Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - XYNOMIC PHARMACEUTICALS HOLDINGS, INC. | f8k011119_bisoncapital.htm |

Exhibit 99.1

Bison Capital Acquisition Corp. & Xynomic Pharmaceuticals, Inc. Investor Presentation January 2019

Disclosure Disclaimer This investor presentation is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to an y s ecurities or in respect of the proposed transaction. This investor presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No registered offering of securities shall be made except b y m eans of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended. Additional Information about the Transaction and Where to Find it The proposed transaction has been approved by the board of directors of both companies and the shareholders of Xynomic Pharma ceu ticals, Inc. (“Xynomic”), and will be submitted to shareholders of Bison Capital Acquisition Corp. (“BCAC”) for their approval. In connection with that approval, BCAC intends to file with the SEC a proxy st ate ment/prospectus containing information about the proposed transaction and the respective businesses of Xynomic and BCAC. BCAC will mail a definitive proxy statement/prospectus and other relevant documents to its sh are holders. BCAC shareholders are urged to read the preliminary proxy statement/prospectus and any amendments thereto and the definitive proxy statement/prospectus in connection with BCAC’s solicitation of proxies fo r t he special meeting to be held to approve the proposed transaction, because these documents will contain important information about BCAC, Xynomic and the proposed transaction. The definitive proxy statement/prospectu s w ill be mailed to shareholders of BCAC as of a record date to be established for voting on the proposed transaction. Shareholders will also be able to obtain a free copy of the proxy statement/prospectus, as well as othe r f ilings containing information about BCAC, without charge, at the SEC’s website (www.sec.gov) or by calling 1 - 800 - SEC - 0330. Participants in the Solicitation BCAC and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxi es from BCAC’s shareholders with respect to the proposed transaction. Information regarding BCAC’s directors and executive officers is available in its annual report on Form 10 - K for the fiscal year ended December 31, 20 17, filed with the SEC on February 21, 2018. Additional information regarding the participants in the proxy solicitation relating to the proposed transaction and a description of their direct and indirect interests will be con tained in the proxy statement/prospectus when it becomes available. Xynomic and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of BCAC in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction will be included in the proxy statement/prospectus for the proposed transaction when available. Forward - Looking Statements This investor presentation includes “forward - looking statements” within the meaning of the safe harbor provisions of the U.S. Pr ivate Securities Litigation Reform Act of 1995 and within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. Any actual results ma y d iffer from expectations, estimates and projections presented or implied and, consequently, you should not rely on these forward - looking statements as predictions of future events. Words such as “expect,” “estimate,” “pr oject,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements. These for ward - looking statements include, without limitation, BCAC’s expectations with respect to future performance, anticipated financial impacts of the proposed business combination, approval of the business combination transac tio ns by security holders, the satisfaction of the closing conditions to such transactions and the timing of the completion of such transactions. Such forward - looking statements relate to future events or future performance, but reflect the parties’ current belief s, based on information currently available. Most of these factors are outside the parties’ control and are difficult to predict. A number of factors could cause actual events, performance or results to differ materially from the ev ents, performance and results discussed in the forward - looking statements. Factors that may cause such differences include, among other things: the possibility that the business combination does not close or that the closin g m ay be delayed because conditions to the closing may not be satisfied, including the receipt of requisite shareholder and other approvals, the performances of BCAC and Xynomic, and the ability of BCAC or, after the closin g o f the transactions, the combined company, to continue to meet The Nasdaq Capital Market’s listing standards; the reaction of Xynomic’s licensors, collaborators, service providers or suppliers to the business combina tio n; unexpected costs, liabilities or delays in the business combination transaction; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give ris e to the termination of the business combination transaction agreement; and general economic conditions. The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors are con tained in BCAC’s most recent filings with the SEC. All subsequent written and oral forward - looking statements concerning BCAC and Xynomic, the business combination transactions described herein or other matters and attributa ble to BCAC, Xynomic, Xynomic’s shareholders or any person acting on behalf of any of them are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue relian ce upon any forward - looking statements, which speak only as of the date made. Neither BCAC, Xynomic, nor Xynomic’s shareholders undertake or accept any obligation or undertaking to release publicly any updates or revi sio ns to any forward - looking statement to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based . 2

Why Xynomic? 3 A pipeline of late stage and early stage innovative small molecule oncology programs Abexinostat (“ Abex ”), the lead program, in - licensed from Pharmacyclics , a subsidiary of AbbVie Inc . (“AbbVie”) » A Phase 3 HDAC inhibitor being investigated for use against lymphomas and renal cancer » Promising objective response rate (“ORR”) and progression free survival (“PFS”) in follicular lymphoma (“FL”), diffuse large B - cell lymphoma (“DLBCL”) and renal cell carcinoma (“RCC”) Three on - going trials (including two potentially pivotal trials) plus potentially six additional trials by Q3’2019 Demonstrated ability to obtain exclusive licenses on assets, including clinical stage assets » Licensed global rights from Pharmacyclics/AbbVie and Boehringer Ingelheim » Collaborating with Janssen in a trial on combination therapy Operations in both the U.S. and China allowing for leveraging global resources Management team composed of industry veterans and supported by world - class scientific/medical advisors

Transaction Overview - 1 4 • On September 12, 2018, Bison Capital Acquisition Corp. (“BCAC”) signed a definitive Merger A greement with Xynomic Pharmaceuticals, Inc. (“Xynomic”) • The merger consideration, entirely payable in BCAC shares at $10.15 per share, consists of » $350 million, subject to certain closing adjustments, and; » Potentially additional $100 million if Xynomic achieves certain earnout criteria x The earnout criteria has been achieved as a result of the recent worldwide exclusive license to develop and commercialize XP - 105 • 3% of the merger consideration will be held in escrow for 18 months, to serve as, among others, security for and exclusive source of BCAC’s indemnity rights under the Merger Agreement • Closing conditions include, but are not limited to » Approval of the Merger Agreement and the transactions by BCAC’s existing shareholders » Approval of listing on Nasdaq of the merger consideration shares » BCAC having at least $7,500,001 of net tangible assets at the closing

• BCAC will re - domesticate as a Delaware corporation prior to closing • Upon closing, BCAC will change its name to “Xynomic Pharmaceuticals Holdings, Inc.” • The board of BCAC will consist of nine directors » Four current directors of BCAC including three current independent directors » Two current directors of Xynomic » One independent director mutually agreed upon by BCAC and Xynomic • The executives of Xynomic are expected to be appointed as executives of BCAC Transaction Overview - 2 5

Experienced Management Team 6 Y. Mark Xu, Chairman, CEO & President Successful serial entrepreneur Pharmacyclics (General Manager, Greater China), Schering (research & development), McKesson (marketing), Bridge Lab (cofounder, China CFO) W. Jason Wu, PhD, COO More than 20 years drug development experience in both US and China Lilly (late stage clinical trial), Merck (marketing), Hutchison China MediTech (business development) Yong Cui, PhD, VP of CMC Leading expert in drug manufacturing Lead pharmaceutical scientist of 2 successful NDA filings in the US (one an oncology drug and the other an anti - viral drug) Expert consultant to the China FDA Genentech, Vertex, Pfizer - Hisun, Qilu Yong Cui, PhD, VP of CMC S. Murray Yule, PhD, CMO More than 17 years experience in the biopharma industry Eisai ( led the team that successfully achieved global market approval of eribulin for breast cancer ) Astex/ Supergen/Otsuka (Medical Director) Board certified medical oncologist

World Class Scientific Advisory Board (SAB) Dr. Pamela Munster • Professor of Medicine and Director of the Early Phase Clinical Trials Unit, University of California San Francisco • Renowned expert in solid tumor • Led cancer clinical trials for numerous big pharma and emerging biotech companies Dr. Anas Younes • Chief of Lymphoma Service, Memorial Sloan Kettering Cancer Center (MSKCC) • Before joining MSKCC, 20 years at MD Anderson in lymphoma practice • L ed the efforts to develop the first FDA - approved targeted drug treating Hodgkin lymphoma in three decades (Adcetris®) and the approval of the first immune checkpoint inhibitor for lymphoma (Opdivo®) Dr. Jun Guo • Vice President, Beijing Cancer Hospital • Head of Department of Kidney Cancer and Melanoma • Led numerous clinical trials for multinational pharmaceutical companies in China 7

Preclinical Phase 1 Phase 2 Phase 3 Abexinostat : HDAC i nhibitor (licensor: Pharmacyclics/AbbVie) Follicular Lymphoma (4L, US, EU & China) Renal Cell Carcinoma (1L or 2L, with Novartis’ Pazopanib ) Multiple Solid Tumors (with Merck’s Keytruda ) Diffuse Large B - Cell Lymphoma & Mantel Cell Lymphoma (with Janssen’s Imbruvica ) Follicular Lymphoma (3L, China) Diffuse Large B - Cell Lymphoma (3L, China) Breast Cancer (with a Marketed CDK4/6 Inhibitor) XP - 105 (BI 860585: mTORC 1/2 inhibitor (licensor: Boehringer Ingelheim ) Breast Cancer (with paclitaxel ) Colorectal Cancer (with XP - 102) XP - 102 (BI 882370): Pan - RAF inhibitor (licensor: Boehringer Ingelheim ) Colorectal Cancer Melanoma Potentially Pivotal Potentially Pivotal Potentially Pivot al Potentially Pivot al Ongoing Clinical Trials Planned Clinical Trials Pre - clinical 8 Innovative Oncology Pipeline (Global Rights) 8

Abex: In - Licensed from Pharmacyclics/AbbVie 9 1. AbbVie 2015 annual report 2. Pharmacyclics December 2014 Investor Presentation 3. imbruvica.com 4. AbbVie and Johnson & Johnson 2017 annual reports Abex was previously jointly developed by Pharmacyclics world class, research and development team and its former U.S. partner, Servier AbbVie paid $21 billion (in a combination of cash and stock) to acquire Pharmacyclics in 2015 1 » Pharmacyclics had two oncology drugs (Imbruvica and Abex) in its pipeline with overlapping indications at the time of the acquisition 2 » Imbruvica was approved for six indications 3 to date and generated $4.3 billion in sales in 2017 4 Xynomic in - licensed the exclusive global rights to Abex from Pharmacyclics/AbbVie in February 2017

Abex: Overview of Clinical Development 10 Already tested on approximately six hundred patients worldwide Unique PK profile HDAC inhibitor Monotherapy against » FL: 56 - 64% ORR, 625 days medium PFS » DLBCL: 34% ORR, 2.8 months medium PFS Combo: treating solid tumor based on epigenetic modification » Heavily pre - treated RCC x 27% ORR vs. standard - of - care (“SOC”) 10 % ORR in treatment naive patients* x Median duration of response 10.5 months vs. SOC’s 8 months in treatment naive patients *Note that this comparison is not based on a head - to - head trial, therefore the data derived from these separate clinical studies may not be comparable and would not form a basis for claiming superiority of abexinostat in marketing

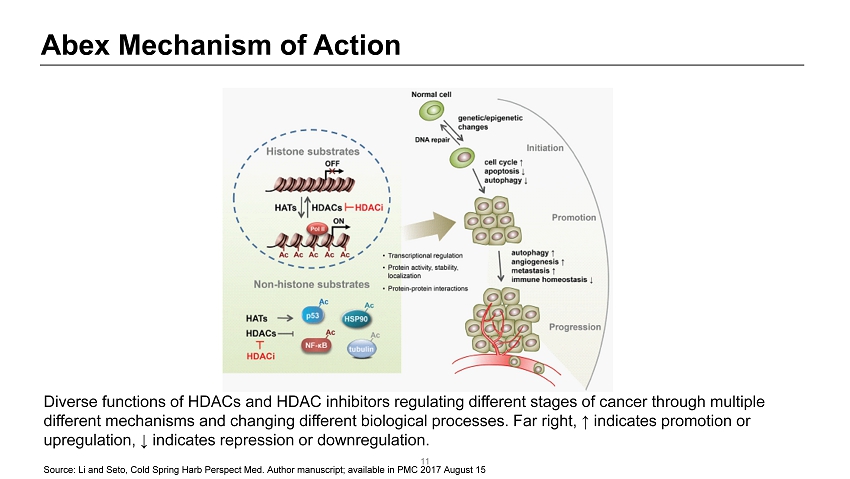

Abex Mechanism of Action 11 Diverse functions of HDACs and HDAC inhibitors regulating different stages of cancer through multiple different mechanisms and changing different biological processes. Far right, ↑ indicates promotion or upregulation, ↓ indicates repression or downregulation. Source: Li and Seto , Cold Spring Harb Perspect Med. Author manuscript; available in PMC 2017 August 15

Abex – Completed Clinical Trials * Monotherapy In Combination Protocol # # of Patients TA Protocol # # of Patients TA PCYC - 0401 15 Solid tumors or hematological cancers CL1 - 005 35 Solid tumors PCYC - 0405 7 Hematological tumors CL1 - 006 32 Digestive cancer CL1 - 010 1 NHL CL1 - 008 19 Late stage s olid tumors PCYC - 0402 3 9 Solid tumors CL1 - 009 8 Nasopharyngeal carcinoma PCYC - 0403 55 Lymphoma PCYC - 1411 16 Breast cancer CL1 - 002 3 9 Solid tumors PCYC - 1403 31 Epithelial ovarian, fallopian tube or primary peritoneal carcinoma PCYC - 1407 17 Leukemia NCT01543763 51 Late stage s olid tumors PCYC - 1417 12 Solid tumors NCT01027910 22 Metastatic sarcoma PCYC - 1401 135 Hodgkin’s disease, non - Hodgkin lymphoma and chronic lymphocytic leukemia PCYC - 1404 62 Late stage s olid tumors (including brain tumor) 12 * All these clinical trials were completed by or on behalf of Pharmacyclics/AbbVie or Servier

Convenient Oral Administration 13 Source: Joseph J. et al. CRA - 024781: a novel synthetic inhibitor of histone deacetylase enzymes with antitumor activity in vitro and in vivo. Mol Cancer Ther; 2006: 1309 - 1317.

Safety Grade 3 and 4 AE% in PCYC - 0403 * Grade 3 and 4 AE% in PCYC - 1401 ** hematological Neutropenia 14 27 Anemia 7 12 Thrombocytopenia 20 80 GI Diarrhea 2 3 Vomiting 0 0 other Fatigue 3 0 Arthralgia 7 0 14 * From Abexinostat trial PCYC - 0403 (1 - week - on / 1 - week - off dosing schedule ) ** From Abexinostat trial PCYC - 1401 (2 - weeks - on / 1 - week - off dosing schedule)

Abex: Objective Response Rate FL DLBCL PTCL Assumption Phase 1 Phase 2 Assumption Phase 1 Phase 2 Assumption Phase 1 Phase 2 40% 60% 44% 56% (n=16) 20% 40% 25% 50% 23% 31% (n=16) 22% 40% (n=15) Target ORR Actual 0% 100% Source: Vincent Ribrag , et al. Safety and efficacy of abexinostat , a pan - histone deacetylase inhibitor, in non - Hodgkin lymphoma and chronic lymphocytic leukemia: Results of a phase 2 study. Haematologica 2017 102 (5): 903 - 909. 15

Significantly Improved Progression - Free Survival FL *N=25= 14 FL + 11 MCL. † Median time on study in FL is 11.9 (1.2 - 24.8) months 16 Source: Andrew M. Evens, et al. A Phase I/II Multicenter, Open - Label Study of the Oral Histone Deacetylase Inhibitor Abexinostat in Relapsed/Refractory Lymphoma. Clin Cancer Res. 2016; 22(5): 1059 - 1066.

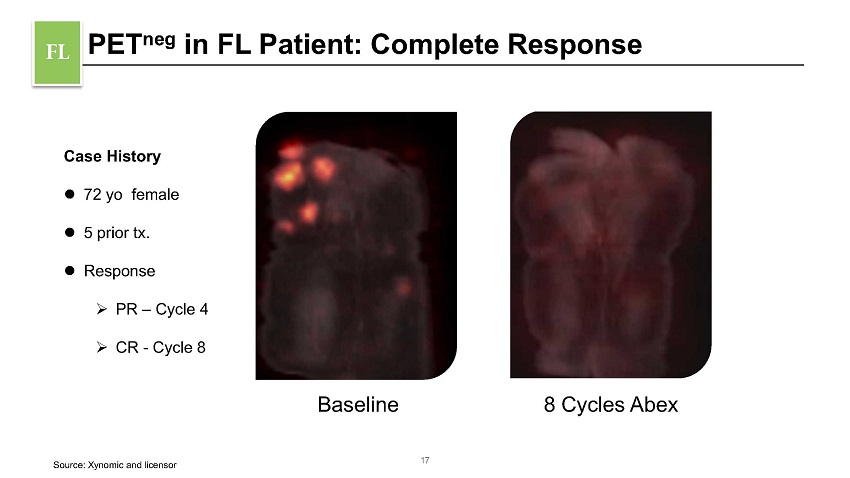

PET neg in FL Patient: Complete Response FL Case History 72 yo female 5 prior tx. Response » PR – Cycle 4 » CR - Cycle 8 Baseline 8 Cycles Abex 17 Source: Xynomic and licensor

Kidney Cancer: Compelling Ph 1b Data in Treating VEGFi - Refractory Solid Tumors in Combination with Pazopanib Sponsored by NCI and UCSF Fifty one patients (72% had received two or more lines of therapy in the locally advanced or metastatic setting), Phase 1b, open - label, do se - escalation/expansion trial of Abex in combination with Novartis’ Pazopanib Safety results » Treatment - related adverse events of any grade were as follows: fatigue (71%), diarrhea (45%), decreased appetite (41%), and naus ea (39%). Grade 3 adverse events were fatigue (16%), thrombocytopenia (16%), neutropenia (10%), anemia (10%), diarrhea (10%), and elevated AS T/A LT (4%). There were no episodes of febrile neutropenia or clinically significant bleeding. one patient experienced grade 3 hypertension. There were no treatment - related grade 5 adverse events » Only two patients (4%) discontinued study treatment because of adverse events, and prolonged dose administration was feasible in patie nts who experienced long - term response First reported clinical trial to test the hypothesis that epigenetic modification with HDAC inhibition may provide the means to recapture res pon se and reverse resistance to Pazopanib in RCC and other solid tumors ORR Clinical Benefit Rate (PR + SD>6 months) Tumor Regression Rate Median Duration of Response n = 43 21% 37% 9.1 months Prior progression on one or more VEGF - targeting therapies (n = 28) 21% RCC subset (n = 22): received an average of 2.5 lines of prior therapy and 1.6 lines of prior VEGF targeting treatment, including 10 patients (45%) with prior progression on Pazopanib monotherapy 27% 10.5 months Patients who had disease progression on VEGF agents and were evaluable (n = 28) 68% Patients who had disease progression on Pazopanib and were evaluable (n = 10) 70% Source: Rahul Aggarwa et al., Journal of Clinical Oncology , Feb 21, 2017 18

Abex Commercial Opportunities Indication Global Market Size in 2023, $ Follicular Lymphoma 4.1 billion Renal Cell Carcinoma (Kidney Cancer) 4.7 billion Breast Cancer 20 billion Solid Tumors (with K eytruda) 8 billion Diffuse Large B - Cell Lymphoma 14.4 billion Sources: Decision Resources, EvaluatePharma, Datamonitor, IMS, WM Foundation and Kantar Health’s CancerMpact 19

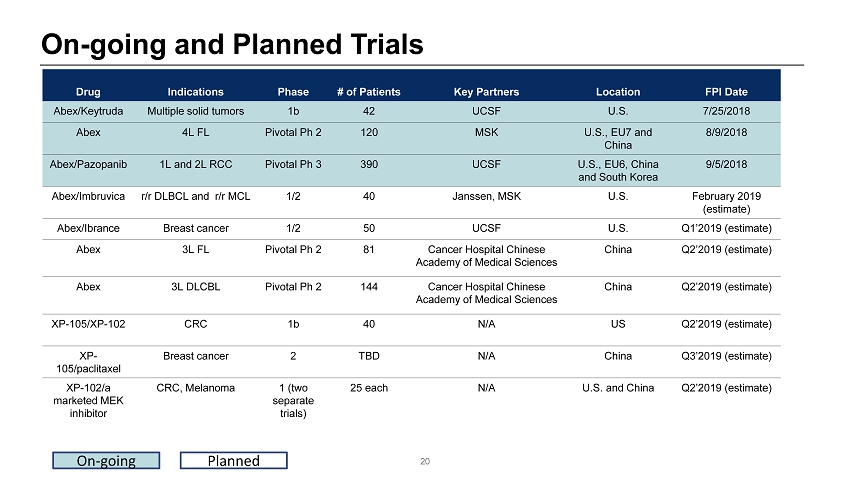

On - going and Planned Trials Drug Indications Phase # of Patients Key Partners Location FPI Date Abex/Keytruda Multiple solid tumors 1b 42 UCSF U.S. 7/25/2018 Abex 4L FL Pivotal Ph 2 120 MSK U.S. , EU7 and China 8/ 9 /2018 Abex/Pazopanib 1L and 2L RCC Pivotal Ph 3 390 UCSF U.S., EU 6 , China and South Korea 9/5/2018 Abex/Imbruvica r/r DLBCL and r/r MCL 1/2 40 Janssen, MSK U.S. February 20 19 (estimate) Abex / Ibrance Breast cancer 1/2 50 UCSF U.S. Q1’2019 (estimate) Abex 3L FL Pivotal Ph 2 81 Cancer Hospital Chinese Academy of Medical Sciences China Q2’2019 ( estimate ) Abex 3L DLCBL Pivotal Ph 2 144 Cancer Hospital Chinese Academy of Medical Sciences China Q2’2019 ( estimate ) XP - 105/XP - 102 CRC 1b 40 N/A US Q2’2019 (estimate) XP - 105/ paclitaxel Breast cancer 2 TBD N/A China Q3’2019 (estimate) XP - 102/a marketed MEK inhibitor CRC, Melanoma 1 (two separate trials ) 25 each N/A U.S. and China Q2’2019 (estimate) 20 On - going Planned

Renal Cell Carcinoma (RCC) Successful EOP2/Pre - Phase 3 meeting with FDA on 3/16/2018 » Authorized to start Ph 3, which potentially is pivotal » Plan to apply for Fast Track designation in Q1’2019 Ph 3 design: 1L or 2L, PFS as primary end point, Abex + Pazopanib vs. Pazopanib Well positioned to become the new SOC in 1st line RCC Sites: U.S., EU 6 , China and South Korea FPI 9/5/2018 US investigator’s kickoff meeting : 12/7 - 12/8/2018 Managed by Parexel 21

Follicular Lymphoma r/r FL: 56 - 64% ORR and 625 days of medium PFS in two Ph 1/2 trials Successful FDA meeting on 4/18/2018 » Authorized to start Ph 2, which potentially is pivotal 4L: 120 subjects, single arm, ORR as primary end point Sites: U.S. , EU7 and China FPI: 8/ 9 /2018 U.S. investigator’s kickoff meeting: 2/8/2019 Managed by PPD 22

China 3L FL potentially pivotal (independent of U.S./EU trials) » ~81 subjects, single arm, ORR as primary end point » FPI expected in Q2’2019 3L DLBCL » ~144 subjects, single arm, ORR as primary end point » FPI expected in Q2’2019 1L or 2L RCC » ~150 patients led by Prof. Jun Guo at Beijing Cancer Hospital » Part of global multi - center trial 23

Updated Clinical Development Timeline Indication Regions 2H’2018 2019 2020 2021 2022 3L FL (Abex as monotherapy) China Enroll ~55 patients Enroll ~26 patients (complete recruitment) NDA submission 4L FL (Abex as monotherapy) U.S. EU7 China Enroll ~90 patients Enroll ~30 patients (complete recruitment) NDA submission 1L or 2L RCC (Abex combined with Pazopanib) U.S. EU 6 China S Korea Enroll ~2 patients Enroll ~130 patients; first 25 - patients safety data readout Enroll ~130 patients; first 25% futility data readout Enroll ~128 patients (complete recruitment) NDA submission 3L DLBCL (Abex as monotherapy) China Enroll ~144 patients (complete recruitment) NDA submission 24

XP - 105 (BI 860585): In - Licensed from Boehringer Ingelheim 25 • A 3rd generation, ATP competitive mTORC1/2 inhibitor against multiple solid tumors • BI has completed a Phase 1 trial on 90 subjects with advanced solid tumors • Disease control rate (complete or partial response plus stable disease) in Phase 1 » 20% as monotherapy » 28% in combination with exemestane » 58% in combination with paclitaxel • Only ~2 years behind competing drug candidates being developed by major multinational pharmaceutical companies • Xynomic plans to initiate a potentially pivotal Phase 2 trial in 2019

Marketed mTORC Inhibitors 26 • 1st generation mTORC inhibitors on the market » e verolimus ( Novartis): $1.525 billion revenue in 2017* » temsirolimus (Pfizer) » Mainly treat kidney cancer and breast cancer • Continuing strong interest in mTORC » In 2017 Celgene , Vivo and Decheng invested $23 million in Aadi Bioscience to develop nanoparticle formulation of 1st generation t emsirolimus » On Jan 2, 2019 Hangzhou based Antengene closed $120 milliion Series B to develop a 3rd generation mTORC1/2 inhibitor CC - 223 (in - licensed from Celgene in 2017) x CC - 223 completed Phase 1 in the west x In 2017 Celgene out - licensed Asia rights to Antengene x Antengene recently applied to start Phase 2 in China * Source: Novartis 2017 annual report

XP - 102: A 2nd - Generation Pan - RAF Inhibitor RAF is a popular molecular target in oncology and represents a significant commercial opportunity Two large pharmaceutical corporations namely, Roche and Novartis have already launched 1st generation oncology drugs that target RAF kinases, with peak annual sales forecast of ~$3.6 billion (including combo therapies with MEK inhibitors) * XP - 102 is a 2nd generation, Pan - RAF inhibitor for RAF mutant cancers, e.g. colorectal cancer (CRC), NSCLC and malignant melanoma XP - 102 potentially offers improved therapeutic window compared with first - generation BRAF inhibitor Exclusive global rights, in - licensed from Boehringer Ingelheim Pan - RAF inhibitor, unique DFG - out binding, very good animal data Ph 1 in U.S. by Q1’2019, in China by Q2’2019 CRC and melanoma 27 * Source: Analyst reports

XP - 102: Pre - Clinical Pharmacology Summary Demonstrated potency and selectivity in cellular and kinase assays » B - RAF V600 cell lines EC 50 <10 nM » B - RAF wild - type cell lines EC 50 >1,000 nM Strong functionality in CRC and melanoma animal models Showed no significant sign of toxicity in exploratory toxicology studies at exposure levels that delivered better inhibiting effects in xenograft models Very promising when used in combination with chemotherapy and other targeted agents 28 Source: Irene C.Waizenegger, et al. A Novel RAF Kinase Inhibitor with DFG - Out Binding Mode: High Efficacy in BRAF - Mutant Tumor X enograft Models in the Absence of Normal Tissue Hyperproliferation. Mol Cancer Ther; 2016; 15(3): 354 - 365.

XP - 102: Current Status 29 API GLP toxicity batch completed All toxicology studies completed Formulation work in progress and expected to be finished by January 2019 Xynomic’s goal is to submit US - IND application in Q1’2019

Research Stage Programs: XP - 103 & XP - 104 (Small Molecule Kinase Inhibitors) XP - 103 » TRK/Fra - 1 inhibitor » A competitor’s TRK inhibitor Larotrectinib’s recent Ph 1 data show ORR of over 90% against multiple tumors, yet drug resistance might be an issue * » Global patent filed in December 2018 XP - 104 » Highly selective RET inhibitor » Being investigated for use against multiple tumors, especially tumors that have developed resistance against other targeted therapies » Global patent filed in September 2018 » Animal studies: under preparation and in discussion with contract research organization s; expected to be launched in Q1’2019 30 * Sources: Loxo Oncology’s presentations at ASCO Annual Meeting 2017 and AACR Pediatric Cancer Research Meeting (12/4/2017)

R&D Center in Shanghai, China 5,600 sf custom - built, fully operational, state - of - the - art leased facility Focused on biology, organic chemistry and analytical chemistry Led by Dr. Niefang Yu, a renowned oncology research scientist Will staff up to 15 MS/PhD scientists Multiple small molecule oncology drug programs across 3 platforms » Kinase inhibition » Immuno - oncology » Epigenetics 31

Pipeline Summary Abex: currently being evaluated in 3 therapeutic areas XP - 105 (BI 860585): breast cancer and CRC » 3rd generation mTORC1/2 inhibitor » Phase - 2 ready XP - 102 (BI 882370): CRC and melanoma » Animal data from initial studies suggest promising potential » Unique binding mode XP - 103 and XP - 104: research stage assets with newer mechanisms of action Breast & Other Solid Tumors Ph 1/2 32 Hematological Cancer Pivotal Ph 2 Kidney Cancer Pivotal Ph 3

Summary – Xynomic Pharma A U.S. oncology company founded by industry veterans Pure play oncology company: oral, proven molecular targets Drug candidates originated from global top - 20 pharma companies ( AbbVie and Boehringer Ingelheim ): high - quality U.S./EU data integrity, exclusive global rights, strong IP estate Collaboration with global big pharma companies (e.g., Janssen) Leverages resources in both China and U.S./EU to cost - effectively and time - efficiently develop these assets Multiple catalysts in the next 12 months 33