Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CHRISTOPHER & BANKS CORP | cbk8-k1x14x2019exhibit991.htm |

| 8-K - 8-K - CHRISTOPHER & BANKS CORP | cbk-form8kx11419.htm |

Christopher & Banks Corporation ICR Presentation January 14, 2019 1

Disclosure or Safe Harbor Statement Certain statements on the slides which follow may be forward-looking statements about Christopher & Banks Corporation (the “Company”). Such forward-looking statements involve risks and uncertainties which may cause actual results to differ. These forward-looking statements may be identified by such terms as “will”, “expect”, “believe”, “anticipate”, “outlook”, “target”, “plan”, “initiatives”, “estimated”, “strategy” and similar terms. You are directed to the cautionary statements regarding risks or uncertainties described in the Company’s filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and other SEC filings made since the date of that 10-K Report. Participants are cautioned not to place undue reliance on such forward-looking statements, which reflect management’s views only as of January 14, 2019. The Company undertakes no obligation to update or revise the forward-looking statements. 2

Investment Highlights • Unique brand positioning serving an attractive customer segment with opportunity to gain more loyal brand ambassadors • New and seasoned management team • Leveraging our investments to drive increased growth through integrated omni- channel initiatives • Significant operational improvements underway to expand operating margin • Cash on hand, with no long-term debt, and no current borrowings under our $55M credit facility 3

Company Snapshot • A heritage brand appealing to an attractive customer segment • A loyal customer base which we know well, capturing customer data for 90% of all transactions • A unique brand promise delivering on our customers’ need for comfort, quality, value and service • Continuing to grow omni-channel capabilities • Flexible real estate portfolio • Improved operating disciplines and cost optimization 4

Company History 1956 1992 2000 2008 2009 2010 2012 – present 2018 First combined store Braun’s - Company Company Launched e- First Outlet Continuing to New CEO, format Company Goes changes name to commerce Store collapse & combine CFO & CMO with Public Christopher & business stores to right size Hired Midwestern Banks and begin retail footprint roots opening CJ Banks in recognition of opportunity in women’s plus size 5

Our Store Base • Current store count of 461 stores • 381 Full-price stores • 80 outlets • 43% are in small & rural markets where we have high brand recognition and minimal competition • 77% of stores are in markets with populations <75,000 • 67% of stores in C&D centers • 65% of stores are in traditional malls 6

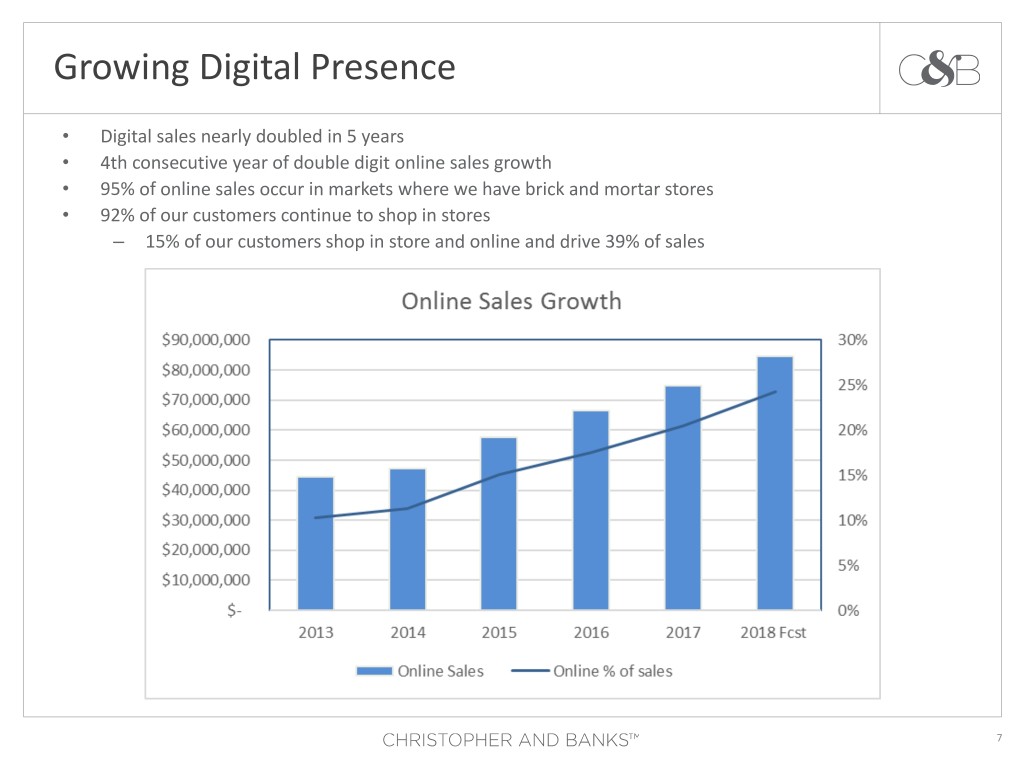

Growing Digital Presence • Digital sales nearly doubled in 5 years • 4th consecutive year of double digit online sales growth • 95% of online sales occur in markets where we have brick and mortar stores • 92% of our customers continue to shop in stores – 15% of our customers shop in store and online and drive 39% of sales 7

Our Customer Demographics Enjoys What She Expects • Baby-Boomer • Family time • Flattering Features • Over 2/3 employed outside • Church/Community Events • Consistent Fits of home (professions • Exercising (low Intensity) • Good Quality include: education, • Shopping • Great Value healthcare, and • Traveling • Timeless Styles professional assistants) • Cooking / Making Crafts • Personalized Service • 85% college educated • Average HHI $75K 8

Our Customer – Loyal Brand Ambassadors Very loyal customer base • 90% are members of our Friendship Reward program • 28% have PLCC & Drive 39% of tender share Purchases 3.6 times a year • Self-reports that she visits more frequently Spends $171 a year • $47 per purchase IN HER WORDS…… “How do you improve on perfection? Quality of merchandise is amazing. Sales and promos are on going. Customer service is fantastic.”.... Joyce B. “I just love this program (Friendship Rewards). Also love your stores. The clothes are stylish for a woman who isn’t too old or too young. I feel comfortable shopping at C&B.”…. Dawn S. “I am advertising for C&B when I go to work, church, where ever or what ever I am doing…. I love the vibrant colors, variety, comfort, absolutely everything! I just can’t get enough of your clothes and always feel beautiful wearing them. Thank you for giving us so many choices!!”…. Tammy B. 9

Winning Through Differentiation Customer Likes Our Brand Role Customer Likes • Broad Selection • Service and Support • Pricing C&B offers a relevant • Curated for me & unique selection, Customer Dislikes for every size with Customer Dislikes • Confusing, little help exceptional service • Limited Choice available at a great value. (styles, sizes) • For everybody • Value (price/quality (versus for me) trade off) 10

Challenges With Prior Strategy • Significant changes made to the real estate portfolio which have not performed to expectations – Collapse and Combine strategy was rolled out too aggressively, with insufficient testing – Misguided outlet expansion resulted in opening locations which diluted operating income and cash flow • Assortment architecture and inventory flow did not align with consumer demand • Inconsistent experience and merchandise misses led customers to stray from brand • Didn’t fully capitalize on our strong store organization and the relationships associates have with our customers 11

Path Forward • New Operating Principles • Rebuilt Leadership Team • Strategic Priorities 12

Operating Principles • Improve Customer Centricity – Continue to deepen our understanding of her and her changing behaviors – Consistently deliver what she expects • Commitment to Operational Excellence – Relentless operating discipline across functions – Right size cost structure • Enhance our Culture – Break down silos – Increase accountability – Play to win 13

New Management Keri Jones, CEO Richard Bundy, SVP, CFO Joined March 2018 Joined July 2018 30+ years of retail experience; 18 years of finance; 14 years retail experience; EVP, CMO Dicks Sporting Goods; 10 years with Chico’s FAS including VP Brand 27 years with Target in roles of EVP, Global Supply Finance & Strategy; Multiple finance & Chain, EVP, Merchandising Planning & Operations analysis roles with Limited Brands, & SVP/VP of Merchandising. Albertson’s, Inc, & NASA’s Jet Propulsion Labs Andrea Kellick, SVP Carmen Wamre, SVP Chief Merchandising Officer Chief Stores Officer Joined July 2018 Joined December 2018 30 years retail experience; 28 years retail experience; 16 years with Target including VP Women’s Field Leadership with Express including Zone VP Apparel; variety of merchandising & planning with for 300+stores, $800M annual sales & 8000 Old Navy, Express & Spiegel. associates. 14

Strategic Initiatives • Enhance the customer experience • Improve marketing & promotional effectiveness • Leverage omni-channel capabilities • Build loyalty & grow our customer file • Optimize our real estate portfolio • Right-size our cost structure 15

Enhance the Customer Experience • Improve relevancy & appropriately balance fashion, updated basics and key items • Better manage inventory flow • Refine vendor structure; improve product lifecycle • Enhance visual merchandising • Strengthen store selling culture 16

Improve Marketing and Promotional Effectiveness • Execute disciplined markdown management • Leverage improved analytics to inform promotions & targeted customer offers • Improve measurement of & increase return on marketing investment 17

Build Loyalty & Grow Customer File • Reallocate marketing spend to drive acquisition while capitalizing on market disruptions • Refresh Reward Loyalty Program & continue to leverage PLCC program to drive growth • Capitalize on our unique positioning & grass roots efforts to drive engagement 18

Leverage Omni-Channel Capabilities • Launch flexible fulfillment capabilities to maximize sales, margin and profitability o Enabled Ship from Store (Nov 2018) o Increased from 67 to 170 stores in December o $2.7M of order demand fulfilled from stores in the month of December o Rollout Buy Online, Pick-up in Store (BOPIS) in Q1 2019 o With ship-to-store; 23% of the time she spends twice as much when she picks up her order o Opportunity to reduce our shipping expense • Continued improvement of online shopping experience 19

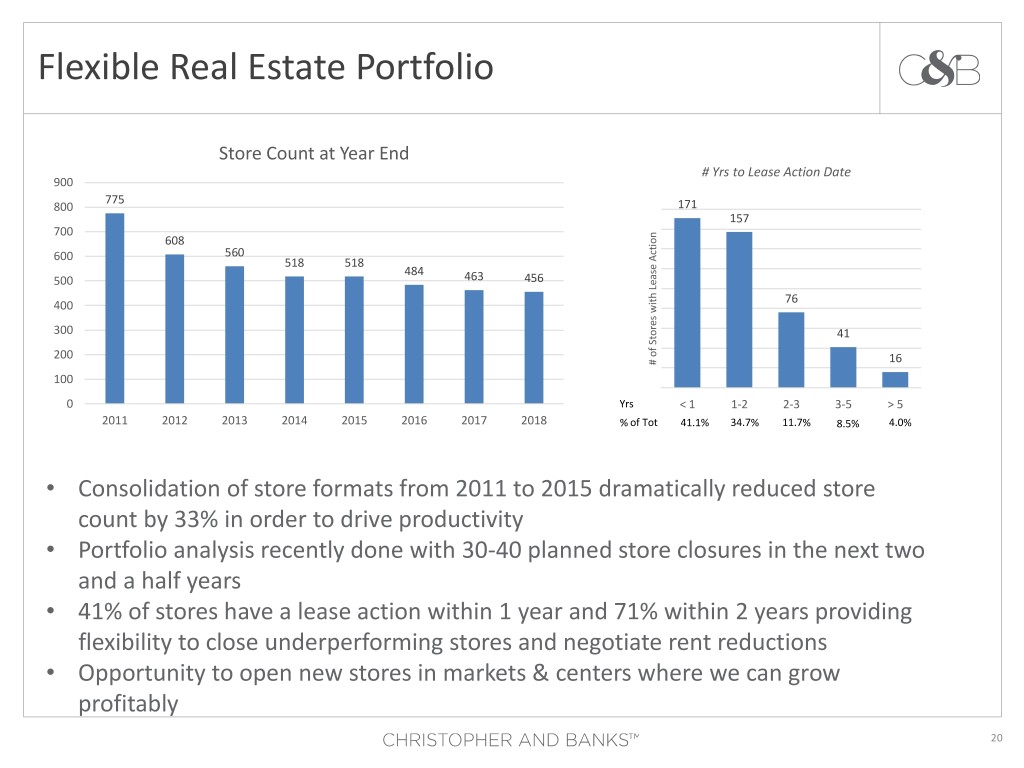

Flexible Real Estate Portfolio Store Count at Year End # Yrs to Lease Action Date 900 775 800 171 157 700 608 600 560 518 518 484 500 463 456 76 400 300 41 200 # of Stores with Lease Action Lease with Stores of # 16 100 0 Yrs < 1 1-2 2-3 3-5 > 5 2011 2012 2013 2014 2015 2016 2017 2018 % of Tot 41.1% 34.7% 11.7% 8.5% 4.0% • Consolidation of store formats from 2011 to 2015 dramatically reduced store count by 33% in order to drive productivity • Portfolio analysis recently done with 30-40 planned store closures in the next two and a half years • 41% of stores have a lease action within 1 year and 71% within 2 years providing flexibility to close underperforming stores and negotiate rent reductions • Opportunity to open new stores in markets & centers where we can grow profitably 20

Right Size Cost Structure • Holistic approach being taken to drive cost reductions – Hired 3rd party non-merchandise procurement specialists to analyze and negotiate cost reductions – Continue to aggressively negotiate rent reductions – Optimize our marketing spend – Review and reduce corporate overhead – Reduce shipping and fulfillment expense 21

2019 Outlook For fiscal 2019 expect: • Net sales to increase 2% to 3% driven by – Expanded omnichannel capabilities – Enhancements to the overall product assortment – More impactful marketing promotions to drive customer file growth • Gross margin expansion of 300 to 350 basis points – Improved inventory management including supply chain and omni-channel initiatives – Greater discipline around promotions – Continued reduction of occupancy costs • SG&A as a percentage of sales to decline 150 to 200 basis points – Non-merchandise procurement savings across all areas including marketing, store operations, IT, & utilities – Marketing optimization – Corporate Overhead • Inventory turns to improve as compared to fiscal 2018 – Improved inventory flow – Inventory utilization from Ship from store and BOPIS 22

In Closing • Unique brand positioning serving an attractive customer segment with opportunity to gain more loyal brand ambassadors • New and seasoned management team • Leveraging our investments to drive increased growth through integrated omni-channel initiatives • Significant operational improvements underway to expand operating margin • Cash on hand, with no long-term debt, and no current borrowings under our $55M credit facility 23