Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PTC THERAPEUTICS, INC. | ex9912019-01x07ptcjpmnewsr.htm |

| 8-K - 8-K - PTC THERAPEUTICS, INC. | a8-k010719.htm |

PTC 2019 JP Morgan Healthcare Conference Stuart Peltz, CEO

Forward looking statement All statements contained in this presentation, other than statements of historic fact, are forward-looking statements, including statements related to preliminary unaudited 2018 financial information with respect to 2018 net product revenue of Translarna for the treatment of nmDMD and EMFLAZA for the treatment of Duchenne muscular dystrophy, statements with respect to 2019 net product revenue guidance and statements regarding: the future expectations, plans and prospects for PTC; expectations with respect to PTC's g ene therapy platform, including any potential regulatory submissions; PTC's expectations with respect to the licensing and potential commercialization of Tegsedi and Waylivra; expansion of commercialization of Translarna and Emflaza; advancement of PTC's joint collaboration program in SMA, including any potential regulatory submissions; PTC's strategy, future operations, future finan cial position, future revenues, projected costs; and the objectives of management. Other forward-looking statements may be identified by the words "guidance", "plan," "anticipate," "believe," "estimate," "expect," "intend," "may," "target," "potential," "will," "would," "could," "should," "continue," and similar expressions. PTC's actual results, performance or achievements could differ materially from those expressed or implied by forward-looking statements it makes as a result of a variety of risks and uncertainties, including those related to: the outcome of pricing, coverage and reimbursement negotiations with third party payors for Emflaza and Translarna and any other product candidates that PTC may commercialize in the future; whether, and to what extent, third party payors impose additional requirements before approving Emflaza prescription reimbursement; PTC's ability to complete any dystrophin study necessary in order to resolve the matters set forth in the denial to the Complete Response letter it received from the FDA in connection with its new drug application for Translarna for the treatment of nonsense mutation Duchenne muscular dystrophy (nmDMD), and PTC's ability to perform additional clinical trials, non-clinical studies, and CMC assessments or analyses at significant cost; PTC's ability to maintain its marketing authorization of Translarna for the treatment of nmDMD in the European Economic Area (EEA), including whether the European Medicines Agency (EMA) determines in future annual renewal cycles that the benefit-risk balance of Translarna authorization supports renewal of such authorization; PTC's ability to enroll, fund, complete and timely submit to the EMA the results of Study 041, a randomized, 18-month, placebo-controlled clinical trial of Translarna for the treatment of nmDMD followed by an 18-month open-label extension, which is a specific obligation to continued marketing authorization in the EEA; expectations with respect to the potential financial impact or PTC's ability to realize the anticipated benefits of the acquisition of Agilis and its gene therapy platform, including with respect to the business of Agilis and expectations with respect to the potential achievement of development, regulatory and sales milestones and contingent payments to the former Agilis equityholders with respect thereto and PTC's ability to obtain marketing approval of PTC-AADC and other product candidates acquired from Agilis, will not be realized or will not be realized within the expected time period; expectations with respect to the potential financial impact and benefits of the collaboration and licensing agreement with Akcea Therapeutics, Inc., including with respect to the timing of regulatory approval of Tegsedi and Waylivra in countries in LATAM and the Caribbean, the commercialization of Tegsedi and Waylivra, and PTC's expectations with respect to contingent payments to Akcea based on net sales and the potential achievement of regulatory milestones; the enrollment, conduct, and results of studies under the SMA collaboration and events during, or as a result of, the studies that could delay or prevent further development under the program, including any potential regulatory submissions with regards to Risdiplam; PTC's ability to realize the anticipated benefits of the acquisition of Emflaza, including the possibility that the expected benefits from the acquisition will not be realized or will not be realized within the expected time period; significant transaction costs, unknown liabilities, the risk of litigation and/or regulatory actions related to the acquisition of Emflaza or the acquisition of its gene therapy pipeline, as well as other business effects, including the effects of industry, market, economic, political or regulatory conditions; changes in tax and other laws, regulations, rates and policies; the eligible patient base and commercial potential of Translarna, Emflaza, PTC-AADC, Tegsedi, Waylivra, Risdiplam or any of PTC's other product candidates; PTC's scientific approach and general development progress; PTC's ability to satisfy its obligations under the terms of the senior secured term loan facility with MidCap Financial; the sufficiency of PTC's cash resources and its ability to obtain adequate financing in the future for its foreseeable and unforeseeable operating expenses and capital expenditures; and the factors discussed in the "Risk Factors" section of PTC's Annual Report on Form 10-K for the year ended December 31, 2017, Quarterly Reports on Form 10-Q for the periods ended March 31, 2018, June 30, 2018 and September 30, 2018 and Exhibit 99.2 to PTC's Current Report on Form 8-K filed on August 24, 2018, as well as any updates to these risk factors filed from time to time in PTC's other filings with the SEC. You are urged to carefully consider all such factors. As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products. There are no guarantees that any product will receive or maintain regulatory approval in any territory, or prove to be commercially successful, including Translarna, Emflaza, PTC-AADC, Tegsedi, Waylivra or Risdiplam. The forward-looking statements contained herein represent PTC's views only as of the date of this presentation and PTC does not undertake or plan to update or revise any such forward-looking statements to reflect actual results or changes in plans, prospects, assumptions, estimates or projections, or other circumstances occurring after the date of this presentation except as required by law. 2

[Corporate Update] 2018: a transformational year $260-280M Expand Perform at least 1 revenue guidance TranslarnaTM Advance Enable SMA Advance 1 business for DMD availability to Oncology development internal research development franchise patients franchise success program to a D.C. deal Revenue 2-5 year old PTC299 & SMA trials FD program Completed guidance met DMD label PTC596 enrolled; set advanced transformational (unaudited) expansion in clinical up to file to development BD and trials in 2019 candidate acquisition deals 3

Started 2018 with a clear 3-year vision PTC is a fully integrated, innovative rare disorder company leveraging research capabilities and core technology platforms, building out world- VISION class commercial capabilities, and being an ideal partner for late-stage, ultra-orphan disorders for which there is high unmet medical need. Fully Integrated Orphan Franchise ST RAT EGY Niche Oncology Platform Flexible and Opportunistic 4

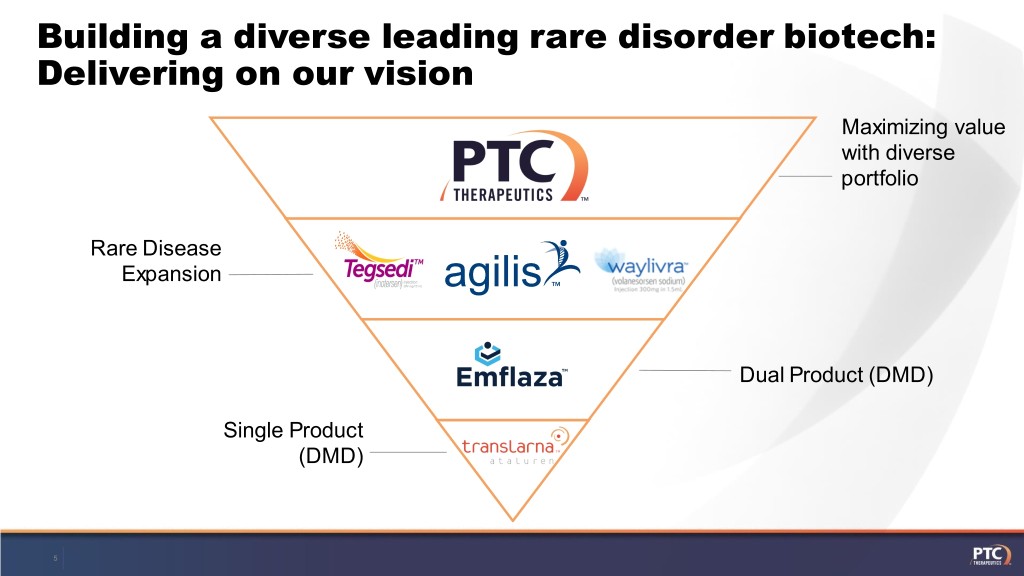

Building a diverse leading rare disorder biotech: Delivering on our vision Maximizing value with diverse portfolio Rare Disease Expansion Dual Product (DMD) Single Product (DMD) 5

[Corporate Update] Pipeline evolution: January 2017 *DMD Commercial Late develop. Aniridia Dravet / CDKL5 SMA Early develop. MPS1 BMI1 Preclinical HD Translarna™ NextGen Alternative Oncology (ataluren) Readthrough Splicing * MA requires annual renewal following reassessment by the European Medicines Agency (EMA) 6

[Corporate Update] Pipeline evolution: January 2018 DMD *DMD Commercial SMA Late develop. Aniridia Dravet / CDKL5 BMI1 Early develop. DHODH 1 Preclinical HD DHODH 2 Emflaza™ Translarna™ NextGen Alternative Oncology (deflazacort) (ataluren) Readthrough Splicing Key 2017 Additions * MA requires annual renewal following reassessment by the European Medicines Agency (EMA) 7

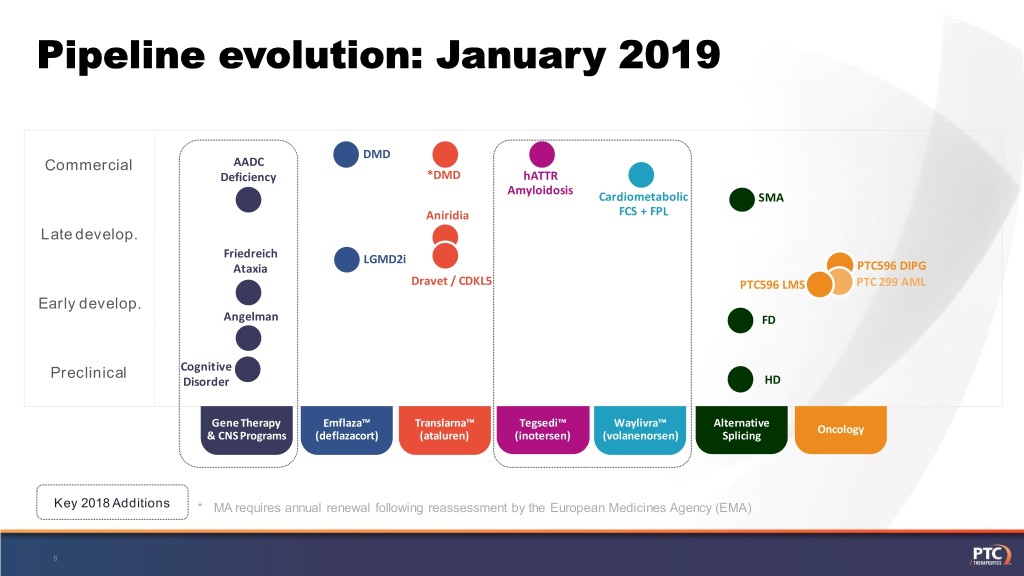

[Corporate Update] Pipeline evolution: January 2019 DMD Commercial AADC Deficiency *DMD hATTR Amyloidosis Cardiometabolic SMA Aniridia FCS + FPL Late develop. Friedreich LGMD2i Ataxia PTC596 DIPG Dravet / CDKL5 PTC596 LMS PTC 299 AML Early develop. Angelman FD Preclinical Cognitive Disorder HD Gene Therapy Emflaza™ Translarna™ Tegsedi™ Waylivra™ Alternative Oncology & CNS Programs (deflazacort) (ataluren) (inotersen) (volanenorsen) Splicing Key 2018 Additions * MA requires annual renewal following reassessment by the European Medicines Agency (EMA) 8

Delivering on our 3-year vision PTC is a fully integrated, innovative rare disorder company leveraging research capabilities and core technology platforms, building out world- VISION class commercial capabilities, and being an ideal partner for late-stage, ultra-orphan disorders for which there is high unmet medical need. Fully Integrated Orphan Franchise ST RAT EGY Niche Oncology Platform Flexible and Opportunistic 9

Looking forward: PTC growth vision for the next 5 years Now Future COMMERCIAL: 2 products (Translarna and (Translarna, Emflaza, Tegsedi, AADC, Emflaza) $262M* $~1.5B Risdiplam, FA) CLINICAL PROGRAMS: (AADC, SMA, Translarna, (AS, DIPG, AML, LMS, HD, FD, Emflaza, DIPG, AML) 6 10 +4) RESEARCH PROGRAMS: (Small molecules, splicing, gene (FA, AS, FD, HD, Reelin) 5 20 therapy and others) BD: Emflaza & Agilis acquisitions, Akcea Opportunistic collaborations & BD in-licensing 3 in/out-licensing 10 * Unaudited 2018 revenue

~$1.5B potential revenues to PTC by 2023 Risdiplam Emflaza (royalties to PTC) ~$300 ~$200 Tegsedi Translarna ex-US ~$150 ~$300 ~$400 ~$200 Emflaza Gene Therapy ~$90 Translarna US ~$170 Translarna ex-US ($ millions*) * Net of royalties 11 * Revenue based on PTC current assumptions and estimates

Building a Leading Rare Disorder Biotech Global DMD Franchise

PTC is the leader in DMD treatment 2 of 3 approved products Translarna is the first-ever targeted therapeutic approved for DMD anywhere in the world (EMA, 2014) Translarna is now available in >40 countries worldwide ex-US and in trials for US potential approval in 2020 Emflaza is the first-and-only corticosteroid approved specifically for DMD anywhere in the world (US, 2017) Emflaza data demonstrates best-in-class corticosteroid PTC DMD franchise is now helping many thousands of families living with Duchenne around the world 13

Translarna™: proven track record of performance • Unaudited 2018 net product revenue of $171M, an 18% increase over 2017 • Global sales outside of the U.S. • Pediatric expansion approved in 2018 • Label expansion for non-ambulatory patients under review • U.S. dystrophin study underway, completion YE:19 14

Emflaza®: Establishing standard of care for all DMD patients in the US • 2018 Emflaza net product revenue of $91M (unaudited) • Revenue increase of >$60M over 2017 • Data from multiple publications demonstrate Emflaza’s clinical benefit over prednisone 15

Continuing to drive long-term growth of DMD franchise Label expansion under review for Translarna™ in non-ambulatory patients by the EMA sNDA for Emflaza® 2-5 year old U.S. patients submitted with potential approval in ‘19 16

An efficient, scalable business engine • 2018 unaudited product net revenue of $262M South Plainfield, Zug Switzerland, Marketing, • 2019 DMD franchise revenue New Jersey Medical and Regulatory Hub guidance of $285 - $305M • Established footprint in >40 countries worldwide • Experienced commercial and medical teams in orphan disease • Fully integrated global infrastructure Dublin, Ireland Latam Regional Office, International HQ Sao Paulo, Brazil 17

Building a Leading Rare Disorder Biotech Leveraging our Global Commercial Franchise

Preparing for successful launch All key hiring completed in Latam Tegsedi best fit for Latin American hATTR market Regulatory dossier filed hATTR polyneuropathy most prevalent Diversifies our rare with ANVISA and rare- phenotype in Latin America ~6,000 patients disease portfolio and revenues disease priority review Sub-cutaneous self administration preferable to infusions granted in the region Expected approval YE:19 19

Two potential assets in Latin America Tegsedi best fit for Waylivra: could utilize our Latin American hATTR market patient support in Latin America hATTR polyneuropathy most prevalent Diversifies our rare Similar economic opportunity to phenotype in Latin America Translarna in Latin America ~6,000 patients disease portfolio and revenues No other treatments available Sub-cutaneous self administration to treat FCS preferable to infusions Under regulatory in the region review in EU FCS = familial chylomicronemia-syndrome FPL = familial partial lipodystrophy 20

Building a Leading Rare Disorder Biotech Leveraging our R&D platforms to continue to grow our pipeline I. Splicing platform

Leaders in small molecule RNA-splicing technology Development of 13 years of Cutting-edge 2nd Splicing Continue to SMA candidate discovering and tech platform Compound: A exploit Splicing as potential developing discovered and Development platform; ad- best-in-class drugs that target developed by Candidate to dressing treatment pre-mRNA PTC treat Familial additional areas splicing Dysautonomia of unmet need Platform Mechanism Targeted Programs SMA – SMN2 Target-splicing events to restore FD – IKBKAP Splicing or decrease protein levels HD – HTT Others 22

Risdiplam in development for Spinal Muscular Atrophy (SMA) • Primary genetic cause of infant mortality • Small molecule promotes the correct splicing of the mutant RNA • Small molecule has potential for best in class therapy • Broad tissue distribution and protein restoration Risdiplam targets-splicing events to restore SMN protein levels 23

Risdiplam has potential to be a $2B product • Revenue > $1B subject to mid-teens* Based on FDA feedback: royalty to PTC from Roche • Potential to PTC to exceed $200M/ Data from Sunfish year; including competitive assumptions for SMA gene therapy & Firefish part 1 should be • Firefish & Sunfish fully enrolled sufficient for NDA filing • Risdiplam well tolerated at all doses, no ocular toxicity found in humans Plan to file in 2019 * Revenue estimates based on PTC solely on assumptions 24 Full tiered royalty table in press release

The splicing technology is a proven platform to identify new therapeutics Development of 13 years of Cutting-edge 2nd splicing Continue to SMA candidate discovering and tech platform compound: A exploit splicing as potential developing discovered and development platform; best-in-class drugs that target developed by candidate to addressing treatment pre-mRNA PTC treat Familial additional areas splicing Dysautonomia of unmet need Platform Mechanism Targeted Programs SMA – SMN2 Target-splicing events to restore FD – IKBKAP Splicing or decrease protein levels HD – HTT Others 25

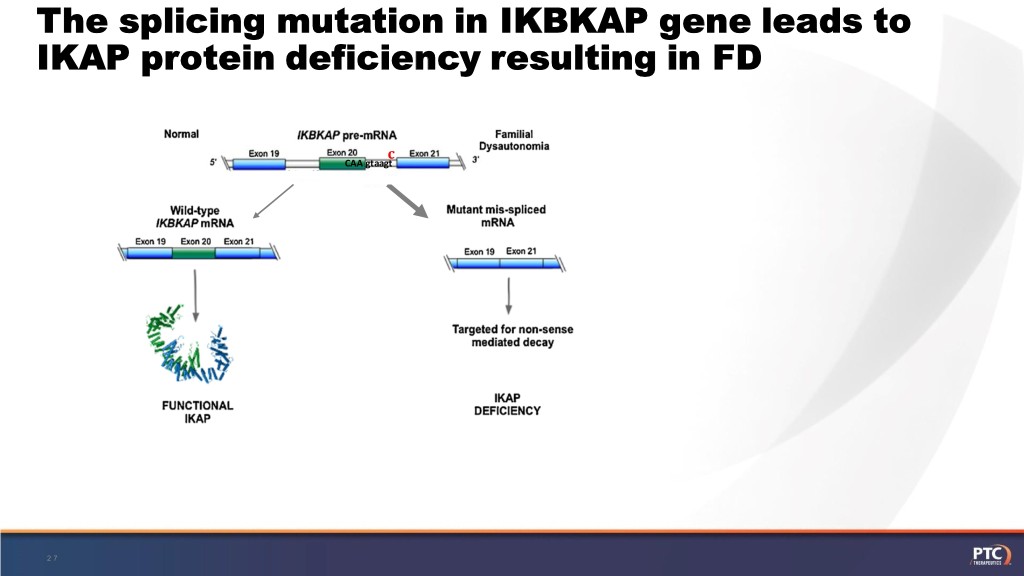

Familial dysautonomia: • Genetic disorder primarily affecting the sensory and autonomic neurons • Caused by a splicing-altering mutation in the IKBKAP (ELP1) gene resulting in low levels of IKAP protein • Ashkenazi Jewish ancestry, carrier frequency is ~1:30 • No therapies are currently available for FD, only supportive treatments • PTC is collaborating with MGH and NYU to advance treatments for FD 26

The splicing mutation in IKBKAP gene leads to IKAP protein deficiency resulting in FD c CAA gtaagt 27

PTC-258 splicing modifiers restore IKAP levels c CAA gtaagt Development candidate PTC-258 selected YE:18 Scheduled to enter the clinic in 2019 28 J a n - 19

Building a Leading Rare Disorder Biotech Leveraging our R&D platforms to continue to grow our pipeline II. A CNS gene therapy platform

Gene therapy development strategy Execute on current Priority to secure in- Expand the programs house manufacturing pipeline with capabilities to support internal research Target dates: long-term capacity and external • AADC Launch 2020 collaboration • Friedreich Launch 2023 • Angelman IND 2020 • Reelin IND 2020 30

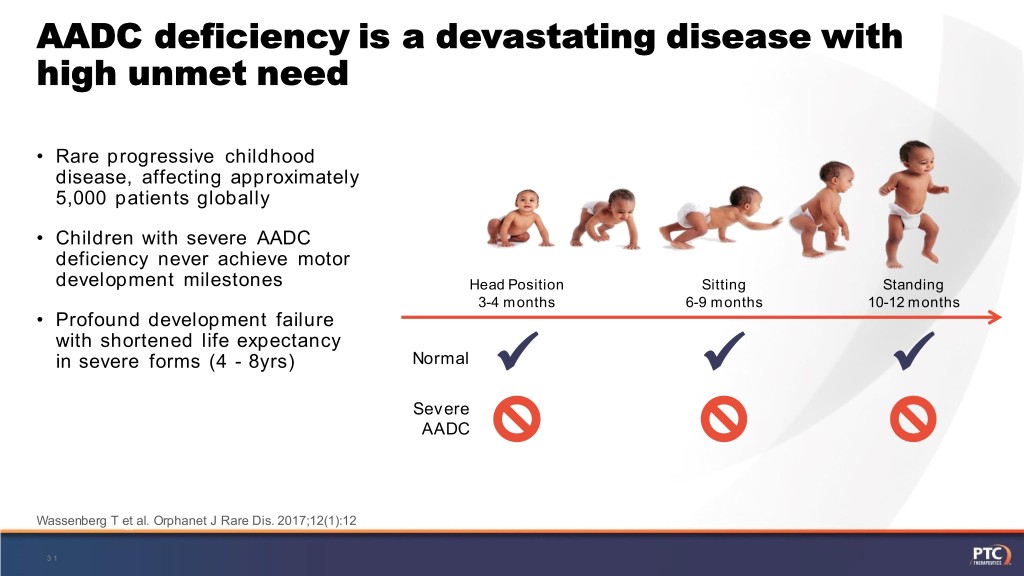

AADC deficiency is a devastating disease with high unmet need • Rare progressive childhood disease, affecting approximately 5,000 patients globally • Children with severe AADC deficiency never achieve motor development milestones Head Position Sitting Standing 3-4 months 6-9 months 10-12 months • Profound development failure with shortened life expectancy in severe forms (4 - 8yrs) Normal Severe AADC Normal Wassenberg T et al.AADC Orphanet J Rare Dis. 2017;12(1):12 Severe 31

Patient identification is our expertise ? Earlier Increase disease diagnosis awareness ~100 AADC patients already identifiedStrategy into thebring US andEmflaza Europe® to naive • Genotypingand patients younger in seizure U.S. and cerebral palsypatients clinics Genotyping Improving • Plan to screen >100K at-risk standards of patients for AADC care 32

Most advanced FA gene therapy program PTC plans to file IND in 2019 Targeted Micro Favorable Animal data Patient group dosing / direct to immunogenic supports engagement CNS profile appropriate dose 33

Moving toward IND filing in 2019 PTC-FA Intracerebellar Dosing in Porcine PTC-FA Intracerebellar Dosing in NHP Model* Model* 1000.0 Cerebellar 3000.0 Cerebellar Cortex Cortex 2500.0 800.0 Dentate Dentate Nucleus Nucleus 2000.0 600.0 1500.0 400.0 Target Frataxin Protein 1000.0 Healthy Human DN Target Frataxin Protein Healthy Human DN 200.0 500.0 ELISA for Human ELISA Human for (ng/g)Frataxin ELISA ELISA for Human Frataxin (ng/g) 0.0 0.0 Unilateral dose of 3.0 x 1012 vg total - Day 28 Mean (SEM) Bi-lateral Dose of 2.4 x 1012 vg total - Day 28 - Mean (SEM) *Human-specific detection *NHP background subtracted 34 34

2019 goals: file an AADC BLA & FA IND IND IND Friedreich Angelman Ataxia Syndrome 2019 2020 FDA BLA + EMA IND MAA submissions Cognitive disorder / Reelin AADC Deficiency Immediate clinical manufacturing capabilities as well as the plan to expand to commercial scale 35

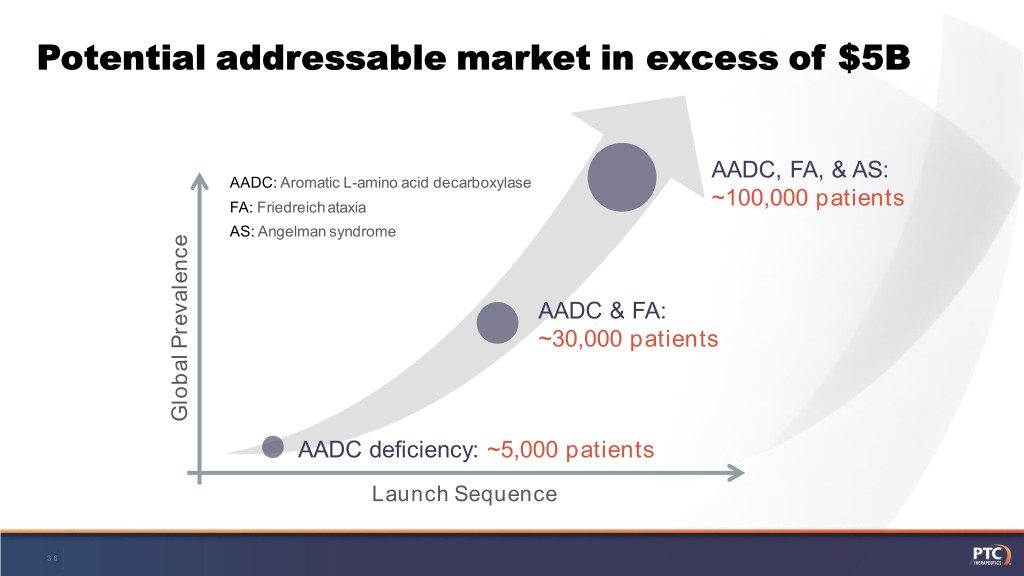

Potential addressable market in excess of $5B AADC, FA, & AS: AADC: Aromatic L-amino acid decarboxylase FA: Friedreich ataxia ~100,000 patients AS: Angelman syndrome AADC & FA: ~30,000 patients Global Prevalence Global AADC deficiency: ~5,000 patients Launch Sequence 36

Niche oncology strategy prioritizes value creation Use of current platforms to add new targets Internal research to portfolio with focus on splicing PTC596 in pediatric brain tumor (DIPG) phase Solid tumors 1/2 trial and Leiomyosarcoma (LMS) Hematologic malignancies PTC299 AML dose escalation trial initiated in 2018 Business development Assess out-licensing opportunities 37

Sustainable growth expected over next 5 years Potential revenues to PTC from DMD franchise, Gene therapy programs, Tegsedi and Risdiplam 2023 2022 2021 Potential Emflaza Limb-Girdle 2i launch 2020 Potential Tegsedi, SMA, AADC and Translarna US launches 2019 Expected SMA milestones for regulatory filings, Emflaza 2-5 launch 38

Everyone has a different definition of progress. For the last 20 years, we’ve measured our progress researching rare disease in moments. Smiling ones and crying ones. Moments spent with our boys’ families and ones with their friends. We know that every step forward comes after several steps backward, because we’ve lived it—whether spending time with families in their homes or with our scientists researching in our labs. It can be easy to lose yourself as you progress further. Although we’ve grown, our heart remains in the same place, because we’ve never measured ourselves like larger companies do. Our biggest accomplishment has always been the time we can give to all of our families. Whether it’s hours, days, months, or years, every small moment is a big win.