Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MEDIFAST INC | tv510983_8k.htm |

Exhibit 99.1

January 2019 INVESTOR PRESENTATION

Safe Harbor Statement Certain information included in this presentation may constitute “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology. Similarly, descriptions o f Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements. Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities a nd Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors. Some of these factors include, among others, Medifast's inability to attract and retain independent OPTA VIA Coaches TM and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth int o new domestic and international markets and new channels of distribution. Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K. All of the forward - looking statements contained herein speak only as of the date of this presentation. 2

An Innovator in Health & Wellness 3

A Dynamic & Exciting New Brand 4

A Mission to Offer the World Lifelong Transformation One Healthy Habit at a Time 5

• Nearly 40 years of research and experience • Double - blind controlled clinical study demonstrates enhanced efficacy of integrated coach model vs solo approach • Substantial credibility with U.S. doctors and medical community • Scientific Advisory Board helps guide and advise development of programs 6 Proven Effectiveness

Holistic approach to improving overall health and wellness Coach and community support clinically demonstrated to contribute meaningfully to success Empowering a new attitude towards food An effective lifestyle solution for people for whom diets have previously failed Lifelong transformation supported through the incorporation of Healthy Habits WEIGHT LOSS IS A CATALYST FOR FURTHER CHANGE Solid Track Record in Health Innovation 7

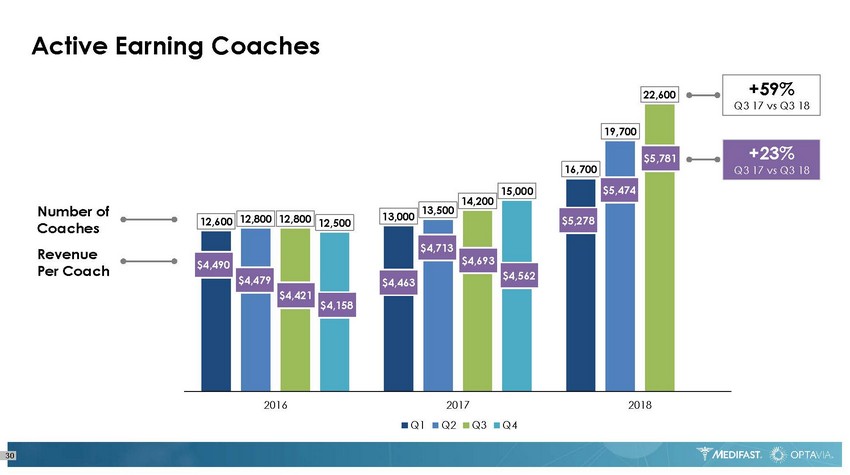

8 Delivering on Our Promises Net Sales Per Active Earning Coach Q3 2017 – Q3 2018 + 23 % Number of Active Earning Coaches Q3 2017 – Q3 2018 + 59 %

9 Generating Exceptional Results Operating Income YTD 2017 – YTD 2018 + 63 % Revenue YTD 2017 – YTD 2018 + 59 % Diluted EPS YTD 2017 – YTD 2018 + 96 % YTD represents nine months ending September.

Now We are Delivering on the Next Stage of Our Growth Journey 10

• 22,600 active earning coaches and growing rapidly • Personal, direct - service and sales strategy, optimal for activating and supporting consumers • Attractive financial model, with higher lifetime value and enhanced profitability • Leverages growing consumer demand for personal advice, customized support and personalized recommendations 11 Fully Focused on Scaling Our Coach Model

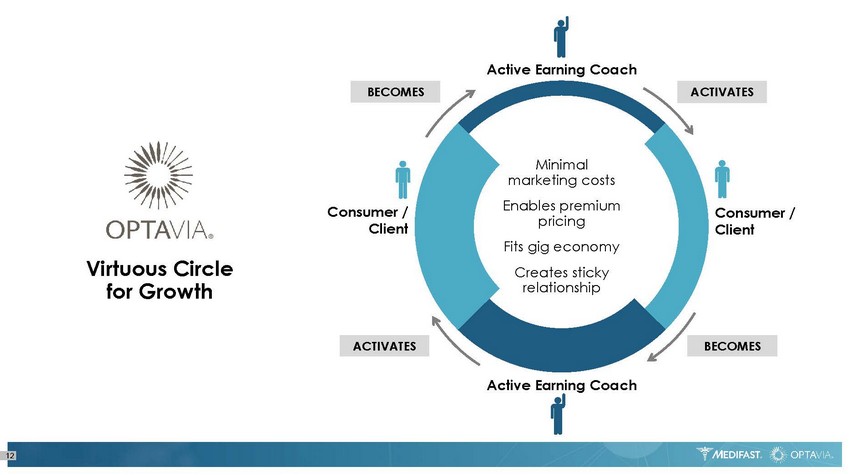

BECOMES BECOMES ACTIVATES Minimal marketing costs Enables premium pricing Fits gig economy Creates sticky relationship ACTIVATES Active Earning Coach Consumer / Client Consumer / Client Active Earning Coach Virtuous Circle for Growth 12

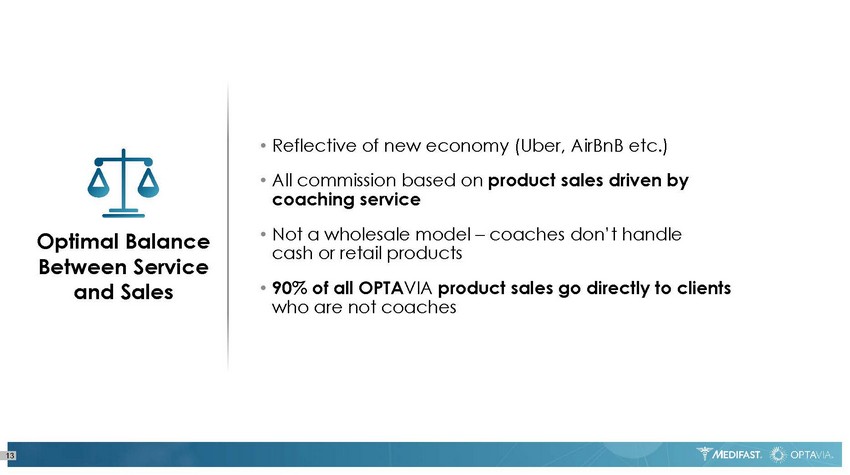

• Reflective of new economy (Uber, AirBnB etc.) • All commission based on product sales driven by coaching service • Not a wholesale model – coaches don’t handle cash or retail products • 90% of all OPTA VIA product sales go directly to clients who are not coaches 13 Optimal Balance Between Service and Sales

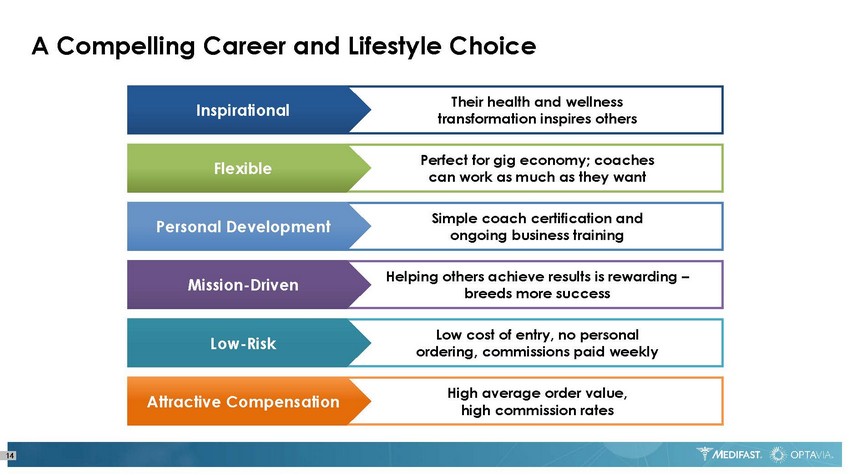

A Compelling Career and Lifestyle Choice Their health and wellness transformation inspires others Inspirational Perfect for gig economy; coaches can work as much as they want Flexible Simple coach certification and ongoing business training Personal Development Helping others achieve results is rewarding – breeds more success Mission - Driven Low cost of entry, no personal ordering, commissions paid weekly Low - Risk High average order value, high commission rates Attractive Compensation 14

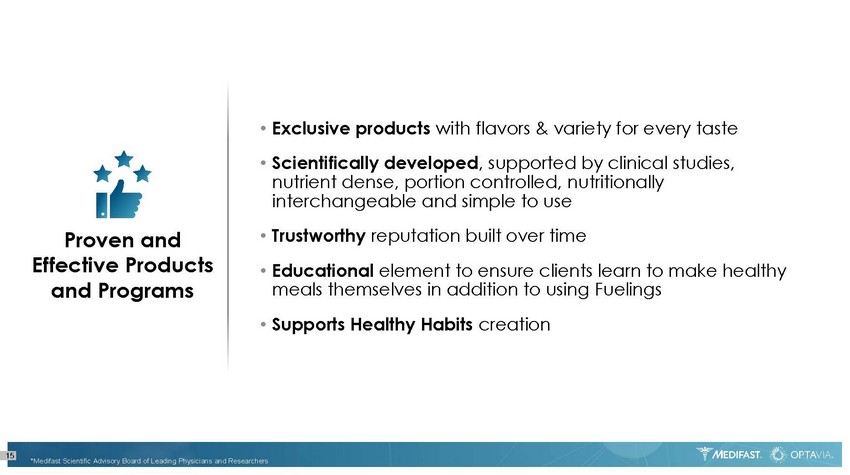

• Exclusive products with flavors & variety for every taste • Scientifically developed , supported by clinical studies, nutrient dense, portion controlled, nutritionally interchangeable and simple to use • Trustworthy reputation built over time • Educational element to ensure clients learn to make healthy meals themselves in addition to using Fuelings • Supports Healthy Habits creation * Medifast Scientific Advisory Board of Leading Physicians and Researchers 15 Proven and Effective Products and Programs

A CLEAR PATH FOR GROWTH 16

17 Double the size of the business every 3 - 4 years by growing in the US and expanding into Asia Pacific Our Vision

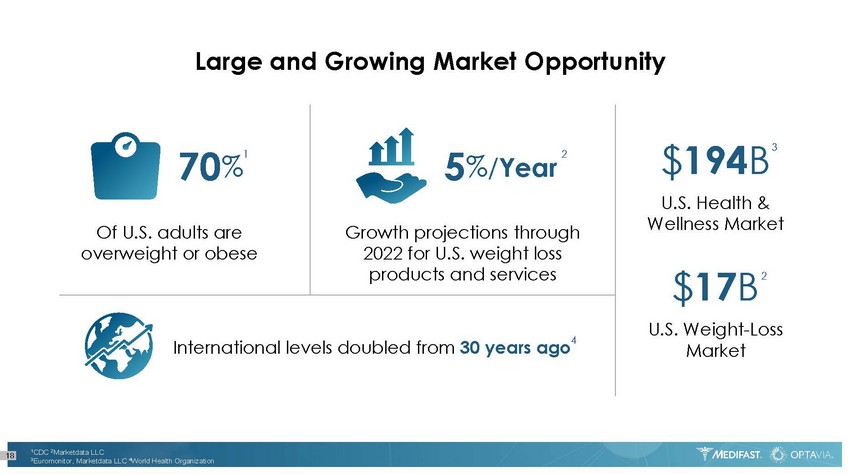

Large and Growing Market Opportunity 18 U.S. Health & Wellness Market $ 194 B U.S. Weight - Loss Market $ 17 B Of U.S. adults are overweight or obese 70 % International levels doubled from 30 years ago Growth projections through 2022 for U.S. weight loss products and services 5 % / Year 1 2 3 4 2 1 CDC 2 Marketdata LLC 3 Euromonitor, Marketdata LLC 4 World Health Organization

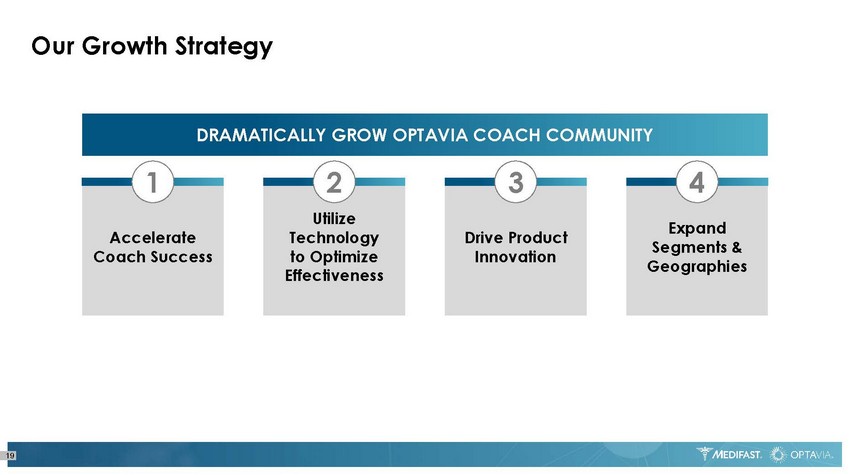

Our Growth Strategy 19 DRAMATICALLY GROW OPTAVIA COACH COMMUNITY Accelerate Coach Success 1 Expand Segments & Geographies 4 Drive Product Innovation 3 Utilize Technology to Optimize Effectiveness 2

Accelerate Coach Success 1 • Capitalize on OPTA VIA Brand and compelling health and wellness message • Leverage new, exclusive products based on company’s proven science and clinical credibility • Deliver on easy to share story about a complex lifestyle issue • Teach a simple growth model • Streamline the coach experience 20

21 SCALABLE TO SUPPORT EXPANSION & GROWTH • Accelerate our repeatable business rhythm • Mobile app - based platform • Improve use of data analytics • Streamline processes • Connectivity powering customer acquisition and insight • Cloud based to enable rapid expansion • Improve coach efficiency Utilize Technology to Optimize Effectiveness 2

Growth into Adjacent Healthy Habits 22 Drive Product Innovation 3 Movement Sleep Hydration Nutrition Aging

23 Expand Segments & Geographies 4 U.S. Opportunities Diversity Outreach to important communities Generational Target younger demographics Regional Underrepresented markets Lifestyle Serve clients in different stages of optimal wellbeing

• Claiming our share of $790B 1 global health & wellness market • Launching in Hong Kong, Singapore gateway markets in the first half of 2019 • Invested $3M – $5M in 2018 in market preparation and development • Building global presence of successful optimal weight loss plans • Strong response to product testing in - market • Actively engaging U.S. coach base now as rollout begins 24 Expand Segments & Geographies 4 International Opportunities 1 Euromonitor, International Health, Racquet and Sportsclub Association ( IHRSA ).

Methodical approach to expansion in global markets • Drive pre - market activity in U.S. • Scale to achieve profitability in newly opened markets • Provide springboard for further expansion • Fund expansion without negatively impacting existing operating margin Source: 2016 10 - K *2013 - 2015 data, World Federation of Direct Selling Associations Significant Potential in International Markets Global Direct Selling Market* Largest Markets U.S. $36B China $35B Korea $17B Germany $15B Japan $15B Fastest Growing (3 - yr. CAGR) China 22.5% Indonesia 11.9% U.K. 9.8% Philippines 9.8% Malaysia 9.4% Medifast has larger U.S. Revenue base than many U.S. - Based peers, but no international presence today PARTICULARLY STRONG GROWTH POTENTIAL IN ASIA PACIFIC 25

STRONG FINANCIAL PERFORMANCE 26

• Efficient direct - to - consumer business • Consistent patterns create strong forward visibility • High percentage of clients on continuity shipments ( ≈ 85% of orders ) • High lifetime value • Variable cost model 27 A Resilient Business Model

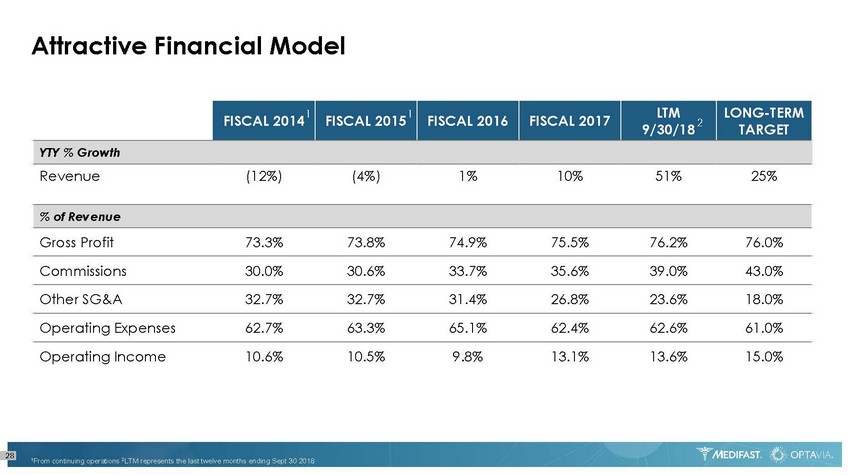

Attractive Financial Model 28 FISCAL 2014 FISCAL 2015 FISCAL 2016 FISCAL 2017 LTM 9/30/18 LONG - TERM TARGET YTY % Growth Revenue (12%) (4%) 1% 10% 51% 25% % of Revenue Gross Profit 73.3% 73.8% 74.9% 75.5% 76.2% 76.0% Commissions 30.0% 30.6% 33.7% 35.6% 39.0% 43.0% Other SG&A 32.7% 32.7% 31.4% 26.8% 23.6% 18.0% Operating Expenses 62.7% 63.3% 65.1% 62.4% 62.6% 61.0% Operating Income 10.6% 10.5% 9.8% 13.1% 13.6% 15.0% 1 From continuing operations 2 LTM represents the last twelve months ending Sept 30 2018 2 1 1

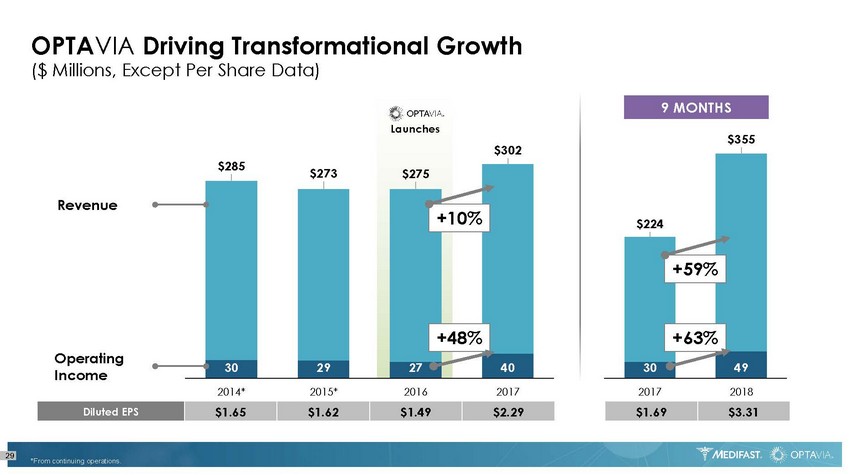

30 29 27 40 $285 $273 $275 $302 2014* 2015* 2016 2017 29 ($ Millions, Except Per Share Data) OPTA VIA Driving Transformational Growth Revenue Operating Income Diluted EPS $ 1.65 $ 1.62 $1.49 $2.29 +10% +48% 30 49 $224 $355 2017 2018 $1.69 $3.31 +59% +63% 9 MONTHS Launches *From continuing operations.

12,600 13,000 16,700 12,800 13,500 19,700 12,800 14,200 22,600 12,500 15,000 2016 2017 2018 Q1 Q2 Q3 Q4 $4,490 $4,463 $5,278 $4,479 $4,713 $5,474 $4,421 $4,693 $5,781 $4,158 $4,562 2016 2017 2018 Q1 Q2 Q3 Q4 Active Earning Coaches Number of Coaches Revenue Per Coach 30 +59% Q3 17 vs Q3 18 +23% Q3 17 vs Q3 18

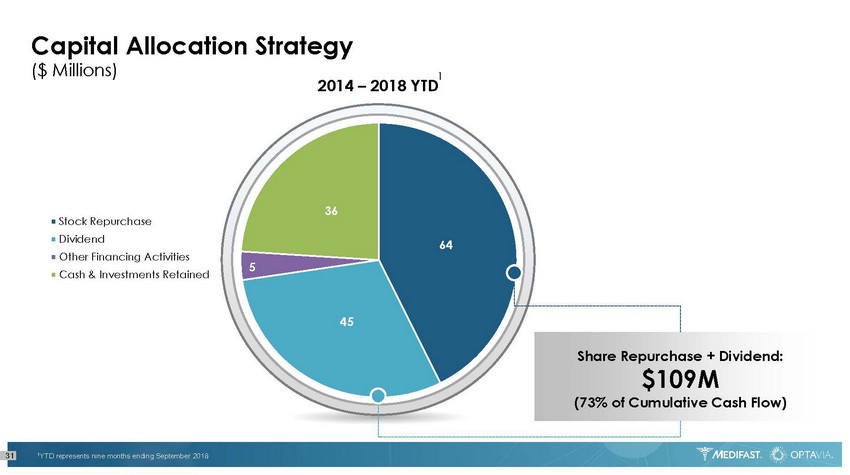

31 ($ Millions) Capital Allocation Strategy 2014 – 2018 YTD 64 45 5 36 Stock Repurchase Dividend Other Financing Activities Cash & Investments Retained Share Repurchase + Dividend: $109M (73% of Cumulative Cash Flow) 1 YTD represents nine months ending September 2018 1

Strong Balance Sheet Facilitating Growth QUARTERLY DIVIDEND $ 0.75 DEBT - FREE CASH & INVESTMENTS $ 103 M • Financial capacity to handle any CAPEX requirements • Strong cash flow • Active share repurchase program • Raised quarterly dividend every year since initiation in 2015 ($0.25 in Dec 15 to $0.75 in Dec 18) 32

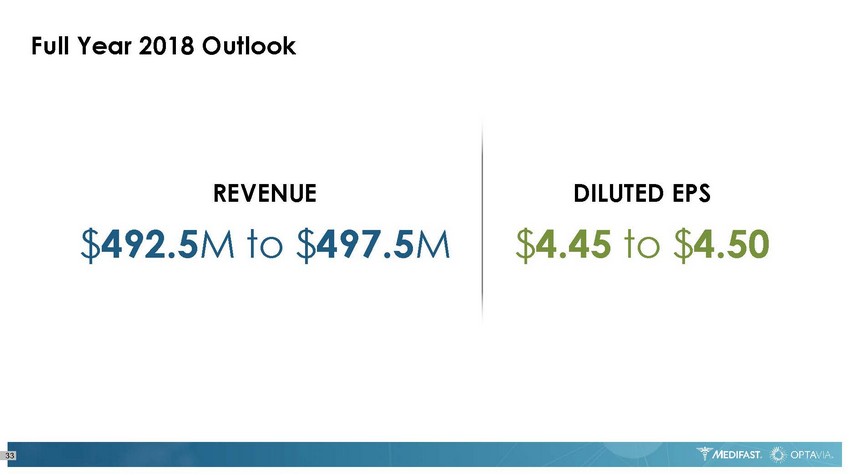

Full Year 2018 Outlook DILUTED EPS $ 4.45 to $ 4.50 REVENUE $ 492.5 M to $ 497.5 M 33

SUMMARY 34

Health & wellness innovator with differentiated, science - based products and programs Large and growing market opportunity addressing a global need Scalable coach - based distribution model Ideally positioned for growth acceleration in U.S. and internationally Attractive, highly predictable business model Significant cash flow, and strong balance sheet Attractive capital allocation strategy Demonstrated record of success Investment Thesis Summary 35

36