Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JPMORGAN CHASE & CO | jpmc4q18form8k.htm |

4Q18 Financial Results January 15, 2019

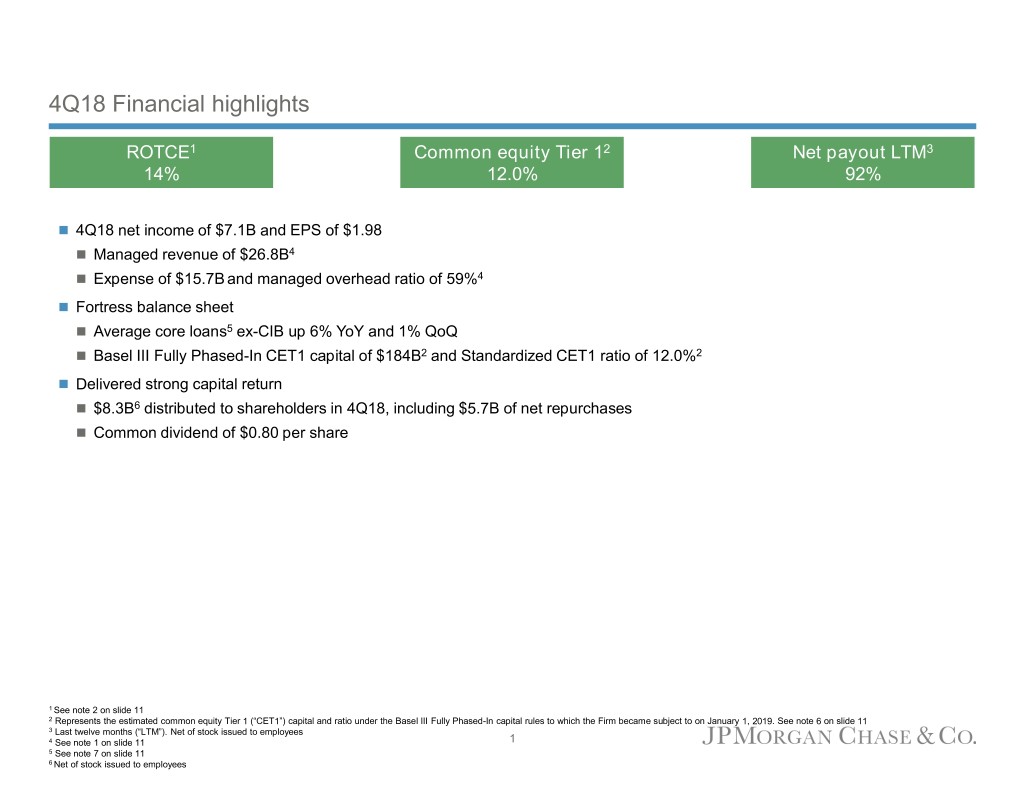

4Q18 Financial highlights ROTCE1 Common equity Tier 12 Net payout LTM3 14% 12.0% 92% 4Q18 net income of $7.1B and EPS of $1.98 Managed revenue of $26.8B4 Expense of $15.7B and managed overhead ratio of 59%4 Fortress balance sheet Average core loans5 ex-CIB up 6% YoY and 1% QoQ Basel III Fully Phased-In CET1 capital of $184B2 and Standardized CET1 ratio of 12.0%2 Delivered strong capital return $8.3B6 distributed to shareholders in 4Q18, including $5.7B of net repurchases Common dividend of $0.80 per share 1 See note 2 on slide 11 2 Represents the estimated common equity Tier 1 (“CET1”) capital and ratio under the Basel III Fully Phased-In capital rules to which the Firm became subject to on January 1, 2019. See note 6 on slide 11 3 Last twelve months (“LTM”). Net of stock issued to employees 4 See note 1 on slide 11 1 5 See note 7 on slide 11 6 Net of stock issued to employees

4Q18 Financial results1 $B, excluding EPS $ O/(U) 4Q18 3Q18 4Q17 Net interest income $14.5 $0.4 $1.2 Noninterest revenue 12.3 (1.5) (0.1) 1 Managed revenue $B 4Q18 3Q18 4Q17 26.8 (1.0) 1.1 Net charge-offs $1.2 $1.0 $1.3 Expense Reserve build/(release) 0.3 (0.1) – 15.7 0.1 0.8 Credit costs Credit costs $1.5 $0.9 $1.3 1.5 0.6 0.2 Reported net income 4Q18 Tax rate $7.1 ($1.3) $2.8 Effective rate: 20.1% Net income applicable to common stockholders Managed rate: 25.9%1,5 $6.6 ($1.3) $2.9 Reported EPS $1.98 ($0.36) $0.91 2 4Q18 ROE O/H ratio 12% 14% 7% ROE CCB 30% 52% ROTCE2,3 CIB 10% 65% 14 17 8 CB 20% 37% 1,2 Overhead ratio – managed AWM 26% 76% 59 56 58 Memo: Adjusted expense 4 $15.7 $0.1 $0.6 Memo: Adjusted overhead ratio 1,2,4 59% 56% 59% Firmwide total credit reserves of $14.5B Consumer reserves of $9.4B – net build of $151mm, driven by Card Wholesale reserves of $5.1B – net build of $161mm, largely select C&I downgrades Note: Totals may not sum due to rounding 1 See note 1 on slide 11 2 Actual numbers for all periods, not over/(under) 3 See note 2 on slide 11 2 4 See note 3 on slide 11 5 Reflects fully taxable-equivalent (“FTE”) adjustments of $695mm in 4Q18, compared to $1.3B in 4Q17

FY18 Financial results1 $B, excluding EPS $ O/(U) FY2018 FY2017 FY2017 Net interest income $55.7 $51.4 $4.3 Noninterest revenue 55.8 53.3 2.5 1 Managed revenue $B FY18 FY17 111.5 104.7 6.8 Net charge-offs $4.9 $5.4 Expense Reserve build/(release) – (0.1) 63.4 59.5 3.9 Credit costs Credit costs $4.9 $5.3 4.9 5.3 (0.4) Reported net income FY18 Tax rate $32.5 $24.4 $8.0 Effective rate: 20.3% Net income applicable to common stockholders Managed rate: 24.9%1,5 $30.7 $22.6 $8.1 Reported EPS $9.00 $6.31 $2.69 2 FY2018 ROE OH ratio 13% 10% ROE CCB 28% 53% ROTCE2,3 CIB 16% 57% 17 12 CB 20% 37% 1,2 Overhead ratio – managed AWM 31% 74% 57 57 Memo: Adjusted expense 4 $63.3 $59.6 $3.8 Memo: Adjusted overhead ratio 1,2,4 57% 57% Net capital distribution to shareholders of $28.5B6 including common dividends of $9.2B, or $2.72 per share, and net repurchases of $19.3B6 Average core loan growth of 7%7 Firmwide net reserve build of $15mm – net build in Consumer of $54mm and net release in Wholesale of $39mm Note: Totals may not sum due to rounding 1 See note 1 on slide 11 2 Actual numbers for all periods, not over/(under) 3 See note 2 on slide 11 3 4 See note 3 on slide 11 5 Reflects fully taxable-equivalent (“FTE”) adjustments of $2.5B in 2018, compared to $4.0B in 2017 6 Net of stock issued to employees 7 See note 7 on slide 11

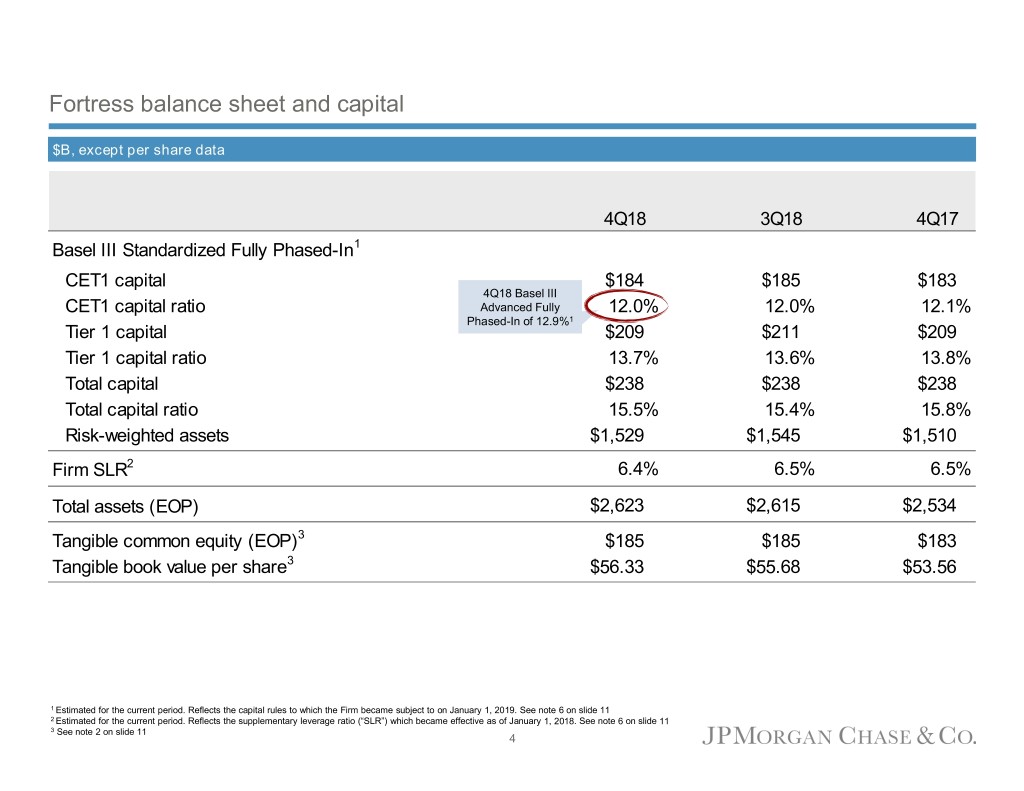

Fortress balance sheet and capital $B, except per share data 4Q18 3Q18 4Q17 Basel III Standardized Fully Phased-In1 CET1 capital $184 $185 $183 4Q18 Basel III CET1 capital ratio Advanced Fully 12.0% 12.0% 12.1% Phased-In of 12.9%1 Tier 1 capital $209 $211 $209 Tier 1 capital ratio 13.7% 13.6% 13.8% Total capital $238 $238 $238 Total capital ratio 15.5% 15.4% 15.8% Risk-weighted assets $1,529 $1,545 $1,510 Firm SLR2 6.4% 6.5% 6.5% Total assets (EOP) $2,623 $2,615 $2,534 Tangible common equity (EOP)3 $185 $185 $183 Tangible book value per share3 $56.33 $55.68 $53.56 1 Estimated for the current period. Reflects the capital rules to which the Firm became subject to on January 1, 2019. See note 6 on slide 11 2 Estimated for the current period. Reflects the supplementary leverage ratio (“SLR”) which became effective as of January 1, 2018. See note 6 on slide 11 3 See note 2 on slide 11 4

Consumer & Community Banking1 $mm Financial performance $ O/(U) Net income of $4.0B 4Q18 3Q18 4Q17 Revenue of $13.7B, up 13% YoY, driven by higher NII on higher Revenue $13,695 $405 $1,625 deposit and card margins and balance growth Consumer & Business Banking 6,567 182 1,010 Expense of $7.1B, up 6% YoY, driven by investments in the business Home Lending 1,322 16 (120) and higher auto lease depreciation, partially offset by lower FDIC Card, Merchant Services & Auto 5,806 207 735 charges and expense efficiencies Expense 7,065 83 393 Credit costs 1,348 368 117 Credit costs of $1.3B, up $117mm YoY Net charge-offs 1,198 118 (18) 4Q18 includes a $150mm reserve build in Card Change in allowance 150 250 135 Net charge-offs down YoY; lower NCOs in Auto and Home Net income $4,028 ($58) $1,397 Lending, predominantly offset by higher NCOs in Card Key drivers/statistics ($B)2 Key drivers/statistics ($B) – detail by business Equity $51.0 $51.0 $51.0 4Q18 3Q18 4Q17 ROE 30% 31% 19% Consumer & Business Banking Overhead ratio 52 53 55 Average Business Banking loans $24.3 $24.1 $23.3 Average loans $482.7 $479.6 $475.0 Business Banking loan originations 1.5 1.6 1.8 Average deposits 673.8 674.2 652.0 Client investment assets (EOP) 282.5 298.4 273.3 Active mobile customers (mm) 33.3 32.5 30.1 Deposit margin 2.55% 2.43% 2.06% Debit & credit card sales volume $270.5 $259.0 $245.1 Home Lending Average loans $242.2 $242.9 $240.7 3 Average loans up 2% and core loans up 5% YoY Loan originations 17.2 22.5 24.4 EOP total loans serviced 789.8 798.6 816.1 Average deposits up 3% YoY Net charge-off/(recovery) rate4 (0.07)% (0.21)% (0.03)% Active mobile customers up 11% YoY Card, Merchant Services & Auto Card average loans $150.6 $146.3 $143.5 Client investment assets up 3% YoY Auto average loans and leased assets 83.5 83.2 82.2 Auto loan and lease originations 7.0 8.1 8.2 Credit card sales up 10% YoY; merchant processing volume up Card net charge-off rate 2.93% 2.91% 2.97% 17% YoY Card Services net revenue rate 11.57 11.50 10.64 Credit Card sales volume5 $185.3 $176.0 $168.0 1 See note 1 on slide 11 Merchant processing volume 375.2 343.8 321.4 For additional footnotes see slide 12 5

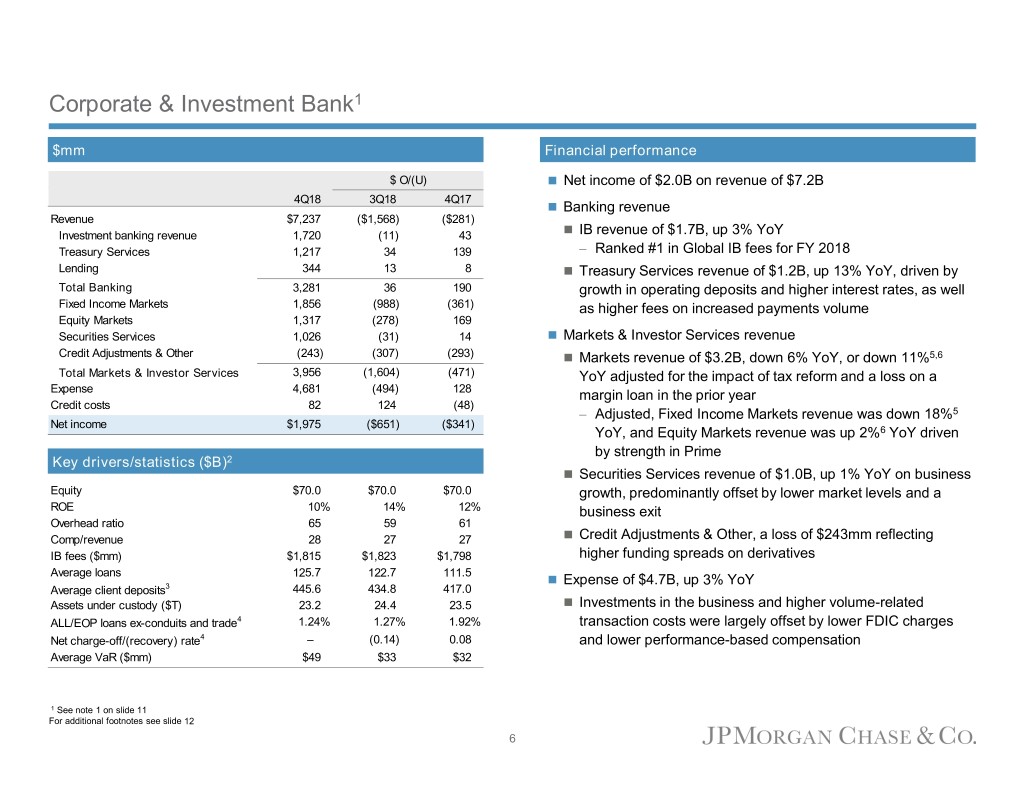

Corporate & Investment Bank1 $mm Financial performance $ O/(U) Net income of $2.0B on revenue of $7.2B 4Q18 3Q18 4Q17 Banking revenue Revenue $7,237 ($1,568) ($281) Investment banking revenue 1,720 (11) 43 IB revenue of $1.7B, up 3% YoY Treasury Services 1,217 34 139 – Ranked #1 in Global IB fees for FY 2018 Lending 344 13 8 Treasury Services revenue of $1.2B, up 13% YoY, driven by Total Banking 3,281 36 190 growth in operating deposits and higher interest rates, as well Fixed Income Markets 1,856 (988) (361) as higher fees on increased payments volume Equity Markets 1,317 (278) 169 Securities Services 1,026 (31) 14 Markets & Investor Services revenue Credit Adjustments & Other (243) (307) (293) Markets revenue of $3.2B, down 6% YoY, or down 11%5,6 Total Markets & Investor Services 3,956 (1,604) (471) YoY adjusted for the impact of tax reform and a loss on a Expense 4,681 (494) 128 margin loan in the prior year Credit costs 82 124 (48) – Adjusted, Fixed Income Markets revenue was down 18%5 Net income $1,975 ($651) ($341) YoY, and Equity Markets revenue was up 2%6 YoY driven by strength in Prime Key drivers/statistics ($B)2 Securities Services revenue of $1.0B, up 1% YoY on business Equity $70.0 $70.0 $70.0 growth, predominantly offset by lower market levels and a ROE 10% 14% 12% business exit Overhead ratio 65 59 61 Comp/revenue 28 27 27 Credit Adjustments & Other, a loss of $243mm reflecting IB fees ($mm) $1,815 $1,823 $1,798 higher funding spreads on derivatives Average loans 125.7 122.7 111.5 Expense of $4.7B, up 3% YoY Average client deposits3 445.6 434.8 417.0 Assets under custody ($T) 23.2 24.4 23.5 Investments in the business and higher volume-related ALL/EOP loans ex-conduits and trade4 1.24% 1.27% 1.92% transaction costs were largely offset by lower FDIC charges Net charge-off/(recovery) rate4 – (0.14) 0.08 and lower performance-based compensation Average VaR ($mm) $49 $33 $32 1 See note 1 on slide 11 For additional footnotes see slide 12 6

Commercial Banking1 $mm Financial performance $ O/(U) Net income of $1.0B 4Q18 3Q18 4Q17 Revenue of $2.3B, down 2% YoY Revenue $2,306 $35 ($47) Middle Market Banking 959 24 89 Net interest income of $1.7B, up 7% YoY, driven by higher Corporate Client Banking 741 (8) 30 deposit margins Commercial Term Lending 331 (8) (25) Gross IB revenue of $602mm, down 1% YoY Real Estate Banking 172 (3) 6 Other 103 30 (147) 4Q17 included a $115mm benefit as a result of the enactment Expense 845 (8) (67) of the TCJA Credit costs 106 121 168 Expense of $845mm, down 7% YoY Net income $1,036 ($53) $79 4Q17 included ~$100mm of impairment on leased equipment Key drivers/statistics ($B)2 Credit costs were $106mm, largely driven by higher loan loss reserves Equity $20.0 $20.0 $20.0 ROE 20% 21% 18% Net charge-off rate of 7 bps Overhead ratio 37 38 39 Average loan balances of $207B, up 2% YoY and flat QoQ Gross IB Revenue ($mm) $602 $581 $608 4 Average loans 206.7 207.2 202.8 C&I up 1% YoY and down 1% QoQ Average client deposits 169.2 168.2 181.8 CRE4 up 2% YoY and flat QoQ Allowance for loan losses 2.7 2.6 2.6 Nonaccrual loans 0.5 0.5 0.6 Average client deposits of $169B, down 7% YoY, with continued Net charge-off/(recovery) rate3 0.07% (0.03)% 0.04% migration into higher yielding investments ALL/loans3 1.31 1.28 1.26 1 See note 1 on slide 11 For additional footnotes see slide 12 7

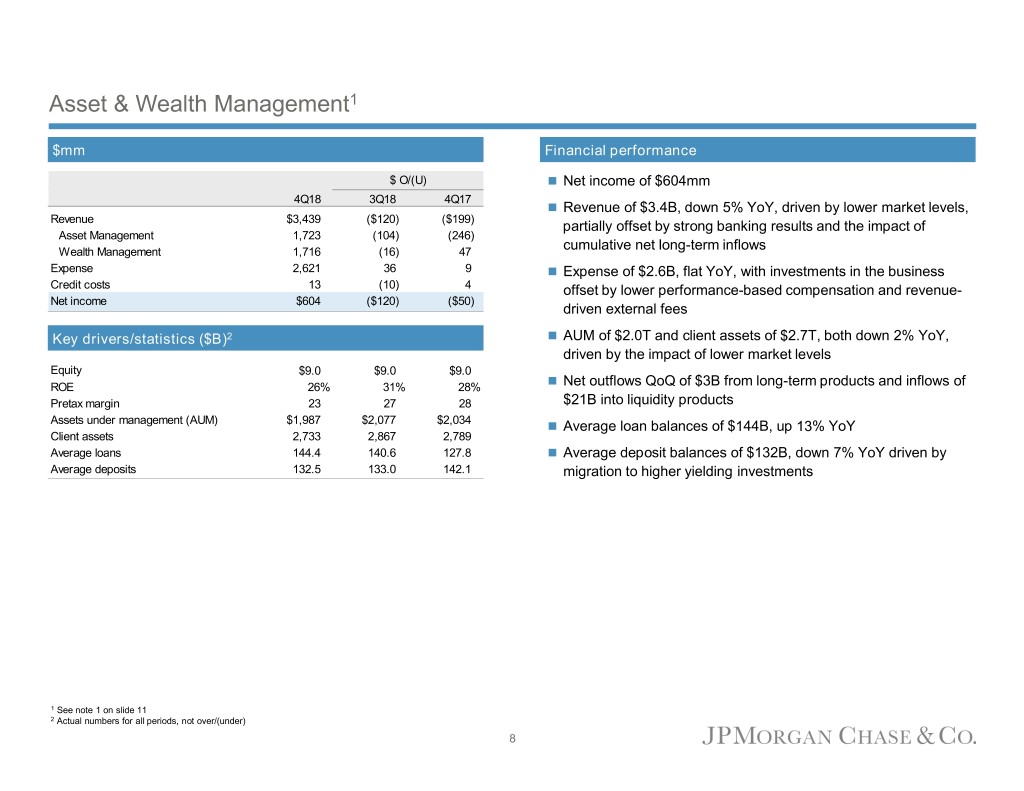

Asset & Wealth Management1 $mm Financial performance $ O/(U) Net income of $604mm 4Q18 3Q18 4Q17 Revenue of $3.4B, down 5% YoY, driven by lower market levels, Revenue $3,439 ($120) ($199) partially offset by strong banking results and the impact of Asset Management 1,723 (104) (246) Wealth Management 1,716 (16) 47 cumulative net long-term inflows Expense 2,621 36 9 Expense of $2.6B, flat YoY, with investments in the business Credit costs 13 (10) 4 offset by lower performance-based compensation and revenue- Net income $604 ($120) ($50) driven external fees Key drivers/statistics ($B)2 AUM of $2.0T and client assets of $2.7T, both down 2% YoY, driven by the impact of lower market levels Equity $9.0 $9.0 $9.0 ROE 26% 31% 28% Net outflows QoQ of $3B from long-term products and inflows of Pretax margin 23 27 28 $21B into liquidity products Assets under management (AUM) $1,987 $2,077 $2,034 Average loan balances of $144B, up 13% YoY Client assets 2,733 2,867 2,789 Average loans 144.4 140.6 127.8 Average deposit balances of $132B, down 7% YoY driven by Average deposits 132.5 133.0 142.1 migration to higher yielding investments 1 See note 1 on slide 11 2 Actual numbers for all periods, not over/(under) 8

Corporate1 $mm Financial performance $ O/(U) Treasury and CIO 4Q18 3Q18 4Q17 Net income of $175mm, up $109mm YoY, primarily driven by Treasury and CIO $175 $79 $109 higher rates Other Corporate (752) (511) 1,640 Net income ($577) ($432) $1,749 Other Corporate Net loss of $752mm included a $200mm contribution to the JPMorgan Chase Foundation, ~$150mm of markdowns on certain legacy private equity investments (both on a pre-tax basis), as well as ~$300mm of tax-related items 4Q17 included a $2.7B increase to income tax expense related to the impact of the TCJA 1 See note 1 on slide 11 9

Outlook for 1Q191 Firmwide Expect 1Q19 NII to be approximately flat QoQ, market dependent Expect 1Q19 expense to be up mid-single digits YoY 1 See note 1 on slide 11 10

Notes Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews Firmwide results, including the overhead ratio, on a “managed” basis; these Firmwide managed basis results are non-GAAP financial measures. The Firm also reviews the results of the lines of business on a managed basis. The Firm’s definition of managed basis starts, in each case, with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm and each of the reportable business segments on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable investments and securities. These financial measures allow management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. For a reconciliation of the Firm’s results from a reported to managed basis, see page 7 of the Earnings Release Financial Supplement. 2. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”), are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. For a reconciliation from common stockholders’ equity to TCE, see page 9 of the Earnings Release Financial Supplement. ROTCE measures the Firm’s net income applicable to common equity as a percentage of average TCE. TBVPS represents the Firm’s TCE at period-end divided by common shares at period-end. Book value per share was $70.35, $69.52, and $67.04 at December 31, 2018, September 30, 2018 and December 31, 2017, respectively. TCE, ROTCE and TBVPS are utilized by the Firm, as well as investors and analysts, in assessing the Firm’s use of equity. 3. Adjusted expense and adjusted overhead ratio are each non-GAAP financial measures. Adjusted expense excluded Firmwide legal expense/(benefit) of $(18) million, $20 million and $(207) million for the three months ended December 31, 2018, September 30, 2018 and December 31, 2017, respectively. The adjusted overhead ratio measures the Firm’s adjusted expense as a percentage of adjusted managed net revenue. Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm’s performance. 4. Net charge-offs and net charge-off rates exclude the impact of purchased credit-impaired (“PCI”) loans. 5. CIB calculates the ratio of the allowance for loan losses to end-of-period loans (“ALL/EOP”) excluding the impact of consolidated Firm-administered multi-seller conduits and trade finance loans, to provide a more meaningful assessment of CIB’s allowance coverage ratio. Notes on key performance measures 6. The Basel III regulatory capital, risk-weighted assets and capital ratios (which became fully phased-in effective January 1, 2019), and the Basel III supplementary leverage ratio (“SLR”) (which was fully-phased in effective January 1, 2018), are all considered key regulatory capital measures. The capital adequacy of the Firm is evaluated against the Basel III approach (Standardized or Advanced) which, for each quarter, results in the lower ratio. These measures are used by management, bank regulators, investors and analysts to assess and monitor the Firm’s capital position. For additional information on these measures, see Capital Risk Management on pages 82-91 of the Firm’s Annual Report on Form 10-K for the year ended December 31, 2017, and pages 44-48 of the Firm’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2018. 7. Core loans represent loans considered central to the Firm’s ongoing businesses; core loans exclude loans classified as trading assets, runoff portfolios, discontinued portfolios and portfolios the Firm has an intent to exit. 11

Notes Additional Notes on slide 5 – Consumer & Community Banking 2. Actual numbers for all periods, not over/(under) 3. Firmwide mortgage origination volume was $18.7B, $24.5B and $26.6B for the three months ended December 31, 2018, September 30, 2018 and December 31, 2017, respectively 4. Excludes the impact of PCI loans, including PCI write-offs of $36mm, $58mm, and $20mm for the three months ended December 31, 2018, September 30, 2018 and December 31, 2017, respectively. See note 4 on slide 11. The net charge-off/(recovery) rates for the three months ended December 31, 2018 and September 30, 2018 include recoveries from loan sales 5. Excludes Commercial Card Additional Notes on slide 6 – Corporate & Investment Bank 2. Actual numbers for all periods, not over/(under) 3. Client deposits and other third-party liabilities pertain to the Treasury Services and Securities Services businesses 4. Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate. ALL/EOP loans as reported was 0.93%, 0.91% and 1.27% at December 31, 2018, September 30, 2018 and December 31, 2017, respectively. See note 5 on slide 11 5. As a result of the Tax Cuts and Jobs Act (“TCJA”), the three months ended December 31, 2018 reflects a reduction of approximately $163mm in FTE adjustments compared with the prior year, which included the estimated impact of $259mm from the enactment of the TCJA 6. The three months ended December 31, 2017 included a loss of $143mm on a margin loan to a single client Additional Notes on slide 7 – Commercial Banking 2. Actual numbers for all periods, not over/(under) 3. Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate and loan loss coverage ratio 4. Commercial and Industrial (“C&I”) and Commercial Real Estate (“CRE”) groupings for CB are generally based on client segments and do not align with regulatory definitions 12

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2017, and Quarterly Reports on Form 10-Q for the quarterly periods ended September 30, 2018, June 30, 2018 and March 31, 2018, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (https://jpmorganchaseco.gcs-web.com/financial-information/sec-filings), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update any forward-looking statements. 13