Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 BVBC ANNOUNCEMENT 01-16-2019 - HEARTLAND FINANCIAL USA INC | ex991acquisitionaccounceme.htm |

| 8-K - 8-K BVBC ANNOUNCEMENT 01-16-2019 - HEARTLAND FINANCIAL USA INC | form8-kacquisitionaccounce.htm |

ACQUISITION OF BLUE VALLEY BAN CORP. CREATING A PREMIER KANSAS CITY COMMUNITY BANK January 16, 2019 Lynn B. Fuller Executive Operating Chairman Bruce K. Lee President and Chief Executive Officer HTLF | www.htlf.com

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about: (1) the benefits of the acquisition by Heartland Financial USA, Inc. (“Heartland” or “HTLF”) of Blue Valley Ban Corp. (“BVBC”) and its wholly owned Kansas banking subsidiary, Bank of Blue Valley (“BankBV”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the acquisition; (2) BVBC’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (3) other statements identified by words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates” or works of similar meaning. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements: the businesses of HTLF, BVBC, Morrill & Janes Bank and Trust Company (Heartland’s Kansas banking subsidiary) (“M&J Bank”) and BankBV may not be combined successfully, or such combination may take longer than expected; the cost savings from the acquisition may be less than expected; governmental approvals of the acquisition may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the acquisition or otherwise; the stockholders of BVBC may fail to approve the acquisition; credit and interest rate risks associated with HTLF’s and BVBC’s respective businesses may be greater than anticipated; and difficulties associated with achieving expected future financial results may occur. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K of Heartland) filed with the Securities and Exchange Commission (“SEC“) and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed acquisition and other matters relating to HTLF and BVBC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, HTLF and BVBC do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward- looking statement is made. 2

Important Additional Information This presentation is being made in respect of the proposed mergers between HTLF and BVBC, and M&J Bank and BankBV. This presentation does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approvals. In connection with the proposed acquisition, HTLF intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement for BVBC shareholders, and a prospectus of HTLF, and HTLF will file other documents regarding the proposed acquisition with the SEC. The registration statement and proxy statement will contain information about the proposed transaction, therefore, before making any voting or investment decision, security holders of BVBC are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents. The documents filed by HTLF with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by HTLF may be obtained free of charge at its website at www.htlf.com or by contacting Heartland Financial USA, Inc., 1398 Central Avenue, Dubuque, IA 52004, Attention: Bryan R. McKeag, Executive Vice President and Chief Financial Officer, Telephone: (563) 589-1994. BVBC and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies of BVBC’s shareholders in connection with the proposed acquisition. Additional information regarding the interests of those participants and other persons who may be deemed participants in the acquisition my be obtained by reading the proxy statement/ prospectus regarding the proposed acquisition when it becomes available. In addition, information about the directors and executive officers of BVBC and their ownership of BVBC common stock is set forth in the proxy statement for BVBC’s 2018 Annual Meeting of the Shareholders, as filed with OTCQX on April 9, 2018. Information about the directors and executive officers of HTLF and their ownership of HTLF common stock is set forth in the proxy statement for HTLF’s 2018 Annual Meeting of the Shareholders, as filed with SEC on Schedule 14A on April 6, 2018. Free copies of the above documents may be obtained as described in the preceding paragraph. 3

Transaction Highlights » The BVBC acquisition brings HTLF to ~$1.3 billion in assets in the Kansas City MSA » Strong deposit franchise brings pro forma total deposits to $1.1 billion » 14th largest deposit market share1 in the Kansas City MSA Strategically » 9th largest deposit market share1 in Johnson County, KS Compelling » Approximately 27% of BVBC’s deposits are non interest bearing » Cohesive banking franchise combining similar cultures due to the management, market and strong insider ownership of HTLF and BVBC » Additional scale and synergies will enhance Heartland’s presence, and are expected to improve financial performance, in the Kansas City MSA » Financially attractive transaction: » 2.4-2.9% EPS accretion in first full year and beyond Strong » Tangible Book Value per share earn back of approximately 3.0 years using crossover method Transaction Economics » IRR in excess of 20% » Significant core deposits and excess liquidity » All metrics reported inclusive of impact of Durbin Amendment » Strong knowledge of local markets: HTLF has operated in the Kansas City MSA through M&J Bank since 2013 and has been familiar with BVBC and its leadership for a number of years Low Execution » Similar credit cultures focused on conservative underwriting with quality portfolios Risk » Comprehensive due diligence process completed » Retention of key personnel: Bob Regnier, Chairman, President and CEO of BVBC, to become Executive Chairman and CEO of the merged subsidiary; Mark Fortino, CFO of BVBC, to become EVP of the merged subsidiary (1) FDIC market rank per deposit market share as of June 30, 2018. 4

Overview of Blue Valley Ban Corp. (Dollars in $MMs) Blue Valley Ban Corp. Overview Branch Footprint Headquarters Overland Park, Kansas Footprint 5 branches Assets $728 Net Loans 527 Deposits 607 Total Equity 50 Loan Composition1 Deposit Composition1 Gross Loans: $533 Total Deposits: $607 Yield on Loans (MRQ): 4.90% Cost of Deposits (MRQ): 0.51% Note: Financial data for the quarter ended September 30, 2018. (1) Regulatory loan and deposit compositions. 5

Diverse, Low Risk Loan Portfolio (As of September 30, 2018) (Dollars in $MMs) Loan Overview » Well diversified loan portfolio across types of credits » Strong commercial lending focus with C&I and Owner Occupied CRE loans totaling approximately 41% of BVBC loans » Excellent asset quality and strong loan loss reserves » In-depth review of credit files, underwriting methodology and policy » 73% of total loans reviewed for BVBC (on an aggregate dollar basis), including 100% of classified loans HTLF BVBC Pro Forma1 Gross Loans: $7,443 Gross Loans: $533 Gross Loans: $8,431 Yield on Loans (MRQ): 5.67% Yield on Loans (MRQ): 4.90% Yield on Loans (MRQ): 5.58% Note: Regulatory financial data for the quarter ended September 30, 2018. (1) Pro Forma combines loans of HTLF and BVBC but excludes purchase accounting adjustments. 6

Attractive Low Cost Deposit Base (As of September 30, 2018) (Dollars in $MMs) Deposit Overview » 0.51% Cost of Deposits » 27% Non Interest Bearing Deposits » 97% Core Deposits HTLF BVBC Pro Forma1 Total Deposits: $9,562 Total Deposits: $607 Total Deposits: $10,649 Cost of Deposits (MRQ): 0.42% Cost of Deposits (MRQ): 0.51% Cost of Deposits (MRQ): 0.43% Note: Regulatory financial data for the quarter ended September 30, 2018. (1) Pro Forma combines deposits of HTLF and BVBC but excludes purchase accounting adjustments. 7

The Acquisition Adds a Strong Wealth Management Operation in the Kansas City Metro Markets » The acquisition of BVBC will provide Heartland’s Wealth Management Division (Assets Under Management) Private Client Services a strong presence in the Kansas City Metro Markets. $400,000 » BVBC’s Wealth Management Division was established $357,053 $350,000 in 1996 and has approximately $357 million of Assets $328,756 $320,771 $119,582 $316,010 Under Management as of September 2018. $287,546 $114,000 $300,000 $117,700 $122,437 » BVBC’s Wealth Management Division offers a full $259,315 $113,000 $250,000 suite of services: Trust Services, Wealth Advisory, $104,000 $237,472 Investment Services and Private Banking. $200,000 $214,756 $203,071 $193,573 » Led by a twenty-year industry veteran, Todd York, the $174,546 $150,000 division employs ten professionals and targets small $155,315 business owners and high net worth professionals. $100,000 » The merger with Heartland will enable BVBC to $50,000 broaden its client base by offering its existing Wealth Management Services to M&J Bank customers and to $- 2013 2014 2015 2016 2017 09/30/2018 access the sophisticated investment platform of Brokerage Trust Services Heartland’s Private Client Services Division. Source: BVBC management as of September 30, 2018. Note: All dollars in thousands. 8

Two Great Franchises Form a Premier Kansas City Community Bank Pro Forma Branch Footprint3 (13 Branches) Pro Forma1 Assets ($000) 592,786 728,402 1,321,188 Net Loans ($000) 390,578 527,287 917,865 Deposits ($000) 511,154 607,483 1,118,637 Deposit Mkt Share %2 0.46% 1.01% 1.47% Kansas City MSA Deposit Market Rank2 30 18 14 Kansas City MSA Deposit Mkt Share %2 0.95% 2.90% 3.85% Johnson County, KS Deposit Market Rank2 20 14 9 Johnson County, KS Note: Financial data for the quarter ended September 30, 2018. (1) Pro Forma excludes purchase accounting adjustments. (2) FDIC deposit market share and market rank as of June 30, 2018. (3) M&J Bank has another branch in Dallas, TX. 9

A New Premier Kansas City Community Bank Led by Exceptional Local Bankers » M&J Bank and Bank of Blue Valley combined will operate as Bank of Blue Valley » Nine offices in the Kansas City MSA and seven in the demographically attractive Johnson County, KS » HTLF will rank 14th in deposit market share in the Kansas City MSA and 9th in Johnson County, KS » Strong local lending team with broad product experience » Low cost deposit base and well diversified loan portfolio » Exceptional leadership team poised for accelerated growth in the Kansas City market » Headquarters for the new Bank of Blue Valley will be in Overland Park, KS LEADERSHIP TEAM OF THE NEW SUBSIDIARY – BANK OF BLUE VALLEY: Bob Regnier Wendy Reynolds Executive Chairman & CEO President Chairman, President, CEO and President and CEO of M&J Bank. Joined Founder of BVBC. Over forty years of HTLF in Colorado in 2011 and was most banking experience with BVBC and recently market President for Citywide Boatmen’s Bank & Trust. Recognized Banks. Has twenty years of banking civic leader in the Kansas City MSA. experience including positions with US Bank, Vectra Bank and Flatirons Bank. 10

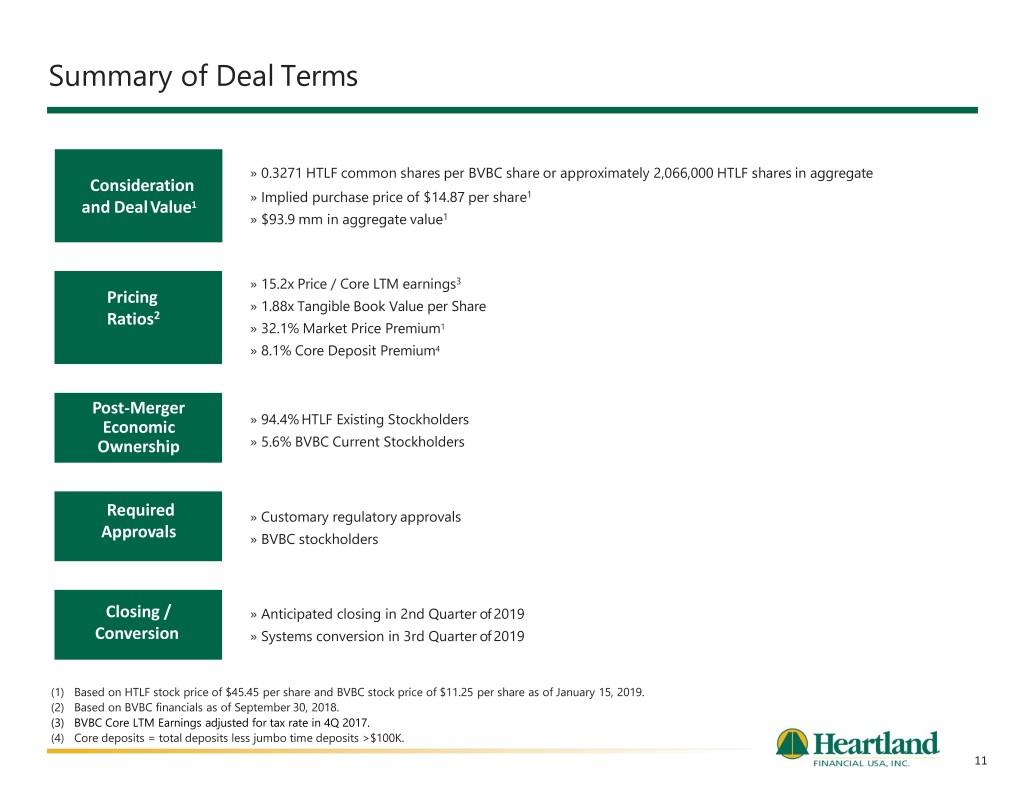

Summary of Deal Terms » 0.3271 HTLF common shares per BVBC share or approximately 2,066,000 HTLF shares in aggregate Consideration » Implied purchase price of $14.87 per share1 and DealValue1 » $93.9 mm in aggregate value1 » 15.2x Price / Core LTM earnings3 Pricing » 1.88x Tangible Book Value per Share Ratios2 » 32.1% Market Price Premium1 » 8.1% Core Deposit Premium4 Post-Merger Economic » 94.4% HTLF Existing Stockholders Ownership » 5.6% BVBC Current Stockholders Required » Customary regulatory approvals Approvals » BVBC stockholders Closing / » Anticipated closing in 2nd Quarter of 2019 Conversion » Systems conversion in 3rd Quarter of 2019 (1) Based on HTLF stock price of $45.45 per share and BVBC stock price of $11.25 per share as of January 15, 2019. (2) Based on BVBC financials as of September 30, 2018. (3) BVBC Core LTM Earnings adjusted for tax rate in 4Q 2017. (4) Core deposits = total deposits less jumbo time deposits >$100K. 11

Consolidated Financial Impact and Assumptions EPS Accretion » ~2.4% accretive to EPS in 2020 » ~2.7% accretive to EPS in 2021 » ~1.4% Tangible Book Value dilution pershare TBV Impact » ~3.0 years Tangible Book Value earnback, using crossover method Internal Rate of Return » In excess of 20% Projected » Pro Forma TCE / TA of 8.2% ProForma » Pro Forma Leverage Ratio of 9.9% 1 Capital Impact » Pro Forma Total Risk-Based Capital Ratio of 13.9% » Projected 30% cost savings, 75% phased in by year-end 2019 and 100% thereafter » Pre-tax, one-time buyer and seller combined merger charges estimated at 9.0% of deal value » Core deposit intangibles of 2.25% amortized over 10 years, using sum of the years digits Transaction » Credit mark of 2.50% or $13.3 million Assumptions » Loan rate mark of 0.50% accreted over 4 years » OREO mark down of 5% or $0.3 million » Trust Preferred mark down of 20% or $3.9 million amortized over 16 years » No revenue enhancements modeled (1) Pro Forma HTLF financials assuming deal closing of June 30, 2019. 12

Kansas City MSA – Overview » The Kansas City MSA is comprised of 15 counties throughout Kansas, as well as Missouri, and is the 30th largest metropolitan statistical area in the U.S. with a population of 2.1 million. » The Kansas City area is a large, influential and important economy in the Midwest, and is home to a multitude of factories, agribusiness, logistics, and technology companies, professional service firms and manufacturing plants. Moreover, Kansas City is an accredited international trade zone with more foreign trade zone space than anywhere else in the nation. » The Kansas City MSA is projecting average household income growth of 9.8% over the next five years while also experiencing 3.5% population growth. The real estate market is booming as well with median home prices projected to rise 6.6% over the next twelve months, adding onto the 9.0% growth experienced over the last twelve months. » According to National Geographic, Kansas City is in the “Top 30 of Best Small Cities in the U.S.” while also having six Kansas City-area companies on the “America’s Best Employers” list by Forbes. » Kansas City is renowned for its sports teams and museums, namely, the Kansas City Chiefs, Kansas City Royals, Sporting Kansas City along with the Nelson Art Gallery, World War I Museum & Memorial and the Negro Leagues Baseball Museum. Source: Forbes, National Geographic, S&P Global Market Intelligence, and Zillow. 13

Kansas City MSA – Major Local Employers Largest Employers in the Kansas City MSA # of Rank Company Name Industry Employees 1 Cerner Corporation Health services 14,000 2 HCA Midwest Health System Health services 9,924 3 Saint Luke's Health System Health services 8,020 4 Ford Car manufacturing 7,030 5 Children’s Mercy Hospitals & Clinics Health services 6,696 6 Sprint Telecommunications 6,000 7 Hallmark Cards, Inc. Greeting card manufacturing 5,166 8 Garmin Ltd. Technology 3,651 9 General Motors Car manufacturing 3,500 10 Truman Medical Center, Inc. Health services 3,225 11 Honeywell FM&T Electronics 3,000 12 Black & Veatch Architects/Engineering 2,988 13 NPC International Inc, Food and Beverage 2,889 14 Burns & McDonnell Architects/Engineering 2,673 15 Olathe Health Health services 2,550 16 Amazon Online commerce 2,500 17 BNSF Railway Co. Utlilties 2,500 18 Shawnee Mission Health Health services 2,453 19 Commerce Bank Banking 2,450 20 UnitedHealth Group Health services 2,400 21 Farmers Insurance Insurance 2,282 22 UMB Financial Corp. Banking 2,208 23 Great Plain Energy, Inc. Energy 2,196 24 U.S. Bank Banking 1,850 25 YRC Worldwide Inc. Shipping and Logistics 1,700 Source: Biz Journals, Proximity One. 14

An Expanding Franchise – Heartland Financial USA, Inc. 11 INDEPENDENT BANK CHARTERS 122 OFFICES 91 COMMUNITIES As of September 30, 2018. 15

Expansion Timeline As of September 30, 2018. 16

A Compelling Opportunity for Heartland and its Stockholders » Reaching critical mass in the attractive Kansas City MSA and well positioned for further organic and acquisition growth » Natural expansion from well established M&J Bank platform and creation of the fifth largest community bank headquartered in Kansas City – Bank of Blue Valley » Acquisition of the attractive Trust and Wealth Management operation of BVBC with approximately $357 million of assets under management » Retention of exceptional local leadership » Strategically attractive with compelling financial metrics » Expected low execution risk » When completed, the acquisition will be Heartland’s 15th acquisition since 2012; Heartland has a history of successful merger execution and integration » Transaction expected to enhance Heartland’s long-term stockholder value 17

Contact Information 18