Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - HELEN OF TROY LTD | fy19_q3xhelenoftroy10-q.htm |

| EX-10.2 - EXHIBIT 10.2 - HELEN OF TROY LTD | exhibit102fourthsuppleme.htm |

| EX-32 - EXHIBIT 32 - HELEN OF TROY LTD | fy19_q3xexhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - HELEN OF TROY LTD | fy19_q3xexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - HELEN OF TROY LTD | fy19_q3xexhibit311.htm |

FIFTH AMENDMENT TO GUARANTY AGREEMENT THIS FIFTH AMENDMENT TO GUARANTY AGREEMENT (this “Fifth Amendment”), dated effective as of September 28, 2018, is entered into among the parties listed on the signature pages hereof as Guarantors (collectively, the “Guarantors”), and BANK OF AMERICA, N.A. (the “Guarantied Party”, and collectively with any Affiliates thereof, the “Guarantied Parties”). BACKGROUND A. The Guarantors and the Guarantied Party are parties to that certain Guaranty Agreement, dated as of March 1, 2013, as amended by that certain First Amendment to Guaranty Agreement, dated as of February 7, 2014, that certain Second Amendment to Guaranty Agreement, dated as of June 11, 2014, that certain Third Amendment to Guaranty Agreement, dated as of January 16, 2015, and that certain Fourth Amendment to Guaranty Agreement, dated as of December 7, 2016 (said Guaranty Agreement, as amended, the “Guaranty Agreement”). The terms defined in the Guaranty Agreement and not otherwise defined herein shall be used herein as defined in the Guaranty Agreement. B. The parties to the Guaranty Agreement desire to make certain amendments to the Guaranty Agreement. C. The Guarantied Party hereby agrees to amend the Guaranty Agreement, subject to the terms and conditions set forth herein. NOW, THEREFORE, in consideration of the covenants, conditions and agreements hereafter set forth, and for other good and valuable consideration, the receipt and adequacy of which are all hereby acknowledged, the Guarantors and the Guarantied Party covenant and agree as follows: 1. AMENDMENTS. (a) Section 1 of the Guaranty Agreement is hereby amended by adding the following defined terms thereto to read as follows: “CFC” means a controlled foreign corporation within the meaning of Section 957 of the Code. “HOT-TX” means Helen of Troy Texas Corporation, a Texas corporation. (b) Clause (v) of Section 8(b)(9) of the Guaranty Agreement is hereby amended to read as follows: (v) if the Acquisition results in a Domestic Subsidiary (other than a CFC or a Subsidiary considered to be a “disregarded entity” for United States federal income tax purposes and owned by a CFC) being acquired having a net worth at the time of such Acquisition of more than $25,000,000, such Subsidiary shall execute and deliver to the Purchaser (x) a supplement to this Guaranty Agreement, (y) incumbency certificate, Organization Documents and documents evidencing due organization, valid existence, DAL 80438036v4

good standing and qualification to do business, and (z) a favorable opinion of counsel to such Person located in the jurisdiction of organization of such Person, in form, content and scope reasonably satisfactory to the Purchaser; (c) Each reference to “HOT-L.P.” set forth (i) in the definition of “Change of Control”, “Credit Facility”, “ERISA Event”, “Multiemployer Plan”, “Multiple Employer Plan”, “Pension Plan” and “Plan” and (ii) in Sections 6(l), 6(o), 7(b), 8(b), 8(d), 8(e) and 8(m) of the Guaranty Agreement is hereby amended to reference HOT-TX, from and after the effectiveness of this Agreement in accordance with Section 3. 2. REPRESENTATIONS AND WARRANTIES TRUE; NO EVENT OF DEFAULT. By its execution and delivery hereof, each of the Guarantors represents and warrants that, as of the date hereof: (a) the representations and warranties contained in the Guaranty Agreement and the other Loan Documents are true and correct on and as of the date hereof as made on and as of such date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct on such earlier date; (b) no event has occurred and is continuing which constitutes a Default or an Event of Default; (c) (i) each Guarantor has full power and authority to execute and deliver this Fifth Amendment, (ii) this Fifth Amendment has been duly executed and delivered by the Guarantors, and (iii) this Fifth Amendment and the Guaranty Agreement, as amended hereby, constitute the legal, valid and binding obligations of the Guarantors, as the case may be, enforceable in accordance with their respective terms, except as enforceability may be limited by applicable Debtor Relief Laws and by general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law) and except as rights to indemnity may be limited by federal or state securities laws; (d) neither the execution, delivery and performance of this Fifth Amendment or the Guaranty Agreement, as amended hereby, nor the consummation of any transactions contemplated herein or therein, will conflict with any Law or Organization Documents of any of the Guarantors, or any indenture, agreement or other instrument to which the Guarantors or any of their respective property is subject; and (e) no authorization, approval, consent, or other action by, notice to, or filing with, any Governmental Authority or other Person not previously obtained is required for the execution, delivery or performance by any of the Guarantors of this Fifth Amendment. 3. CONDITIONS TO EFFECTIVENESS. This Fifth Amendment shall be effective upon satisfaction or completion of the following: (a) the Guarantied Party shall have received counterparts of this Fifth Amendment executed by each of the Guarantors and acknowledged by the Borrower; 2

(b) the representations and warranties set forth in Section 2 above shall be true and correct; and (c) the Guarantied Party shall have received, in form and substance satisfactory to the Guarantied Party and its counsel, such other documents, certificates and instruments as the Guarantied Party shall reasonably require. 4. REFERENCE TO THE GUARANTY AGREEMENT. (a) Upon the effectiveness of this Fifth Amendment, each reference in the Guaranty Agreement to “this Agreement”, “hereunder”, or words of like import shall mean and be a reference to the Guaranty Agreement, as affected and amended hereby. (b) The Guaranty Agreement, as amended by the amendments referred to above, shall remain in full force and effect and is hereby ratified and confirmed. 5. COSTS, EXPENSES AND TAXES. The Guarantors agree to pay on demand all reasonable costs and expenses of the Guarantied Party in connection with the preparation, reproduction, execution and delivery of this Fifth Amendment and the other instruments and documents to be delivered hereunder (including the reasonable fees and out-of-pocket expenses of counsel for the Guarantied Party with respect thereto). 6. BORROWER’S ACKNOWLEDGMENT. By signing below, the Borrower (a) acknowledges, consents and agrees to the execution, delivery and performance by the Guarantors of this Fifth Amendment, (b) acknowledges and agrees that its obligations in respect of the Guaranty Agreement (i) are not released, diminished, waived, modified, impaired or affected in any manner by this Fifth Amendment or any of the provisions contemplated herein, (c) ratifies and confirms its obligations under the Guaranty Agreement, and (d) acknowledges and agrees that it has no claims or offsets against, or defenses or counterclaims to, its obligations under the Loan Agreement. 7. EXECUTION IN COUNTERPARTS. This Fifth Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. For purposes of this Fifth Amendment, a counterpart hereof (or signature page thereto) signed and transmitted by any Person party hereto to the Guarantied Party (or its counsel) by facsimile machine, telecopier or electronic mail is to be treated as an original. The signature of such Person thereon, for purposes hereof, is to be considered as an original signature, and the counterpart (or signature page thereto) so transmitted is to be considered to have the same binding effect as an original signature on an original document. 8. GOVERNING LAW; BINDING EFFECT. This Fifth Amendment shall be governed by and construed in accordance with the laws of the State of Texas applicable to agreements made and to be performed entirely within such state, provided that each party shall retain all rights arising under federal law, and shall be binding upon the parties hereto and their respective successors and assigns. 3

9. HEADINGS. Section headings in this Fifth Amendment are included herein for convenience of reference only and shall not constitute a part of this Fifth Amendment for any other purpose. 10. ENTIRE AGREEMENT. THE GUARANTY AGREEMENT, AS AMENDED BY THIS FIFTH AMENDMENT, AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS BETWEEN THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES. REMAINDER OF PAGE LEFT INTENTIONALLY BLANK 4

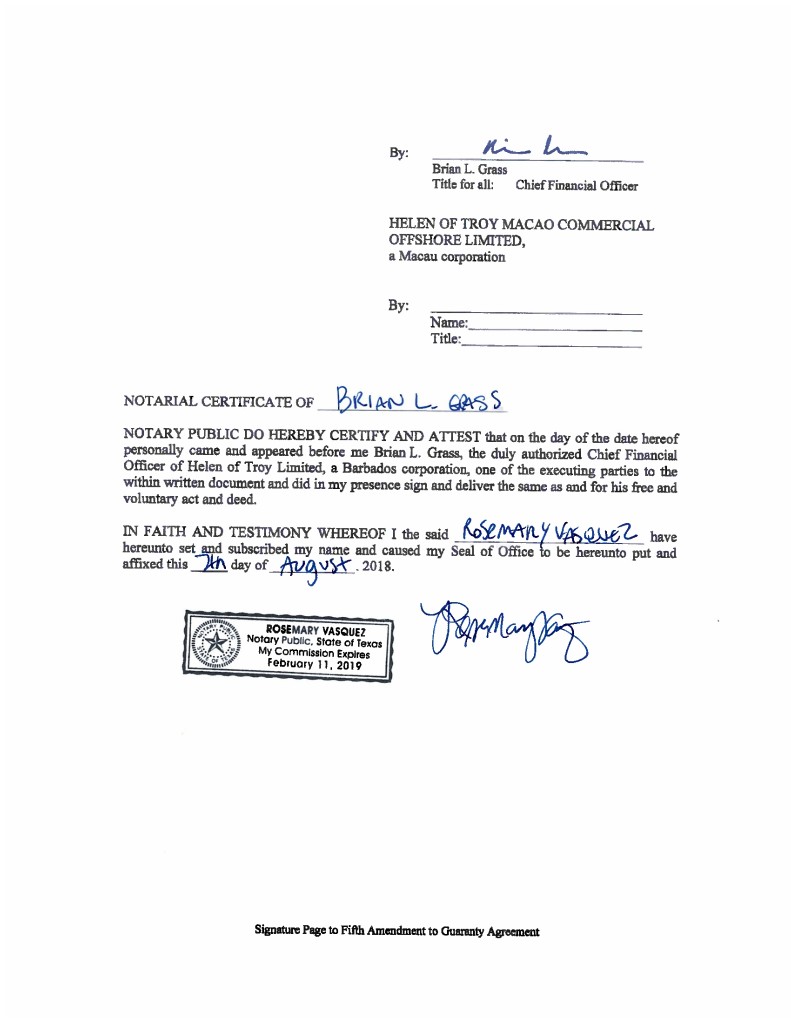

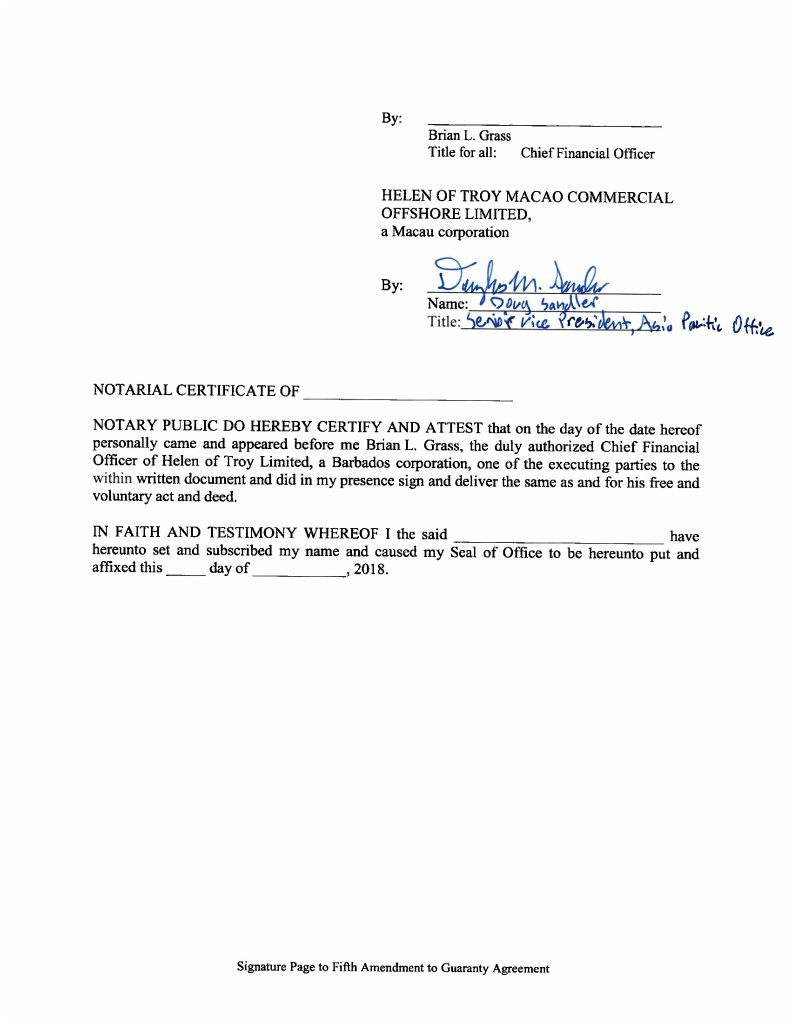

IN WITNESS WHEREOF, this Fifth Amendment is executed as of the date first set forth above. GUARANTORS: HELEN OF TROY L.P., a Texas limited partnership By: HELEN OF TROY NEVADA CORPORATION, a Nevada corporation, General Partner HELEN OF TROY LIMITED, a Bermuda company HELEN OF TROY LIMITED, a Barbados corporation HOT NEVADA, INC., a Nevada corporation HELEN OF TROY NEVADA CORPORATION, a Nevada corporation HELEN OF TROY TEXAS CORPORATION, a Texas corporation IDELLE LABS LTD., a Texas limited partnership By: HELEN OF TROY NEVADA CORPORATION, a Nevada corporation, General Partner OXO INTERNATIONAL LTD., a Texas limited partnership By: HELEN OF TROY NEVADA CORPORATION, a Nevada corporation, General Partner PUR WATER PURIFICATION PRODUCTS, INC., a Nevada corporation KAZ, INC., a New York corporation KAZ USA, INC., a Massachusetts corporation KAZ CANADA, INC., a Massachusetts corporation STEEL TECHNOLOGY, LLC, an Oregon limited liability company Signature Page to Fifth Amendment to Guaranty Agreement