Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FORD MOTOR CO | wolfeconference8-kdated1x1.htm |

Wolfe Research Global Auto Industry Conference January 15, 2019 Hau Thai-Tang Executive Vice President, Product Development and Purchasing Ford Motor Company

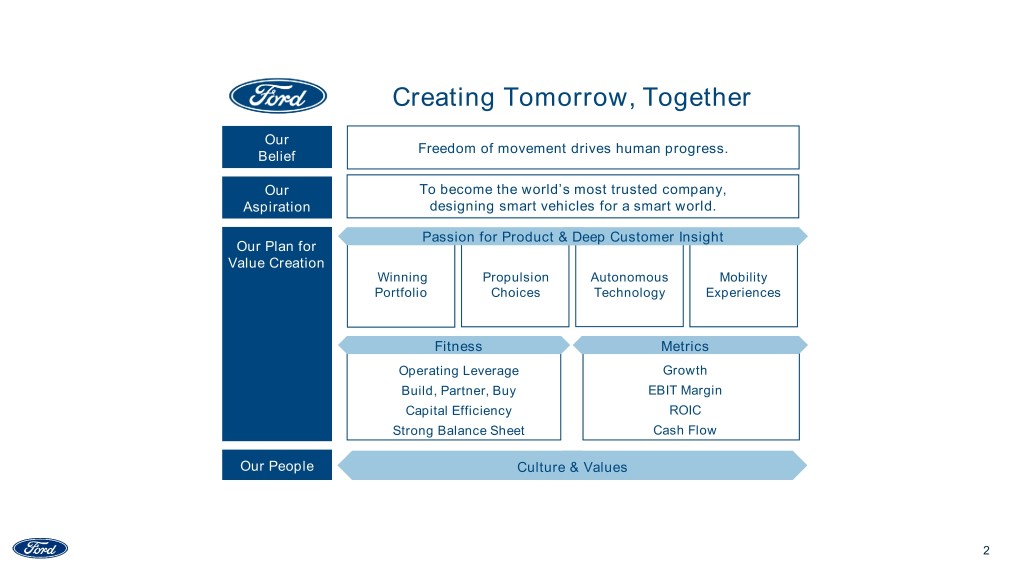

Creating Tomorrow, Together Our Freedom of movement drives human progress. Belief Our To become the world’s most trusted company, Aspiration designing smart vehicles for a smart world. Passion for Product & Deep Customer Insight Our Plan for Value Creation Winning Propulsion Autonomous Mobility Portfolio Choices Technology Experiences Fitness Metrics Operating Leverage Growth Build, Partner, Buy EBIT Margin Capital Efficiency ROIC Strong Balance Sheet Cash Flow Our People Culture & Values 2

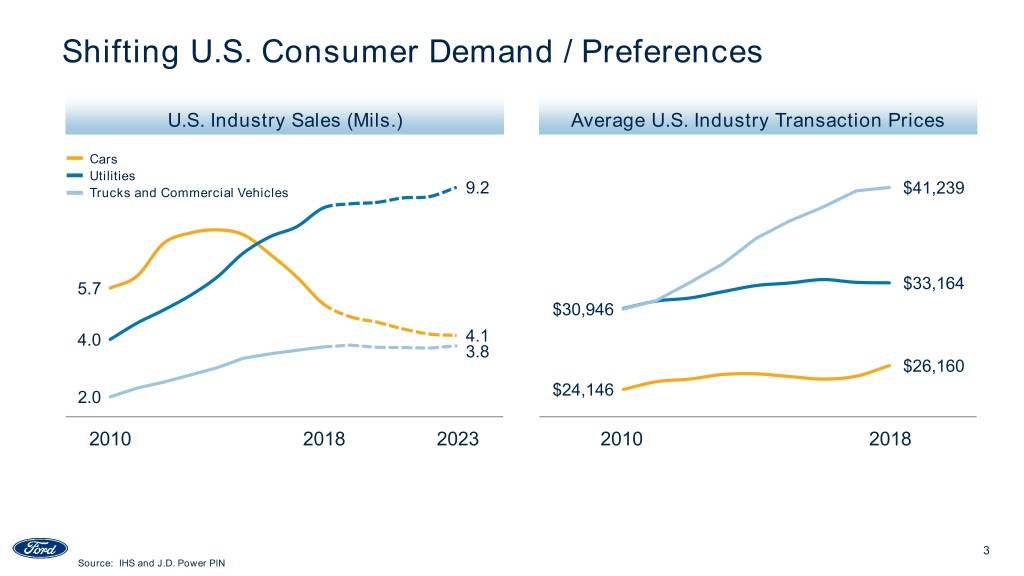

Shifting U.S. Consumer Demand / Preferences U.S. Industry Sales (Mils.) Average U.S. Industry Transaction Prices Cars Utilities Trucks and Commercial Vehicles 9.2 $41,239 5.7 $33,164 $30,946 4.0 4.1 3.8 $26,160 2.0 $24,146 2010 2018 2023 2010 2018 3 Source: IHS and J.D. Power PIN

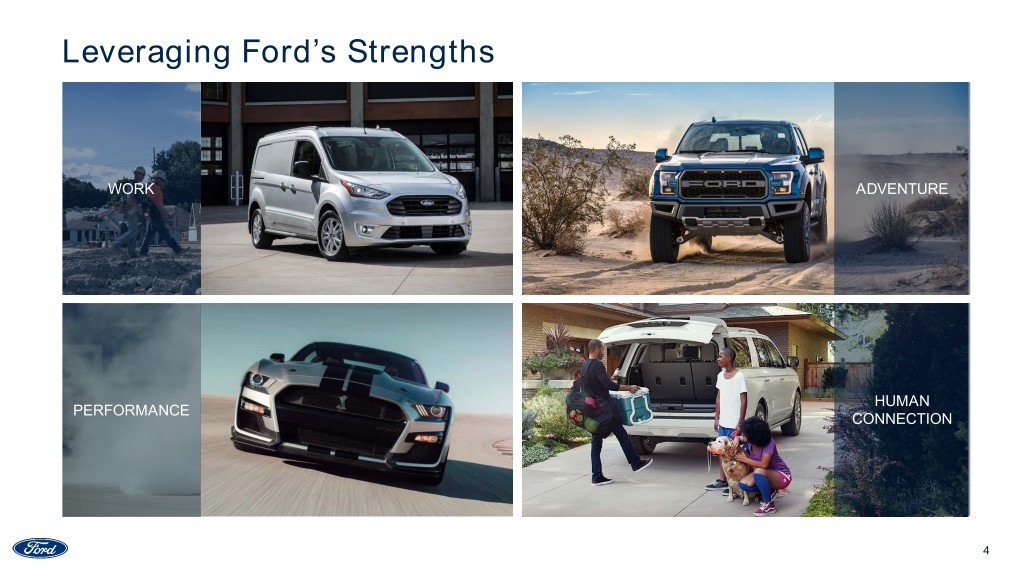

Leveraging Ford’s Strengths WORK ADVENTURE HUMAN PERFORMANCE CONNECTION 4

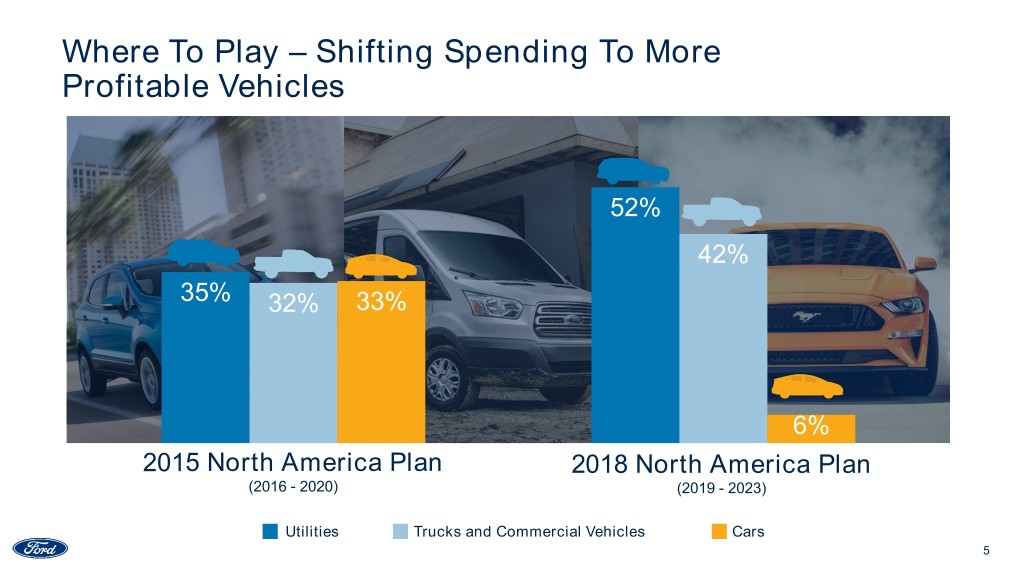

Where To Play – Shifting Spending To More Profitable Vehicles 52% 42% 35% 32% 33% 6% 2015 North America Plan 2018 North America Plan (2016 - 2020) (2019 - 2023) Utilities Trucks and Commercial Vehicles Cars 5

How To Win Leverage 1 Ford’s Strengths 2 Add Growth Products Improve 3 Profitable Mix 6

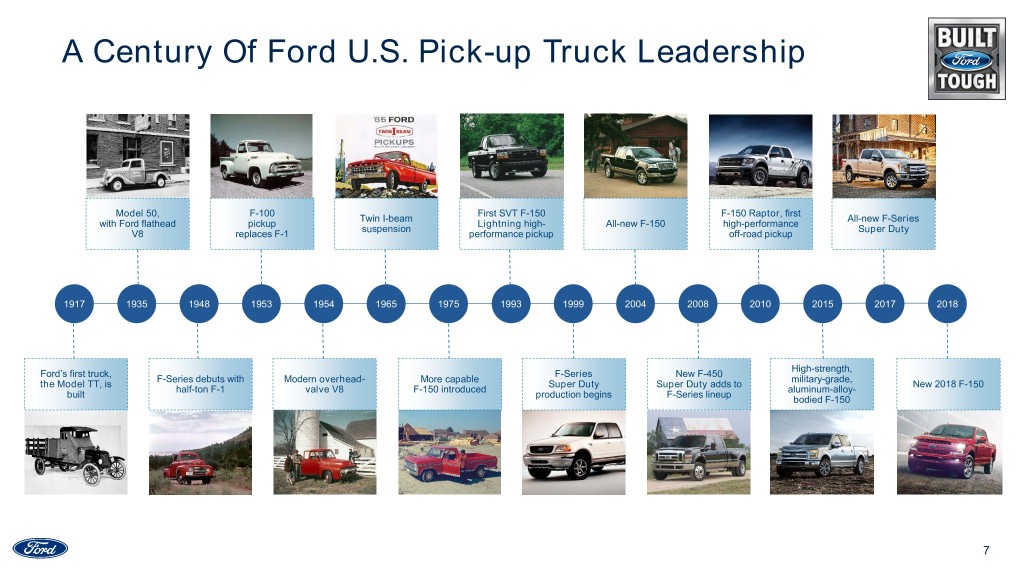

A Century Of Ford U.S. Pick-up Truck Leadership First first Model 50, F-100 Twin I-beam SVT F-150 F-150 Raptor, All-new with Ford flathead pickup high- All-new high-performance F-Series suspension Lightning F-150 V8 replaces F-1 performance pickup off-road pickup Super Duty 1917 1935 1948 1953 1954 1965 1975 1993 1999 2004 2008 2010 2015 2017 2018 High-strength, Ford’s first truck, New F-Series debuts with Modern More capable F-Series F-450 military-grade, , is overhead- adds to New 2018 the Model TT half-ton introduced Super Duty Super Duty aluminum-alloy- F-150 built F-1 valve V8 F-150 production begins F-Series lineup bodied F-150 7

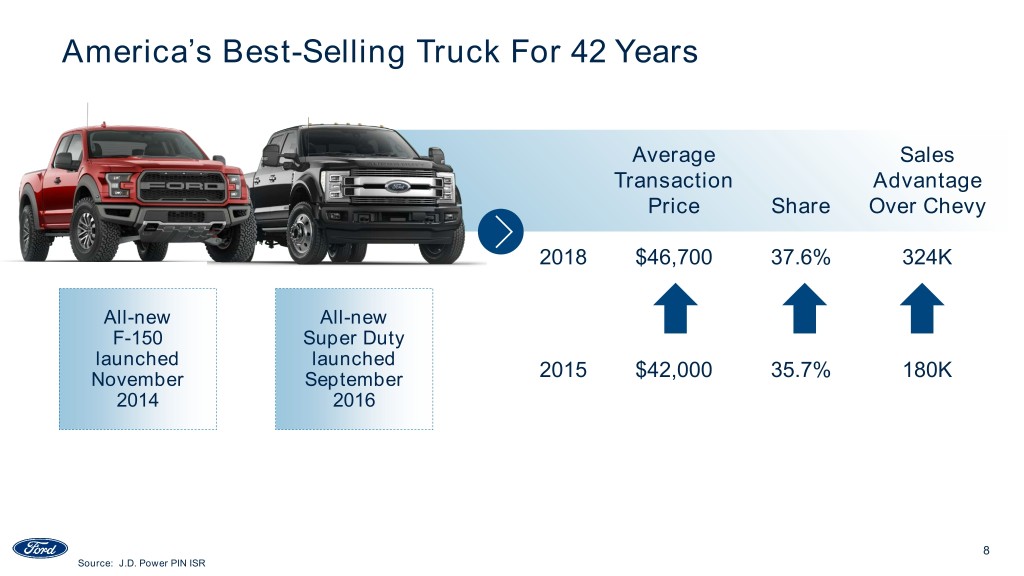

America’s Best-Selling Truck For 42 Years Average Sales Transaction Advantage Price Share Over Chevy 2018 $46,700 37.6% 324K All-new All-new F-150 Super Duty launched launched November September 2015 $42,000 35.7% 180K 2014 2016 8 Source: J.D. Power PIN ISR

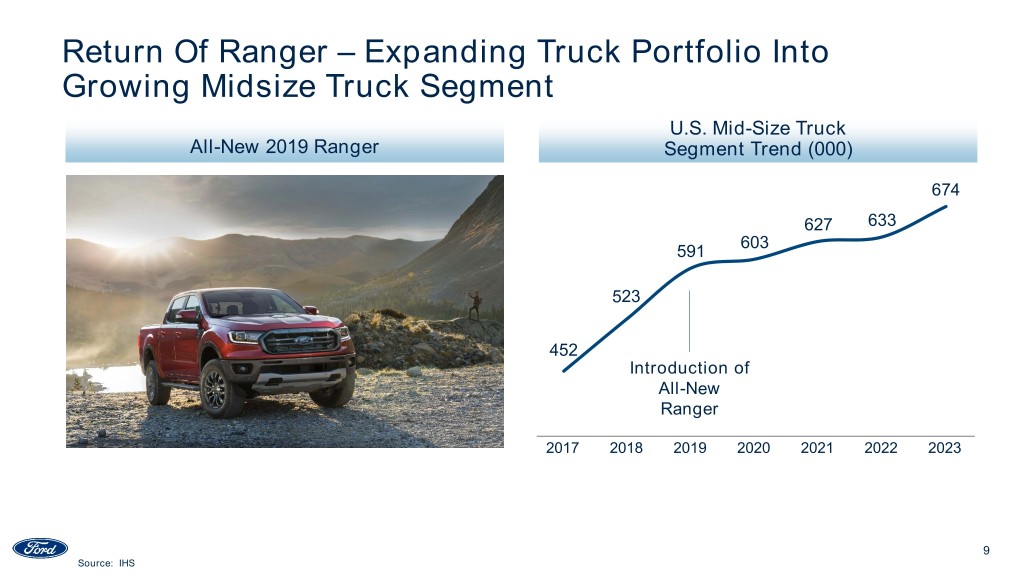

Return Of Ranger – Expanding Truck Portfolio Into Growing Midsize Truck Segment U.S. Mid-Size Truck All-New 2019 Ranger Segment Trend (000) 674 627 633 603 591 523 452 Introduction of All-New Ranger 2017 2018 2019 2020 2021 2022 2023 9 Source: IHS

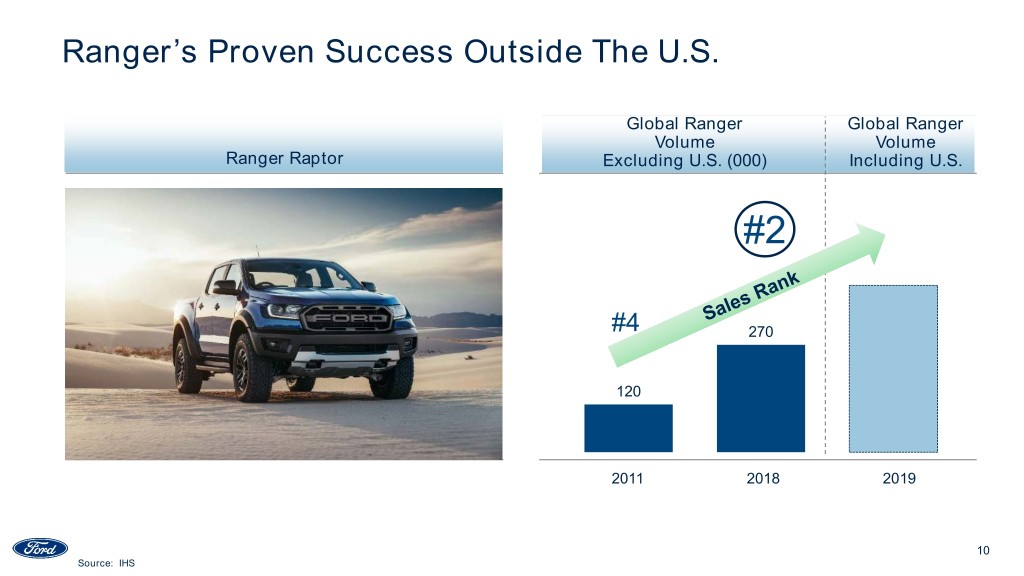

Ranger’s Proven Success Outside The U.S. Global Ranger Global Ranger Volume Volume Ranger Raptor Excluding U.S. (000) Including U.S. #2 #4 270 120 2011 2018 2019 10 Source: IHS

2018 Expedition “It's hard to undersell how good the 2018 Ford Expedition is in its full-size SUV class.” – Kelley Blue Book “The 2018 Ford Expedition’s blend of performance (both on- and off-road), comfort, utility, and tech easily make it the new benchmark for the full-size 2018 WINNER – SUV class.” – Motor Trend BEAST OF BURDEN Awards HEAD TO HEAD COMPETITION 11

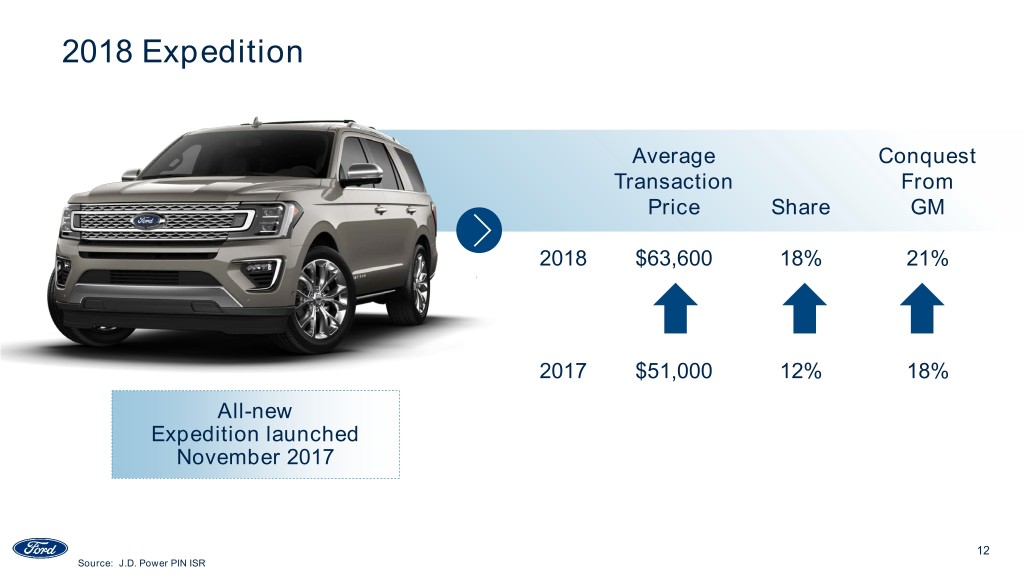

2018 Expedition Average Conquest Transaction From Price Share GM 2018 $63,600 18% 21% 2017 $51,000 12% 18% All-new Expedition launched November 2017 12 Source: J.D. Power PIN ISR

Explorer – America’s Best-Selling 3-Row SUV U.S. Sales Since 2011 Redesign (000) 227.7 135.7 1991 Explorer 2011 2018 13

2020 Explorer Will Set The Bar Even Higher ST • All-new RWD architecture • Smarter and more capable Platinum Hybrid • Broadest-ever lineup with richer mix 14

Incremental Product Offerings To Broaden Appeal Urban Active 2019 Escape Rugged Off-Road 15

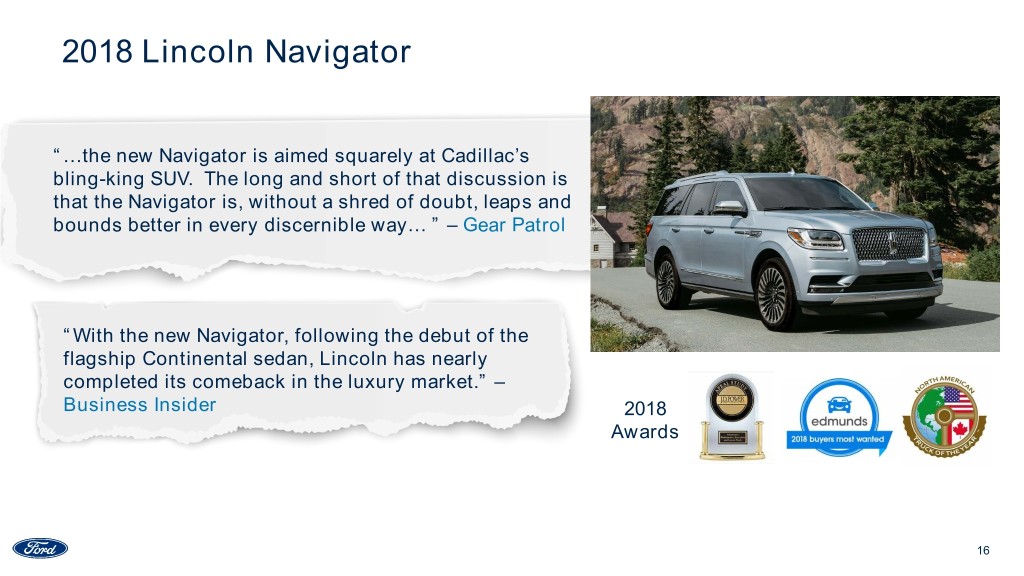

2018 Lincoln Navigator “…the new Navigator is aimed squarely at Cadillac’s bling-king SUV. The long and short of that discussion is that the Navigator is, without a shred of doubt, leaps and bounds better in every discernible way… ” – Gear Patrol “With the new Navigator, following the debut of the flagship Continental sedan, Lincoln has nearly completed its comeback in the luxury market.” – Business Insider 2018 Awards 16

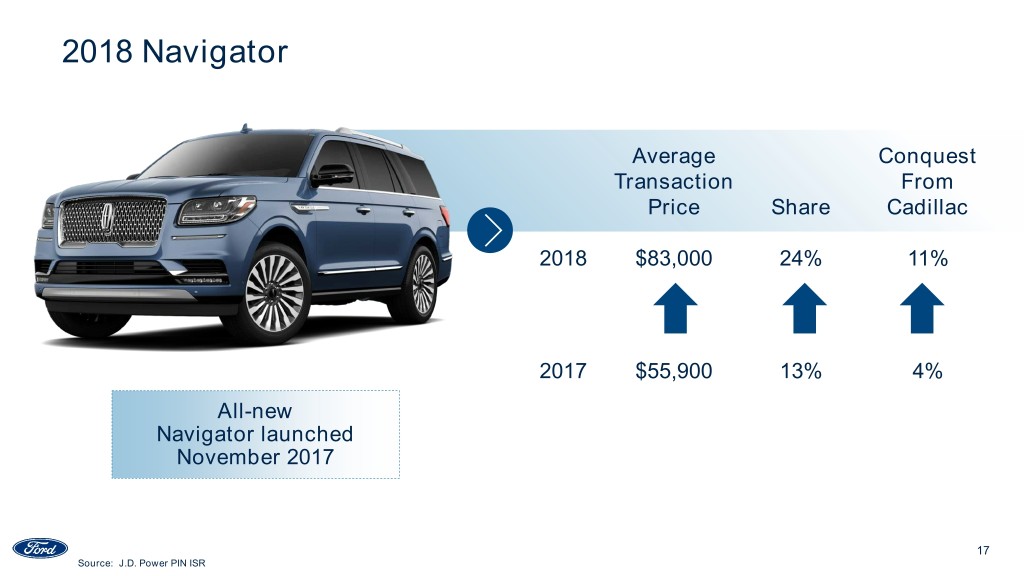

2018 Navigator Average Conquest Transaction From Price Share Cadillac 2018 $83,000 24% 11% 2017 $55,900 13% 4% All-new Navigator launched November 2017 17 Source: J.D. Power PIN ISR

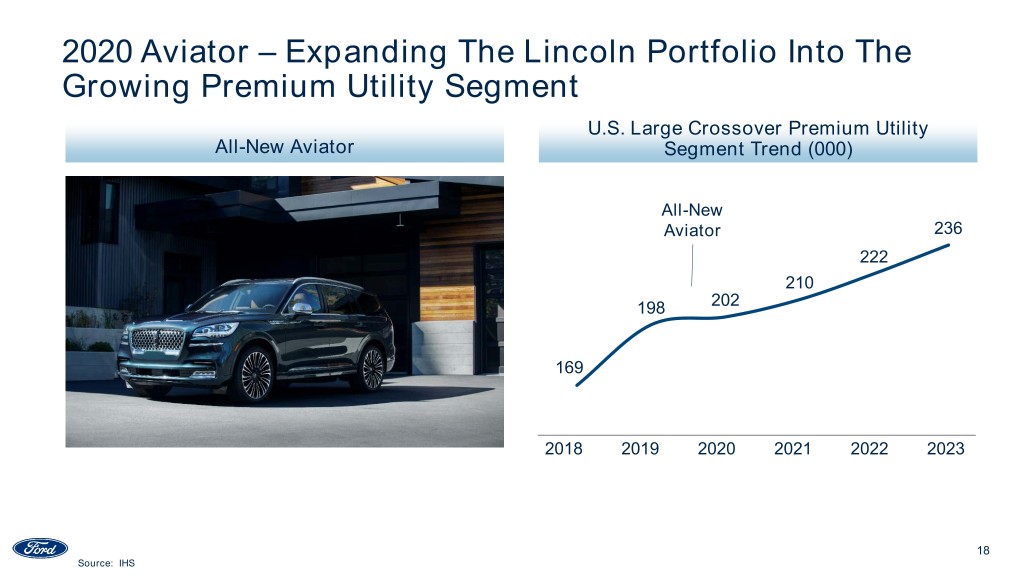

2020 Aviator – Expanding The Lincoln Portfolio Into The Growing Premium Utility Segment U.S. Large Crossover Premium Utility All-New Aviator Segment Trend (000) All-New Aviator 236 222 210 198 202 169 2018 2019 2020 2021 2022 2023 18 Source: IHS

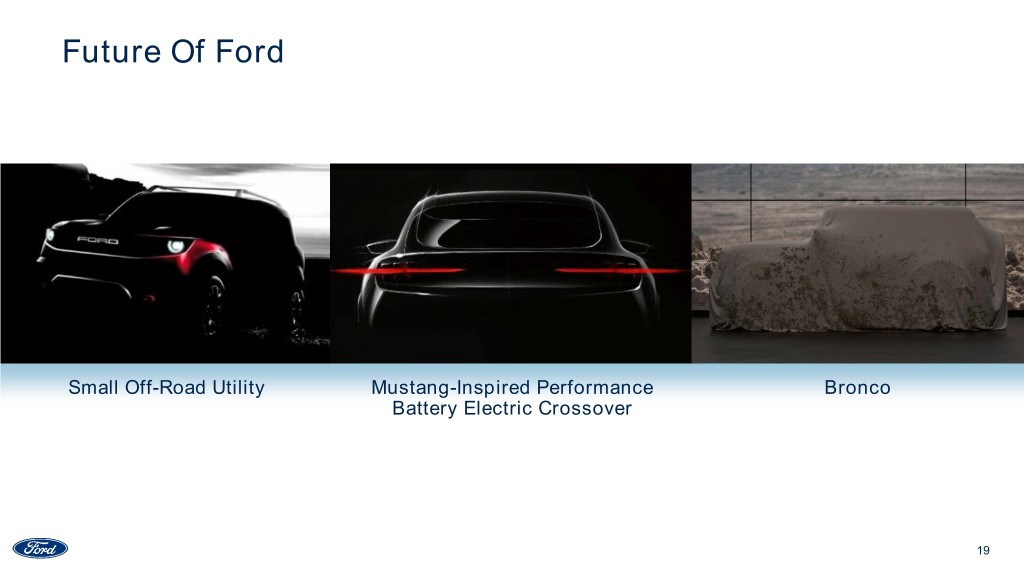

Future Of Ford Small Off-Road Utility Mustang-Inspired Performance Bronco Battery Electric Crossover 19

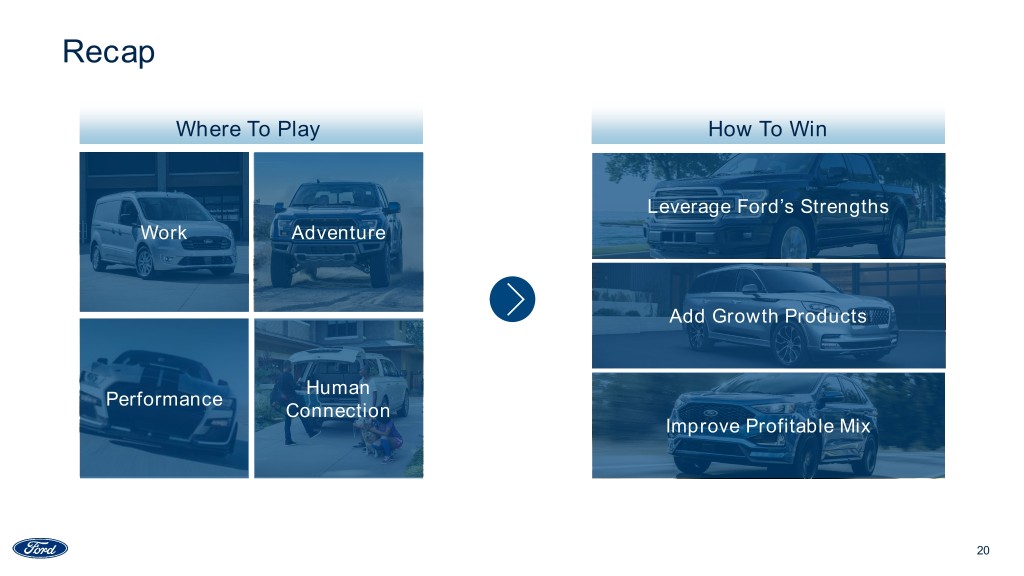

Recap Where To Play How To Win Leverage Ford’s Strengths Work Adventure Add Growth Products Human Performance Connection Improve Profitable Mix 20

Q&A

Cautionary Note On Forward-Looking Statements Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford’s long-term competitiveness depends on the successful execution of fitness actions; • Industry sales volume, particularly in the United States, Europe, or China, could decline if there is a financial crisis, recession, or significant geopolitical event; • Ford’s new and existing products and mobility services are subject to market acceptance; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • Ford may face increased price competition resulting from industry excess capacity, currency fluctuations, or other factors; • Fluctuations in commodity prices, foreign currency exchange rates, and interest rates can have a significant effect on results; • With a global footprint, Ford’s results could be adversely affected by economic, geopolitical, protectionist trade policies, or other events; • Ford’s production, as well as Ford’s suppliers’ production, could be disrupted by labor disputes, natural or man-made disasters, financial distress, production difficulties, or other factors; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs; • Safety, emissions, fuel economy, and other regulations affecting Ford may become more stringent; • Ford could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise; • Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Operational systems, security systems, and vehicles could be affected by cyber incidents; • Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Ford Credit could face increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and • Ford Credit could be subject to new or increased credit regulations, consumer or data protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 22