Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-k1819jpmppt.htm |

J.P. Morgan Healthcare Conference JANUARY 8, 2019 | SAN FRANCISCO, CA

Forward Looking Statement and Use of Adjusted Measures This presentation contains forward-looking statements including but not limited to statements with respect to financial results and the related assumptions, the impact of various factors on operating and financial results, expected savings and synergies (including from the LaunchPad initiative and as a result of acquisitions), and the opportunities for future growth. This presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions and other unforeseen changes and general uncertainties in the marketplace, changes in government regulations, including health care reform, customer purchasing decisions, including changes in payer regulations or policies, other adverse actions of governmental and third-party payers, changes in testing guidelines or recommendations, adverse results in material litigation matters, the impact of changes in tax laws and regulations, failure to maintain or develop customer relationships, our ability to develop or acquire new products and adapt to technological changes, failures in information technology systems or data security, challenges in implementing business process changes, employee relations, and the effect of exchange rate fluctuations on international operations. Actual results could differ materially from those suggested by these forward-looking statements. The Company has no obligation to provide any updates to these forward- looking statements even if its expectations change. Further information on potential factors, risks and uncertainties that could affect the operating and financial results of Laboratory Corporation of America Holdings (the “Company”) is included in the Company’s Form 10-K for the year ended December 31, 2017, and subsequent Forms 10-Q, including in each case under the heading risk factors, and in the Company’s other filings with the SEC. This presentation contains “adjusted” financial information that has not been prepared in accordance with GAAP, including Adjusted EPS, and Free Cash Flow, and certain segment information. The Company believes these adjusted measures are useful to investors as a supplement to, but not as a substitute for, GAAP measures, in evaluating the Company’s operational performance. The Company further believes that the use of these non-GAAP financial measures provides an additional tool for investors in evaluating operating results and trends, and growth and shareholder returns, as well as in comparing the Company’s financial results with the financial results of other companies. However, the Company notes that these adjusted measures may be different from and not directly comparable to the measures presented by other companies. Reconciliations of these non-GAAP measures to the most comparable GAAP measures are included in this presentation. 2

Agenda Company Overview Long-Term Strategic Initiatives & 2019 Priorities Financial Update 3

Who We Are LabCorp is Our Mission a leading global is to life sciences company improve health that is deeply integrated and improve lives in guiding patient care Our Strategic Objectives are to: Deliver World-Class Diagnostics Bring Innovative Medicines to Patients Faster Use Technology to Improve the Delivery of Care 4

LabCorp Overview LabCorp Diagnostics Covance Drug Development • Patient database reaching • Serves the top 40 biopharma and ~50% of U.S. population high-growth emerging segments • Global footprint with business in • Proprietary data sets with >100 countries; 60,000 employees • Supports ~50% of all clinical trials >30 billion lab test results • Unmatched real-world data and • Broad physician, health system patient intelligence • >175,000 unique investigators and managed care relationships • Deep scientific and therapeutic • Involved in all top 50 best-selling • Consumer engagement through experience drugs on the market(1) ~1,850 PSC locations and • Leader in Companion Diagnostics >5,500 in-office phlebotomists, • (CDx) Supported over 60% of all CDx on with expanding retail presence the market today • Innovative technology-enabled • Proprietary decision-support solutions for customers • Robust technology suite for trial and reporting tools planning and execution • Significant IT connectivity, including >65,000 electronic data interfaces with clients 1. Based on revenue in 2017. 5

Attractive Growth Opportunities Across Multiple Markets Leadership in Large, Fragmented Markets Positions LabCorp for Continued Consolidation U.S. Clinical Lab Testing Market Global Outsourced R&D Spend Ex-U.S. Clinical Lab Testing Market LabCorp(3) Hospital Hospital Reference, $3B Outreach, $17B LabCorp, $4B (1) IQVIA, $6B ~$45 billion Hospital ~$80 billion Inpatient & market growing ~$100 billion Outpatient, market growing at Other, LabCorp, $27B $25B at mid single (2) market and low single digits $7B Other digits Public growing CROs, $10B Quest Diagnostics, $8B Independent Labs, $13B Source: Industry reports and company estimates. 1. Includes company estimates for IQVIA’s Research and Development Solutions segment only. 2. Includes company estimates for ICON, Medpace, PRA Health, Syneos Health’s Clinical Solutions segment, and Charles River Laboratories’ DSA segment. 3. LabCorp’s ex-U.S. clinical laboratory testing revenue (primarily related to operations in Canada) is less than 1% of the total ex-U.S. clinical lab testing market. 6

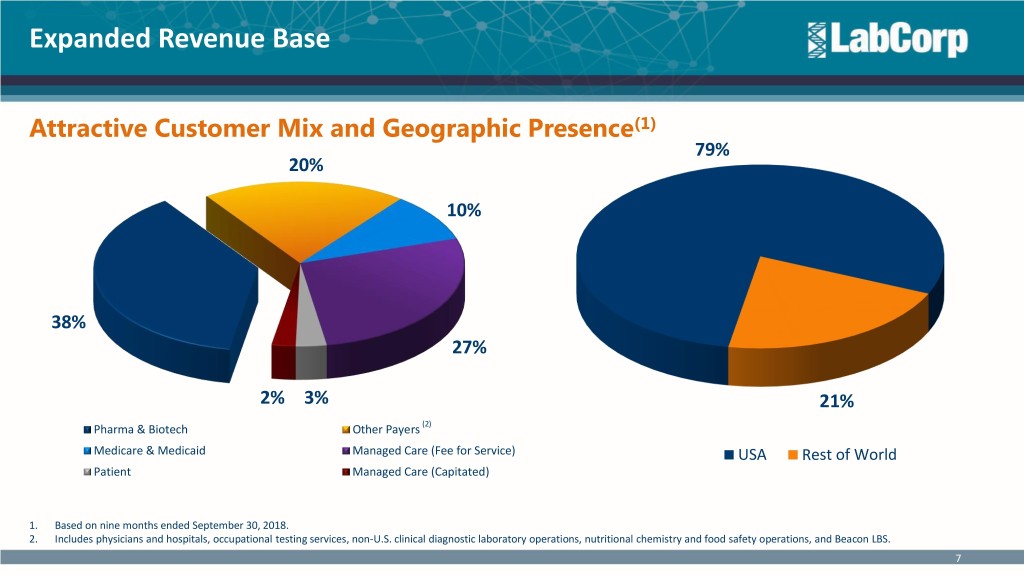

Expanded Revenue Base Attractive Customer Mix and Geographic Presence(1) 79% 20% 10% 38% 27% 2% 3% 21% Pharma & Biotech Other Payers (2) Medicare & Medicaid Managed Care (Fee for Service) USA Rest of World Patient Managed Care (Capitated) 1. Based on nine months ended September 30, 2018. 2. Includes physicians and hospitals, occupational testing services, non-U.S. clinical diagnostic laboratory operations, nutritional chemistry and food safety operations, and Beacon LBS. 7

Agenda Company Overview Long-Term Strategic Initiatives & 2019 Priorities Financial Update 8

Evolving Healthcare Environment Transition to Transition to Growing Importance Data-Driven Drug Value-Based Care of the Consumer Development Process • Customers are seeking improved • Dealing with increased trial • Increased interest in and influence efficiency in care delivery complexity, and competition for over healthcare decision-making • Stakeholders view value-based patients and investigators • Technological advances driving care as a model to reduce the • Greater need for scalable, expectation of convenience overall cost of patient care innovative tools and processes to • Consumer satisfaction increasingly • Increased provider demand for initiate and manage trials important to other healthcare advanced tools and analytics that • Increased sponsor demand for stakeholders (i.e., Patient Net deliver better outcomes via data-driven study design and Promoter Scores) personalized medicine and execution, as well as access to population health relevant biomarkers To thrive in this environment we are intently focused on leadership in service, quality and innovation 9

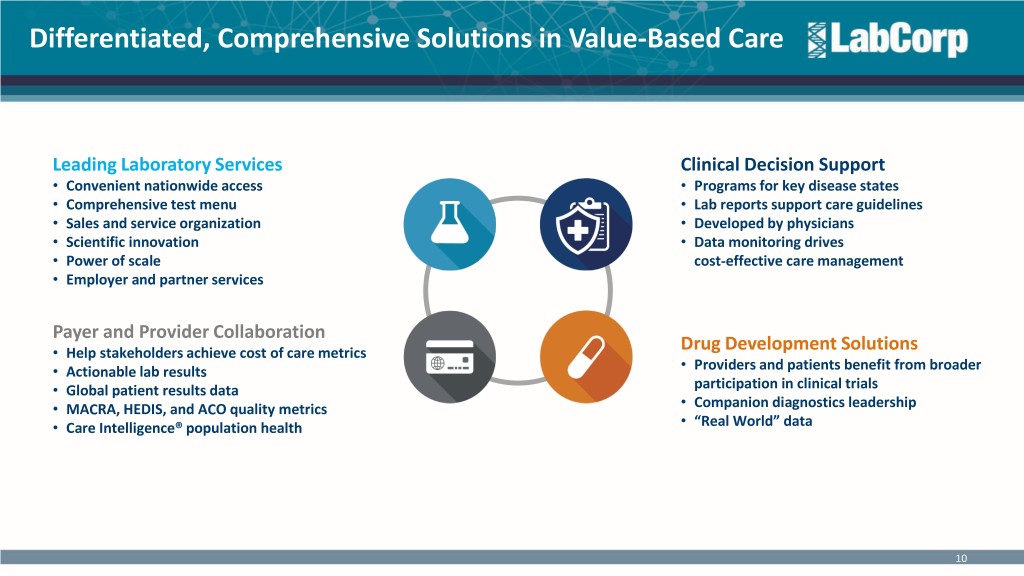

Differentiated, Comprehensive Solutions in Value-Based Care Leading Laboratory Services Clinical Decision Support • Convenient nationwide access • Programs for key disease states • Comprehensive test menu • Lab reports support care guidelines • Sales and service organization • Developed by physicians • Scientific innovation • Data monitoring drives • Power of scale cost-effective care management • Employer and partner services Payer and Provider Collaboration • Help stakeholders achieve cost of care metrics Drug Development Solutions • Actionable lab results • Providers and patients benefit from broader • Global patient results data participation in clinical trials • MACRA, HEDIS, and ACO quality metrics • Companion diagnostics leadership • Care Intelligence® population health • “Real World” data 10

Innovative Examples of Helping Hospitals, Health Systems, and Public Institutions Transition to Value-Based Care Utilizing a customized hepatitis C data feed to support an ACO’s patient risk stratification initiative Partnering with preferred Establishing digital Investing in Dedicated Teams, Covance trial sites to pathology center of reduce study timelines excellence with leading Enhanced Capabilities, and and accelerate patient academic medical center Purpose-Built Technology enrollment Conducting a chronic disease surveillance program to facilitate a public health institution’s targeted and timely community-based interventions 11

Streamlining Clinical Studies Investing in Unmatched Combination of Capabilities, Analytics and Scale Focused on Customers’ Top Needs Xcellerate® Investigator & Informatics Direct Patient Real World Engagement Evidence and Insights Patient Data Companion Virtual and Diagnostics Hybrid Trial and Biomarker Capabilities Solutions Data-Driven Capacity Trials Improve Flexible Management Quality, Speed Delivery in Early and Success Models Development Rate 12

Differentiated Data and Capabilities Drive Improved Trial Design Critical Insights Improve Protocol Design and Enhance Patient Recruitment and Retention Sponsor Patient Intelligence Opportunity for Change • Benefits from LabCorp’s direct access to consumers Biotech sponsor Roughly 50% of targeted Alter approach to site and focused on rare patient population not willing investigator selection diseases to travel 50+ miles to • Data in more than 20 key indications participate in a study • Provides sponsors with an early Top 5 pharma Roughly 50% decline in Adjust the protocol by sponsor patients’ willingness to weighing these trade-offs indication of anticipated patient conducting an participate in a study as length (monitoring time vs. patient acceptance of a proposed protocol, infectious of time required in a burden) disease trial physician’s office for influencing clinical trial enrollment monitoring increased from 4 expectations to 7 hours Biotech sponsor Data showed that patients Helped convince top • Global voice of patient data collected focused on rare would consider halting current investigators, who were from ~30 countries diseases treatment regimen to enroll in concerned about this obstacle a double-blind, placebo- to enrollment, to participate controlled study in the sponsor’s trial 13

Differentiated Data and Capabilities Drive Improved Performance • Covance Clinical Development Global Regional performance measured based on an analysis of trials processed Neurology EMEA 19.39 through Covance Central By Region 15.18 Laboratory SAVE 4.9 21.09 Oncology Americas 16.07 MONTHS • Examples show timeline (in EMEA 18.46 12.17 months) for Site Activation to Last Patient In Muscle 15.59 Neurology Americas & Skeletal 9.71 • Savings seen across regions and SAVE 8.6 EMEA 15.78 13.71 therapeutic areas MONTHS 15.40 Skeletal Americas Muscle Muscle and 6.09 • Other metrics tracked include: • Patients per site Americas 14.18 Oncology - 9.67 • Screen failure rate Cardo vascular 0.00 5.00 10.00 15.00 20.00 • Enrollment rate SAVE 4.2 Months • Non-performing sites MONTHS • Retention rate Rest of Market Covance Clinical Development 14

Differentiated Data and Capabilities Drive Innovation Deploying Technology and Leveraging LabCorp Infrastructure to Deliver Mobile and Virtual Trial Strategies Scalable Approach • LabCorp’s rich data set, direct patient Traditional Hybrid Virtual relationships, and de-centralized patient access Site Records Identification / Recruitment Digital Patient Access points (e.g., PSCs) are important capabilities for Multiple / Localized Investigator(s) Single / Centralized this type of trial On-Site Consent and Enrollment Remote On-Site Site Management / Monitoring Remote • Incorporating various mobile health On-Site Patient Reported Data Mobile App technologies into traditional studies (e.g., Active Physiological Assessments Passive mobile apps, wearable devices, telemedicine) At Sites Blood Draws PSCs / POC Site Staff Patient Compliance App, Text, Call Center • Providing a customizable “designed around At Sites Drug Supply Courier you” suite of virtual trial capabilities, tailored Local Investigator Medical Assessment(s) Telemedicine to customer specifications Site Staff Safety Monitoring AE Portal Customized Study Design 15

Differentiated Data and Capabilities Drive Innovation Extending Our Industry Leadership in Companion and Complementary Diagnostics (CDx) • Exceeded $200 million in cumulative new CDx-related revenue from the acquisition of Covance through 2018 CDx-Related Backlog • Delivered approximately $300 million in Drug (Dollars in millions) Development orders in 2018 $382 $306 • Collaborated with over 50 clients on more than 110 CDx projects in 2018 $114 $153 • Expanding technology offerings, with dedicated CDx (1) laboratory focused on assay development, distributing 2015 2016 2017 Q3 2018 assays to Central Lab sites for clinical trials, and regulatory support • Partnership with Unilabs expands channel for commercialization of CDx in Europe 1. As of September 30, 2018. 16

New Tools and Technology Create a Leading and Differentiated Consumer Experience Innovations Increase Consumer Engagement and Build Brand Loyalty • Access lab results through the LabCorp | PatientTM mobile app and the Apple Health app • Receive price estimates before certain services are performed • Pay balances during LabCorp Express check-in • Make reservation and check in from mobile device • Capture consumer feedback and Net Promoter Score through mobile-friendly survey • Educate consumers about clinical research participation through “Better Together” campaign 17

New Channels Enhance Consumer Convenience and Access to our High-Quality Lab Services Self-Collection Patient Service Center Access • Opened 26 locations across six states • In November 2018, launched consumer-initiated • Plan to add consumer-initiated, wellness testing offering, which features sample phlebotomy-based offering to the Pixel • Announced agreement to open at least 600 self-collection from the comfort of the home platform in 2019 locations over the next four years • Offering Wellness Screen, Heart Health, Diabetes • Will enhance consumer access to most • Net Promoter Scores exceed scores at Check, and Colorectal Cancer Screening; will important and frequently requested tests traditional PSCs expand menu • Pursuing additional collaboration opportunities • Rigorous validation process; data to be published • Consumers will order tests online and visit focused on data integration to enhance LabCorp PSCs to have sample drawn offerings and improve consumer experience • Potential future use cases include high-need patients (home and non-ambulatory), retail sales, and support of clinical trials 18

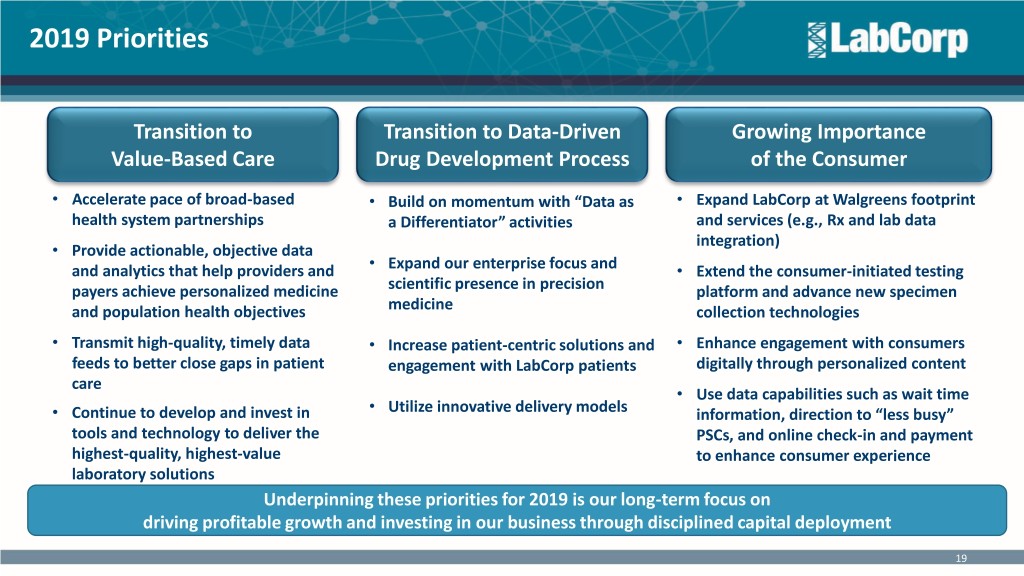

2019 Priorities Transition to Transition to Data-Driven Growing Importance Value-Based Care Drug Development Process of the Consumer • Accelerate pace of broad-based • Build on momentum with “Data as • Expand LabCorp at Walgreens footprint health system partnerships a Differentiator” activities and services (e.g., Rx and lab data integration) • Provide actionable, objective data • and analytics that help providers and Expand our enterprise focus and • Extend the consumer-initiated testing payers achieve personalized medicine scientific presence in precision platform and advance new specimen and population health objectives medicine collection technologies • Transmit high-quality, timely data • Increase patient-centric solutions and • Enhance engagement with consumers feeds to better close gaps in patient engagement with LabCorp patients digitally through personalized content care • Use data capabilities such as wait time • • Continue to develop and invest in Utilize innovative delivery models information, direction to “less busy” tools and technology to deliver the PSCs, and online check-in and payment highest-quality, highest-value to enhance consumer experience laboratory solutions Underpinning these priorities for 2019 is our long-term focus on driving profitable growth and investing in our business through disciplined capital deployment 19

Agenda Company Overview Long-Term Strategic Initiatives & 2019 Priorities Financial Update 20

Proven Track Record of Delivering Strong Results Across Key Revenue Drivers Diagnostics Drug Development Drug Development Year Over Year Trailing Twelve Month Backlog Organic Volume Growth Net Book-to-Bill (In Billions) $9.4 3.2% $8.7 1.36x $7.7 2.4% 1.33x 1.34x 2.2% $7.1 1.34x 1.25x 1.23x 1.24x 1.29x 1.2% $4.9 1.15x 1.22x 1.11x (1) (2) (2) 2015 2016 2017 YTD Q3 2018 Q4' 16 Q1 '17 Q2 '17 Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Q4' 16 Q4' 17 Q3 '18 ASC 605 ASC 606 ASC 605 ASC 606 1. Based on nine months ended September 30. Excludes disposition of businesses and acquisitions; includes impact from the ransomware attack discussed on the Third Quarter earnings call on Oct. 24, 2018. 2. Includes backlog from the acquisition of Chiltern. 21

Financial Performance Under ASC 606 Revenue Adjusted EPS(2) Free Cash Flow(3) (1) (1) 2018 Guidance 2018 Guidance 2018 Guidance(1) Midpoint Midpoint Midpoint (In Millions) (In Billions) $11.3 $12.00 $11.00 $1,400 $12.0 $10.3 $1,185 $9.6 $1,200 $10.0 $4.3 $10.00 $9.20 $8.63 $1,000 $918 $125 $3.5 $8.00 $8.0 $3.2 $800 $960 $6.0 $6.00 $600 $6.3 $6.9 $7.0 $4.0 $4.00 $400 $200 $2.0 $2.00 $0 $0.0 $0.00 (4) (5) (4) (5) (6) 2016 2017 2018 2016 2017 2018 2016 2017 2018 Drug Development Diagnostics Tax Payment: Free Cash Flow Food Solutions Divestiture 1. Based on guidance issued on November 30, 2018. 2. EPS, as presented, represents an adjusted, non-GAAP financial measure (excludes amortization, restructuring and other special charges). See Appendix for non-GAAP reconciliation. 3. Free cash flow represents operating cash flow less capital expenditures in each of the years presented. See Appendix for non-GAAP reconciliation. 4. Free cash flow in 2017 and 2016 has been reduced by $8.7 million and $13.4 million, respectively, as the result of implementation of ASU 2016-18. This amount represents the amount of historical payments made on the Company’s zero-coupon subordinated notes deemed to be accreted interest. 5. Free cash flow increased by $47.4 million and $34.6 million in 2017 and 2016, respectively, for the reclassification of tax payments for net share settlements relating to employee stock vesting from operating activities to financing activities. 6. Free cash flow includes a fourth quarter tax payment of approximately $125 million related to the disposition of the Food Solutions business. 22

Track Record of Effective Capital Deployment to Build Shareholder Value Approximately $4.0 Billion in Capital Deployment Since 2016(1) Covance Share Repurchases Drug Development $0.7 Billion (17%) Acquisitions $1.4 Billion (33%) Capital Expenditures $0.8 Billion (21%) LabCorp Diagnostics Acquisitions $1.2 Billion (29%) 1. Based on January 1, 2016 through September 30, 2018. Dollar amounts do not tie due to rounding. 23

Strong Balance Sheet Enables Return of Capital to Shareholders (1) Covance Acquisition Date: Feb. 19, 2015 Debt and Leverage Leverage = 4.2x Share Repurchases (In Millions) Chiltern Acquisition • Investment grade philosophy with targeted Leverage $1,200 Date: Sept. 1, 2017 Leverage = 3.6x leverage of 2.5x – 3.0x gross debt to EBITDA 4.0x • Strong liquidity including >$900 million in $1,000 unutilized revolving credit facility $800 3.0x • Attractive debt profile: >80% is fixed interest rate debt and matures in 2022 or later $600 2.0x Share Repurchases $400 • Repurchased total of approximately $2.0 billion 1.0x between 2013 and Q3 2018 $200 $1,200 • Had $843.5 million of authorization remaining $0 4.0x0.0x under its share repurchase program at the end of $1,000 2013 2014 2015 2016 2017 YTD Q3 2018(2) Q3 2018 $800 Share Buyback Leverage 3.0x 1.$600Data presented under ASC 606 where available. 2. Share repurchases from January 1, 2018 to September 30, 2018. Leverage as of September2.0x 30, 2018. 24 $400 1.0x $200 $0 0.0x 2013 2014 2015 2016 2017 2018

LabCorp is Well Positioned for Long-Term Value Creation Stable and Financial Strength Multiple Avenues Innovation Quality and Service Global Business and Flexibility for Future Growth 25

J.P. Morgan Healthcare Conference JANUARY 8, 2019 | SAN FRANCISCO, CA

Appendix 27

Reconciliation of Non-GAAP Financial Measures (1) LABORATORY CORPORATION OF AMERICA HOLDINGS Reconciliation of Non-GAAP Financial Measures (in millions, except per share data) Twelve Months Ended December 31, Adjusted EPS 2017 2016 Diluted earnings per common share $ 11.81 $ 6.82 Restructuring and special items 0.98 0.64 Tax reform act adjustments (5.00) - Amortization expense 1.41 1.17 Adjusted EPS $ 9.20 $ 8.63 Free Cash Flow (2) (3) Net cash provided by operating activities $ 1,498 $ 1,197 Less: Capital expenditures $ (313) $ (279) (2) (3) Free cash flow $ 1,185 $ 918 1. Restated for ASC 606, the FASB-issued converged standard on revenue recognition, and ASU 2017-17. 2. Operating cash flow in 2017 and 2016 has been reduced by $8.7 million and $13.4 million, respectively, as the result of implementation of ASU 2016-18. This amount represents the amount of historical payments made on the Company’s zero-coupon subordinated notes deemed to be accreted interest. 3. Operating cash flow increased by $47.4 million and $34.6 million in 2017 and 2016, respectively, for the reclassification of tax payments for net share settlements relating to employee stock vesting from operating activities to financing activities. 28

©2018 Laboratory Corporation of America® Holdings All rights reserved.