Attached files

| file | filename |

|---|---|

| 8-K - 8-K ASC 842 INVESTOR RELATIONS PRESENTATION - AARON'S INC | a8k_asc842xirpresentation1.htm |

New Lease Accounting Standard Anticipated Adoption Date: First Quarter 2019 January 8, 2019

Topics Covered • Overview of the new lease accounting standard • Key impacts to Aaron’s, Inc. as a lessor • Key impacts to Aaron’s, Inc. as a lessee • Transition approach and timing • Use of Non-GAAP financial information • Progressive bad debt classification impacts Forward-Looking Information The statements in this presentation regarding the impact of ASU 2016-02, Leases (“ASC 842”), on our financial results are not historical facts and represent “forward-looking statements” that involve risks and uncertainties which could cause the actual impact to differ materially from the impacts described in these forward-looking statements. This presentation also contains information on the expected lessor accounting impact of ASC 842 as if it had applied during those periods. This information adjusted for ASC 842 is provided for illustrative purposes only. The actual impact of ASC 842 on our financial results will be described in detail in our periodic reports filed with the Securities and Exchange Commission beginning with our quarterly report on Form 10-Q for the first quarter of 2019. You are cautioned not to place undue reliance on any forward- looking statements or the other illustrative information contained in this presentation, both of which speak only as of the date of this presentation. Except as required by law, we undertake no obligation to update this presentation to reflect subsequent events or circumstances occurring after the date of this presentation. 2

Overview of New Lease Accounting Standard In February 2016, the FASB issued ASU 2016-02, Leases (“ASC 842”), which supersedes the current lease accounting guidance (“ASC 840”) and is effective for annual and interim periods beginning after December 15, 2018. Accordingly, Aaron’s, Inc. will be impacted by ASC 842 beginning with the first quarter of 2019. Overview of the New Guidance Definition of a • An arrangement contains a lease only when such arrangement conveys the right to lease “control” the use of an “identified asset.” Lessor accounting • If the assessment of collectability with the customer changes after the lease commencement date, the difference between the cumulative lease revenue recognized and cumulative lease payments received will be recognized as an adjustment to lease revenue rather than an adjustment to bad debt expense. Lessee accounting • Substantially all leases will be accounted for on the balance sheet. • Operating leases will continue to be expensed on a straight-line basis as lease expense. • Finance leases will continue to be expensed similar to capital leases in ASC 840. • No bright lines in determining lease classification. 3

Key impacts to Aaron’s, Inc. as a Lessor Progressive Leasing Bad Debt Expense – Classification change on Statement of Earnings Current Treatment Progressive bad debt expense is recorded within Operating Expenses. Future Treatment Progressive bad debt charges will be recorded as a reduction to Lease (effective first quarter 2019) Revenues and Fees. What’s not impacted? No impact to our estimation process for calculating bad debt allowance No impact to our cash flows or write-off policies No impact to customer lease arrangements or how we interact with customers No impact to lease merchandise write-offs, which will continue to be classified within Operating Expenses Continued transparency of impacts of bad debt write-offs - we will continue to disclose impacts of bad debt to both Aaron’s Business and Progressive in our earnings releases Our accounting policy for Aaron’s Business Bad Debt is currently, and will continue to be, classified as a reduction to Lease Revenues and Fees; therefore, the Progressive change results in consistency in lease bad debt classification No impact to our DAMI Provision for Loan Losses, which will continue to be classified within Operating Expenses 4

Key impacts to Aaron’s, Inc. as a Lessee Operating Leases from perspective of Lessee (i.e. real estate, fleet, equipment leases) Current Treatment Operating leases are “off-balance sheet” and expensed as incurred on a straight-line basis as lease expense. Losses associated with future lease obligations, net of estimated sublease income, for store closures are recorded at the time the store is closed (cease-use date). Future Treatment Substantially all operating leases will be reported on the balance sheet within new line (effective first quarter 2019) items: “Right-of-Use Asset” and “Operating Lease Liability.” Generally, operating leases will continue to be expensed on a straight-line basis as lease expense. There will be various other impacts to the statement of earnings, primarily related to the earlier recognition of a Right-of-Use Asset impairment charge for the Company’s store closing and consolidation programs. We are currently quantifying the impacts of operating leases that will be reported on balance sheet and will disclose the impacts in the first quarter 2019 earnings release and Form 10-Q. What’s not impacted? No impact to our outstanding debt upon adoption. Operating lease liabilities are not reported as Debt. Capital lease (now referred to in ASC 842 as a “Finance” lease) liabilities will continue to be reported within Debt. Finance lease accounting remains unchanged and will continue to result in depreciation expense and interest expense. No impact to treatment of leases in EBITDA or Adjusted EBITDA. Operating lease expense will continue to be reported within EBITDA and Adjusted EBITDA. Expenses associated with finance leases will continue to be reported outside of EBITDA and Adjusted EBITDA as depreciation expense/interest expense. No change in the classification (operating vs. finance) of leases entered into prior to January 1, 2019. No impact to our cash flows or reporting with the statement of cash flows. 5

Transition approach and timing We will adopt the accounting standard for the three months ending March 31, 2019 using the New presentation modified retrospective approach. • We plan to adopt an optional transition method in which reporting entities are permitted to not apply ASC 842 for comparative periods in the year of adoption. Therefore, we will not recast or restate 2018 or prior periods to conform to the new standard. • We will describe the impacts of the change in classification of Progressive bad debt in the footnotes to our financial statements and in the management’s discussion and analysis section of our periodic reports beginning in the first quarter of 2019. • We will begin reporting substantially all lessee operating leases on our balance sheet beginning in the first quarter 2019 earnings release and Form 10-Q. We will not quantify the lessee impacts of our adoption of ASC 842 to 2018 or prior periods. 6

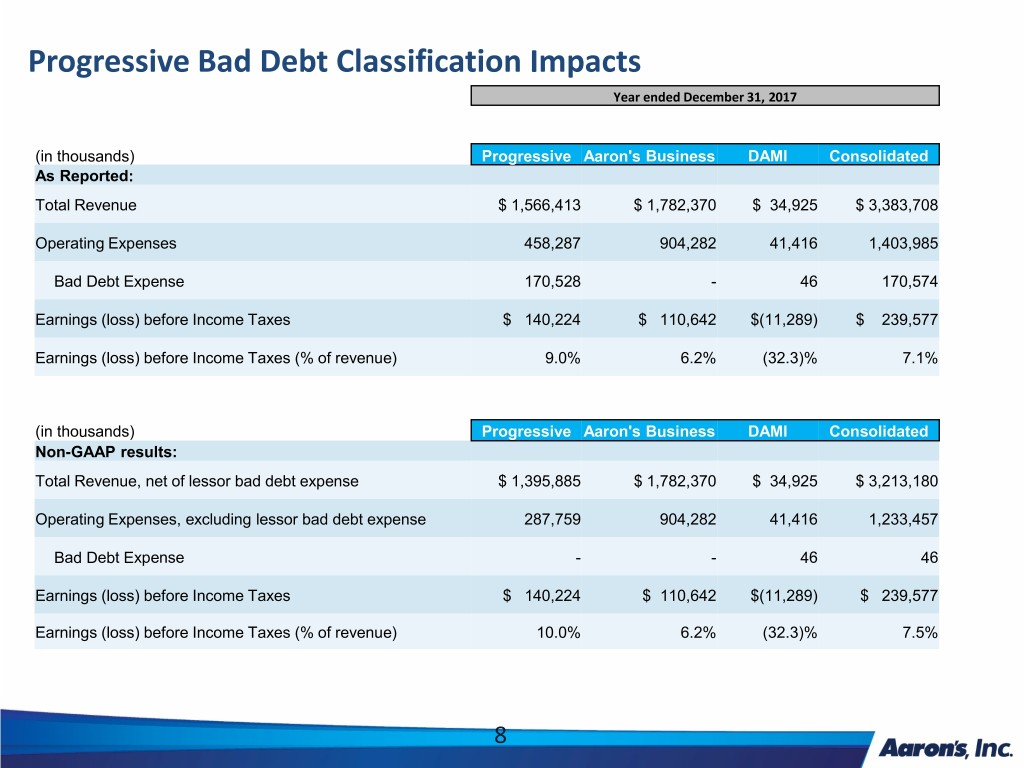

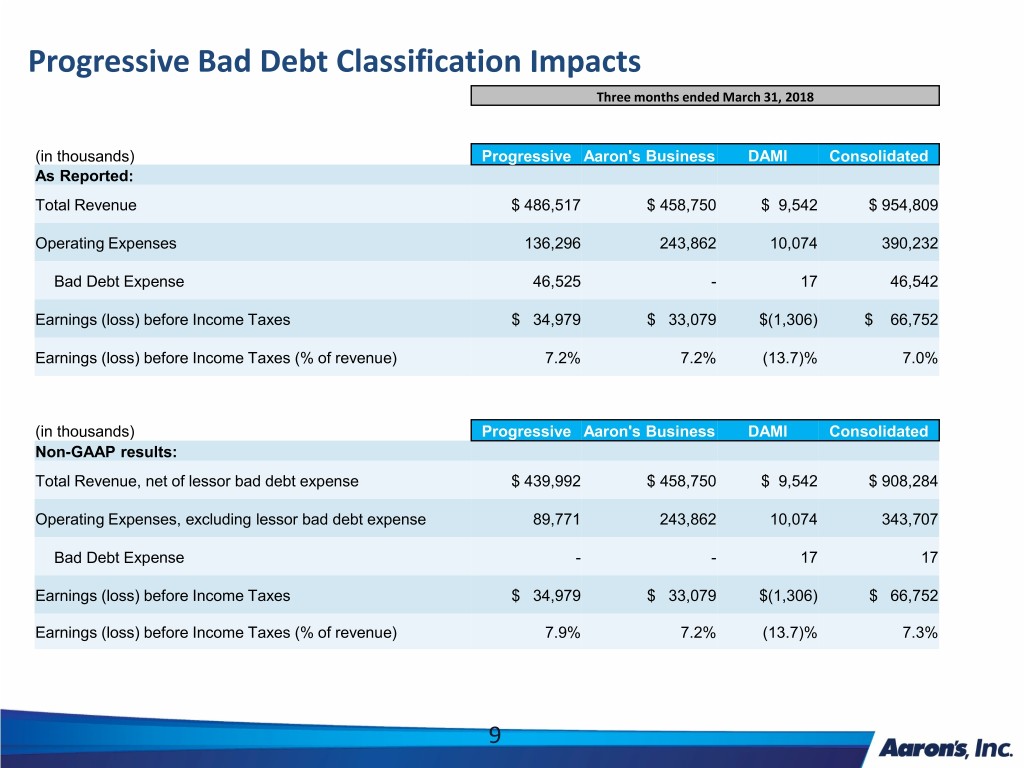

Use of Non-GAAP Financial Information For illustrative purposes only, the following slides disclose non-GAAP revenues and operating expenses for the year ended December 31, 2017 and the first three quarters of 2018, as if the lessor accounting impacts of ASC 842 was in effect inNew these presentation periods. “Revenue, net of lessor bad debt expense” and “Operating Expenses, excluding lessor bad debt expense” for 2017 and 2018 are supplemental measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) in place during these years. These non-GAAP measures assume that Progressive bad debt expense is recorded as a reduction to revenue instead of operating expenses in 2017 and 2018. Management believes these non-GAAP measures for 2017 and 2018 provide relevant and useful information for users of our financial statements, as it provides comparability with the financial results we will be reporting beginning in 2019 when ASC 842 becomes effective and we begin reporting Progressive bad debt expense as a reduction to revenue. We believe these non-GAAP measures provide management and investors the ability to better understand the results from the primary operations of our business in 2019 compared with 2018 and 2017 by classifying bad debt expense consistently between the periods. In addition to the lessor accounting impacts the new lease standard would have had on the Company’s statement of earnings for the prior periods presented in this presentation, there would have been several immaterial lessee accounting impacts to the statement of earnings for certain of those prior periods, primarily related to the accounting for the Company’s store closure and consolidation programs. The Company will quantify and disclose in the first quarter 2019 Form 10-Q the cumulative statement of earnings impact of these lessee accounting items, which will be recorded as an adjustment to retained earnings on the date of adoption of January 1, 2019. These non-GAAP financial measures should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP. 7

Progressive Bad Debt Classification Impacts Year ended December 31, 2017 New presentation (in thousands) Progressive Aaron's Business DAMI Consolidated As Reported: Total Revenue $ 1,566,413 $ 1,782,370 $ 34,925 $ 3,383,708 Operating Expenses 458,287 904,282 41,416 1,403,985 Bad Debt Expense 170,528 - 46 170,574 Earnings (loss) before Income Taxes $ 140,224 $ 110,642 $(11,289) $ 239,577 Earnings (loss) before Income Taxes (% of revenue) 9.0% 6.2% (32.3)% 7.1% (in thousands) Progressive Aaron's Business DAMI Consolidated Non-GAAP results: Total Revenue, net of lessor bad debt expense $ 1,395,885 $ 1,782,370 $ 34,925 $ 3,213,180 Operating Expenses, excluding lessor bad debt expense 287,759 904,282 41,416 1,233,457 Bad Debt Expense - - 46 46 Earnings (loss) before Income Taxes $ 140,224 $ 110,642 $(11,289) $ 239,577 Earnings (loss) before Income Taxes (% of revenue) 10.0% 6.2% (32.3)% 7.5% 8

Progressive Bad Debt Classification Impacts Three months ended March 31, 2018 New presentation (in thousands) Progressive Aaron's Business DAMI Consolidated As Reported: Total Revenue $ 486,517 $ 458,750 $ 9,542 $ 954,809 Operating Expenses 136,296 243,862 10,074 390,232 Bad Debt Expense 46,525 - 17 46,542 Earnings (loss) before Income Taxes $ 34,979 $ 33,079 $(1,306) $ 66,752 Earnings (loss) before Income Taxes (% of revenue) 7.2% 7.2% (13.7)% 7.0% (in thousands) Progressive Aaron's Business DAMI Consolidated Non-GAAP results: Total Revenue, net of lessor bad debt expense $ 439,992 $ 458,750 $ 9,542 $ 908,284 Operating Expenses, excluding lessor bad debt expense 89,771 243,862 10,074 343,707 Bad Debt Expense - - 17 17 Earnings (loss) before Income Taxes $ 34,979 $ 33,079 $(1,306) $ 66,752 Earnings (loss) before Income Taxes (% of revenue) 7.9% 7.2% (13.7)% 7.3% 9

Progressive Bad Debt Classification Impacts Three months ended June 30, 2018 New presentation (in thousands) Progressive Aaron's Business DAMI Consolidated As Reported: Total Revenue $ 483,666 $ 434,985 $ 9,208 $ 927,859 Operating Expenses 139,312 238,283 10,742 388,337 Bad Debt Expense 50,036 - 73 50,109 Earnings (loss) before Income Taxes $ 44,575 $ 7,697 $(2,292) $ 49,980 Earnings (loss) before Income Taxes (% of revenue) 9.2% 1.8% (24.9)% 5.4% (in thousands) Progressive Aaron's Business DAMI Consolidated Non-GAAP results: Total Revenue, net of lessor bad debt expense $ 433,630 $ 434,985 $ 9,208 $ 877,823 Operating Expenses, excluding lessor bad debt expense 89,276 238,283 10,742 338,301 Bad Debt Expense - - 73 73 Earnings (loss) before Income Taxes $ 44,575 $ 7,697 $(2,292) $ 49,980 Earnings (loss) before Income Taxes (% of revenue) 10.3% 1.8% (24.9)% 5.7% 10

Progressive Bad Debt Classification Impacts Three months ended September 30, 2018 New presentation (in thousands) Progressive Aaron's Business DAMI Consolidated As Reported: Total Revenue $ 504,407 $ 439,156 $ 9,508 $ 953,071 Operating Expenses 157,256 251,548 11,798 420,602 Bad Debt Expense 64,213 - 22 64,235 Earnings (loss) before Income Taxes $ 40,839 $ 15,641 $(3,065) $ 53,415 Earnings (loss) before Income Taxes (% of revenue) 8.1% 3.6% (32.2)% 5.6% (in thousands) Progressive Aaron's Business DAMI Consolidated Non-GAAP results: Total Revenue, net of lessor bad debt expense $ 440,194 $ 439,156 $ 9,508 $ 888,858 Operating Expenses, excluding lessor bad debt expense 93,043 251,548 11,798 356,389 Bad Debt Expense - - 22 22 Earnings (loss) before Income Taxes $ 40,839 $ 15,641 $(3,065) $ 53,415 Earnings (loss) before Income Taxes (% of revenue) 9.3% 3.6% (32.2)% 6.0% 11