface, or from any other place or by dampness, stoppage or leakage from sewer pipes or from any other cause whatsoever. All property of Tenant kept or stored on the Leased Premises shall be so kept and stored at the risk of Tenant only and unless herein otherwise provided, Tenant shall hold Landlord harmless from any claim arising out of damage to the same. Tenant’s sole recourse against Landlord and any successor to Landlord’s interest in this Lease, is the interest of Landlord (or of such successor in interest) in the Leased Premises. Tenant will not have any right to satisfy any judgment that it may have against Landlord or against such successor in interest from any other assets of Landlord or such successor.

6.08 Indemnification of Landlord. Tenant shall indemnify, save harmless and defend Landlord, its agents and servants from and against any and all claims, actions, damages, losses, risks, suits, judgments, decrees, orders, liability and expense, including without limitation, reasonable legal fees and costs, suffered or incurred by any of them directly or indirectly, which arise out of, are occasioned by, or are in any way attributable to the following events occurring during the Term: (i) Tenant’s use and occupancy of the Leased Premises; (ii) the conduct of Tenant’s business; (iii) any activity, work or thing done, permitted or suffered by Tenant in or about the Leased Premises; (iv) the condition of the Leased Premises during the Term; (v) any breach of any representation or warranty or default in the performance of any covenant or obligation to be performed by Tenant beyond the expiration of any applicable notice and cure periods under the

terms of this Lease or arising from any act, neglect, fault or omission of Tenant, its agents and servants; or (vi) any accident, injury to or death of any person or damage to any property howsoever caused in or on the Leased Premises during the Term, except to the extent that any of such claims, actions, demands, judgments, damages, liabilities or expenses arise from or are caused by the gross negligence or willful misconduct of Landlord, its agents and servants. In case any action or proceeding shall be brought against Landlord by reason of any such claim, Tenant, upon receipt of notice from Landlord shall defend the same at Tenant’s expense (excluding, however, any such claim caused by Landlord’s gross negligence or willful misconduct).

6.09 Additional Rent. If Tenant shall not comply with its covenants made in this Article, Landlord may cause insurance as aforesaid to be issued, in such event Tenant agrees to pay, as additional rent, the premium for such insurance upon Landlord’s demand.

ARTICLE I

PRIORITY OF LEASE

7.01 Subordination. Landlord shall have the right to transfer, mortgage, assign, pledge and convey in whole or in part the Leased Premises, the Property, this Lease and all rights of Landlord existing and to exist, and rents and amounts payable to it under the provisions hereof; and nothing herein contained shall limit or restrict any such right, and, subject to the requirements in Section 7.04 that Tenant attorn to the rights of a subsequent landlord, and the requirements in Section 16.01 that such subsequent landlord honor the rights of Tenant hereunder so long as Tenant is not in default hereunder, the rights of Tenant under this Lease shall be subject and subordinate to all instruments executed and to be executed in connection with the exercise of any such right of Landlord, including, but not limited to, the lien of any mortgage, deed of trust or security agreement now or hereafter placed upon the Leased Premises and the Property and to all renewals or modifications thereof. Said subordination shall not require the agreement or consent of Tenant, but Tenant covenants and agrees, if requested, to execute and deliver upon demand such further instruments subordinating this Lease to the lien of any such mortgage, deed of trust or security agreement as shall be requested by Landlord and/or any mortgagee, proposed mortgagee or holder of any security agreement, and Tenant hereby irrevocably appoints Landlord as its attorney-in-fact to execute and deliver any such instrument for and in the name of Tenant. Landlord agrees to reimburse Tenant for the reasonable attorney fees Tenant may incur in reviewing such subordination agreement.

Notwithstanding anything set out in this Lease to the contrary, in the event the holder of any mortgage or deed of trust elects to have this Lease superior to its mortgage or deed of trust, then, upon Tenant being notified to that effect by such encumbrance holder, this Lease shall be deemed prior to the lien of said mortgage or deed of trust, whether this Lease is adopted prior to or subsequent to the date of said mortgage or deed of trust.

7.02 Notice to Landlord of Default. In the event of any act or omission by Landlord which would give Tenant the right to terminate this Lease or claim a partial or total eviction, or make any claim against Landlord for the payment of money, Tenant will not make such claim or exercise such right until it has given written notice of such act or omission to:

(a) Landlord; and

(b) the holder of any mortgage, deed of trust or other security instrument as to whom Landlord has instructed Tenant to give copies of all of Tenant’s notices to Landlord; and

after thirty (30) days shall have elapsed following the giving of such notice, during which such parties or any of them have not commenced diligently to remedy such act or omission or to cause the same to be remedied. Nothing herein contained shall be deemed to create any rights in Tenant not specifically granted in this Lease or under applicable provisions of law.

7.03 Estoppel Certificate. Tenant agrees, at any time, and from time to time, upon not less than ten (10) days’ prior notice by Landlord, to execute, acknowledge and deliver to Landlord, a statement in writing addressed to Landlord or other party designated by Landlord certifying that this Lease is in full force and effect (or, if there have been modifications, that the same is in full force and effect as modified and stating the modifications), stating the actual commencement and expiration dates of the Lease, stating the dates to which rent, and other charges, if any, have been paid, that the Leased Premises have been completed on or before the date of such certificate and that all conditions precedent to the Lease taking effect have been carried out, that Tenant has accepted possession, that the lease term has commenced, Tenant is occupying the Leased Premises and is open for business, and stating whether or not there exists any default by either party in the performance of any covenant, agreement, term, provision or condition contained in this Lease, and, if so, specifying each such default of which the signer may have knowledge and the claims or offsets, if any, claimed by Tenant, it being intended that any such statement delivered pursuant hereto may be relied upon by Landlord or a purchaser of Landlord’s interest and by any mortgagee or prospective mortgagee of any mortgage affecting the Leased Premises or the Property. Landlord agrees to reimburse Tenant for the reasonable attorney fees Tenant may incur in reviewing such Estoppel Certificate. If Tenant does not deliver such statement to Landlord within such ten (10) day period, Landlord, and any prospective purchaser or encumbrancer, may conclusively presume and rely upon the following facts: (i) that the terms and provisions of this Lease have not been changed except as otherwise represented by Landlord; (ii) that this Lease has not been canceled or terminated except as otherwise represented by Landlord; (iii) that not more than one (1) month’s Minimum Rent or other charges have been paid in advance; and (iv) that Landlord is not in default under the Lease. In such event, Tenant shall be estopped from denying the truth of such facts. Tenant shall also, on ten (10) days’ written notice, provide an agreement in favor of and in the form customarily used by such encumbrance holder, by the terms of which Tenant will agree to give prompt written notice to any such encumbrance holder in the event of any casualty damage to the Leased Premises or in the event of any default on the part of Landlord under this Lease, and will agree to allow such encumbrance holder a reasonable length of time after notice to cure or cause the curing of such default before exercising Tenant’s right of self-help under this Lease, if any, or terminating or declaring a default under this Lease.

7.04 Attornment. Tenant agrees that no foreclosure of a mortgage affecting the Leased Premises, nor the institution of any suit, action, summary or other proceeding against Landlord

herein, or any successor Landlord, or any foreclosure proceeding brought by the holder of any such mortgage to recover possession of such property, shall by operation of law or otherwise result in cancellation or termination of this Lease or the obligations of Tenant hereunder, and upon the request of the holder of any such mortgagee, Tenant covenants and agrees to execute an instrument in writing satisfactory to such party or parties or to the purchaser of the mortgaged premises in foreclosure whereby Tenant attorns to such successor in interest and such successor in interest agrees to .

ARTICLE I

ASSIGNMENT AND SUBLETTING

8.01 Consent Required. Tenant shall not voluntarily or involuntarily or by operation of law, assign, transfer or encumber this Lease, in whole or in part, nor sublet all or any part of the Leased Premises without the prior written consent of Landlord in each instance. The consent by Landlord to any assignment or subletting shall not constitute a waiver of the necessity for such consent in any subsequent assignment or subletting.

Landlord agrees to consent to Tenant subleasing all or a portion of the Leased Premises to a subtenant entity that is controlled by Tenant or Guarantor, provided that Landlord reasonably determines that the sublease does not impair the Tenant’s ability to perform its obligations hereunder.

Notwithstanding any assignment or sublease, Tenant shall remain fully liable on this Lease and shall not be released from performing any of the terms, covenants and conditions hereof without Landlord’s specific written release.

Landlord shall have the right to convey all or any part of its interest in the real property of which the Leased Premises are a part or its interest in this Lease. All covenants and obligations of Landlord under this Lease shall cease upon the execution of such conveyance, but such covenants and obligations shall run with the land and shall be binding upon the subsequent owner or owners thereof or of this Lease.

In the event that a permitted sublease hereunder generates Minimum Rent in excess of the proportional amount then being paid by Tenant under the terms of this Lease and such sublease is not with a subtenant entity that is controlled by Tenant or guarantor, then in such event Landlord and Tenant shall share equally in such profit pursuant to a document confirming the terms and conditions of such sublease.

ARTICLE I

WASTE, GOVERNMENTAL REGULATIONS AND HAZARDOUS SUBSTANCES

9.01 Waste or Nuisance. Tenant shall not commit or suffer to be committed any waste upon the Leased Premises or any nuisance or other act or thing which may disturb the quiet enjoyment of any other Tenant in the Property.

9.02 Governmental Regulations. Tenant shall, at its sole cost and expense, comply with all of the requirements of all county, municipal, state, federal and other applicable governmental authorities, now in force or which may hereafter be in force. Tenant shall comply with all applicable statutes, ordinances, rules, regulations, codes, orders, requirements, directives, binding written interpretations and binding written policies, rulings, and decrees of all local, municipal, state and federal governments, departments, agencies, commissions, boards or political subdivisions applicable to or having jurisdiction over the use, occupancy, operation and maintenance of the Leased Premises, including without limitation all Environmental Laws (as hereinafter defined), the Americans with Disabilities Act and other access laws, zoning restrictions and those which require the making of any structural, unforeseen or extraordinary changes and including those which involve a change of policy on the part of the governmental body enacting the same (“Laws”). Tenant shall procure and maintain all material permits, licenses and other authorizations required for the use of the Leased Premises or any part thereof then being made and for the lawful and proper installation, operation and maintenance of all equipment and appliances necessary or appropriate for the operation and maintenance of the Leased Premises, and shall comply in all respects with the Permitted Exceptions.

9.03 Hazardous Substances.

(a) Tenant represents and warrants to Landlord that it shall not transport, use, store, maintain, generate, manufacture, handle, dispose, release, or discharge any Hazardous Materials (as hereinafter defined) upon or about the Leased Premises, nor permit any of its agents, representatives, employees, contractors, subcontractors, subtenants, licensees or invitees to engage in such activities upon or about the Leased Premises, and Tenant further agrees to indemnify and hold Landlord harmless from and against any and all claims, demands, actions, damages, losses, risks, litigation, liabilities and expenses (including reasonable attorneys’ fees and costs), from any claim now existing or which may arise due to Environmental Liabilities (as defined hereinafter), Tenant’s breach of said representation and warranty or violation of Environmental Law (as hereinafter defined). However, the foregoing provisions shall not prohibit products of the type and in the amounts typically used or sold in the ordinary course of business in connection with the operation of the Tenant’s business, provided: (i) such substances shall be used and maintained only in such quantities as are reasonably necessary for Tenant’s permitted use of the Leased Premises, in accordance with Environmental Law and the manufacturers’ instructions therefor; (ii) such substances shall not be disposed of, released, or discharged at the Leased Premises and shall be transported to and from the Leased Premises in compliance with Environmental Law, (iii) if Environmental Law or Tenant’s trash removal contractor requires that any such substances from the Leased Premises be disposed of separately from ordinary trash, Tenant shall make arrangements at Tenant’s cost and expense for such disposal directly with a qualified and licensed disposal company at a lawful disposal site, and shall ensure that disposal occurs frequently enough to prevent unnecessary storage or accumulation of such substances in the Leased Premises, or on the Land, and (iv) any remaining such substances shall be completely, properly and lawfully removed by Tenant from the Leased Premises upon expiration or earlier termination of this Lease or Tenant’s right to possession.

(b) TENANT FOREVER RELEASES AND DISCHARGES LANDLORD AND ITS AFFILIATES FROM AND AGAINST ANY AND ALL LOSSES WHICH ARISE OUT OF, OR ARE ALLEGED TO HAVE ARISEN OUT OF: (A) THE VIOLATION OF ANY ENVIRONMENTAL LAW BY ANY PERSON (INCLUDING LANDLORD OR ANY OF ITS AFFILIATES) IN CONNECTION WITH THE LEASED PREMISES; OR (B) THE PRESENCE, USE, GENERATION, STORAGE, REMEDIATION OR RELEASE OF HAZARDOUS MATERIAL ON, UNDER, AT OR ABOUT THE LEASED PREMISES ATTRIBUTABLE TO THE ACTIONS OR OMISSIONS OF ANY PERSON (INCLUDING LANDLORD AND ITS AFFILIATES). WITHOUT LIMITING THE FOREGOING, THIS RELEASE SHALL INCLUDE ANY AND ALL COSTS FOR ANY INVESTIGATIONS OF THE LEASED PREMISES AND OTHER AFFECTED PROPERTY, ANY CLEANUP, REMOVAL, REPAIR, REMEDIATION OR RESTORATION OF THE LEASED PREMISES AND OTHER AFFECTED PROPERTY, THE PREPARATION OF ANY WORK PLANS REQUIRED OR PERMITTED BY ANY GOVERNMENTAL AUTHORITY, THE PREPARATION OF ANY CORRECTIVE ACTION, CLOSURE OR OTHER PLAN OR REPORT, AND ALL FORESEEABLE AND UNFORESEEABLE CONSEQUENTIAL DAMAGES, IN EACH CASE ARISING DIRECTLY OR INDIRECTLY OUT OF THE PRESENCE, USE, GENERATION, STORAGE, REMEDIATION OR RELEASE OF HAZARDOUS MATERIAL BY ANY PERSON ON, UNDER, AT OR ABOUT THE LEASED PREMISES.

(c) Tenant shall promptly notify Landlord upon the Tenant becoming aware of: (i) any enforcement, cleanup, or other regulatory action taken or threatened against Tenant by any governmental or regulatory authority with respect to the presence of any Hazardous Material at the Leased Premises, or the migration thereof from or to other property, (ii) any demands or claims made or threatened by any party against Tenant relating to any loss or injury resulting from any Hazardous Material, (iii) any unlawful release, discharge, or non-routine, improper or unlawful disposal or transportation of any Hazardous Material on or from the Leased Premises and (iv) any matters where Tenant is required by Environmental Law to give a notice to any governmental or regulatory authority respecting any Hazardous Materials in the Leased Premises. Landlord shall have the right (but not the obligation) to join and participate, as a party, in any legal proceedings or actions affecting the Leased Premises, or the Land initiated in connection with Environmental Law. At such times as Landlord may reasonably request, Tenant shall provide Landlord with a written list identifying any Hazardous Material then actually known to Tenant to be the used, stored, or maintained in, on or upon the Land. Tenant shall additionally provide Landlord information with respect to the use and approximate quantity of each such material, a copy of any material safety data sheet issued by the manufacturer therefor, written information concerning the removal, transportation, and disposal of the same, and such other information as Landlord may reasonably require or as may be required by Environmental Law.

(d) “Hazardous Materials” shall mean (i) any lead-based paint, petroleum, hazardous or toxic petroleum‑derived substances or petroleum products, flammable explosives, radioactive materials, radon, asbestos in any form that is or could become friable, urea formaldehyde foam insulation, and transformers or other equipment that contain dielectric fluid containing levels of polychlorinated biphenyls (PCBs); (ii) any chemicals or other materials or substances which are regulated, classified or defined as or included in the definition of “hazardous substances”, “hazardous

wastes”, “hazardous materials”, “extremely hazardous wastes”, “restricted hazardous wastes”, “toxic substances”, “toxic pollutants”, “pollutant” or “contaminant” or any similar denomination intended to classify substances by reason of toxicity, carcinogenicity, ignitability, corrosivity or reactivity under any Environmental Law; and (iii) any other waste, material (including, building construction materials and debris) or substance that is regulated by, or may in the future form the basis of liability under, any Environmental Law.

(e) “Environmental Law” means all Laws and any writ, judgment, decree, injunction or similar order, directive or other requirement of any governmental authority (in each such case whether preliminary or final), and contractual obligations concerning pollution or protection of the environment, sanitation, public and worker health and safety, including Laws relating to wetlands, emissions, discharges, releases, or threatened releases of pollutants, contaminants, or chemical, industrial, hazardous, or toxic materials or wastes into ambient air, surface water, groundwater, or lands or otherwise relating to the manufacture, processing, distribution, use, treatment, storage, disposal, transport, or handling of pollutants, contaminants, or chemical, industrial, hazardous, or toxic materials or wastes, including the Comprehensive Environmental Response, Compensation and Liability Act of 1980 and all rules and regulations promulgated thereunder, the Comprehensive Environmental Response, Compensation and Liability Information System, as provided for by 40 C.F.R. § 300.5 and all rules and regulations promulgated thereunder, the Resource Conservation and Recovery Act, the Clean Air Act, the Clean Water Act, the Toxic Substance Control Act, the Occupational Safety and Health Act, and similar federal, state, provincial, municipal or local Laws, in all cases as the same have been or may be amended from time to time.

(f) “Environmental Liabilities” means those liabilities arising in connection with or in any way relating to the Leased Premises or any activities or operations at any time occurring or conducted at the Leased Premises, the presence of any Hazardous Materials on, about or under the Leased Premises or migrating thereto or therefrom, or any releases or threatened releases of Hazardous Materials from the Leased Premises (including any removal and offsite disposal of Hazardous Materials from the Leased Premises), which in each case arise under or in connection with any applicable Environmental Law, including any and all liabilities arising in connection with or relating to any investigation, remediation or other response or any claim, demand, litigation or other proceeding.

(g) Notwithstanding anything contained in this section to the contrary, Landlord agrees that during the term of this Lease Landlord shall not introduce any Hazardous Materials to the Leased Premises and shall not take any other action that would in any way increase any Environmental Liability.

ARTICLE I

DESTRUCTION OF LEASED PREMISES

10.01 Damage or Destruction. If the Leased Premises are damaged or destroyed by fire or other casualty, this Lease shall continue in full force and effect provided Landlord and its mortgagee(s) shall make such casualty insurance proceeds available to Tenant for the repair and reconstruction of the Premises through an appropriate, as determined by Landlord, independent

escrow of such proceeds. Tenant shall, as promptly as possible, and, subject to the approval of Landlord and its mortgagee(s) and in compliance with all applicable laws, restore, repair or rebuild the Leased Premises to substantially the same condition as existed before the damage or destruction using materials of the same or better grade than that of the original construction, including any improvements or alterations required to be made by Law. Tenant shall for this purpose use all, or such part as may be necessary, of the insurance proceeds received from the insurance policies carried on the Leased Premises. If such insurance proceeds are not sufficient to pay such costs, Tenant shall pay such deficit. In the event that the Premises are so damaged as to make restoration or repair impractical as determined by Landlord, then Landlord may terminate this Lease as a permitted termination by written notice to Tenant (the “Termination Notice”) and Tenant shall be released from its obligation to pay future Minimum Rent from and after the date of Tenant’s receipt of such notice. Should Landlord or its mortgagee(s) fail to make such insurance proceeds available to Tenant for reconstruction or repair, then Tenant may terminate this Lease as a permitted termination effective as of the date of the casualty, provided any notice is received by Landlord within twenty (20) days of Tenant’s receipt of Landlord’s written notice in respect of the unavailability of such proceeds.

ARTICLE I

EMINENT DOMAIN